Three Things We’re Hearing

- Marketing boom for savings here to stay???

- Epic Credit Card Mt. Rushmore!!!

- Consumer credit digital and TV marketing rise

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Marketing Boom for Savings Here to Stay?

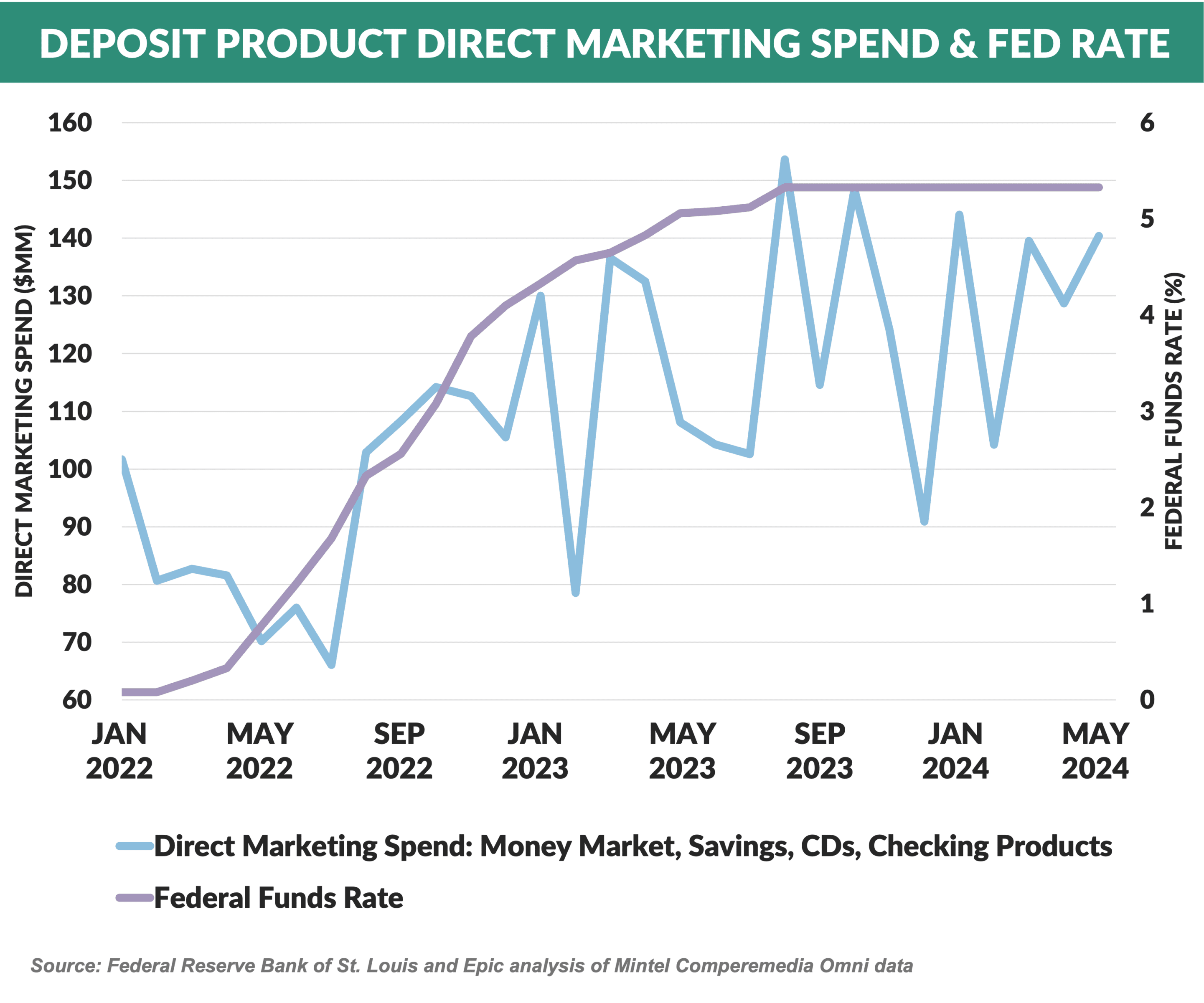

