Three Things We’re Hearing

- Tidal wave of new credit card products

- Cash back and specialized spending bonuses popular with consumers

- Non-card products lagging

A three-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Tidal Wave of New Credit Card Products

- Unlike other consumer financial products, the credit card sector came roaring back from a post-pandemic malaise

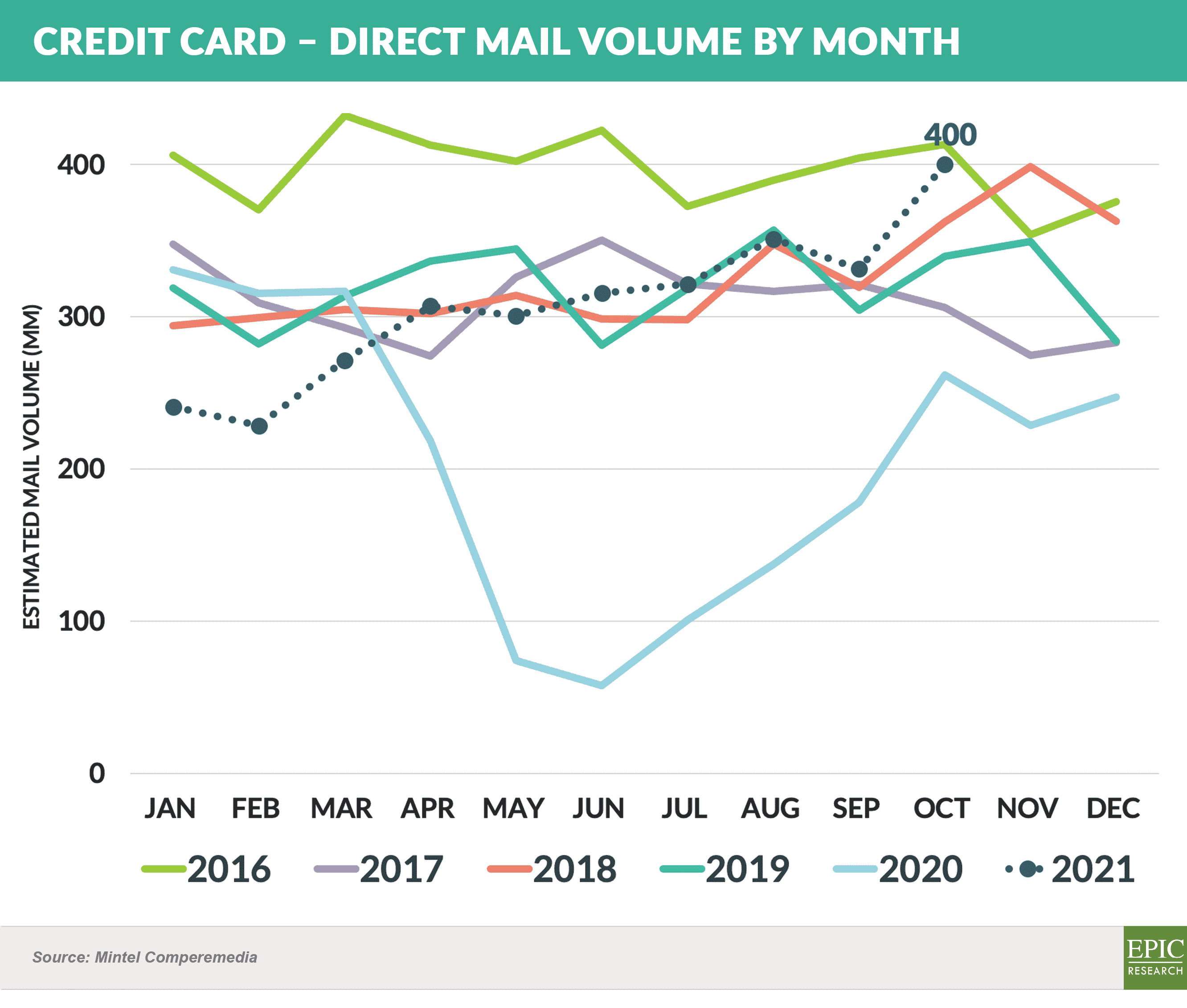

- Following the trend of earlier months, October credit card mail volume surged to the highest levels since 2016

- Issuers announced new card products at a sizzling pace over the past six months in an attempt to re-build shrinking credit card outstandings

- These new product announcements generally fall into two categories: cash back and re-invigorated features on premium travel-oriented products

