Three Things We’re Hearing

- Near-Prime cools

- Meet Barclays and Denny Nealon

- HELOC mail peps up!

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Near-Prime Cools

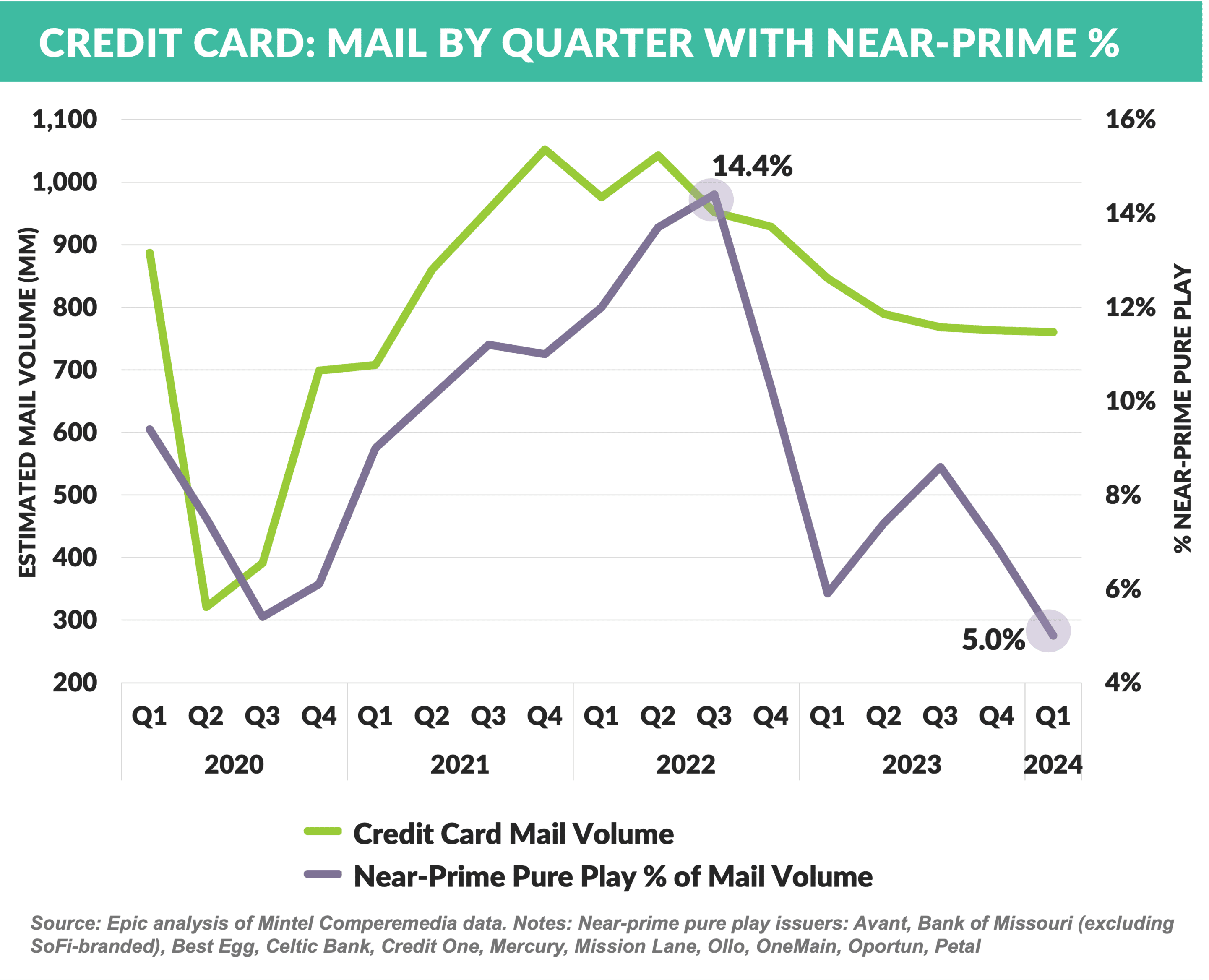

- Mail volume for sub-prime and near-prime credit card issuers (we’ll refer to them as near-prime), which reached a high of over 14% of all card mail volume in 2022, has dropped significantly to a recent low of less than 5%

