Three Things We’re Hearing

- Personal loan market fully recovered

- Credit card sector in good health

- Direct mail still dominates

A three-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Personal Loan Market Fully Recovered

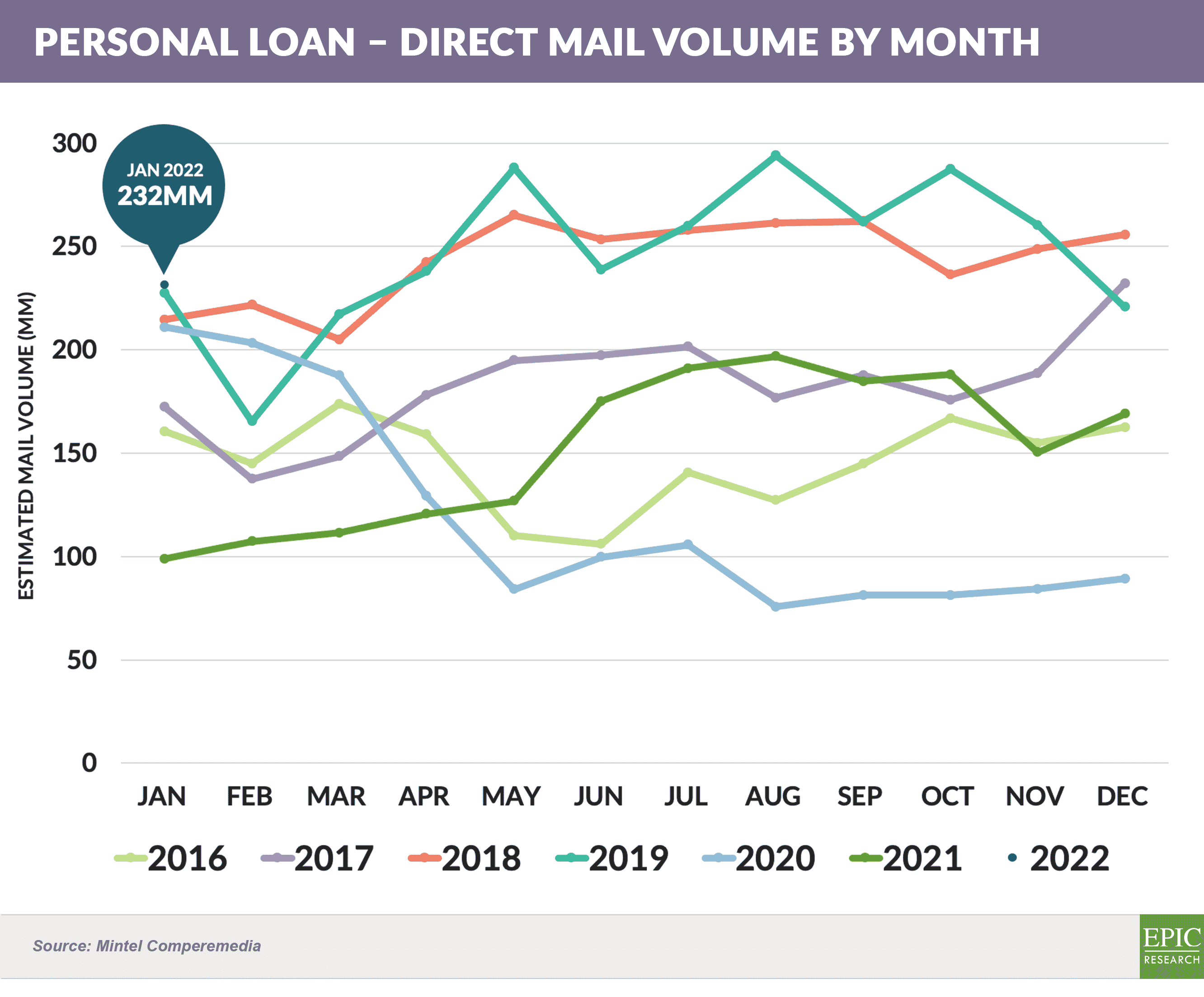

- Following years of growth, personal loan mail volume dropped 65% from January to June 2020

- However, after a slow recovery, January 2022 mail volume eclipsed that of January 2020 by 10% to match the highest January volume of the past five years

