What We’re Hearing

THIS WEEK’S HIGHLIGHTS

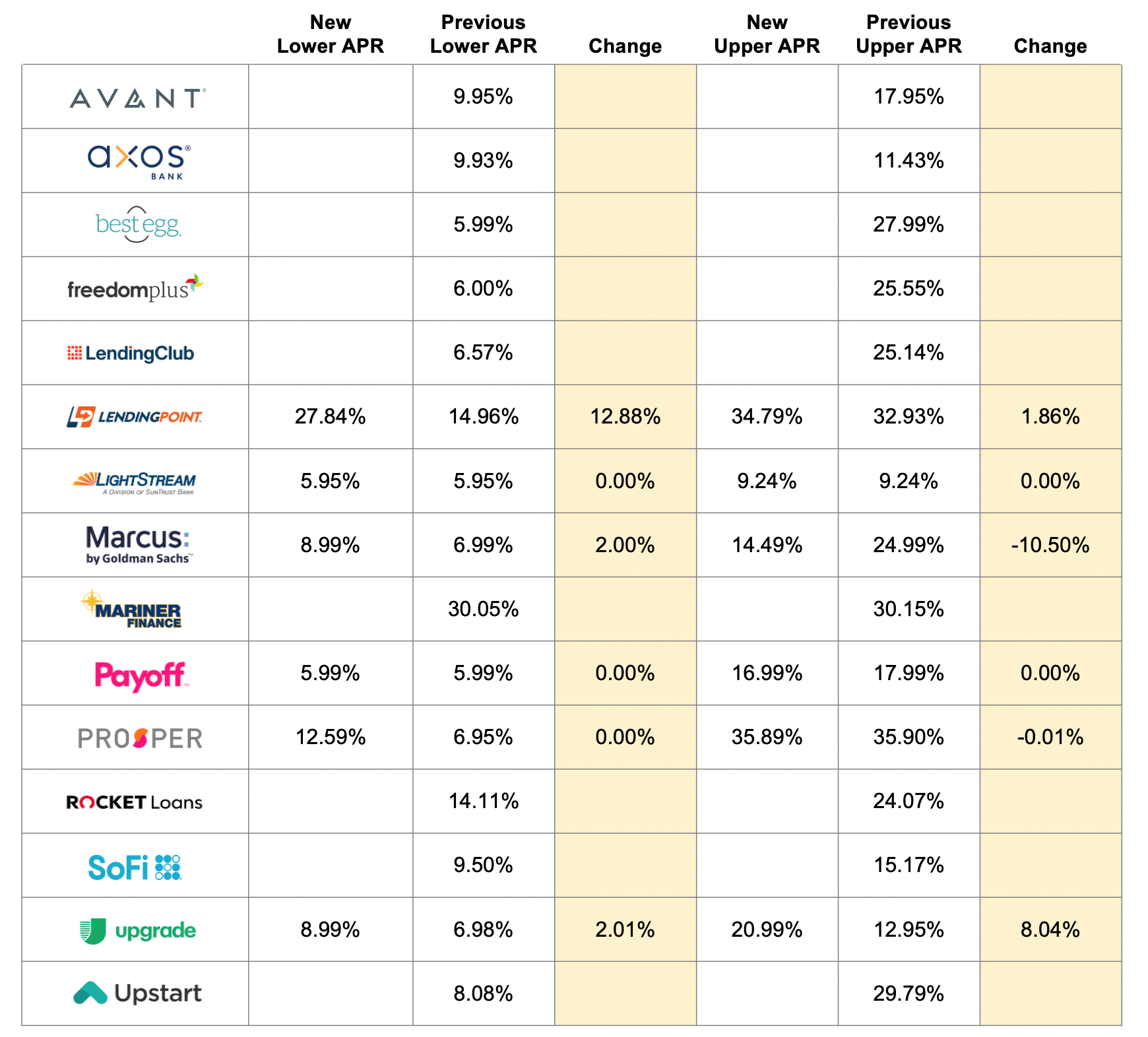

- Over half the lenders on the LendingTree personal loan table have been removed since last week

