Three Things We’re Hearing

- One year later…

- What’s going on with credit card growth?

- Online savings rates showing no love

A three-minute read

One Year Later…

- It seems like just yesterday that banks were scrambling to discontinue marketing programs in the face of spiking unemployment caused by the COVID epidemic

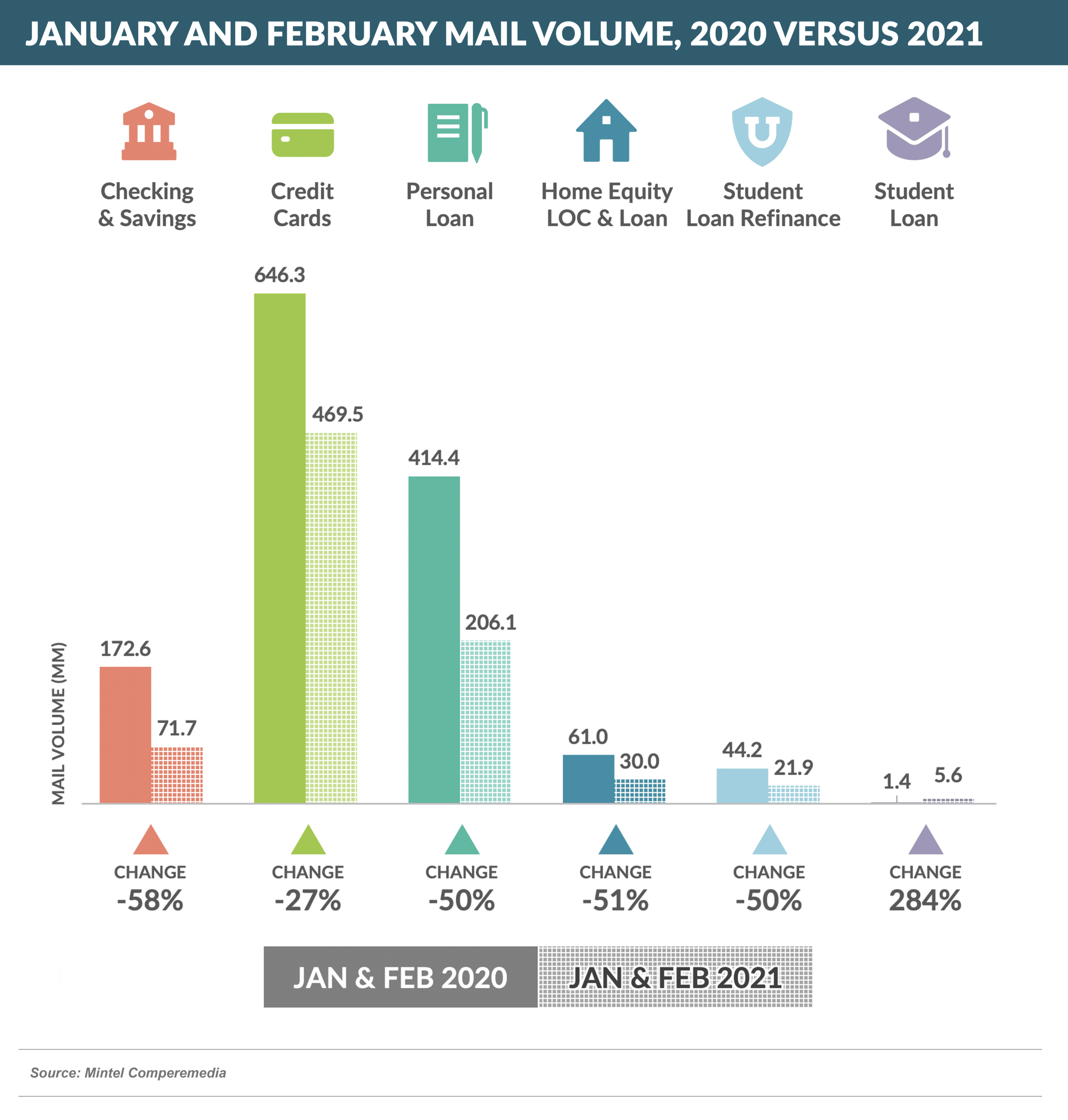

- One year later, new customer solicitation volumes for financial products have rebounded from the summer lows, but generally remain at levels of roughly half of pre-pandemic numbers for many products

- As banks sit on excess deposits amid an environment of stagnant loan growth, these trends are due to change in the coming months – more below

What’s Going on with Credit Card Growth?

