Five Things We’re Hearing

- Younger consumers like “pre-qual”

- HELOC lenders still scarred from 2009

- Credit card mail volume soars, other products lag

- Overall financial services ad spending still recovering

- Consumer loan credit criteria loosens

A five-minute read

Younger Consumers Like “Pre-qual”

- Epic recently surveyed 1,228 consumers on their experiences and preferences regarding opening financial accounts online

- In summary

- Most respondents have opened a credit card online, however some expressed hesitancy due primarily to information security concerns

- Consumers appreciate the ability to conduct a “soft inquiry pre-qualification” check with an issuer, and they like to “shop” at several issuers prior to applying

- Of those surveyed, 59% had opened a credit card account online, with consumers under the age of 45 more likely (75%) than older consumers (45%) to have done so

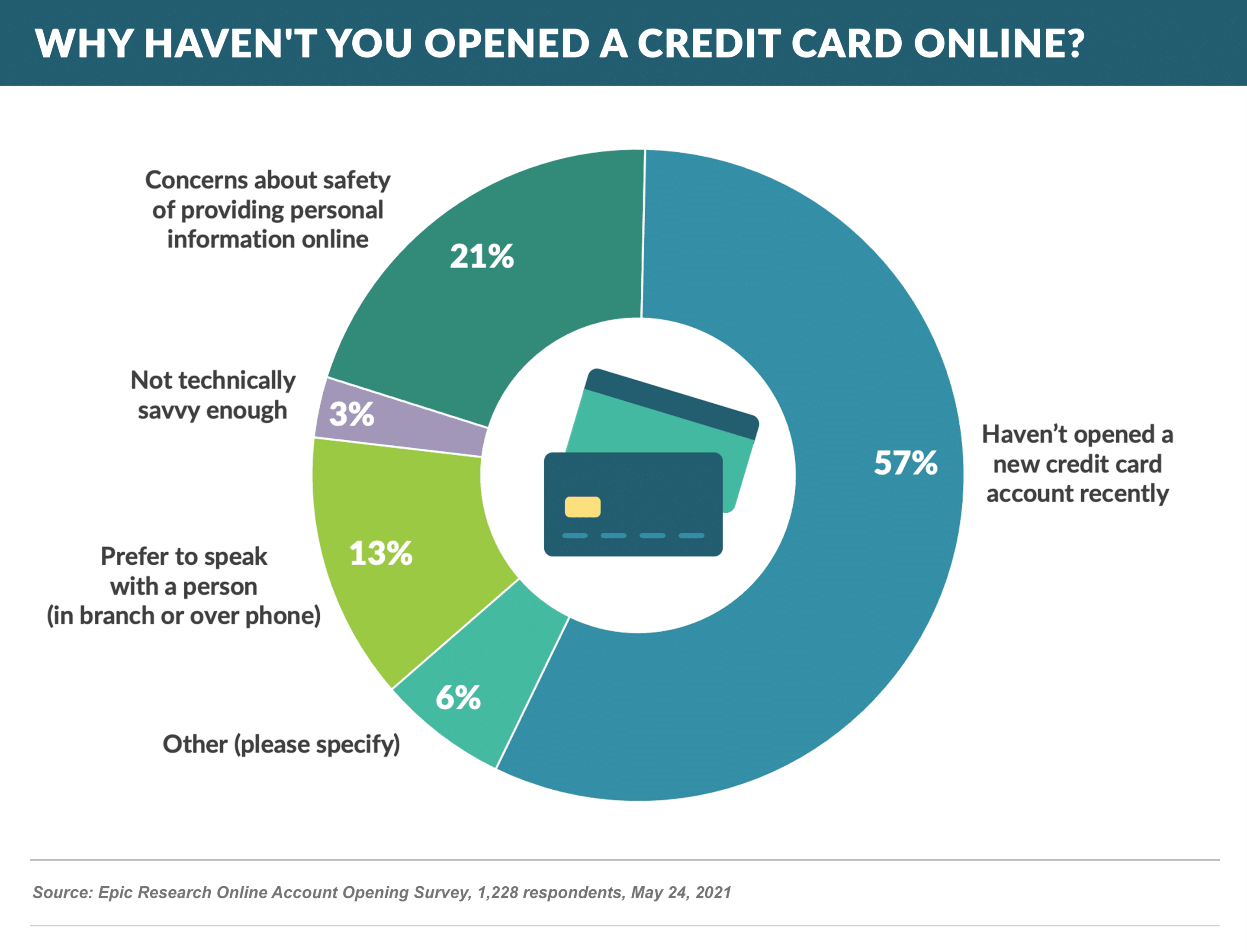

- Beyond not needing a card, the primary reasons cited for not opening a card account online were concerns about providing personal information online and preferring to speak with a person

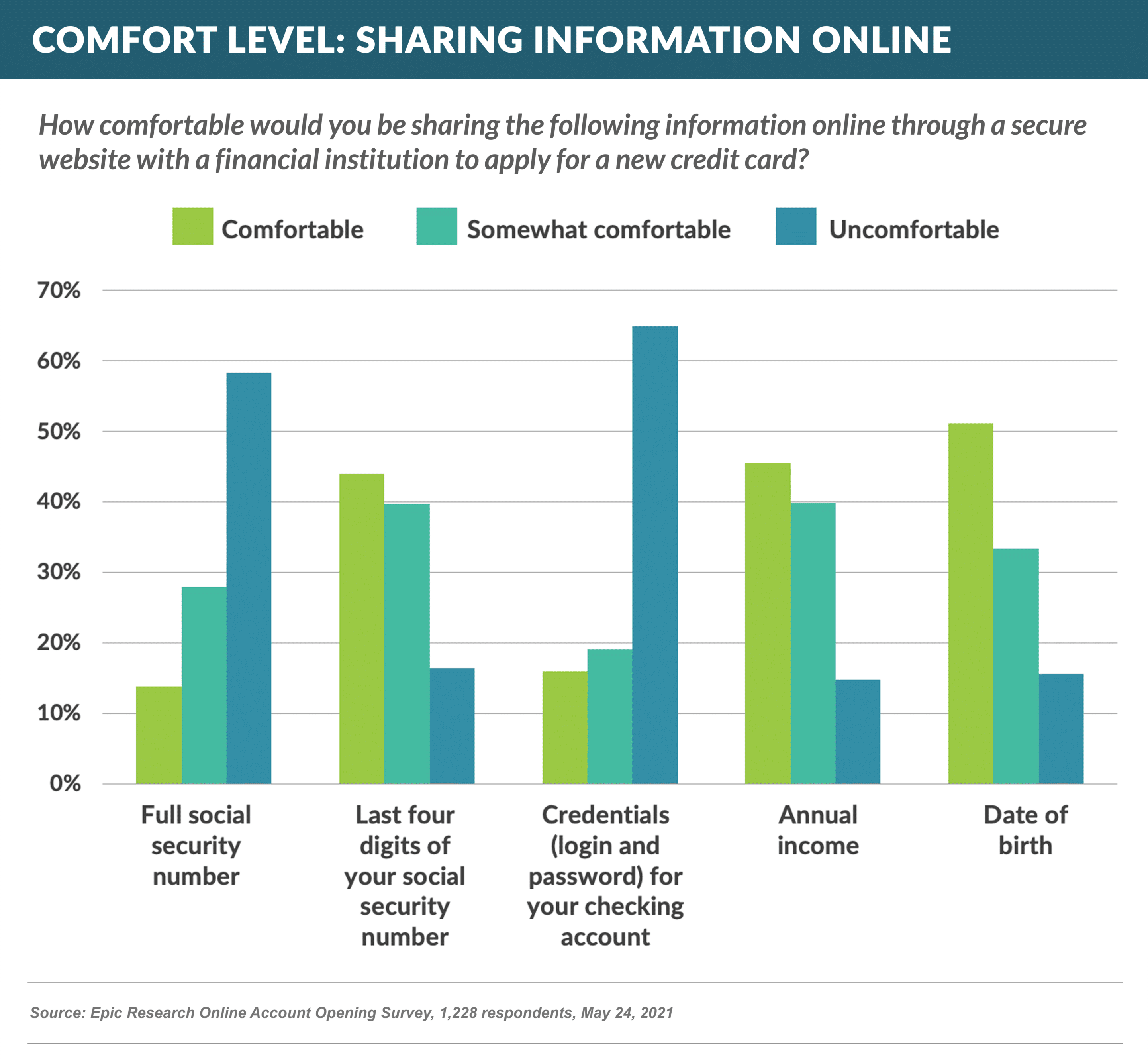

- Consumers’ concerns with the safety of their personal information is most pronounced with social security number – 58% were uncomfortable providing the full number, and 16% were uncomfortable supplying even the last four digits – and login credentials for a checking account (such as used to interface with Plaid) – 65% uncomfortable

