Three Things We’re Hearing

- How do you prefer I pay you???

- Home equity marketing vaults!

- Citizens Financial – consumer banking powerhouse!!!

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

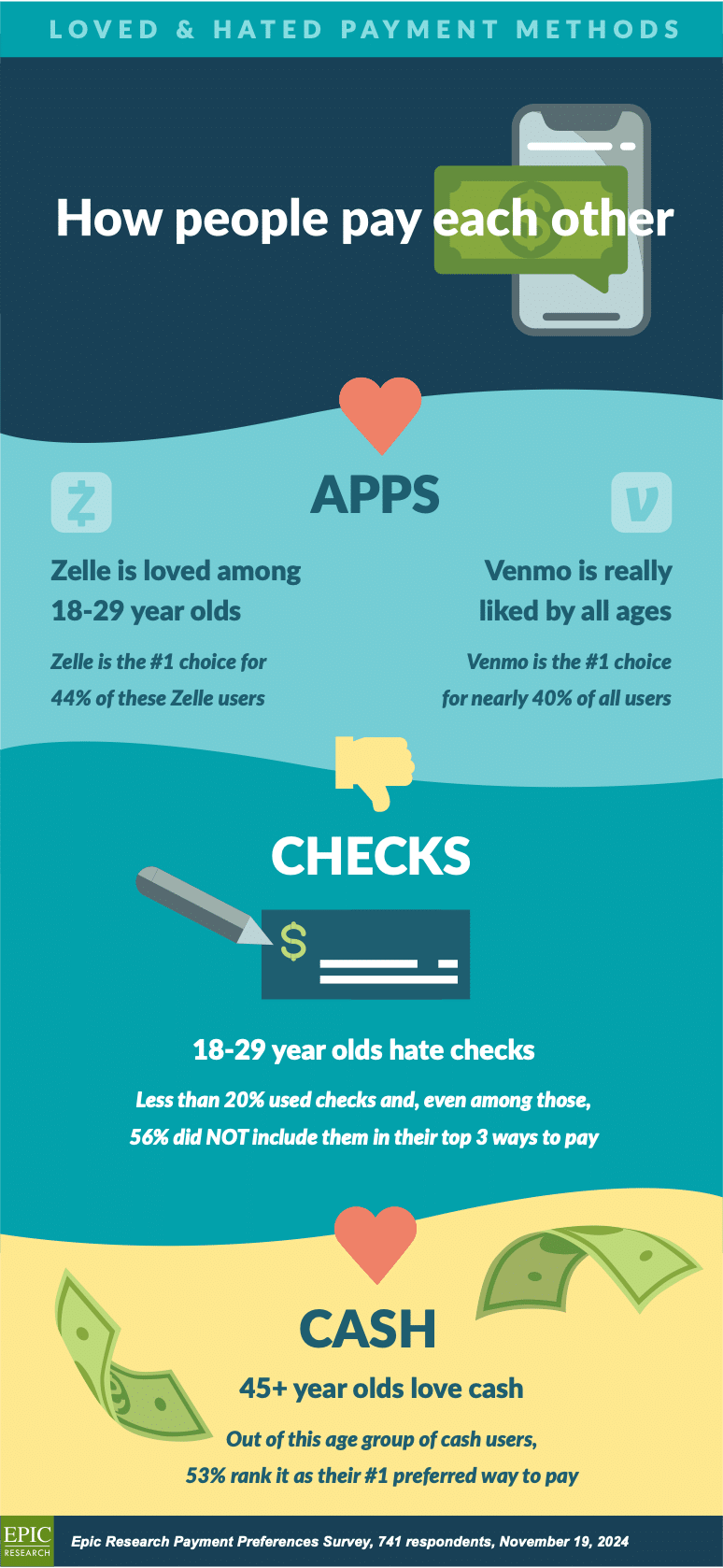

How Do You Prefer I Pay You???

- Across all age groups, most people use a combination of cash/checks and apps to pay other people

- Epic surveyed 741 consumers to discover their preferences for person-to-person payments

Home Equity Marketing Vaults!

