Three Things We’re Hearing

- Epic Predictions!!!

- Shake up in 2023 personal loan market!

- Cobrand card offers becoming less prevalent

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Epic Predictions!!!

2023 Prediction Review

- This time of year, everyone else likes to make predictions and why not? We’ll start with our review of last January’s predictions for 2023

- Our first 2023 prediction was “At least one large bank CEO will announce their departure,” reasoning, without any inside information, that it had been a while since a top job has turned over and we were due

Although Discover and PayPal each lost their CEO this year, I guess we technically missed this one as neither company is known as a “large bank,” but we’ll take half credit as they represent two large financial services companies (and Discover has a bank!)

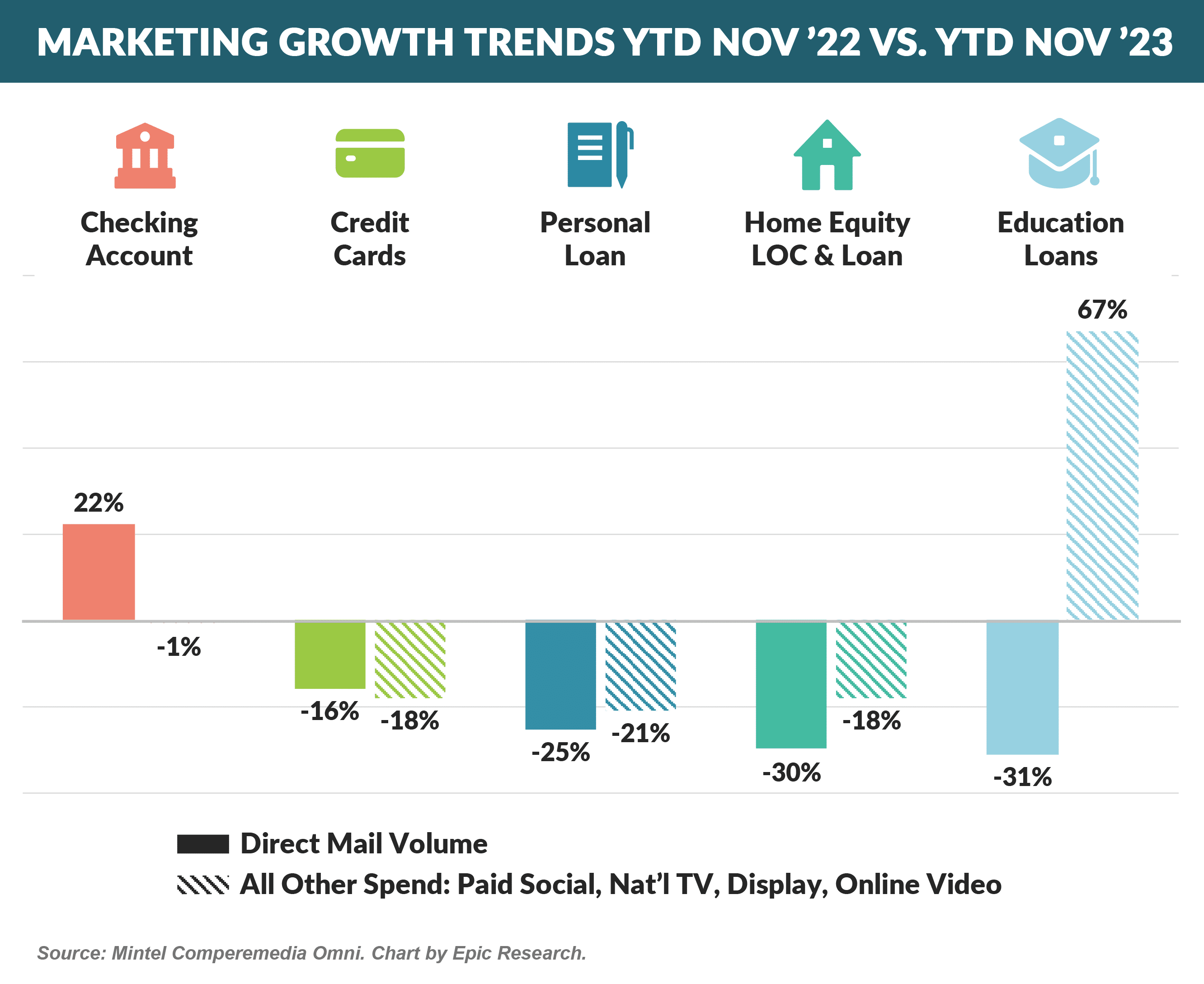

- “Credit card mail volume will outperform other lending products, and 2023 mail volume will be higher than 2022”

Credit card mail volume did outperform other lending products in 2023. However, through November 2023, volume was actually 16% below that of 2022

- At least one BNPL issuer will blow up – this has become a perennial prediction based upon the bad underlying fundamentals of high funding costs, competition, and potentially high credit losses

As far as we know, there was no BNPL explosion in 2023, and companies such as Affirm (which lost $707.4 million in 2022) and Klarna ($1 billion 2022 loss) continue to grow, so we’ll put this one to rest for a year (even though we still wouldn’t want to be involved in a monoline BNPL operation!)

- We will share our predictions for 2024 in the February Epic Report

Shake Up in 2023 Personal Loan Market!

