Three Things We’re Hearing

- Neobank growth surge

- Ease of use drives neobank popularity

- Highest credit card mail volume in years

A three-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Neobank Growth Surge

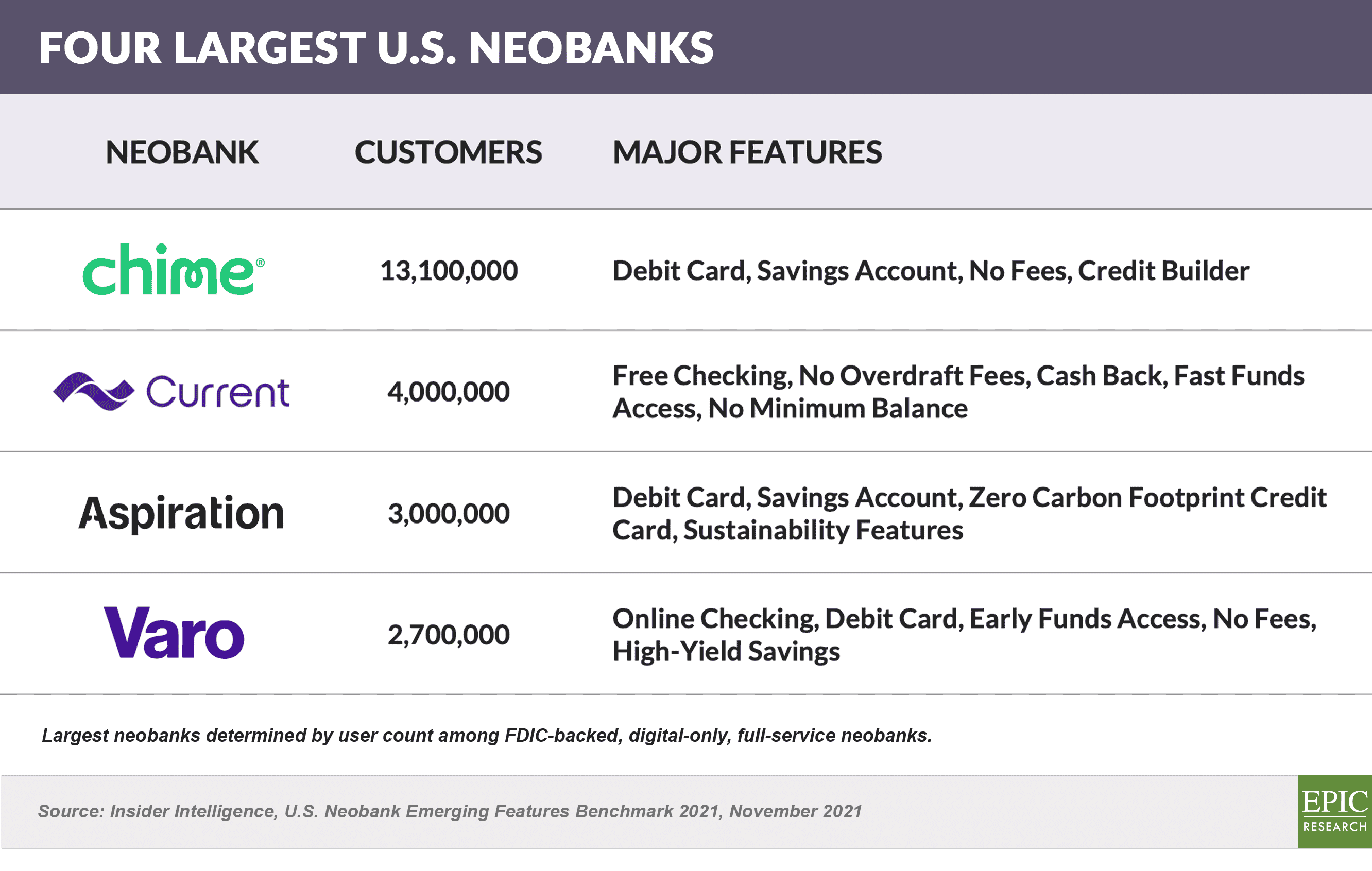

- Neobanks are fintech companies that offer streamlined mobile and online banking services such as debit cards, credit cards, high-yield savings accounts, and access to crypto currencies

