Three Things We’re Hearing

- Will the credit environment ever return to “normal”???

- Epic predictions!

- Solicitation volumes remain sluggish

A three-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Will the Credit Environment Ever Return to “Normal”???

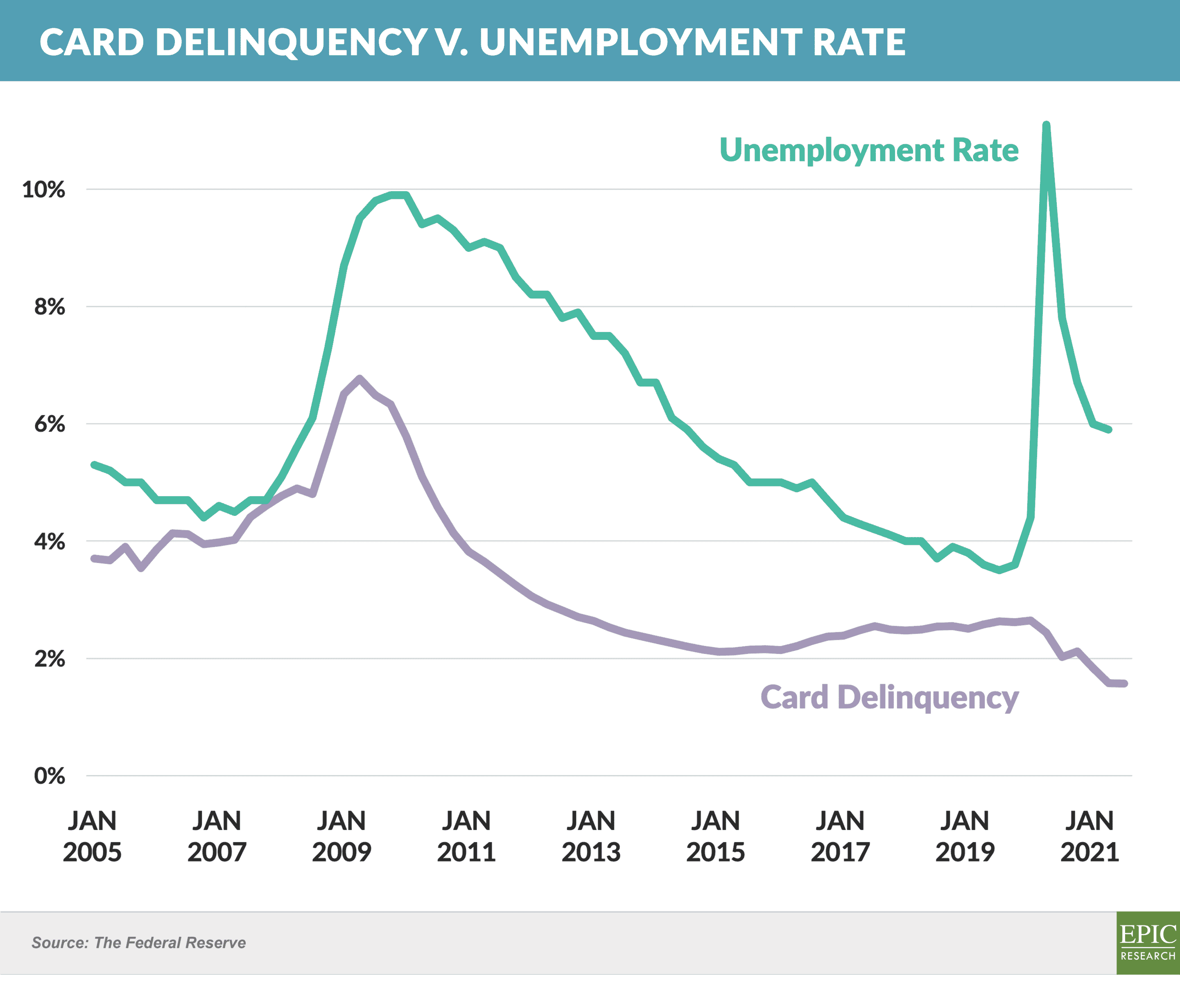

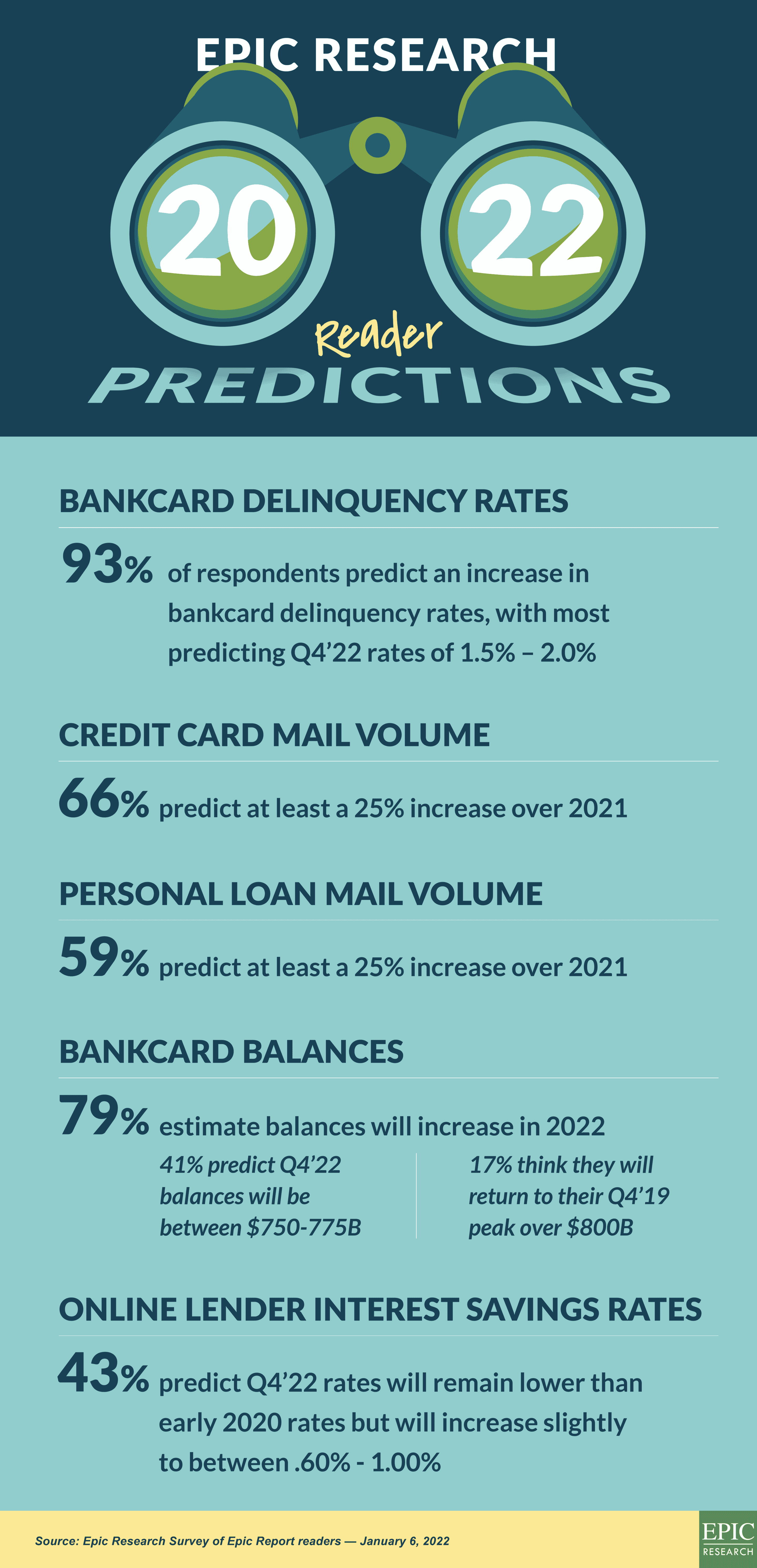

- As noted in the October 24th, 2020 Epic Report, the historic trend of bankcard delinquencies closely tracking the unemployment rate was broken during the recent pandemic-inspired spike in unemployment

- Looking at the longer-term trend, the ’08/’09 financial crisis had the effect of accelerating many future bankruptcies and other losses, such that the following years experienced lower-than-normal delinquencies and losses

