Three Things We’re Hearing

- Why delinquencies remain low and payments high

- Co-branded credit card mail volume rebounds

- Personal loan mail volume – more of the same

A four-minute read

Why Delinquencies Remain Low and Payments High

- Industry observers have been surprised at the resiliency of consumers since the outset of the pandemic, in particular the record low levels of delinquencies and high payment rates on consumer loan portfolios

- The following historical credit card trends suggest we should be experiencing a very different situation with significant deterioration of asset quality:

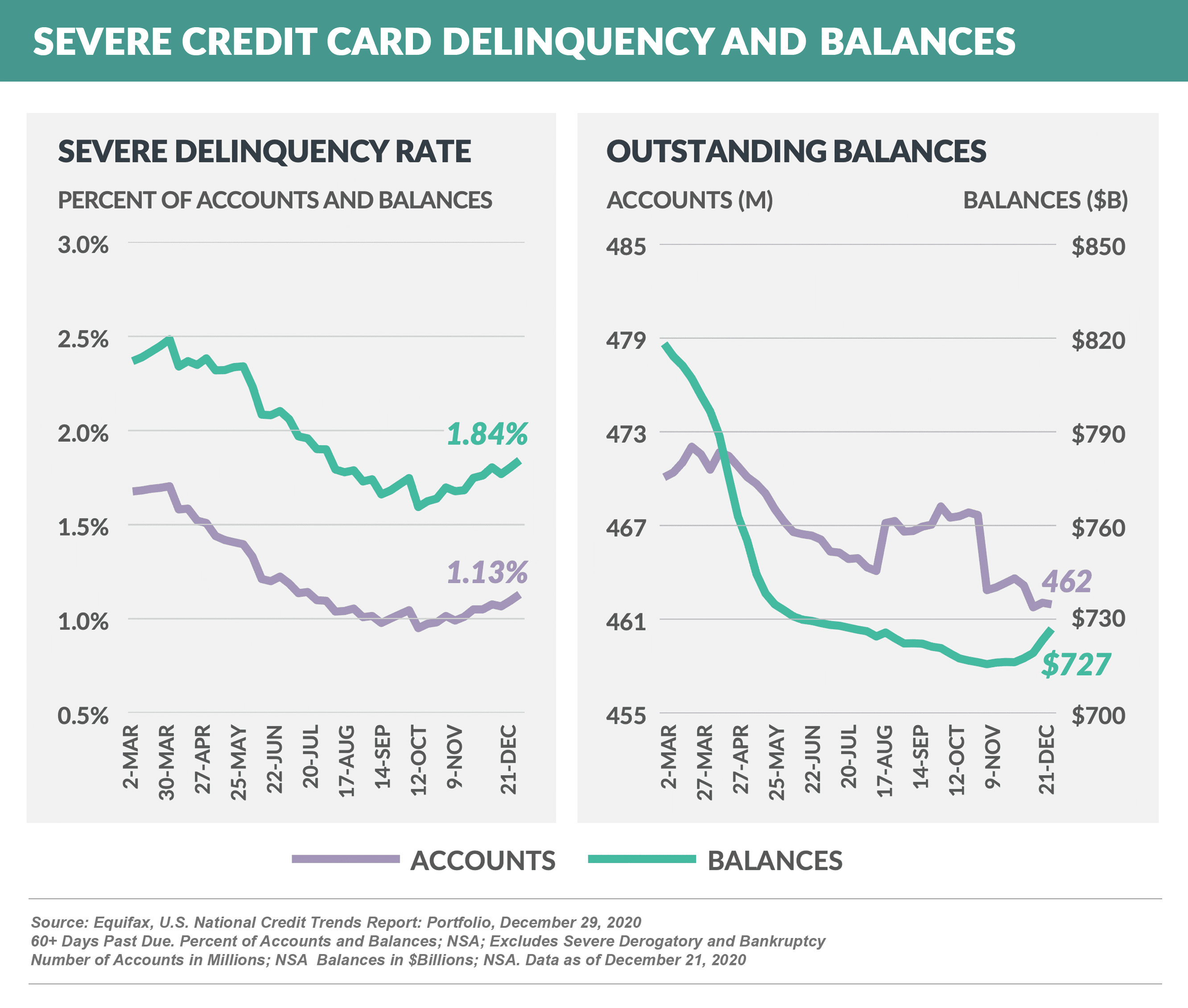

- Declining balances – credit card balances are down 11% since February due to a decline in new customer acquisition, consumer spending, and higher payment rates – consequently reducing “good balances,” which should cause delinquencies to rise

- Seasonality – credit card delinquency historically peaks in January, then falls in subsequent months until beginning a late-summer uptrend to the next January peak – this didn’t happen in 2020; rather, delinquencies continued to fall through September

