Three Things We’re Hearing

- Education refinance loan marketing set to rebound?

- Consumers react to student loan forgiveness

- Cash back and near prime products dominate credit card mail

A three-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Education Refinance Loan Marketing Set to Rebound?

- President Biden announced plans to cancel $10,000 - $20,000 of federal student loan debt for eligible borrowers

- The announcement follows a pause on student loan repayments and interest in effect since 2020, which is set to finally expire on December 31, 2022

- 43.4 million borrowers hold $1.3 trillion in federal student loans

- The debt forgiveness measure does not apply to private student loans

- Additionally, more than 8 million student loan borrowers who fell into delinquency or defaulted on their payments before the pandemic will find their credit records cleared

- Biden also announced a new proposed income-driven repayment plan that will lower payments for more federal loan borrowers

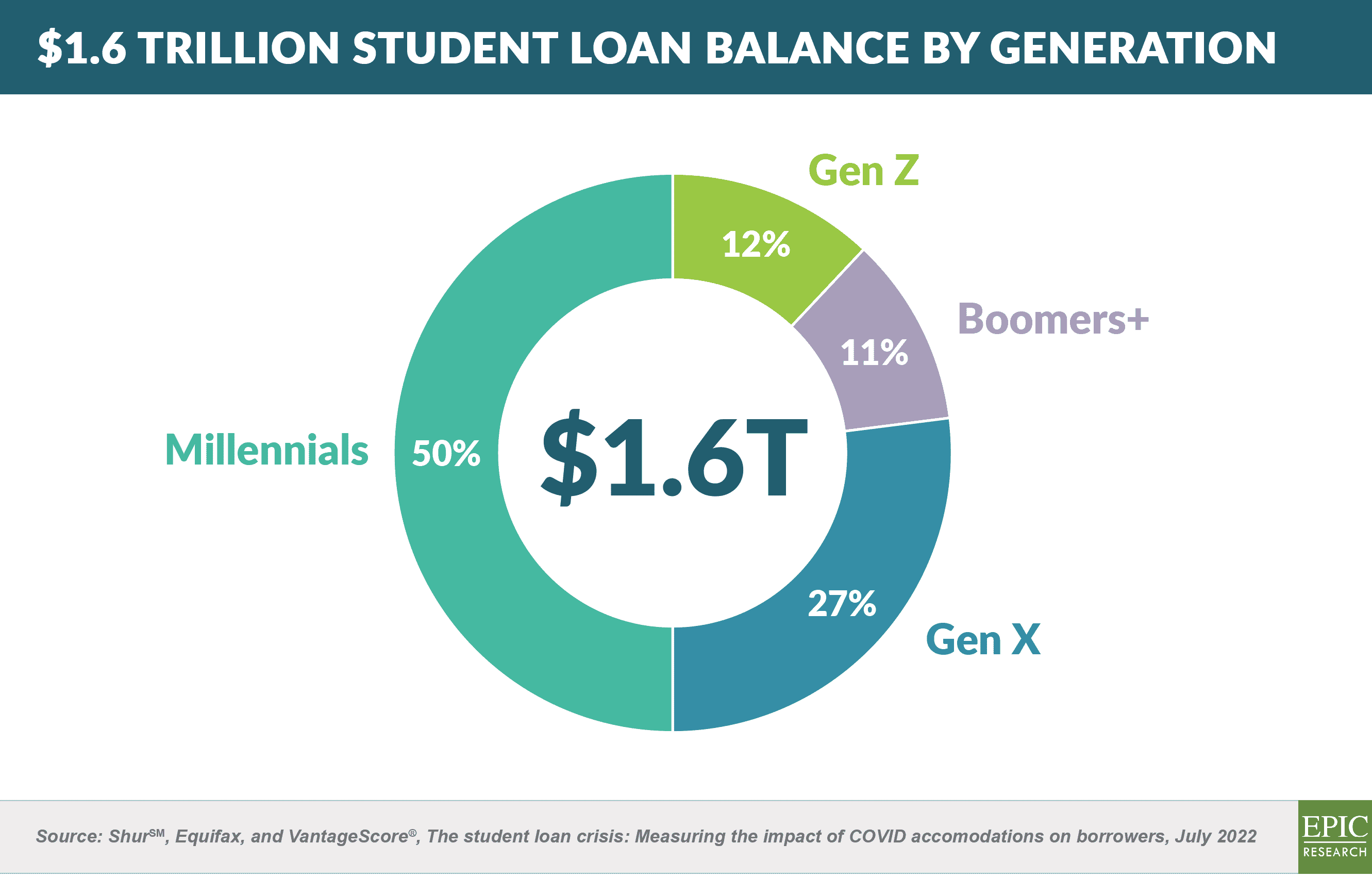

- Millennials, holding half the federal student debt, will be most impacted by the forgiveness program

