Four Things We’re Hearing

- Personal loan applicants like branches

- Credit card competition surges

- Ad spending for some products still recovering

- Is there a hotter new product than BNPL?

A five-minute read

Personal Loan Applicants Like Branches

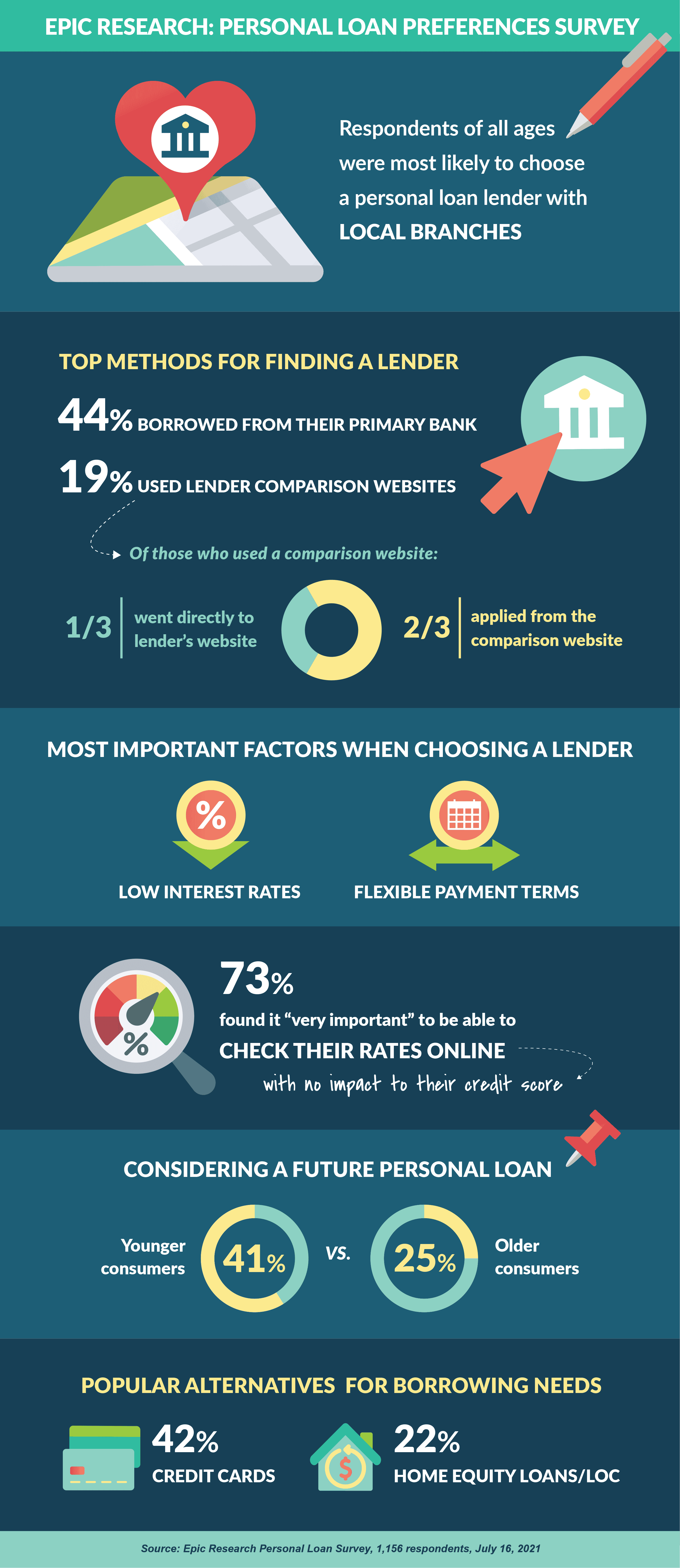

- Epic recently surveyed 1,156 consumers regarding their personal loan experiences and preferences, which uncovered the following findings:

Credit Card Competition Surges

- As I’ve mentioned in previous Epic Reports, credit card growth has resumed

- Mail volume is back to 2019 levels

- New account acquisitions have followed

- Sales on existing accounts are up

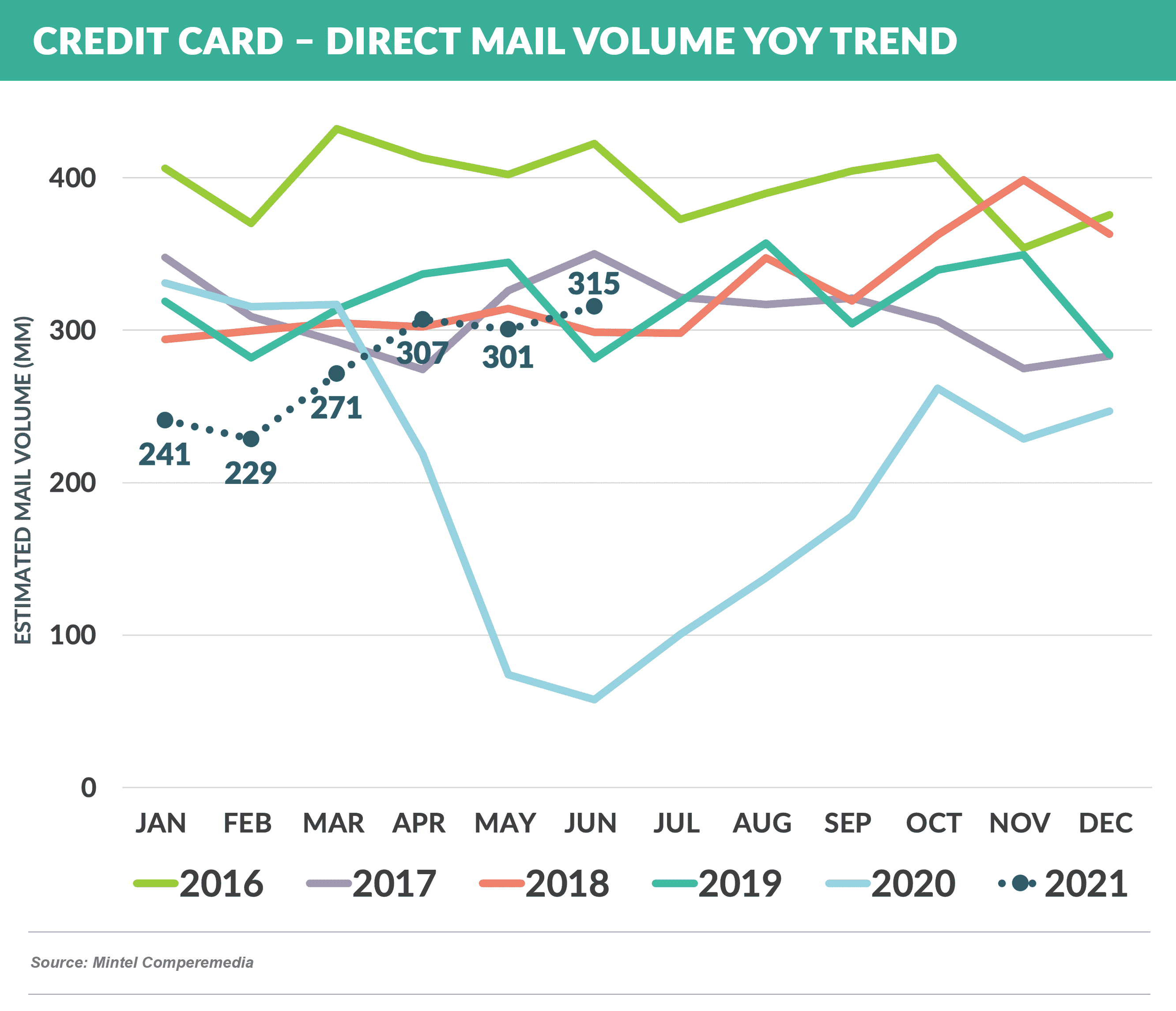

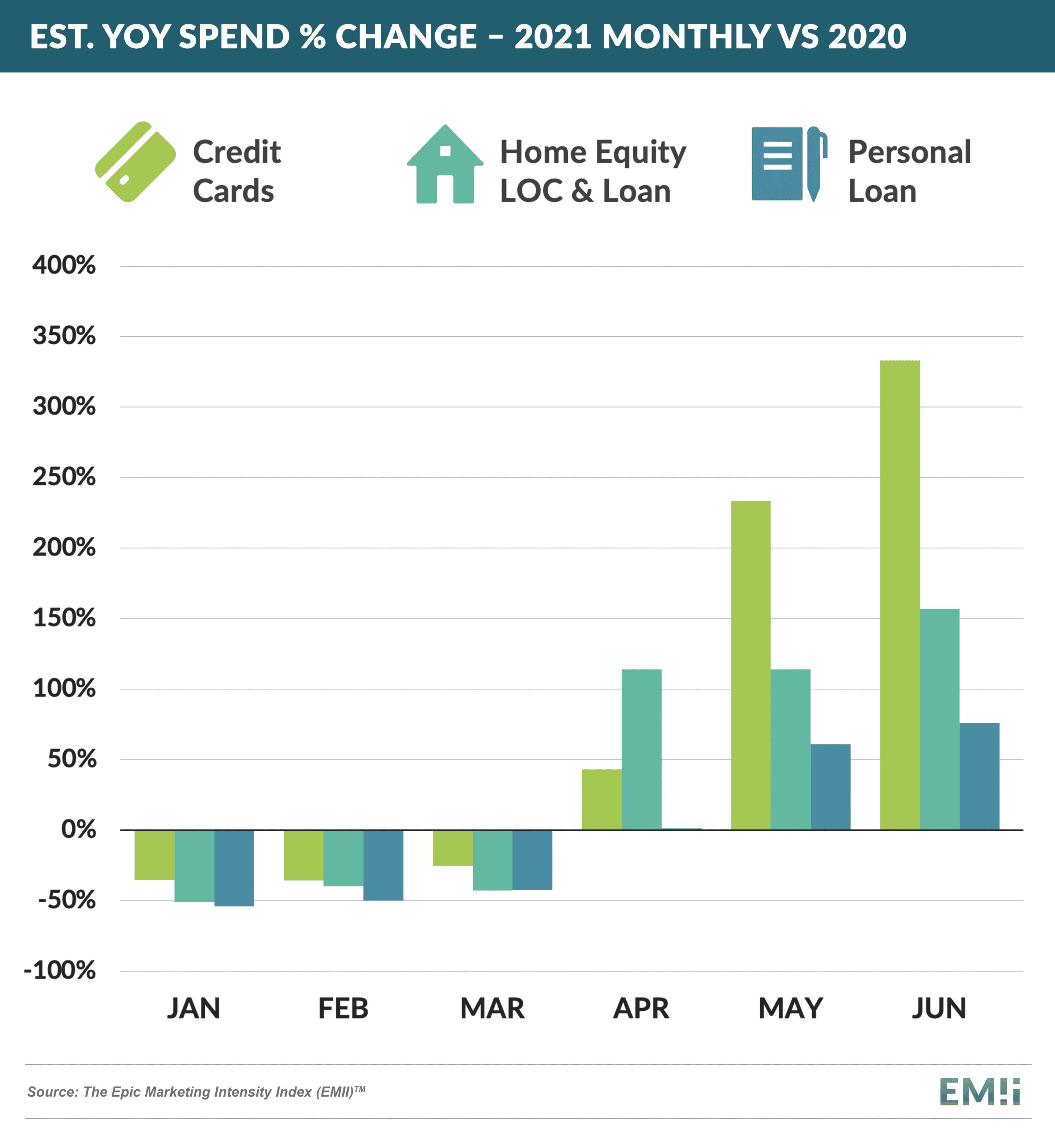

- Mail volume in June continued its rise from prior months and was above 2019 levels for the first time since the pandemic

- Large issuers primarily drove this growth, with Capital One alone accounting for 60 million mail pieces – primarily its Quicksilver product – and almost 20% of total June card mail volume

