Three Things We’re Hearing

A three-minute read

- BNPL asset quality watch

- Home equity and personal loan marketing soars

- Consumer interest for cards and HELOCs grows

If the Epic Report was forwarded to you, click here to add your name to the mailing list

BNPL Asset Quality Watch

- The feeding frenzy of activity around BNPL has raised questions regarding the asset quality of BNPL loans

- BNPL lending has grown during a historically benign credit environment and the loans are largely underwritten without credit bureau data

- There is no “institutional memory” at many leading BNPL providers regarding experience with down credit cycles in the product

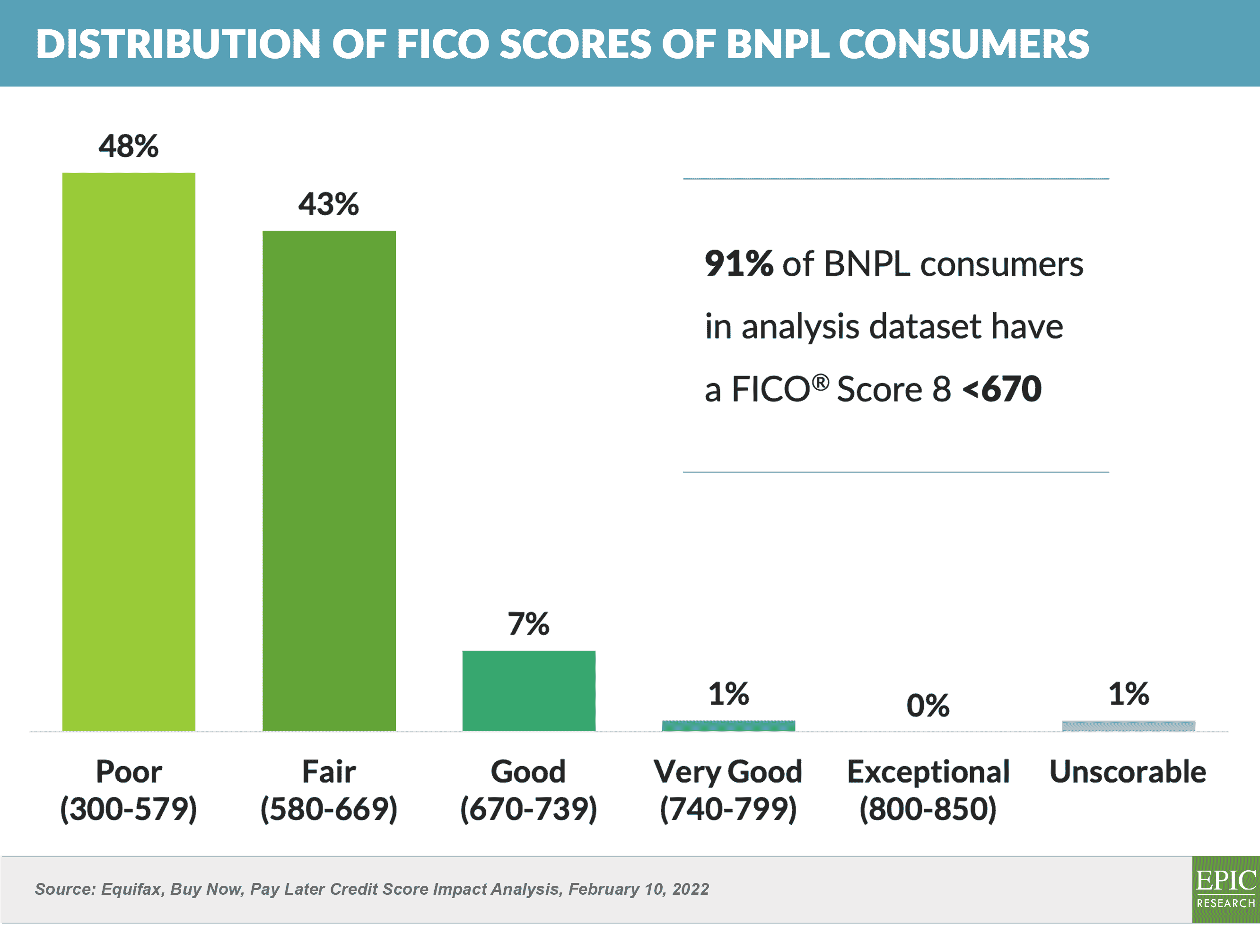

- A recent study by Equifax showed 91% of BNPL consumers have FICO scores lower than 670, reflective of adverse selection

