Three Things We’re Hearing

- Marketing spend is down across all channels and categories

- Travel reward card issuers respond to a challenged value proposition

- Delinquency finally starts ticking up

Today’s newsletter takes 3 minutes to read

Marketing Spend Down

- Our last Epic Report showed May mail volume for credit cards and personal loans plummeting from pre-COVID levels

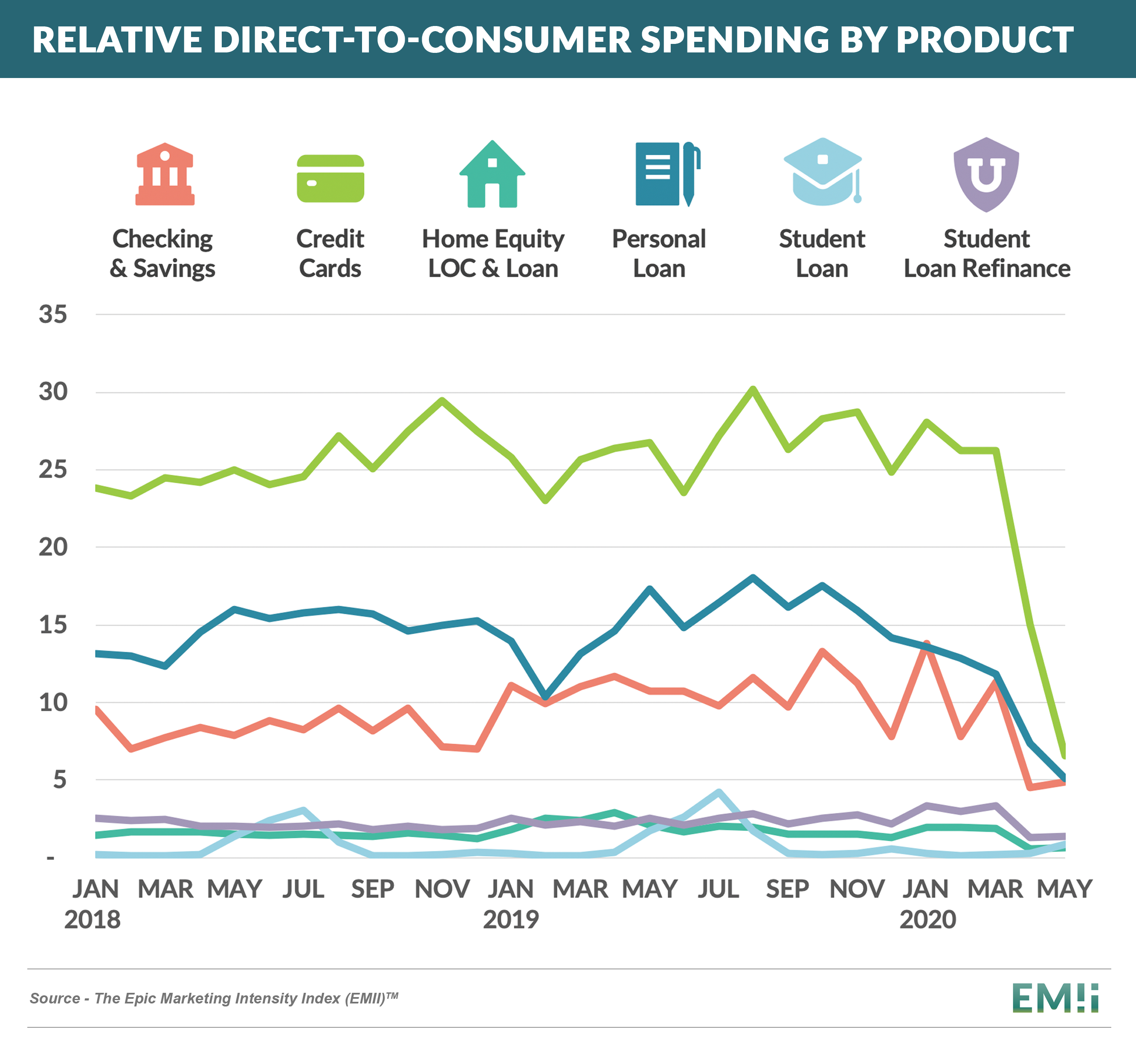

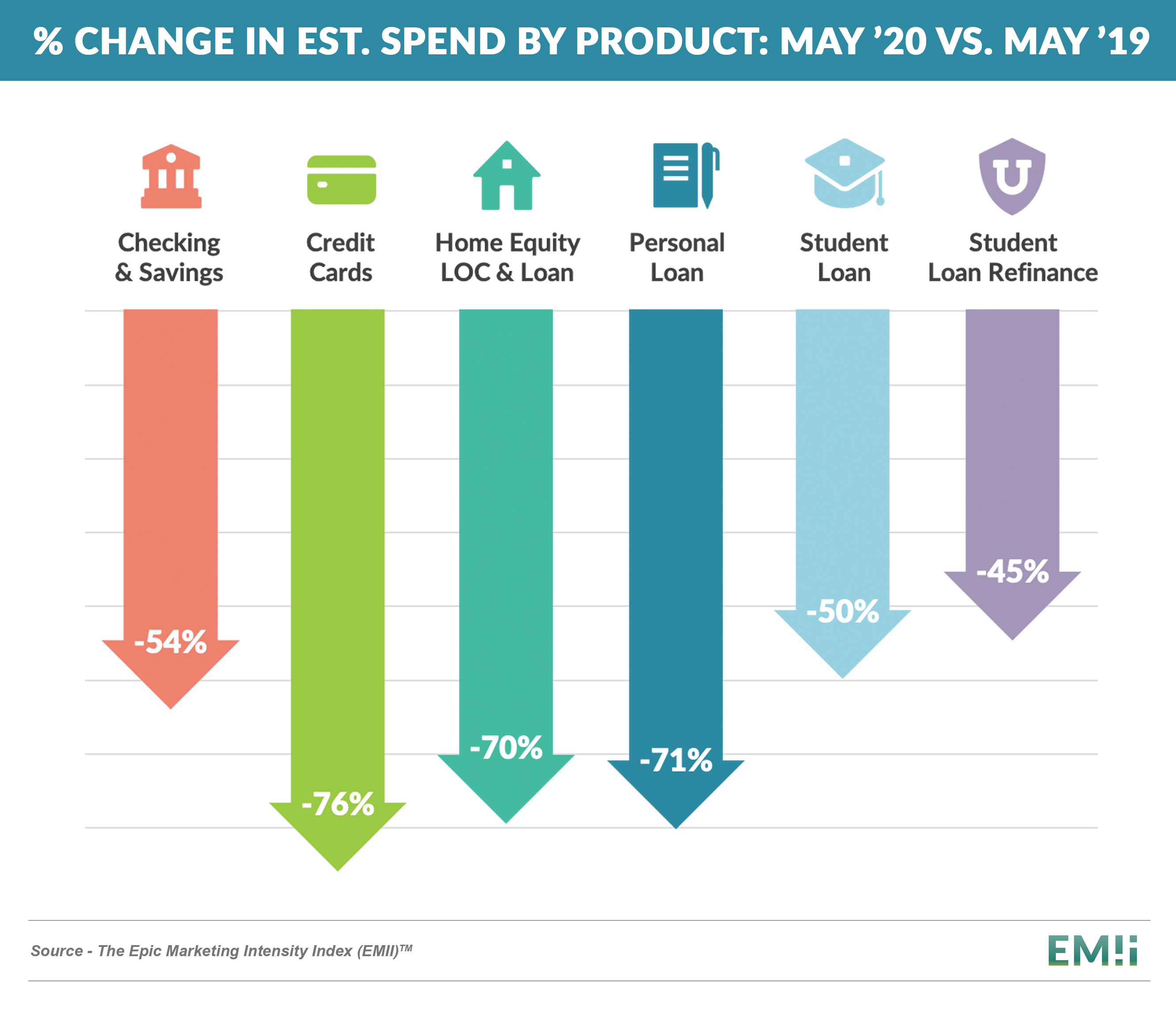

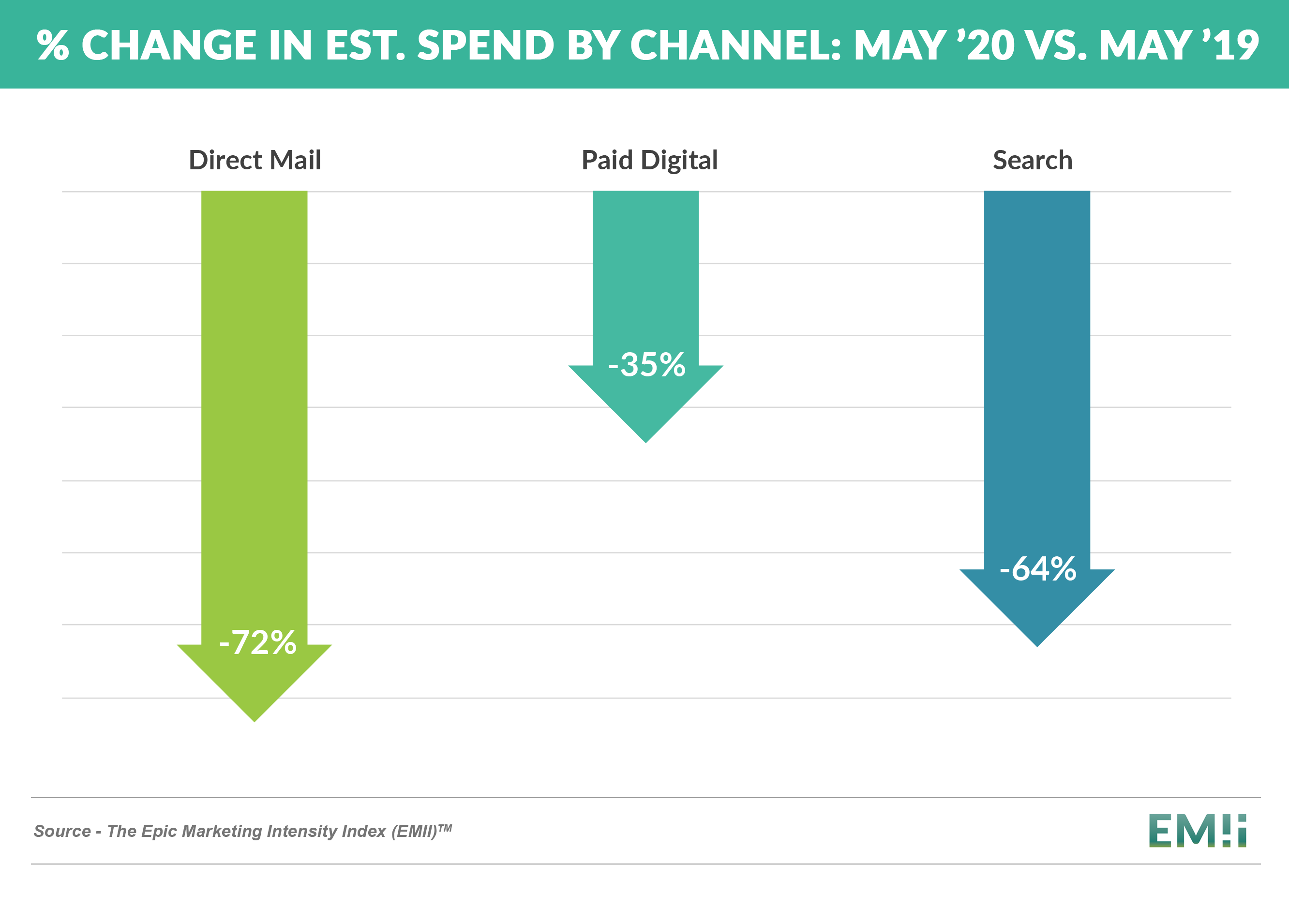

- The Epic Marketing Intensity Index (EMII) – which measures estimated marketing spend across direct mail, search, and paid digital – shows that downward trend across all products and channels

