Four Things We’re Hearing

- 64% of consumers are using digital banking services more than pre-pandemic

- Two-thirds of colleges are currently planning to welcome students to campus in the fall, but uncertainty lingers

- Online deposit rates have fallen an average of 20bp since January

- Personal loan interest rates remain in flux

Today’s newsletter takes 3 minutes to read

Consumer Digital Servicing Adoption

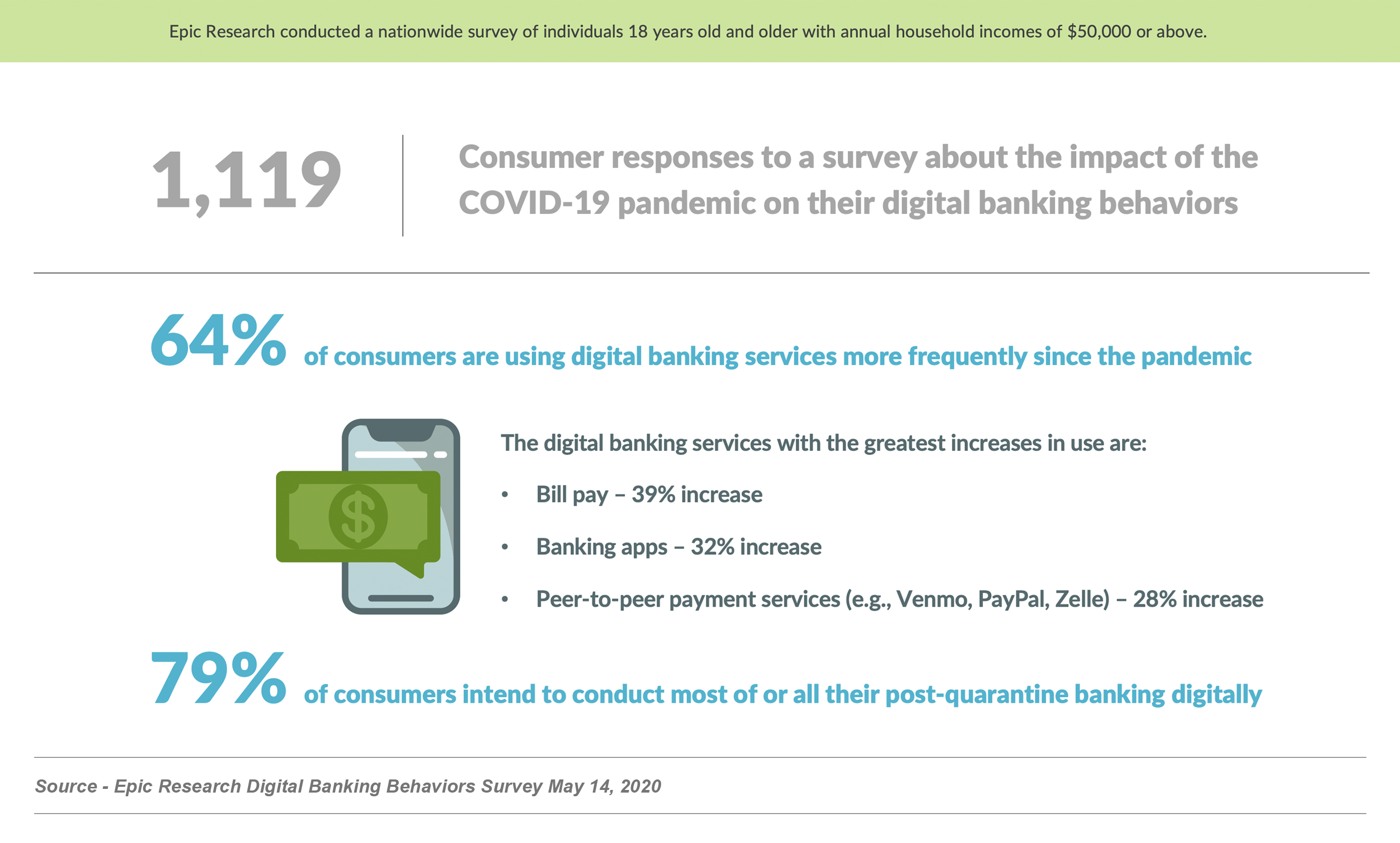

- Epic fielded research this week on consumer preferences regarding the use of digital servicing in their banking relationships, surveying 1,119 adults with incomes of $50,000 or greater

