Three Things We’re Hearing

- Activity in the HELOC market

- Card mail volume continues to climb

- Ed refi poised for growth

A three-minute read

After reading, please take our anonymous 30-second survey to help us keep the Epic Report topics relevant

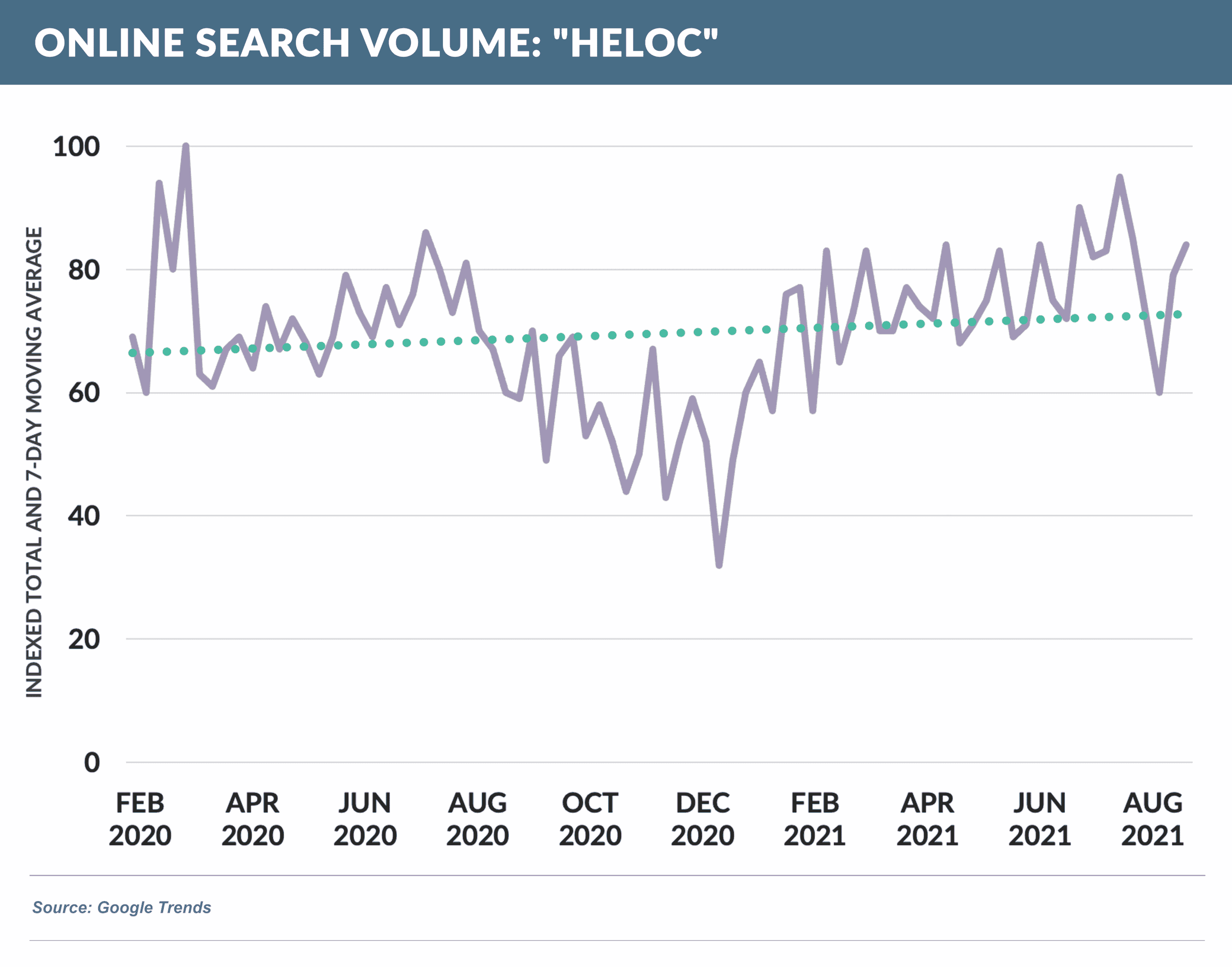

Activity in the HELOC Market

- As noted in a previous Epic Report, home equity lines of credit (HELOCs) fell out of favor following the 2008-2009 housing crisis as both consumers and lenders were scarred by the negative effects, resulting in current HELOC balances stalling around half of the pre-recession level

- We have seen an increase in recent market activity from both consumers and lenders, fueled by increased home values and banks’ desires for organic growth