- Banks have been clamoring for deposits since rates began rising in 2022

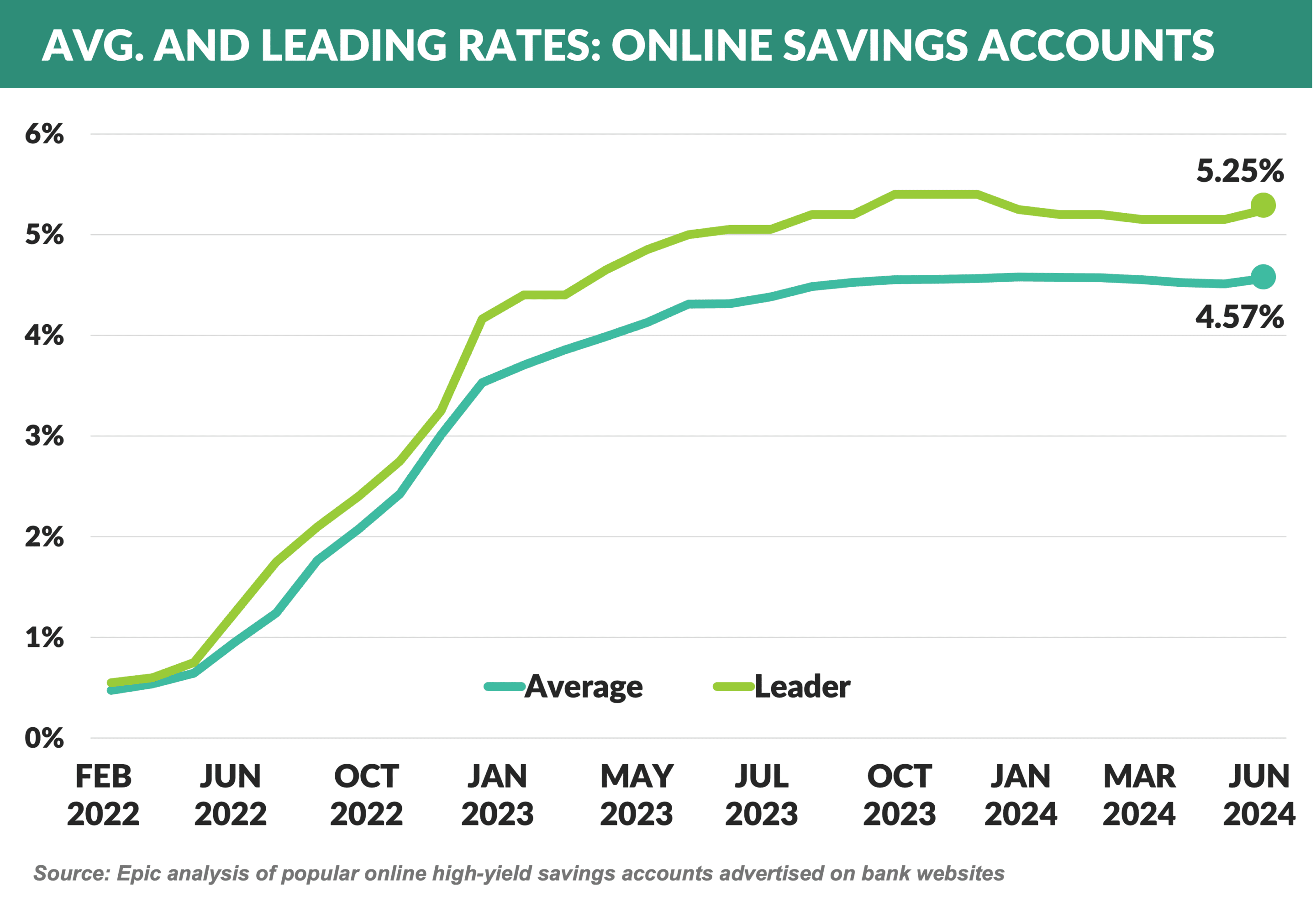

- And consumer demand for high yield savings accounts has grown 5X

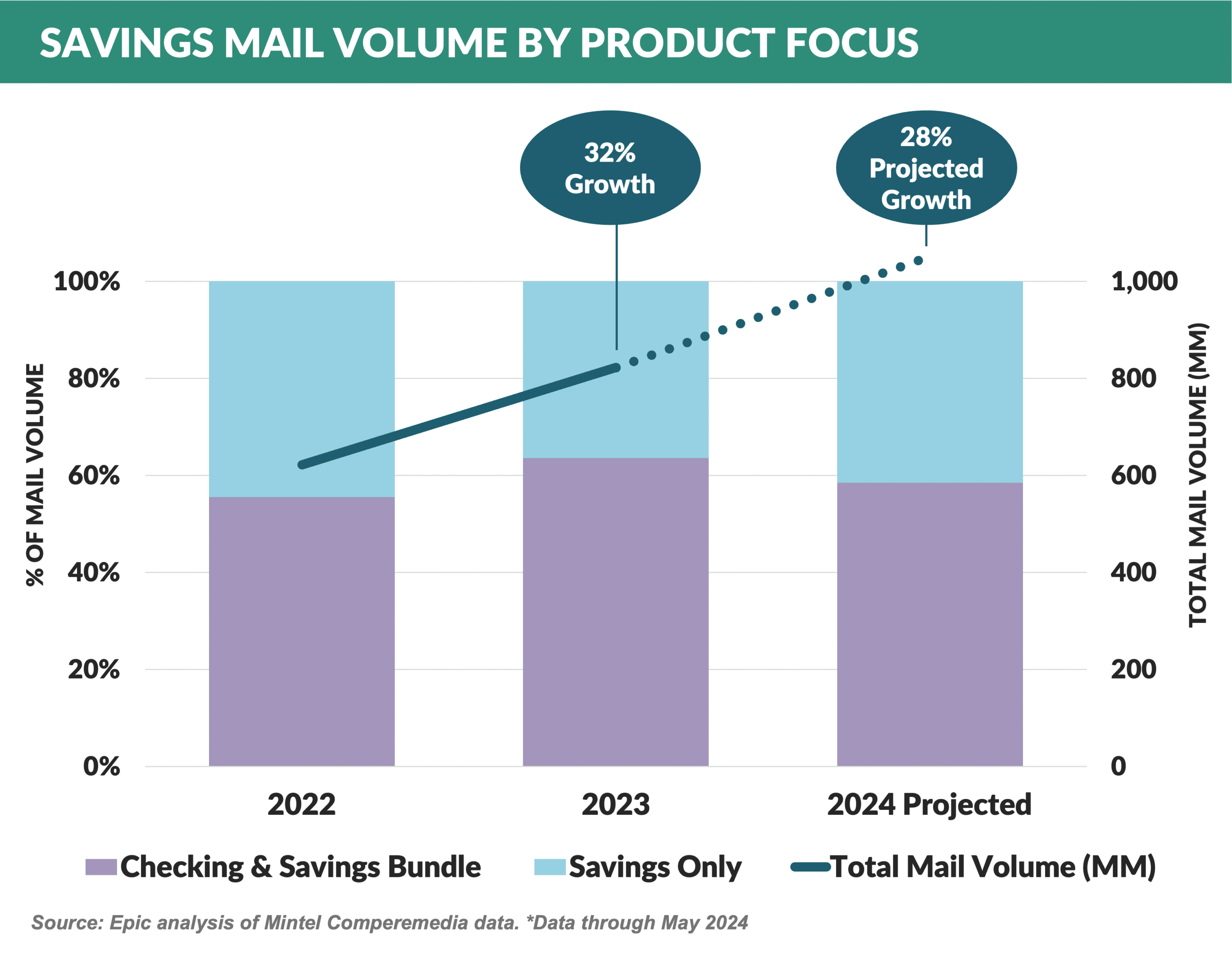

- Much of the marketing for deposits has focused on savings; however, 64% of savings promotions offered a bundle with checking in 2023