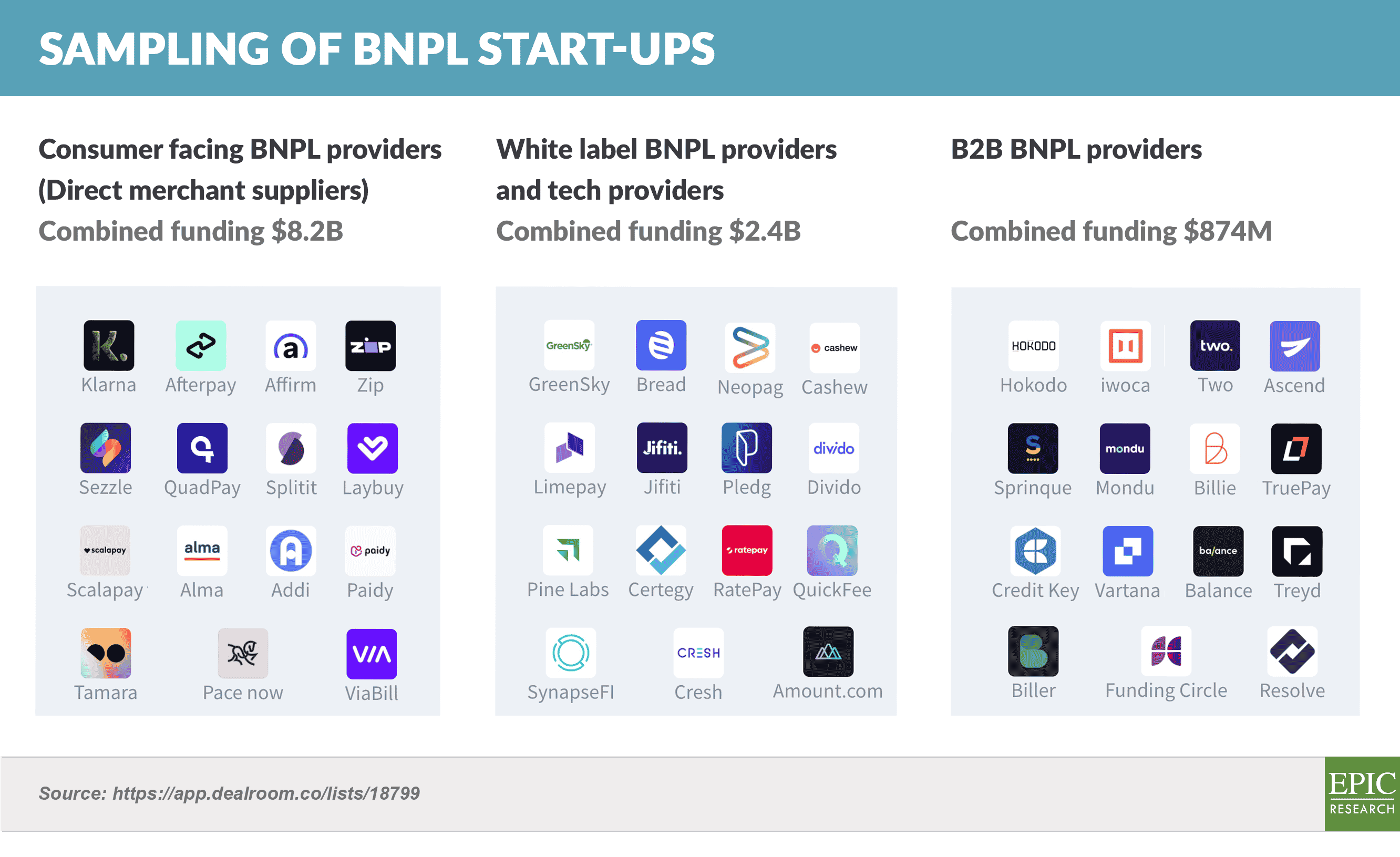

- Dealroom documented over 170 BNPL related start-ups, reflecting the free-for-all in the space – below is a sample, with the full list here

- Credit Suisse recently reported positive delinquency statistics from Affirm’s securitizations

- With rapid growth in the segment and the absence of vintage-level delinquency data, asset quality trends remain difficult to read; however, the competitive and economic environment suggests we keep an eye on this space

Home Equity and Personal Loan Marketing Soars

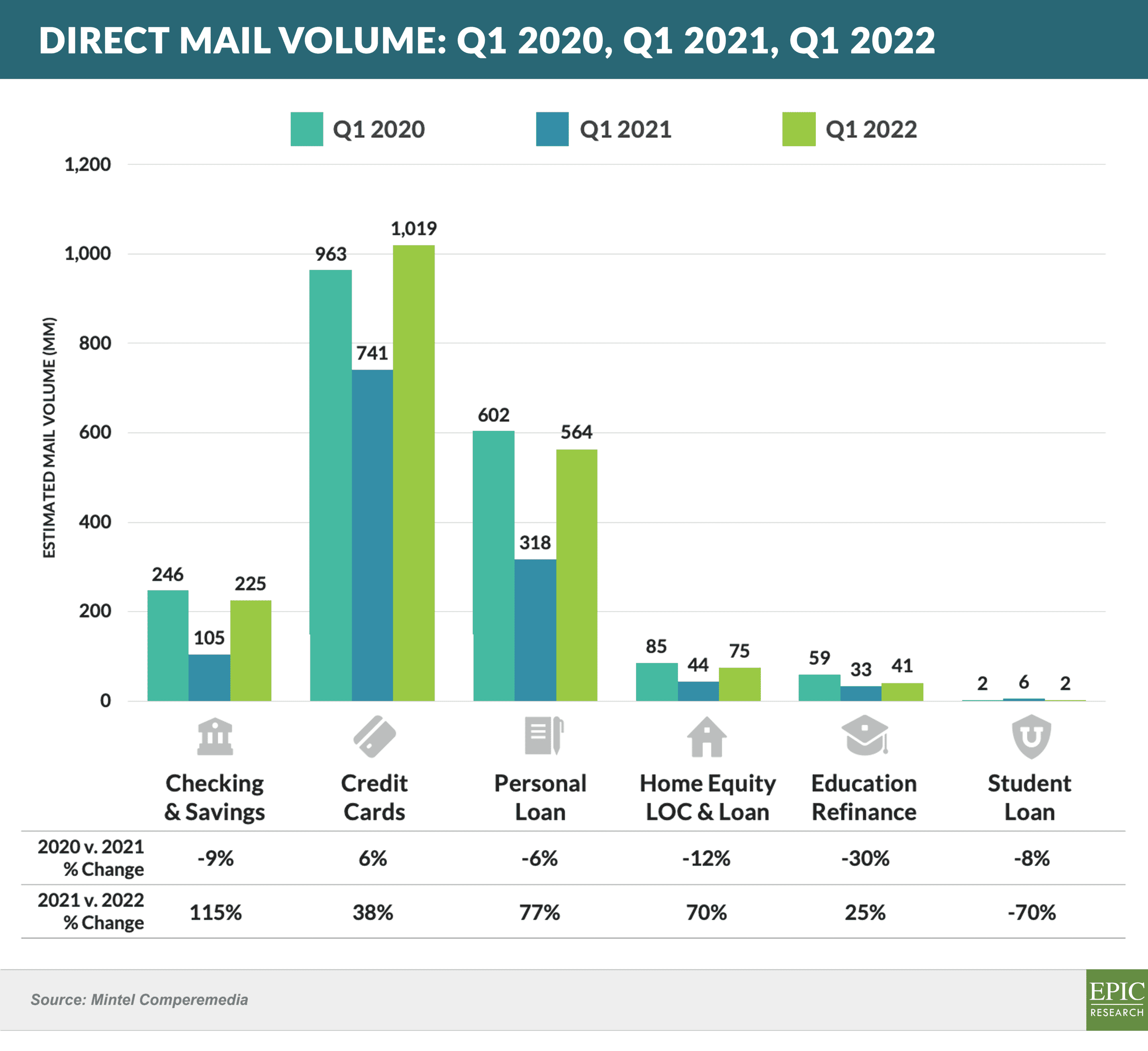

- New acquisition marketing for consumer financial services continues to be dominated by direct mail, which accounts for 60%+ of spending