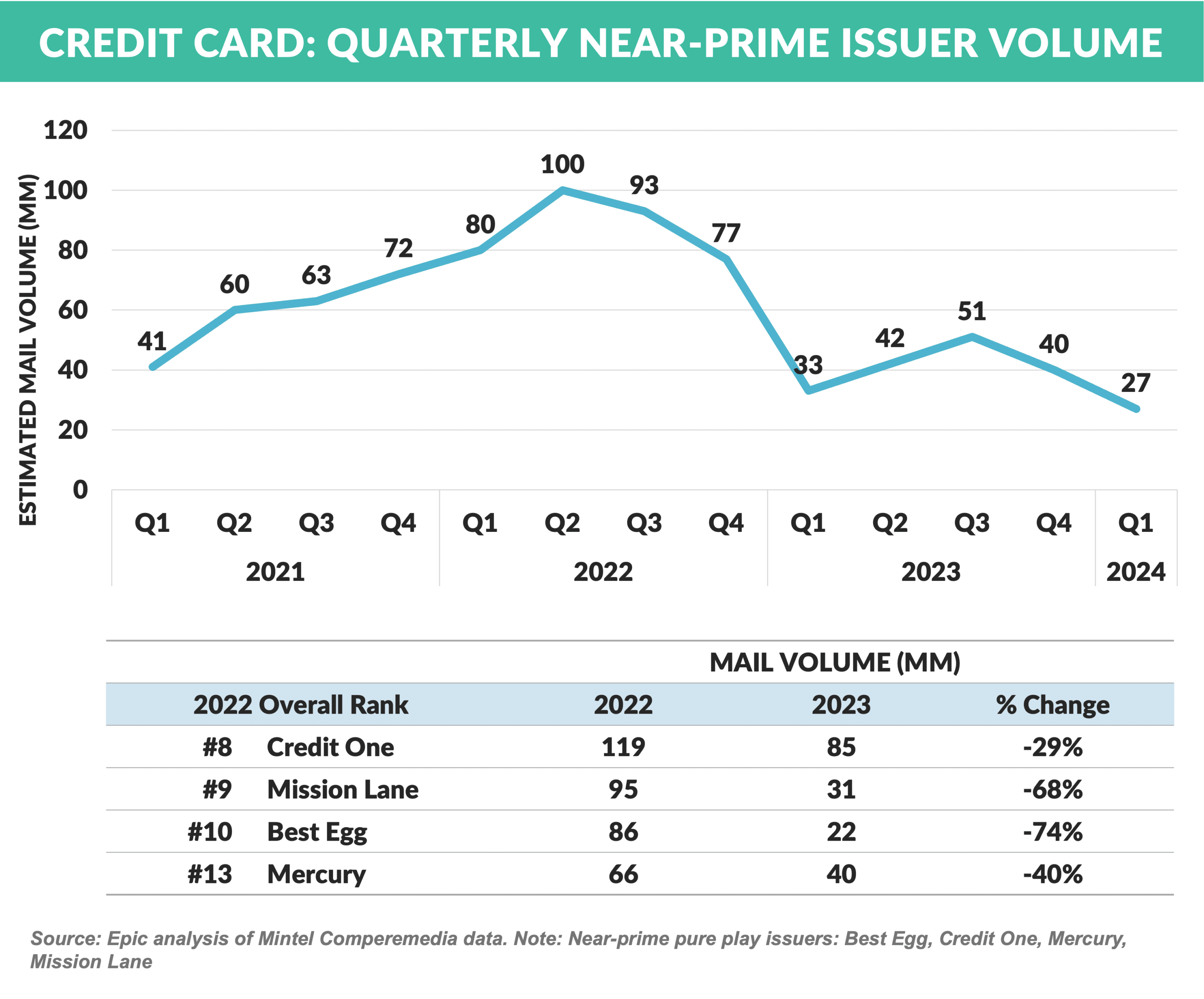

- Near-prime specialists Mission Lane, Best Egg, Credit One, and Mercury accounted for four of the top 20 card products mailed in 2022, yet all have dropped out of the top 20 in recent months