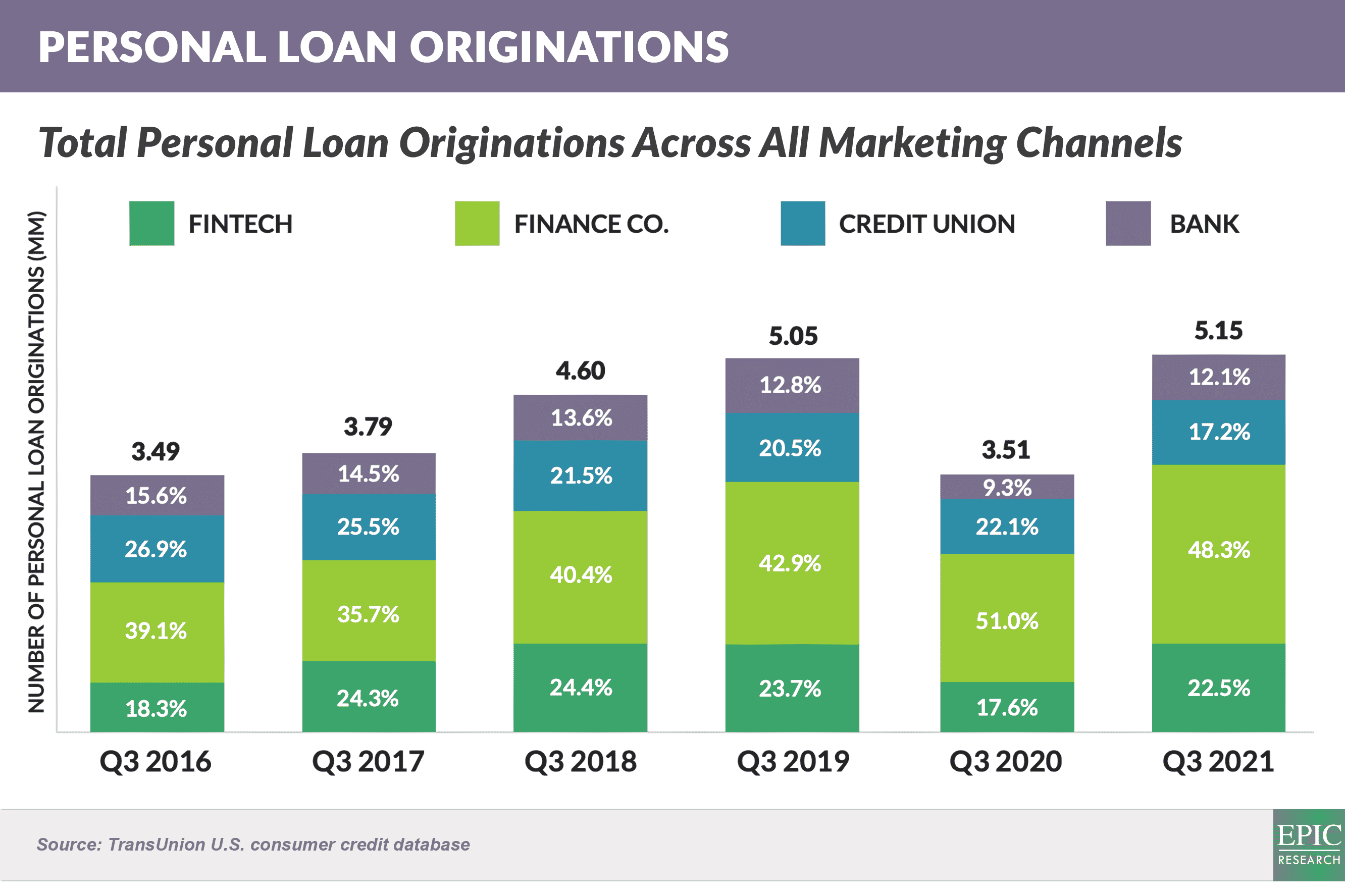

- Personal loan originations across all channels also bounced back in Q3 2021, reaching the highest level in six years