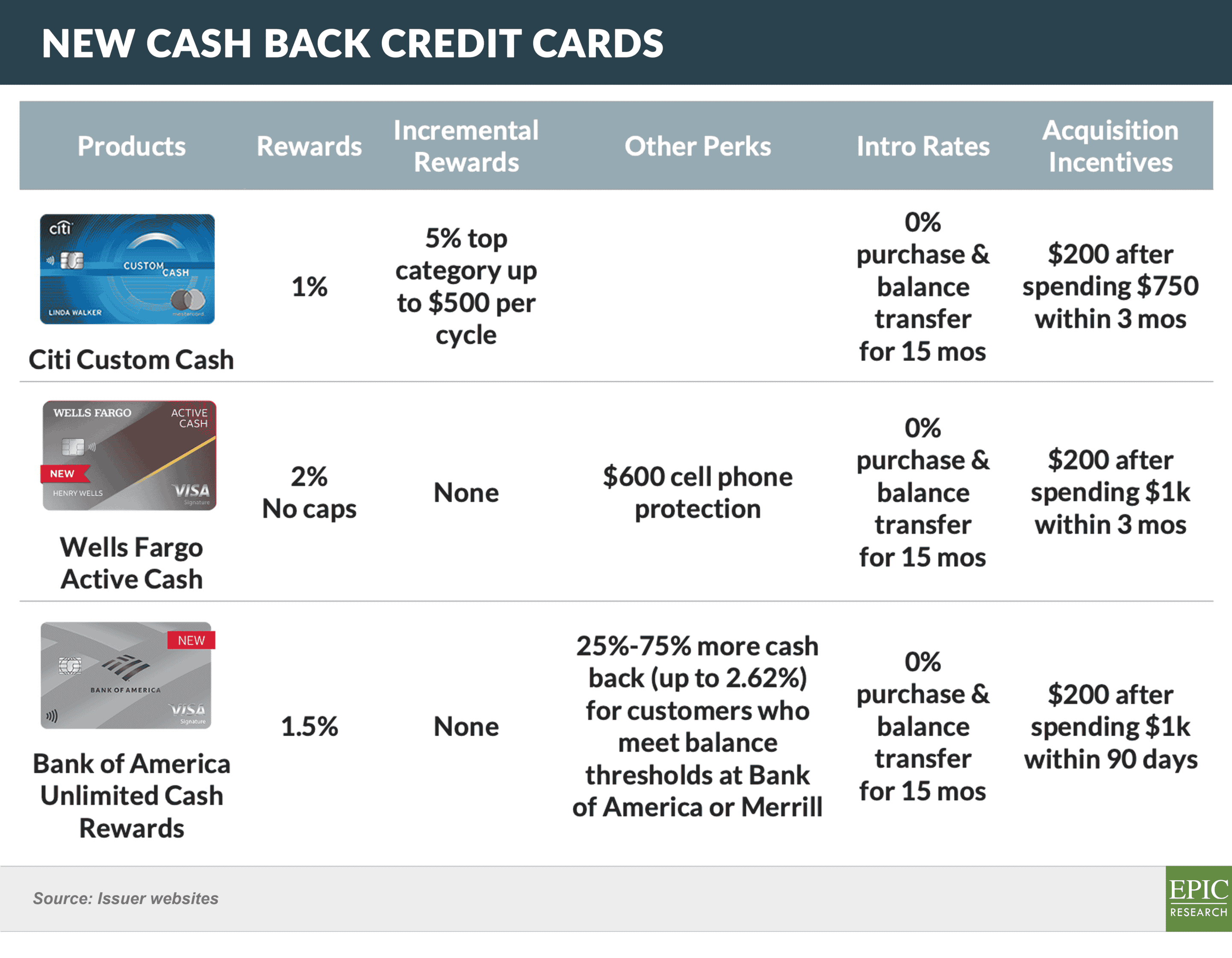

- Citibank, Wells Fargo and Bank of America all introduced new products targeted to the cash back audience with all three products offering a $200 acquisition incentive and 0% for 15 months on purchases and balance transfers

- Wells Fargo’s Active Cash card wins the rewards race with 2% cash back across all purchases

- Bank of America’s Unlimited Cash Rewards offers 1.5% cash back with higher levels, up to 2.62%, for customers who meet deposit or investment balance thresholds at Bank of America or Merrill

- The Citi Custom Cash card offers a base rewards rate of 1%, with 5% cash back in the top spend category (up to $500)

- TD Bank’s new TD Double Up card offers 1% cash back matched by an additional 1% if deposited into a TD account

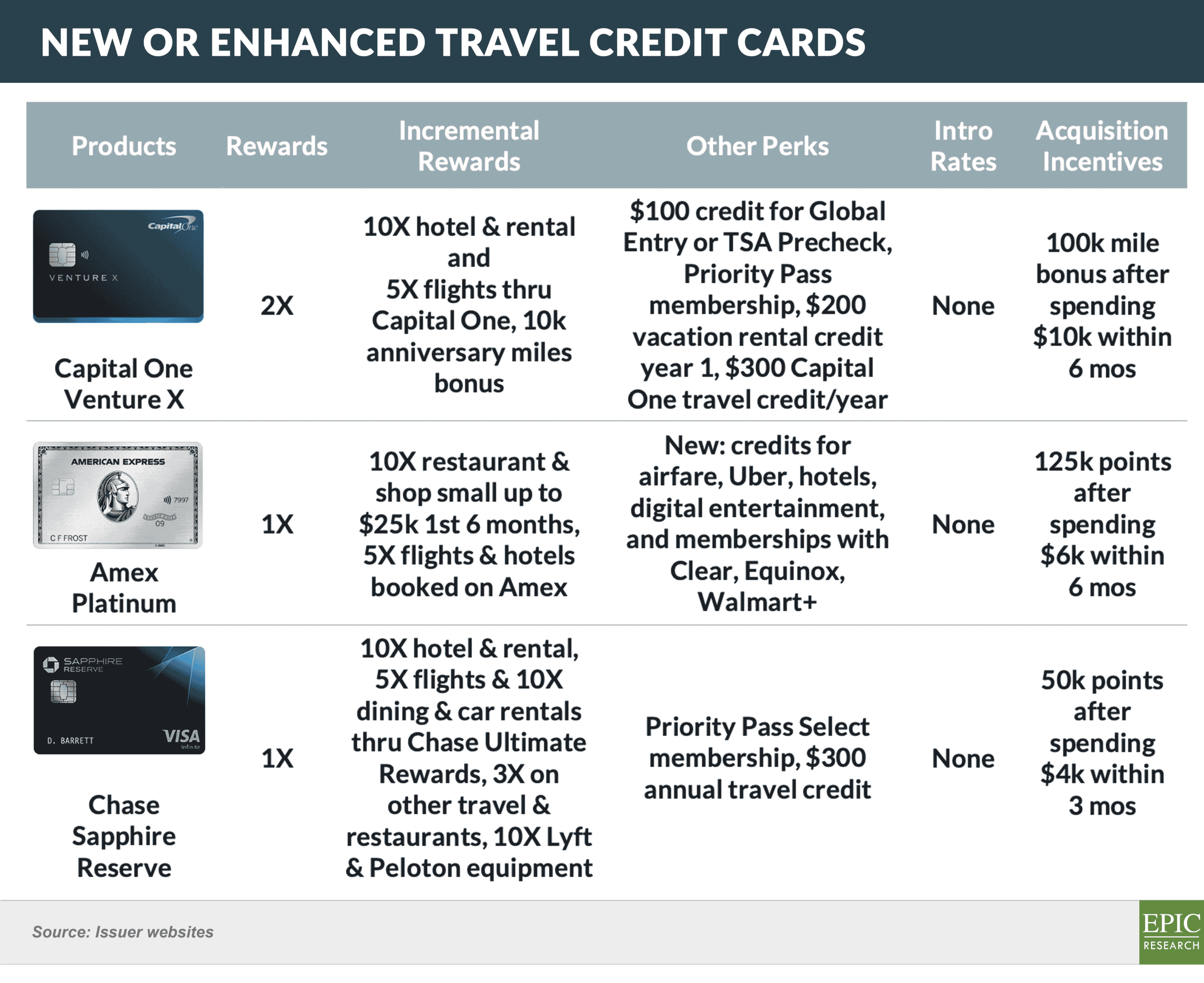

- On the travel front, following major enhancements to both the American Express Platinum Card and Chase Sapphire Reserve, Capital One announced an addition to its Venture Card suite of products: the new Venture X card, which features a $395 annual fee, 10X miles on hotels, 5X miles on flights, a base reward rate of 2X, a $200 credit on a vacation rental in year one, and a $300 annual travel credit

