Three Things We’re Hearing

- Online savings rates climb

- Little change among top credit card issuers

- February mail volume dips for cards, loans, and ed refi

A four-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Online Savings Rates Climb

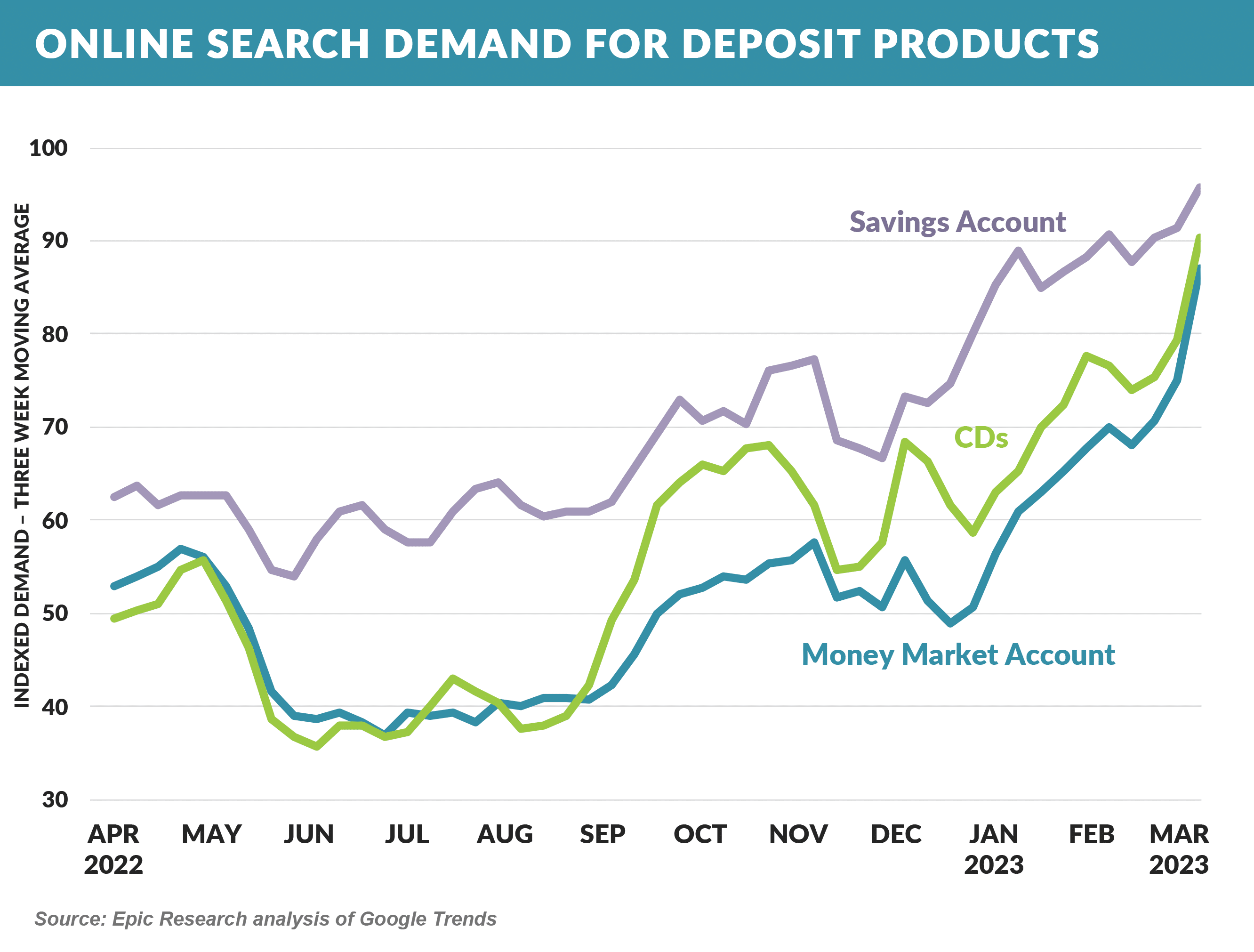

- Consumer demand for CDs, Savings, and Money Market accounts has spiked following the 2022 rise in rates

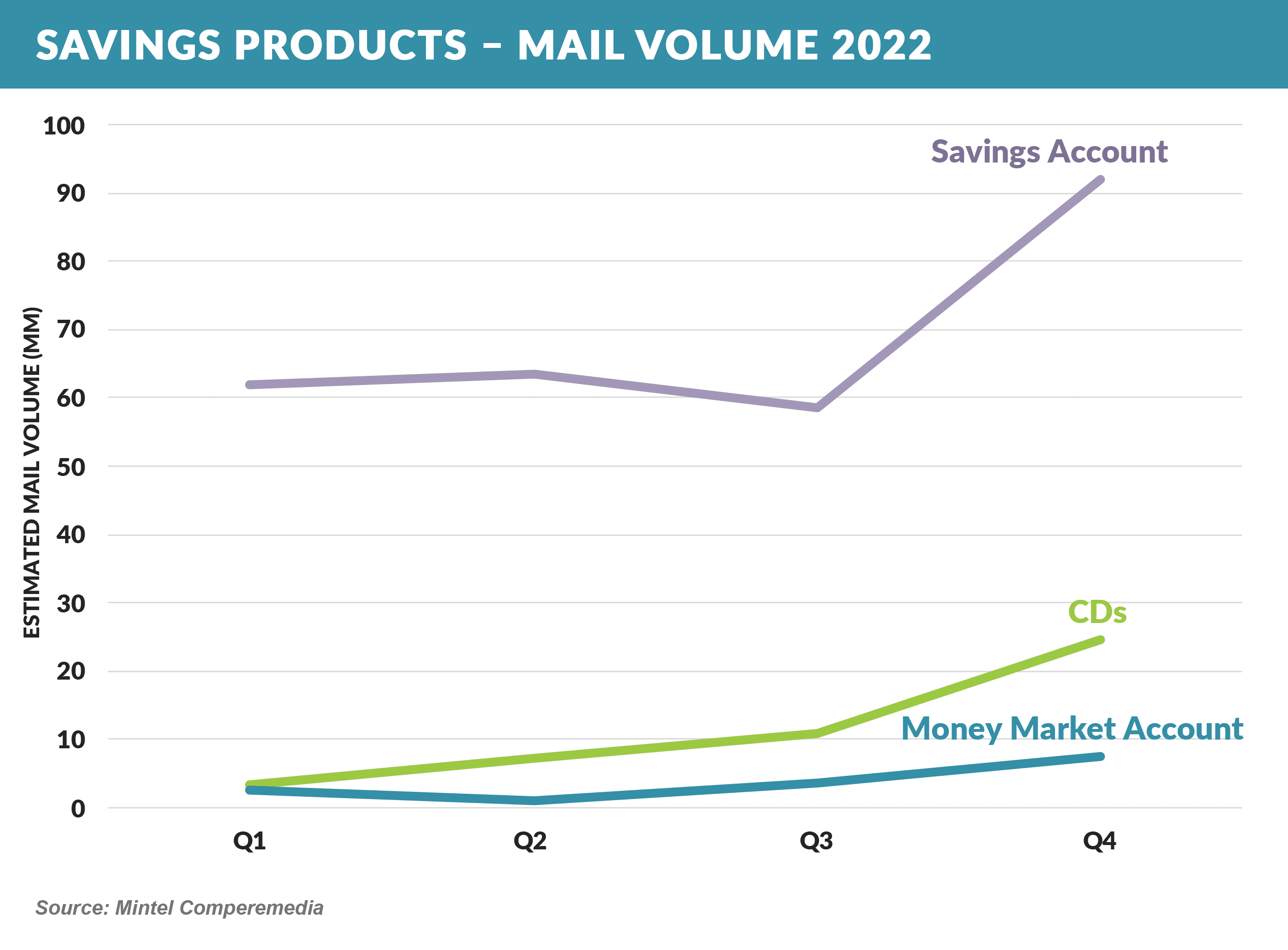

- Financial institutions, experiencing outflows of low-interest-bearing deposits, have correspondingly increased mail volume for CDs, savings, and money market accounts

