Three Things We’re Hearing

- What is the impact of resuming student loan payments???

- What happened at Goldman Sachs? – Part II

- Personal loan ad spending remains sluggish

A four-minute read

If the Epic Report was forwarded to you, click here if you’d like to be added to our mailing list

What is the Impact of Resuming Student Loan Payments???

- Payments on federal student loans were halted in March 2020 (private student loan payments have not been affected) and, following several extensions and a failed attempt at forgiveness, payments for 27 million consumers are scheduled to resume in October

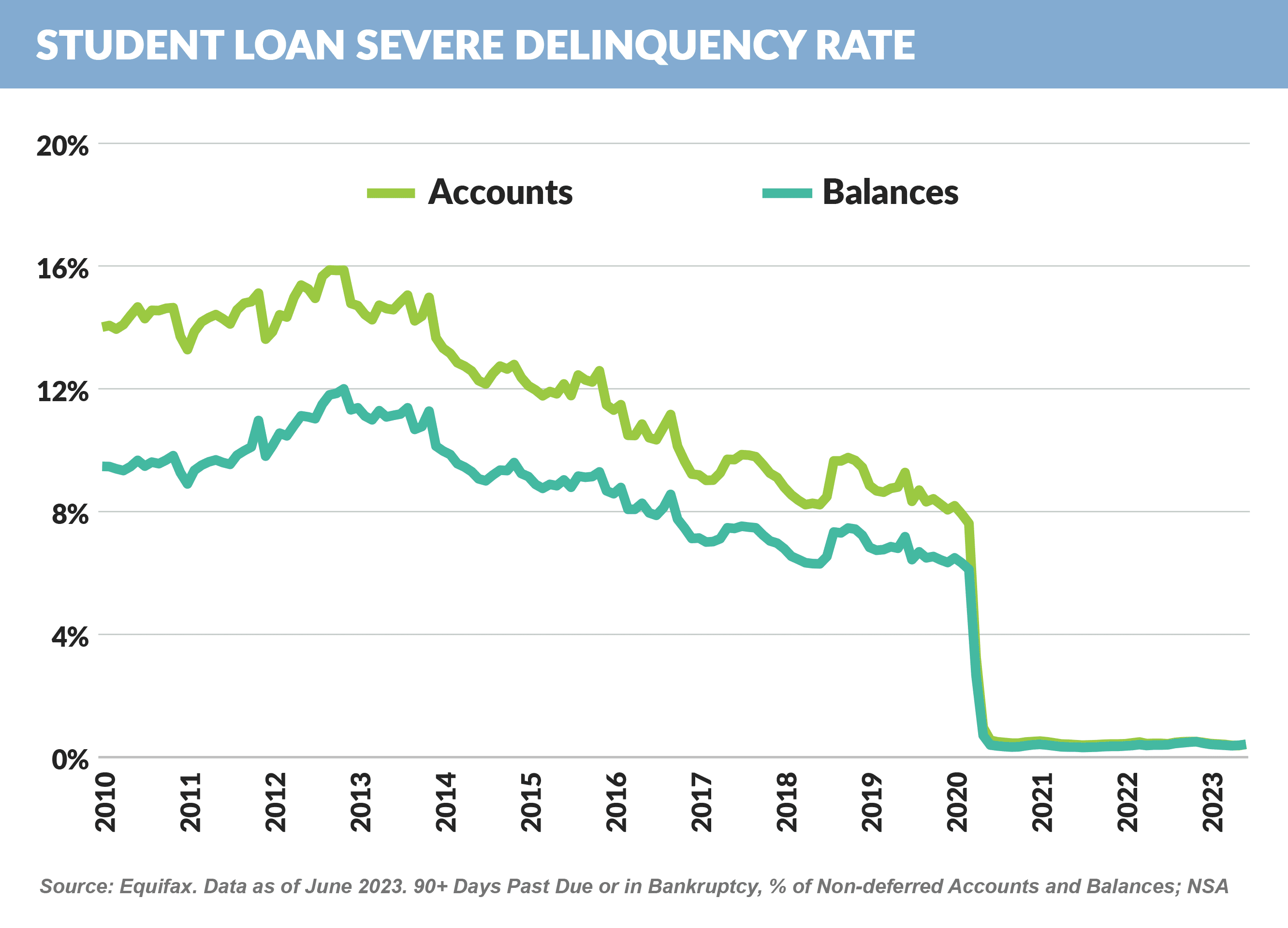

- Predictably, the payment moratorium had a positive effect on student loan asset quality

