Three Things We’re Hearing

- Premium travel card marketing soars!

- Credit One dominates near prime marketing

- The Epic Report turns five!

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Premium Travel Card Marketing Soars!

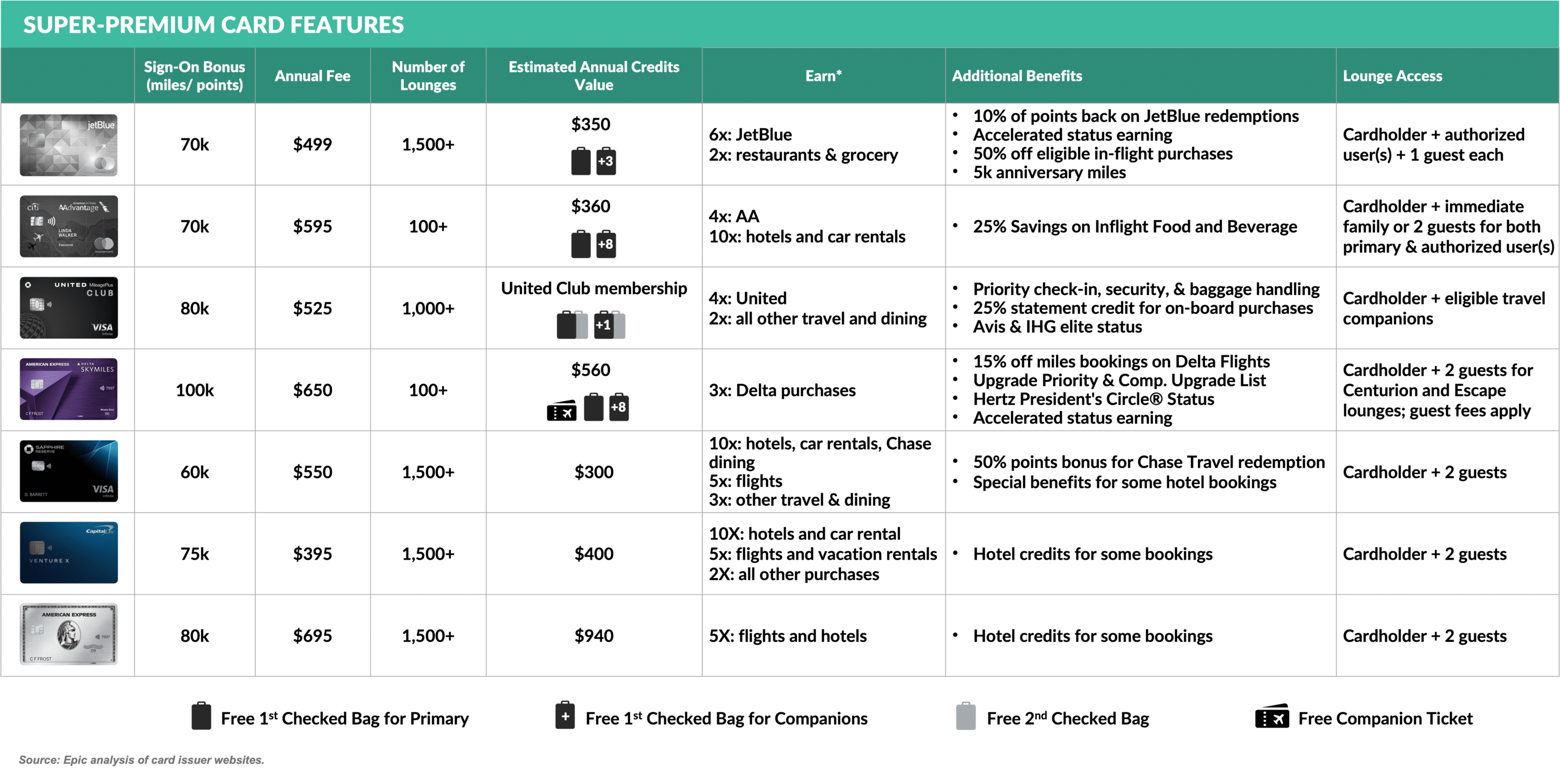

- Barclays and JetBlue introduced the JetBlue Premier Card in January, joining cards such as Capital One Venture X, Chase Sapphire Reserve, and United Club Infinite in the high-end travel card market

- To justify the high annual fees ($395 - $550+), these “super-premium” cards typically feature:

