Three Things We’re Hearing

- Personal loan online acquisition perked up in July

- Credit Card mail volume edges up

- Student loan acquisition unfazed by the pandemic

A two-minute read

Personal Loan Online Acquisition Perked Up in July

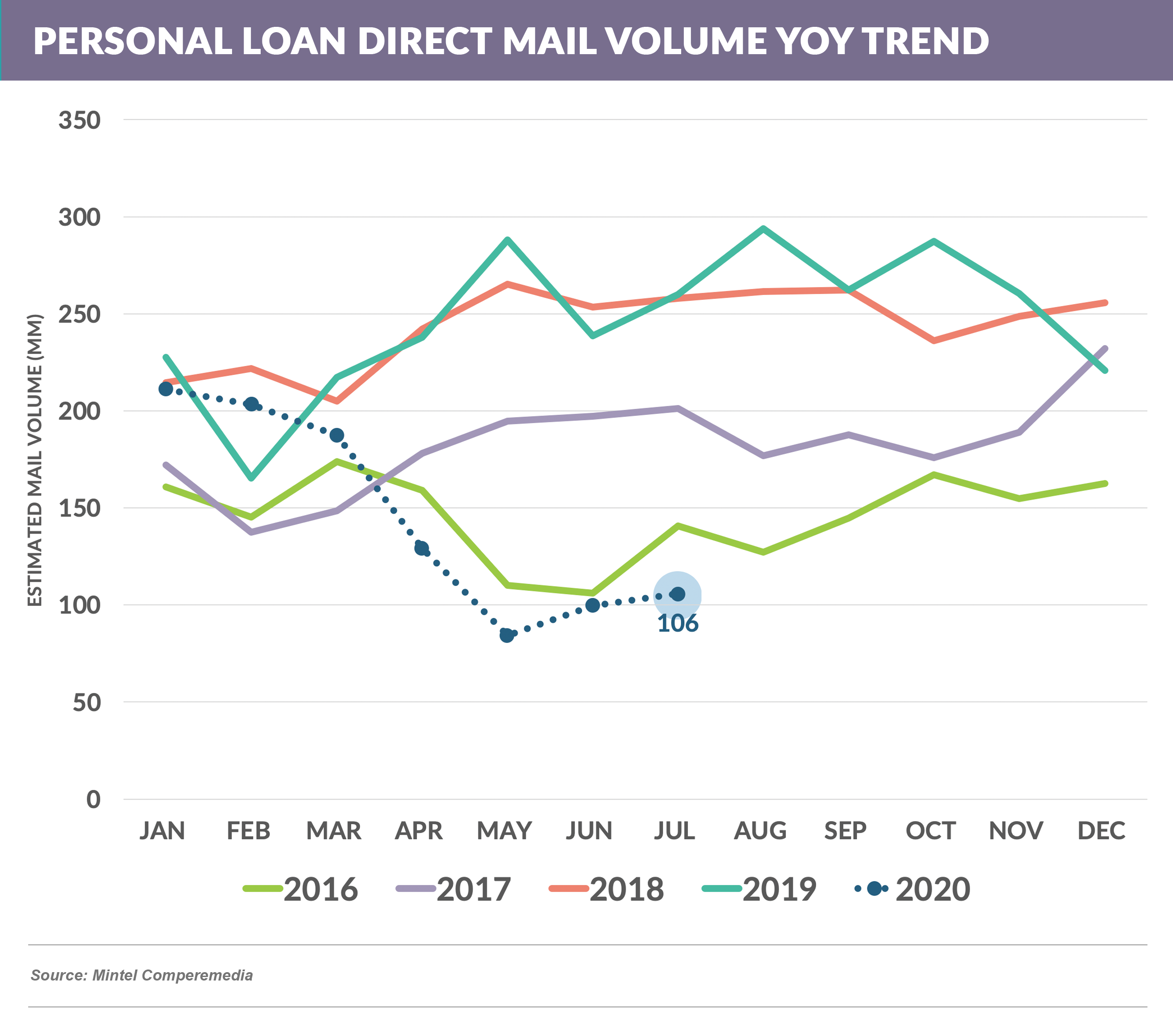

- Personal loan July mail volume showed a slight rise from prior months, but was still 59% below July 2019