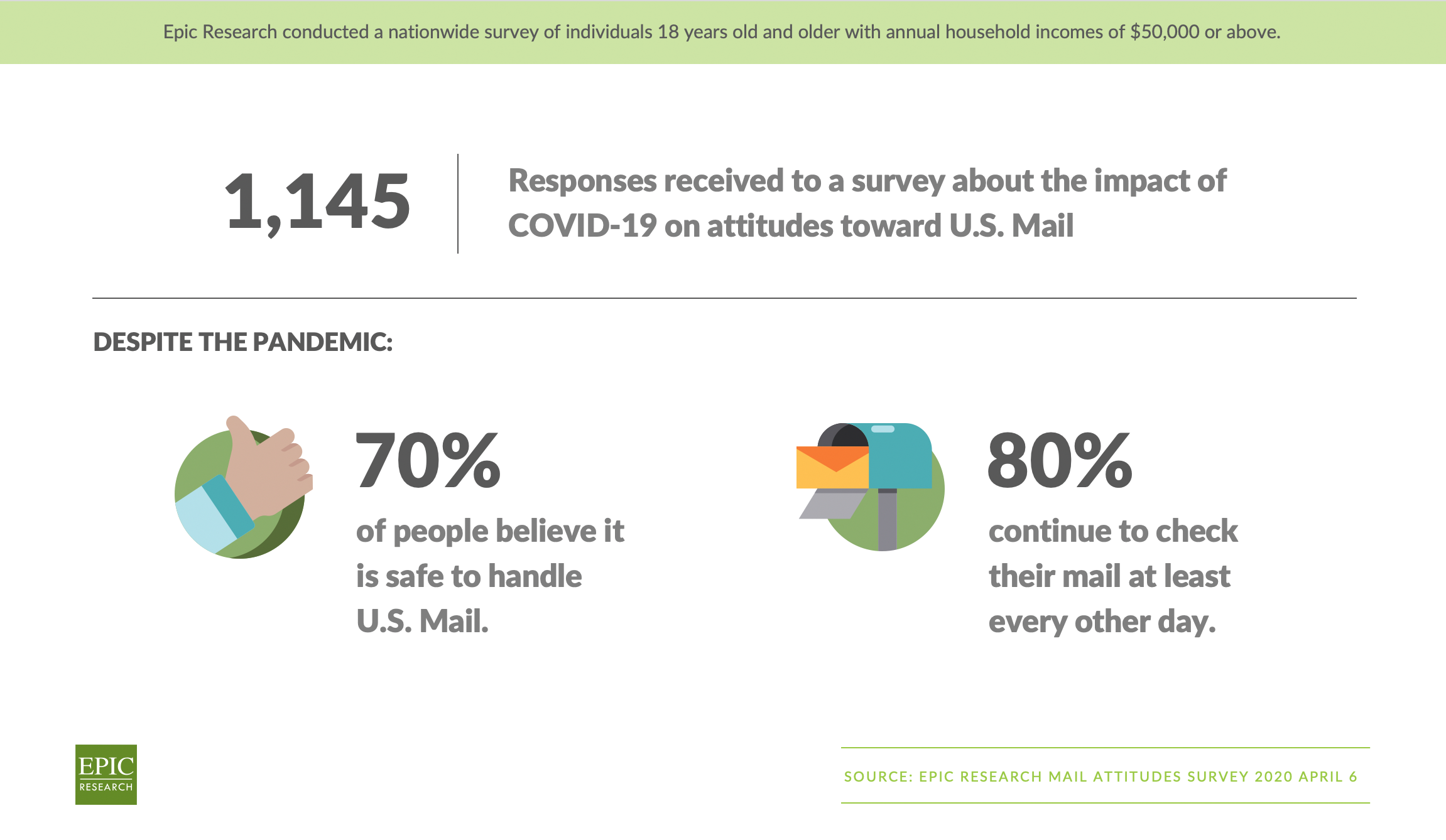

- Despite evidence of a significant drop in responses to direct mail offers, 80% still check their mail at least every other day, and 70% believe it is “safe”

