What We’re Seeing

THIS WEEK’S HIGHLIGHTS

- Early anecdotal feedback has some direct mail response rates off 10% - 50% beginning in mid-March

- Digital search volume has returned to prior levels for some products, stabilized at higher rates for others

- Student lending is approaching “peak season” with questions about campuses opening in the fall semester

- Traditional banks are on the lookout for acquisitions in the fintech and other sectors

- Today’s newsletter takes 3 minutes to read

We are monitoring trends in the consumer and small business lending segment in light of the unprecedented impact of the Covid-19 pandemic. Following is data we are watching along with anecdotal information we have gathered in discussions with industry contacts. Please email me with your thoughts.

Consumer Demand

DIRECT MAIL

- Anecdotal feedback from a number of lenders indicates a sharp decline in direct mail response rates beginning in mid-March

- The decline varies by product, and trends are too early to detect, however we have heard anecdotally of drops from 10% - 50%+ compared to forecast

- Speculation is that some of the effect might be due to people being hesitant to open mail

DIGITAL

- Following the March 16th post-Fed-rate-cut spike in online search activity for some loan products, online-search volume has subsided for most products, with some settling at higher than prior levels, and others lower

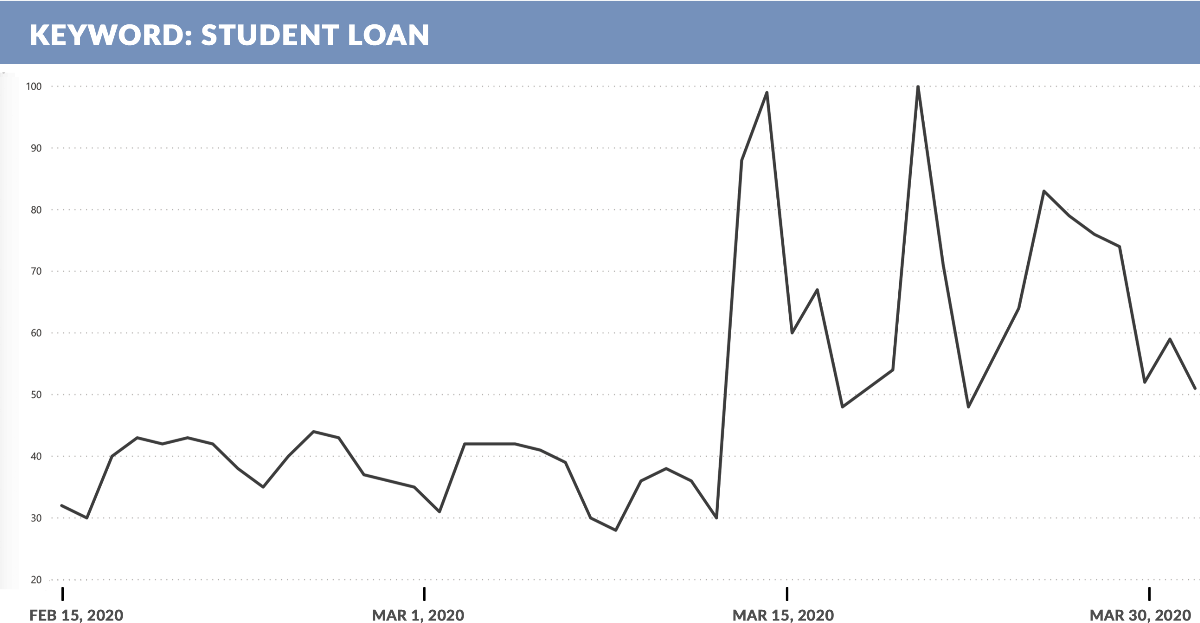

- Online search traffic for “Student Loan” is double that of February, although some of this is due to the seasonality of the product

Source: Epic analysis of Google Trends

- Student Loan Refinance online search rates have returned to levels close to January-February

- Checking, Savings, and Money Market search rates are relatively flat to slightly down January – February