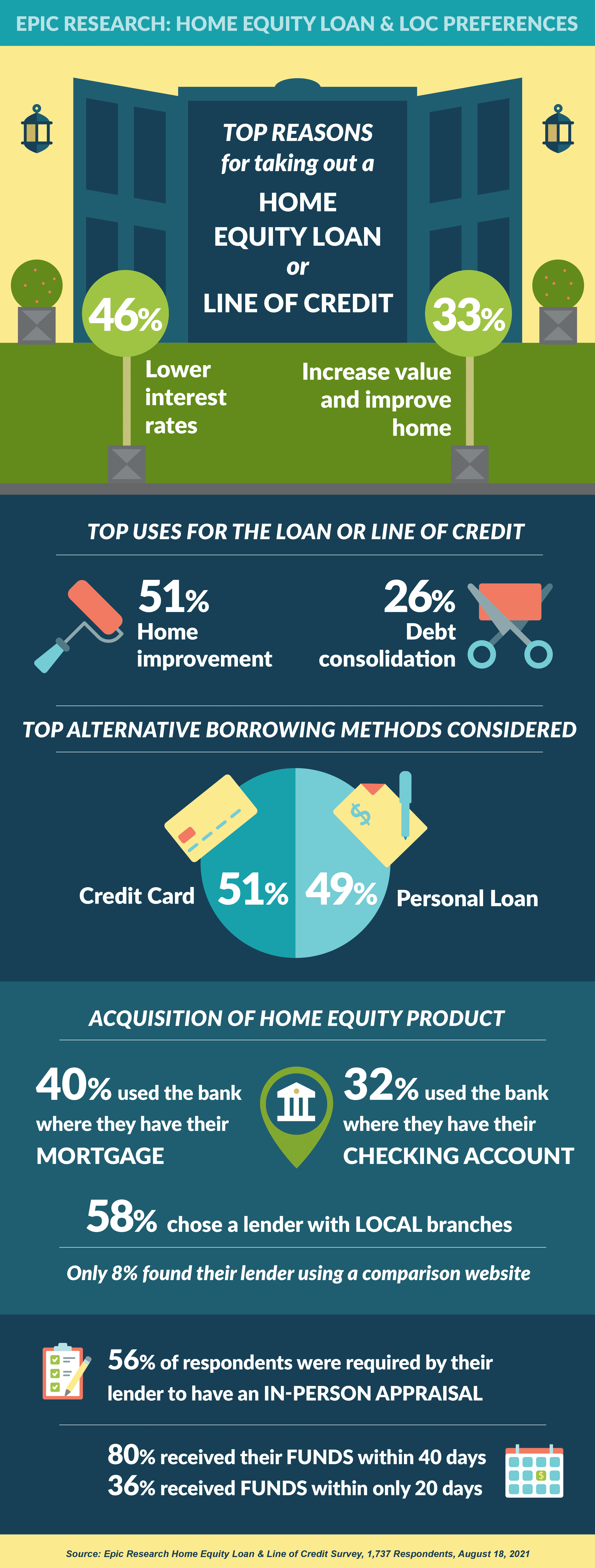

- We recently surveyed consumers who acquired a new HELOC about their preferences and experiences