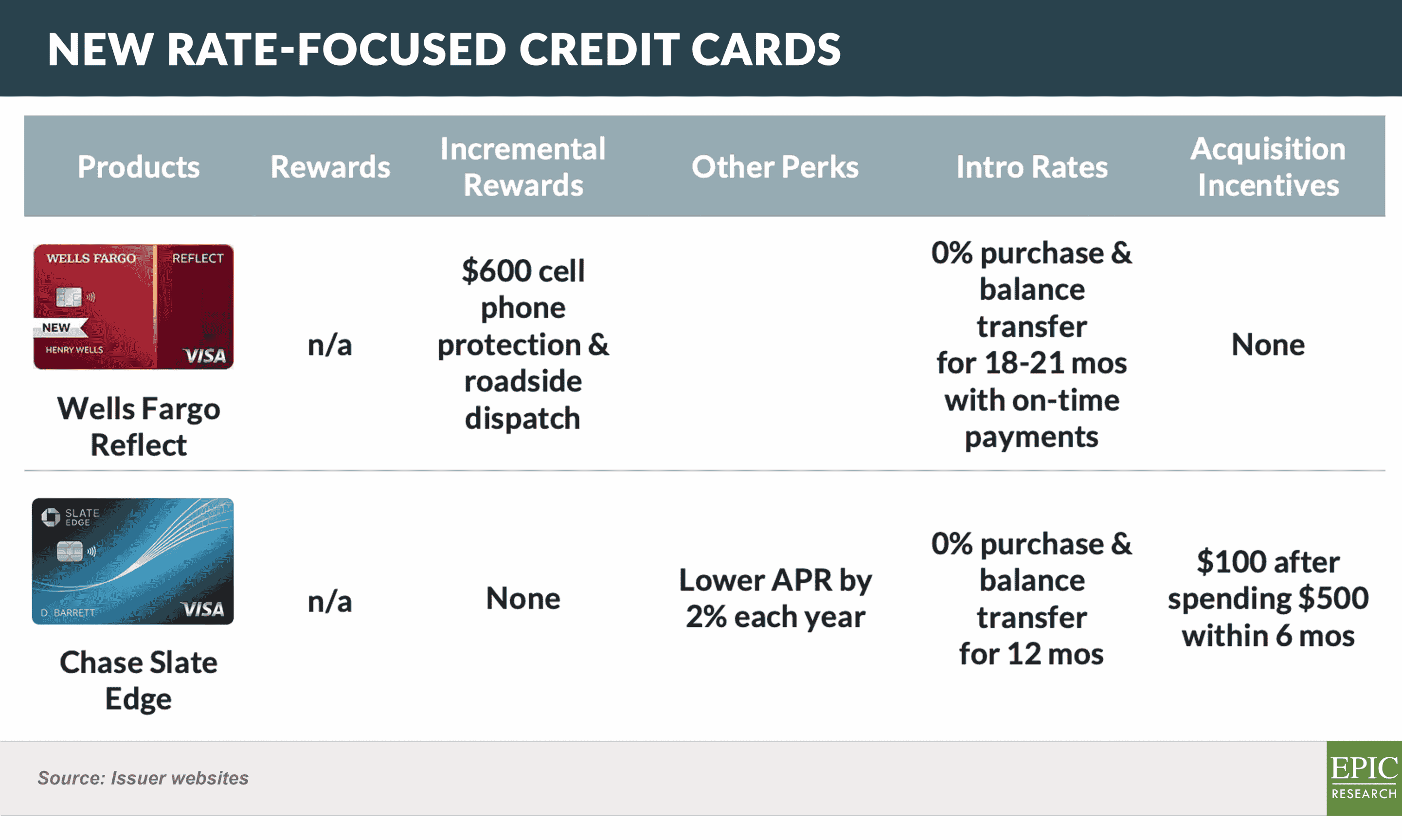

- For the rate conscious consumer, other notable recent announcements include the Wells Fargo Reflect Card, which offers a headline of 0% for 21 months, and Chase’s new Slate Edge product, which offers to lower the APR by 2% per year

