Three Things We’re Hearing

- Credit card mail volume recovering

- Personal loan mail volume steady

- Acquisition spending up across products and channels

A Three-minute read

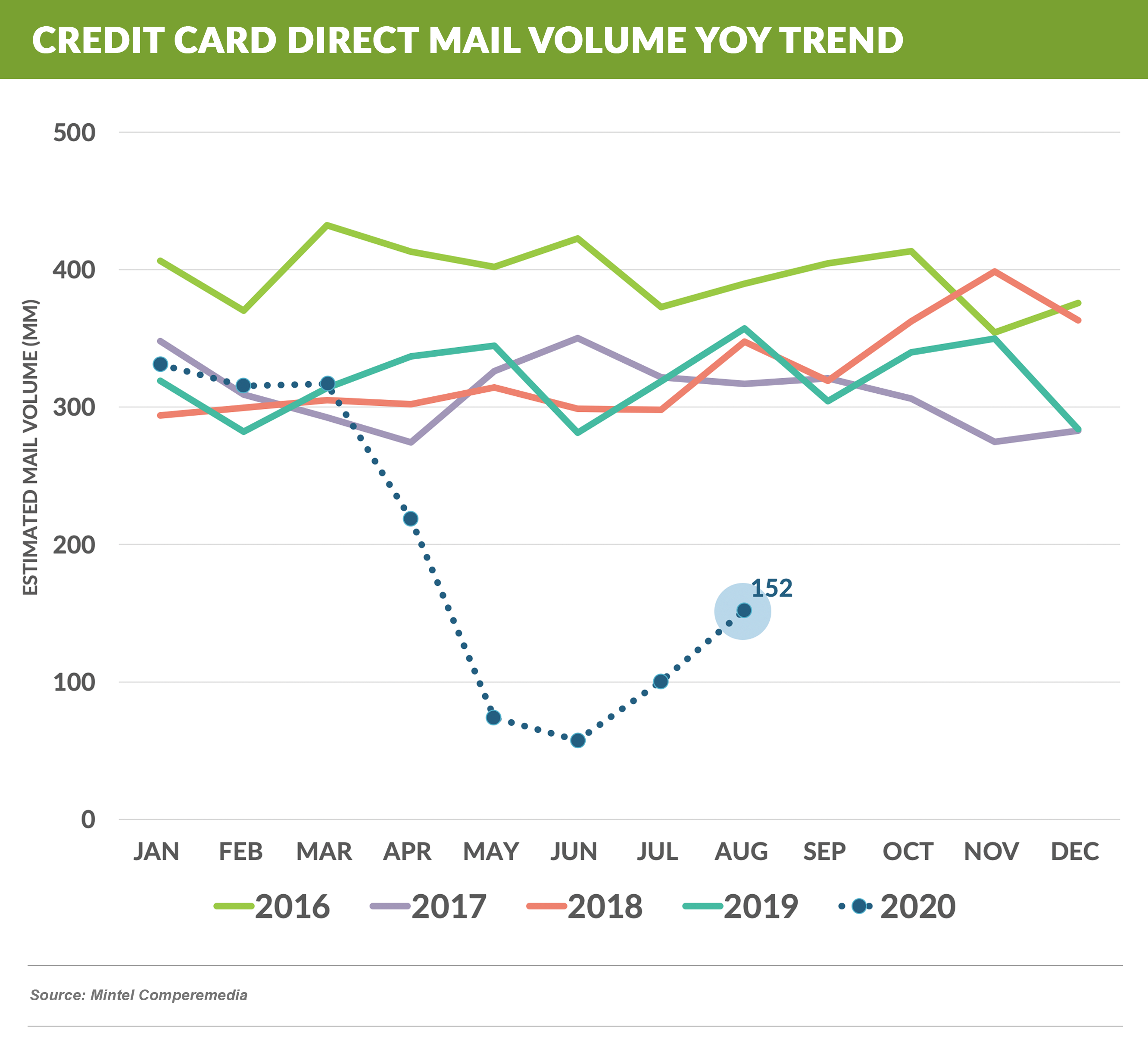

Credit Card Mail Volume Recovering

- Activity in the credit card segment has rebounded, with August mail volume continuing the climb from the June bottom, rising to 152 million pieces

- While still half of pre-COVID levels, volume is up 50% from July and 167% from June

