Three Things We’re Hearing

- But what about the mail?

- Credit card balances continue to shrink

- Consumer spending is back, but different

A two-minute read

But What About the Mail?

- With the USPS making headlines, we took an objective look at recent delivery trends for direct mail in the financial services sector

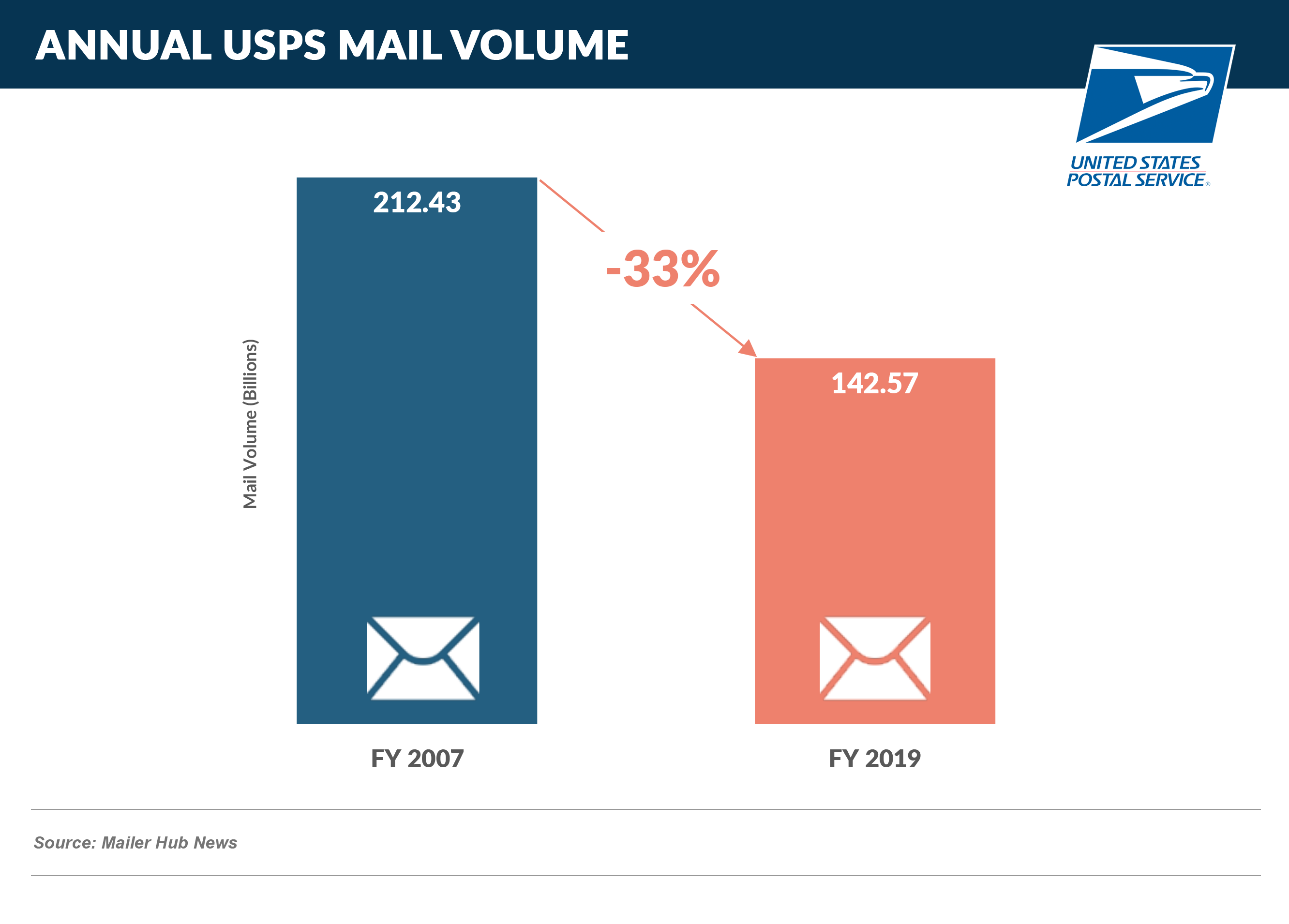

- Not surprisingly, mail volume has declined significantly over the past decade

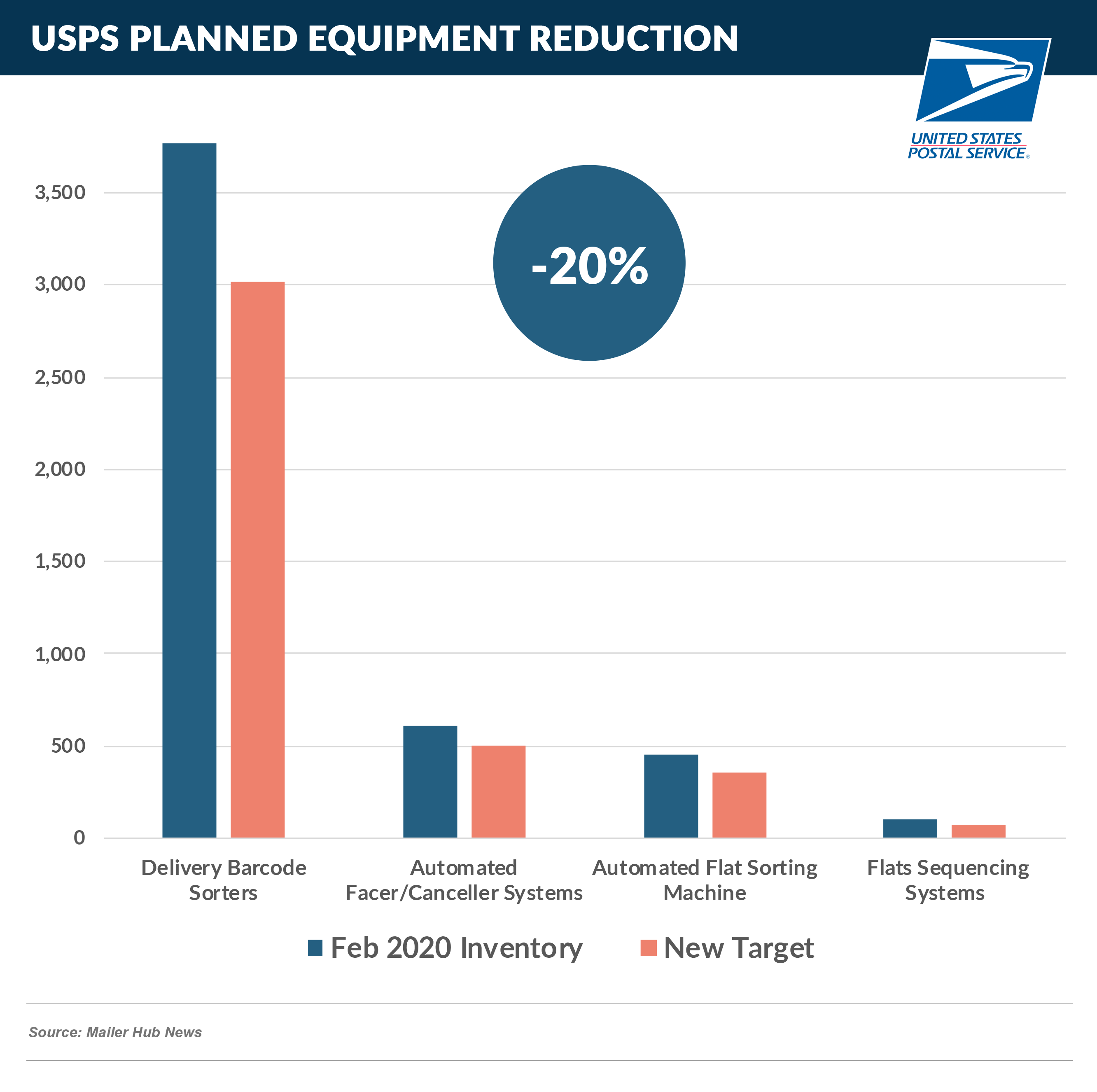

- As a result of declining volume, the USPS planned to sunset about 20% of all machinery