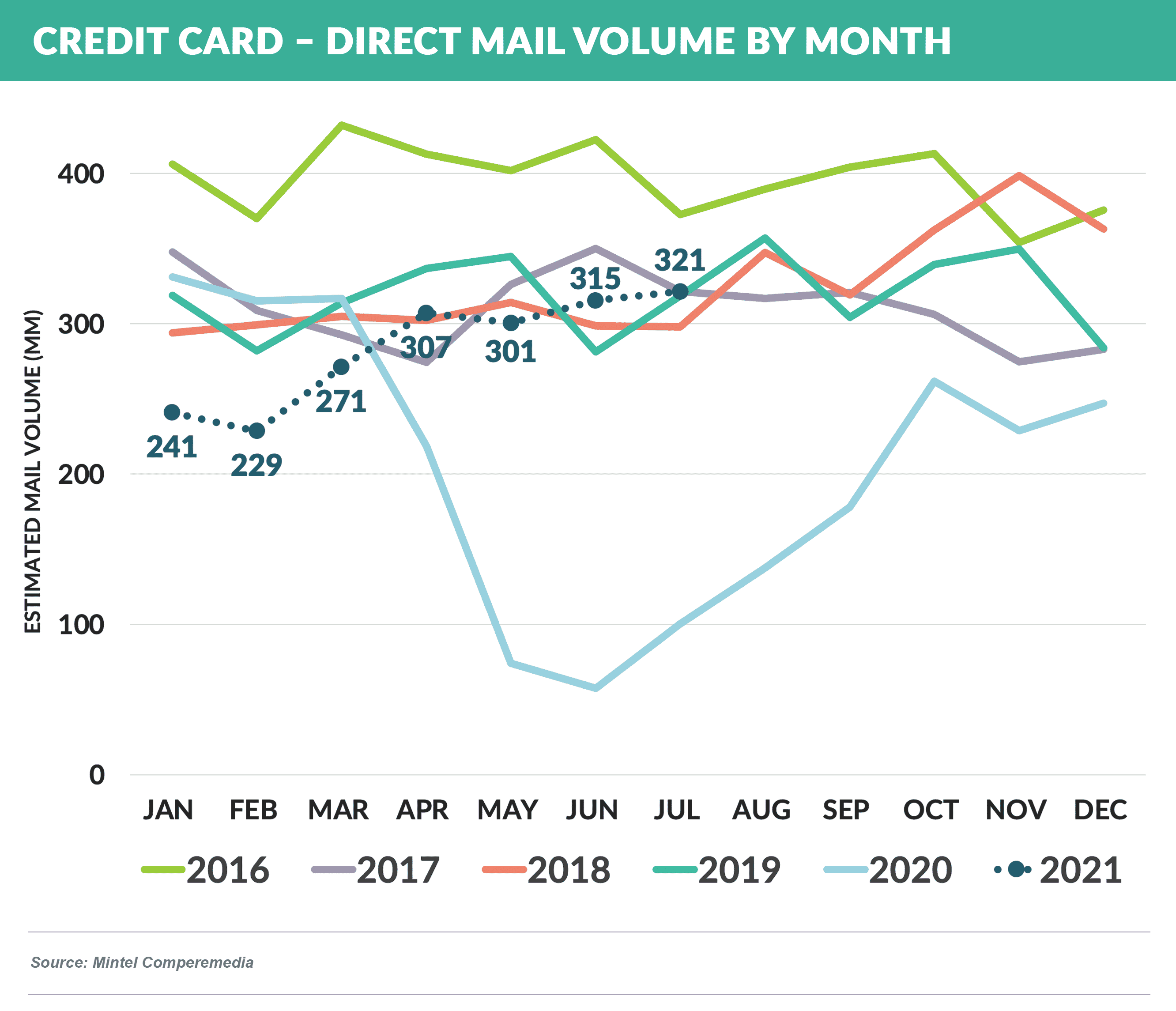

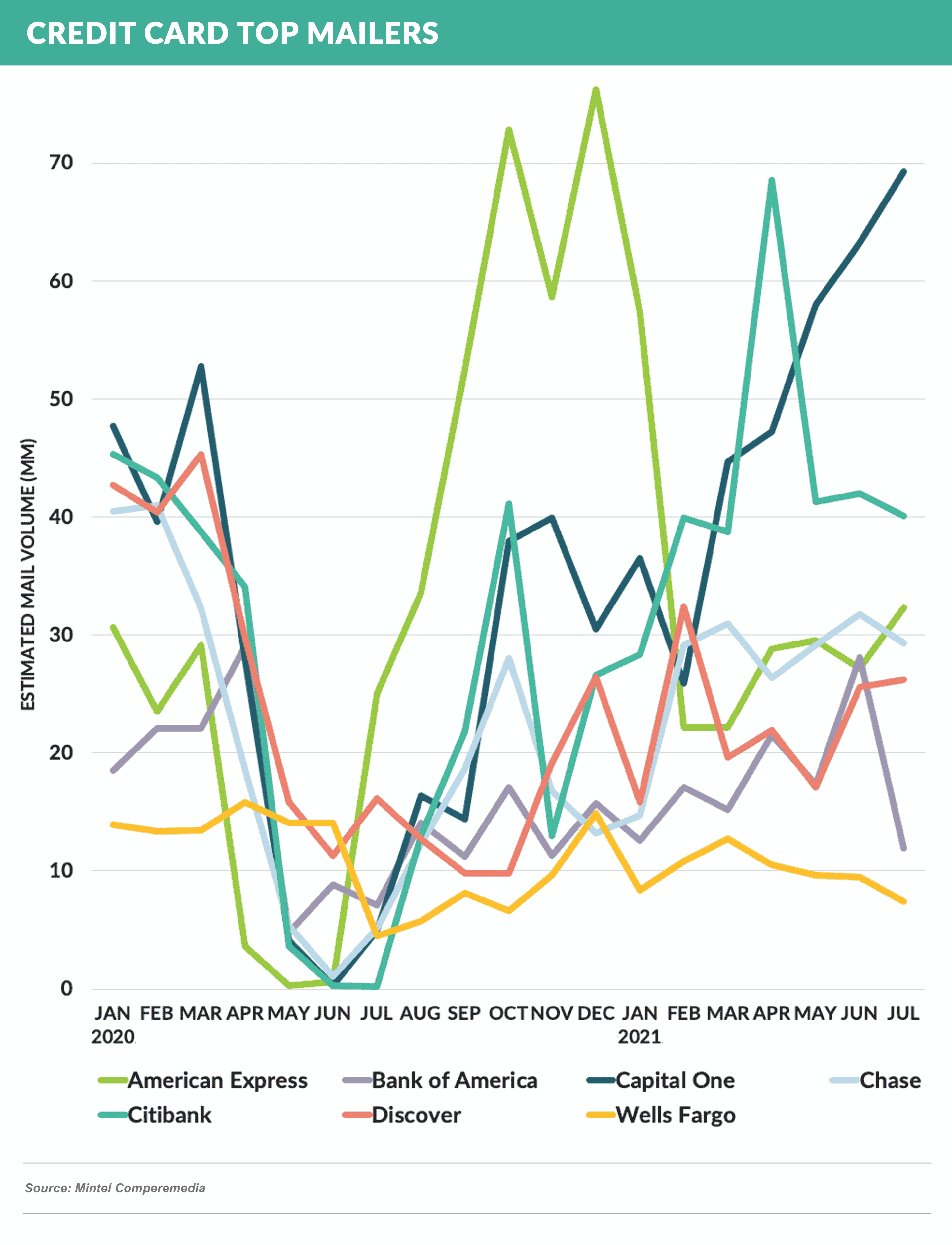

Card Mail Volume Continues to Rise

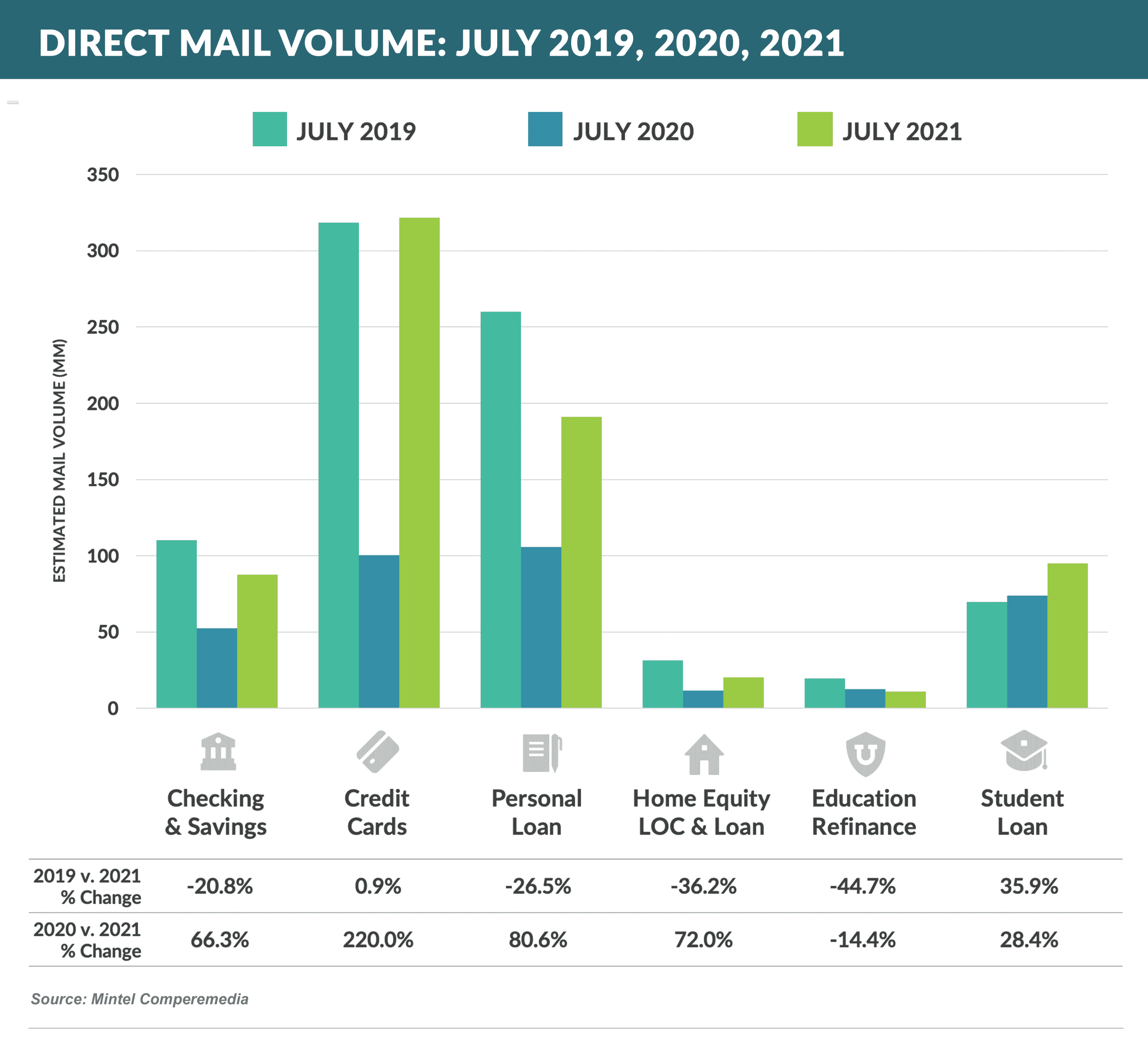

- Overall credit card mail volume has fully recovered and is now at 2019 levels

- Capital One has taken a firm lead as the top card