- Most segments have recovered to levels near those of Q1 2020, with the exception of education refinance, which continues to be slowed by the federal government’s payment freeze

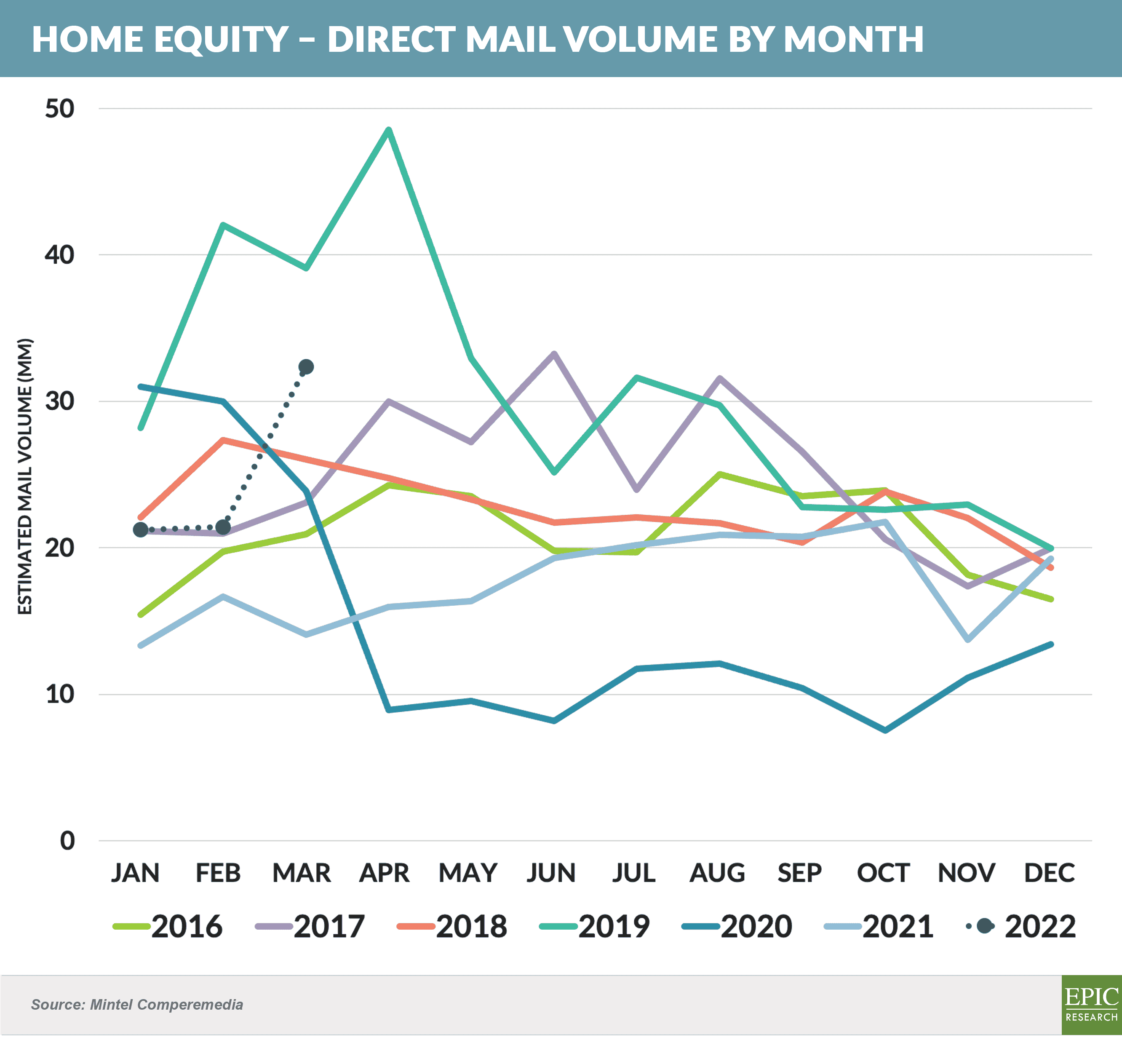

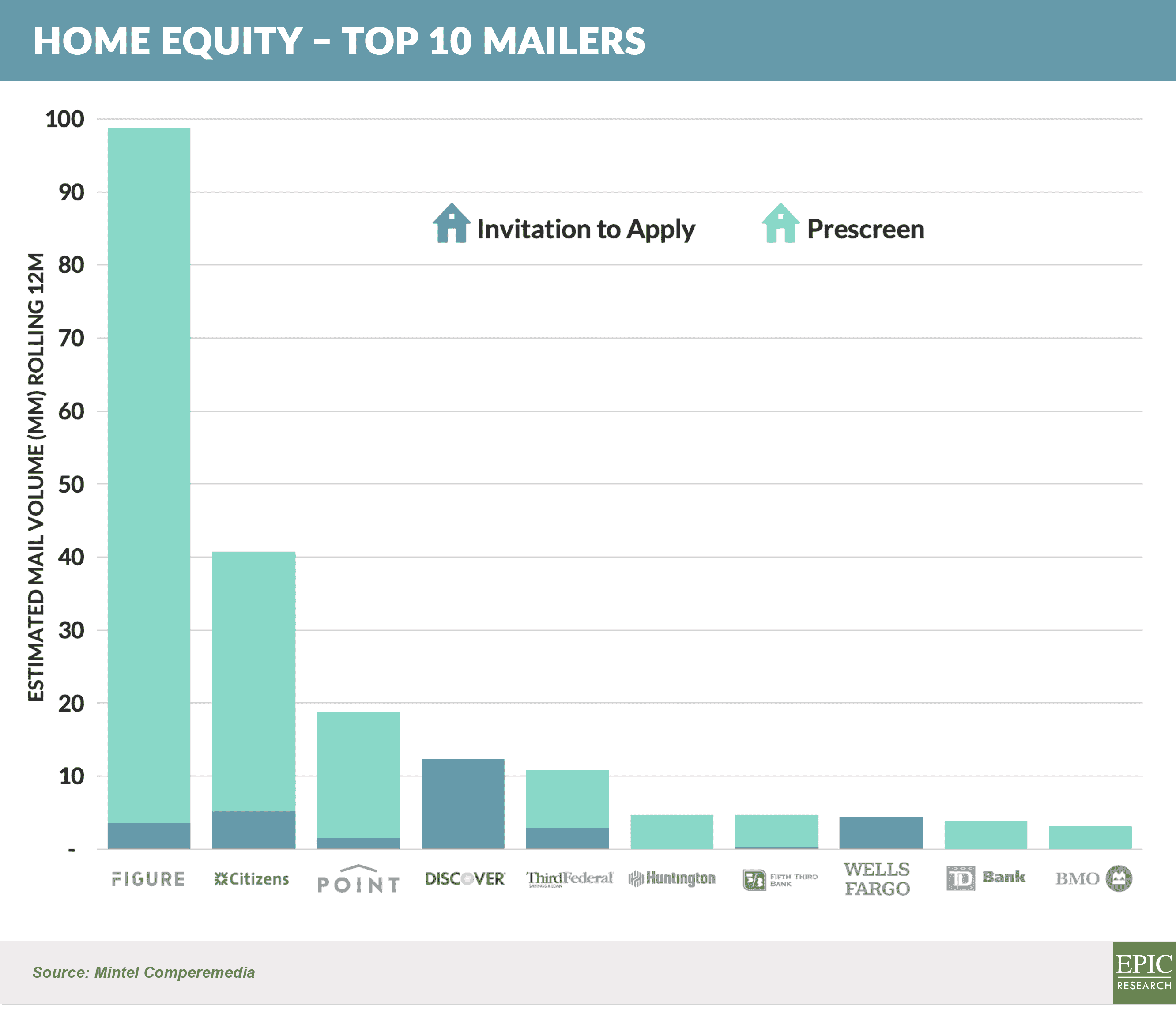

