Three Things We’re Hearing

- Consumer lending executives are cautiously optimistic

- Student lending activity still lags

- Further signs of life in credit cards

A three-minute read

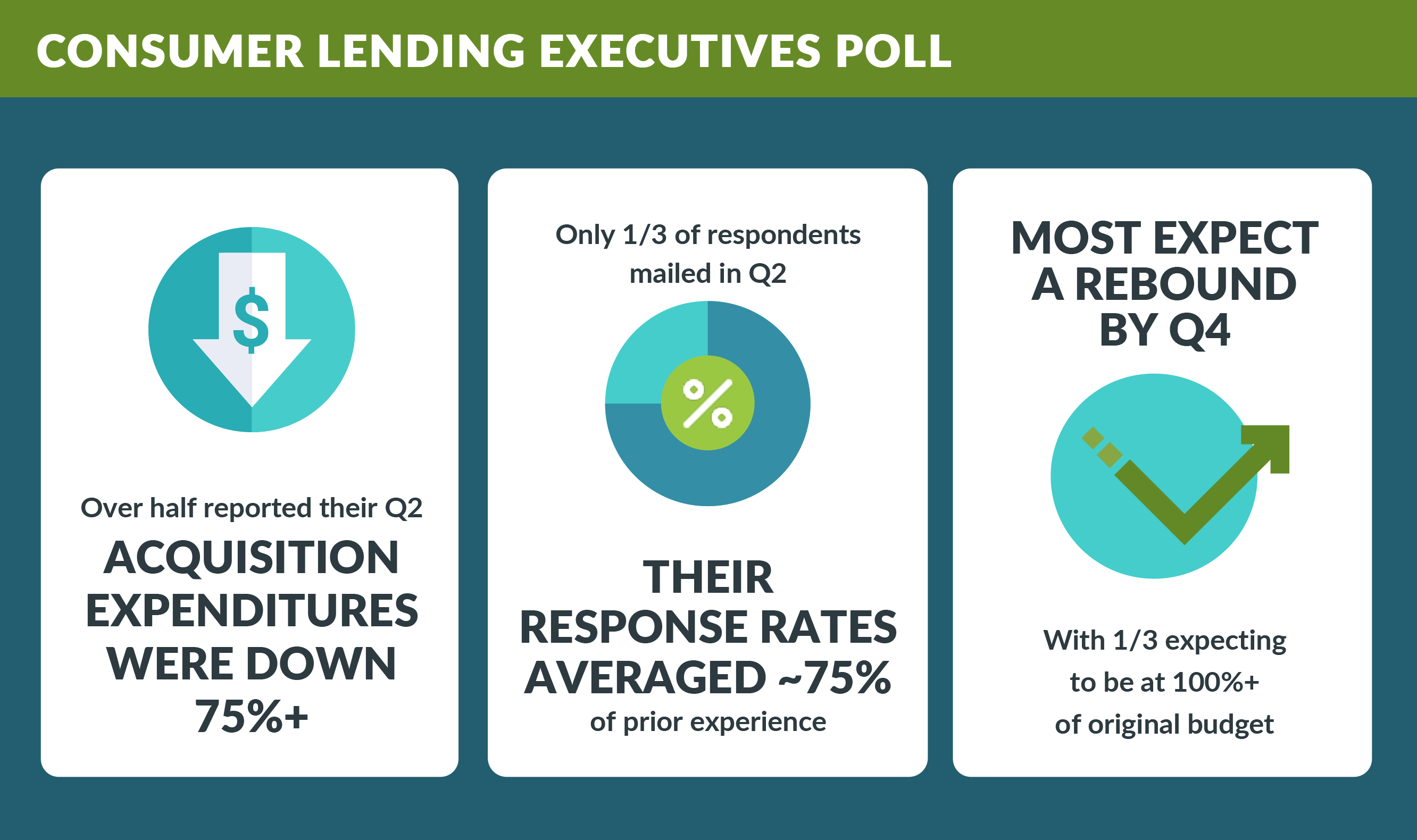

Consumer Lending Executives are Cautiously Optimistic

- Consumer lending executives responding to an informal Epic poll this week indicate they expect a rebound in acquisition marketing in the fourth quarter of 2020

- Respondents’ answers represented acquisition plans for credit cards, personal loans, HELOC, student loans, and education refinance loans

Student Lending Off to Slow Start, but Big Finish?