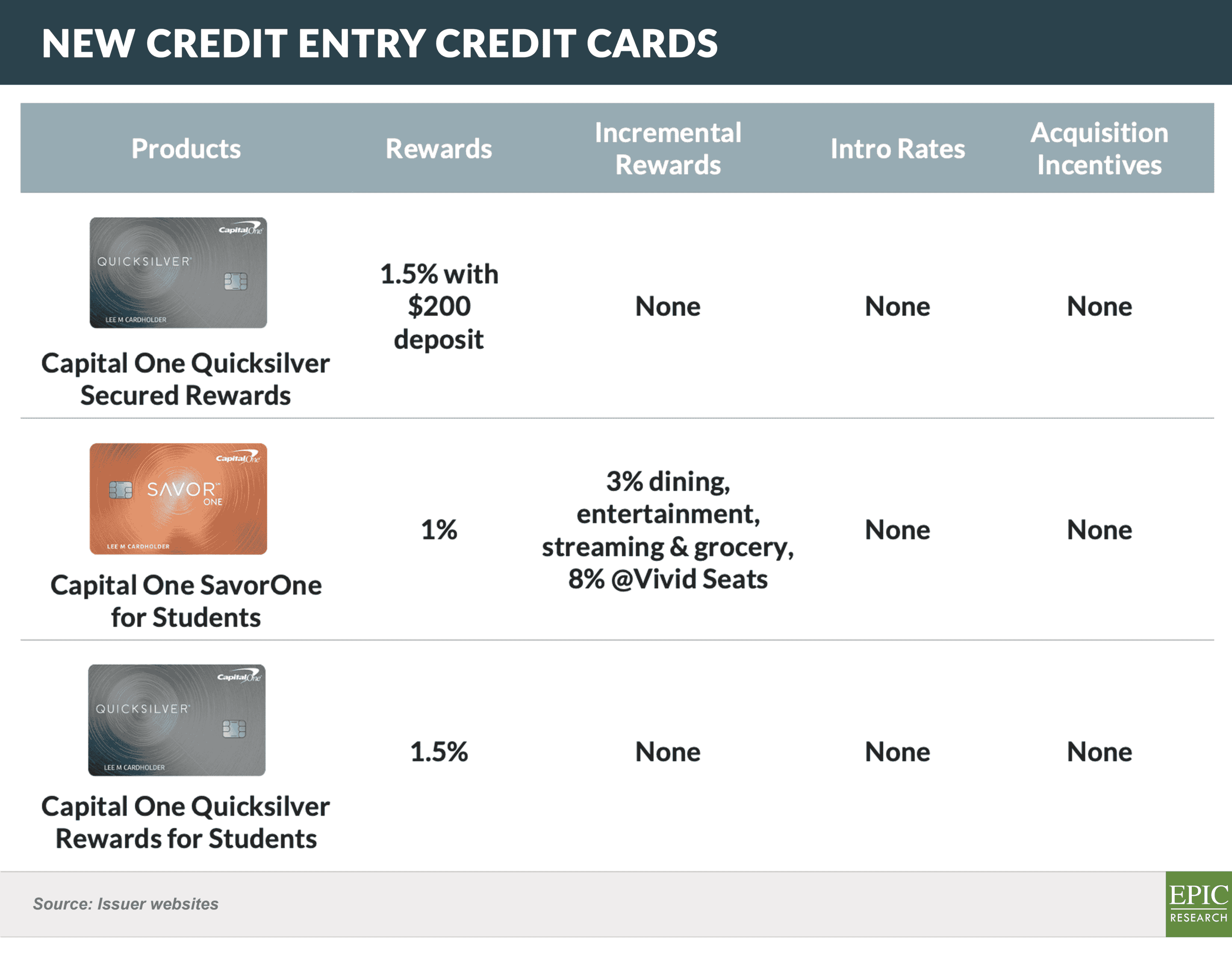

- Another growing area is the credit entry segment, which includes Capital One’s Quicksilver Student Rewards, SavorOne Rewards for Students, and Journey Student Rewards products

- Unlike most cards in the credit entry segment, these Capital One cards offer base rewards, and in the case of SavorOne Rewards for Students, 3% back on dining, entertainment, streaming, and grocery

- With a few exceptions, the top card marketers are the national issuers, with retail banks concentrating primarily on mailing to their customer base

- This is a missed opportunity for branch-based banks in our view, caused largely by a lack of confidence in underwriting non-customers

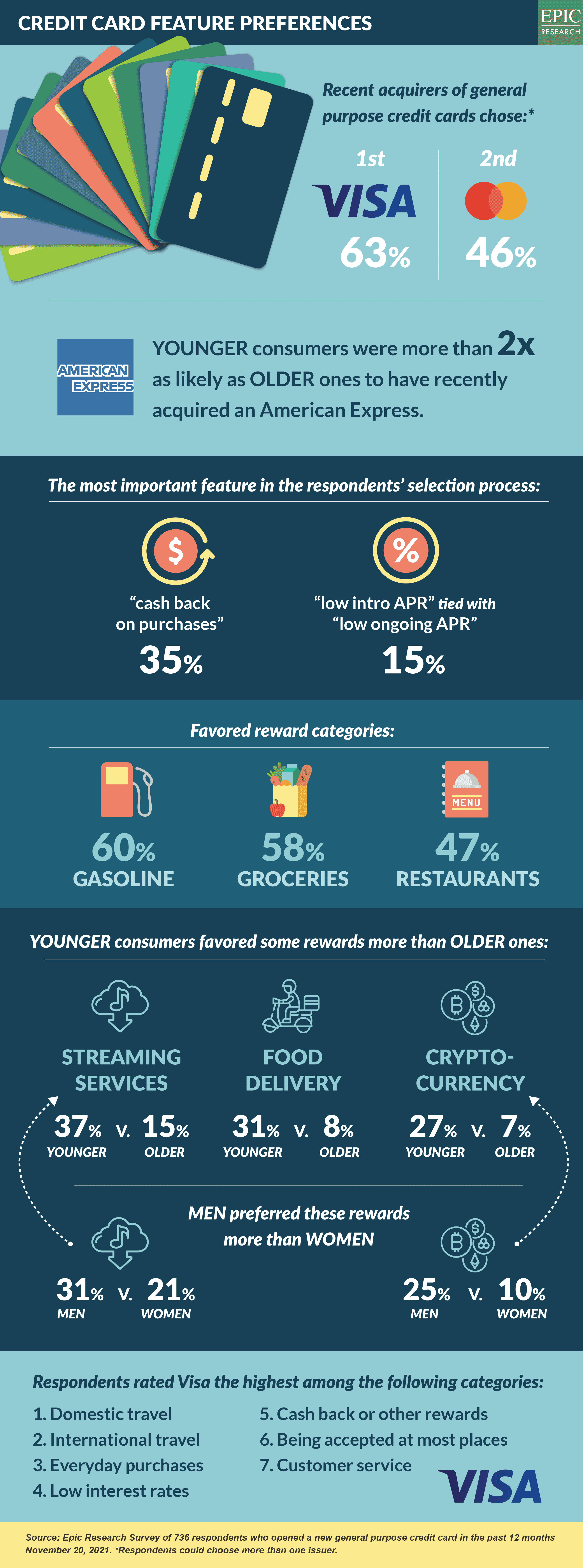

Cash Back and Specialized Spending Bonuses Popular with Consumers

- Epic surveyed 736 consumers who recently opened a new general purpose credit card account regarding their credit card feature preferences