- After rising 400bp+, rates offered on high yield savings accounts have now plateaued

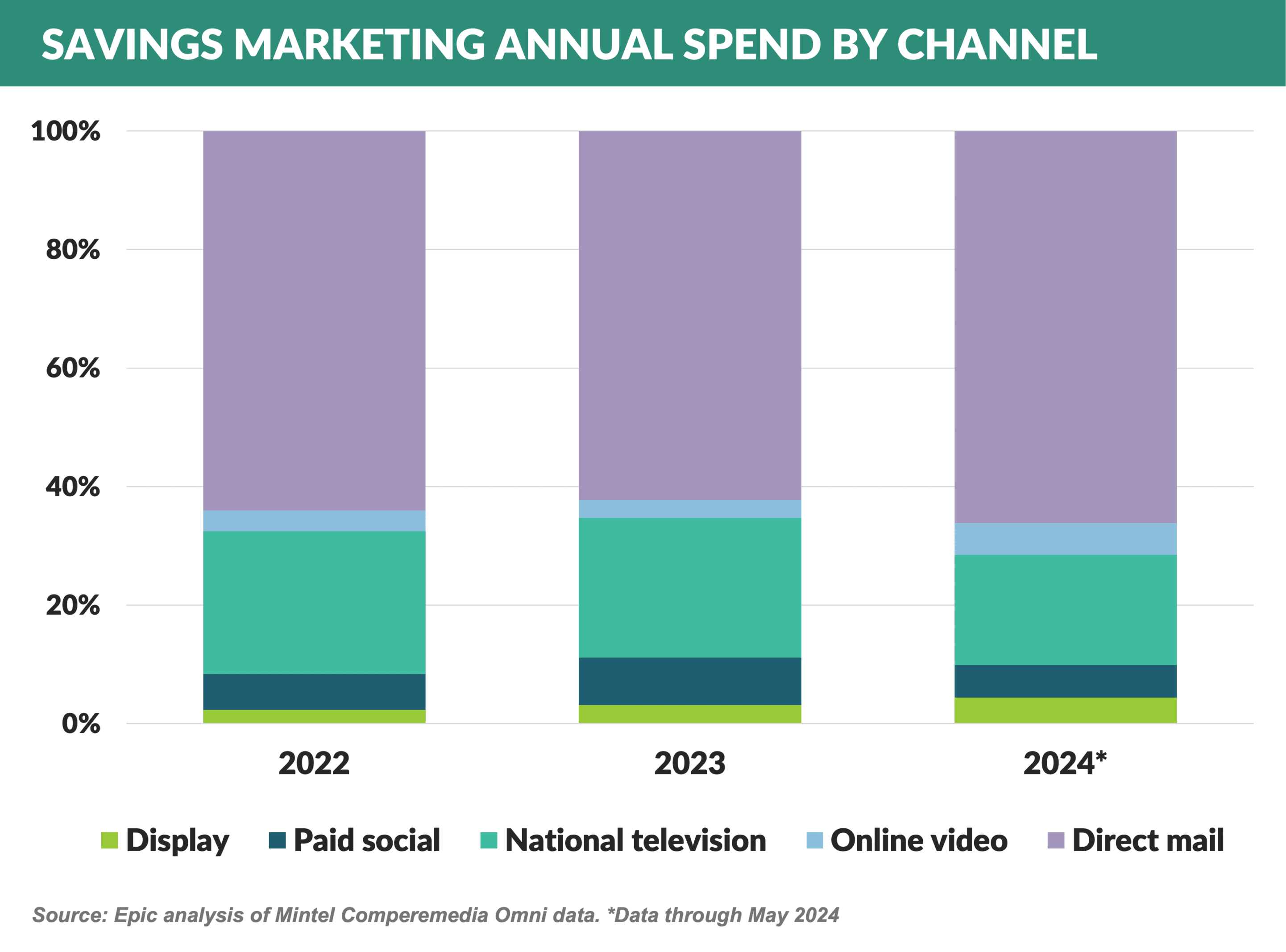

- Direct mail accounts for over 60% of all savings marketing spending, followed by national TV with over 20%

