Three Things We’re Hearing

- HELOC poised for growth?

- Personal loan growth sluggish

- Cash back cards dominate the mail

A two-minute read

HELOC Poised for Growth?

- We predict HELOC will be a key growth target for 2021, and many banks have already invested in product and system innovations

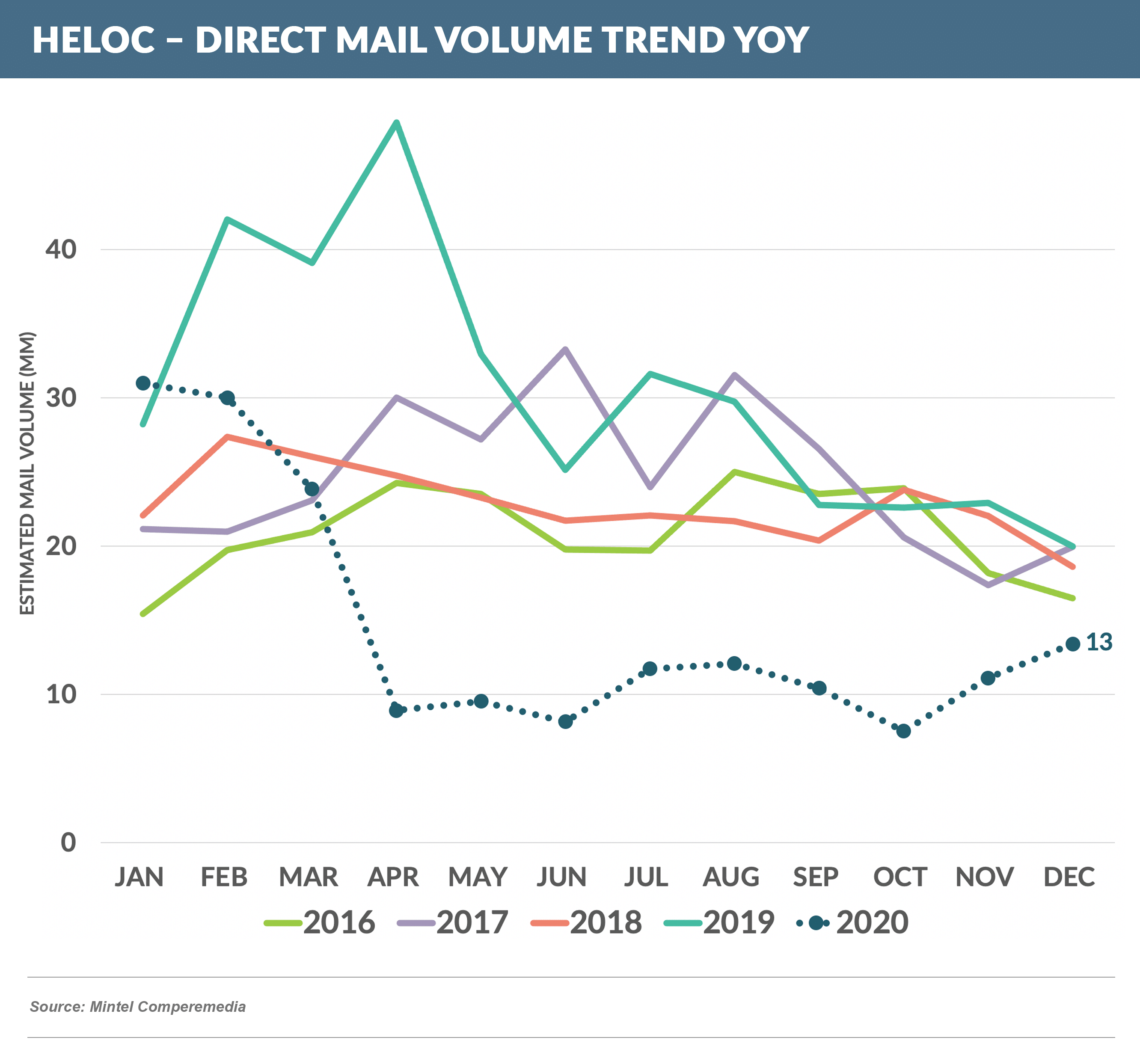

- This would indicate a change from 2020, when acquisition marketing, balance growth, and consumer demand all remained flat to down – mail volume for HELOC products was down 49% in 2020 vs. 2019, and HELOC advertising spending across all channels was down 47%