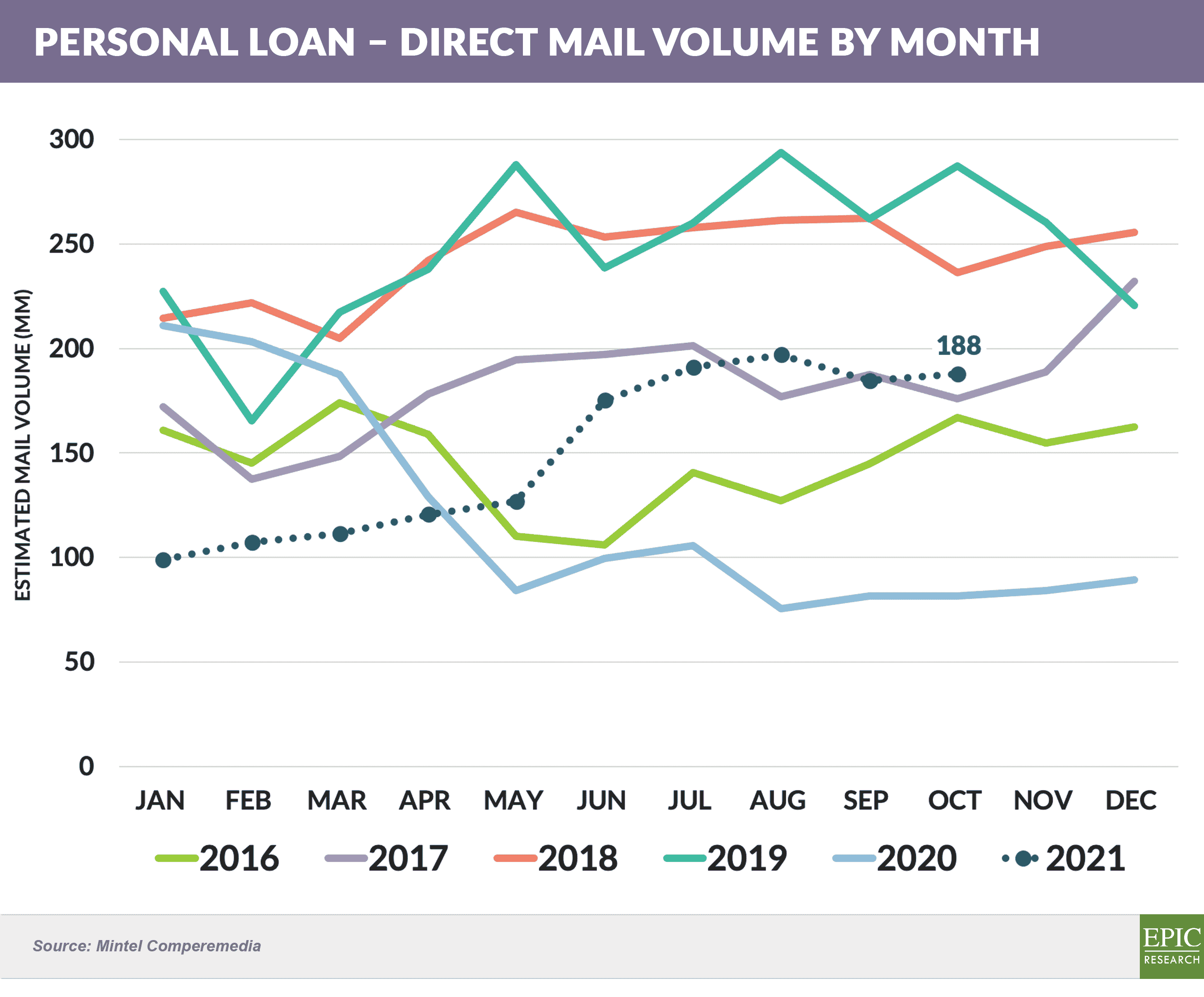

Non-Card Products Lagging

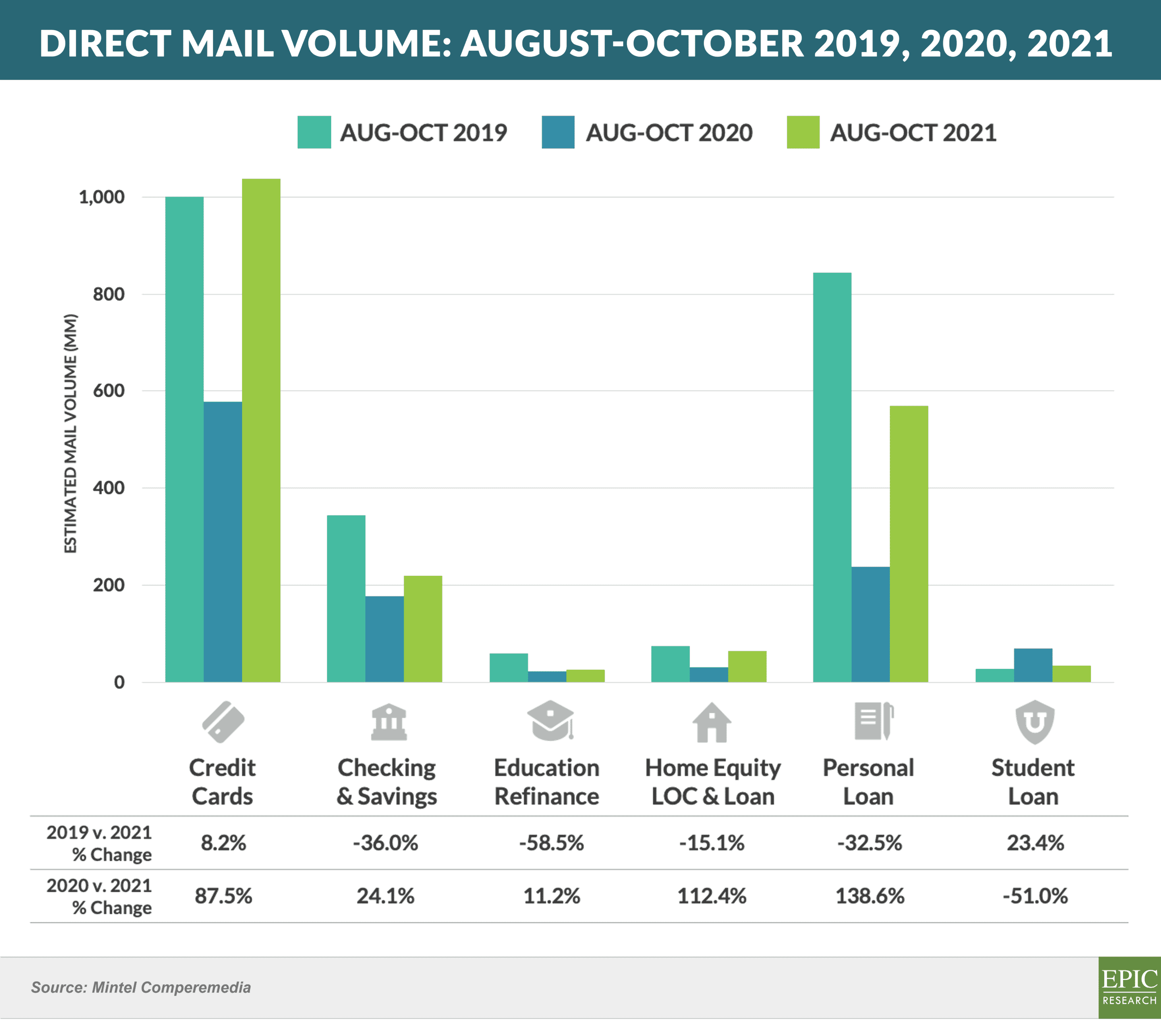

- Other than credit cards and student loans, most consumer financial product mail volume continues at levels markedly lower than before the pandemic

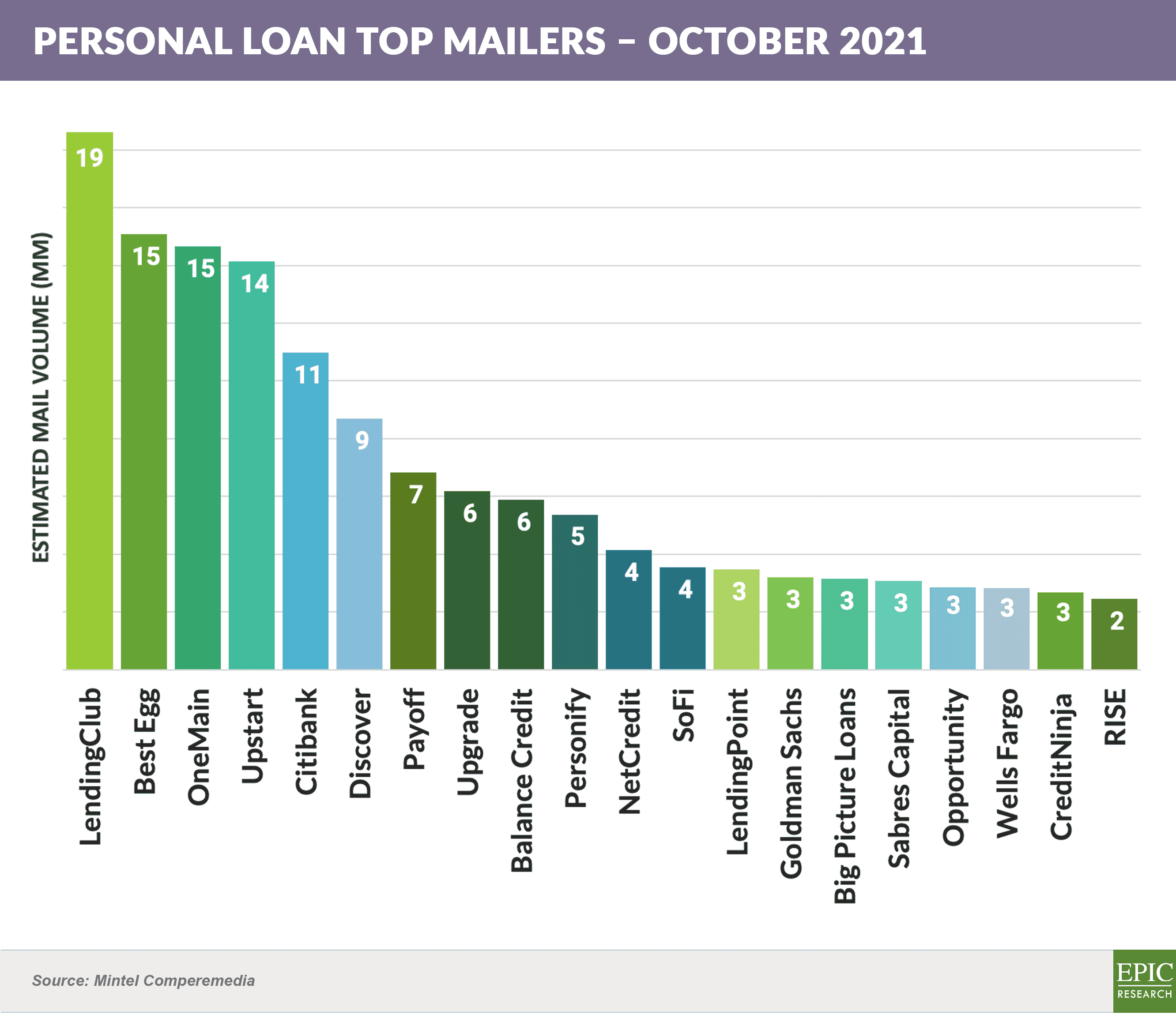

- Personal loan is particularly interesting, as despite an overall drop in volume, fintechs such as LendingClub, Best Egg, and Upstart have reached mail volume levels equaling or surpassing those of OneMain, which dominated the space over the past 18 months

- Along with personal loan, mail volumes for education refinance, checking and savings, and HELOC are 25% - 50% lower than 2019 levels