- Email marketing offers for these products have become increasingly competitive

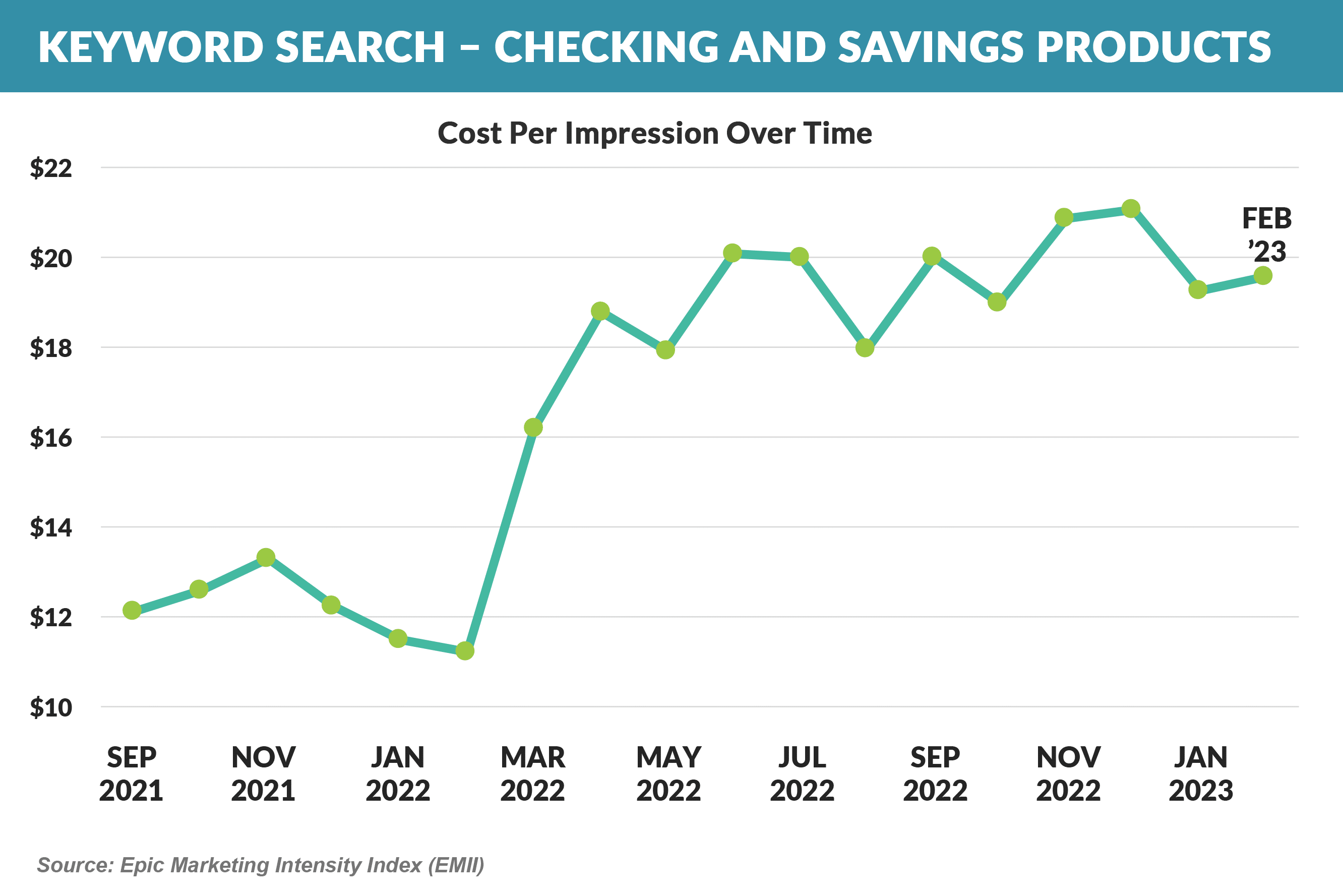

- And there has been a corresponding increase in cost per click for relevant keywords

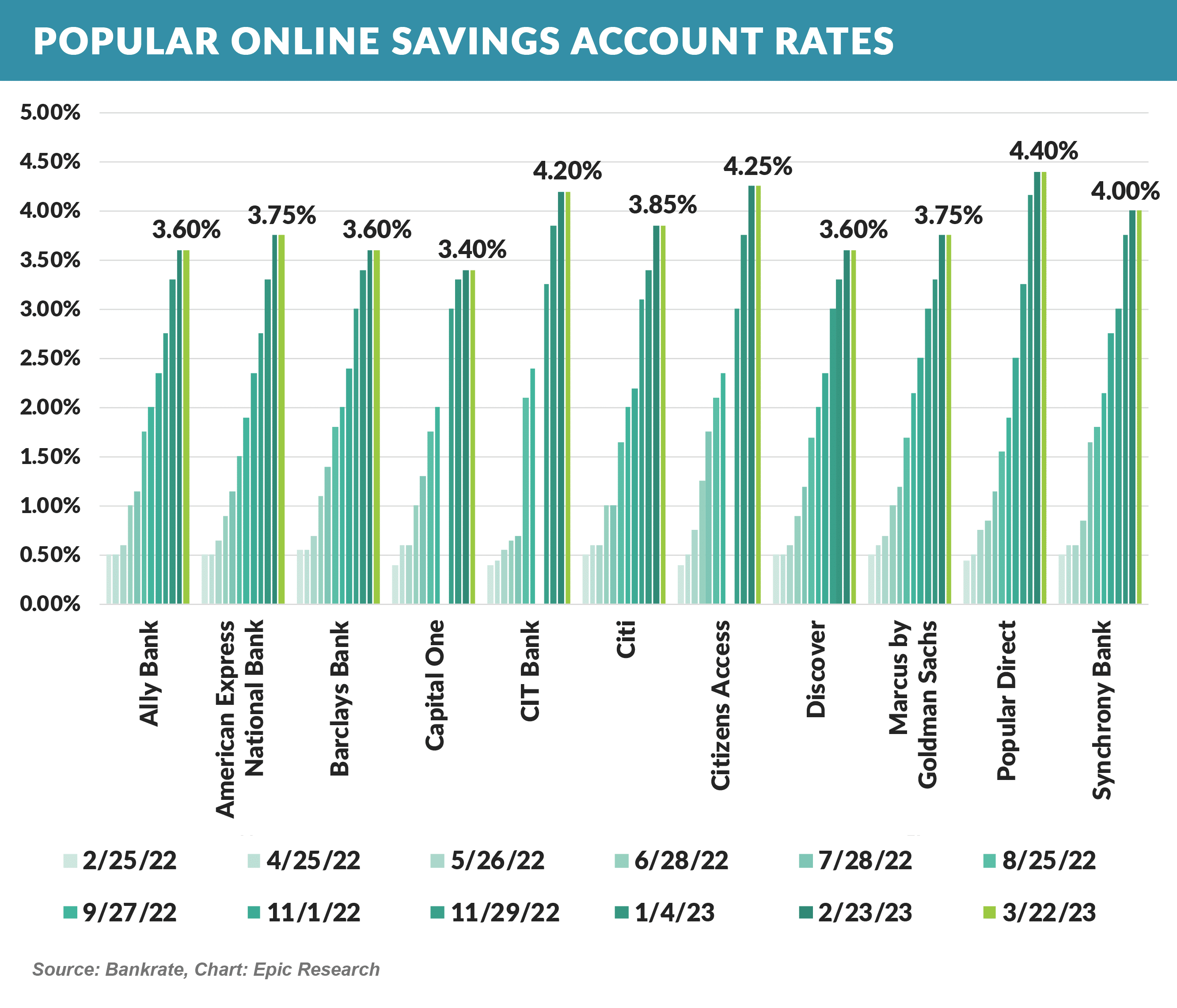

- Consumers are benefitting from rising savings interest rates

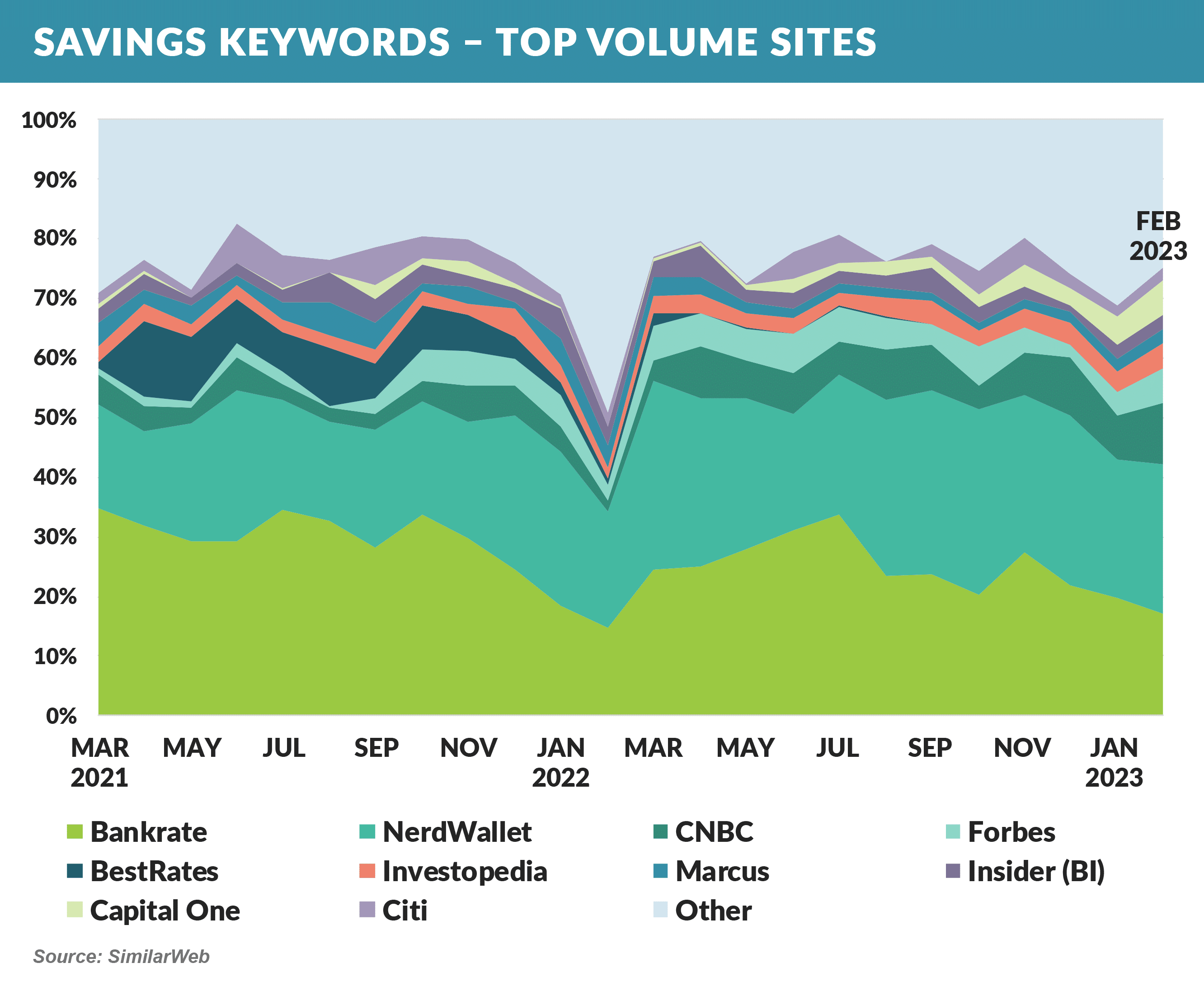

- Savings-related keywords continue to be dominated by Bankrate and NerdWallet, with recent growth from CNBC, Forbes, and Capital One

