Three Things We’re Hearing

- Growth for near-prime cards

- Consumer checking account preferences

- Uneven growth in various loan categories

A four-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Growth for Near-Prime Cards

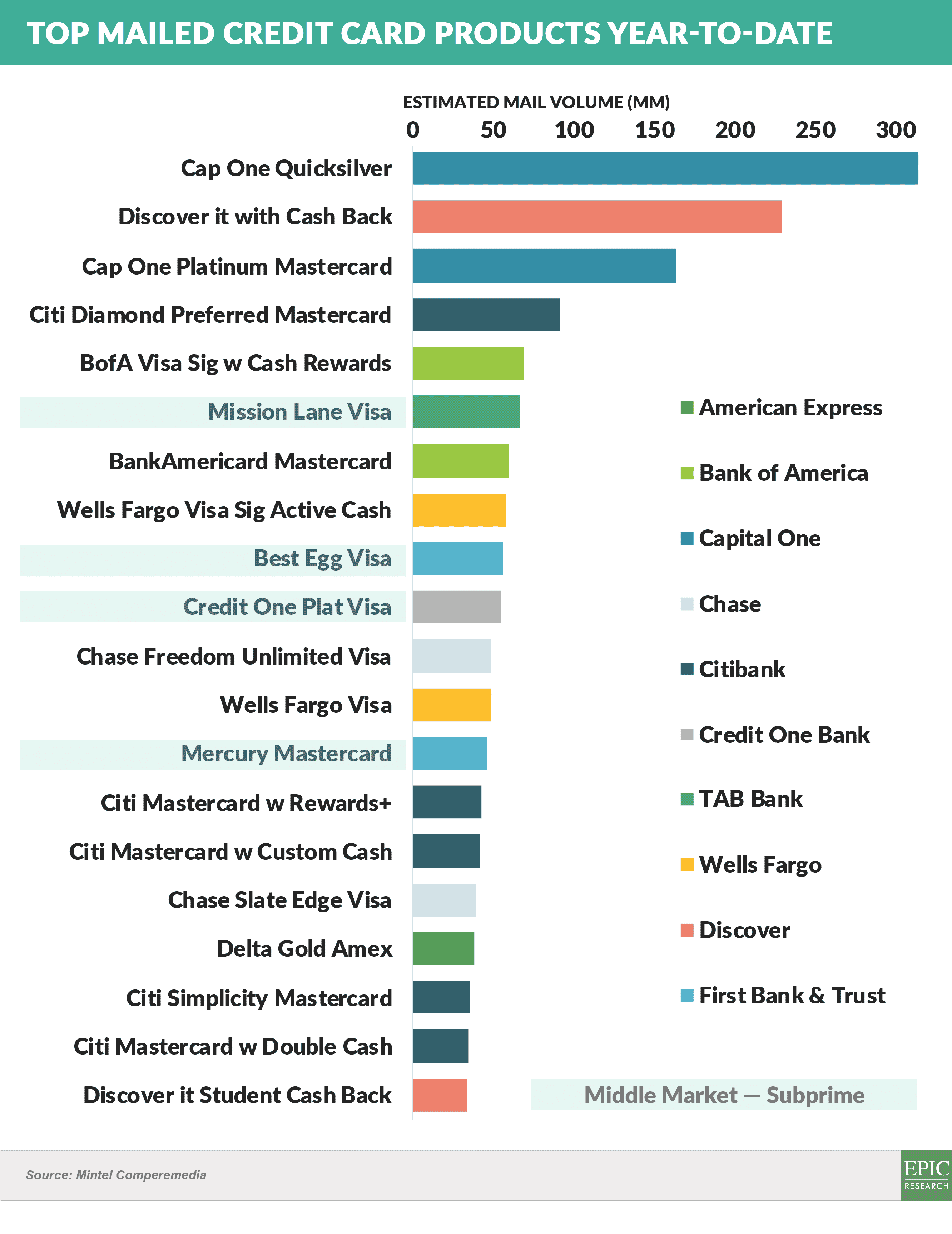

- Capital One has dominated the near-prime market for years, however monoline subprime and near-prime issuers have grown to the point where they now account for four of the top 20 cards mailed in 2022

