Three Things We’re Hearing

- We review regional bank marketing!!!

- Epic Credit Card Mt. Rushmore – who’s next???

- Spending on TV and online channels perks up

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

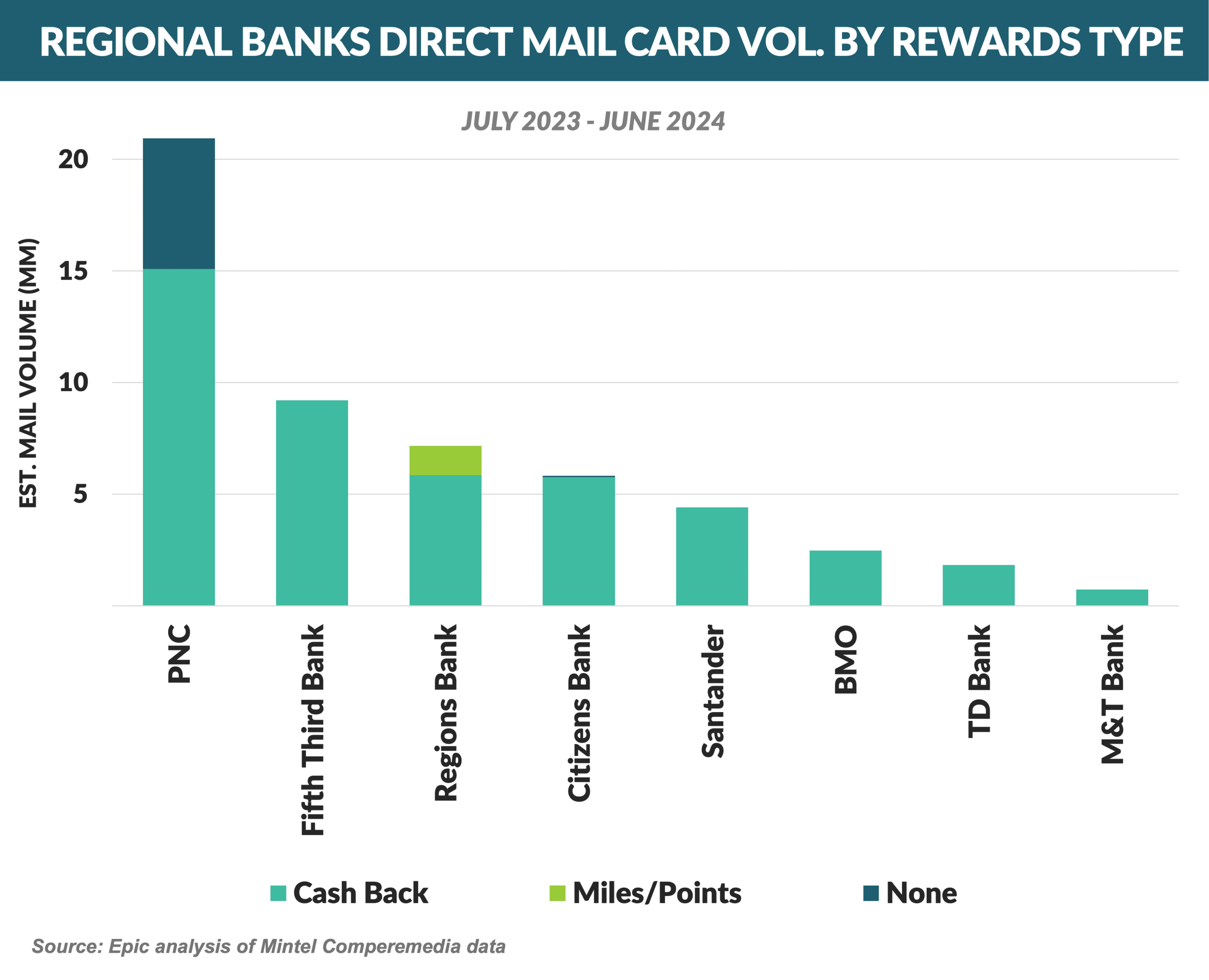

We Review Regional Bank Marketing

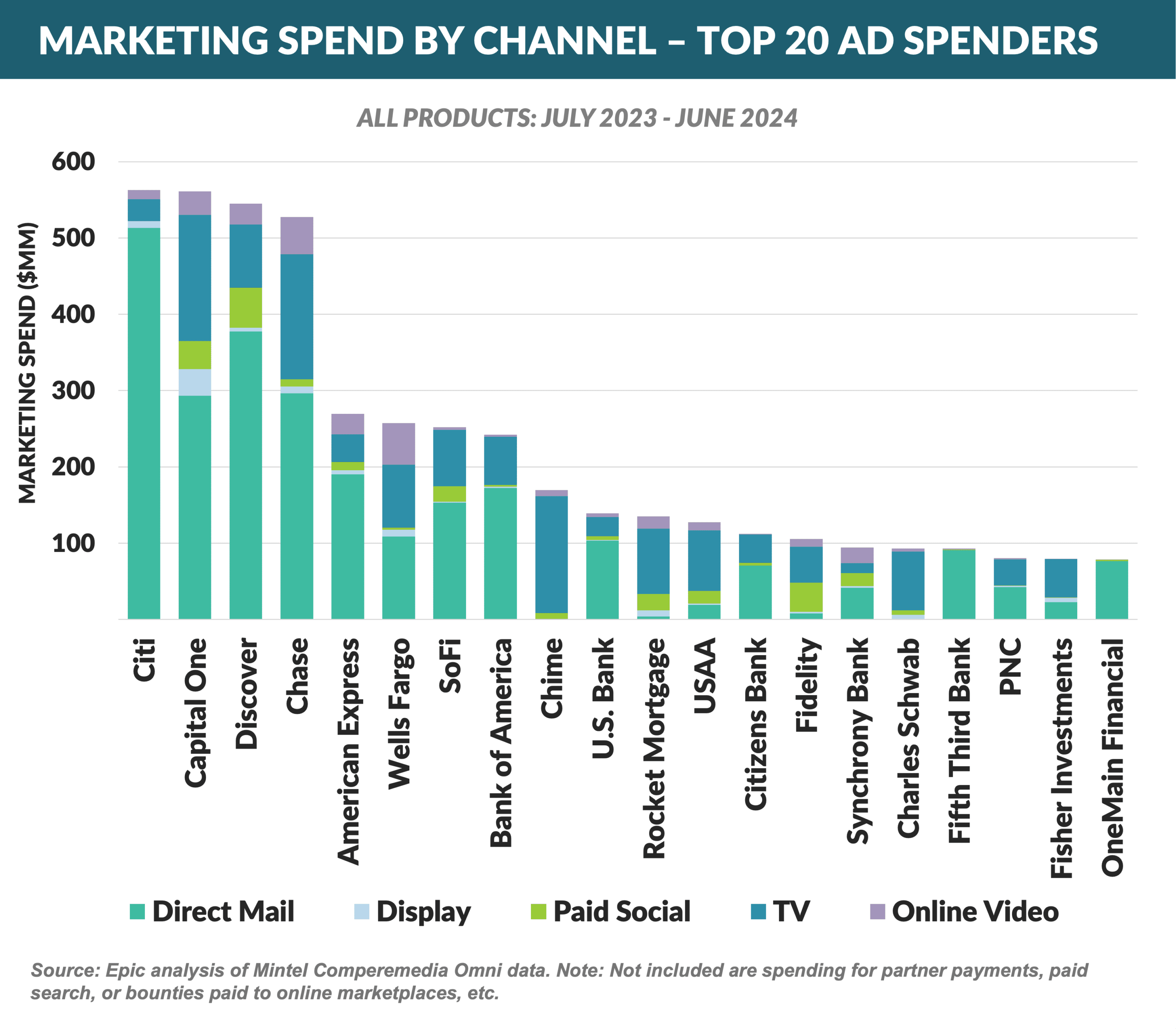

- Citi, Capital One, Discover, and Chase have been the largest advertisers of consumer financial products in the past 12 months