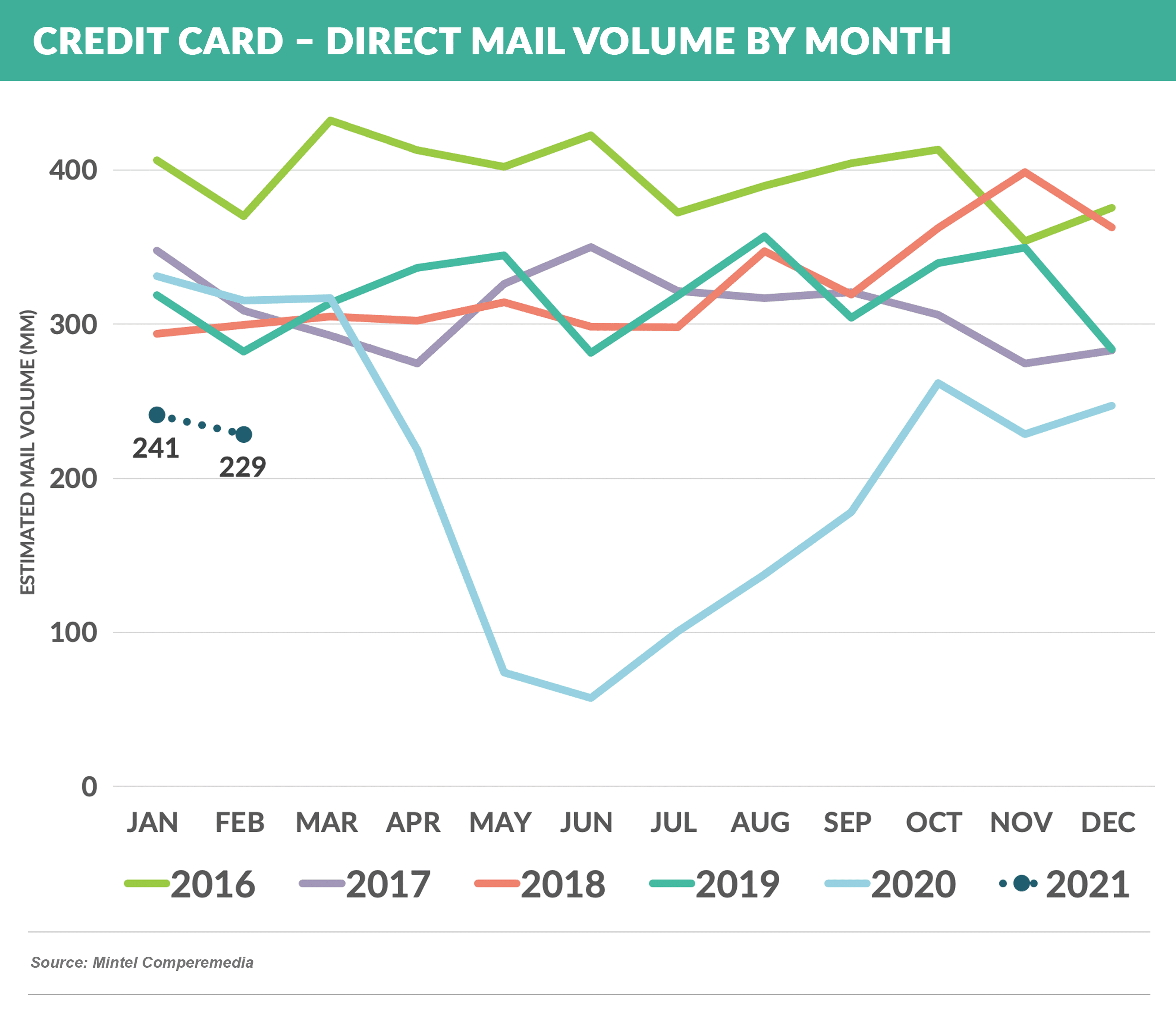

- Credit card direct mail acquisition advertising has rebounded faster than acquisition advertising for most financial products, bottoming out in June at a level 80% below pre-pandemic numbers and recovering in the fall to a level that is still ~25% below 1Q 2020 volumes

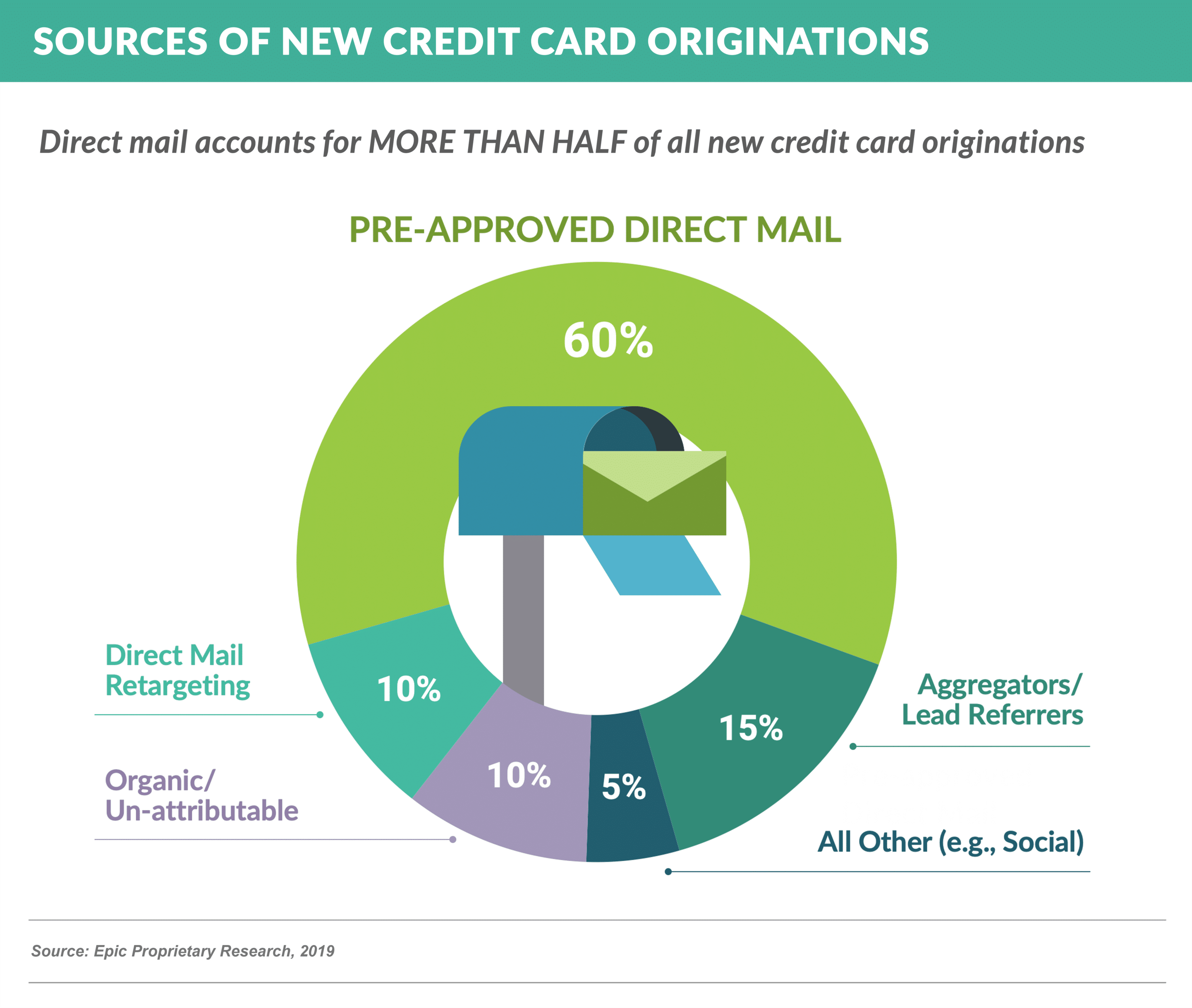

- Direct mail still accounts for ~60% of all credit card advertising spend

- Several positive developments have occurred in the credit card sector in the past year