- Chime, launched in 2013, is the largest, with over 13 million customers

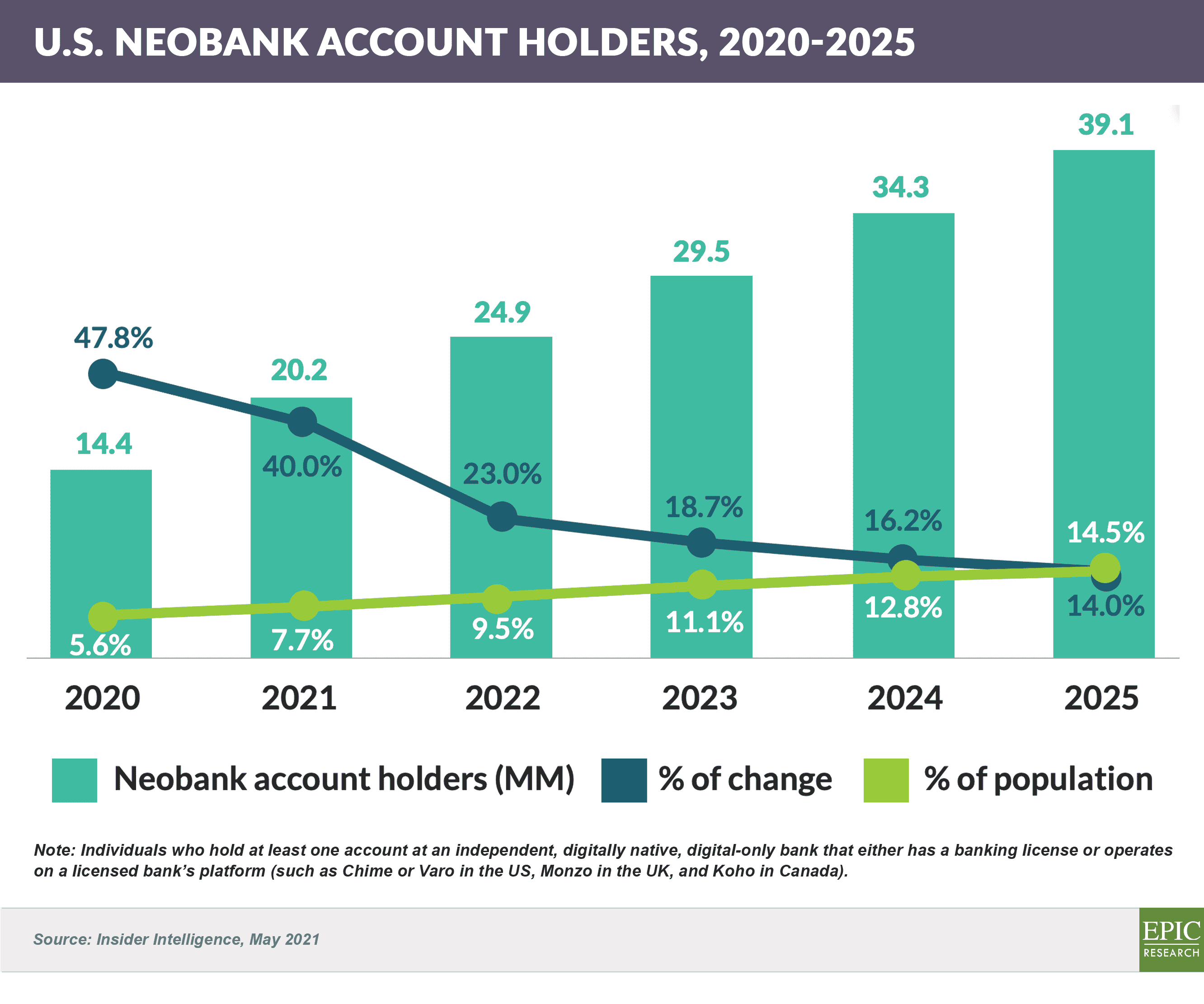

- There were over 20 million U.S. neobank account holders in 2021, with the total expected to double by 2025

