Three Things We’re Hearing

- Comparison sites drive fintech growth

- Consumers love Visa and Mastercard

- Digital marketing soars

A three-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Comparison Sites Drive Fintech Growth

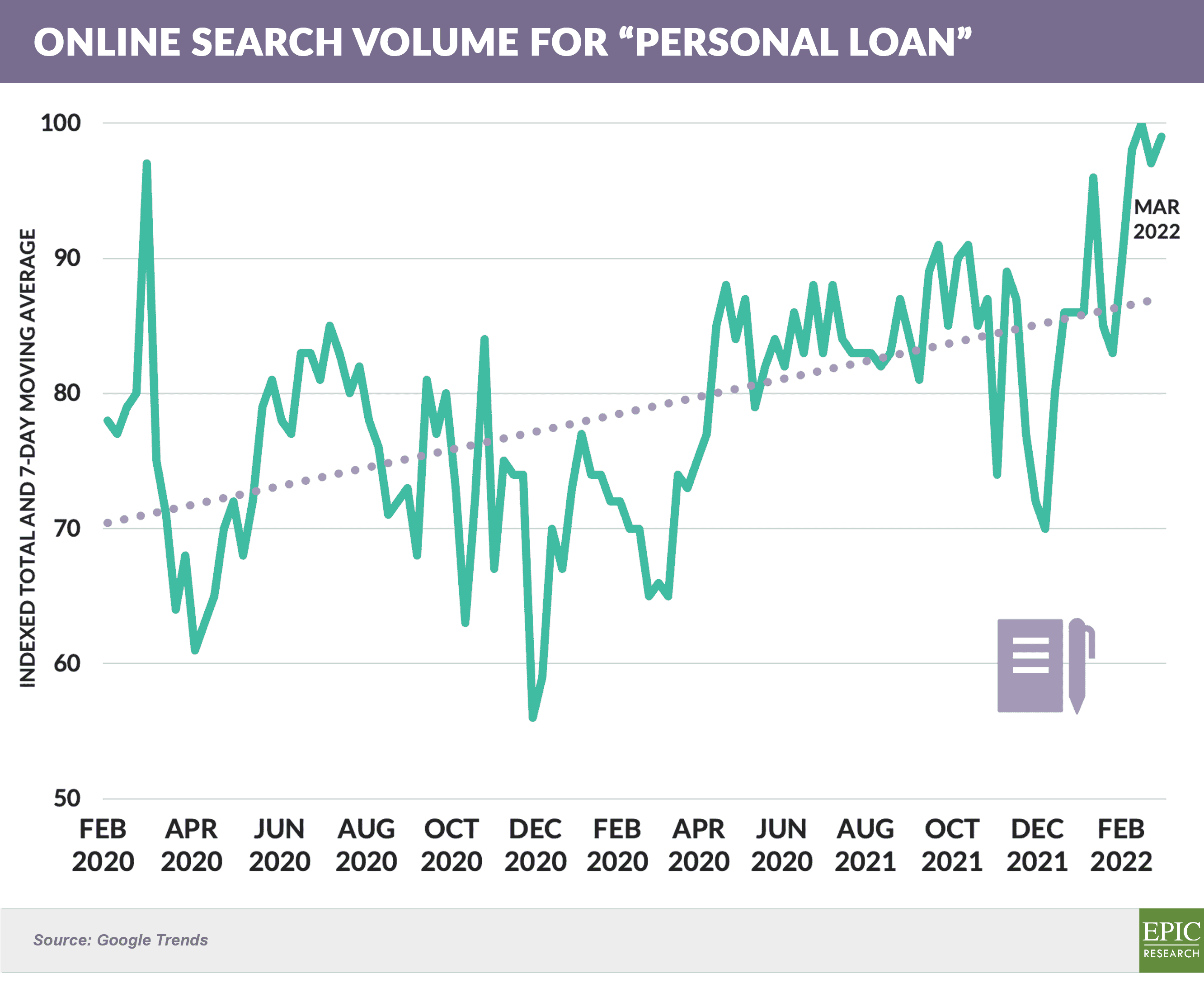

- After a post-pandemic decline, online search for personal loans trended upward over the past year