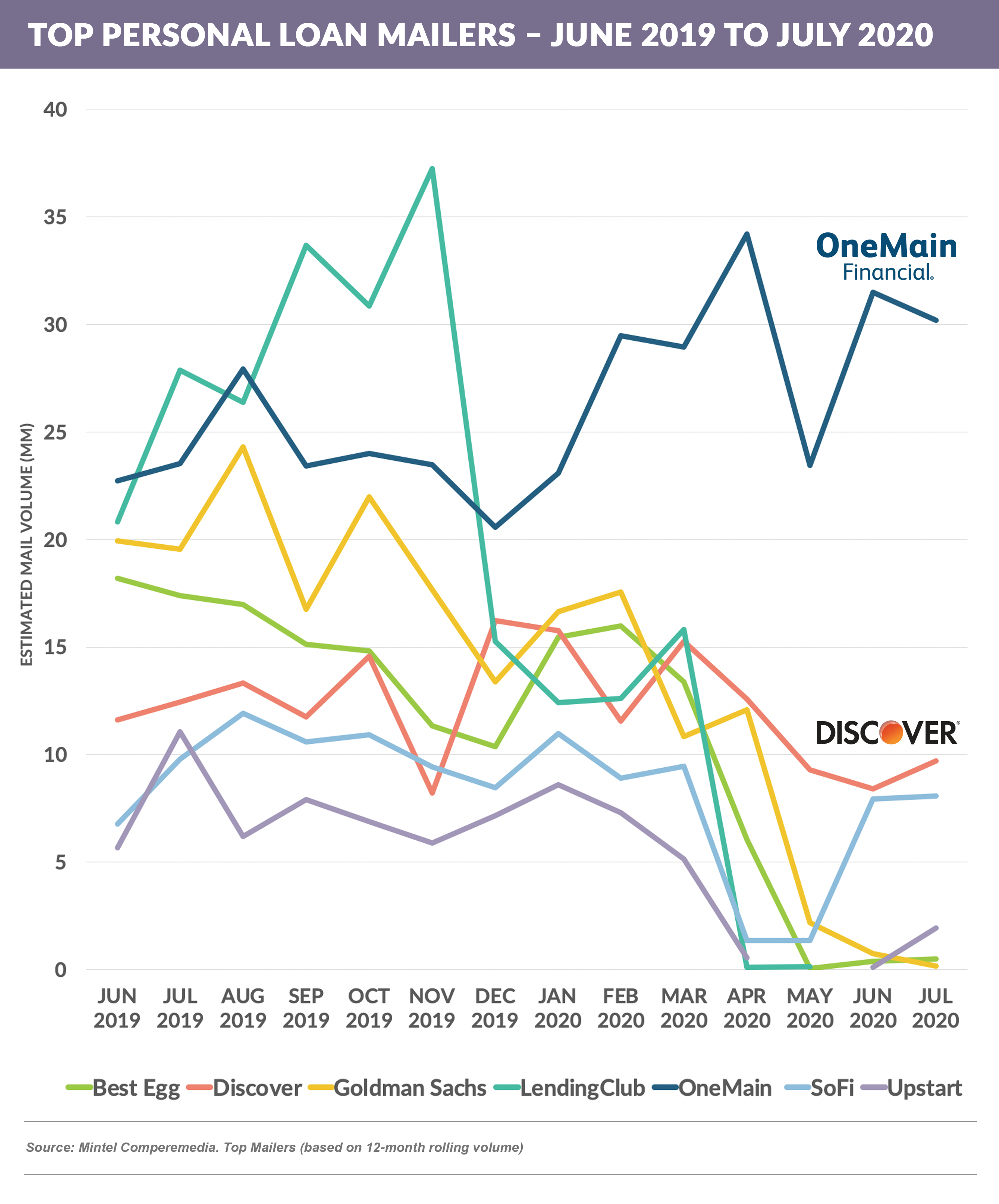

- OneMain remains the top mailer, with little pause since January, and Discover, which has remained fairly consistent since January, is the second largest

