Three Things We’re Hearing

- Fintechs dominate personal loans

- Consumers respond to higher interest rates

- Direct mail volume higher than pre-pandemic levels

A three-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Fintechs Dominate Personal Loans

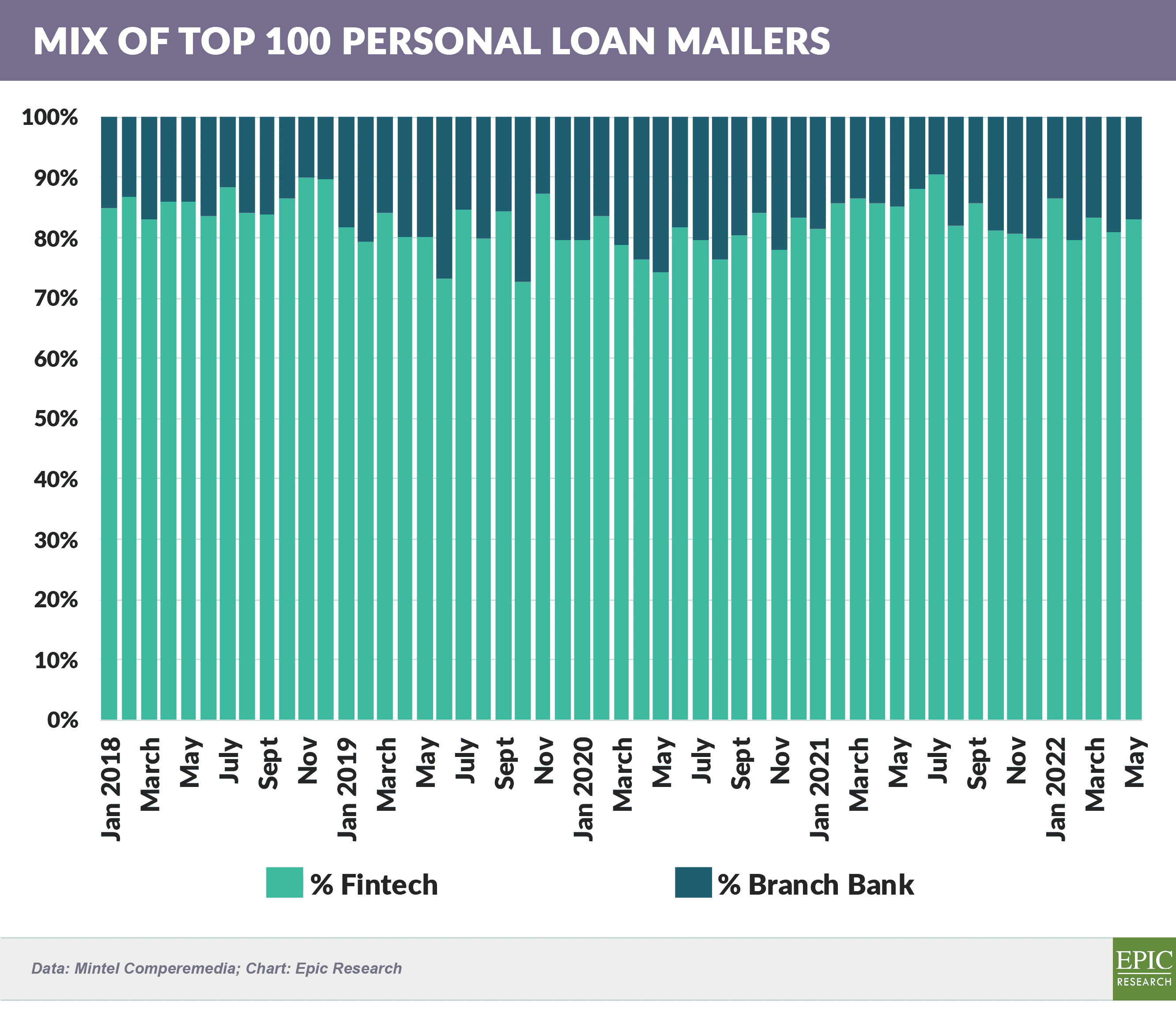

- As mentioned in previous Epic Reports, the personal loan business has become dominated by monolines and fintechs – defined here as lenders without branches

- Since 2018, fintechs have consistently accounted for 70% – 85% of direct mail offers

