Three Things We’re Hearing

- Surprising credit card preferences for younger consumers

- Younger consumers prefer choice in personal loans

- Consumer spending binge in late 2021?

A three-minute read

Surprising Credit Card Preferences for Younger Consumers

- Epic has surveyed consumers over the past year to assess their behaviors and preferences regarding financial services products

- We have segmented the results to show key differences between the preferences of younger consumers (those 18-44 years old) and older consumers (age 45+)

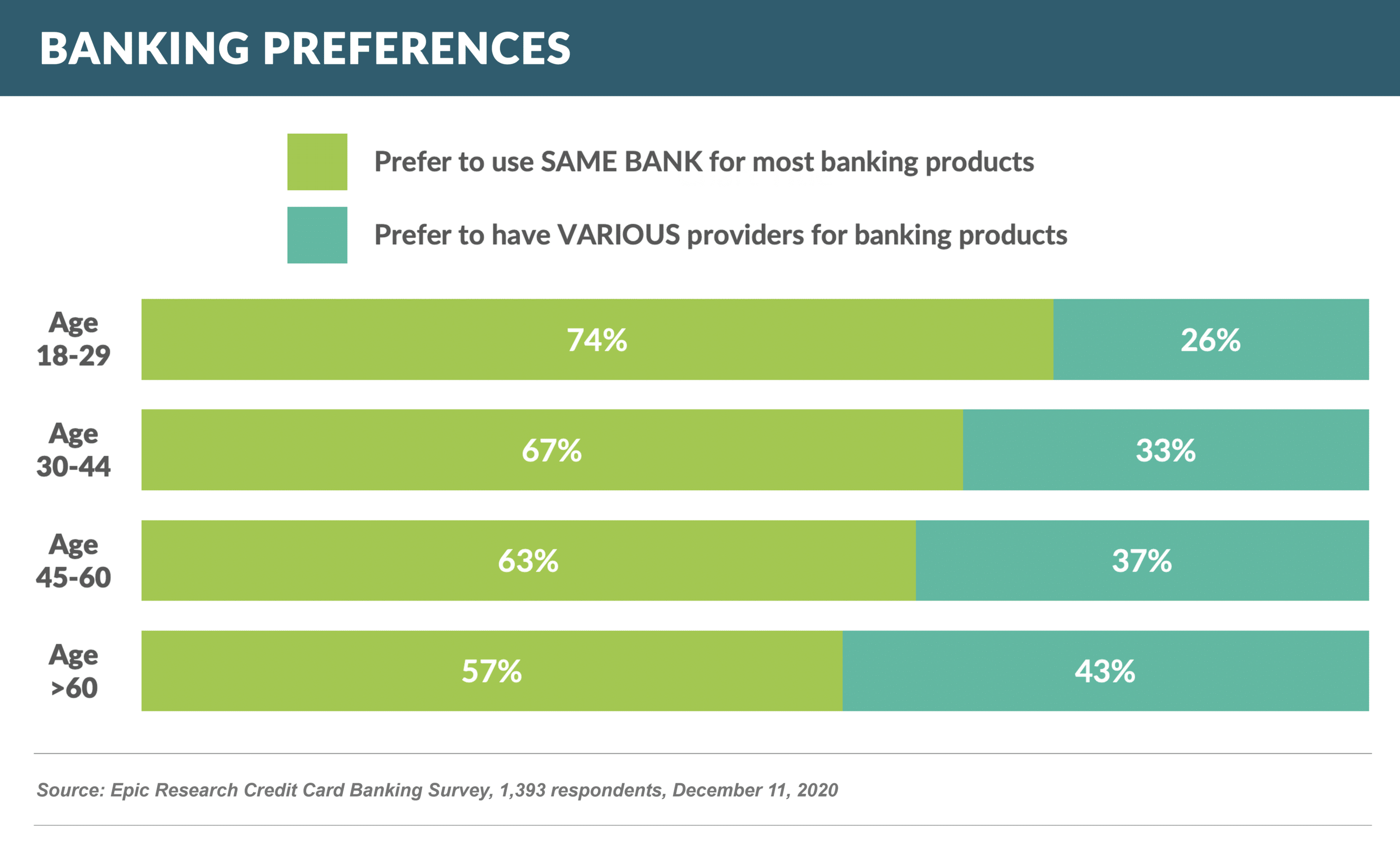

- Surprisingly, younger consumers are more likely (70%) to prefer having most of their financial products at one bank (vs. 60% for those 45+)