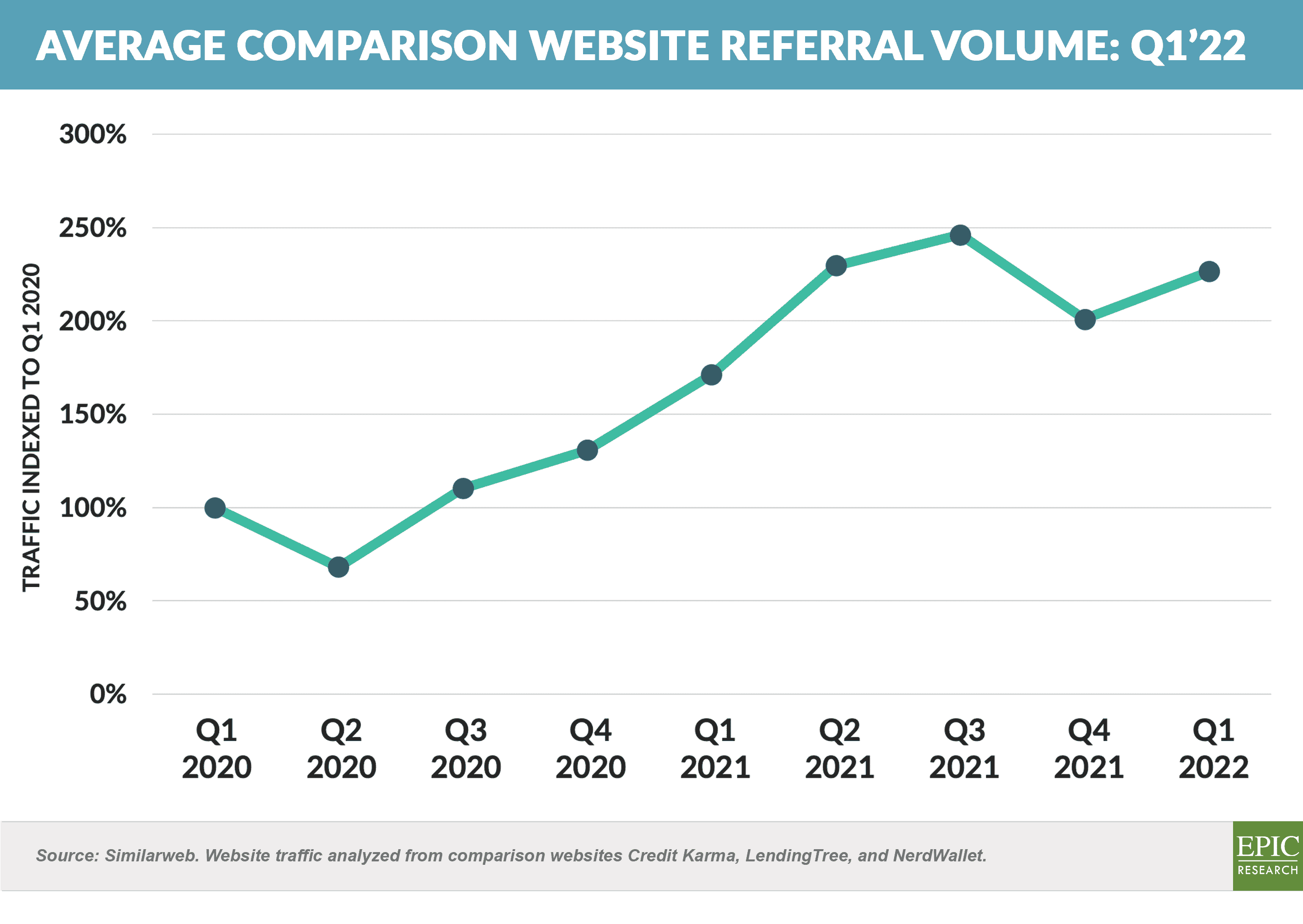

- Online traffic to top fintech lenders has similarly rebounded and grown from pre-pandemic levels, with referrals from comparison websites such as Credit Karma, LendingTree, NerdWallet, and Bankrate to those top lenders having grown over 200% since Q1 2020