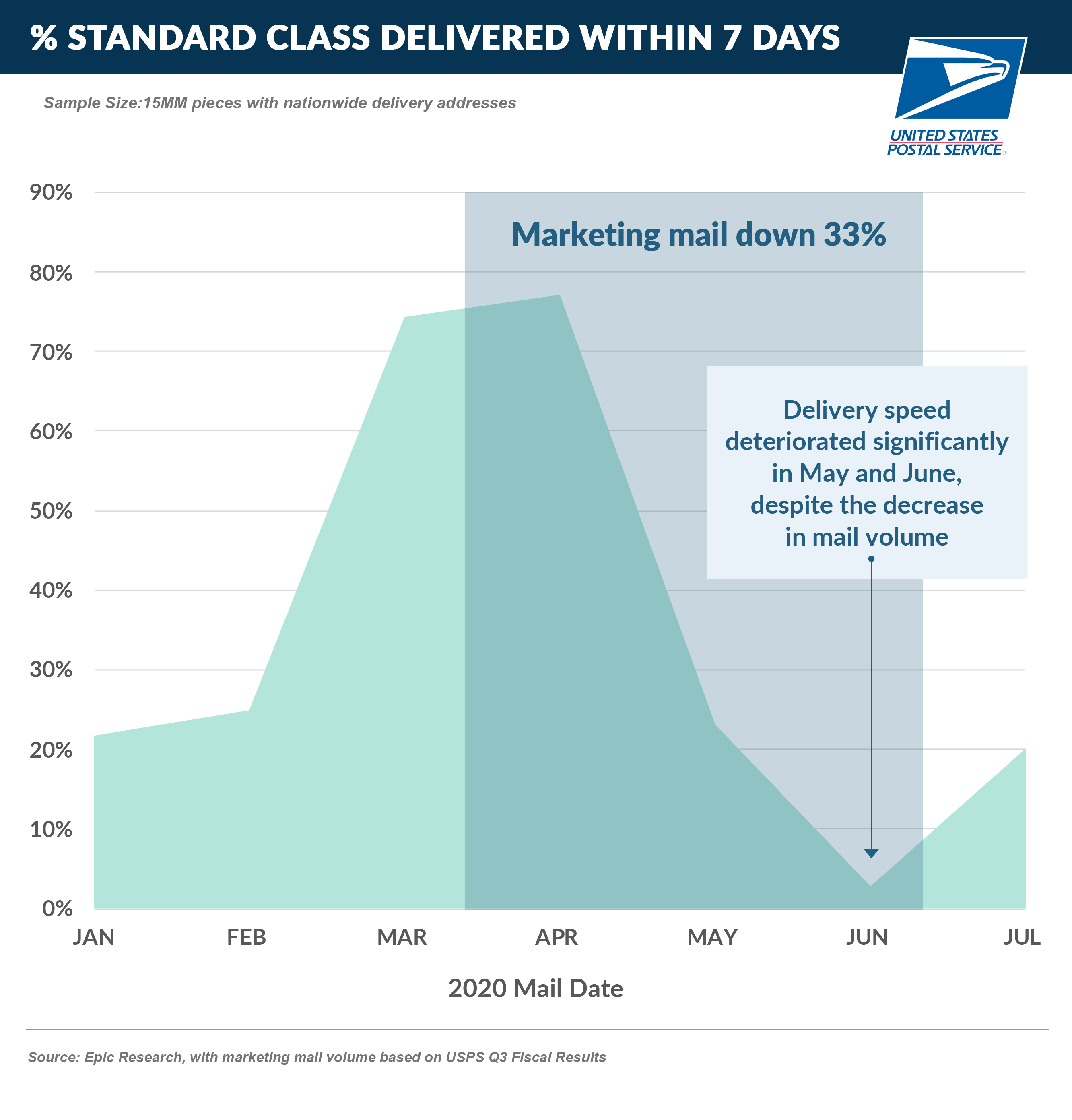

- To assess the impact on direct mail delivery speed, Epic tracked its experience since January, which shows tremendous variability in delivery timing

- As volumes plummeted during the beginning of the pandemic, we saw an acceleration of delivery

- Conversely, delivery of mail sent in June lagged considerably despite lower mail volumes

- There is significant public debate over the drivers of the mail delays – e.g., removal of equipment and intentional slow downs by postal workers protesting reduced overtime

- While it’s difficult to know the exact reasons for the slow down, our data shows that the delays in June were real and substantial and early indicators suggest delivery time frames for mail sent in July and August are rebounding to pre-pandemic levels