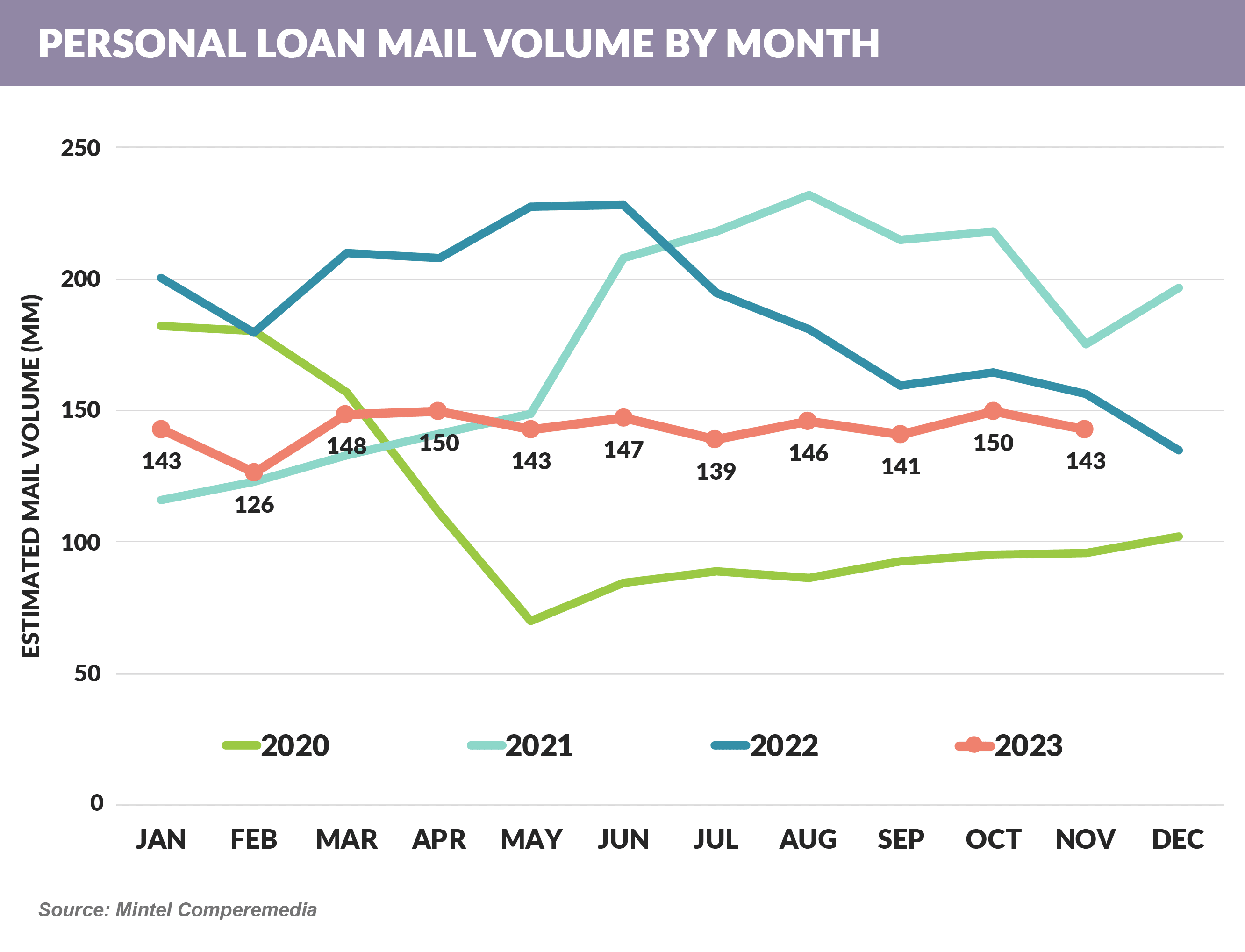

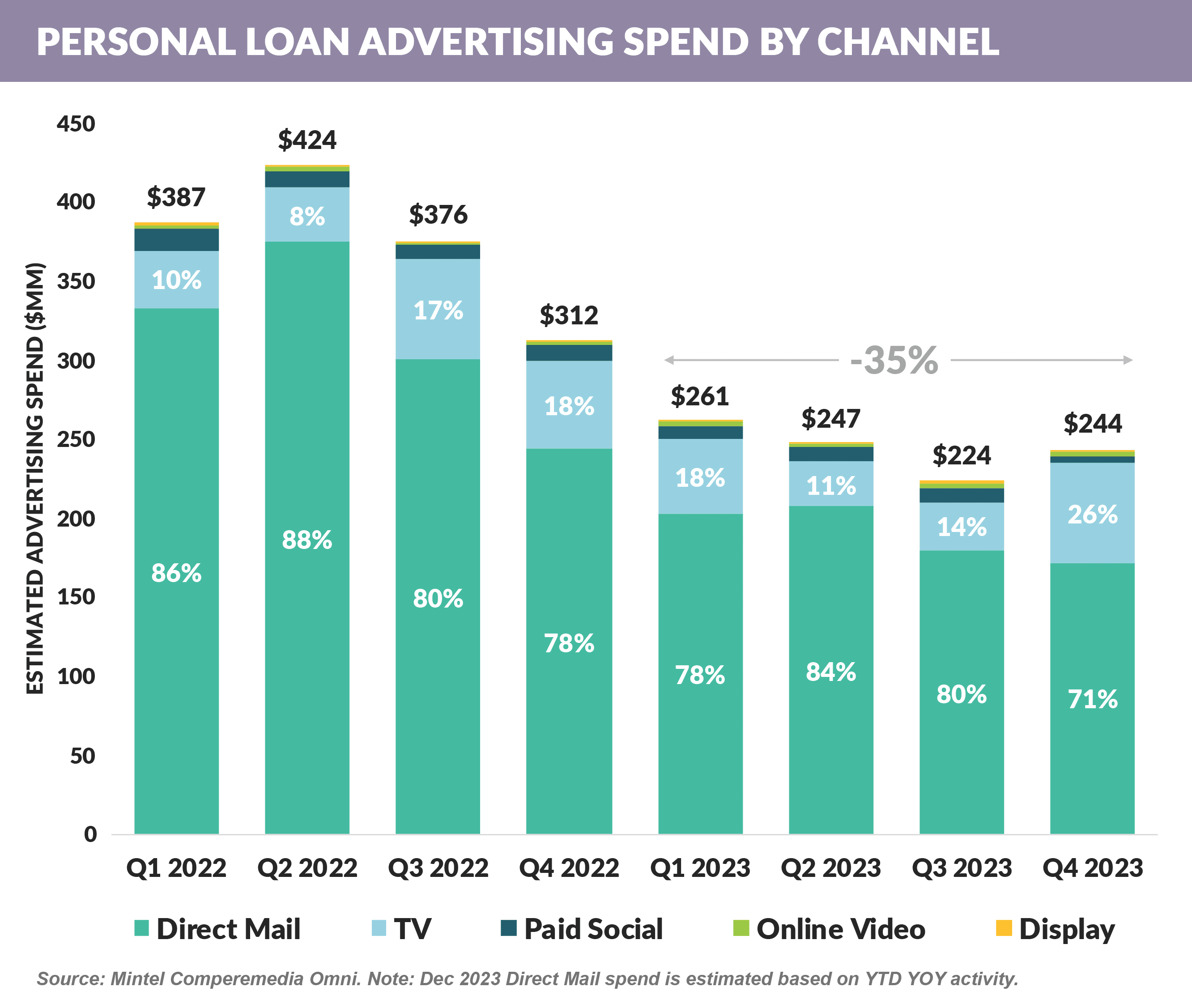

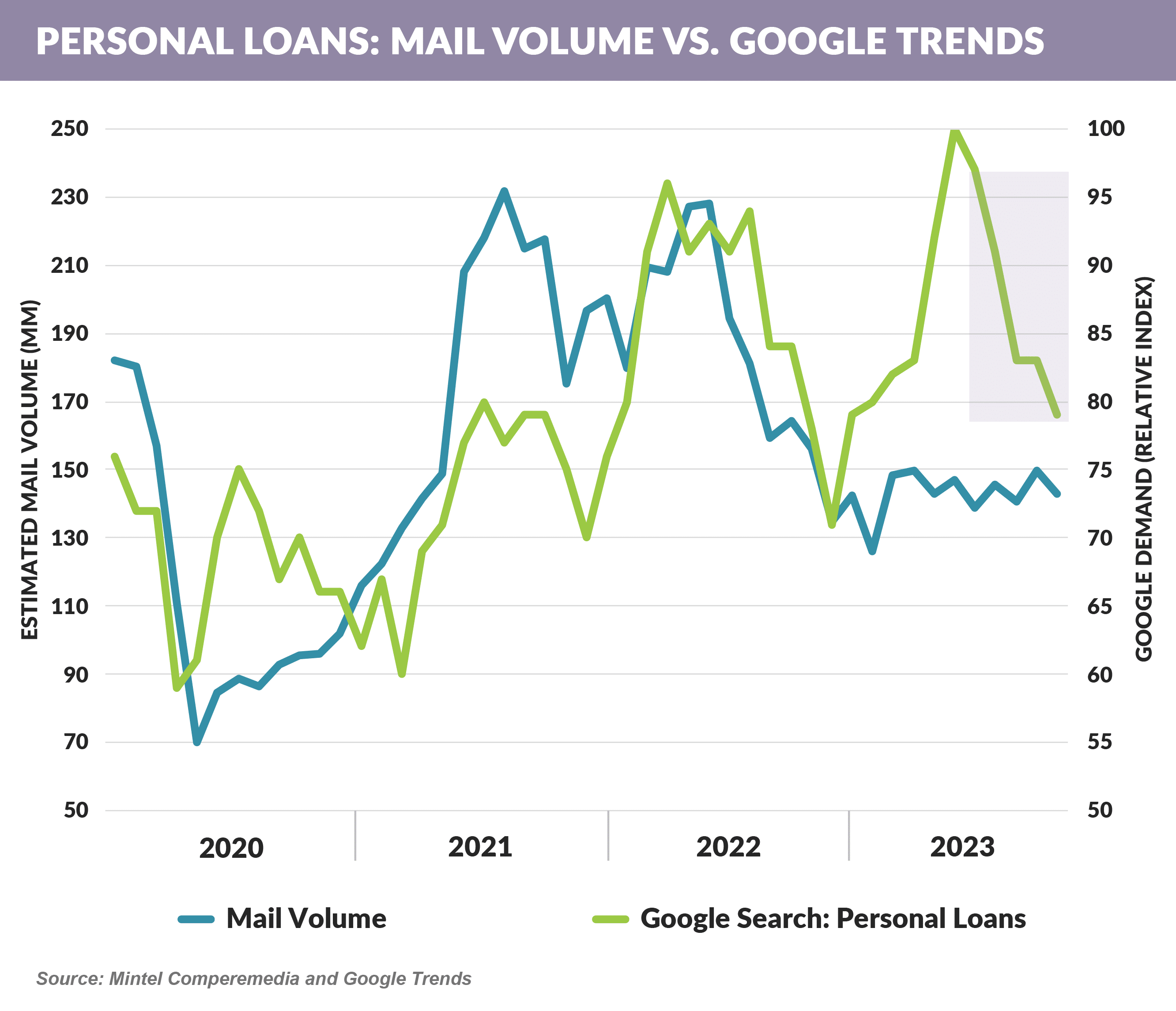

- 2023 personal loan marketing activity was significantly lower than the prior two years

- YTD November ’23, personal loan mail volume was 25% lower than the same period in 2022 – the lowest level since pandemic-impacted 2020