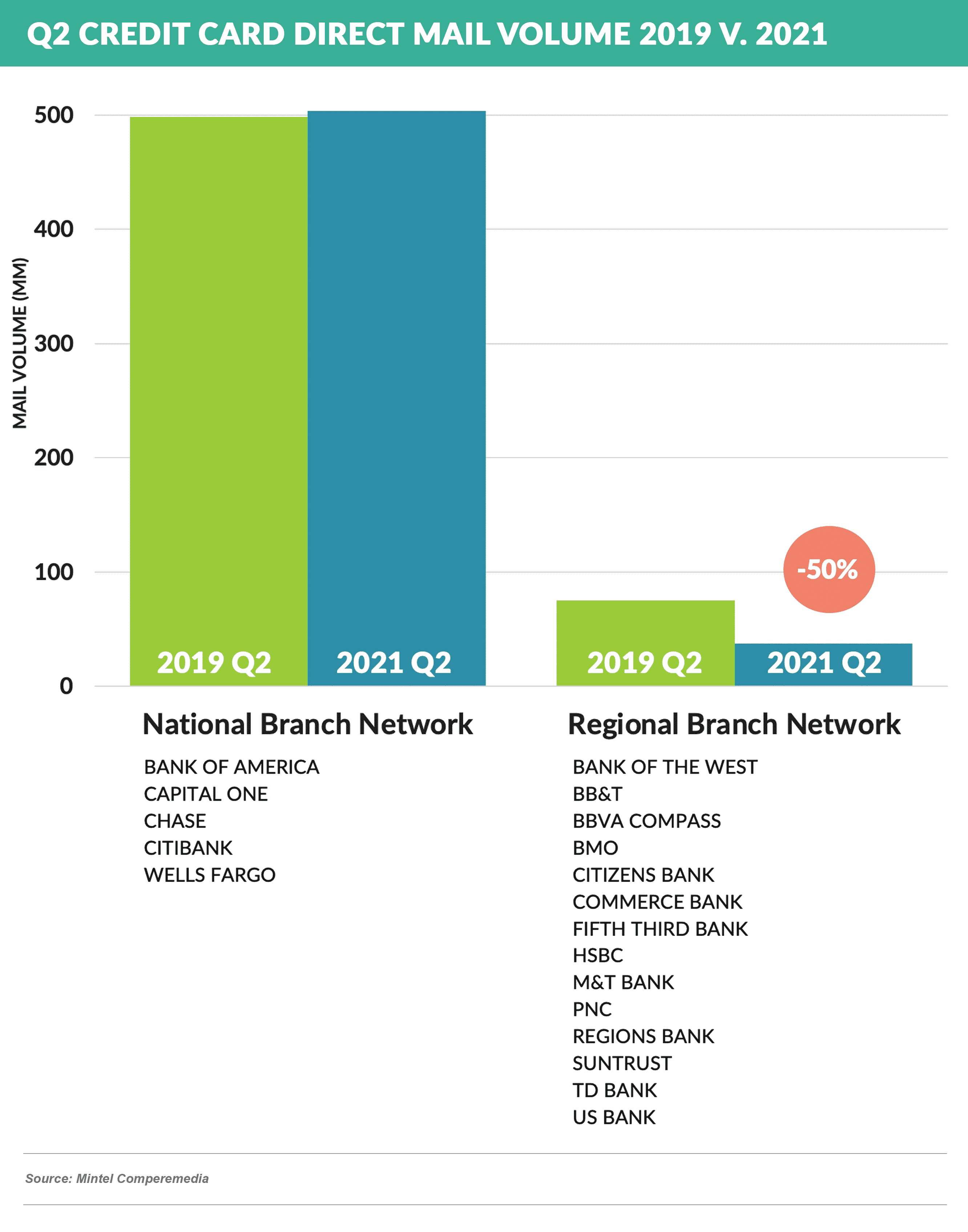

- Card offers from national branch network issuers rose to 2019 levels, while regional bank offers remain at levels half of that