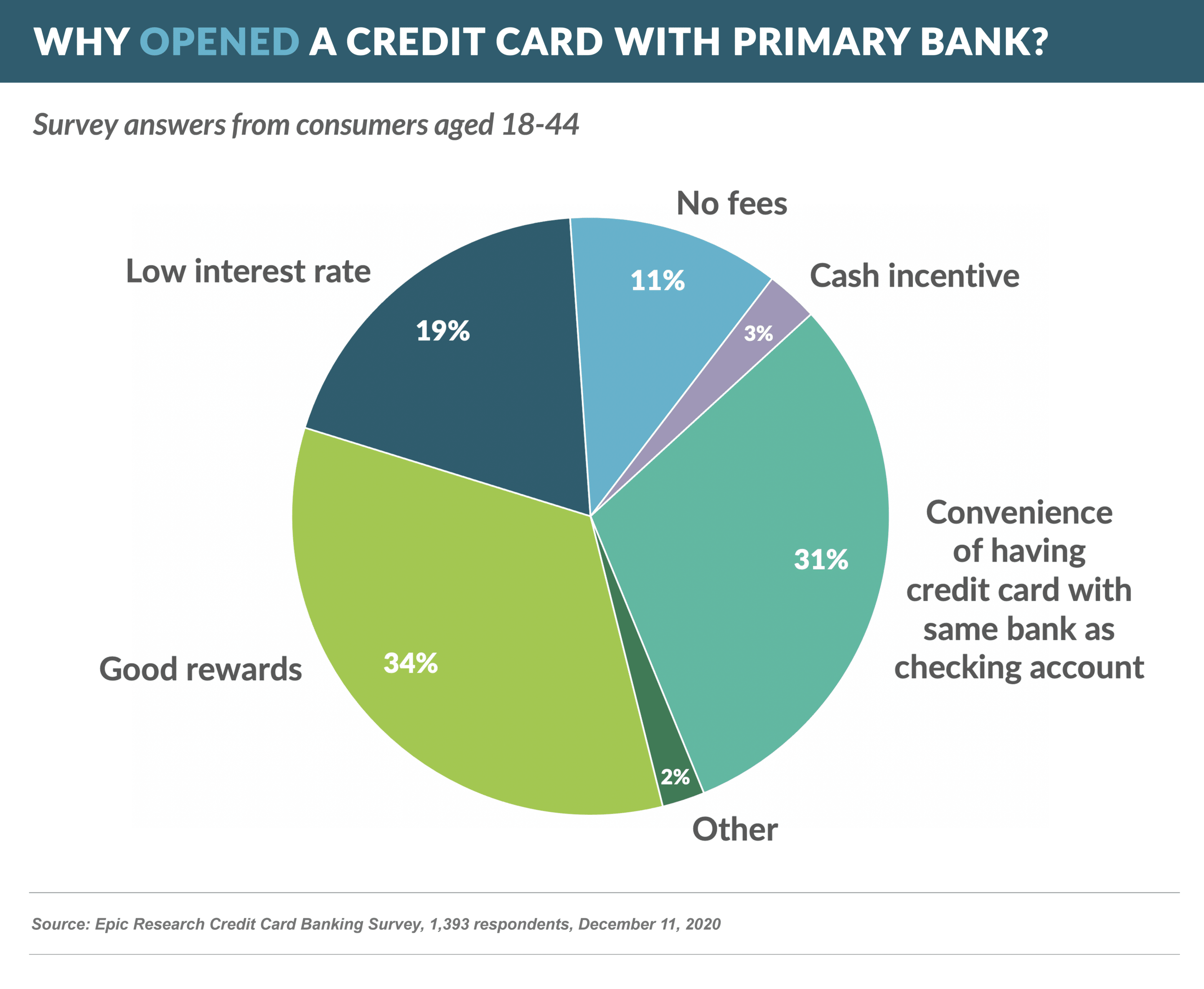

- When asked why they prefer to have their credit cards at their primary banks (i.e., the bank where they have their checking account) younger consumers cited “good rewards” and “convenience”