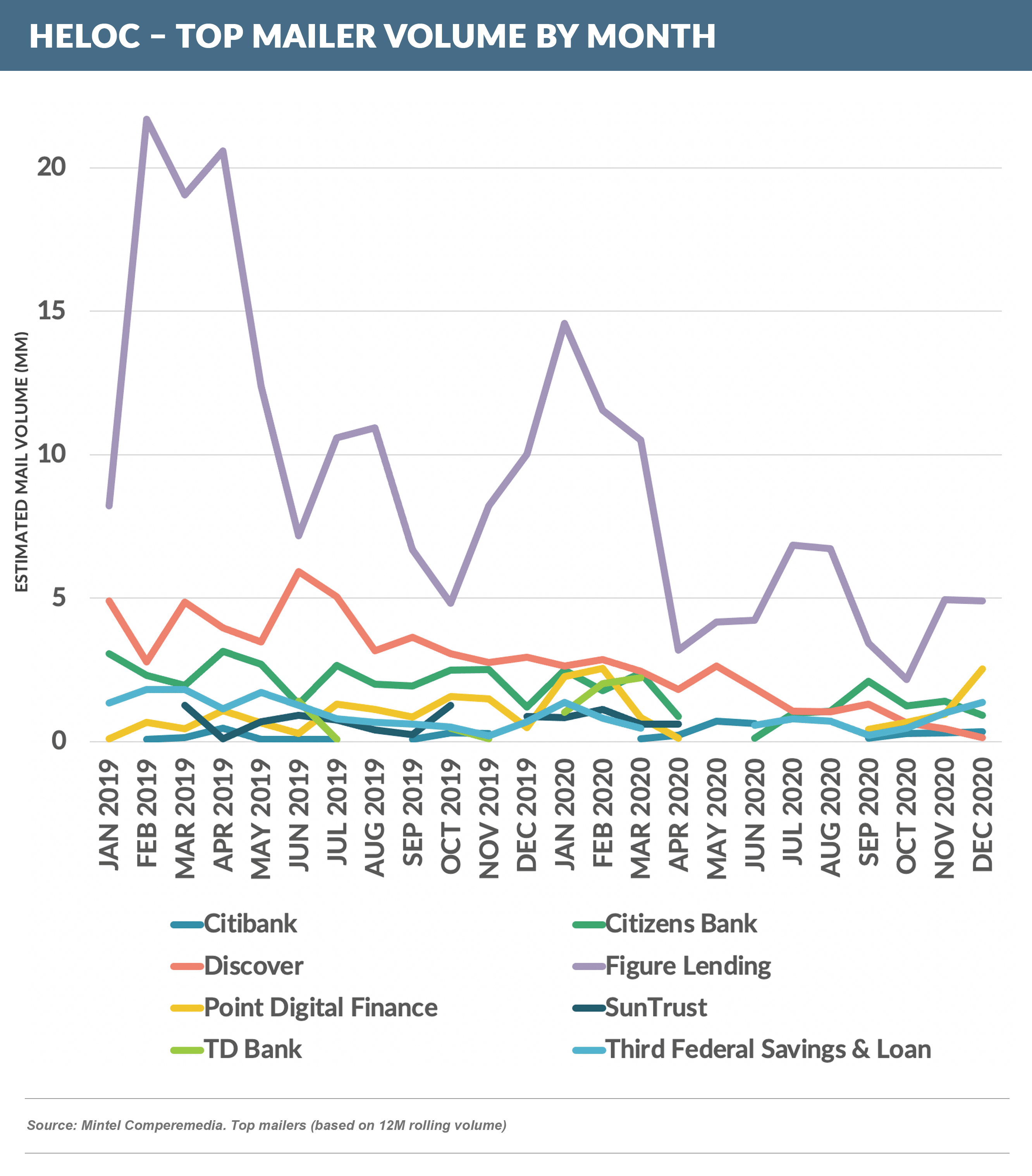

- Figure was by far the largest HELOC mailer in 2020, despite being down 45% from the same period in 2019

- Discover and Citizens were second and third largest, down 59% and 44% respectively from the prior year