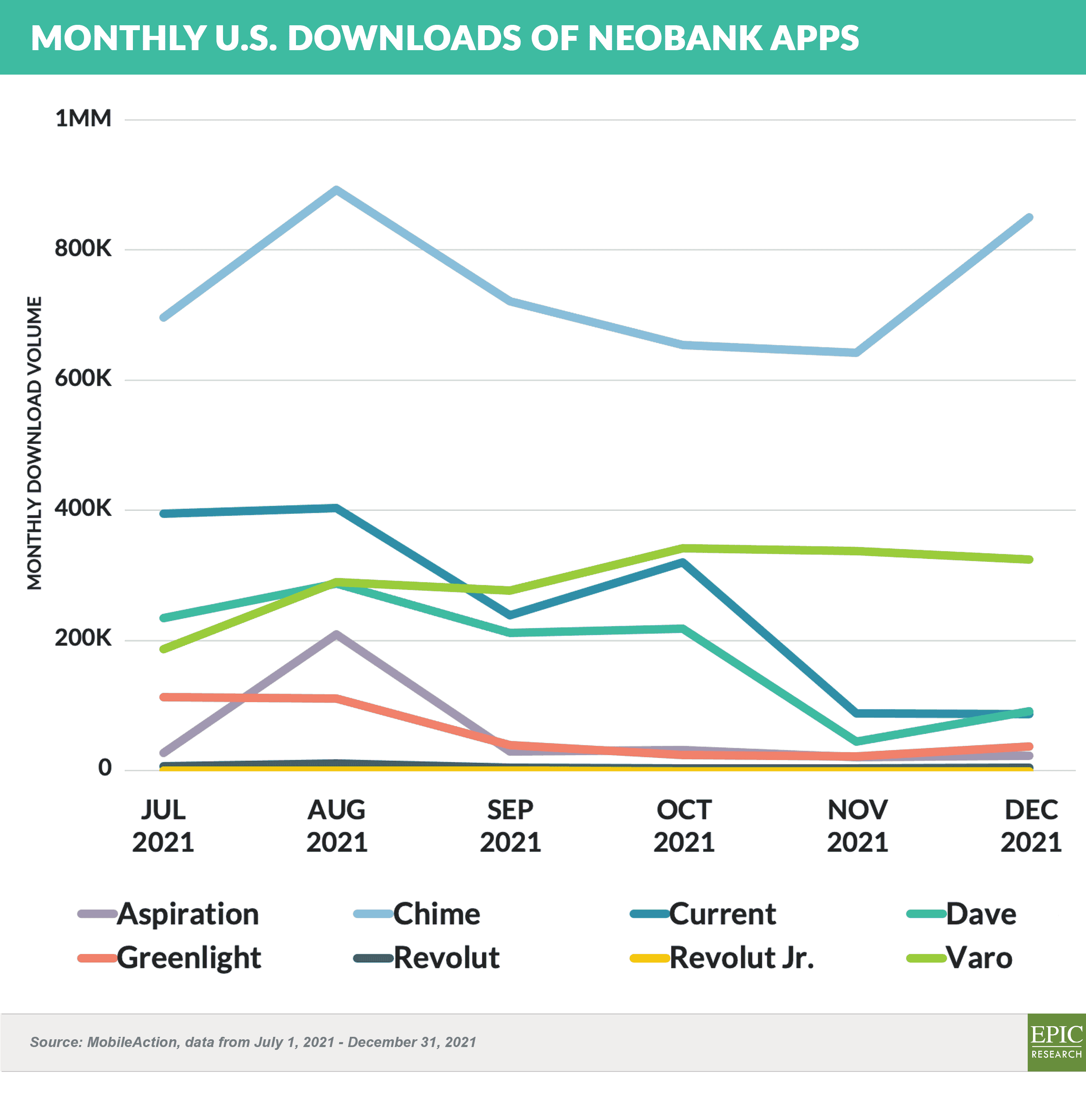

- Chime continues to dominate app downloads in the neobank sector, followed by Varo, Current, and Dave

- A major source of revenue for neobanks comes from debit card interchange revenue, which can be substantially more than that of large banks since neobanks use bank charters from smaller banks that have higher regulatory limits on debit interchange

- Neobanks’ valuations have soared, with Chime completing a funding round in August 2021 at a $25 