- March home equity mail volume approached the previous highs from 2019

- Figure has been the number one home equity mailer each month for the past year

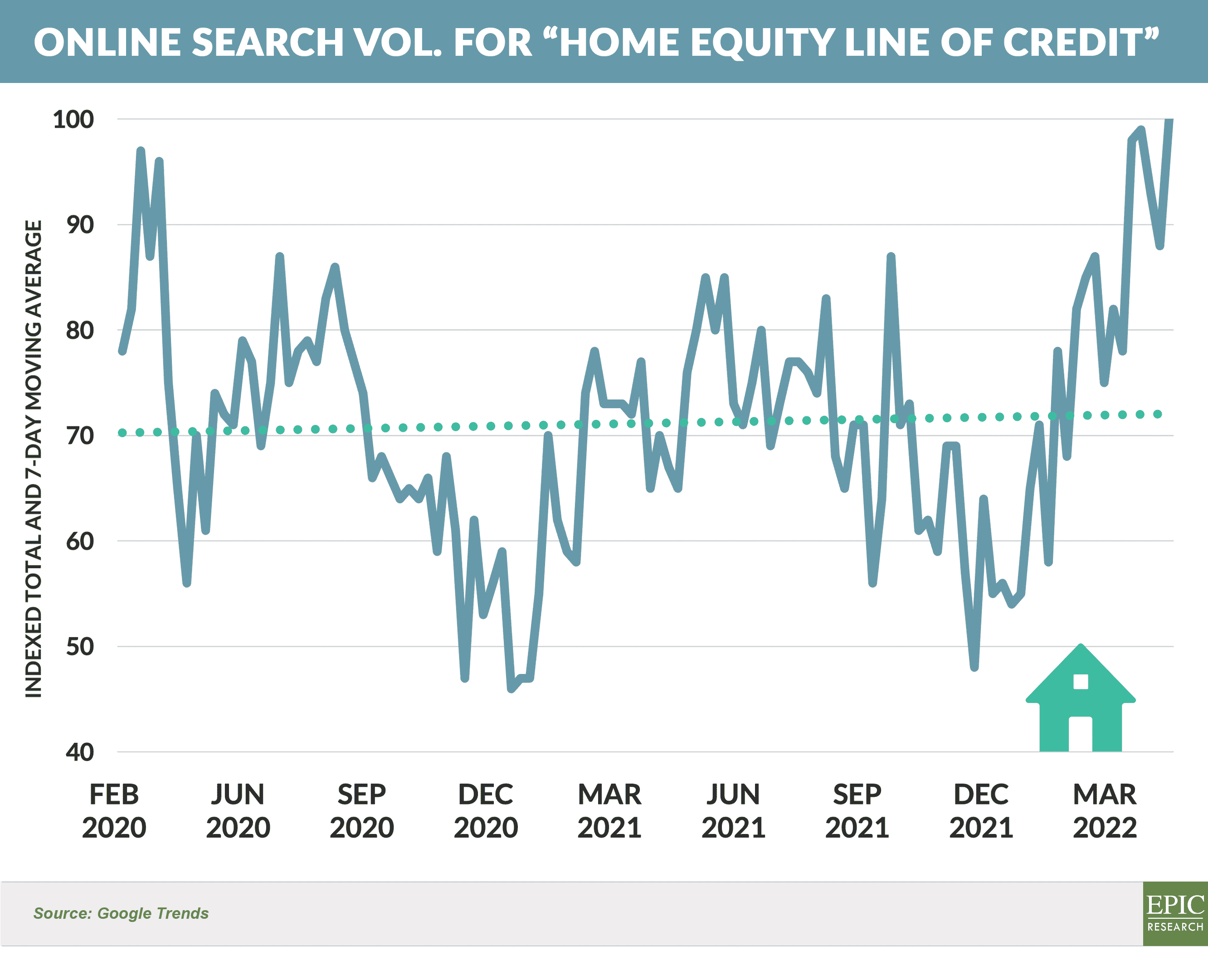

- Online search volume for “home equity line of credit” reached a multi-year high in Q1 and appears to be increasing in Q2