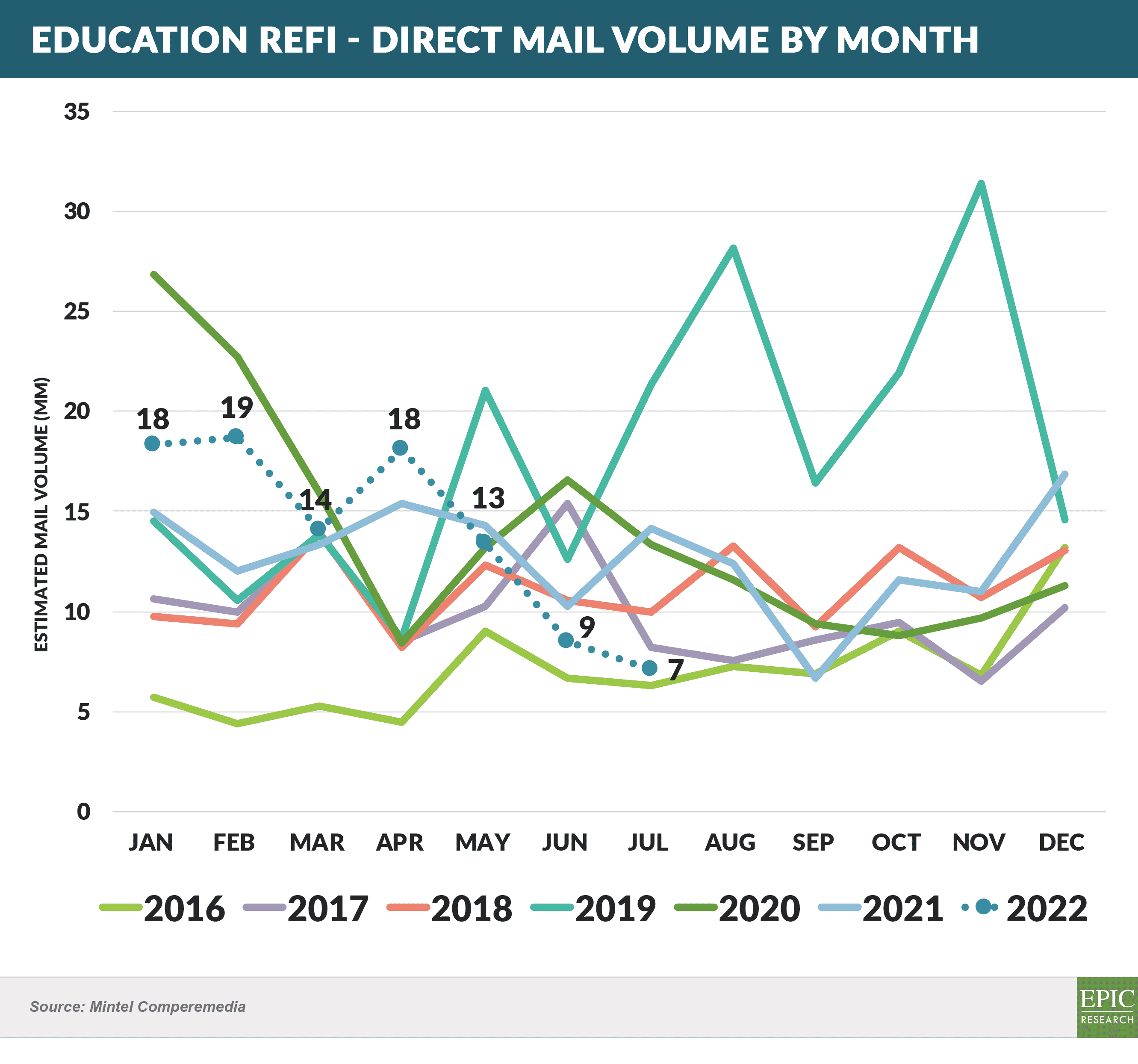

- Since the onset of the payment pause, education refi loan originations have fallen as consumers hesitate to consolidate loans that are not currently drawing interest or requiring payment – recent months’ direct mail volume for refi has reached its lowest level in five years

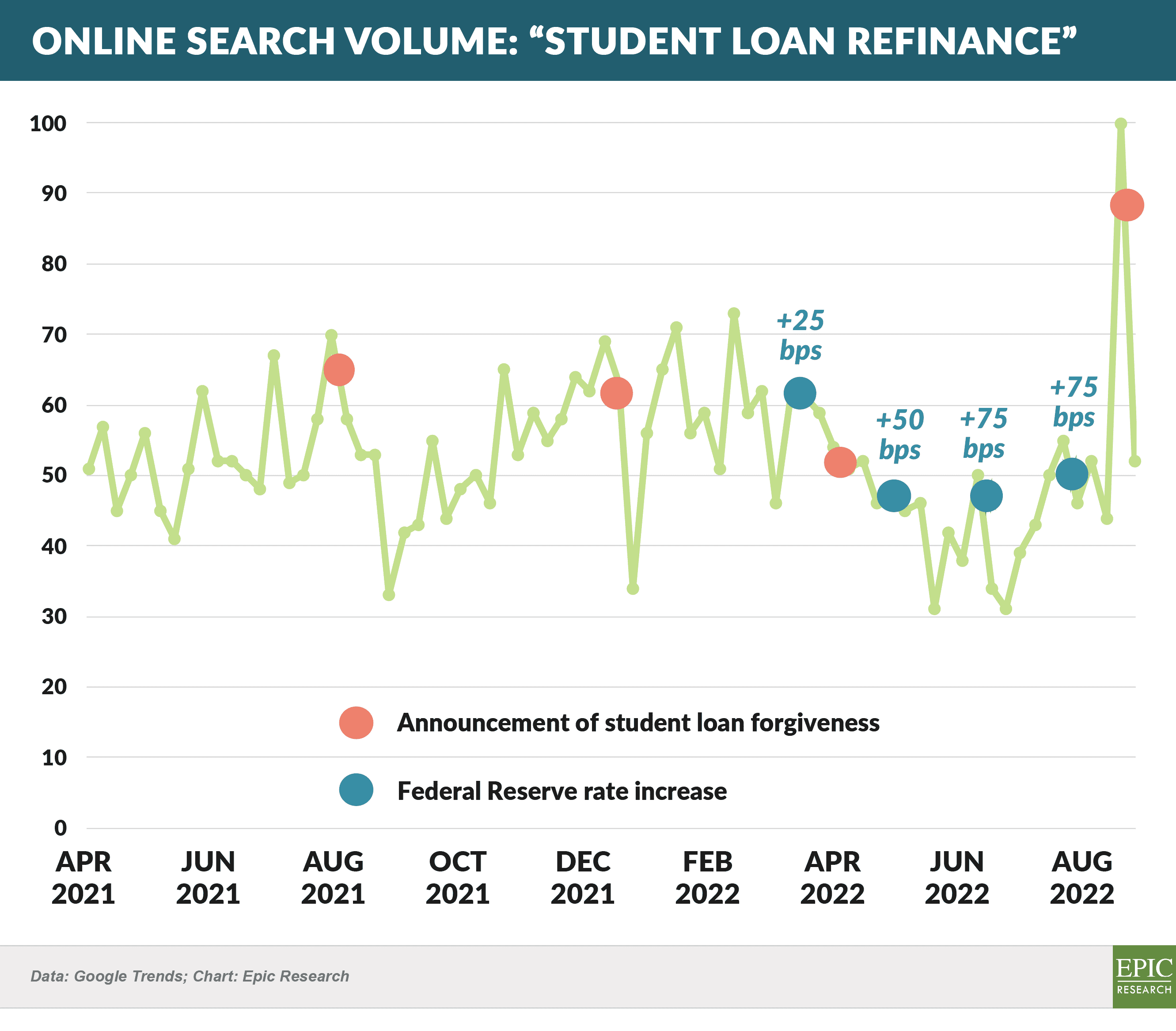

- The original loan repayment pause was part of the COVID-related CARES Act, intended to provide relief to consumers during a period of high unemployment and uncertainty, and has been extended five times, with consumer demand for education refi loans, as reflected in online search volume, falling following each extension