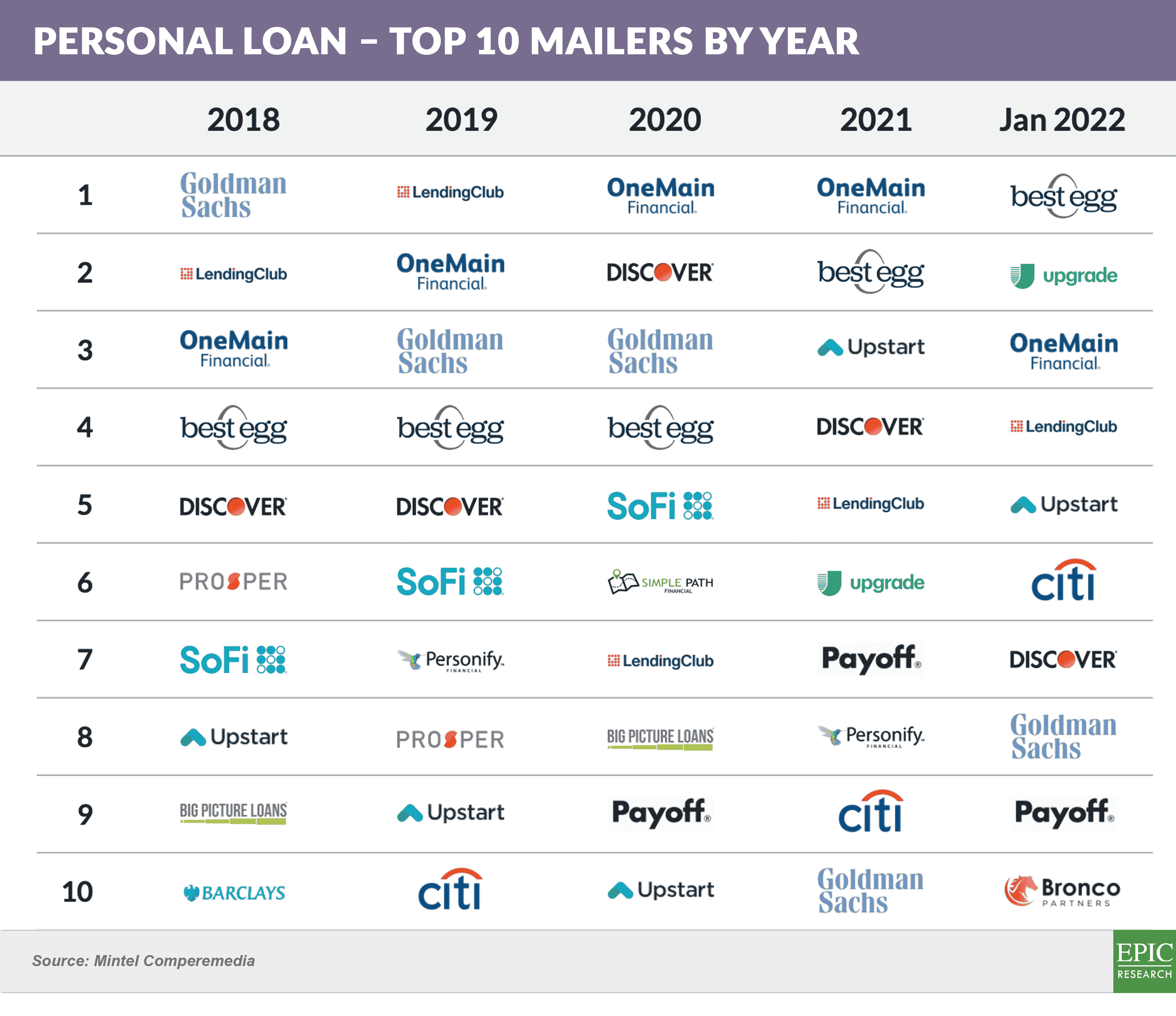

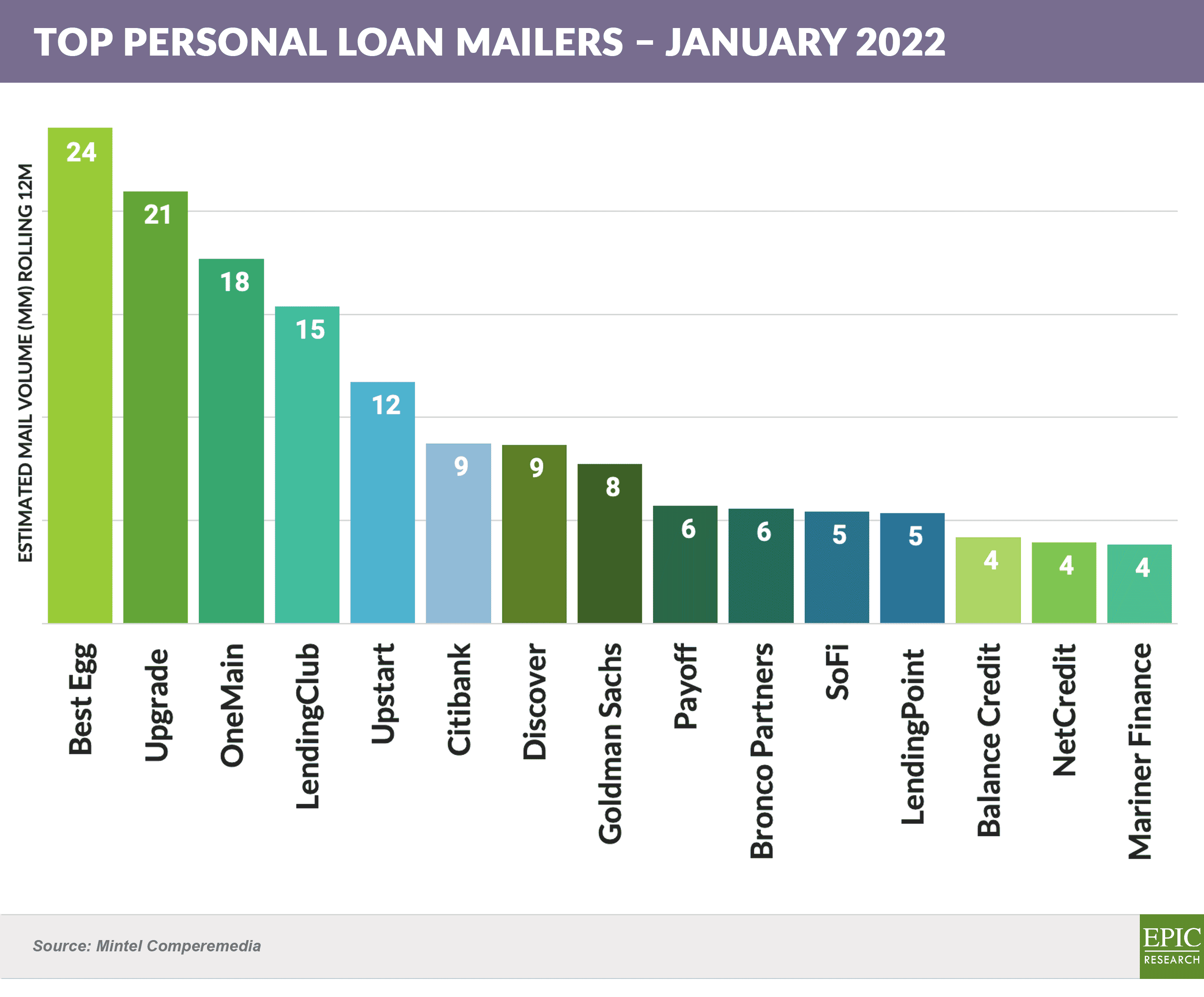

- Over the past four years, OneMain, Best Egg, and Discover have consistently ranked in the top five mailers, with others, such as LendingClub and Goldman Sachs, being less consistent

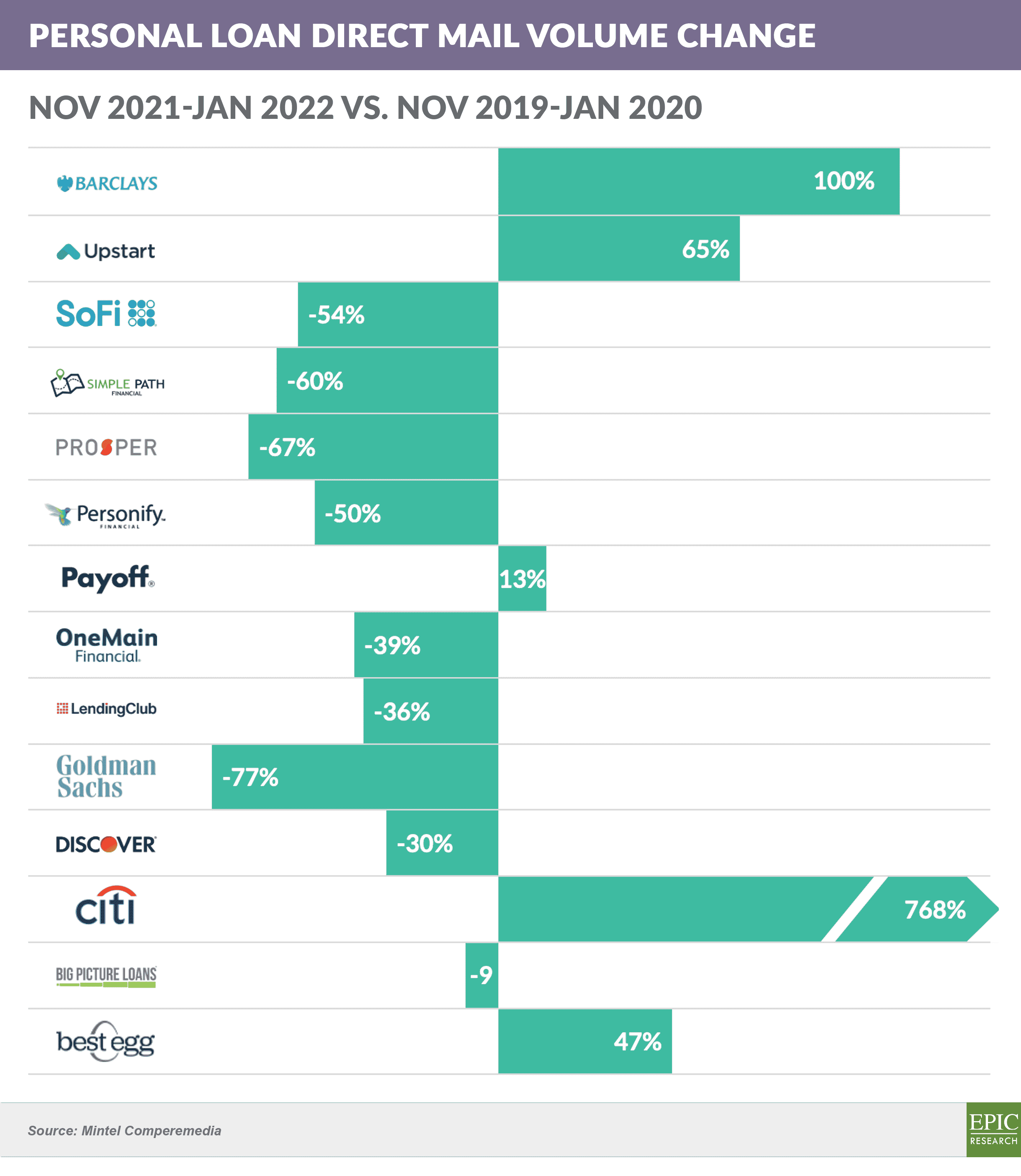

- Citi, Best Egg, Barclays, and Upstart are all mailing significantly more than before the pandemic

- Of the top 15 mailers in January 2022, only Citibank has a branch banking presence – given that branch banks drive higher direct mail response rates, significant opportunity exists in the direct mail space for a regional or national player