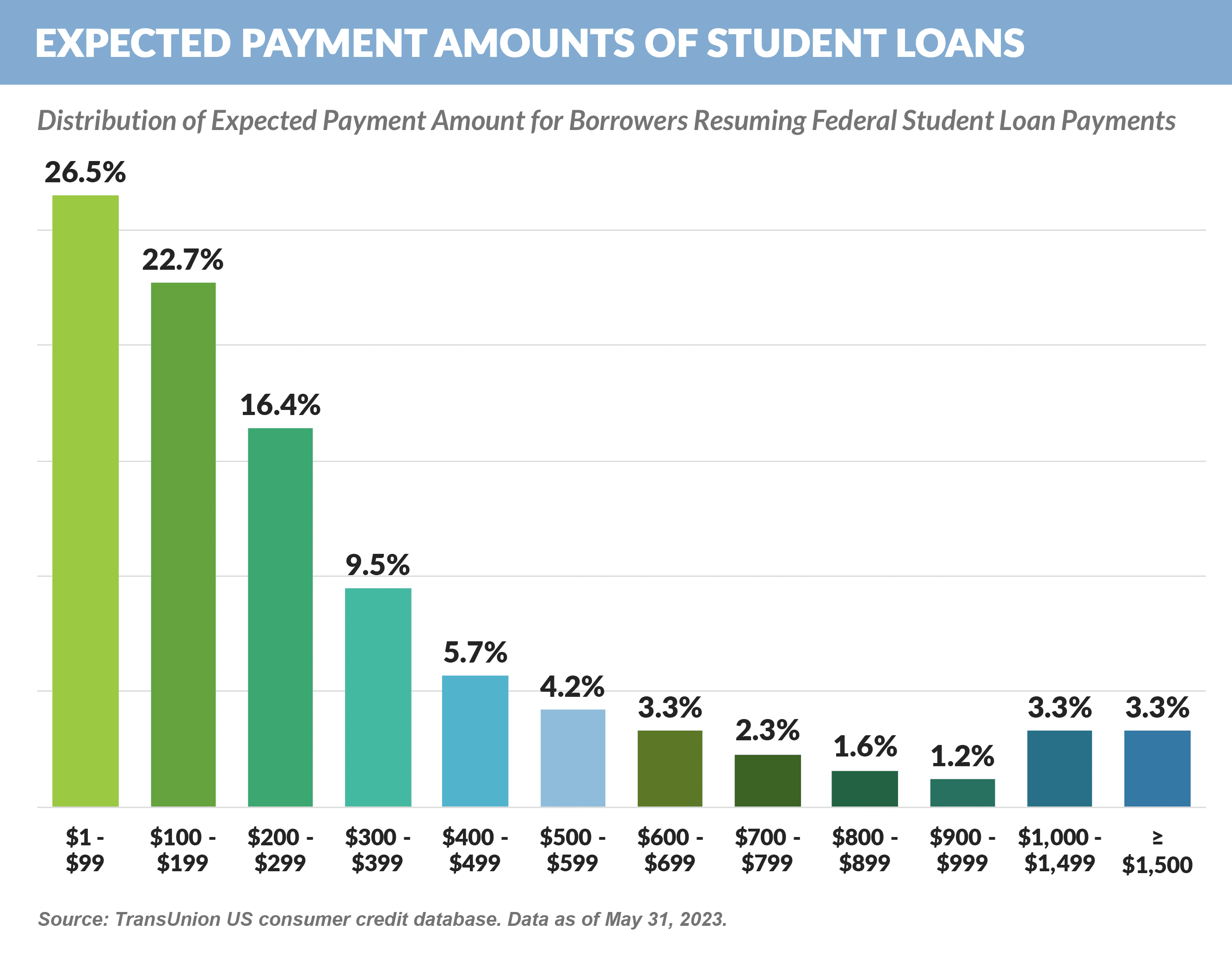

- But now there are questions about the effect the resumption of payments will have on consumer loan asset quality as over half of student loan holders will resume monthly payments totaling $200 or more

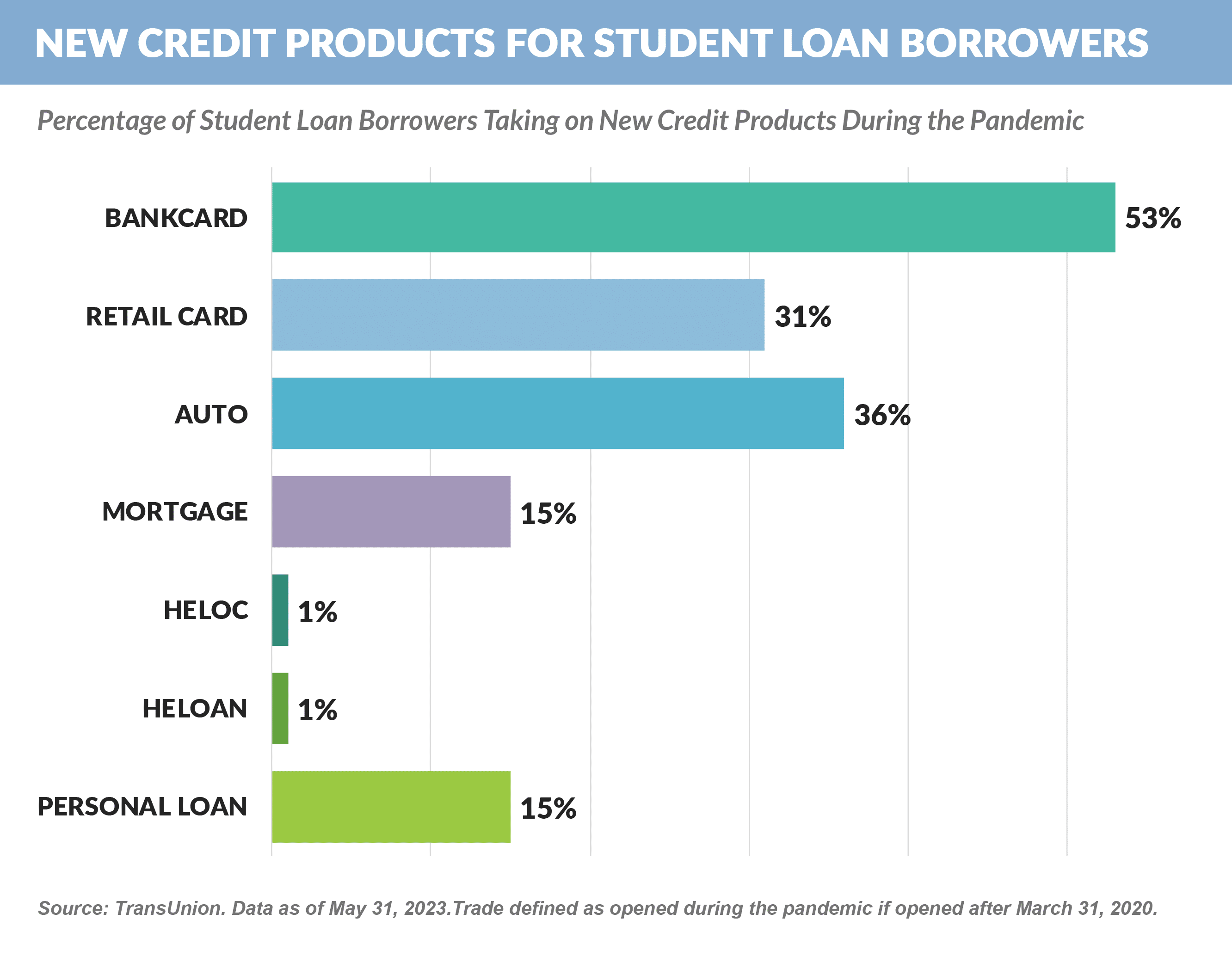

- In addition to the resumed payments, TransUnion reports that many student loan holders took on new credit during the pandemic, with over half acquiring a new credit card

- Those with loans have been encouraged to apply for various income-based repayment plans, however, a Credit Karma survey showed 45% of student loan holders expect to go delinquent on their payments

