Three Things We’re Hearing

- Travel rewards cards are not dead!

- Checking and savings acquisition spending picks up

- Student lending originations slightly down?

A three-minute read

Travel Rewards Cards are not Dead!

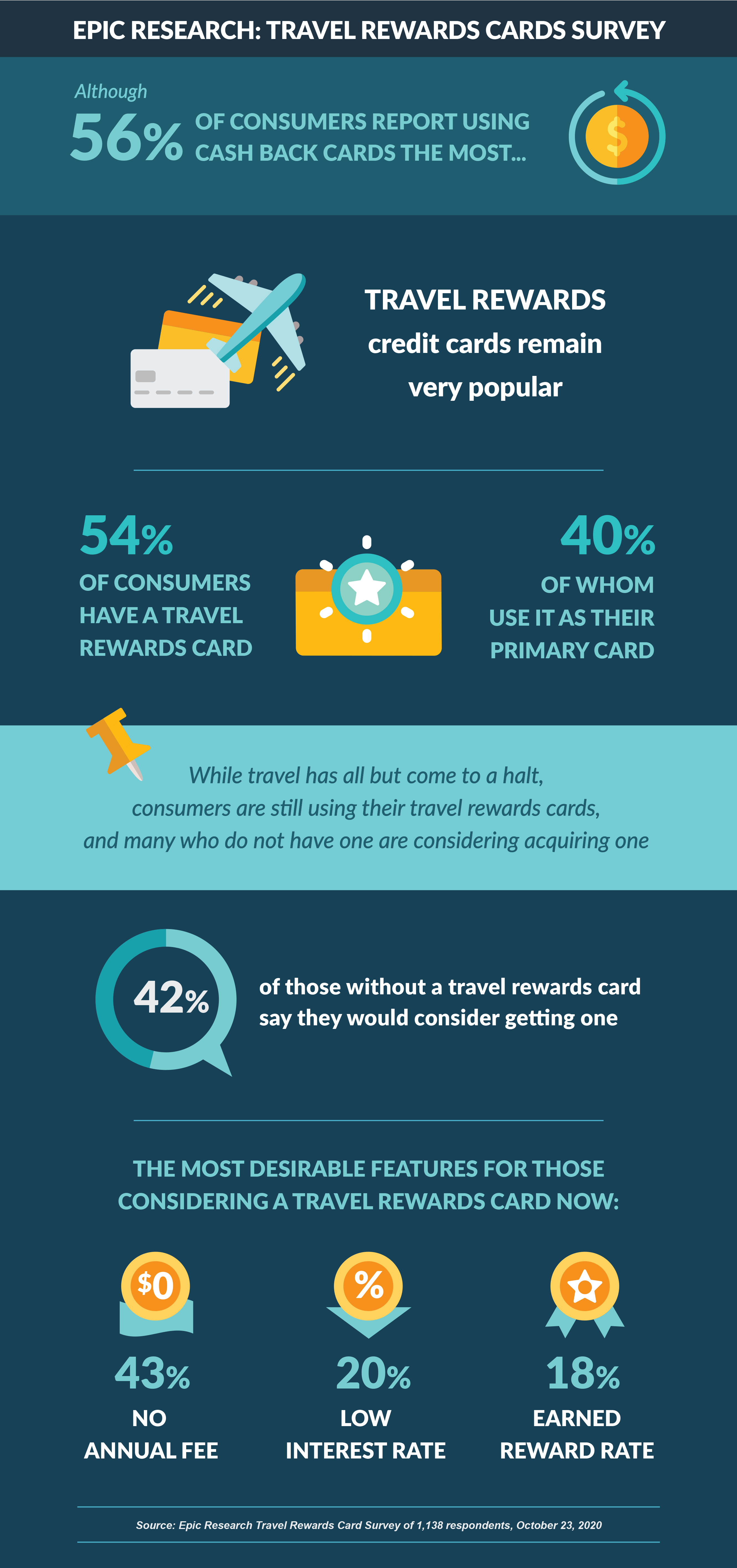

- Cash back credit cards are most popular among consumers, with 56% of those responding to a recent Epic survey saying a cash back card is what they use “the most”

- Travel rewards credit cards remain very popular with consumers, with 54% having a travel rewards card, and 40% of those using it as their primary card

- Since the early ’90s when “no fee” cards became widely available, consumers have consistently, and many times irrationally, shown disproportionate preference for no fee cards, even when the “savings” are materially outweighed by the savings associated with low interest rates and/or higher rewards rates

- Banks without airline specific co-brand cards are not necessarily at a disadvantage, as only 6% of those considering a new card said “ability to redeem points/miles at a specific airline or hotel” is an important factor

- Other than the handful of banks with proprietary airline or hotel co-brand cards, issuers would be wise to offer a no fee rewards card with cash back and travel rewards options

