Three Things We’re Hearing

- Small business credit card preferences

- Consumer delinquencies moving up

- Growth in cards and loans

A four-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

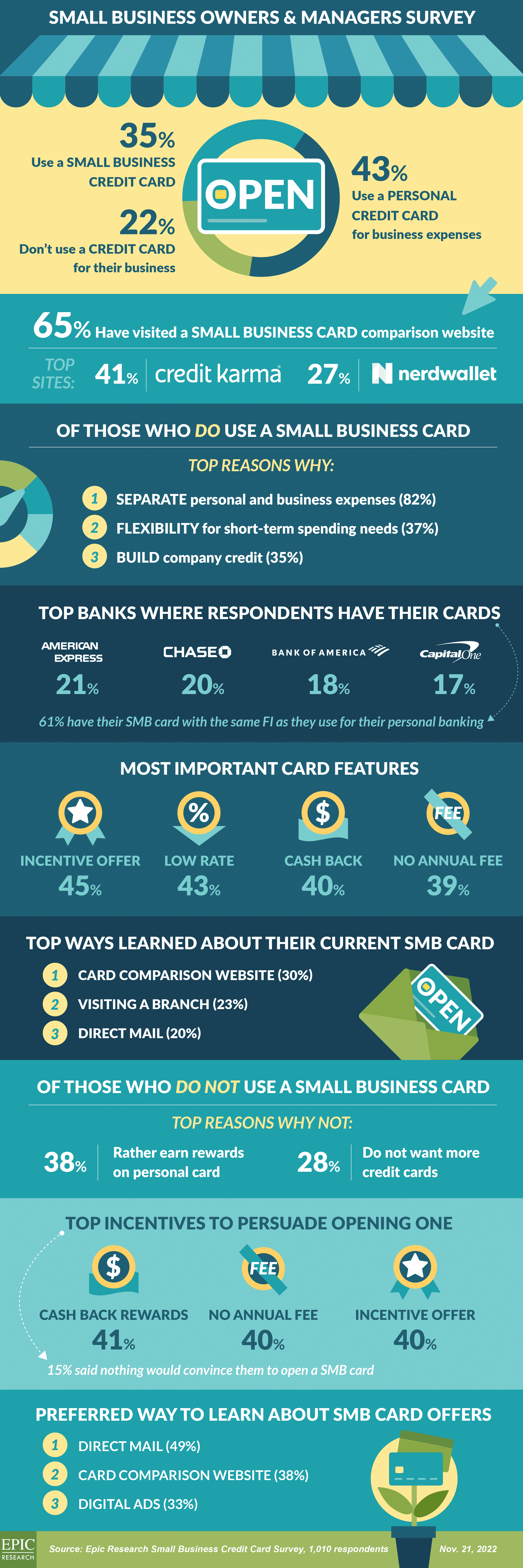

Small Business Credit Card Preferences

- Epic surveyed 1,010 small business owners and managers regarding their credit card preferences, revealing that nearly half prefer to learn about card offers via mail

Consumer Delinquencies Moving Up

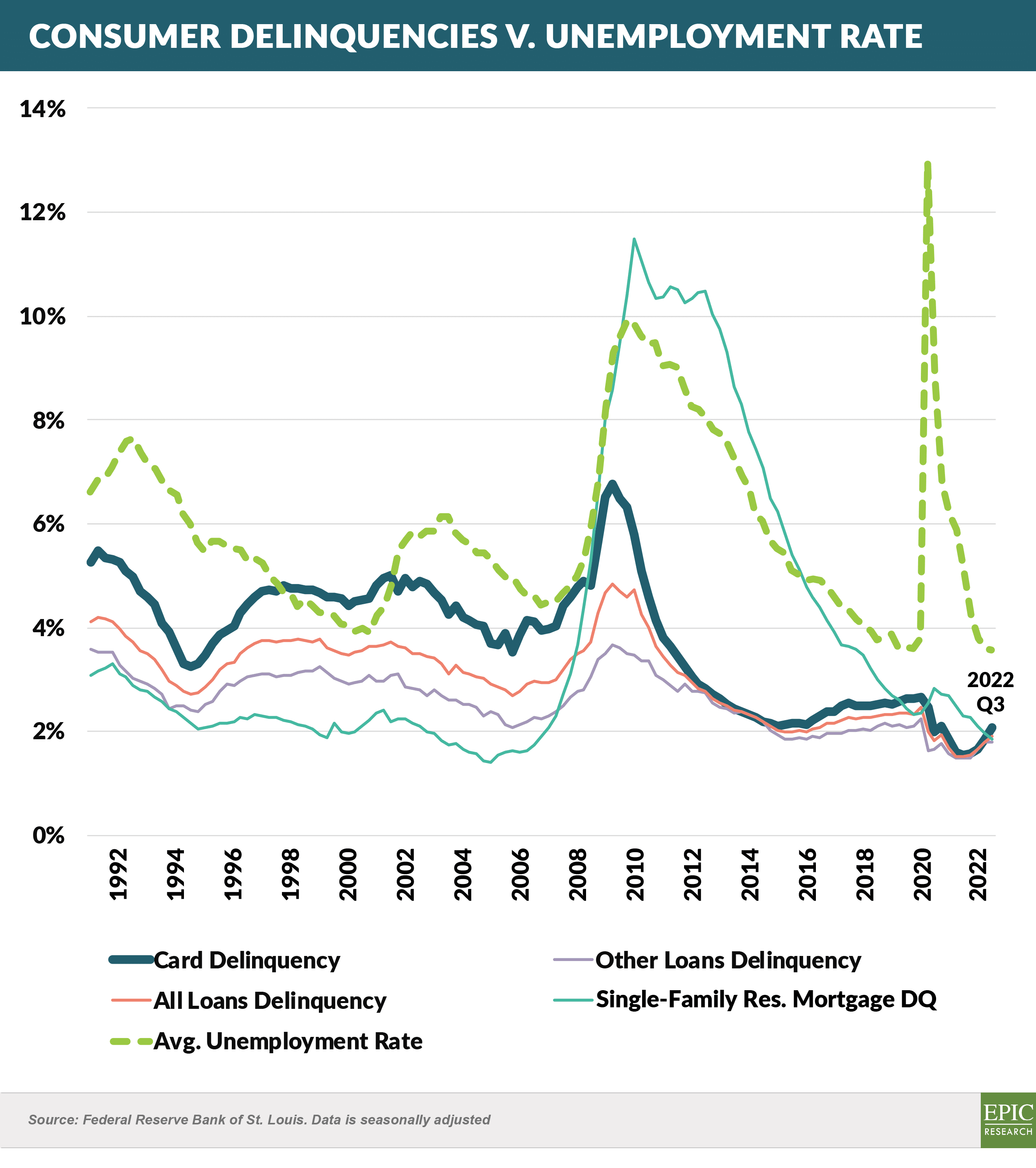

- Despite a weakening in the economy, lenders have continued to report consumer delinquencies at the low end of historical levels

- As shown in the chart above, consumer delinquencies have typically correlated with unemployment; however, in the past two years, the negative effects on asset quality of the (relatively temporary) spike in unemployment were offset by massive government subsidies and reduced consumer spending