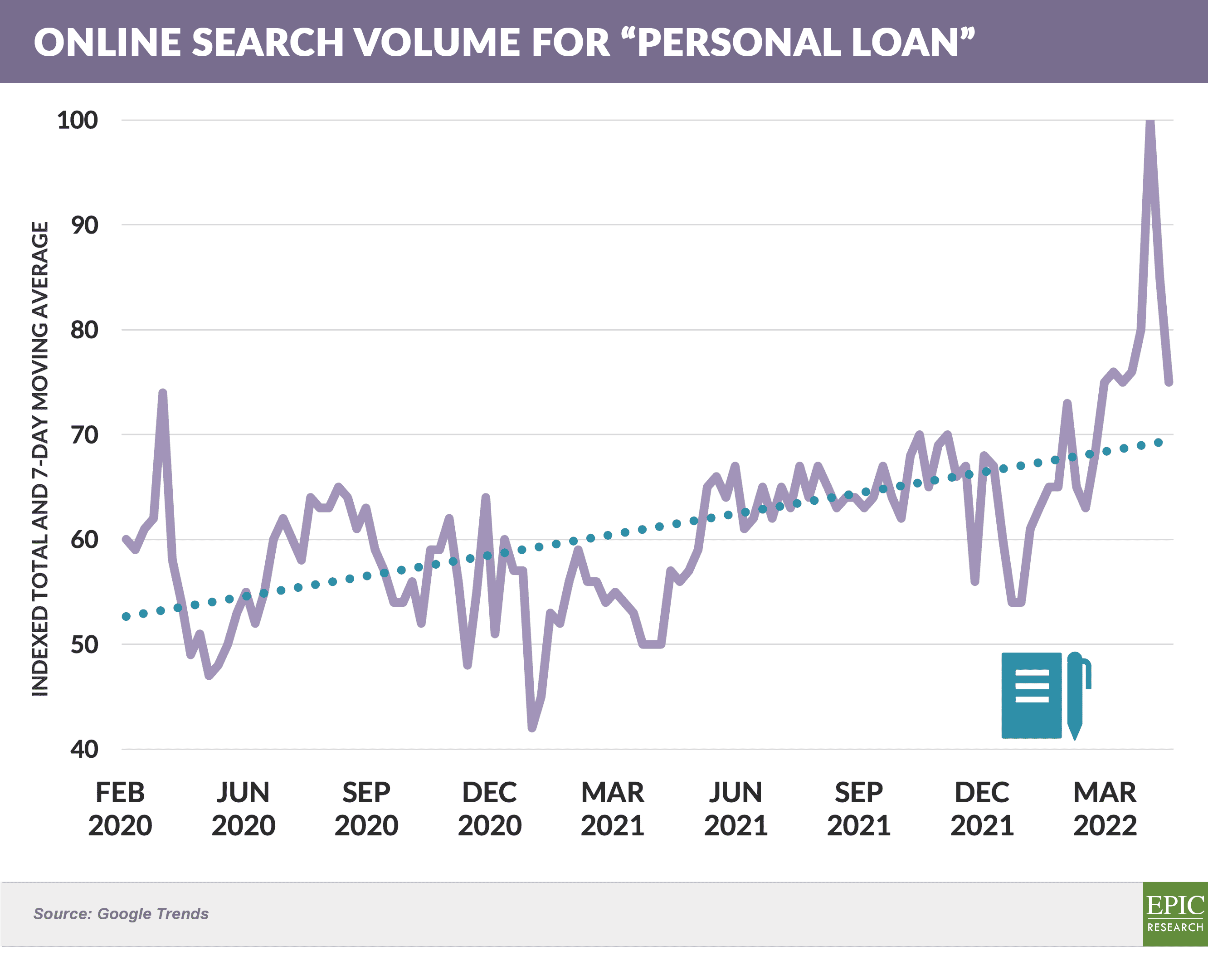

- Online search volume for “personal loan” also picked up in recent months

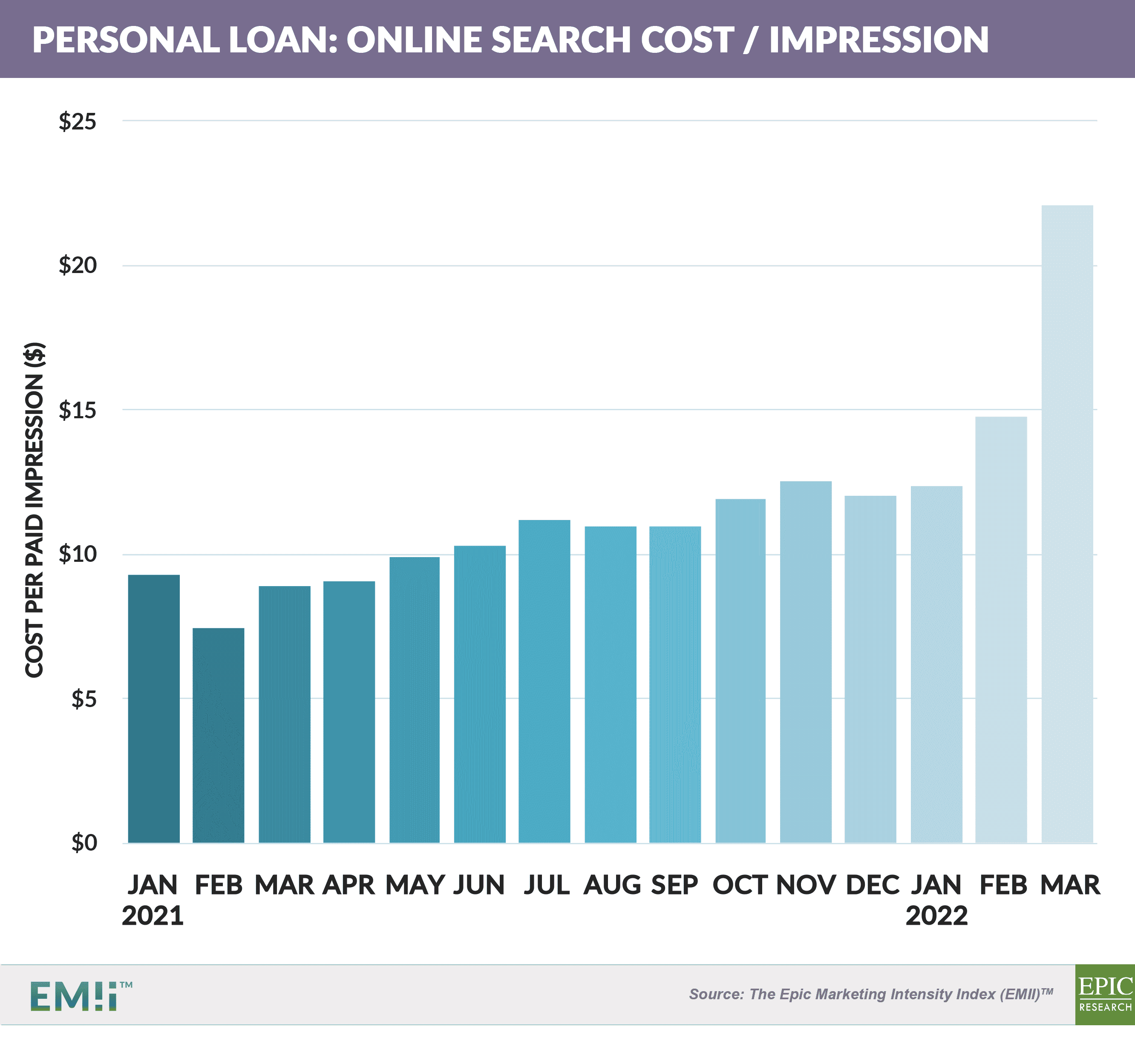