- And spending for all acquisition channels was down 35%

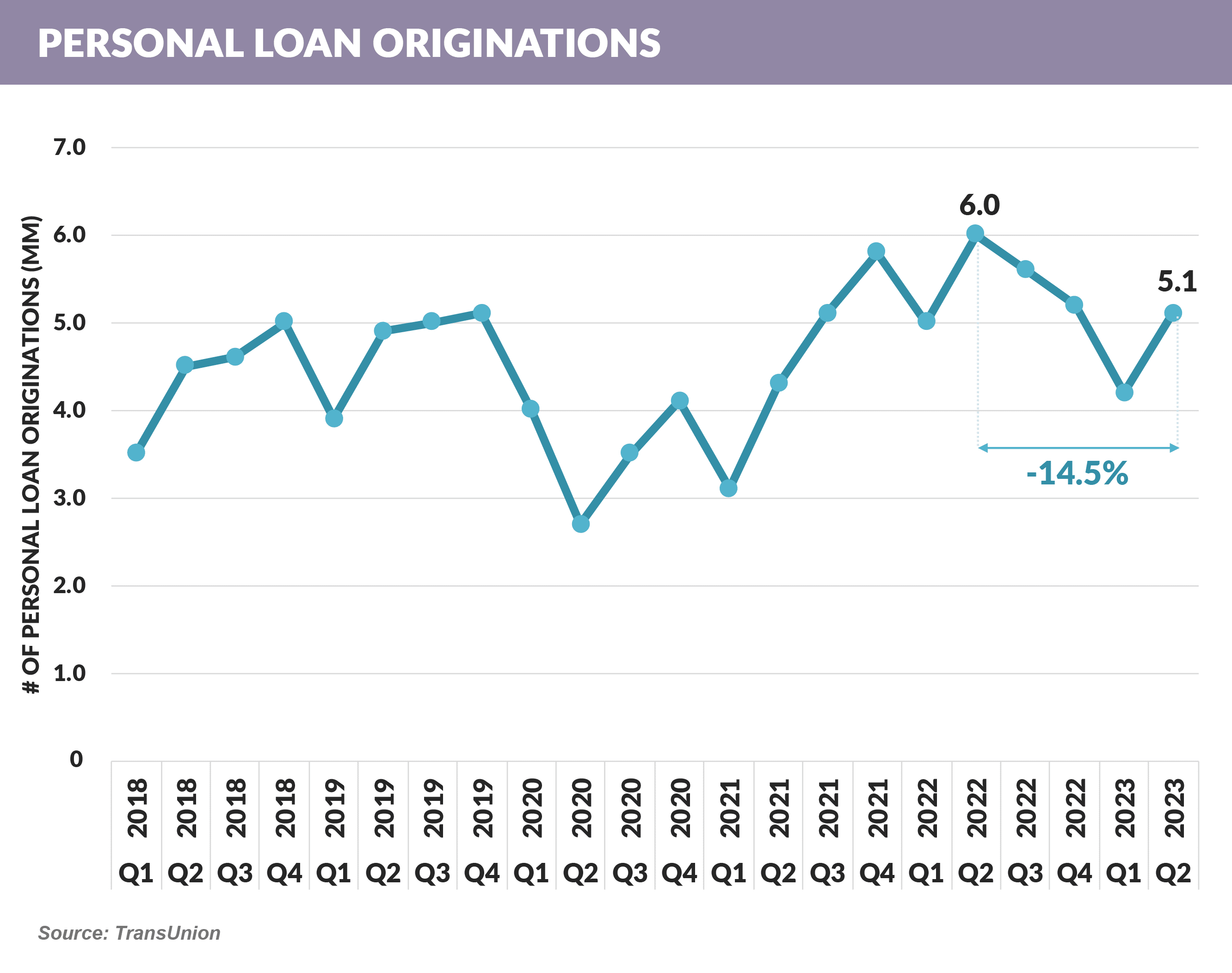

- Consequently, new loan originations were down 14.5%

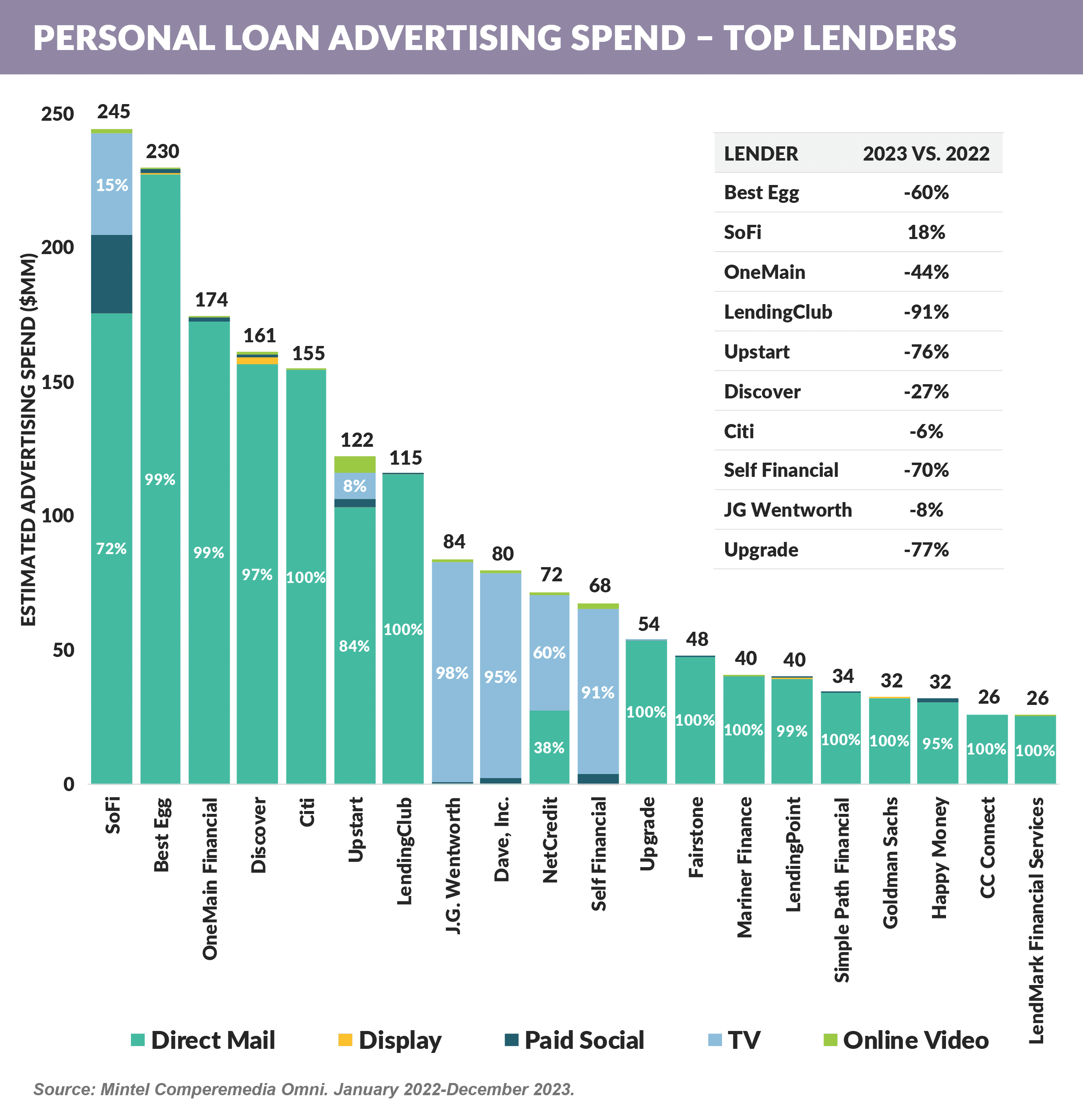

- There was quite a bit of movement amongst the top advertisers

- Number one mailer SoFi obtained a bank charter in 2022 and showed the biggest jump in personal loan mail volume – up 38% year-over-year

- All other 2022 top mailers had lower volume in 2023 with the largest year-over-year drops coming from Lending Club (91%), Upstart (76%), and Best Egg (60%)

- Other than Citi (2nd largest), Discover (3rd), and Santander (11th), the top 20 mailer list is once again dominated by FinTechs and finance companies