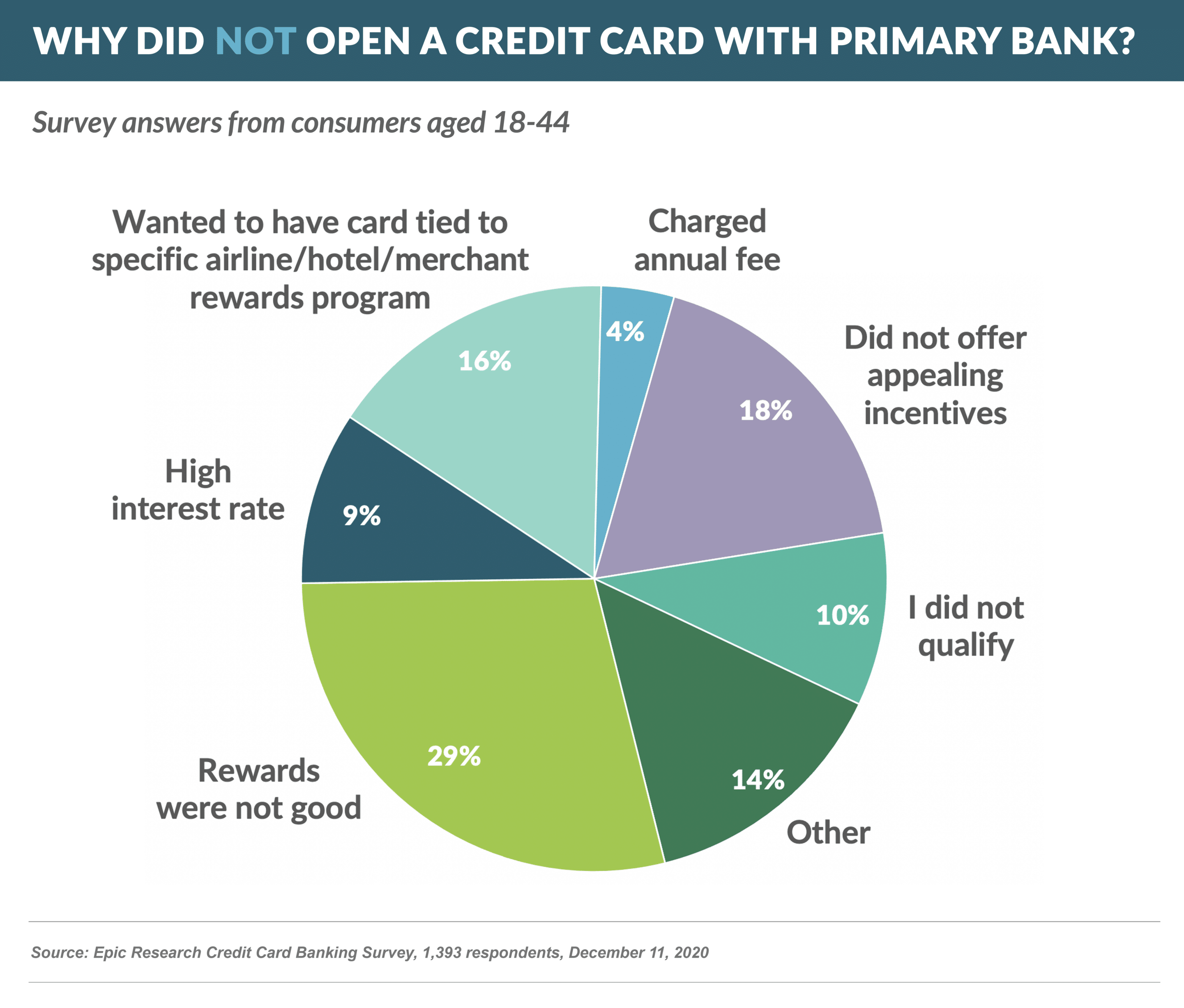

- Of those who did not have a card with their primary bank,

- 29% said rewards were not good enough

- 18% cited the lack of an appealing “acquisition incentive”, which they say needs to be at least $100

- When targeting younger consumers, banks should offer a cash back or “generic” travel rewards card

- 63% of younger consumers use a cash back card as their primary card (vs. 48% of the over 45 demographic)

- 23% report using a travel rewards card, however only 44% of those (10% of the total) use a card tied to one particular airline or hotel, so banks do not need a co-brand partner to have a successful travel rewards card

- Younger consumers are much more likely to open a new credit card account, with 40% saying they would consider acquiring a new card in the next three months vs. only 28% of the 45+ group

- The younger demographic also likes to use comparison websites (e.g., Credit Karma, Nerd Wallet) to acquire a card, with 62% having used one in the past year (however, a third of those using comparison sites end up going directly to the card issuer to apply)