- Credit card spend remained the highest among financial products, but it also had the largest drop from 2019 volume

- While direct mail, which accounted for two-thirds of 2019 credit card marketing spend, remained the largest channel for cards, it also had the largest decline from 2019 volume

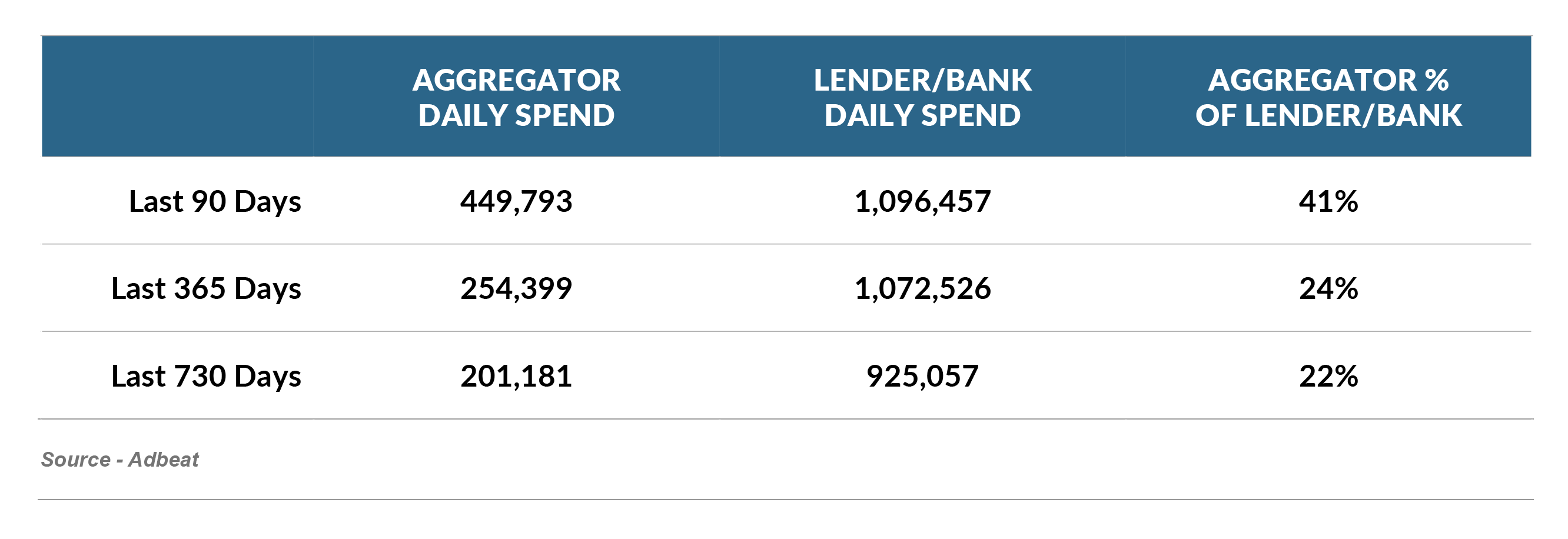

- Of additional interest, aggregators have been quicker to return to the online market than lenders