mailer in the past six months, with 12-month rolling volume 75% higher than number two Citi

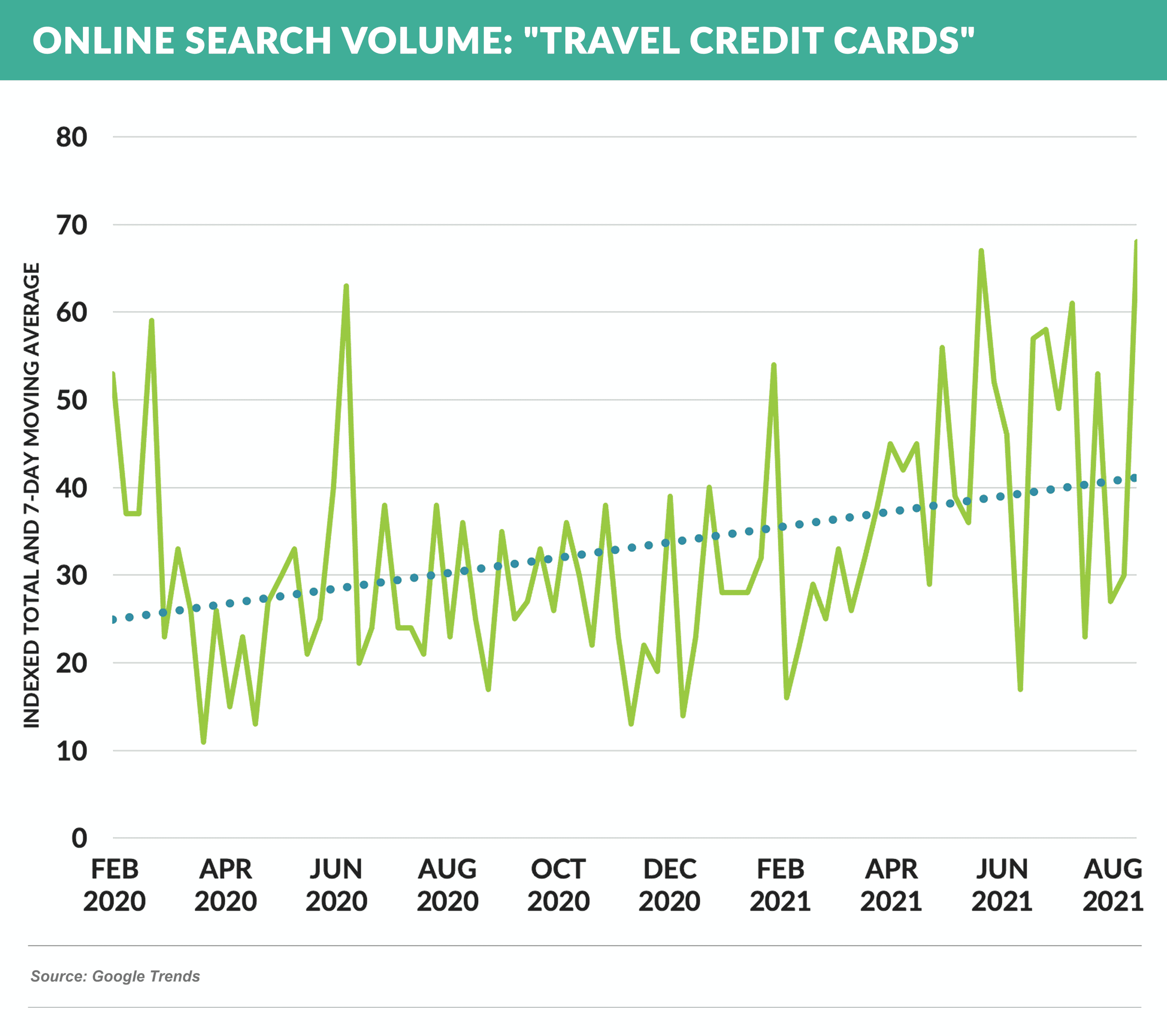

- Online search traffic for “travel credit cards” fell dramatically in April 2020, however consumer interest has steadily tracked upward since spring 2021