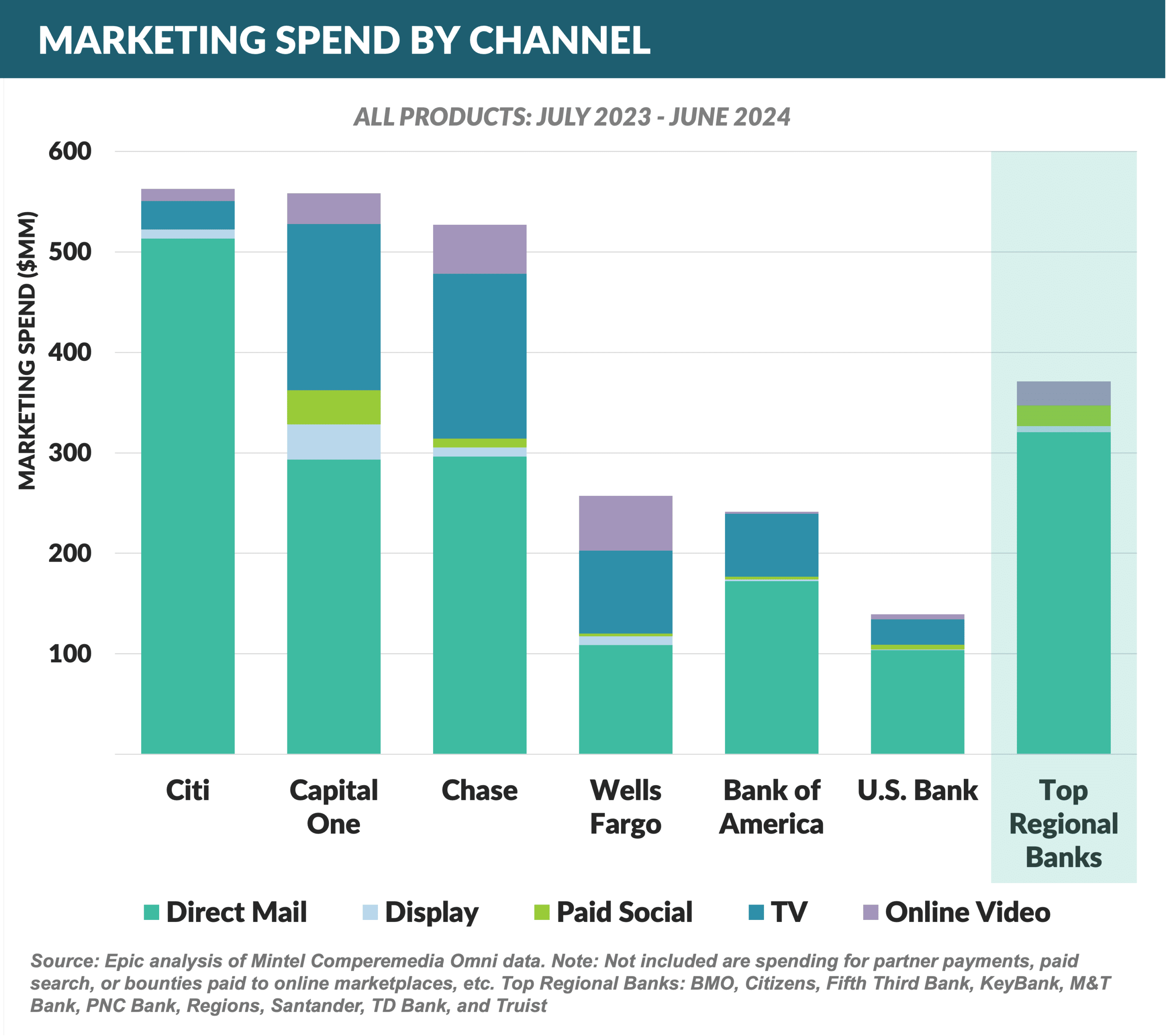

- Most of the spending by both the largest advertisers and the top regional banks is through direct mail, with TV as the second biggest channel