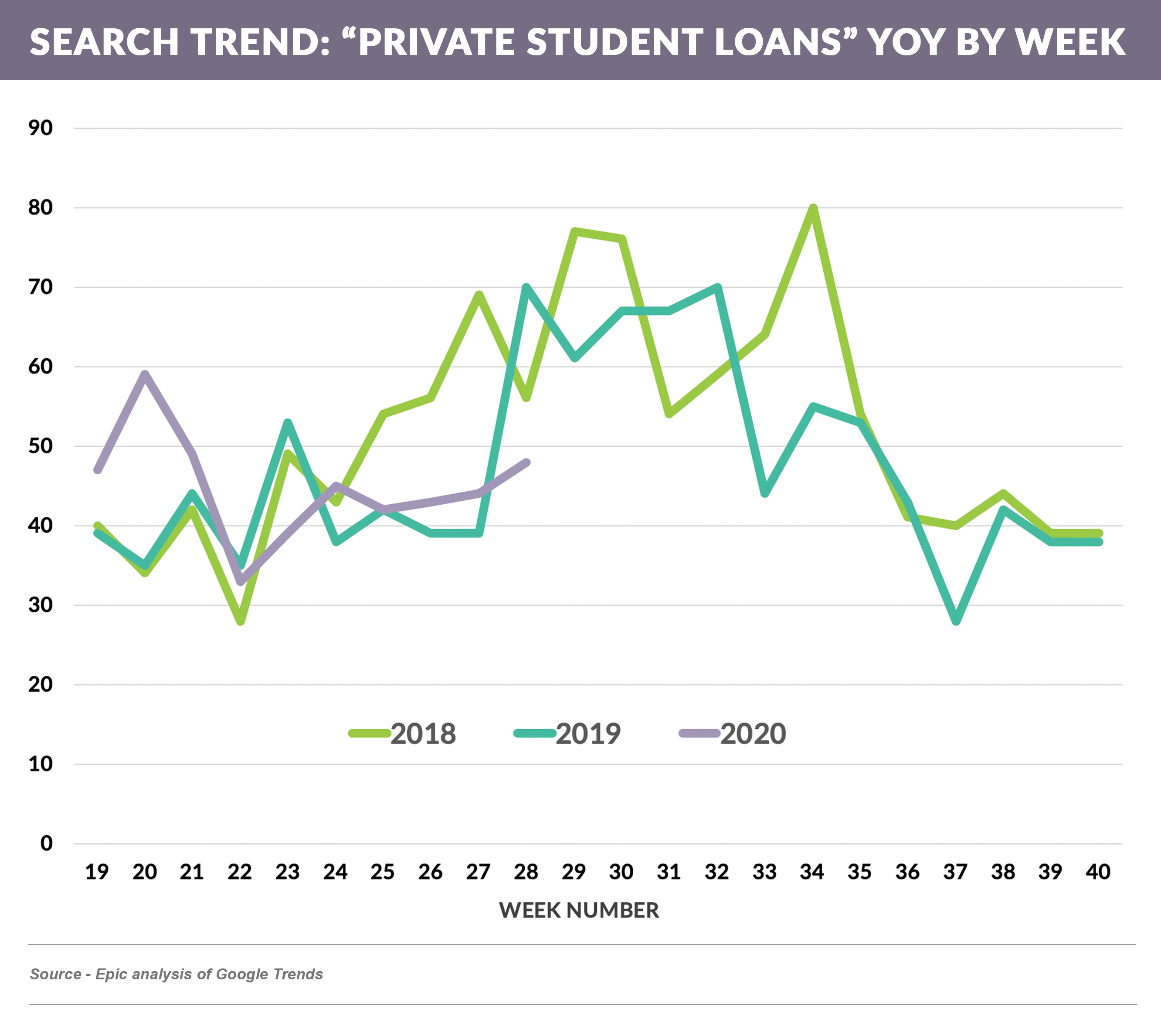

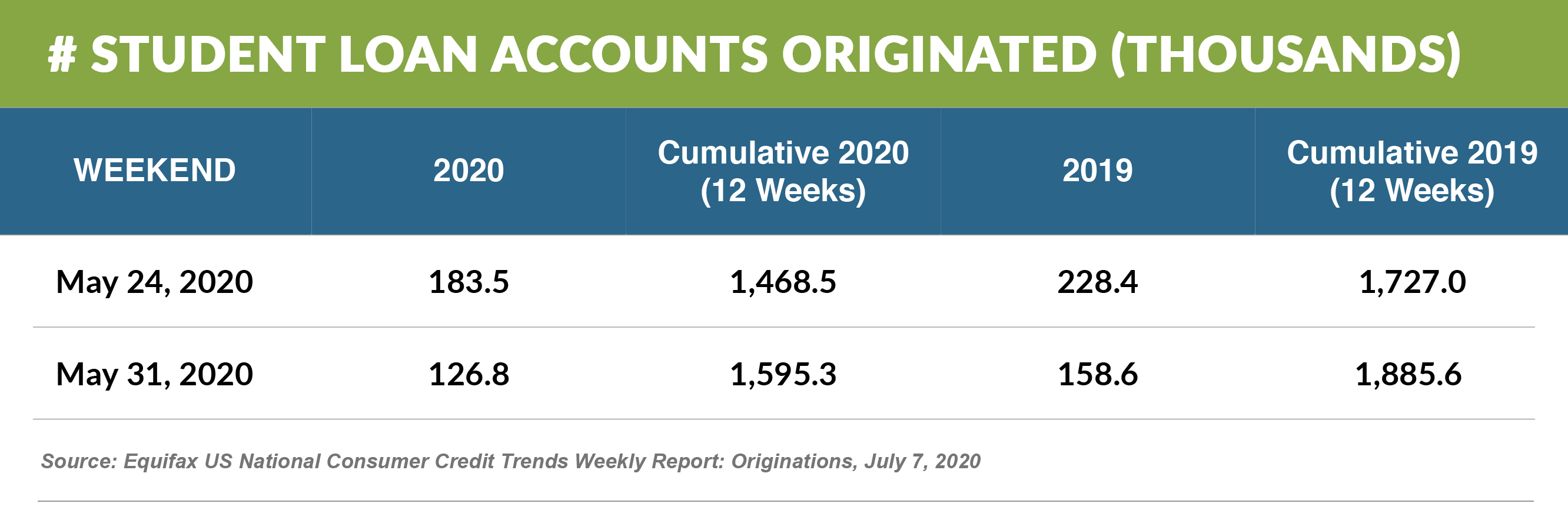

- Student loan demand is down this year, as indicated by early direct mail volume, activity on our Nitrocollege.com student loan aggregator site, and, to a lesser degree, online search volume

- While only showing new loan activity through the end of May, Equifax reports new student loan originations are down 15% from the same period in 2019