billion valuation, and Current valued at $2.2 billion in an earlier 2021 funding

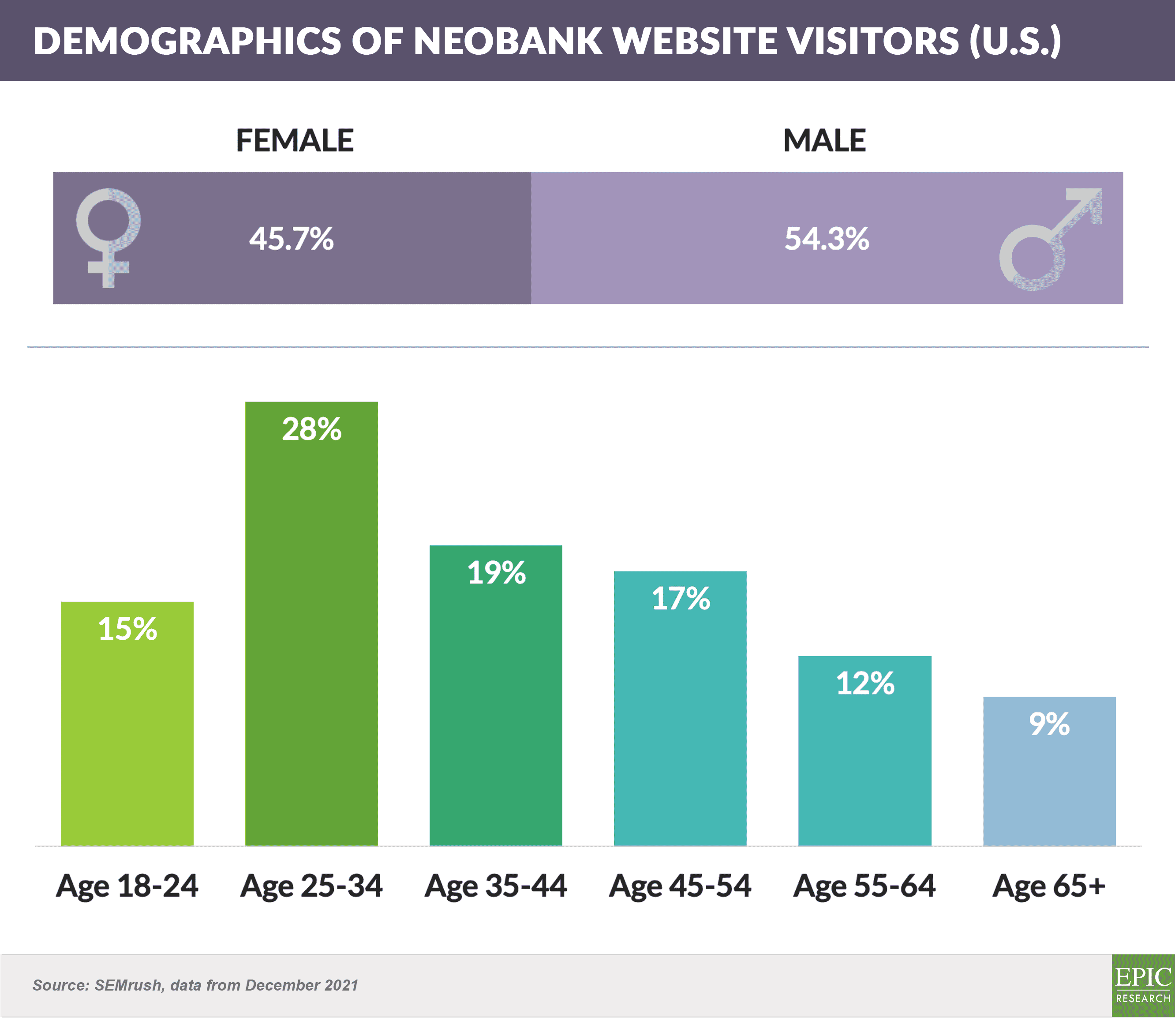

- Demographics of neobank customers appear to skew slightly male and younger, with almost two thirds of website visitors under the age of 45

- Traditional banks have been spending billions to upgrade their digital platforms to match the neobanks’ ease of use and low ongoing servicing costs, which would seem to be a requirement as the neobank consumer population ages