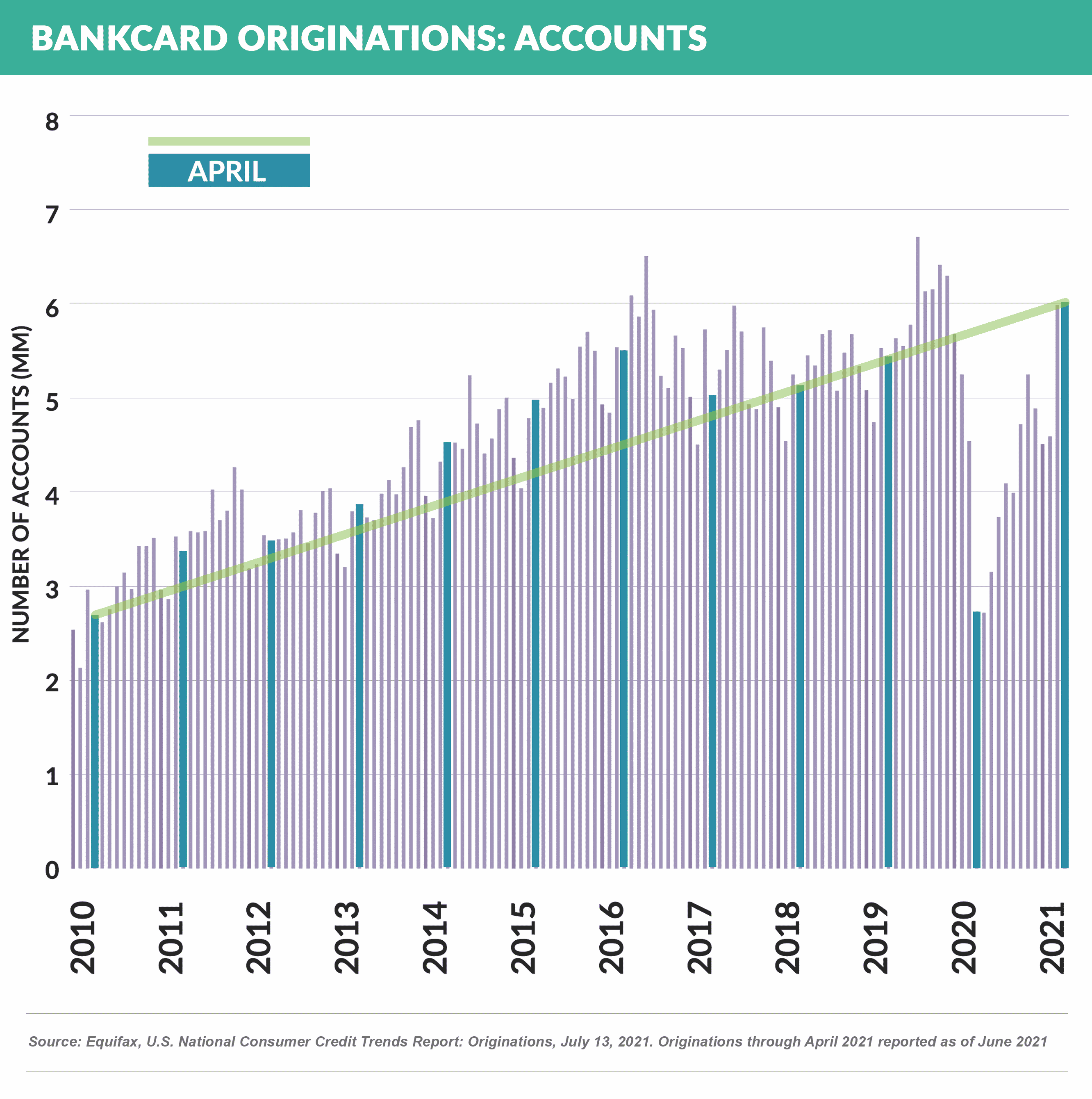

- While the number of new bankcards issued in 2020 was down 27% from 2019, cards issued in 2021 through April are 16% greater than the same period in 2020, and the 6 million cards issued in April of this year mark the highest April total in over 10 years

- U.S. credit card spending continued to improve with Credit Suisse reporting that 2Q ’21 spending at Citi, Chase, Bank of America, and Wells Fargo grew a combined 46.5% more than 2Q ’20, and 13.2% over 2019, exceeding 1Q ’21's 4.4% growth vs. Q1 ’19

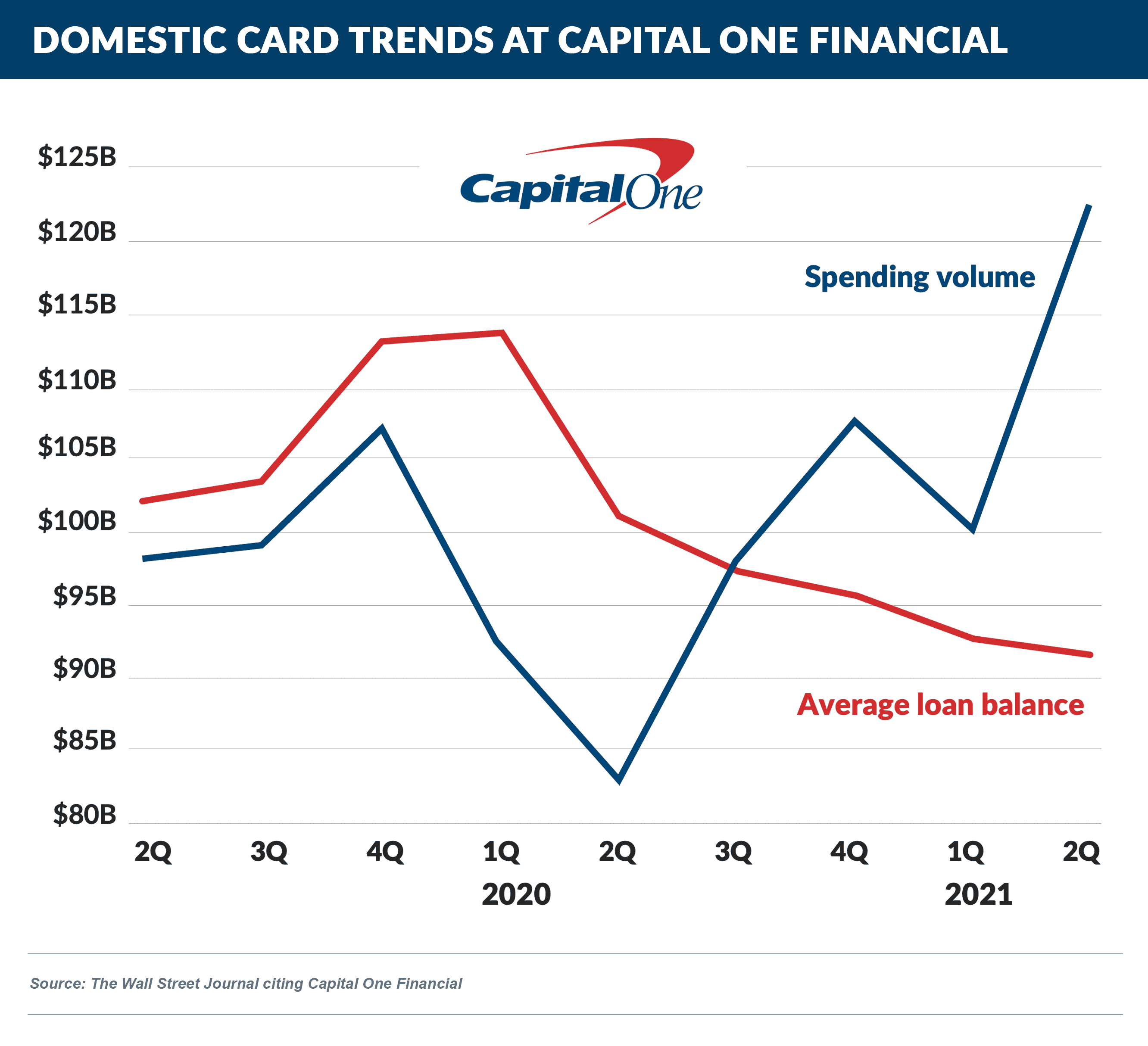

- While spending is up, balance growth at most issuers still lags with June balances down 3.9% vs. June 2020 – Capital One’s numbers below illustrate the disparity