- Unsurprisingly, consumers are using online portals and mobile apps at a greater rate than pre-pandemic, with almost two-thirds of respondents indicating greater usage of digital banking services since the onset of the quarantine

- Click here for the full study

- Banks have responded by increasing their focus on development of digital capabilities

- Visa has reported a 150% increase in “tap payments” for March year-over-year, and a has reported a PayPal reported their largest ever single day of transactions was on May 1st

Back to School Uncertainty

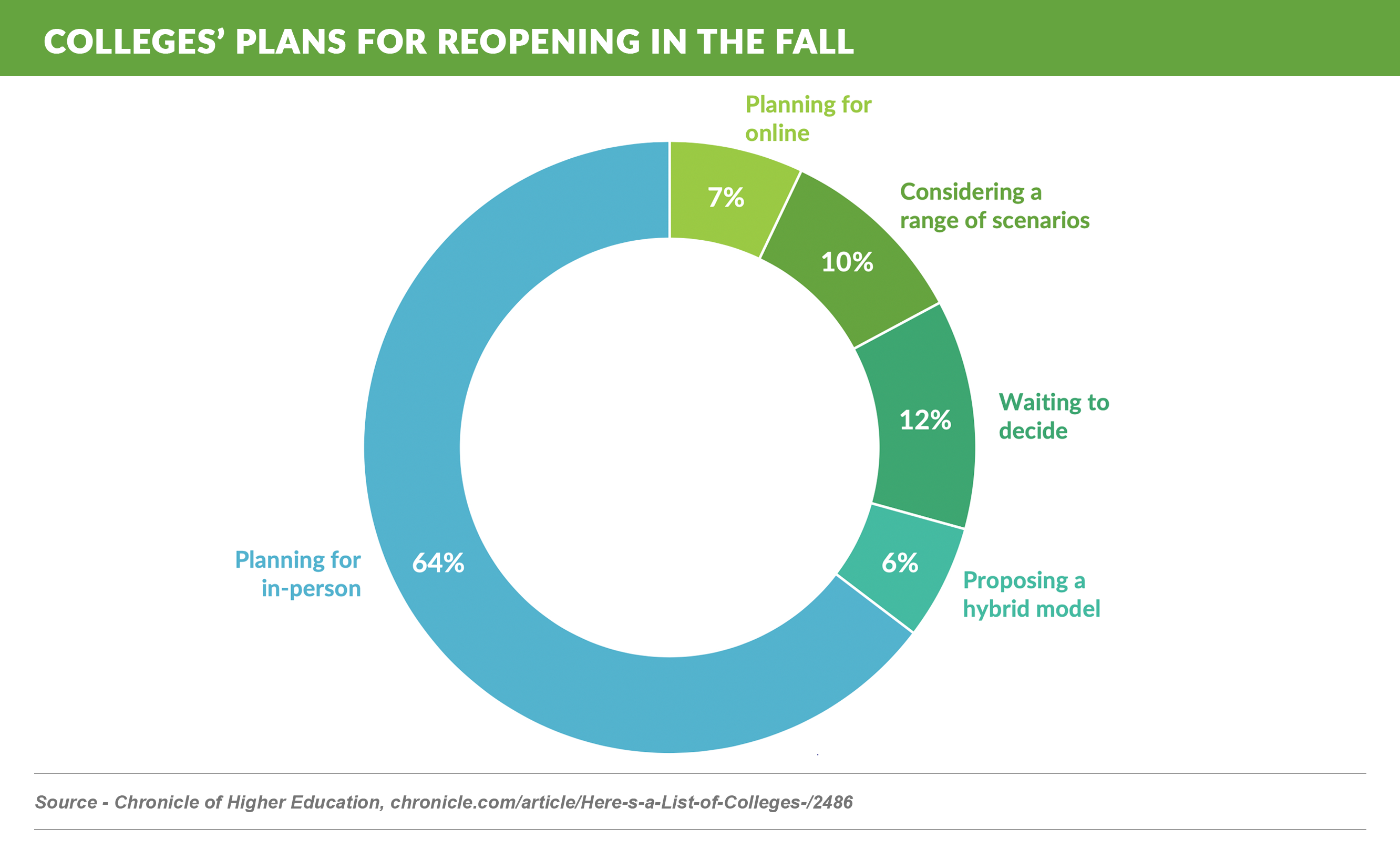

- Whether or not campuses open this fall remains an open question at most colleges, with most planning to re-open but reserving the right to adjust as appropriate