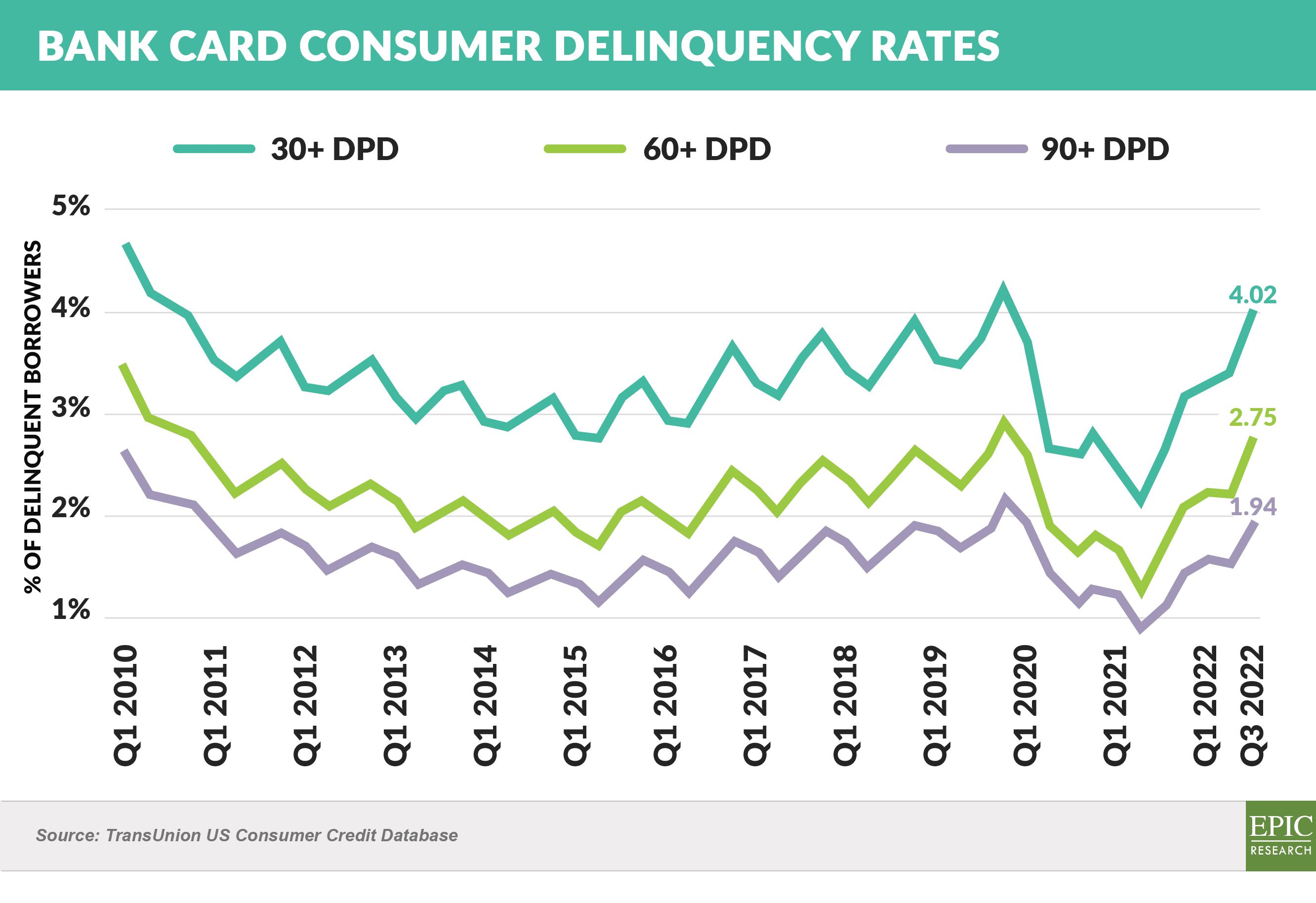

- Recently, consumer bank card delinquencies have begun to increase back towards historical norms

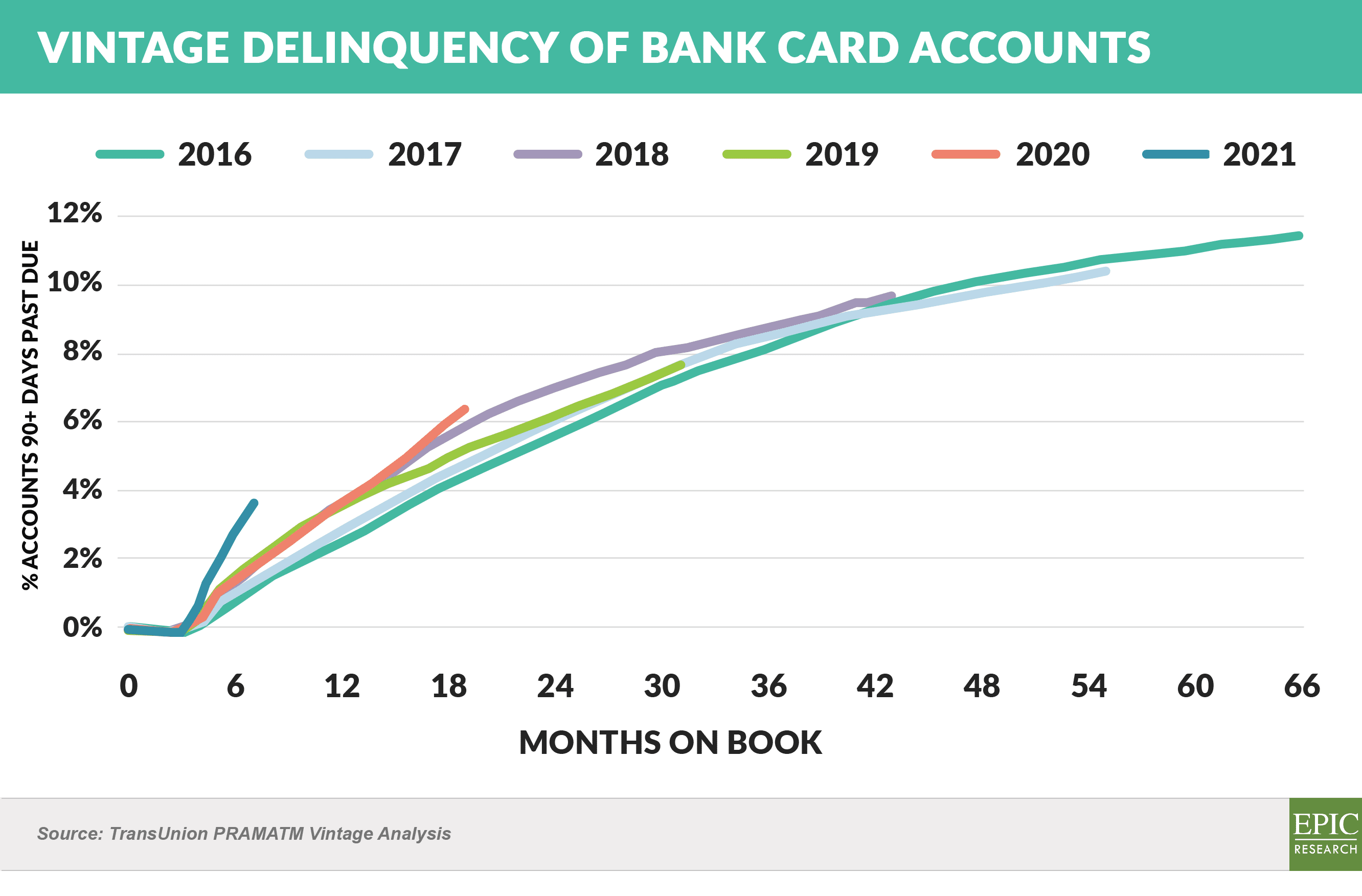

- Much of the increase in bank card delinquencies comes from more recent vintages