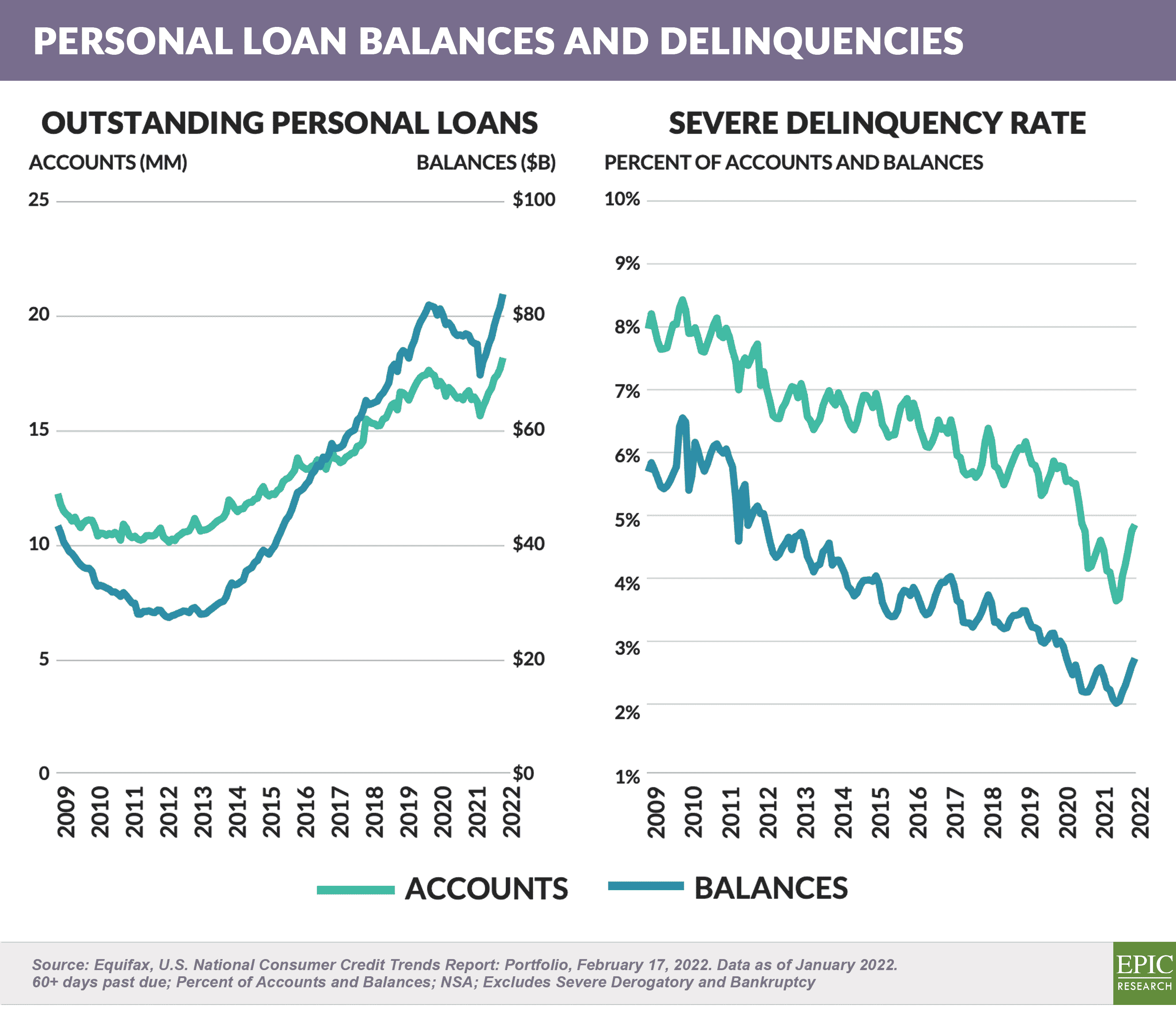

- Personal loan balances and delinquencies have both ticked back up from post-pandemic lows

- For the most part, lenders are competing purely on rates, coupled with promises of a frictionless process without a hard credit pull

- Recent different creative treatments include:

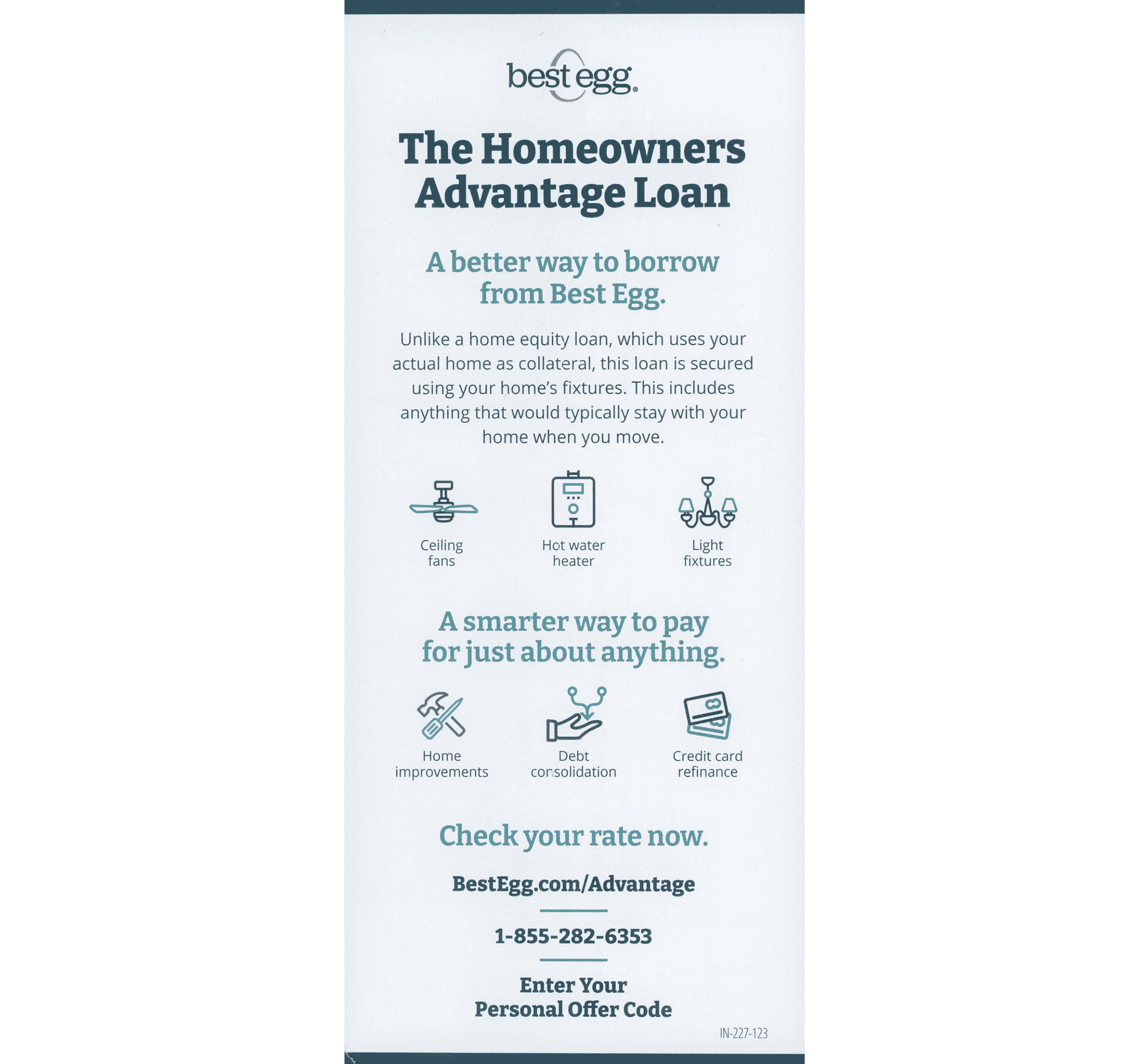

- Best Egg’s Homeowner Advantage Loan is secured by the fixtures inside the home (not the home itself) – resulting in quick closing and low rates (3.99%)

- Figure has a new personal loan creative inclusive of a $150 refer-a-friend offer

- Overall, the personal loan market has finally rebounded and continues to be dominated by non-retail banks

Credit Card Sector in Good Health

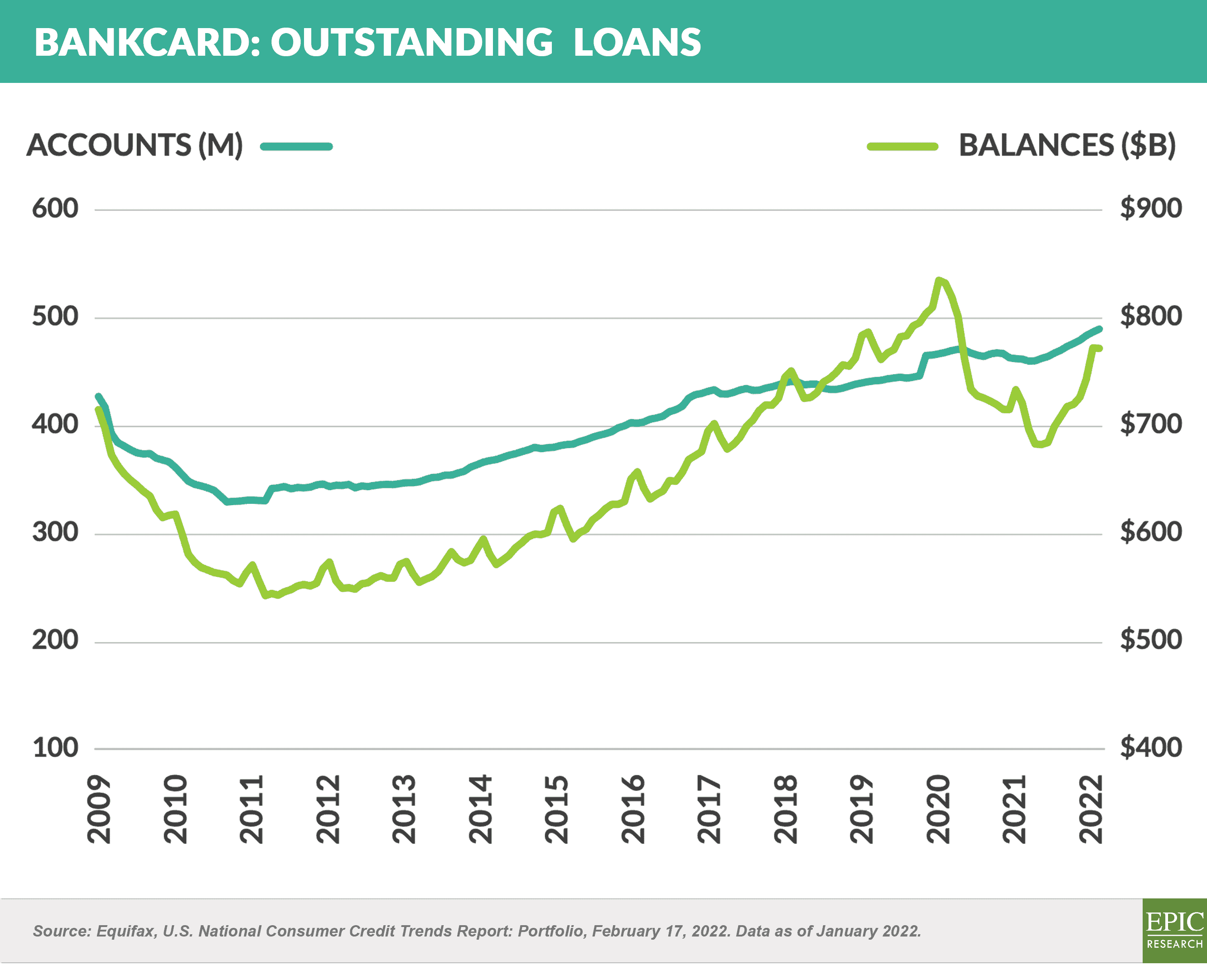

- Bankcard loans outstanding fell 15% in the 12 months following the Q1 2020 onset of the pandemic

- Year-over-year declines were finally reversed in Q3 2021 and ended the year 7% higher than December 2020