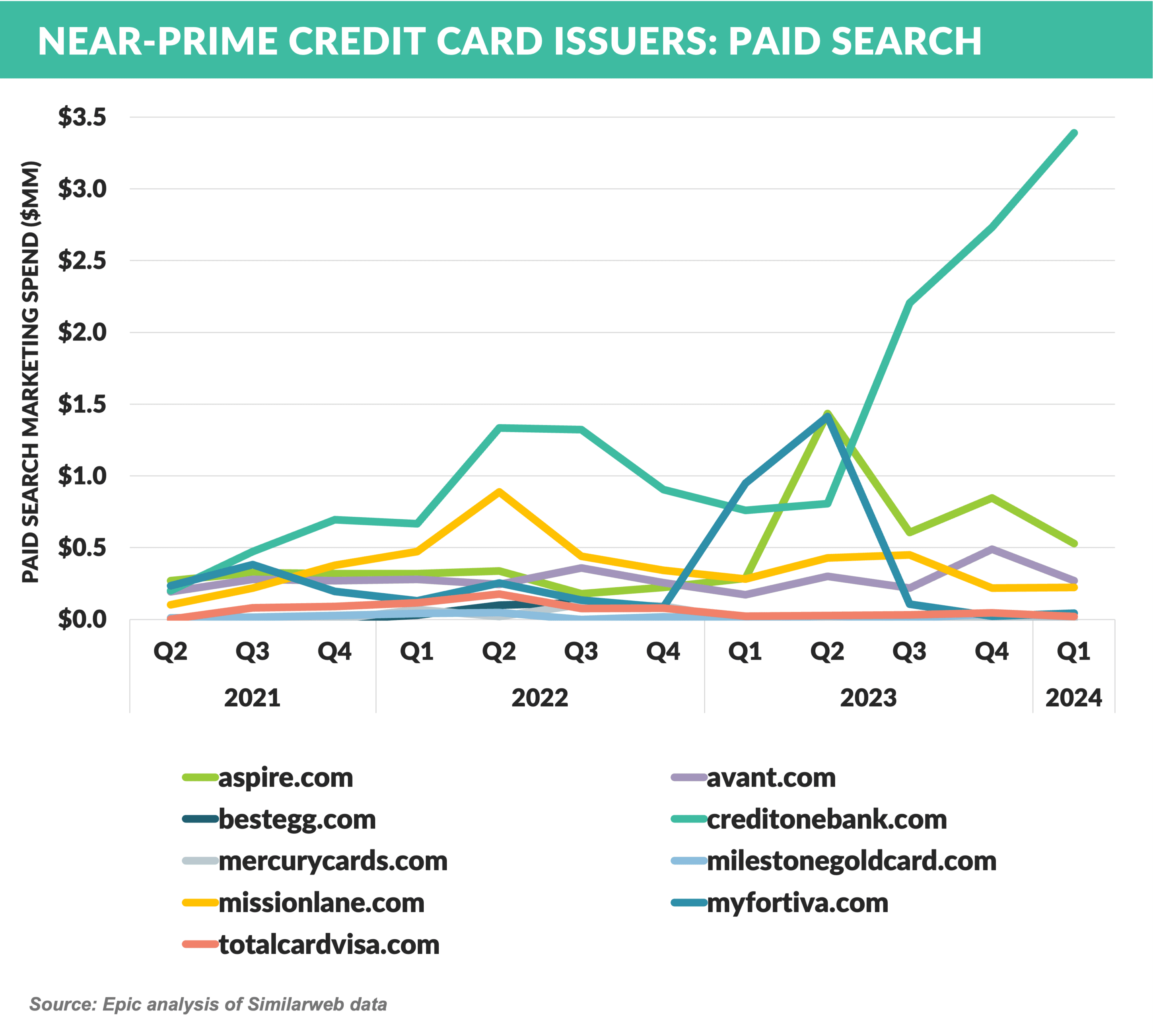

- Counter to the trend in direct mail, paid search marketing spend on near-prime cards has risen since 2022, led by Credit One which is spending over $1 million per month

