Three Things We’re Hearing

- Point of Sale (POS) lending is growing

- Education lending bucks the downward trend

- No movement yet on card or loan delinquencies

A four-minute read

POS Lending is Growing

- Competition in the POS lending sector has accelerated over the past few years

- Along with new players, such as Uplift, Affirm, and Marcus (Apple and JetBlue), more established lenders, including PayPal and Citizens (Apple), have been active in the space

- Epic conducted a survey of consumer attitudes towards POS lending

- When asked for which purchase types they would be “more likely to use a POS loan,” those surveyed chose “Electronics” and “General Merchandise” (21% for each), followed by “Home Repair” (19%) and “Auto Repair” (12%)

- Possibly foreshadowing continued growth in POS lending, survey respondents over age 60 chose “General Purpose Card” for paying over time at a 40% greater rate than those under 60, with the under 60 group preferring “POS loans” 44% more than those over age 60

Education Lending Bucks the Downward Trend

- Unlike other products, education lending volume – both in-school private loans and education refinance loans – has held up during the pandemic

- Education refinance mail volume has generally remained within the range of prior years (other than the 2H spike in 2019)

- Ed-refi is less competitive than most other consumer finance products, with only six major mailers and SoFi as the dominant mailer over the past several years

- In-school private student loan mail volume had a record year in the 2020 summer season

- Discover was responsible for 77% of the volume in the past 12 months

- Unlike most other lending programs, the majority of private student loan solicitations are primarily “invitations to apply” due to the lack of effective credit bureau targeting data for college students

- While there are student lists available to market, Discover is thought to have an advantage over most other issuers due to the large amount of customer data they have available from their card and other products

No Movement Yet on Card or Loan Delinquencies

- Into September, both credit cards and unsecured loans maintained the lowest delinquency levels in over a decade

- Publicly traded card issuers will likely benefit from being over-reserved

- A survey published in the Economist confirms the impact of stimulus payments on card and other loan payments, with 20% - 30% of funds received going to “debt payments” in all income segments

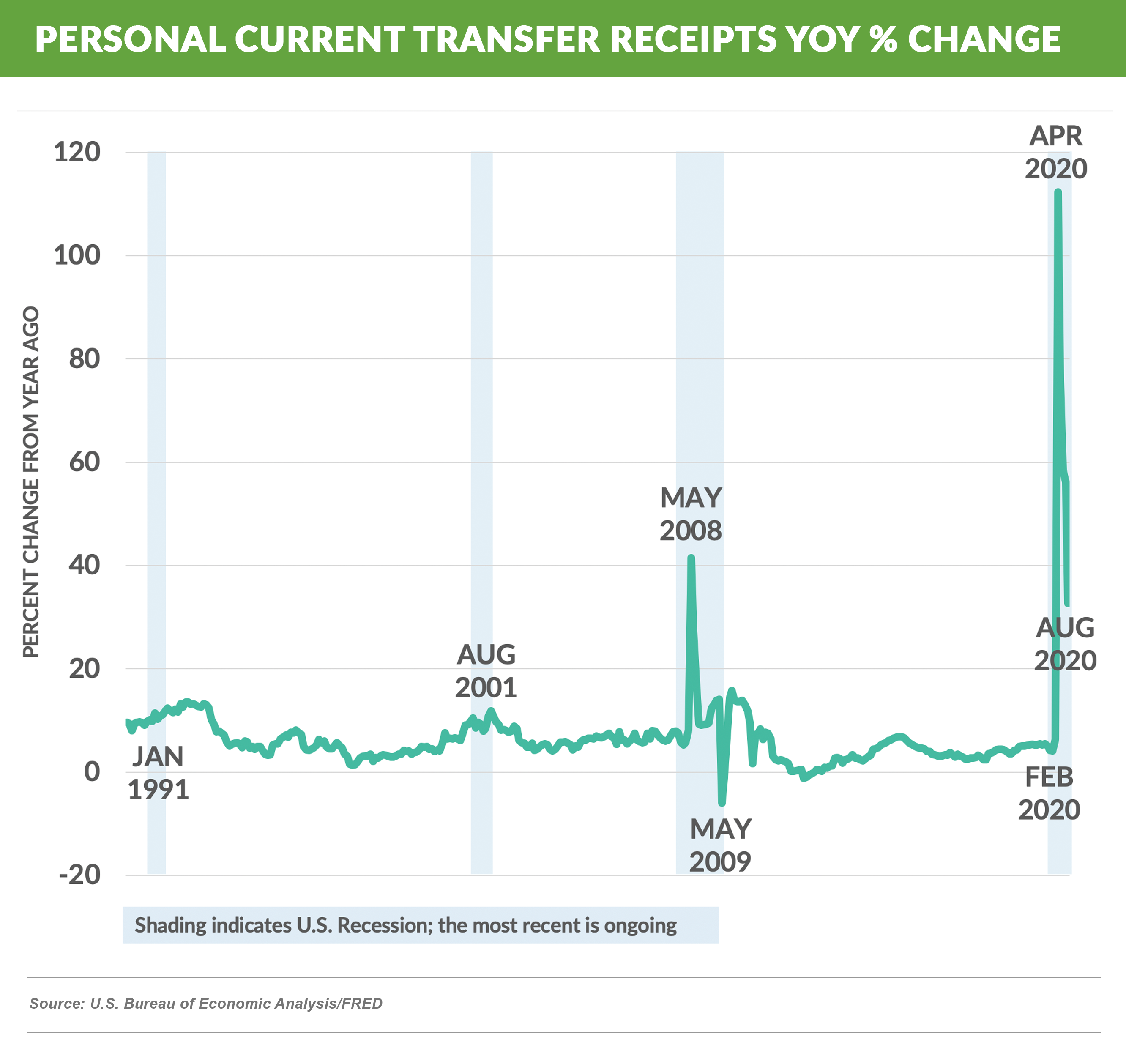

- The unprecedented scale of the effect of stimulus payments is shown in the August data below