Ease of Use Drives Neobank Popularity

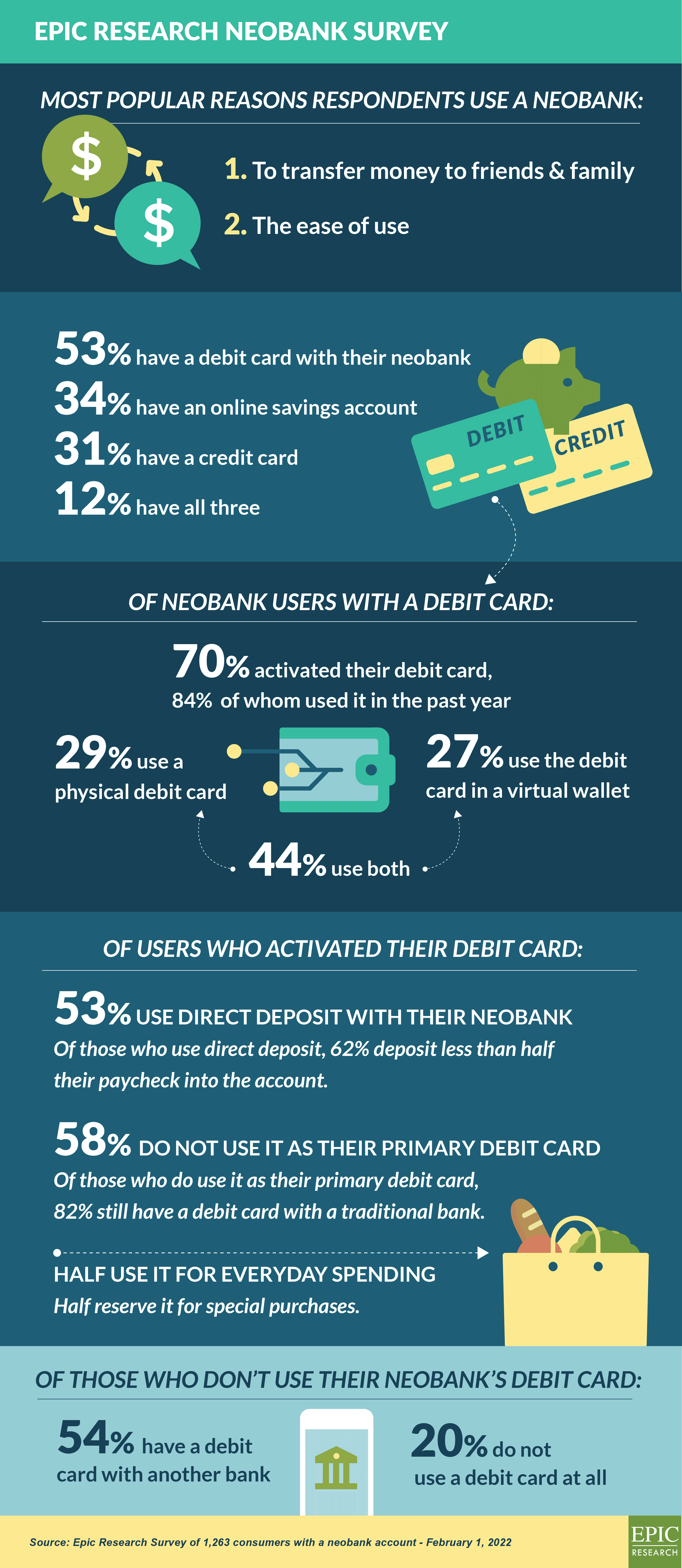

- Epic recently surveyed 1,263 consumers who have accounts at a neobank

Highest Credit Card Mail Volume in Years

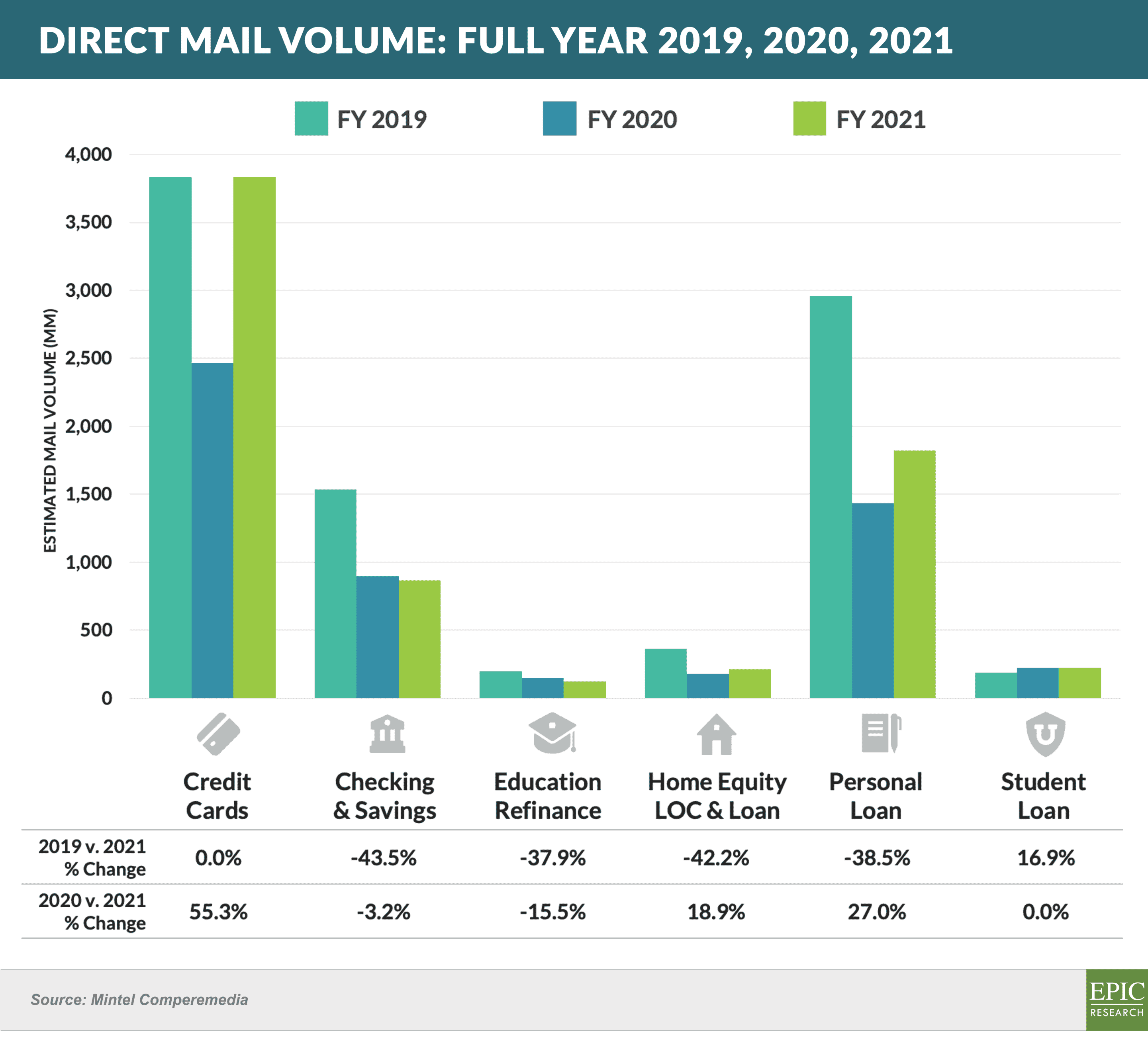

- Despite the rising popularity of digital channels over the past several decades, consumer financial services marketing is still dominated by direct mail

- Credit card and private student loan volume remain the only two products with mail volume at or above that of 2019 – card volume in December was the highest of any month in the past five years