- Delinquent student loan payments will not be reported to the credit bureaus for 12 months after they resume; however, the longer-term impact on overall consumer credit asset quality could be noticeable

What Happened at Goldman Sachs? – Part II

- The August Epic Report reviewed missteps that led Goldman Sachs to explore transitioning the Apple Card to another issuer

- This month we look at their experience in the personal loan business, where their desire to get big fast was clearly evident

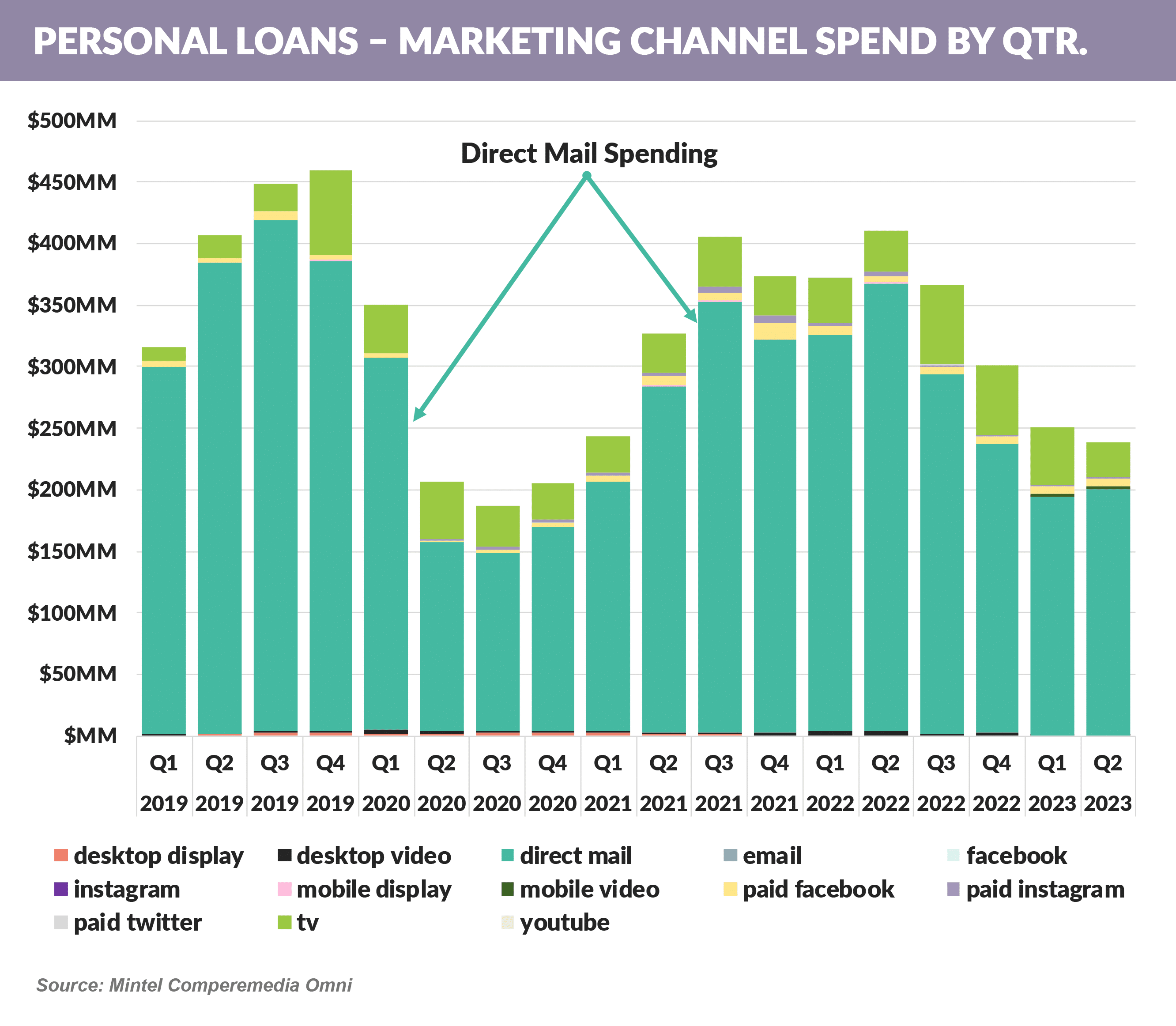

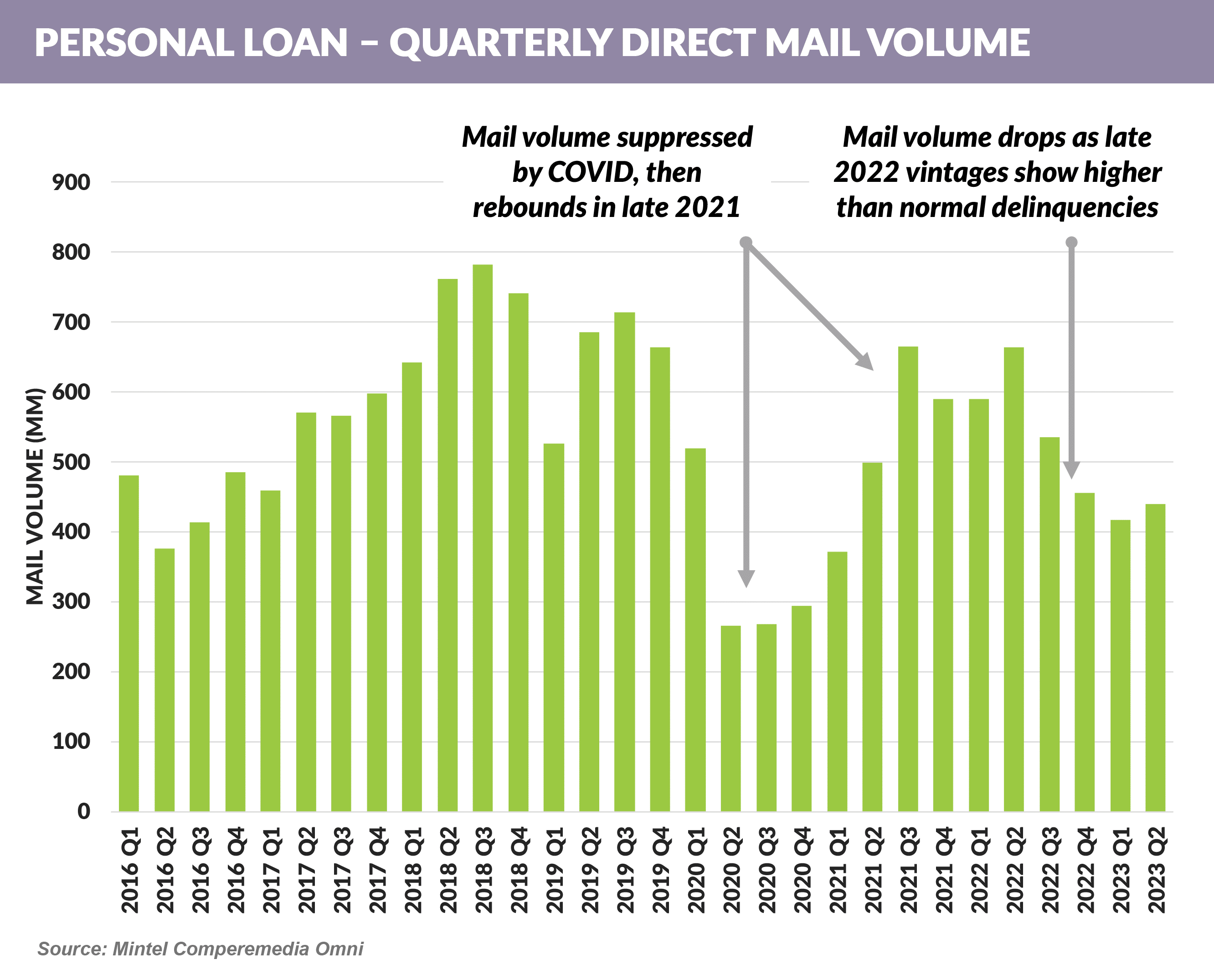