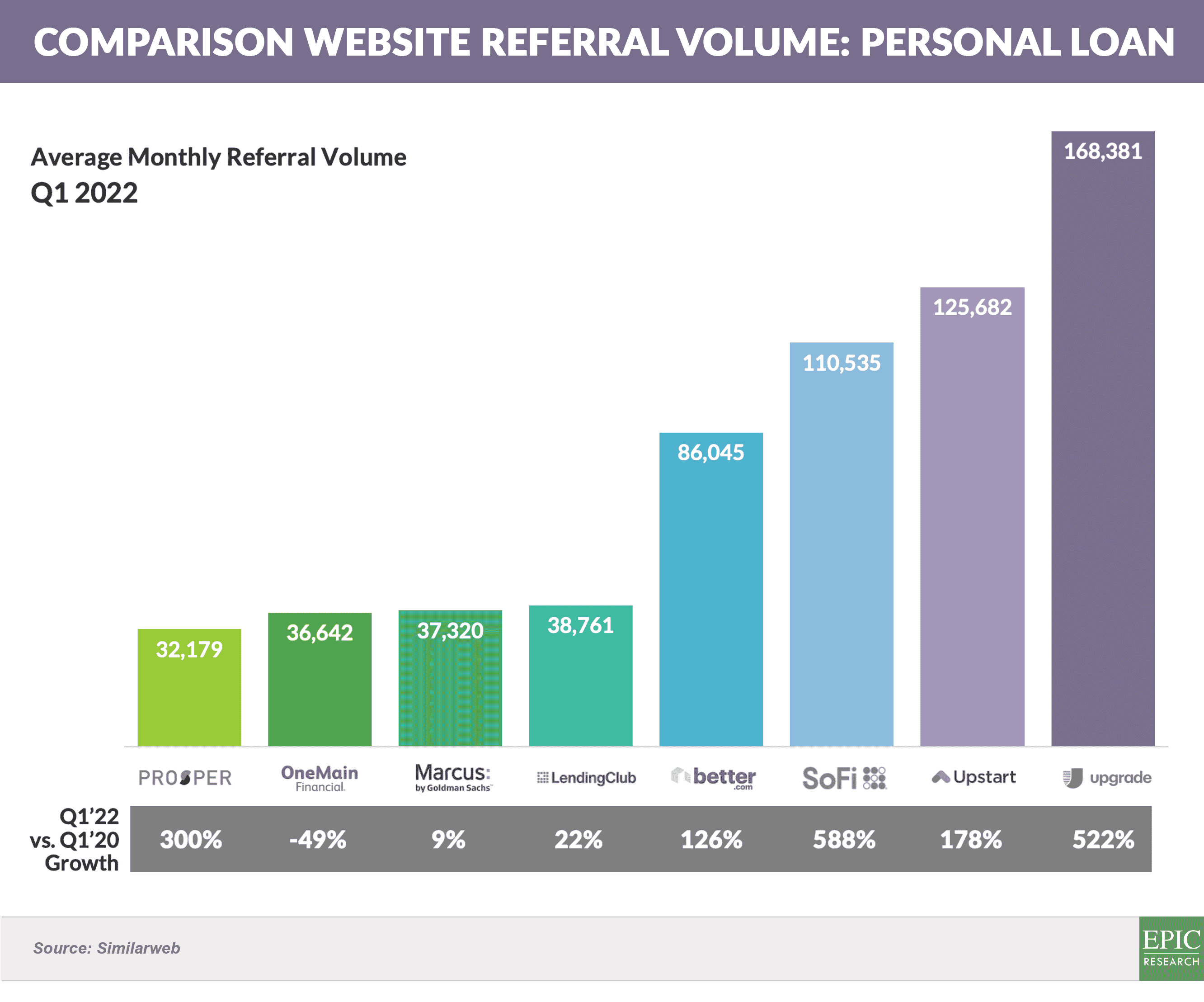

- Upgrade and Upstart received the largest number of referrals from the sites monitored, with Upgrade and SoFi showing the highest growth since Q1 2020

- Fintechs have been at the forefront of sourcing loans from comparison sites, while most retail banks have yet to cultivate relationships with comparison sites