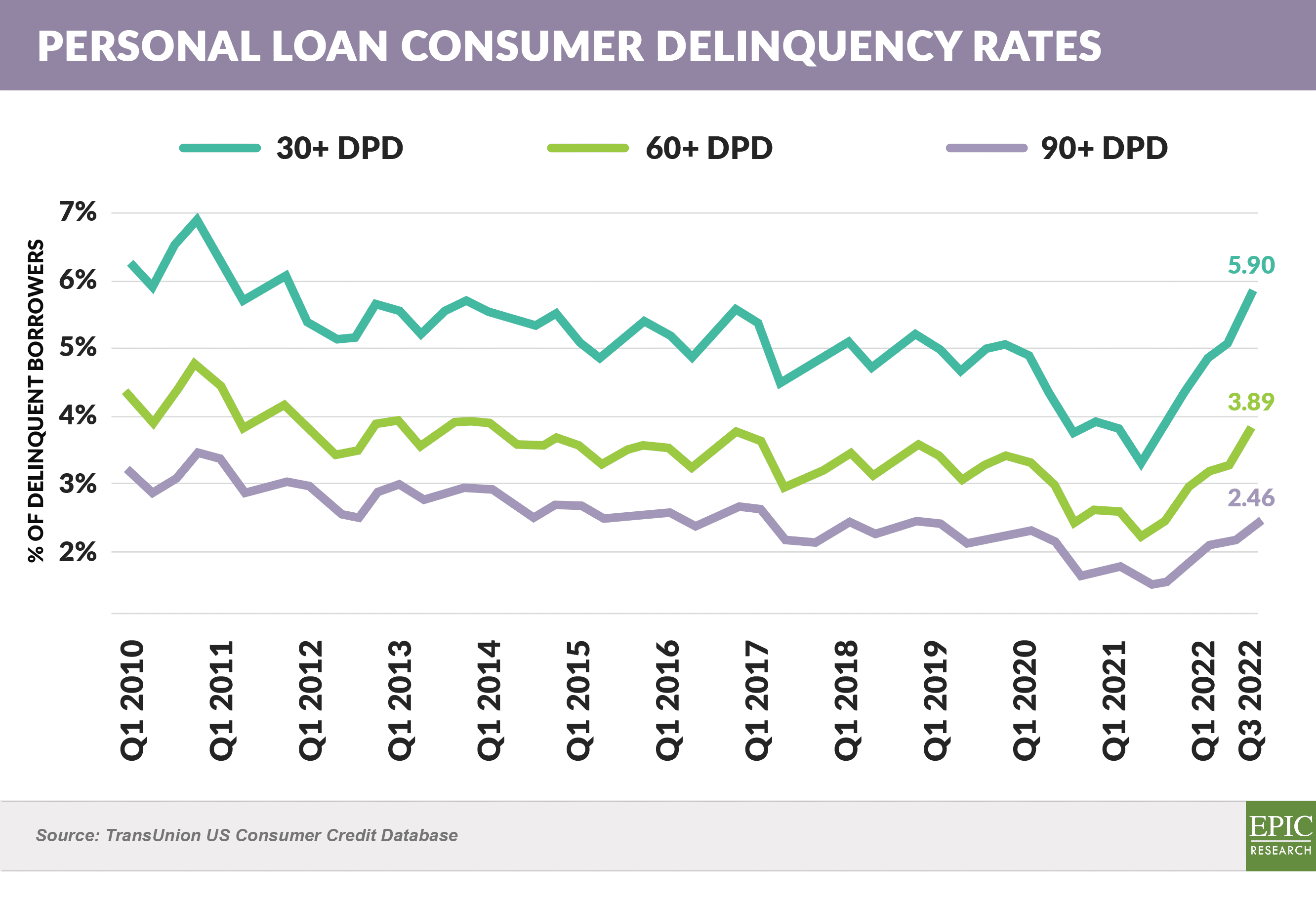

- Personal loan delinquencies are also rising…

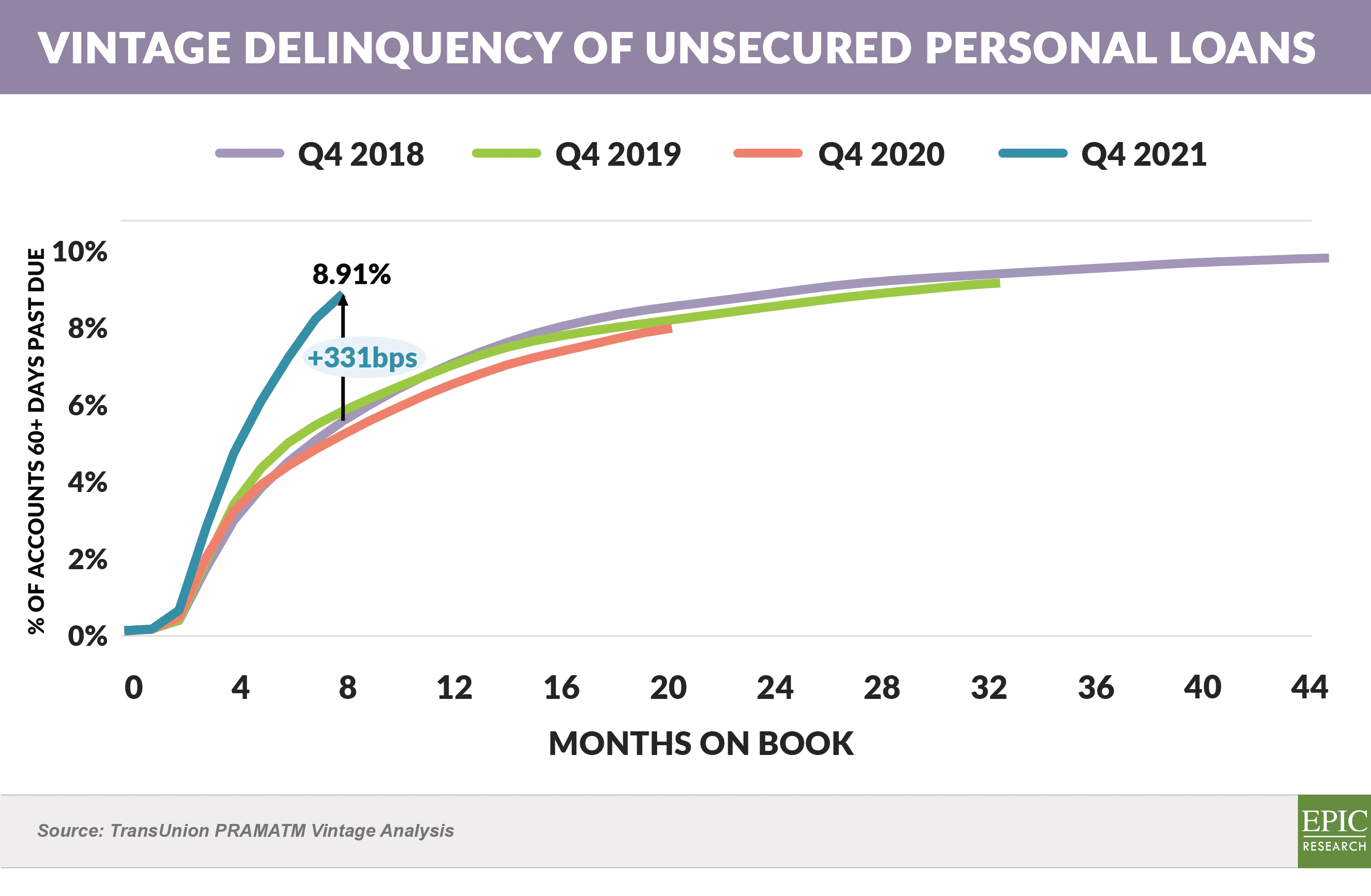

- With increases similarly stemming from recent vintages

- Deterioration in personal loan asset quality has begun at the lower end of the credit spectrum

- Q2 ’22 subprime balances were up 92% year-over-year, and sub-prime delinquencies (60+ days past due) for this segment have now risen for four straight quarters

- The 3.37% Q2 ’22 delinquency reading is up 47% from last year, though it remains near pre-pandemic levels