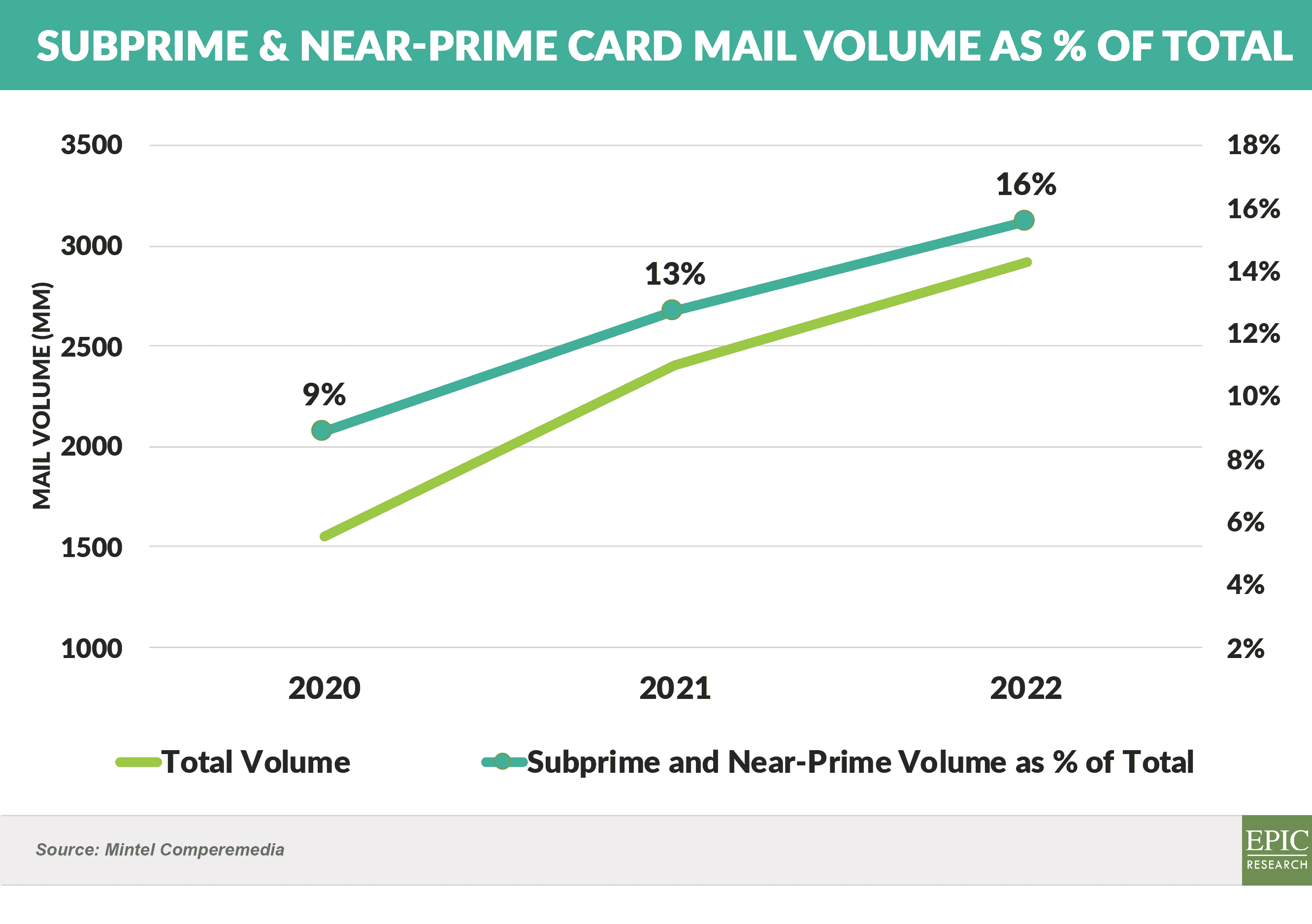

- Combined mail volume for subprime and near-prime mailers rose to 16% of total credit card mail volume in 2022, up from just 9% in 2020