Consumers Love Visa and Mastercard

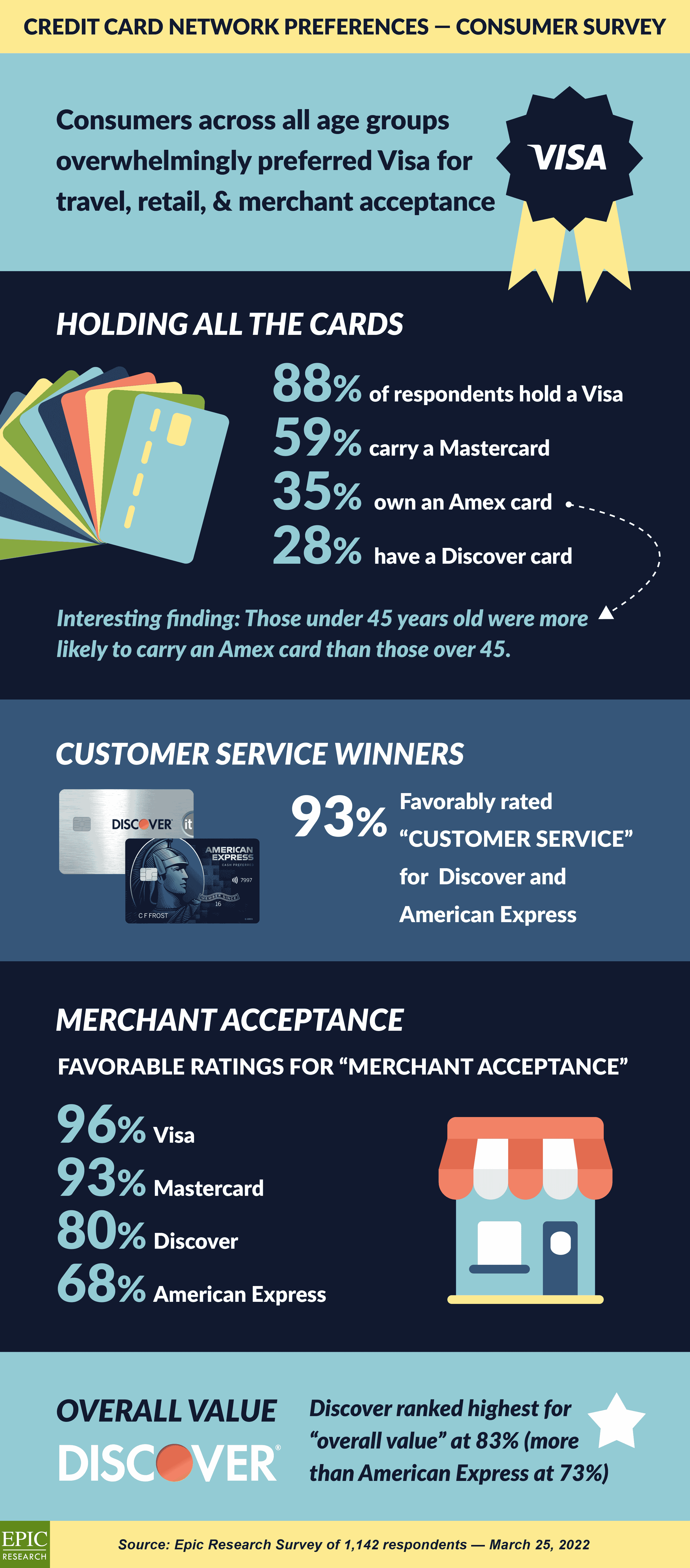

- Epic recently surveyed 1,142 consumers regarding their opinions on the major general purpose card networks

- While many attributes of Visa and Mastercard cards are more issuer-specific (e.g., customer service, pricing, and rewards) than those of American Express and Discover, we wanted to gauge consumers’ brand perceptions across these and other criteria