Younger Consumers Prefer Choice in Personal Loans

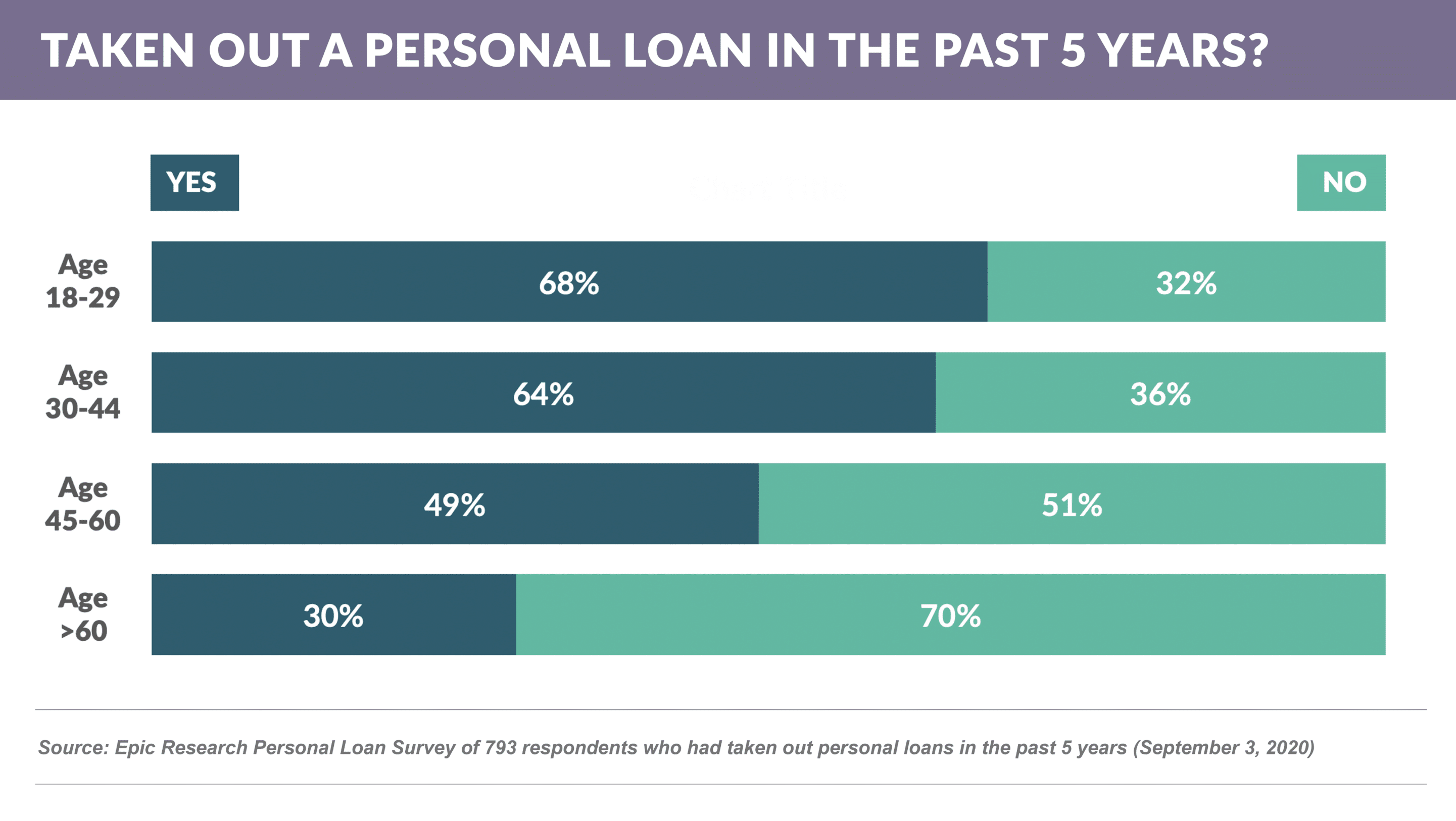

- A similar look at preferences and behaviors of younger consumers as it relates to personal loans shows that they are 60% more likely to have taken out a personal loan in the past five years than the older segment