- Growth in the personal loan market is driven primarily by direct mail, with 80% – 95%+ of personal loan advertising spending going to direct mail in any given quarter

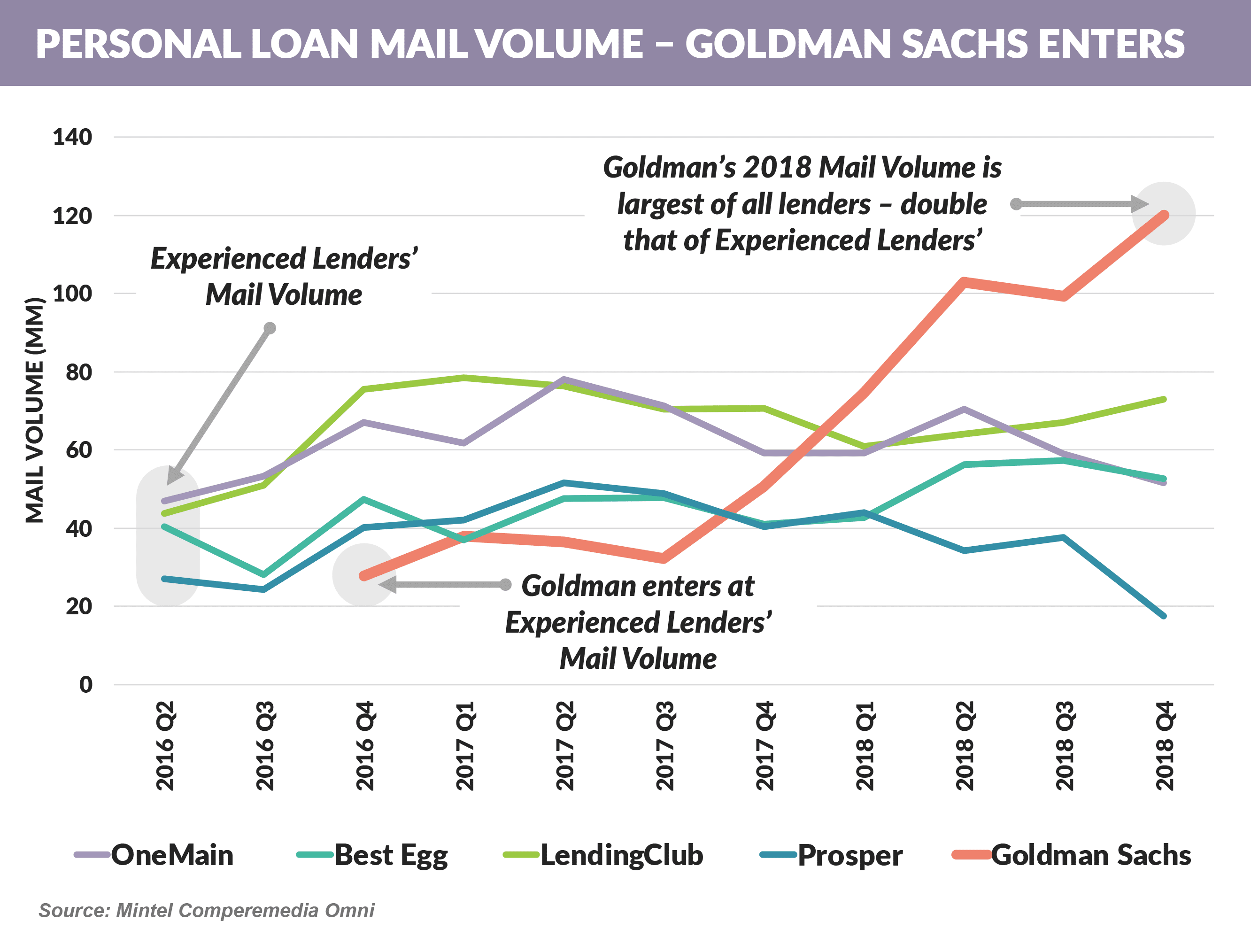

- Goldman came out of the starting gates in late 2016 with a bang, immediately entering the ranks of top mailers

- By 2018, experienced personal loan lenders found a profitable universe of mailable names of 60 - 70 million pieces, while Goldman, just 18 months after their launch, almost doubled that, becoming the largest personal loan mailer with volume 50% higher than the next largest