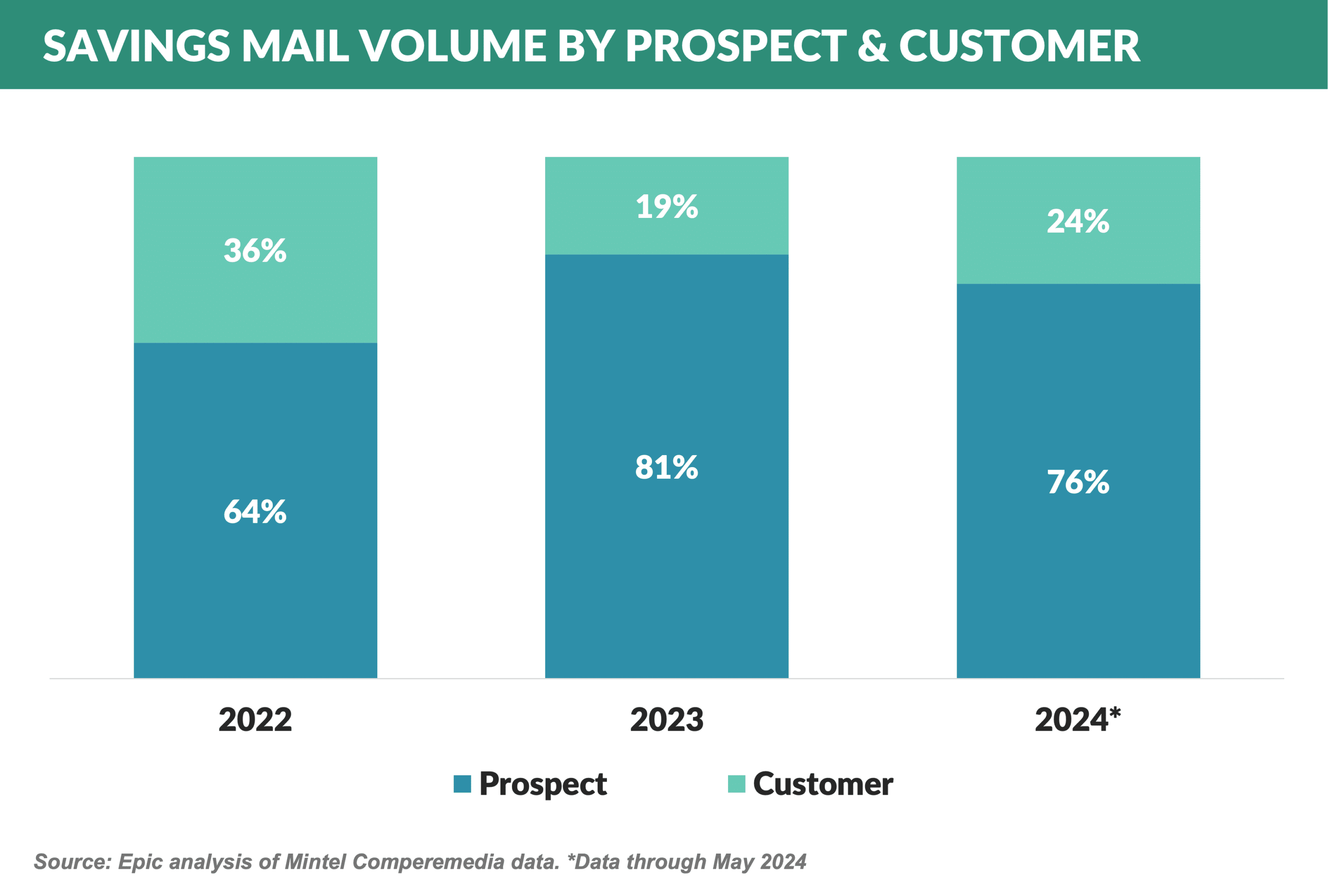

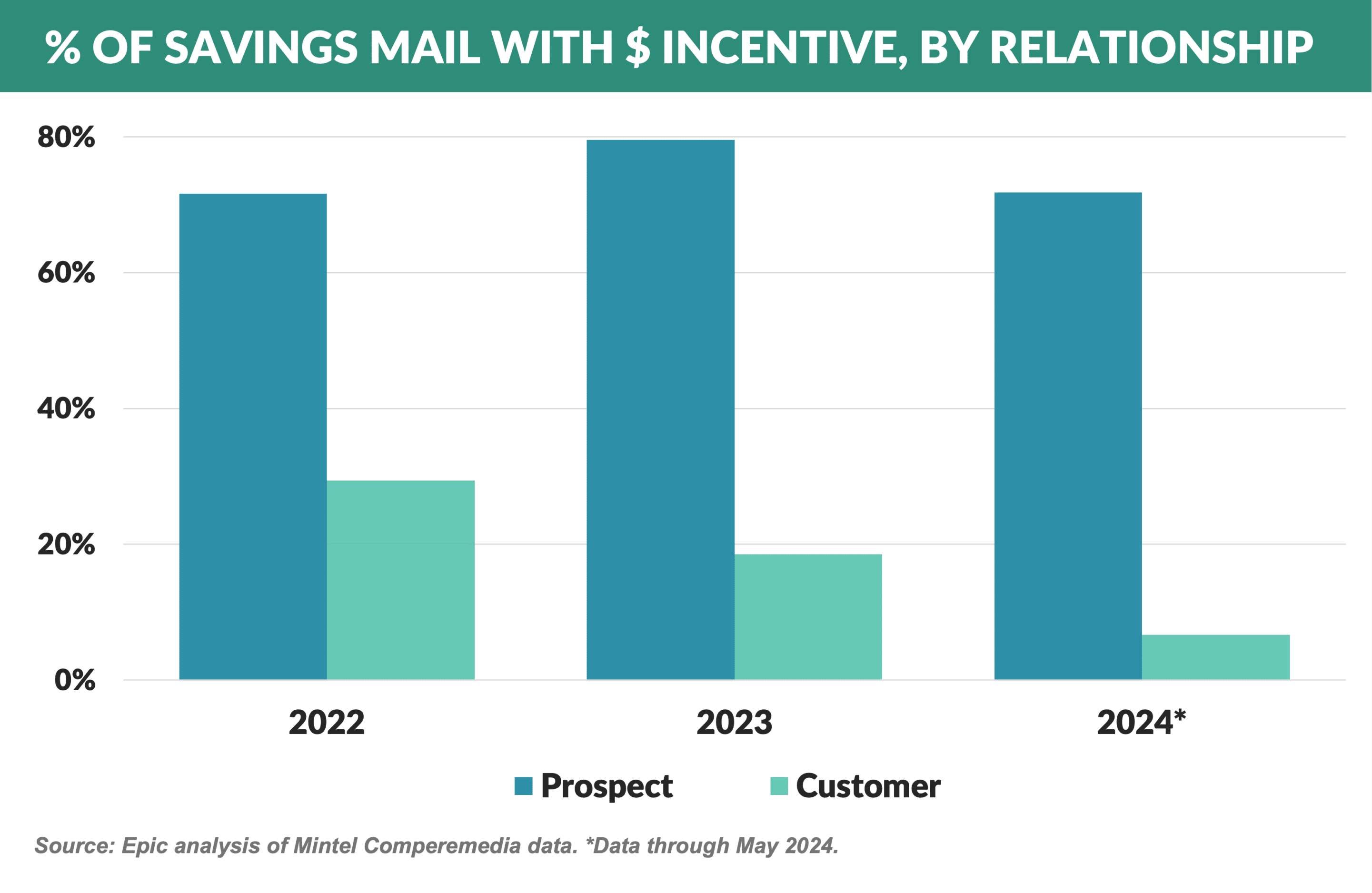

- Banks are targeting most of their savings marketing spending on new depositors vs. cross-selling to existing customers