- High sign-on bonuses

- Travel credits

- Special spending tier bonuses

- Other benefits such as TSA Pre-Check and Global Entry credits

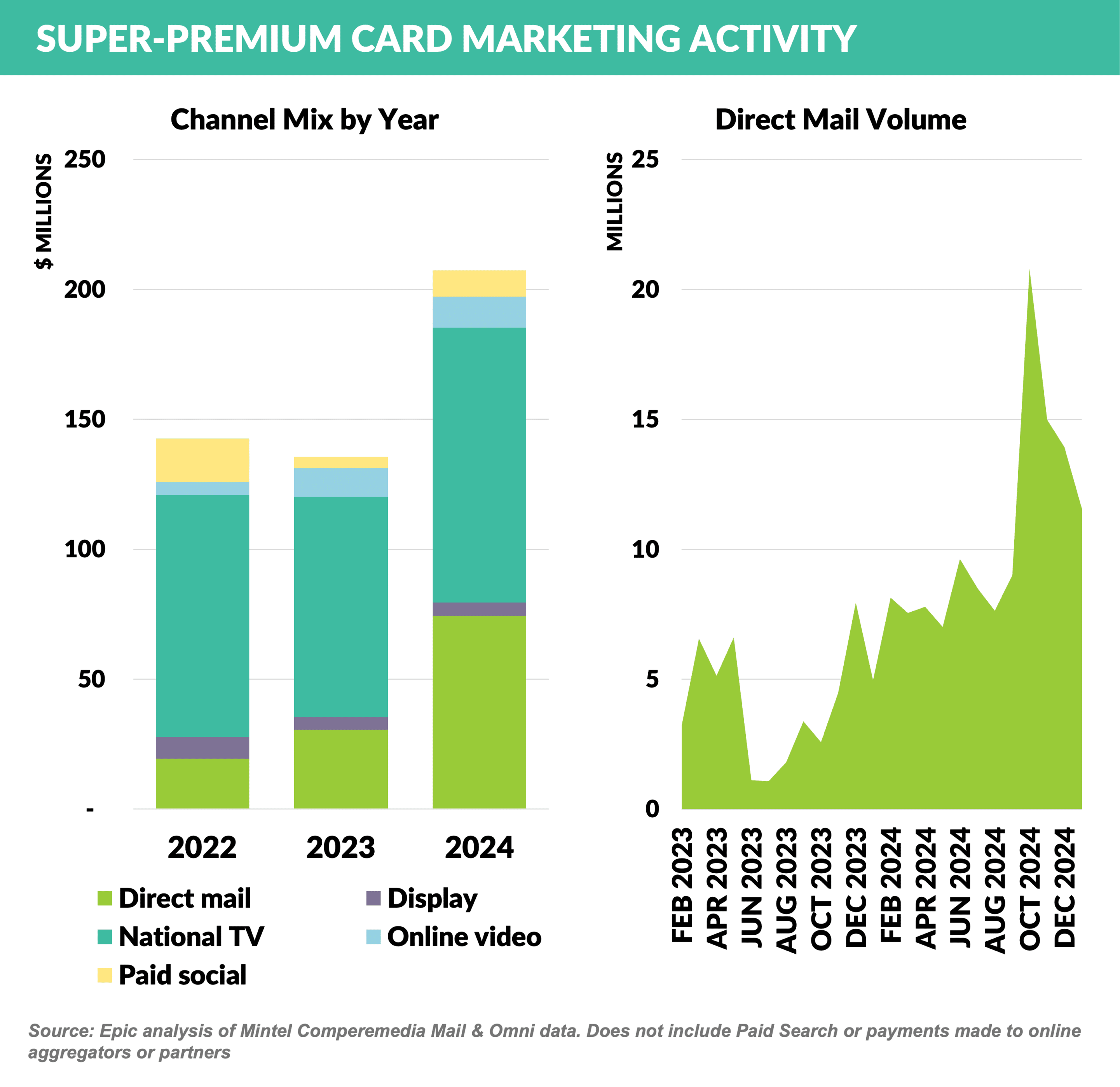

- Super-premium card marketing activity was up over 50% in 2024, with American Express Platinum driving a surge in Q4 2024 mail volume