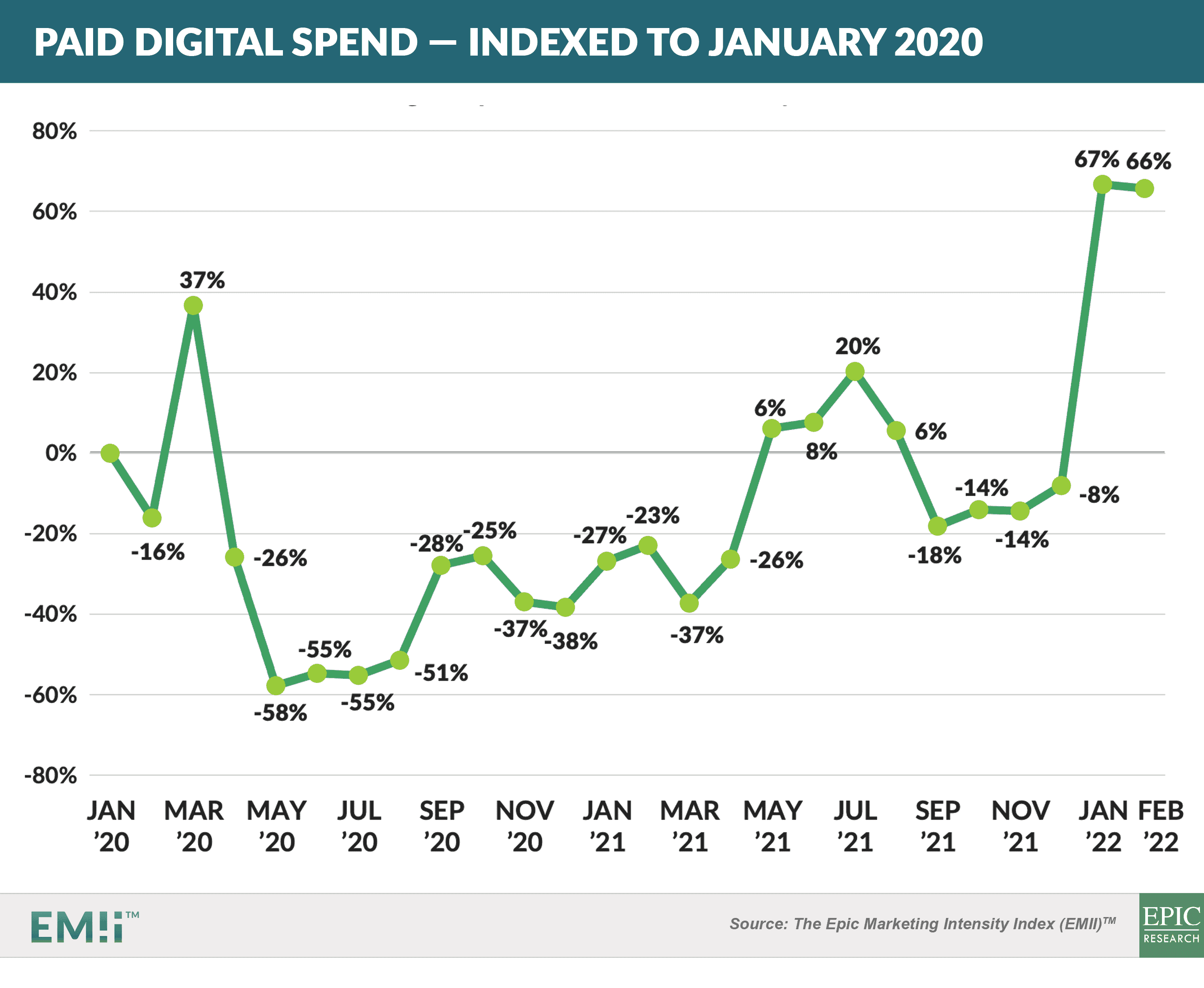

Digital Marketing Soars

- The post-COVID drop in paid digital spend across all consumer financial products recovered in 18 months and, in recent months, has far exceeded pre-pandemic levels

