Four Things We’re Hearing

- Card balance growth finally turning the corner

- College students are savvy loan shoppers

- New bank overdraft products gaining traction

- Consumer lending mail volume still sluggish

A Four-minute read

Card Balance Growth Finally Turning the Corner

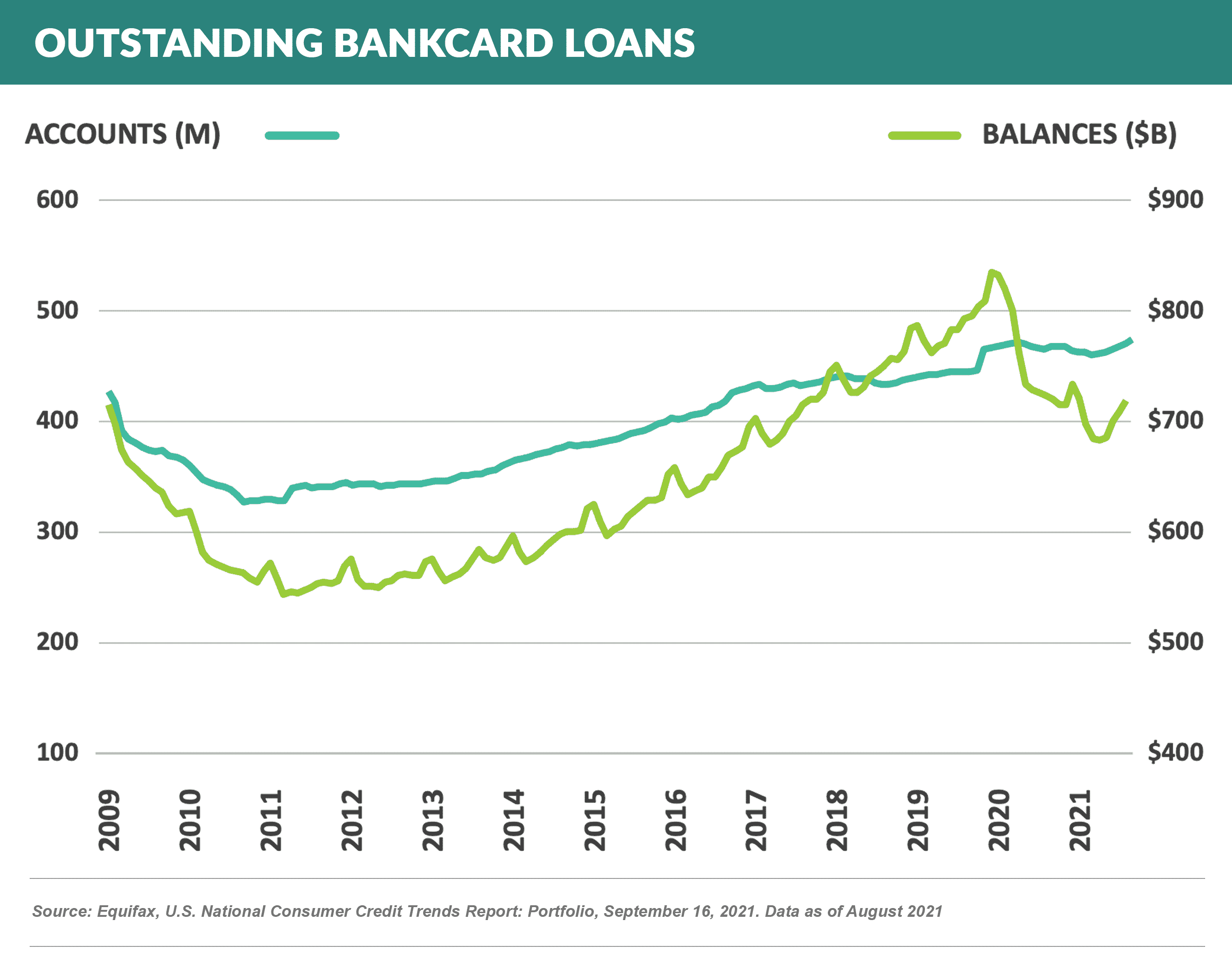

- Outstanding card balances have stabilized somewhat, having declined only .7% since August 2020

- September reports from some large card issuers reflect this trend towards stabilization after shrinking in 2020 and early 2021 due to a combination of higher consumer pay down rates and dramatic cuts in new customer marketing

- Capital One reported year-over-year growth of .3%

- Discover announced similar slight growth, up .4% vs. the prior year

- American Express reported 8.9% growth vs. 2020, primarily reflecting the reversal of the sharp drop in T&E spending along with heavy new customer marketing activity in late 2020 and early 2021