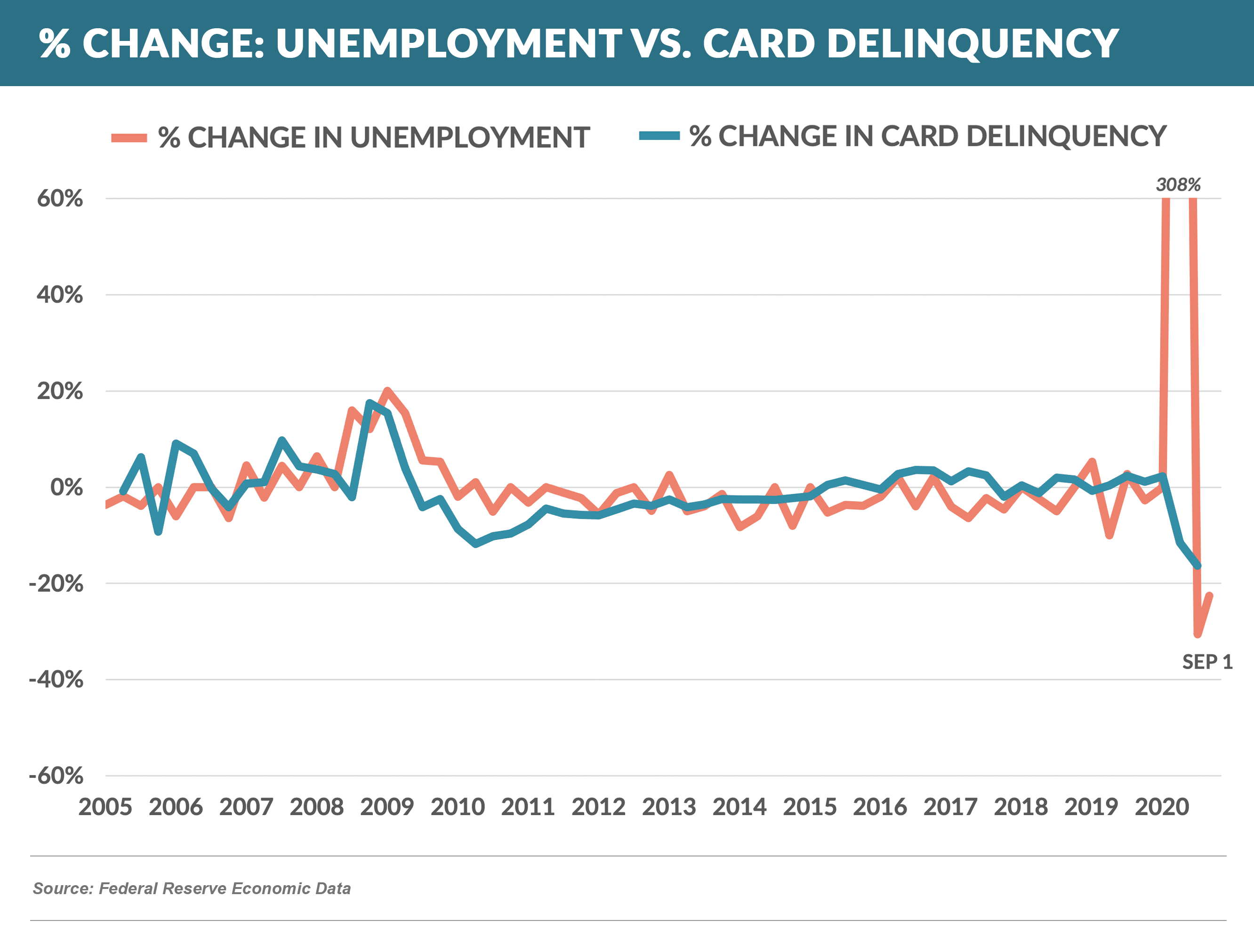

- Unemployment – historically, consumer bankruptcy has closely tracked unemployment rates – a correlation that did not hold in 2020

- Although these trends have begun to change in recent months following the expiration of various government payment programs, delinquencies still remain relatively low

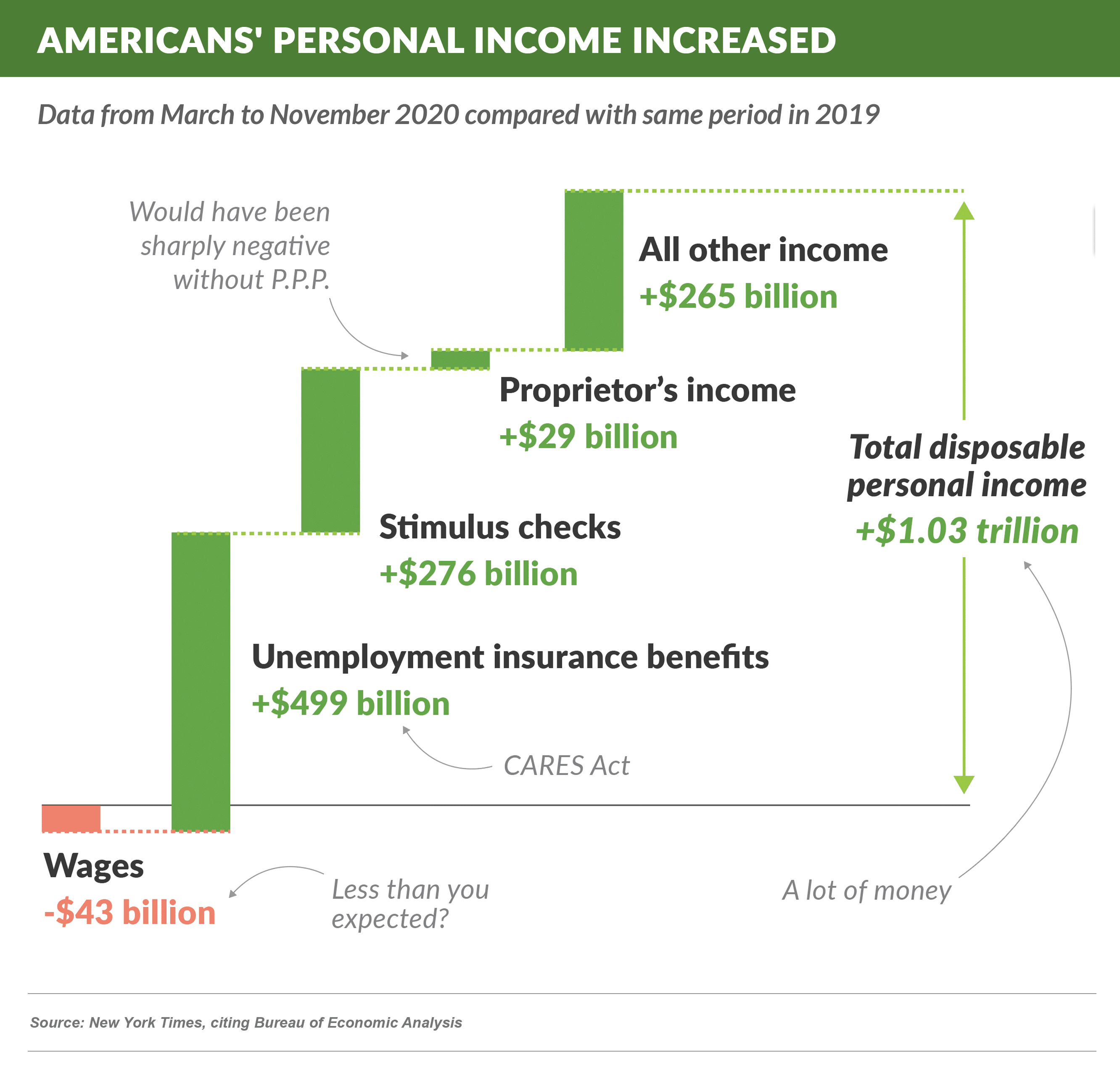

- Why did 2020 buck the trends? A New York Times article shows that a combination of wages falling less than might be expected, combined with a significant drop in spending, caused the average consumer’s financial situation to remain stable, or even improve, this year

- Although wages were down overall $43 billion

- Total disposable income from government and other sources was up $1.03 trillion!