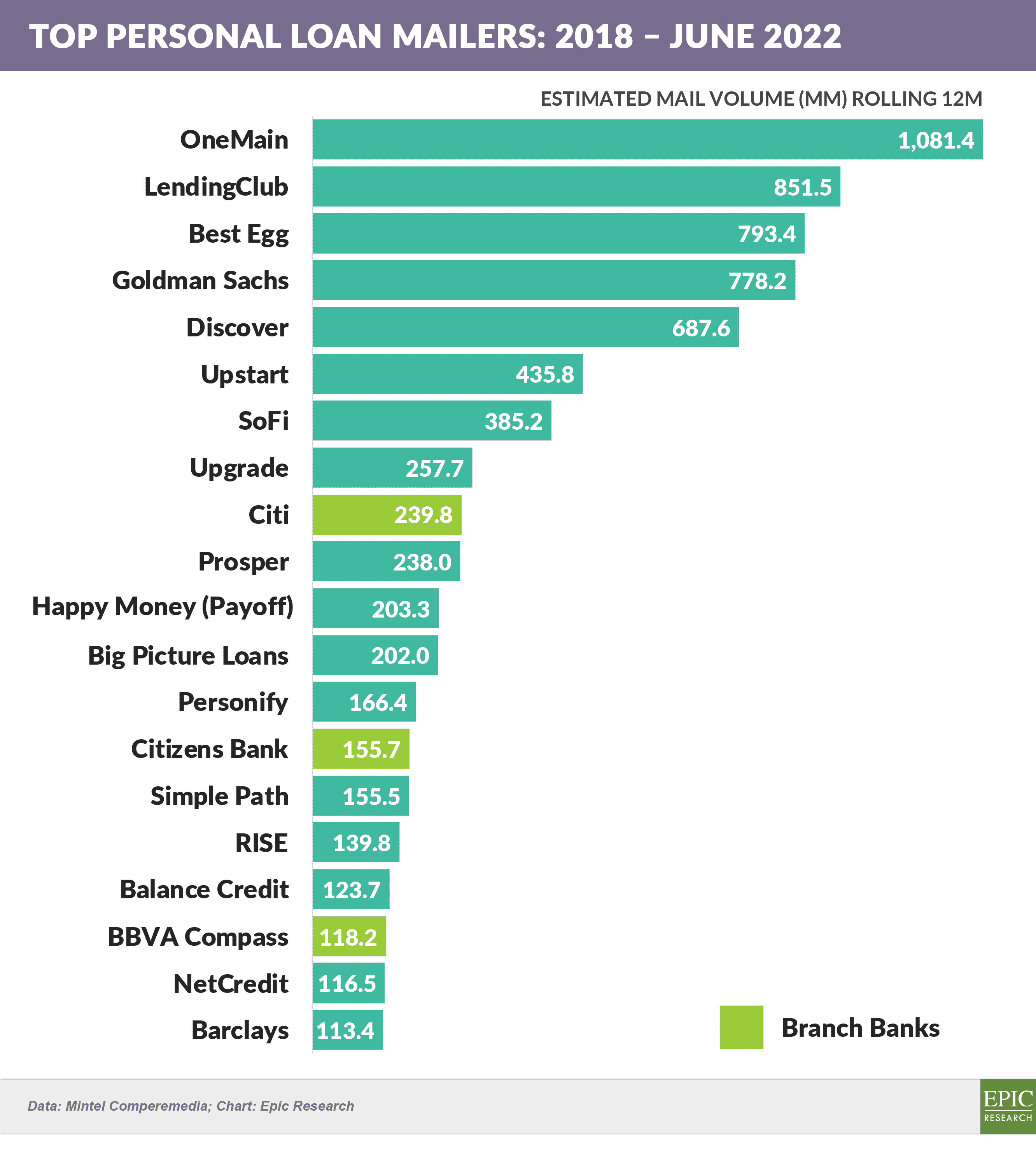

- Only three of the top mailers in the past five years are “traditional” retail banks with branches

- Two of the three branch-bank top mailers, BBVA Compass (acquired by PNC) and Citizens, have not been in the mail during the past year, and many of the top fintech mailers are not household names