-

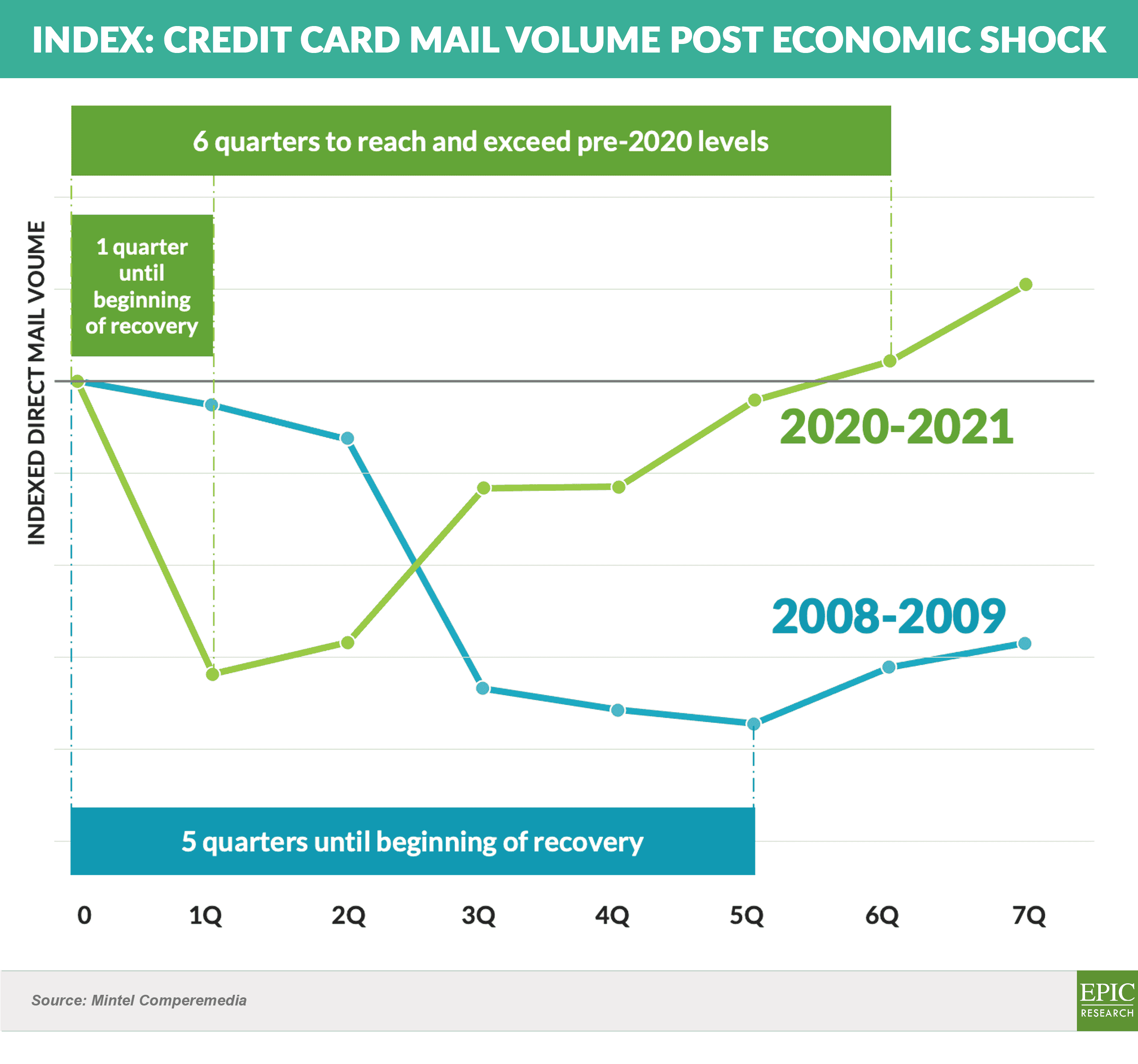

As noted in prior Epic Reports, post-pandemic mail volume for credit cards has recovered faster than for most products and at a much faster pace than following the previous major industry shock in 2008-2009

- The beginning of the 2020 recovery took just one quarter vs. five quarters in 2008-2009

- While credit card mail volume has never returned to the 7-8 billion annual volume of the early 2000’s, it took only six quarters following the 2020 drop to reach and exceed pre-2020 levels