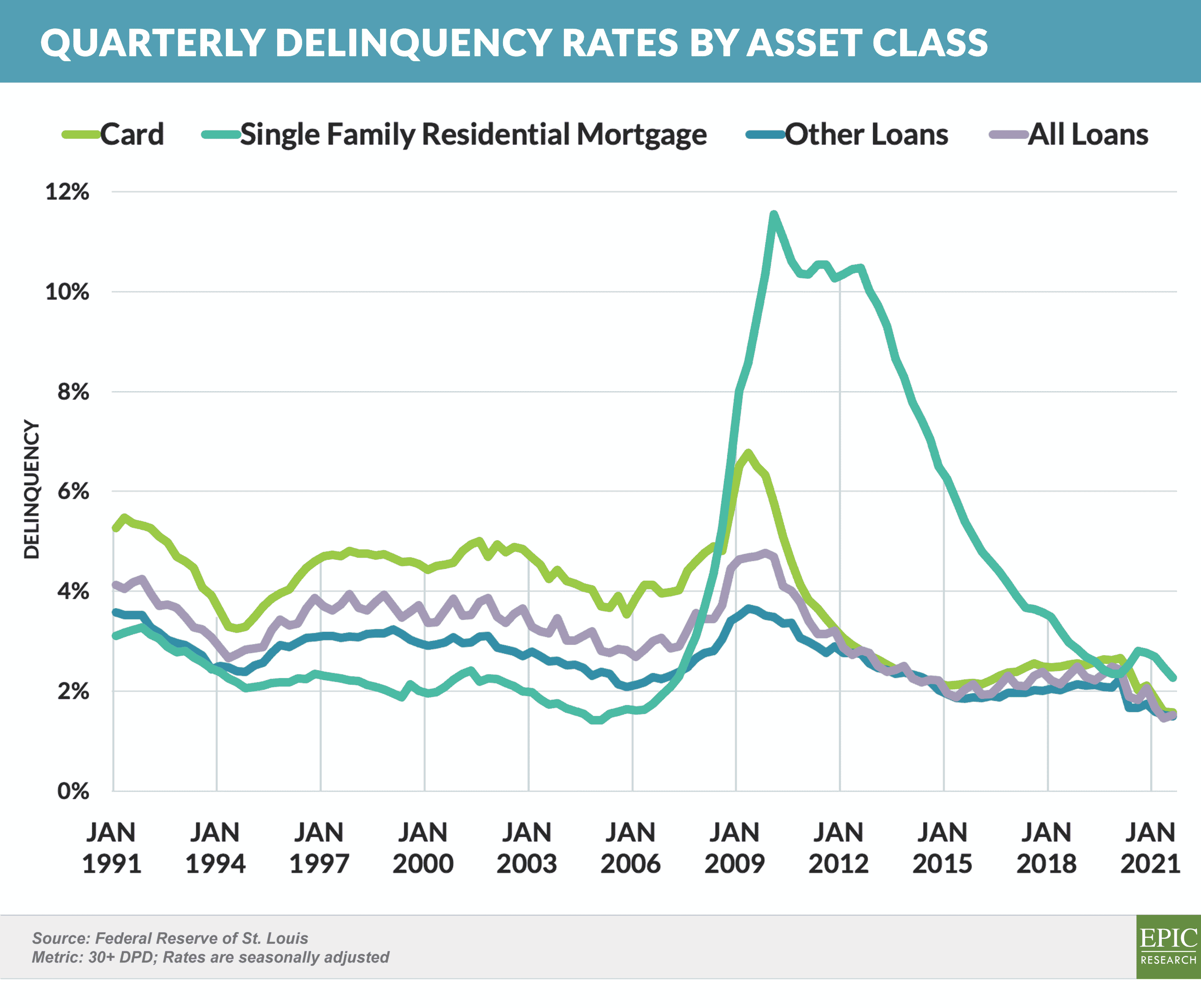

- More recently, unprecedented government stimulus, along with a “V-shaped” economic recovery, have driven card delinquencies to historic lows

- Other consumer loan categories have benefitted from the same factors, creating an unprecedented benign credit environment