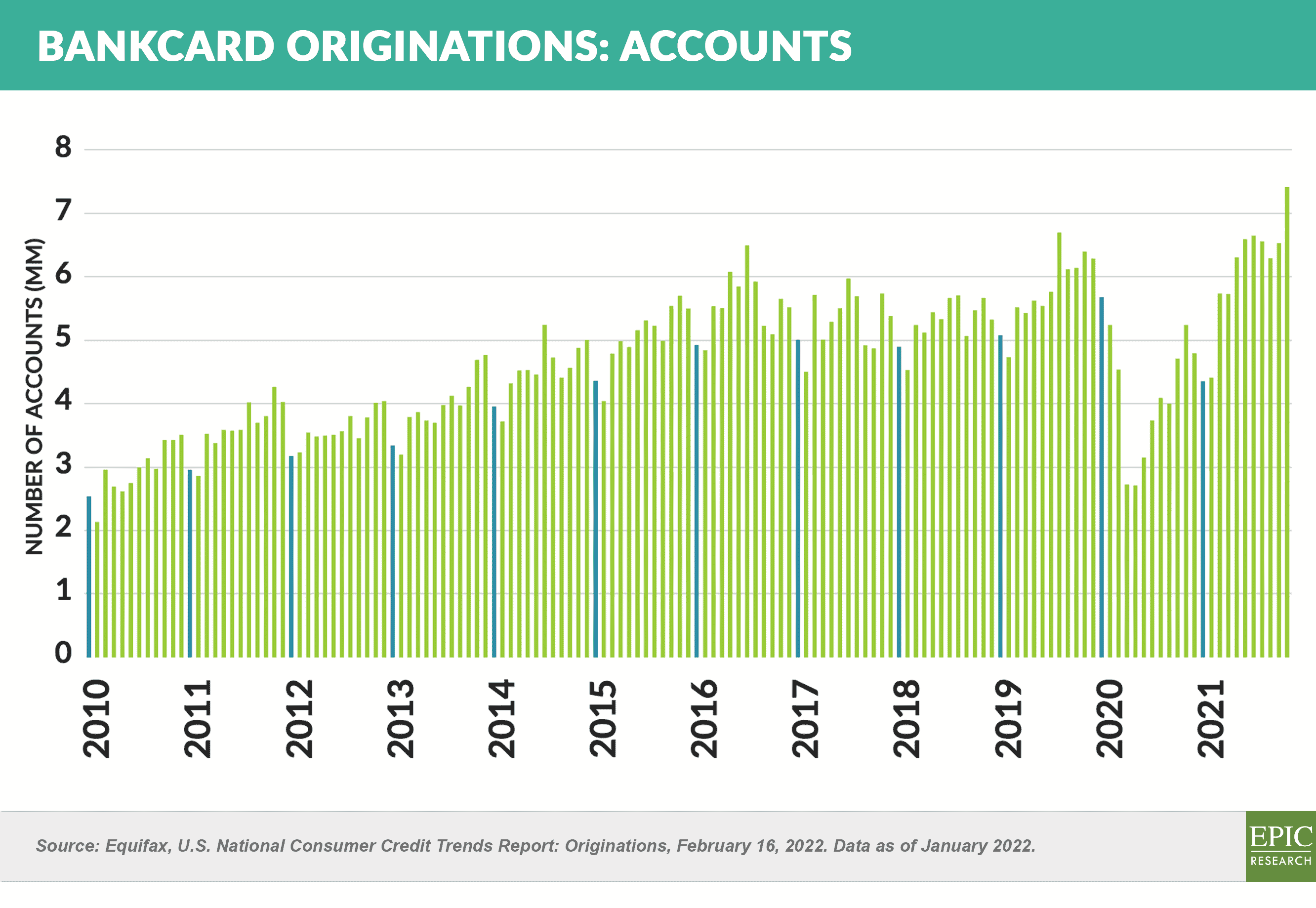

- New customer marketing has rebounded, with 66.6 million bankcards originated year-to-date through November ’21 – a 45.4% increase in new accounts from the previous year and the highest new account volume in over a decade

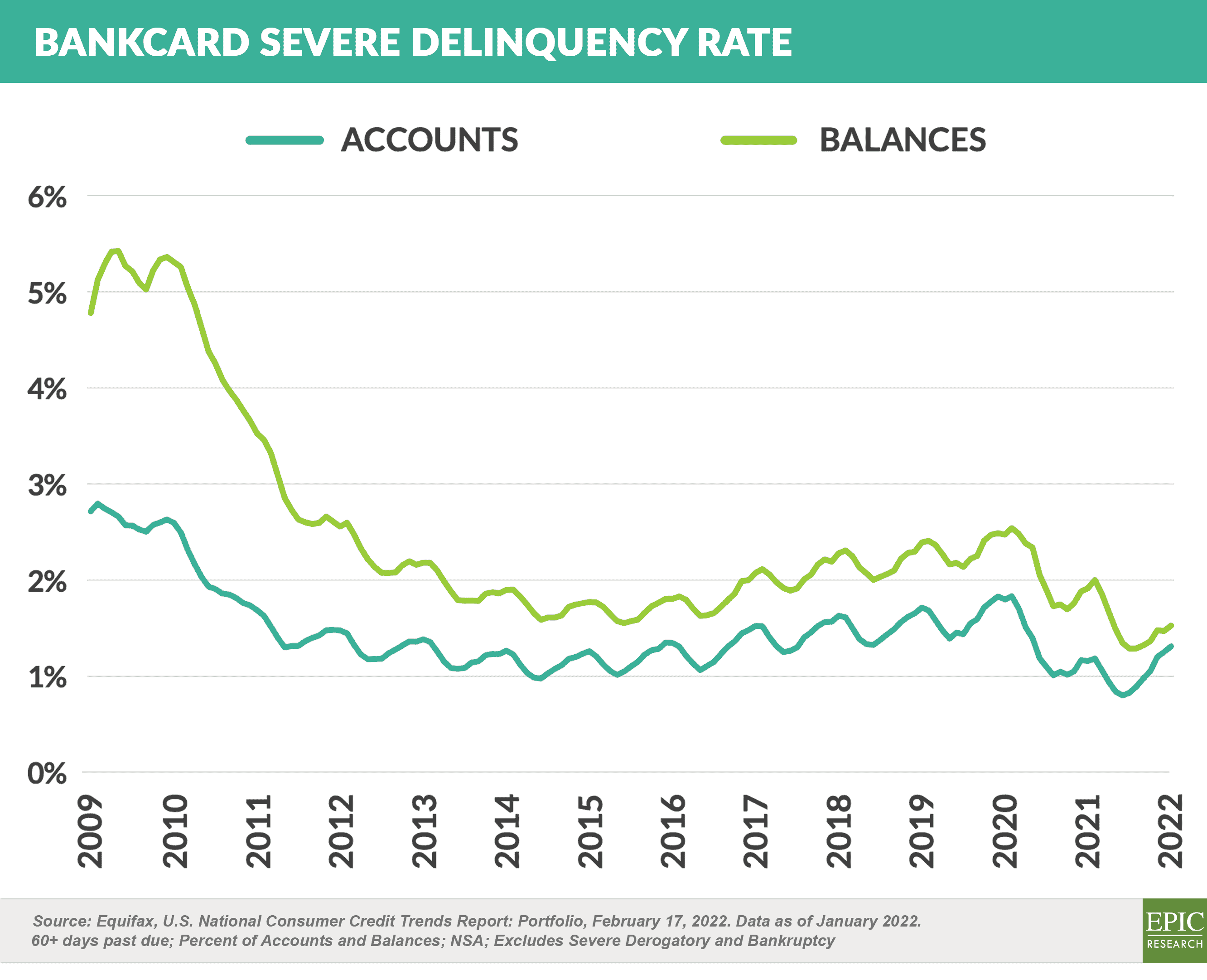

- Bankcard delinquencies, although recently bouncing up from record lows, remain at historically low levels