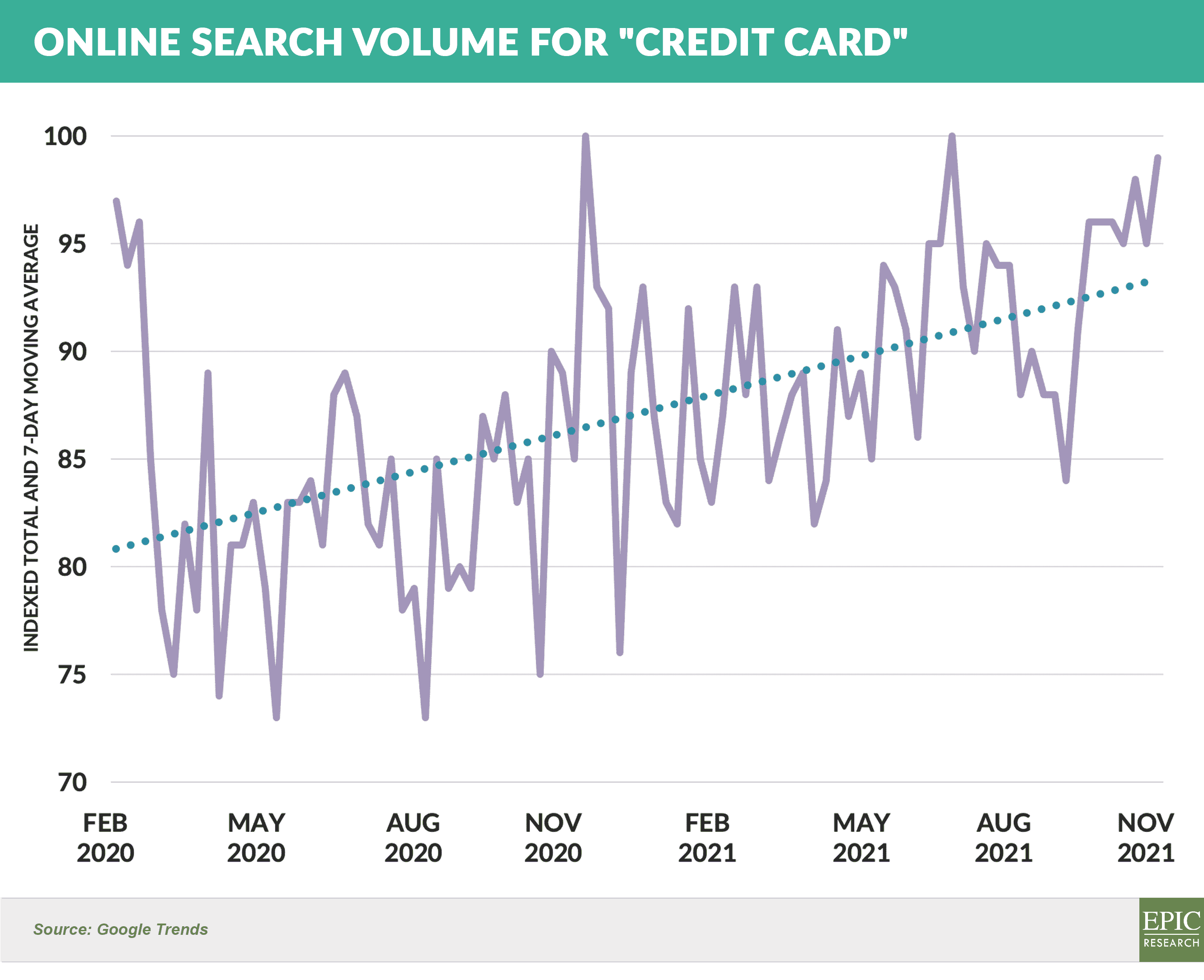

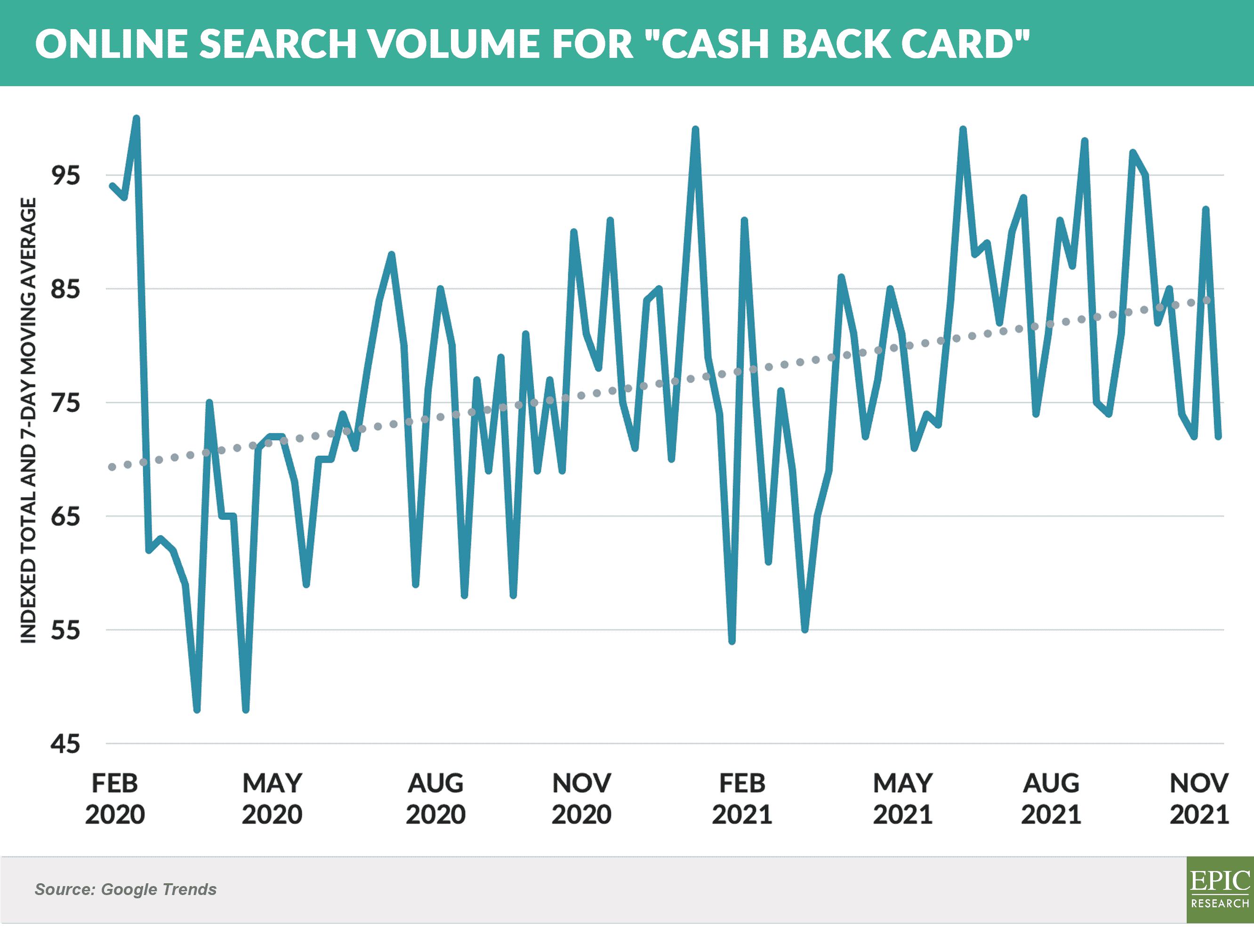

- Since bottoming in the summer of 2020, online search volume for “credit cards” has trended upward and has now reached levels surpassing those of 1Q 2020

- The majority of credit card online search growth has been in the “cash back” sector, as search volume for “balance transfer” and “travel rewards” has lagged

Quick Takes

- Venmo signed a deal to allow Amazon shoppers to pay for purchases through Venmo – Venmo gains scale in its bid for merchant acceptance, and Amazon benefits by lowering its cost for payments and by making shopping easier for Venmo’s wide customer base

- A survey by the New York Federal Reserve reveals a sharp rebound in consumer credit demand in 2021, with most credit application rates returning to 2019 levels

- Credit card application rates showed the largest increases, especially among those with credit scores below 680