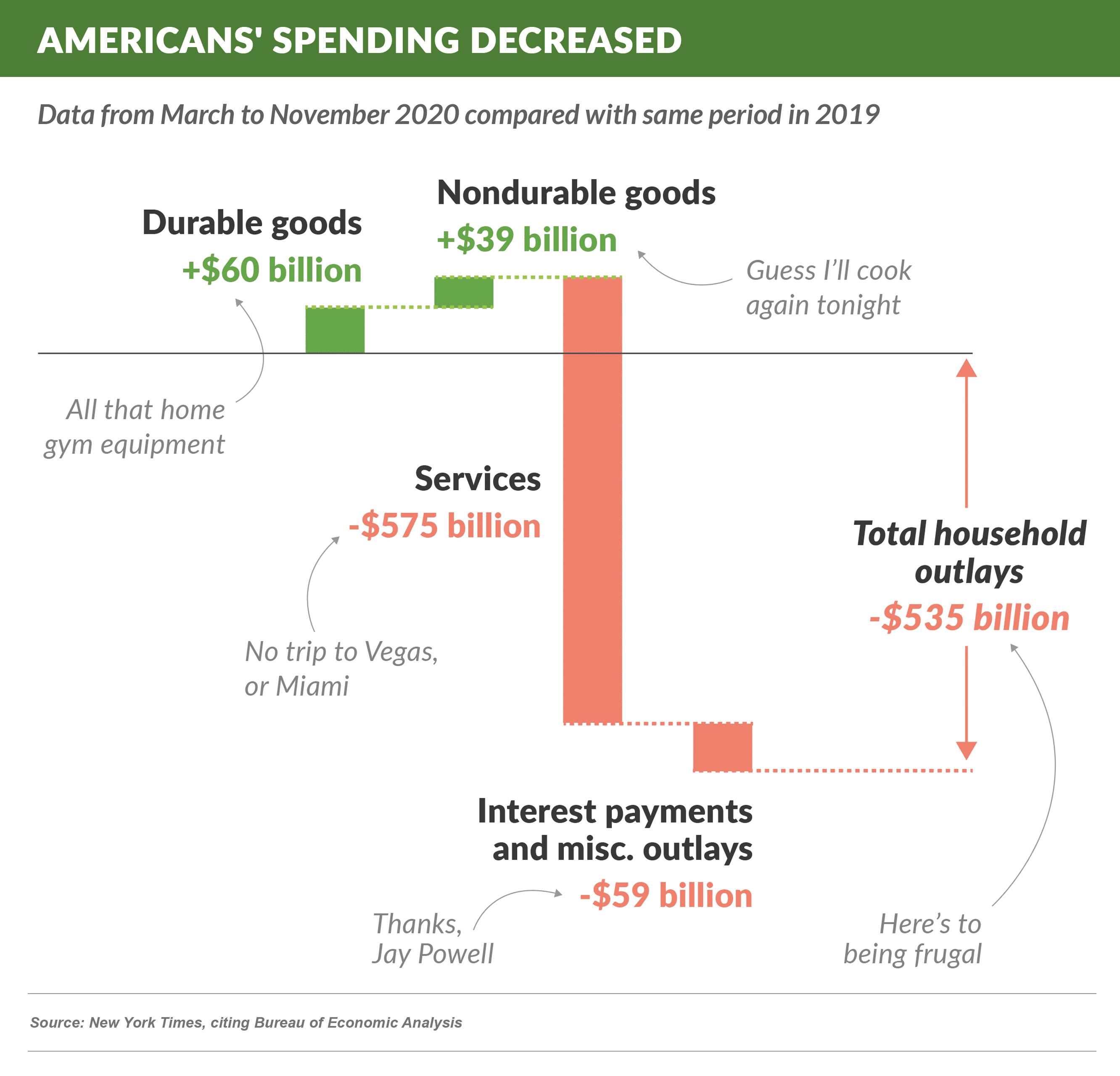

- On the other hand, total household spending was down $535 billion due primarily to declines in spending on services – travel, restaurants, and entertainment

- The combined effect on consumers’ financial well-being helped keep delinquencies low

- With 6-9 months to go before we get close to “back to normal,” additional government programs are needed to fill the gap

Co-brand Credit Card Mail Volume Rebounds

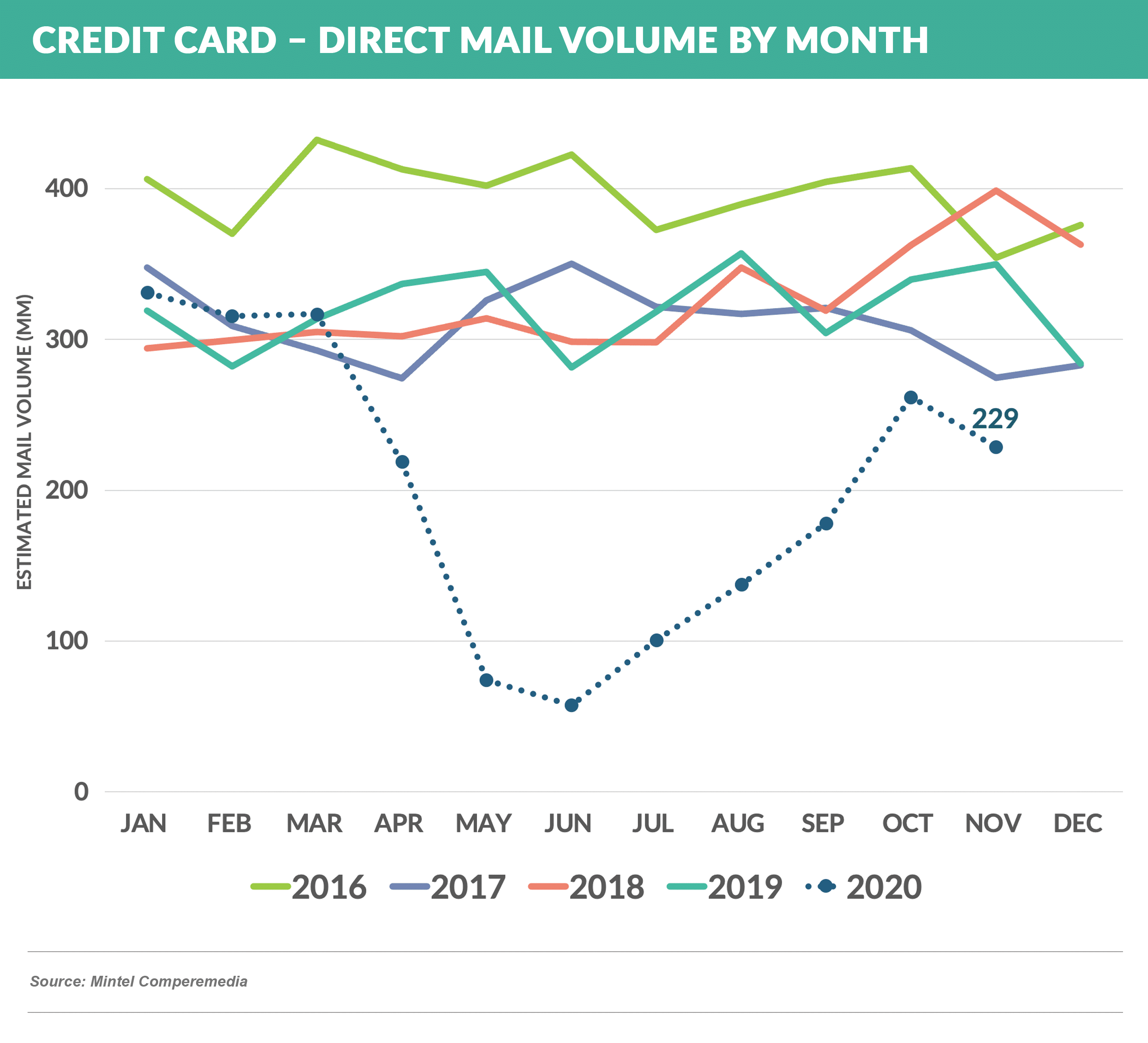

- After a steady rise since June, overall November credit card mail volume was down from October and was down 33% year-over-year