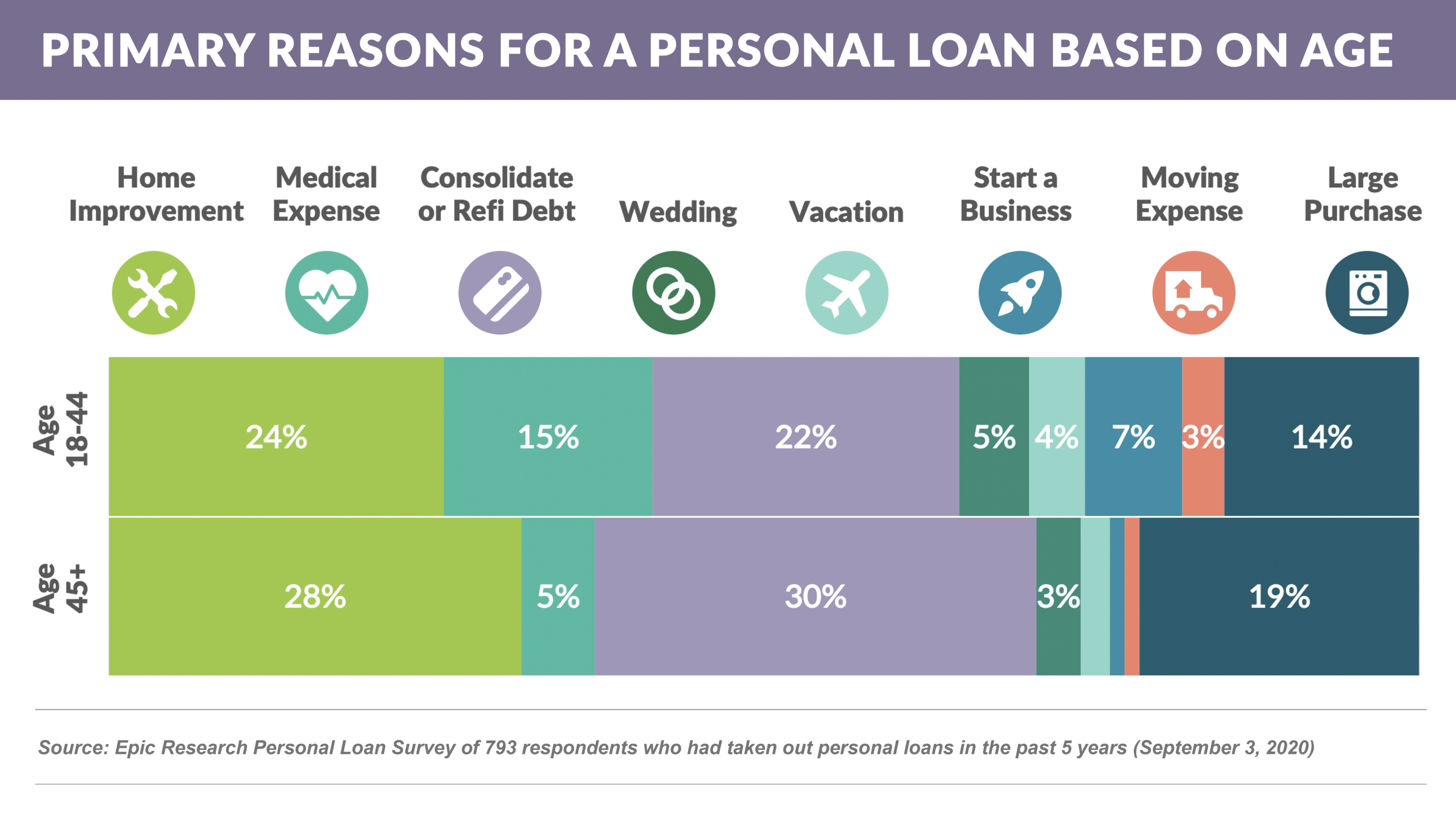

- Surprisingly, when compared to the older age group, younger consumers’ primary reason for needing a loan was more likely to be medical expense and less likely to be debt consolidation