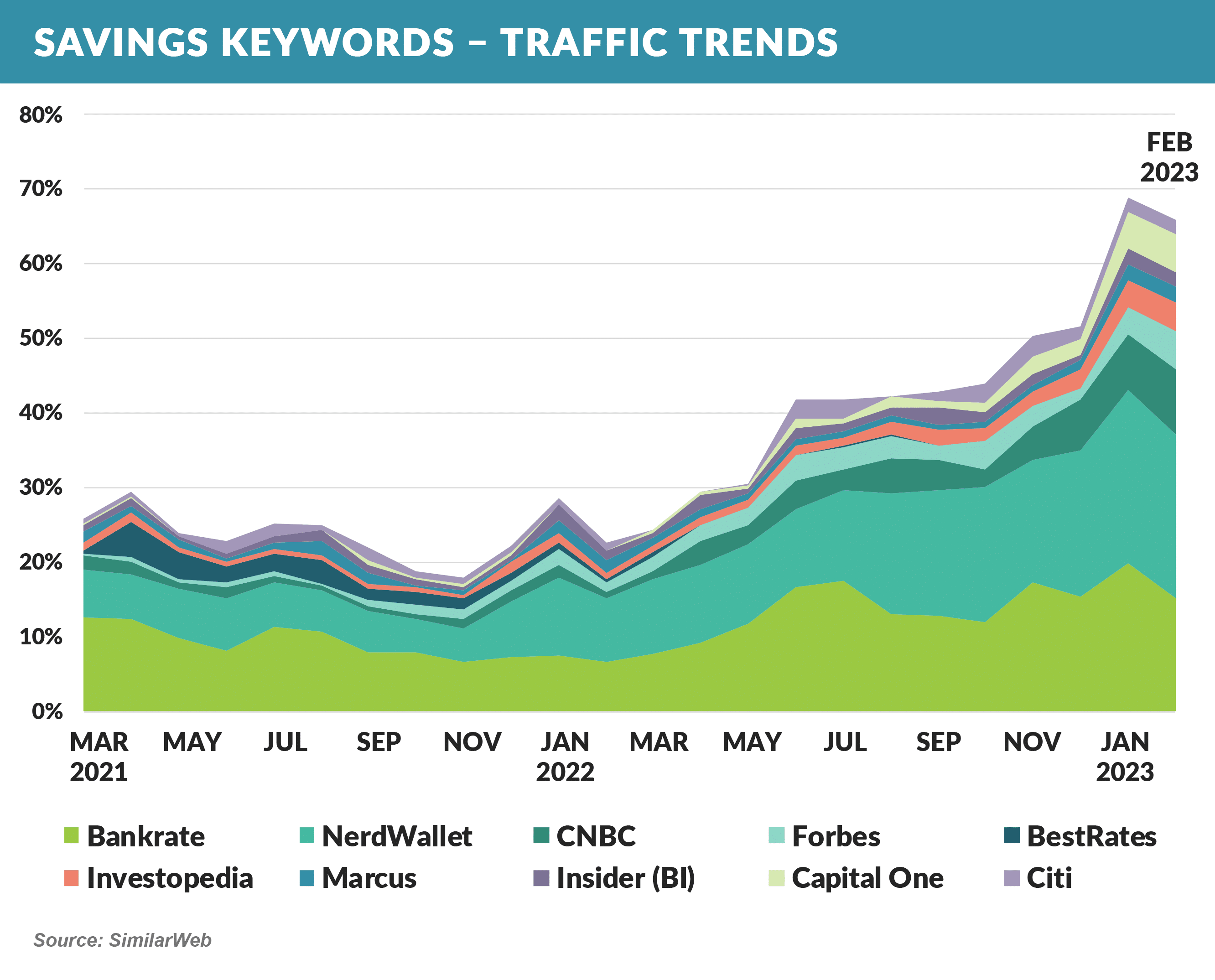

- Paid and organic search have driven increased traffic since rates began rising in early ’22

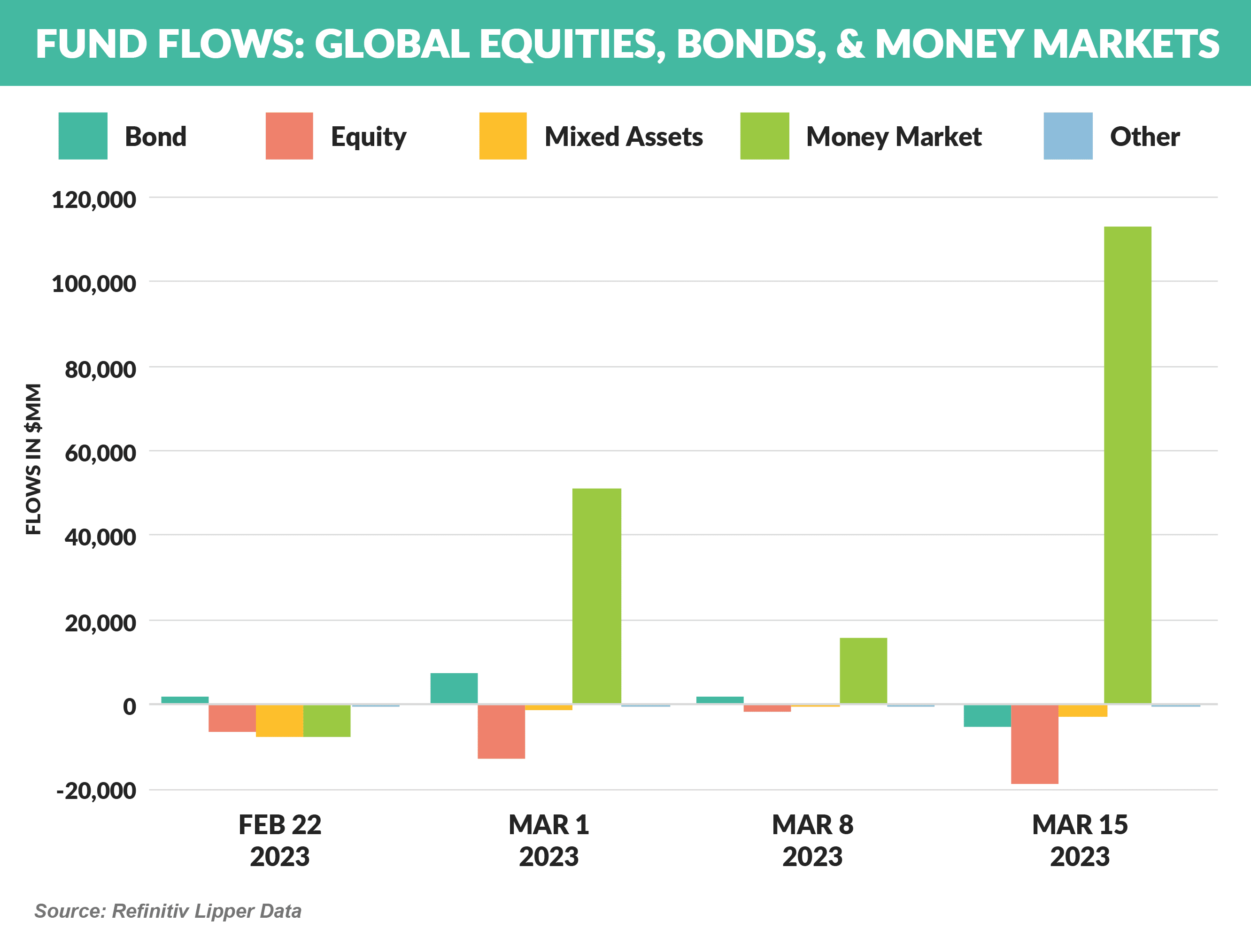

- Global money market and government bond funds obtained massive weekly inflows as investors rushed to safer assets on fears of contagion from the collapse of three U.S. banks last month