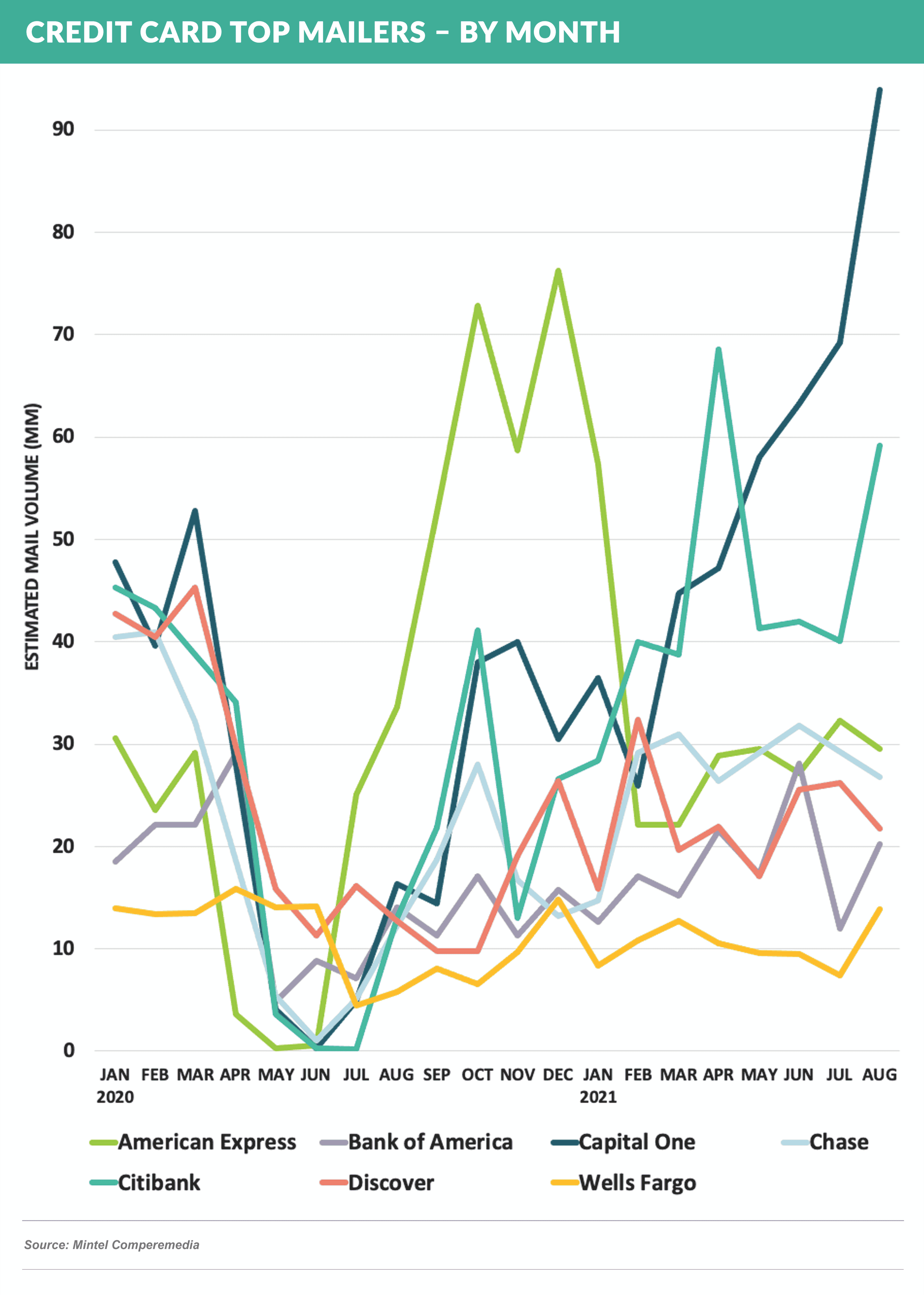

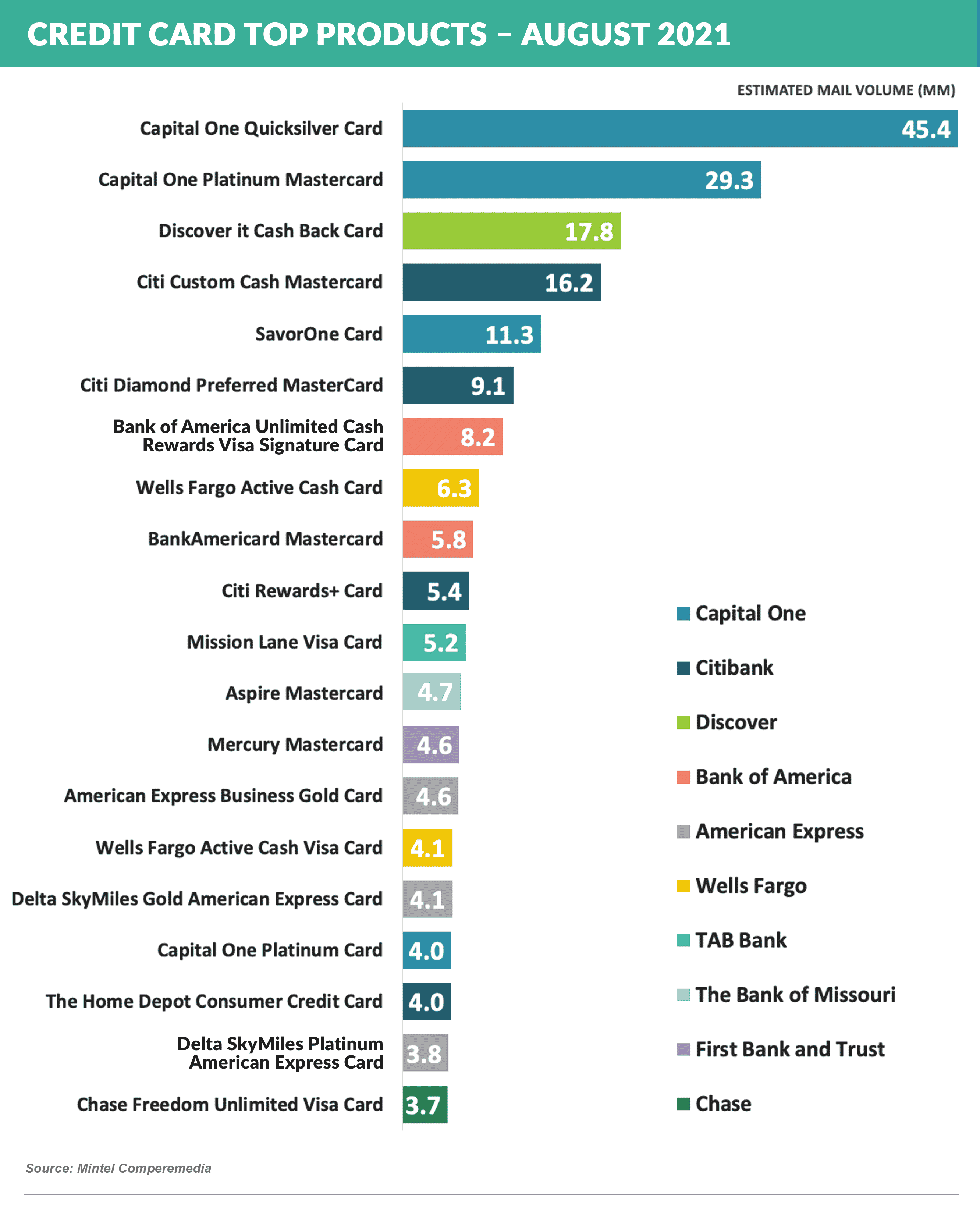

- As I’ve noted in our recent newsletters, credit card mail volume is essentially back to pre-COVID levels, with Capital One and Citi far ahead of the rest of the pack

- One major market trend is the domination of proprietary branded cards over cobranded cards, accounting for the top 15 offers mailed in August and over 80% of total volume