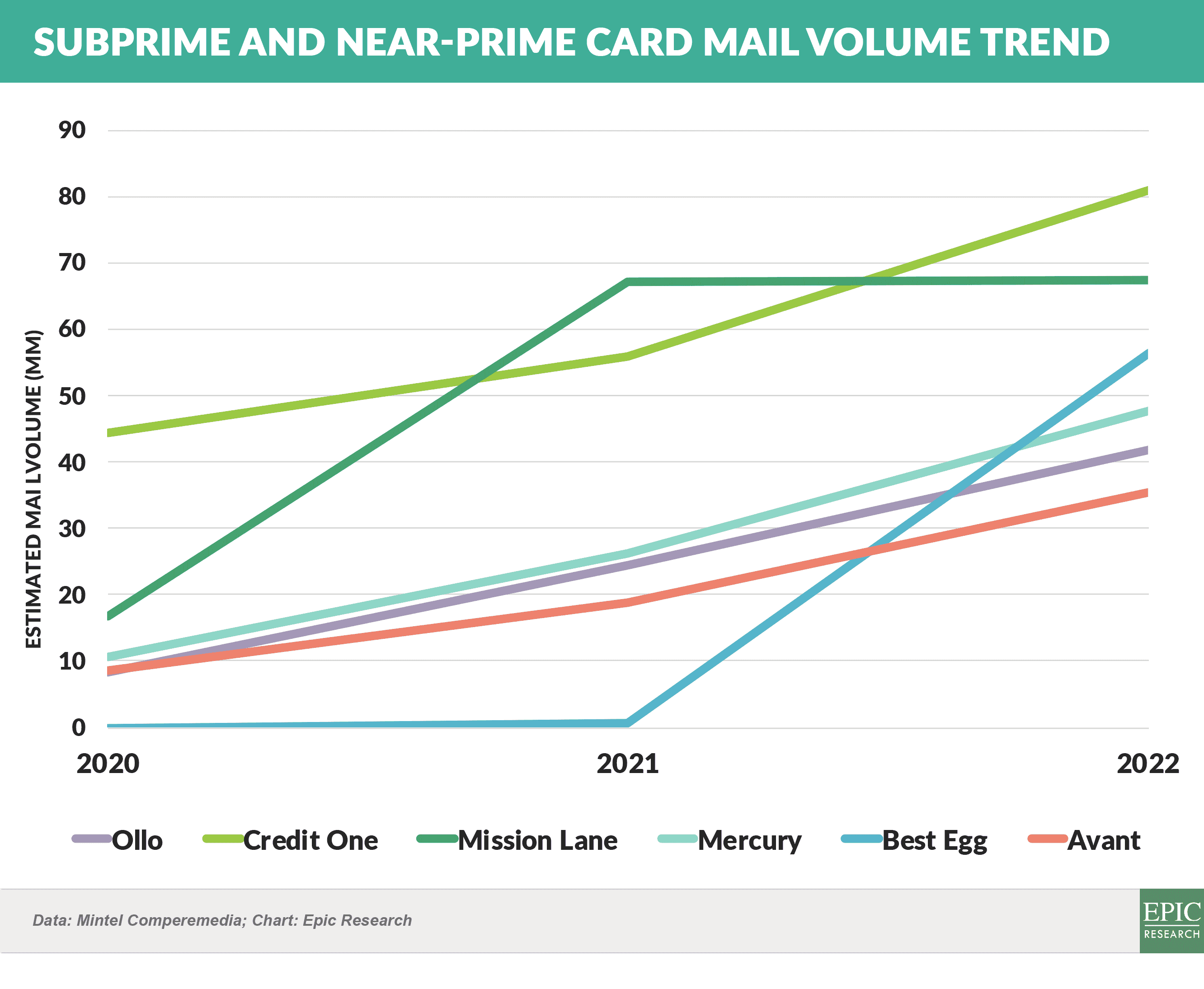

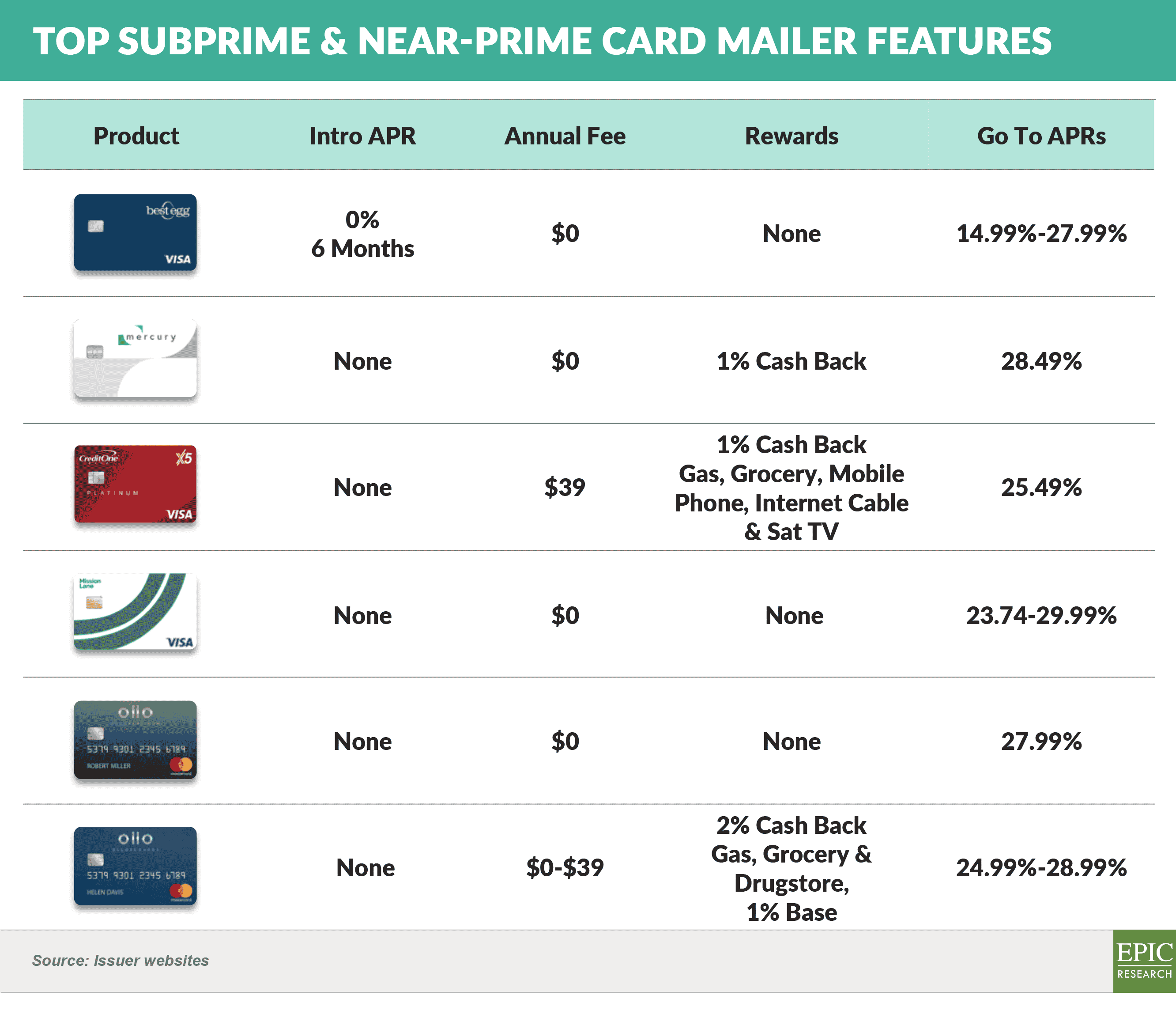

- Over the past three years, Credit One, Mission Lane, and Ollo have been the leading mailers in this segment, followed by more recent entrants Mercury and Best Egg

- Credit One Bank – Headquartered in Las Vegas, Credit One offers its Platinum Visa for rebuilding credit

- Mission Lane – Headquartered in Virginia, with over two million credit cards issued, Mission Lane has raised $675M in funding over four rounds

- Ollo – Founded in 2016 and headquartered in Wilmington, Delaware, Ollo is issued by Fair Square Financial, which was recently acquired for $750 million by Ally Financial

- Mercury Financial – Headquartered in Austin, and owned by alternative investment firm Varde Partners, Mercury entered the credit card sector several years ago via a purchase of Barclays’ near-prime card portfolio

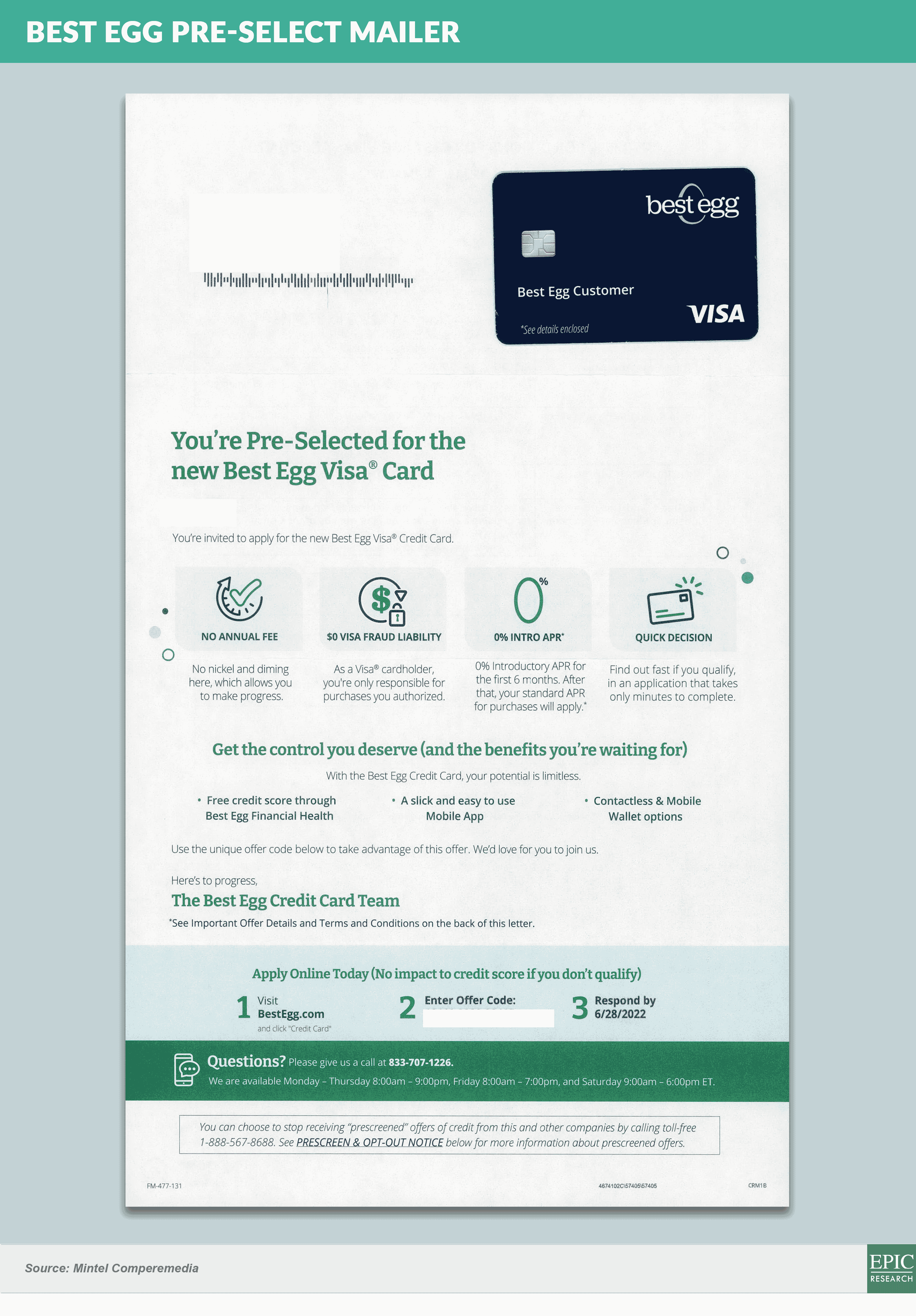

- Best Egg – Headquartered in Wilmington, Delaware, Best Egg has been a major player in the personal loan market and launched its credit card in 2021