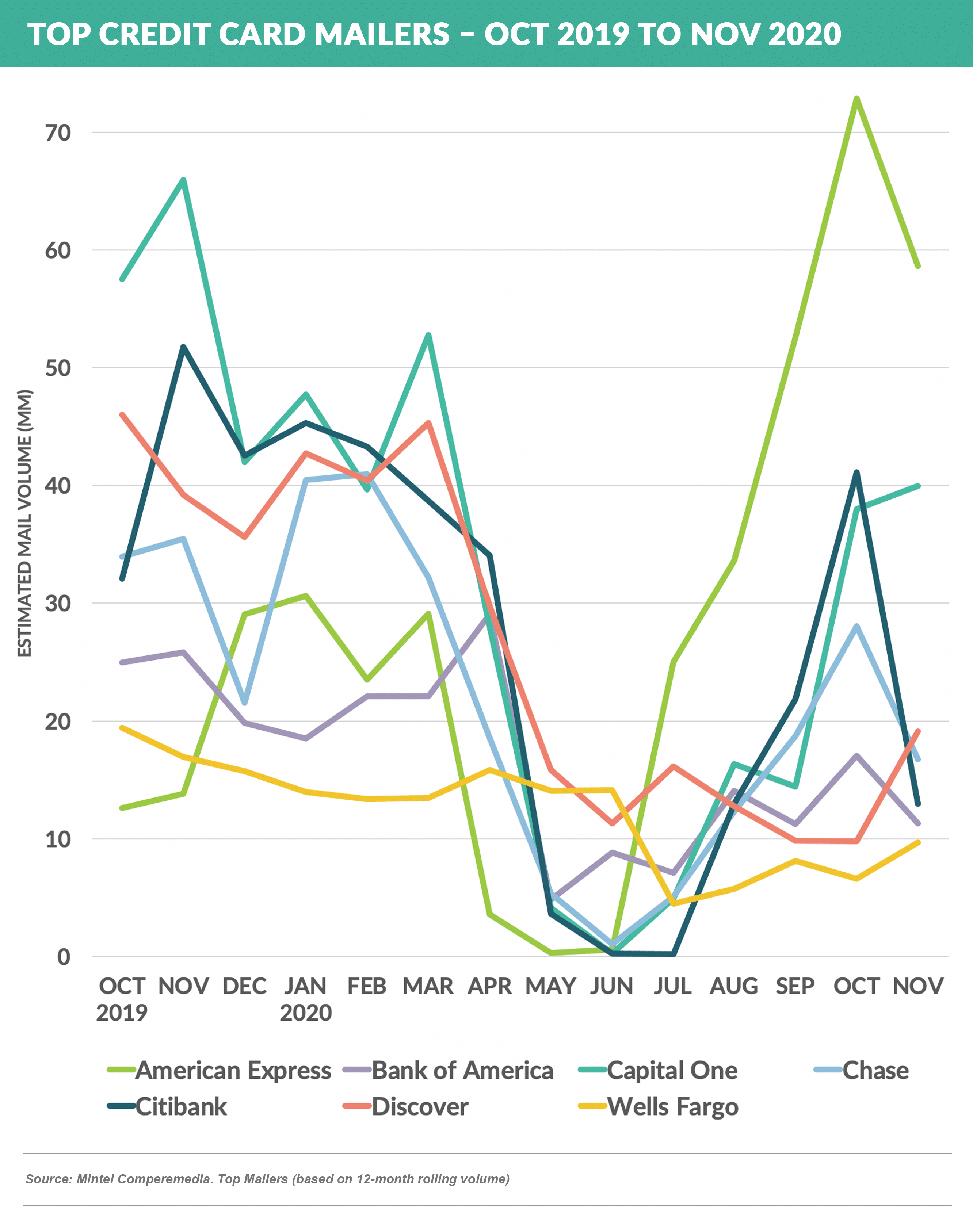

- American Express, Citi, and Chase were all down compared to the prior month, however Amex remained at a relatively high level (58 million pieces) compared to its pre-COVID volumes

- Amex continued to mail large volumes of the Hilton co-brand product and its Blue Cash Preferred Card, while number two mailer Capital One (40 million pieces) mailed its Quicksilver rewards offer