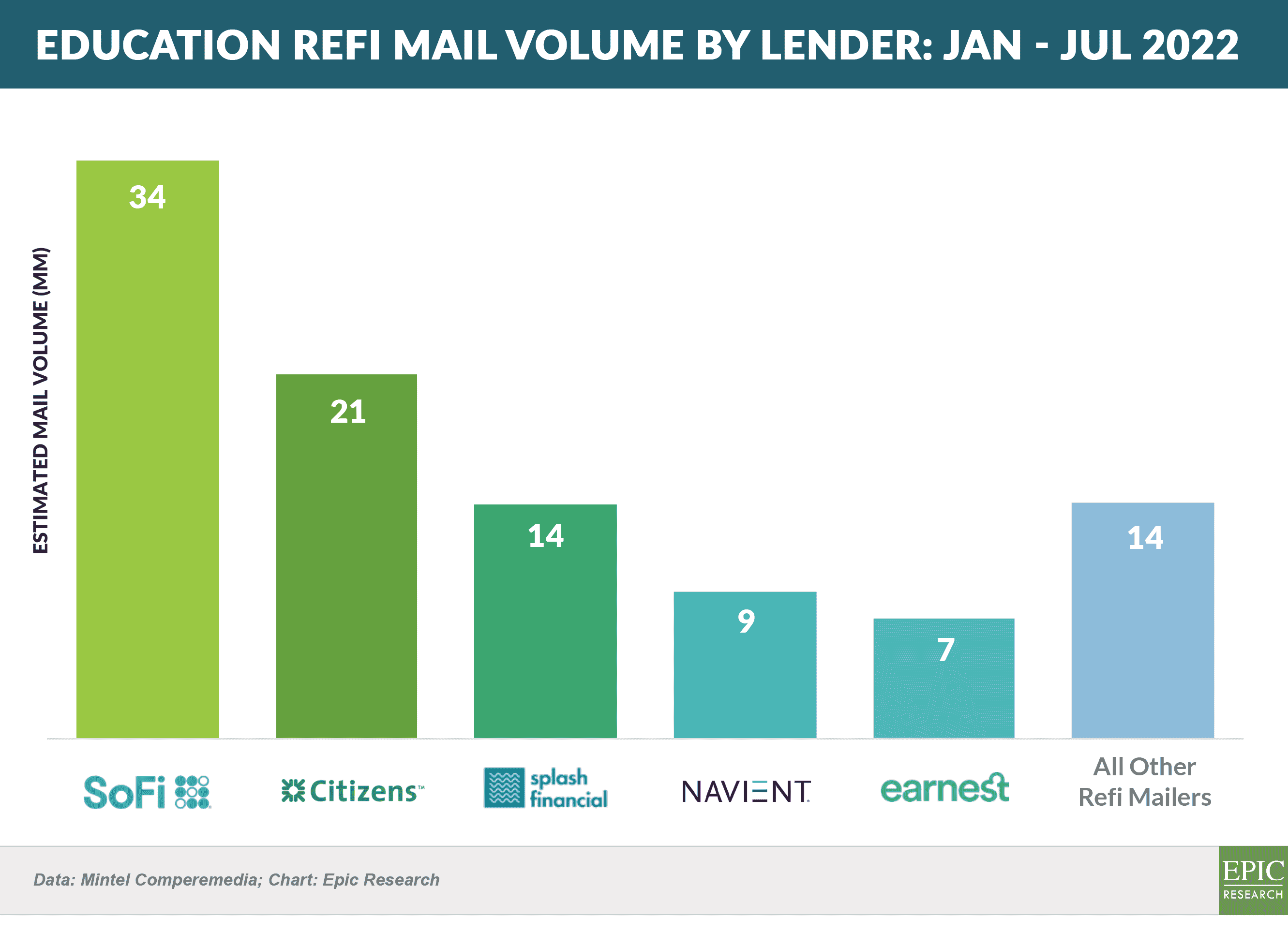

- Education refi loan marketing has been dominated by five lenders this year

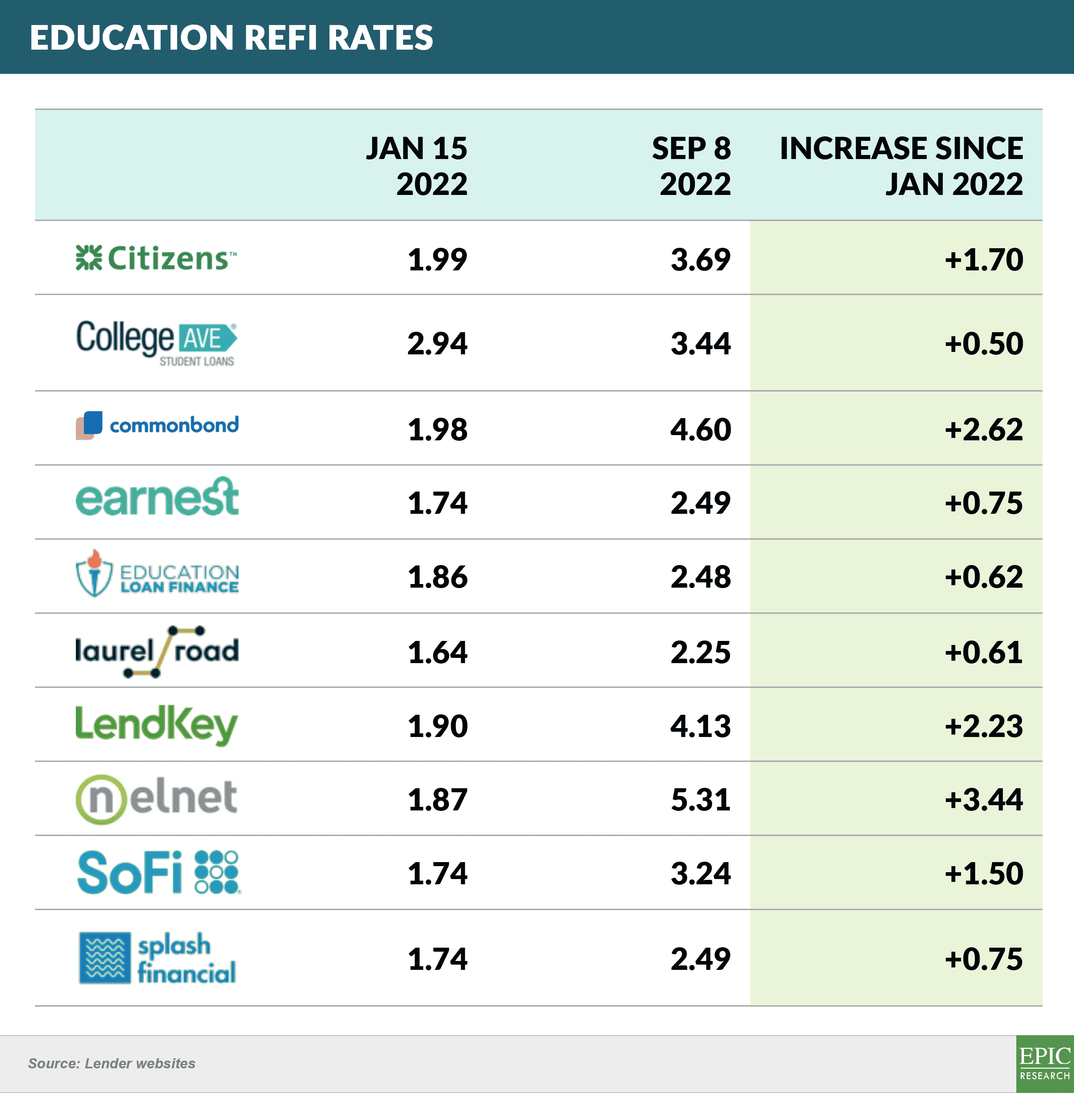

- Along with other rates, refi rates have ticked up in the past eight months, with most lenders’ lowest offerings up 50 – 150 bps since January