- While mail volume for credit cards bounced back and volume for education lending never really dropped, mail volumes for personal loans, deposit products, and HELOCs are still well below pre-pandemic levels

Ed Refi Poised for Growth

- With student loan payment deferrals resulting from the CARES Act and federal loan payment holiday, consumers are enjoying extra money in their pockets and are perhaps a bit less likely to refinance student loans

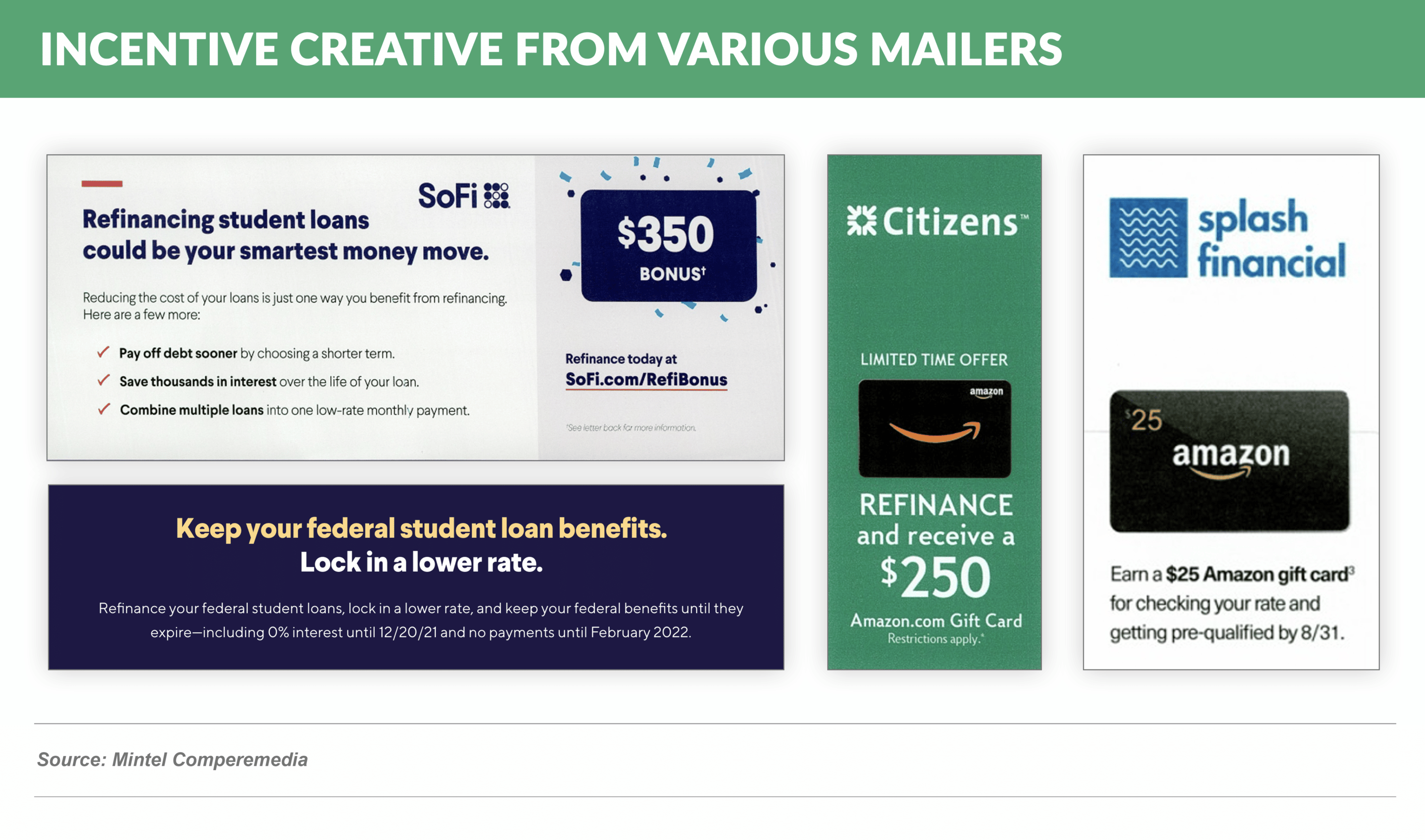

- Lenders are responding to this inertia with an avalanche of new perks and promises to try to grab market share before CARES expires in January