Checking and Savings Acquisition Spending Picks Up

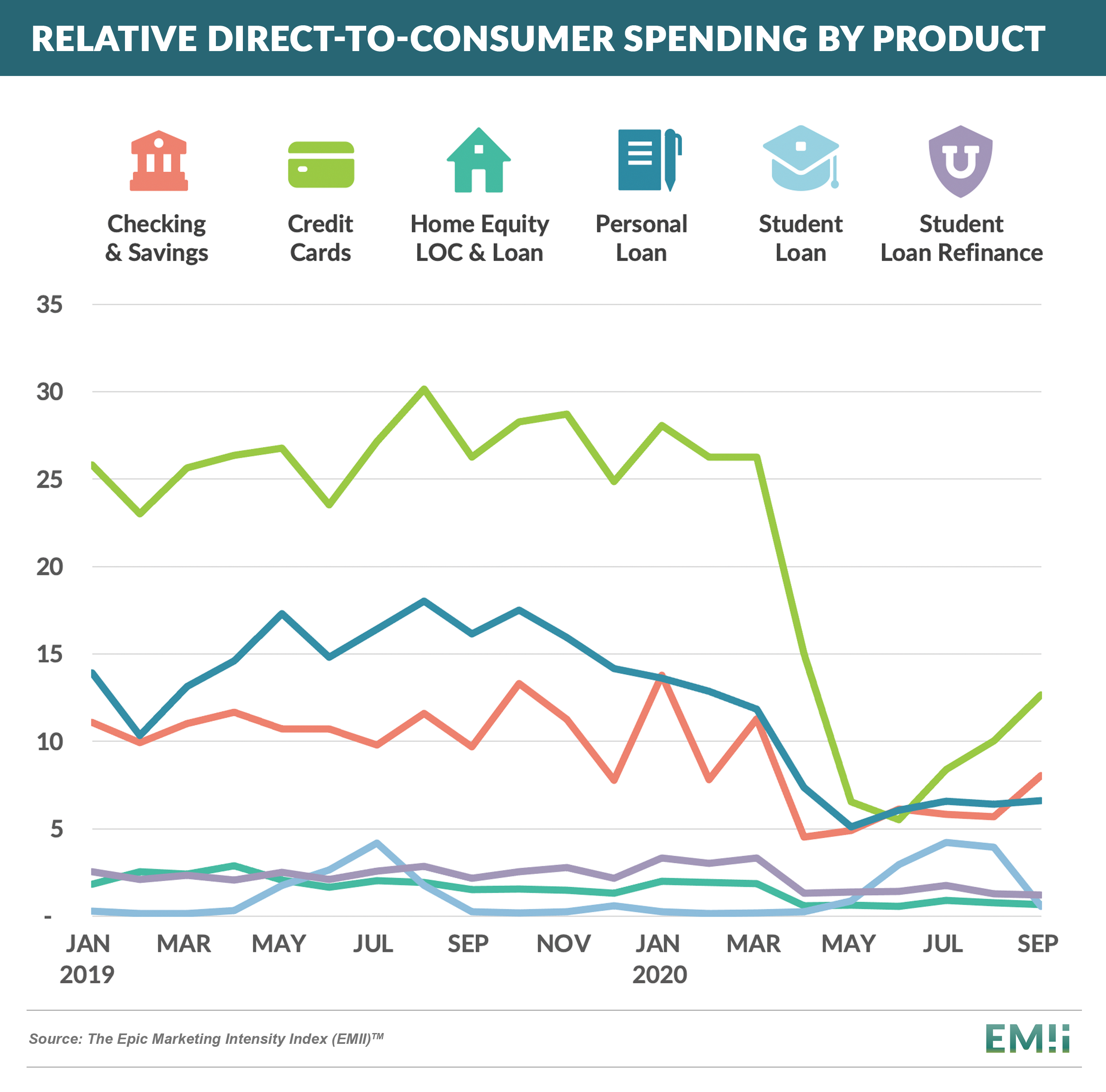

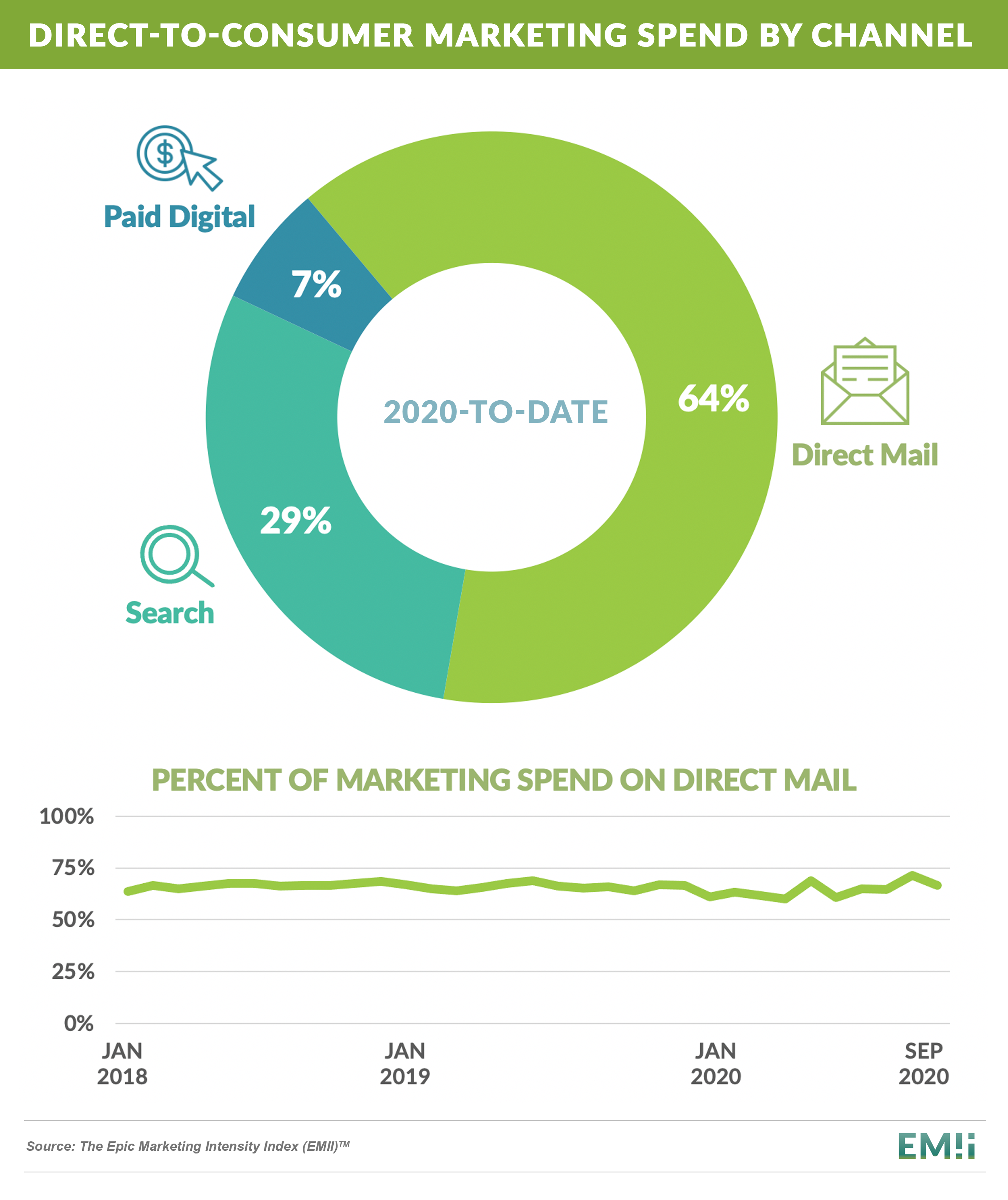

- The Epic Marketing Intensity Index (EMII) measures acquisition spending for consumer finance products (cards, loans, deposits, home equity, education) and channels (direct mail, search, paid digital)

- Checking and savings acquisition spending rose in the past month, which is somewhat surprising given the glut of deposits at most banks

- Across all products, credit cards stood out with a third upward month in a row, driven heavily by American Express direct mail expense