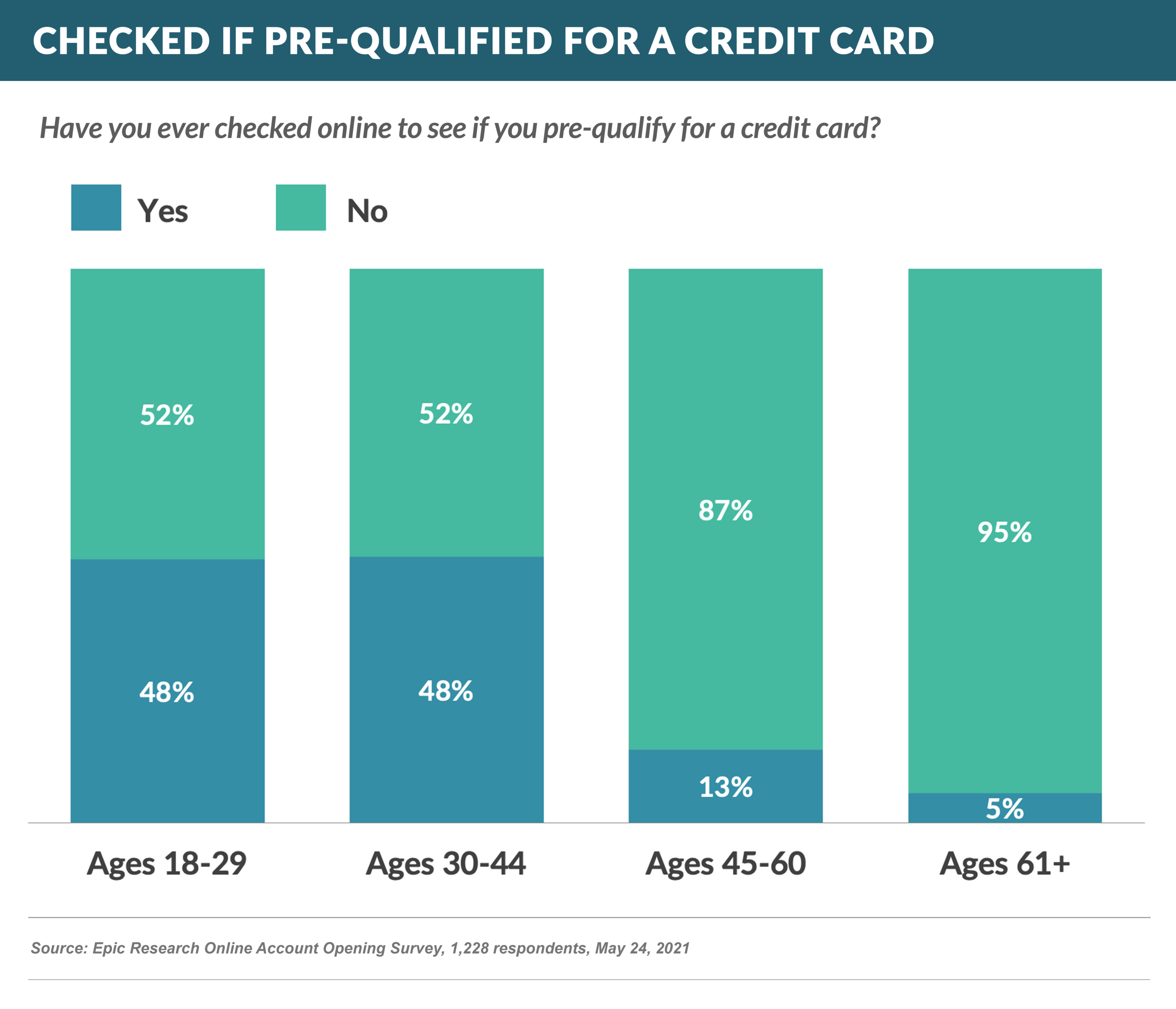

- While only 25% of respondents have conducted a “soft credit inquiry” to assess the likelihood of being approved prior to applying for a card (“pre-qual”), there was a big difference between consumers under 45 years of age – 48% of whom had done so – and older consumers – less than 10%

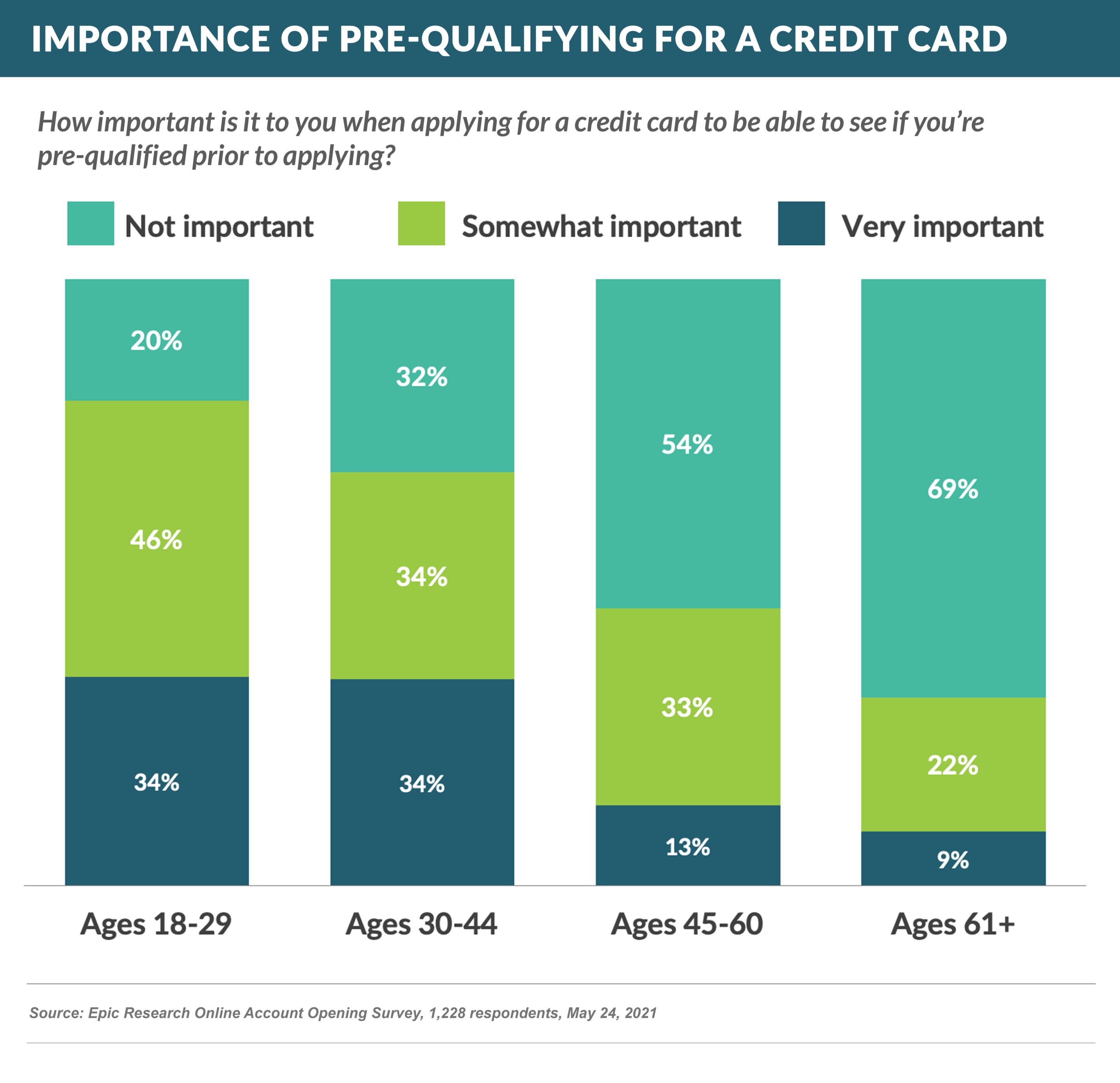

- Pre-qualification was a popular feature amongst younger consumers, with two-thirds of them deeming it important