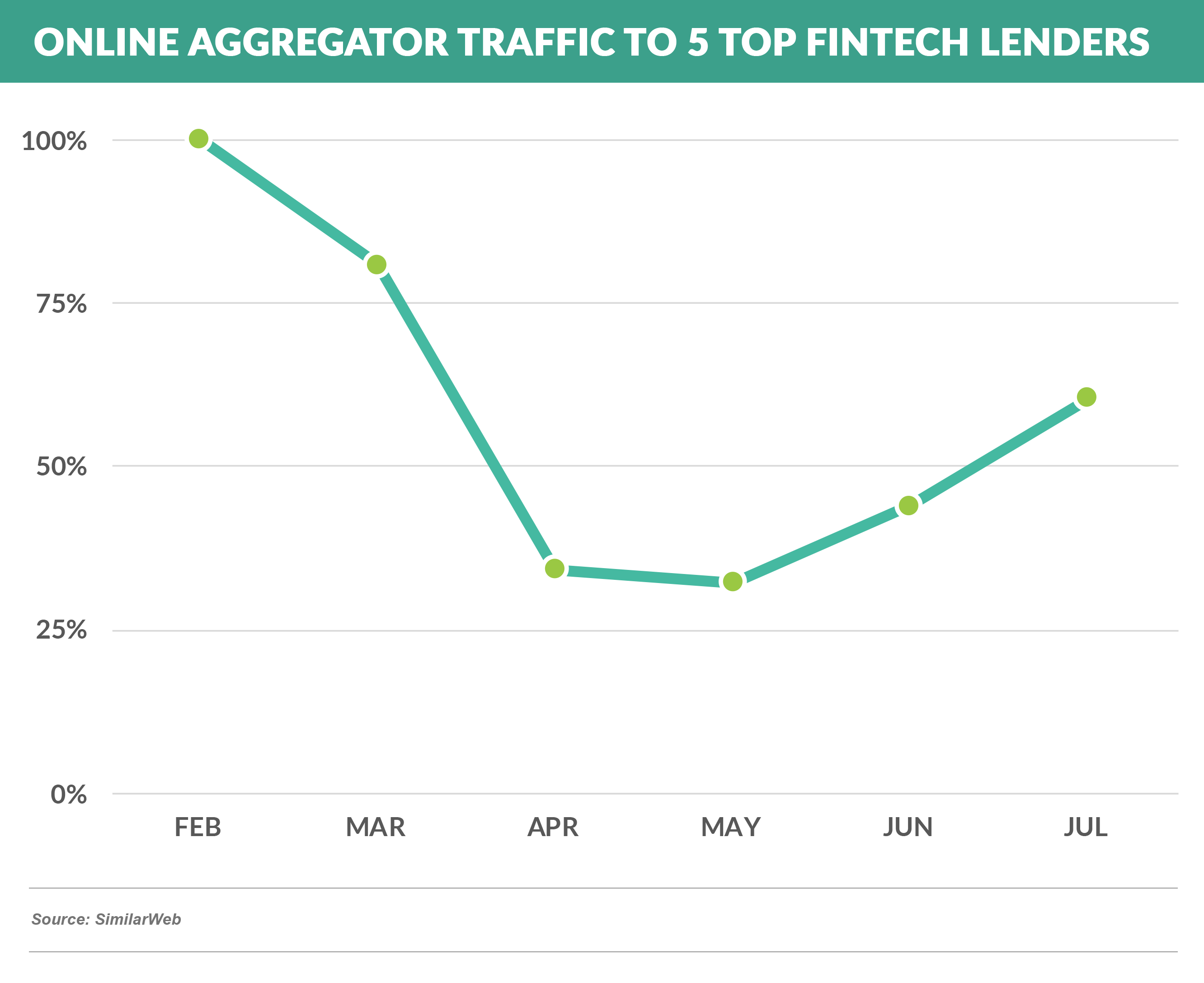

- While the personal loan direct mail channel continues to lag, industry commentary indicates increased activity in online channels, especially aggregators

- This observation is confirmed when looking at online traffic to the top five prime fintech lenders from the major aggregators, which has doubled since the May bottom and is now at 60% of the February level