- There are glimmers of hope that college campuses will open this fall

- Digital advertising for credit products dropped over 50% by the end of March

Today’s newsletter takes 3 minutes to read

We are monitoring trends in the consumer and small business lending segment in light of the unprecedented impact of the COVID-19 pandemic. Following is data we are watching along with anecdotal information we have gathered in discussions with industry contacts. Please email us with your ideas for future research or commentary.

Consumer Demand

DIRECT MAIL

- More anecdotal feedback from a number of lenders indicates a continued decline in direct mail response rates beginning in mid-March

- The decline varies by product, and trends are too early to detect, however we have heard anecdotally of drops from 10% - 75% compared to forecast

- While still early, the hardest hit seems to be personal loan, followed by credit card, with education refinance generally holding up the best

- We emphasize that these reports are anecdotal and a small sample size

- Despite the drop in direct mail response rates, Epic proprietary research shows less concern among consumers with handling mail than might be thought:

- 80% still retrieve their mail at least every other day, down from 88% pre-COVID-19

- 71% view mail sent via the USPS as “safe to handle”

- The survey was conducted on April 8th among 1,145 adults with household incomes greater than $50,000

DIGITAL

- Online search volume for most lending categories has dropped back to or below their January/February levels, including:

- Personal Loan

- Student Loan Refinance

- Credit Card

- Home Equity

- Checkng

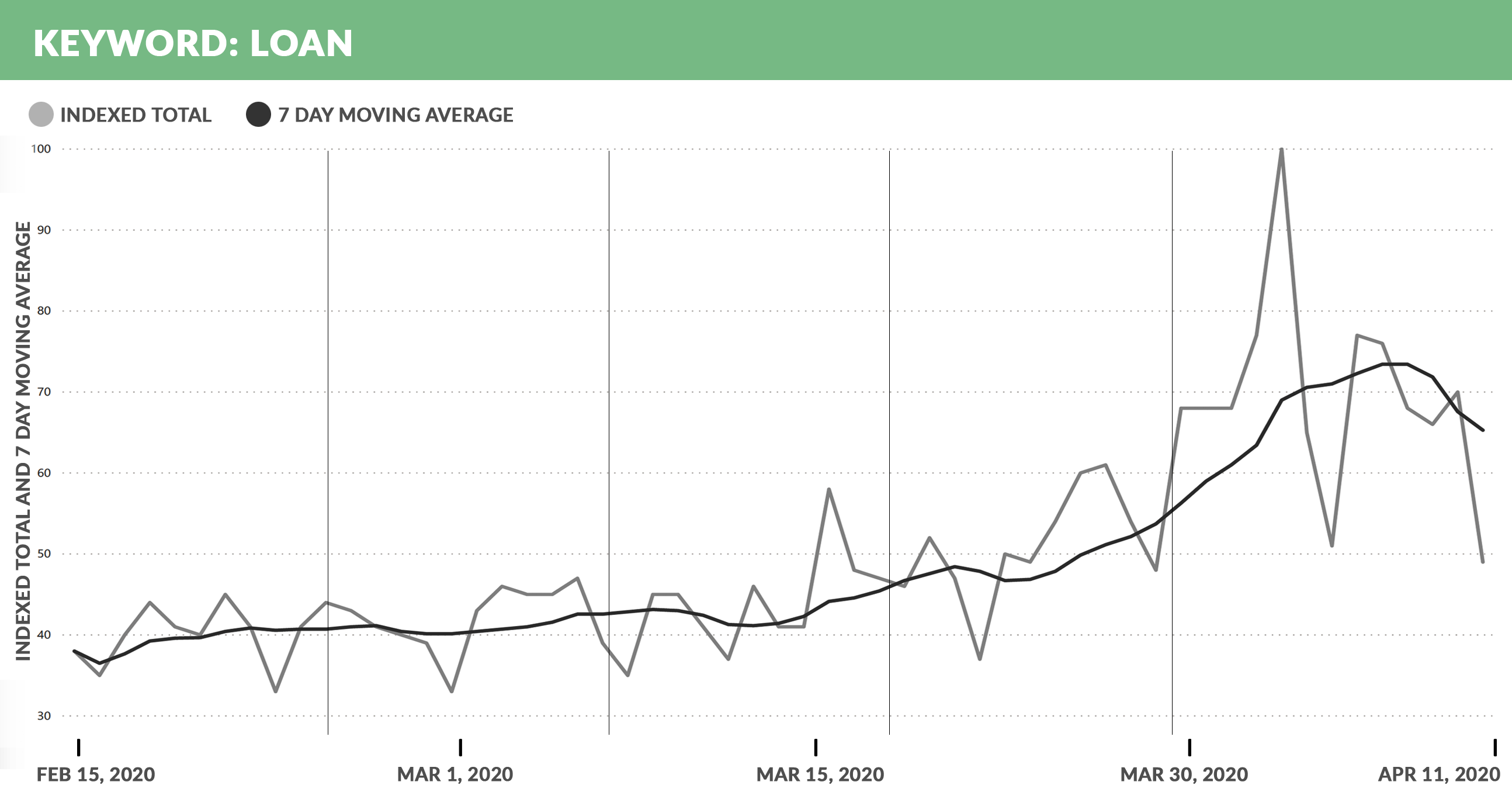

- However, online search volume for the generic term “Loan” has risen significantly since mid-March