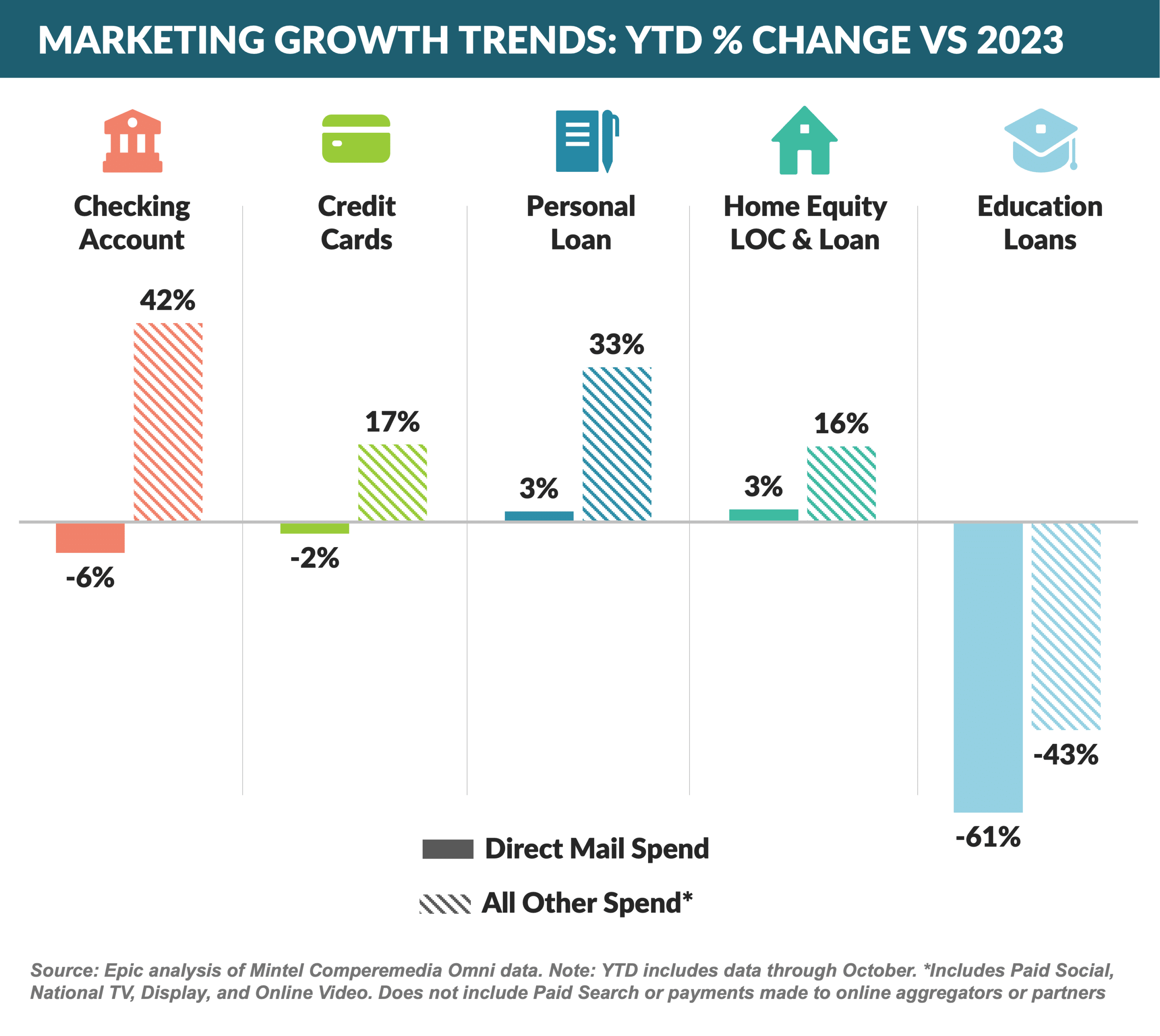

- Non-mail channels (national TV, display, paid social, and online video) have grown faster than direct mail in 2024