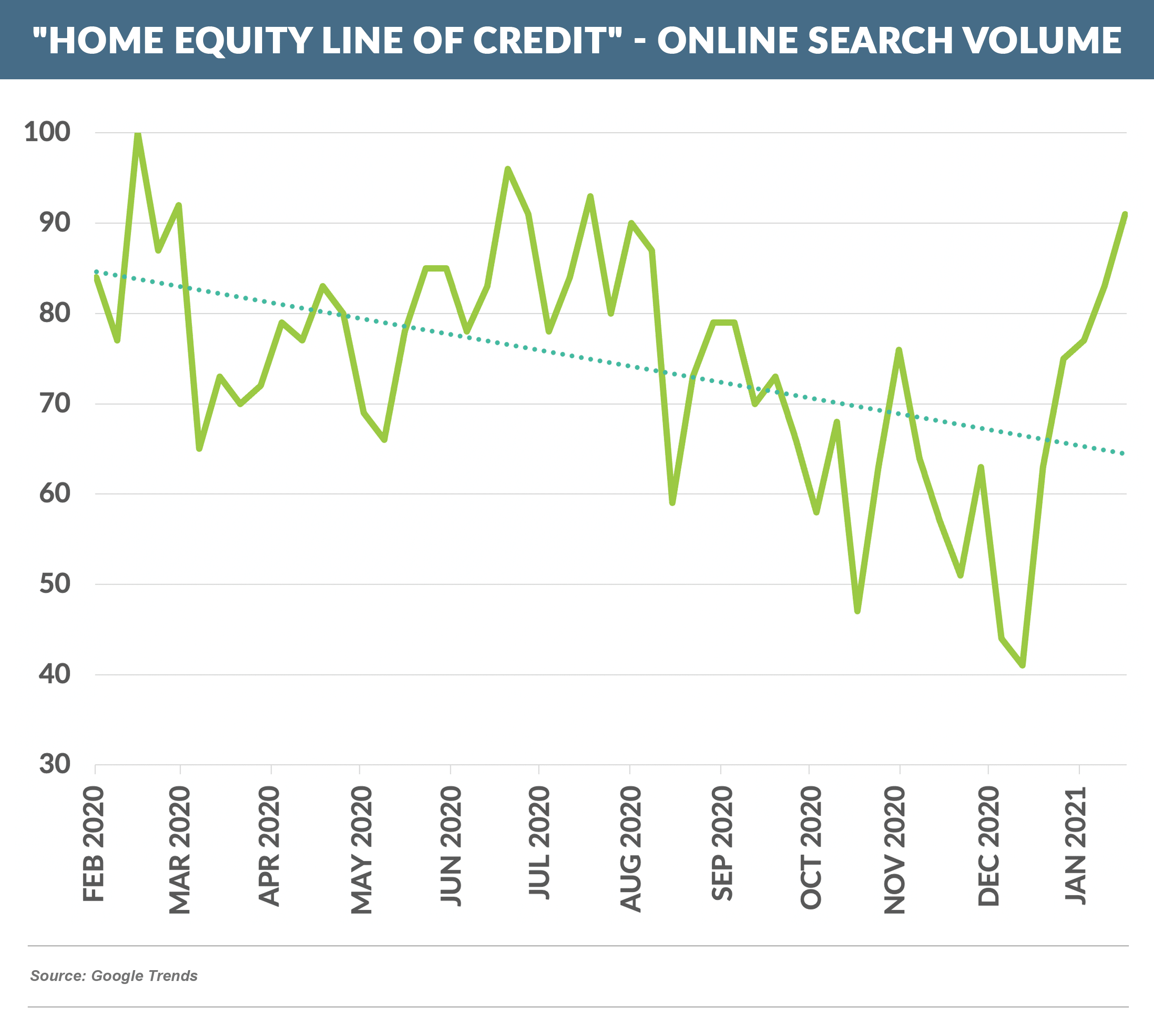

- Consumer demand for HELOC has trended downward since March as indicated by online search volume