Source: Epic analysis of Google Trends

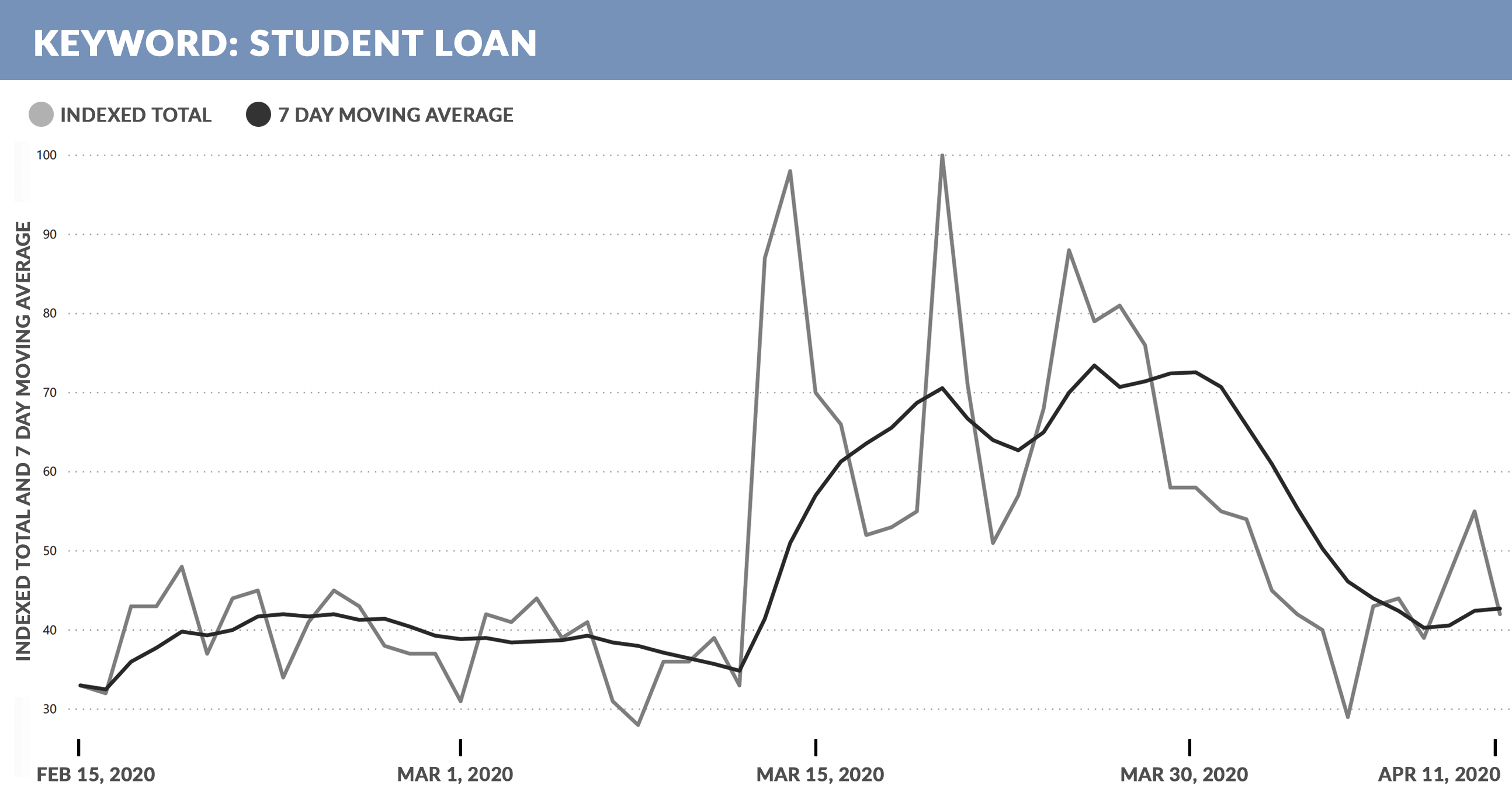

- Traffic for “Student Loan” has dropped somewhat in the last few weeks and has settled at a level above January/February

Source: Epic analysis of Google Trends

Lender Activity

ONLINE

- Over half of the lenders on the Lending Tree personal loan site have been removed from the site since last week:

- Most of those removed are funded via capital markets, which have been all but closed in some categories