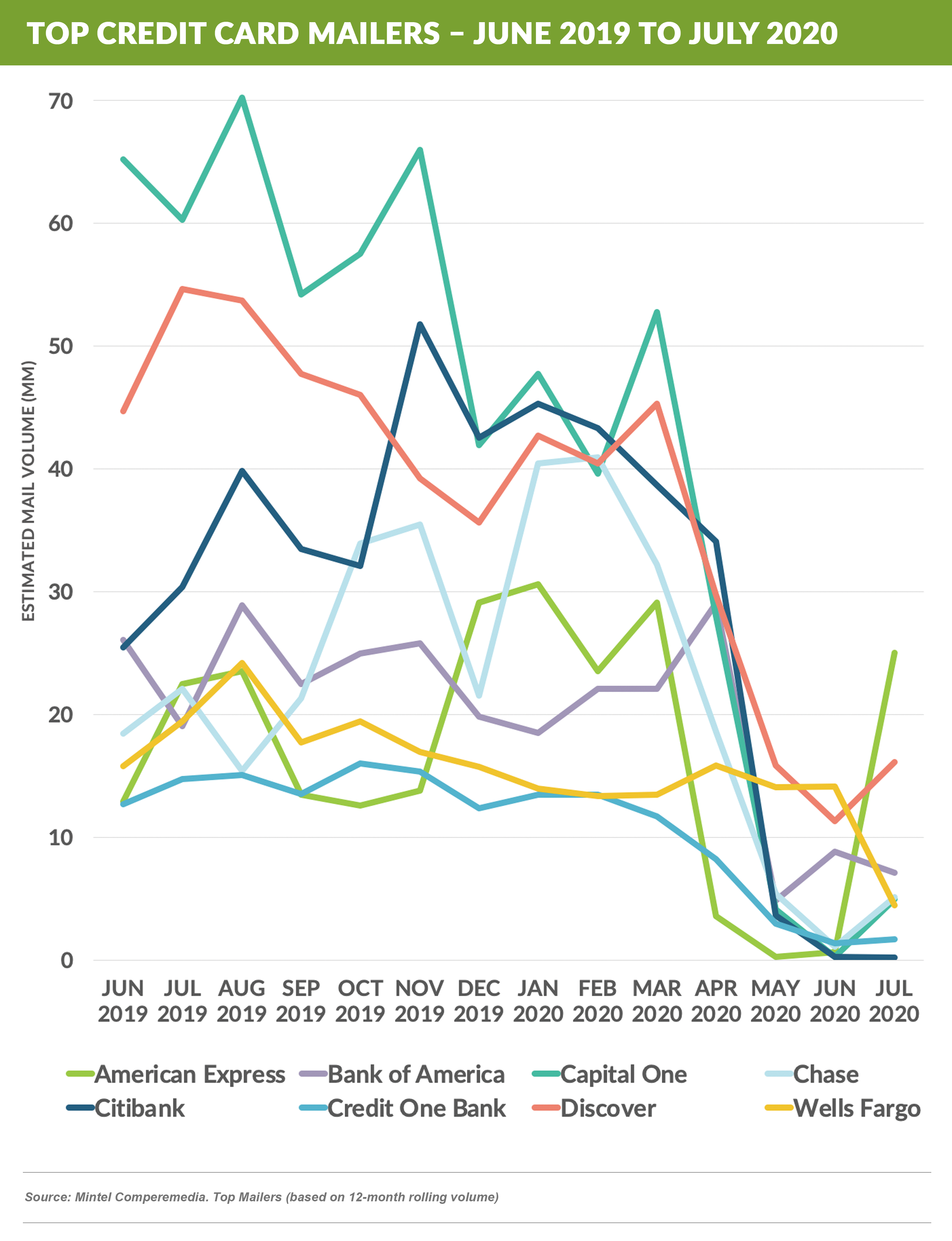

Credit Card Mail Volume Edges Up

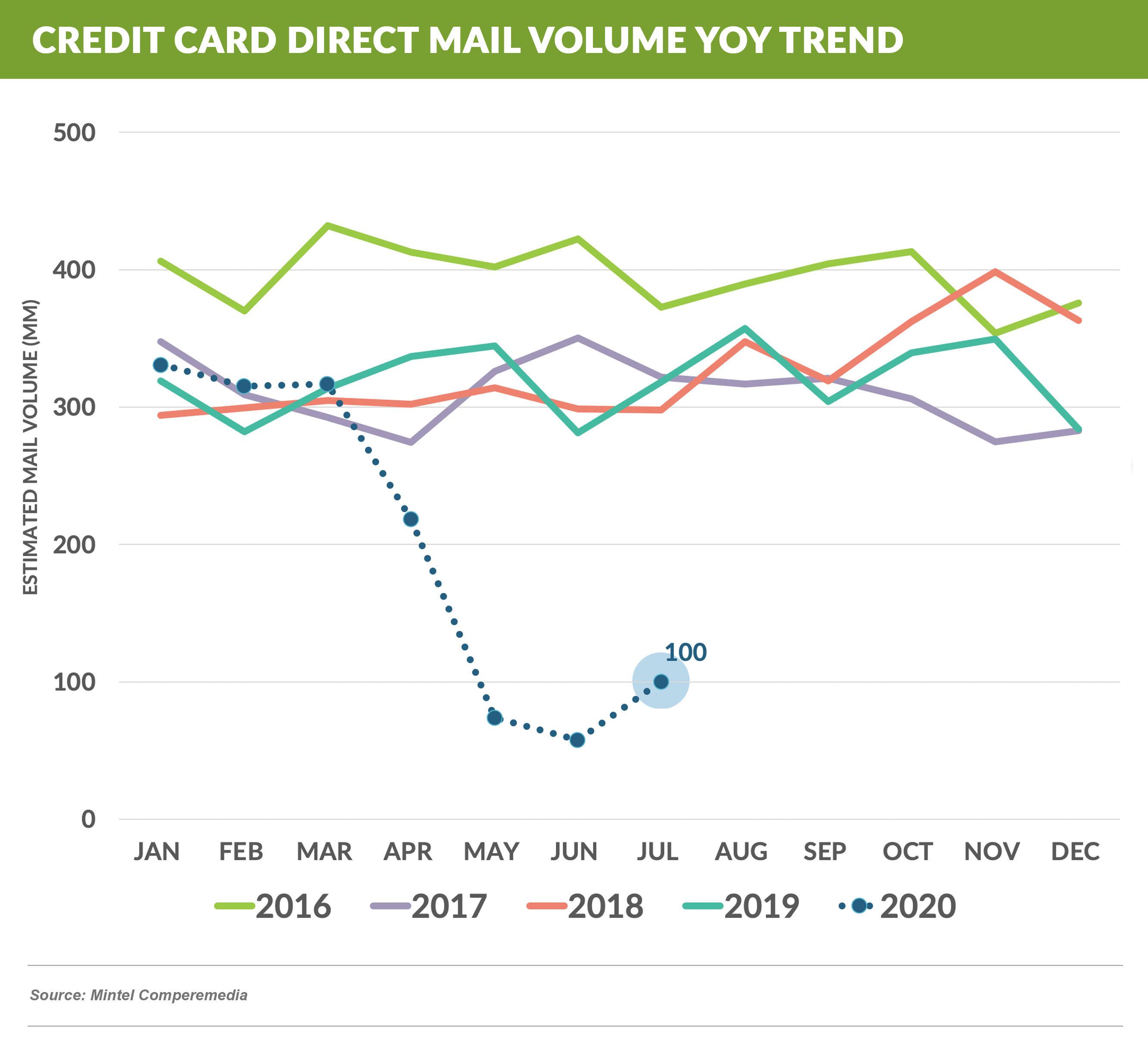

- Credit card mail volume crept up slightly from its June bottom; however, it is still well below pre-COVID levels and 68% lower than July of 2019