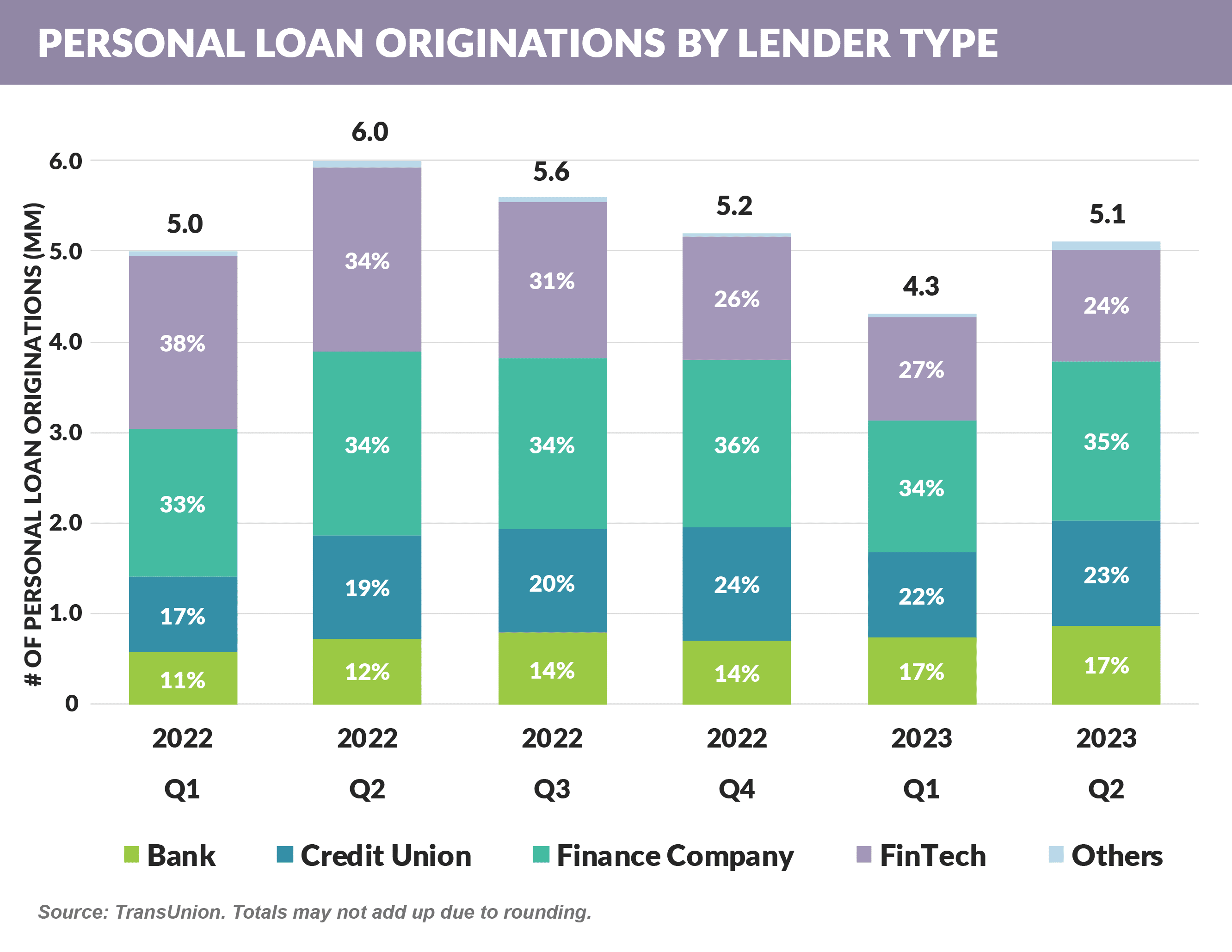

- Despite the dominance of FinTechs in direct mail, their share of new originations in Q2 dropped to 24.2% from 30.7% a year earlier, and FinTech’s share of originations remains lower than the shares of finance companies and is almost on par with the share of credit unions