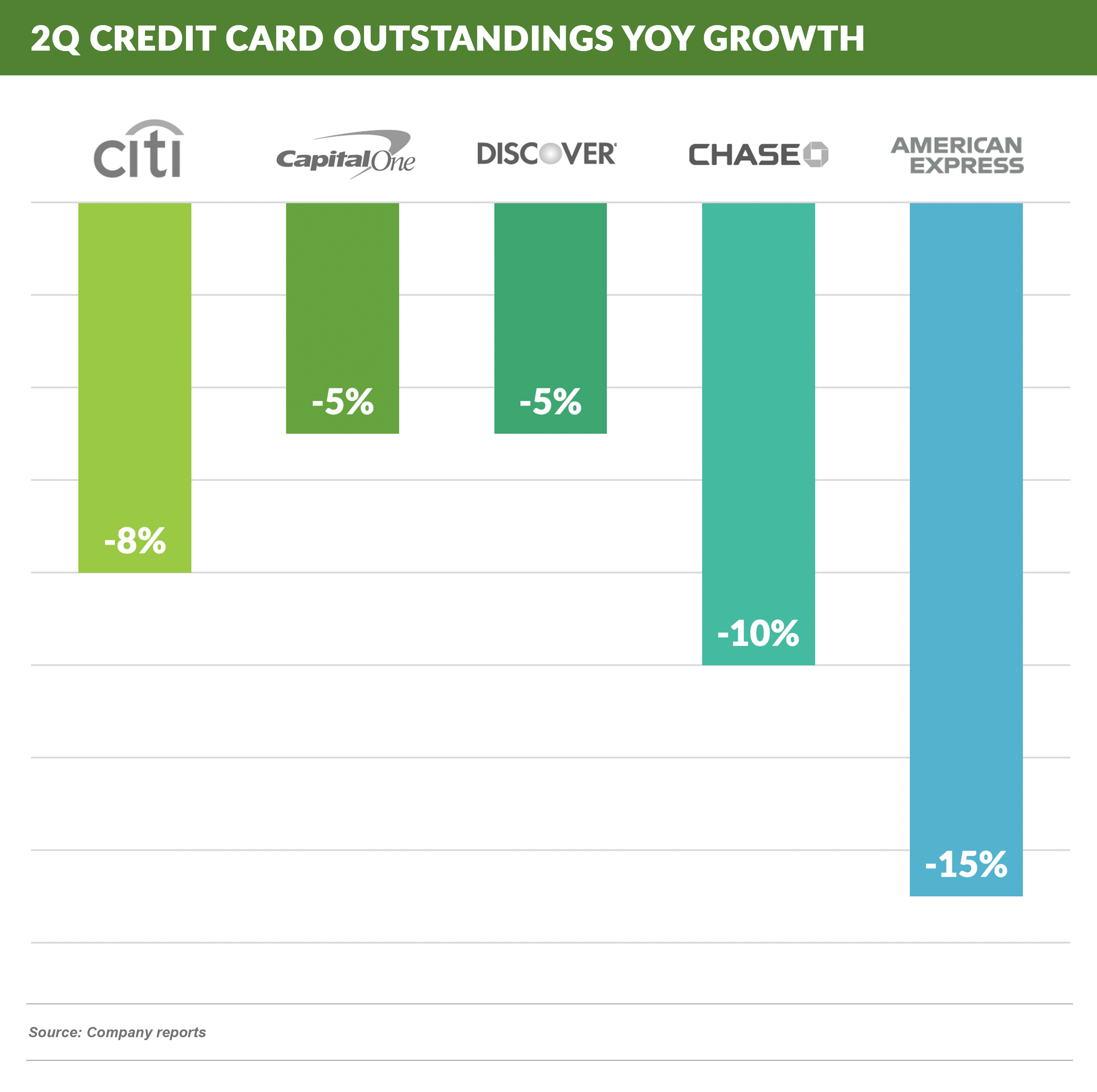

Credit Card Balances Continue to Shrink

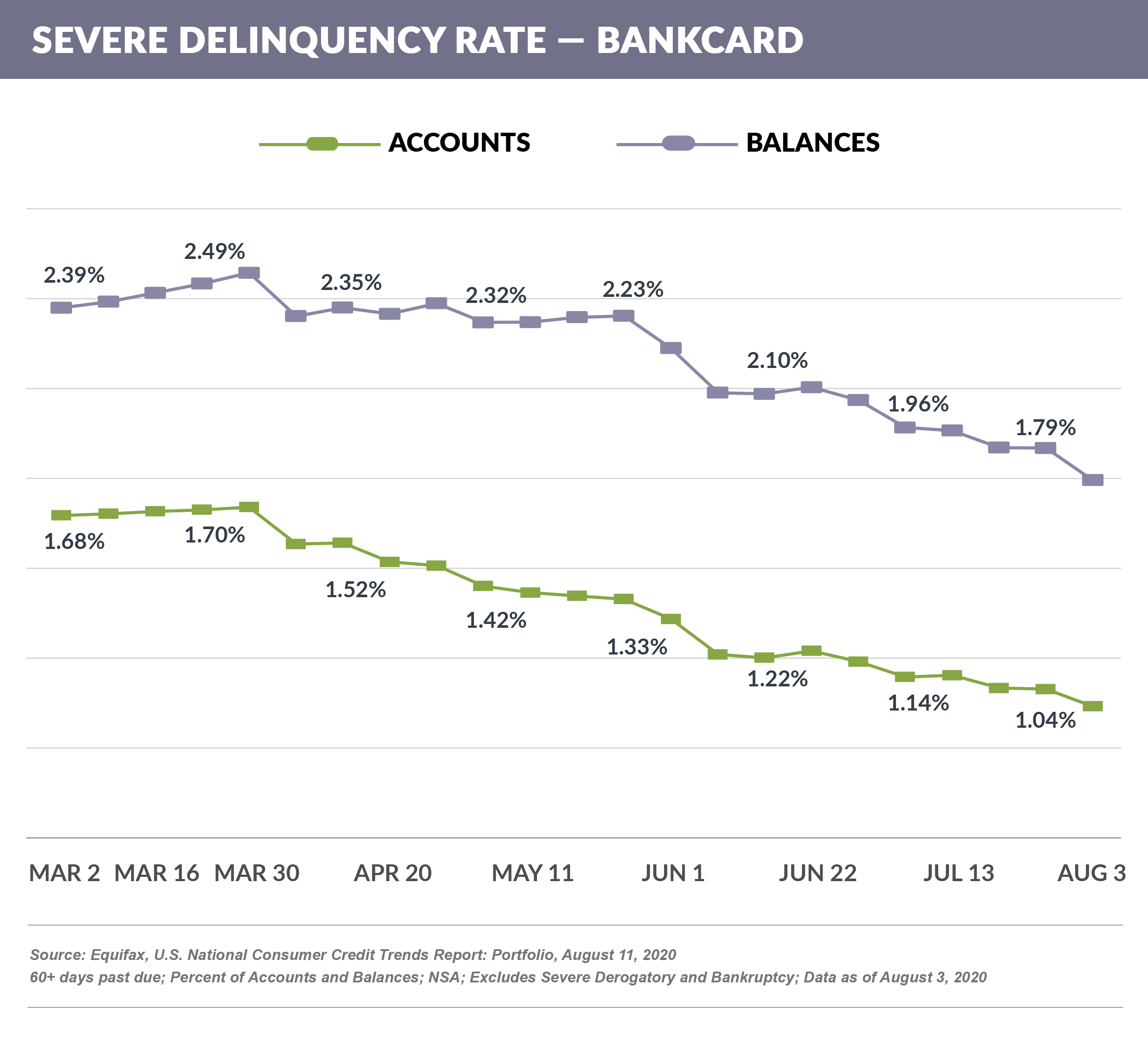

- Recent credit card data shows no signs of reversing the trends of:

- Lower delinquency

- Higher payment rates

- Lower balances

- 2Q reporting from large issuers consistently shows lower delinquency and shrinking average loans outstanding

- Causes of the positive delinquency news have been widely discussed (forbearance, stimulus payments)

- The drop in balances reflects, in addition to seasonal variances, the dramatic reduction in new customer acquisition, which Epic has reported is down 75% from pre-COVID levels