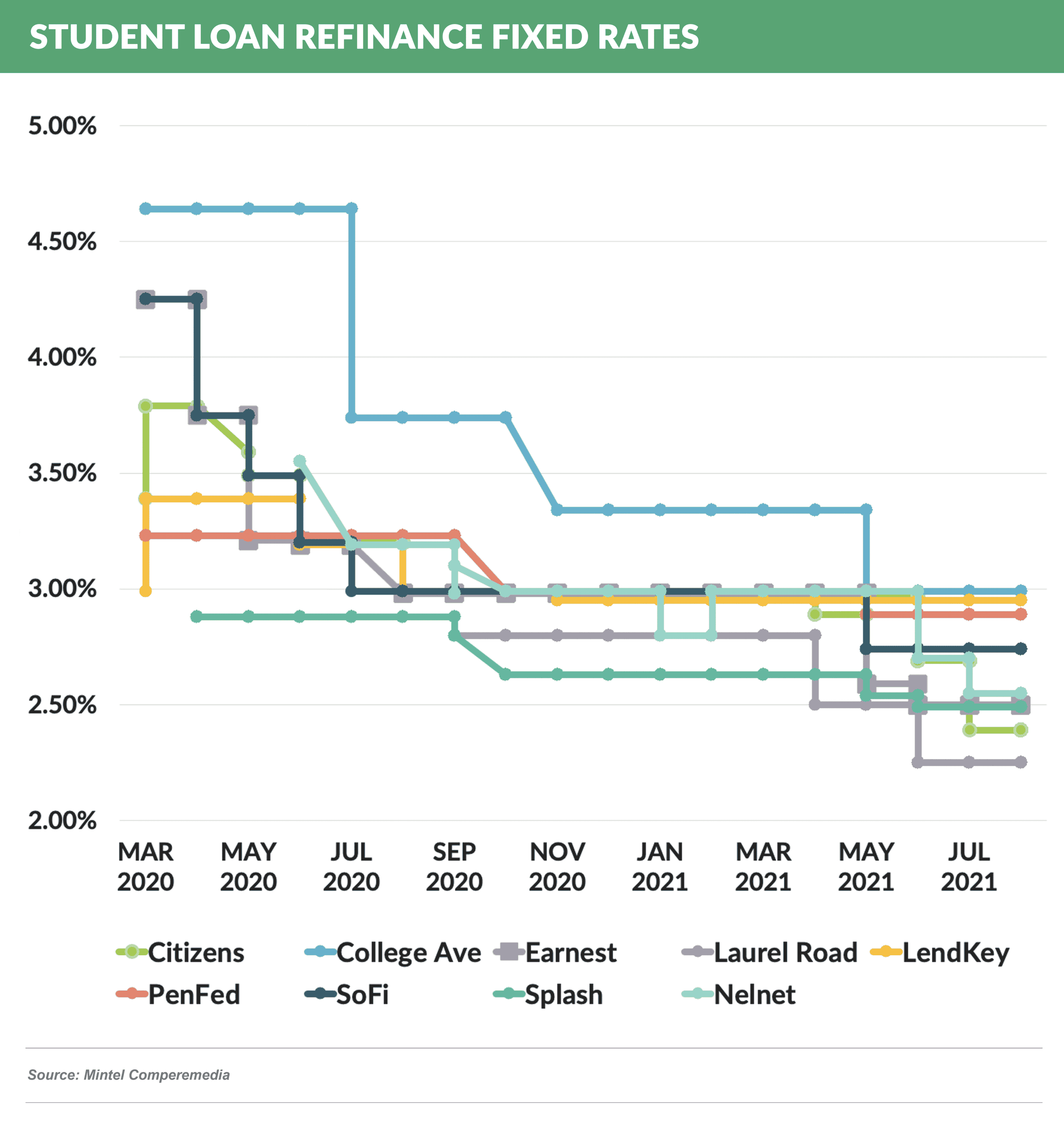

- One result has been a steady decrease in the “lowest advertised rates” by many issuers

- Additionally, issuers are offering:

- payment holidays of their own, such as SoFi’s “no payments until February”, and

- cash-like incentives, such as Citizens’ $500 Amazon gift card, SoFi’s $350 cash offer, and Splash’s $25 Amazon gift card offer just for checking your rate

- With the rate wars at an all-time high, SoFi is offering a rate match coupled with a $100 incentive