- Education refi marketing activity should rise in 2023 following the end of the payment moratorium and will likely be met favorably due to pent up consumer demand

- However, higher interest rates and lower loan balances resulting from the forgiveness program will likely moderate growth as well as borrowers’ likelihood to consolidate remaining student debt

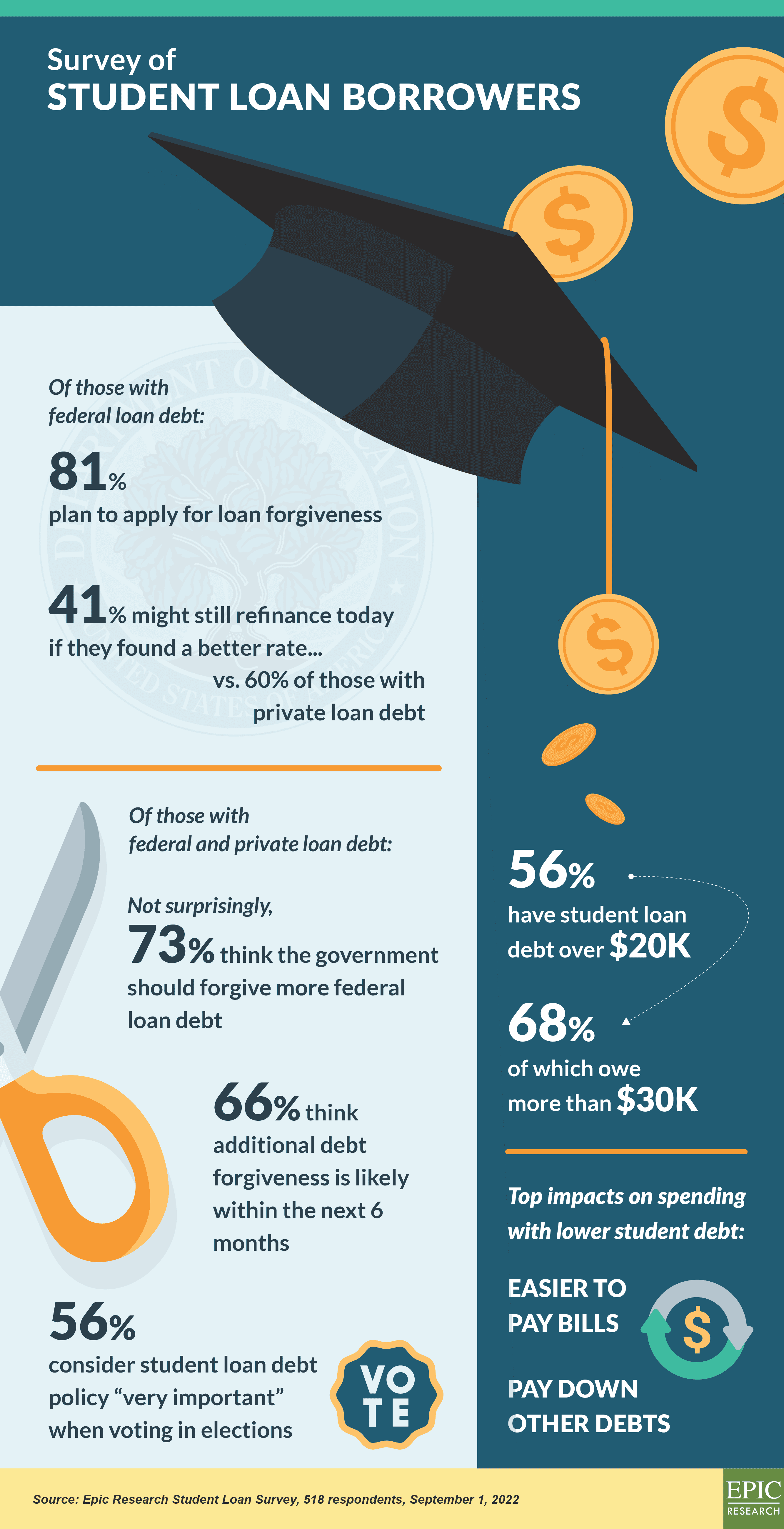

Consumers React to Student Loan Forgiveness

- In the wake of the student loan forgiveness announcement, Epic surveyed 518 consumers with student loans to assess the potential effect on their spending and savings behaviors

