Three Things We’re Hearing

- Possible good news coming?

- Asset quality trends are misleading

- Credit card growth has stalled

Today’s newsletter takes 2 minutes to read

Possible Good News Coming?

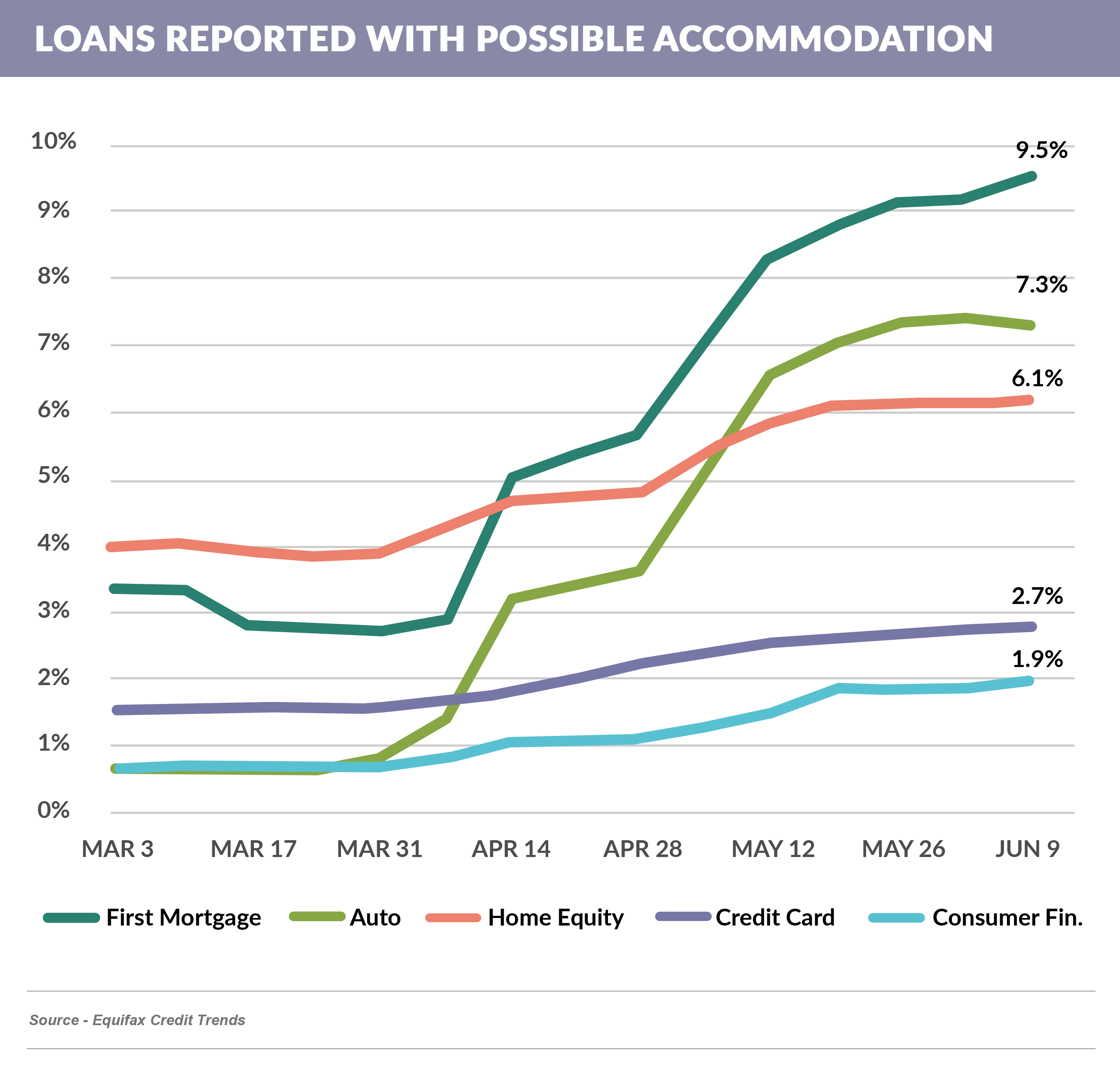

- The number of consumers with modified payments has risen since late March

- Lender profitability and future loan growth is dependent on consumers’ ability to resume paying their bills