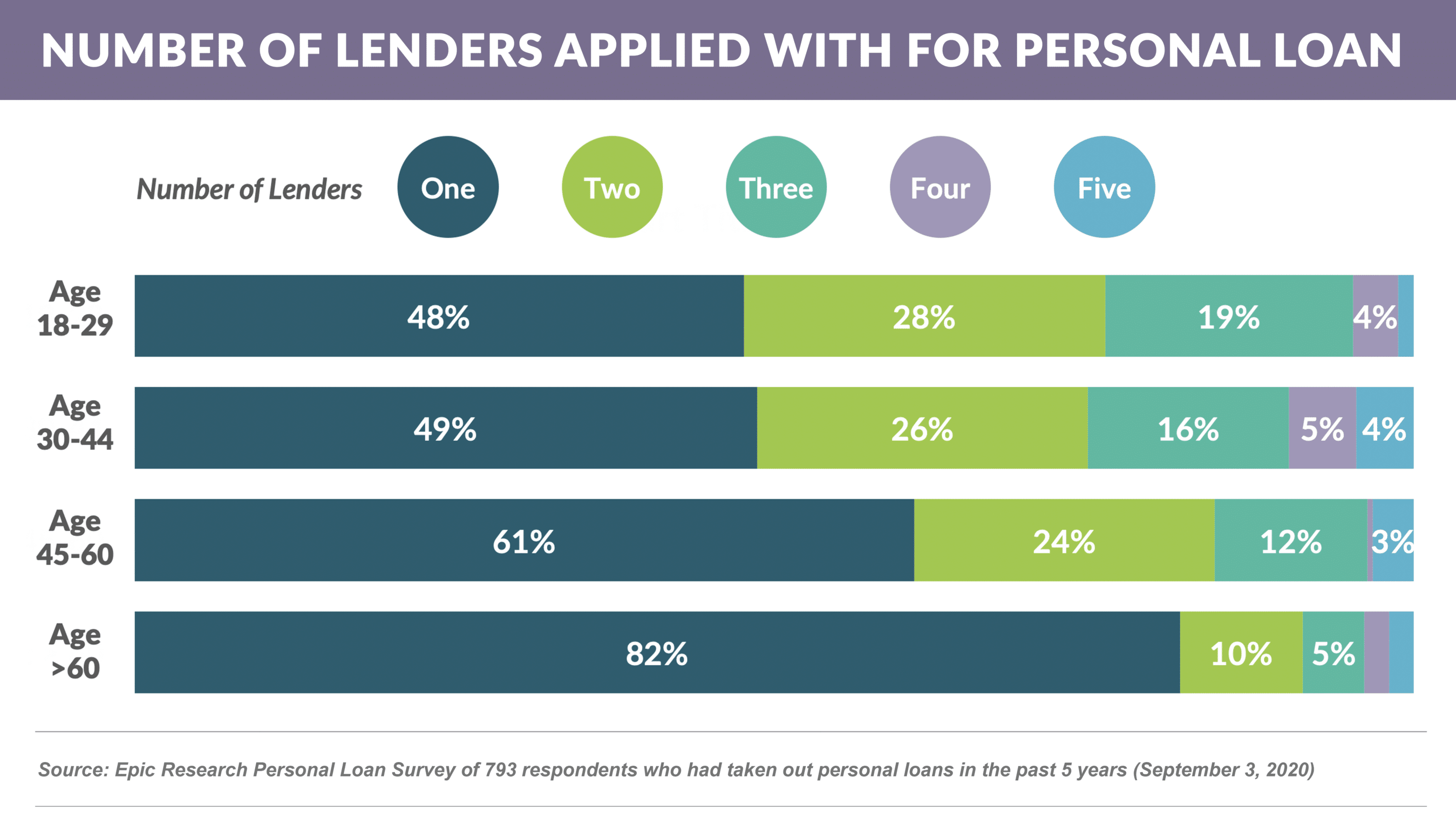

- Younger consumers applied for loans with more lenders than older consumers

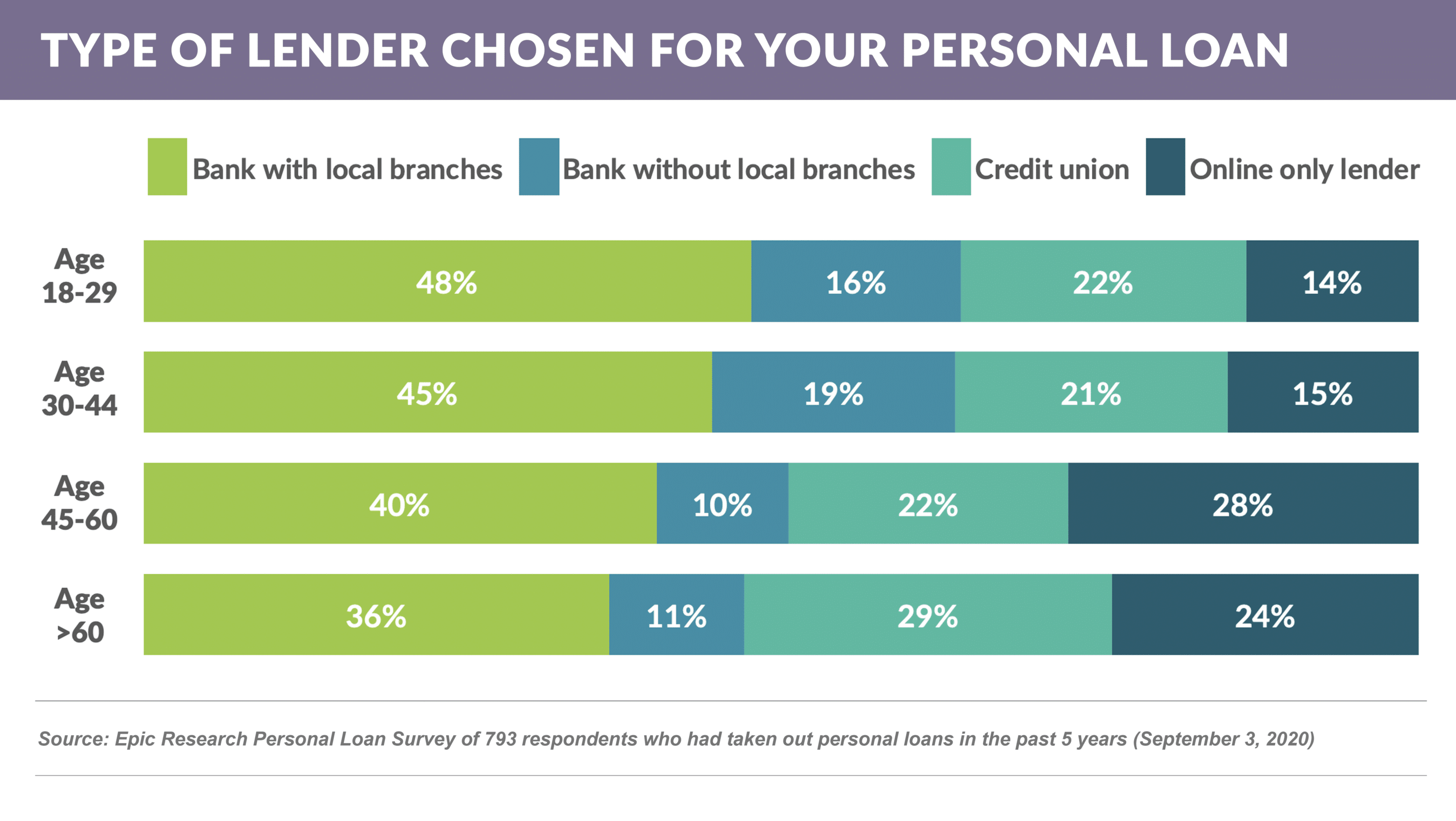

- However, younger consumers were actually less likely to use an online bank for their loans and were slightly more likely to use a bank with local branches

Consumer Spending Binge in Late 2021?