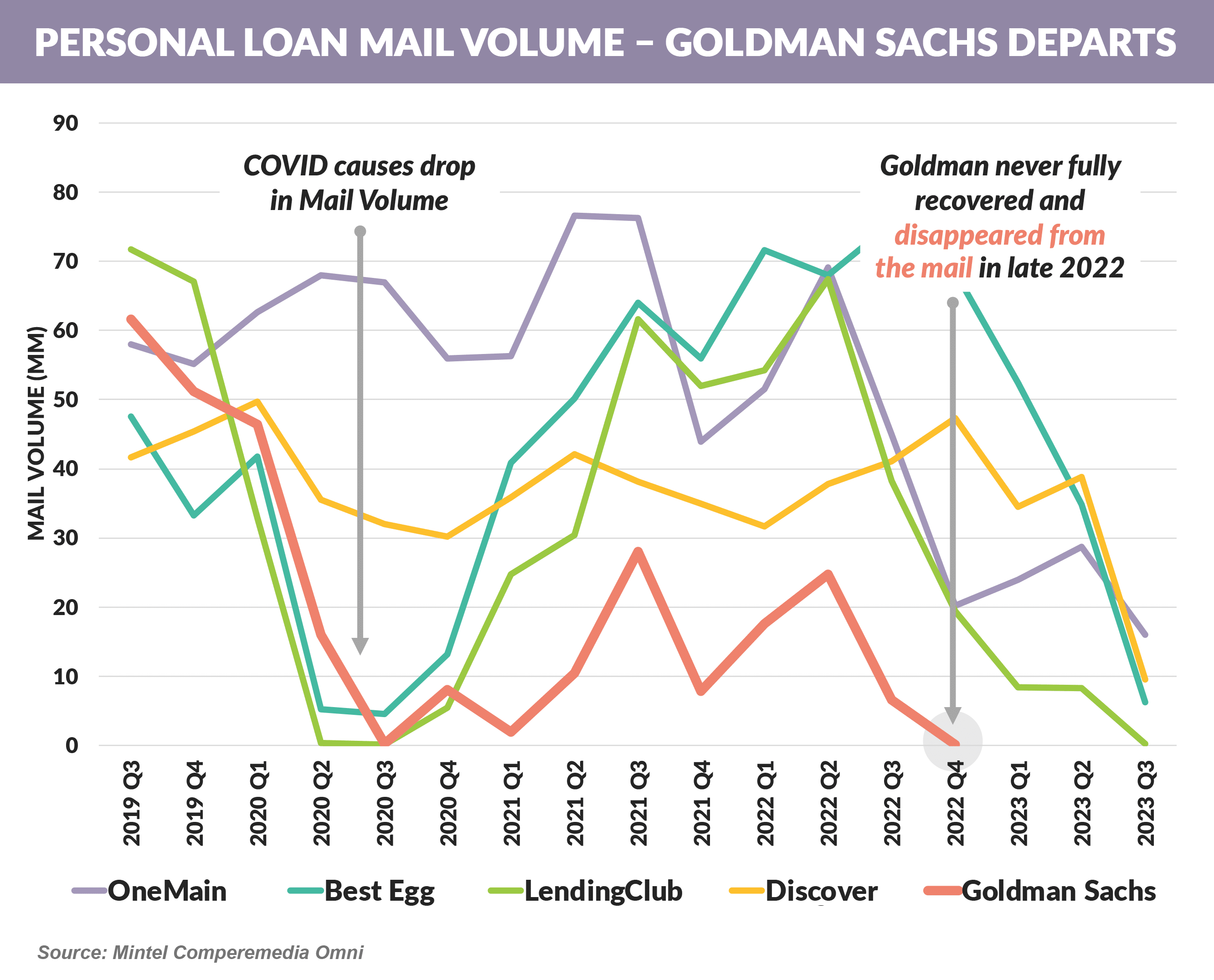

- The pandemic slowed most personal lender mail volume in 2020, but Goldman never fully recovered and disappeared from the mail in late 2022

- Several observations might provide insight into the exit from the personal loan market:

- Higher mail volumes often lead to reduced response rates, elevating Goldman's customer acquisition costs above competitors

- The lack of standard origination or late fees, common revenue sources in the industry, compromised the profitability of Goldman's loan product