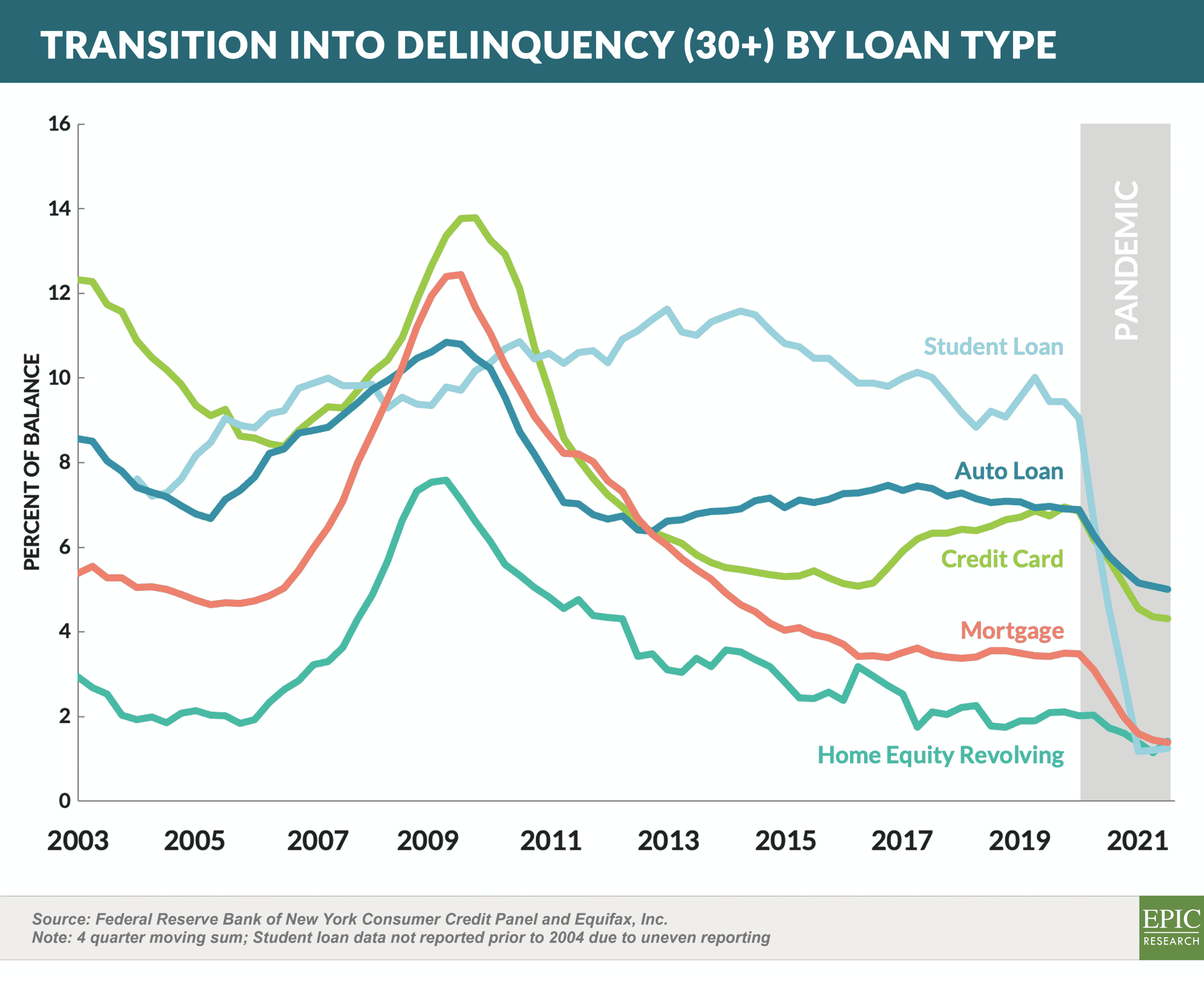

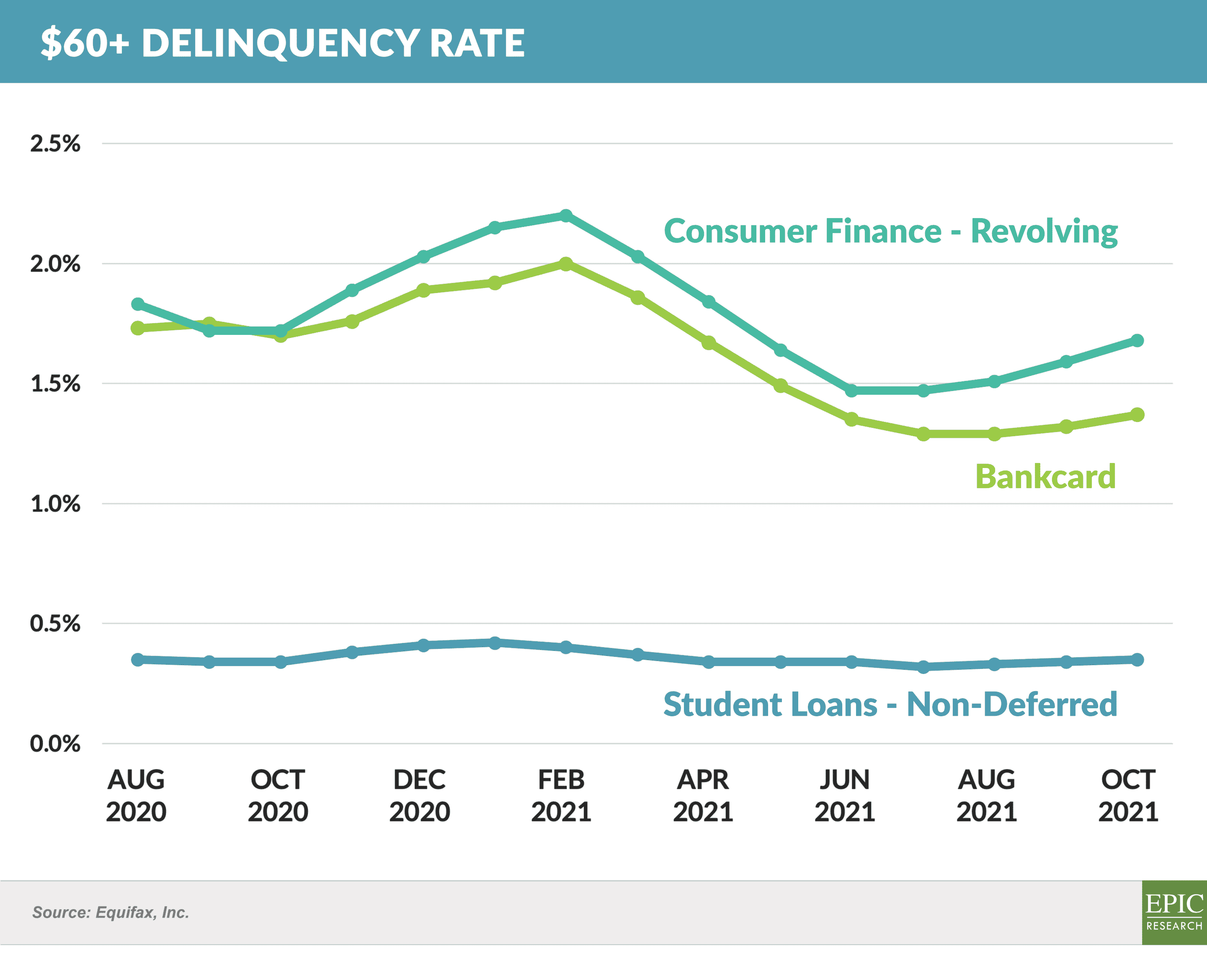

- However, bankcard and unsecured loan delinquencies have begun to tick up in the past several months

- While the timing tracks along traditional seasonal patterns – a summer trough followed by an uptrend in the fall – it has yet to be seen if the rise in delinquencies is part of a broader “return to normal”

- A reversal in the credit cycle in the next few years is inevitable, and it will be interesting to see how companies, and their management who have not experienced a true adverse credit environment, react

Epic Predictions!

- Before we get into 2022, let’s review the 2021 predictions we made in our January 23rd, 2021 Epic Report:

- We were mostly on target, as noted below:

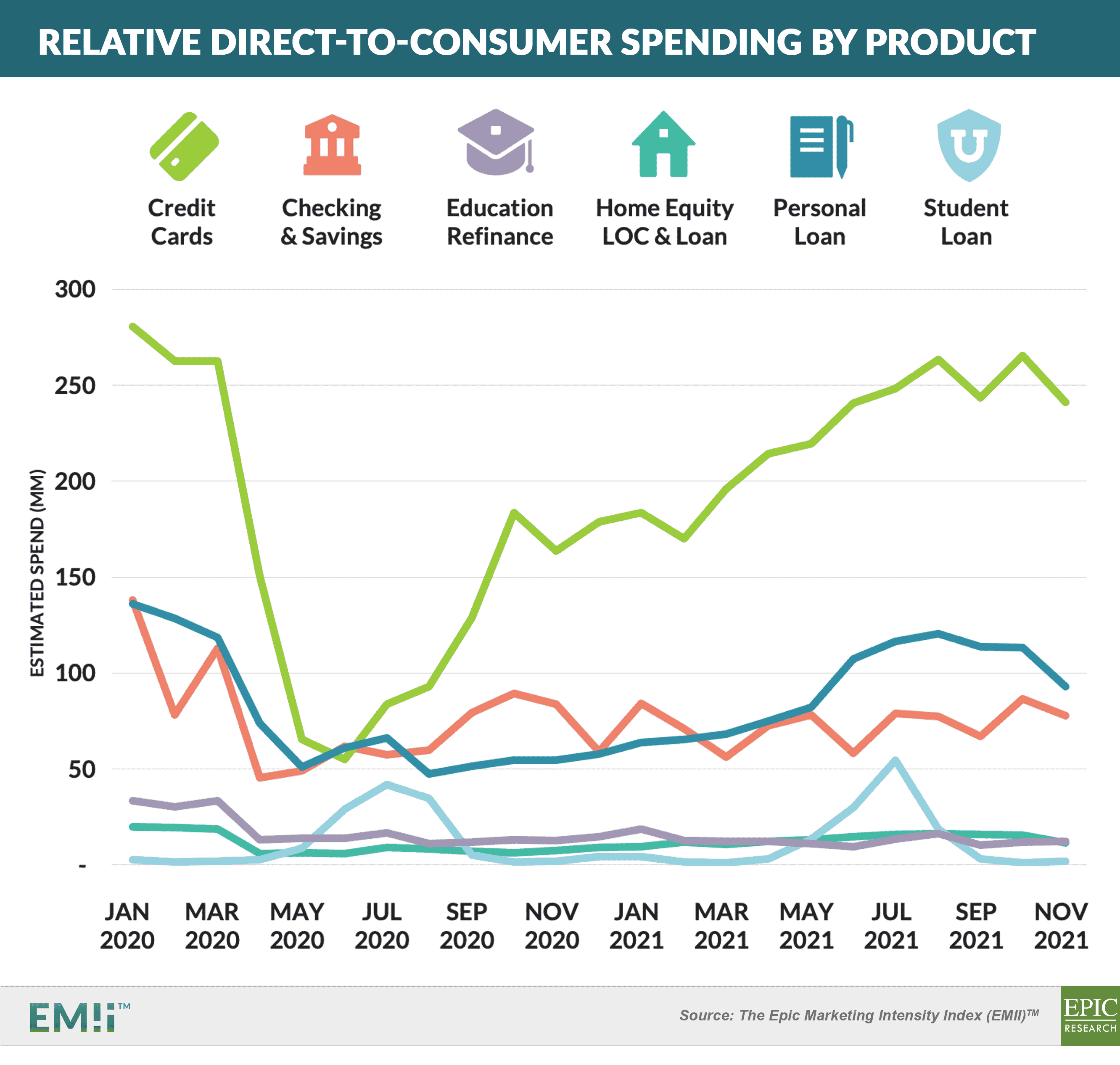

- 1 - While advertising spending on credit cards and student loans did recover to pre-COVID levels, overall financial services advertising spending did not

- 2 - Consumer credit delinquencies did not see a substantial spike (see commentary in section above)