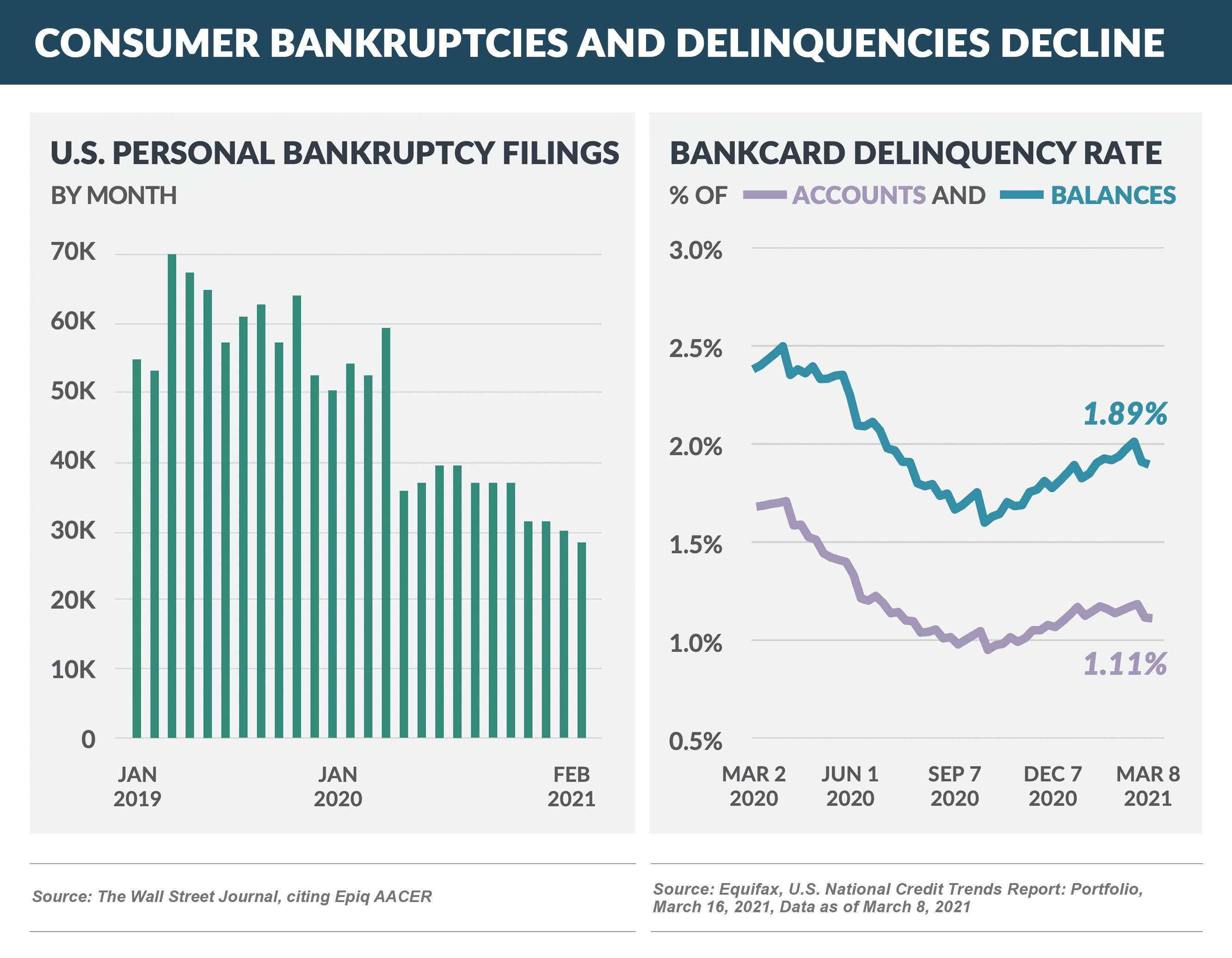

- The widely and logically held view that consumer delinquencies and bankruptcies would spike as a result of the unprecedented rise in unemployment never materialized, and in fact, the opposite happened

- New rounds of government stimulus along with a forecasted jump in GDP later this year and a decrease in unemployment would indicate that the worst is behind us in consumer delinquencies