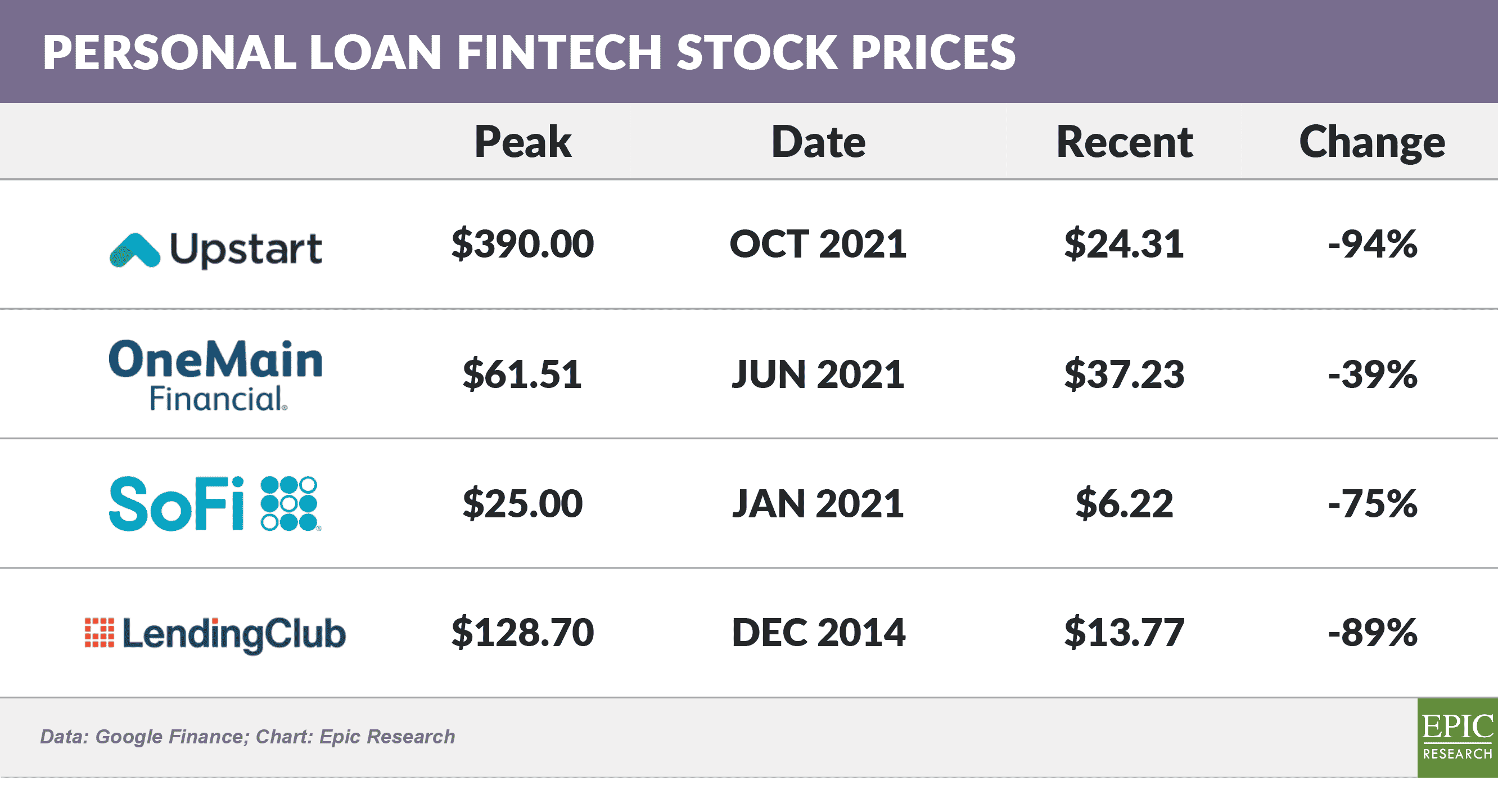

- Once lofty valuations have fallen back to earth, with some publicly traded fintech stocks down 39% - 94% from their peaks, and some privately held companies struggling to raise money at previous levels

- Less is known about privately held lenders; however, some, such as Best Egg, have experienced sustained growth with large rounds of capital infusions:

- Other privately held subprime players continue to invest significant marketing dollars:

- Personify Financial – online lender owned by Applied Data Finance, offers personal loans in 25 states for subprime borrowers with interest rates up to 199.99% APR

- Big Picture Loans – formed by the Lac Vieux Desert Band of Lake Superior Chippewa Indians in Michigan, operates pursuant to tribal lending laws and offers loans up to $5,000 with an APR range of 35% to 699%

- Happy Money (formerly Payoff) – offers its Payoff Loan for credit card consolidation with fixed rates between 5.99% and 24.99% to consumers with a 600 minimum FICO score