- Application rates for mortgages surpassed both 2019 and 2020 levels

- Marketing for credit cards, personal loans, and other consumer financial products is being negatively impacted by capacity and logistics issues at commercial printers

- Many financial products are heavily dependent on direct mail, with 60%+ of all new customer acquisition volume in some products coming via mail

- Paper mills are essentially “firing” clients with poor payment records, as a way of allocating stock

- Printers, which typically have 6-8 months of inventory on hand, now have none at all

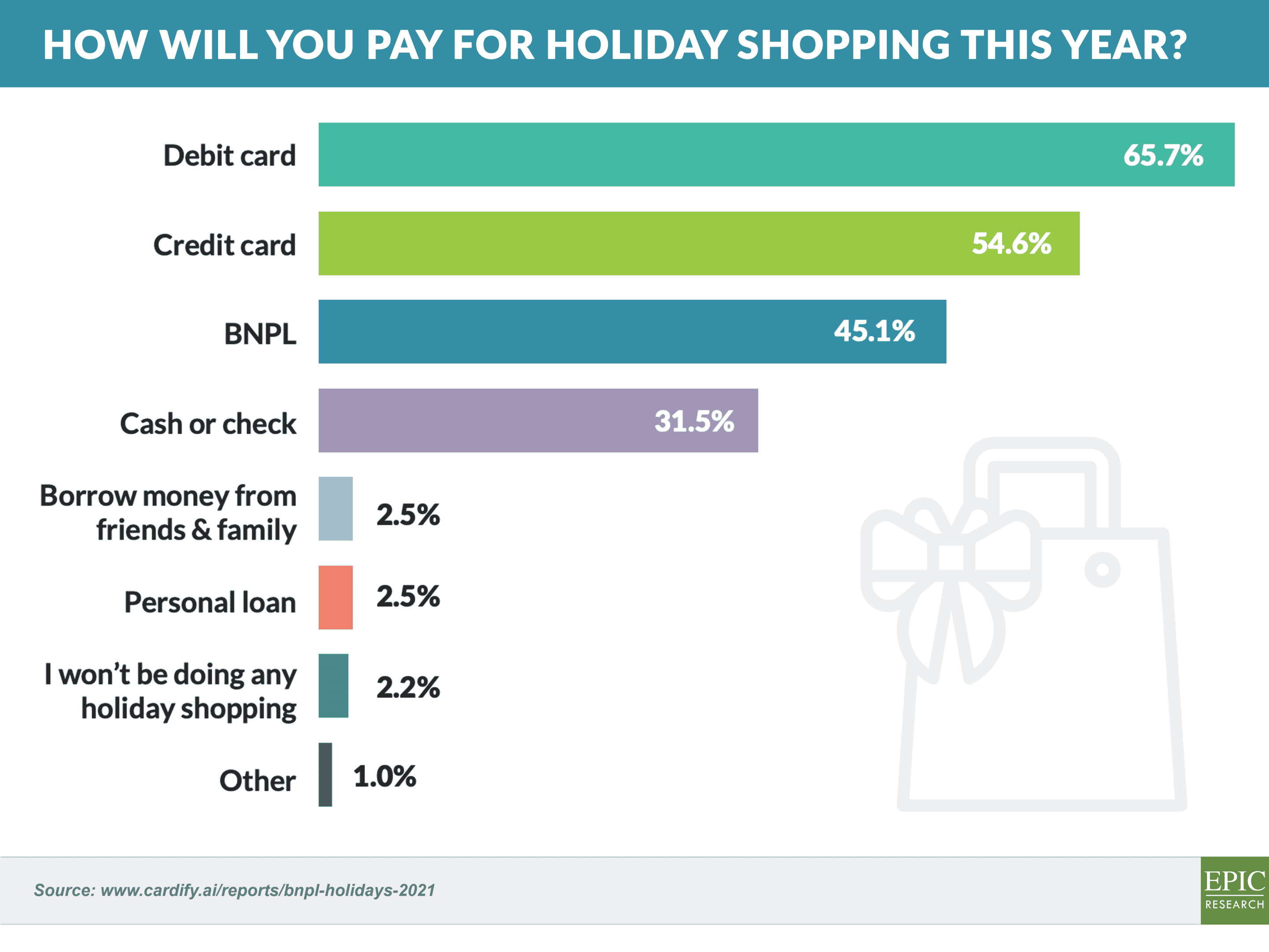

- 45% of consumers surveyed by Cardify said they plan to use BNPL for holiday shopping this year, while 10.8% indicated they have previously defaulted on a BNPL loan

The Epic Report is published monthly, and we’ll distribute the next issue on January 8th.

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here. To subscribe to our newsletter, click here.