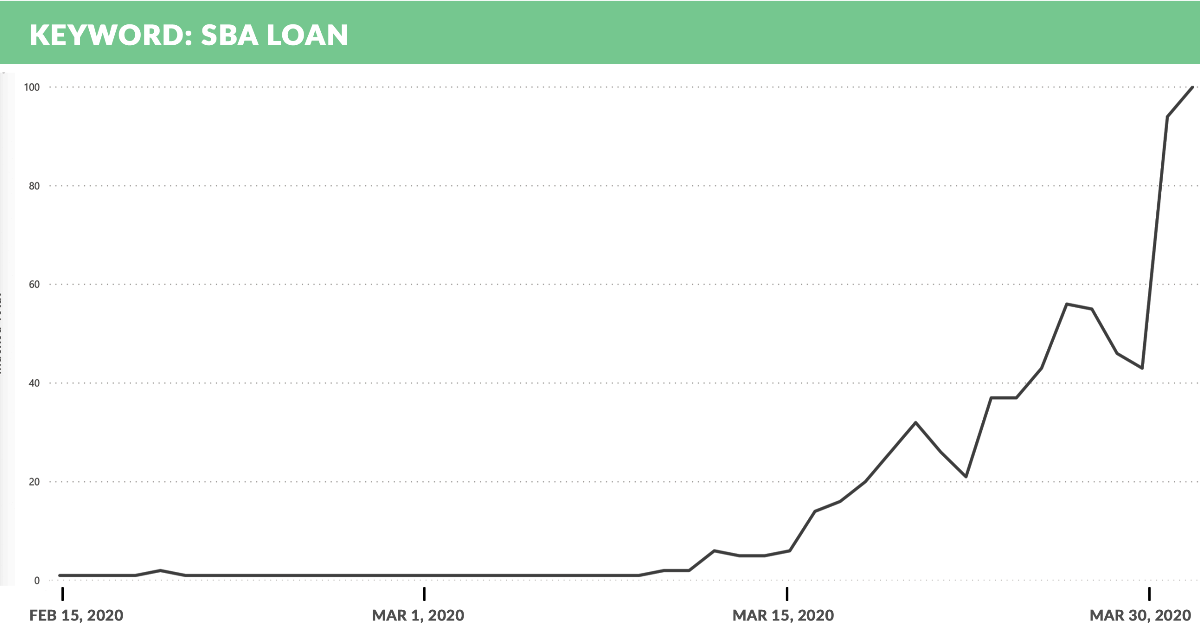

- “SBA Loans” search rates have skyrocketed to levels 50+ times early ’20 levels

Source: Epic analysis of Google Trends

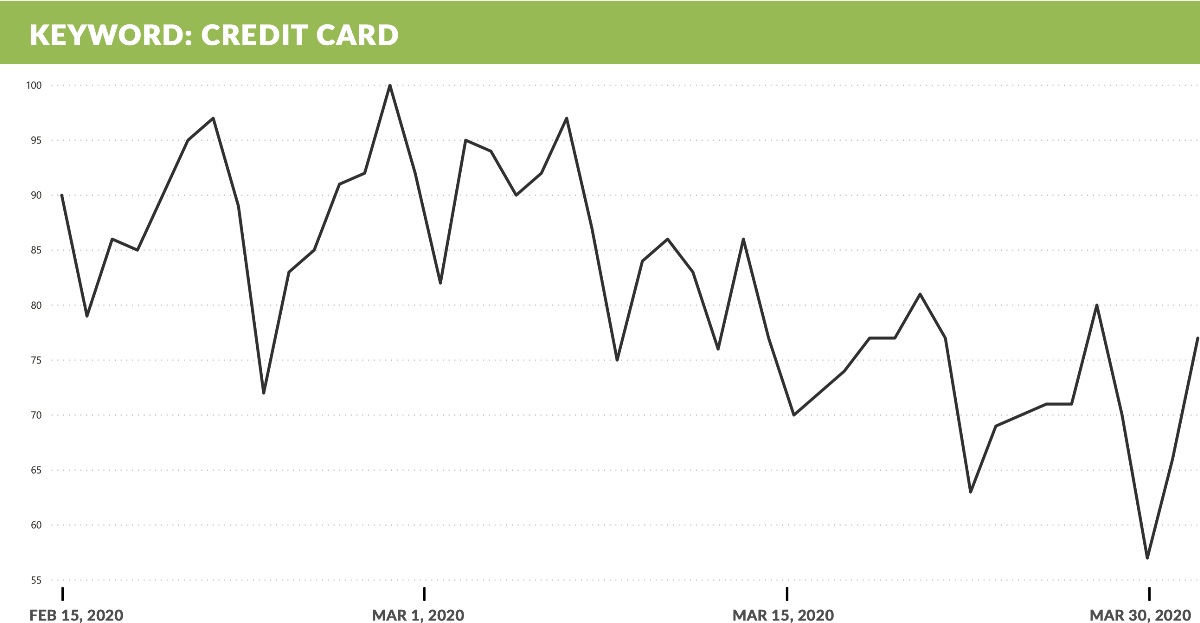

- Credit Card search volume has continued its decline since January

Source: Epic analysis of Google Trends