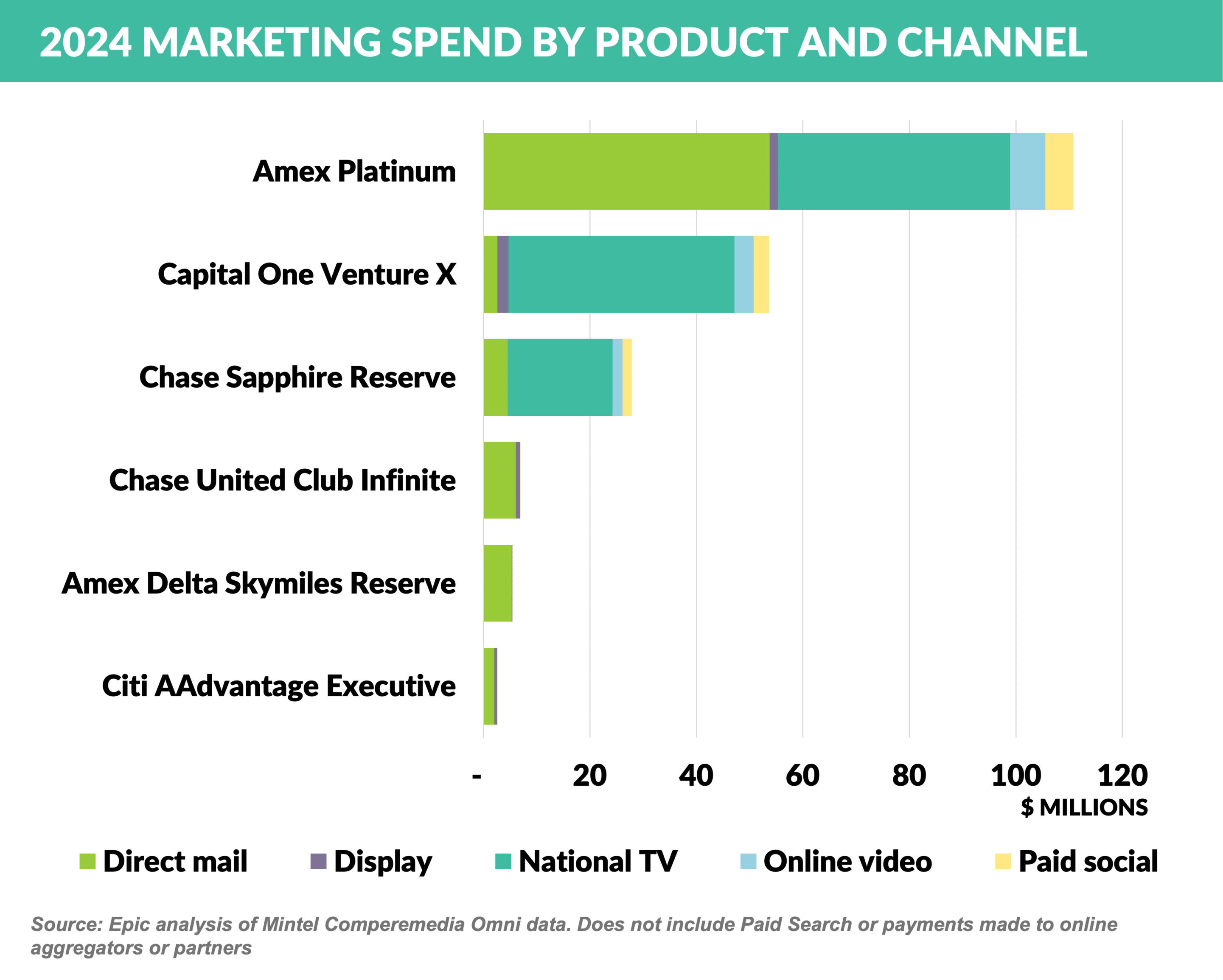

- Amex Platinum spent over twice that of number two Capital One Venture X, driven primarily by direct mail – each spent $43 million on national TV advertising

- Creative typically focuses on acquisition bonus, lounges, annual credits, and earn rate