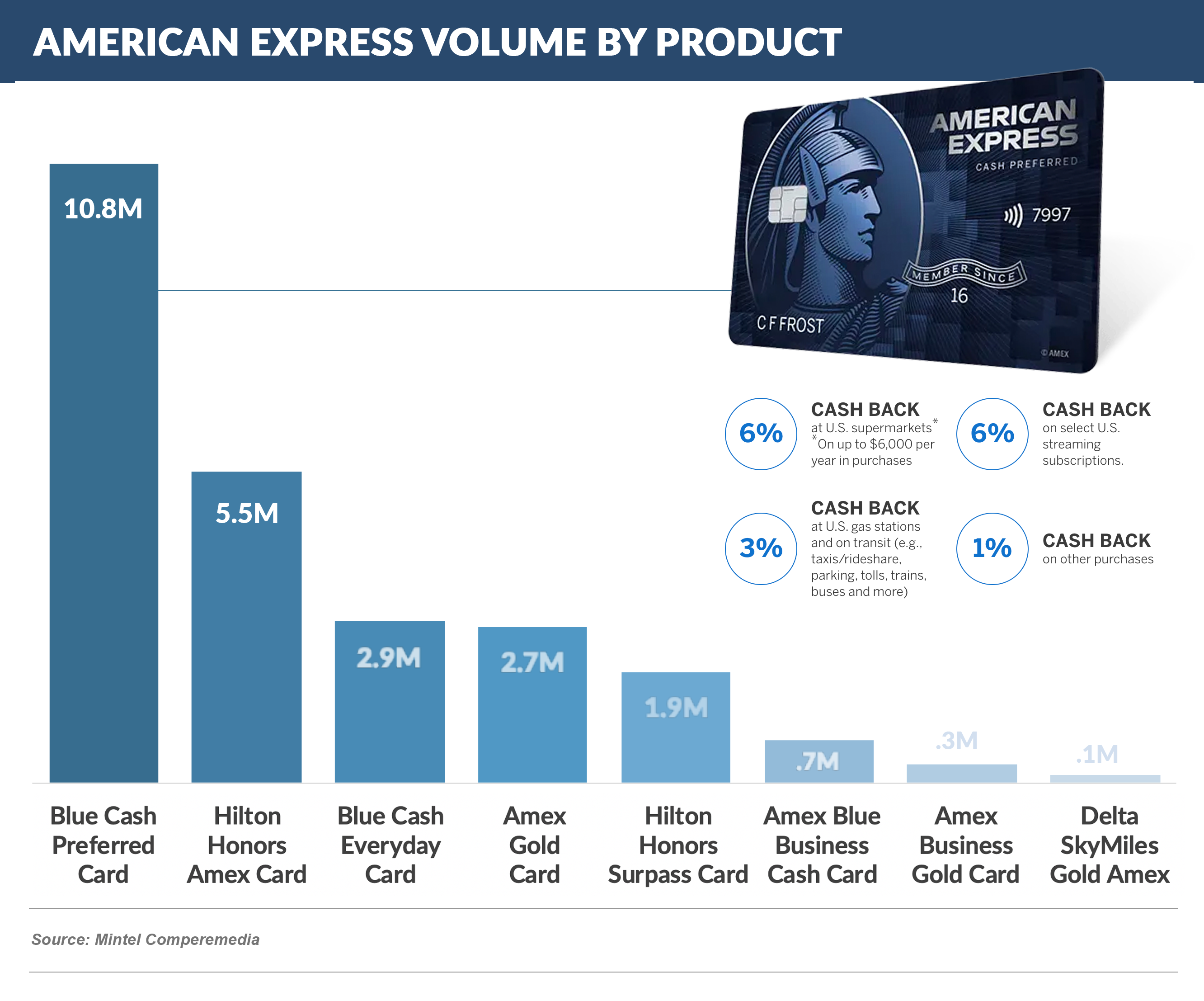

- There was, however, a slight uptick by some of the top mailers, including Amex, Chase, and Capital One

- Over half of Amex’s volume was in its “Blue Cash” product, which includes 6% cash back on groceries and streaming services

- Our experience with the Comperemedia data (and its predecessors) over the past several decades has shown it to be an accurate representation over time when compared to known actual data, however there are occasional sampling “blips” on a monthly basis that may or may not be representative