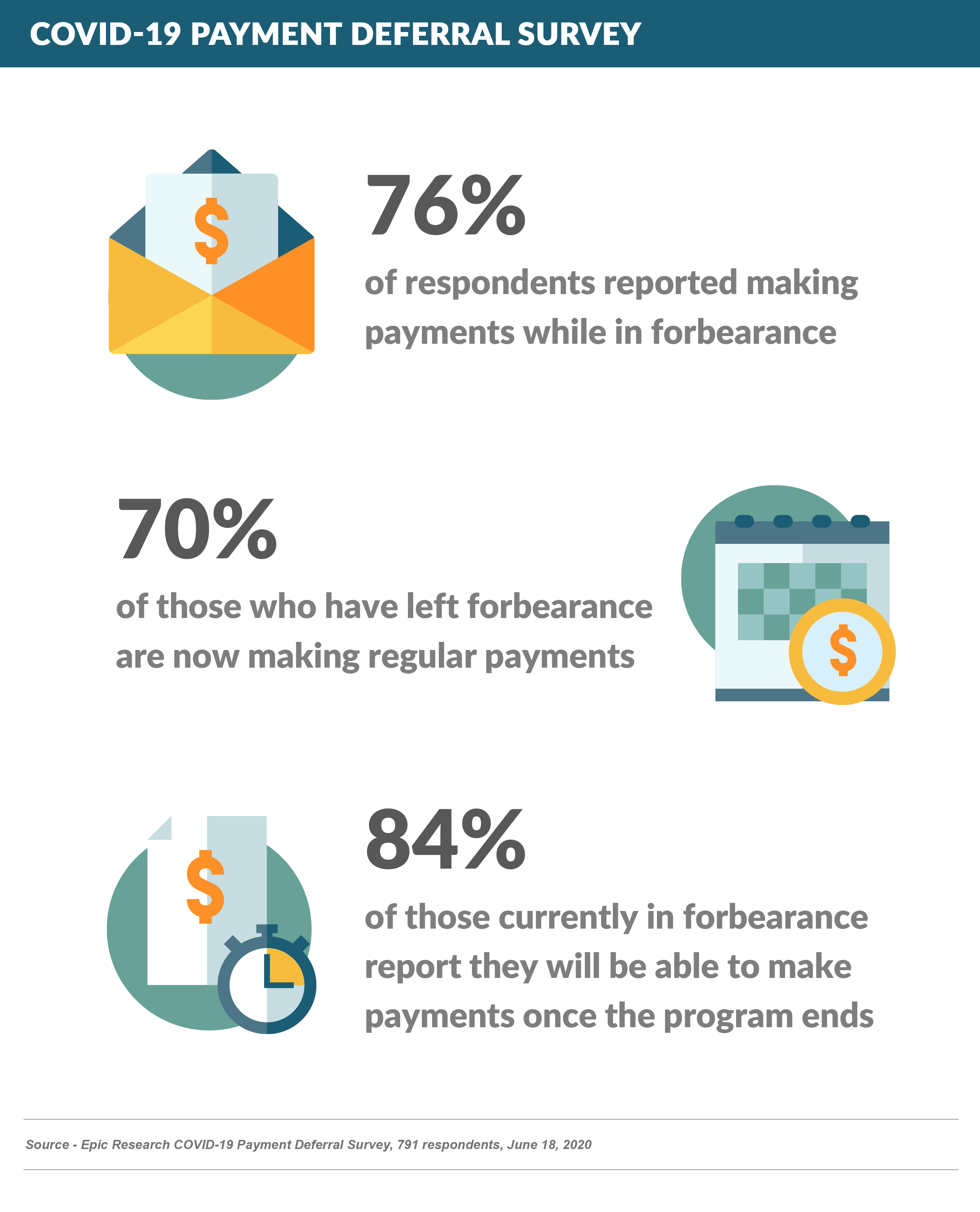

- Epic fielded a survey earlier this week, which showed potentially positive news for the post-forbearance period:

- This positive news could be tempered by the fact that those receiving unemployment benefits were 21% more likely to be making payments, and those benefits will soon end.