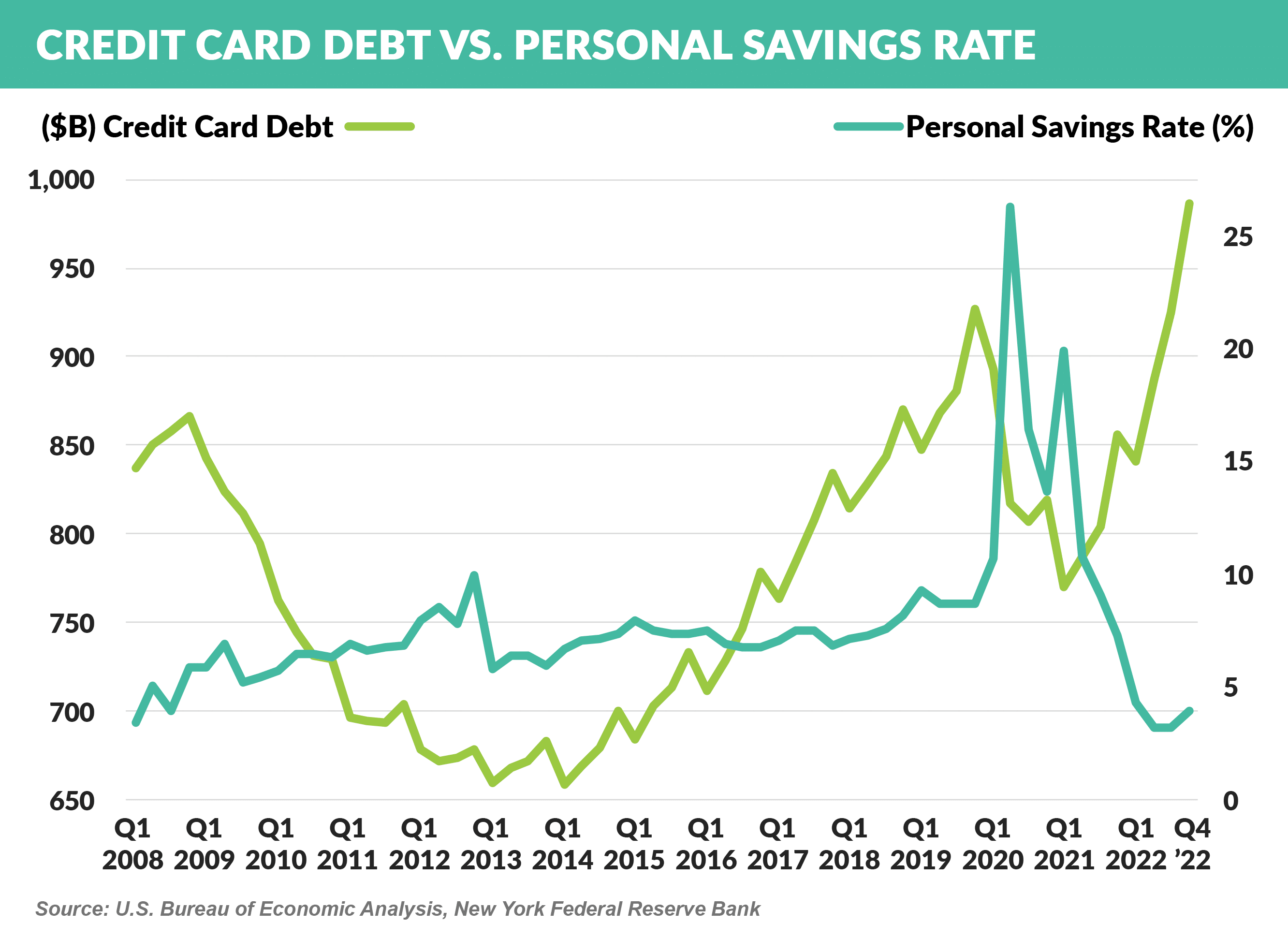

- Consumers’ lower savings rate combined with recent bank headlines should cause the continuation of increased marketing activity for interest-bearing deposits

Little Change Among Top Card Issuers

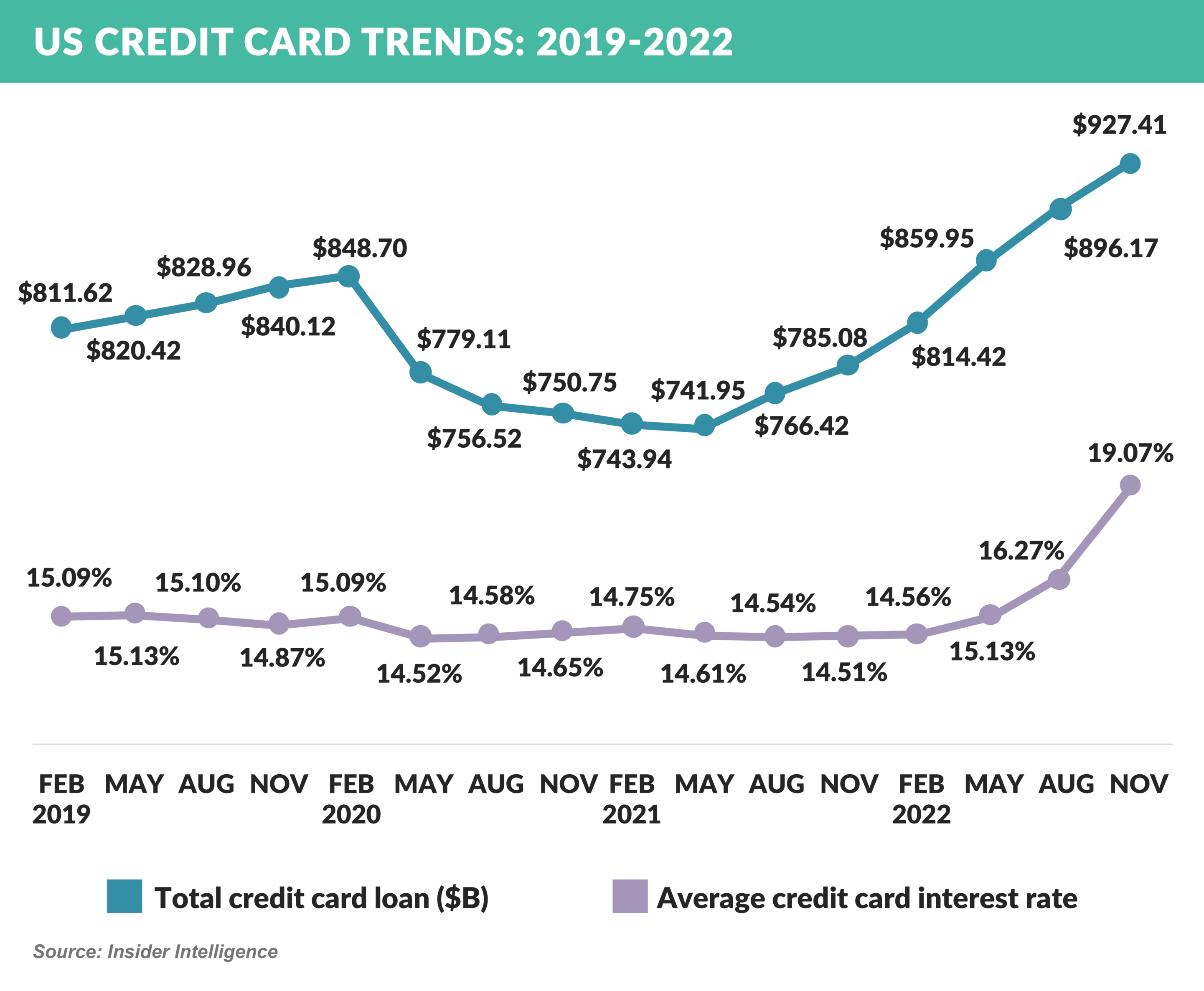

- Following a pandemic-era drop, credit card loans outstanding rebounded in 2022, growing 17.3% to a record of over $900 billion as consumers spent more and saved less, with savings now falling below pre-pandemic levels.