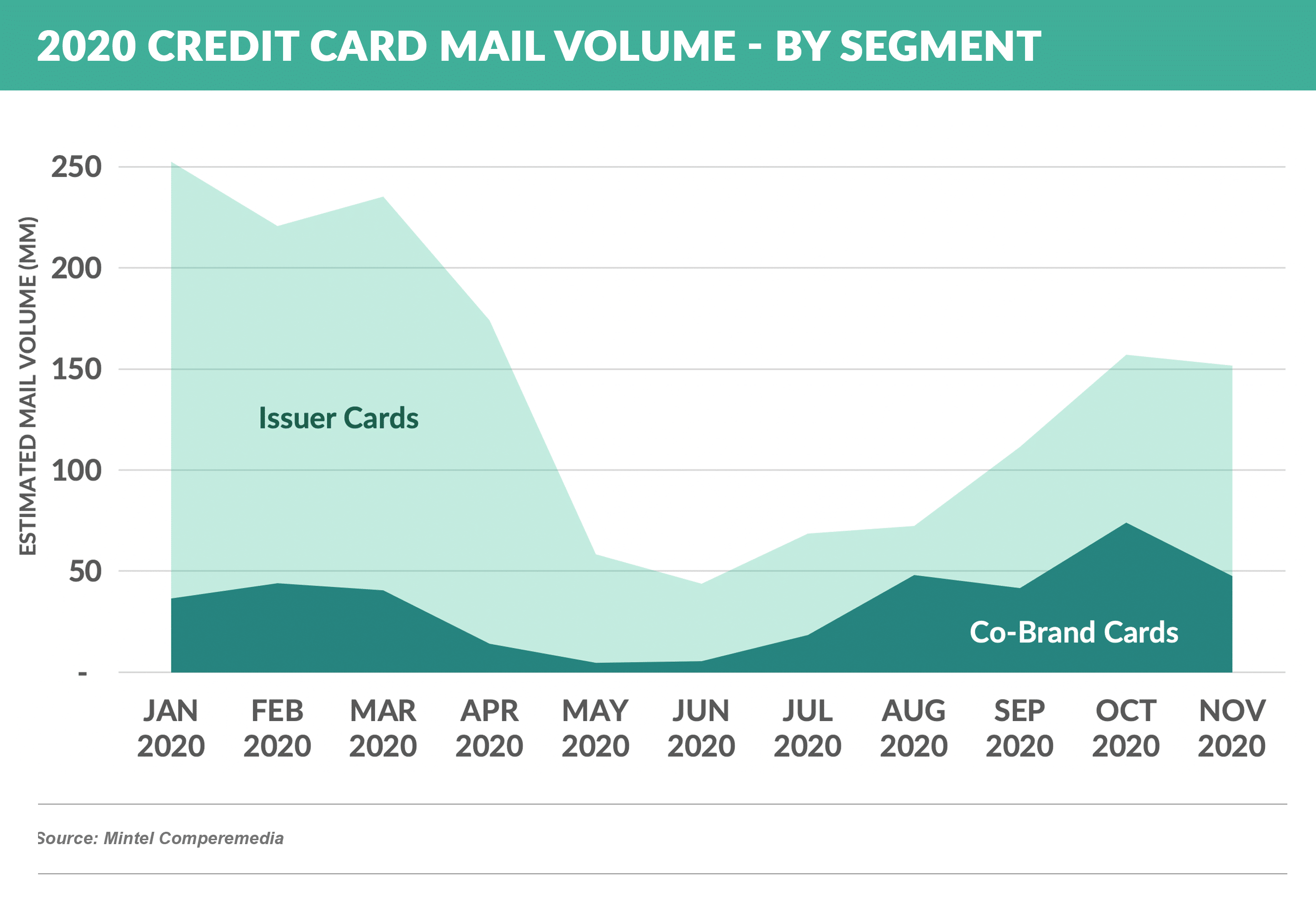

- Co-brand volume, which virtually disappeared in May, has rebounded faster than bank-branded (“Issuer”) volume and is now at a higher volume than January 2020

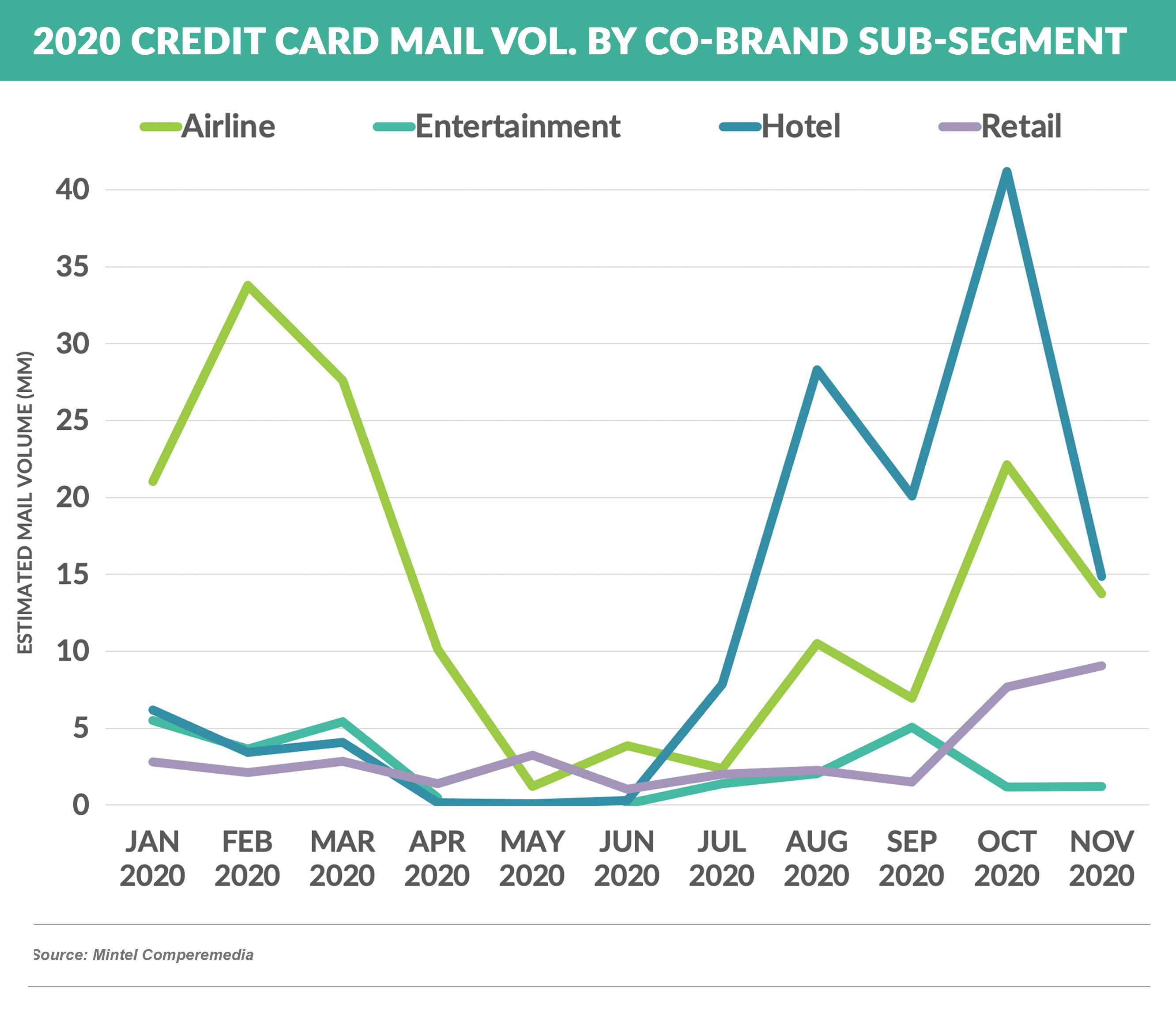

- The hotel segment, dominated by the Amex Hilton offer, increased above pre-pandemic levels while both airline and retail offers have rebounded in Q4