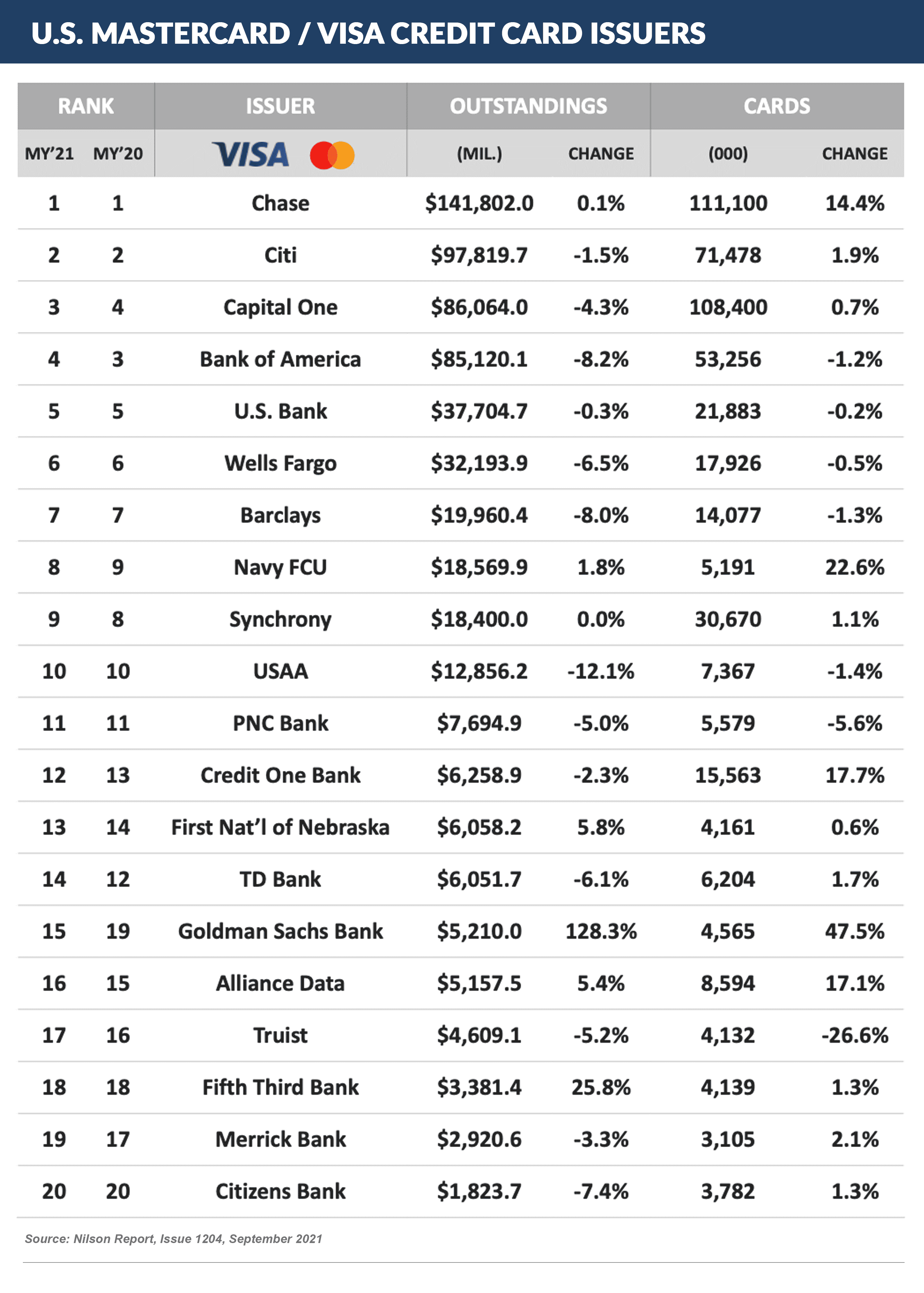

- With few exceptions, mid-year 2021 card issuer rankings provided by Nilson reflect the trend of lower balances with Capital One overtaking Bank of America for the third slot by shrinking slightly less (4.3%) than BofA (8.2%)