- Combined with the frequent new and enhanced product announcements and heightened cobrand program activity, all signs are positive for the credit card segment

Direct Mail Still Dominates

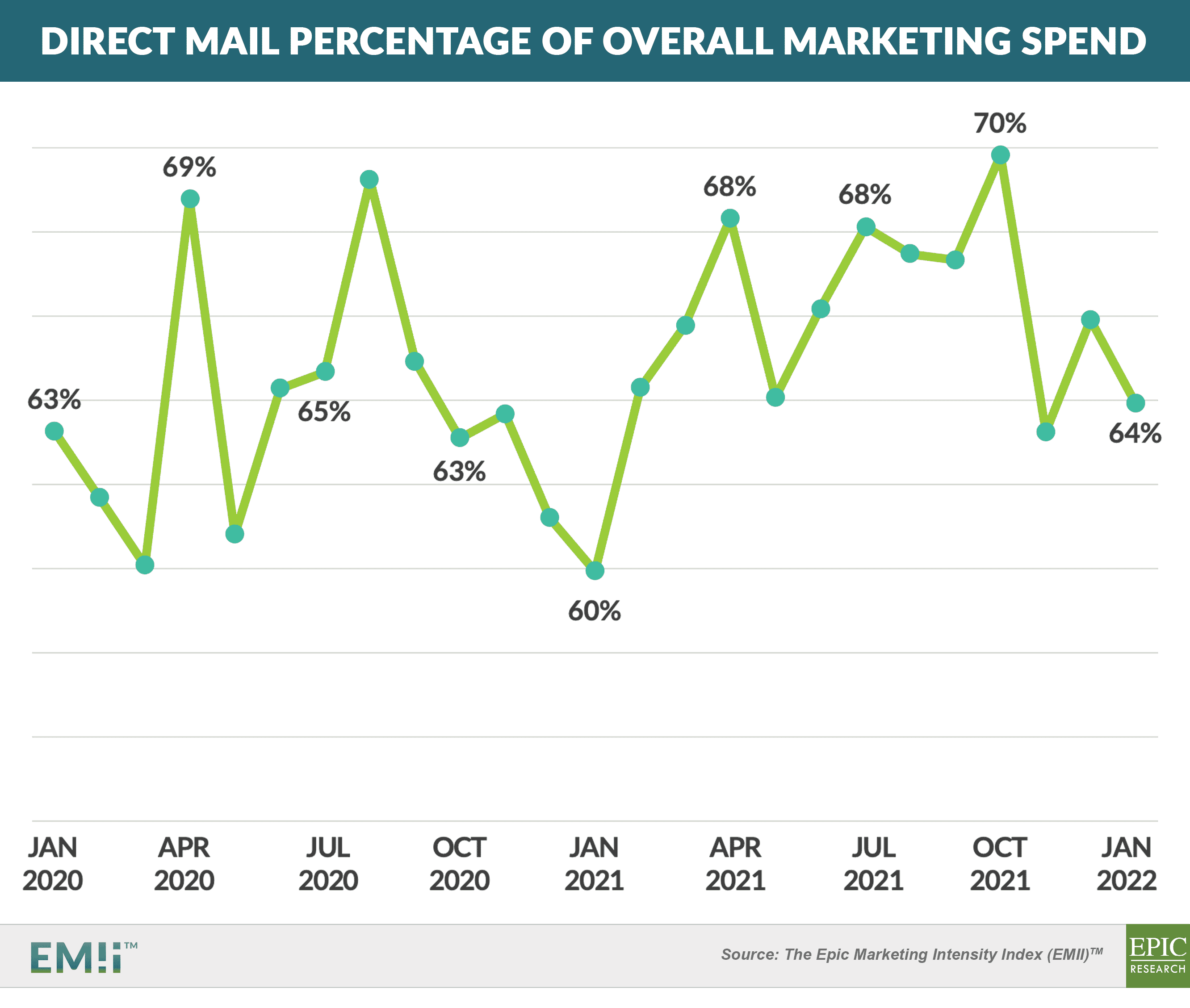

- Although many may think direct mail is “obsolete” and that digital acquisition channels have taken over, consumer financial services marketing is still dominated by direct mail, which consistently accounts for 60%+ of marketing spend