Asset Quality Trends Continue to Mislead

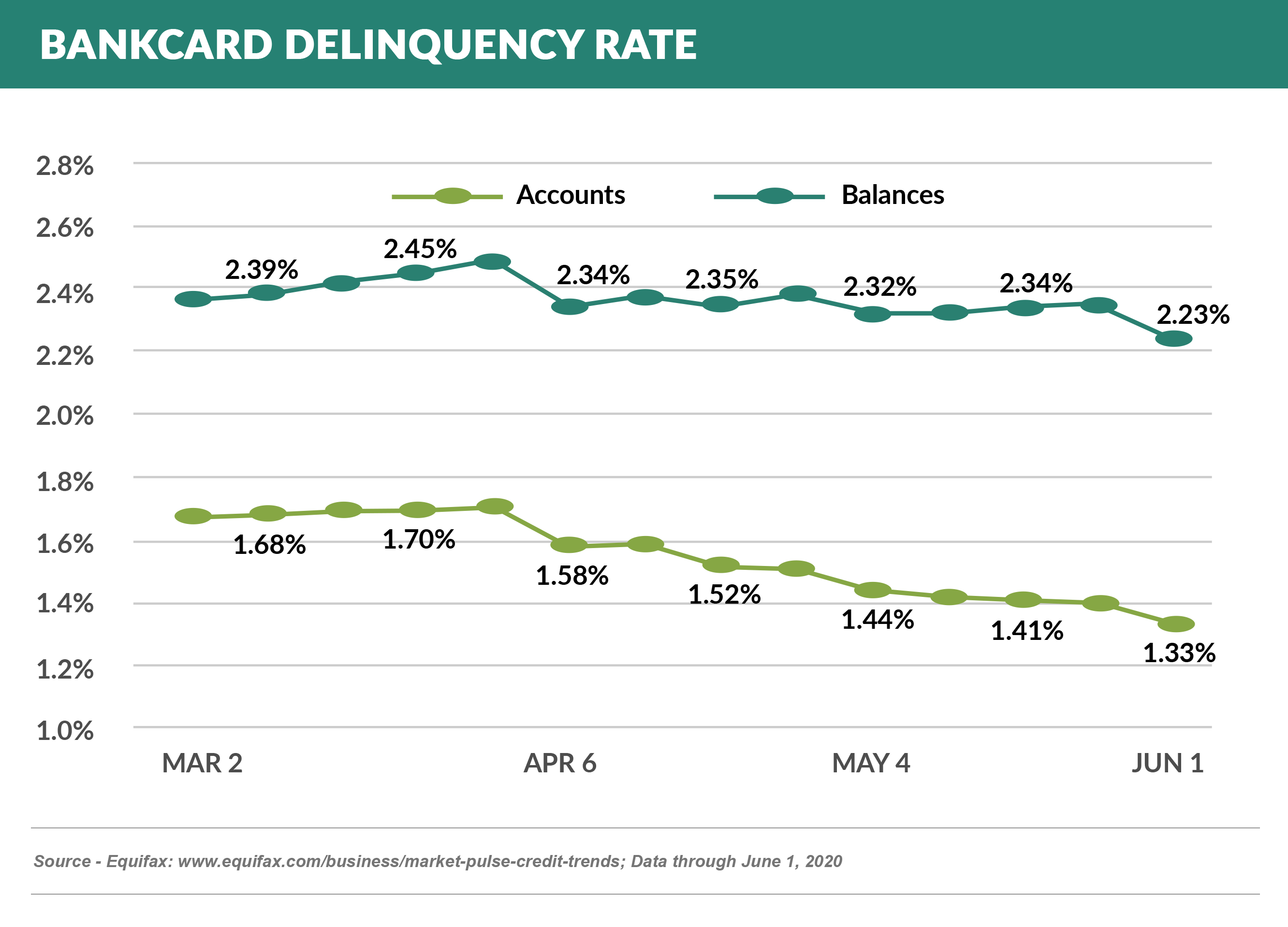

- As discussed in previous newsletters, asset quality numbers do not yet reflect the unprecedented rise in unemployment, largely due to economic stimulus and unemployment payments, along with widespread forbearance programs provided by lenders

- This trend will change over the next few months as supplemental payments and forbearance programs end