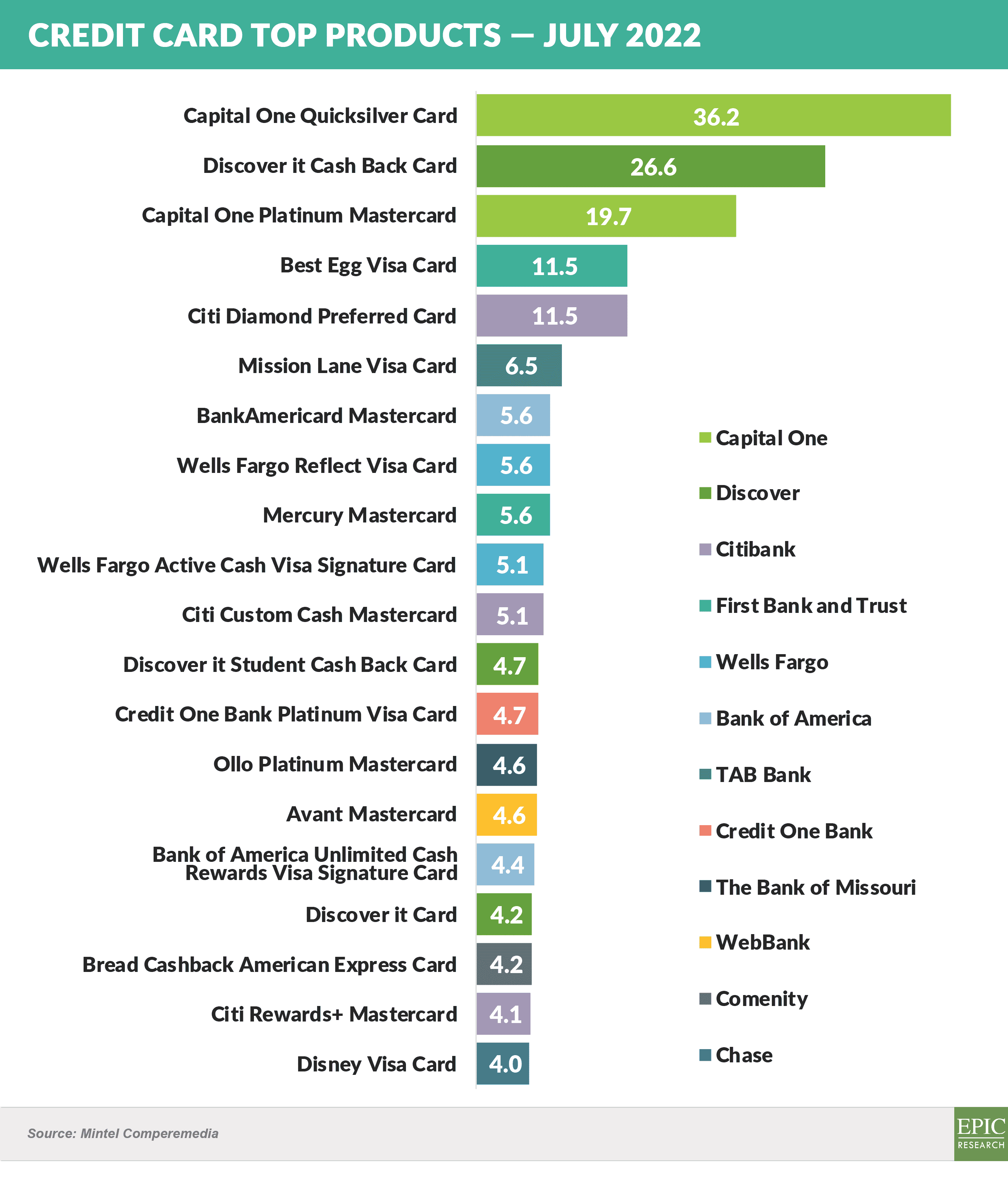

Cash Back and Near Prime Products Dominate Credit Card Mail

- Bank-branded cash back and credit builder products dominated July card offers, with the Disney Visa card being the only co-brand offering in the top 25