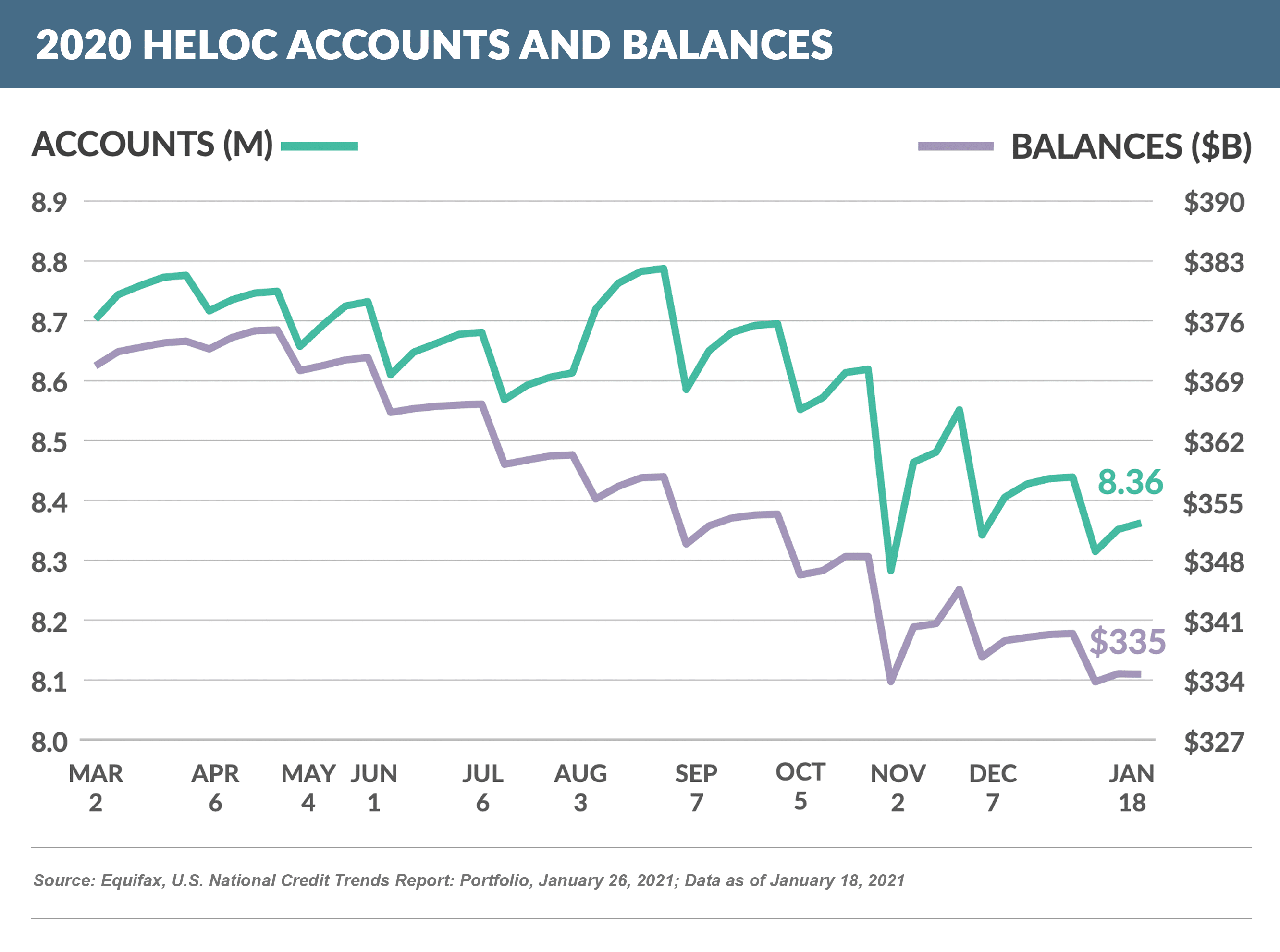

- HELOC balances declined in 2020

Personal Loan Growth Sluggish

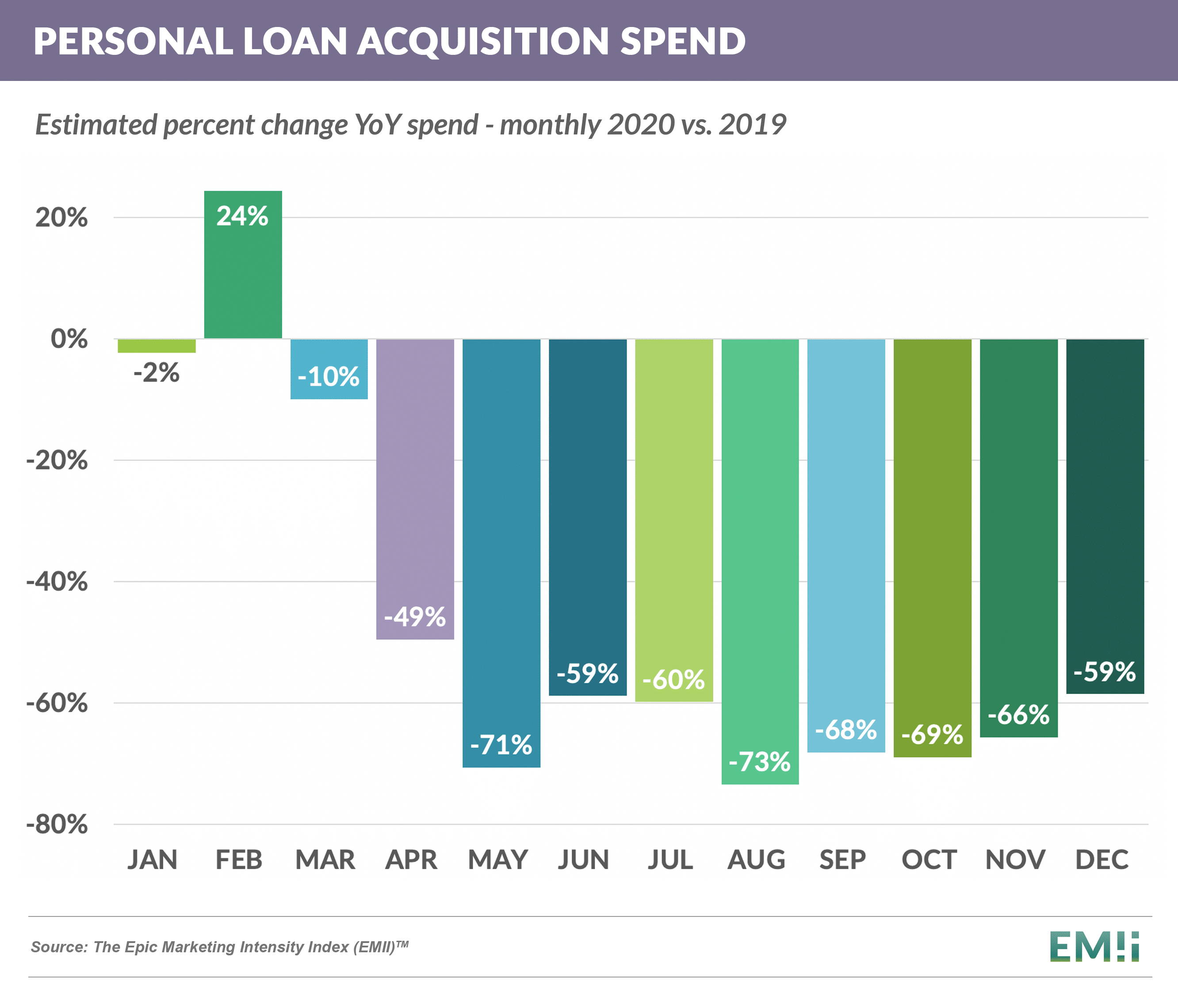

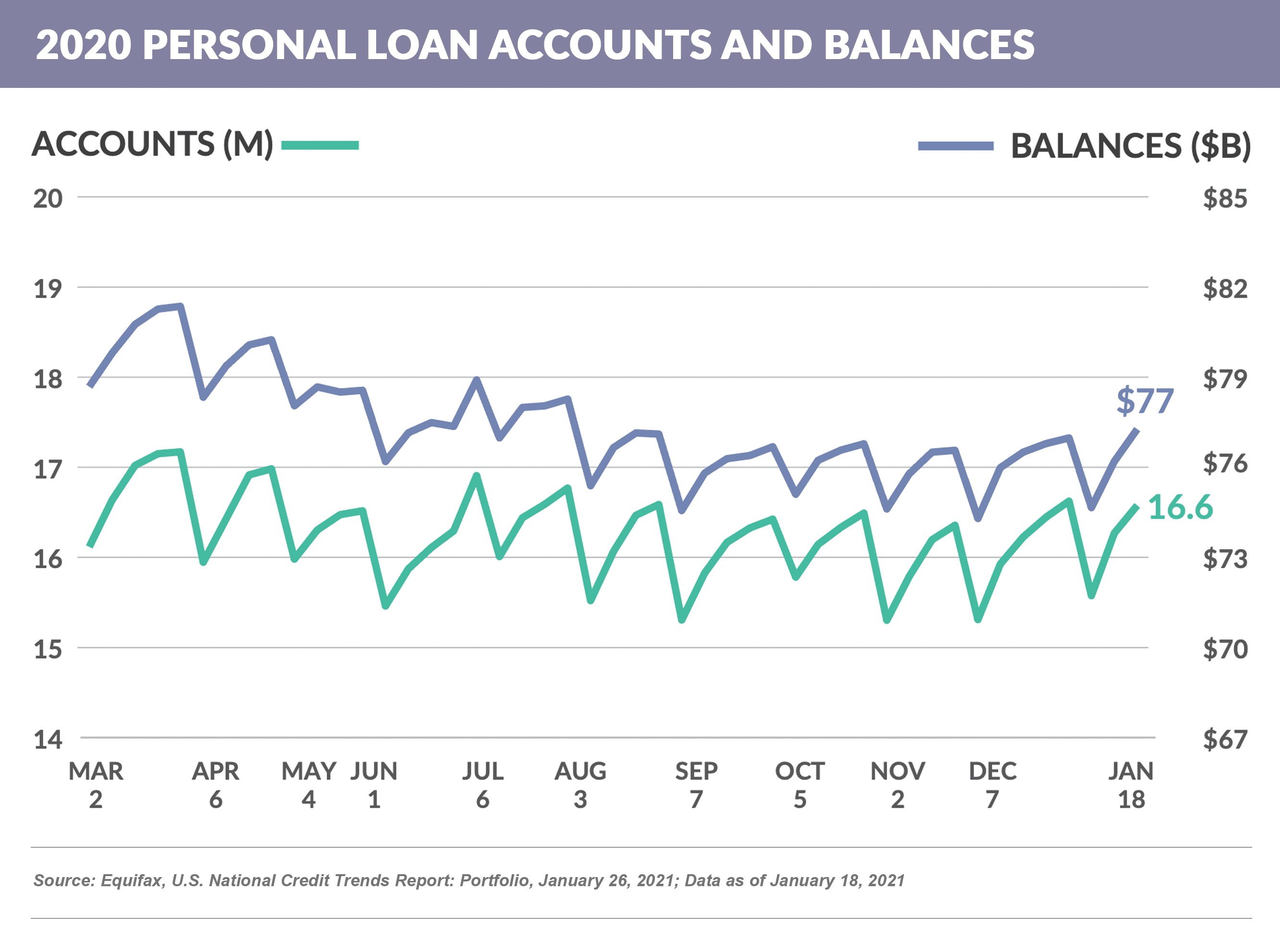

- Personal loan lenders retrenched significantly in the months following the onset of the pandemic, and unlike credit cards, overall acquisition spending has not recovered