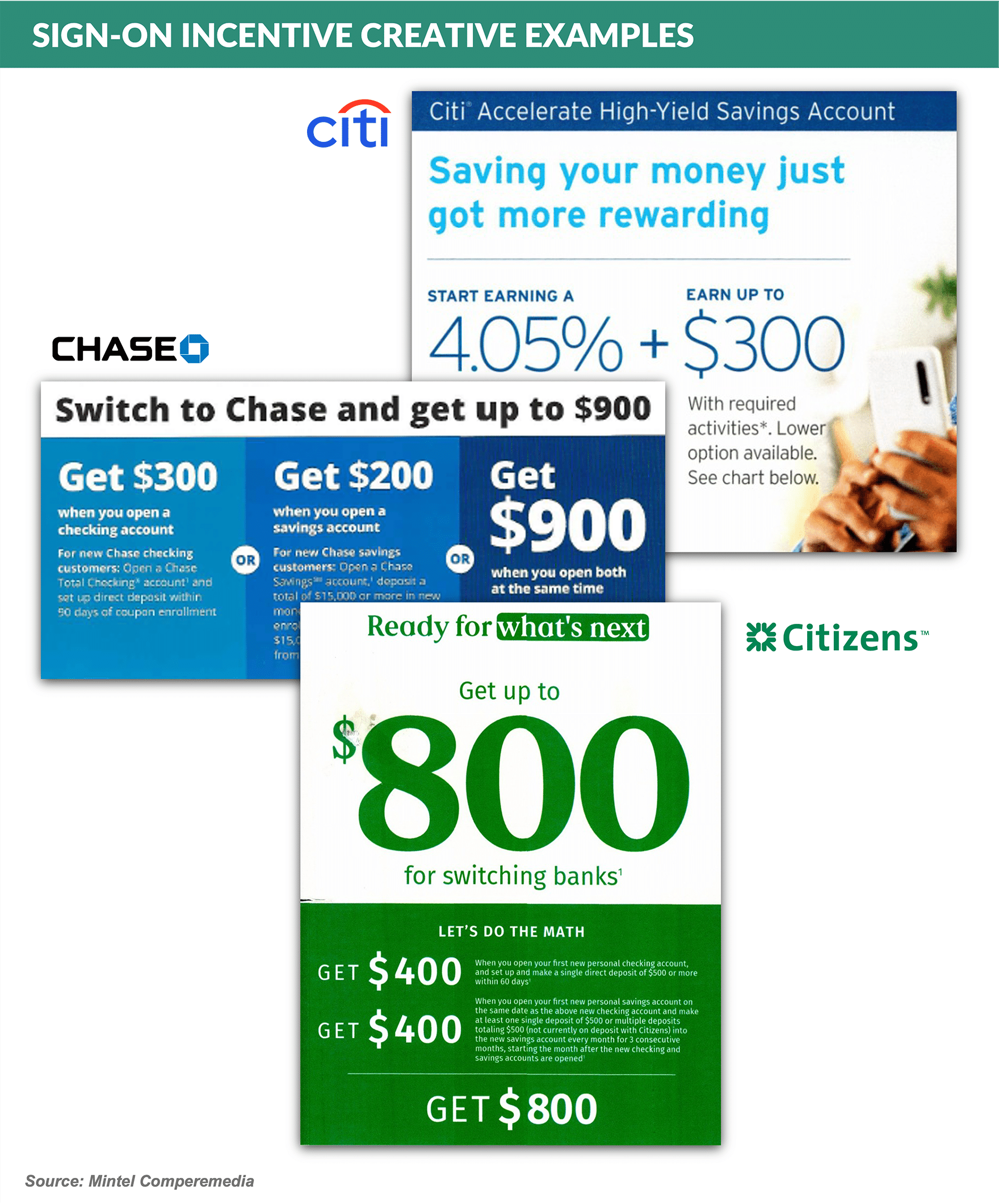

- In addition to higher marketing spend, sign-on incentives have also grown

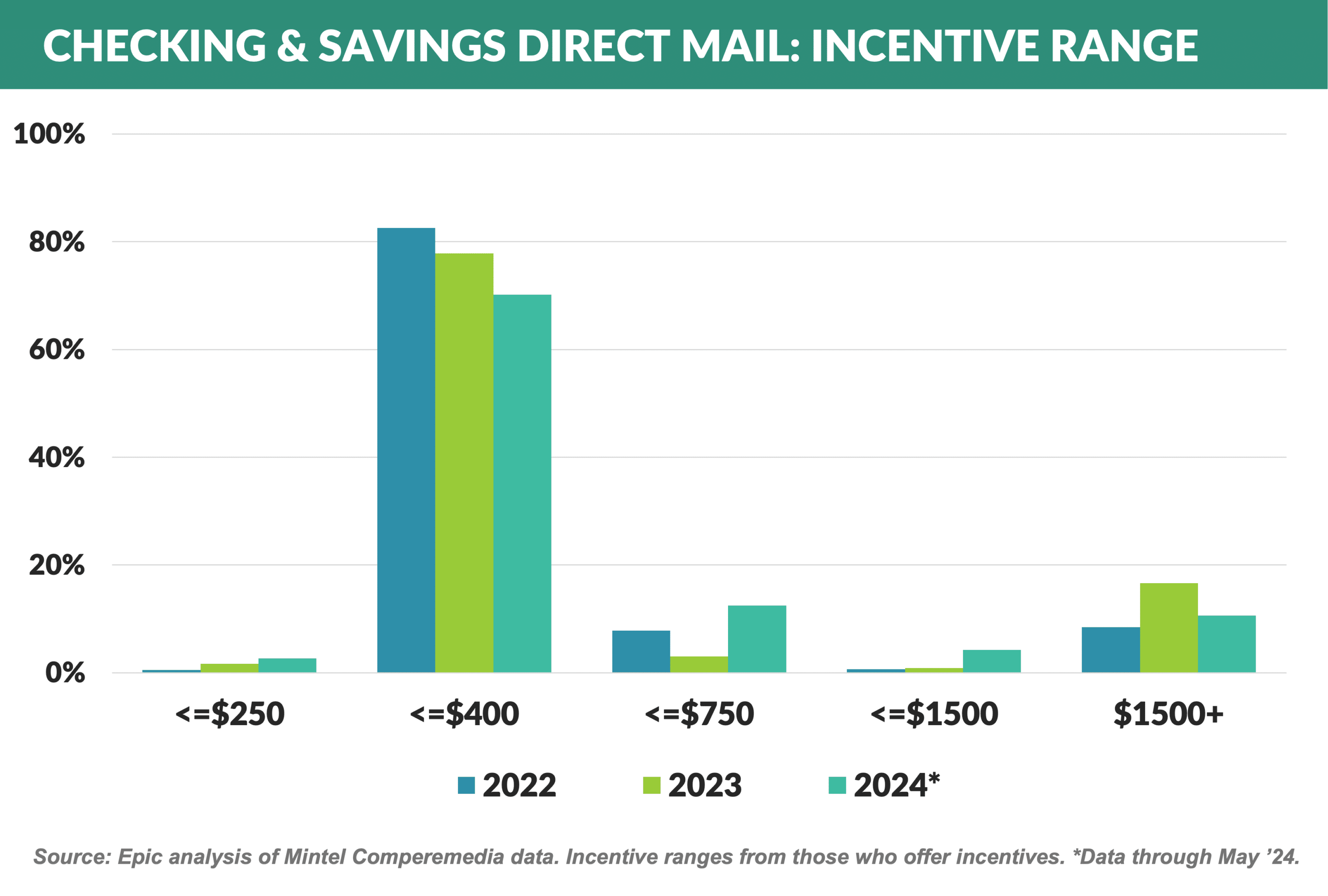

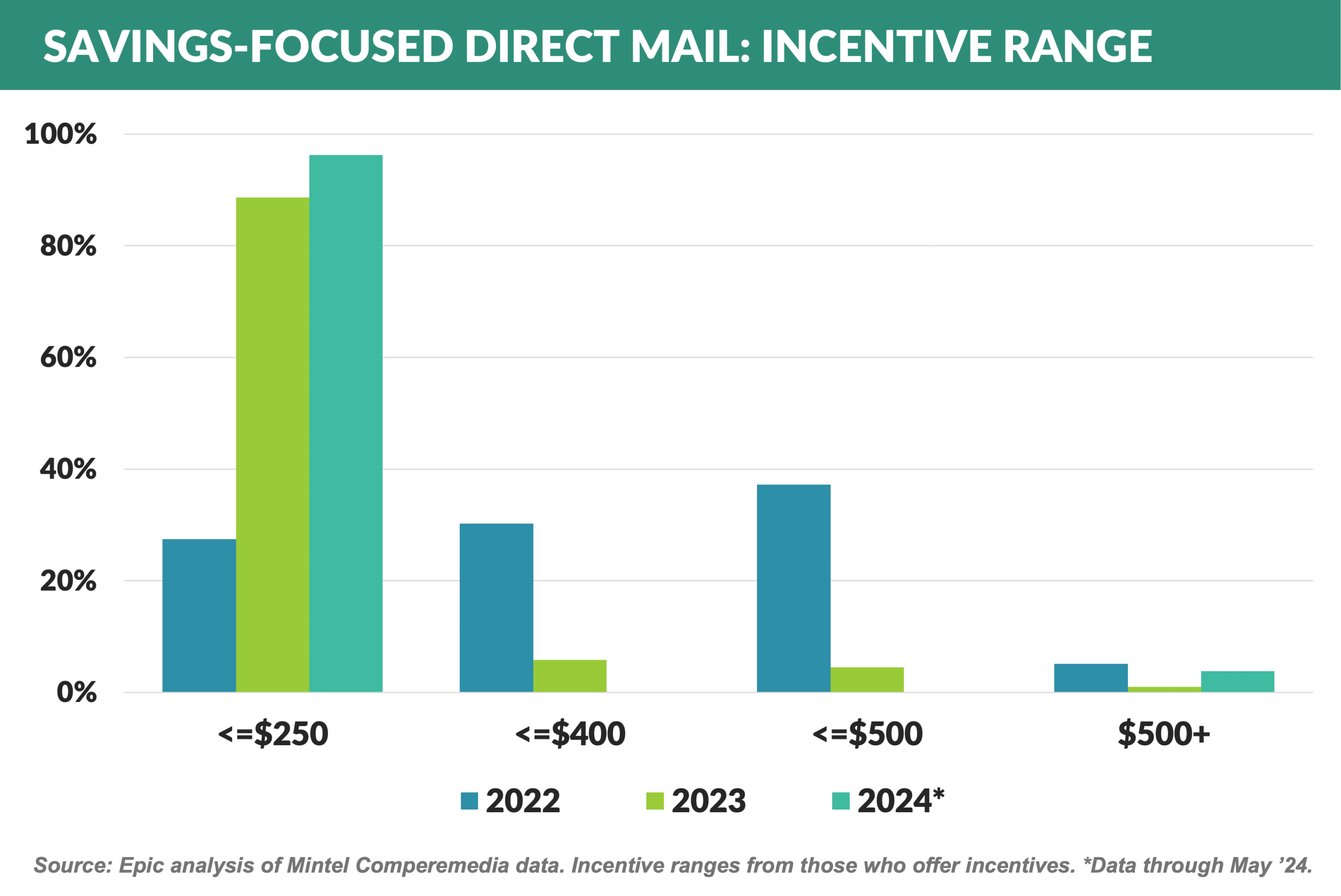

- Bundled checking and savings incentives are clustered between $250 and $400, with most savings-only incentives around $250 or less

- And the incentives are offered almost exclusively to new customers

- With rates expected to stay high for a while, the current marketing environment should remain static

Epic Credit Card Mt. Rushmore!!!