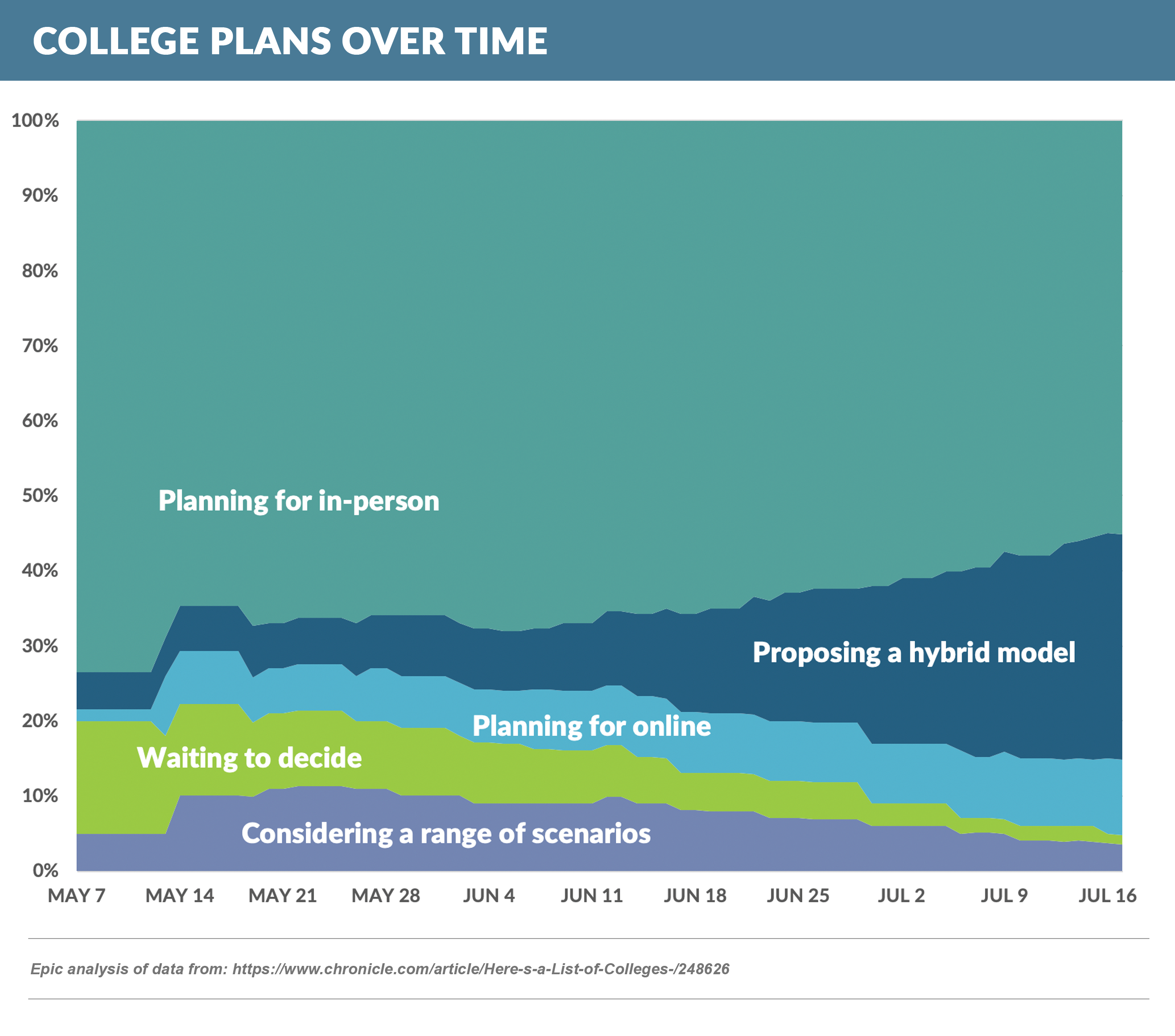

- The lower volume is undoubtedly due to the uncertainty surrounding students returning to campus in the fall – recent announcements reveal a trend of more colleges planning a hybrid or online model