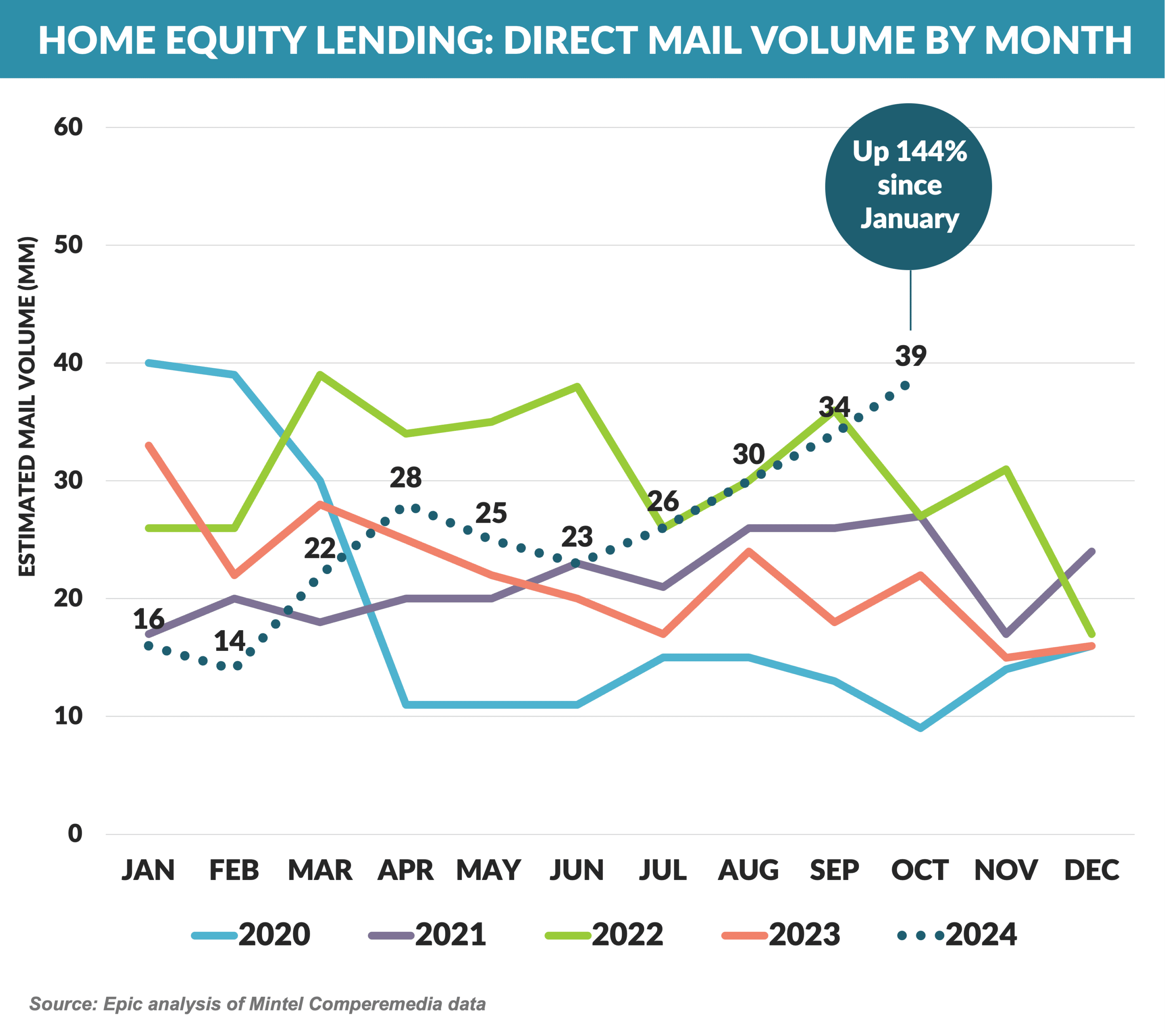

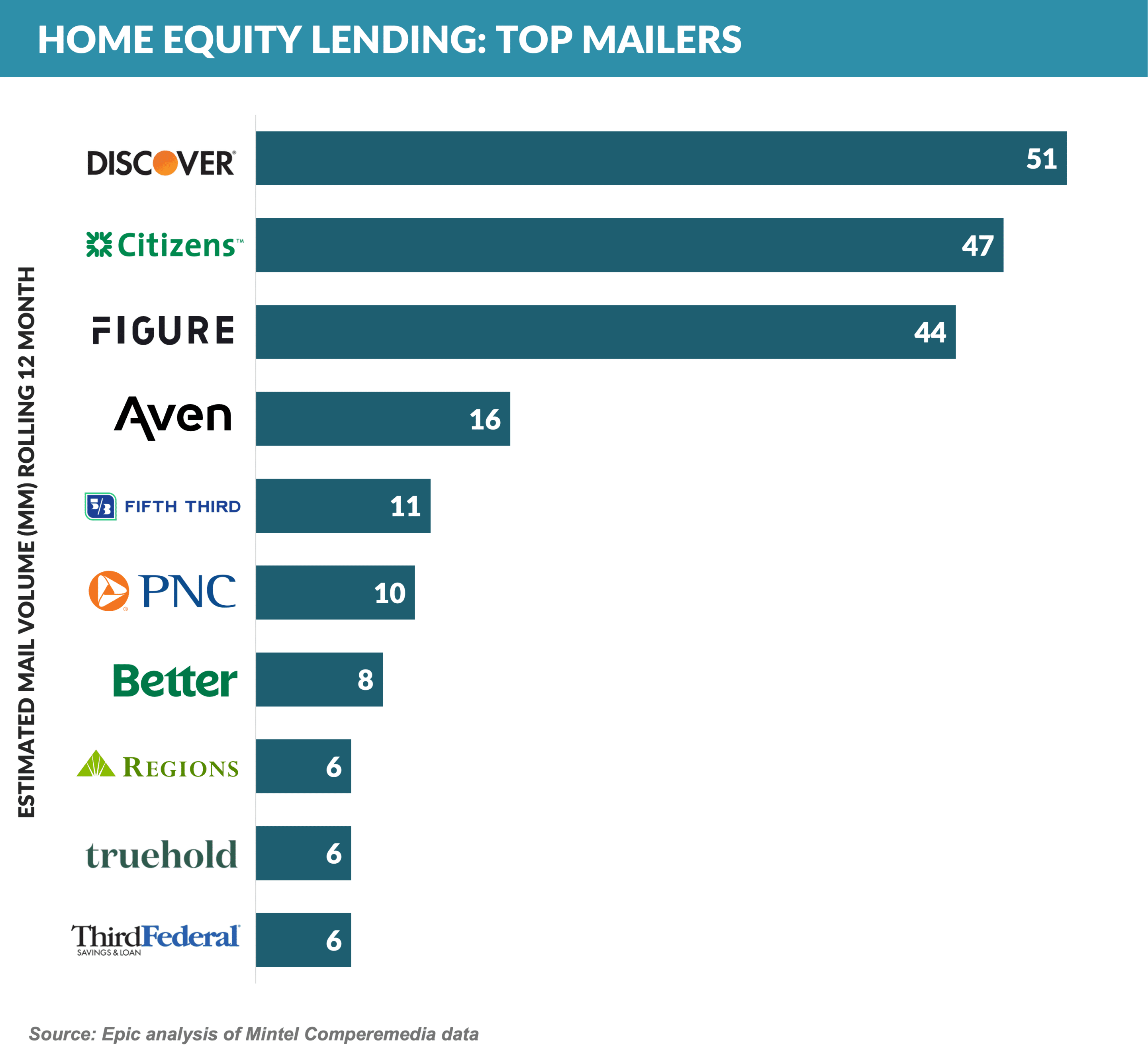

- Home Equity mail volume has risen dramatically – up 144% since January – with October mail volume higher than every October we have on record since 2009