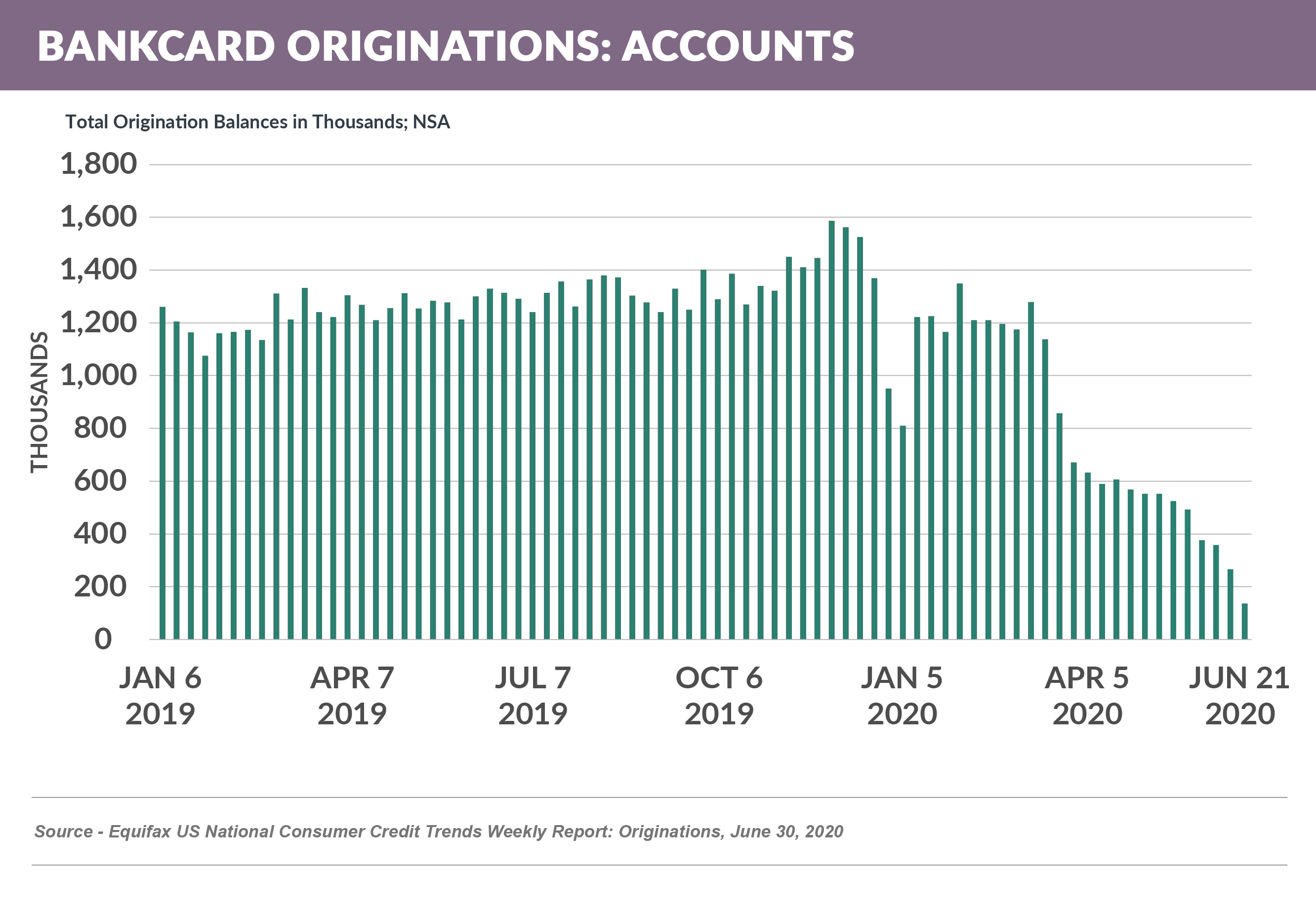

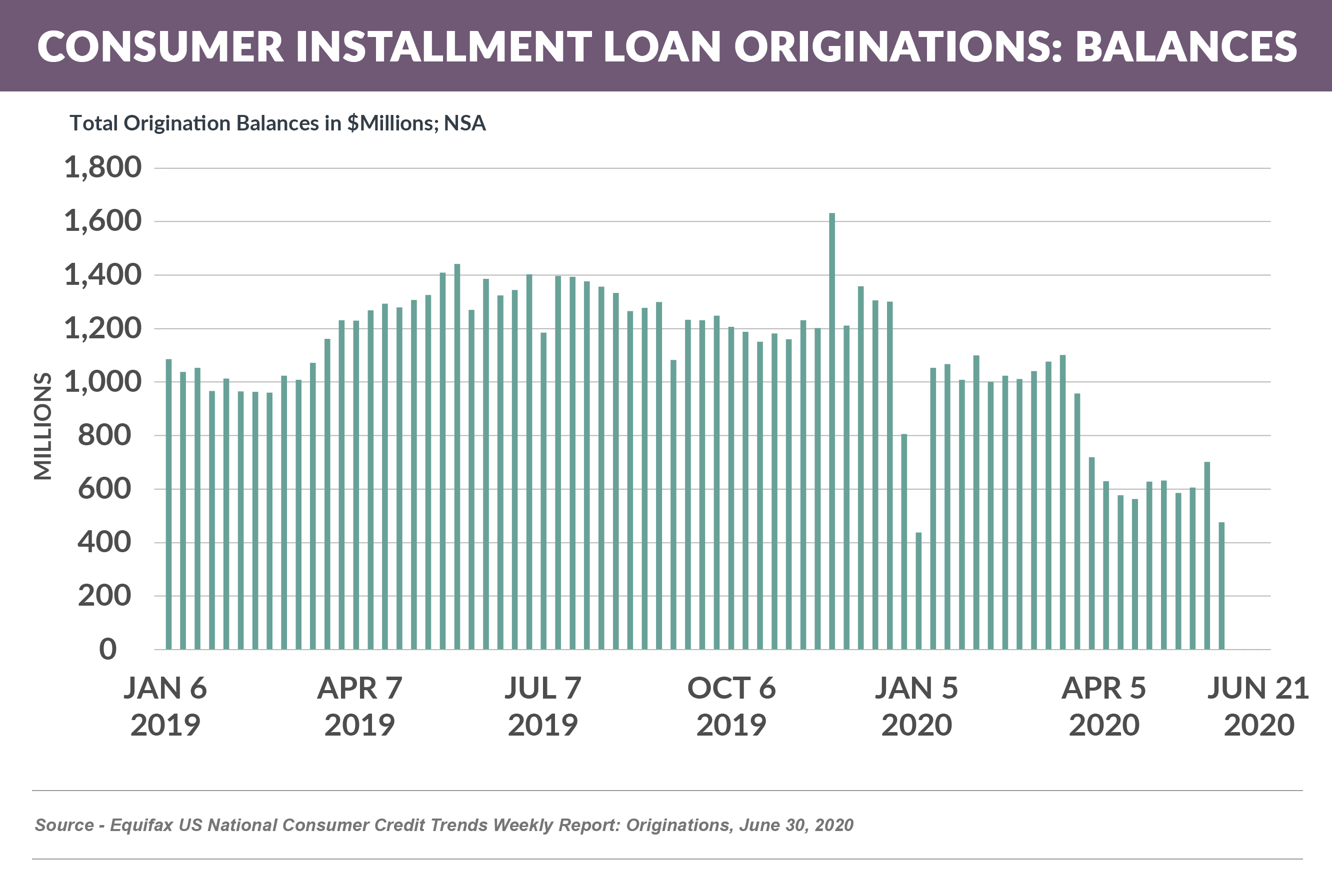

- It is no surprise that this drop in advertising spend resulted in sharp reductions in new credit cards and personal loans