- The flurry of new card product introductions noted in last month’s Epic Report has continued:

- Chase added a revamped Slate Edge card targeted at consumers trying to pay off credit card debt and increase their credit scores

- Highly successful personal loan marketer Best Egg is getting into the credit card segment with a credit builder product it says is the first in a series of new product capabilities that the company is poised to launch in 2021

- Bank of America became the latest large issuer to launch a new cash back product with the introduction of the Unlimited Cash Rewards card

- Amex and Chase are revamping their high-end products:

- Amex paired an annual fee increase on its Platinum Card with enhanced benefits, including up to $200 in annual statement credits for prepaid hotel bookings, credits toward a CLEAR membership and a number of subscription services, and access to additional airport lounges

- Chase is rumored to announce enhancements to their Sapphire Cards this month

- Demonstrating the heated competition in the high-end card market, Citi has stopped taking new applications for the $495-a-year Citi Prestige card, encouraging prospective customers to instead consider its lower-fee or no fee cards

Ad Spending for Some Products Still Recovering

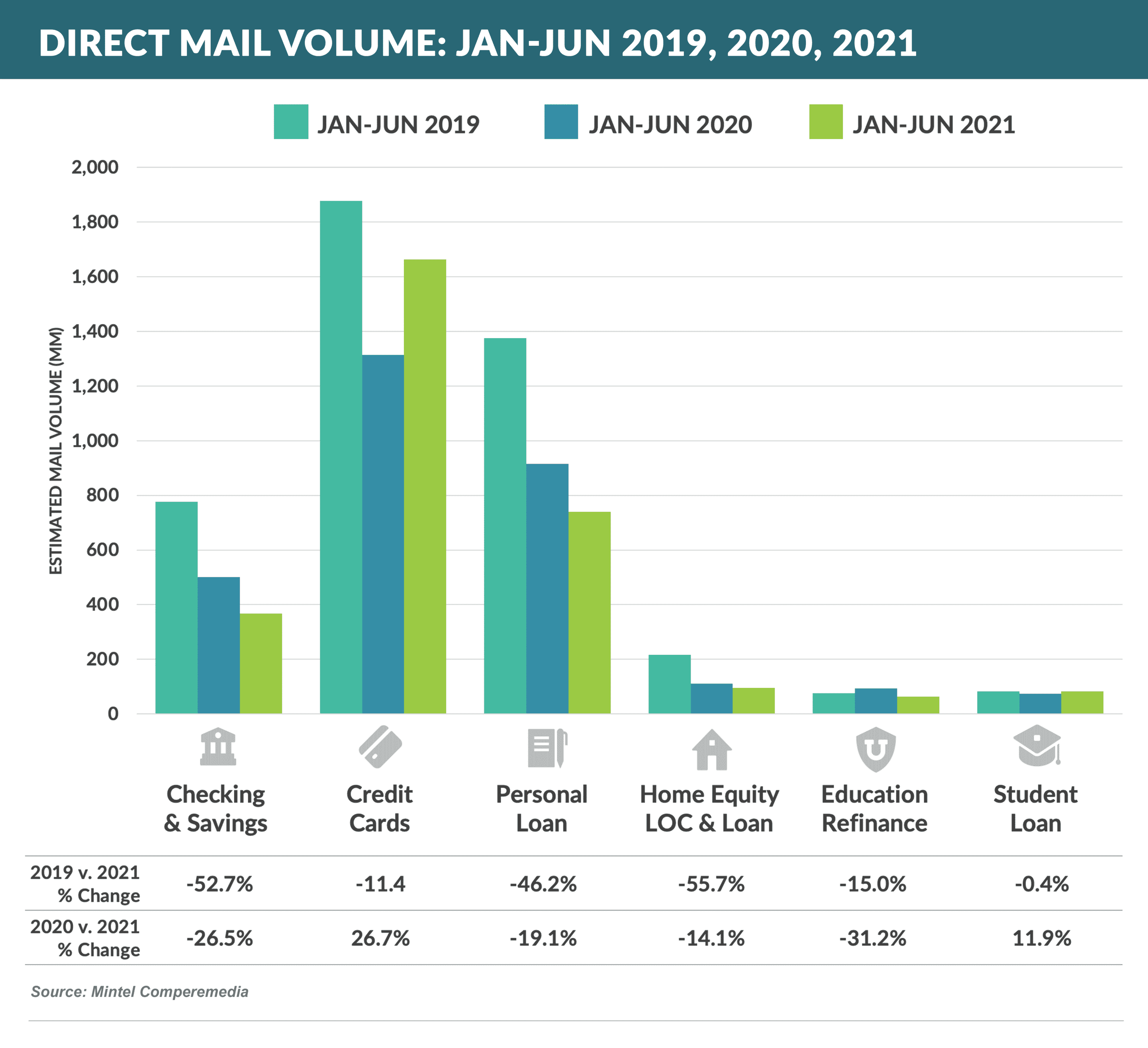

- While credit card mailers in June were back to prepandemic volumes and student loan mail volumes remain above prior years’, other products have not fully recovered