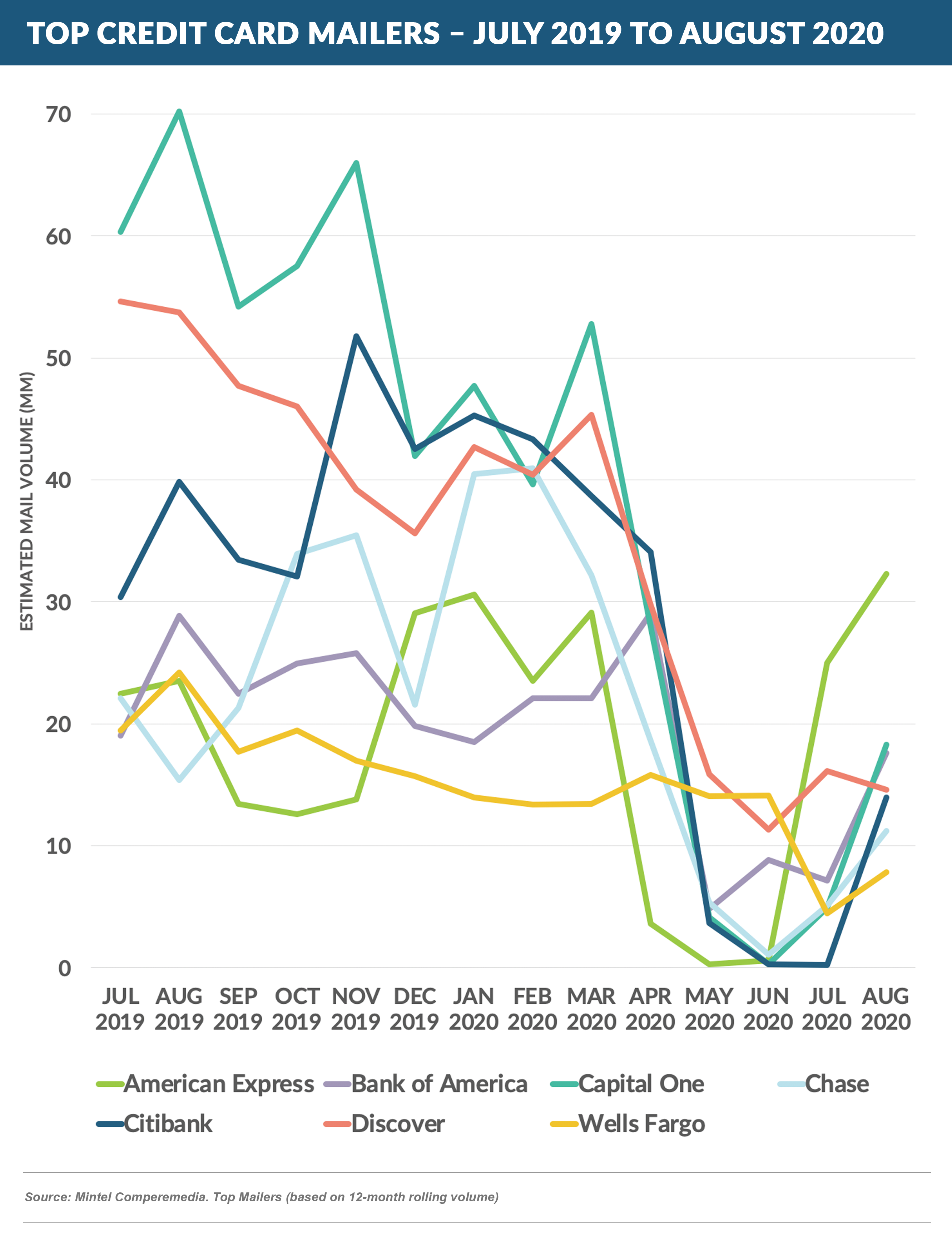

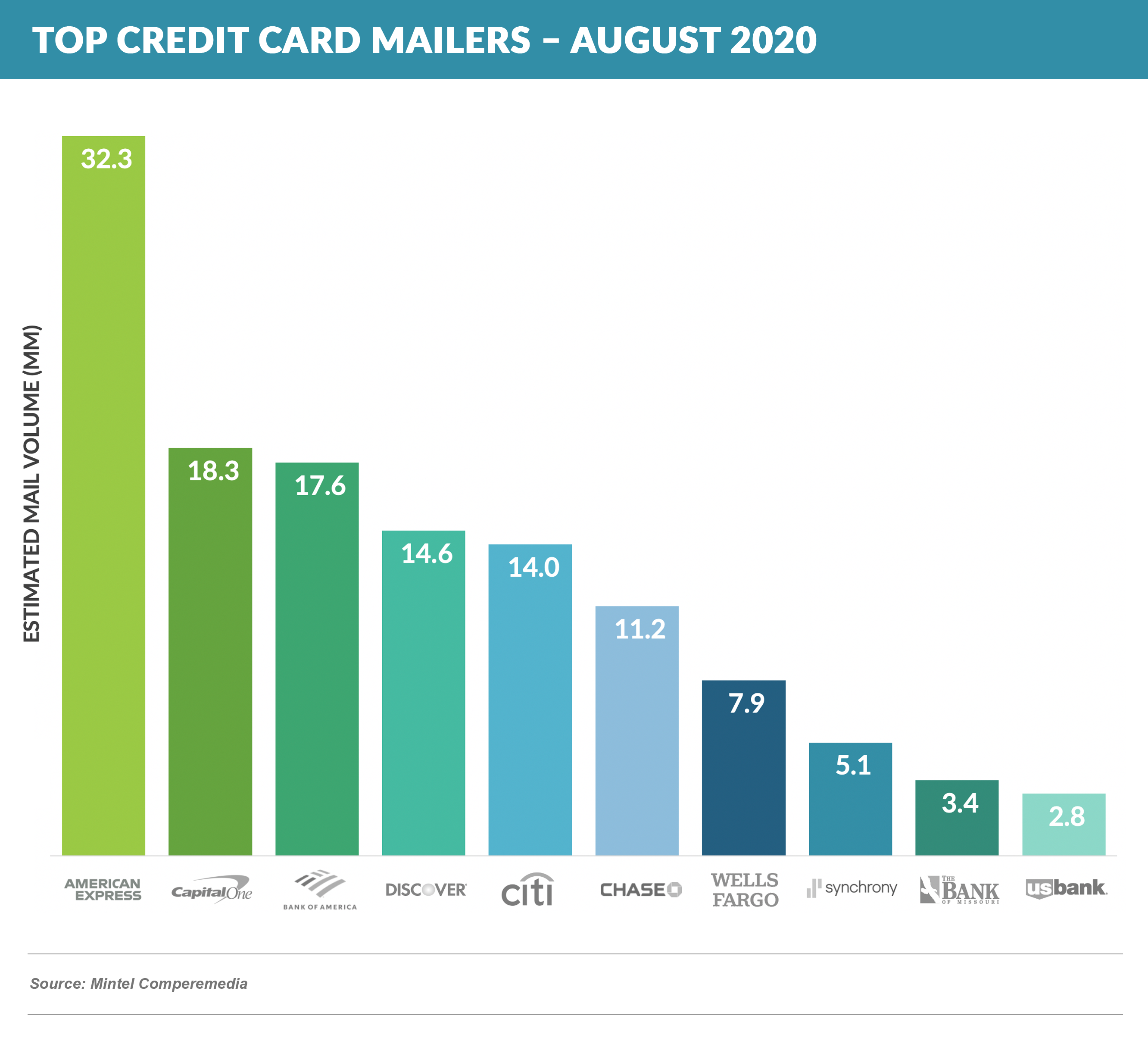

- American Express was the top mailer for the second straight month (no, not a blip), up 29% from July, and 19% higher than the pre-pandemic average of January and February

- Other top mailers – Bank of America, Capital One, Chase, Discover, and Citi – were up 90% - 370% from the prior month