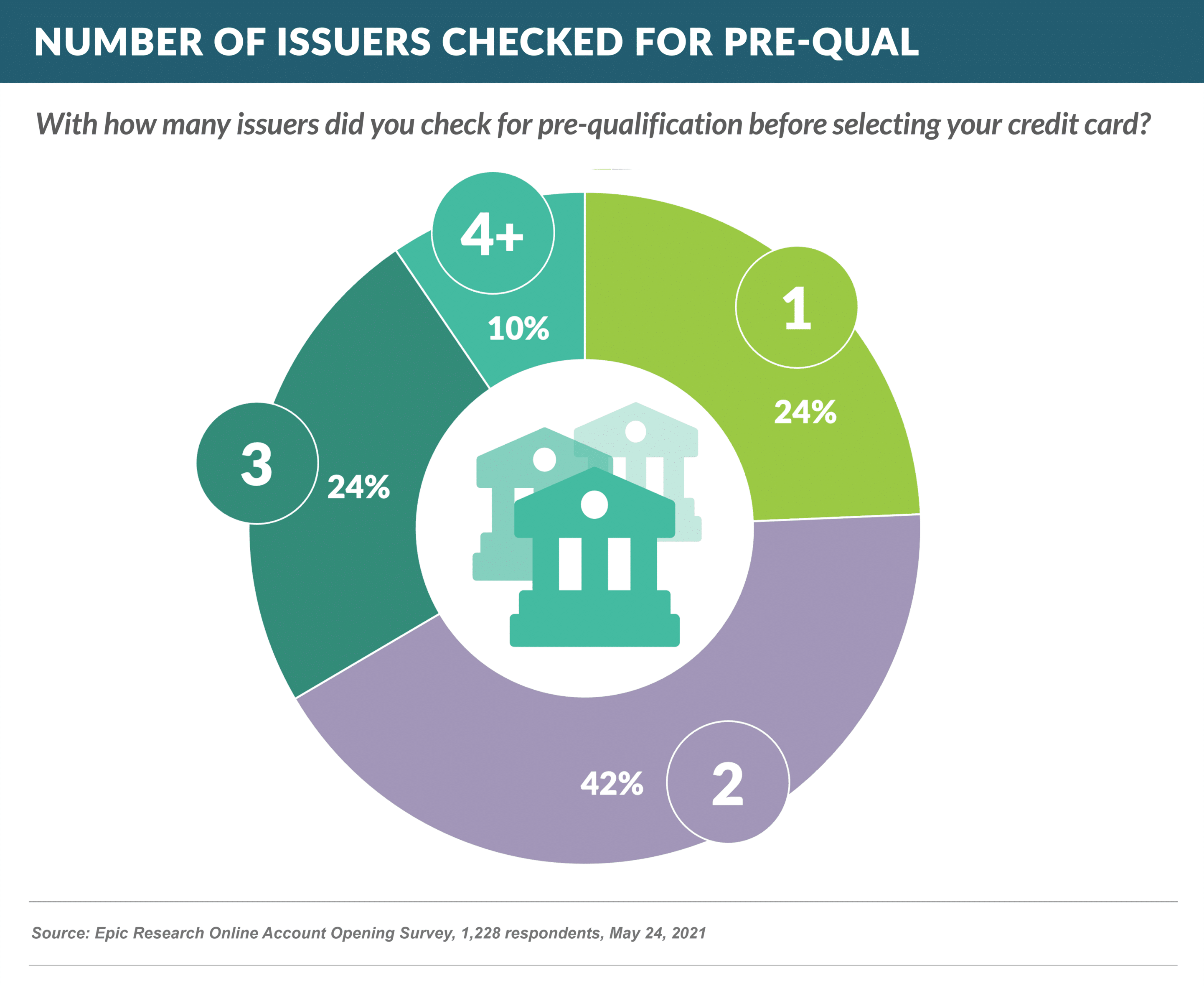

- The majority of consumers who checked for pre-qualification prior to applying for a card did so at multiple issuers, with 34% checking at three or more sites

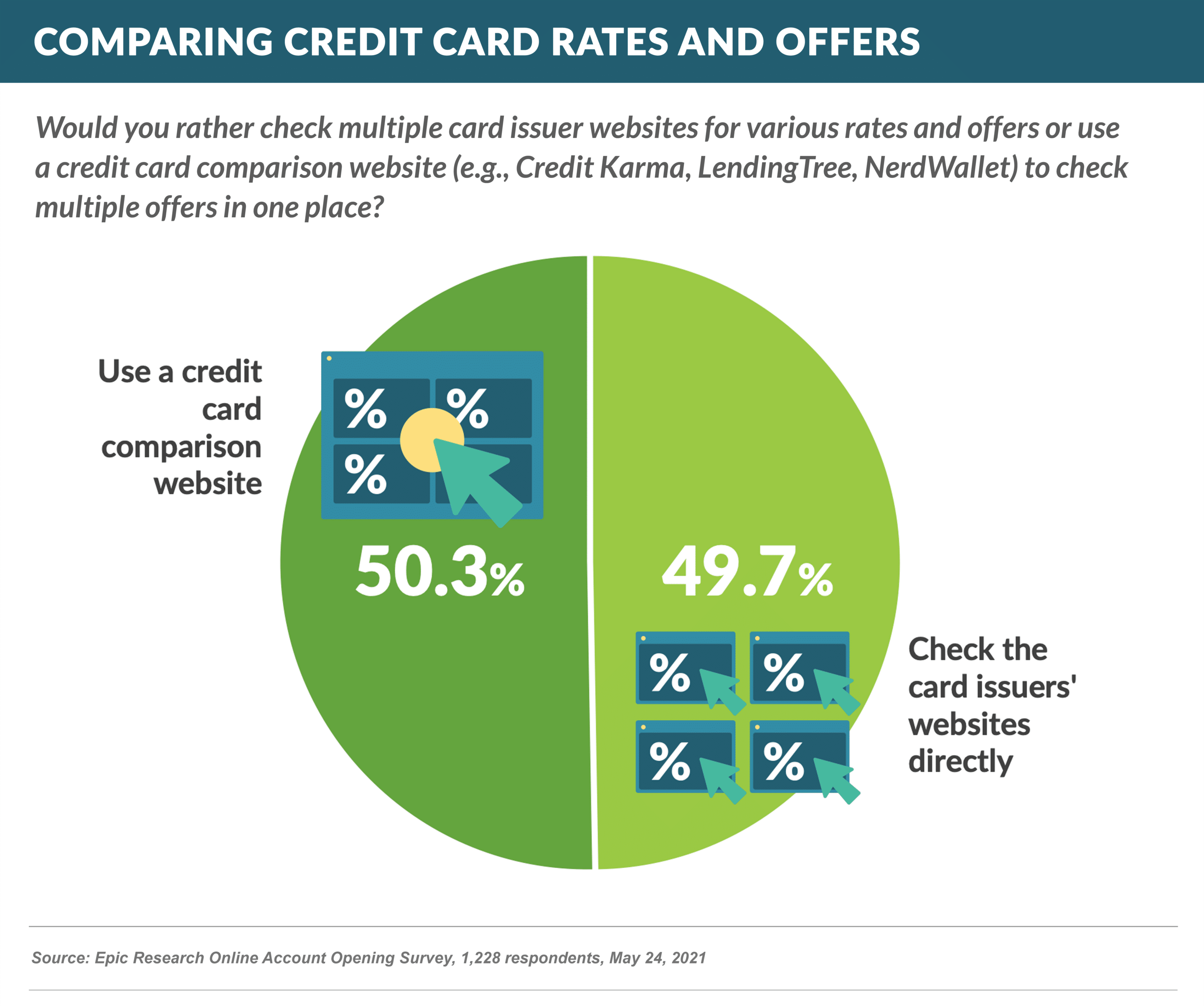

- When asked whether they would rather compare rates using a site such as Credit Karma or NerdWallet, versus going directly to the card issuers’ websites, consumers were split 50/50