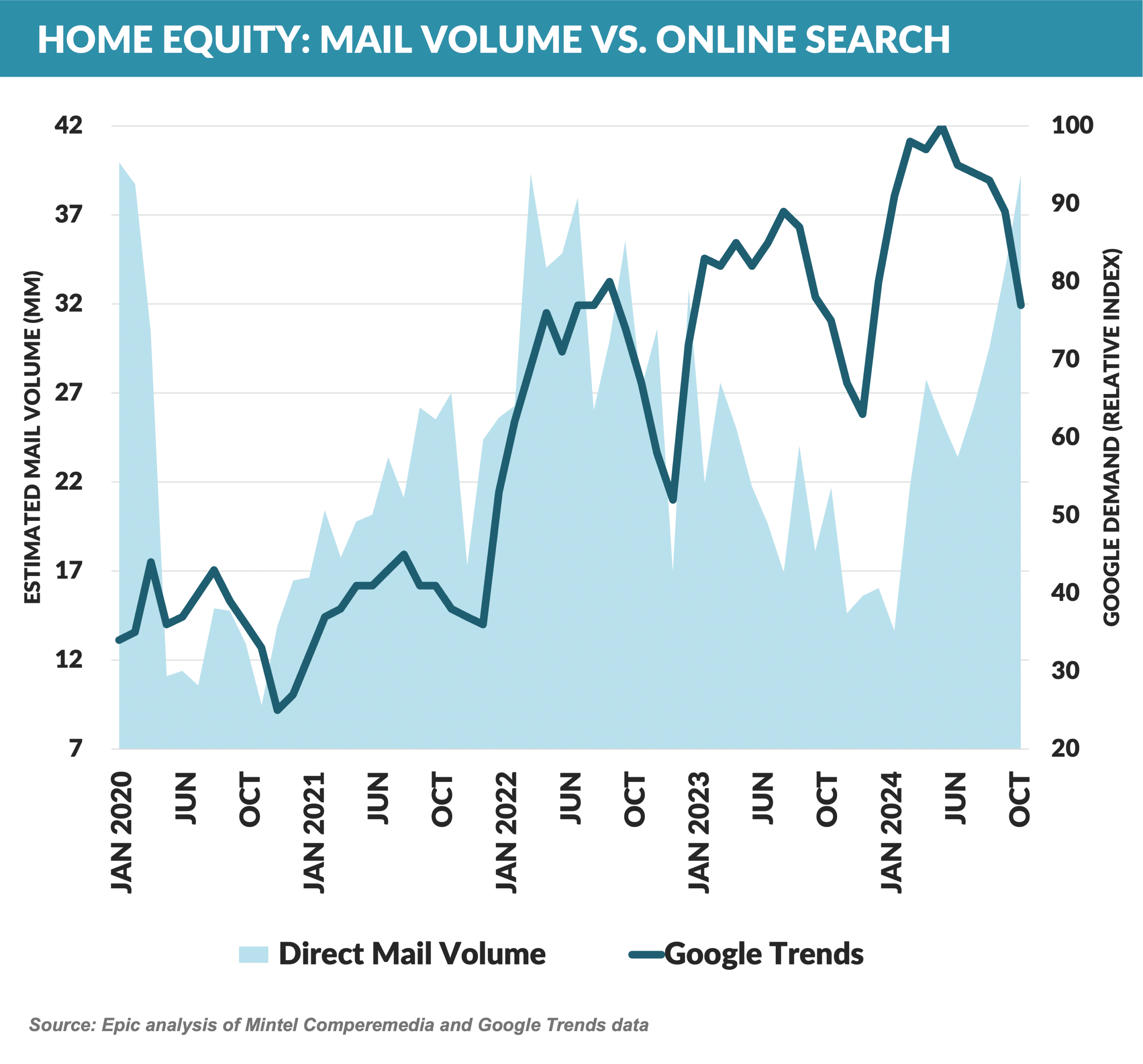

- Home equity “supply” (i.e., marketing offers) is finally catching up to “demand” as measured by Google searches for “home equity”

- The home equity market is dominated by Discover, Citizens, and Figure

- American Express was the top credit card mailer with both Platinum and Gold card solicitation volumes exceeding 15 million pieces – up 75% from the levels of last Spring

Citizens Financial – Consumer Banking Powerhouse!