Lender Activity

ONLINE

- There were no meaningful interest rate changes in personal loan aggregator websites

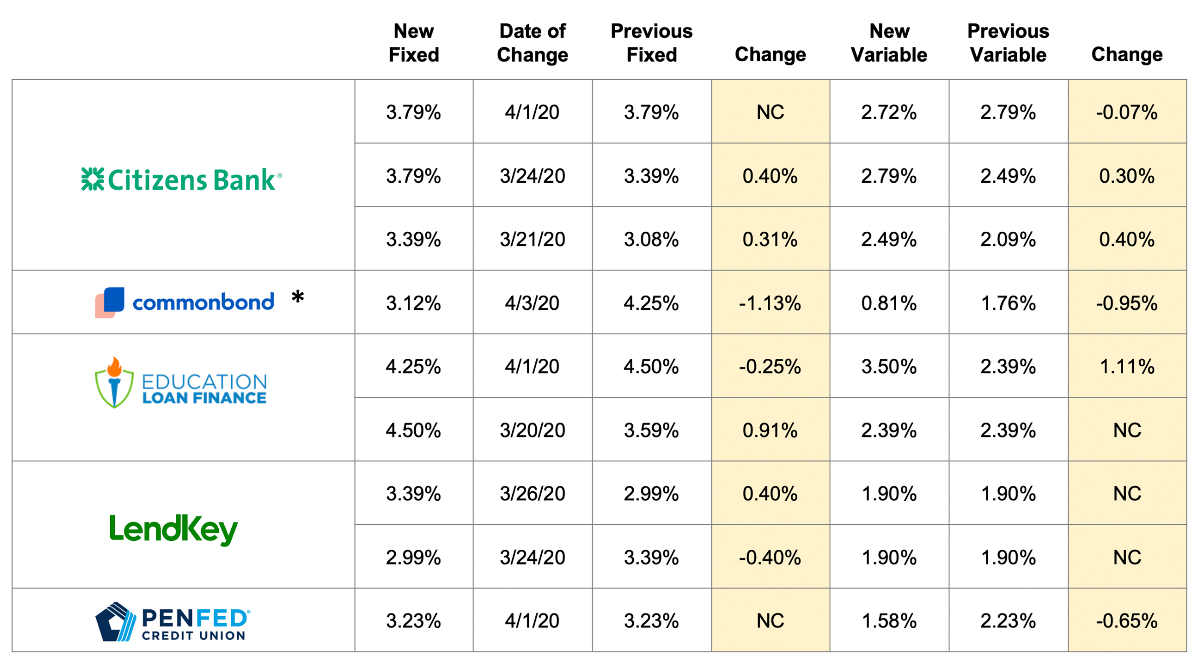

- Education refinance lenders have continued to raise their rates since mid-March, however CommonBond has a variable rate of 0.81% listed on its website!