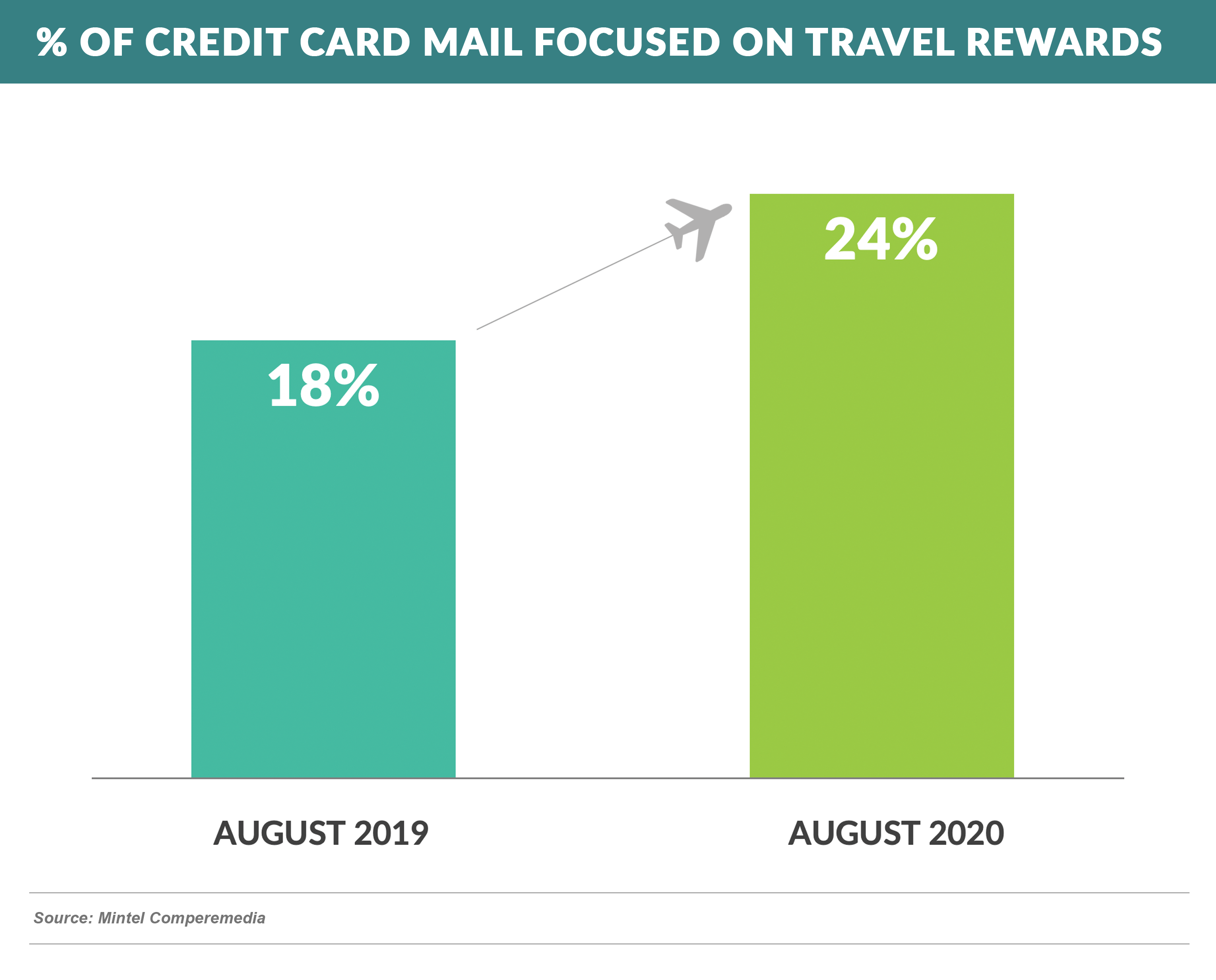

- Interestingly, travel card mail volume as a percentage of overall volume was actually up a third over August 2019

- Bank of America, American Express, and Chase were among those offering travel-related cards

- Informal conversations with executives for some of the top 20 mailers indicate plans for increased activity in the fourth quarter and into 2021