- And has been accompanied by a spike in search cost

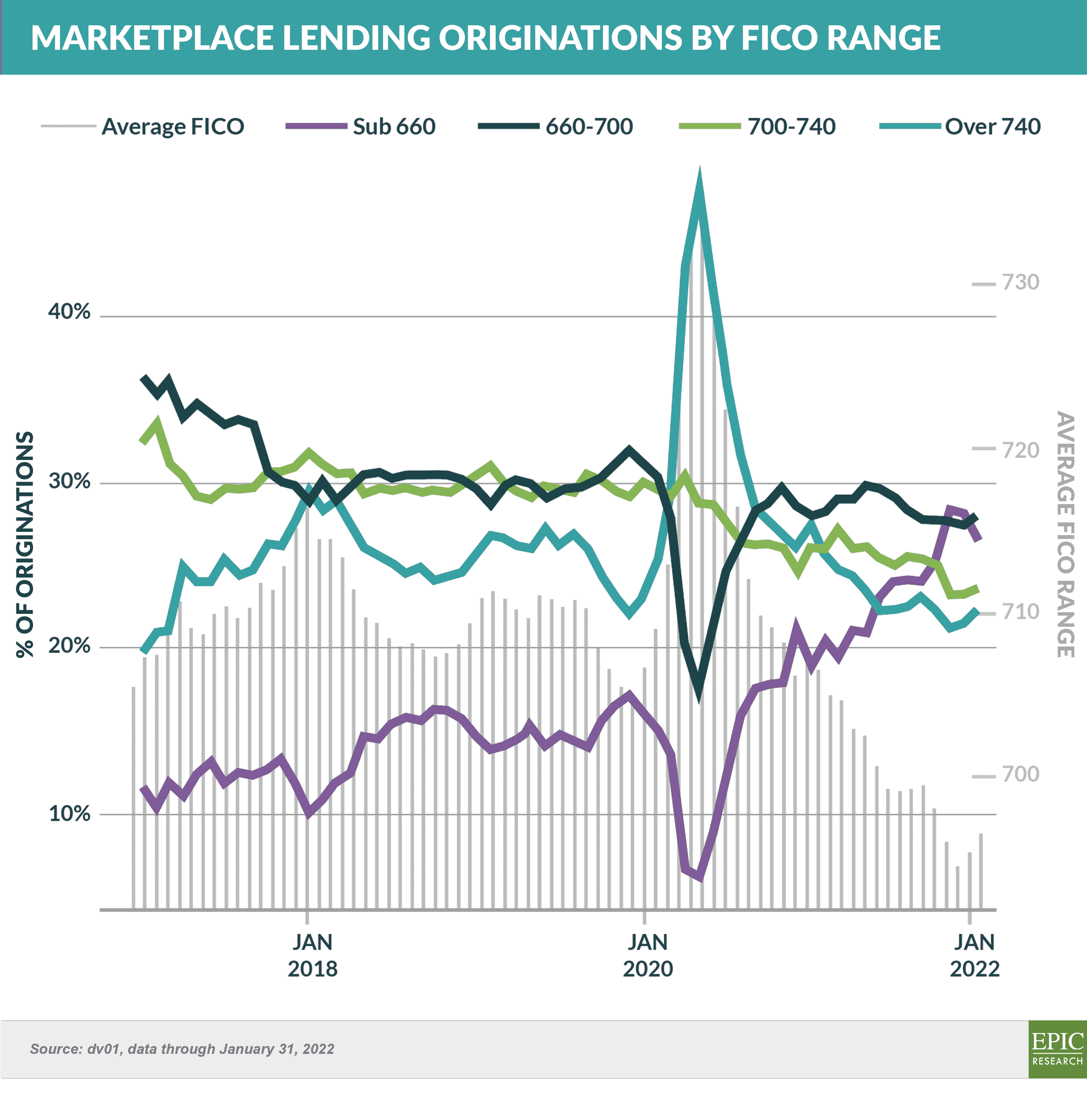

- In the past year, much of the increase in personal loan lending has come in the segment below 660 FICO