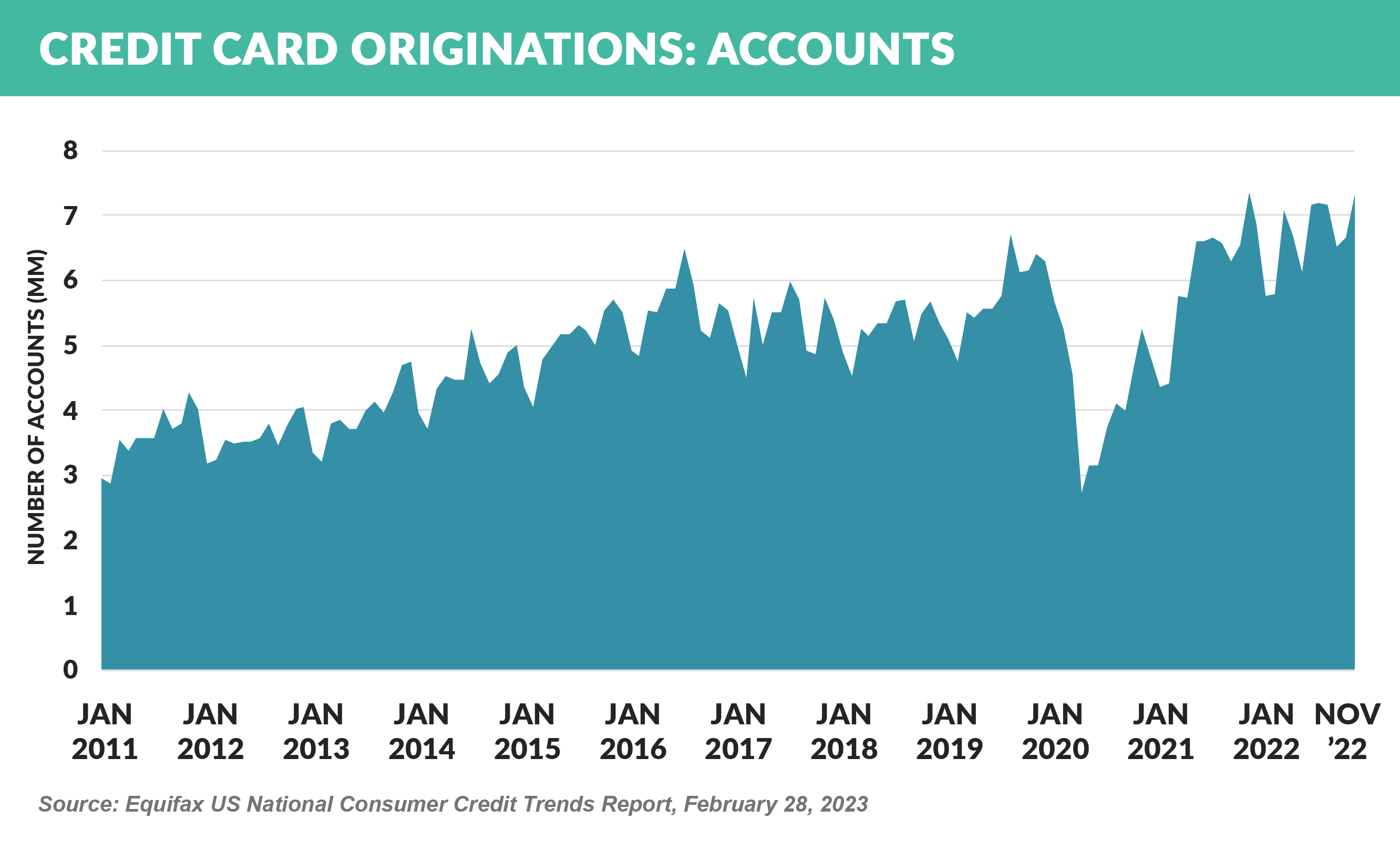

- New card originations reached record levels in 2022

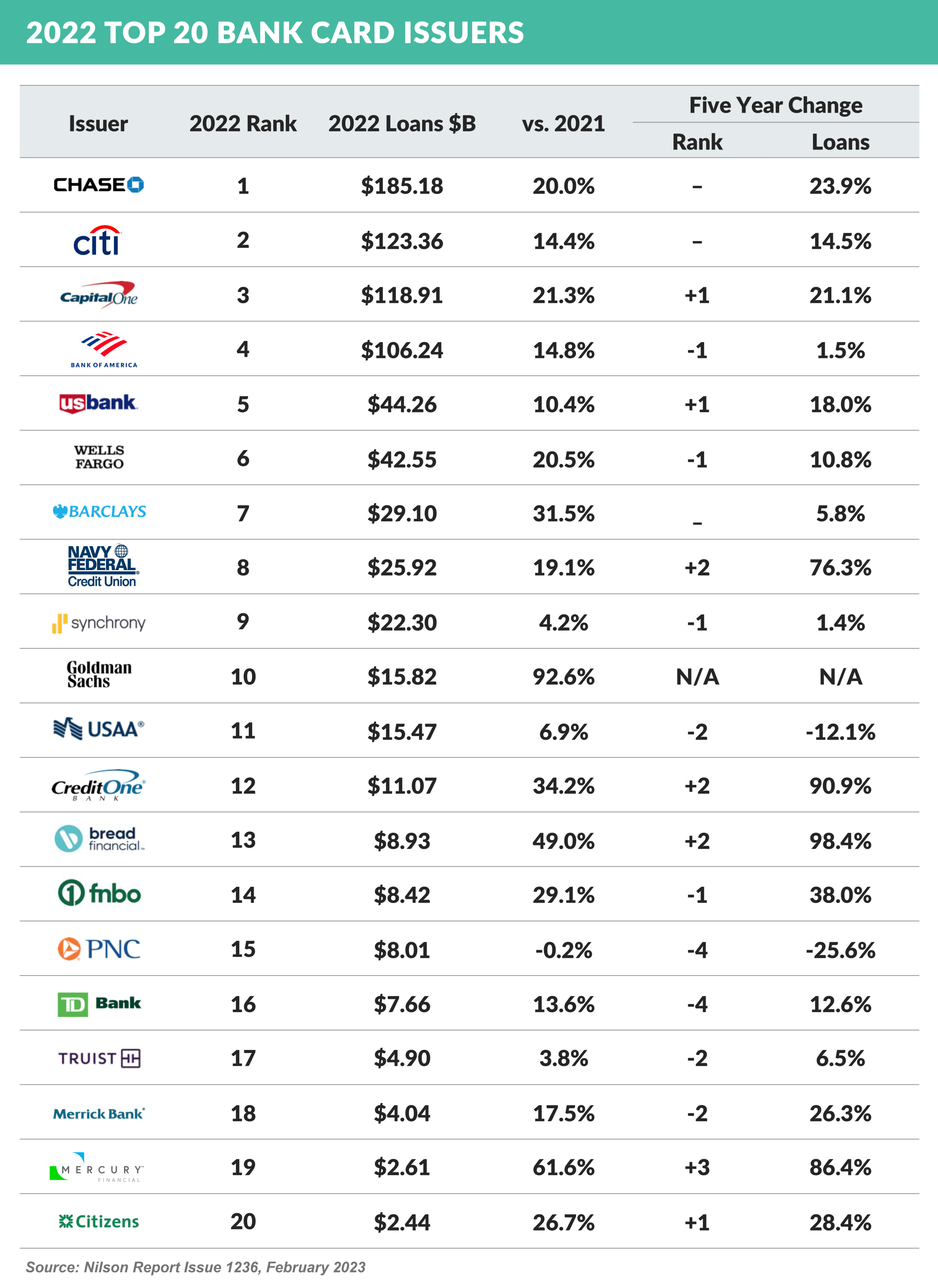

- JPMorgan Chase ended 2022 at the top of the card issuer charts – a spot it has held for decades – with Citi, Capital One, and Bank of America once again rounding out the $100+ billion tier

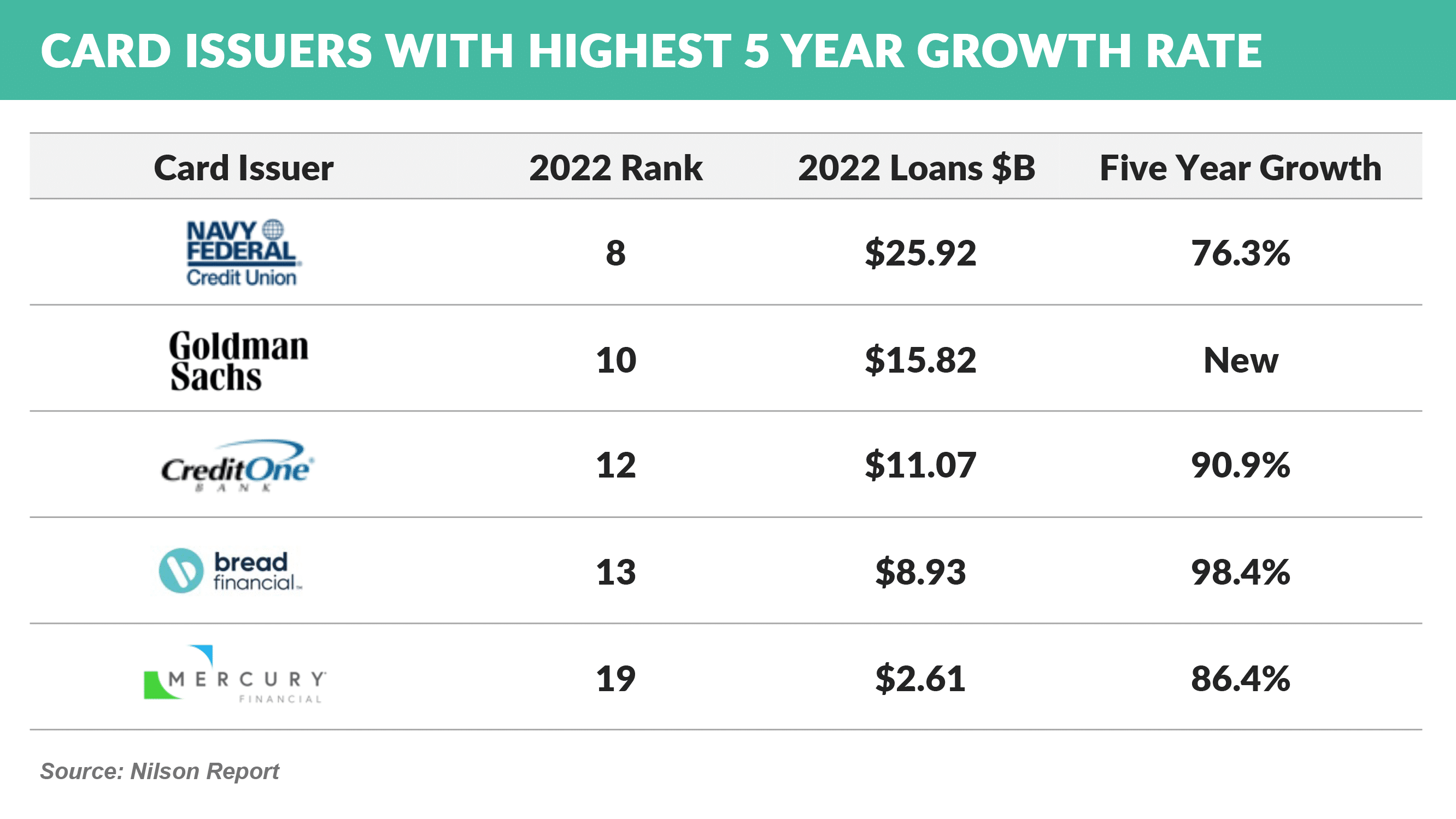

- Several issuers below the top tier have shown the highest growth rate in the past five years