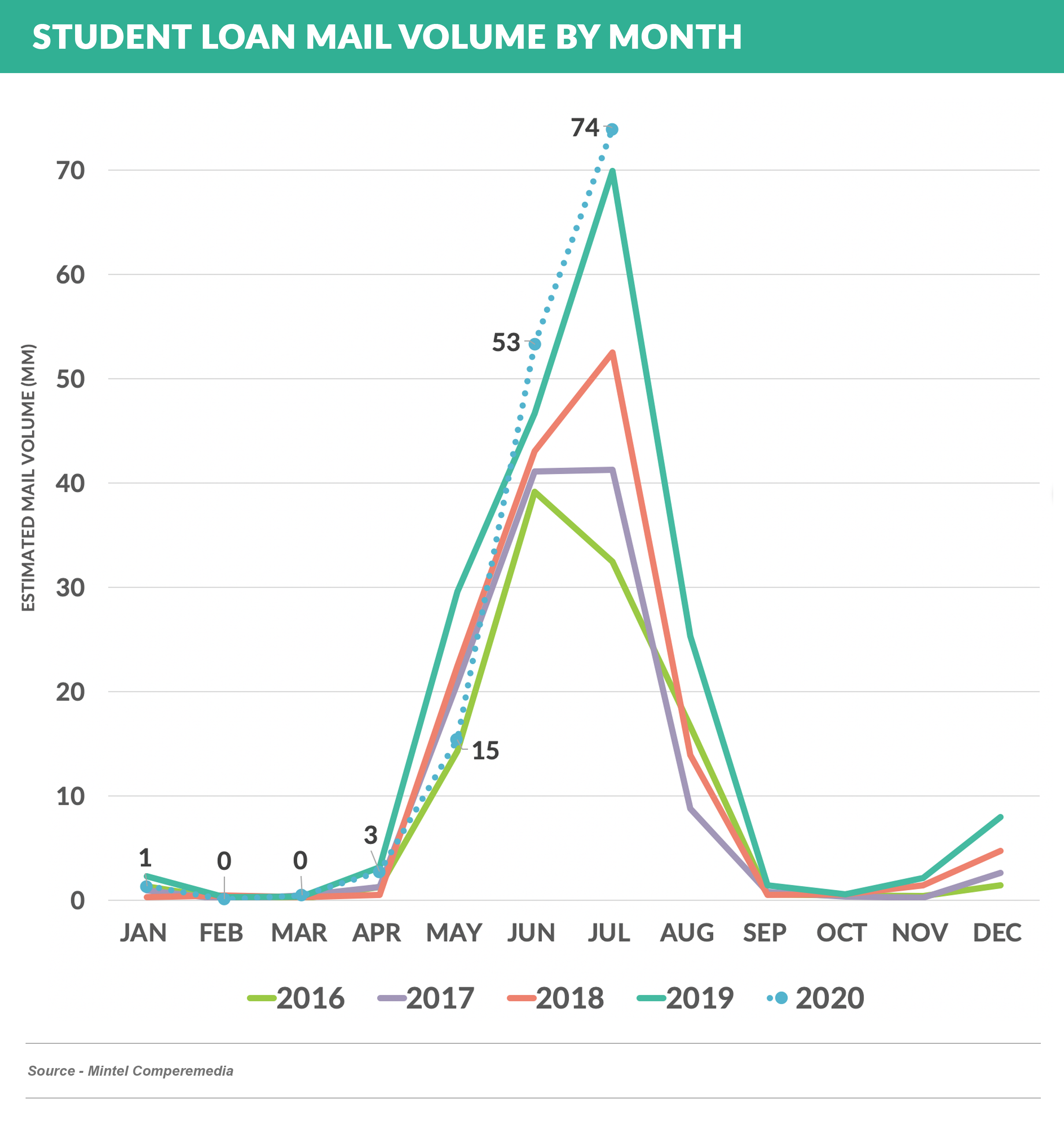

Student Lending Unfazed by COVID

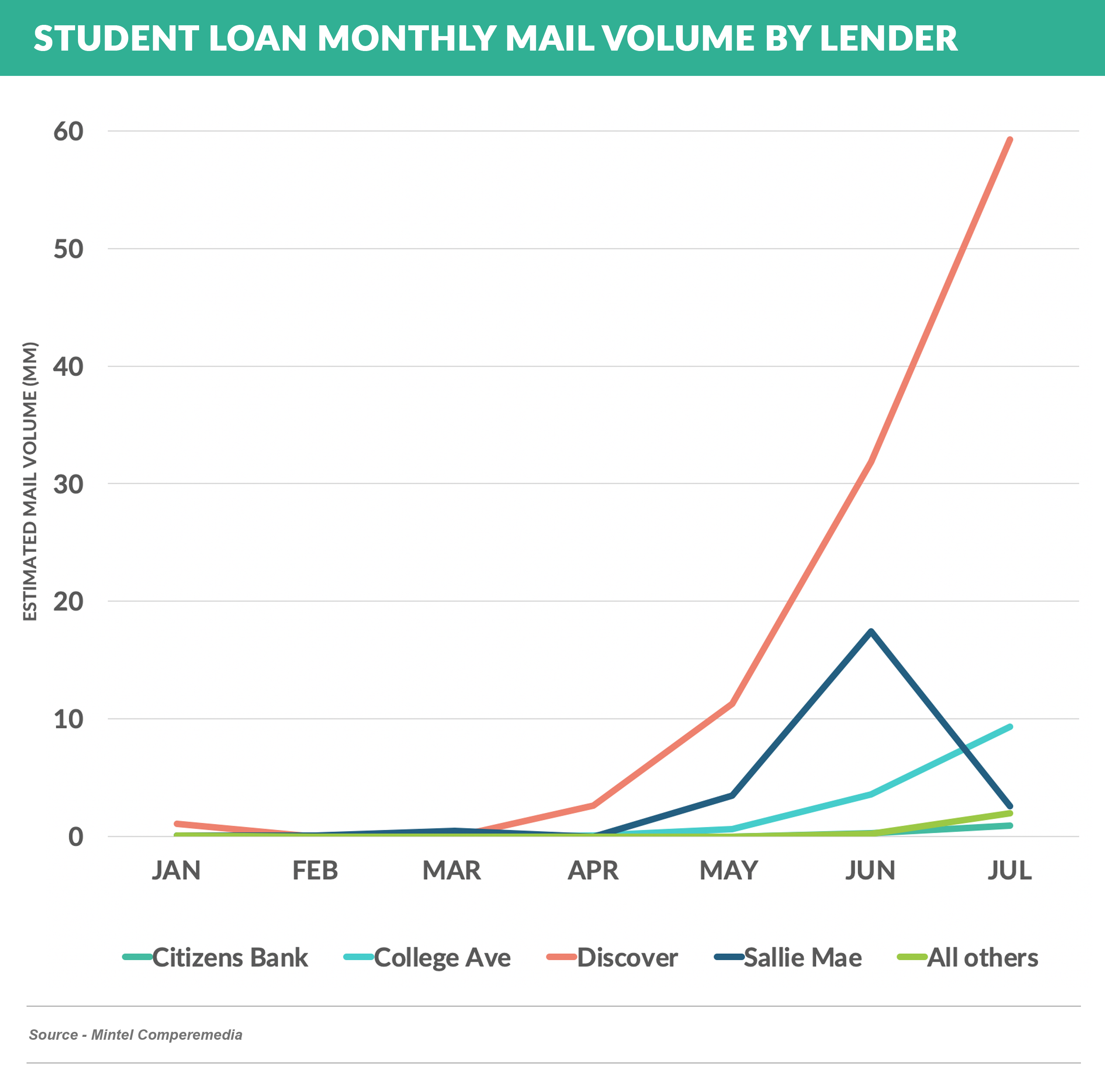

- Unlike other lending products, student lending volume has been relatively unfazed by the pandemic with year-to-date volume down only 5% from 2019, and June and July