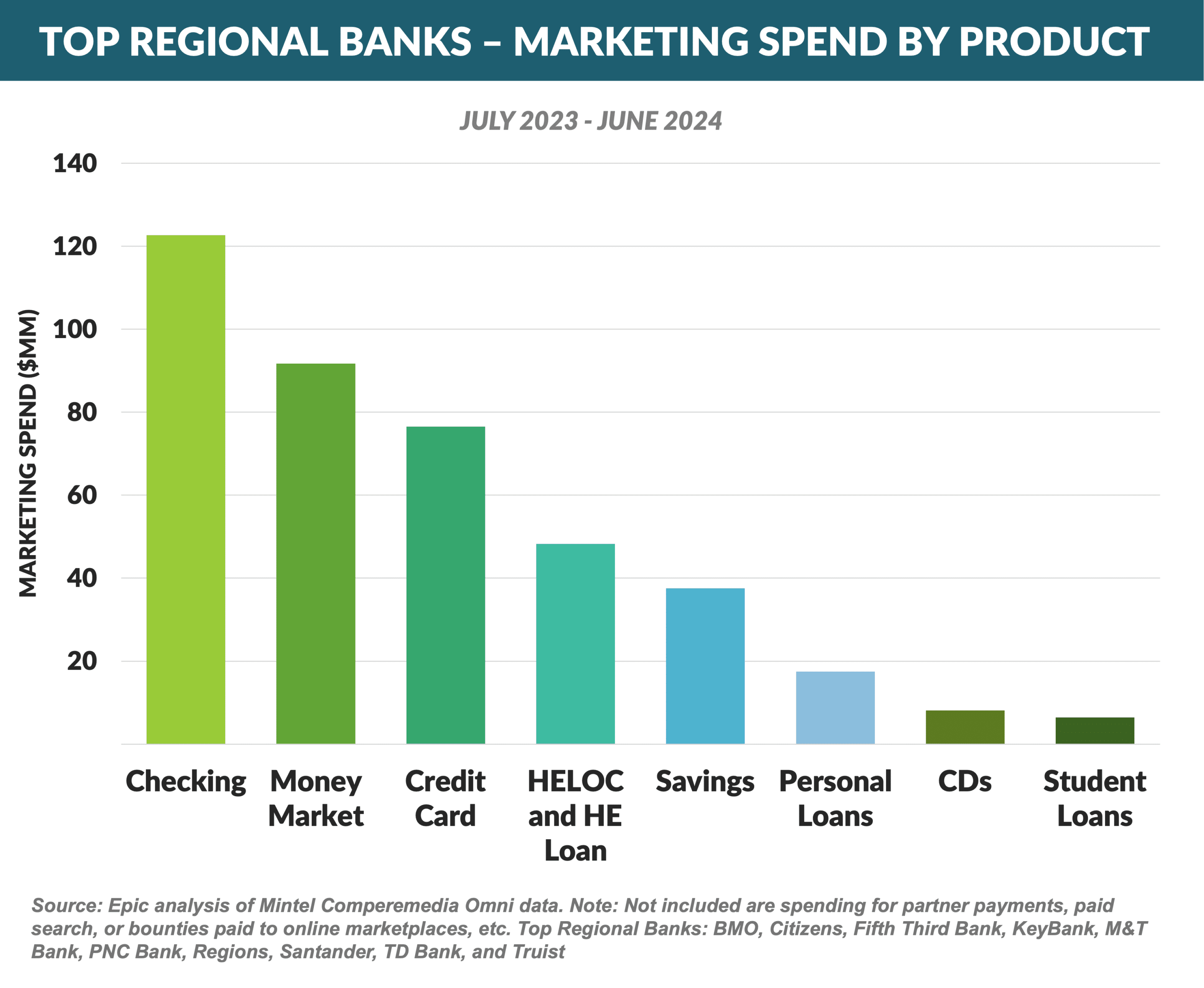

- Checking, money markets, and credit cards were the leading products advertised by regional banks in the past 12 months