HELOC Lenders Still Scarred by 2009

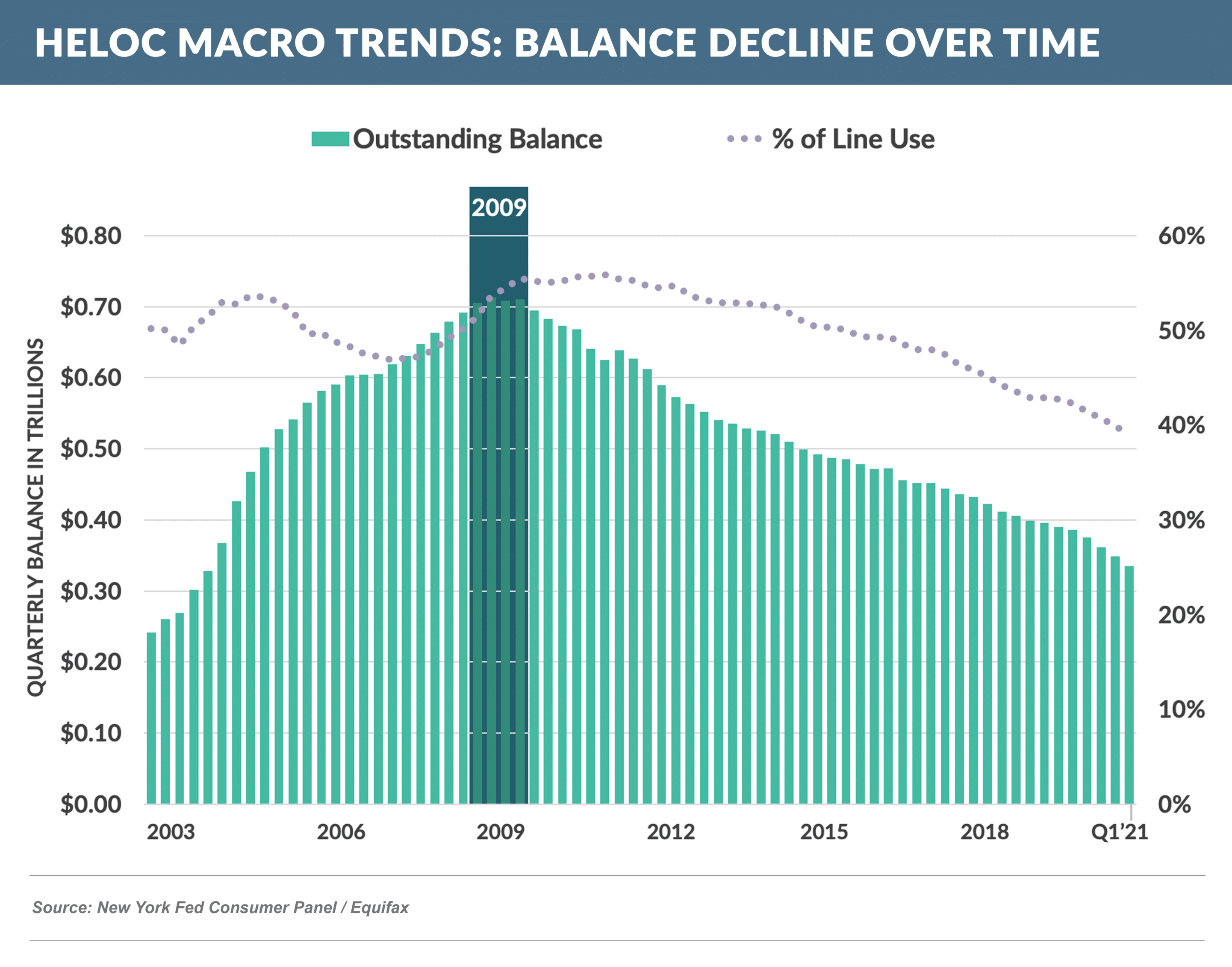

- After peaking in 2009, HELOC balances have shown a steady decline

- In the meantime, equity in homes has surged

- The average homeowner with a mortgage has more than $200,000 in equity

- In 2020 alone, equity in homes increased an average of 16%

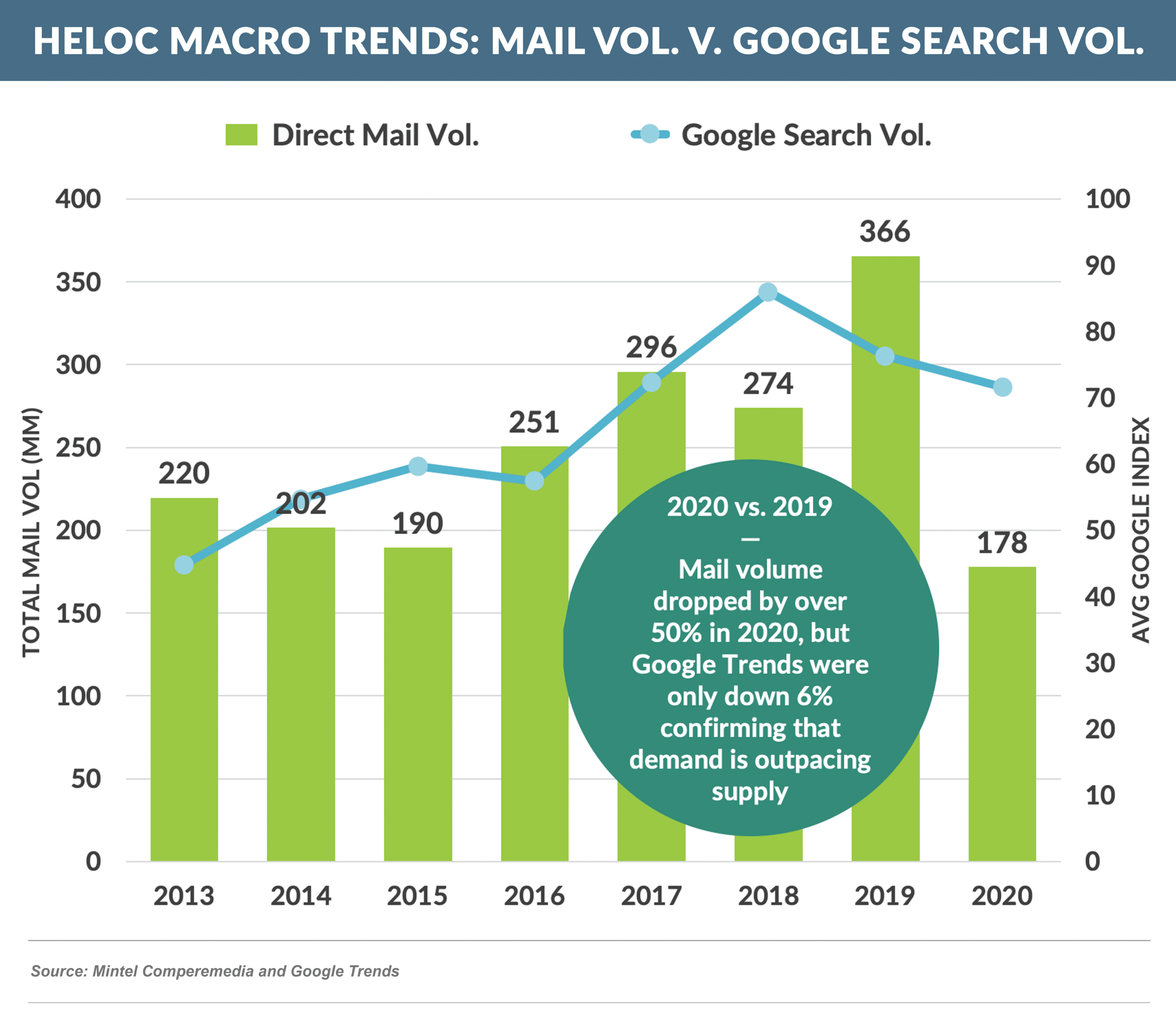

- Consumer interest in HELOCs remains, with the primary driver of lower balances being banks pulling back from the market

- Lenders are wary of the home equity market given the bad experience in 2008-2009, with prominent players such as Chase, Citi, and Wells Fargo having temporarily withdrawn from the market