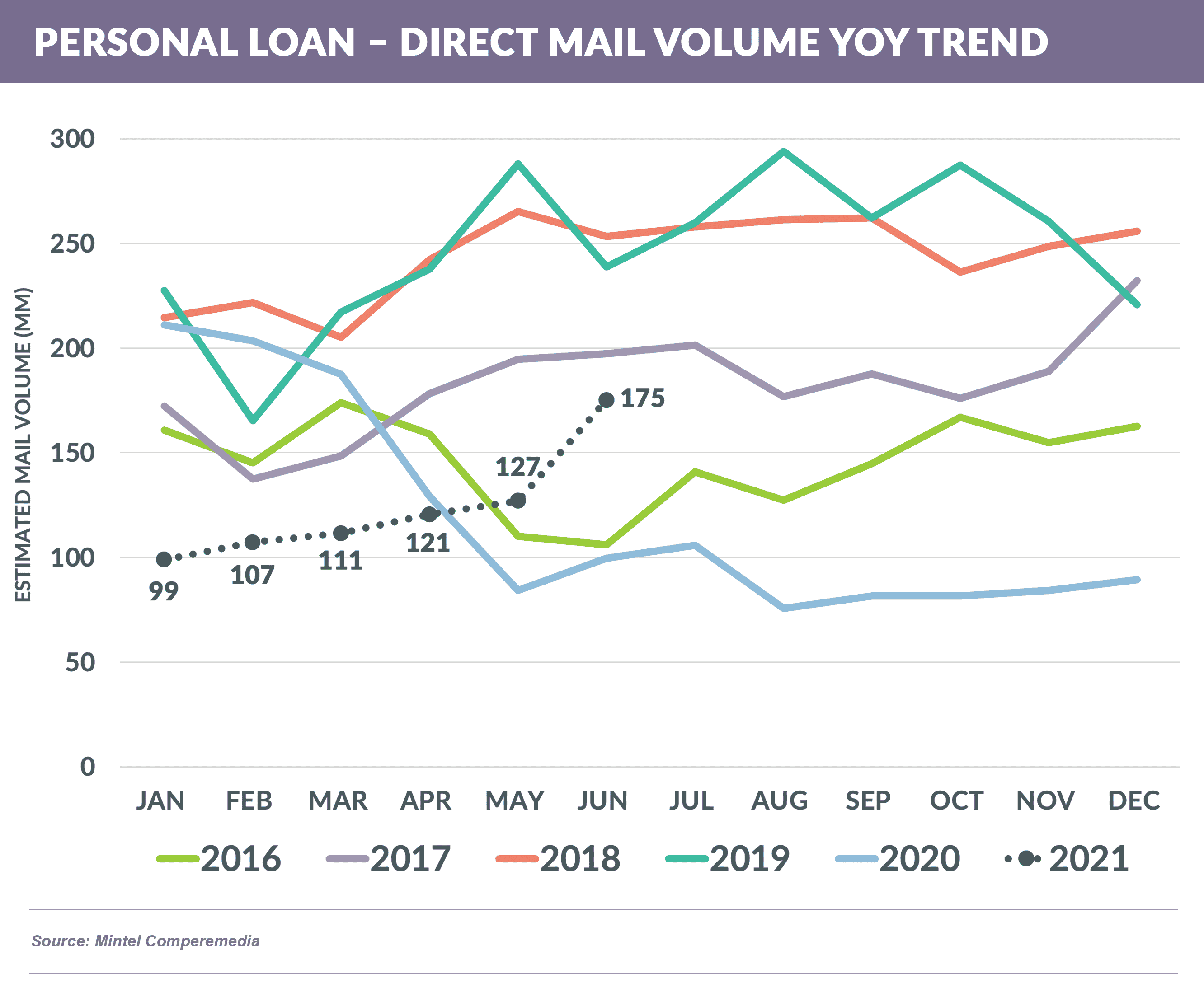

- Personal loan mail volume fell ~50% since the onset of the pandemic, but finally accelerated in June to within 25% of June 2019

- Direct mail typically accounts for 60%+ of total acquisition spend (including online search and paid media), and credit card remains the most resilient product overall

Is There a Hotter New Product than BNPL?

- By far the trendiest new segment has to be Buy Now, Pay Later (BNPL)