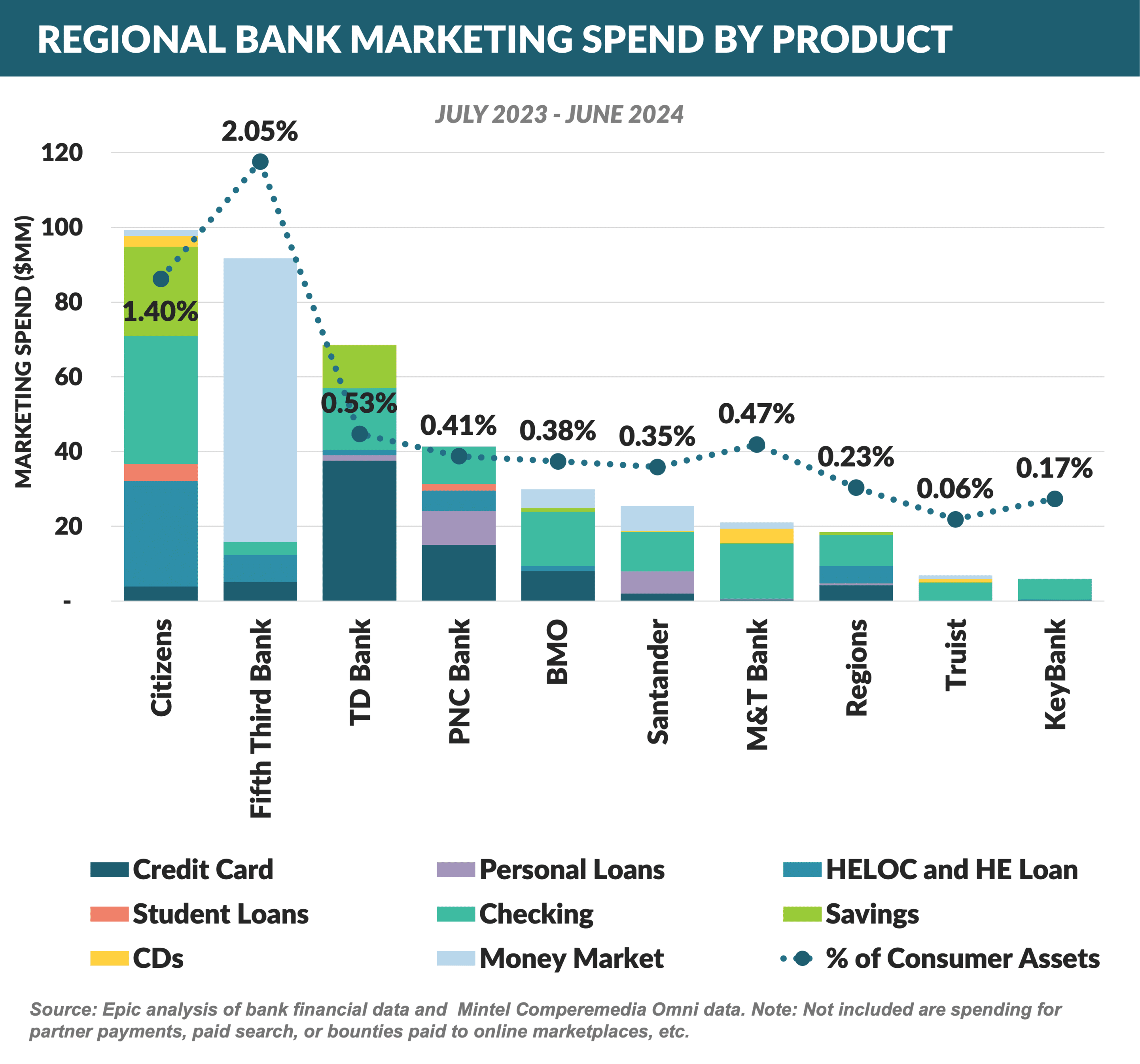

- With most regionals spending marketing budgets on checking and money market accounts, the proportion of marketing spend on other products changes from bank-to-bank