Reckoning with Changing Travel Rewards Preferences

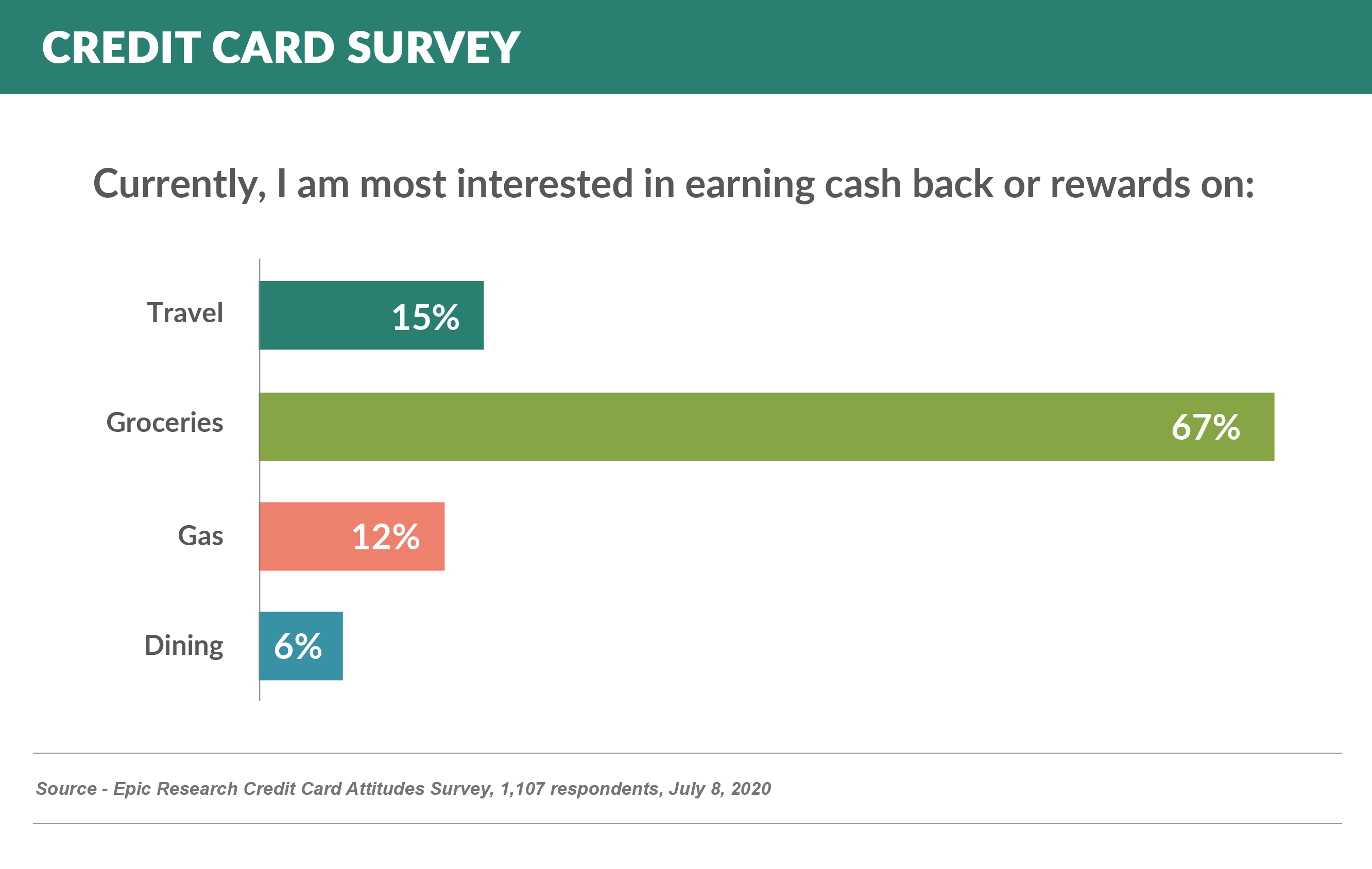

- Epic recently repeated a consumer survey on the impact of the quarantine on consumer credit card preferences

- Our survey showed a continued strong preference for non-travel rewards, with 85% of consumers preferring non-travel categories

- It is not news that travel rewards credit cards have been challenged during the pandemic, with overall spending down, travel itself all but halted, and travel redemption options impractical at the moment

- A number of issuers have responded by changing their reward and redemption structures to emphasize non-travel categories. Among those changes:

- American Express has seen Membership Rewards points use on online retailers double over last year and added statement credits for select streaming and wireless phone services

- Chase Sapphire temporarily increased rewards for groceries to five points per dollar spent and added a 50% bonus when redeeming points for grocery, dining, and home improvements

- Citi’s AAdvantage card added double miles per dollar spent at gas stations and restaurants and allows miles earned on purchases to count toward lifetime elite status until end of the year