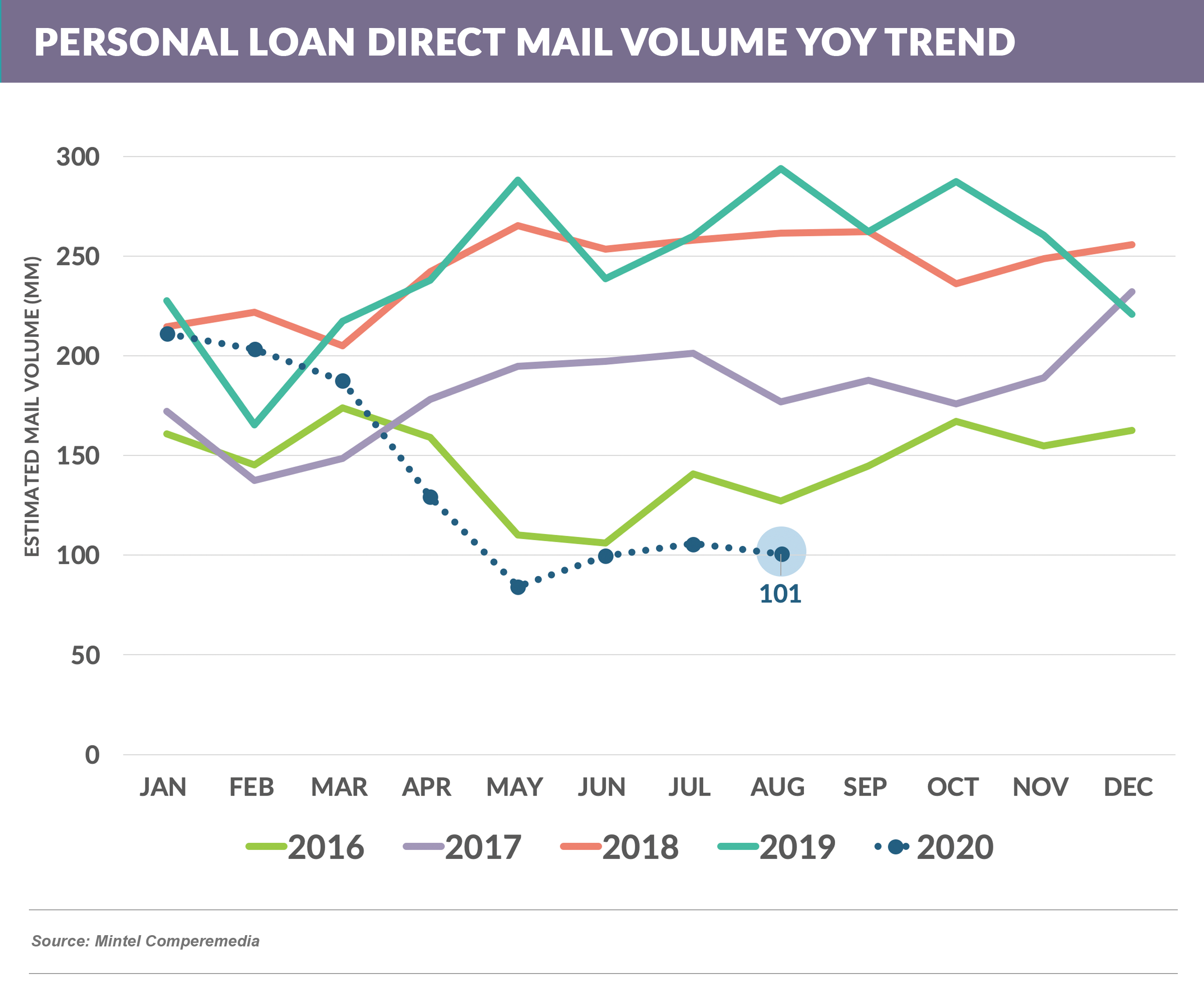

Personal Loan Mail Volume Steady

- While personal loan mail volume did not drop as much as credit card volume, it has remained at a level of roughly half of pre-COVID January/February volumes

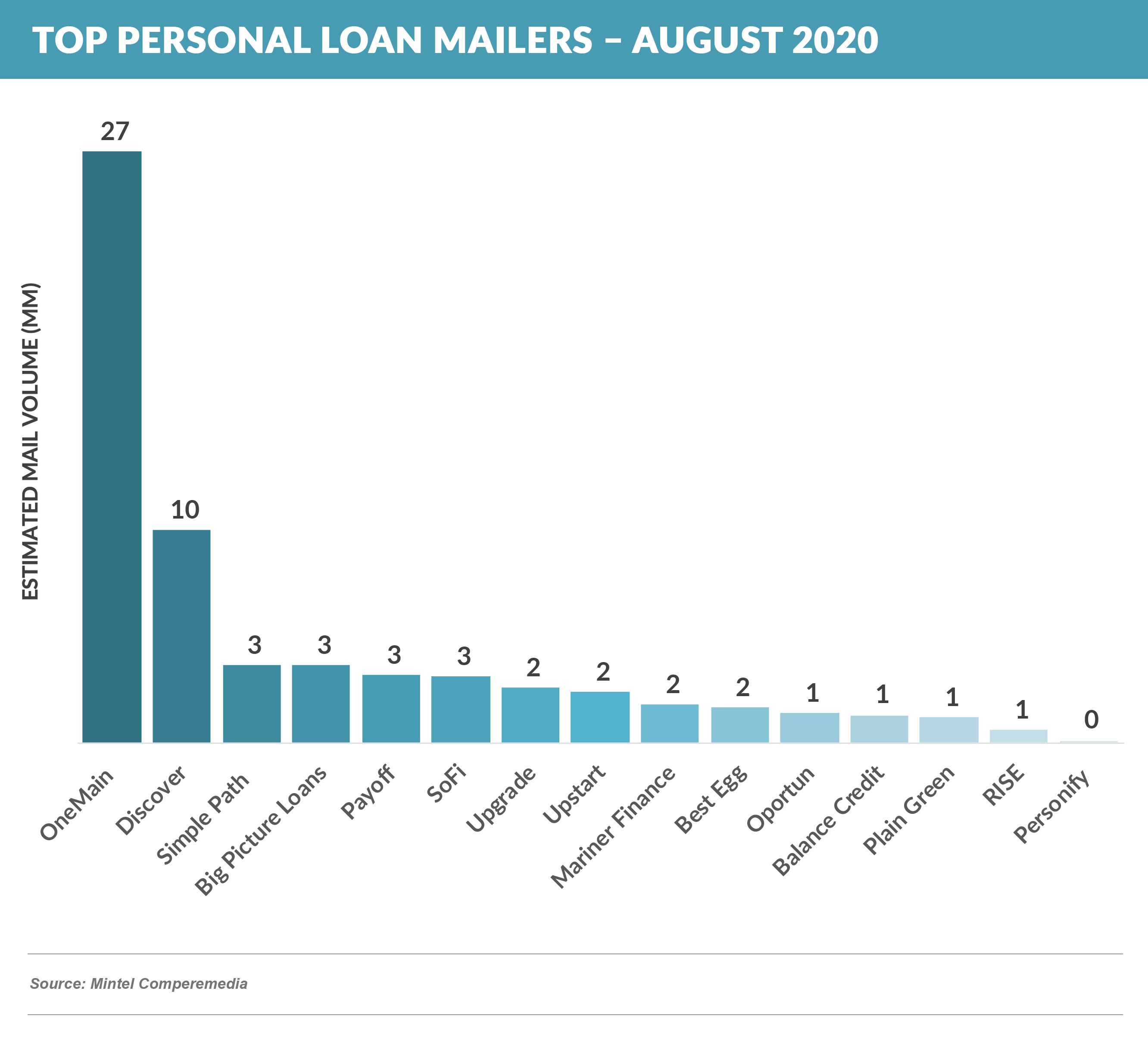

- OneMain has not slowed down since February and remains the top mailer at a level of more than double the second largest’s volume

- Former top mailers Goldman Sachs, BBVA, and Citizens Bank are no longer on the list, and Best Egg has returned at a low volume