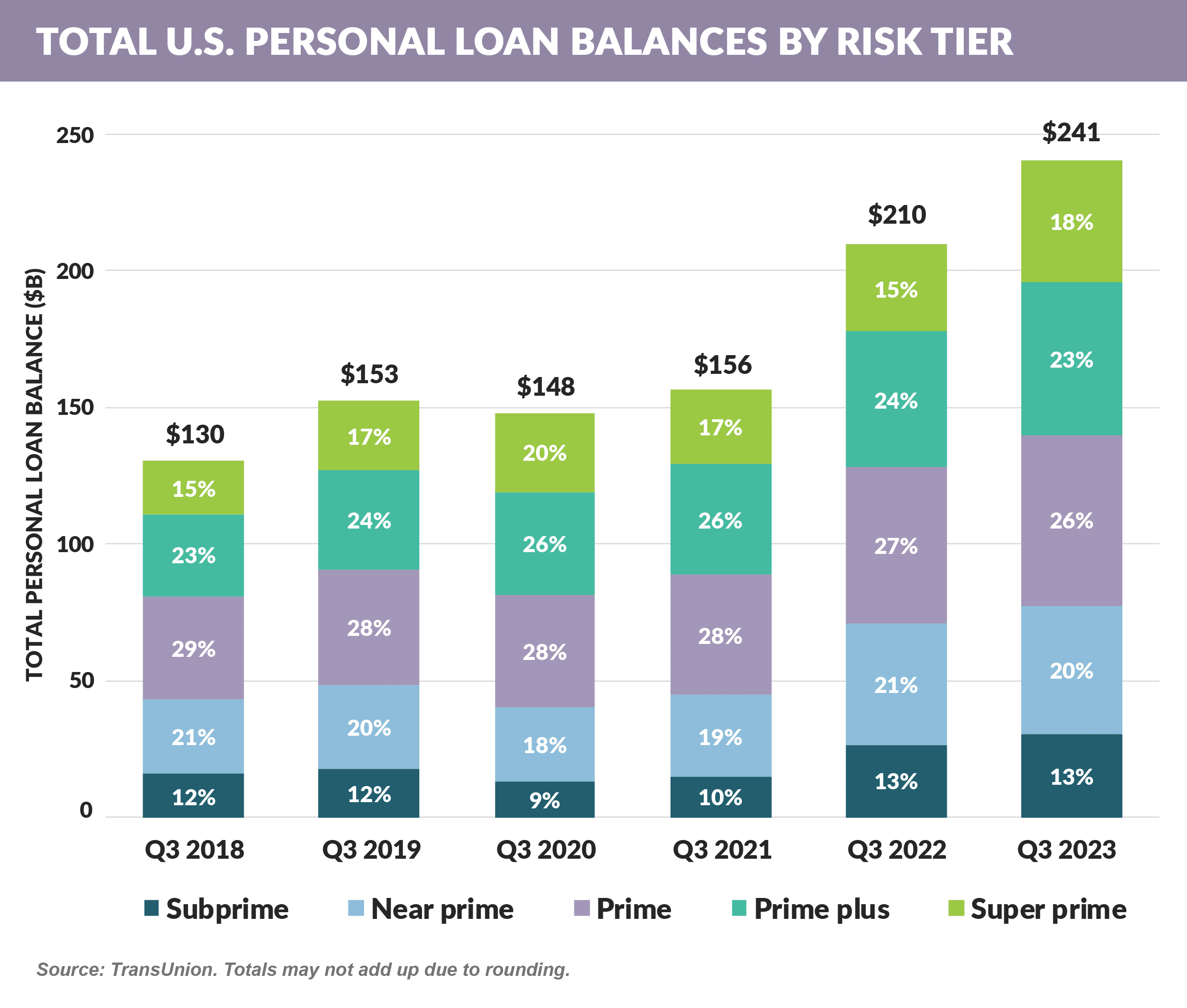

- Even with lower advertising volume, personal loan balances grew 21% year-over-year in Q3 2023 with near- and sub-prime loans accounting for just under a third of total balances

- Online search traffic for personal loans was up earlier in 2023 before declining in Q3, revealing a disconnect with lower marketing volumes

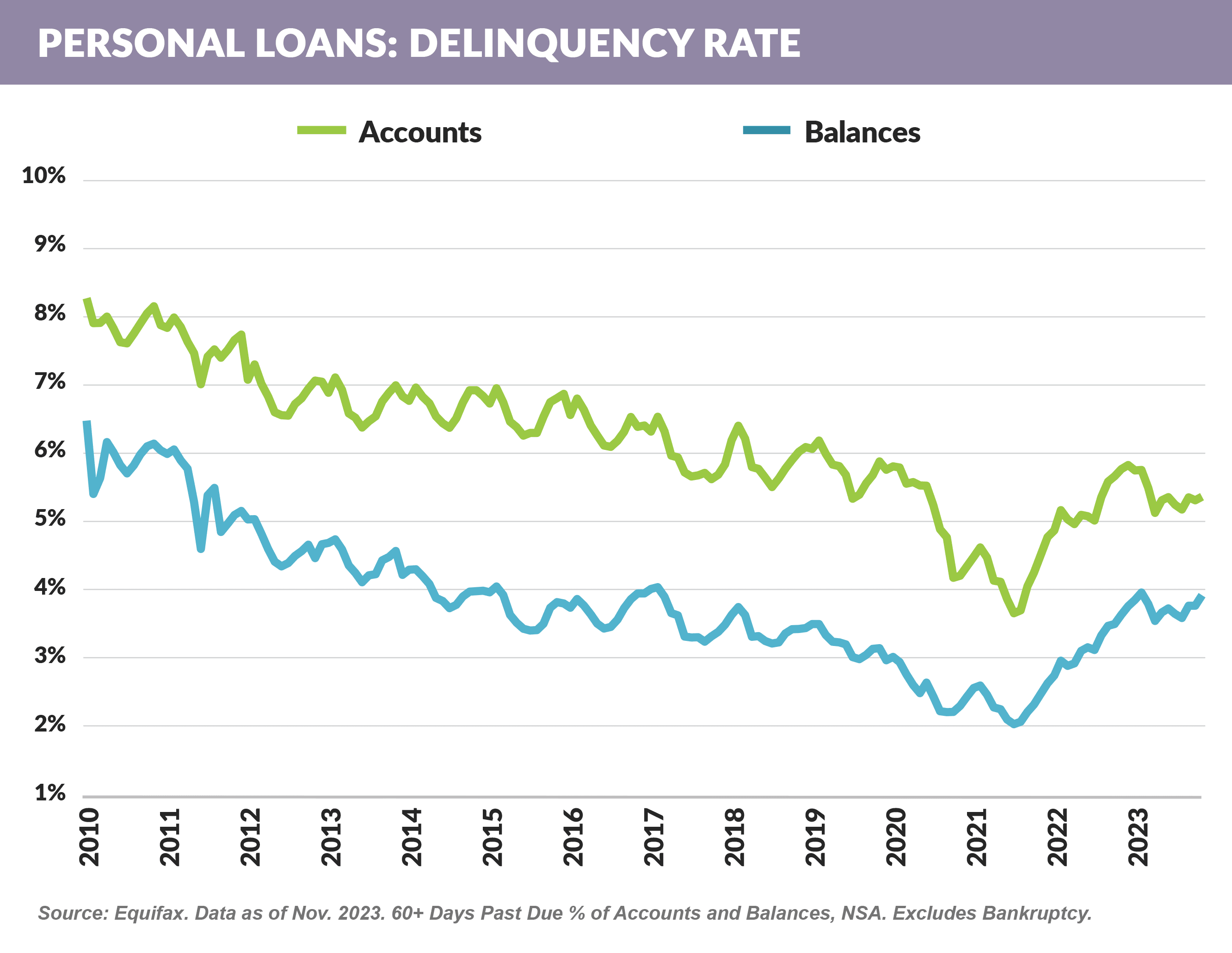

- And rising 2023 personal loan delinquencies – which finally reached pre-pandemic levels – combined with higher interest rates resulted in margin and funding pressures on non-depository lenders