- Pure play lenders have advantages over commercial banks due to their focus on one product, however the extremely favorable funding and credit environment of the past 10+ years is returning to “normal,” and only those lenders showing profitability, good credit quality, and access to tighter funding markets will emerge as winners

Consumers Respond to Higher Interest Rates

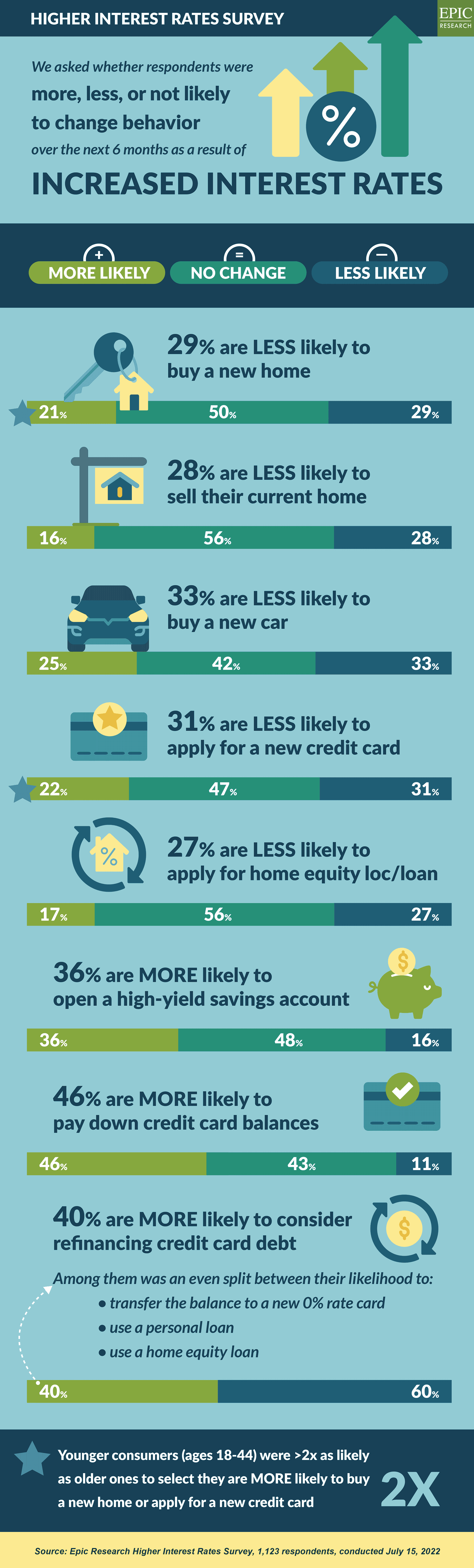

- Epic surveyed 1,123 U.S. consumers regarding the effect of higher interest rates on their financial behaviors

- The results showed an expected hesitancy towards making major purchases, such as a new home or car

- The respondents were also generally cautious about taking out new loans, and were more likely to open a high yield savings account and to pay down credit cards and take new loans to refinance their credit card debt

Direct Mail Volume Higher than Pre-Pandemic

- All product categories we track have YTD mail volumes that are higher than the same period last year

- Checking and HELOC still lag 2019 mail volume, with card, personal loans, education refinance, and in-school student loans all running above pre-pandemic levels

- Other than education refinance, cost per click rates increased across the board the last few months