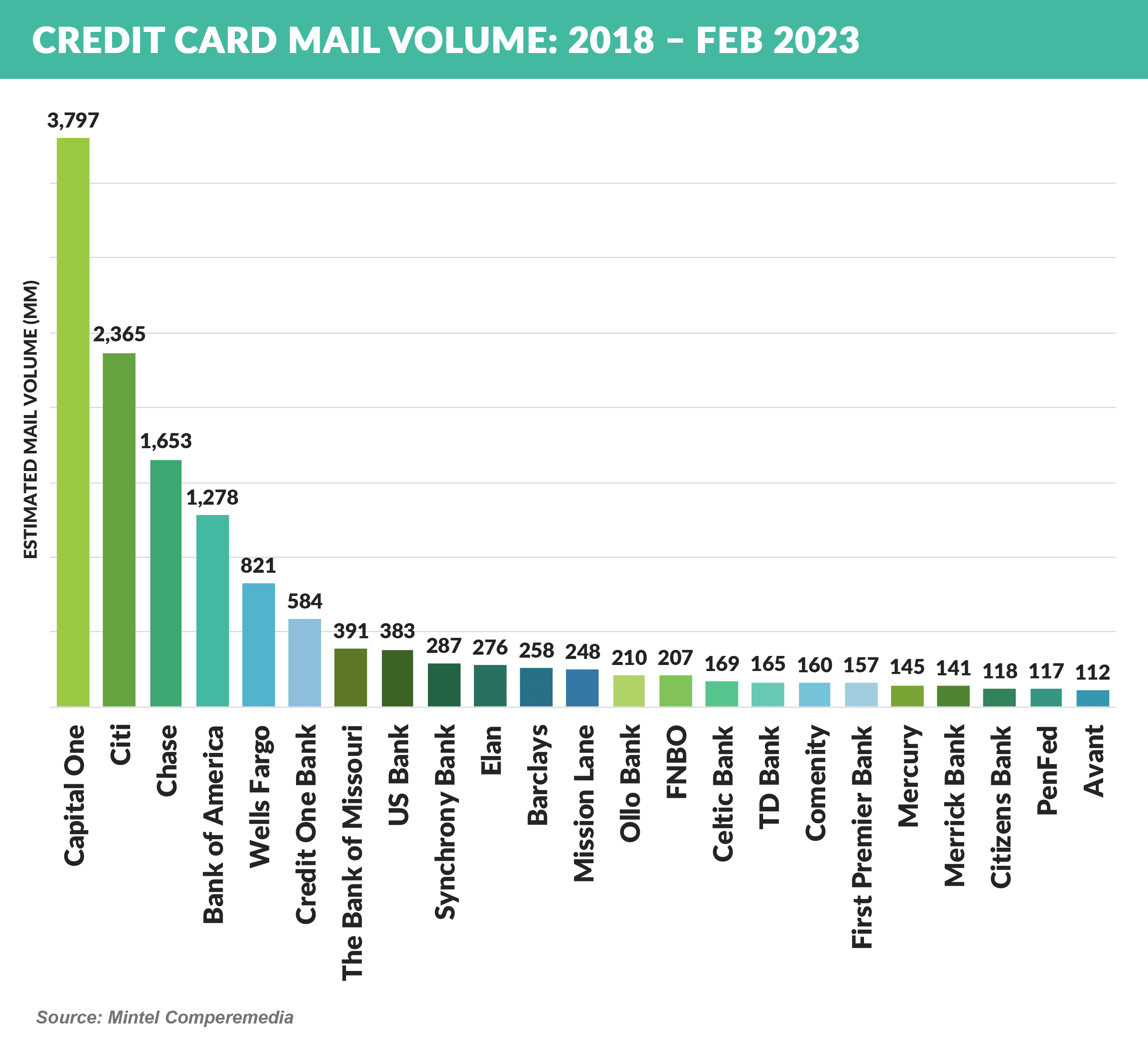

- Over the past five years, the largest issuers have also been the leading mailers