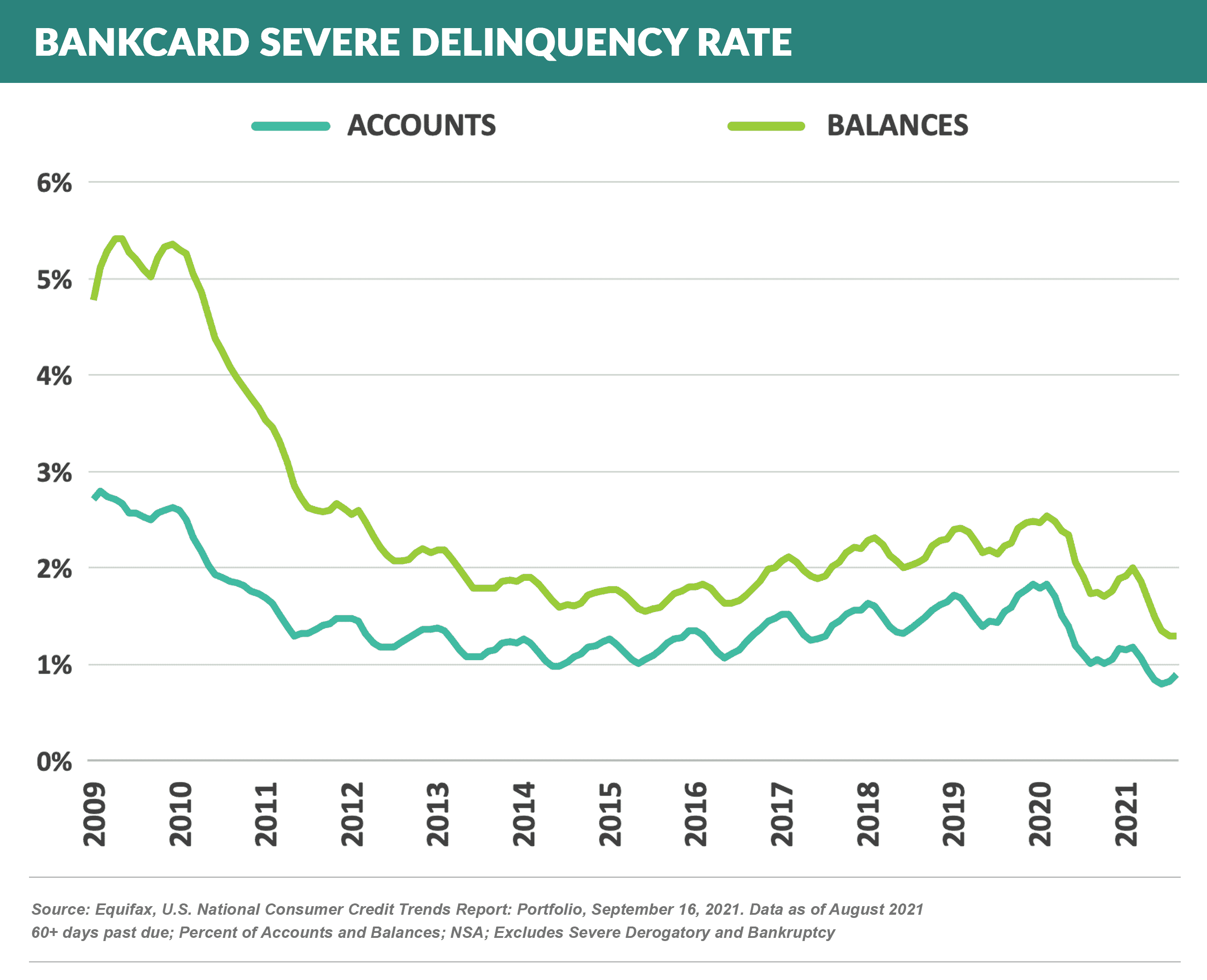

- Card delinquencies continue at record-low levels, with Equifax reporting total August 60+ delinquency for bankcards at 1.29%, 25% lower than the previous record of 1.73% in August 2020

- Growth in both balances and delinquencies will undoubtedly return in 2022, the question is how much

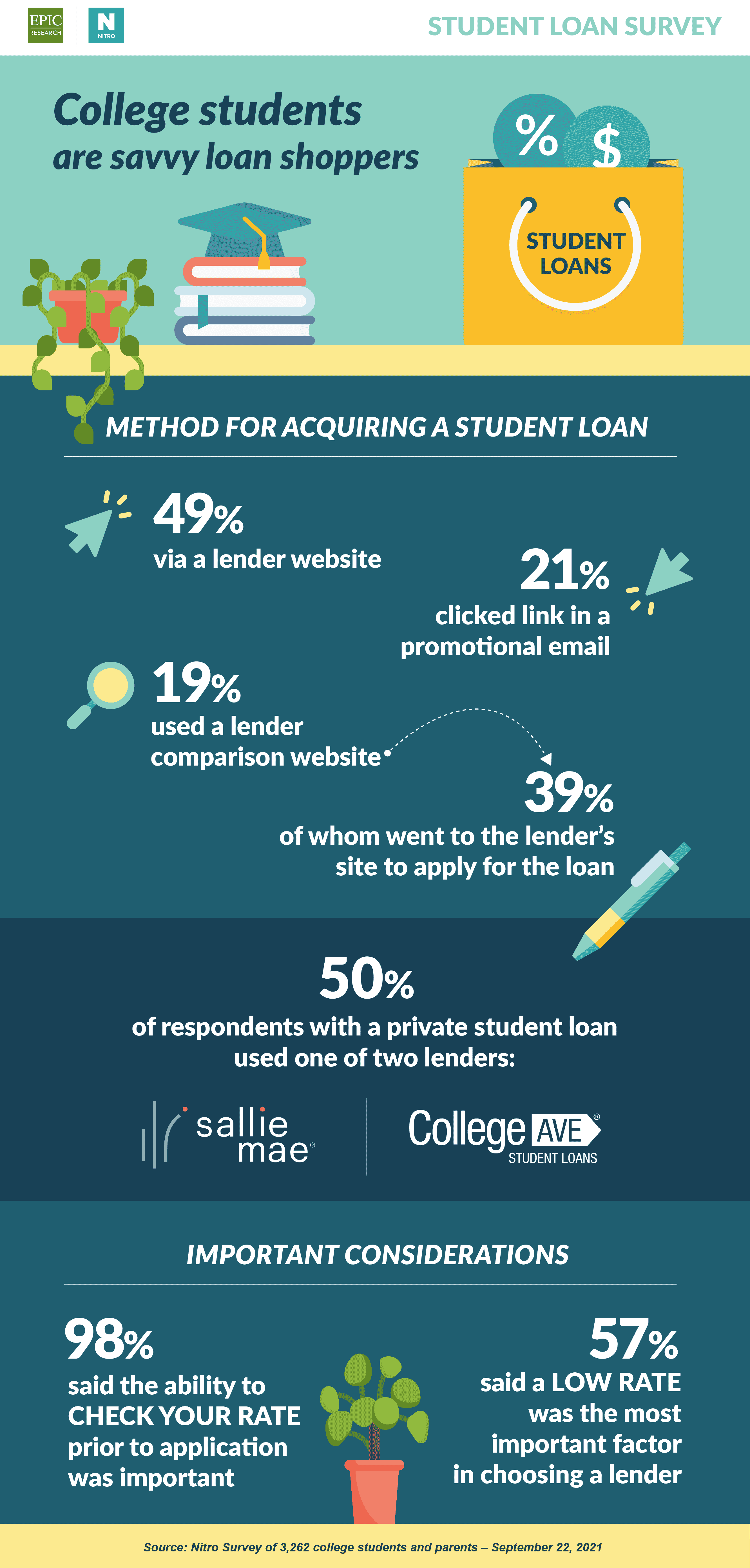

College Students are Savvy Loan Shoppers

- As student lending “peak season” comes to an end, we surveyed 3,262 members of Nitro, Epic’s “How to Afford College” website, to assesses how they chose their private student loan