- Epic recently repeated a March 2020 survey of incoming college freshmen and their parents, which showed continued uncertainty regarding the pandemic’s impact on campuses opening in the fall

- 57% of parents have heard from their child’s college regarding fall plans, up from only 30% in March

- 66% of parents currently believe students will be allowed on campus in the fall, which is down 7% from March

- 17% of parents are considering delaying their child’s entry to college

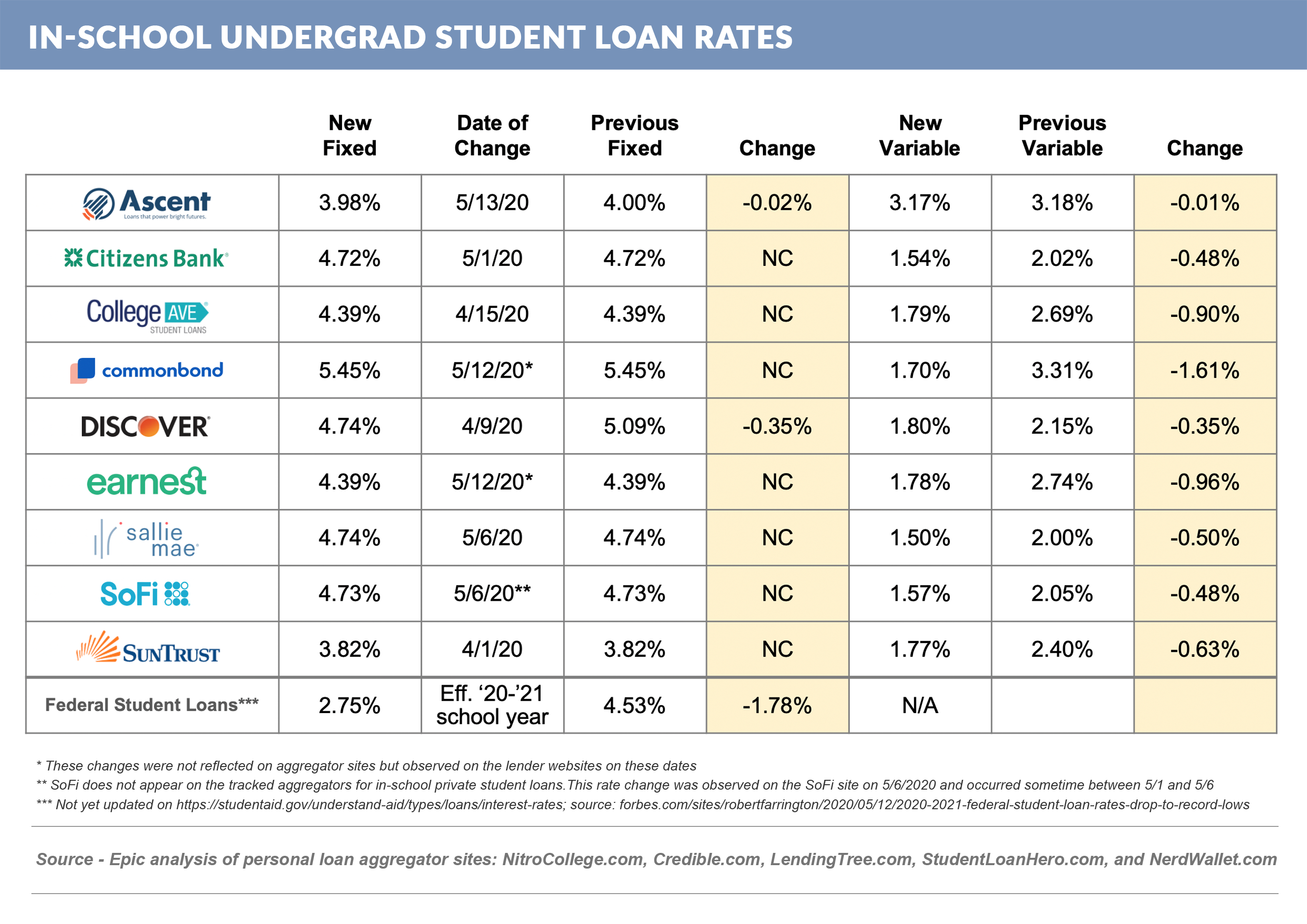

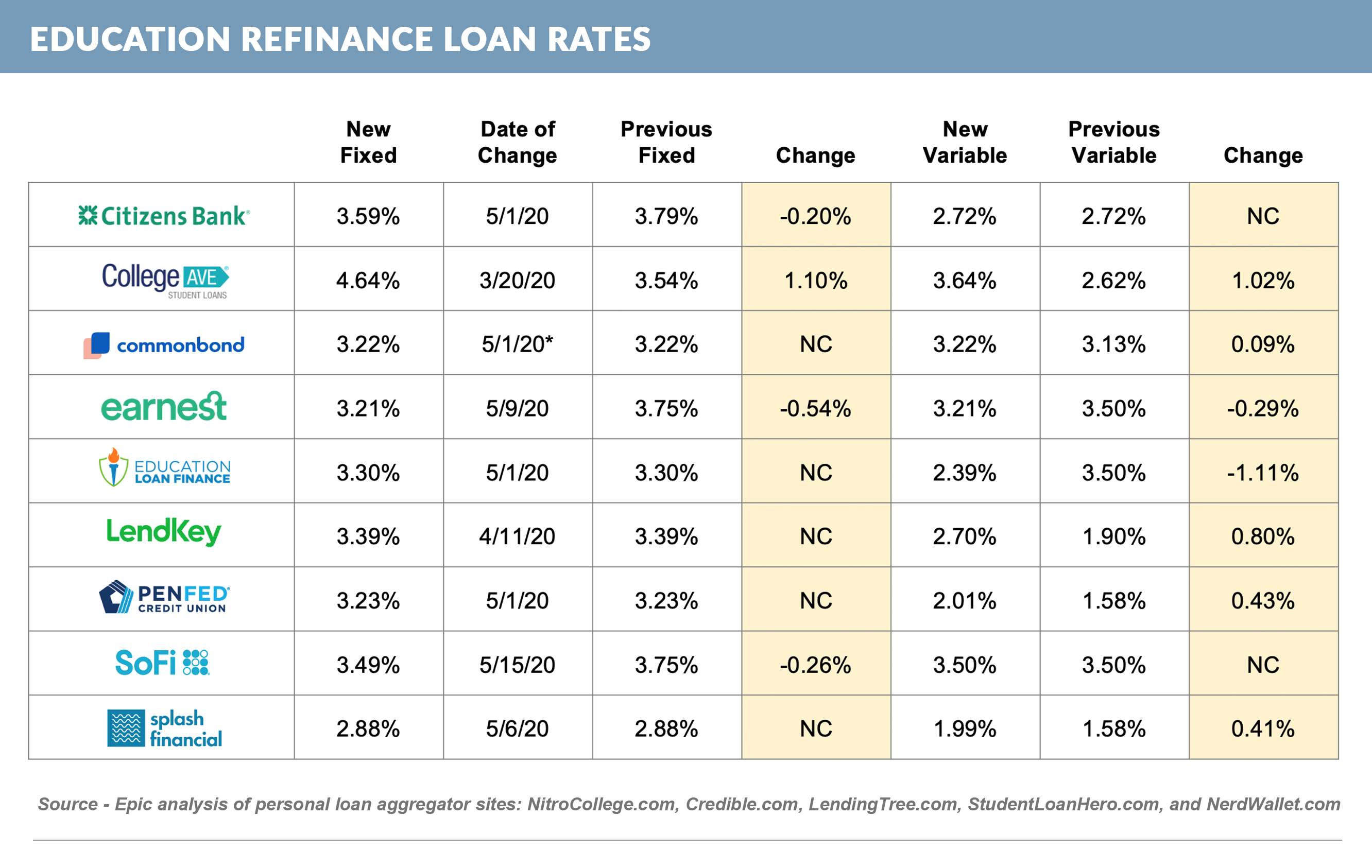

- Federal student loan rates for the 2020/2021 school year were released this week, with fixed rates down 1.78% from last year. Despite the decrease, many variable private student loans are processed below the federal student loan rate of 2.75%.