- Personal loan volume never dropped as far as card volume, but for now, lenders in this segment appear less eager to ramp up to prior levels

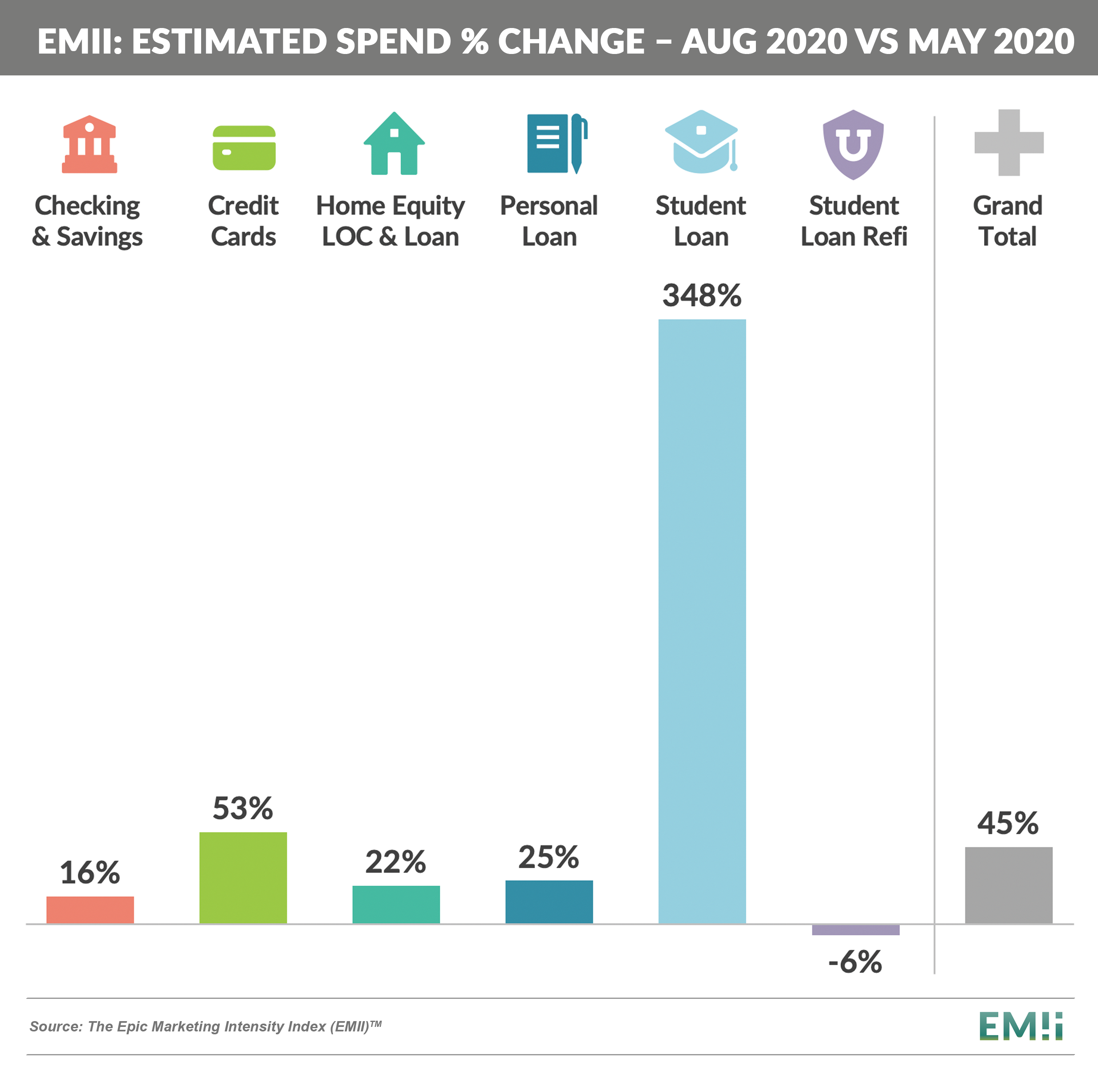

Acquisition Spending Trends Rebound Across All Products and Channels

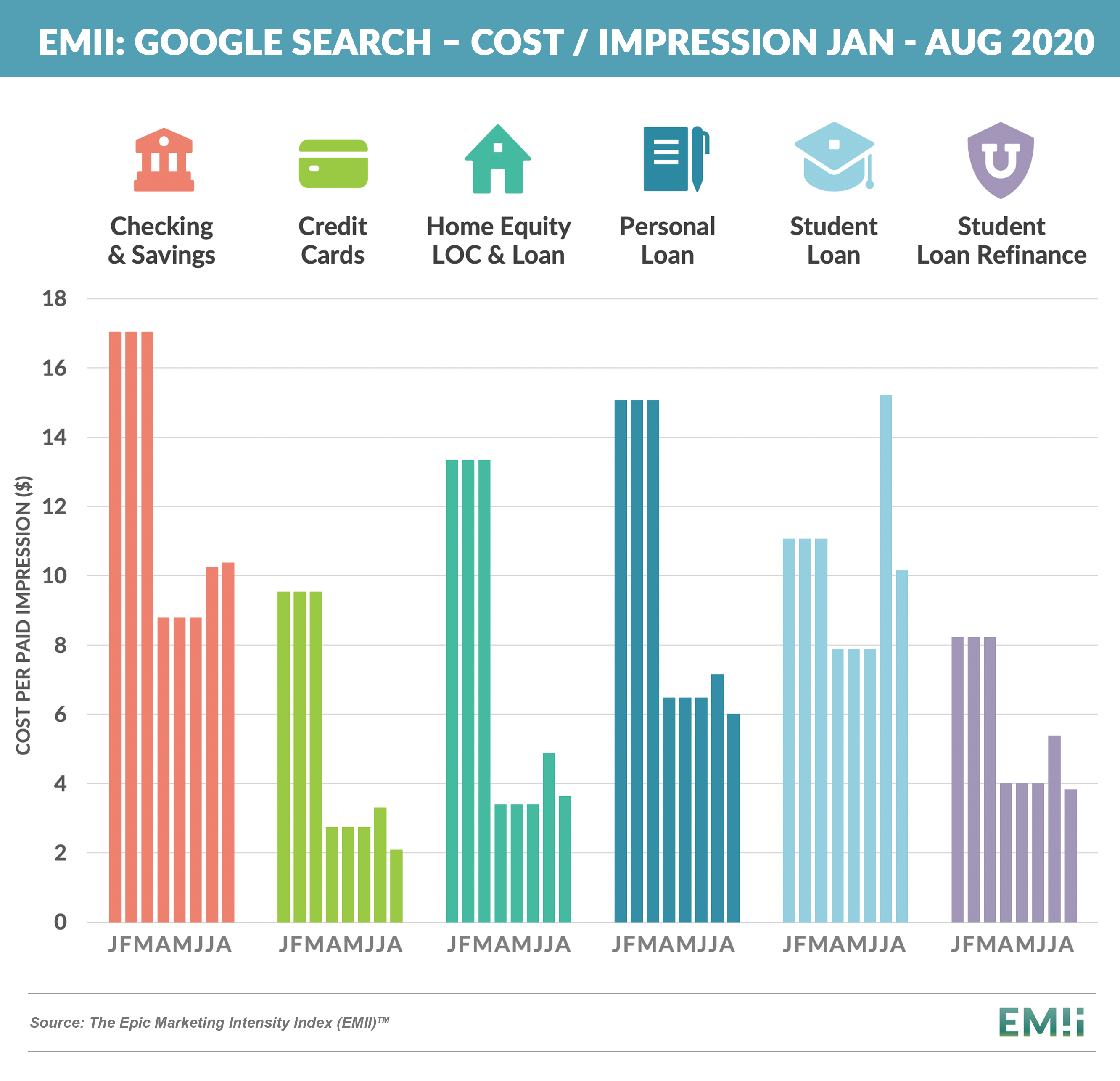

- The Epic Marketing Intensity Index (EMII) measures acquisition spending across products (cards, loans, deposits, home equity, education) and channels (direct mail, search, paid digital)