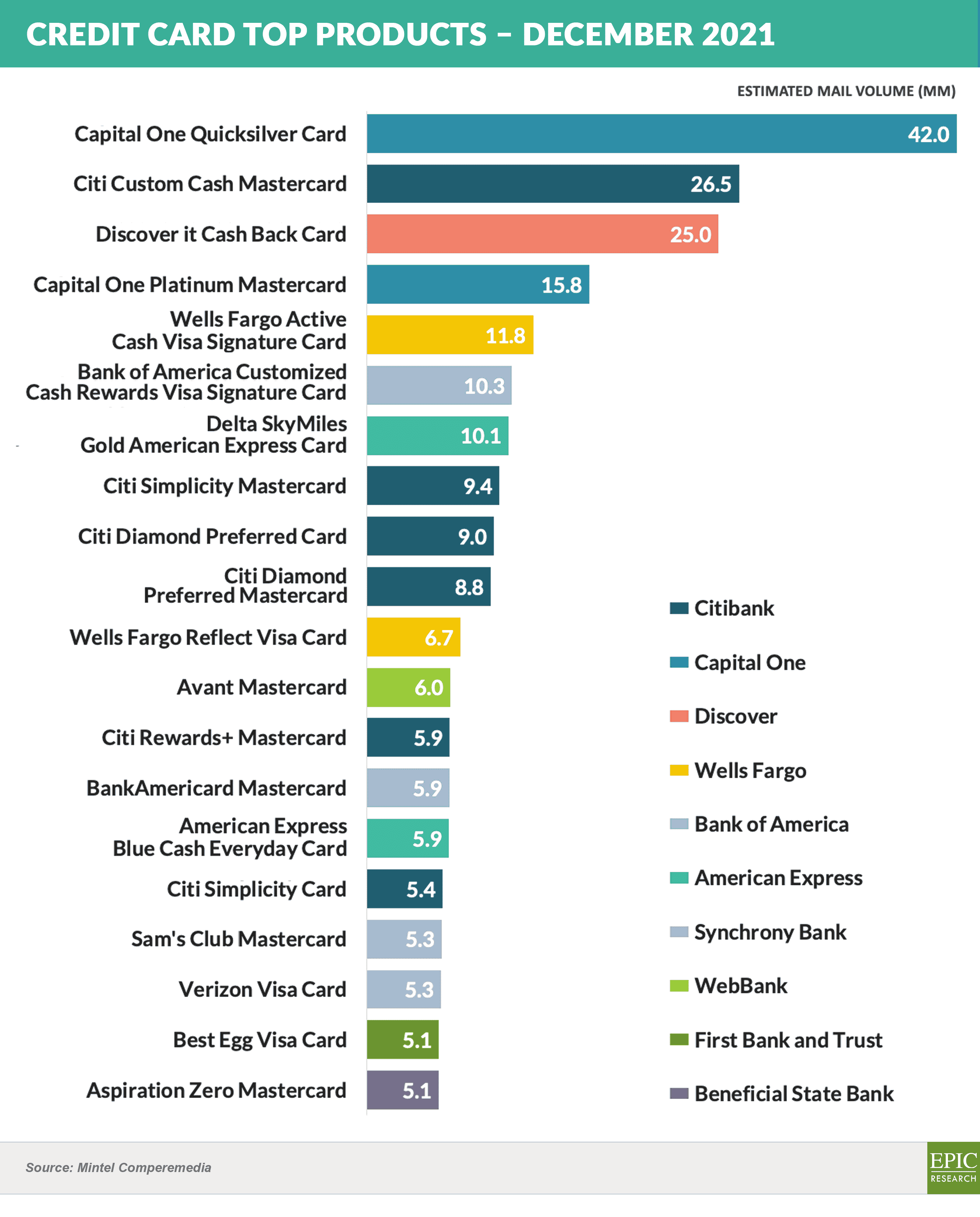

- Citi and Capital One were by far the largest December mailers

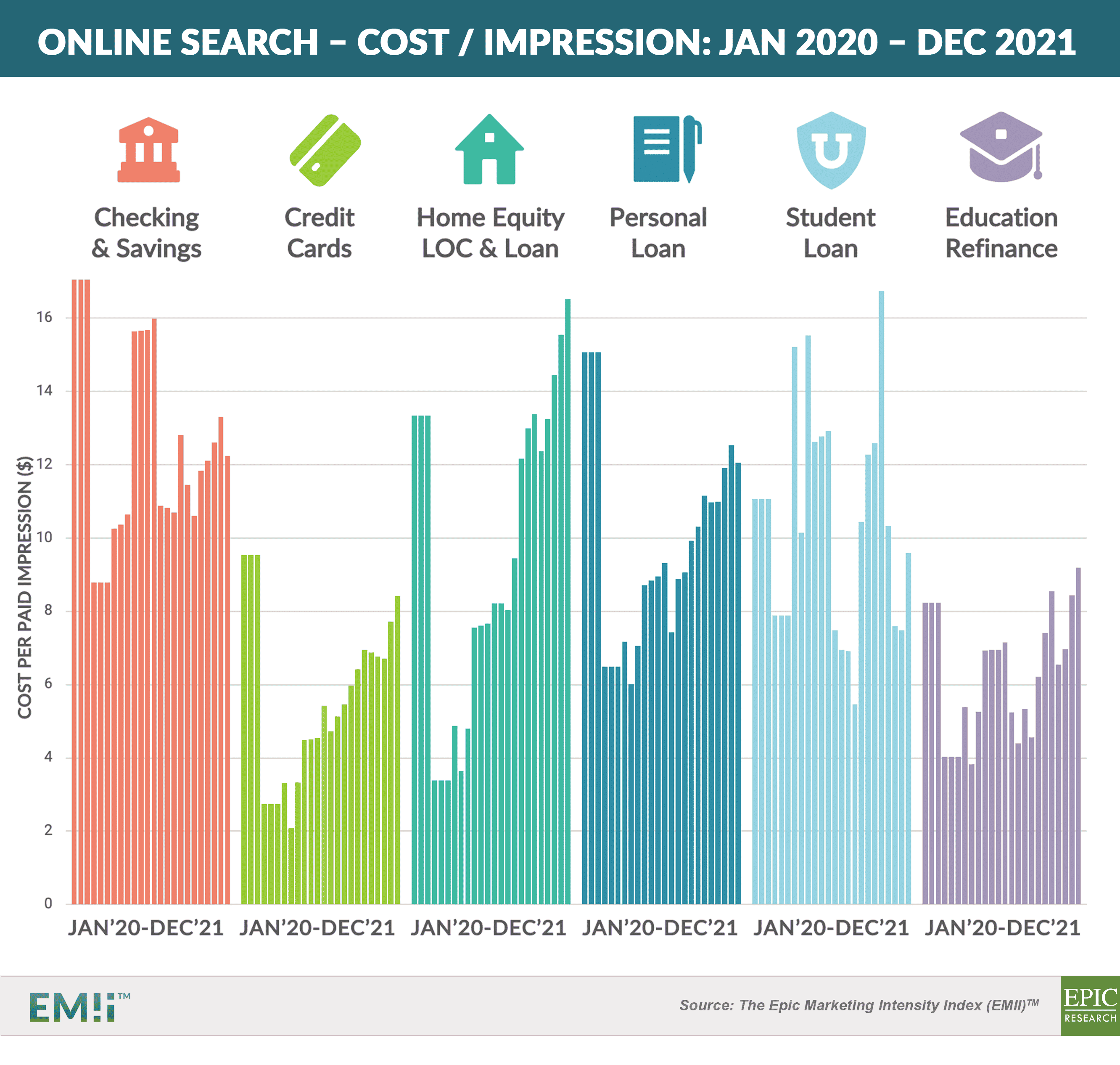

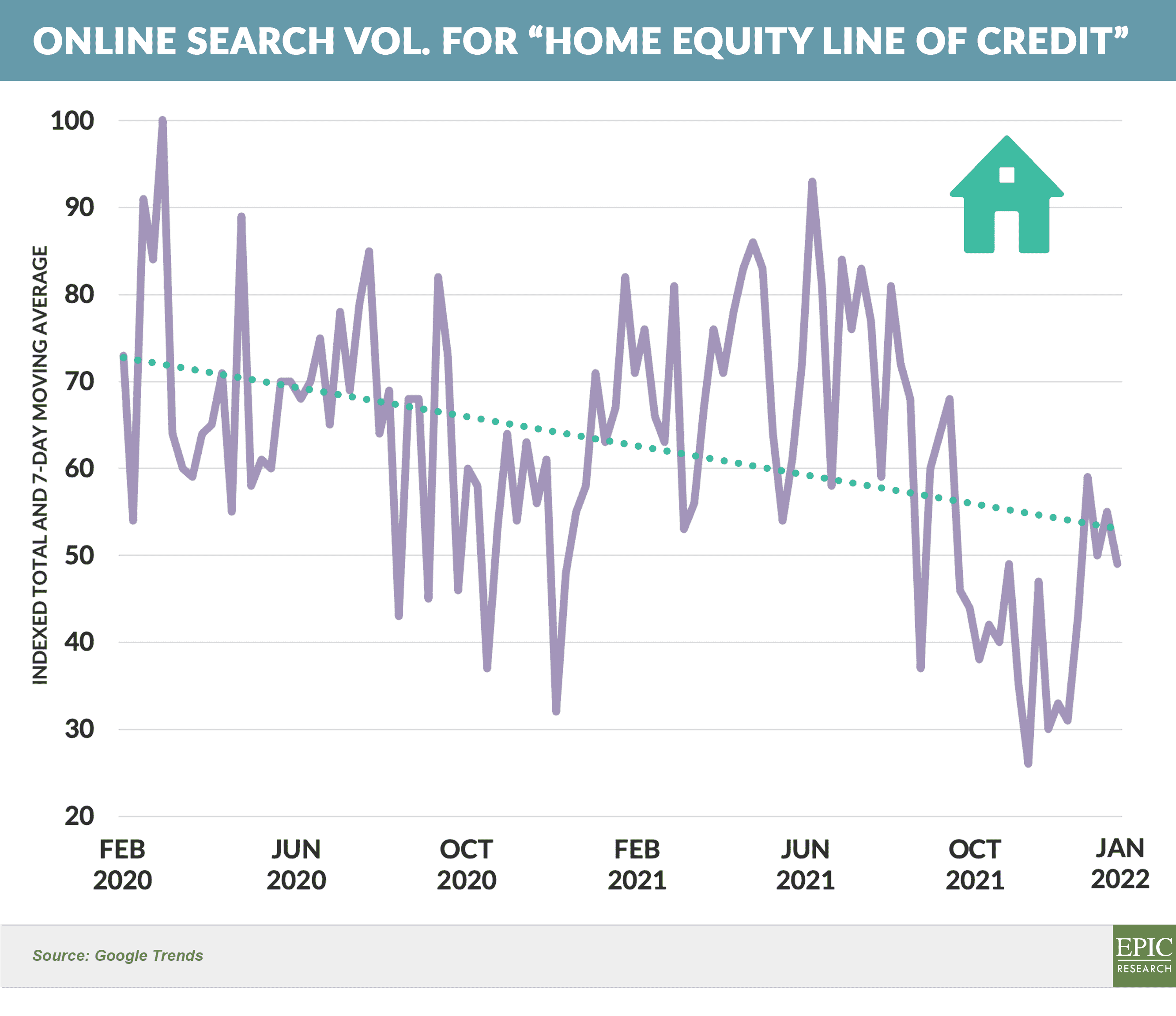

- Home equity online search cost per impression has trended higher in the past few months, reaching levels above those of January 2020

- At the same time, home equity online search volume has declined

Quick Takes

- Speaking of neobanks, Walmart announced that its fintech partnership, Hazel, has acquired platforms Even and ONE with the goal of creating a “super app” under the brand name “ONE”

- Goldman Sachs announced the acquisition of the GM credit card partnership, including the existing $2+ billion portfolio – the GM card had previously been issued by Capital One

- Bank of America and Capital One joined the list of banks revising or eliminating their overdraft fee policies

- The CFPB announced it is looking into credit card companies’ business practices – including, specifically, “junk fees”, “anti-competitive practices”, and “making it simpler to compare, switch, or refinance your credit card”