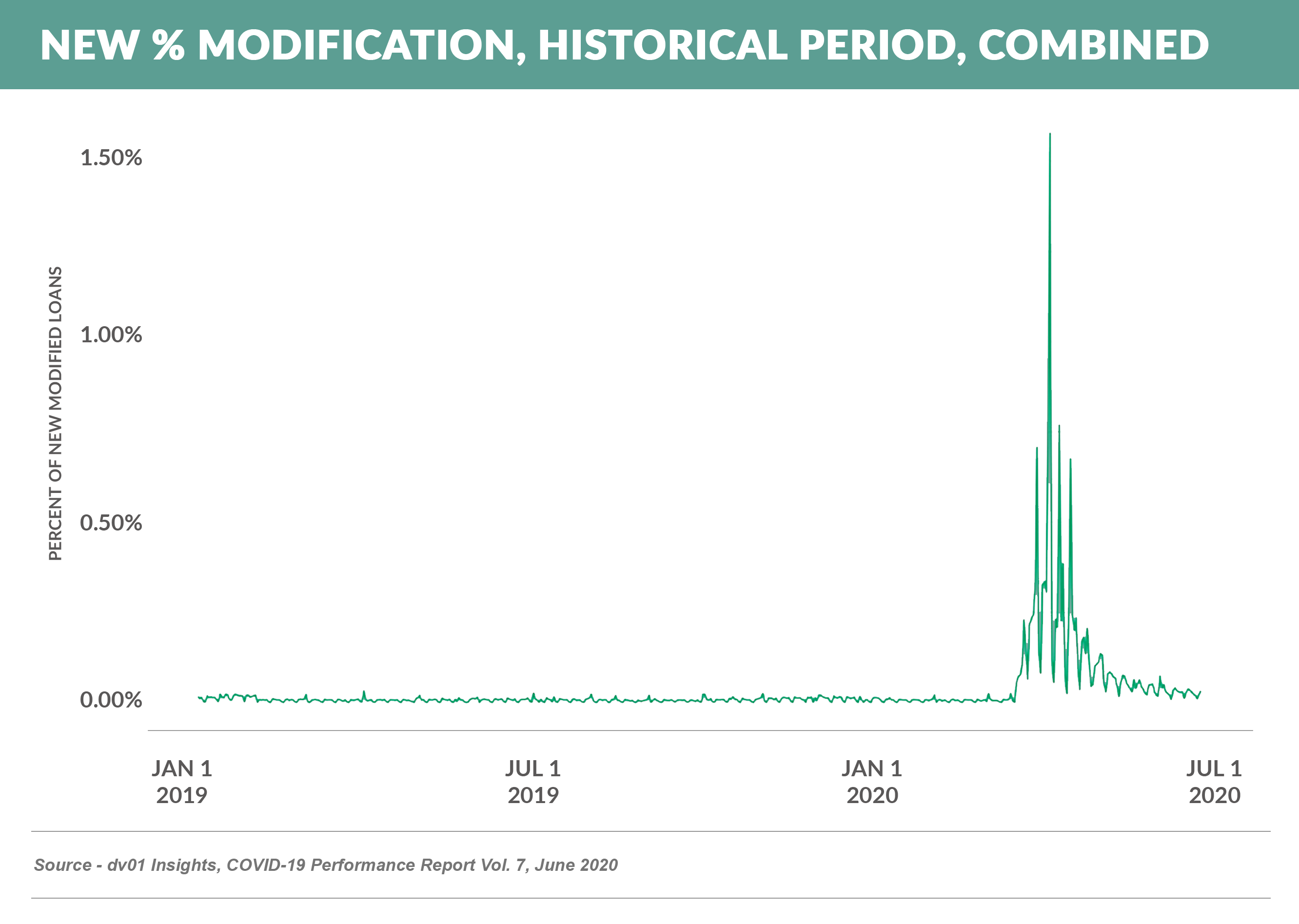

Forbearances Trend Toward Pre-COVID Levels – Delinquency Ticks Up

- There has been a sharp drop in new forbearances in the past month, approaching traditional levels

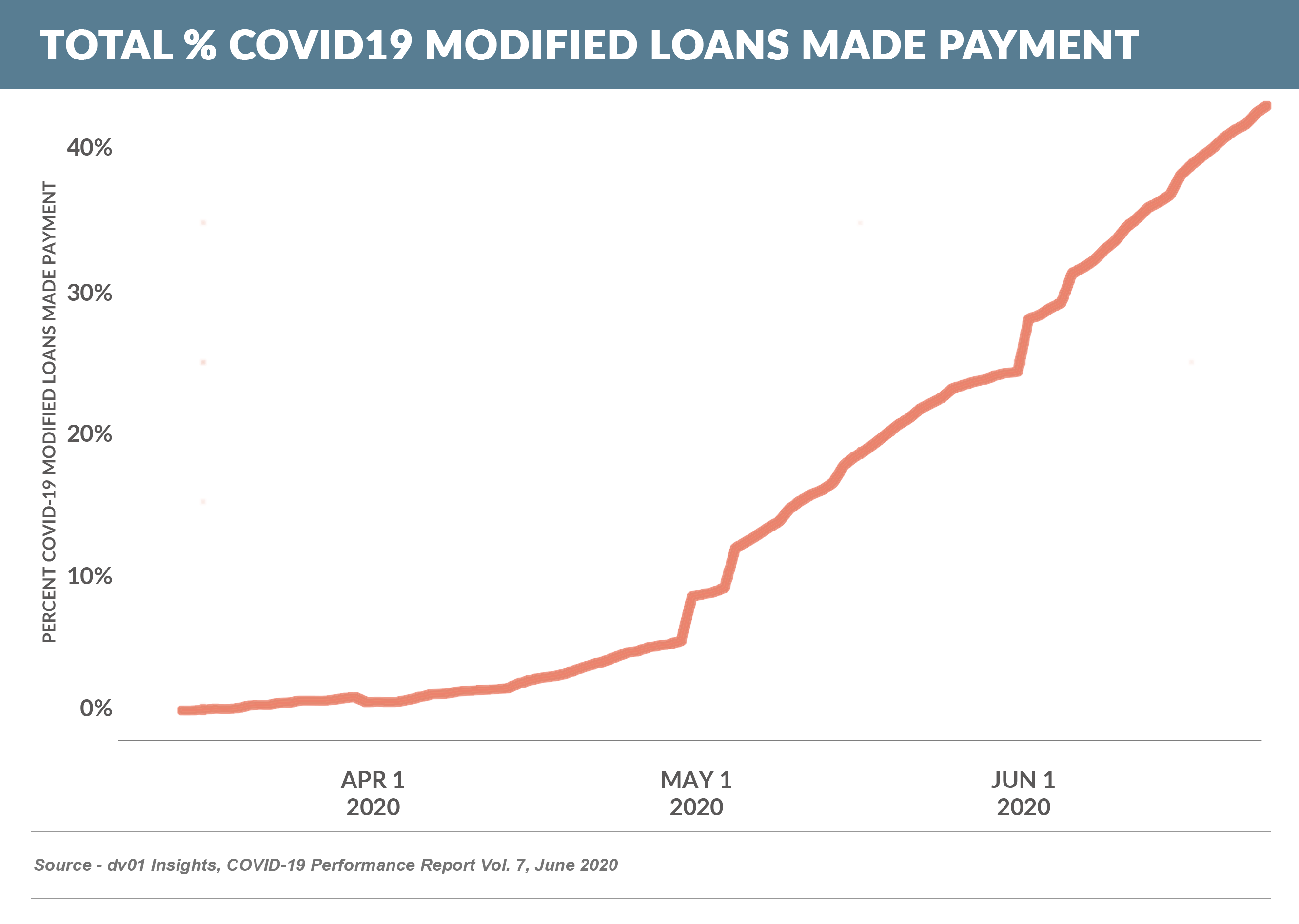

- As reflected in Epic’s consumer survey in the June 20th Epic Report, a large number of those in forbearance are actually making payments