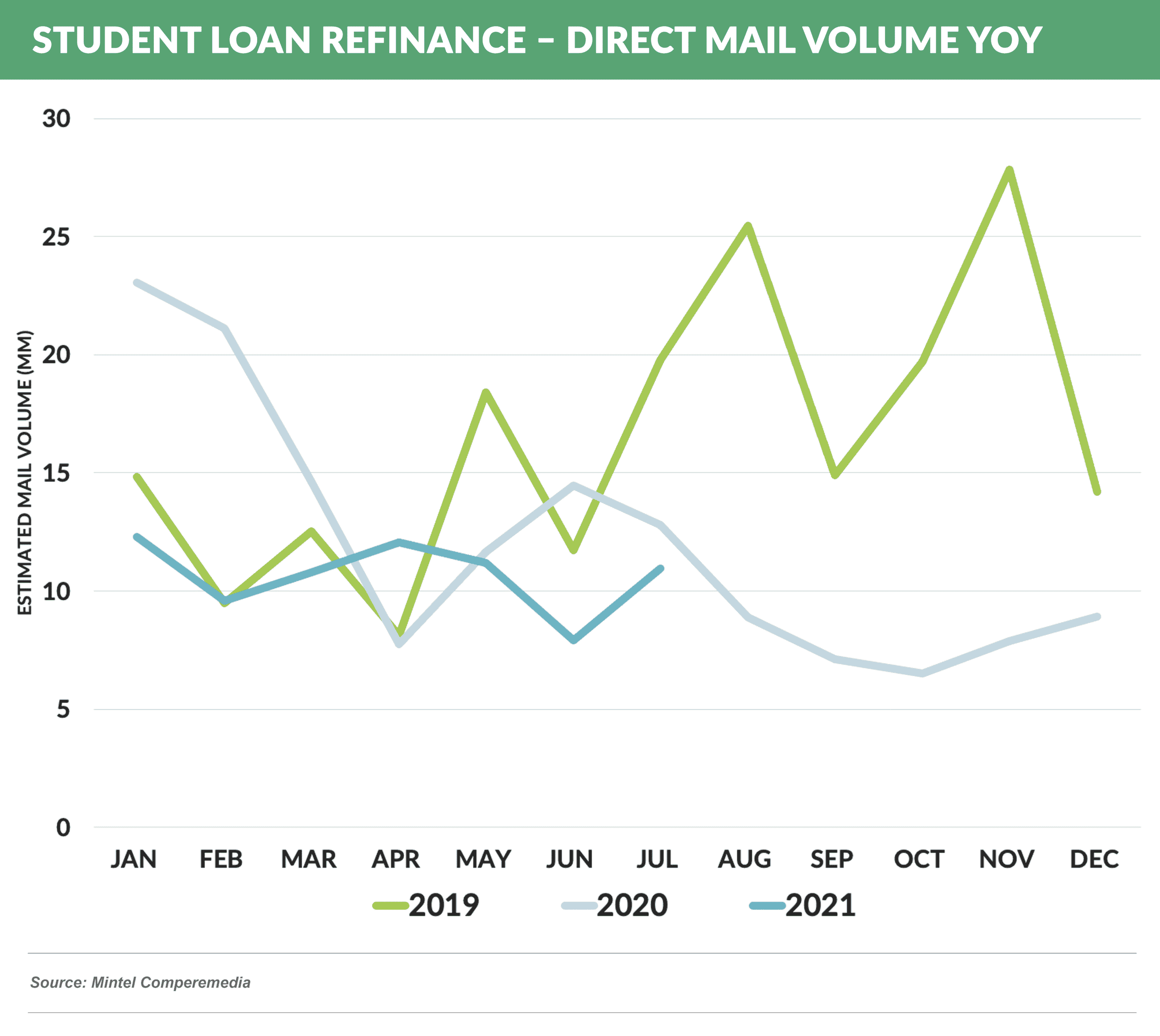

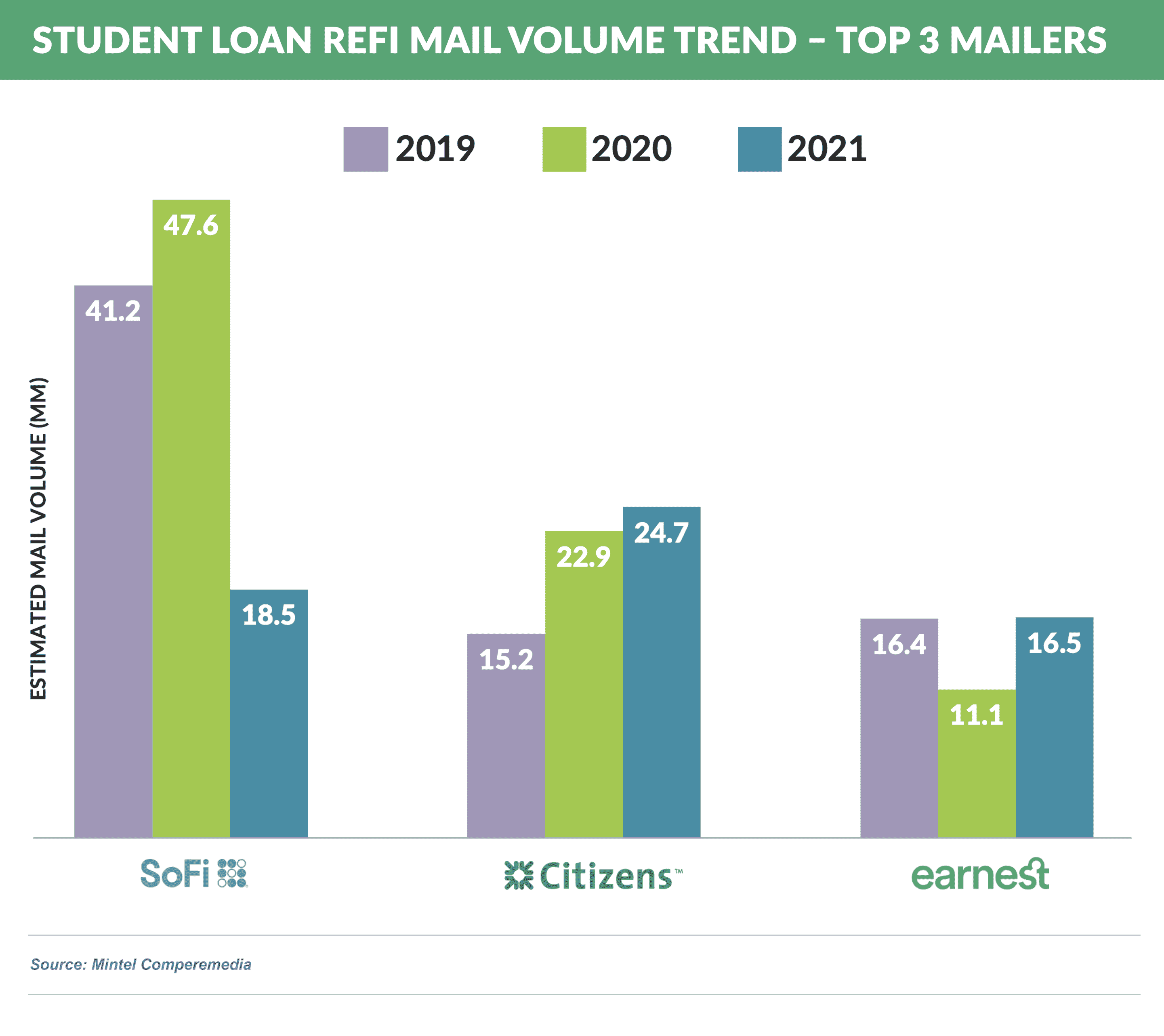

- Despite the CARES Act implications, direct mail is still highly competitive with lenders sending 75MM pieces through July 2021, down 30% vs. 2020, driven by reduced volume from SoFi; meanwhile, other large lenders have continued to invest in incremental volume