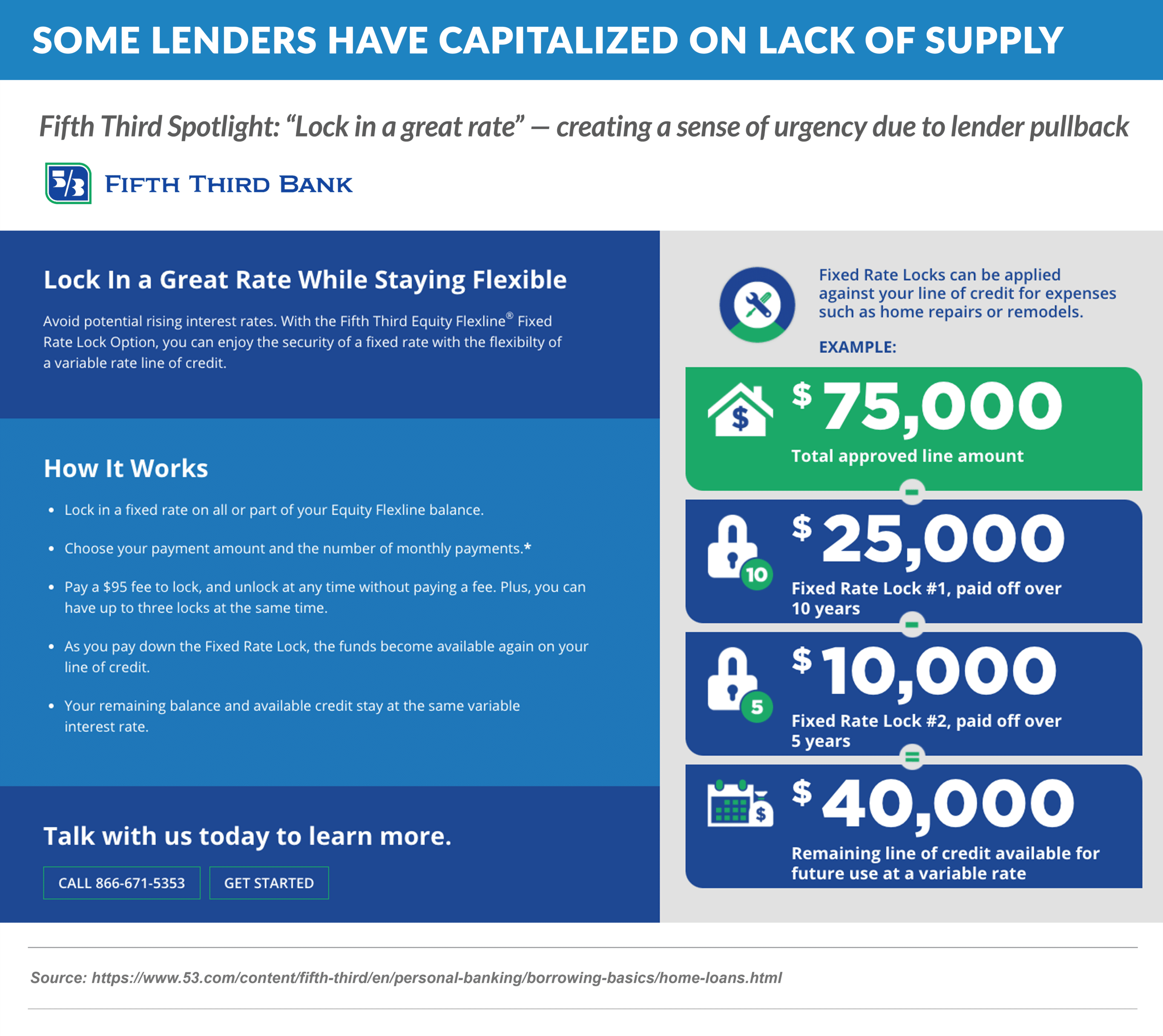

- Other lenders are seeking to take advantage of the lack of supply

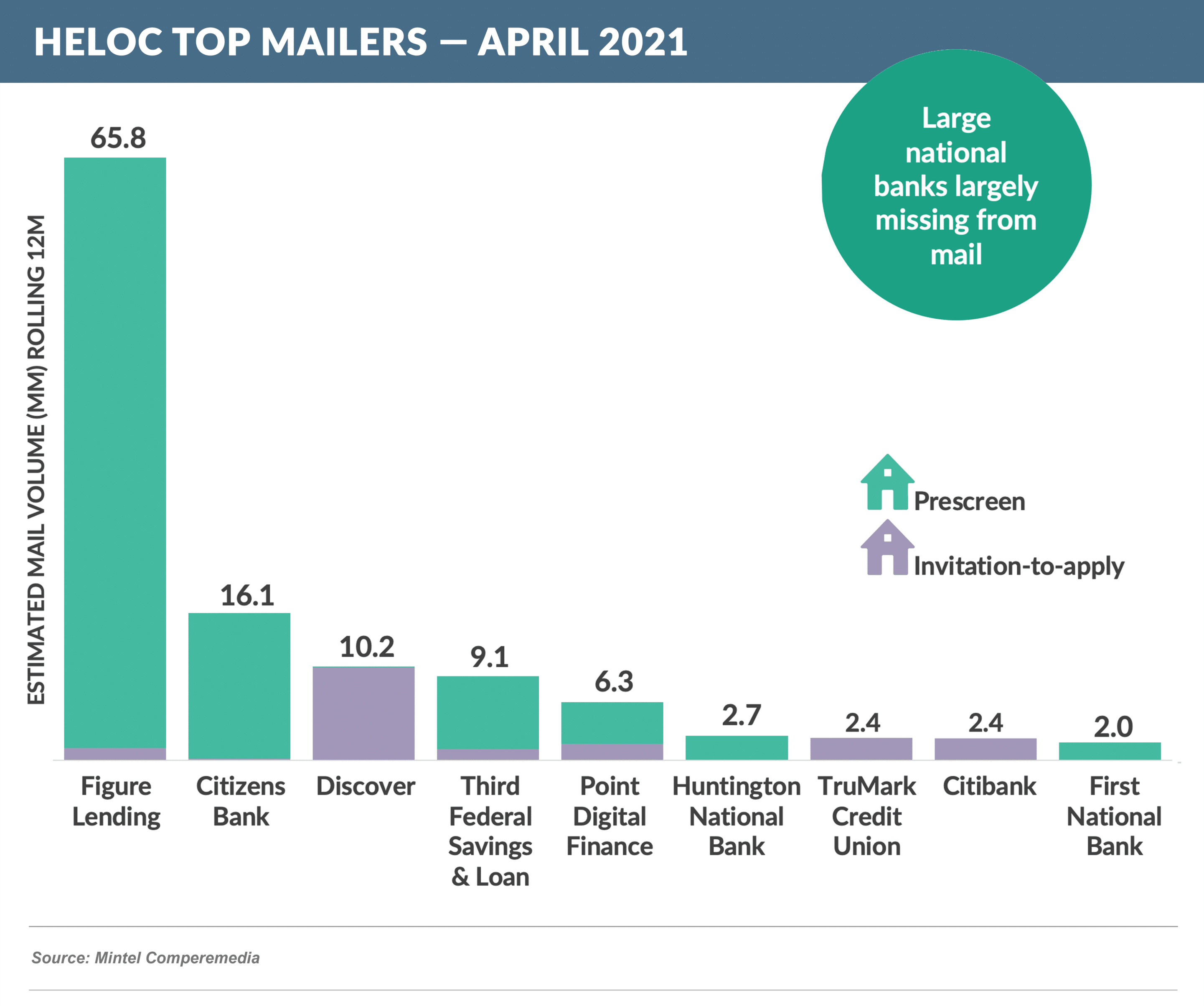

- Alternative lender Figure has been the dominant HELOC mailer in the past year

- Figure’s product is somewhat unique – unlike other HELOC lenders, Figure requires immediate drawdown of the entire credit line and charges a 3% - 5% origination fee

- Personal loans and cash-out refi have undoubtedly taken some market share away from HELOCs, but lenders’ willingness to re-enter the market with innovative products remains the question going forward

Credit Card Mail Volume Soars, Other Products Lag

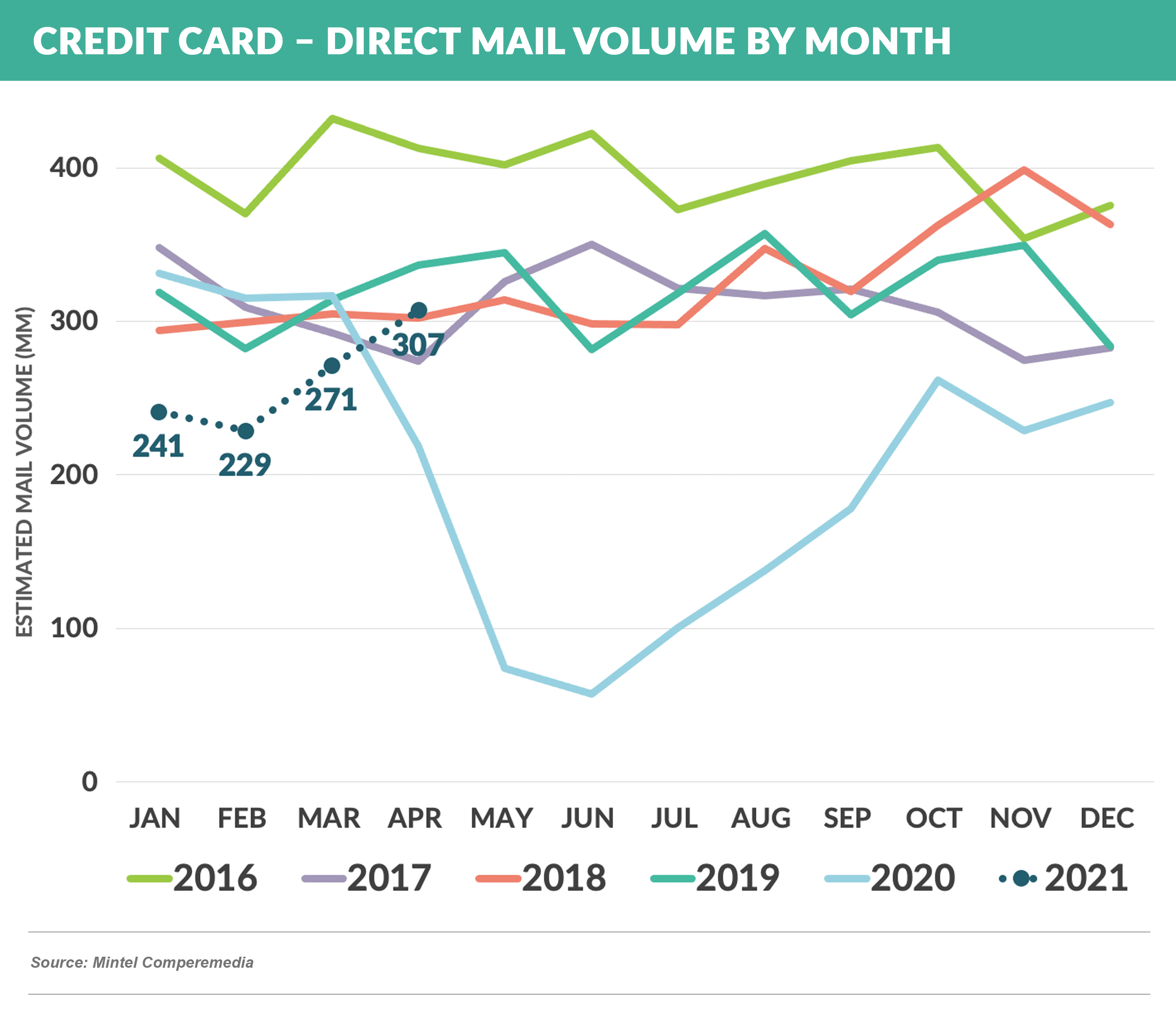

- After an 80% pandemic-related drop in credit card mail volume, mail has finally recovered and reached a volume higher than April 2017 and 2018 levels

- This follows a steady recovery over the past six months and is consistent with issuer commentary signaling a strong marketing push in 2021