Growth in Cards and Loans

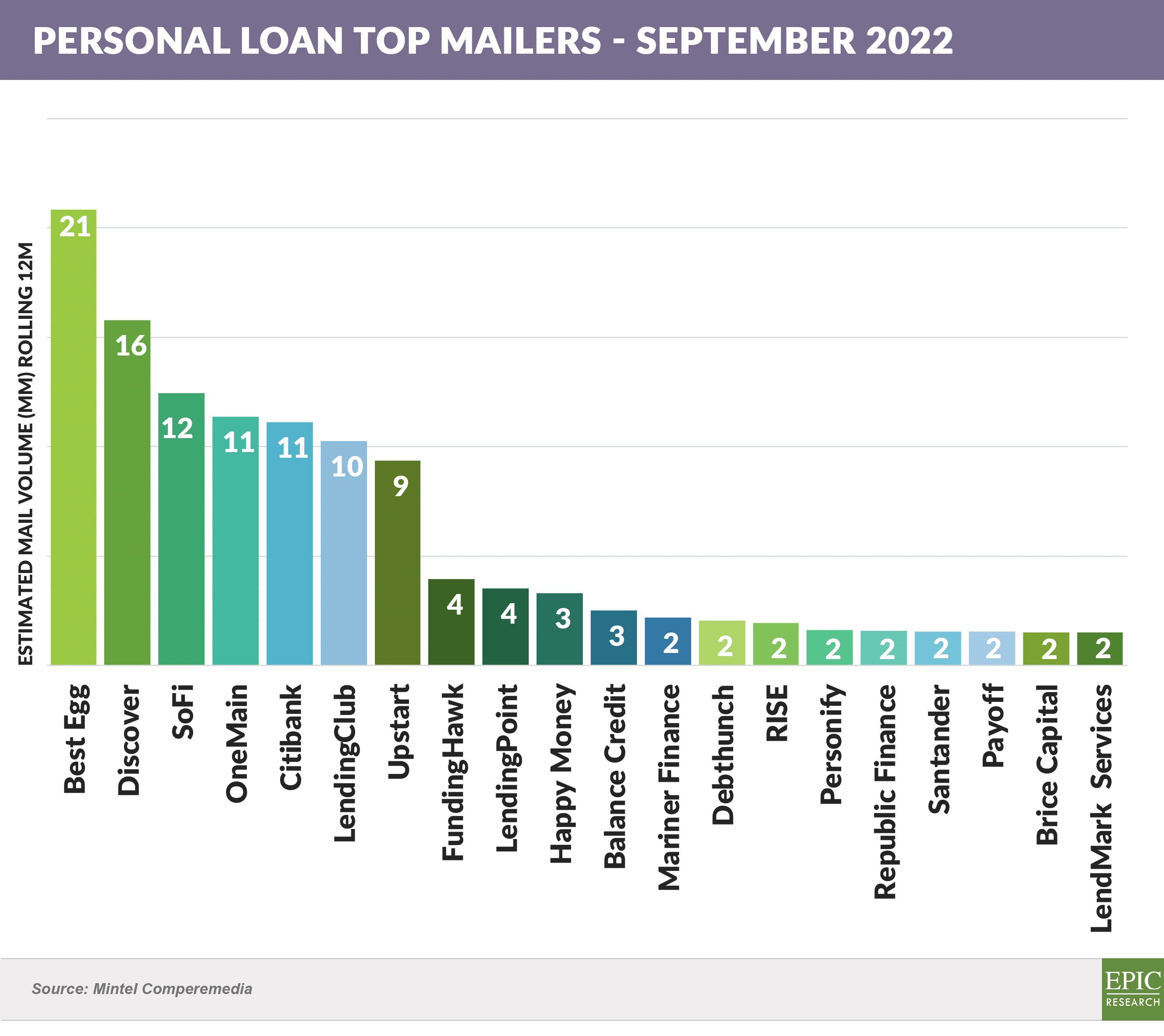

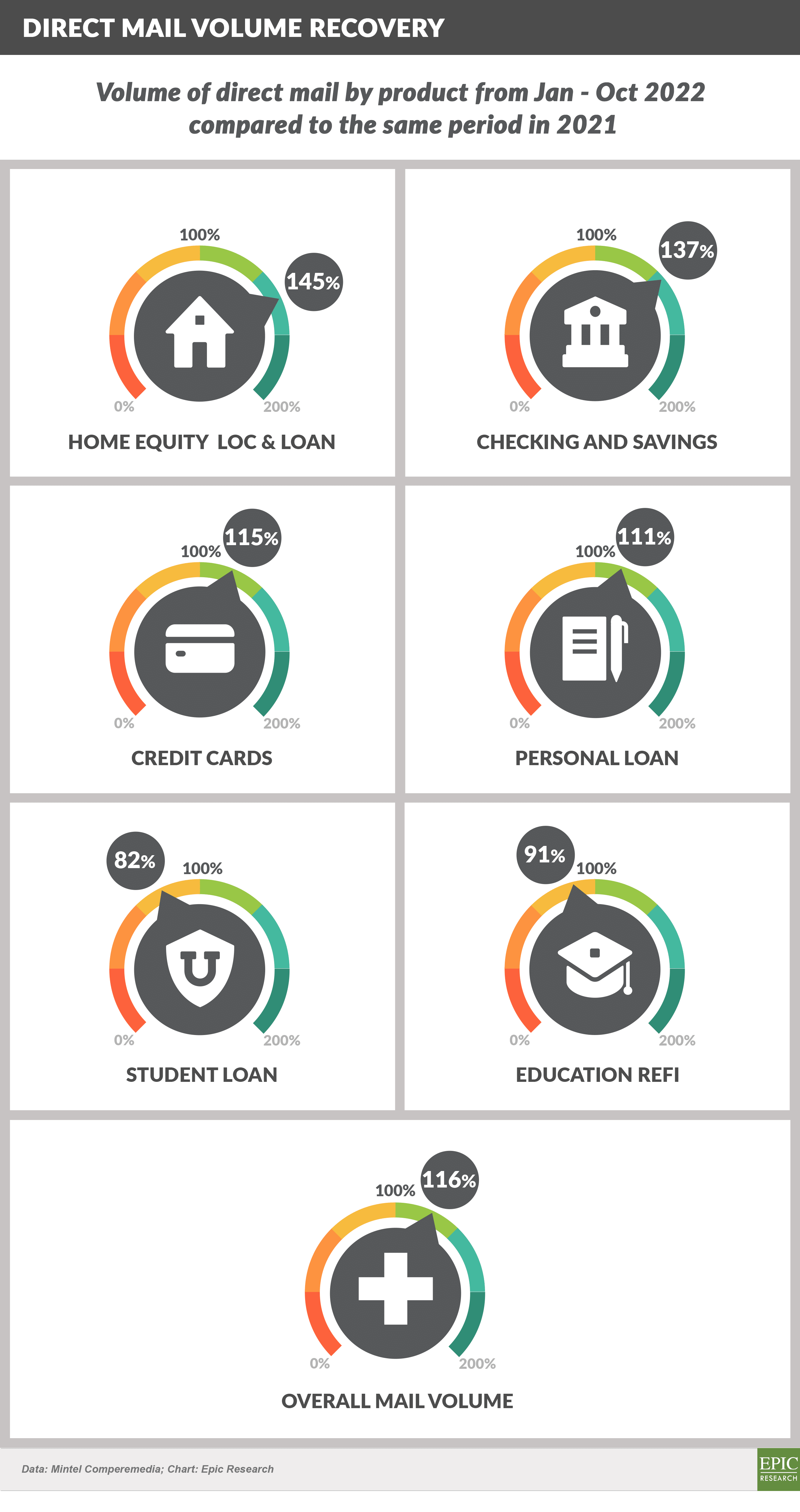

- Year-to-date personal loan mail volume sits 11% above the same period in ’21

- Best Egg ramped up its direct mail significantly, with volume far above others – 27 million mail pieces in October vs. number two SoFi with 16 million pieces

- Among retail banks, Citi had a larger presence than previous months, with Wells Fargo and Santander joining the fintechs in the top 25 mail rankings