Quick Takes

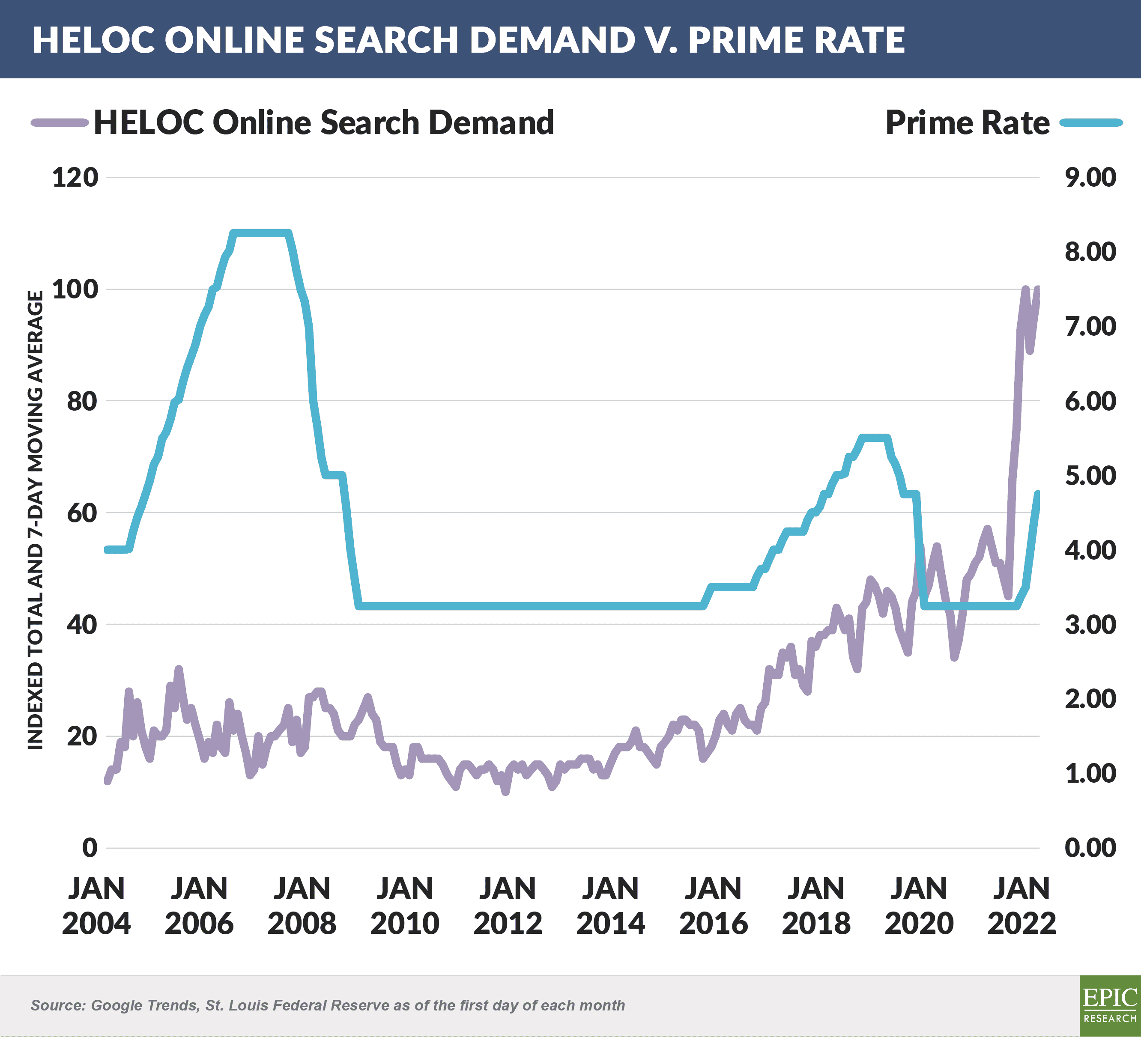

- Online demand for home equity lines of credit (HELOCs), having remained relatively consistent for the past several years, has doubled since the beginning of the year, likely due to the rise in first mortgage interest rates and the increase in home equity seen during the pandemic-era spike in home values

- HELOC demand has historically not correlated with interest rates

- Wells Fargo is launching the Autograph Card, which offers 3X points on top spending categories for everyday living and day-off adventures, including restaurants, travel, gas stations, transit, popular streaming services, and phone plans

- We have done many product, offer, and creative tests over the past three decades and like to highlight some of the more interesting results, this blast from the past illustrates that sometimes the more things change, the more they stay the same!

- In the early ’90s, we were one of the first card issuers to offer “introductory rates”

- We started with a 5.9% introductory rate on a card that went to 16.9% after six months, and response rates doubled from the straight 16.9% offer

- In tandem with the intro rates, we began offering the option of transferring balances from other issuers, which dramatically increased the average balance for a new card

- Following this success, we tested various intro rate offers – 2.9%, 3.9%, 4.9% – as well as the duration of the introductory rate – 3 months, 6 months, 9 months – with notable response differences at each level

- The most interesting result came when we tested an offer of “0% for 18 months” against a stated expiration date (e.g., “0% until July 31st”), which provided only 15 months of the 0% intro rate

- The shorter, stated expiration date offer resulted in no meaningful decrease in response compared to the “18 months” offer, saving us three months’ worth of lost finance charges

- Try it!

The Epic Report is published monthly, with the next issue publishing on September 10th.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.