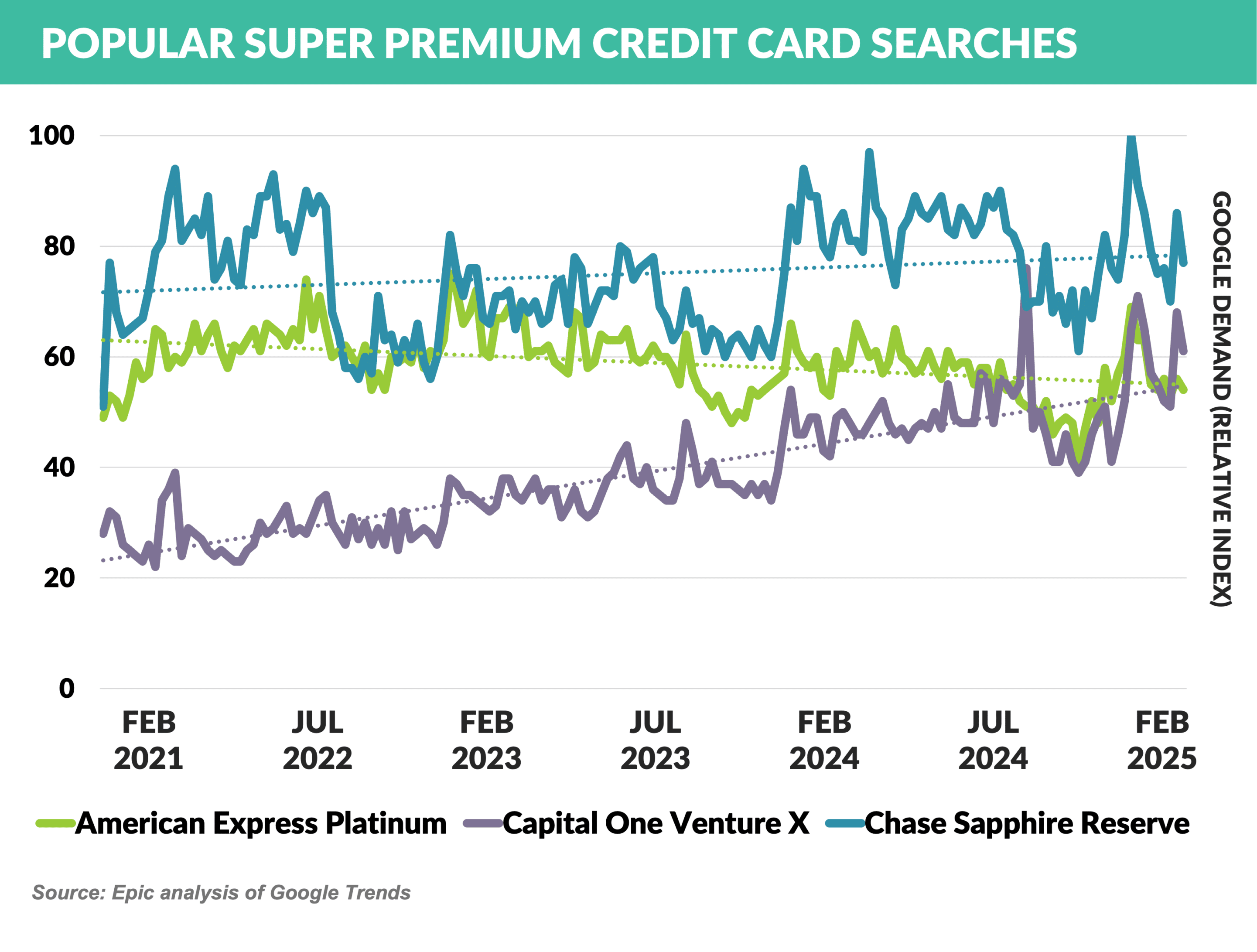

- Chase Sapphire Reserve has typically led online search volume, and along with Platinum and Venture X, spiked in Q4 ’24 reflecting the increase in marketing through all channels

Credit One Dominates Near and Subprime Marketing

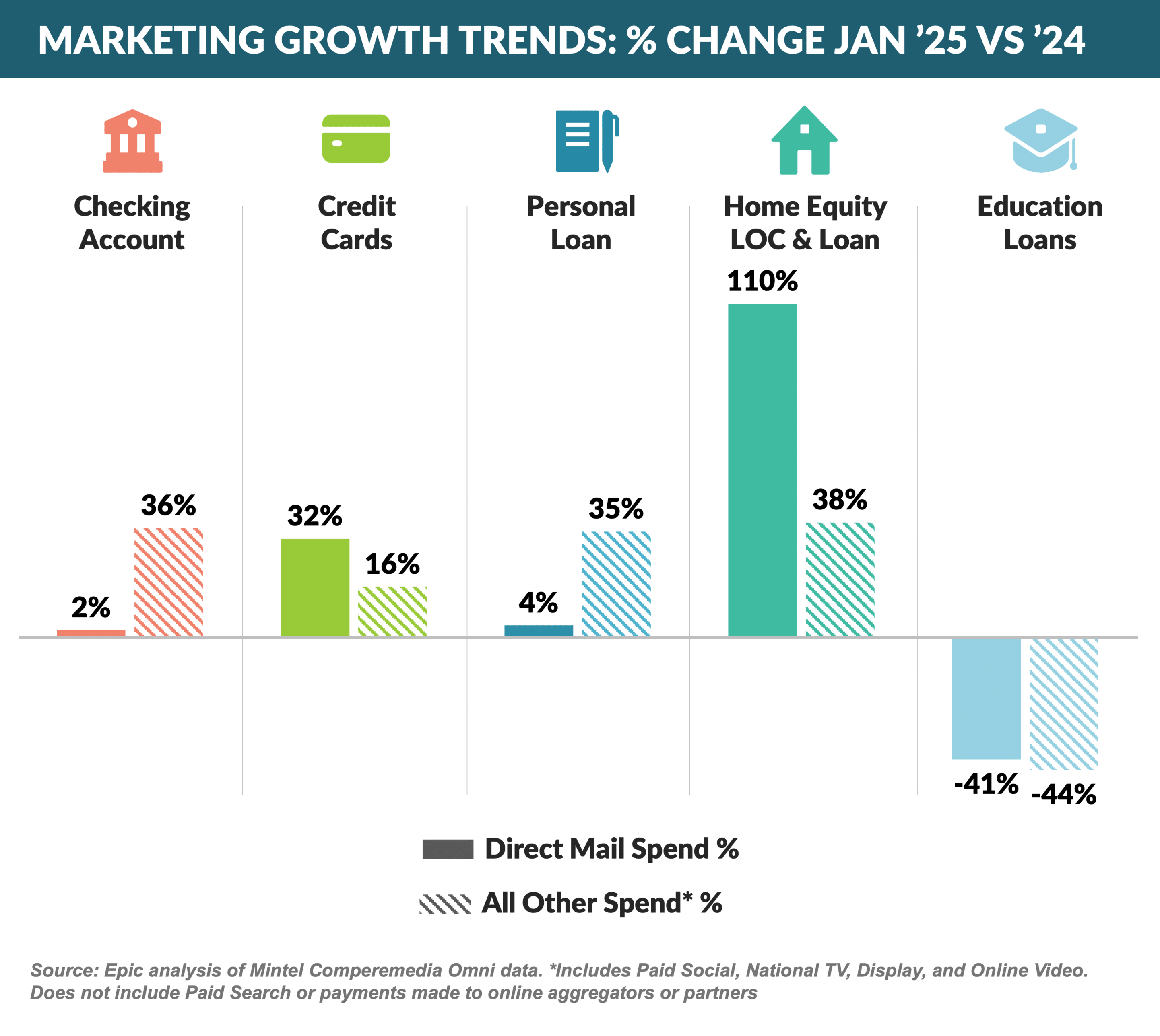

- The largest change in January ’25 vs. January ’24 spend was in HELOC marketing, with direct mail up 110% and other channels rising 38%