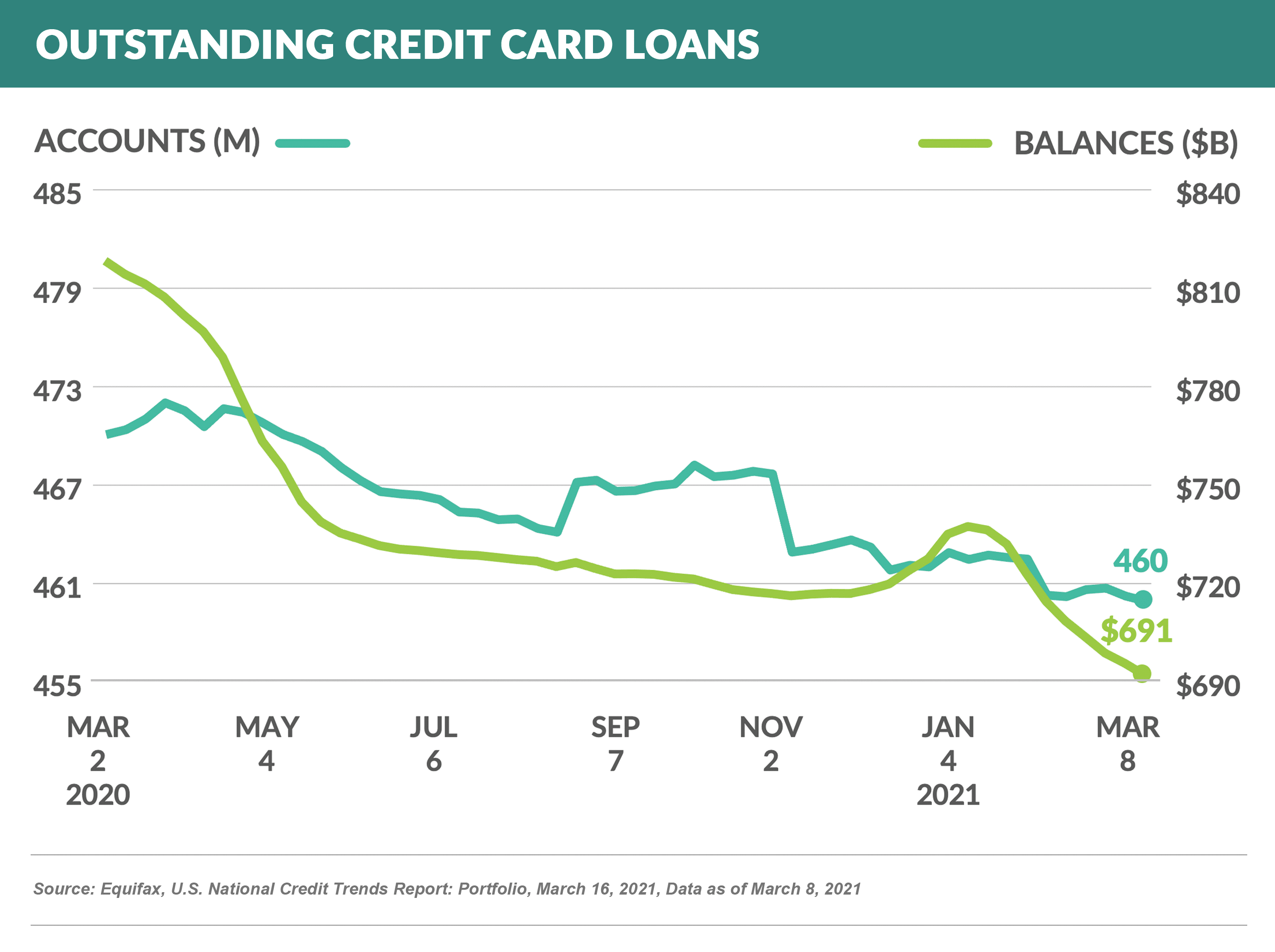

- At the same time, card portfolios have shrunk as consumer spending slowed and cardholders used stimulus checks to pay down debt

- Those issuers who have returned to the new customer acquisition market have been rewarded with response rates that are 75% - 100% higher than “normal”

- One would think issuers would be looking to reverse the shrinkage in their portfolios, and many issuers have indicated a desire to not be left behind and to resume “normal” levels of marketing, so…

Online Savings Rates Showing No Love

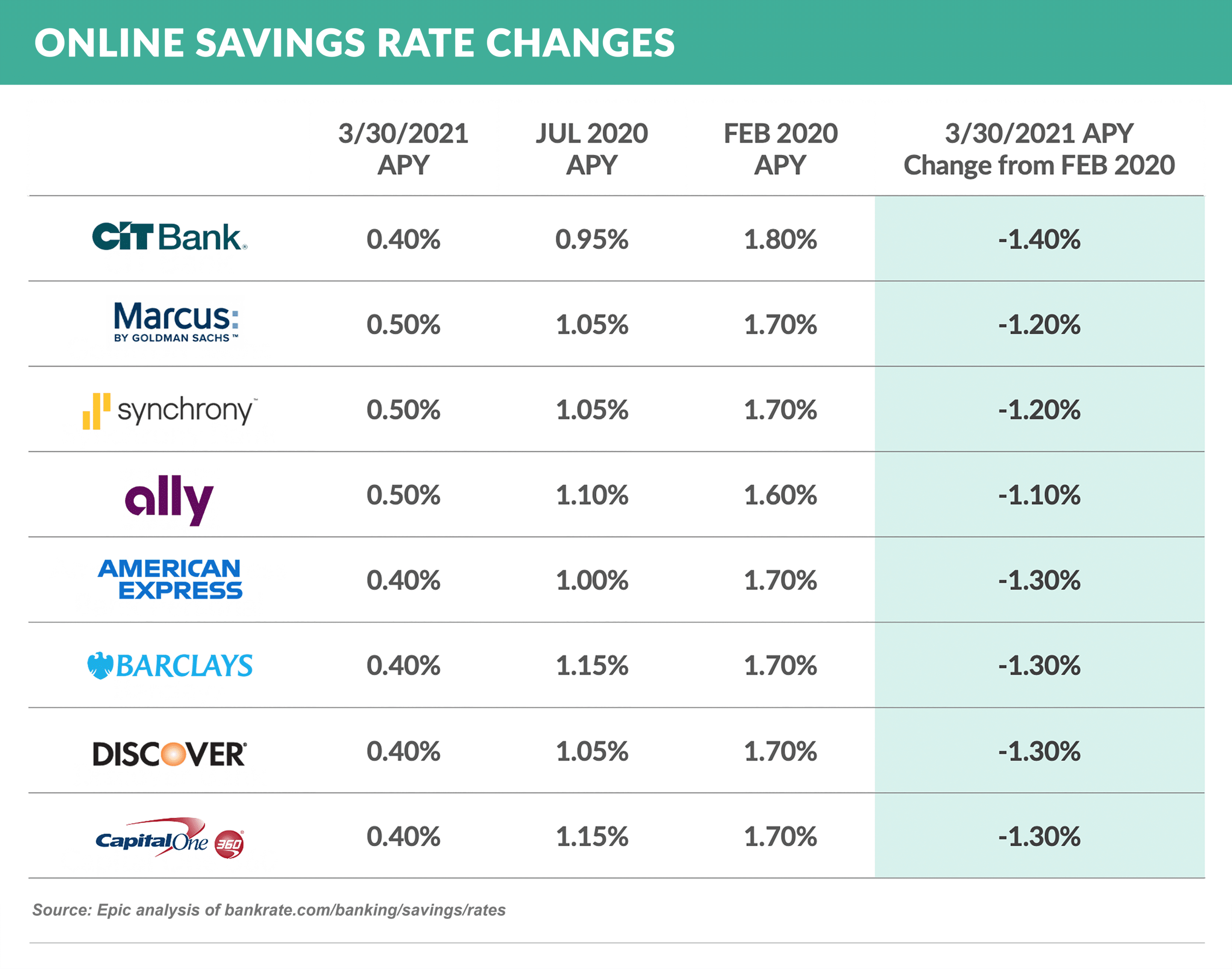

- Rapidly declining online savings rates have finally stabilized, but at a level 60 – 100 basis points lower than pre-pandemic rates