- Mail volume is the primary driver of acquisition spending, and the low volume in 2020 is fairly consistent across all lenders, with OneMain being the exception with volume 5% higher in 2020 than 2019

- Other previously large mailers were down significantly, including Lending Club (85%), Goldman Sachs (70%), Citi (92%), and Prosper (85%)

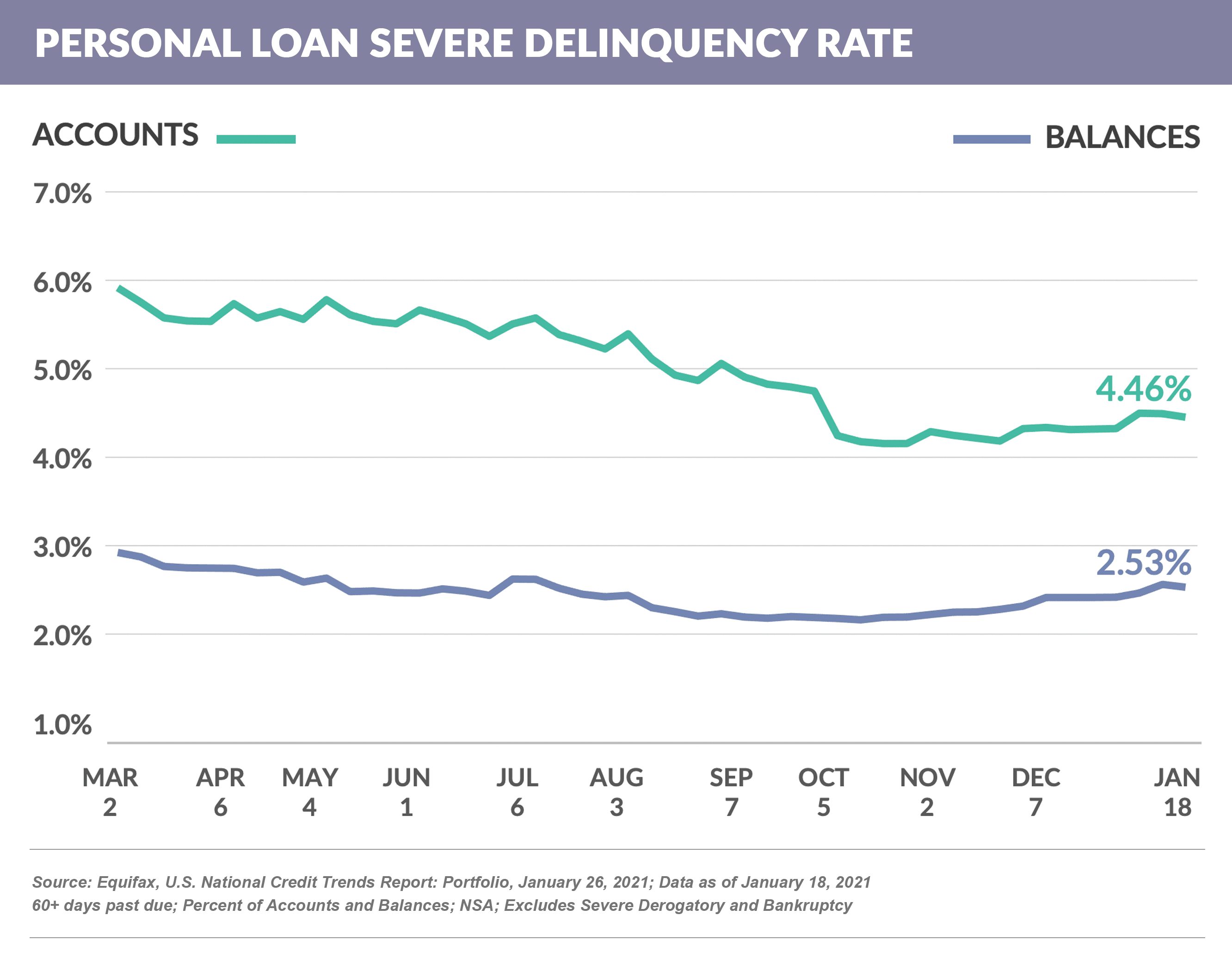

- Disruptions in funding facilities initially caused many fintechs to pull back, and credit concerns affected all lenders, however funding has since stabilized, and the feared uptick in delinquency has not materialized