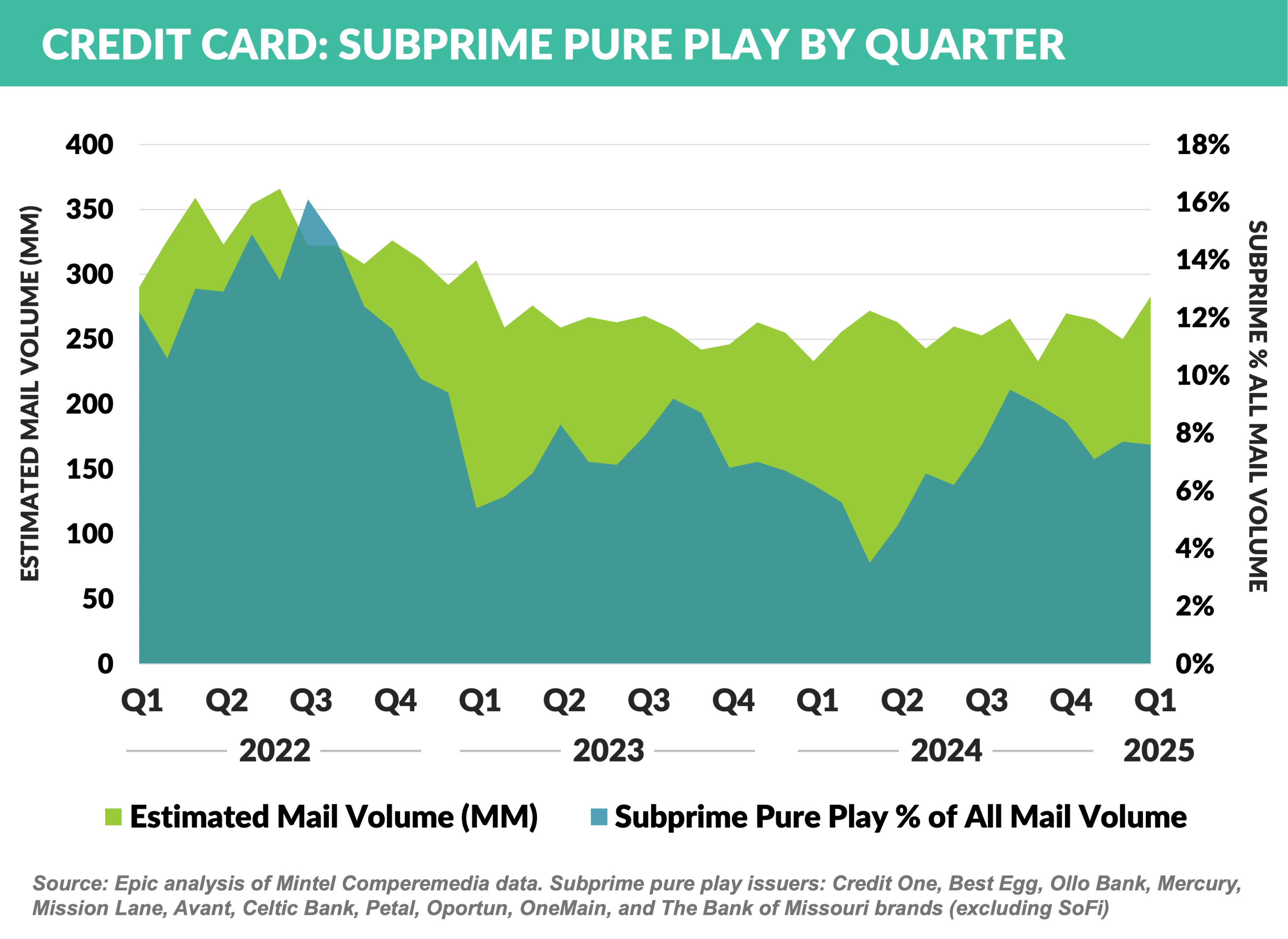

- Subprime and near prime card mail has trended between 5% and 10% of all card mail volume in the past few years