- Total spending in August was up 45% from the May bottom and reached 50% of January/February pre-pandemic levels

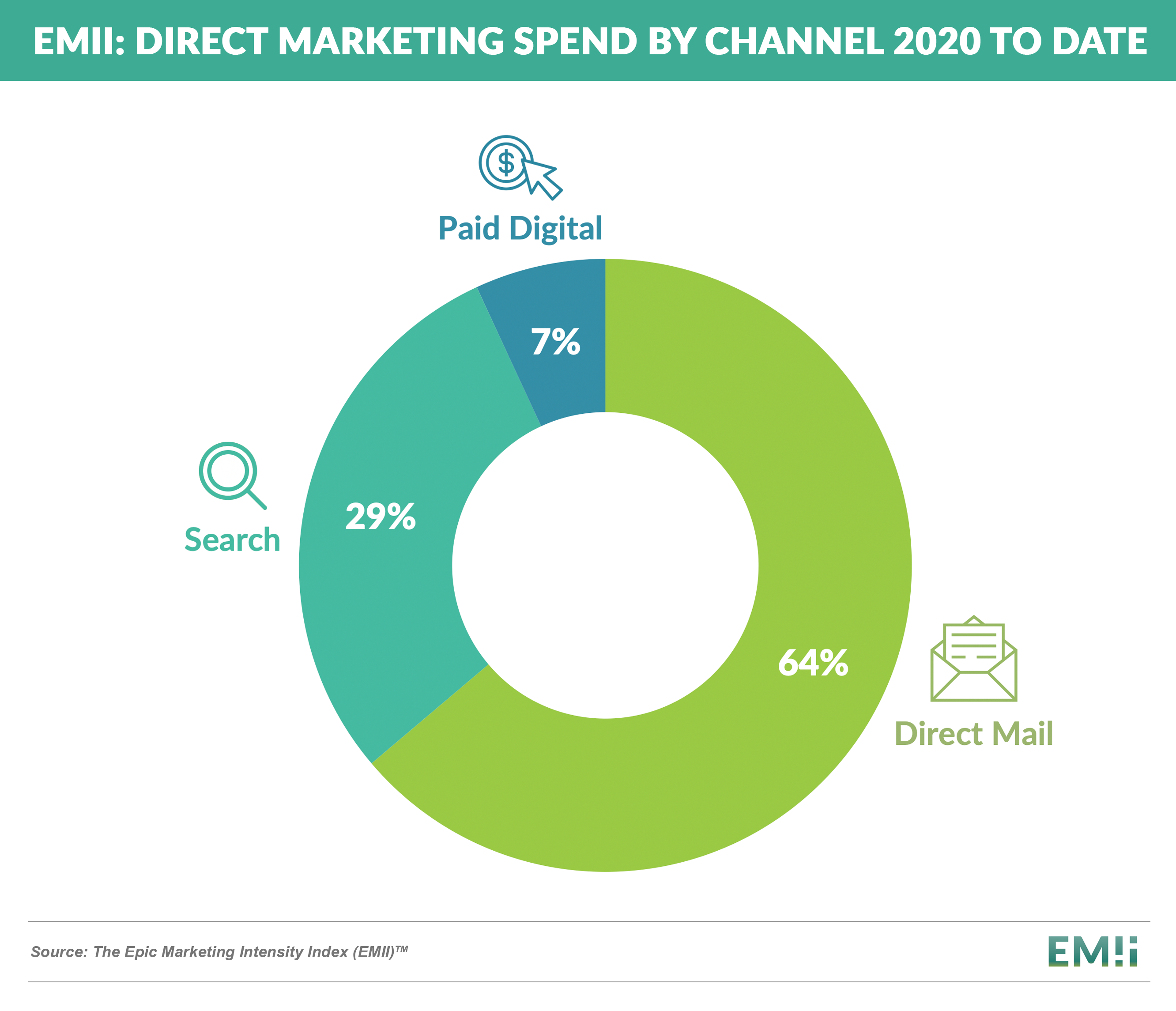

- Direct mail remains the channel for close to two-thirds of all acquisition spending

- Cost per click rates have dropped across most products, with student lending falling less than others due to its unique nature