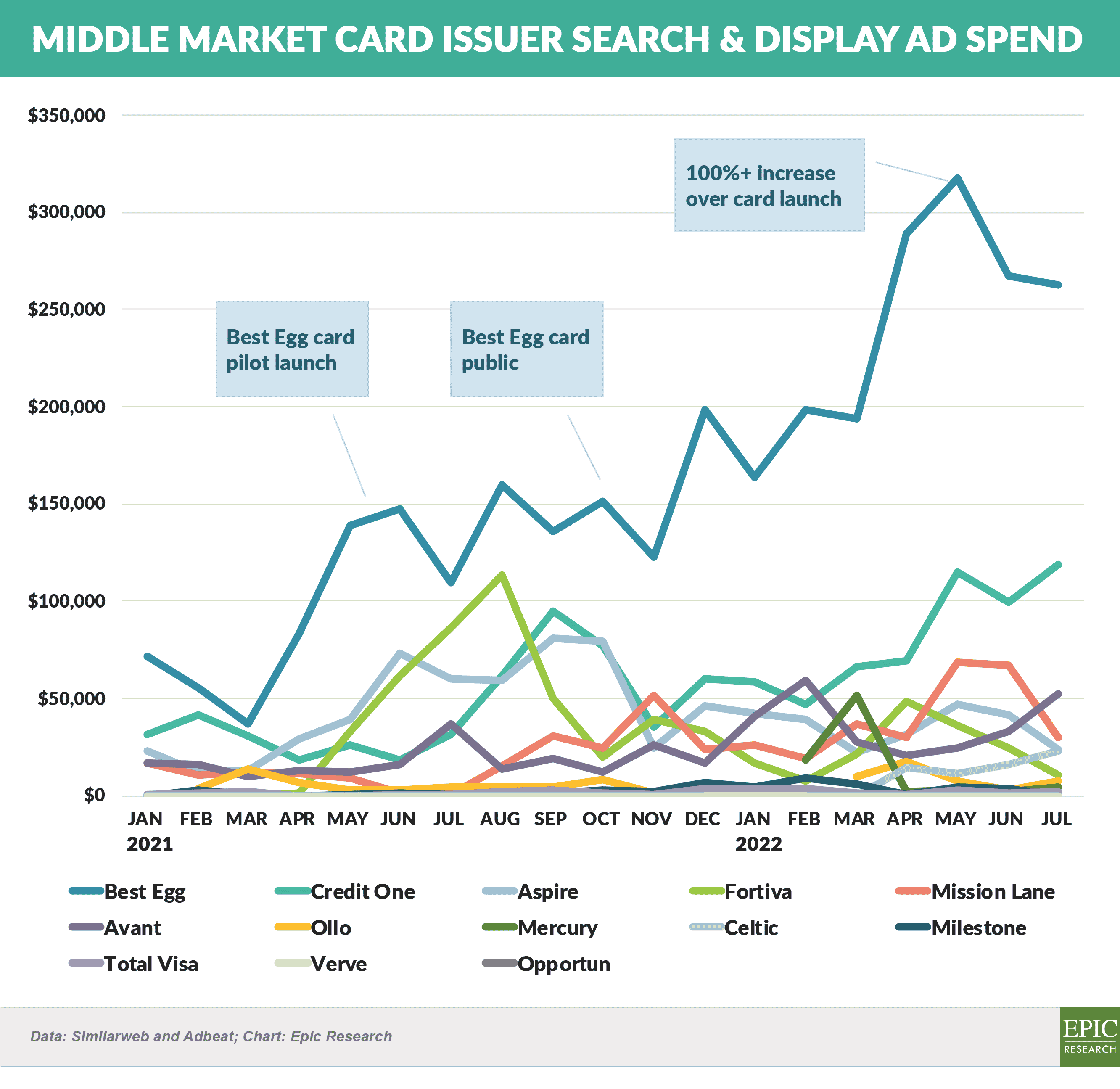

- Best Egg leads in search and display ad spend by a large margin, followed by Credit One

- The top subprime and near-prime mailers share some general characteristics:

- APRs in the mid-20s

- Mostly no annual fees

- Initial credit lines of $5,00 - $2,000

- Free credit reports

- $35 - $40 late and returned payment fees

- Few balance transfer promotions and 0% intro rates

- Low acquisition costs (~$40 - $75) and higher ROAs than prime

- Typically use advanced response and credit modelling

- Credit quality is more stable in downturns than most think

- Proactive credit line management is important for retention and overall profitability

- Other than Capital One, the majority of marketing in the segment is done by fintechs, as commercial banks have historically lacked the perceived risk appetite and specialized skills needed to profitably acquire and manage customers in this sector