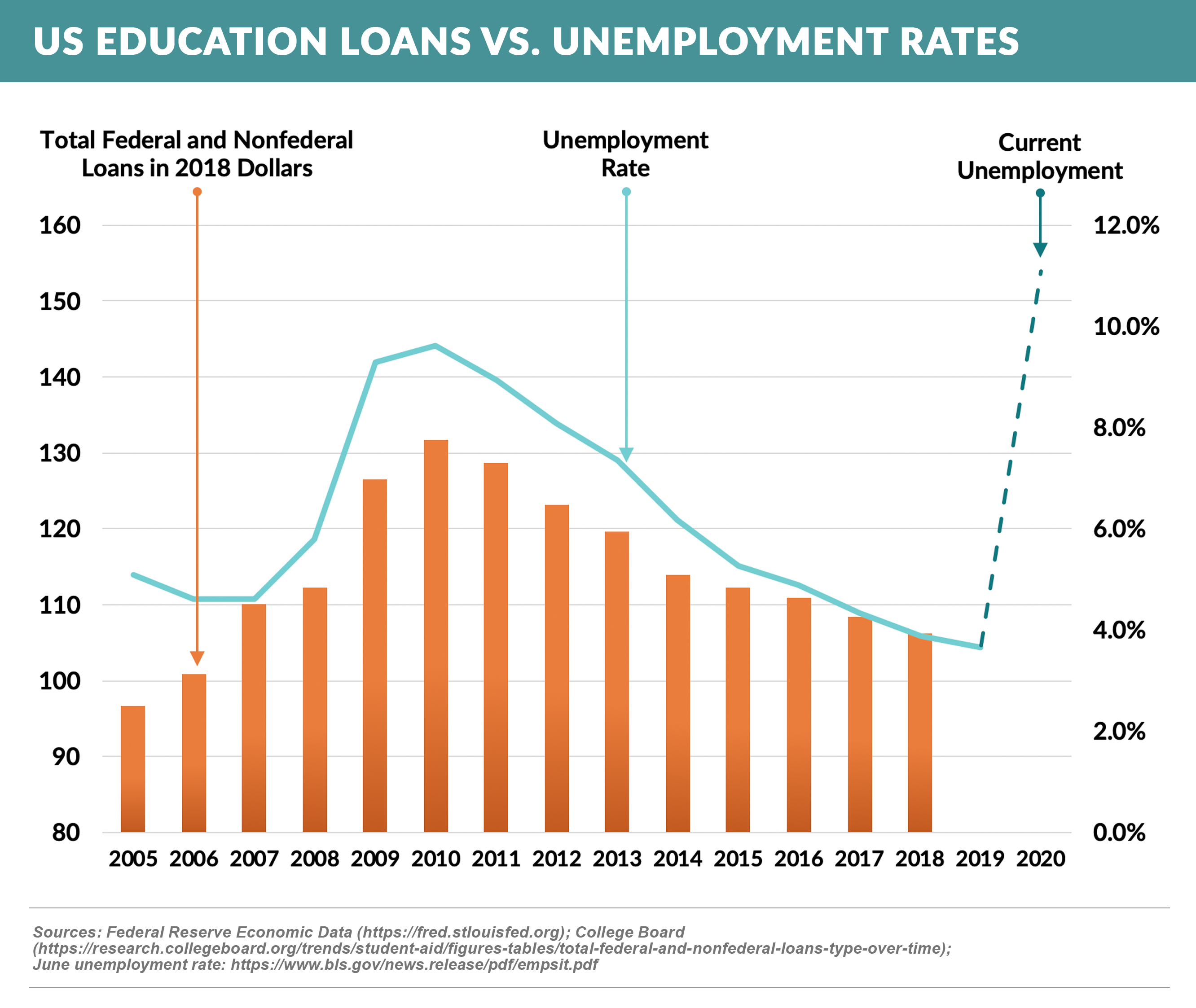

- However, if the past is an indicator, some shrinkage in overall attendance might be somewhat offset by a greater need for loans as there has historically been a direct correlation between the unemployment rate and student loan volume

Signs of Life in Credit Cards?

- Recent company reports show the major credit card issuers’ 2Q spending is down ~25% for the full quarter

- However, there has been a substantial recovery since the April trough, with the June numbers indicating drops of only 10-15%

- Overall, Visa and MasterCard volume (including debit) for 2Q was down ~6%, with varying reports of debit volume actually being positive year-over-year – T&E volume is still down 50%+

Source for above: Company 2Q 2020 financial reports

- And there are further signs of life in the credit card sector as several issuers have recently introduced new products

- Chime launched the Chime Credit Builder Visa on June 30th

- Appeals to younger consumers’ preference for debit cards while allowing them to build their credit history

- Requires no credit check to apply and spending is limited to the amount in users’ Chime Spending Accounts

- The new Verizon Visa was launched June 26th

- Only available to Verizon customers, with users earning Verizon Dollars to be used toward any Verizon purchase

- Offers 4% on groceries and gas, 3% on restaurants and dining (including takeout), 2% on Verizon purchases, and 1% on all other purchases

- This is the first card for Verizon; however, predecessor company Bell Atlantic offered a Visa card with Chase in the late ’90’s

- US Bank launched its new Altitude Go Visa Signature Card on June 8th

- Extra points earned on takeout, food delivery, dining, grocery, and gas stations