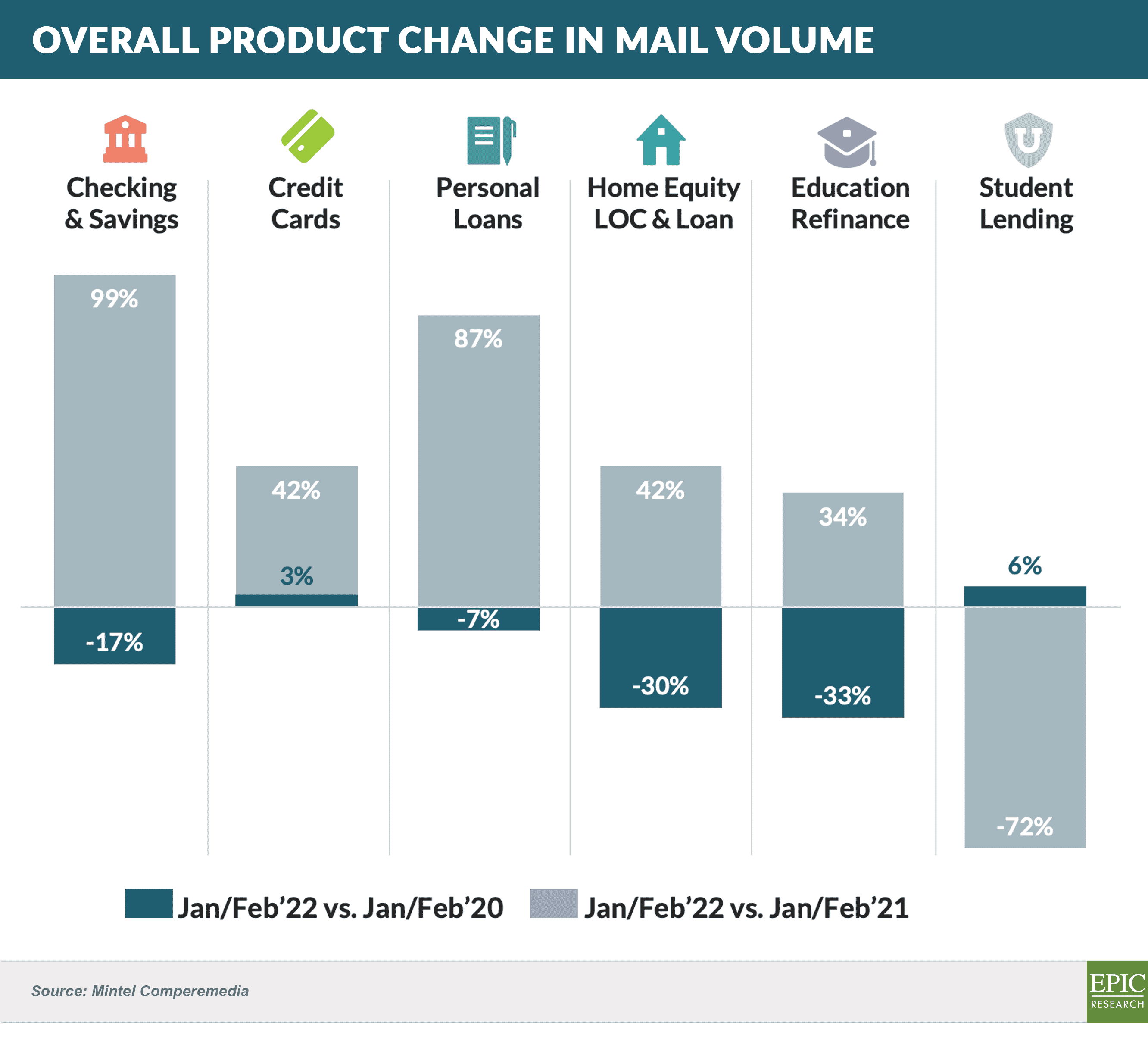

- Recent positive trends in mail volume have continued, with volumes for card, personal loan, and private student loans having reached or exceeded early 2020 levels

- Education refinance mail volume still lags as lenders wait for the expiration of the Cares Act