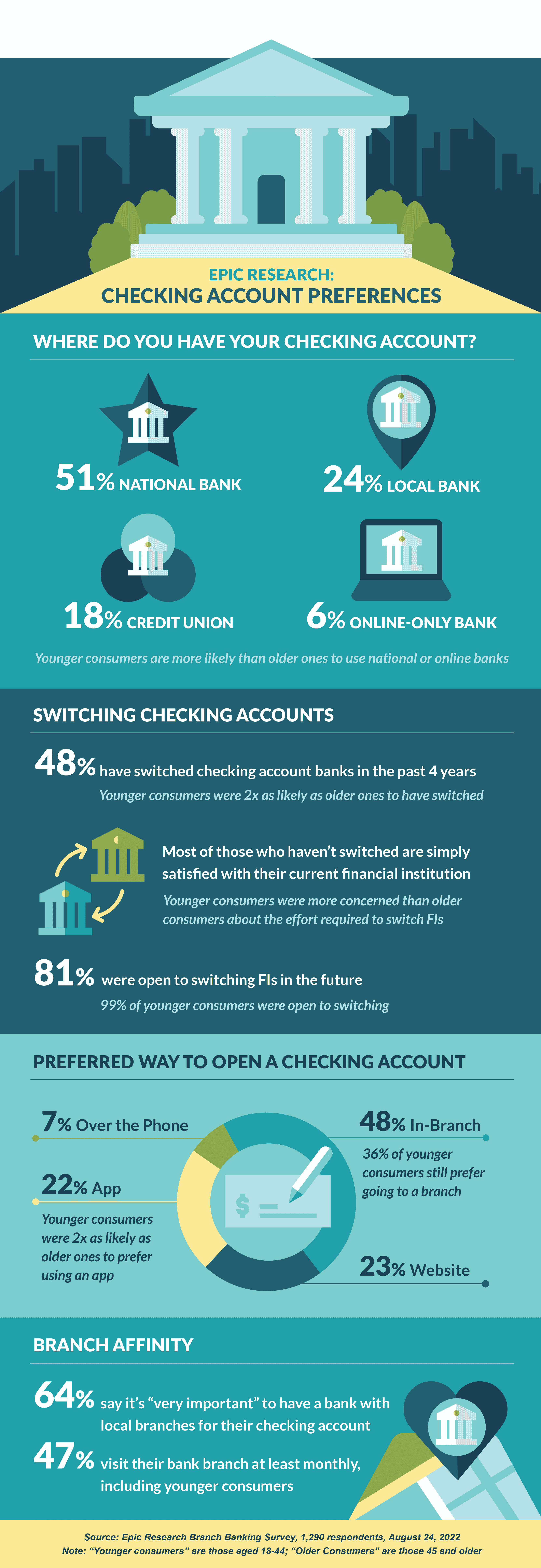

Consumer Checking Account Preferences

- Epic recently surveyed 1,290 consumers regarding their checking account preferences

- The findings align with those from a similar survey we ran in July 2020, with some interesting new insights from younger consumers, who are more likely to switch checking accounts than those in the older demographic

Uneven Growth in Various Loan Categories

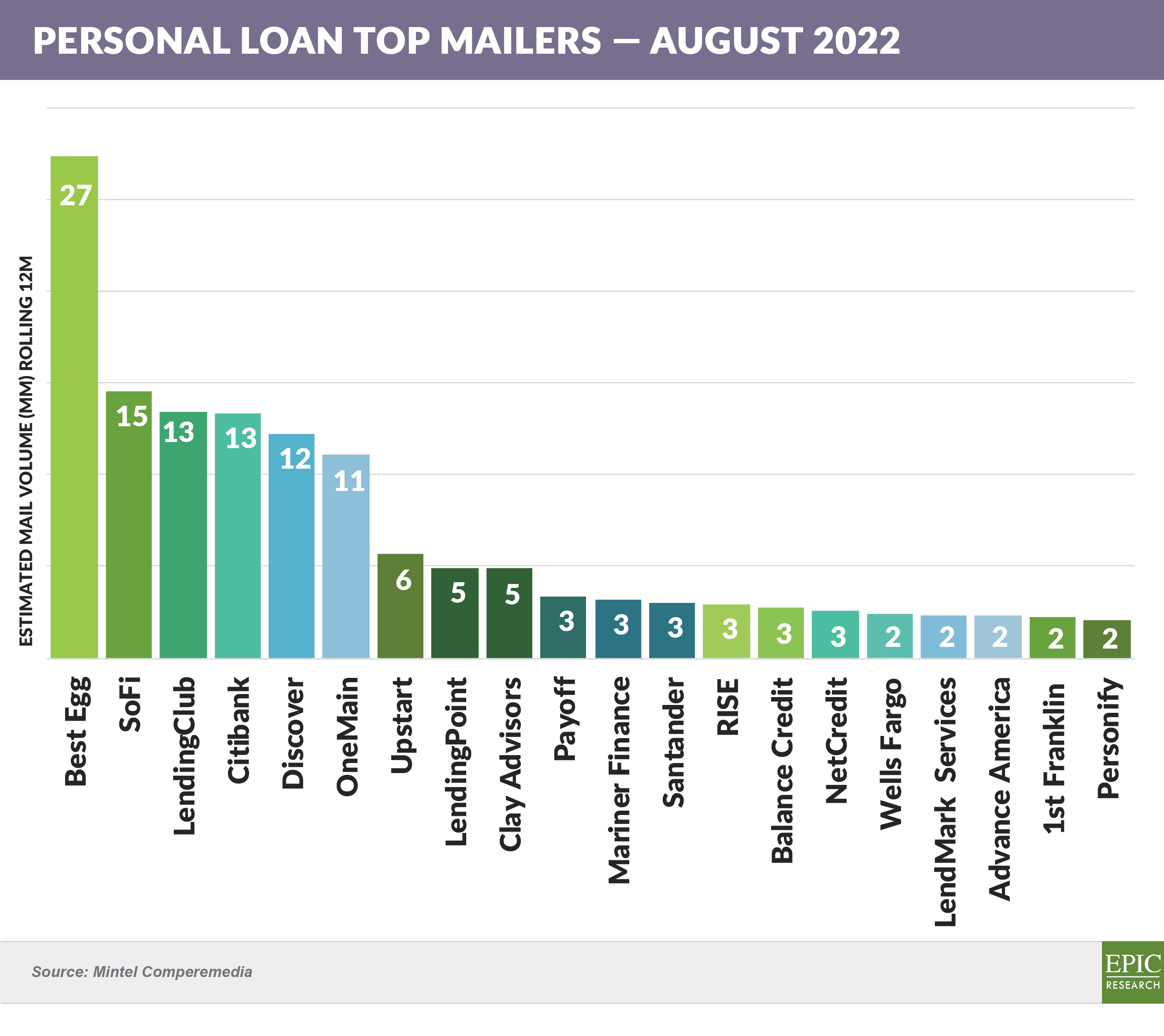

- Best Egg maintained the number 1 position in personal loan mail volume, nearly doubling the volume of second place contender SoFi