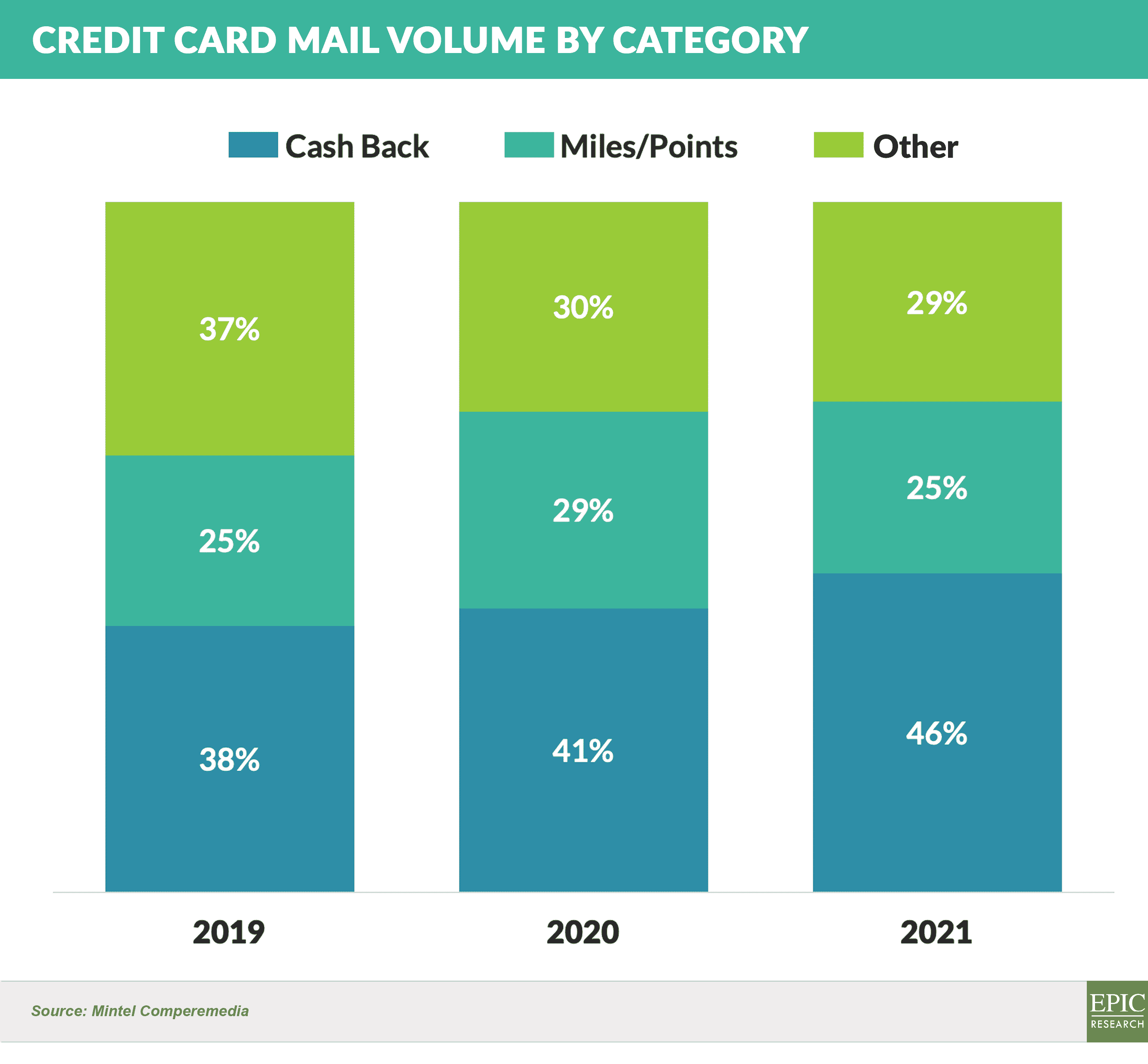

- 3 - Cash back and generic rewards cards did gain share

- Before making our own predictions for 2022, we informally polled our readers to see what you thought about several consumer financial services trends, with your predictions below

- Lastly, following are the Epic predictions for the next 12 months

- 1 - Several retail banks will enter the personal loan market

- Over the past few years, the absence of commercial banks from the list of top 25 mailers of personal loans has been noticeable

- One or more retail banks will realize that the combination of their funding advantage and brand equity will give them a significant competitive advantage over fintechs that have dominated the space, causing more traditional banks to enter the market in a significant way

- 2 - BNPL will level off in its popularity and remain a niche product with low, single-digit market share

- BNPL is a niche product, and lenders are already highly competitive in the race to acquire new merchants

- The underlying economics are challenging and will become more so as credit losses approach “normal” levels, which will cause merchants to push back on discount rates

- 3 - At least one BNPL issuer will blow up

- BNPL is a relatively new product with many companies dominated more by those with “tech” experience vs. “fin” experience

- Credit models and underwriting criteria developed in this historically benign credit environment will fail, resulting in high levels of credit losses that severely impact at least one player in the segment

- The result will perhaps lead to additional, or more uniform, credit reporting requirements for all players