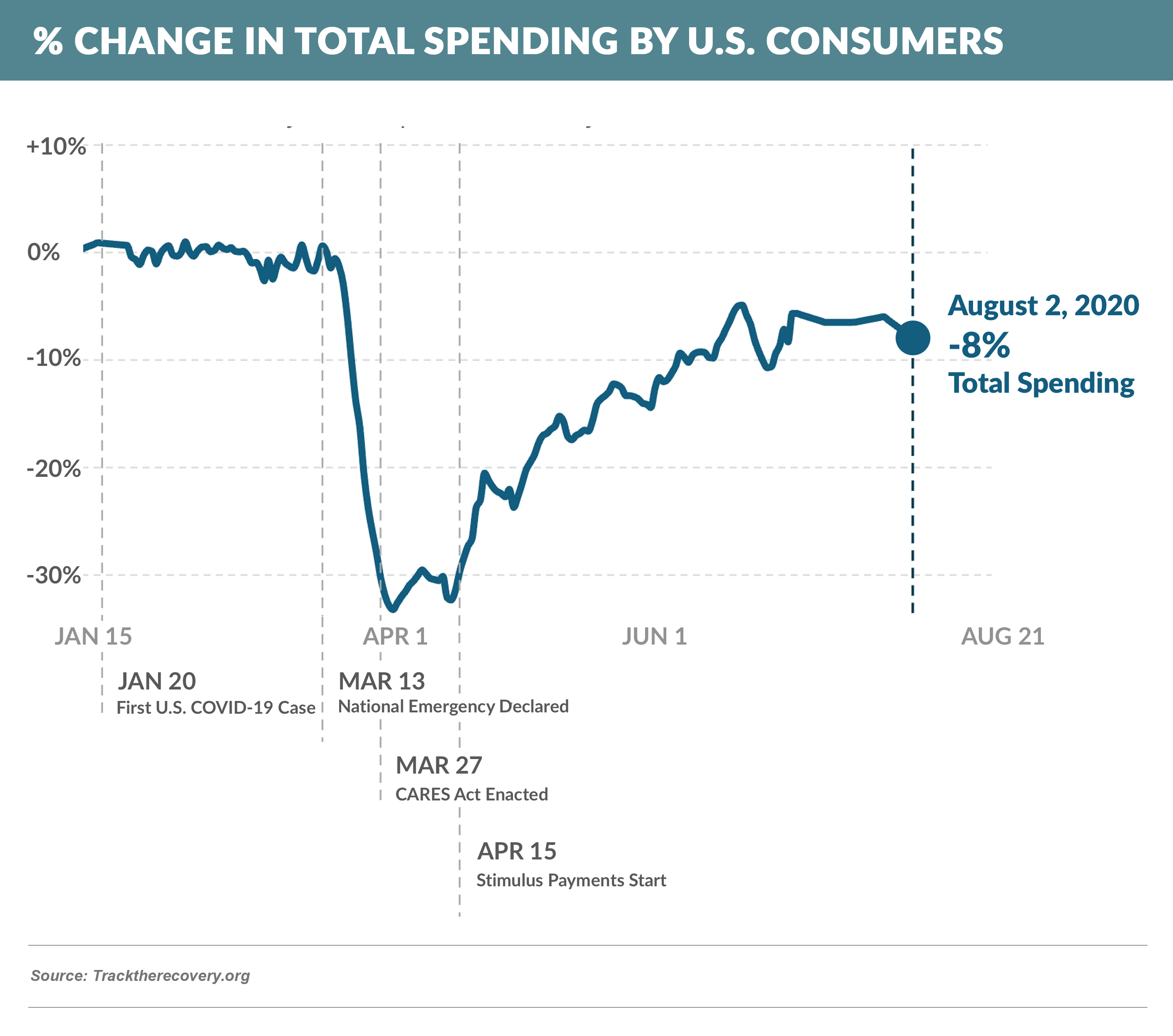

Consumer Spending

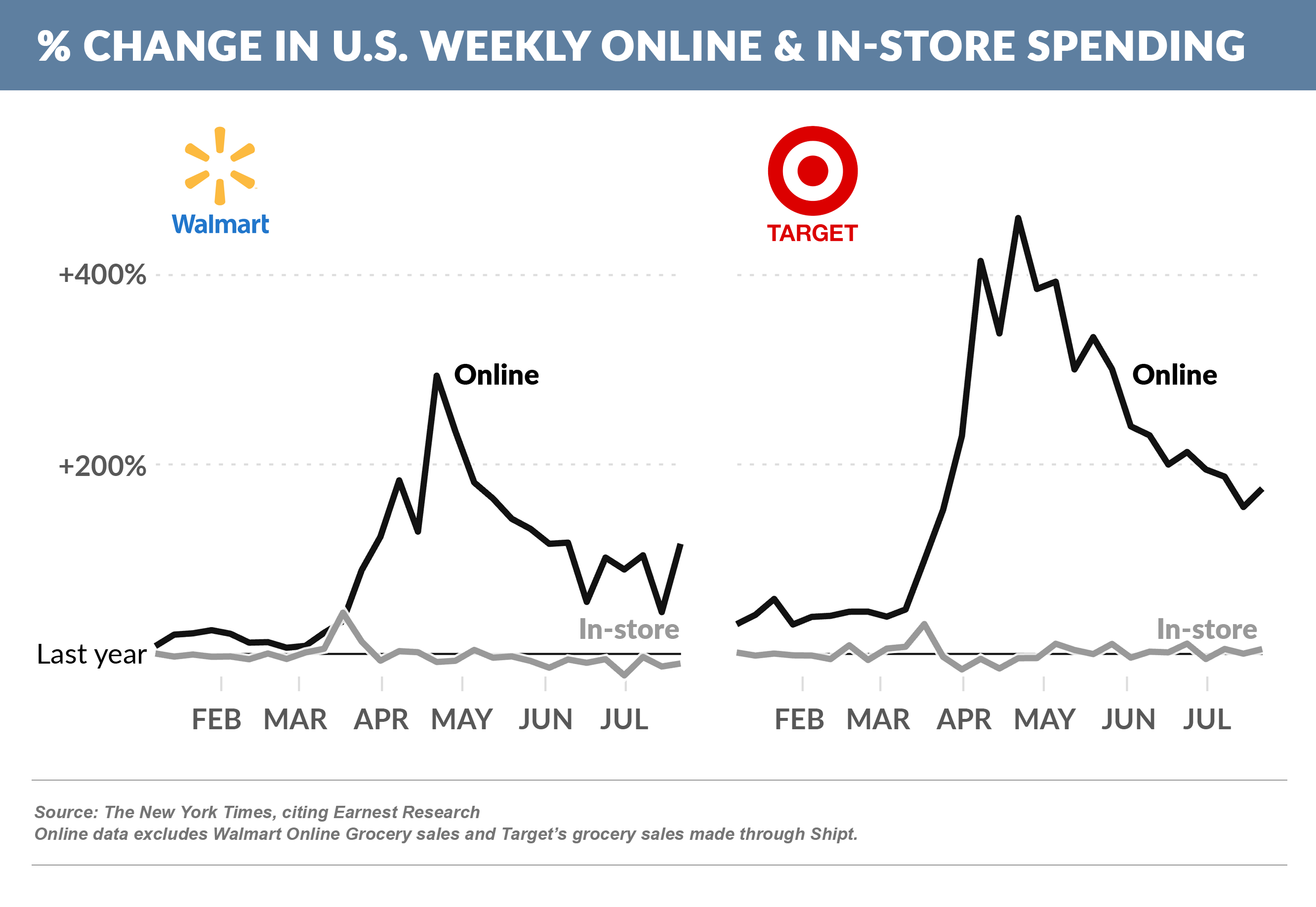

- As previously noted, retail spending has shown a consistent recovery in past months since plummeting in March

- However, the recovery in online spending has outpaced in-store spending by a large margin