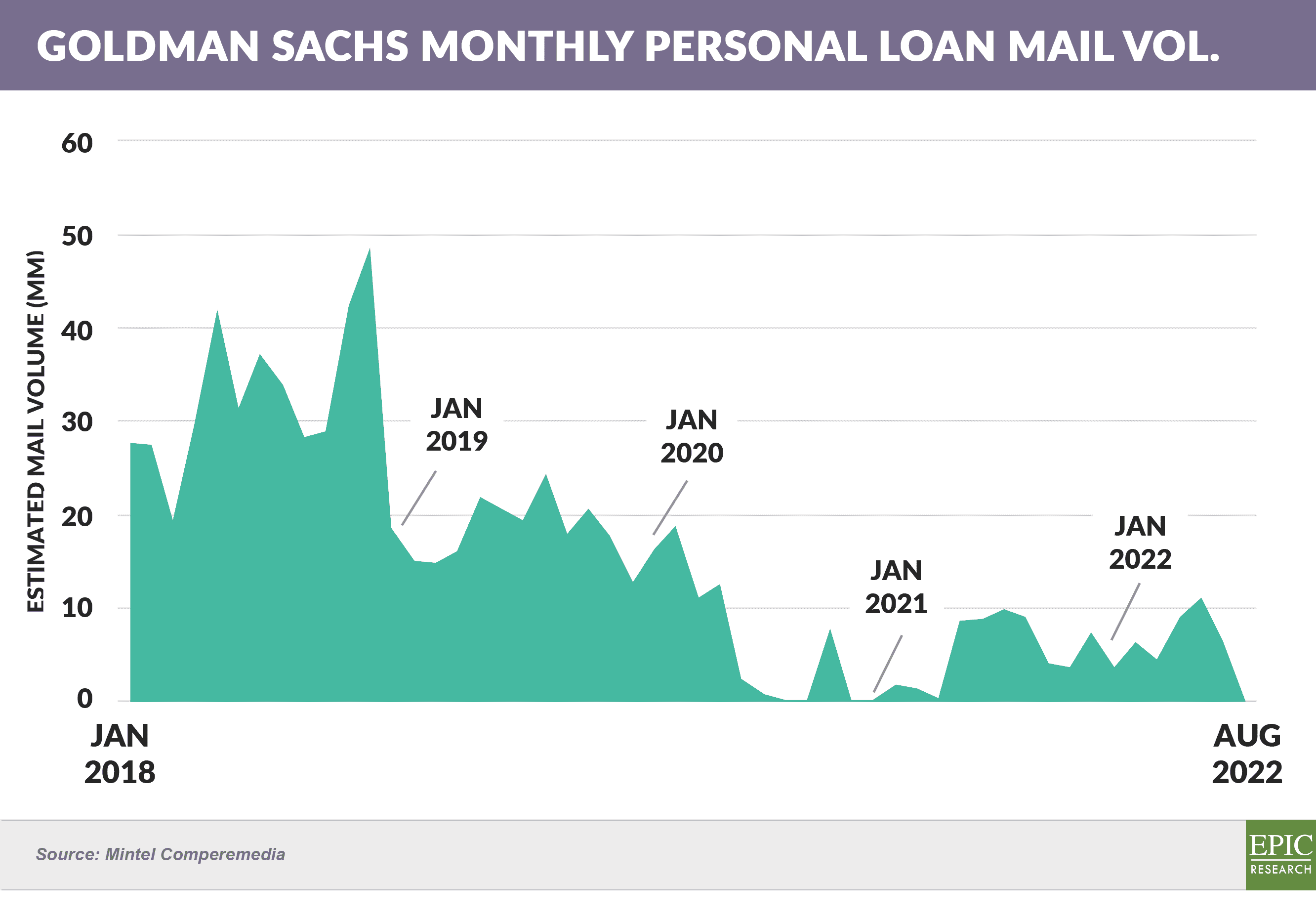

- Goldman Sachs, whose consumer unit is reportedly under duress, has severely cut its personal loan direct mail activity since launching Marcus

- Goldman, which regularly mailed 30 – 50 million monthly personal loan pieces in recent years, has scaled back dramatically in 2022, averaging around 7 million pieces per month