- While remaining a niche product, education refinance lending is less competitive than most and, over the past several years, has shown a continuing high level of asset quality

Quick Takes

- Big BNPL news as Affirm and Amazon announced a new partnership

- Affirm’s stock shot up on the news, however the Amazon payment space is going to be busy with its Chase co-brand card, Synchrony private label card, gift cards, direct debit, pay-with-points, post-payment installment options from Citi and others, and other cards

- While benefitting from the “network effect”, with millions of additional users added to their platform, Amazon is a notoriously aggressive negotiator and Affirm’s margins will likely be thinner than is typical

- Some analysts predict that BNPL will ultimately settle at around 3% market share in the US

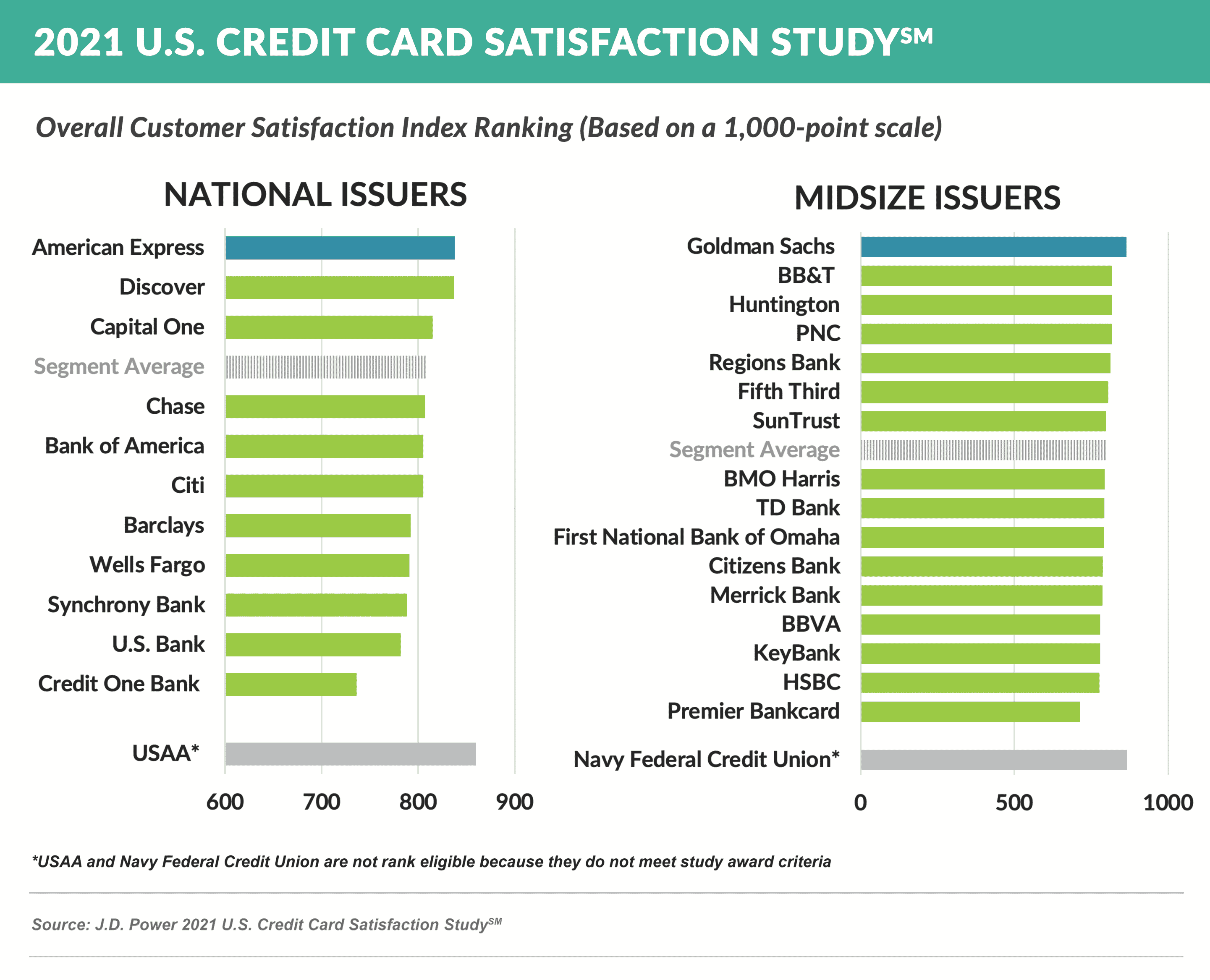

- American Express and Goldman Sachs led the 2021 J.D. Power U.S. Credit Card Satisfaction StudySM – Discover was just behind Amex among large issuers, but Goldman ran away with the Midsize Issuer category

- Barclays announced its purchase of the $3.8 billion Gap card portfolio from Synchrony, significantly increasing the size of its $20-something billion portfolio and strengthening its already strong position in the co-brand market

- As consumers have paid down debt over the past 16 months, their credit scores have improved accordingly – FICO reported that the average FICO score has reached 716, up 8 points in just a year, with those in the subprime 550-599 range up 20 points

Please take 30 seconds to complete our anonymous three question survey to help keep the Epic Report topics relevant to you.

The Epic Report is published monthly, and we’ll distribute the next issue on October 2nd.

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers. Click here to find out how we can help you.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here. To subscribe to our newsletter, click here.