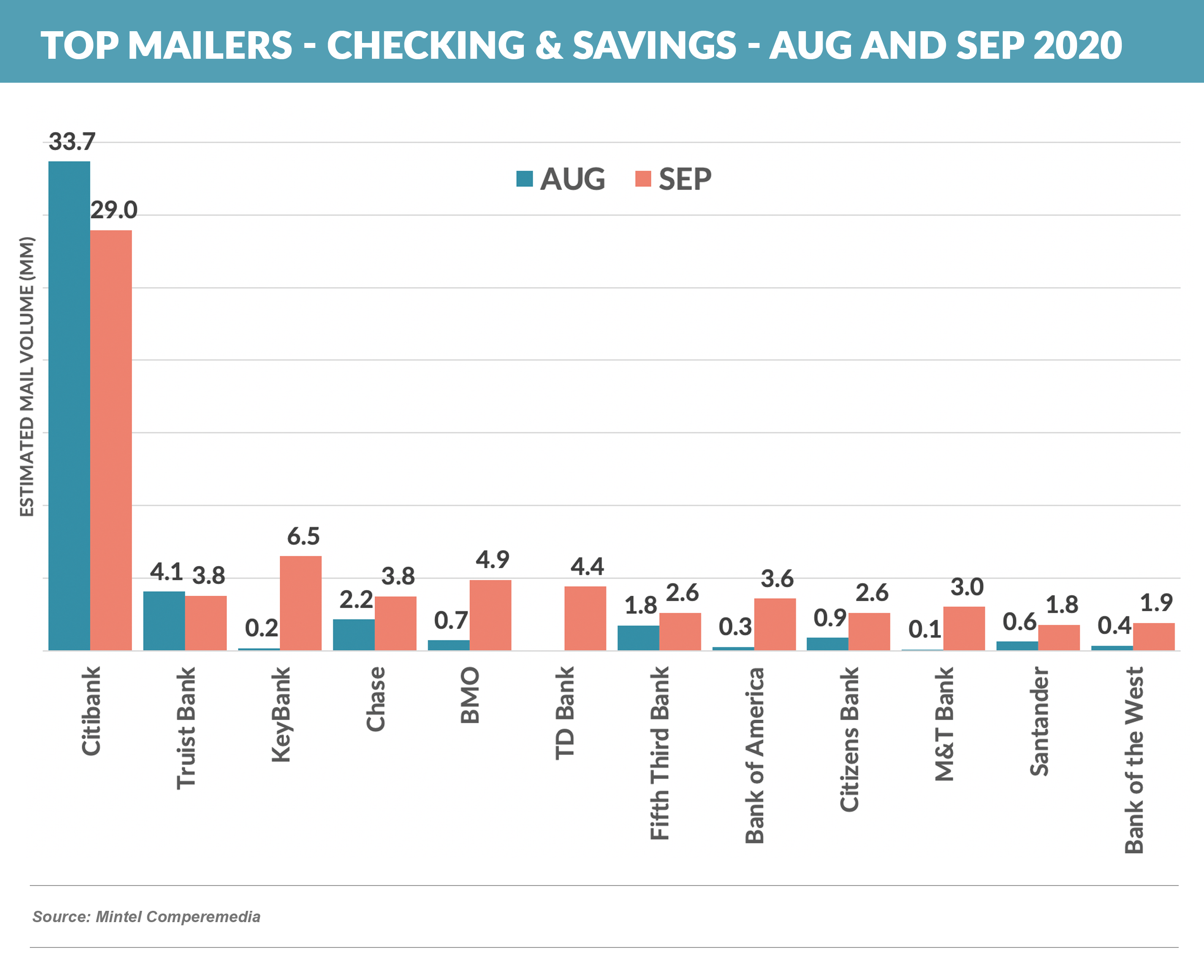

- Citi was the by far the largest spender on checking and savings, with over 40% of the direct mail total for the category