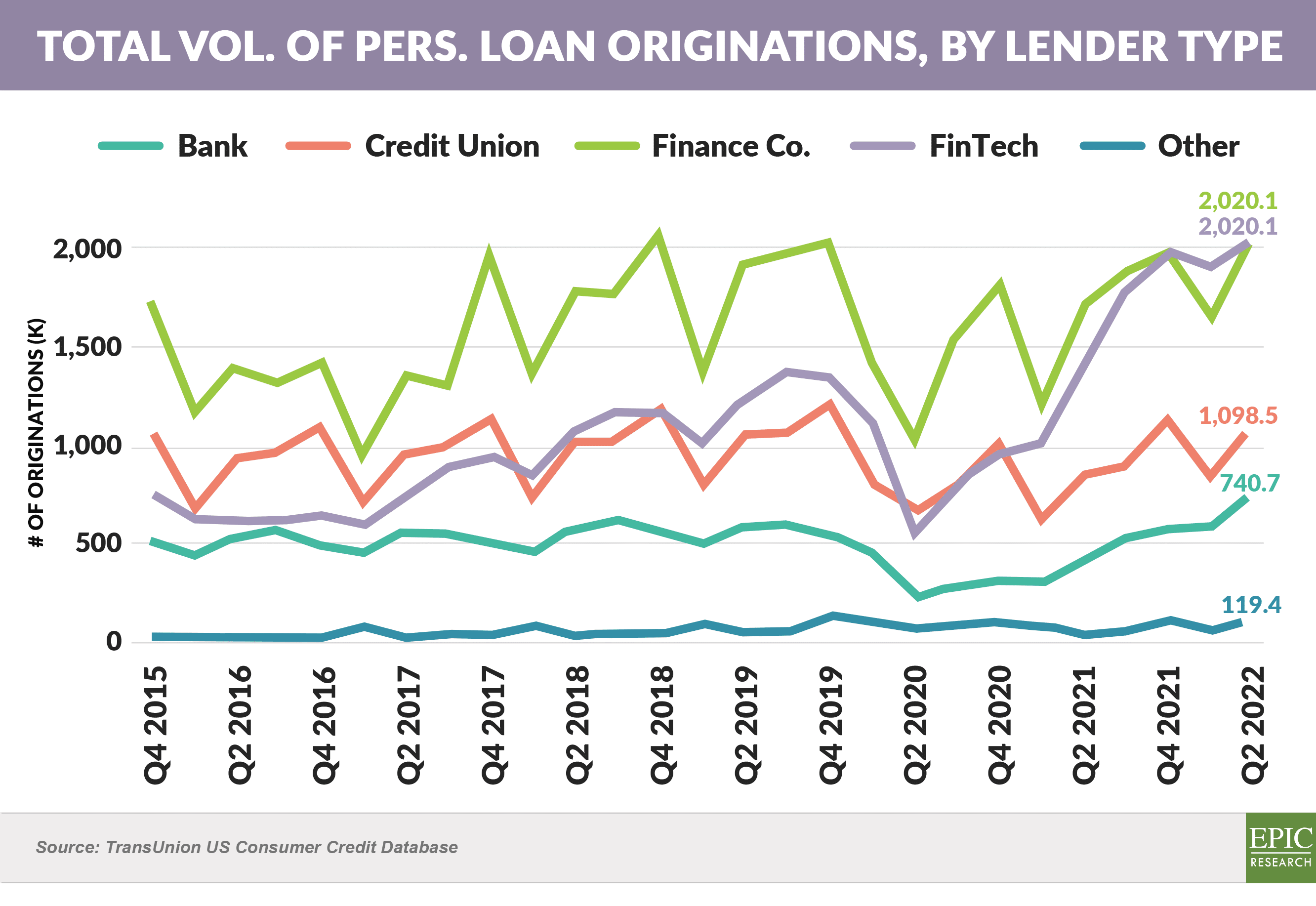

- Fintechs continue to originate a large percentage of new personal loans

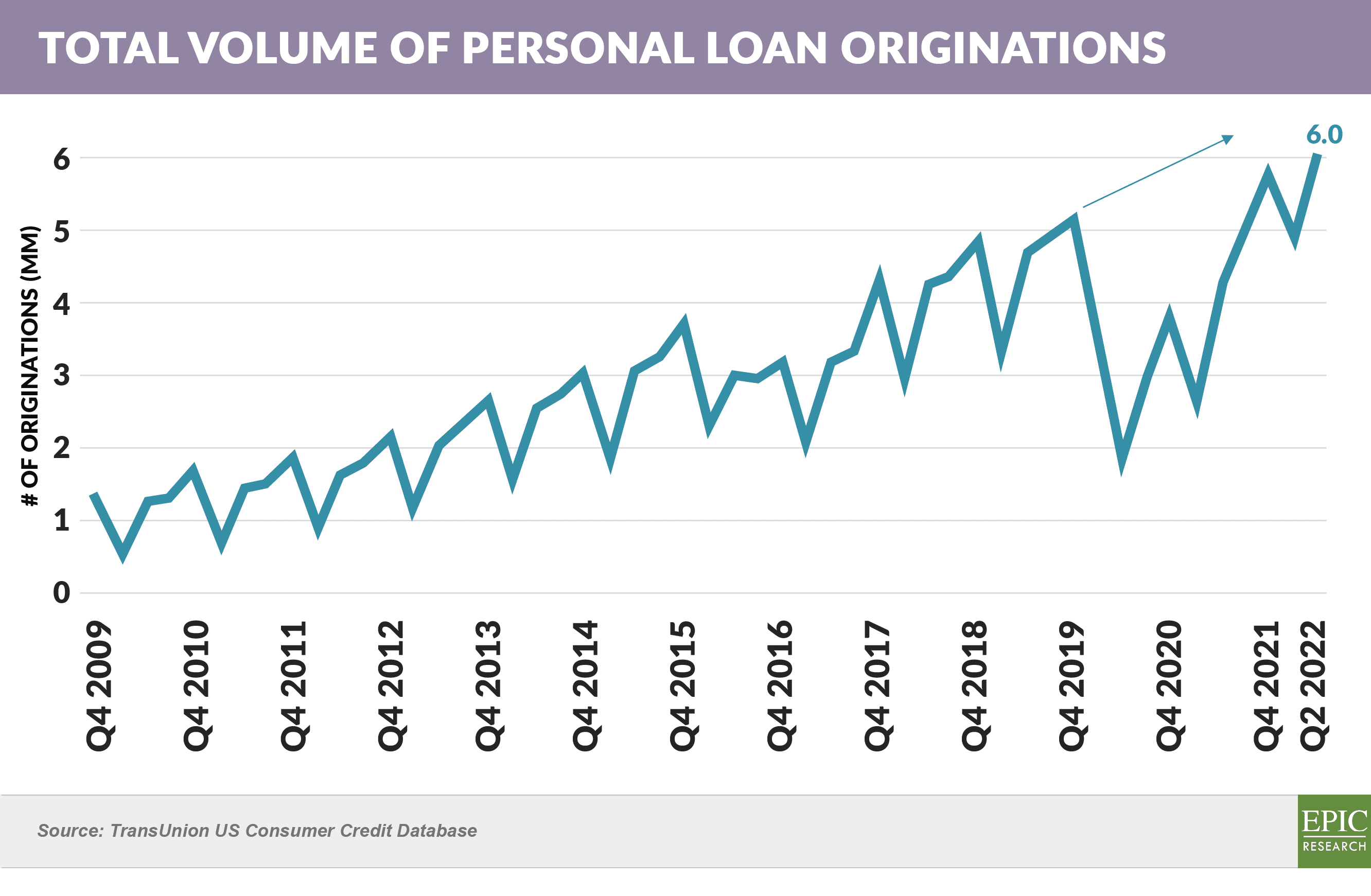

- Overall, total personal loan originations have resumed the upward trend established prior to the pandemic

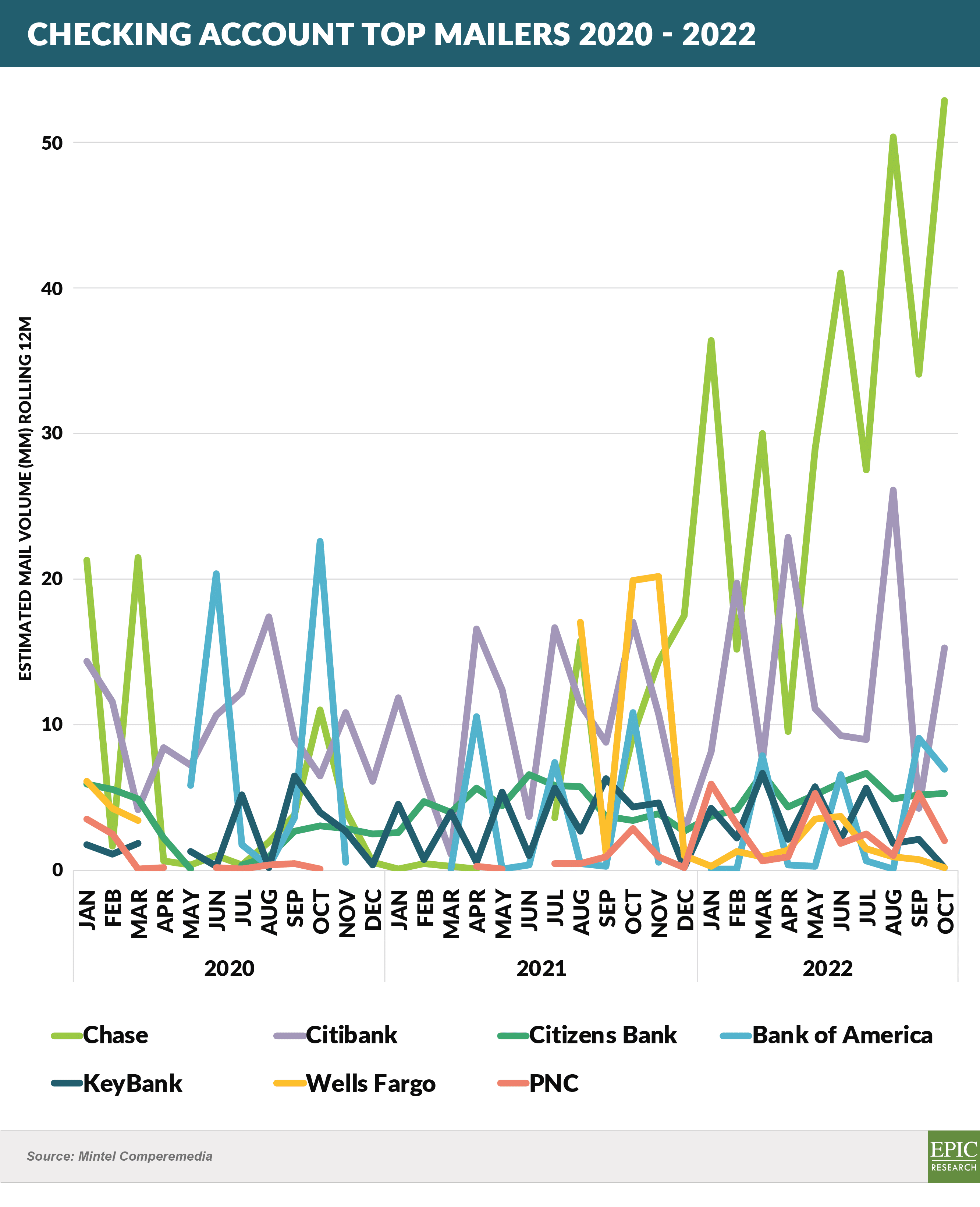

- Chase significantly increased its DDA mailings – 2022 volumes through October soared 958% above 2021 levels (326MM in 2022 vs. 31MM in 2021)