Solicitation Volumes Remain Sluggish

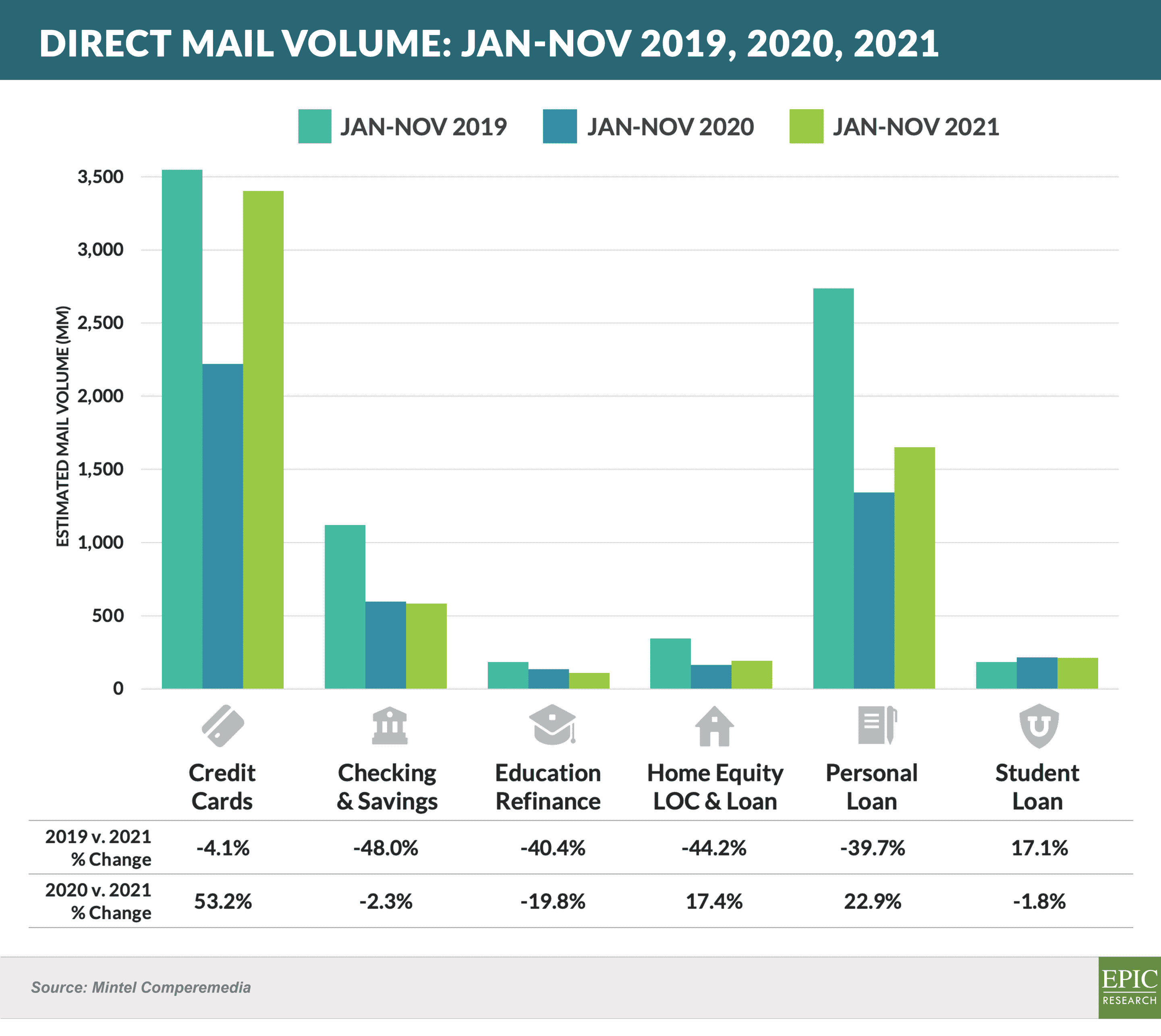

- Mail volume for most consumer financial products was seasonally lower in November

- For the full year, credit cards and student loans remained the only two products that recovered at or above pre-COVID levels

- Other products remain at mail volumes ~40%+ lower than 2019

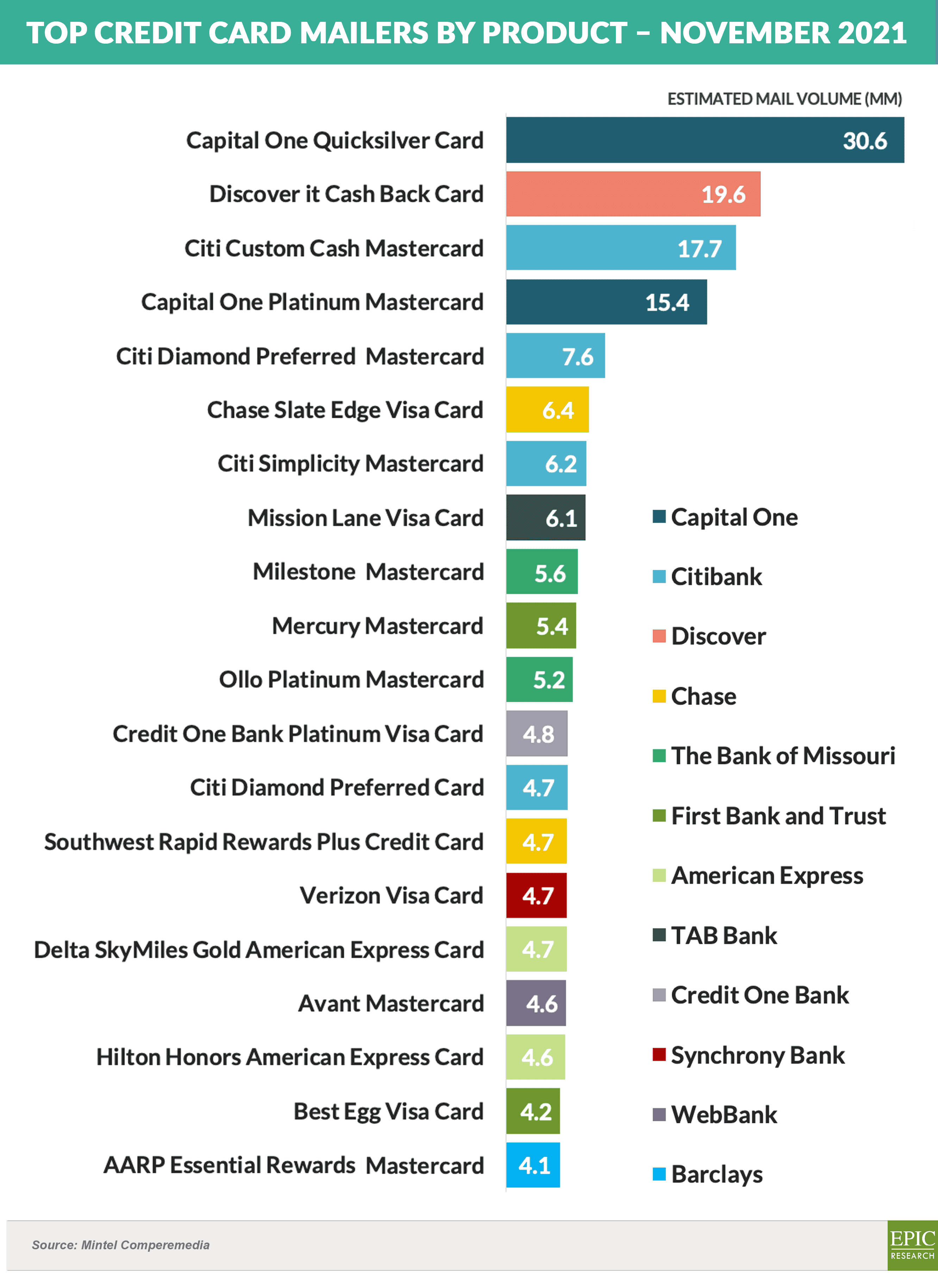

- Best Egg’s recently launched credit card joined competitors Ollo, Mercury, Mission Lane, Milestone, Credit One, and Avant in the “near-prime/credit-builder” segment, a segment which accounted for 7 of the top 25 card products mailed in November