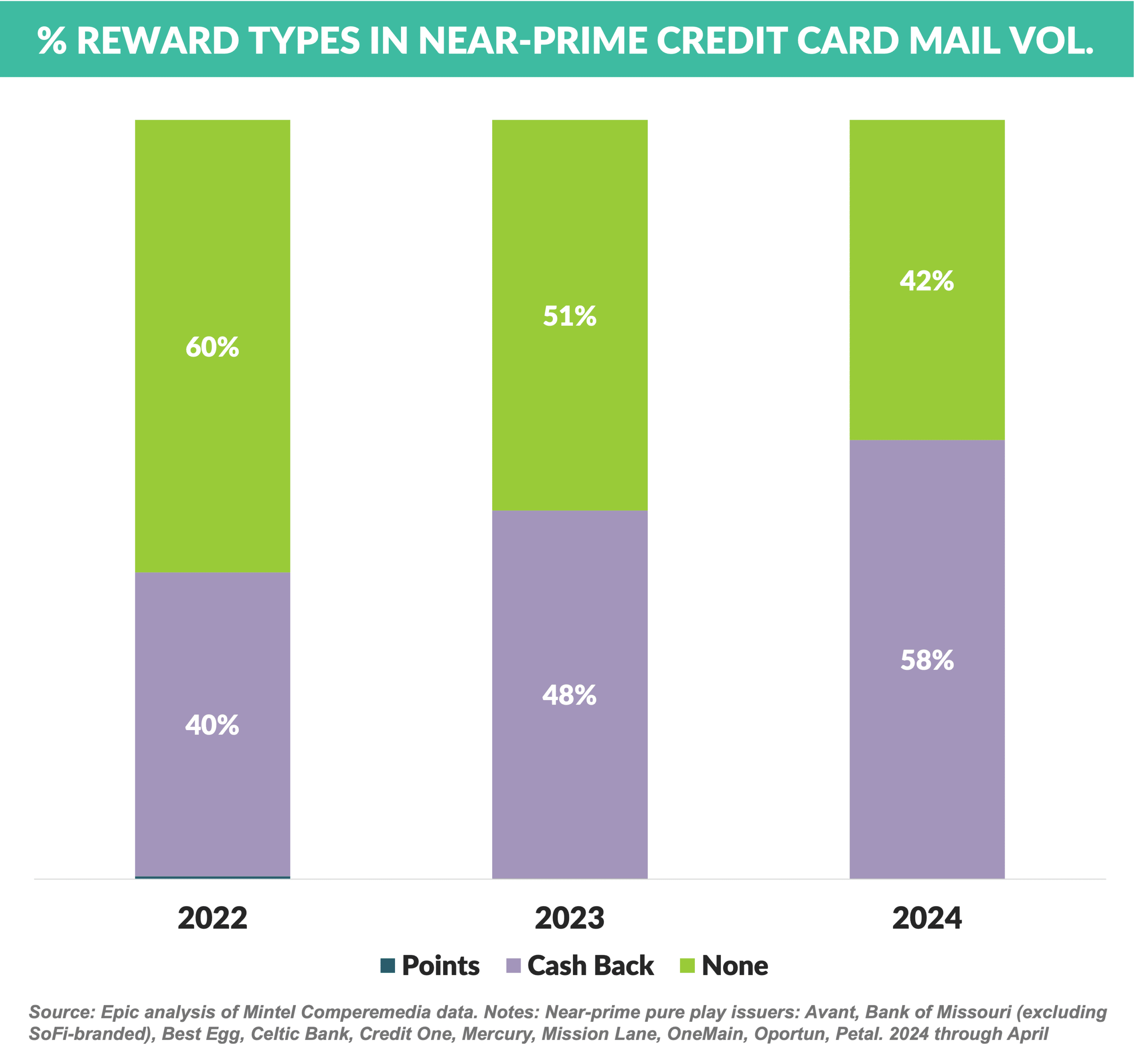

- Near-prime product offers show an increase in the percentage of mail offering rewards, with cash back offers growing from 40% in 2022 to 58% in 2024

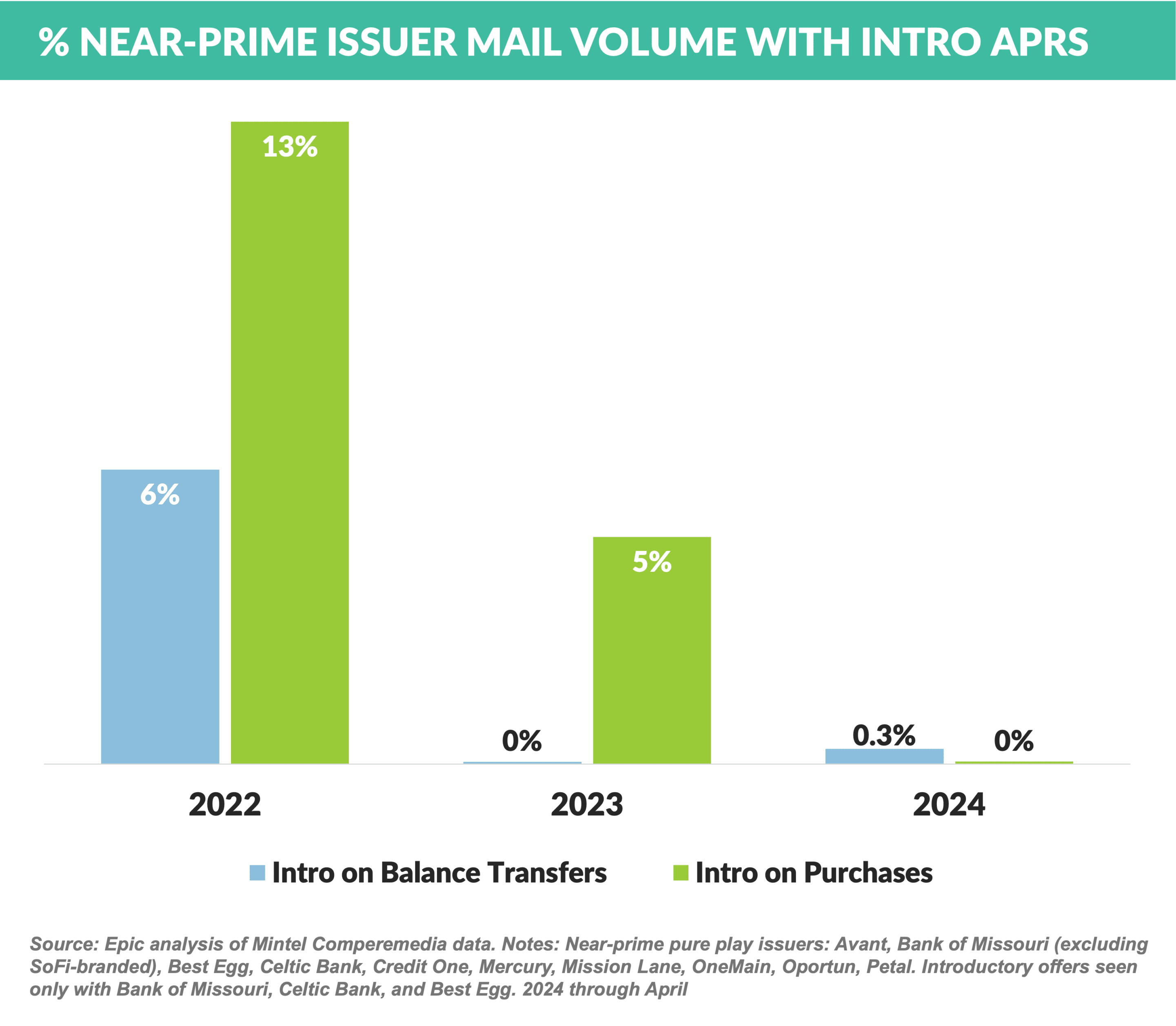

- Introductory offers, while never common in this segment, have all but disappeared in 2024