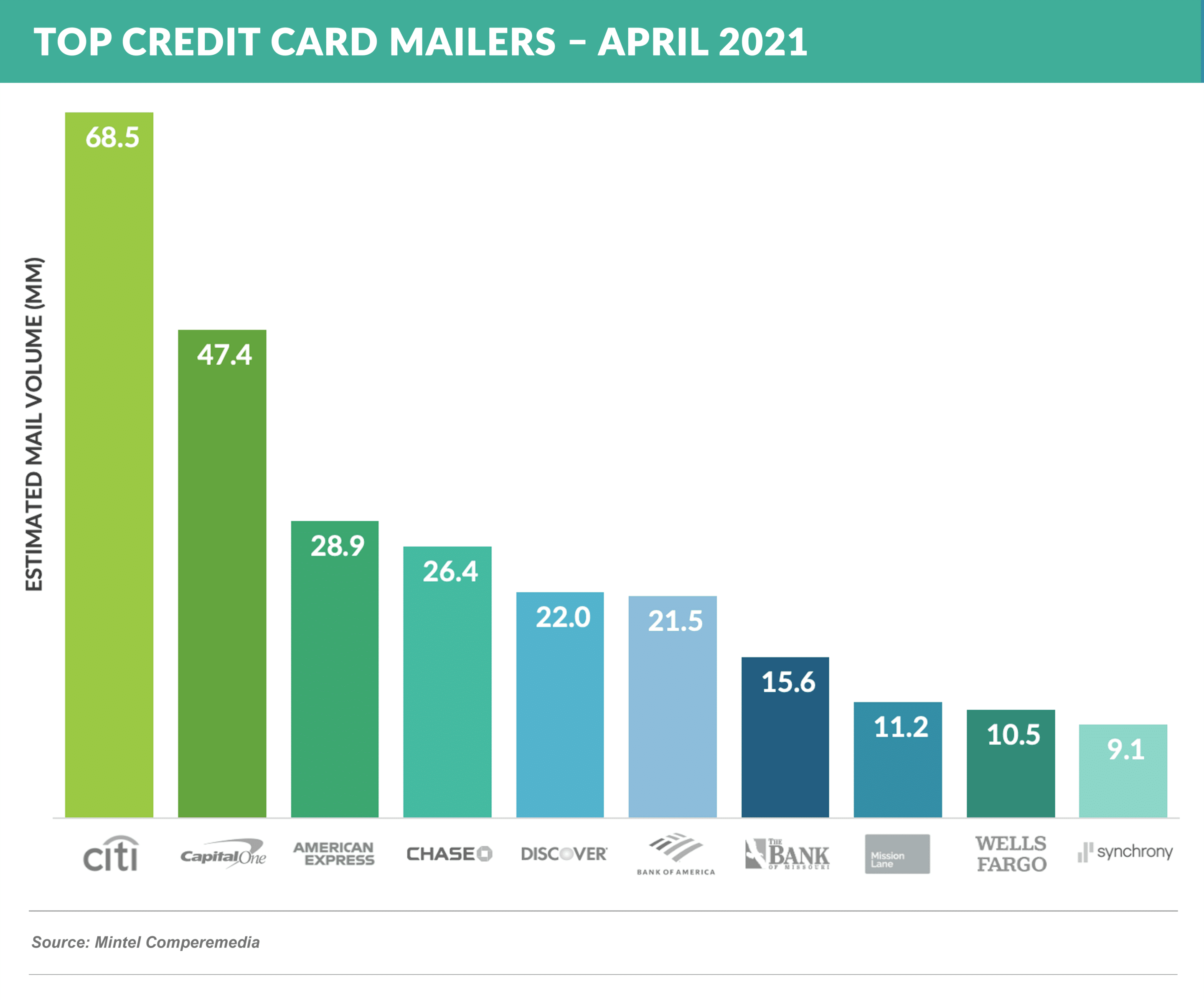

- Citi led the way, followed by Capital One, American Express, and Chase with relatively new issuer Mission Lane entering the top 10 with its credit builder product

- Cash back and rewards cards were the dominant products

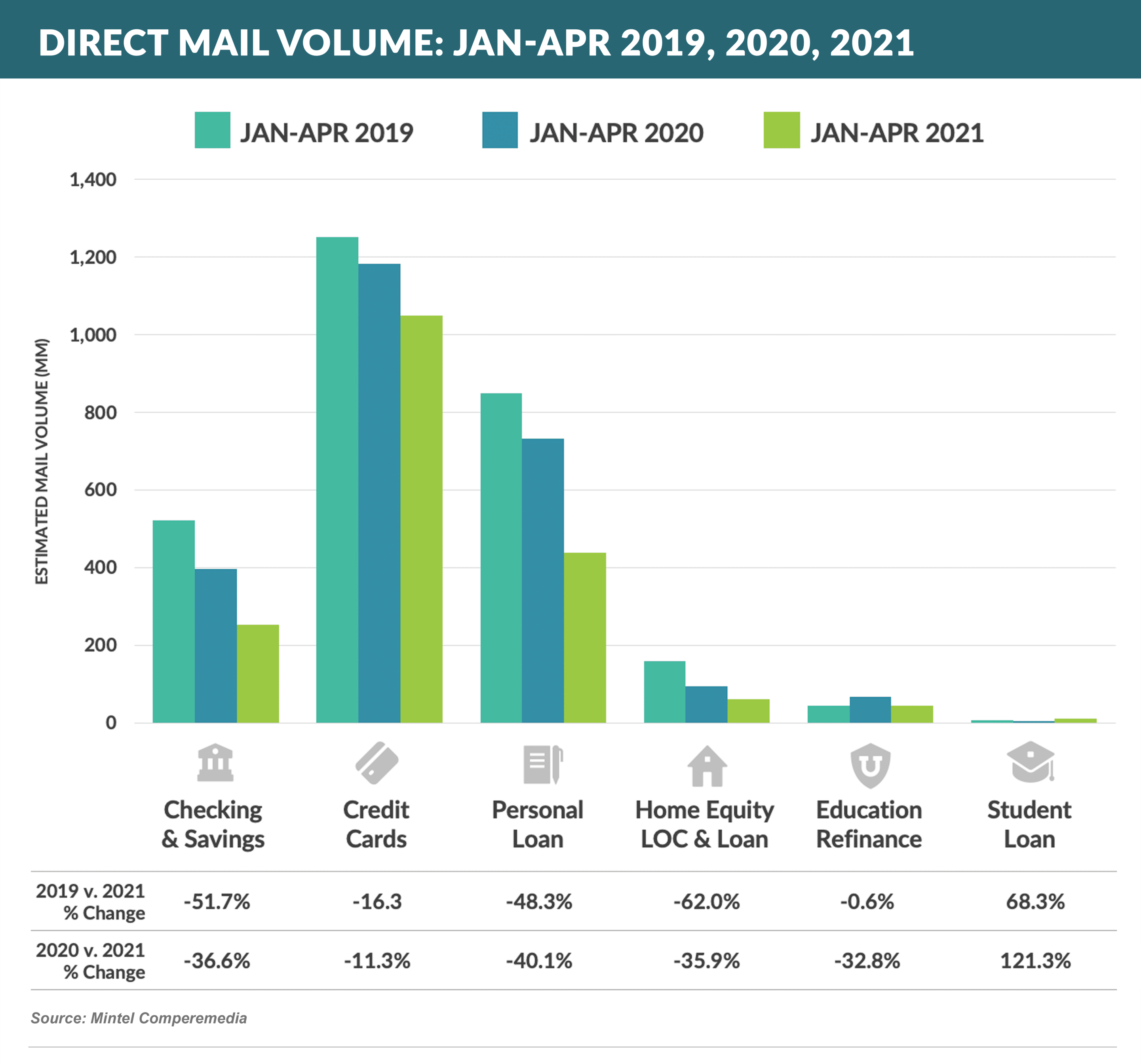

- When comparing mail volume for the first four months of 2021 to the same period in prior years, checking and savings, personal loan, and HELOC significantly lag behind credit card