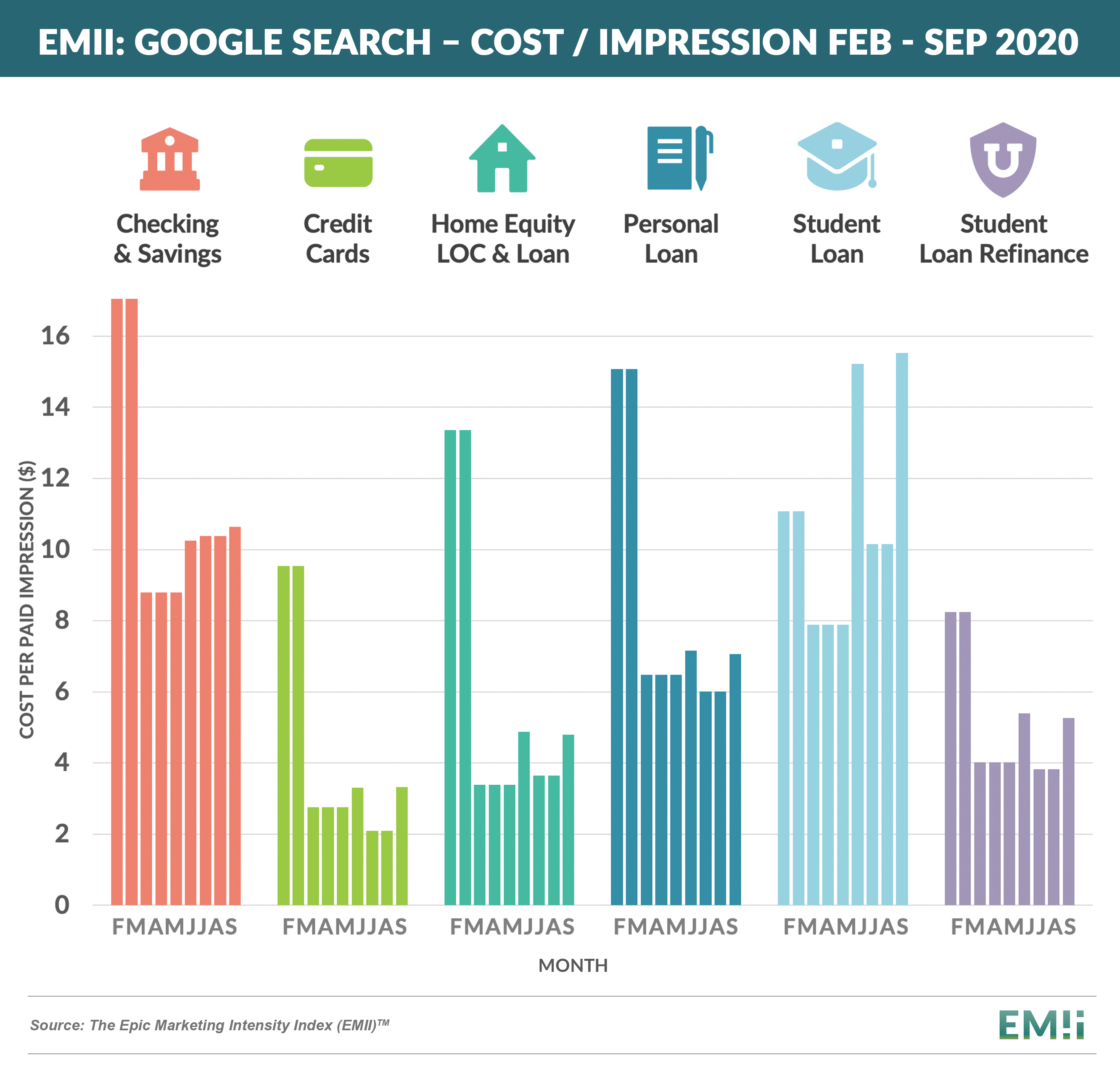

- Checking and savings search cost per impression has also rebounded somewhat over the past few months (student loan increased too, due to seasonality)

- And, as our periodic reminder about why we talk about direct mail so much…

Student Lending Originations Slightly Down?