volumes being the largest of the past five years

- Discover has been the dominant mailer, with 75% of the total 2020 mail volume

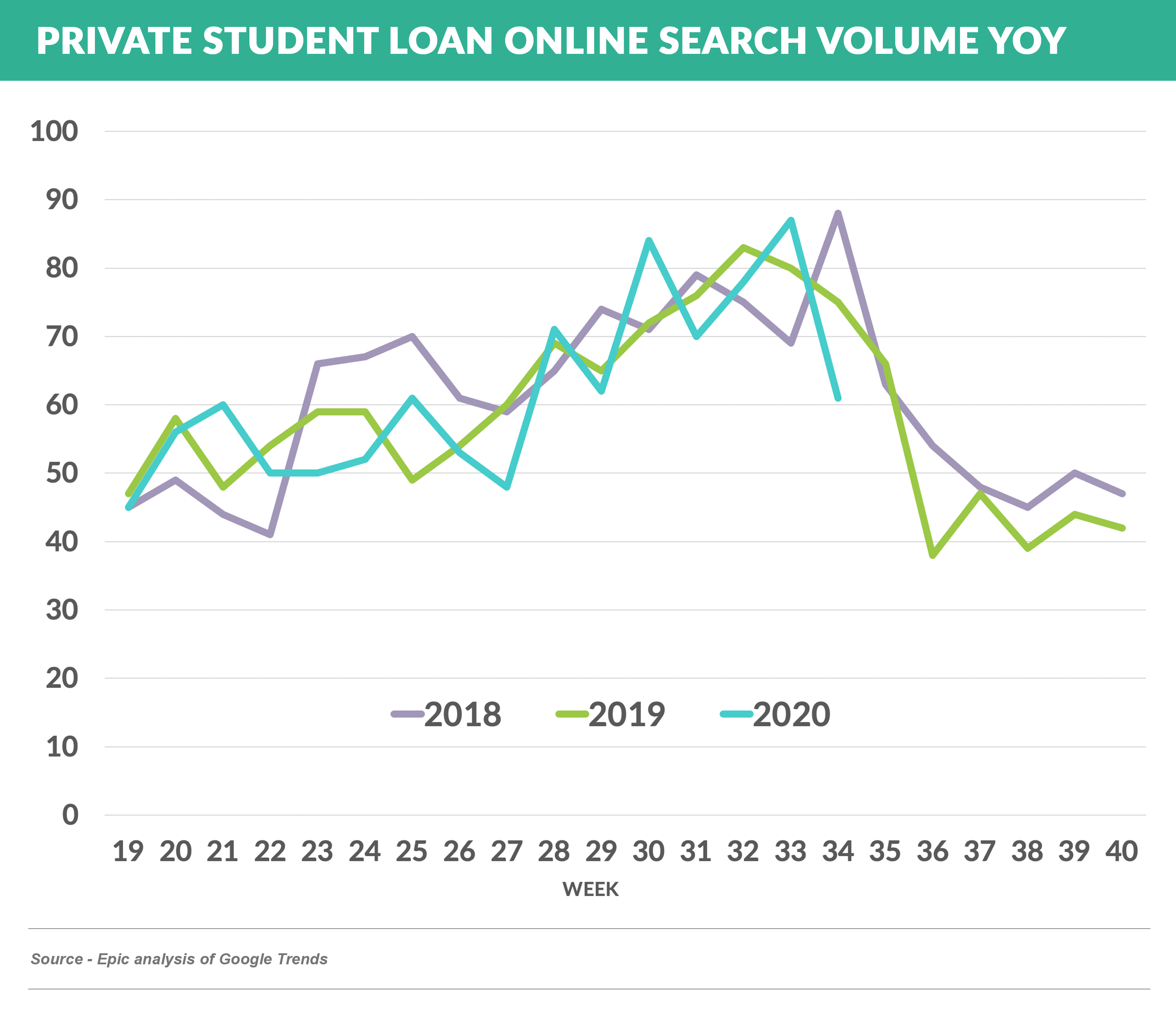

- Student loan rates have stabilized recently, which coincides with a steep drop-off in private student loan searches