- Of the regionals, Citizens and Fifth Third are the top spenders for consumer finance products

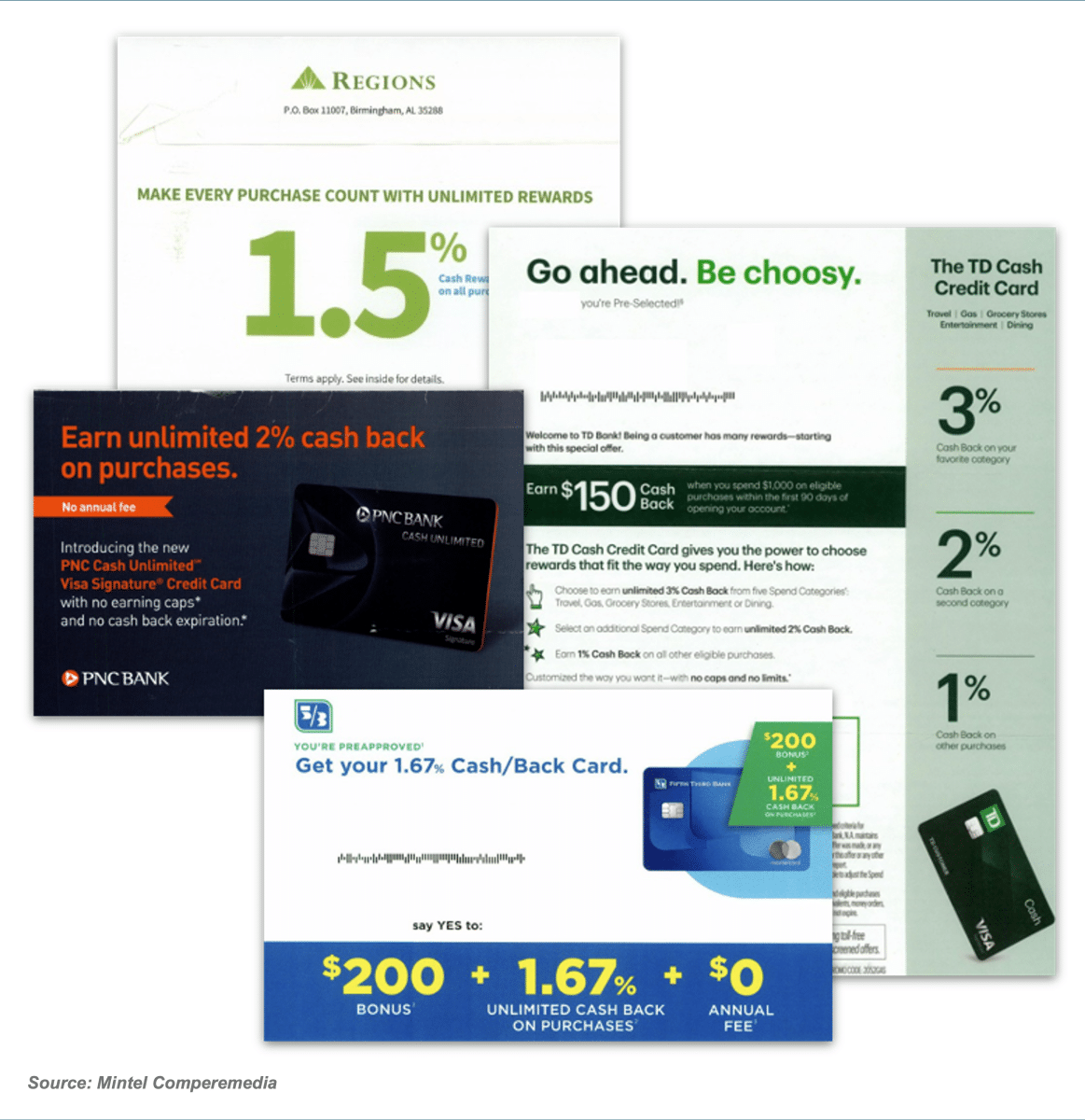

- Credit card mail is largely devoted to bank branded cash back cards

Epic Credit Card Mt. Rushmore – Who’s Next???