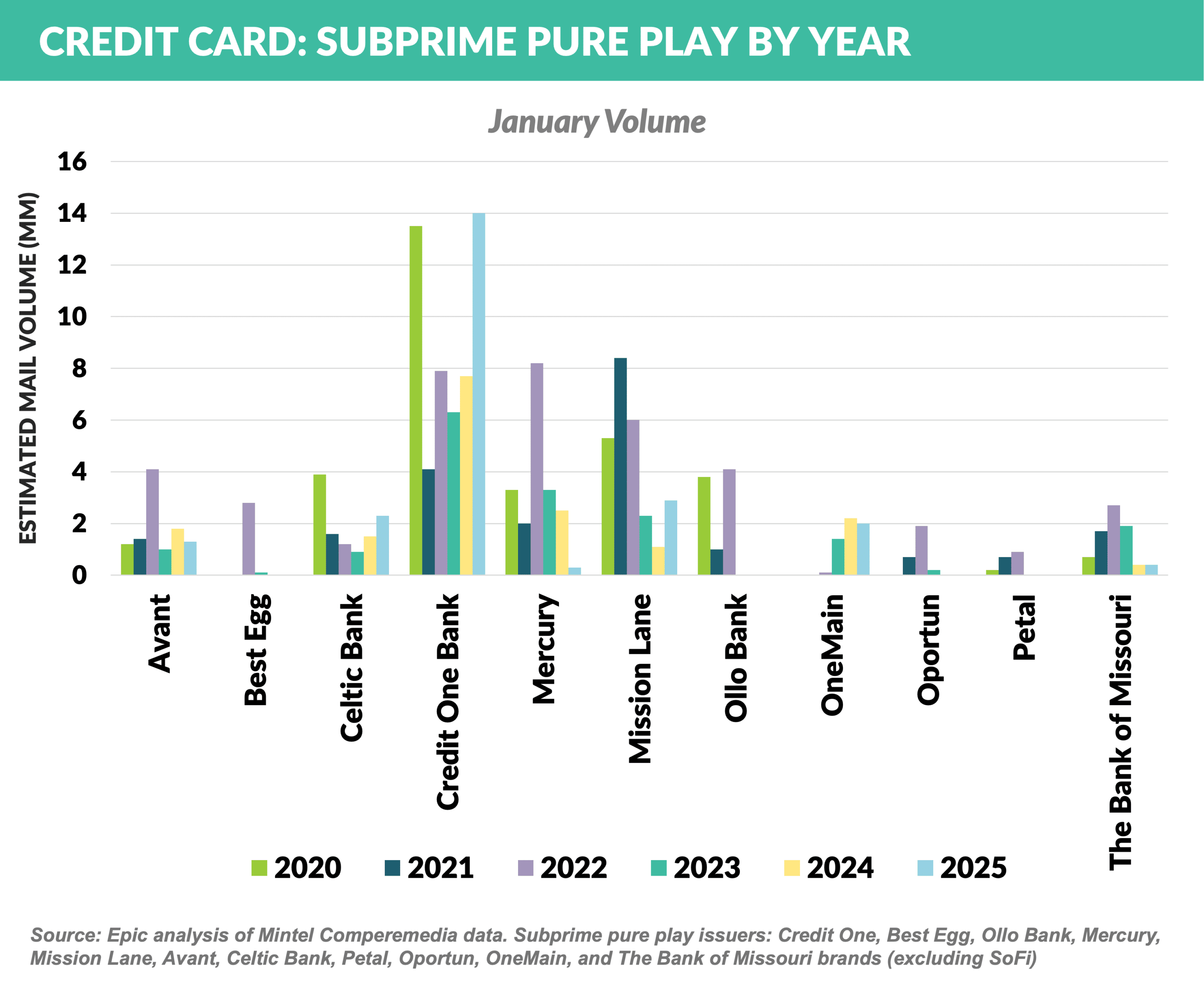

- Despite the relatively stable overall volume in the segment, most issuers have pulled back from direct mail, with their lower volumes being made up by Credit One