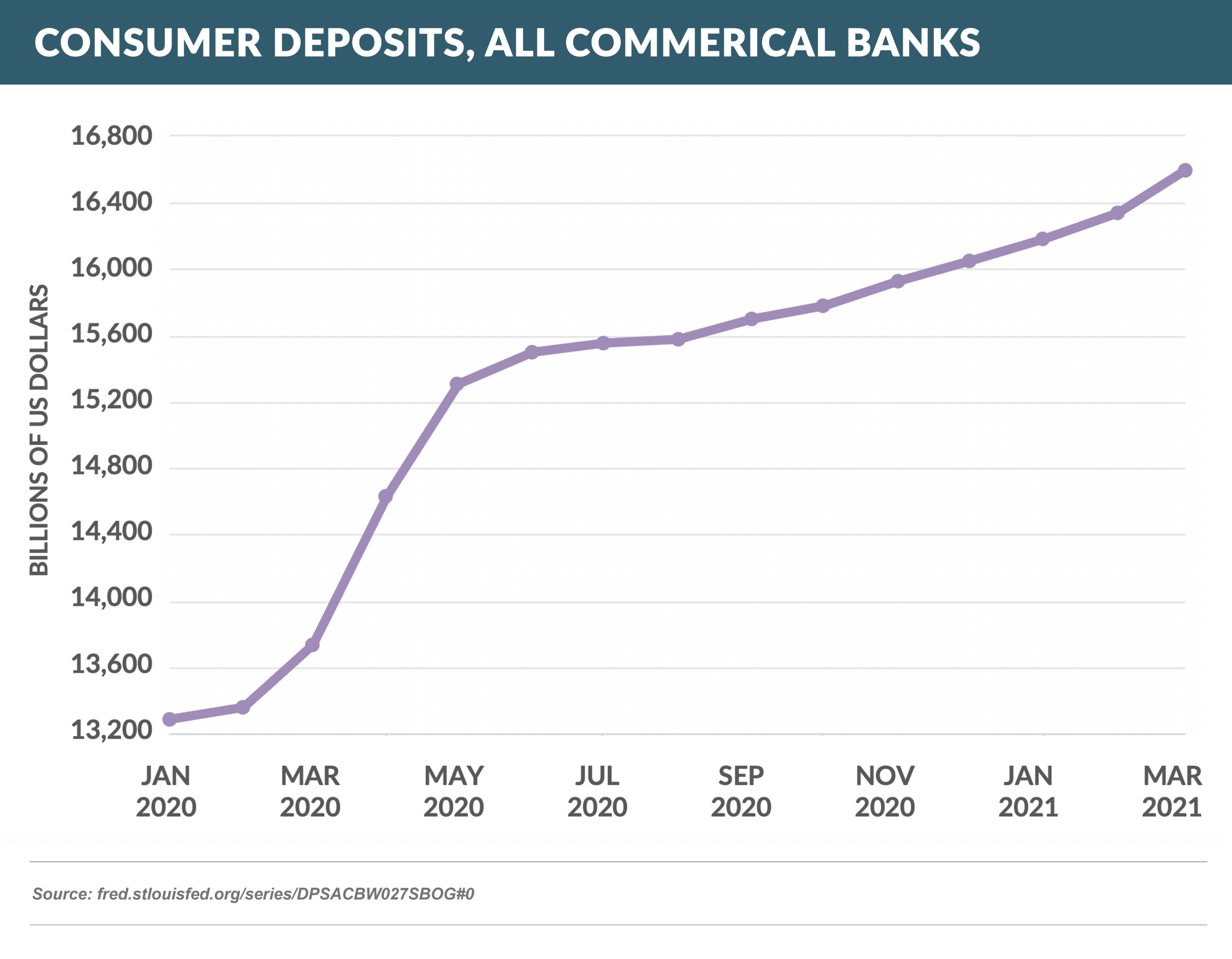

- Consumer deposits have skyrocketed, fueled by lower spending, government stimulus payments, and overall cautionary behavior in an uncertain time, while rates have fallen