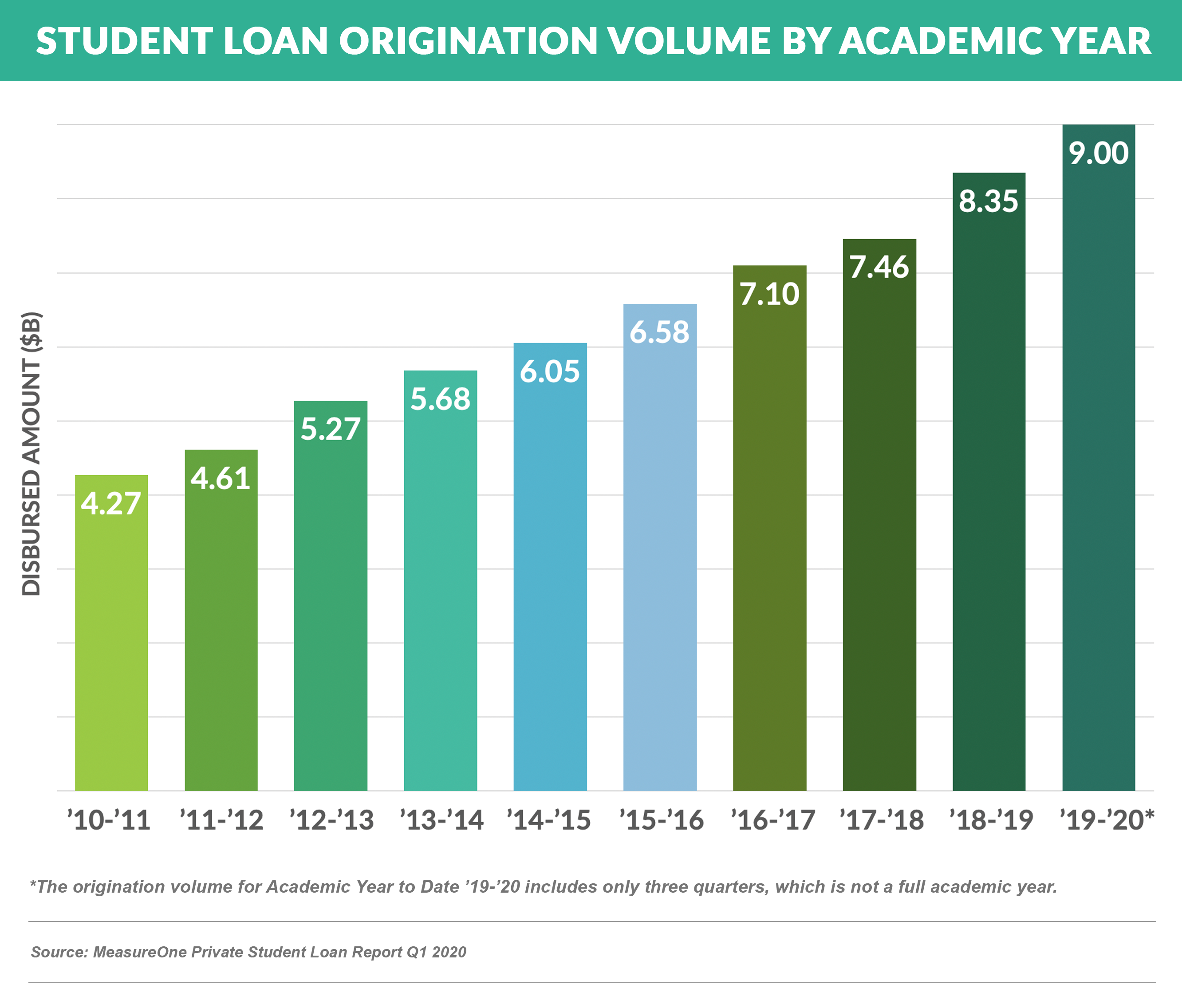

- Private student loan originations have doubled over the past decade

- While direct mail plays an important role in selecting a student loan provider, private student loans are also originated through emails to existing customers (serial loans), other digital channels, and through relationships with colleges

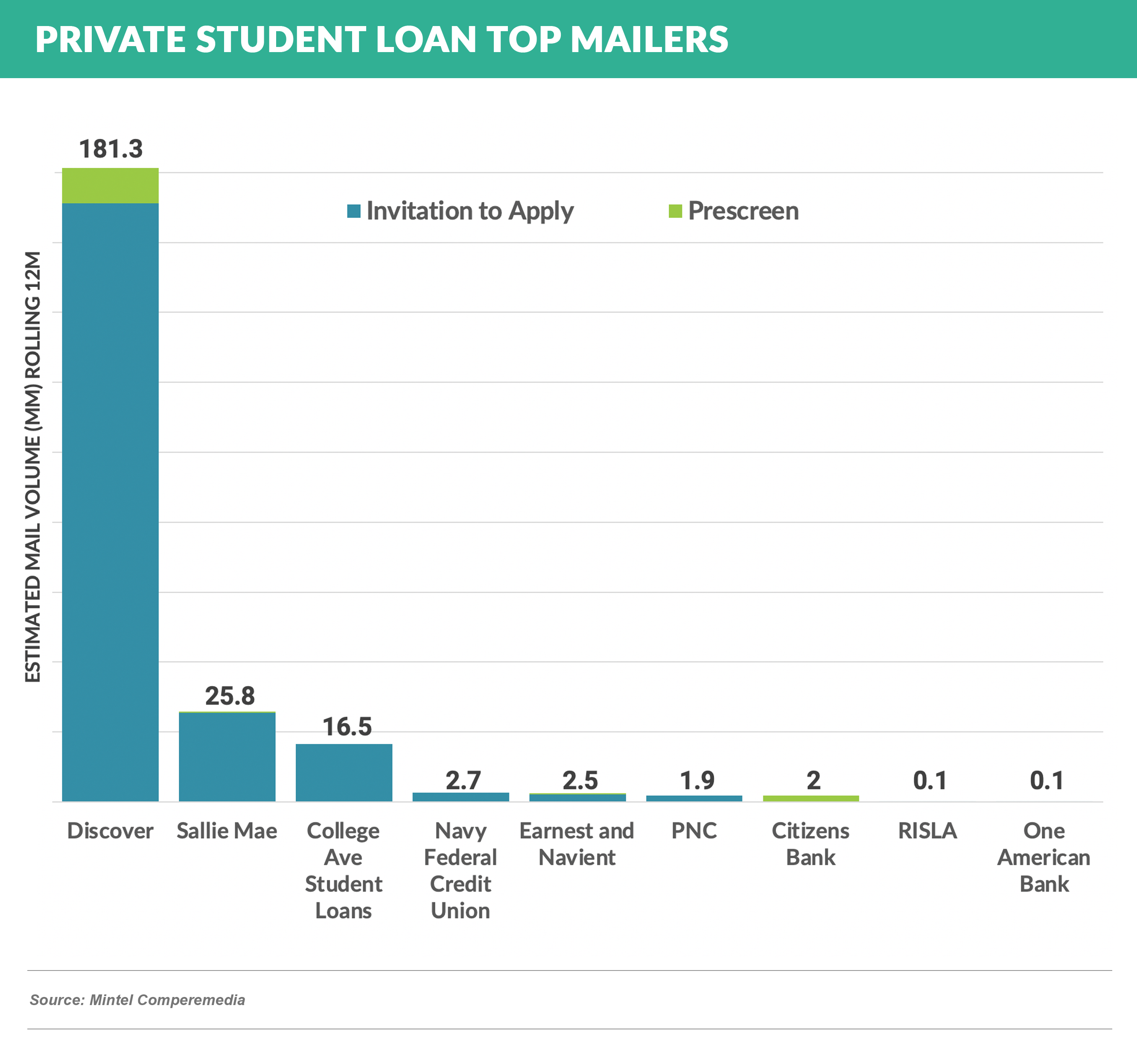

- During the 2020 “peak season” (May – August), there were only three large mailers – Discover (by far the largest), Sallie Mae, and College Ave – with Wells Fargo exiting the business except for existing customers and SunTrust having pulled out earlier