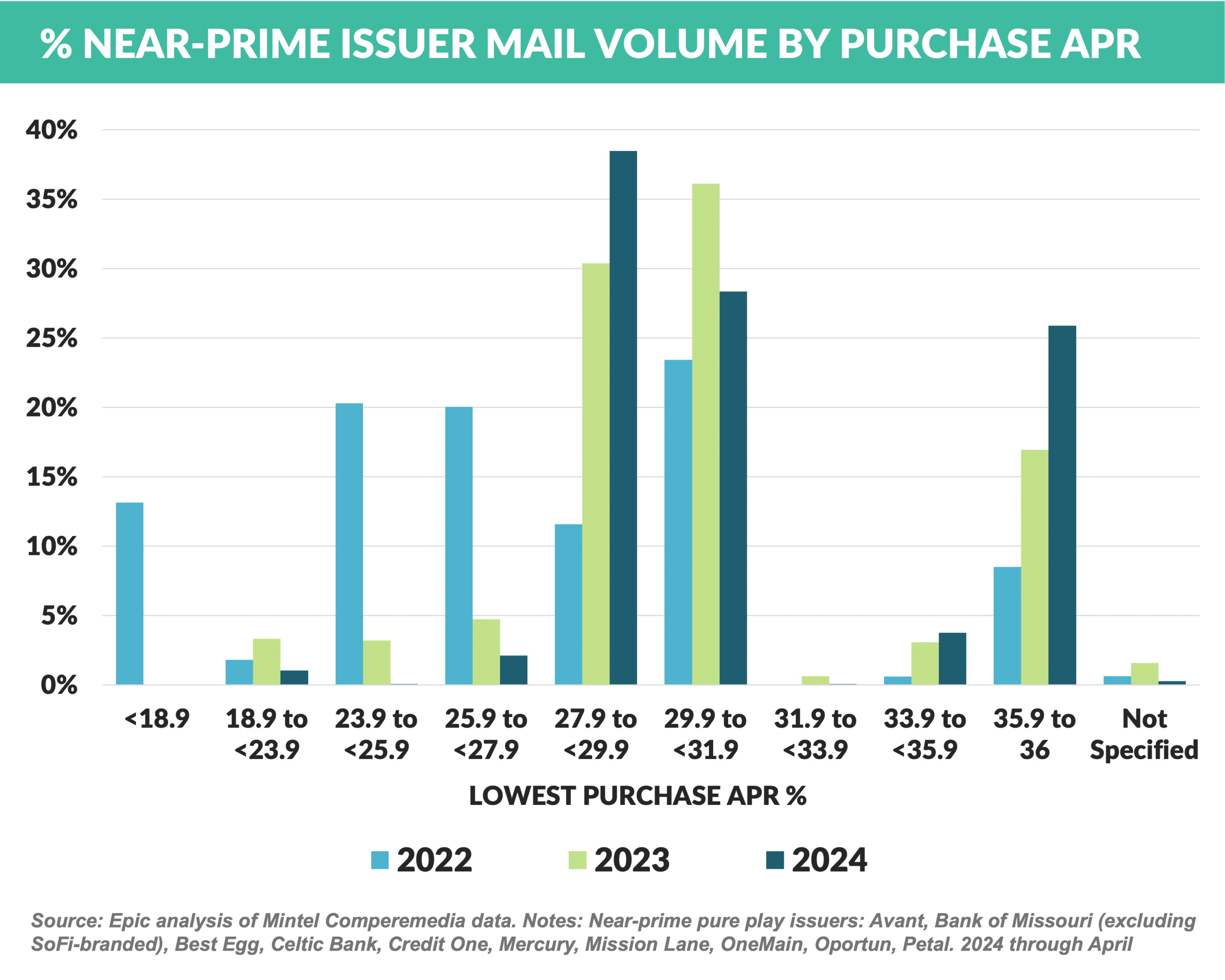

- 26% of direct mail in the segment now has an advertised purchase APR of ~36% — up from 17% of the mail in 2023 and 8.5% in 2022

Meet Barclays and Denny Nealon

- Barclays US Consumer Bank, based in Wilmington, Delaware, was founded in 2000 as Juniper Financial, a start-up bank backed by Silicon Valley’s Benchmark Capital

- Barclays purchased Juniper in 2004 and transitioned to the Barclays brand

- Barclays has no US retail branches and focuses on a partnership-based strategy, with over 20 cobrand relationships including American Airlines, JetBlue, AARP, Gap, and Wyndham

- Barclays entered the ranks of top 10 Visa/Mastercard issuers within 10 years of its founding and is currently the 7th largest with $32 billion in loans