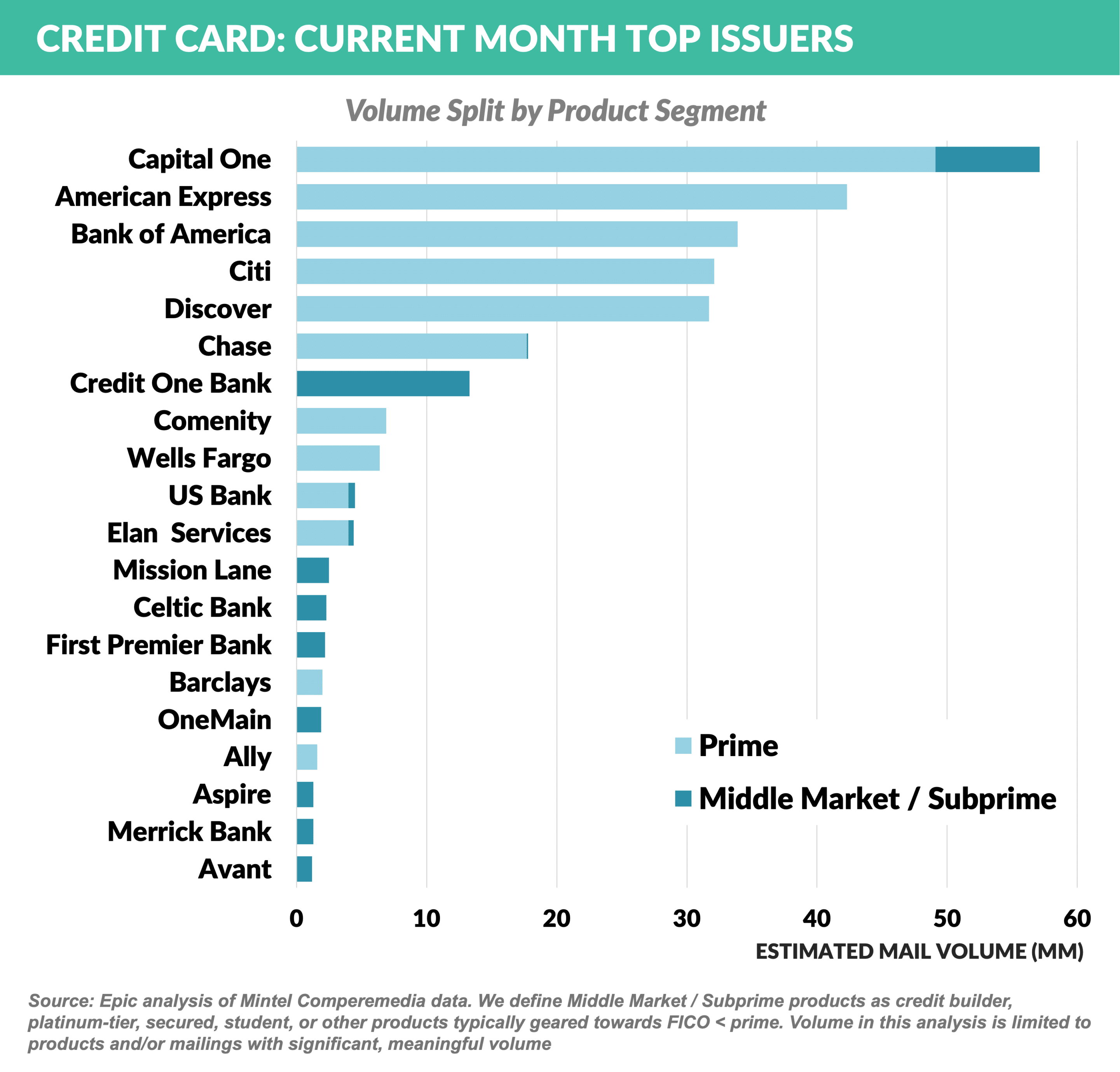

- In January ’25, Credit One was the seventh largest mailer of all card issuers mailing 13.4 million pieces which was more than all other pure play subprime issuers combined

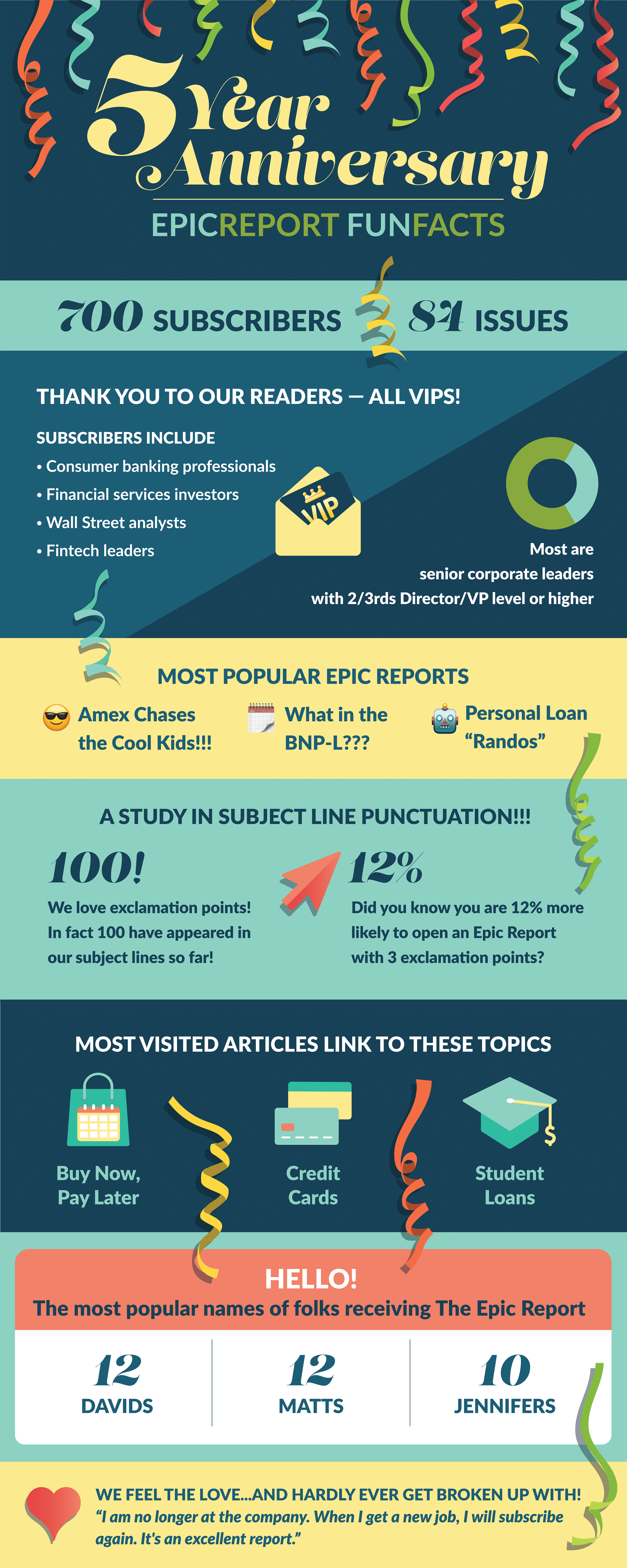

The Epic Report Turns Five!!!

- This issue marks the five-year anniversary of the Epic Report

- First published on March 21st, 2020, we launched the newsletter at the beginning of Covid as many of our clients and friends were asking “what are you hearing?”