- Anecdotally, Epic has heard that many lenders are back to “all in” on personal loans, however through December, it has not been reflected in digital or direct mail spend or overall balance growth

Cash Back Cards Dominate the Mail

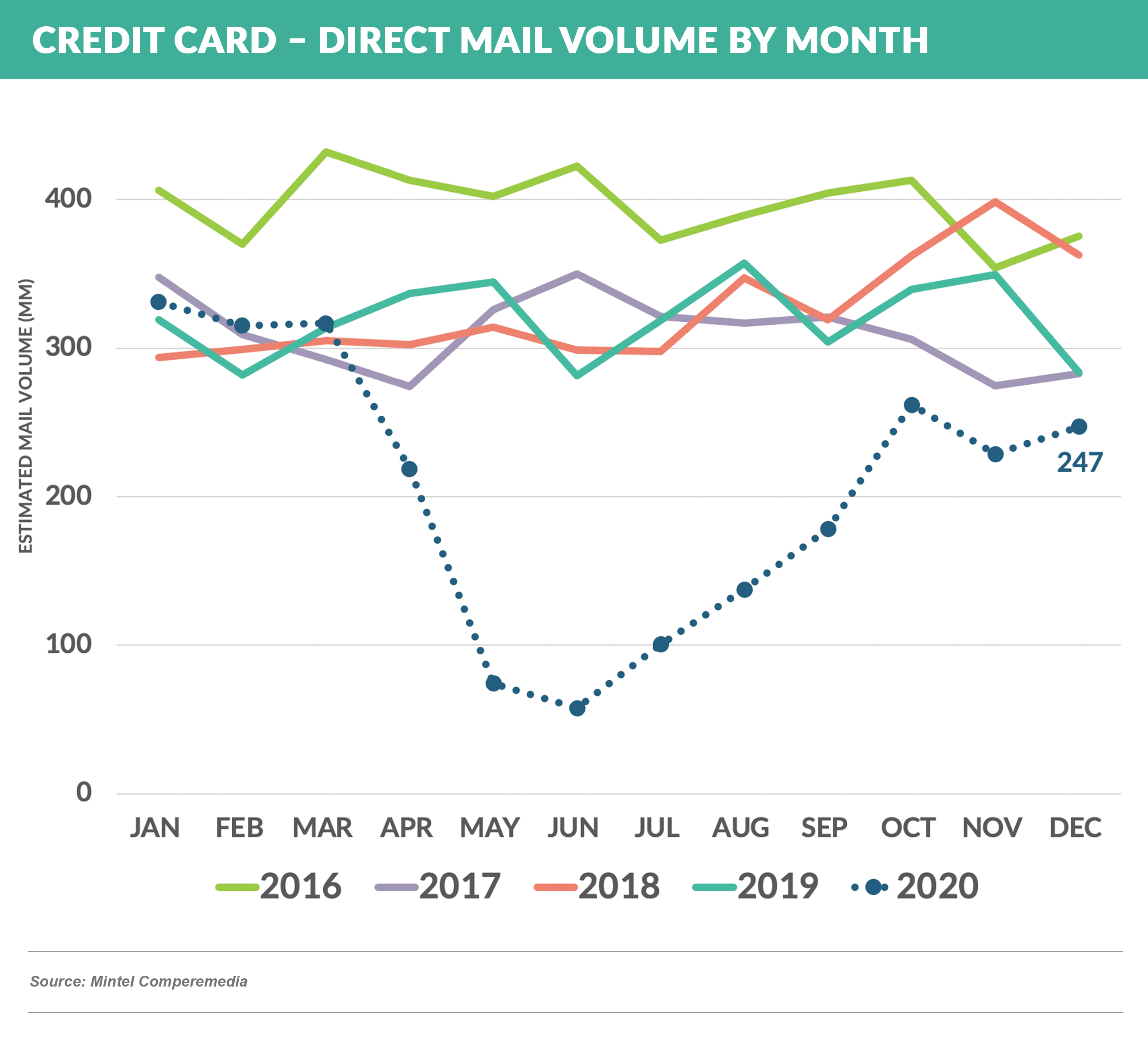

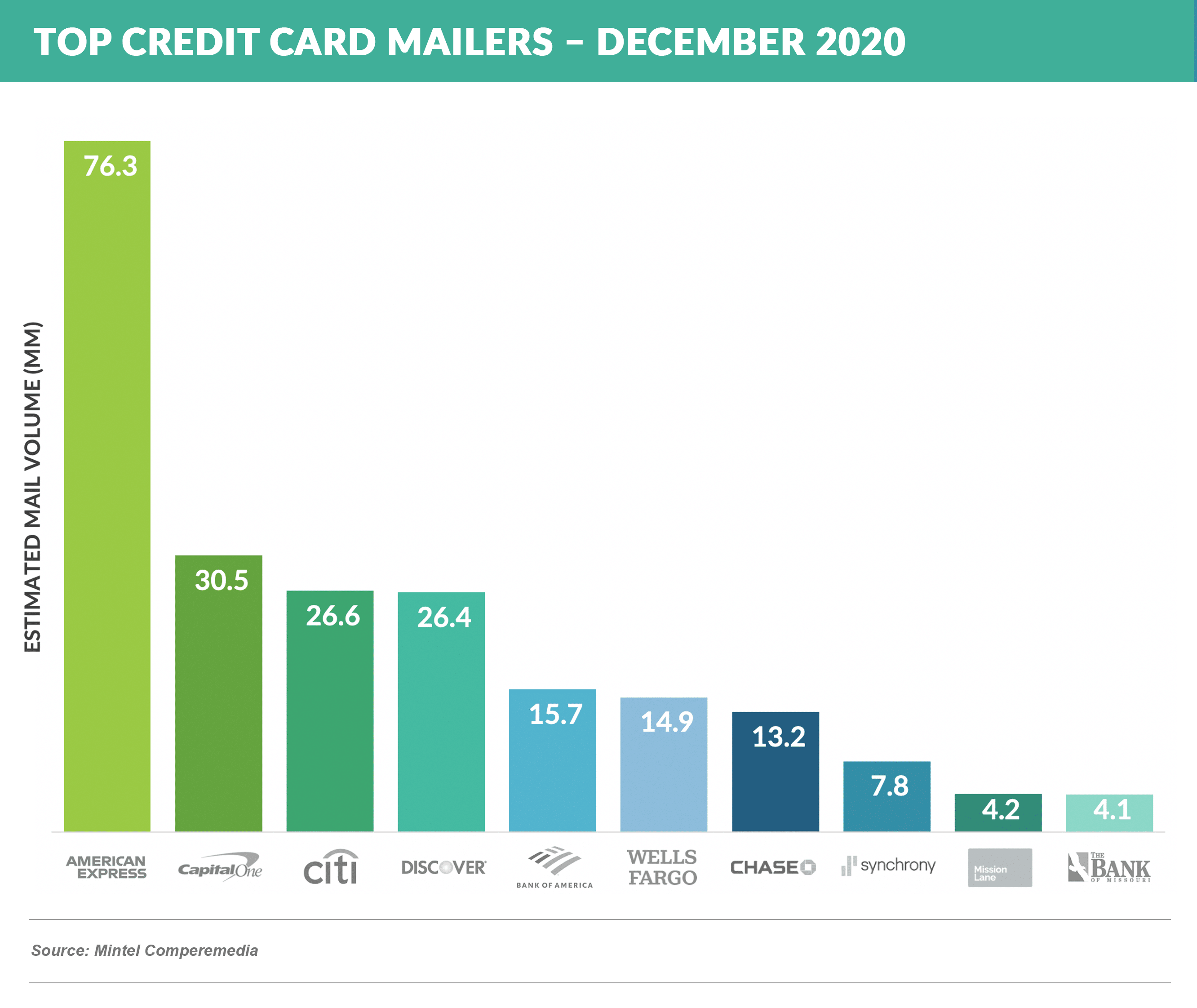

- Credit card mail volume was down 36% in 2020 vs. 2019, however it has recovered in December to 80% of prior year volumes

- American Express remains the number one mailer by far, with Capital One, Citi, and Discover all having returned to higher mail volumes