Online Deposit Rates

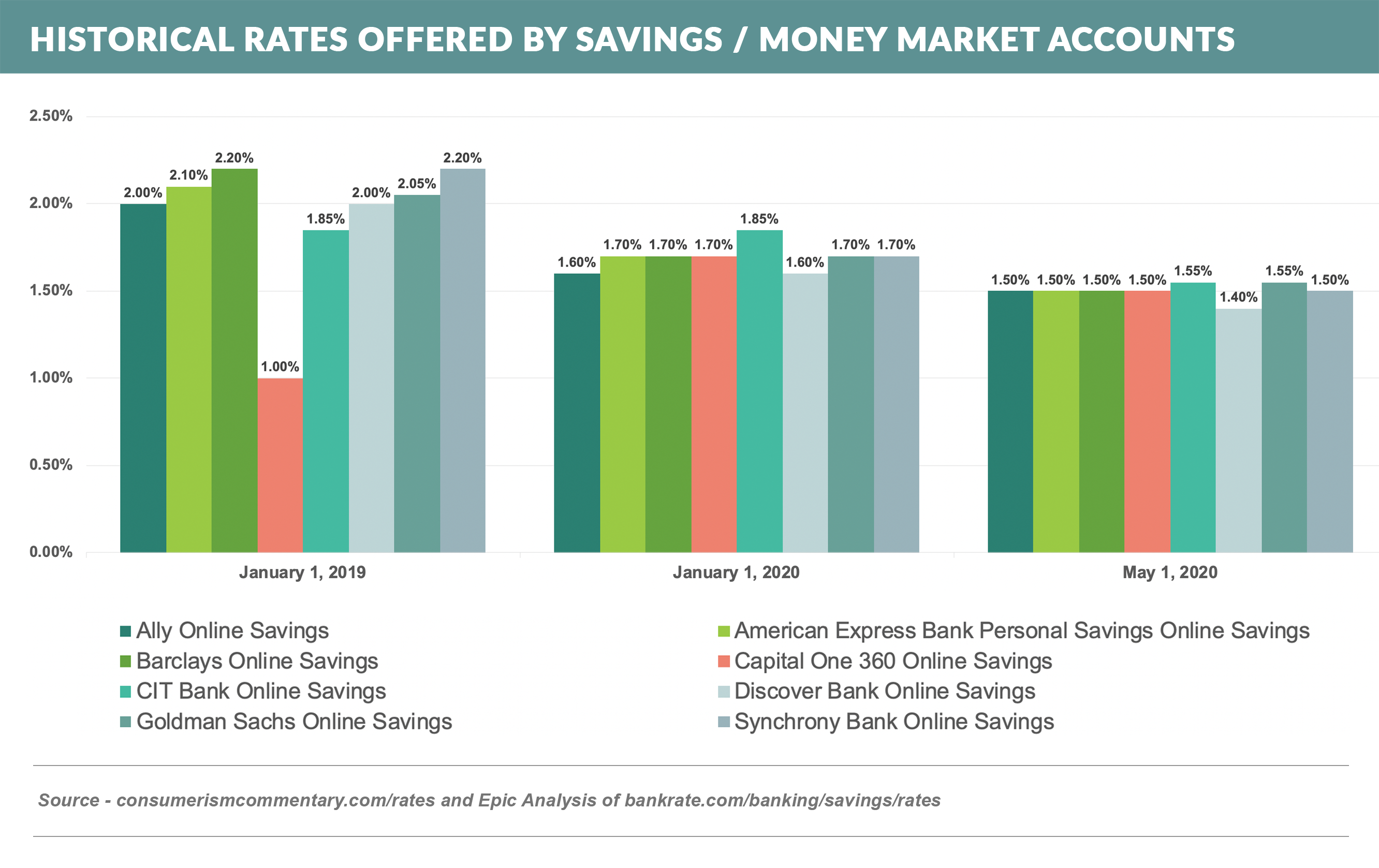

- Online deposit rates have fallen by ~20bp since January 2020

- Ally recently cut rates 25bp to 1.25%, leading the way down among the top Bankrate “high interest savings” players