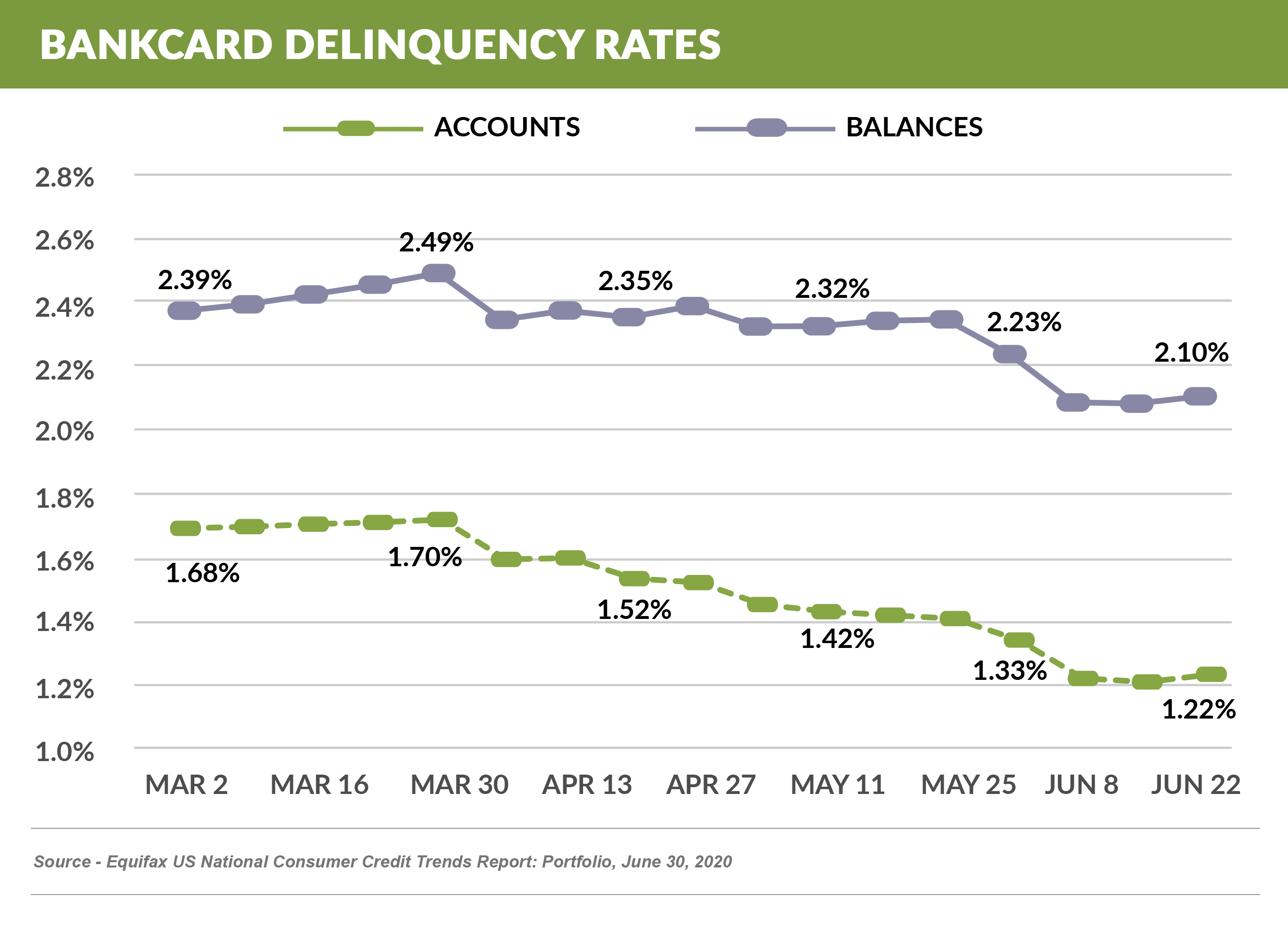

- Mid-summer is typically when the seasonal upward trend in credit card delinquencies begins – it might be expected to be amplified this year with the concurrent expiration of loan modifications

- This chart of credit card delinquencies shows that an upward trend might be on the horizon