Quick Takes

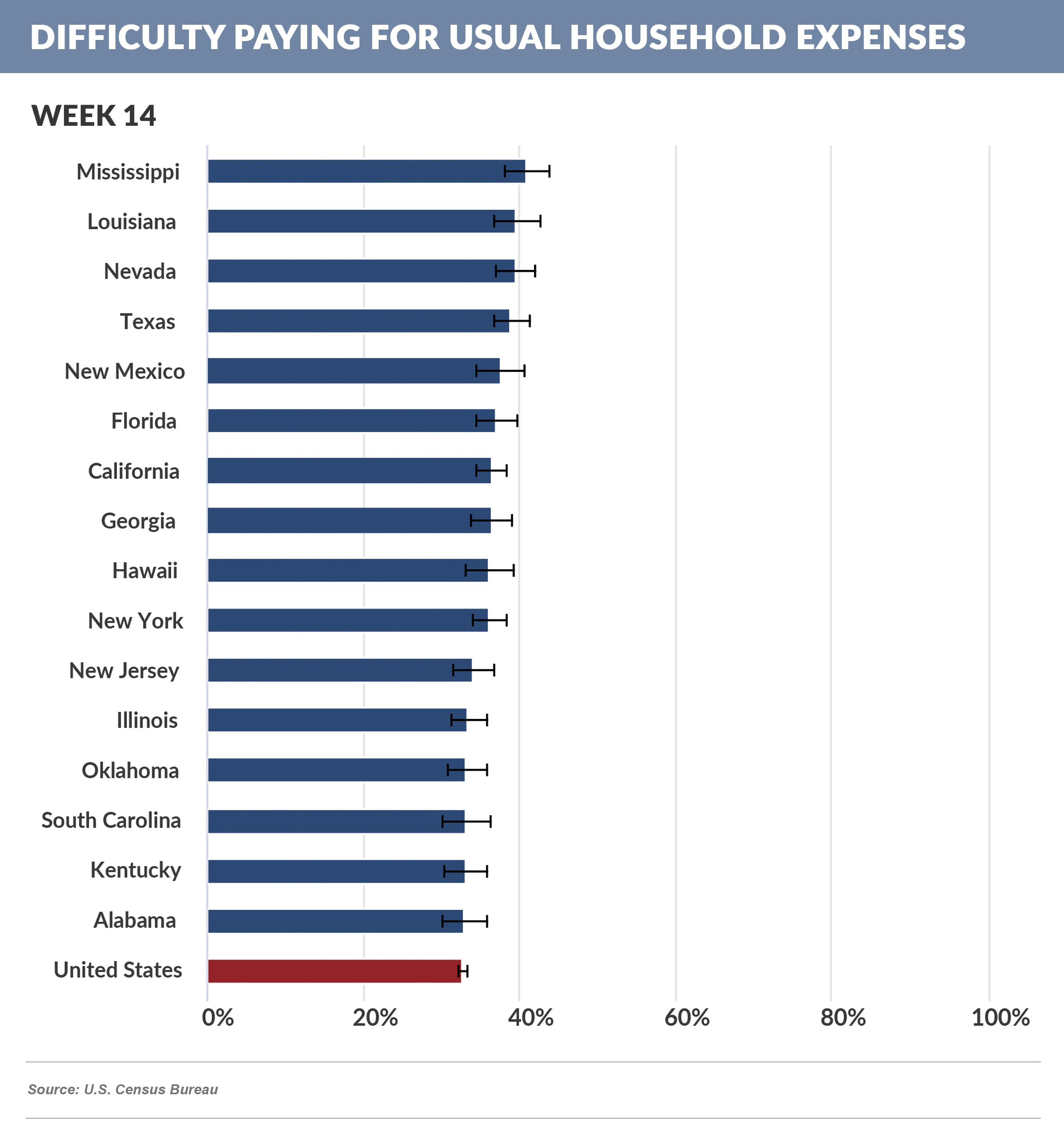

- The US Census Bureau lists states and metro areas by the percentage of adults in households experiencing “Difficulty Paying for Usual Household Expenses” during the pandemic, which may be of interest to risk managers