* New CommonBond rates were found on commonbond.co on 4/3/2020 and are not reflected on any aggregator sites

Note: on 3/25/2020, Student Loan Hero’s site replaced Splash Financial with Citizens in the refi rate charts

Source – Epic analysis of personal loan aggregator sites: NitroCollege.com, Credible.com, StudentLoanHero.com, and NerdWallet.com

DIRECT MAIL

- Lenders continue to reduce and postpone new direct mail campaigns

- This trend is expected to continue for at least a quarter or two

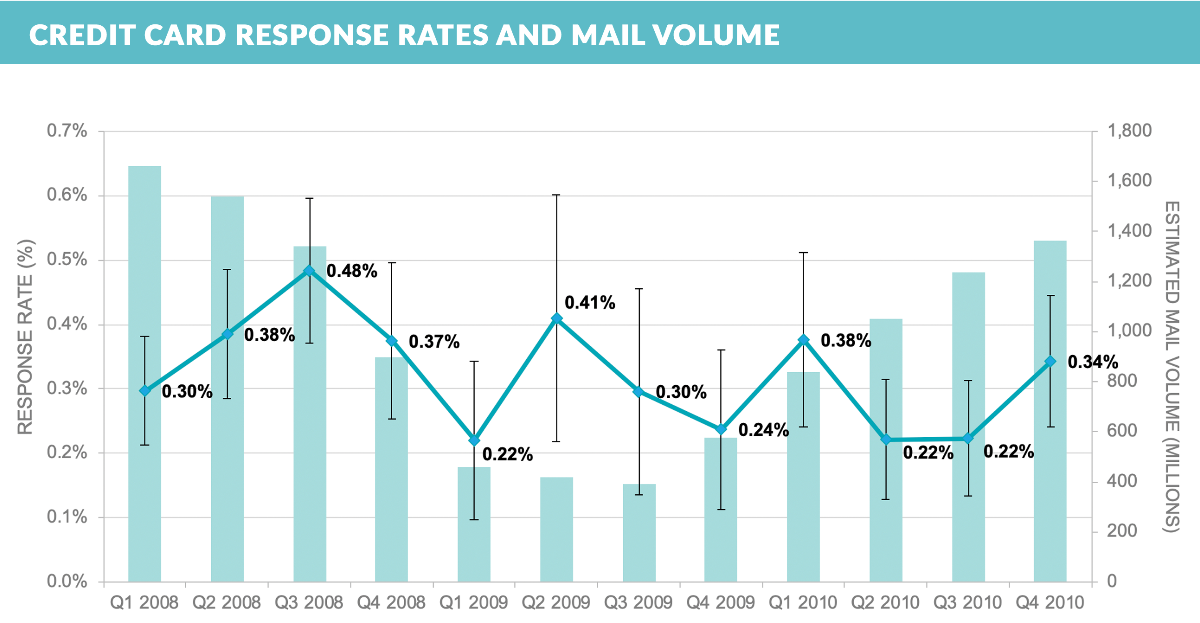

- We have looked at 2008/2009 credit card mail volume, which may be a proxy for the current situation:

- Credit card mail volume began dropping in Q4 ’08, declining further in Q1 ’09 to roughly a third of prior levels

- Net response rates were also lower, due to credit tightening and more focus on prime segments

- That level was maintained for three quarters, then began to increase returning to volumes 80%+ of pre-crisis levels two years following the crisis

Source: Mintel Comperemedia Q4 2010 Credit Card Acquisition Response Rate Tracker