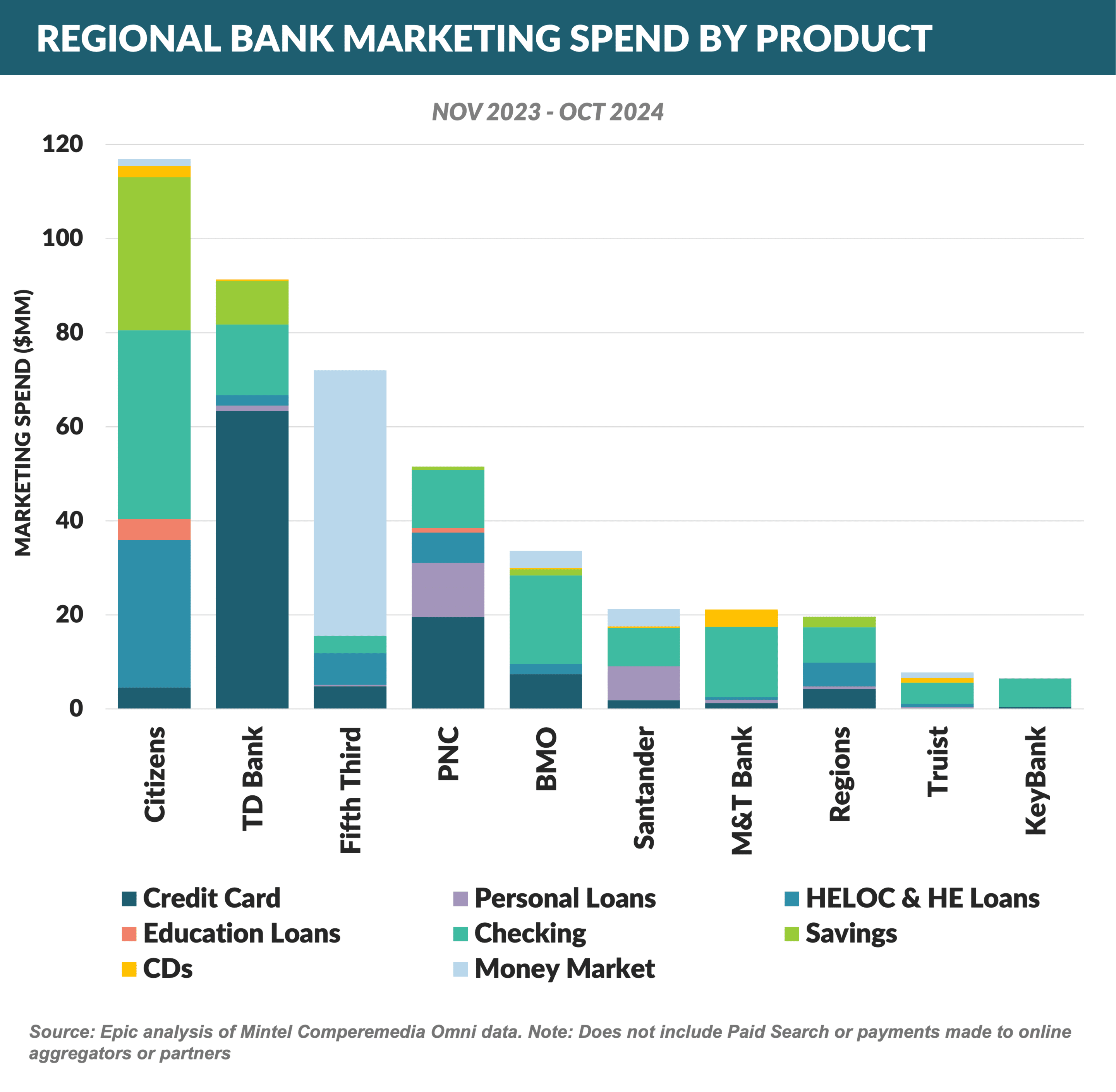

- Citizens Bank has a higher focus on consumer banking than most regional banks, consistently outspending their peers on new customer acquisition

- Citizens Financial Group was spun off from RBS in a 2014 IPO and, at $227 billion in assets, is the 18th largest US Bank with 1,100 branches

- Brendan Coughlin has been with Citizens for over 20 years and is Vice Chair and head of the Consumer Banking division

- He has led Citizens’ consumer banking initiatives, including the Apple iPhone Upgrade Program and industry-leading positions in HELOC, Student, and Education Refinance lending

- Brendan was recently named 2025 Board Chair for the Consumer Bankers Association

Q: What is behind Citizens’ success in growing the consumer banking business?