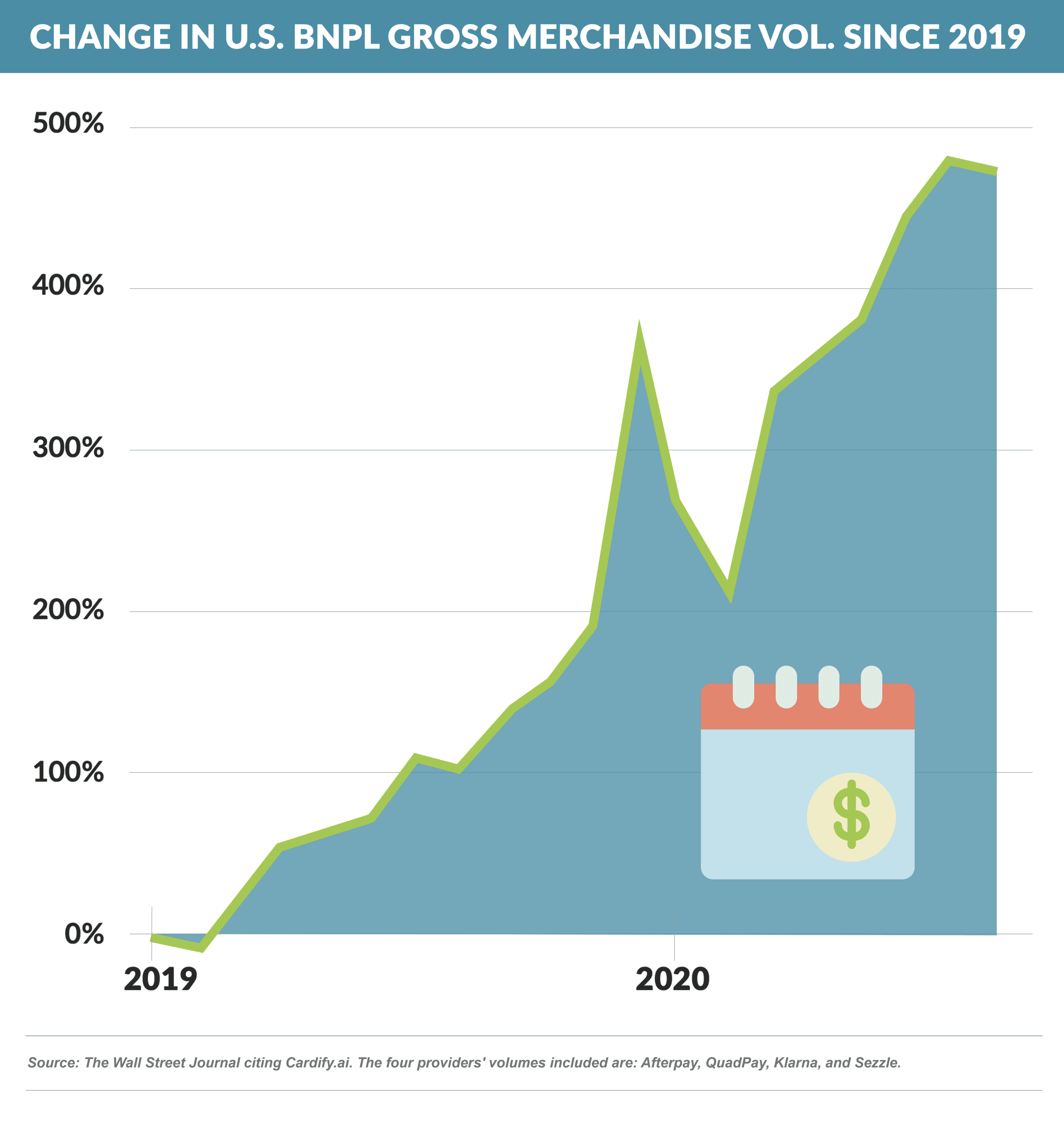

- BNPL volume at Afterpay, QuadPay, Klarna, and Sezzle grew almost 500% from January 2019 through August 2020 (while accounting for just 3% of total spending among the consumers tracked)