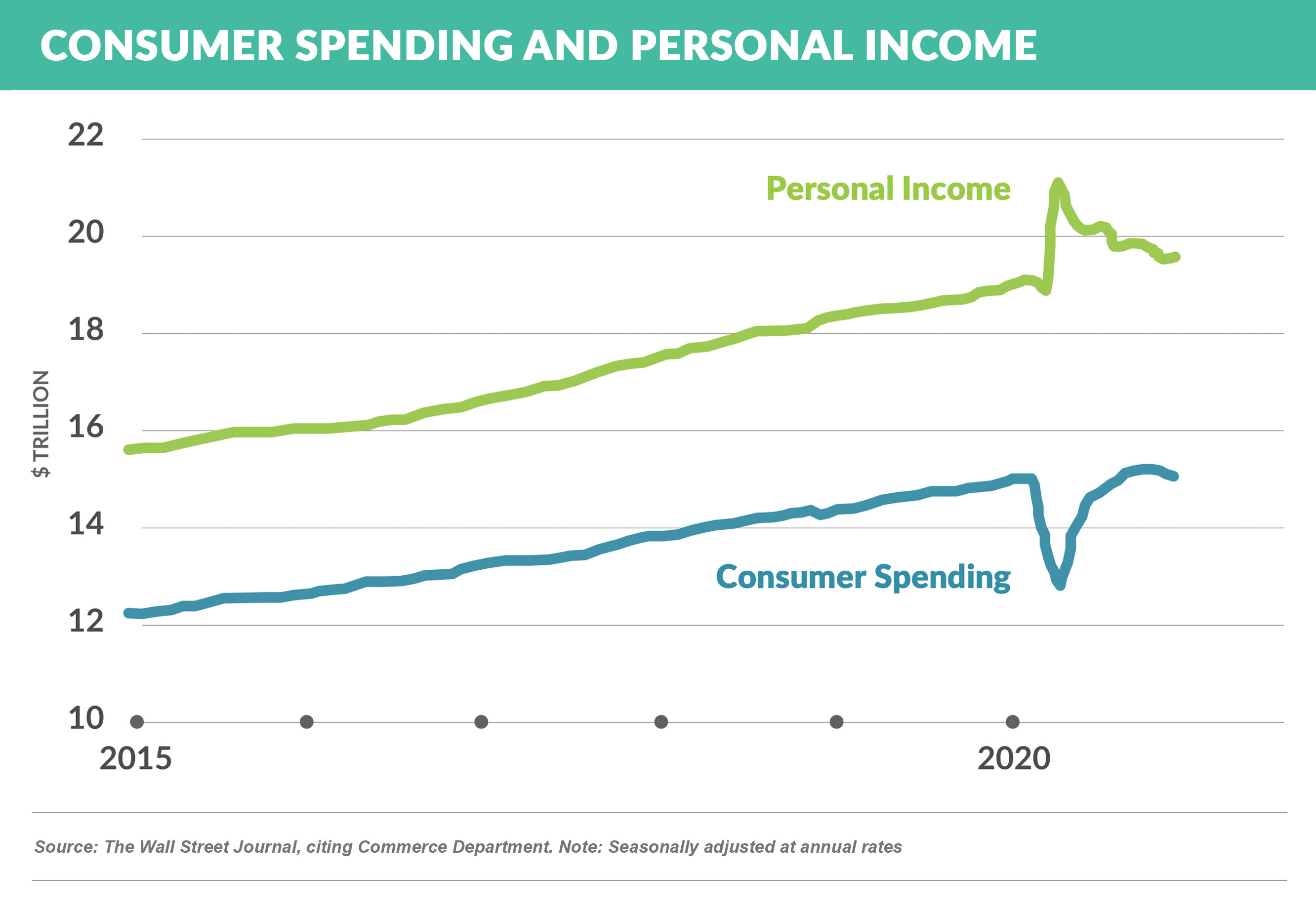

- As discussed in previous Epic Reports, the asset quality of credit card, personal loan, and other consumer credit assets has remained stubbornly stable during the pandemic-related economic downturn, as government stimulus programs have propped up incomes and changed consumer behavior has resulted in lower spending and higher savings