New Bank Overdraft Products Gaining Traction

- Banks are designing new products and policies to deal with regulatory and political pressure on overdraft fees

- Bank of America premiered Balance Connect, which allows customers to provide a list of up to five outside accounts from which to automatically transfer funds in the event of an overdraft

- BofA also revealed that its no-overdraft-fee account, Advantage SafeBalance Banking, grew to over 3 million customers, up 40% in the past year

- The bank also reported that its short-term liquidity program, Balance Assist, exceeded 100,000 accounts in the six months following its national launch

- PNC’s “Low Cash Mode” gives consumers the ability to decide whether to pay transactions that might overdraft their account, sends alerts as they reach a low balance, and allows customers 24 hours to make a deposit to cover a potential overdraft

- Ally Bank, the largest U.S. digital bank, announced it is eliminating overdraft fees altogether

- Regions recently introduced its new Regions Now Checking with a flat $5 monthly fee and no overdraft fees

- Fintechs Current and Chime provide overdraft protection up to $100 and $200, respectively

- As the noise and competition builds around overdraft fees, it will be interesting to see how entrenched banks, which generate billions from overdraft fees, react

- The environment is somewhat reminiscent of the early ’90’s introduction of no annual fee credit cards by monoline issuers such as First USA and Capital One, which the established issuers could not match, ultimately costing the legacy issuers billions