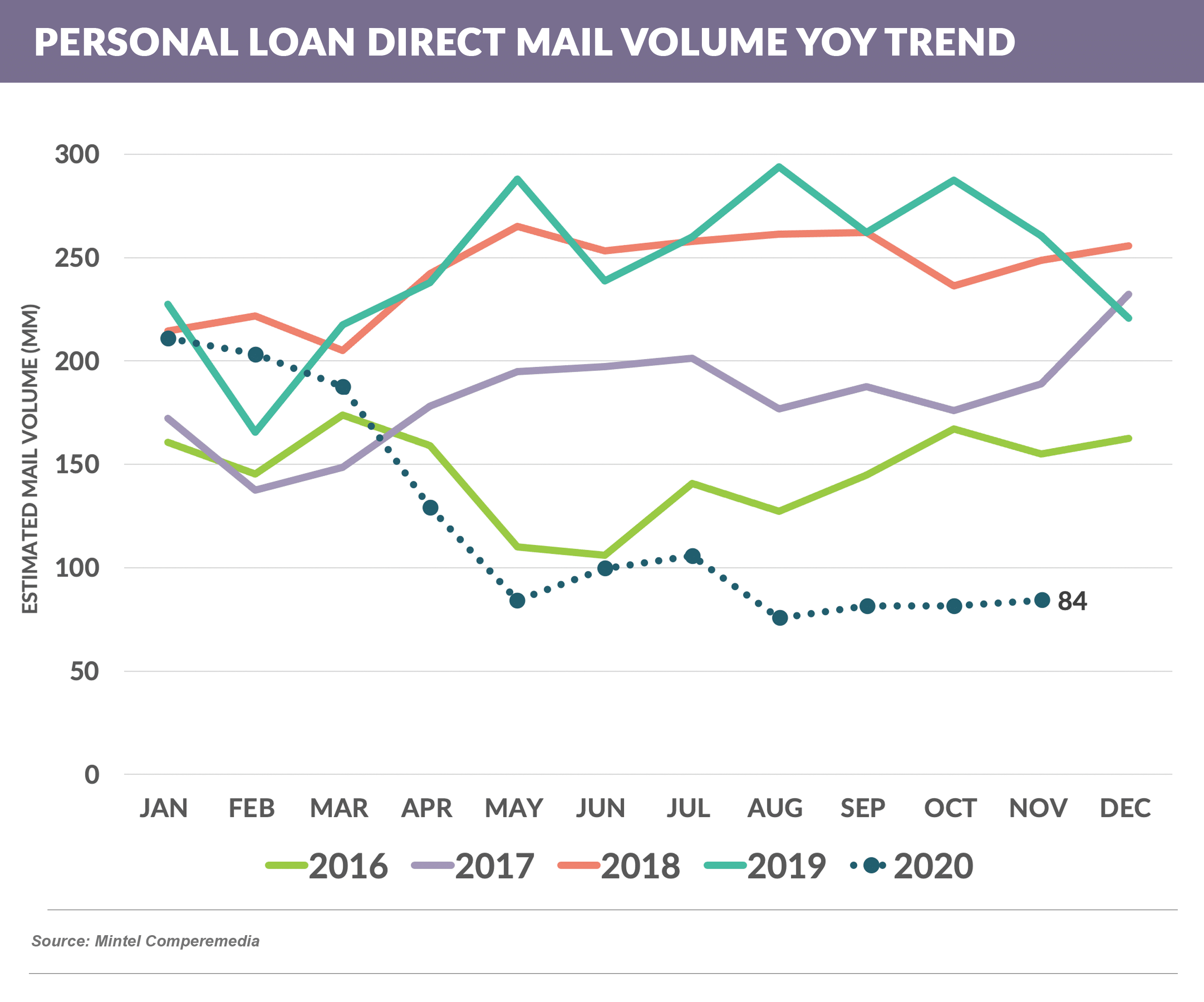

Personal Loan Mail Volume – More of the Same

- After dropping over 60% from March through May, personal loan mail volume has maintained a steady pace of ~80 million monthly pieces – well below the ~250 million monthly level of 2019