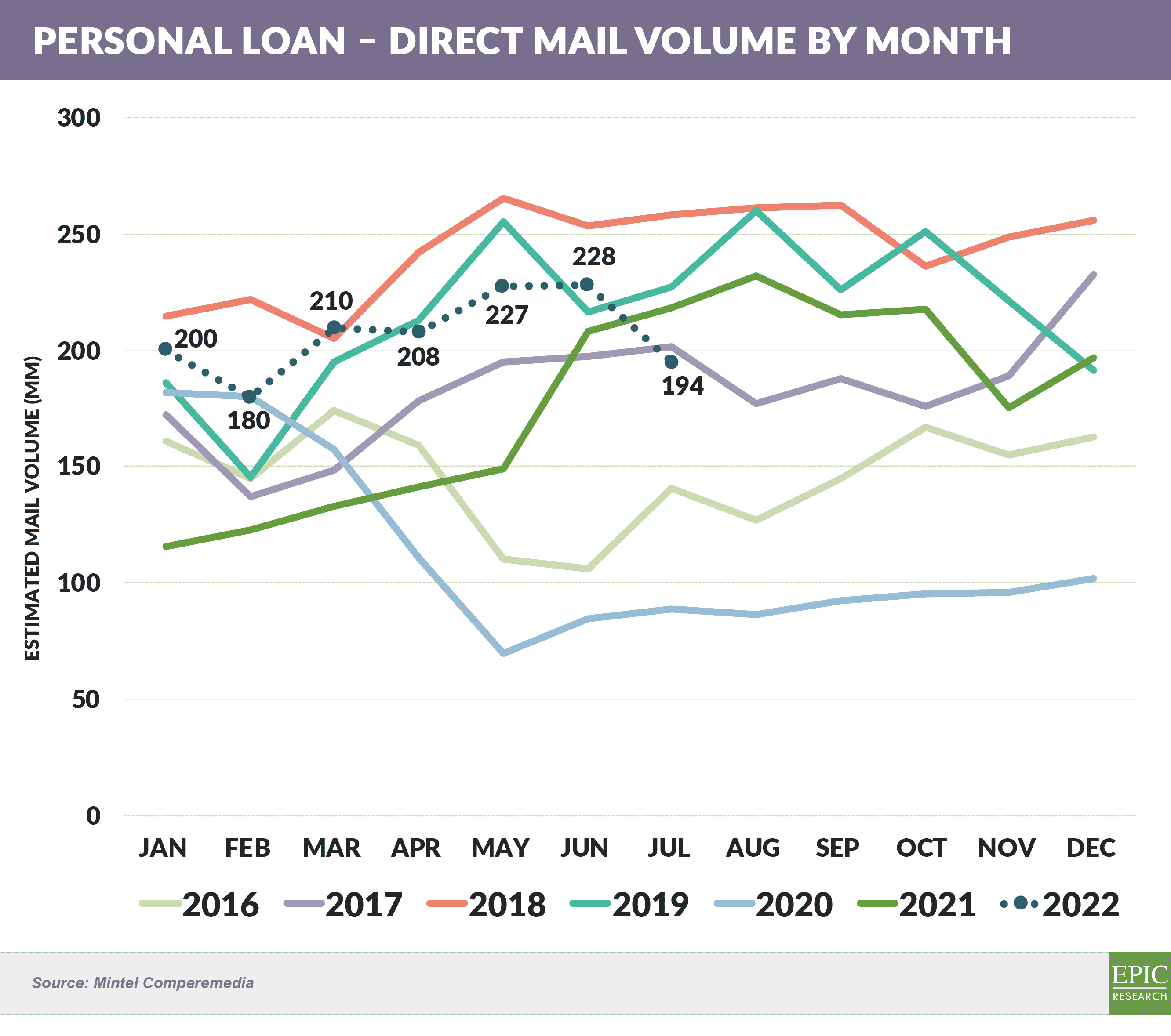

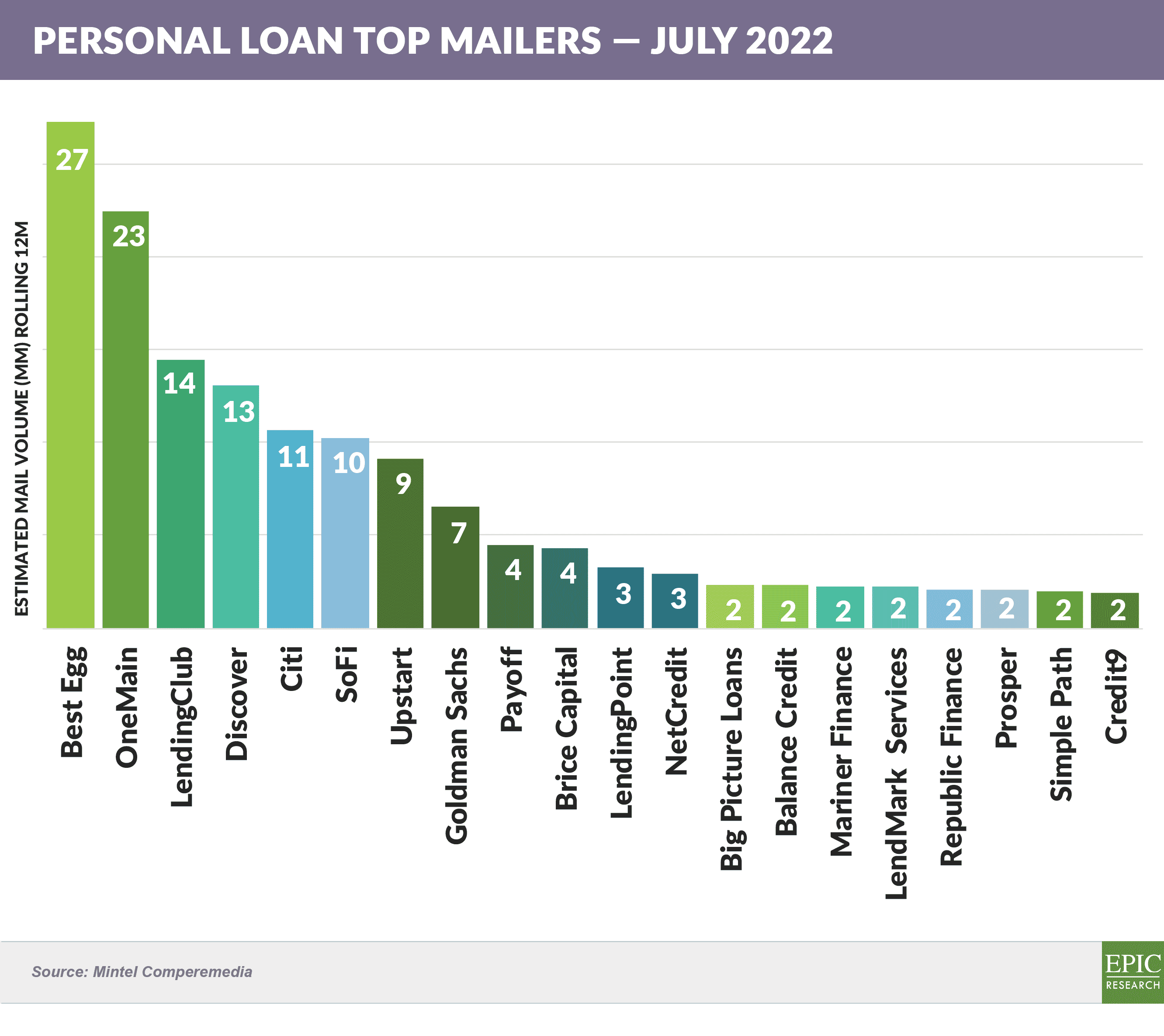

- Personal loan direct mail volume dipped slightly in July

- However, Best Egg and OneMain continue to aggressively market

- With rates rising, issuers are touting the benefits of ease of access to funds and the ability to check your rate prior to application