Citizens has always leaned more toward Consumer Banking compared to regional peers, making success in this area even more critical for us.

The game has shifted from just “branch density and convenience” to a more complex formula—blending technology, digital capabilities, national reach, brand strength, and a complete product suite. We’ve stayed ahead by recognizing this shift early, making bold moves, and building a platform that combines direct-to-consumer innovation with a high-performing physical network.

Since going public in 2014, we’ve focused on driving growth. We entered Private Student Lending as others exited, pioneered the U.S. student loan refinance market, and launched Citizens Pay with Apple, powering the iPhone Upgrade Program. In HELOC, we used data and analytics to transform originations, becoming a market leader. We strengthened our mortgage business with the 2017 Franklin American acquisition and launched Citizens Access, a digital bank that has added $10 billion in deposits.

Q: How do you compete successfully both nationally and regionally against the largest banks?

The money-center banks have clear strengths in brand, technology, and national reach. However, regional and super-regional banks often overlook their own advantages—adequate scale and greater agility compared to the top five U.S. banks. With ~4,700 banks in the U.S., FDIC data shows the top 25 gaining share while others fall behind. As a top-10 bank, we believe we have what it takes to win.

Success isn’t about copying money centers but differentiating in 1-2 segments where you excel. By innovating and delivering superior customer experiences, we’ve grown deposits 9% in Manhattan. Nationally, where branches aren’t practical, targeted strategies in life-stage products like high-yield savings, student loans, and mortgages enable meaningful customer partnerships.

Q: How do you see the banking landscape changing in the next five to ten years in terms of further consolidation and the role of fintechs?

While consolidation will continue, I don’t foresee a U.S. banking system with just 5-7 banks. Political and regulatory pressures will slow, though not stop, this trend. Scale matters, as younger consumers gravitate toward the top 25 banks, and advancements in technology favor larger institutions. Winning the deposit game at scale still requires a strong branch network alongside world-class digital CX, making it hard for some models to sustain momentum.

Fintechs, despite digital innovation, often lack strong funding, capital, and branch networks. Many struggle with profitability and face growing regulatory oversight. However, fintechs that partner with banks can thrive, driving innovation in the industry. Over the next decade, I expect U.S. banks to consolidate to ~3,500 in five years and ~2,500 in ten, maintaining a fragmented yet evolving landscape.

Q: What do you know now that you wish you had known when you started your career?

I have learned to push yourself way out of your comfort zone early in your career. The faster you can broaden out your experiences, the more effective you will likely be as a general manager to connect complex dots and have a bigger impact.

Q: Is it true that you met Tom Brady when you were both rookies?

Well, I am not sure I would fare all that well getting hit by a 250 lb middle linebacker as a rookie on the Patriots – especially these days with no offensive line! But I did work for the Patriots in college when Drew Bledsoe was the quarterback and Tom was the backup. My job was on the marketing team helping to run the gameday experience. I ran the flag across the field when they scored a TD, managed both the punt/pass/throw halftime experience and the pizza delivery of the game on the jumbotron. Let’s just say those things are not as random as you would hope and many of my college friends were the recipients of a free pizza on the big screen.

- The American AAdvantage credit card will be issued only by Citi beginning in 2025

- American has been unique among airline cobrands in having two issuers, following the merger of US Airways – whose card was issued by Barclays – and American Airlines – who first issued a card with Citi in 1987

- American will acquire the existing Barclays cards creating a combined portfolio of over $30 billion – a size only a handful of banks could absorb due to concentration issues