- As mentioned last month, we have been thinking about the most influential issuers in the modern credit card industry (i.e., since the late 1980s, not including the inventors of Visa, Mastercard, Discover, or Amex) – those who combined innovation with execution to transform the business

- Our scholarly historic research has identified four issuers we deem worthy for the Epic Credit Card Mt. Rushmore

- The first inductee is Citi

- In the 1980s, Citi was the first Visa / Mastercard issuer to conduct nationwide mass mailings to attract new card customers – previously, most issuers solicited only their checking account customers

- Beyond pioneering mass direct mail marketing, Citi was among the first to use sophisticated analytics for marketing optimization and credit underwriting

- Citi launched the AAdvantage Mastercard in 1987 – one of the first and historically most successful cobrands

- These innovations allowed Citi to become the largest US bankcard issuer in the mid-80s, a title it held until 2006 when JPMorgan Chase took over

- For these reasons, Citi is our first issuer on the Epic Credit Card Mt. Rushmore

Consumer Credit Digital and TV Spending Up

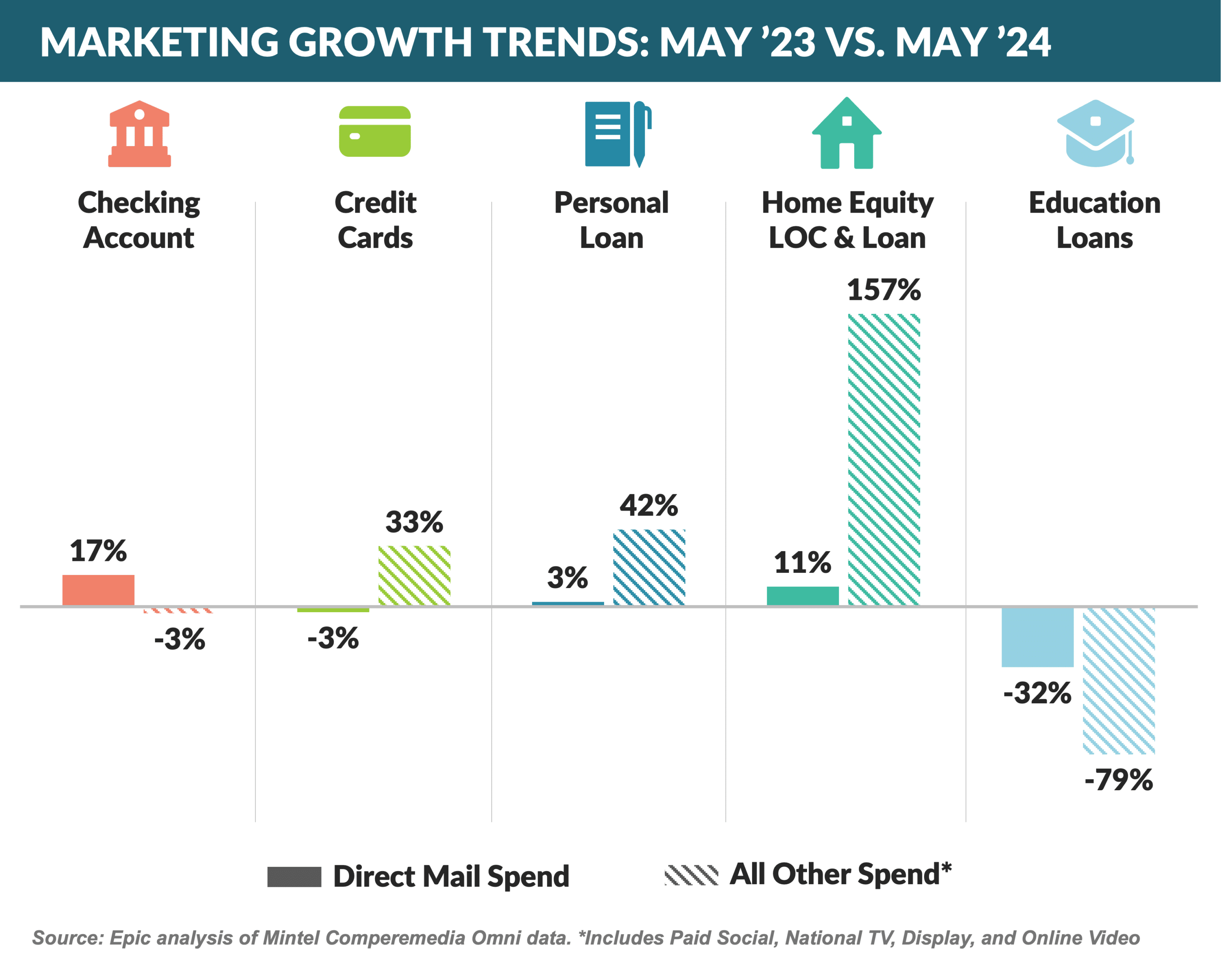

- Year-over-year digital and TV spending was up in May for credit card (+33%), personal loans (+42%), and home equity (+157%)