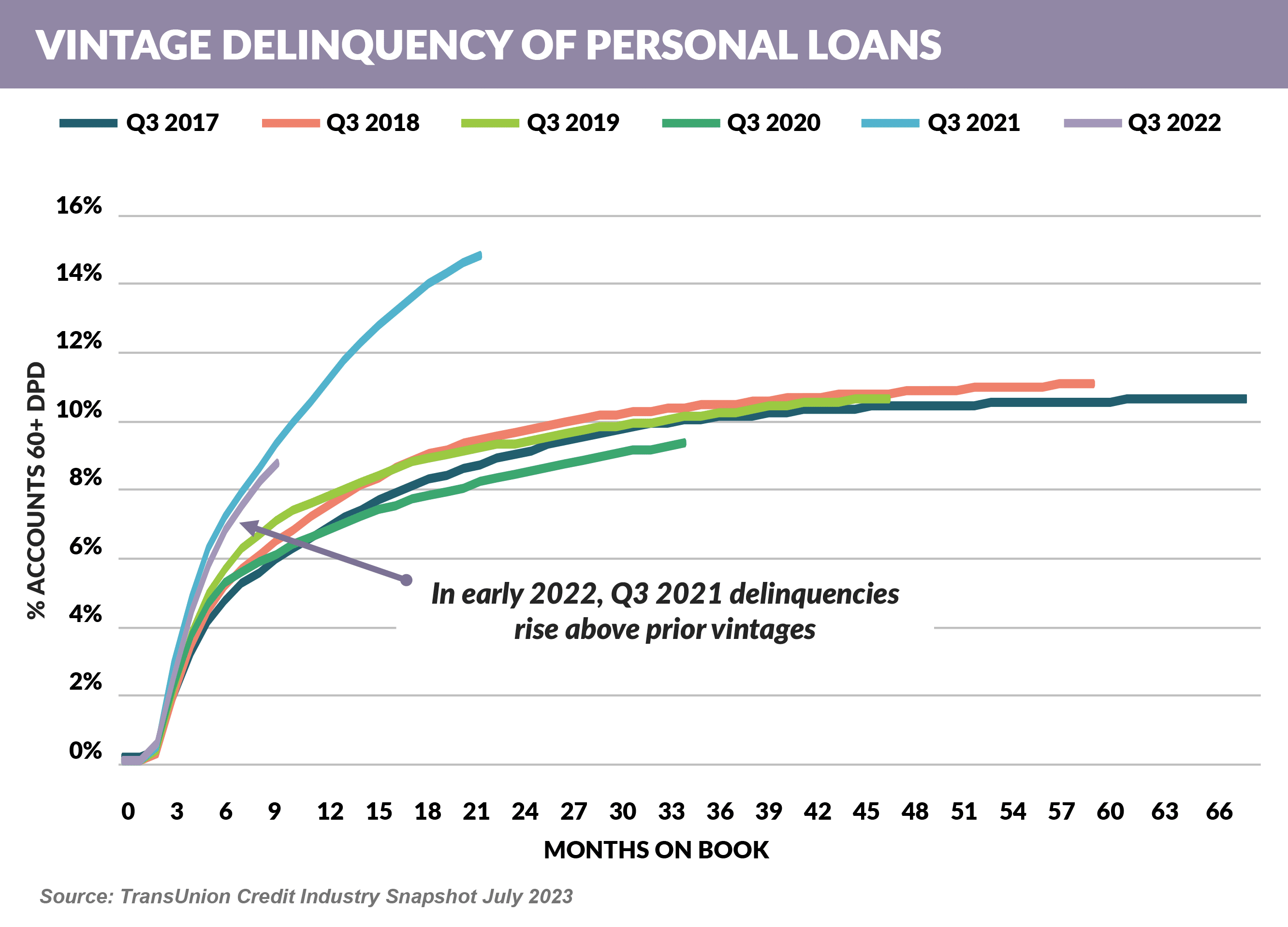

- Furthermore, asset quality is crucial and Goldman's exit and discounted portfolio sale could indicate credit quality concerns – typically, a loan product's creditworthiness takes time to assess and lacking a historical record for their loan offering, a prudent approach would be to start small and gather data

- Personal loan originations ended in 2022, and following a sale of over $1 billion in consumer loans earlier this year, another tranche was sold in June at a loss of nearly $500 million

Personal Loan Ad Spending Remains Sluggish

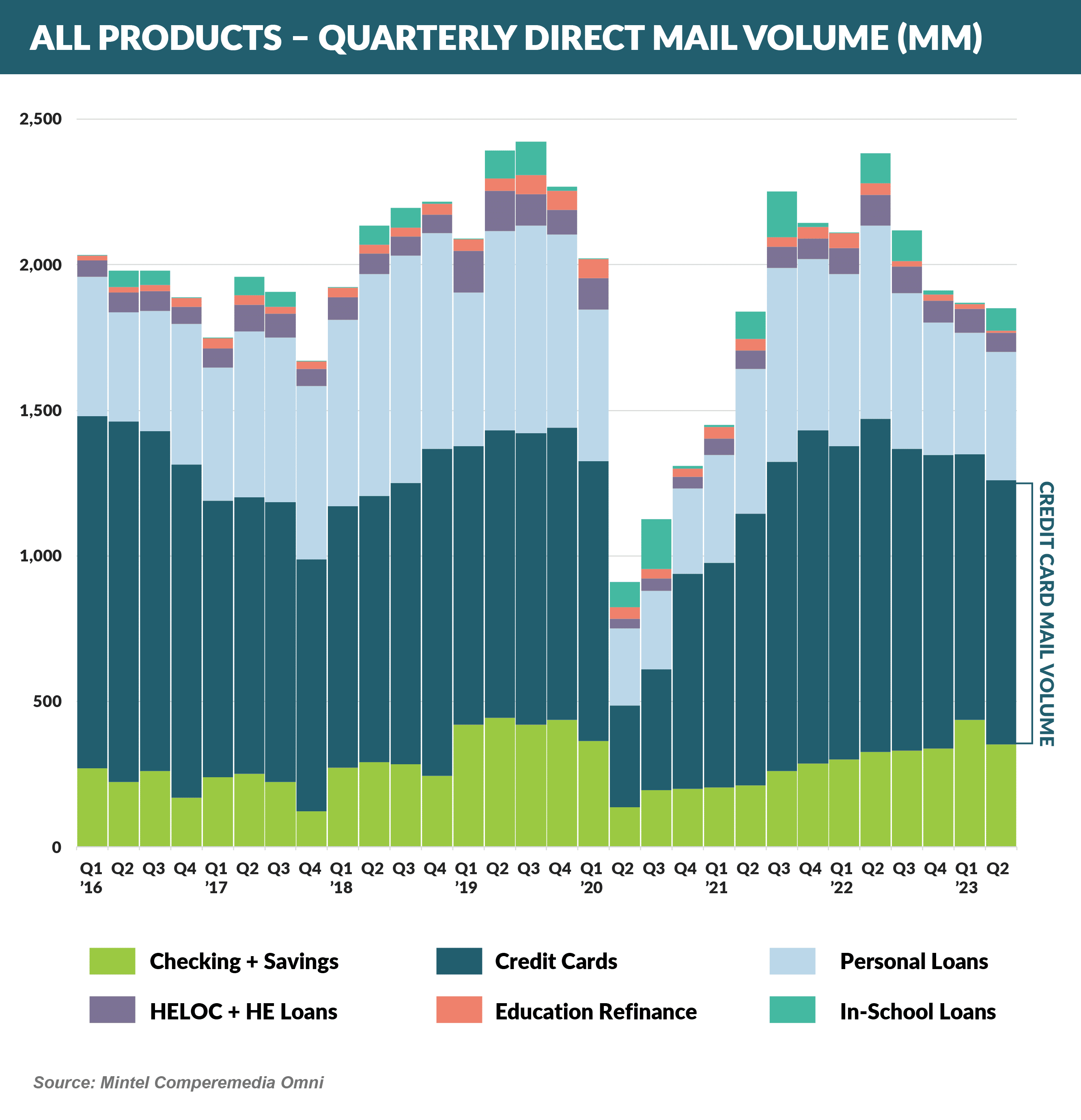

- Credit card dominates all consumer financial services mail volume with 49% of direct mail spending in 2Q 2023, followed by personal loan (24%) and savings/checking (19%)

- Personal loan mail volume was strong in 2019, and, after falling along with other products during Covid, bounced back in late 2021 to close to pre-pandemic levels