- Last month, we began our series about the most influential issuers in the modern credit card era by adding Citi as the first card issuer on the Epic Credit Card Mt. Rushmore

- This month we add MBNA to the list

- Maryland National Bank moved their credit card business – Maryland Bank, NA – to Delaware in 1982 to take advantage of new state legislation that was favorable to card issuers

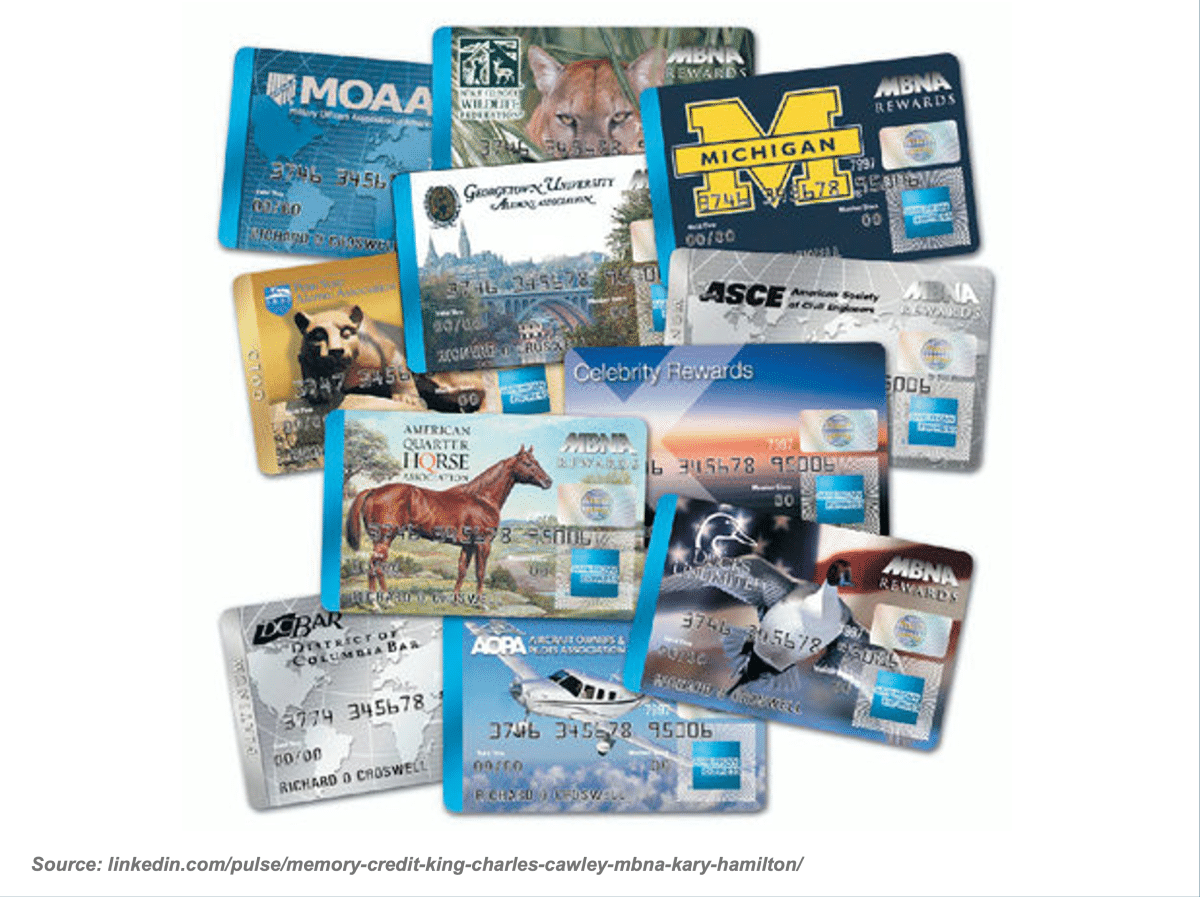

- Led by legendary Charles Cawley, MBNA issued the first affinity card with Georgetown University in 1983 and became the leader in the affinity card market

- MBNA had a hyper-focus on “The Customer” (customer always with a capital “C”), with all calls, whether from customers or internal, being answered with “MBNA at your service”

- While many issuers were transitioning to voice response units, MBNA continued to rely on human operators

- To ensure that management stayed connected with their customers, they were all required to spend a fixed number of hours each month on “customer listening” for inbound service calls

- Instead of strictly using credit models to underwrite new customers, MBNA had a rigorous manual credit process

- MBNA’s culture was extraordinarily strong

- While many companies adopted casual dress, MBNA stuck with suits, ties, and lapel pins