- They are also a major player in personal loans and online savings

- Denny Nealon is the Chief Executive Officer for Barclays US Consumer Bank reporting into the Barclays CEO

- Denny played lacrosse at the Naval Academy and later served as a Lieutenant on a destroyer

- He has been at Barclays since 2004, following a career at First USA and Chase

- We asked Denny how Barclays has become the seventh largest US Visa/Mastercard issuer without the retail branch network that most other issuers have:

“Going back to the Juniper days, we recognized we didn’t have a known consumer brand or branches in the US…but we’re fortunate to work in the largest B2B2C market – the US cobrand market…and so we focused there and invested in the specialized capabilities required to compete in this space leveraging the great brands that our partners have built”

- On Barclays’ success in winning so many partners in a competitive market:

“Our entire organization is focused on the fact that we have two customers – the partner and the end consumer…we have to use data, technology, and process to make sure we can fulfill our promises to both…for our partners that means helping to drive their sales volume and increase customer loyalty…for example, you can buy a JetBlue ticket on any card, but when you use the JetBlue card you get benefits that make flying with JetBlue better, such as early boarding, free checked bags, status, and other things a generic travel rewards card can’t offer”

- On the biggest challenges in US consumer banking today:

“The macro environment and cumulative impact of inflation, but the health of the US consumer is really good…many things happening in the regulatory environment that are not all that coordinated…keeping pace with consumer expectations as they pertain to user experience – Uber, Amazon, and others keep raising the bar”

- On how his experience as a Lieutenant on a US Navy destroyer relates to his current role at Barclays:

“It showed me the power of what’s possible by having a group of people with a shared mission, working as a team, with great leadership”

HELOC Mail Peps Up!