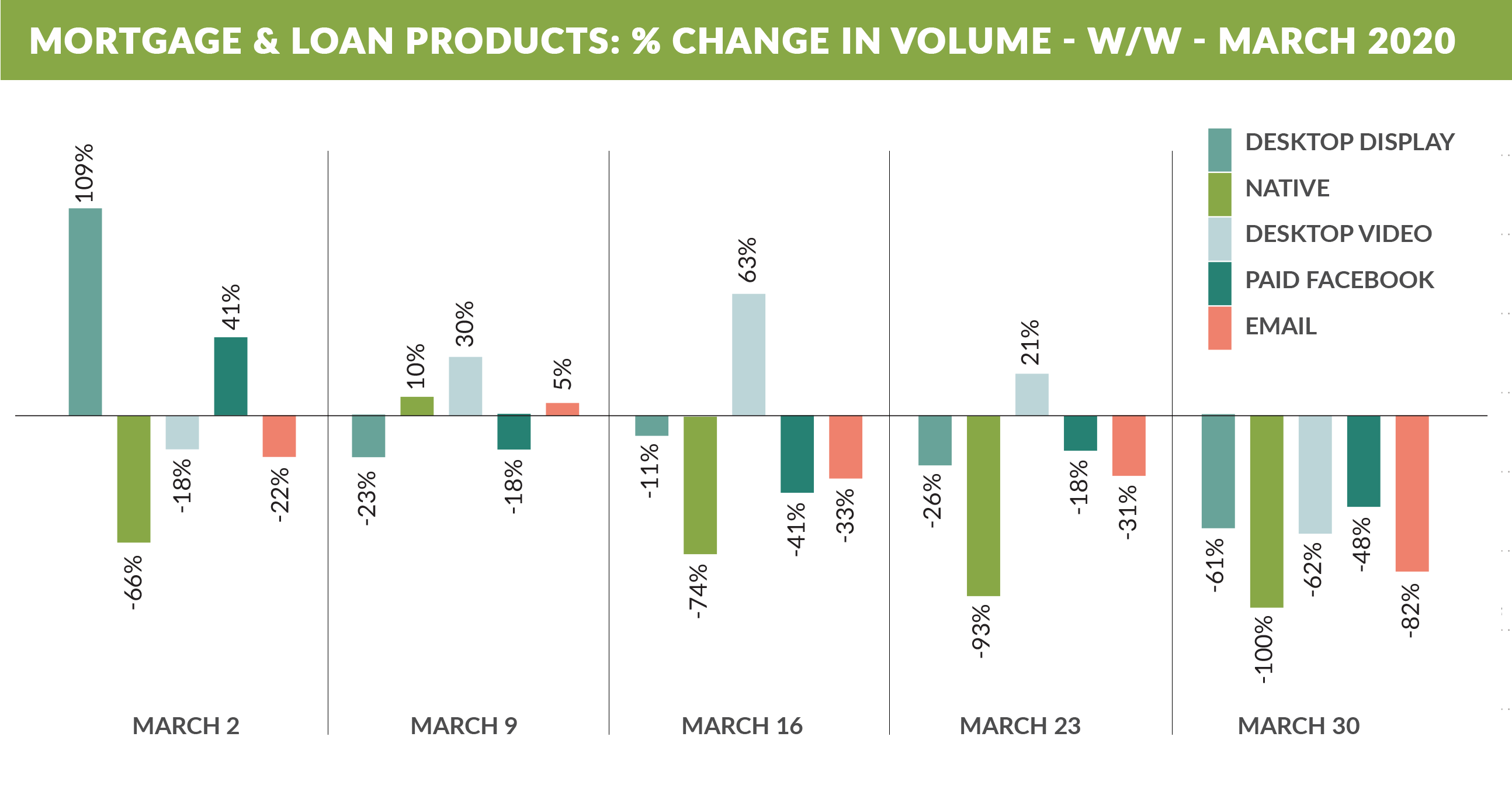

- Digital spend across online categories dropped 50% - 100% by the end of March

Source: Comperemedia Omni (03/01/19 – 03/31/20), as of 04/02/20; Mintel “While FS spend dips, support and creativity rise” (Apr. 2020).

DIRECT MAIL

- Lenders continue to reduce and postpone new direct mail campaigns

- HELOC remains one of the exceptions, with some continued activity in this secured product

STUDENT LENDING

- Student lenders remain in a “wait and see” mode regarding the question of schools opening up their campuses in the fall, however optimistic comments have recently appeared:

- From Politico Education quoting Anthony Fauci:

- WILL SCHOOLS BE ABLE TO OPEN THIS FALL? Fauci offered this assessment on Tuesday as the Covid-19 outbreak pushes more campuses offline: "Bottom line is: No absolute prediction, but I think we're going to be in good shape." Click here to read full story.

- From CNBC

- Billionaire philanthropist Bill Gates told CNBC he thinks schools will be able to resume in the fall… (Click here to read full story)