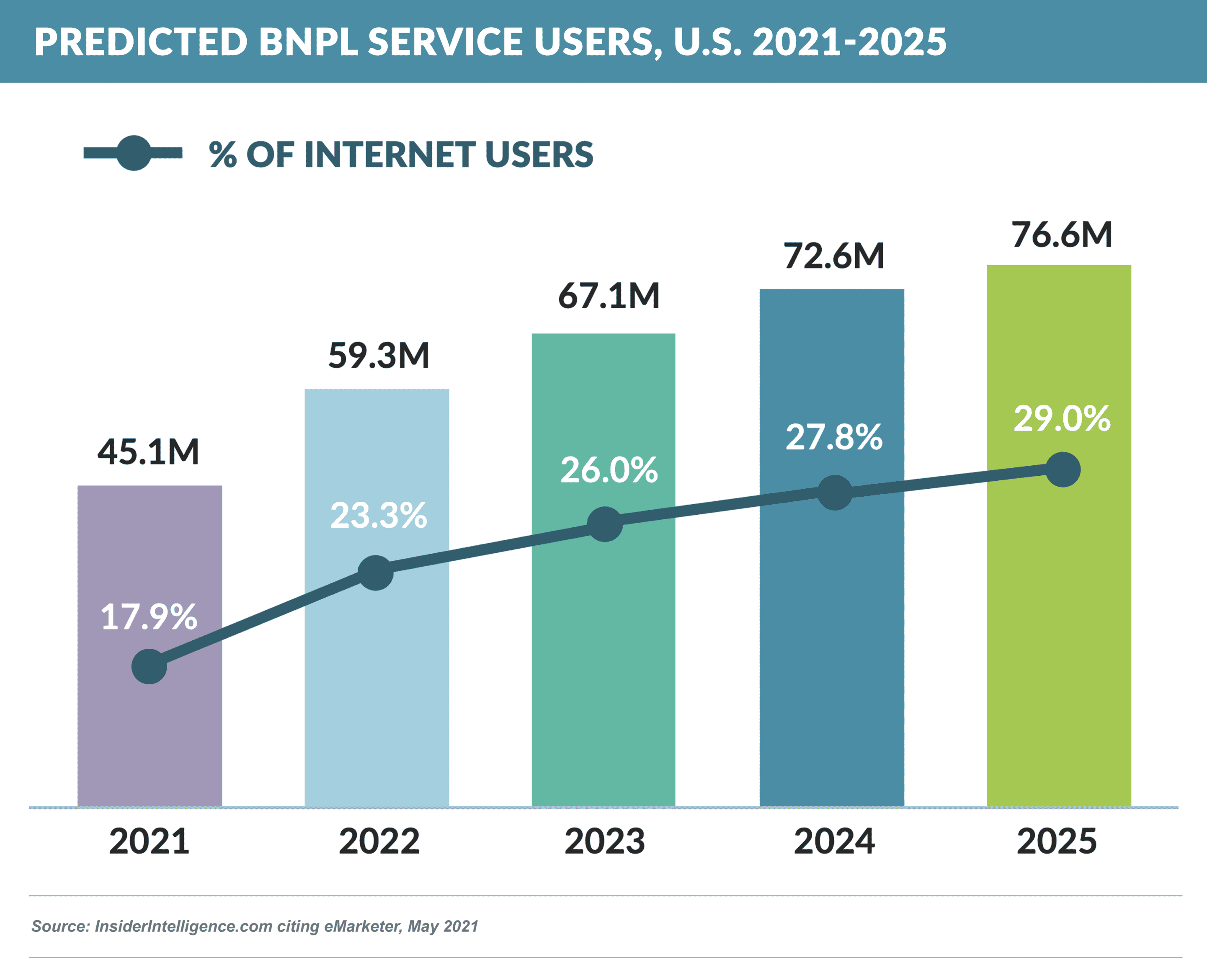

- BNPL users are projected to continue growing

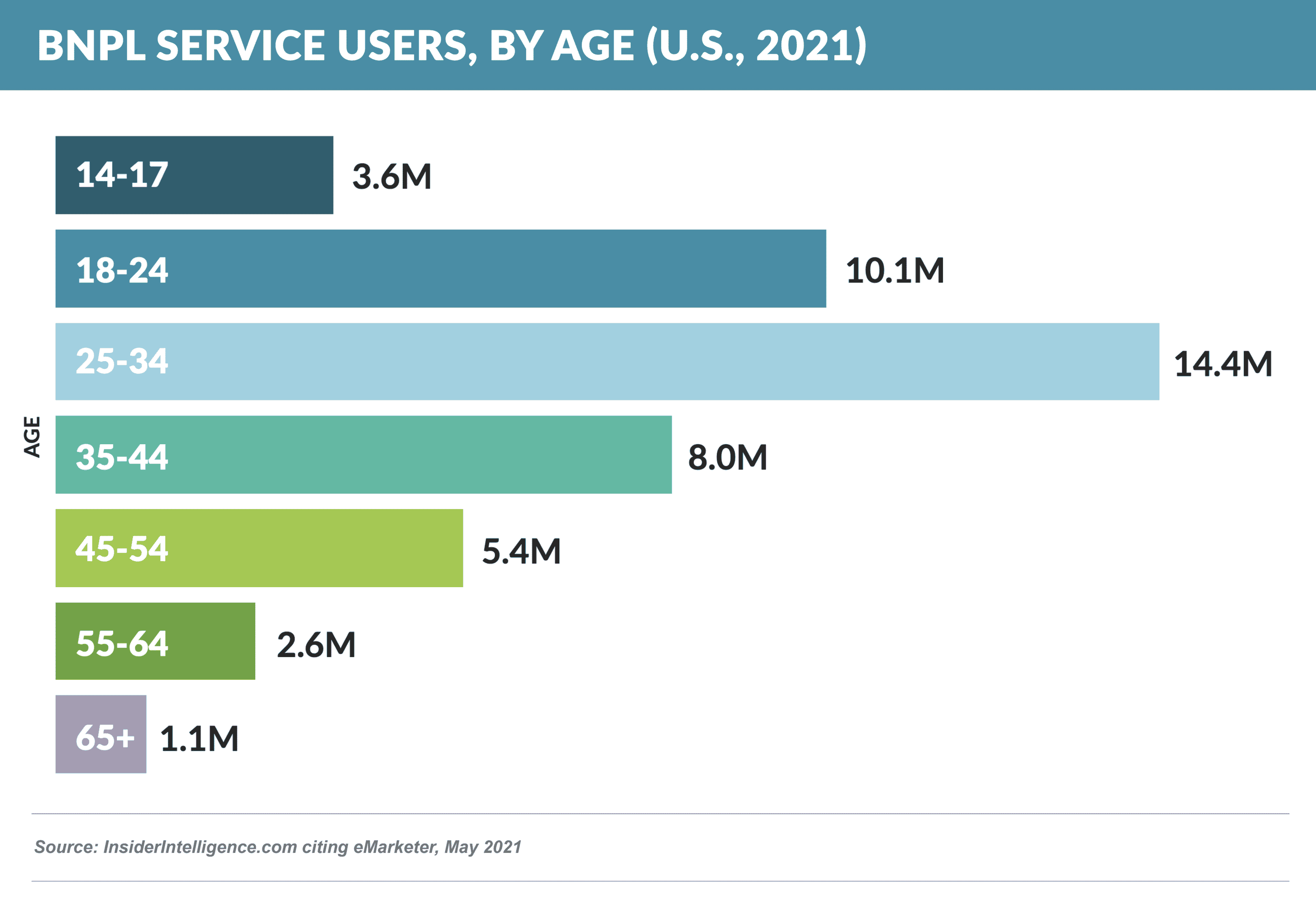

- BNPL is most popular amongst consumers between the ages of 18 - 45

- Existing players have acquired significant customer bases:

- Affirm is forecasted to reach 6 million U.S. users this year

- Afterpay is projected to reach 12.7 million users, and Square Inc., the digital-payments platform led by Twitter Inc. founder Jack Dorsey, just announced it would acquire Afterpay for $29 billion in its largest-ever acquisition

- Klarna is expected to hit 21.9 million users

- Sezzle, with over 2.6 million shoppers and 34,000 merchants, just received a $30 million investment from Discover

- Plus, there has been a blizzard of new or enhanced product announcements this past year:

- Barclays announced in April a partnership with fintech Amount to roll out a white-label BNPL offering that allows merchants to provide the service to their customers under their own brand

- PayPal’s new BPNL product, Pay in 4, was launched last fall

- Chase offered its version of BNPL with the November launch of My Chase Plan, which allows cardmembers to make fixed payments over time for specific purchases

- Citi’s similar program, Flex Pay, was extended to Amazon last year

- Amex’s Pay It Plan It shares similar features with some of the others

- Citizens, which has had a BNPL program with Apple since 2015, reported its expansion of Citizens Pay to consumer electronics, health and fitness, virtual learning, and home improvement verticals

- According to Bloomberg, Apple and Goldman Sachs plan to announce Apple Pay Later, which will operate through Apple Pay with features similar to those of Affirm and PayPal – this follows Goldman’s MarcusPay alliance with JetBlue from last year

- Amazon Pay Later, which allows payments over 12 months, has over 2 million customers in India

- Ally announced a point of sale loan partnership with Mastercard’s Vyse last August

- Meanwhile, Capital One announced it will no longer allow transactions identified as point of sale loans on its credit cards

- And we’re sure there are more…

- Epic's Take

- BNPL is a growing space with a large number of competitors – both new and entrenched

- So far, pricing for both consumers and merchants appears to be mostly rational

- The frenzy is somewhat reminiscent of the co-brand and affinity credit card gold rush of the ’90s, when many issuers jumped in only to ultimately withdraw due to their lack of competitiveness

Quick Takes

- JetBlue renewed its co-brand card deal with Barclays – Barclays has grown the program significantly since taking it over from Amex in 2016

- Wells Fargo will eliminate its personal lines of credit as part of an initiative to streamline its product lineup, which follows its earlier discontinuance of marketing new HELOC products and its exit from the student loan business

- Wells’ recent introduction of a market-leading 2% cash back card has the potential to more than offset the loss of those two products

- Speaking of BNPL, as those players continue efforts to monetize their customer base, Afterpay is testing a new money mobile app that offers users a debit card and savings account

Thank you for reading.

The Epic Report is published monthly, and we’ll distribute the next issue on September 11th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research uses innovative, data-driven techniques to model, design, and execute high-performing direct marketing campaigns to help financial services companies acquire new customers. Click here to find out how we can help you.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here. To subscribe to our newsletter, click here.