- August’s panel showed no personal loan direct mail for Goldman

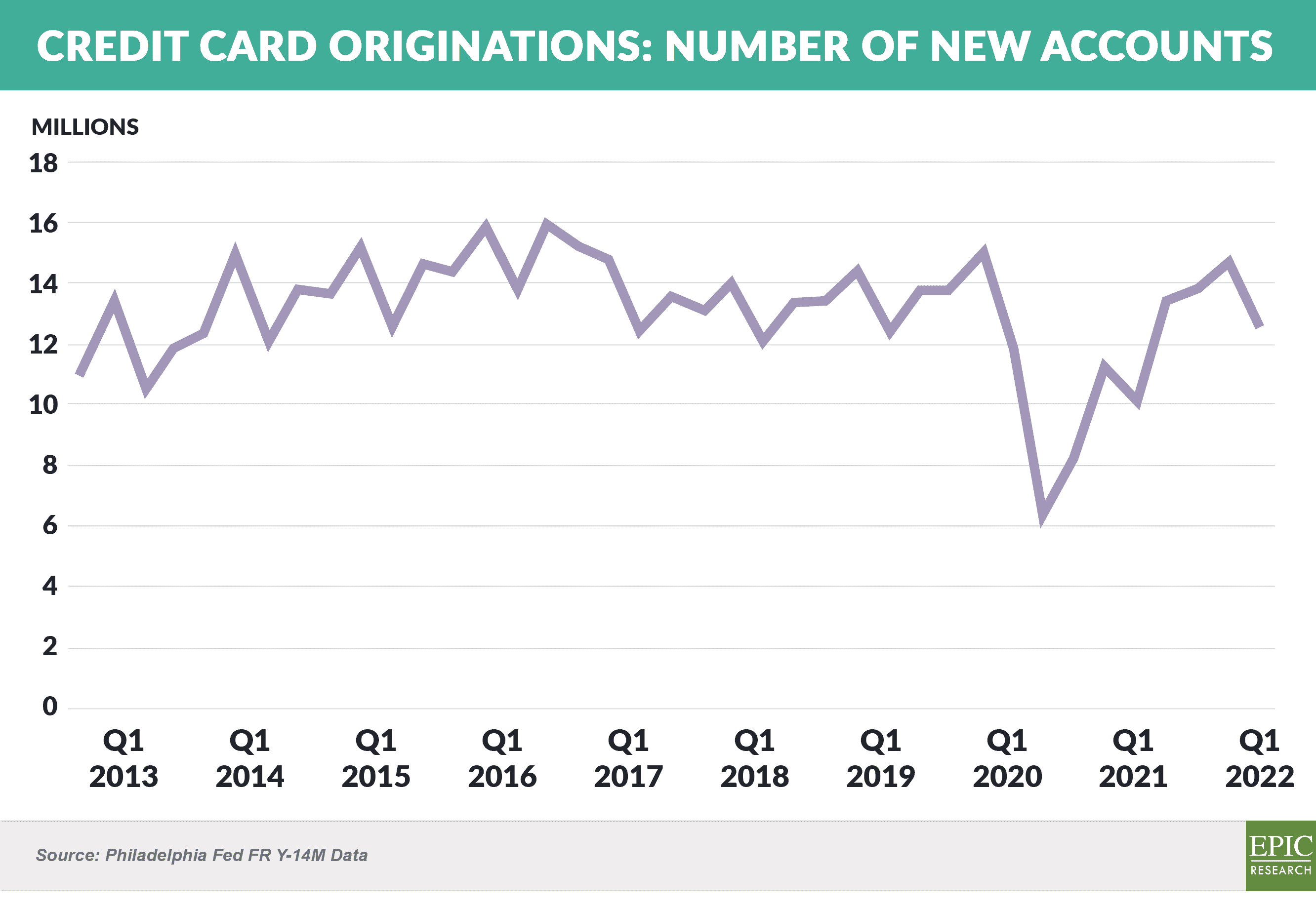

- Credit card originations have rebounded to pre-pandemic levels

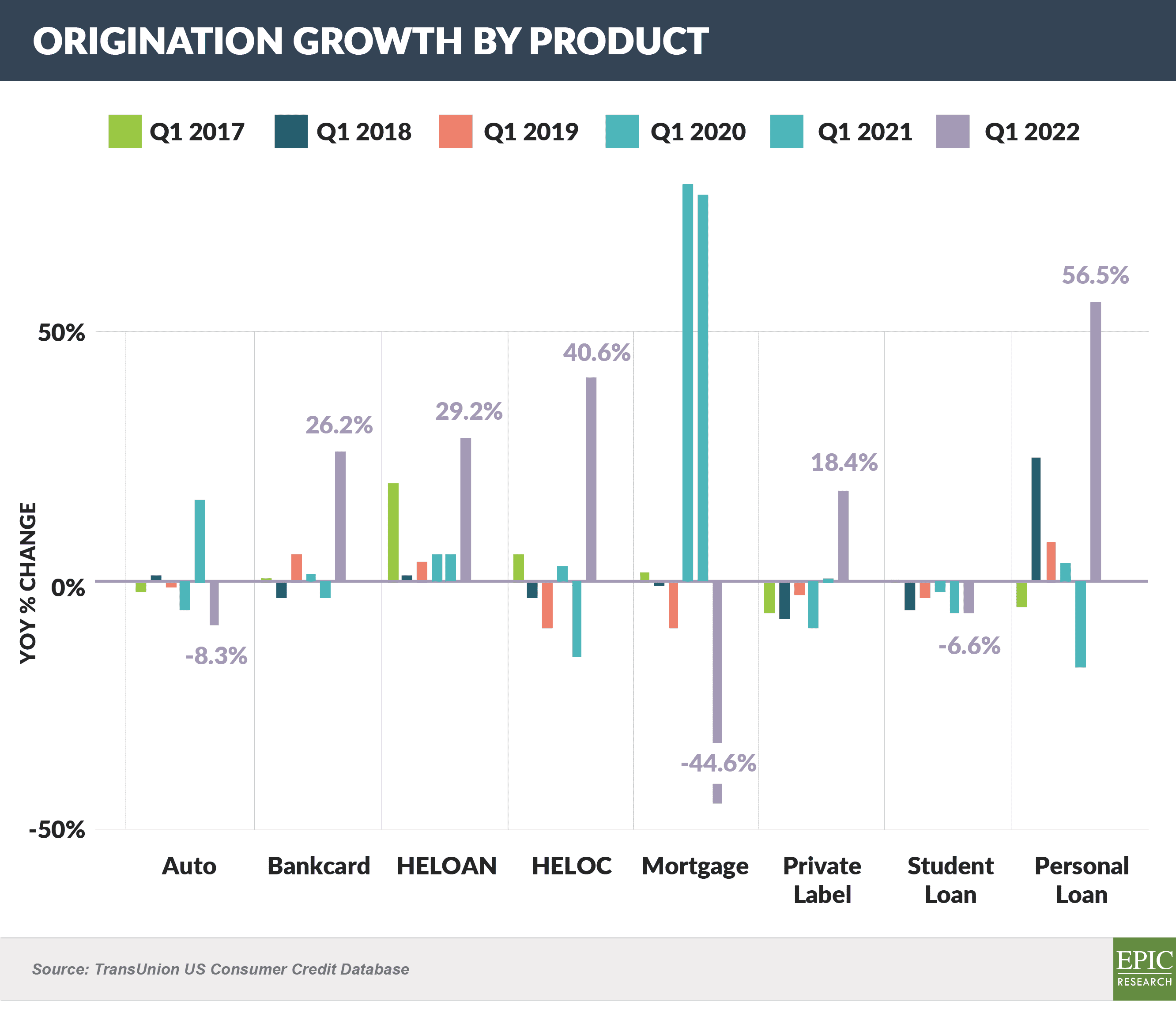

- Personal loan, HELOC/HELOAN, and private label originations are also higher than in recent years, with auto, mortgage, and student loans reporting lower origination levels