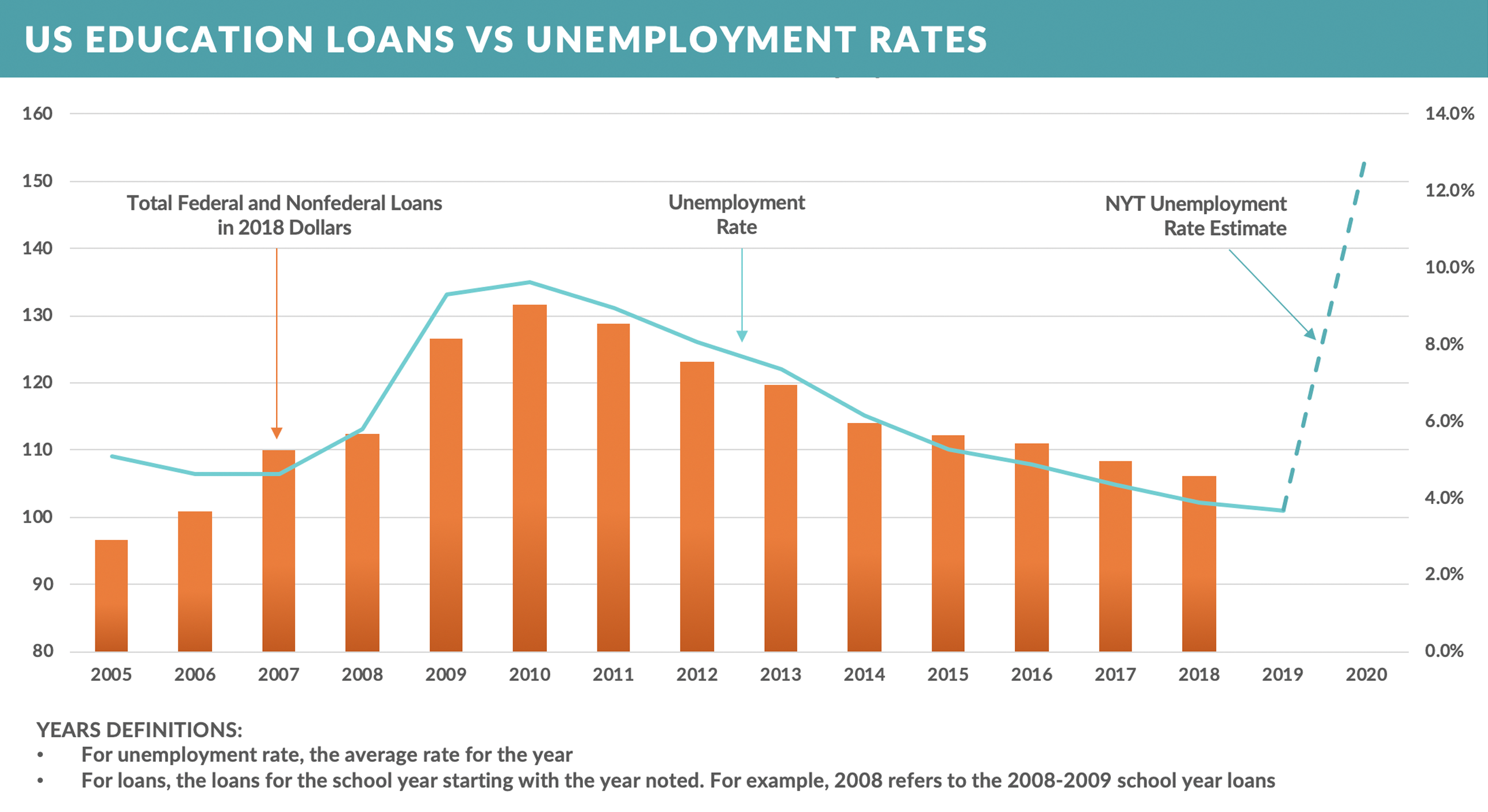

- As to the effect of an economic downturn on student lending, a look at student loan demand following the ‘08/’09 recession shows a high correlation between unemployment rates and demand for student loans:

Going Forward

Lenders have begun to look at the post-quarantine period, and many of our conversations reflect an aggressive posture by lenders upon re-entering the new customer acquisition market.

Please let us know what you think.

Click here to provide emails to add to our distribution, or if you do not wish to receive future emails.