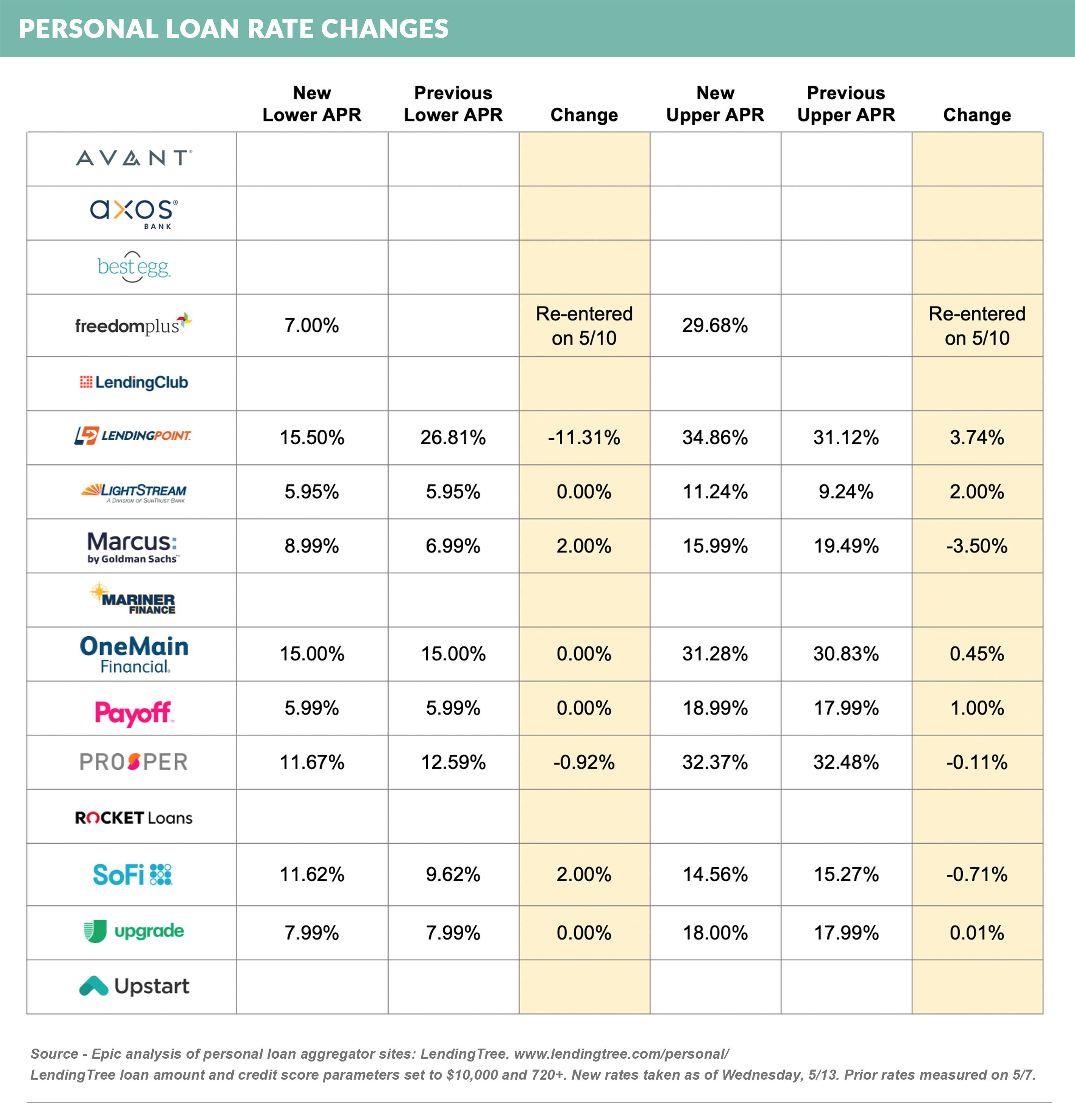

Alternative Lenders

- Alternative lenders continue to be either absent from or at higher rates on the personal loan aggregator sites

- Marcus is at 8.99% vs. a pre-shutdown rate of 6.99%

- SoFi currently shows a low rate of 11.62% vs. an early March rate of 4.74%

- Best Egg and Upstart reappeared on Credit Karma on 5/15 after being absent from the aggregator since March. While both remain absent from LendingTree as of this publication, we expect them to reappear after LendingTree’s weekly update this Sunday

- After a number of weeks of volatility, education refinance rates have converged across most lenders to rates close to where they were in January 2020

Going Forward

- Loan and rate volatility have lessened over the past few weeks compared to March and April

- Digital servicing appears to have had a transitional moment

Thank you for reading.

Let us know what you think.

Jim Stewart

www.epicresearch.net

You can read this newsletter in your browser and see our previous newsletters here.