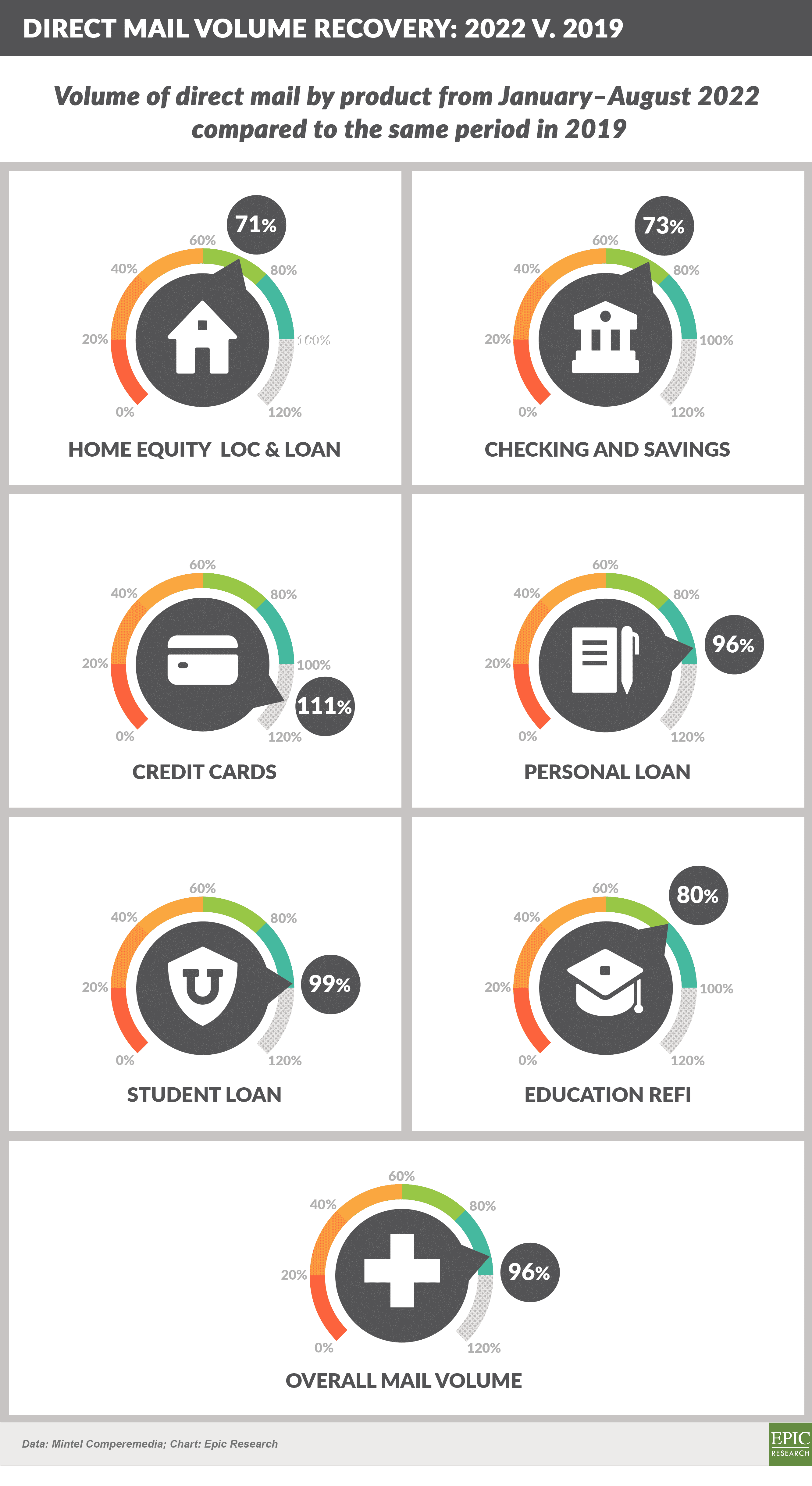

- Mail volume for most consumer loan categories remained consistent in recent months

Quick Takes

- Average credit card variable interest rates hit a 26-year high of 18.03% earlier this month

- The prevailing prime rate for the recent average was 5.50%, 2.75% lower than the 8.25% rate during the previous high in 1996

- This comes as credit card ROAs are higher and credit losses lower than historical averages

- Possible factors driving today’s higher spreads are:

- A portion of low rate revolving balances have moved from cards to personal loans

- Rewards cards, which feature relatively high APRs, are more prevalent now than in past years

- There are a number of recent announcements in the credit card co-brand sector

- Goldman Sachs and T-Mobile are reported to be launching a co-brand card, though no further details have been revealed yet

- Chase and DoorDash will offer a offer a co-branded card with rewards for spending with DoorDash and other merchants – Chase currently offers DashPass

- TD Bank has extended its co-brand card agreement with Target through 2030

- The CFPB fined Credit Karma $3 million for “falsely advertising credit card pre-approvals”

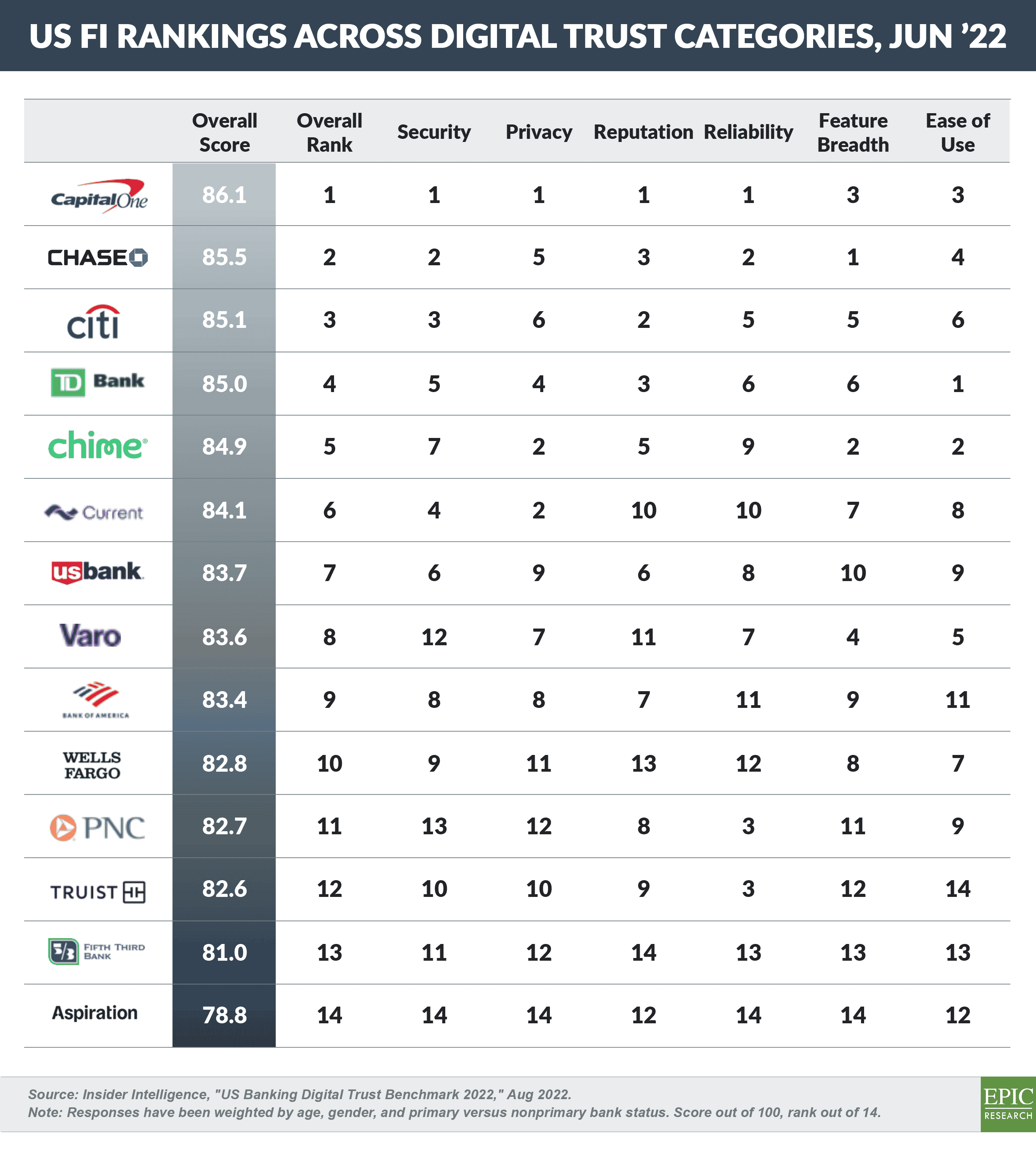

- Capital One is the highest rated bank for “digital trust,” as reported by Insider Intelligence

- Banks spend millions on branding, whether on TV commercials, print advertising, stadium sponsorships, or other media

- Direct marketing response rates prove the value of brand investment – offers with in-market bank brands typically have twice the response rate of unknown or lesser-known brands

- One exception: when banks leverage an even better-known brand – in past years we tested our precious bank branded card offer against a generic “Visa” offer, and the Visa offer response was 20% higher!

- We shifted to “Visa,” but heard of similar tests at other big banks that, while showing comparable results, were ignored due to management’s ego or other, less objective reasons

- Try it!

The Epic Report is published monthly, with the next issue releasing on November 5th.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.