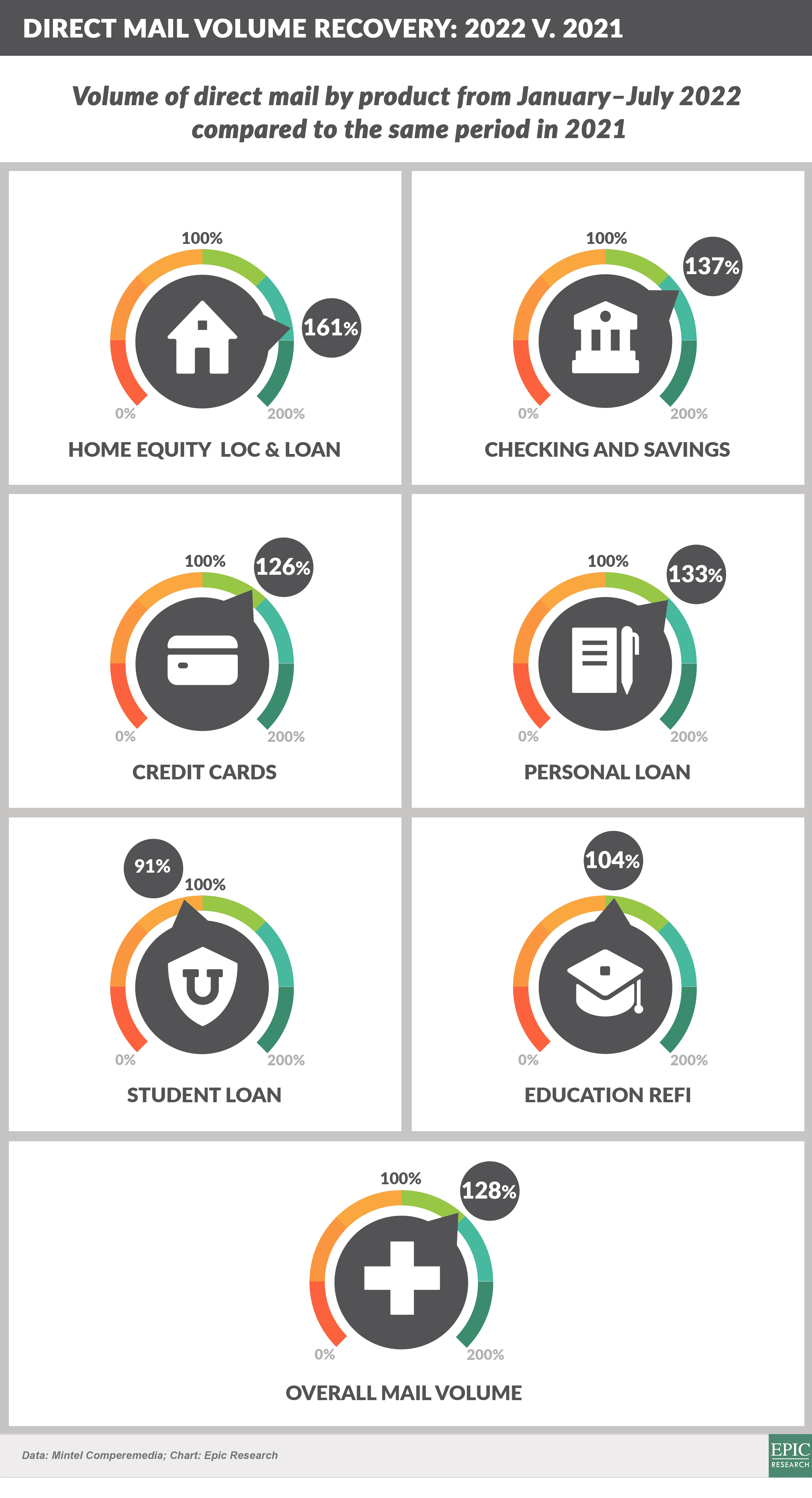

- July direct mail volumes remained generally consistent with earlier months in ’22, with volumes continuing to rise above those of last year

Quick Takes

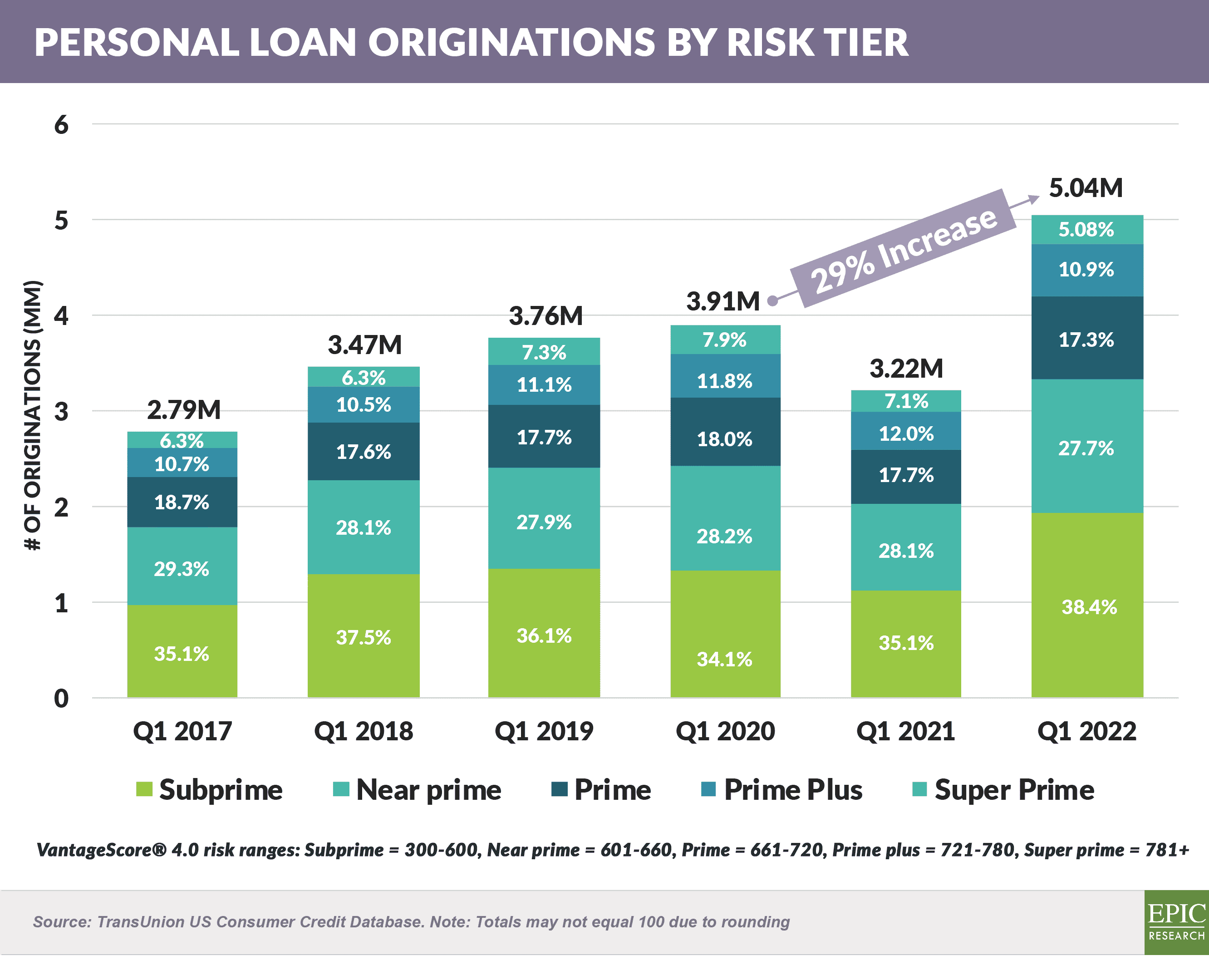

- Following our review last month of fintechs’ dominance of the personal loan market, recent Q1 ’22 data from TransUnion shows a 29% increase in personal loan originations from Q1 ’20, with the proportion of subprime and near prime loans comprising two-thirds of all Q1 ’22 loans