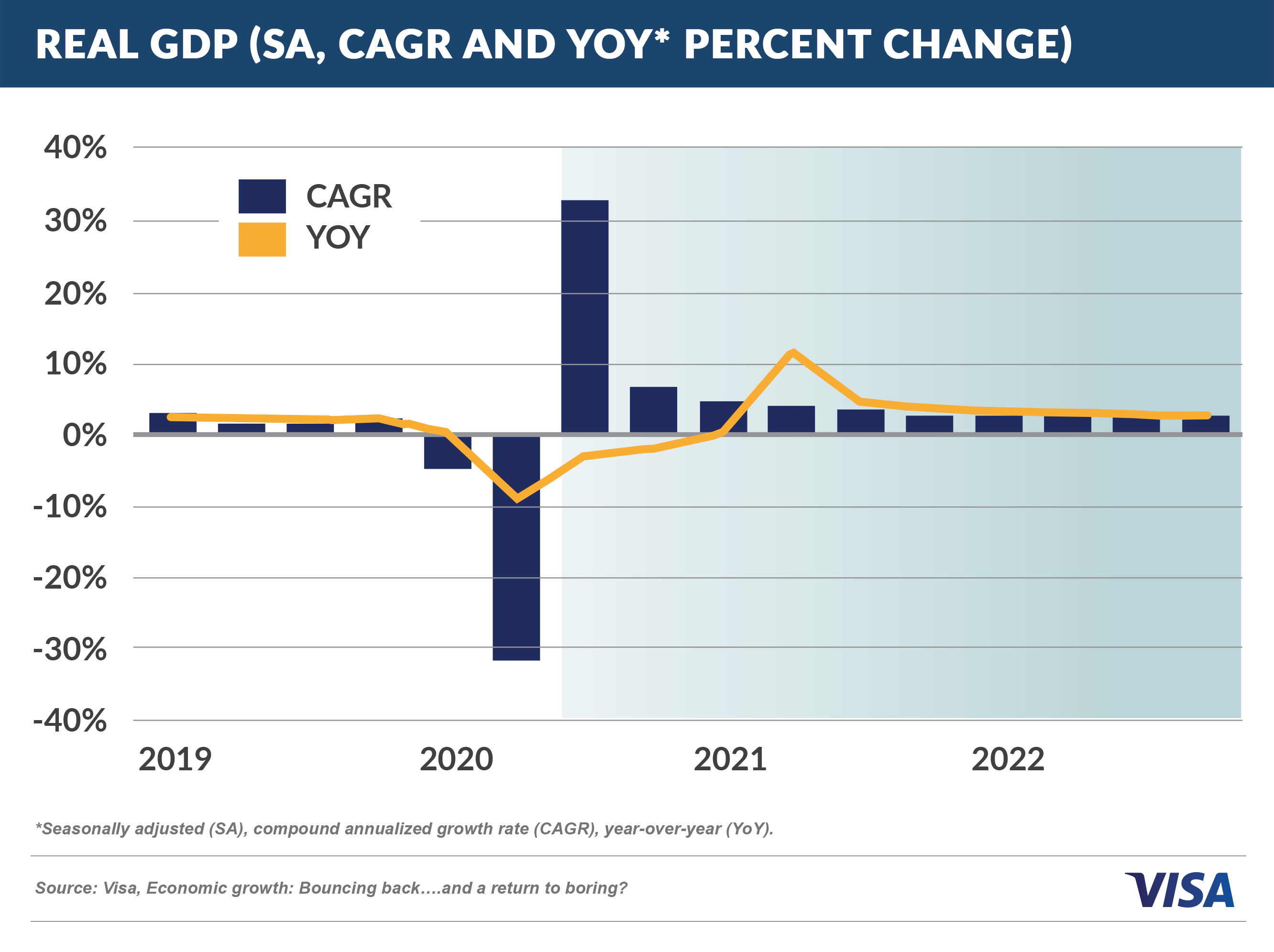

- Like most economic forecasts, Visa’s predicts a large increase in Q3 GDP, and it describes subsequent quarters as a “return to boring”, which sounds pretty exciting right about now

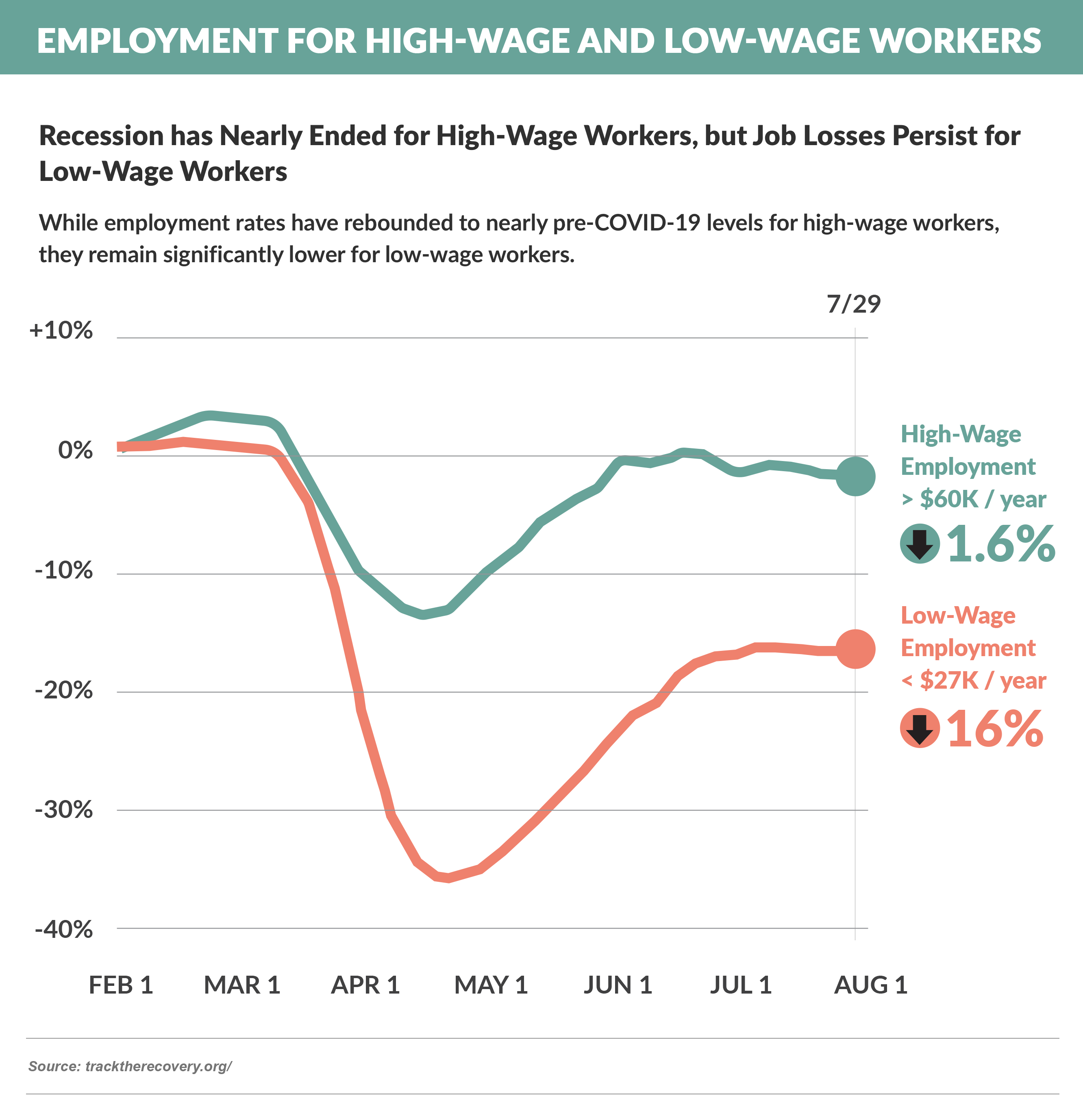

- Unemployment and consumer bankruptcy rates have historically tracked very closely, however the current record-low delinquency rates in cards and other consumer loan assets might be partially explained by the disparity in unemployment by income

Thank you for reading.

The next Epic Report will publish in two weeks on October 10th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.