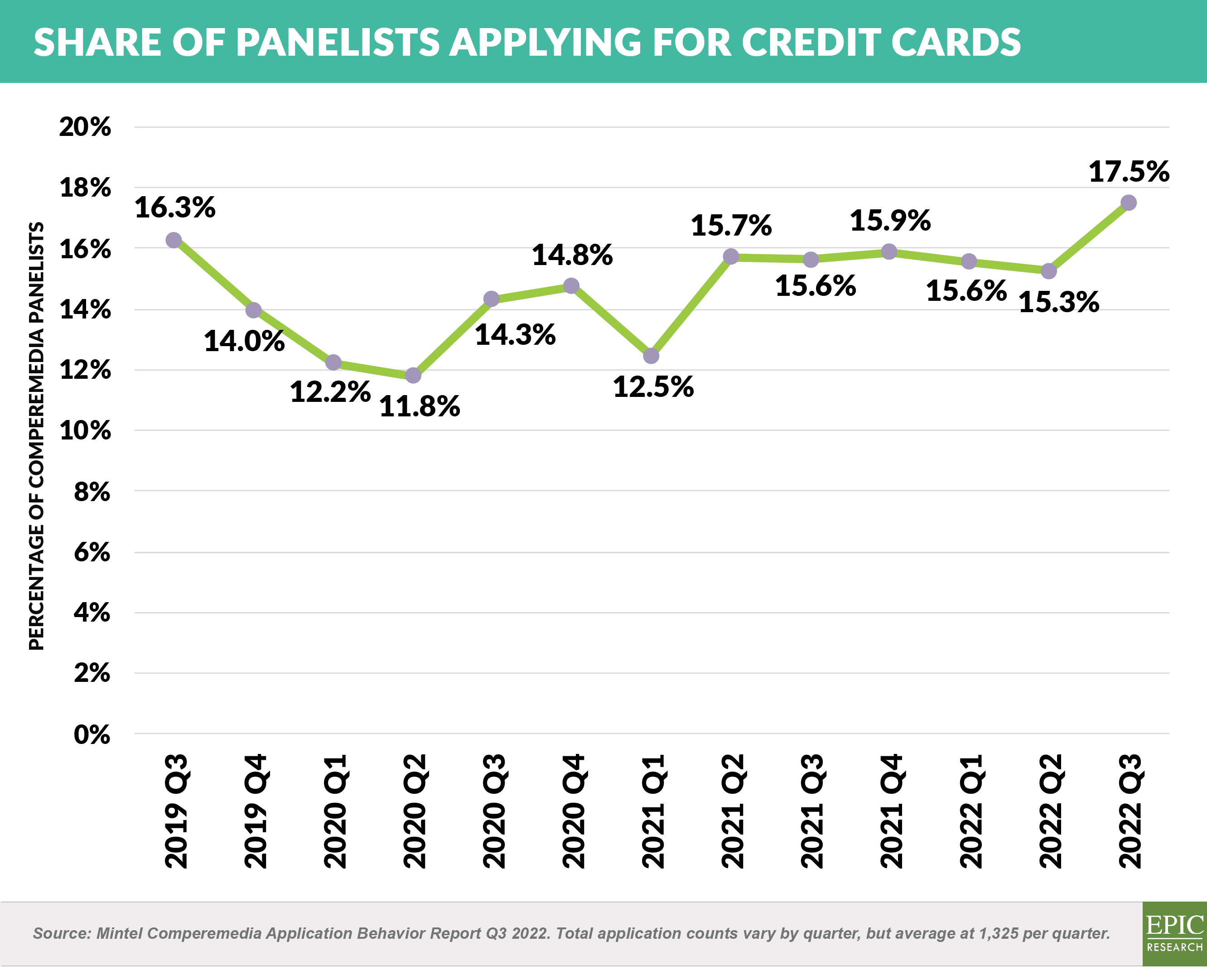

- Comperemedia reports that the percentage of its panelists applying for a credit card in Q3 ’22 reached a three-year high