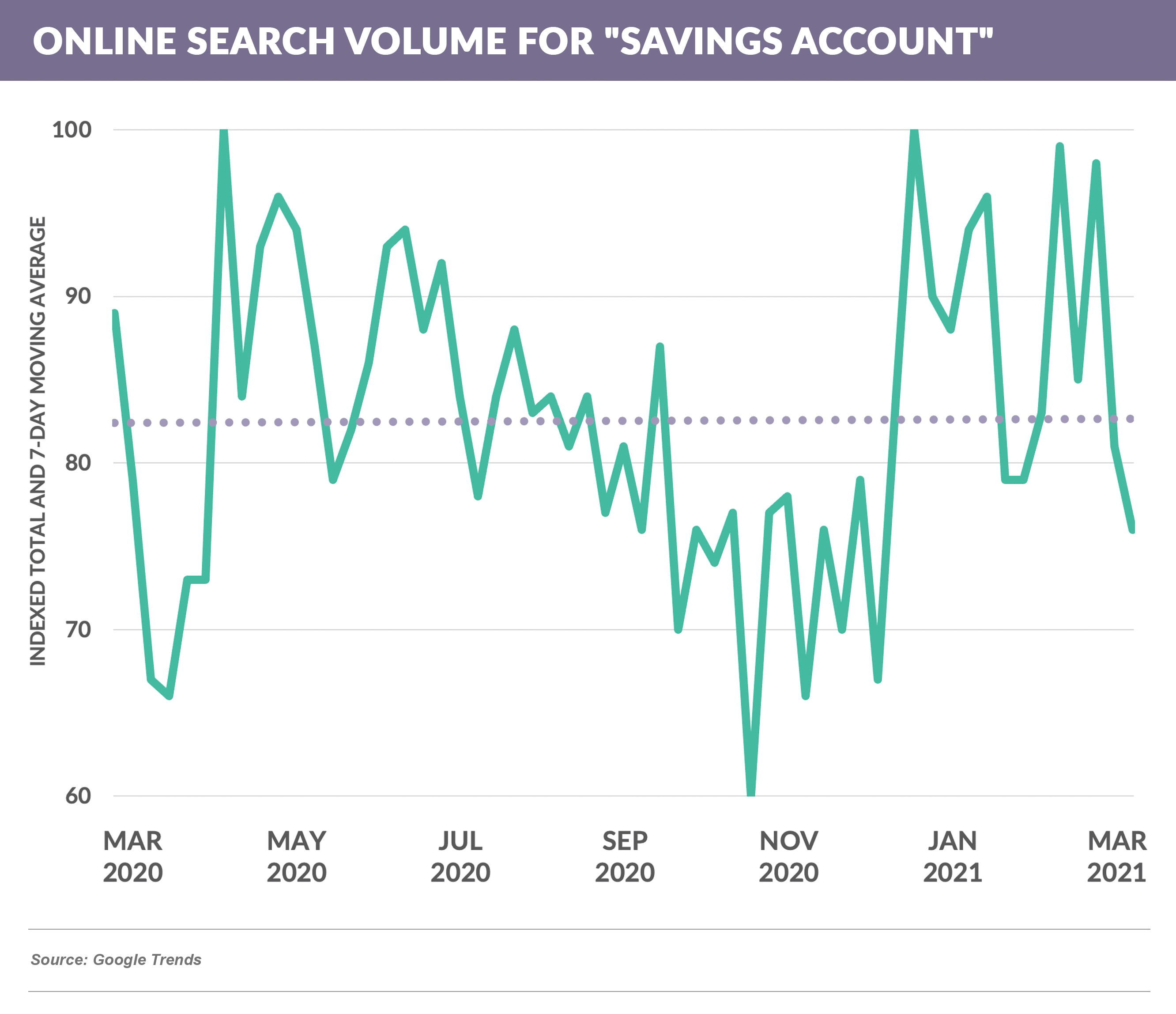

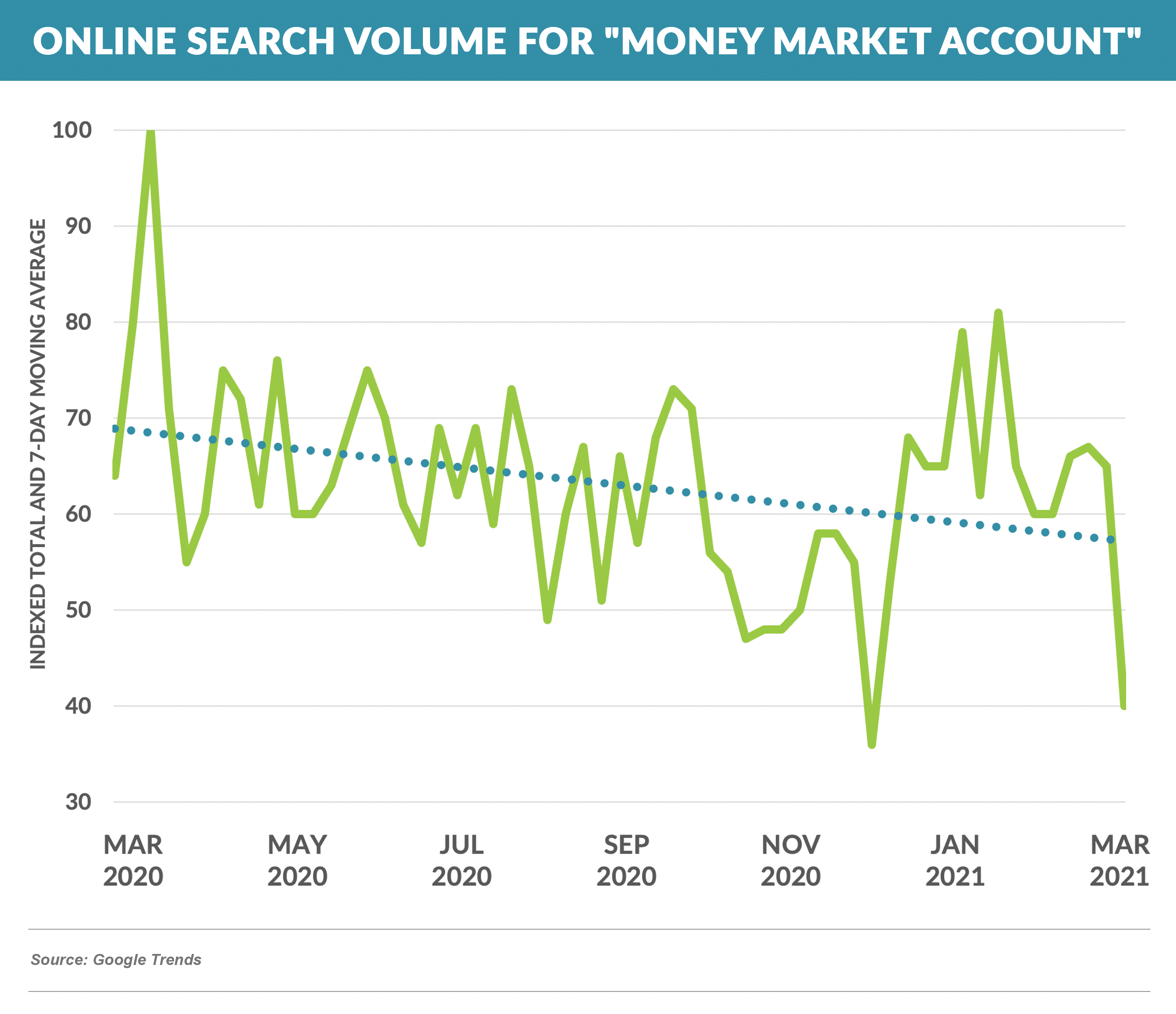

- Online search traffic has tapered off for savings and money market accounts, and financial institutions have reduced checking solicitations by 58% since the months prior to the pandemic