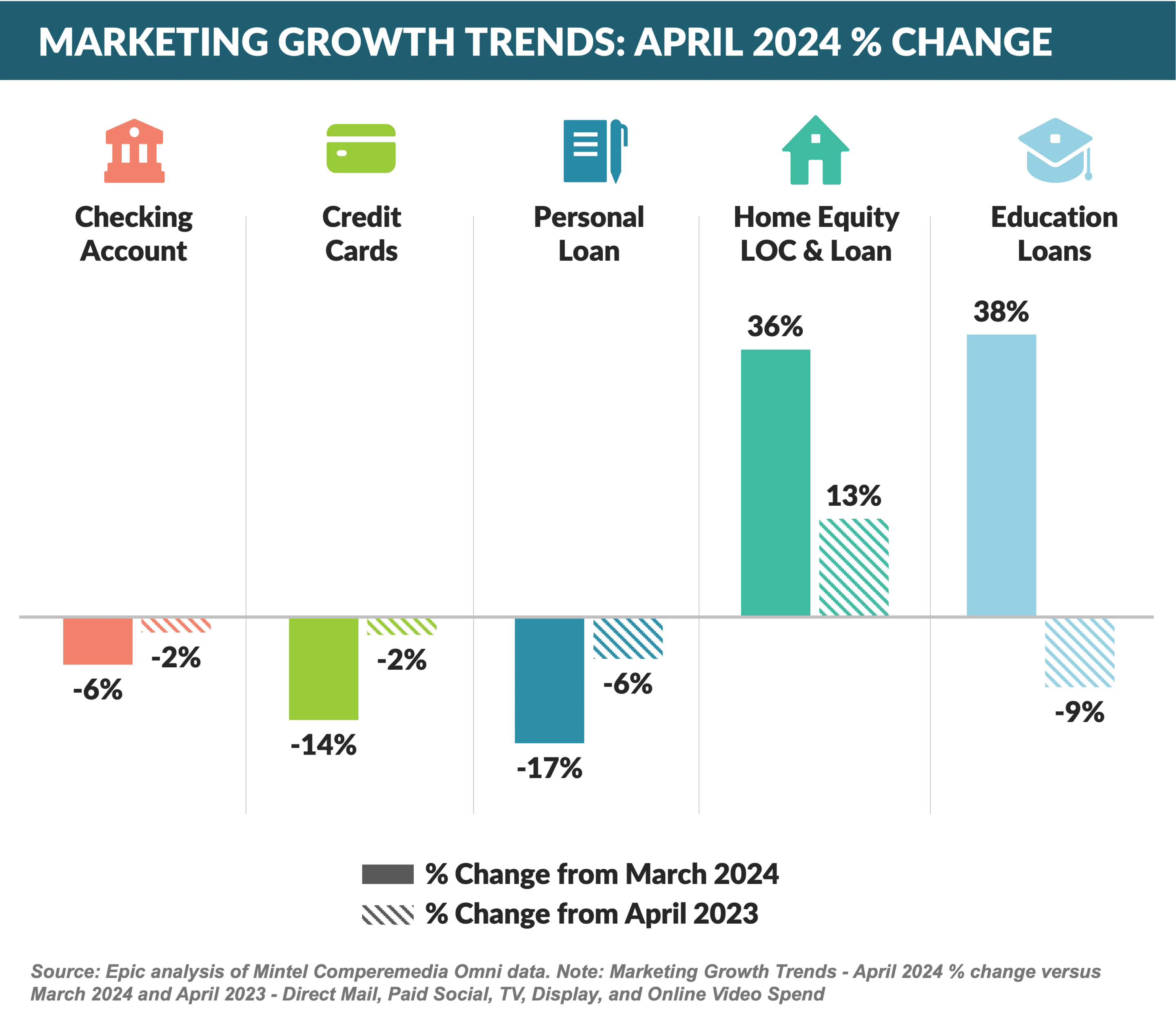

- March mail trends of note

- Personal Loan – resumed recent downtrend – American Express mailed 15 million last month and 0 this month

- HELOC – mail volume has doubled from February to April

- Credit Cards – Miles/Points cards are continuing their comeback, from ~17% of overall mail in 2021, to 28% of mail YTD