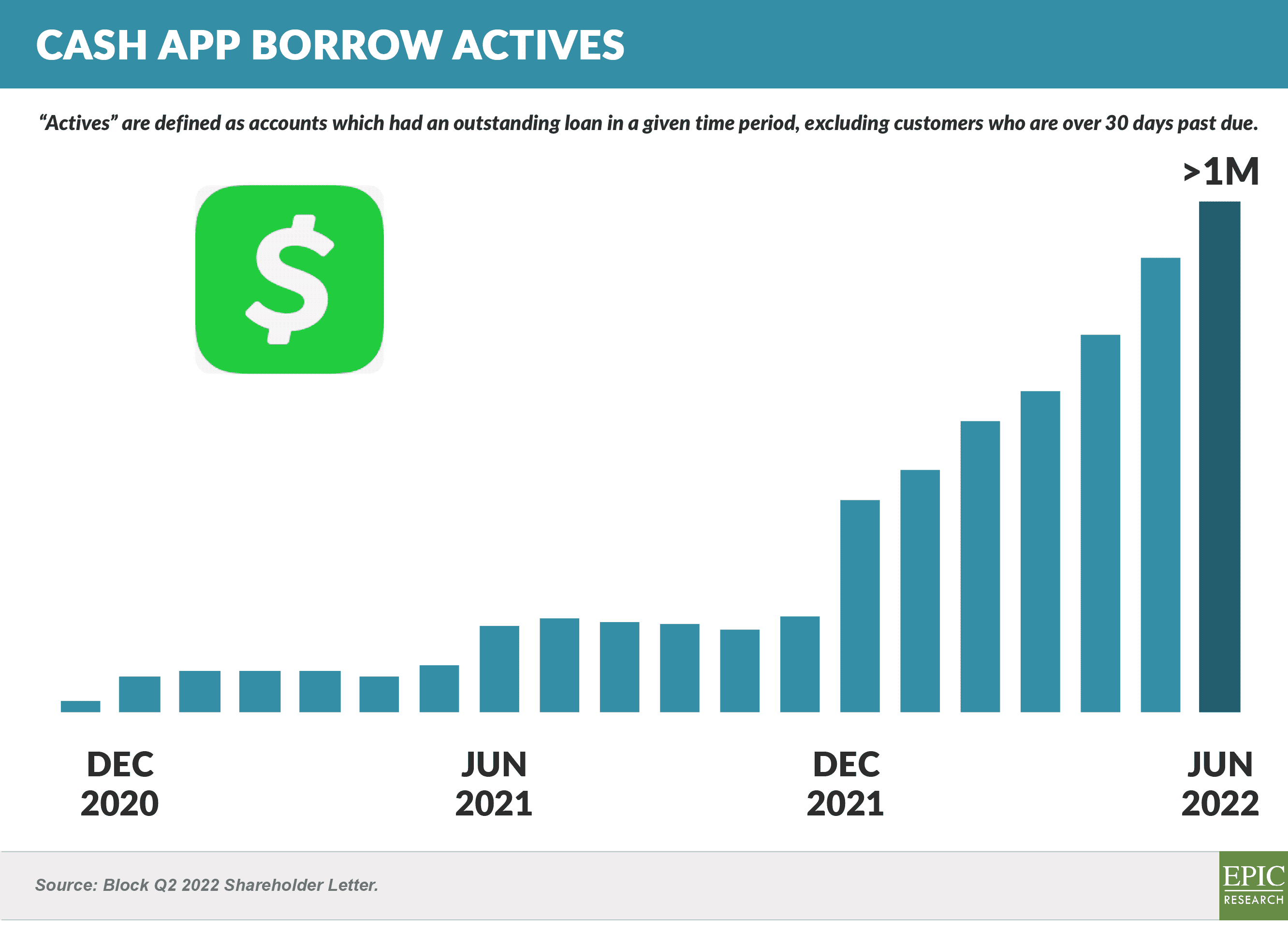

- Cash App announced that its small dollar loan product, Cash App Borrow, generated over 1 million loans in June – the product offers customers up to $600 that can be paid back in scheduled installments or as a percentage of what they receive into Cash App

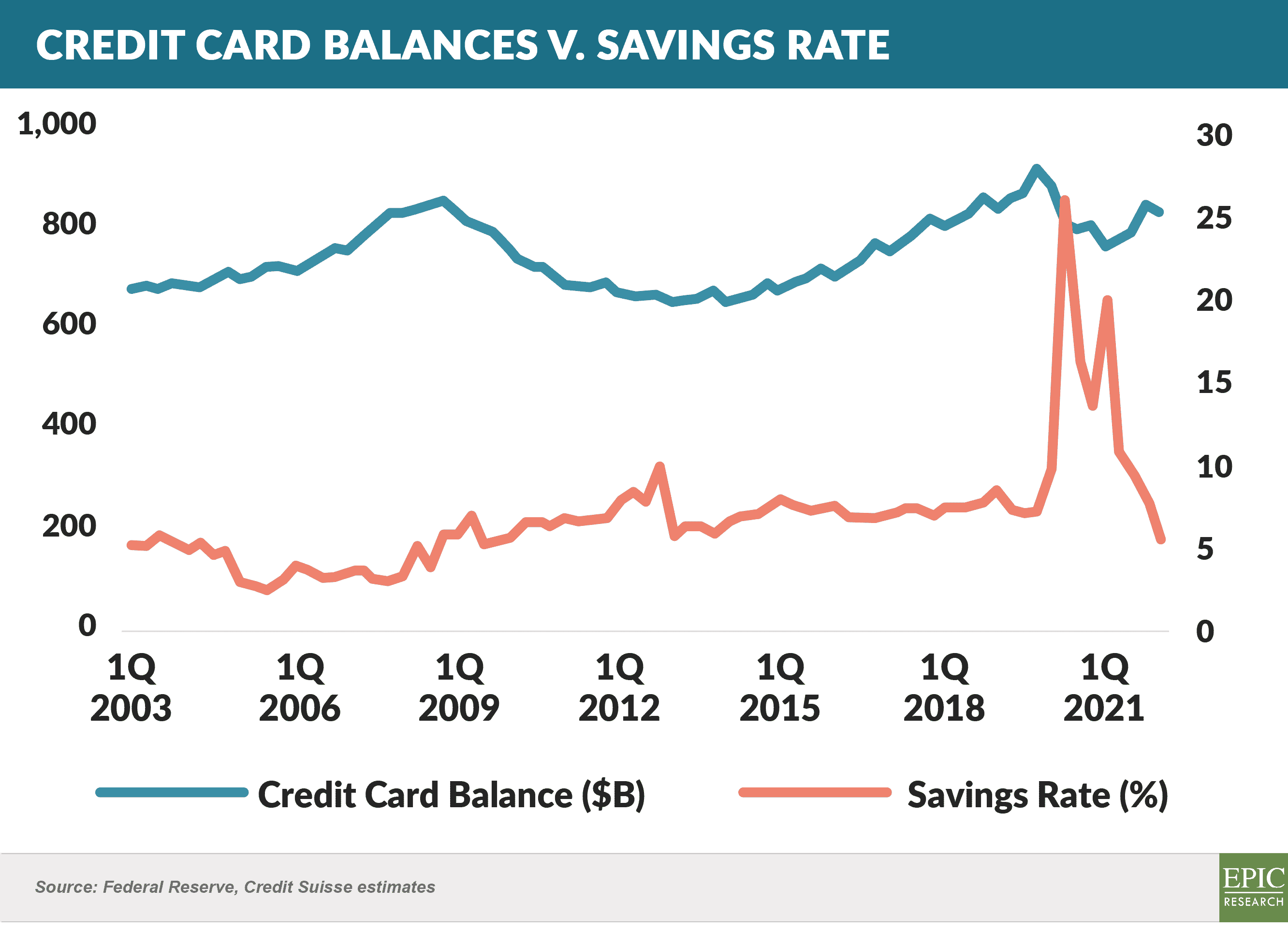

- A recent Credit Suisse report suggests that the recent decline in the consumer savings rate is leading to higher credit card balances

- Credit costs are always under forecasted when going up and over forecasted when coming down

The Epic Report is published monthly, with the next issue publishing on October 1st.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.