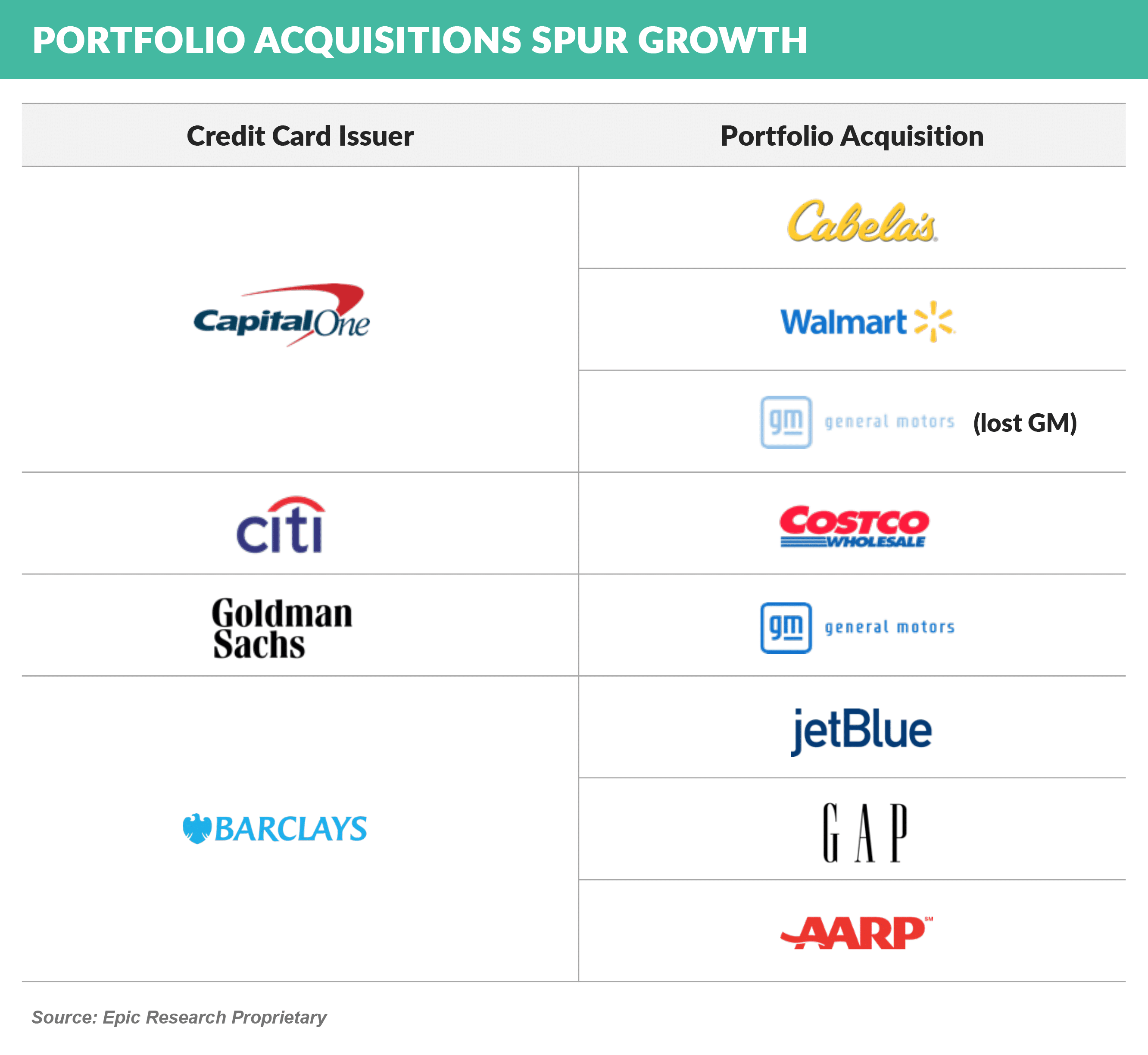

- Portfolio acquisitions have also played a major role in growth since 2016

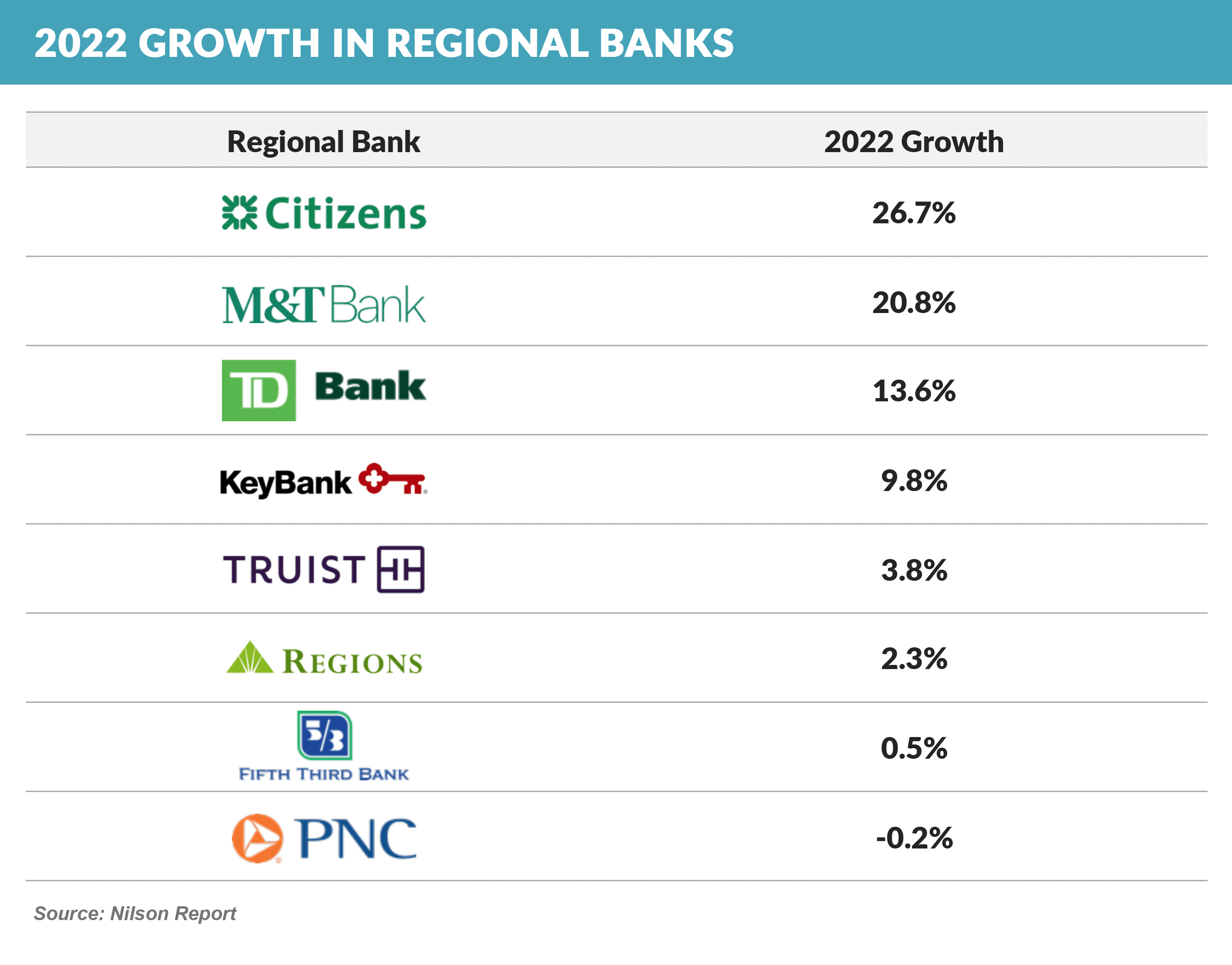

- Citizens and M&T led ’22 growth in the regional bank sector

February Mail Volume Dips for Cards, Loans, and Ed Refi

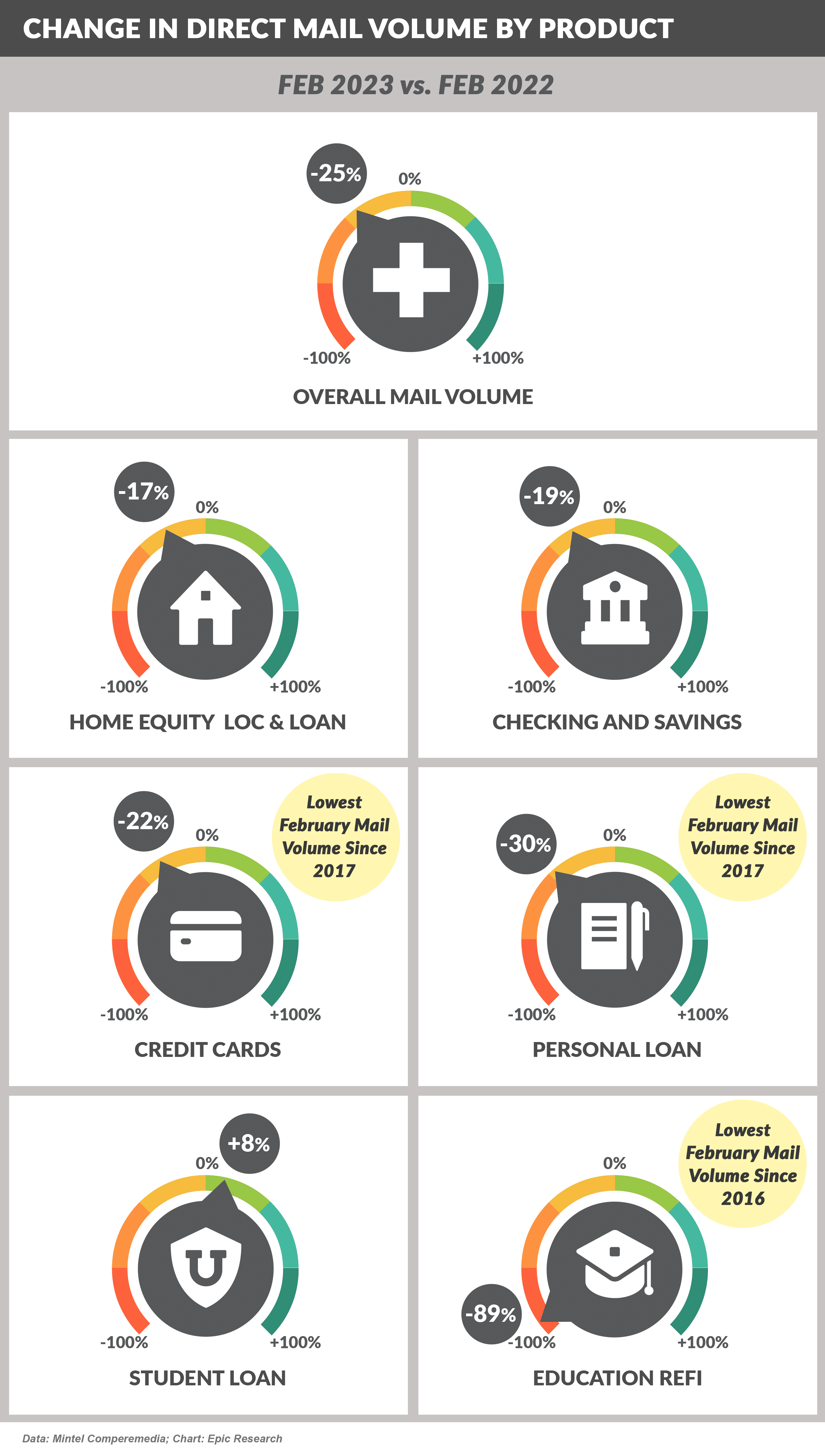

- February saw a significant drop in mail volumes, with several products reaching the lowest quantities in years

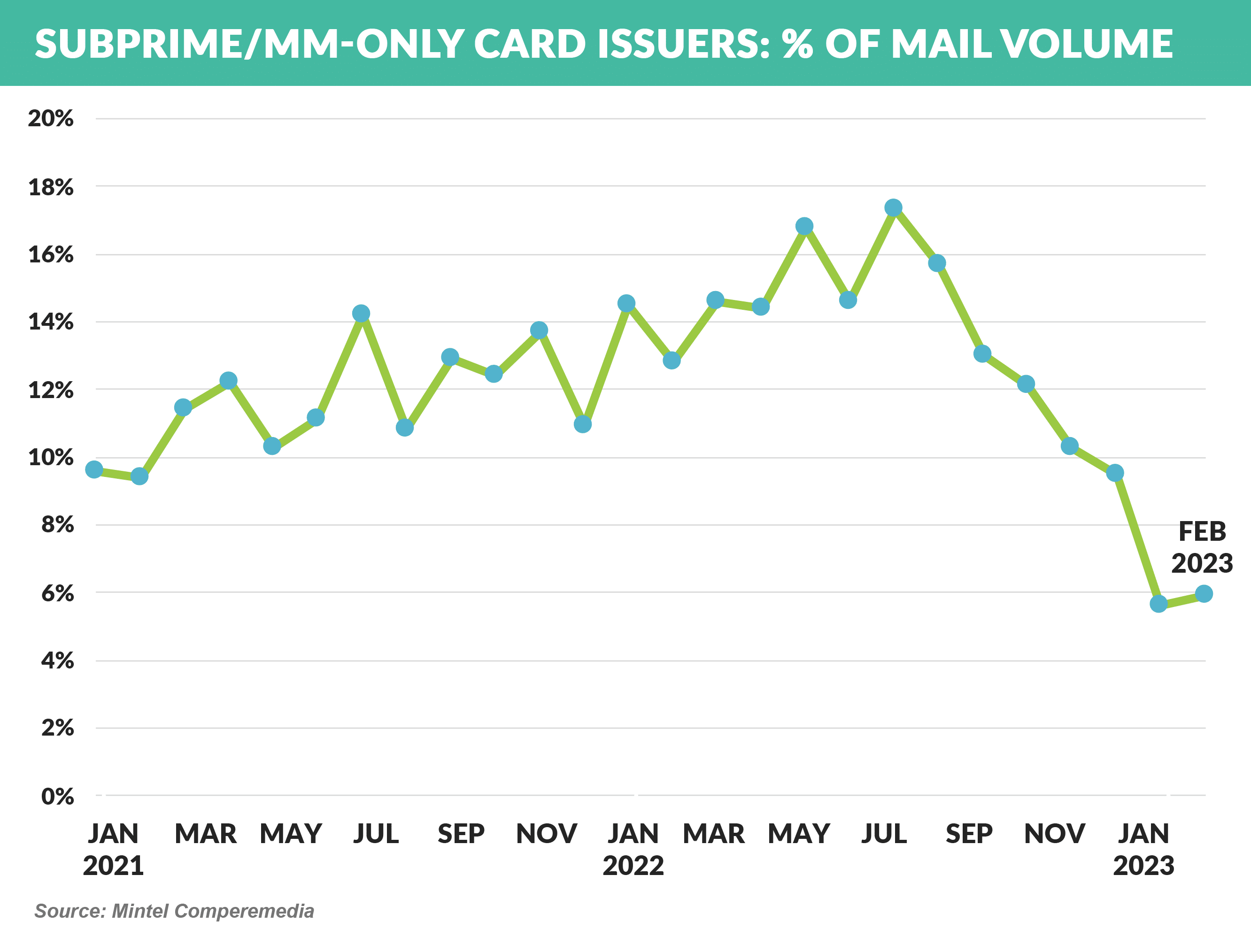

- Mail volume from middle market card issuers – such as Best Egg, Mission Lane, and Mercury – which peaked at 17% of all card volume last summer, has dropped sharply since then and accounted for only 6% of card mailings in February ’23