- Points redeemable for merchandise, cash, and travel

Quick Takes

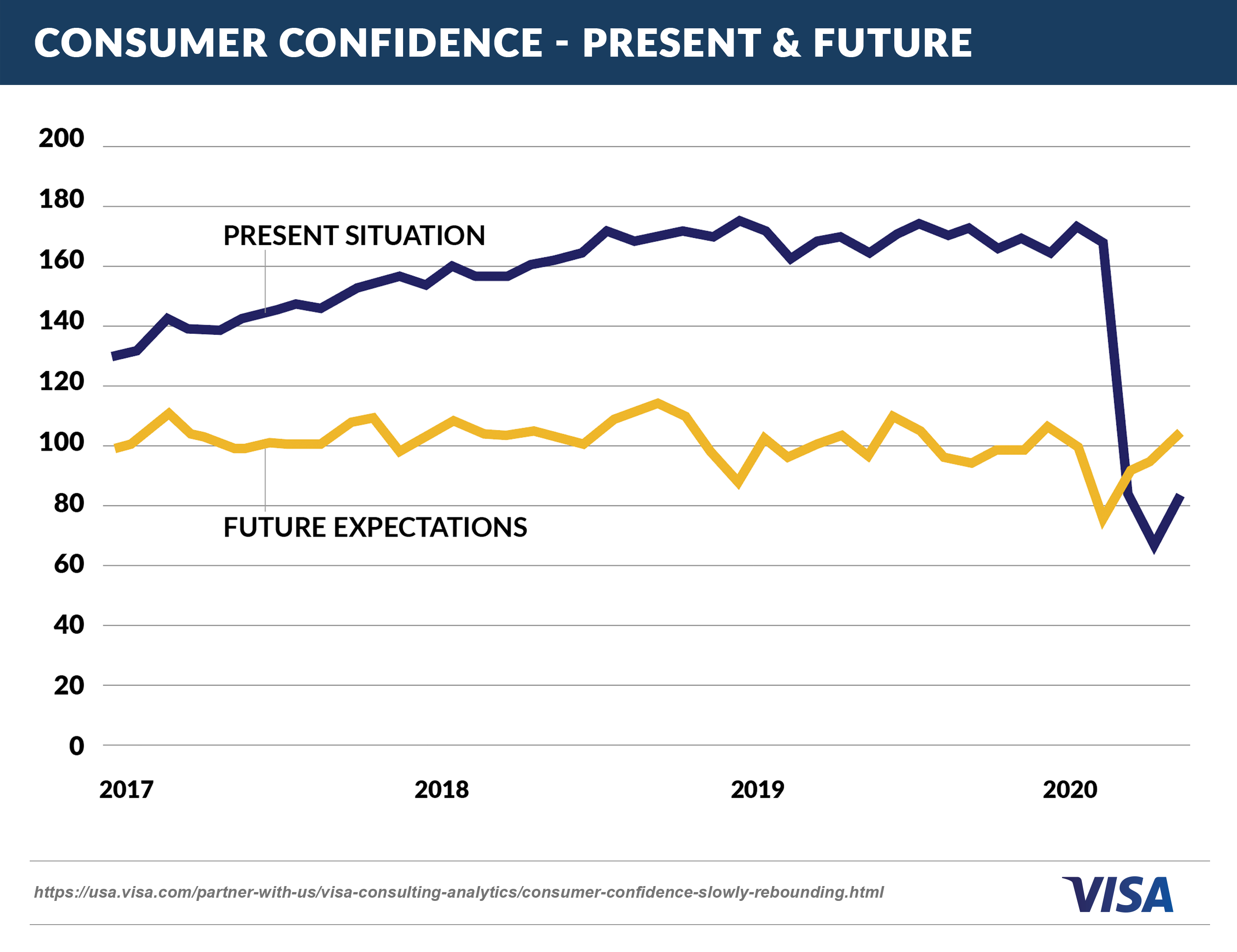

- The Conference Board, via Visa, reports that consumer confidence has begun to improve after the May plunge

- Both trust statistics and anecdotal data have shown near and sub-prime portfolios holding up well so far with delinquencies and payment rates stable

- Our experience has shown that in times of economic distress these portfolios actually hold up better than prime portfolios – especially in the case of credit cards

- Sub-prime utilization rates are usually 80%+, so dollar loss rates more closely mirror account loss rates

- Prime portfolios can average 20% utilization, so a slight uptick in account charge-off rates can result in a disproportionate impact on dollar rates

Going Forward

- Lending executives are being more cautious about “opening up too early” than politicians

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.