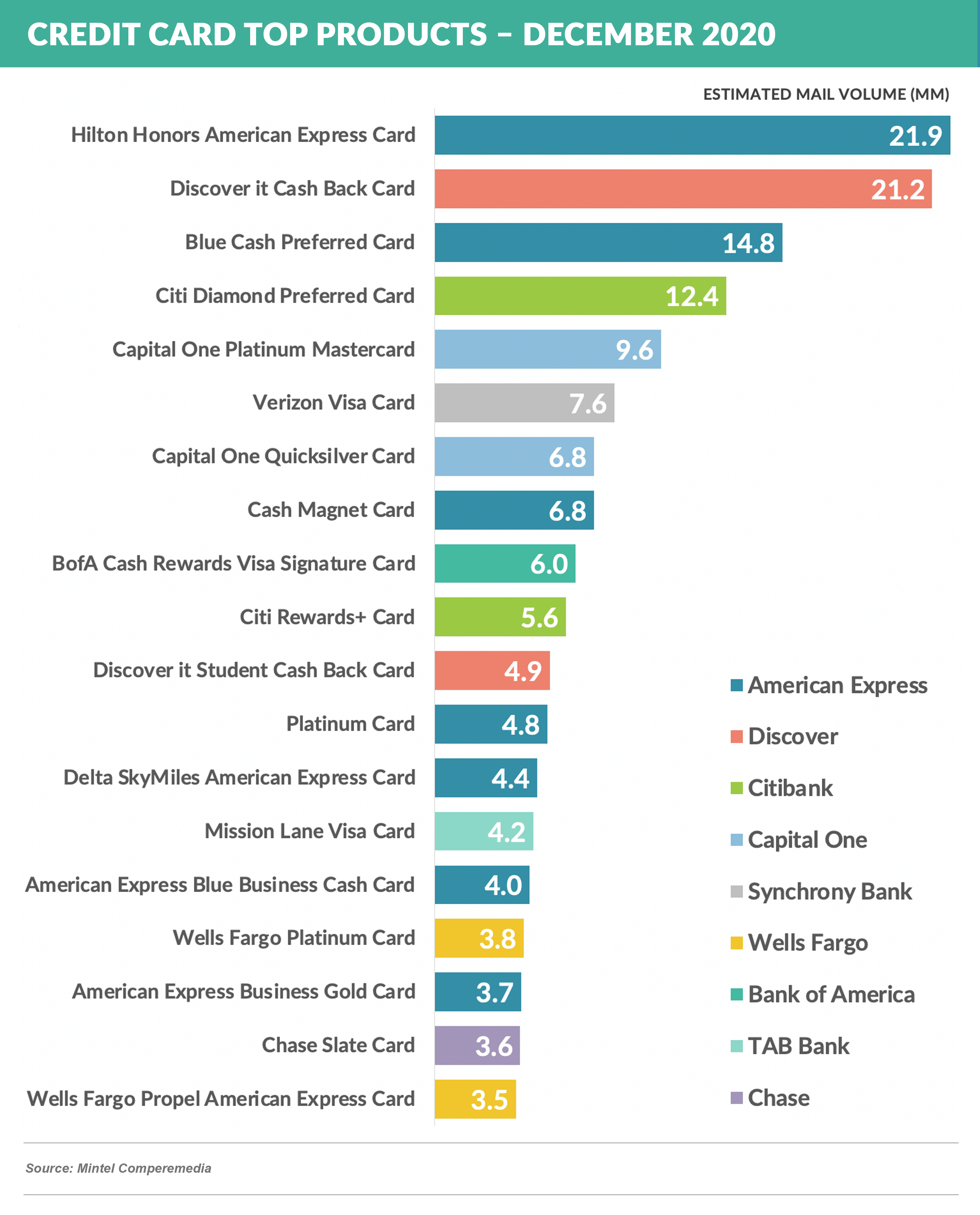

- Other than the Amex Hilton product, cash back cards dominate the offers

Quick Takes

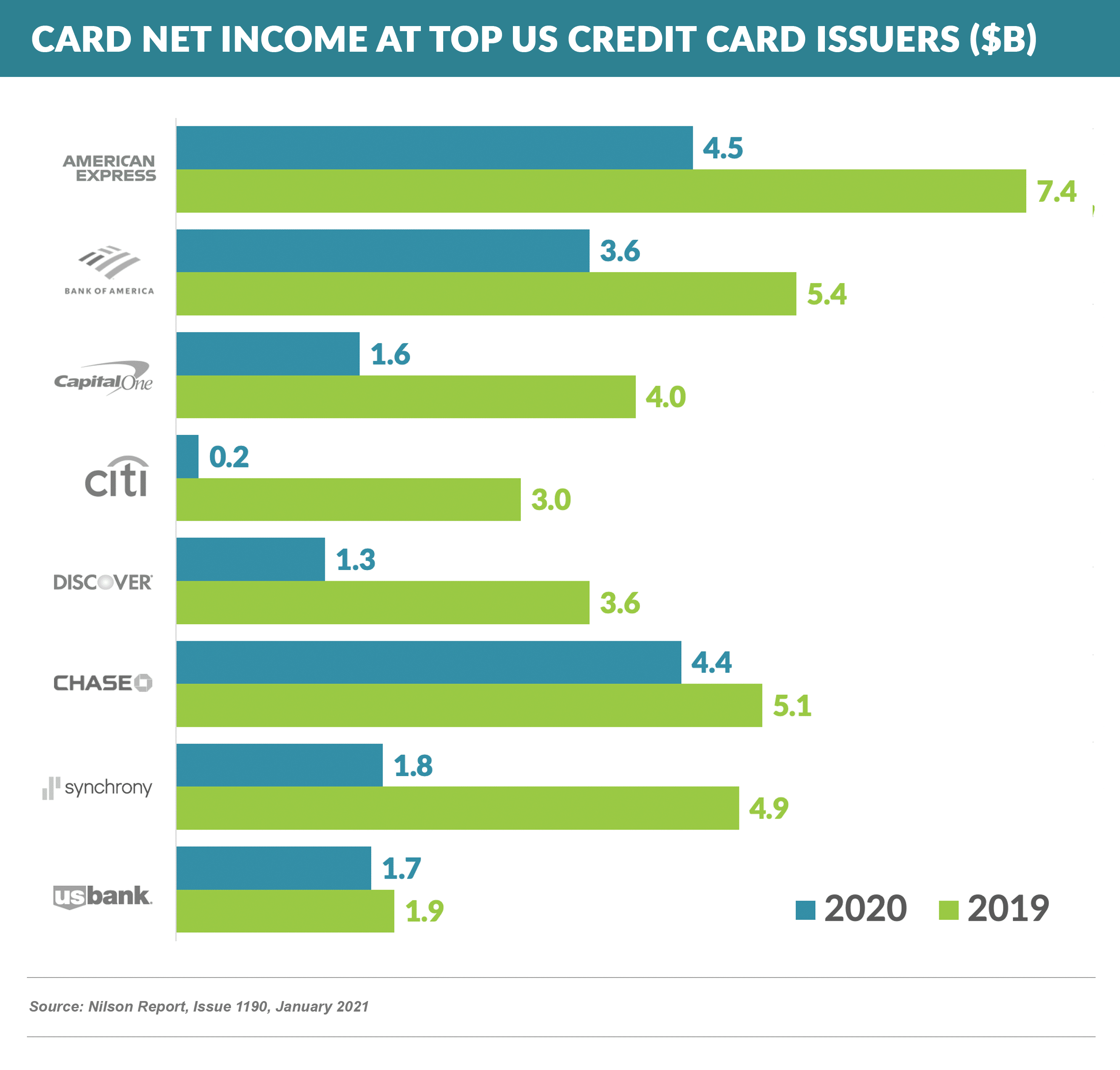

- 2020 credit card profits declined 45% at large issuers as pandemic-related provision expense was up 86% from 2019

- In better news, lenders broadly reported better than expected 4Q credit reports – further evidence that the anticipated shock on consumer financial assets was not as bad as feared

Thank you for reading.

The next Epic Report will publish on February 20th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.