- Spending on education loan marketing continued its decline, with digital down 79% from May '23 and mail spend down 32%

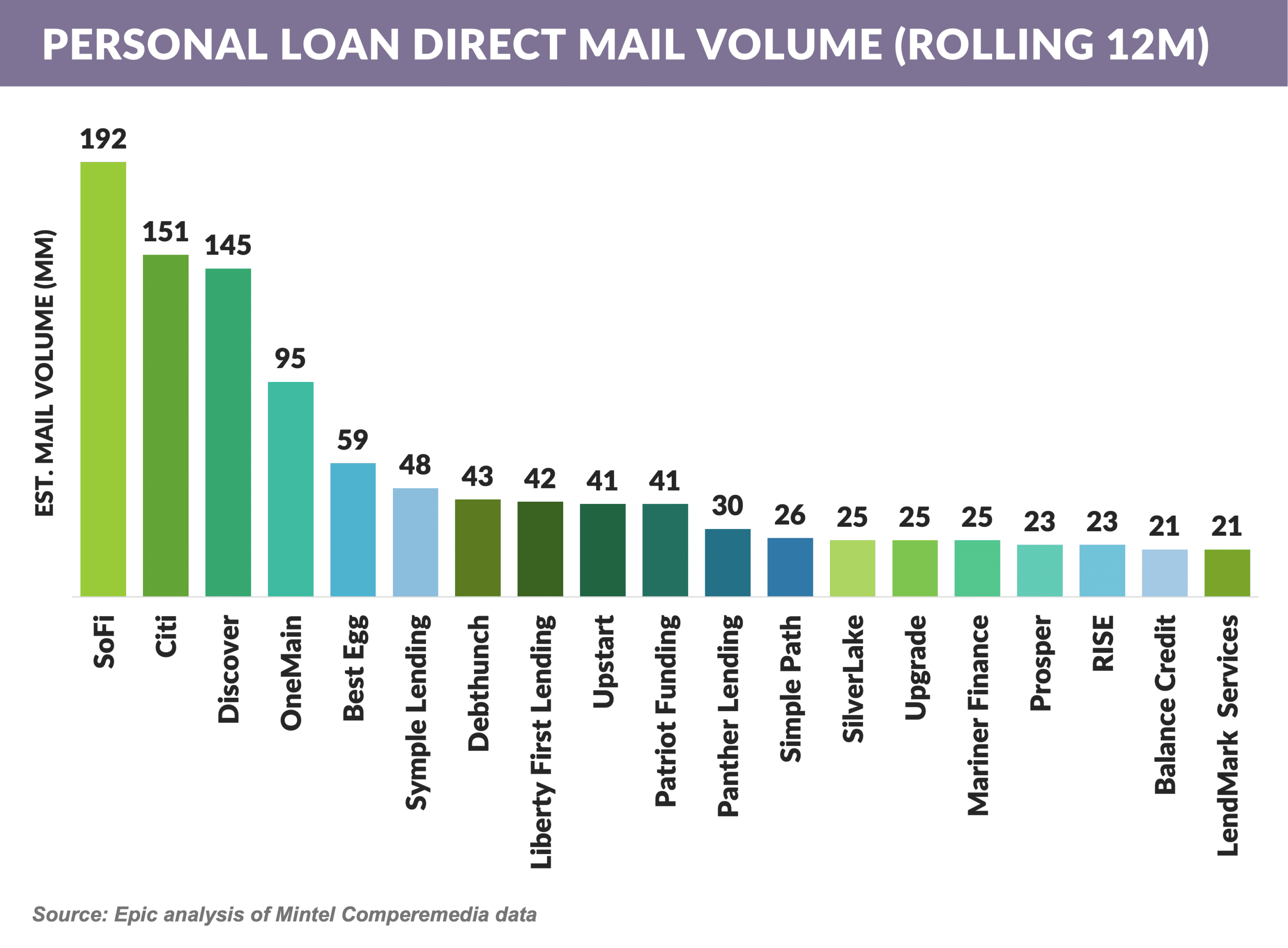

- Lenders with bank charters – SoFi, Citi, and Discover – have dominated personal lending mail over the past year as lenders relying on non-deposit sources of funding are finding funding to be more expensive and less available

- A Wall Street Journal article on Wells Fargo’s credit card partnership with Bilt reports that a combination of high revenue sharing, rewards, and low revolving activity are causing the program to lose as much as $10 million per month

- It is worth noting that new cobrand concepts such as the Bilt card – which rewards cardmembers for putting their monthly rent on the card – are difficult to model without pre-existing data from comparable programs

- Additionally, some degree of monthly loss numbers is to be expected as even the most successful new programs lose money in the first few years due to disproportionately high acquisition costs and less than peak revolving activity

- Apple has scrapped its BNPL service, Apple Pay Later

- Later this year, Apple will offer BNPL services from outside companies such as Affirm

- The new partnerships will be available to consumers globally, unlike Apple Pay Later that was only available in the US

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on August 10th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.