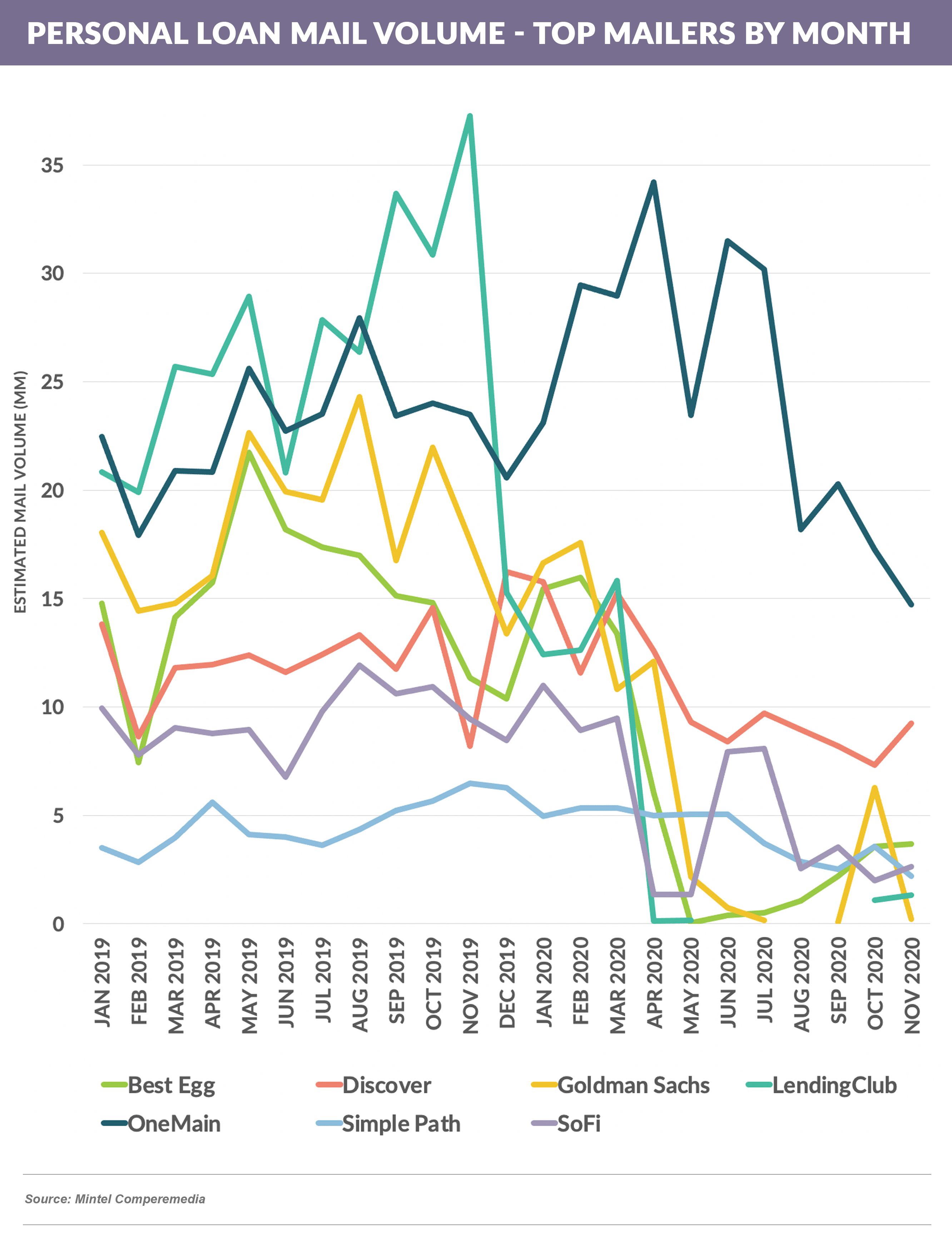

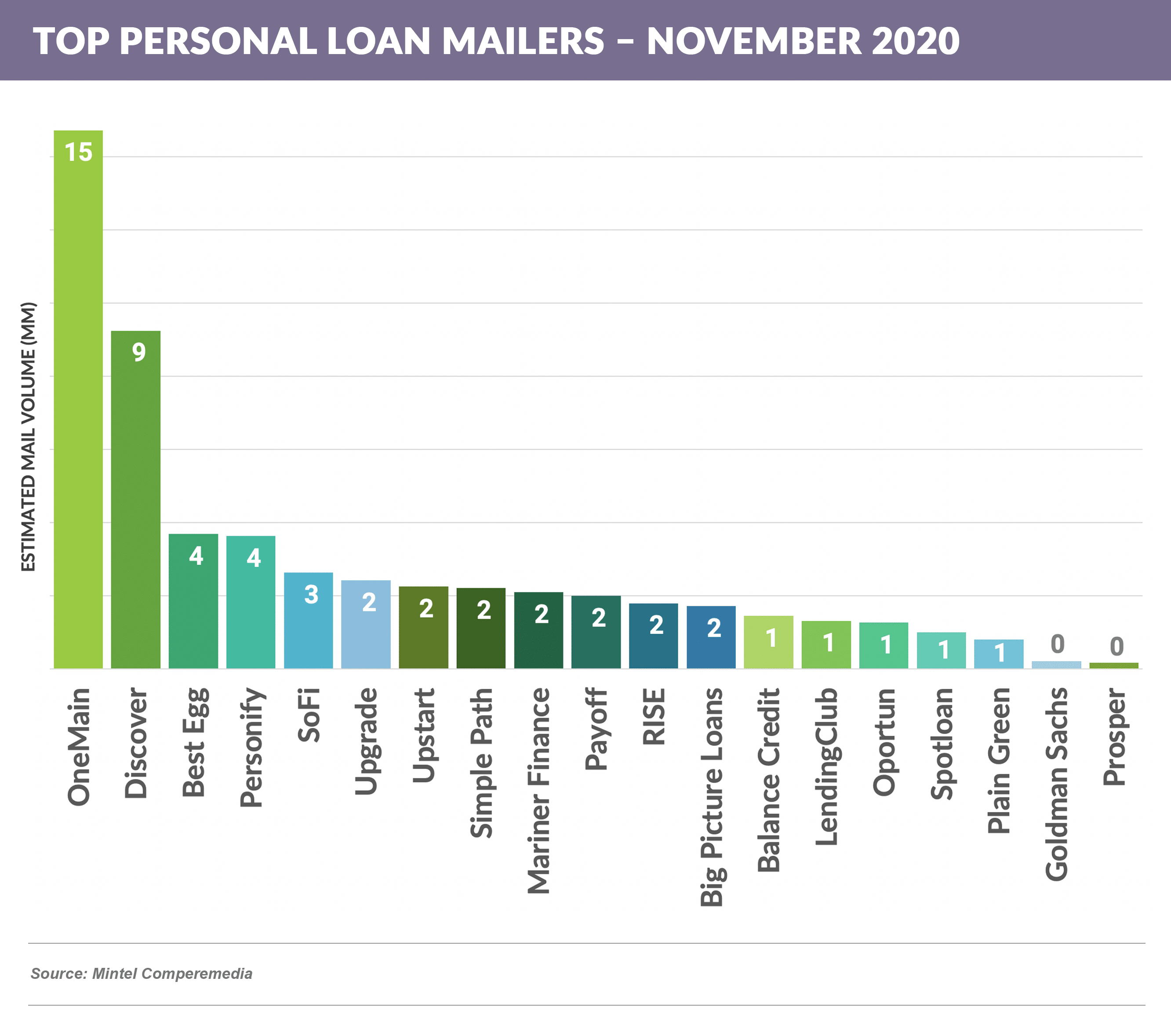

- OneMain has been the largest personal loan mailer all year, however its volume has tailed off the past two months while still maintaining the top spot

- Discover maintains the second spot, while other lenders continue to focus on digital channels at the expense of mail