- The drop in mail volume which began in Q3 2022 can be attributed partially to credit tightening in response to the sudden rise in delinquencies that began with the Q3 2021 vintage and became apparent in early 2022

- YTD ’23 Personal loan originations are down one-third from ’22 and continue to be suppressed as higher delinquencies and interest rates have negatively impacted the price that fintechs get from institutional loan buyers

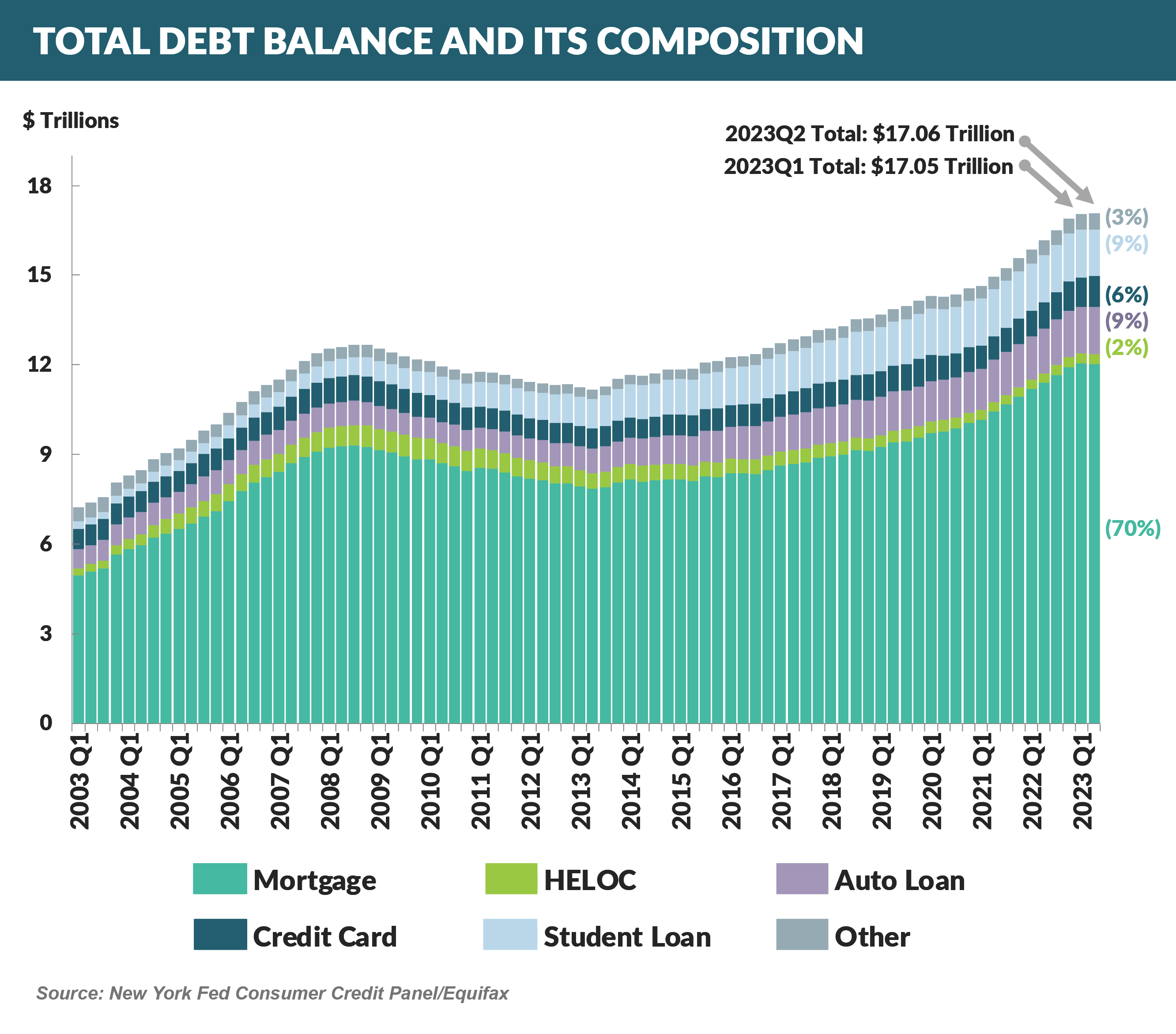

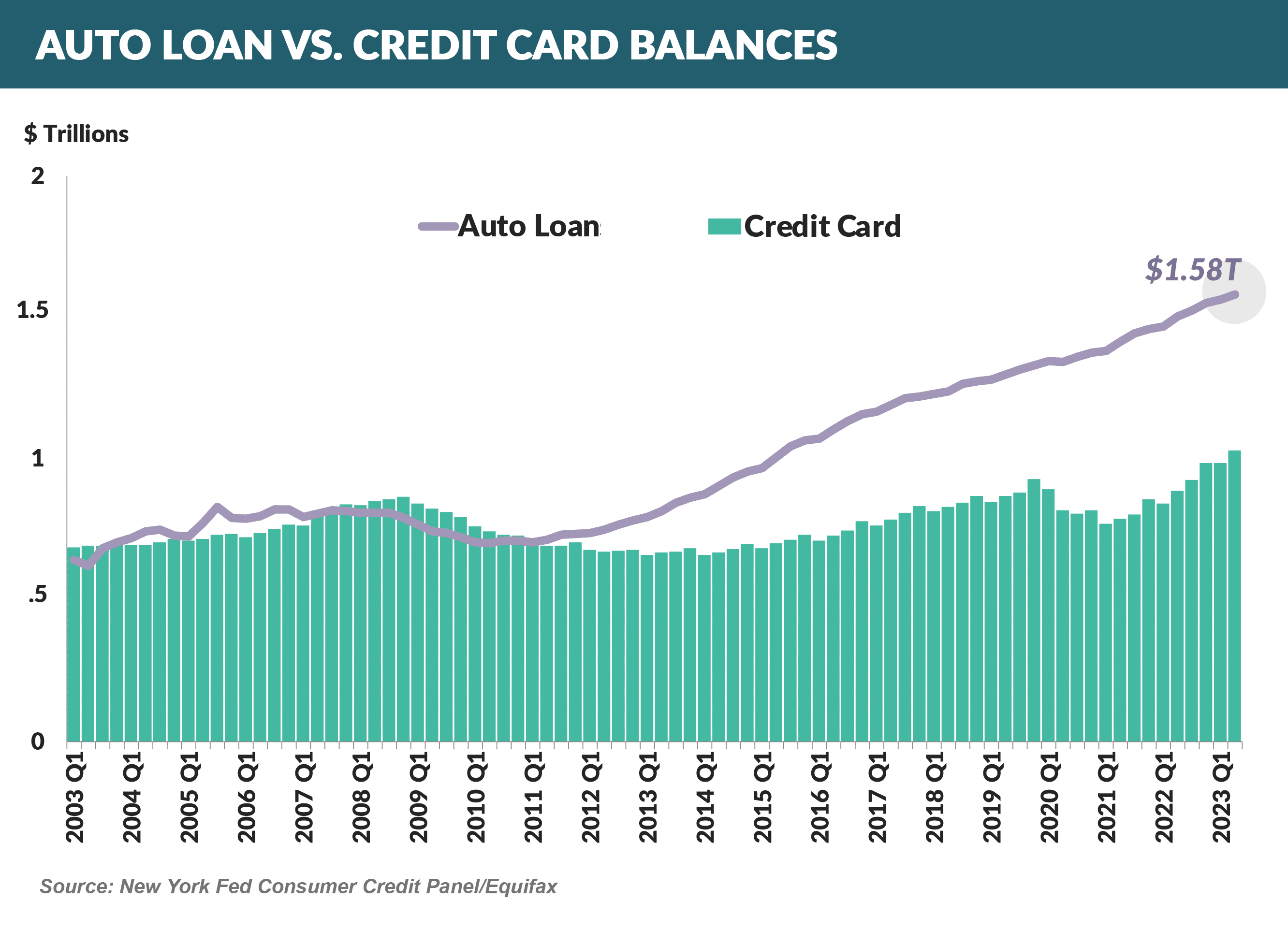

- Many recent headlines have reported that credit card balances topped $1 trillion in July

- However, the magnitude of card balances may be over-hyped as they still represent only 6% of consumer debt