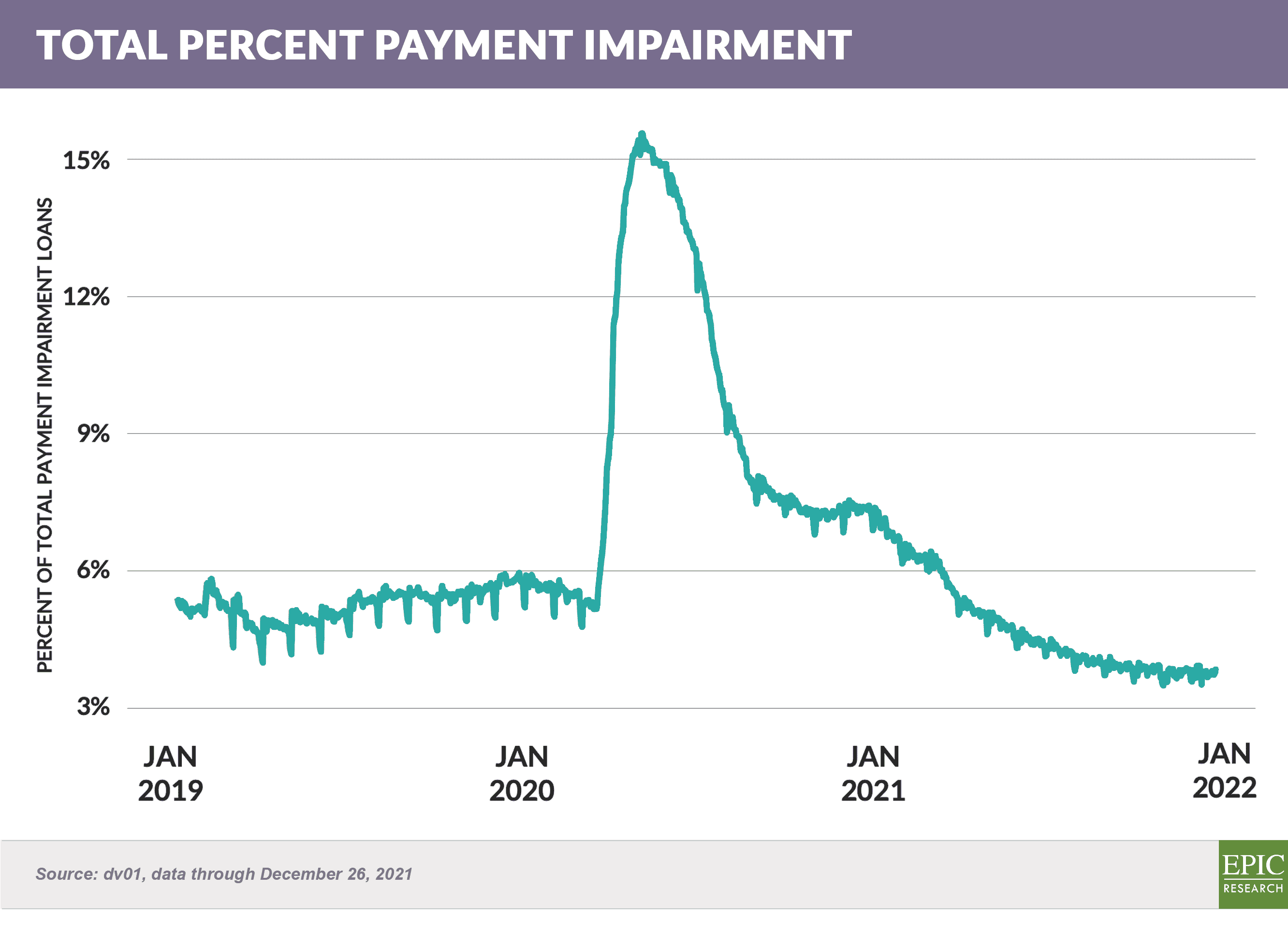

- Overall personal loan impairments remain lower than pre-pandemic levels

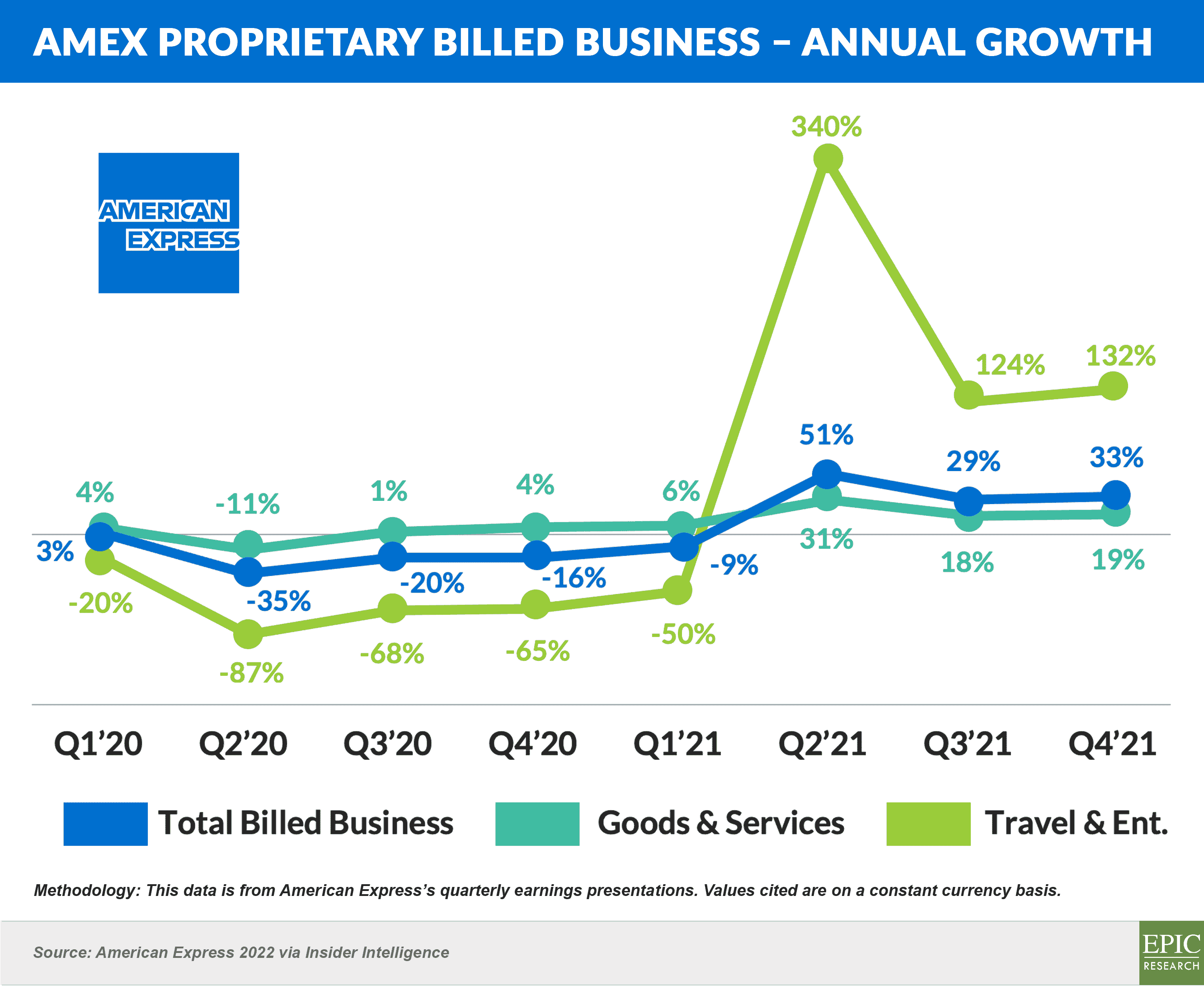

- American Express billed business was up over 30% in 2021 over 2020 with “travel and entertainment” volume rising 132%

- Sallie Mae announced an agreement to acquire Epic’s digital marketing and educational solutions company, Nitro

The Epic Report is published monthly, and we’ll distribute the next issue on March 5th.

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here. To subscribe to our newsletter, click here.