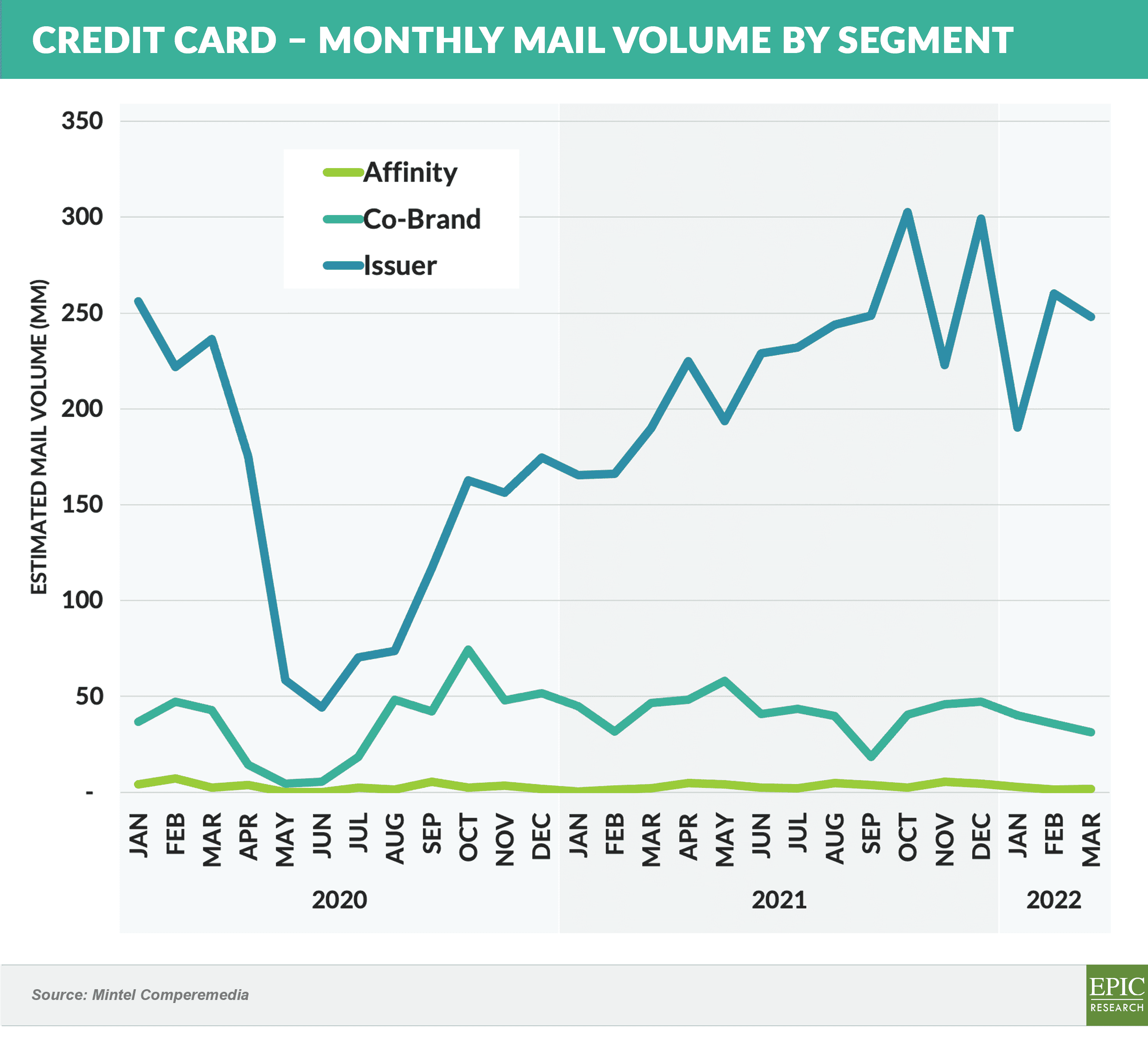

- Credit card mail volume is exceeding pre-pandemic levels with the “Issuer” segment – e.g., Capital One Venture, Wells Fargo Reflect, Bank of America Unlimited Cash Rewards – growing in proportion compared to co-branded offers

- With mail volume back to “normal” levels, and many issuers signaling an intent to grow further, paper shortages may temper these expectations

Consumer Interest in Cards and HELOC Products Grows

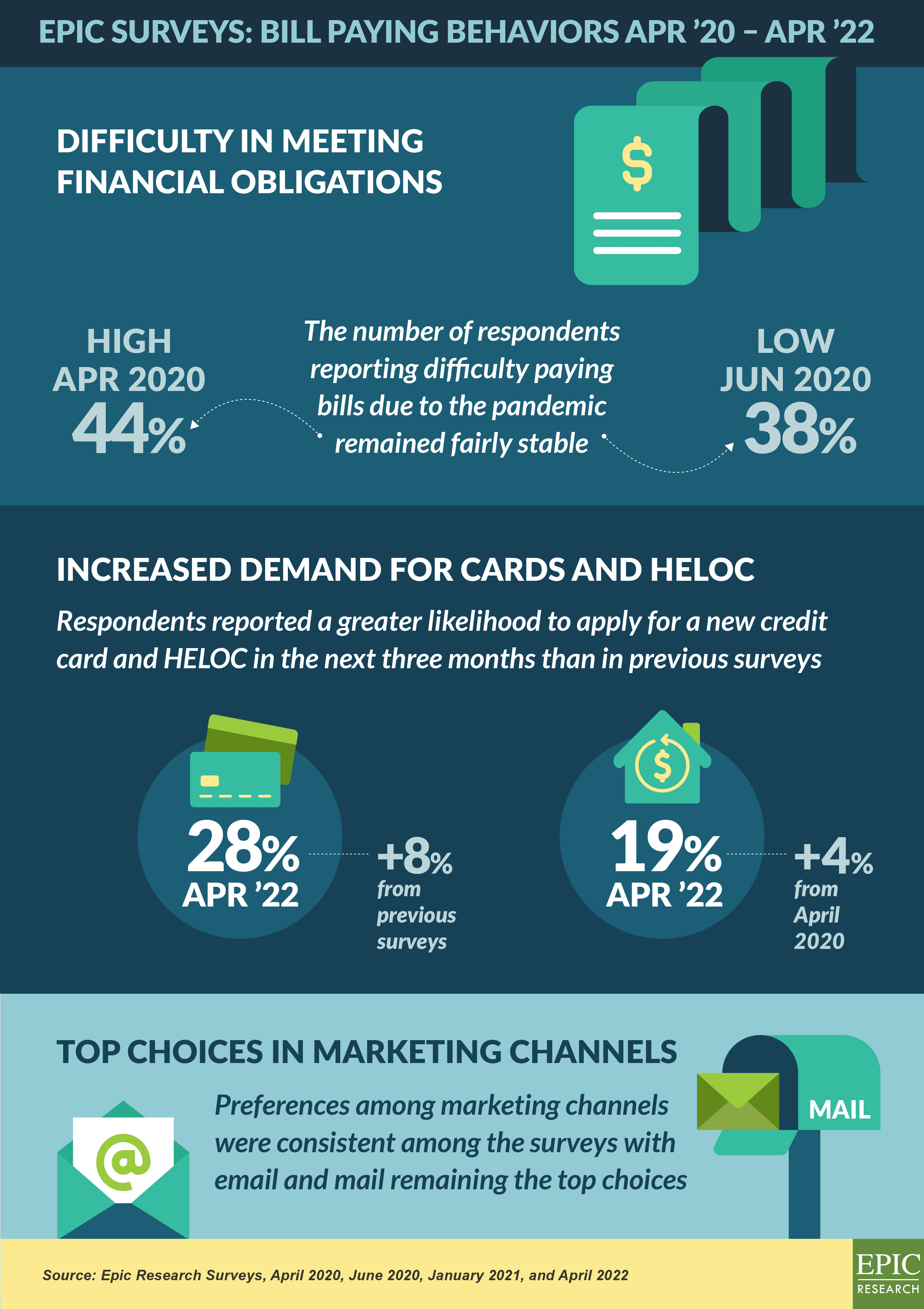

- Since April 2020, Epic has surveyed consumers several times regarding their bill paying behaviors as well as their attitudes about acquiring new financial products