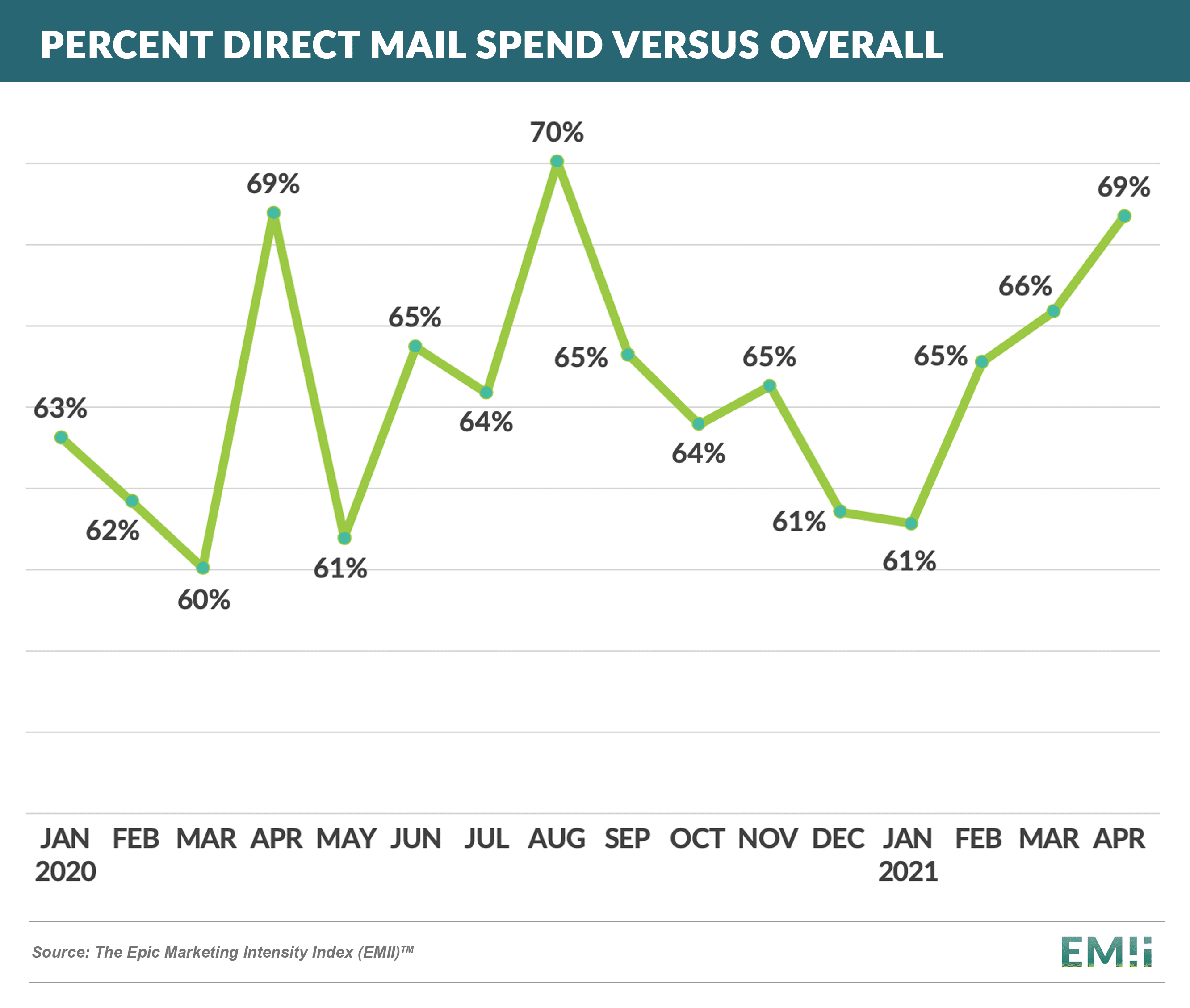

Overall Financial Services Ad Spending Still Recovering

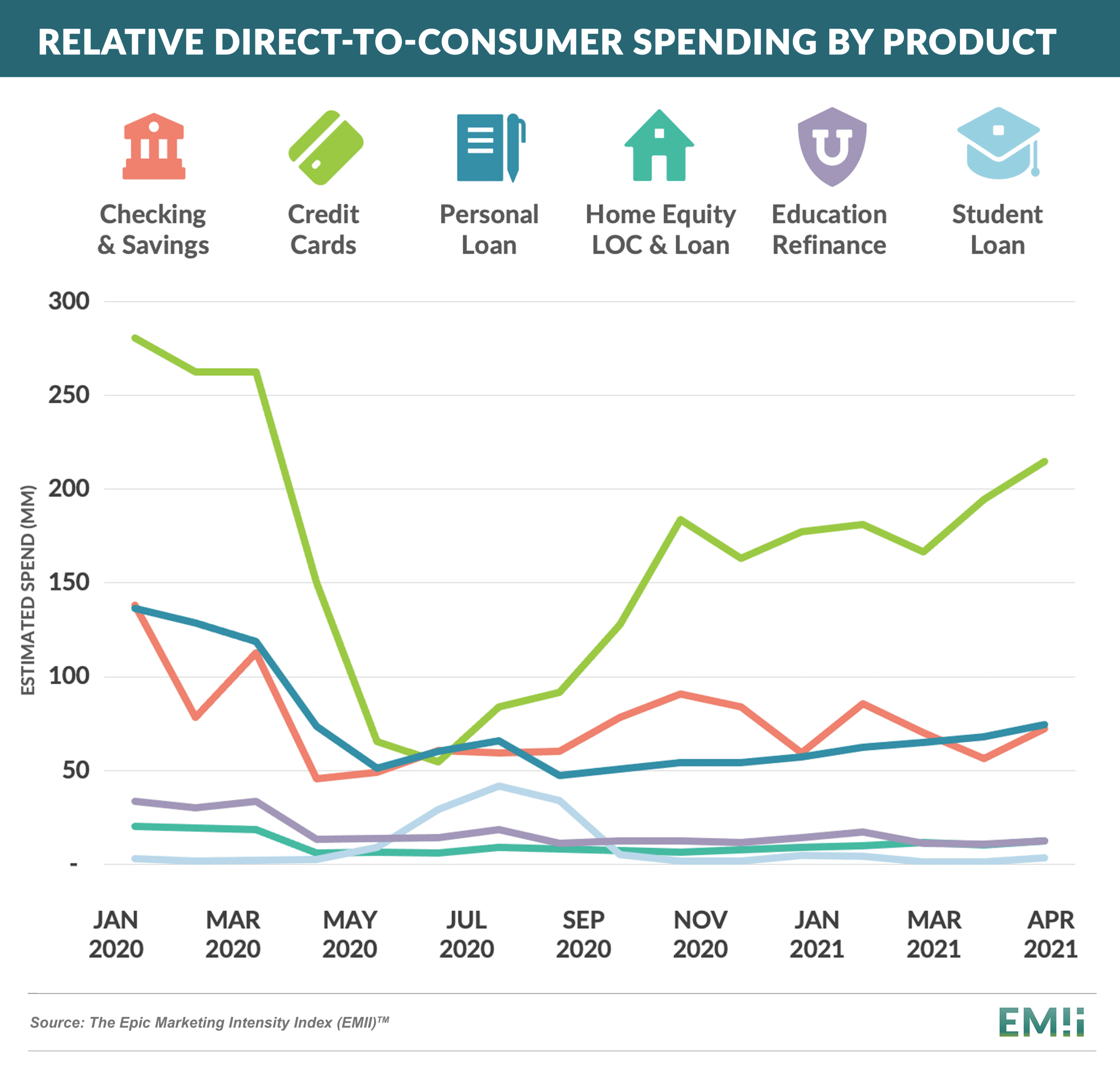

- The Epic Marketing Intensity Index (EMII) – which measures estimated marketing spend across direct mail, search, and paid digital – shows a continued recovery across most products and channels

- The increase in ad spending is driven by a return of direct mail, which now represents almost 70% of all spending

- We expect a continued uptrend in financial services acquisition spending throughout 2021