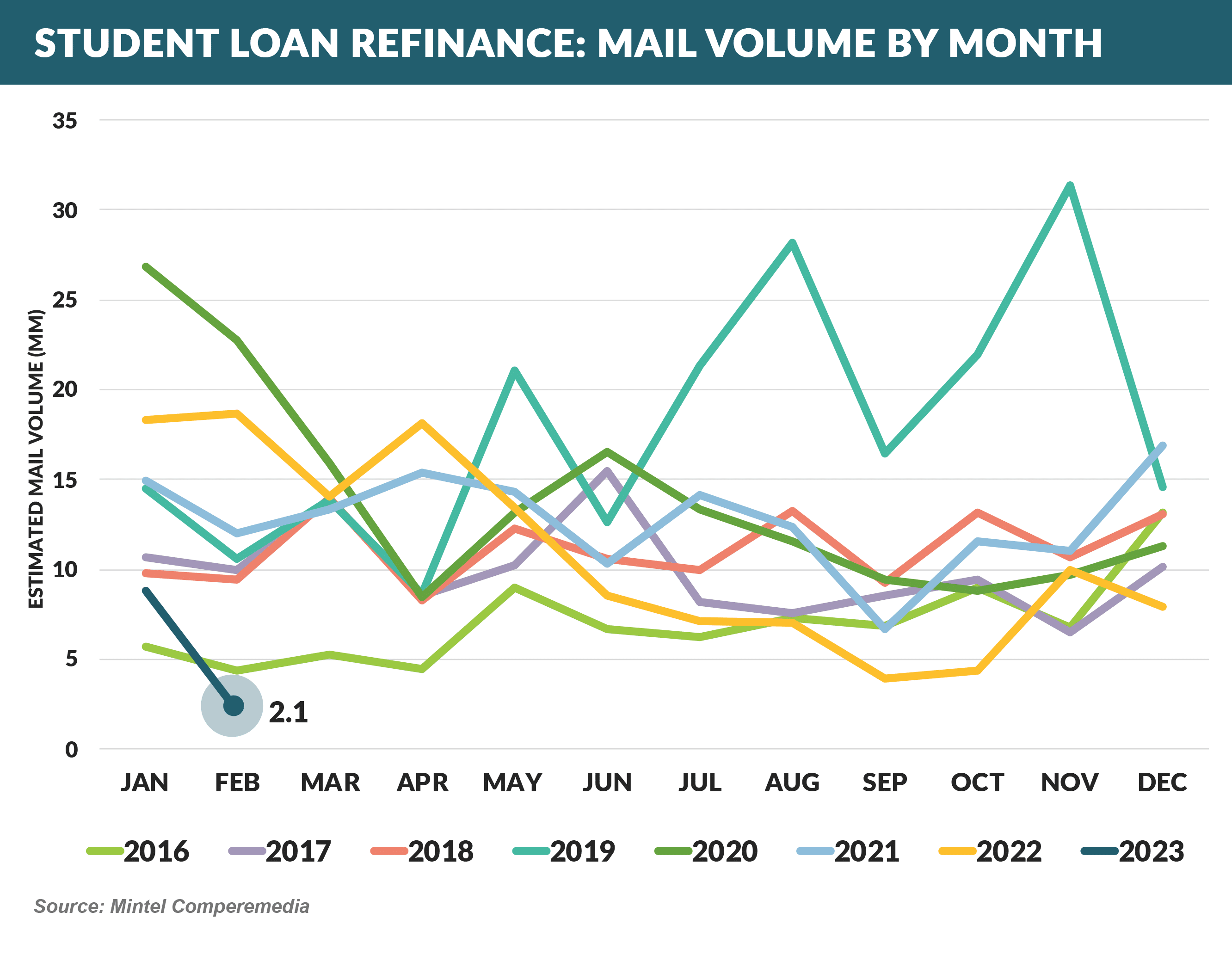

- Education refinance lending hit the lowest level in over seven years as both the repayment moratorium and potential debt forgiveness have impacted marketing activity

- Apple this week introduced Apple Pay Later, its version of BNPL

- Apple Pay Later allows users to split purchases into four payments, spread over six weeks with no interest and no fees

- Users can apply for Apple Pay Later loans of $50 to $1,000, which can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay

- As detailed in the February Epic Report, consumer behavior with credit cards indicates less interest rate sensitivity than some other lending products, as shown by the steep rise in card balances concurrent with increasing interest rates

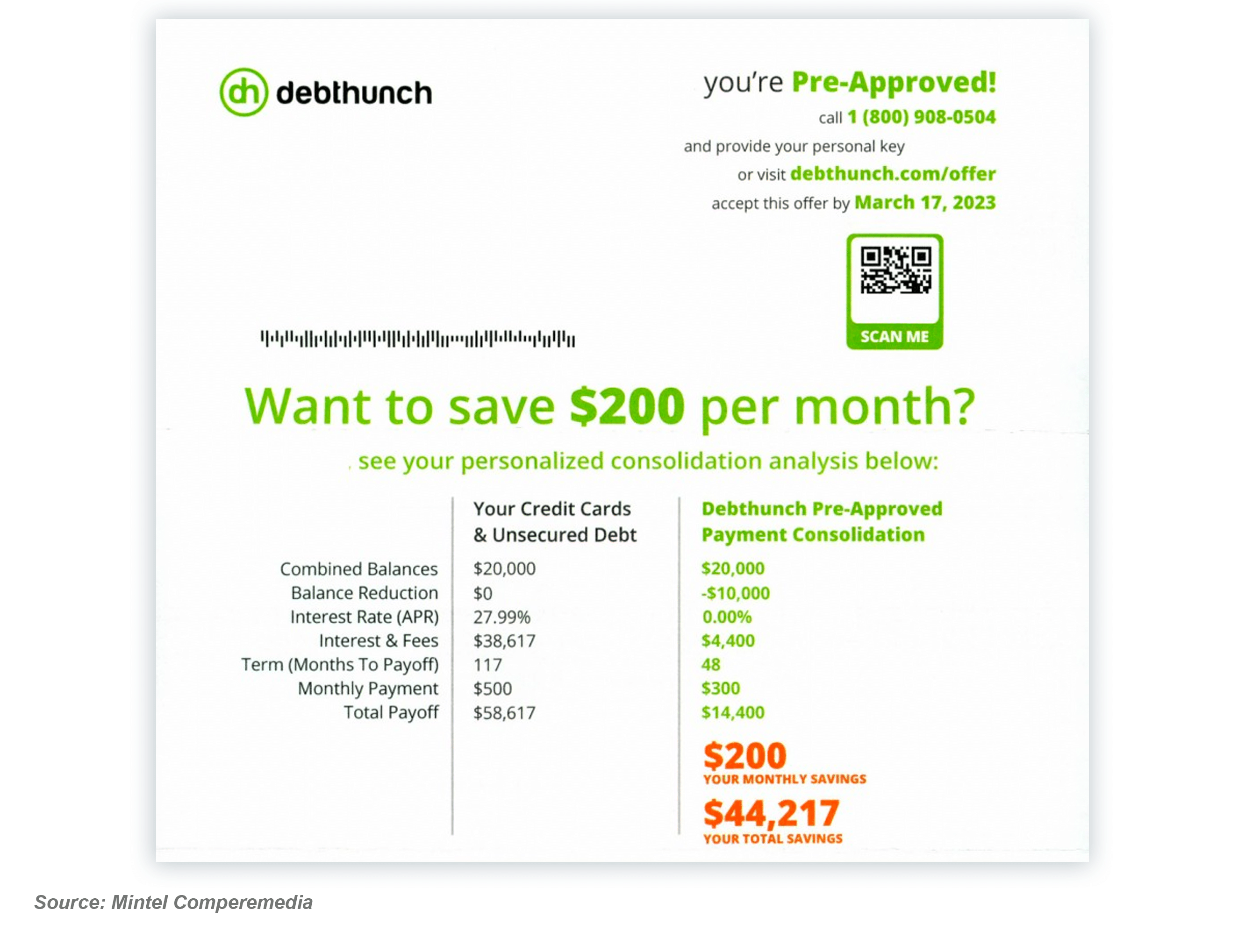

- Debthunch is mailing a 0% loan which appears to be a debt consolidation offer

- JPMorgan will pilot biometric payments in a program that includes palm and face identification for payments authentication in-store

The Epic Report is published monthly, with the next issue publishing on May 6th.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Add jim@epicresearch.net to your contacts to avoid junk filter issues.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.