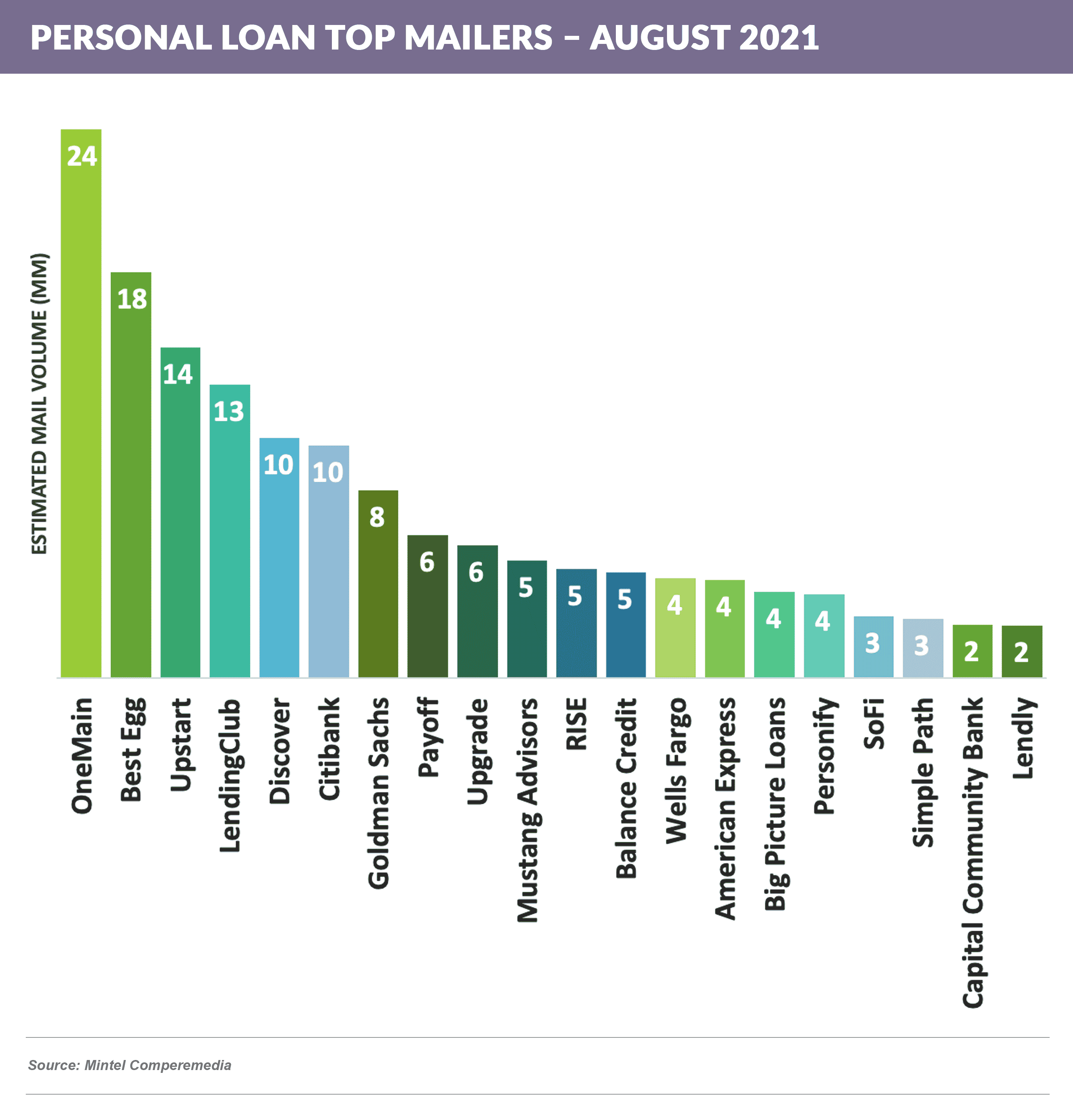

Consumer Lending Mail Volume Still Sluggish

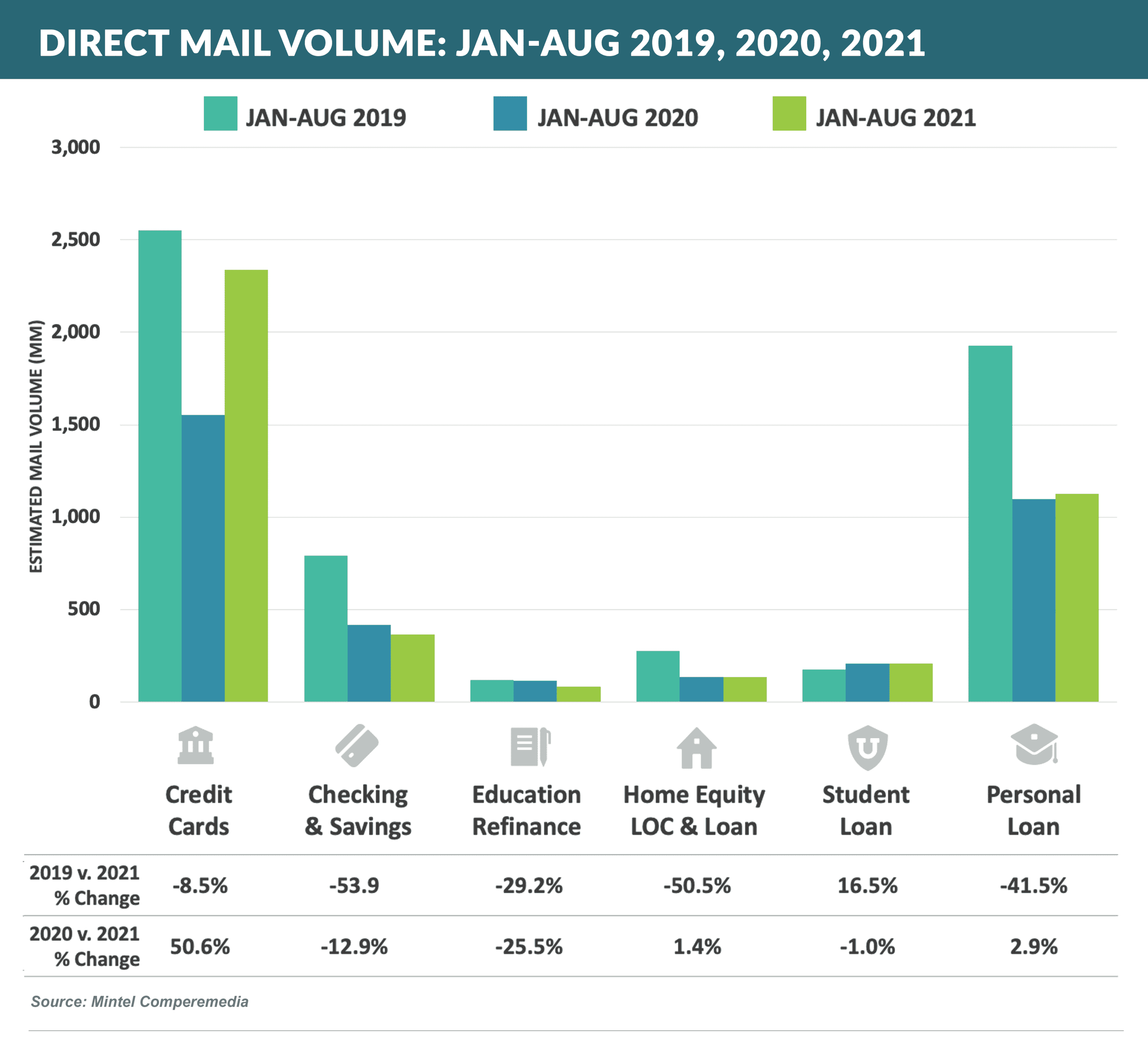

- Much of consumer financial product acquisition marketing is driven by direct mail, with mail channels accounting for 60%+ of new customers for some products

- Direct mail volume was a good barometer of the sharp marketing pull-back during the pandemic and has somewhat reflected the “return to market” sentiment in 2021

- As mentioned above, credit card mail volume has essentially returned to pre-lockdown levels, however volumes for most other products (with the exception of in-school student loans), having recovered somewhat, remain well below the magnitude of 2019