- Apparently, if you throw several trillion dollars at a problem, it does have some effect

Quick Takes

- Venmo introduced a credit card in partnership with Synchrony offering varying levels of cash back in different categories

- Among other features, the card will be integrated with the Venmo app, and each card will have its own unique QR code that can be used in the Venmo app by friends to send a payment or split purchases

- The Venmo card is a strong offering for its users given the app integration and cash back features, and should grow rapidly given its ability to market to existing customers digitally for “free”

- Goldman Sachs is buying the $2.5 billion GM card portfolio from Capital One according to the Wall Street Journal

- With its launch in 1992, the GM card was one of the first large co-brand programs

- Given the level of competition in the rewards credit card sector, it will be a challenge to significantly grow the portfolio

- The Journal reports that Barclays was also a bidder

- LendingClub has announced that it is getting out of the peer-to-peer lending business

- LendingClub was one of the pioneers in letting individual investors fund loans for borrowers since launching in 2006

- However, this type of funding has fallen to only 5% - 15% of total loans over the past several years

- Temperature Check

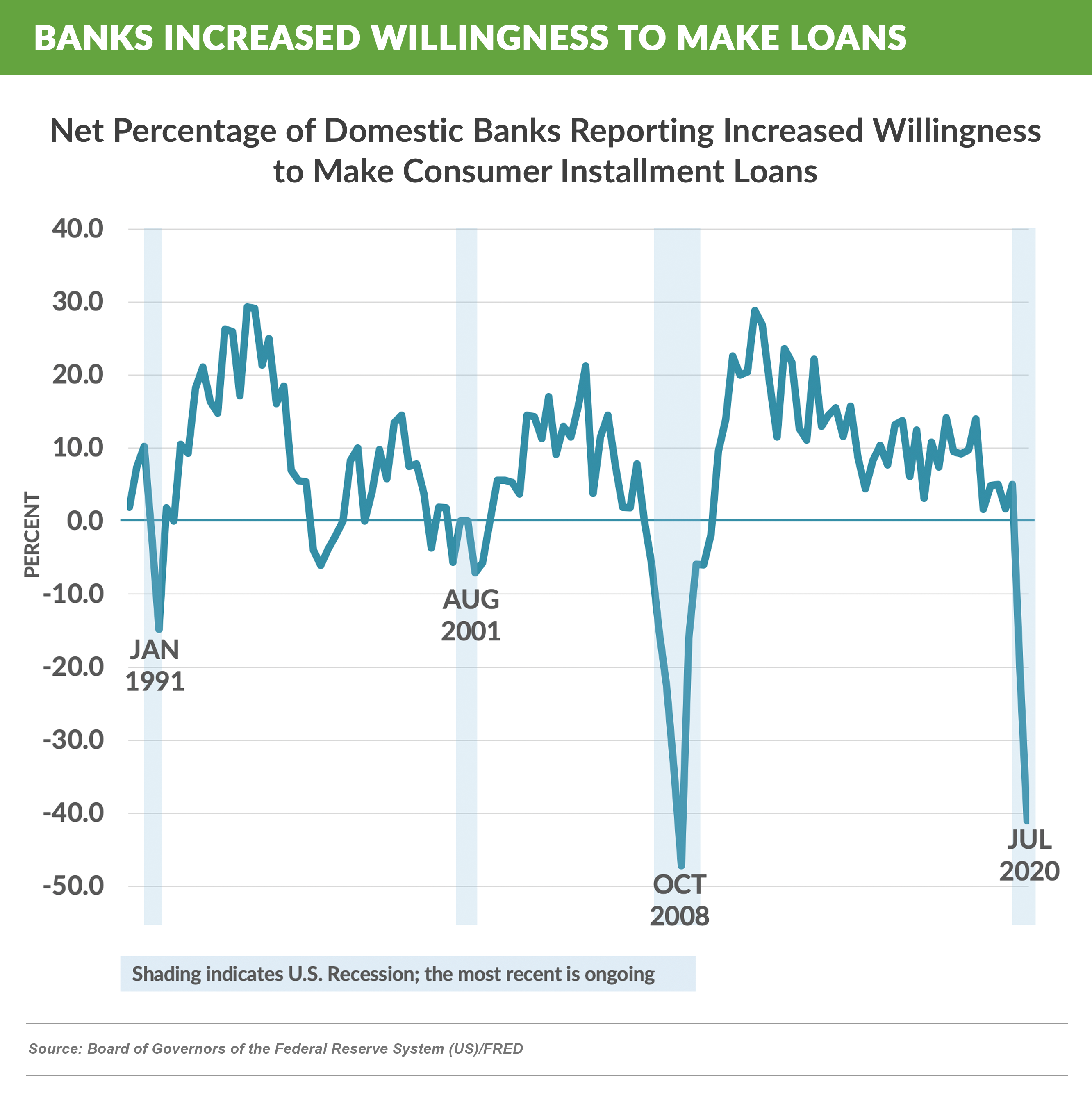

- Many large and medium card issuers are eagerly anticipating taking advantage of the market lull and returning to large-scale acquisition campaigns

- Recovery in the personal loan market has so far been largely restricted to fintechs

Thank you for reading.

The next Epic Report will publish in two weeks on October 24th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.