Quick Takes

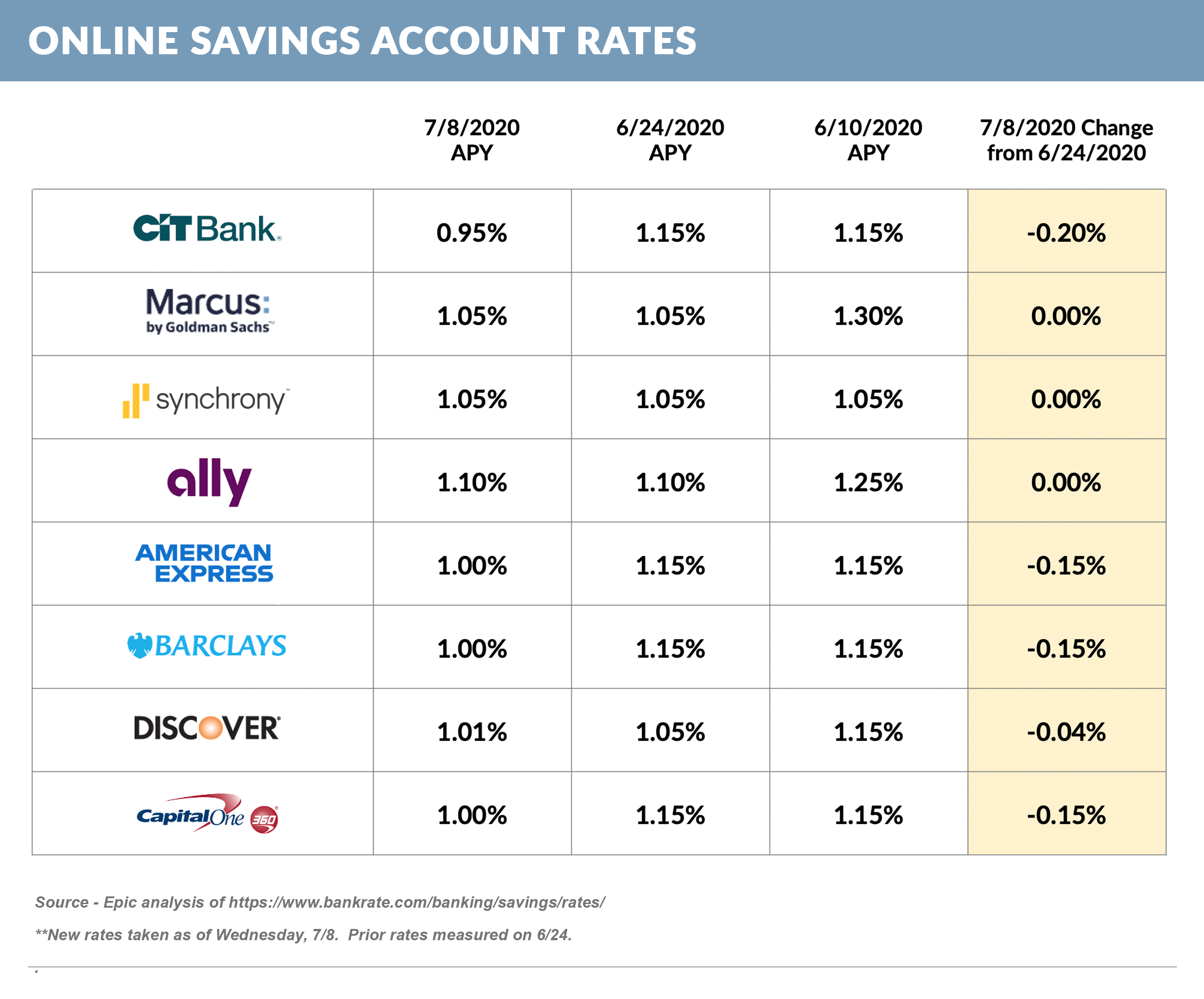

- Savings rates maintain their downward trend and are now at the 1% level (down from 1.75% in January), as banks are awash in deposits and loan originations decline

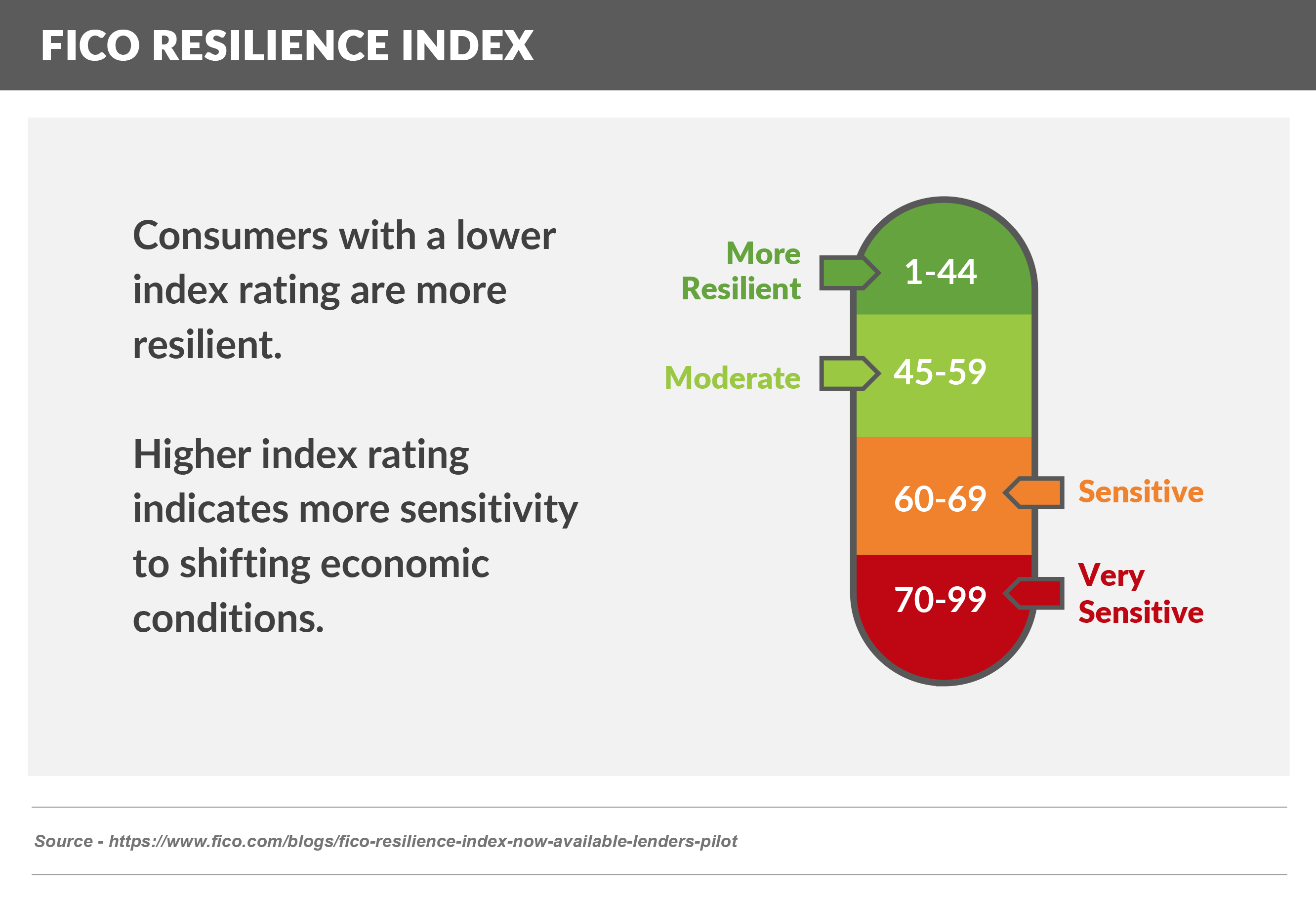

- FICO is introducing the FICO® Resilience Index, which is designed to give lenders a view of a consumer’s resilience during unexpected economic disruption

Going Forward

- “Word on the street” continues to signal that acquisition marketing is opening back up

- Recent virus spikes in some markets may have some negative effects; however, continued positive employment numbers may offset that to some degree

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.