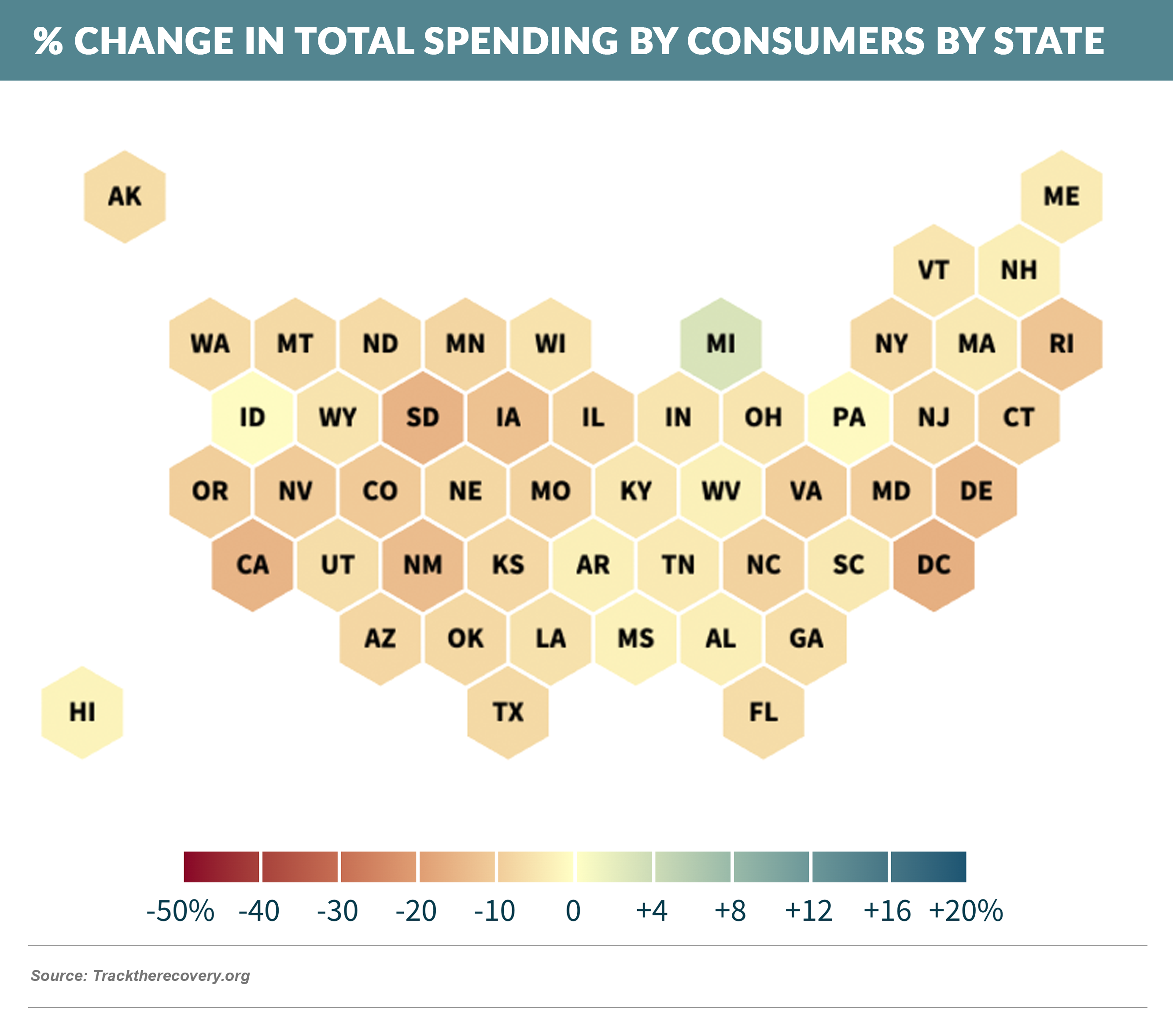

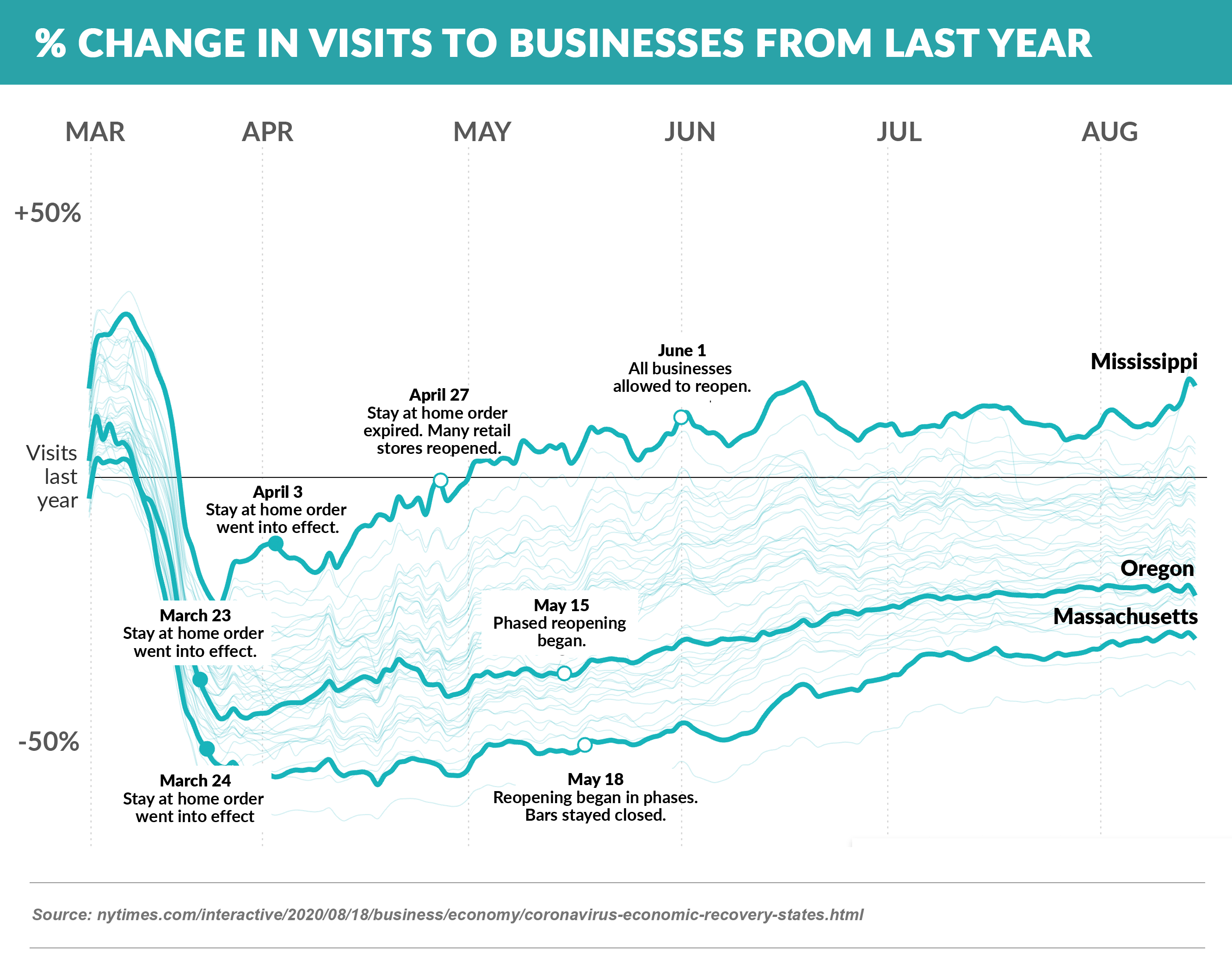

- Also notable are wide differences in spending patterns across the country

- Like the S&P 500, consumer spending appears to be adapting to COVID-related headwinds

Quick Takes

- News reports that the GM credit card program is on the market are noteworthy since large co-branded card programs are highly coveted by the largest issuers and come up for bid rarely

- While we are not privy to any details regarding the status, terms, or timing of any new deal, the bidding is sure to be vigorous, and we are reminded of our firm belief over the years that “the only thing worse than losing a deal, is winning a bad one”

- Epic is pleased to announce that Justin Moran has joined us as Chief Digital Officer and Managing Director of Finance

- Before coming to Epic, Justin lead the effort to build out OneMain’s digital marketing platform and ran the analytics function

- Prior to OneMain, Justin worked at Marlette Funding and Barclays

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.