- Signs with “Think of Yourself as a Customer” were hung above every door

- Their buildings were adorned with green awnings, and the company owned a fleet of antique cars and an extensive art collection

- MBNA went public in 1991, becoming one of the new “monoline” card issuers along with Capital One, First USA, and Advanta

- The combination of culture and execution rewarded stockholders with consistently strong returns

- MBNA was sold to Bank of America in 2005 for $35 billion

- MBNA becomes the second issuer added to the Epic Credit Card Mt. Rushmore

Spending on TV and Online Channels Perks Up

- While year-to-date direct mail spending is down, some marketing spending has been redirected to the TV, paid search, and paid social category, which is higher than last year

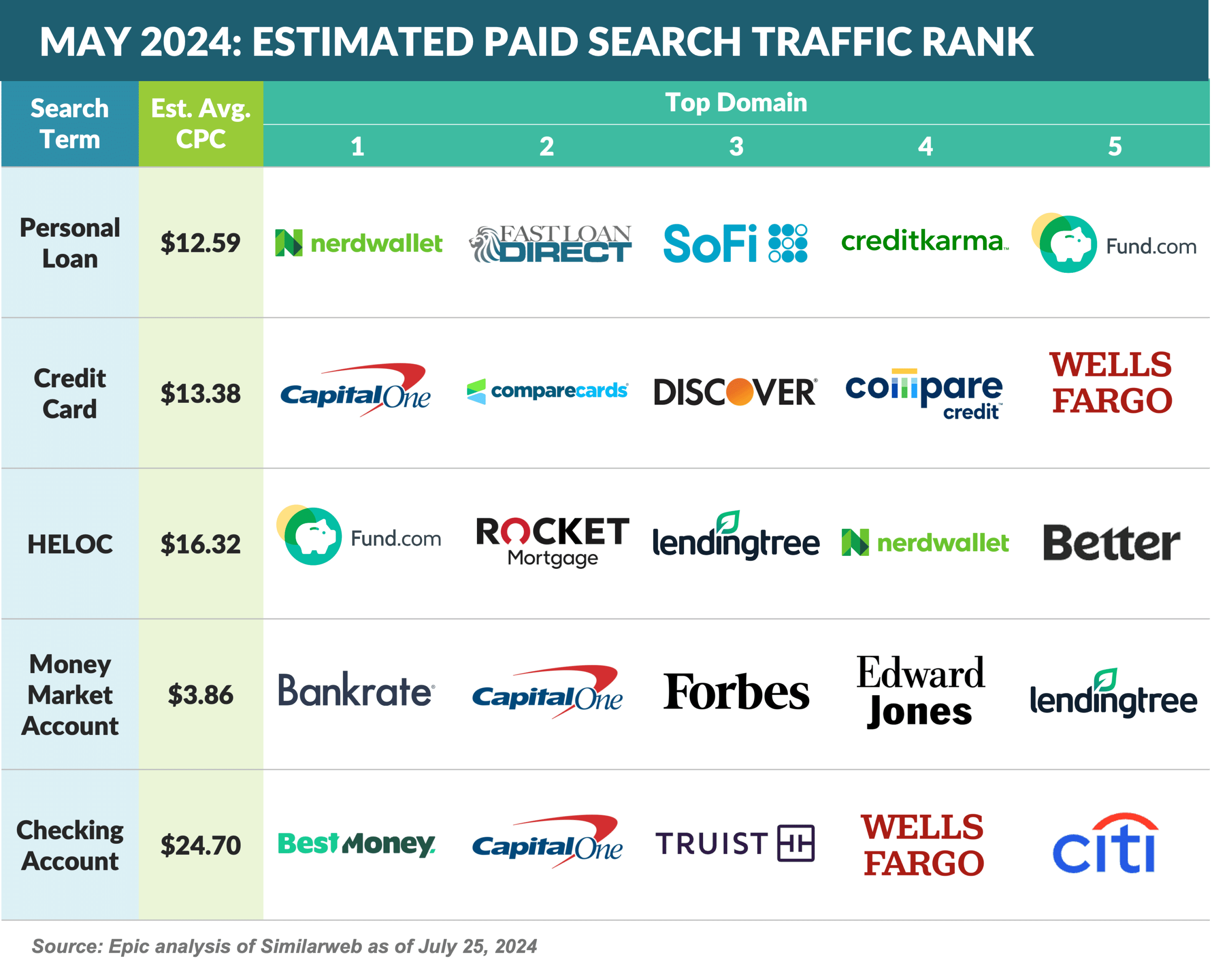

- A recent look at paid search volume shows a mix of financial institutions and marketplace sites competing for consumer finance related keywords

- Capital One is the most prevalent bank amongst the top online marketers, appearing in the top two for credit card, money market, and checking