- HELOC and home equity loan mail volume is 30% lower than pre-COVID

Quick Takes

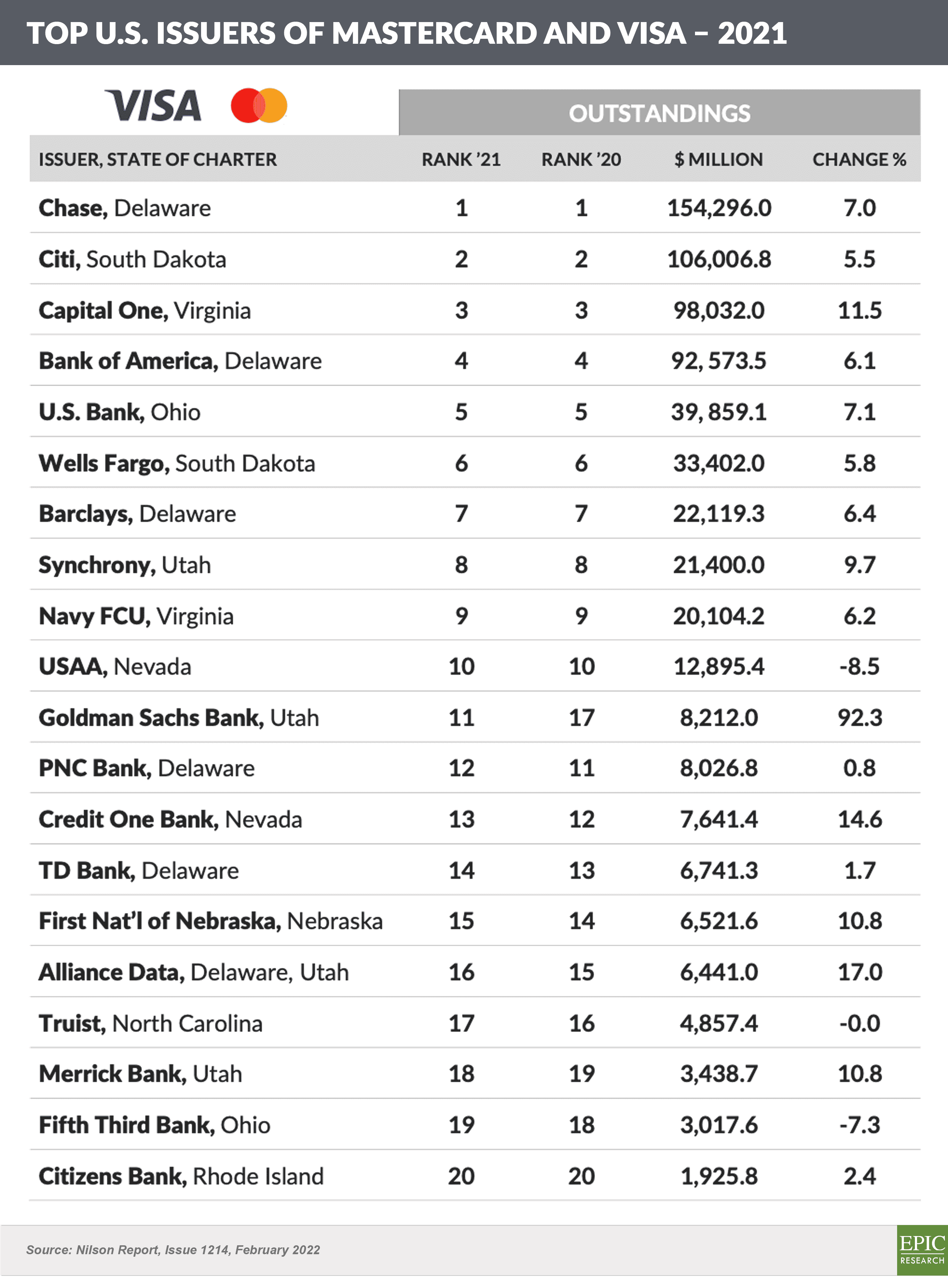

- There has been little change in the top Visa / Mastercard issuers in the past year, with the exception of Goldman Sachs’ 92% year-over-year growth

- Goldman jumped from being the 17th largest issuer in 2020 to the 11th spot in 2021

- The primary drivers behind Goldman’s rise were the acquisition of the General Motors cobrand portfolio and aggressive marketing across other products and channels

- “Fill up now. Pay later.”

- Klarna is allowing consumers to pay for gas using its BNPL service

- Despite the increase in gas prices, gas, like groceries, has not typically been an item that has been purchased using installments

- BNPL Watch

- Affirm delayed an asset-backed securities sale to following the withdrawal of a major investor, with those close to the matter citing “general market volatility” as the reason

- BNPL asset quality is under close scrutiny as delinquencies normalize

- Capital One has extended its Kohl’s private label partnership and announced the 2023 launch of a Kohl’s cobrand card – this is the second major retailer deal by Capital One following the January report that BJ’s Wholesale Club would be moving its cobranded cards to Capital One from ADS

If the Epic Report was forwarded to you, click here to add your name to the mailing list

The Epic Report is published monthly, with the next issue publishing on May 7th.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.