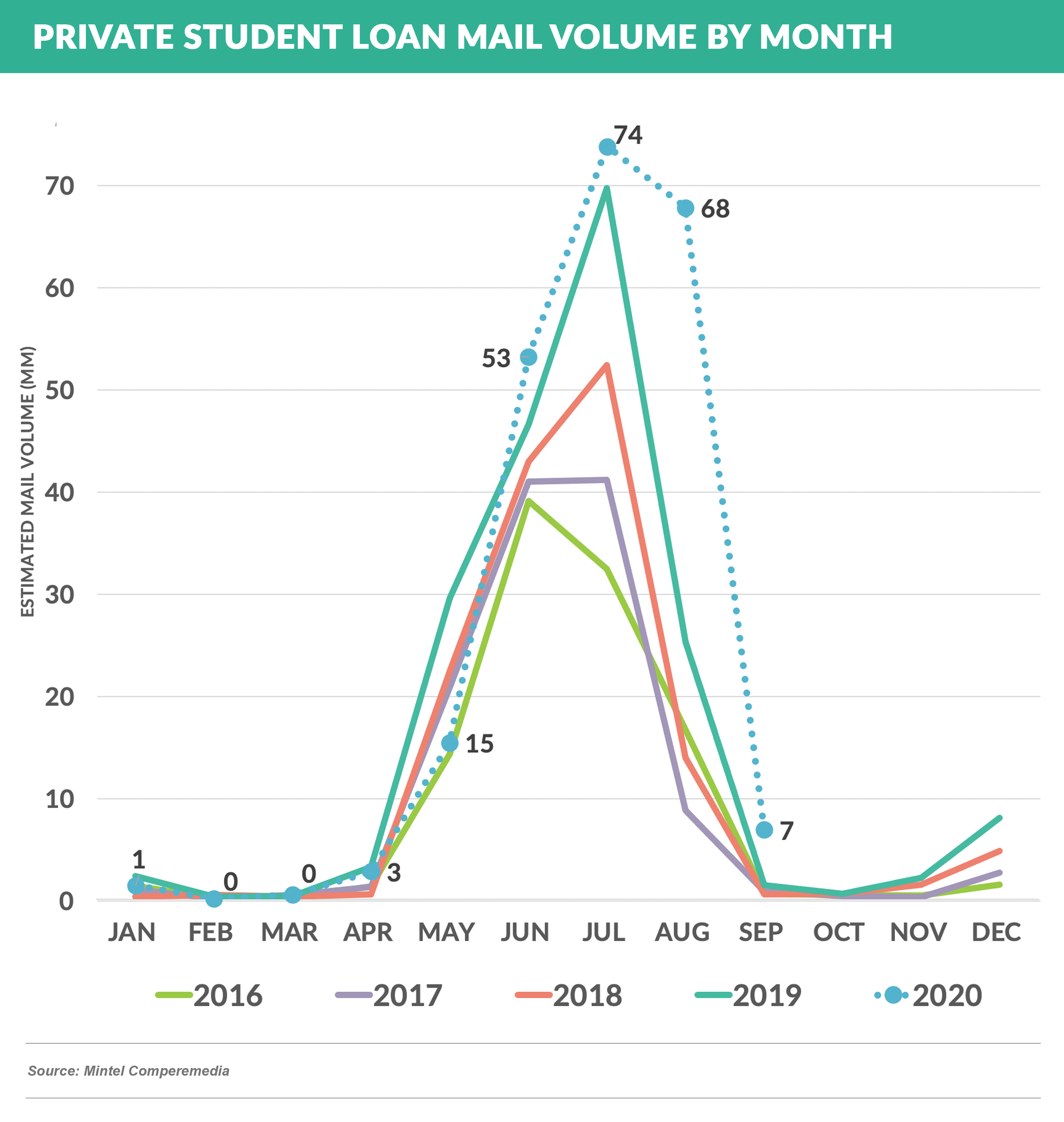

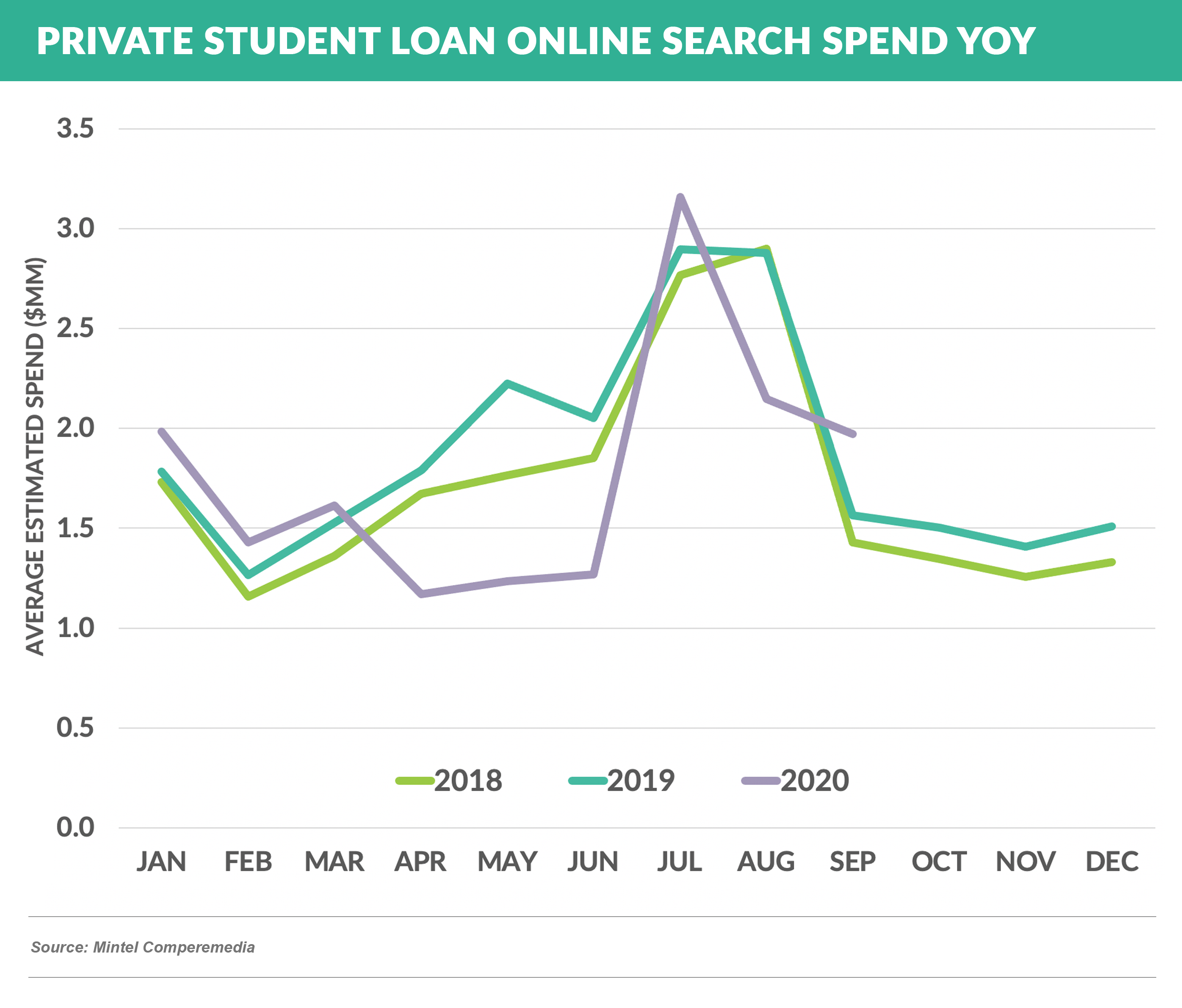

- Students going back to campus was a large unknown until mid-to-late summer, which likely caused mail and online search to lag

- Sallie Mae reported on its third quarter conference call that its loan originations were down 6% YTD, and estimates for the entire industry have been estimated as down 10-15%

Quick Takes

- Some regional banks seem to have held credit losses in check so far, however most feel like they are adequately reserved even though they expect losses to continue to rise

- Zions expects charge-offs to peak next year

- Synovus states that while charge-offs might continue to increase in early 2021, it expects its loan loss reserve at end of Q3 to be sufficient

- Citizens projects charge-offs to remain stable in the coming quarters and could begin reducing reserves as soon as Q4 2020

- Regions sees a risk that consumer losses continue to rise in 2021 and has no immediate plans to reduce reserves

- Credit card trends

- Loan growth continued to slow across most major issuers due to decreased new customer acquisition combined with increased payment rates

- Discover led the field in sales volume growth – up 7% year-over-year

- Credit card sales at T&E heavy American Express continue to lag, which may partially explain its emergence as the biggest acquisition mailer

- SoFi received preliminary approval for a bank charter, which if ultimately approved, will, among other things, allow it to gather deposits, narrow the current funding disadvantage up to 200 basis points, and access stable funding that is typically unavailable to fintechs

Thank you for reading.

The next Epic Report will publish in two weeks on November 21st.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.