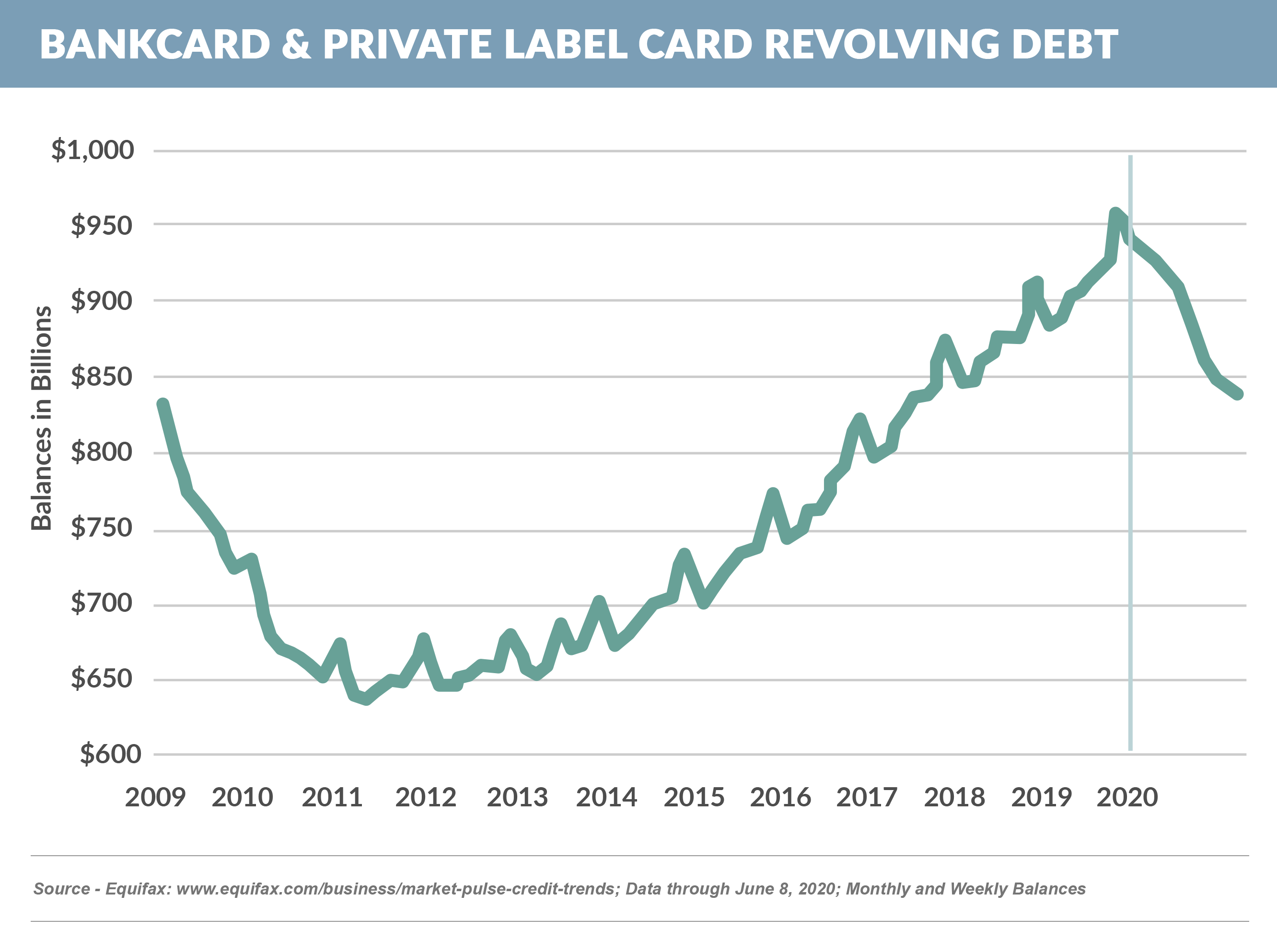

Credit Card Issuer Growth Has Stalled

- May month-end reporting reflects the trends of positive delinquency and loss rates shown above, however year-over-year growth rates have stalled:

- Capital One reported a 3% decline in card loans

- Discover was down 2.2%

- And transactor-heavy American Express declined 13.3%

- Lower growth rates will be further tested if loss-impaired profitability causes further reductions in new customer acquisition

Going Forward

- As the summer approaches, will growth return?

- Or will CEOs return to the failed strategy of cutting marketing and hiring too many collectors?

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.