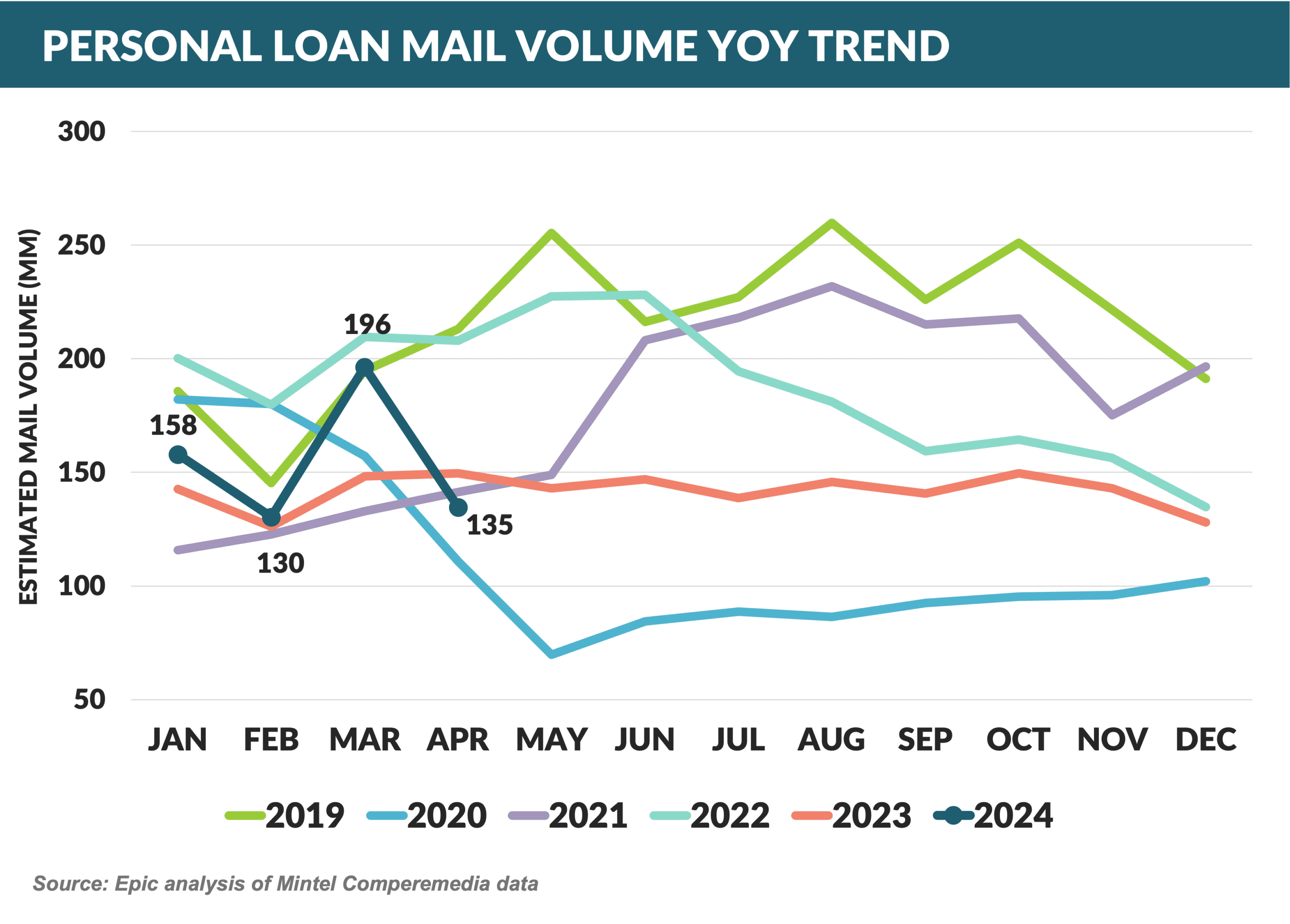

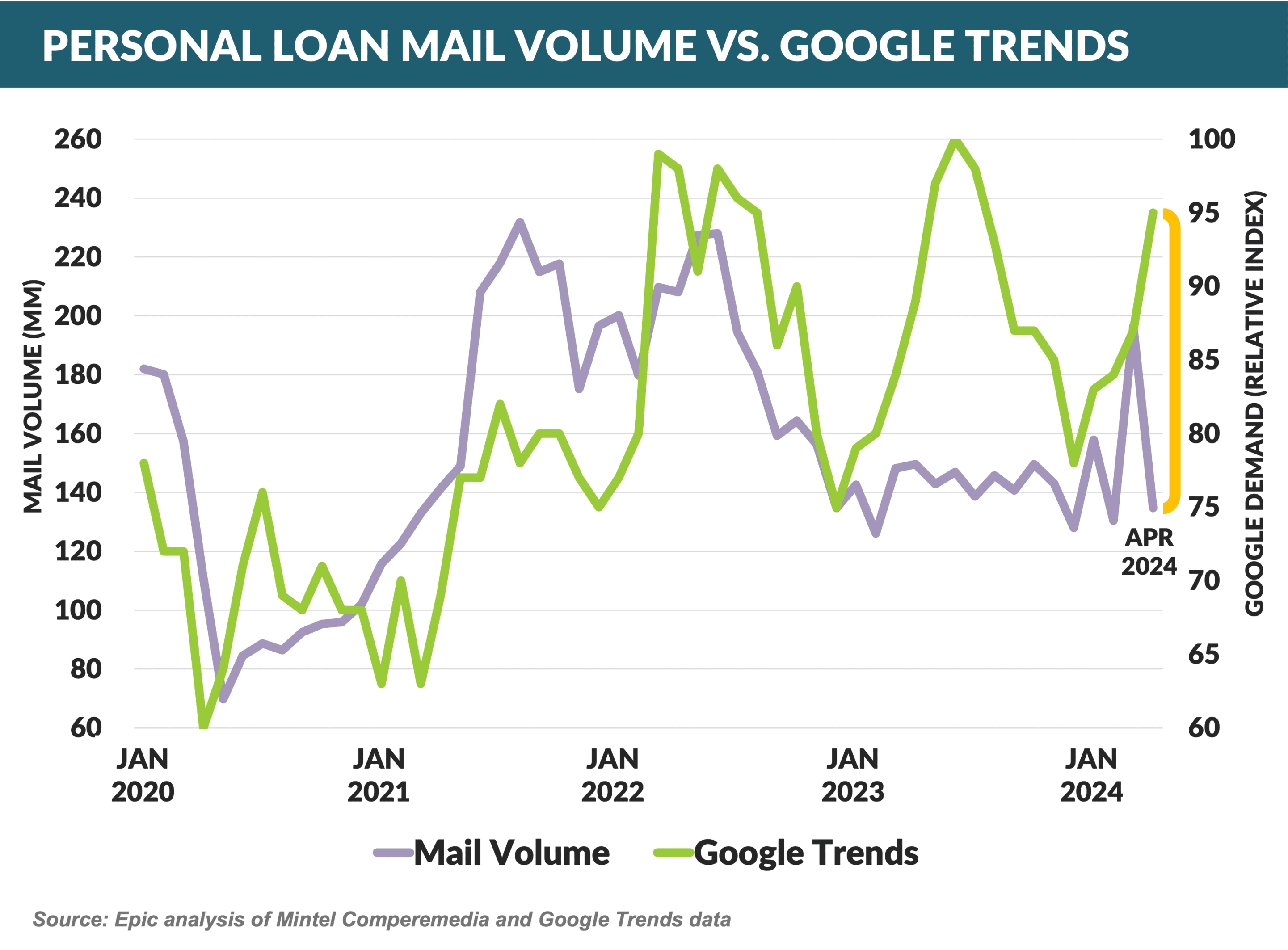

- March’s spike in personal loan mail volume (Personal Loan Mail Volume Awakening?) appears to be an aberration as April volume fell 30% to the lowest level since pandemic-impacted April 2020

- Personal loan mailings remain low despite the increasing value to consumers for refinancing credit card debt (Personal Loans Pay for Consumers!), and online search trends reflect consumer demand for personal loans amplifying the opportunity for lenders to serve this audience

- Walmart and Capital One issued a statement announcing the end of their partnership for cobrand and private label cards

- The announcement follows a ruling in March that Walmart was entitled to terminate the partnership early, owing to Capital One breaching provisions around customer service levels in the companies’ 2018 agreement

- Capital One will rebrand the existing $8.5 billion portfolio to Capital One branded cards, and Walmart is expected to start a card program with its majority-owned neobank One

- American Express is having success in drawing Gen Z consumers to its premium cards

- The Wall Street Journal reports that 75% of new Amex Gold and Platinum cards were issued to Gen Z and millennials

- The group is interested in maximizing available perks, with many by-passing the no fee cards and opting for the $695 annual fee Platinum Card

- Click here to send your credit card Mt. Rushmore nominations. We will unveil our first nominee in the July Epic Report!

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on July 13th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.