- With rates generally starting to tick up, savings rates may follow

Quick Takes

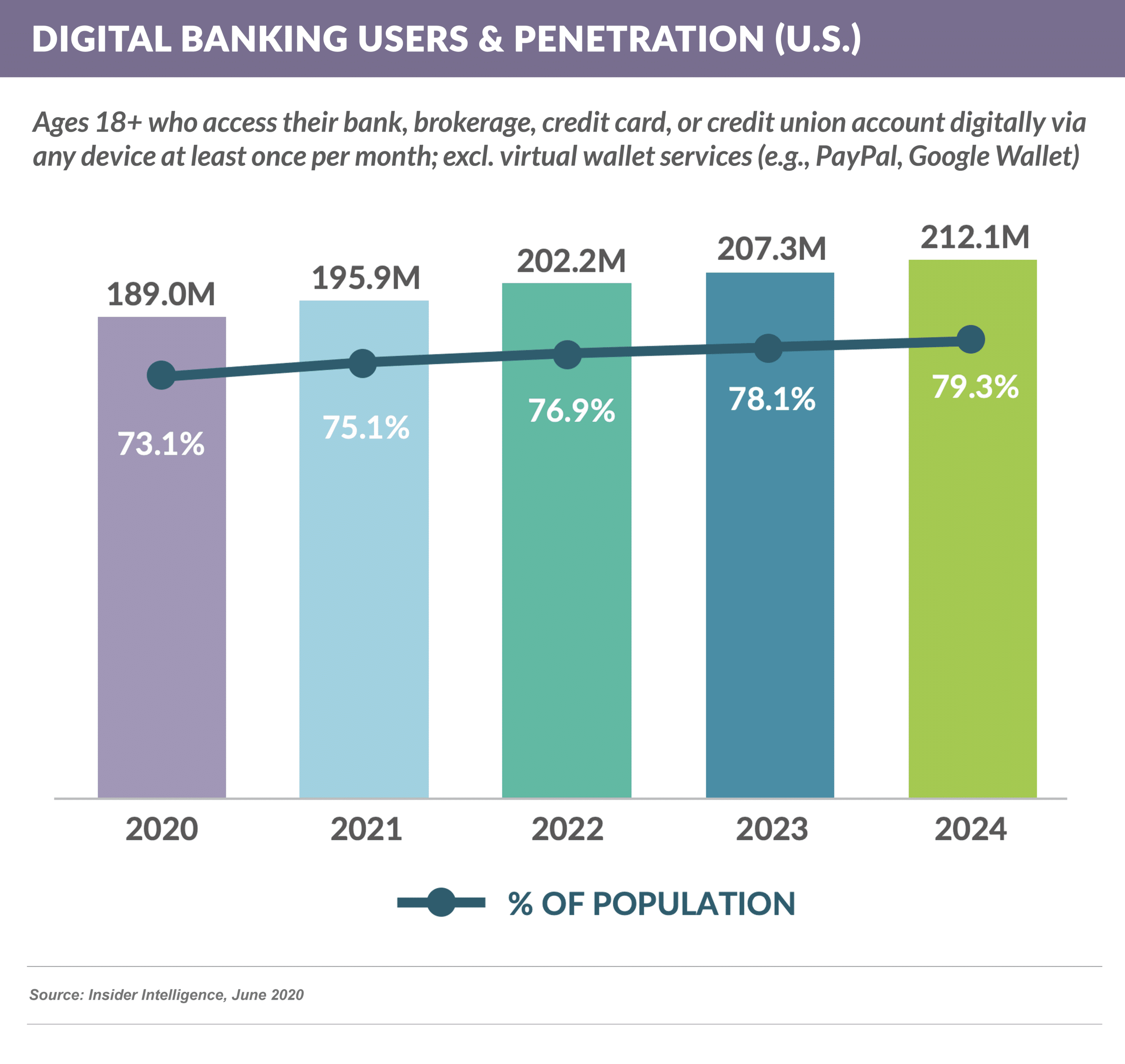

- After steady growth over the past 20 years, digital servicing became even more prominent in the past year as the pandemic restricted in-person customer interactions with banks and financial services companies adjusted to avoid the risks of having large groups of customer service representatives work in congregate settings

- Insider Intelligence predicts digital servicing penetration will continue to grow 1-2% a year