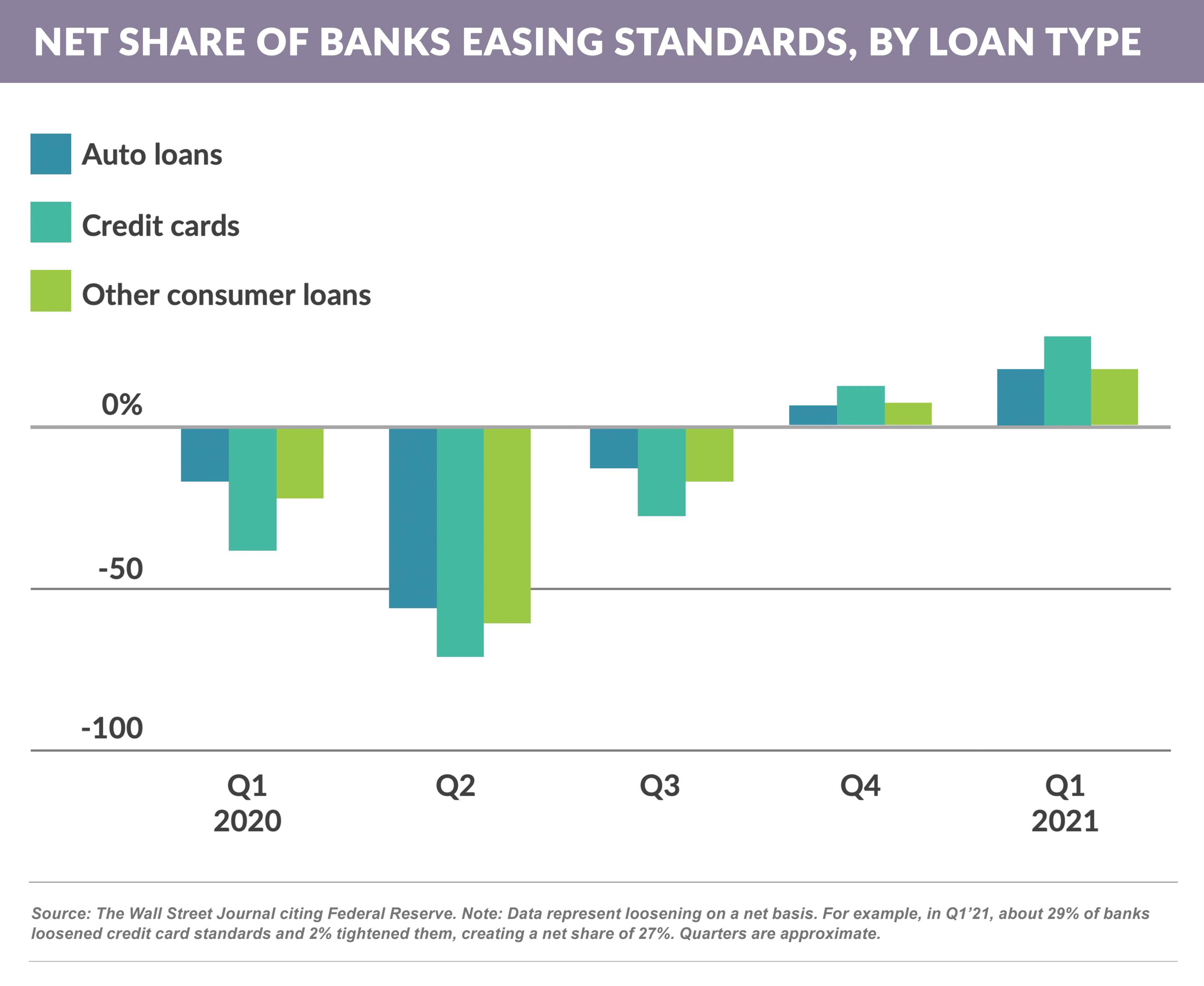

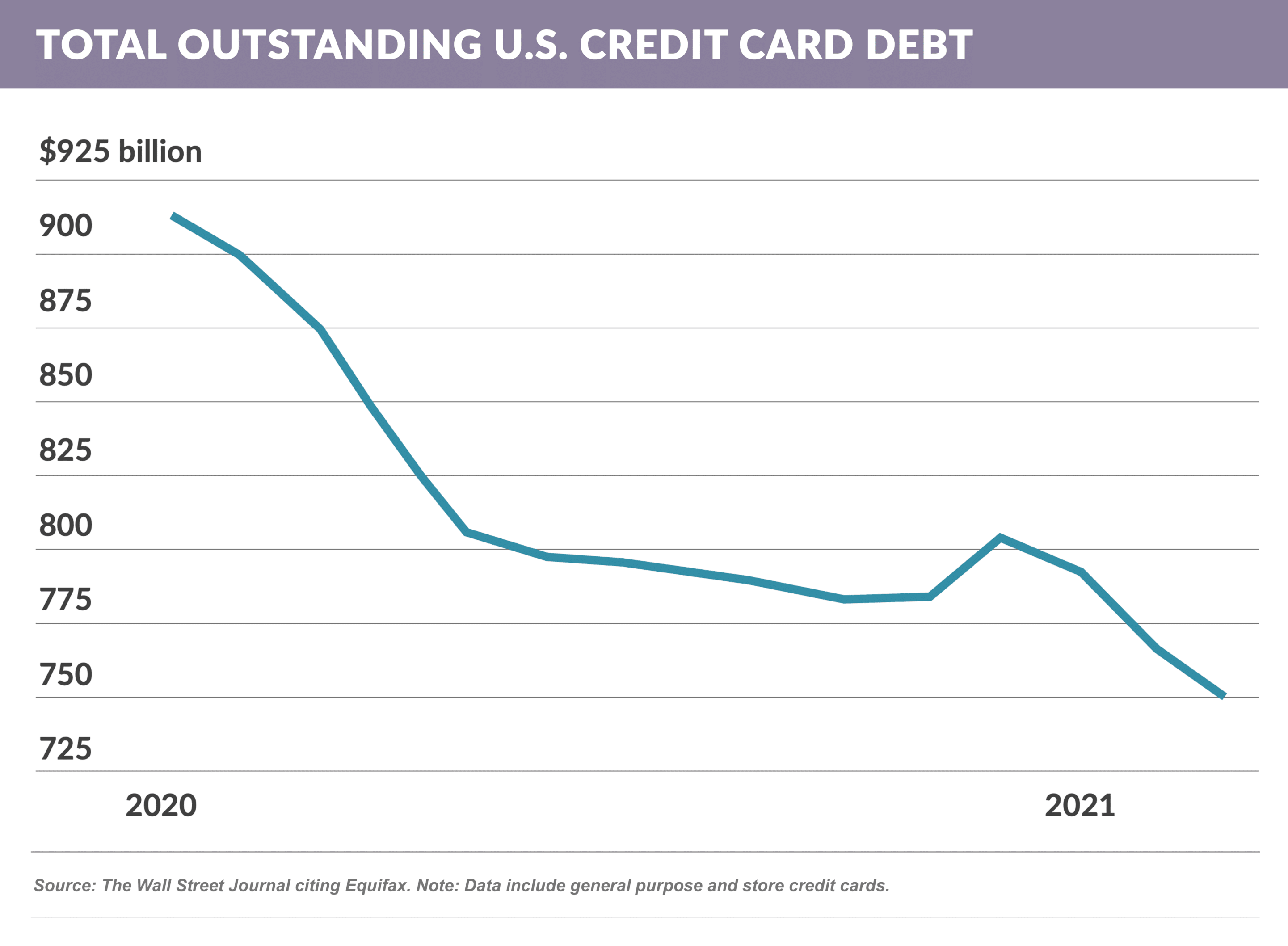

Consumer Loan Credit Criteria Loosens

- The Wall Street Journal reports that banks are easing credit criteria for credit cards and other consumer loans according to a survey by the Federal Reserve

- 29% of banks eased their credit criteria for cards in Q1 2021, in part to reverse the massive drop in outstanding card loans experienced in 2020

- Additionally, a recent report reveals that JPMorgan, US Bank, Wells Fargo, and others plan to share data on consumer deposit accounts in an effort to increase the opportunity for credit card approval for the 53 million adults without credit scores

- While checking and savings data should add value to credit decisions, any thoughts that it will replace credit bureau data for all scoring decisions are dubious given the unprecedented predictive power of credit data

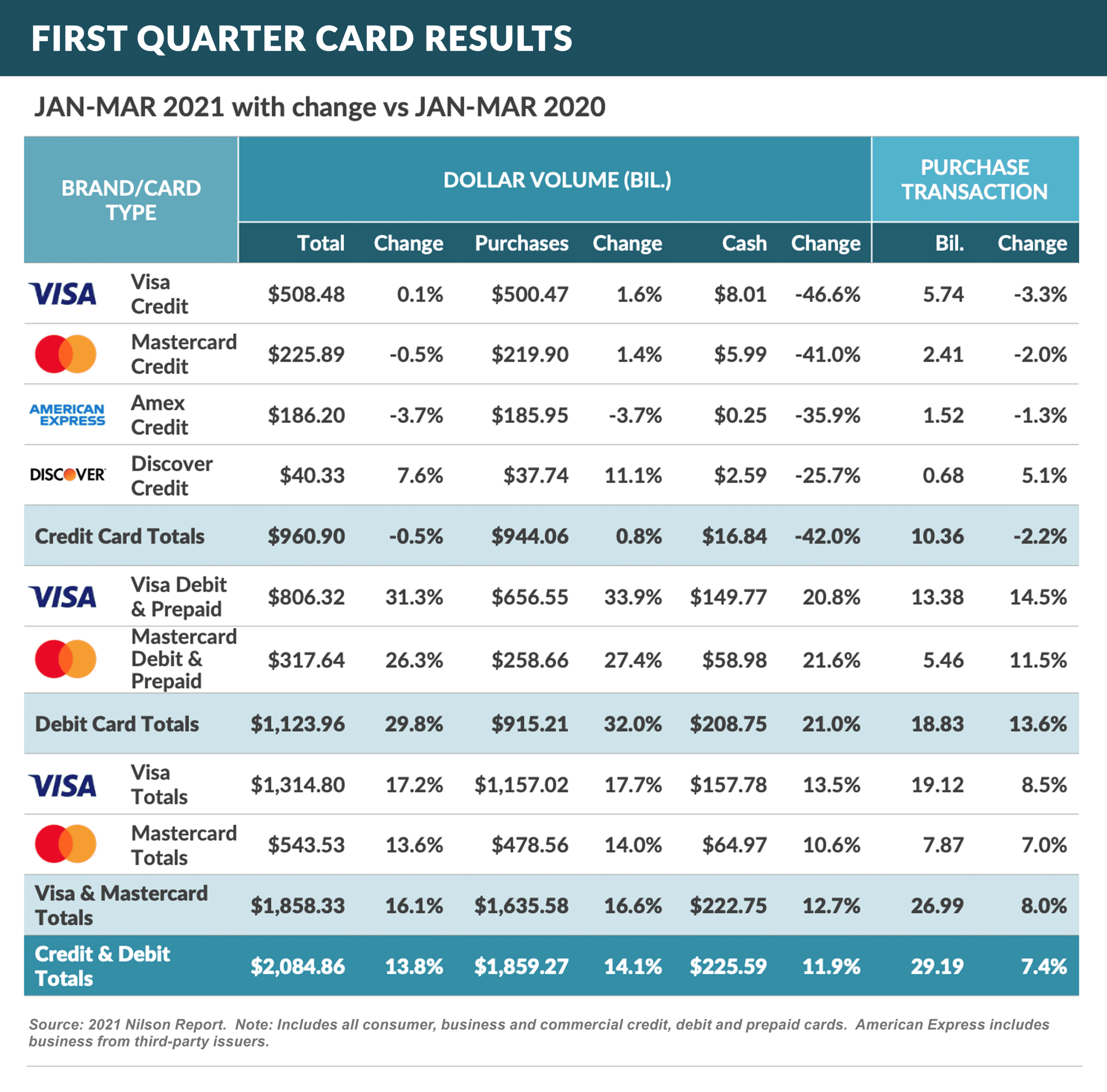

Quick Takes

- Q1 2021 credit card purchase volume was flat to Q1 2020, however debit card purchase volume rose 32% as consumer spending began to re-ignite

- There are indications that innovative point of sale payment provider Square will enter the market for small business checking and savings accounts

- Q1 earnings reports show that banks continued to release credit loss reserves at a higher-than-expected rate; however, loan balance growth still lags

Thank you for reading.

The Epic Report is published monthly, and we’ll distribute the next issue on July 10th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here