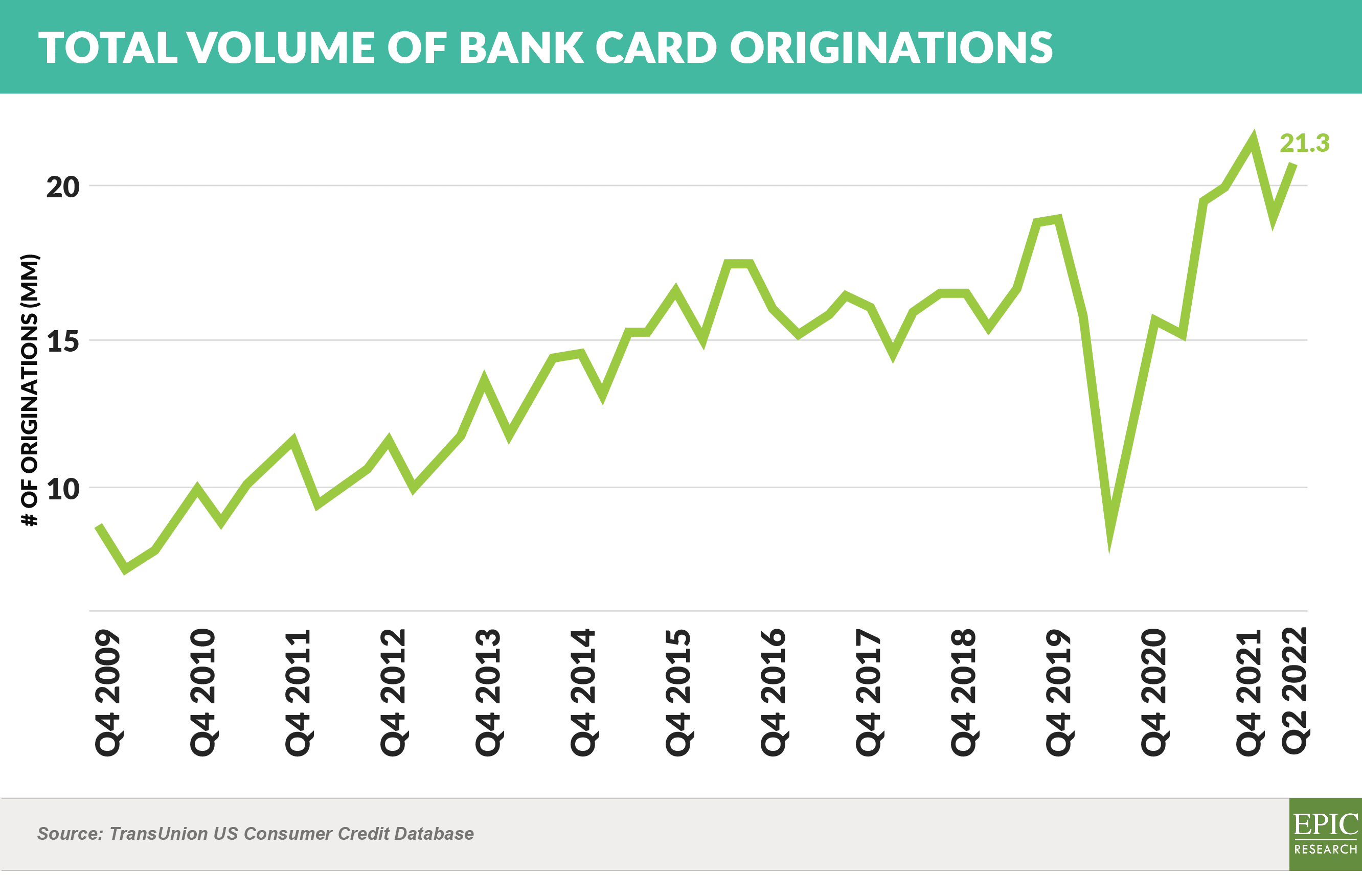

- Q2 ’22 bank card origination volume was the second highest on record

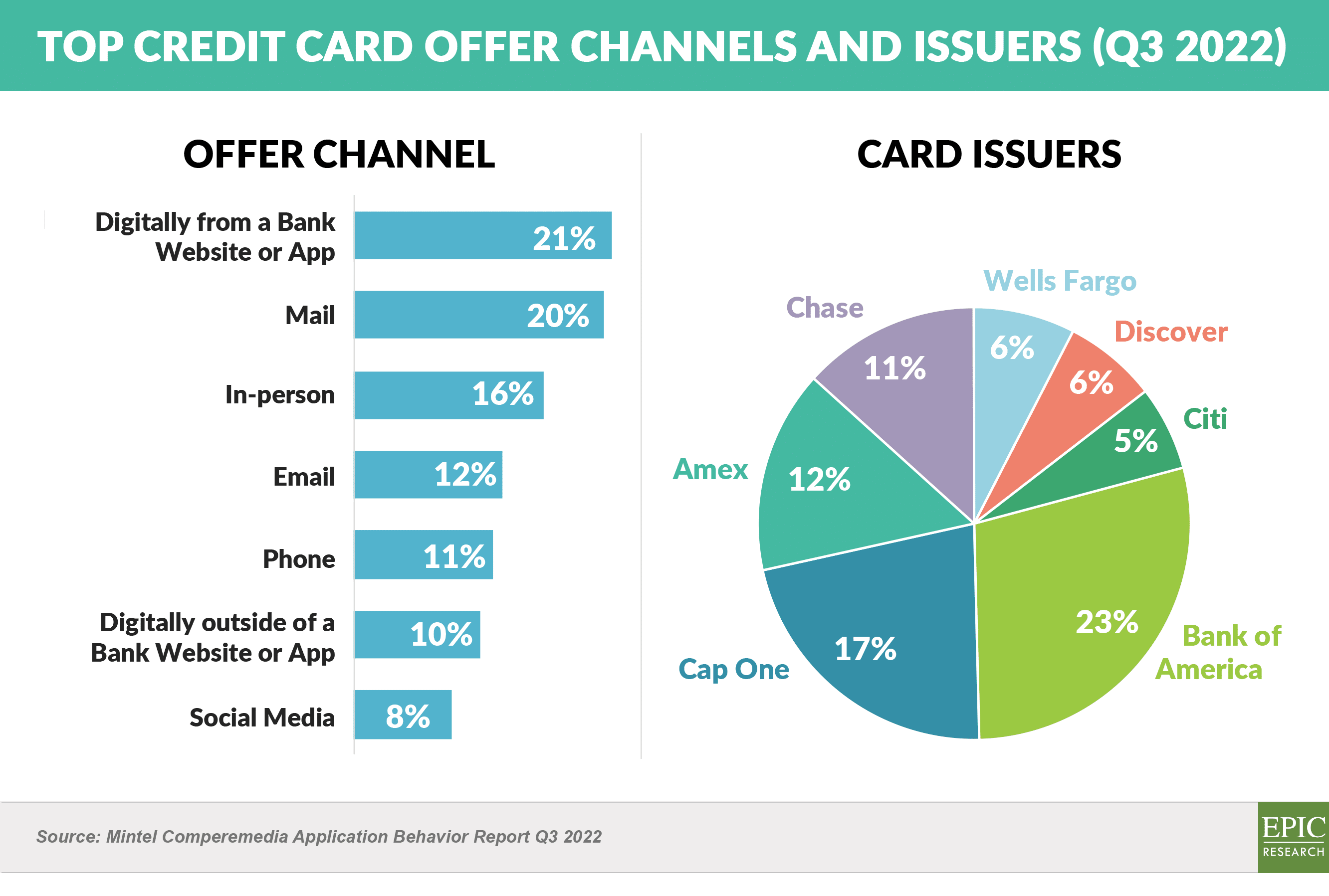

- Digital and mail channels proved the most prevalent sources of card offers for respondents

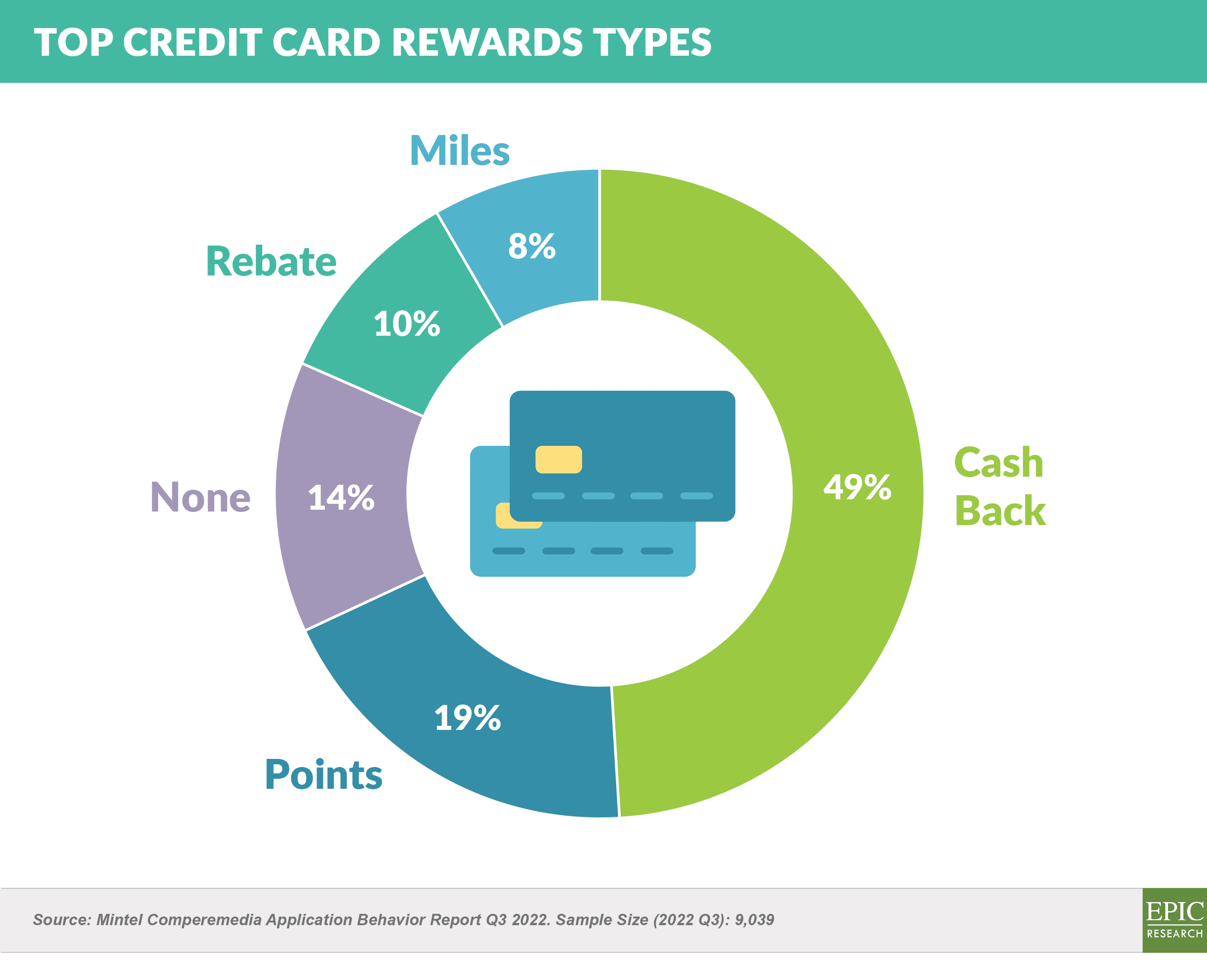

- Half of the card offers included cash back rewards, and “points” came in second with 19%