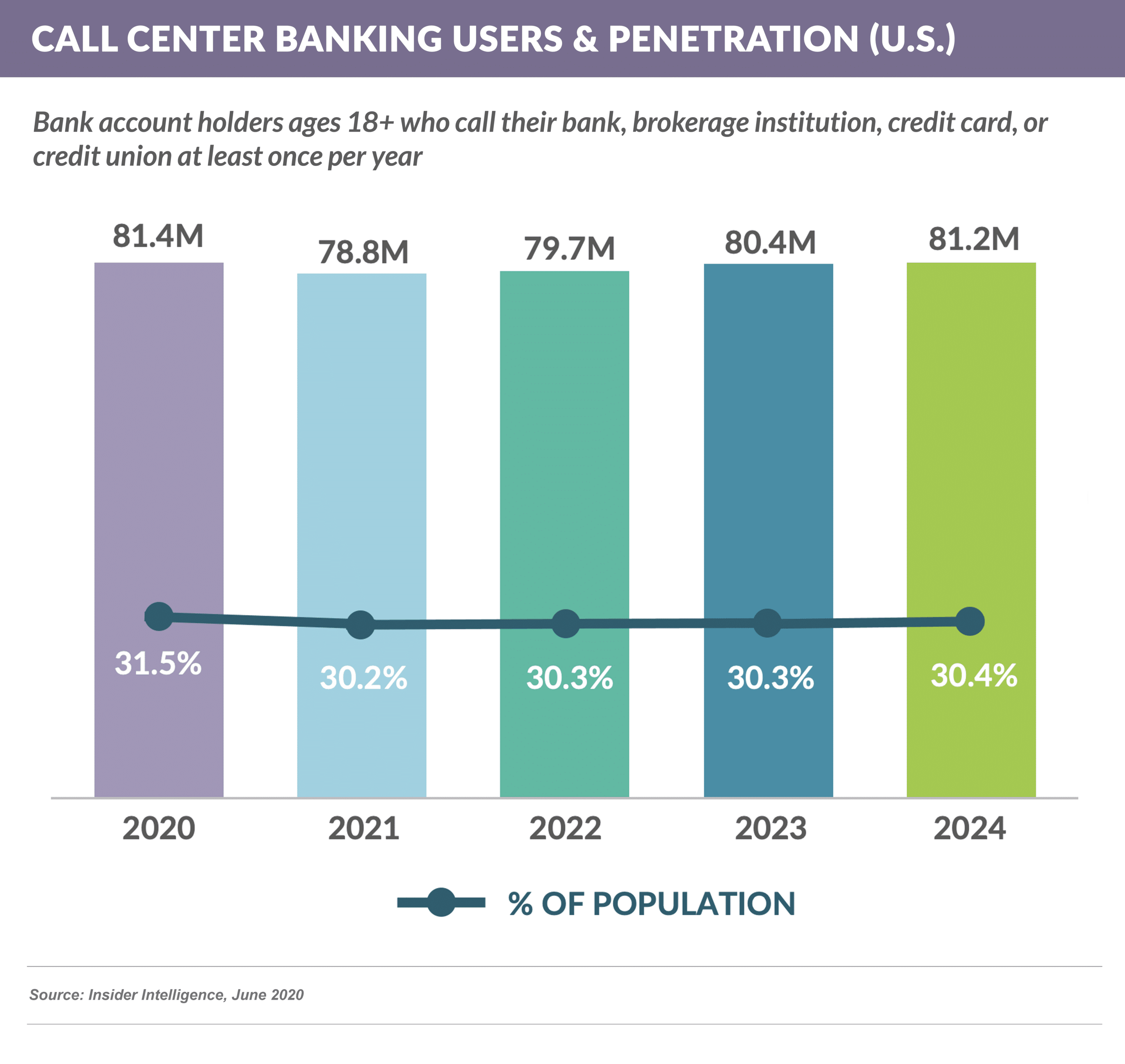

- While it seems like digital servicing is all you read about these days in banking circles, InsiderIntelligence.com also notes that call center usage is projected to remain steady, with 30% of U.S. consumers interacting with their financial institutions via phone at least once a year

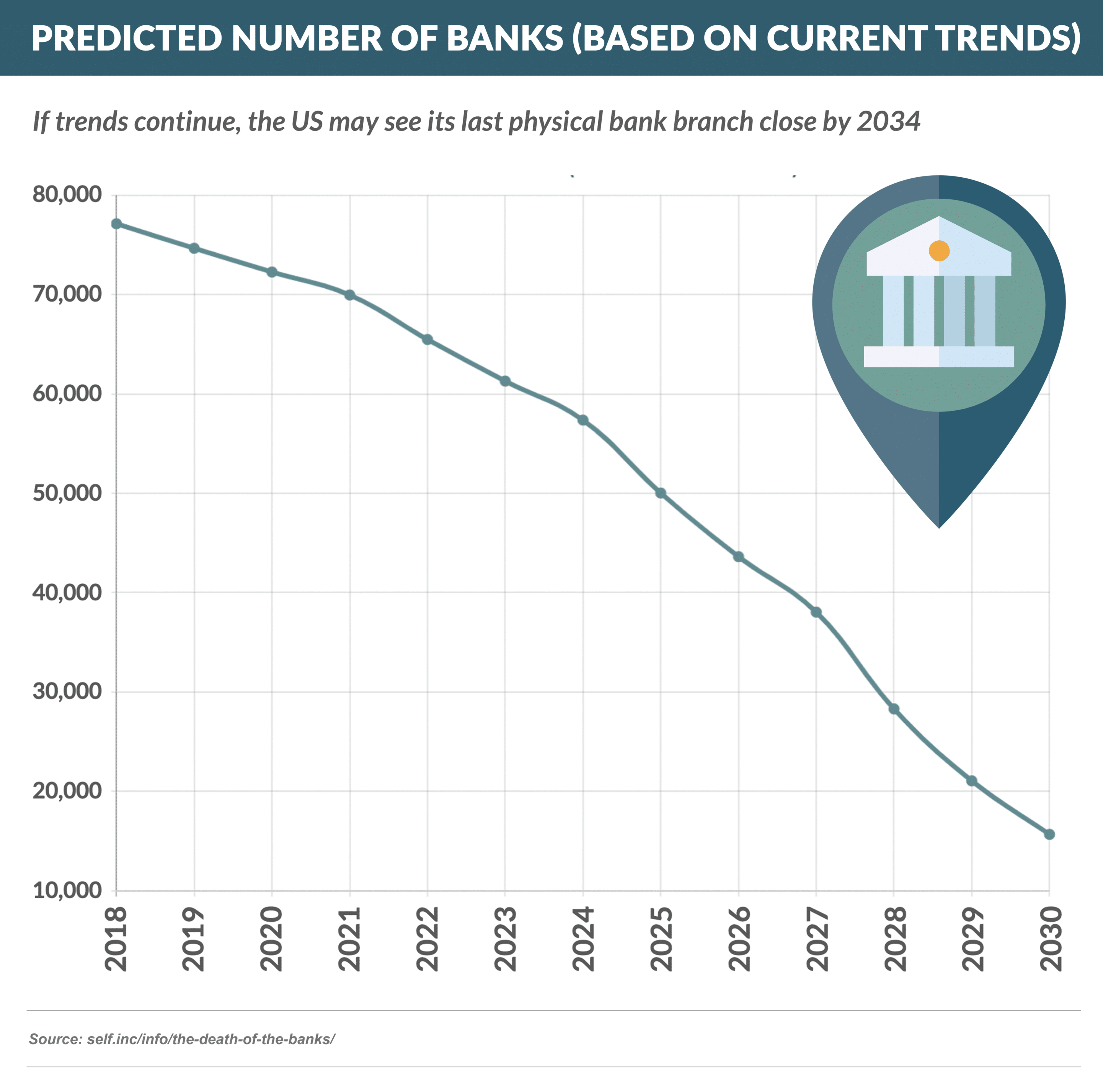

- Meanwhile, Self predicts that all bank branches will disappear by 2034

- As branch design and utility continue to adapt, we think this is one of those predictions that will not come true

- Further, while the number of traditional branches may be shrinking, the number of non-traditional physical banking locations may not be

- For example, months after launching a credit and prepaid debit card, Walgreens has announced that it will also offer deposit accounts through a relationship with MetaBank – accounts that can be serviced both online and in Walgreens’ 9,000 stores

Thank you for reading.

Moving forward, we will be publishing the Epic Report on a monthly basis. The next Epic Report will publish on May 1st.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.