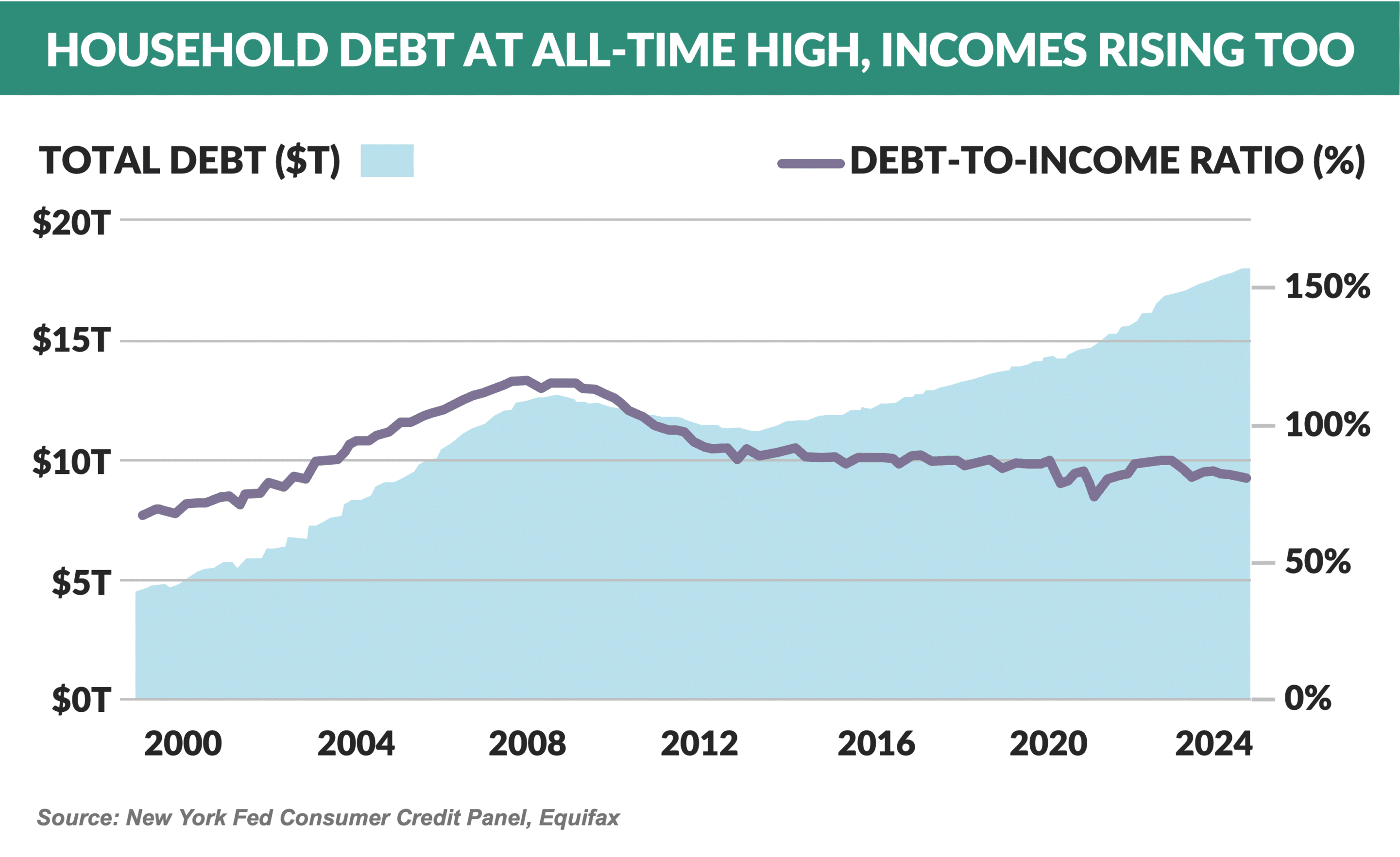

- The ubiquitous headlines about rising consumer debt generally leave out minor factors such as inflation; however, this chart adds some needed perspective about consumer debt to income levels

- Ally is reported to be considering the sale of its credit card business

- Ally entered the credit card segment in 2021 via the $750 million purchase of start up near prime card issuer Fair Square

- The report follows the September comments from Ally’s CFO that their borrowers “have been struggling with the cost of living and now are struggling with an employment picture that’s worse”

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in January.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.