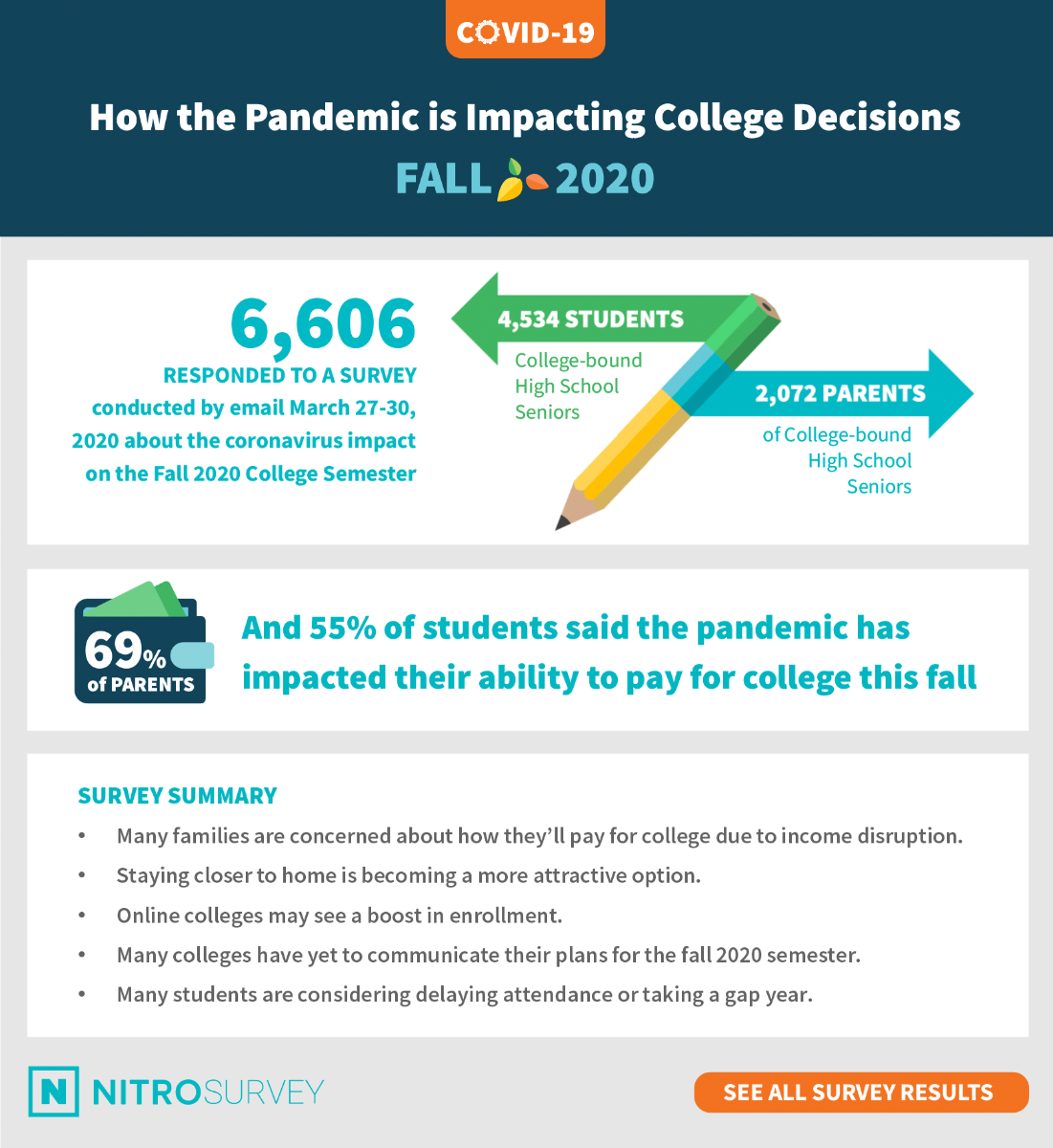

STUDENT LENDING

- Student lenders are in a “wait and see” mode regarding the question of schools opening up their campuses in the fall

- Epic subsidiary Nitrocollege.com just completed a survey of incoming freshman students and their parents, which revealed a growing concern with how to pay for college

Going Forward

Uncertainty is the rule for consumer lenders, given the massive unemployment numbers and still unknown severity and duration of the pandemic:

- The shape of the “infection curve” is starting to form and suggests a possible mid-April peak followed by a drop to low levels in June

- What this means for unemployment and the re-emergence of consumer credit is yet to be seen