- The most recent survey was conducted in April 2022 among 1,107 consumers

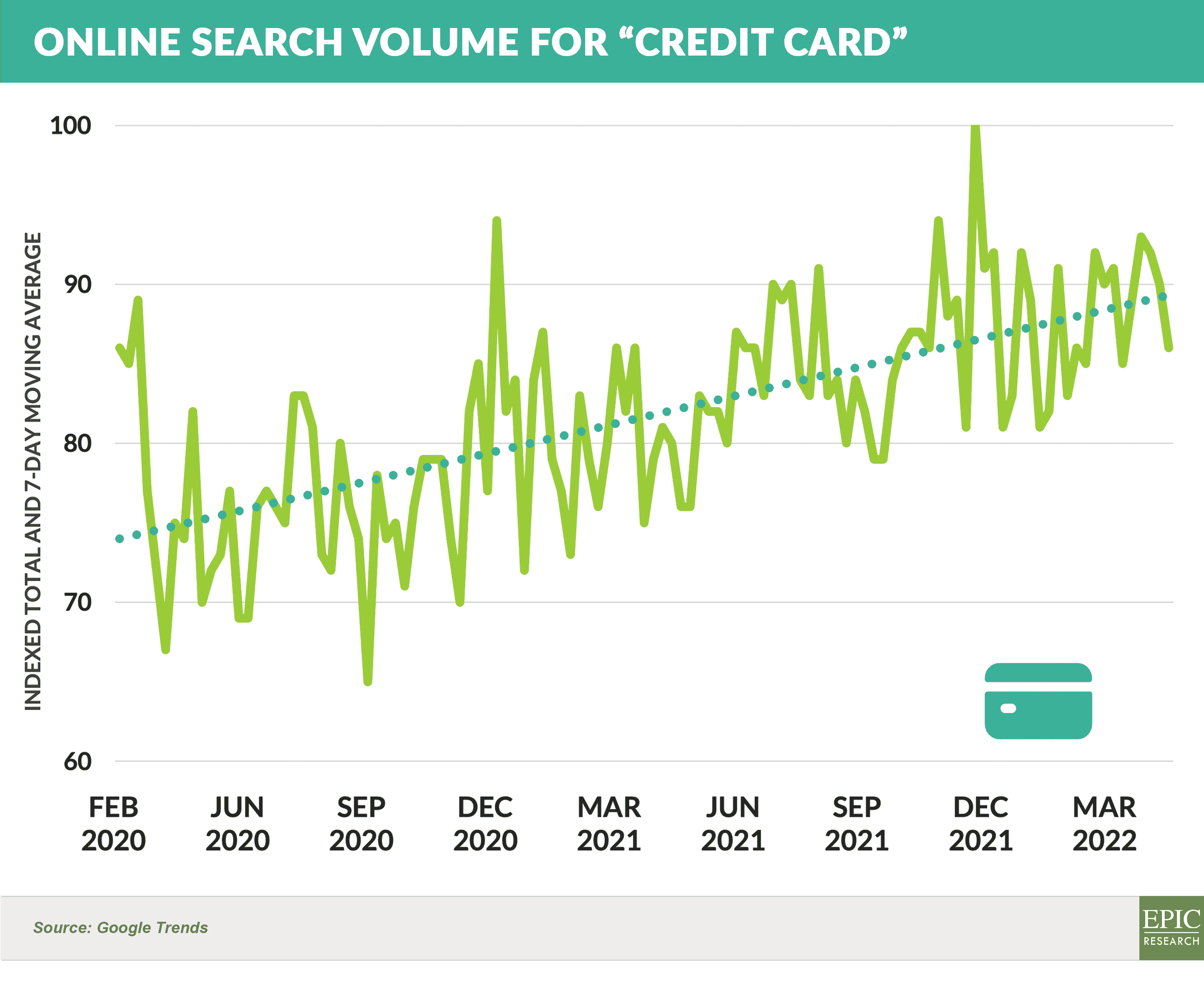

- As mentioned above, online search volume for HELOC has reached a recent high, and search volume for “credit card” has similarly trended upward

Quick Takes

- Bloomberg reports that Apple is developing its own payment processing technology and infrastructure

- The initiative, called “Breakout,” will reduce Apple’s reliance on outside financial services companies

- The move represents a departure from Apple’s previous U.S. approach, which centered on partnerships with firms like Barclays, Citizens, and Goldman Sachs

- First quarter results from major card issuers showed a significant rebound in U.S. consumer spending from Q1 2021

- Credit card spending increased 23% at Citi, 29% at JPMorgan Chase, and 33% at Wells Fargo

- Chase reported 64% higher card spending on travel and dining than in ’21

- The CFPB signaled its intent to lower the cap on credit card late fees

- The limits were initially set in 2009 with the passage of the CARD Act

- The card industry will undoubtedly respond to a lower cap by adjusting other pricing levers to meet their return hurdles

- Amazon renewed its co-brand relationship with Chase

- It had been widely predicted that Amazon would move to another issuer, with American Express and Synchrony reported as other bidders

- Other co-brand news includes

- Capital One signed a $125 million "banking partnership" with MLB

- PayPal revamped its Cashback Mastercard to offer 3% cash back when checking out on PayPal and 2% on other purchases

- Subsequent to Alliance Data Systems rebranding to Bread Financial, it announced a partnership with Victoria’s Secret to issue a rewards credit card

- Zelle is reportedly considering expanding acceptance beyond consumers to retailers, thus competing with Visa and Mastercard

If the Epic Report was forwarded to you, click here to add your name to the mailing list.

The Epic Report is published monthly, with the next issue publishing on June 4th.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.