- Card loans are also growing substantially slower than auto loans, which were the same amount as credit cards in 2012, and have now grown to over $1.5 trillion – 50% higher than card balances

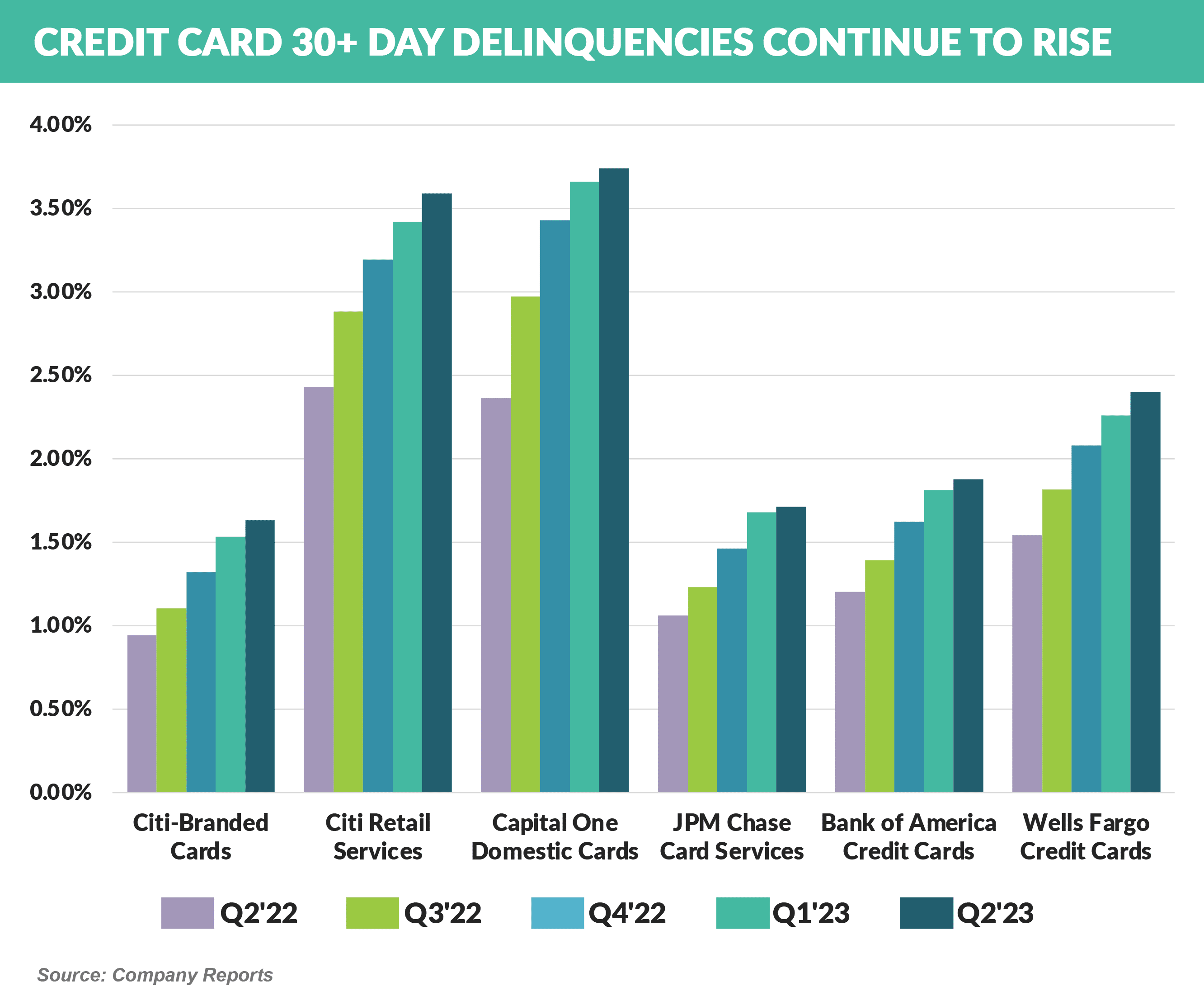

- Card delinquencies continued to “normalize” (i.e., go higher) as major issuers reported higher Q2 numbers – some of which is seasonality (delinquency goes up January - July, and turns lower through the end of the year); however, the year over year numbers show a significant increase

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on October 7th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.