- Several marketplaces – Nerdwallet, BankRate, and Lending Tree – are also included in the top rankings

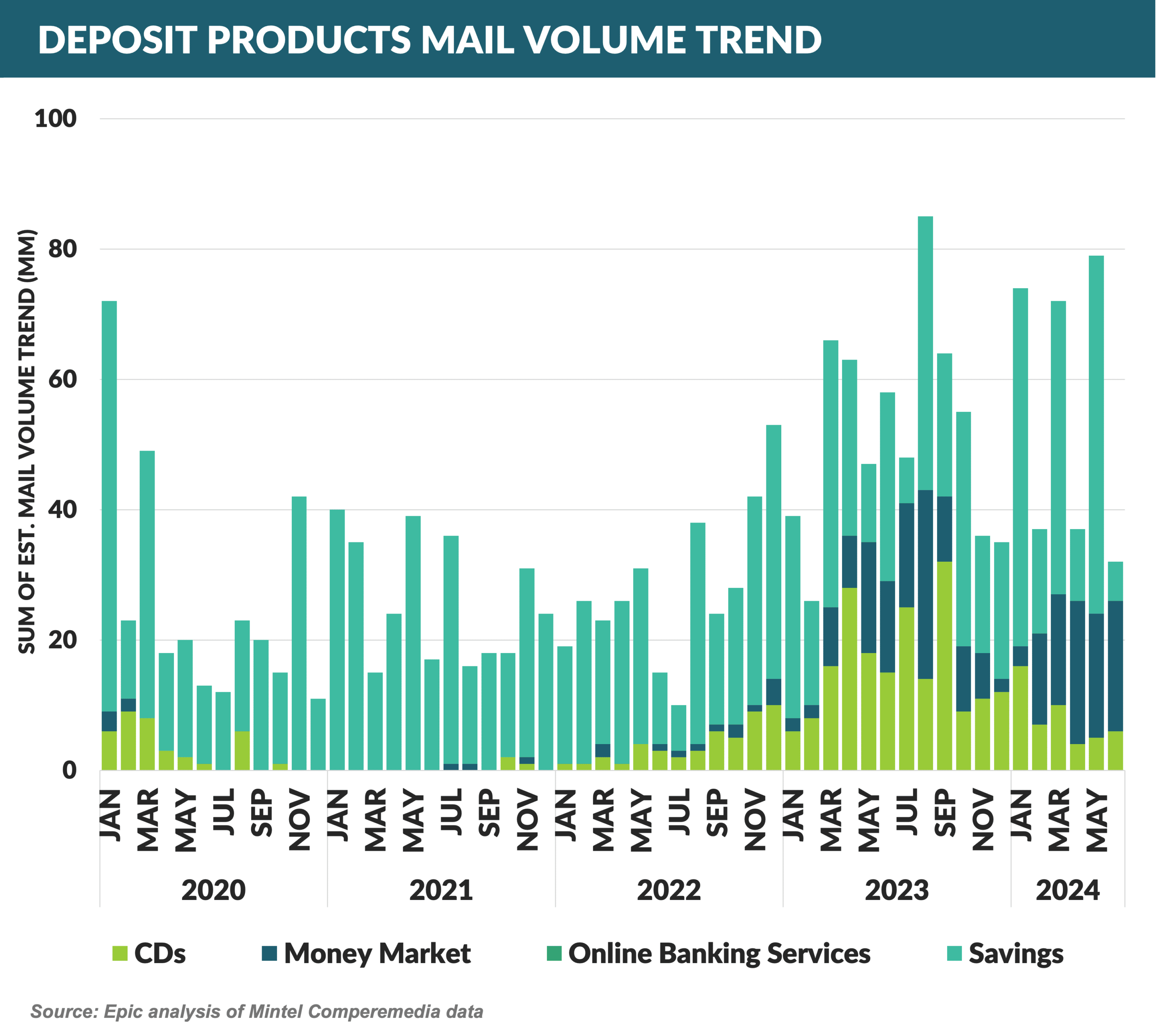

- Direct mail spending on money market and savings accounts has steadily increased since Q1 2022, while volume for CD products has declined

- Fintech Aven recently raised $142 million giving it a valuation of over $1 billion

- Aven offers a credit card combined with a home equity line of credit with APRs of 7.99% - 15.99%

- The company reports it has issued over $1.5 billion in credit lines helping its customers save over $100 million in interest payments

- The new capital will fund entry into new lending categories including auto-backed cards and mortgage refinance

- Discover announced the sale of its $10 billion student loan portfolio to an investor group including Carlyle and KKR

- Nelnet affiliate Firstmark Services will take over servicing of the portfolio

- The Discover brand, which accounted for close to 50% of student loan direct mail in 2023, will no longer be used to market new student loans

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in September.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.

Read our previous newsletters.