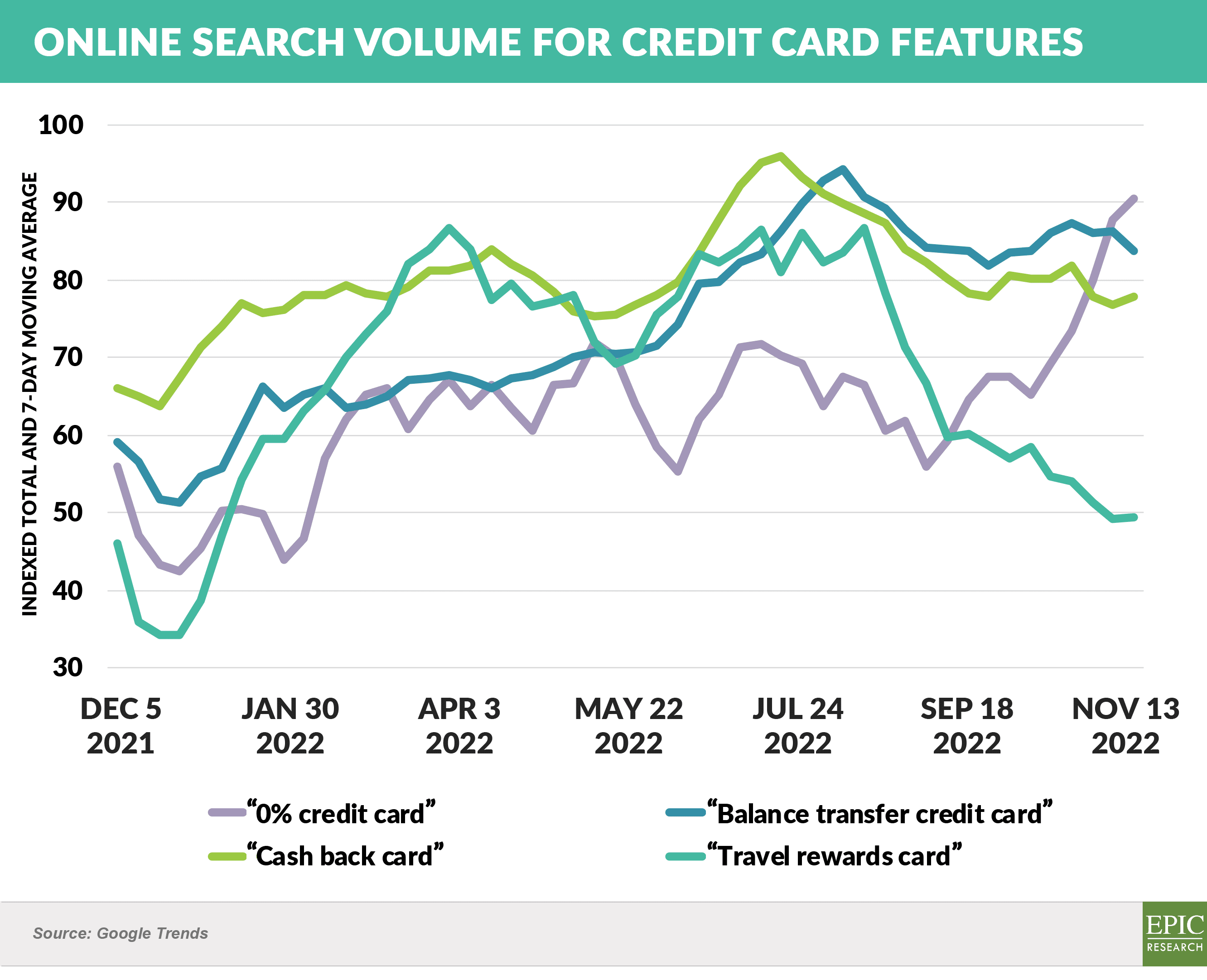

- Google Trends shows a sharp increase in online search volume for “0% credit cards” in recent months as rates have risen

- Overall mail volume for the consumer finance products we track was 116% above the same period last year

Quick Takes

- Square has partnered with American Express to issue a new small business credit card

- Square’s new card will be available to Square merchants and “integrate directly with Square’s broader ecosystem of solutions, empowering sellers to organize their finances and manage their cash flow from the same platform they use to run their business”

- Additional details about the card and benefits will be announced in 2023

- The Biden administration extended the student loan payment moratorium while it awaits the Supreme Court’s ruling on Biden’s student loan forgiveness plan

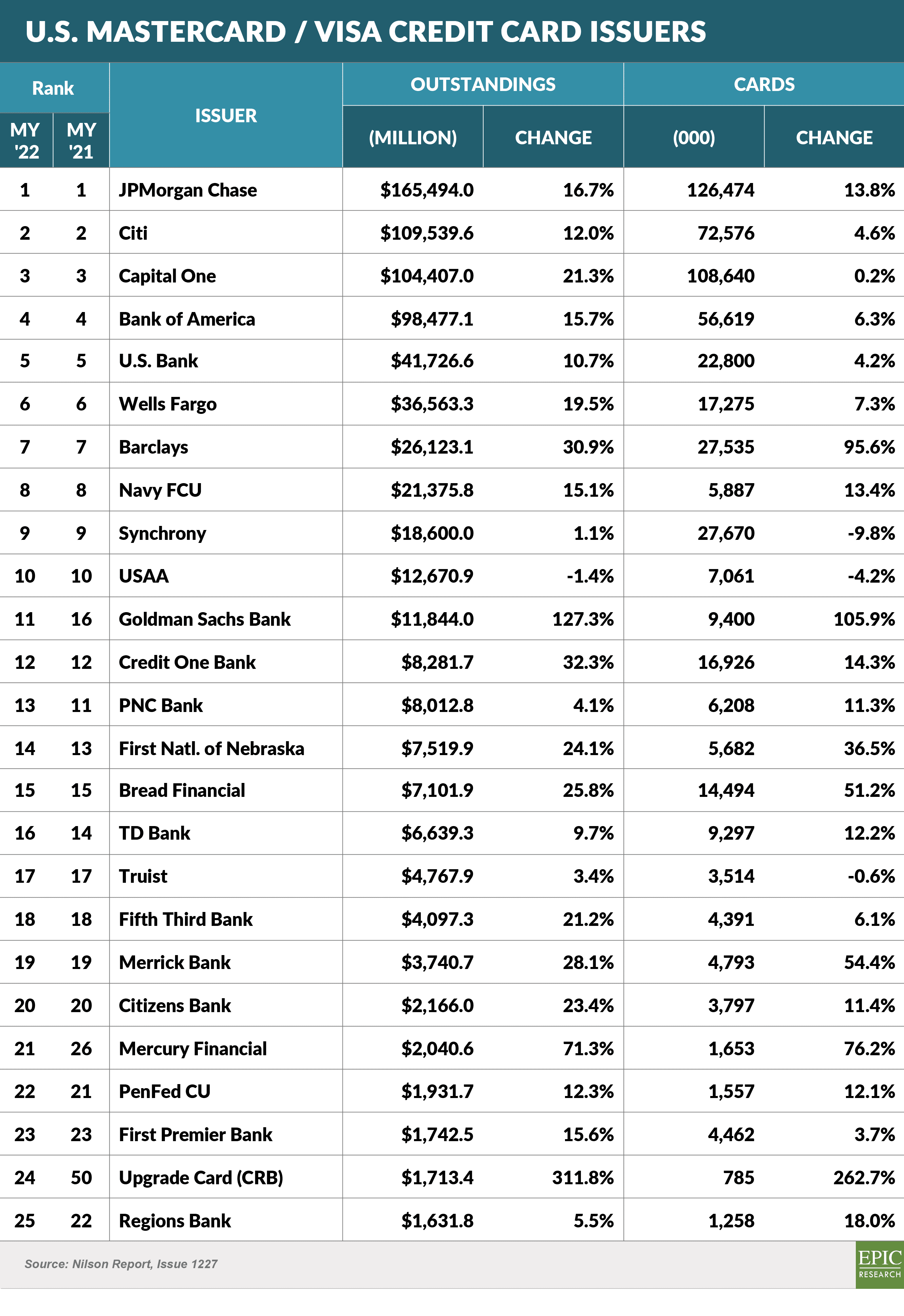

- The mid-year top credit card issuer rankings reflect the return of balance growth, with most showing solid double-digit gains over 2021

- Funnel vision!

- One of the primary differences between “monoline” issuers of lending products and less specialized retail banks is monoline issuers’ attention to the acquisition “funnel” – the progression of applicants through the process to becoming approved loans

- Many legitimate reasons exist for preventing an applicant from becoming a customer – e.g., poor credit scores and potential fraud – however, many credit and fraud policies remain overly broad and inefficient (what is the lost NPV of all of the accounts lost to multiple fraud checks?)

- Although requiring attention to detail and a commitment to testing, the cumulative effect of funnel improvements can vastly increase approval rates and turn a large number of applicants who may have previously been lost into “free” customers

- Give it a try!

The Epic Report is published monthly, with the next issue releasing on January 7th.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.