Quick Takes

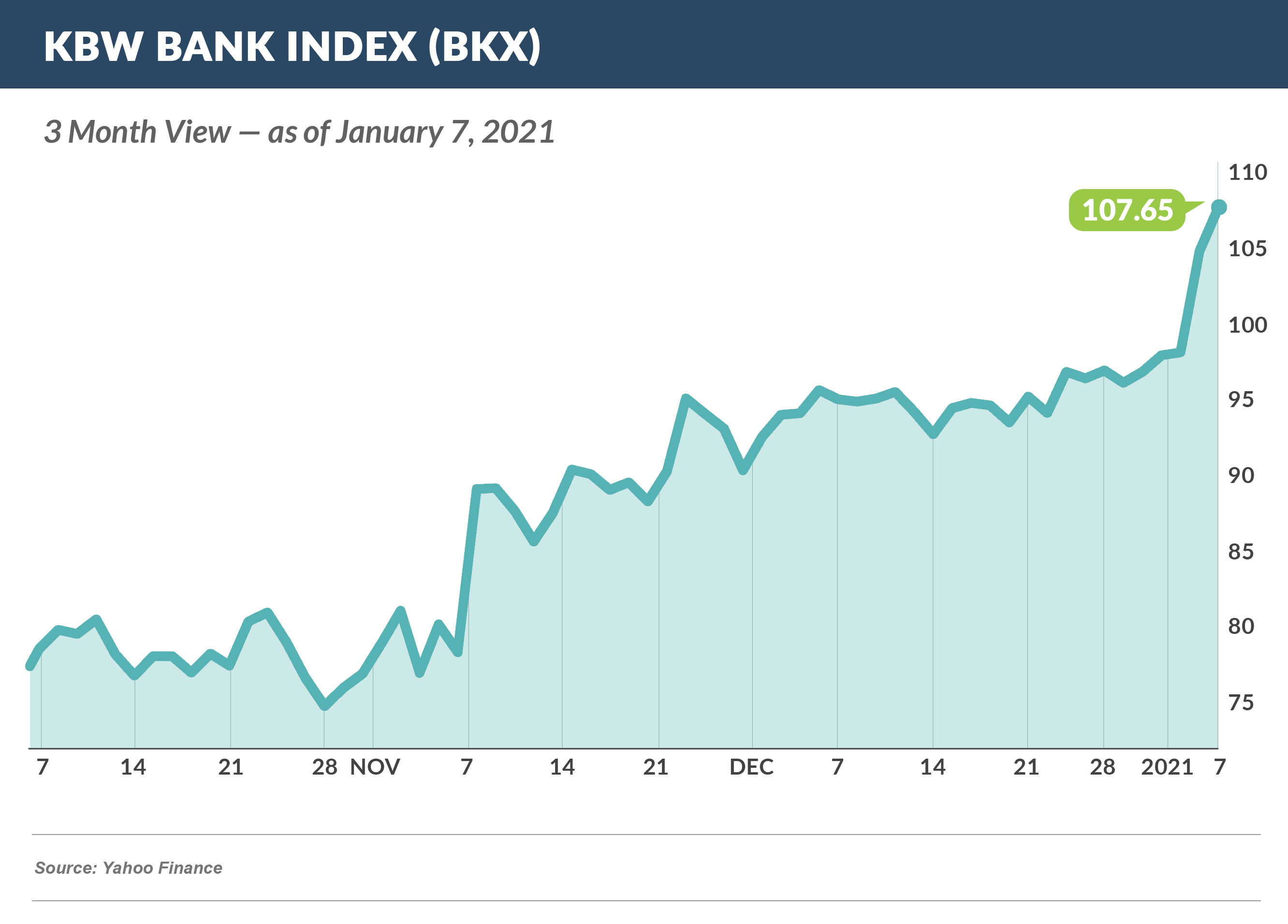

- After stocks tanked last March, many sectors have recovered and gone even higher than before

- However, bank stocks had been a laggard until a post-election rally, which has extended into early January, fueled by the vaccine, stock buy backs, a more stable political environment, and now a rise in rates

- Some large banks – JPMorgan, Wells Fargo, and Bank of America – are up 30% - 50% since the election

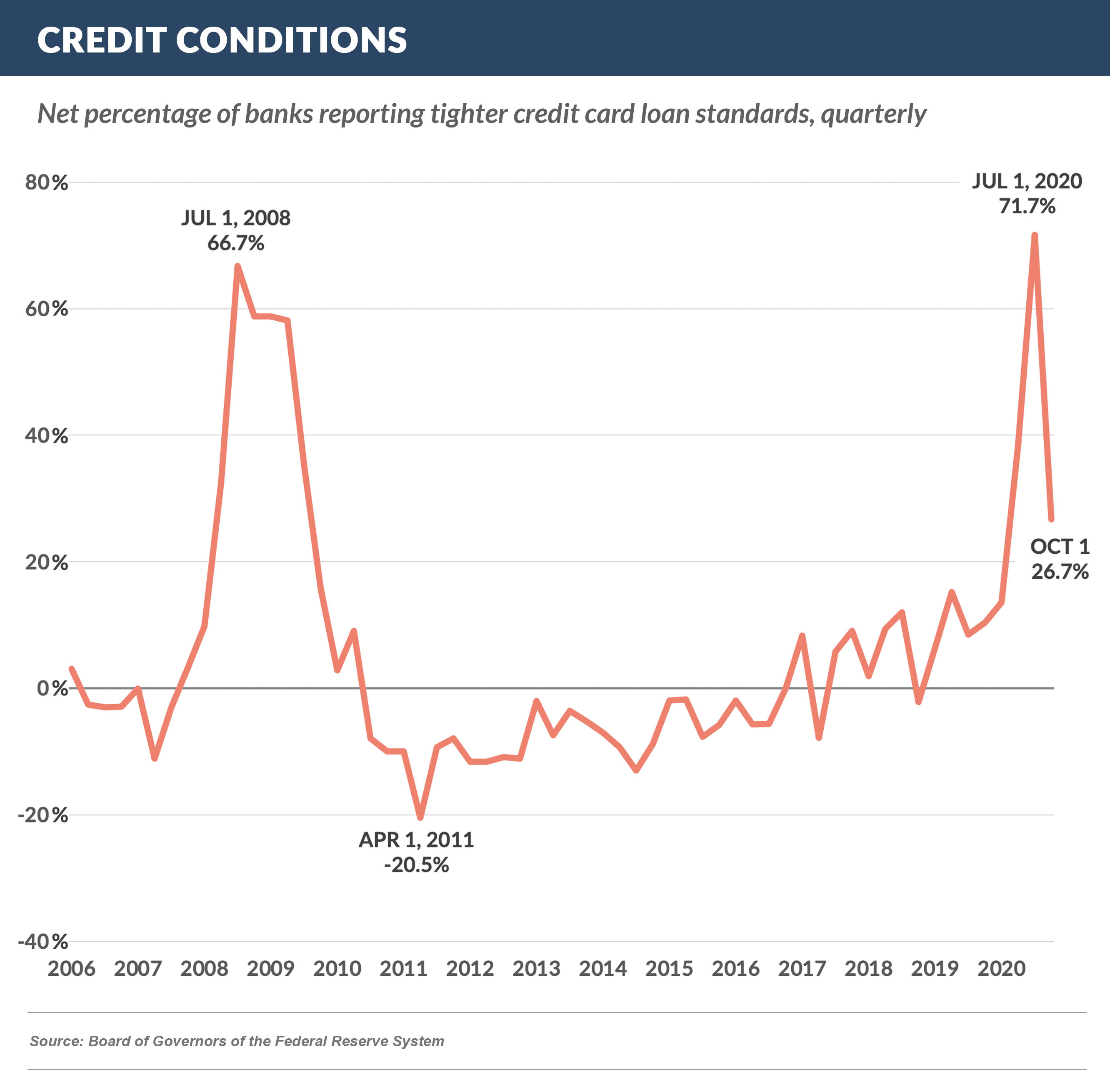

- We all know banks have tightened credit standards over the past ten months, but this chart from the Federal Reserve via the Wall Street Journal indicates that might be finally slowing down

- In addition to lower approval rates, much of the slower pace in new customer acquisition has come from the smaller available prospect universe resulting from tighter criteria

Thank you for reading.

The next Epic Report will publish in two weeks on January 23rd.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.