- Personal loan mail volume remains 42% below 2019

- Upstart is becoming a top player

- LendingClub volume dropped after a large spike in July

- Best Egg continues to lead the price war with significant volumes at 3.99% and 4.99%

Quick Takes

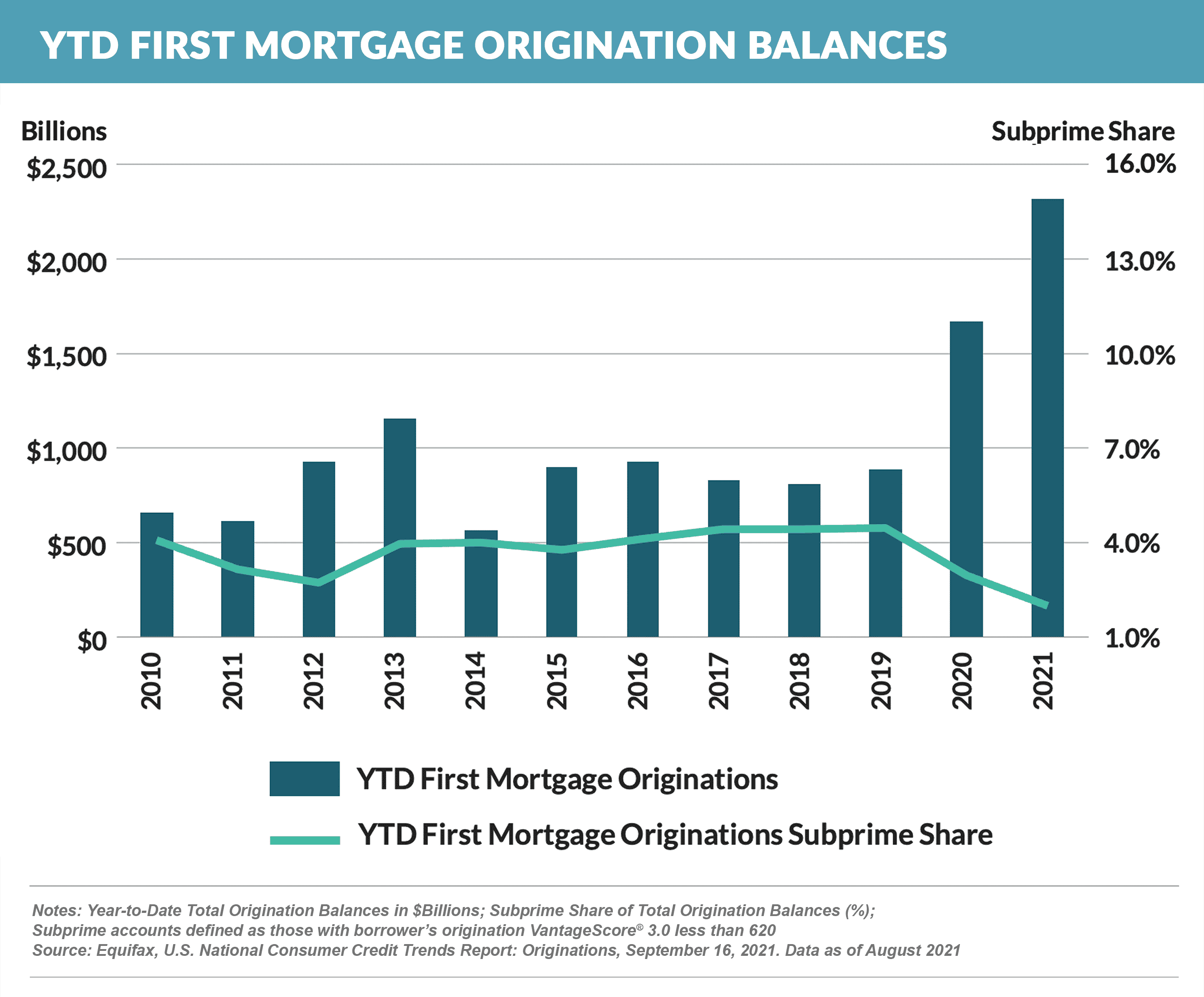

- While credit card loans may have contracted over the past year, overall year-over-year consumer debt at the end of 2Q ’21 grew by 5%, primarily driven by mortgage debt – first mortgage origination balances were almost three times those in the 2017-2019 annual numbers

- In this month’s big “BNPL*” news, Goldman Sachs announced its $2.2 billion acquisition of home improvement financing fintech GreenSky (*although our personal definition of BNPL would involve much smaller ticket items than the $25,000+ average home improvement loans that are GreenSky’s specialty)

- Education lender Earnest, a subsidiary of Navient, reported the acquisition of Going Merry, a financial aid platform where students can apply for scholarships, institutional aid, and government grants via one application

- In a similar move, JPMorgan Chase is buying Frank, an online portal with tools to help students apply for financial aid and find scholarships

The Epic Report is published monthly, and we’ll distribute the next issue on November 6th.

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here. To subscribe to our newsletter, click here.