- Amid the universal worries about the health consequences of the then-new pandemic, financial services marketing activities came to a screeching halt as worries about the economy and credit quality were prevalent

- Subsequent issues covered the massive decline in marketing and lending activity and the ultimate recovery to pre-Covid levels

- You can help us make the Epic Report better by giving us feedback – tell us what you want to see more of and what is written about too much

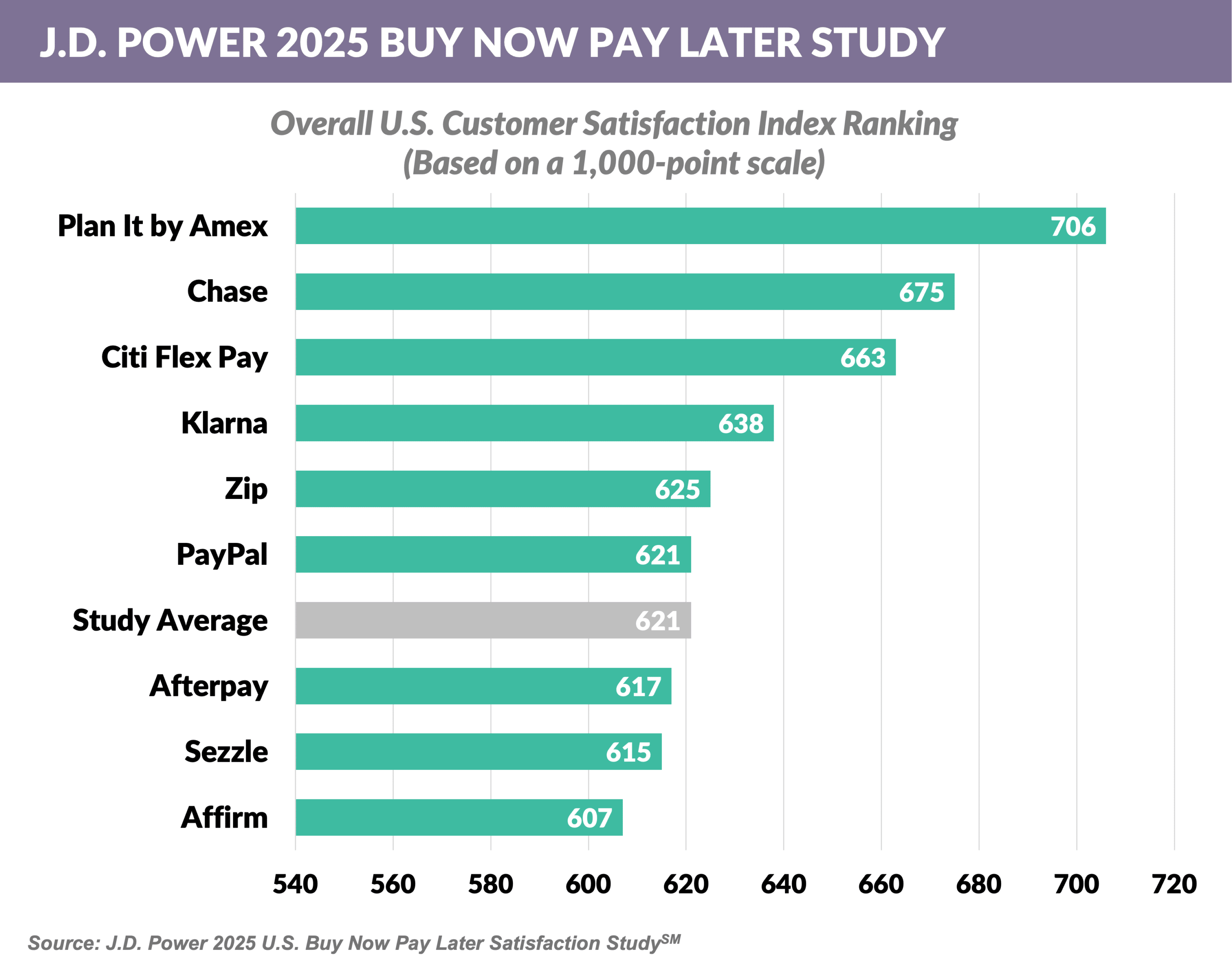

- A recent customer satisfaction survey by JD Power ranked “on card” extended payment plans ahead of those provided by standalone BNPL providers

- Offerings by American Express, Citi, and Chase scored highest among consumers

- Affirm, Sezzle, and Afterpay scored lowest

- JPMorgan Payments is expanding its BNPL offerings by integrating Klarna, allowing 900,000 businesses to offer installment payments at the point of sale and strengthening Klarna’s U.S. presence ahead of its IPO

- Klarna has previously partnered with Stripe, Adyen, and Worldpay while exploring a U.S. banking license to enhance its customer experience and service offerings

- Klarna’s IPO, expected in April, could value the company at up to $15 billion

- Affirm’s Q2 FY 2025 revenue surged 47% YoY, with $80M net income versus a $167M loss last year

- The growth was driven by optimized transaction costs, smarter loan pricing, and growth in merchants (+21% YoY) and consumers (+23% YoY)

- Black Friday/Cyber Monday GMV grew 44%, travel jumped 42%, and Affirm Card usage rose 113%

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in April.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.