- There is obviously a large opportunity in the near-prime space, which commercial banks have until now ignored for fear of increased losses in an economic downturn

- However, a fatal credit spike did not occur in the ’08/’09 credit crisis for the few issuers in the space at the time (e.g., Capital One, Barclays)

Quick Takes

- BNPL issuers have come under heightened scrutiny

- BNPL stocks fell following the announcement of a CFPB inquiry into the risks and benefits of their products

- Credit bureaus have also announced that they will begin reporting on BNPL loans

- Bank of America announced its Diamond and Diamond Honors credit cards, targeting affluent customers with average investment balances from $1 - $10+ million

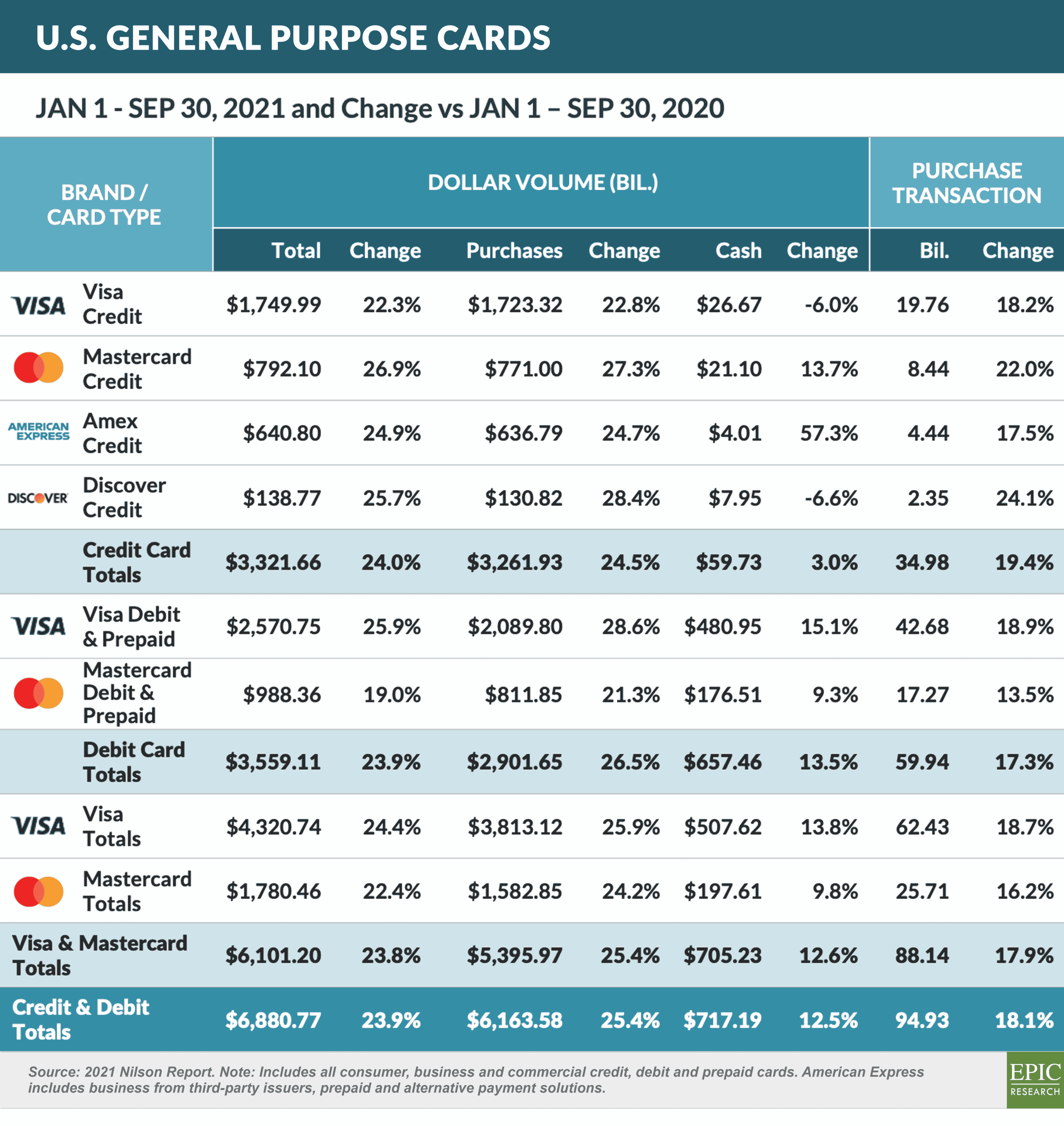

- 2021 general purpose card spending through September 2021 exceeded the same period in 2020 by 25%

The Epic Report is published monthly, and we’ll distribute the next issue on February 5th.

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here. To subscribe to our newsletter, click here.