- Many government programs lapsed in the third and fourth quarter of 2020, however a recent Wall Street Journal article noted that the new round of government programs caused both household income and savings to rise in December for the first time in three months

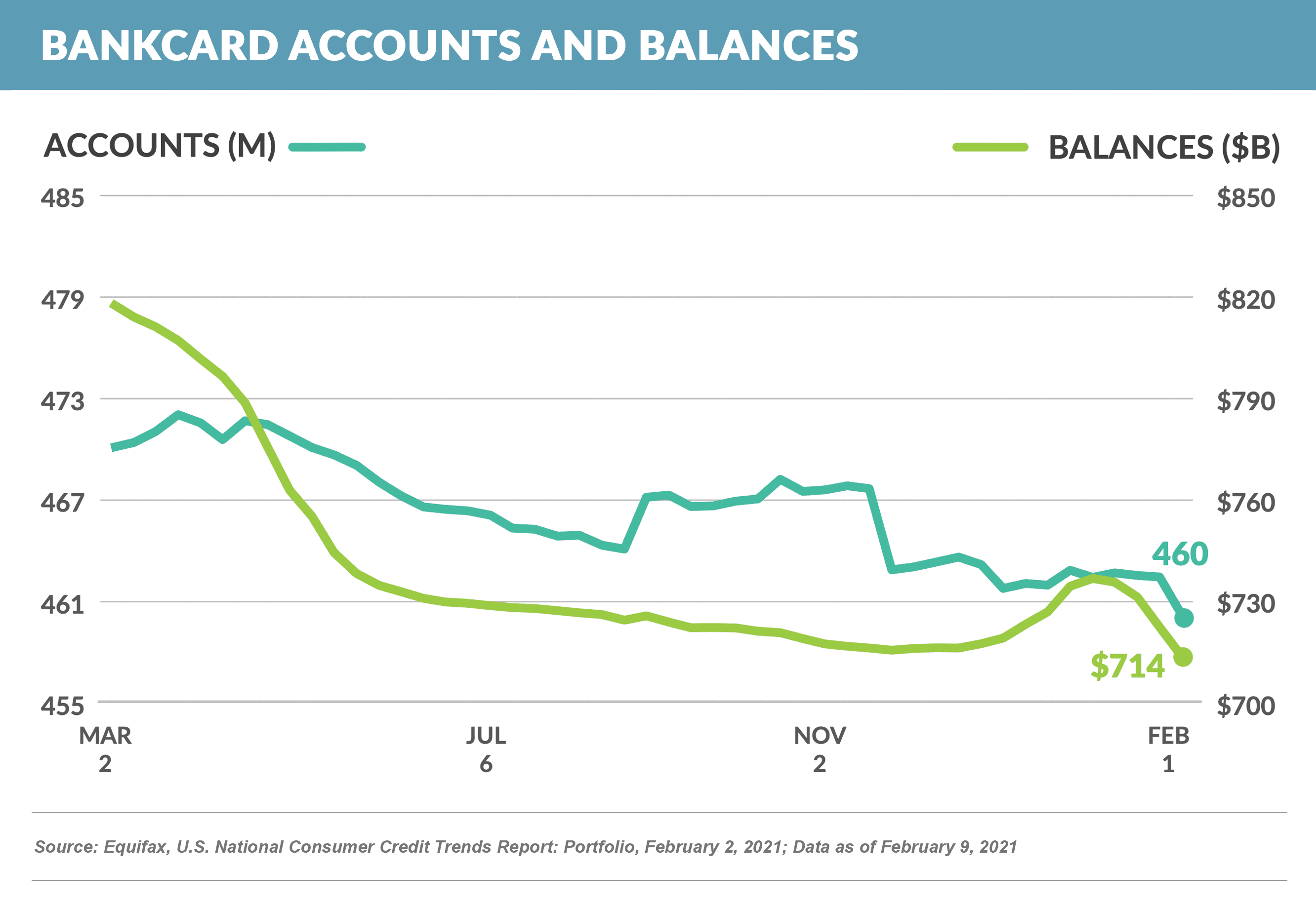

- Economists generally expect spending to remain low in the early part of 2021, however as the pandemic recedes, pent-up demand and savings could result in a spending spike, helping credit card portfolios that have had significant balance declines in 2020

- Several issuers, including American Express, which has indicated it will spend a record amount on marketing in 2021, and Capital One, have notably increased their new account acquisition efforts to aid in resuming portfolio growth

Quick Takes

- Credit card and personal loan lenders who have resumed mailing are reporting significant response rate lifts since before the pandemic-related slow down

- Card response rates in some cases have been up as much as 100%

- Personal loan lenders report lifts of 25% - 50%

- Epic recently refreshed its proprietary response models, which provide between a 15% - 229% lift over generic bureau models (learn more here)

Thank you for reading.

The next Epic Report will publish on March 6th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.