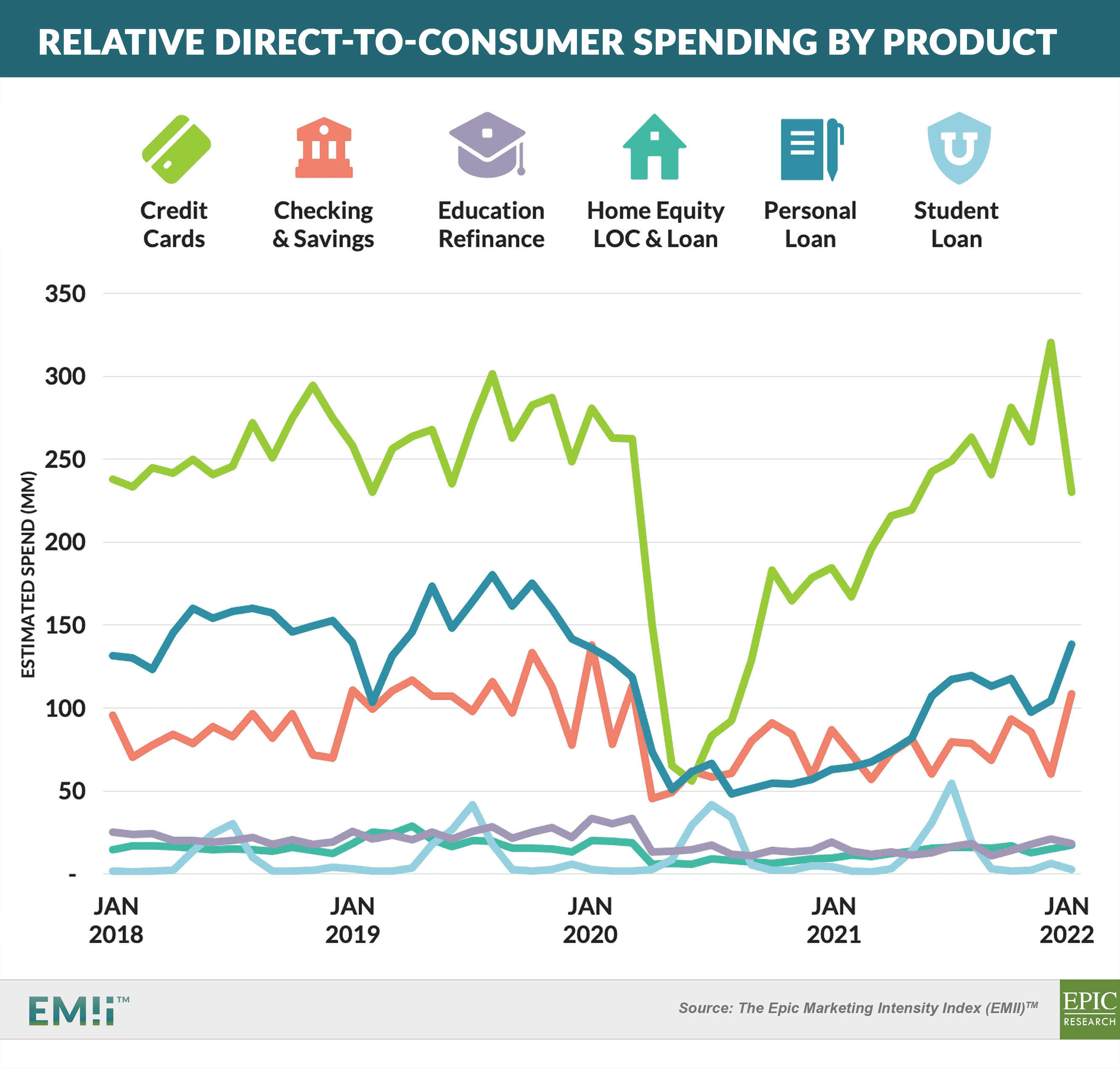

- Across digital and direct mail channels, credit card continues to demand by far the largest marketing spend of any consumer banking product, followed by personal loan

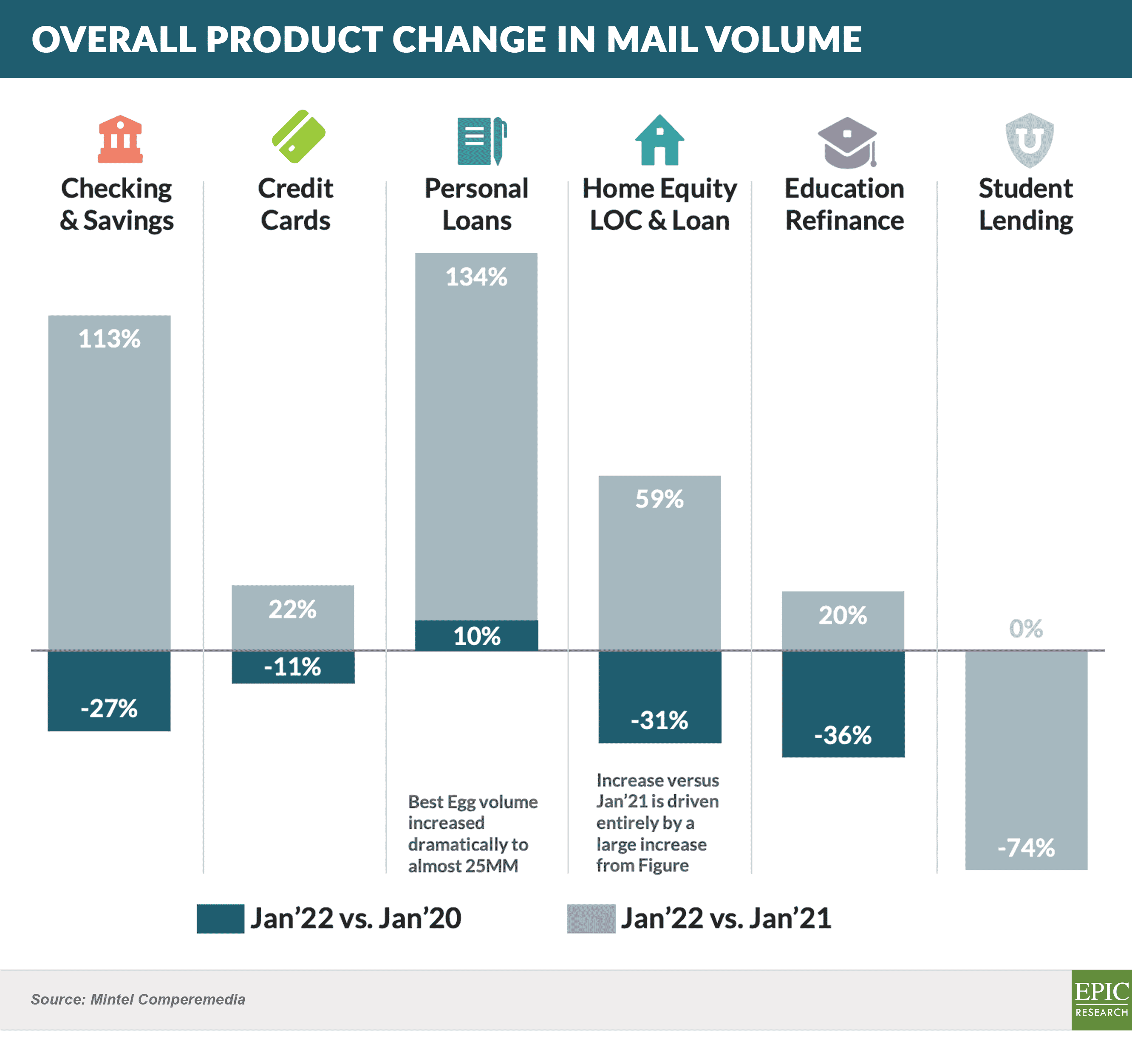

- January ’22 mail volumes were predominantly higher than January ’21, with personal loans, credit cards, and in-school student loan mail volumes having now returned to pre-pandemic levels and checking, HELOC, and education refinance mail volumes still below prior quantities

Quick Takes

- Are the hotter-than-hot BNPL and neobank sectors beginning to cool?

- Despite 100% growth in GMV, Affirm has seen its stock drop 75% in the past four months

- Leading neobank Chime delayed its planned March IPO, likely due to the poor market performance of public fintech stocks

- American Express launched its first digital checking account

- The product targets Millennials and Gen Z consumers who prefer debit cards

- The account also offers a 0.50% APY interest rate and will allow cardholders to earn one membership rewards point for each $2 spent on the accompanying debit card

- Experian announced an industry-first buy now, pay later (BNPL) bureau

- Experian notes that most BNPL loans are not currently reported to credit bureaus

- The separate bureau reflects the fact that most current credit scoring models are developed using data from “mainstream” credit products, and not BNPL accounts

- In the wrap up from its annual Financial Services Forum, Credit Suisse noted a recent trend that may soon extend to other product segments:

Customer acquisition via media properties: Another theme is the acquisition of businesses in media, content and consumer tools, to gain market share. Sallie recently acquired Nitro College, Earnest purchased Going Merry, and Money Lion acquired MALKA media. All should help their new owners gain share in their core markets.

The Epic Report is published monthly, with the next issue publishing on April 2nd.

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here. To subscribe to our newsletter, click here.