- Additionally, towards the end of the student loan season, we have seen behaviors changing on our Nitro site showing a similar drop-off in activity

Help Us with Our Surveys

- Over the past few months we have done a number of surveys, including:

- Consumer lending executives' marketing intentions

- Checking account customer behavior

- Digital behaviors

- Consumers’ attitudes toward their ability to pay their bills

- Consumer preferences for credit card rewards

- What other topics would you be interested in hearing about? Please click here or reply to this email to let us know

Quick Takes

- Ally announced it is entering into the POS lending business via a partnership with Mastercard’s Vyze subsidiary

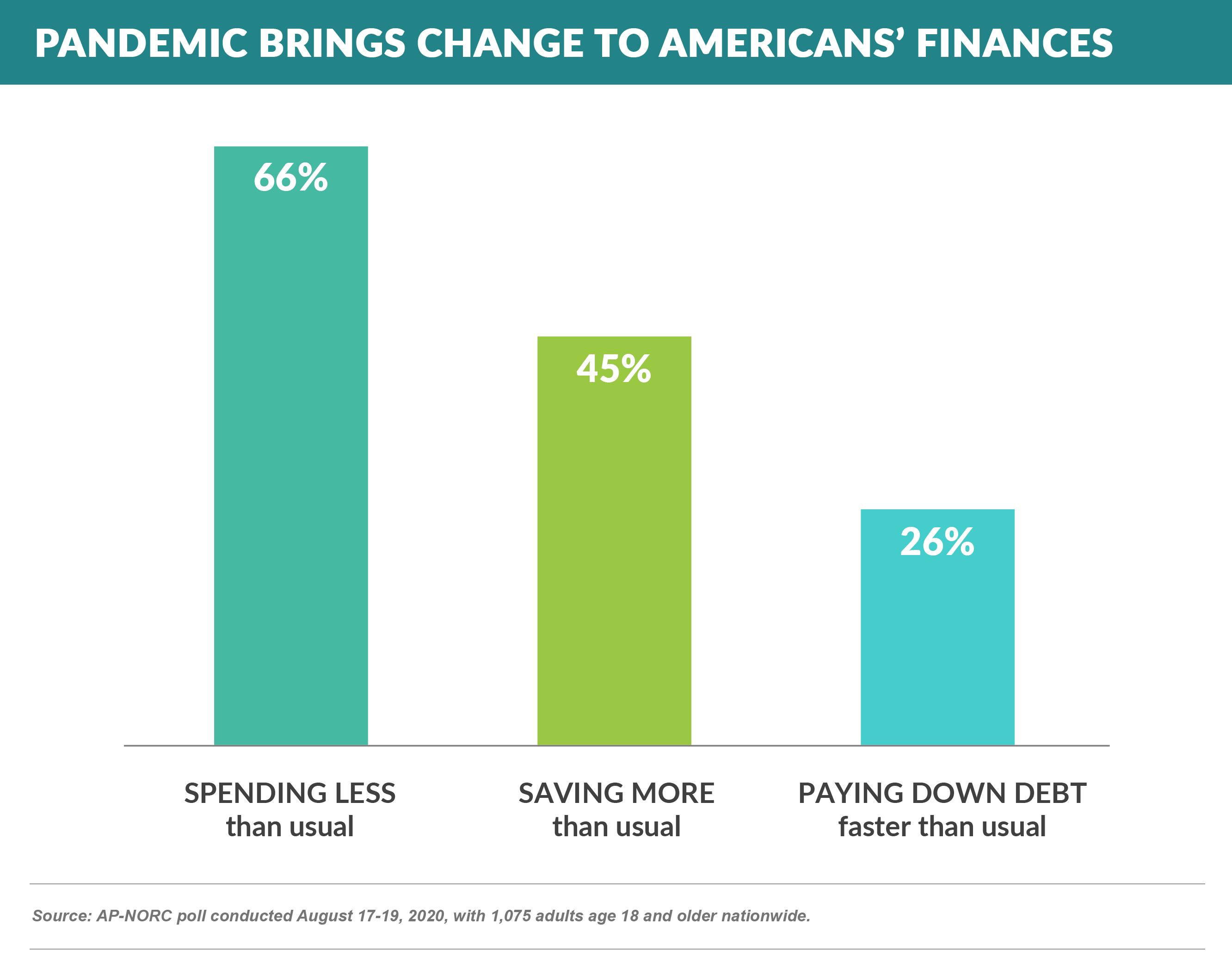

- A poll by The Associated Press corroborates trends reported by banks in finding that 45% of Americans say they are setting aside more money than usual, by either saving more or paying down debts, with respondents crediting government stimulus payments along with fewer opportunities to spend money

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.