Our Takeaways

- Despite higher interest rates, there remains a favorable interest rate arbitrage for consumers looking to refinance mid-20% credit card loans to rates in the low- to mid-teens on personal loans

- Commercial banks have yet to step in to take advantage of this opportunity

Cobrand Card Offers Becoming Less Prevalent in the Mail

- 2023 YTD November advertising spending on all acquisition channels for credit card, personal loan, and home equity products is ~20% below the same period in 2022

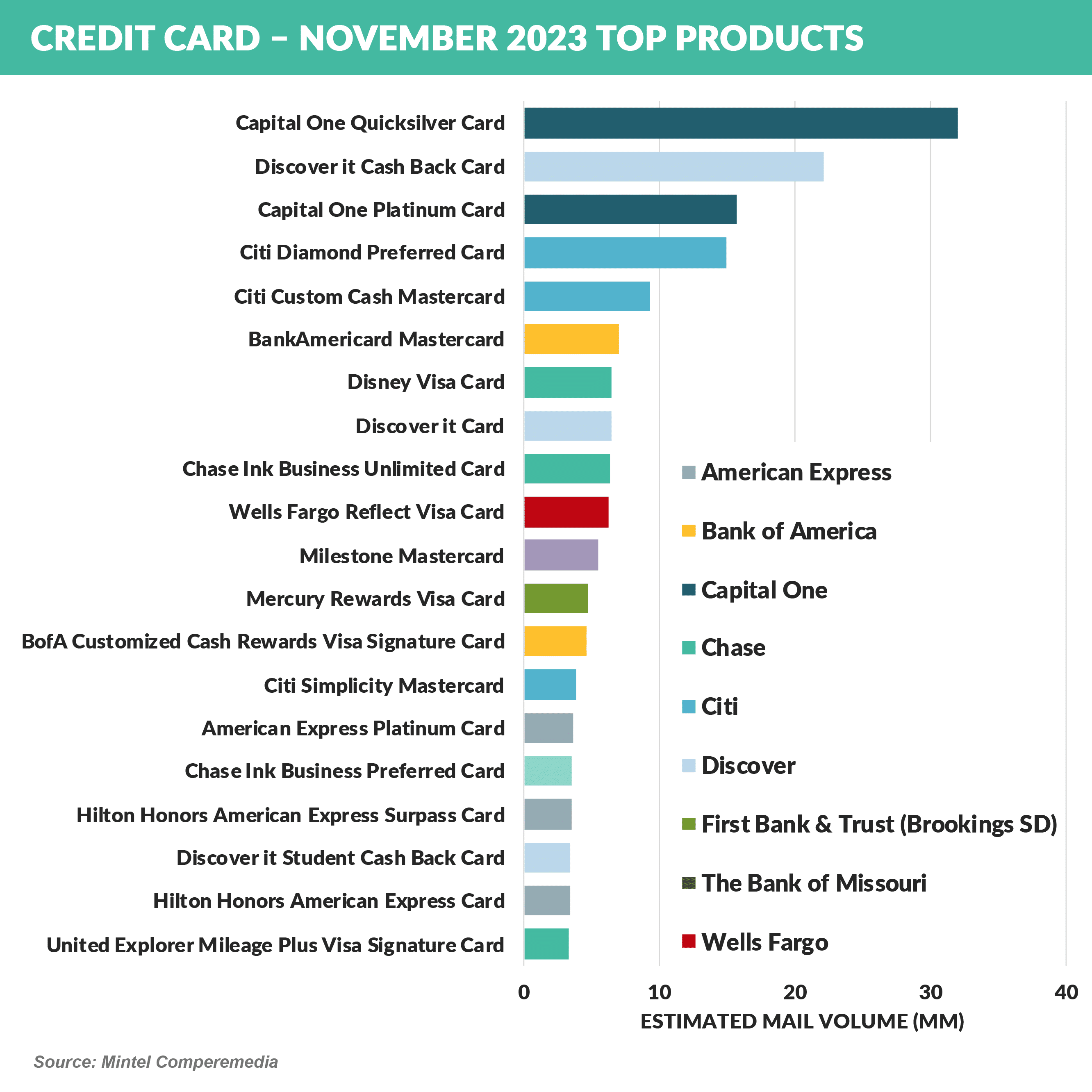

- Largest card mailer Capital One focused primarily on two products with Quicksilver (cash back) accounting for 56% of their mail volume and Capital One Platinum (credit builder) adding 27%

- There were no cobrand rewards cards among the top 10 products mailed, and only three – Delta, Disney, and Southwest – in the top 20 products mailed

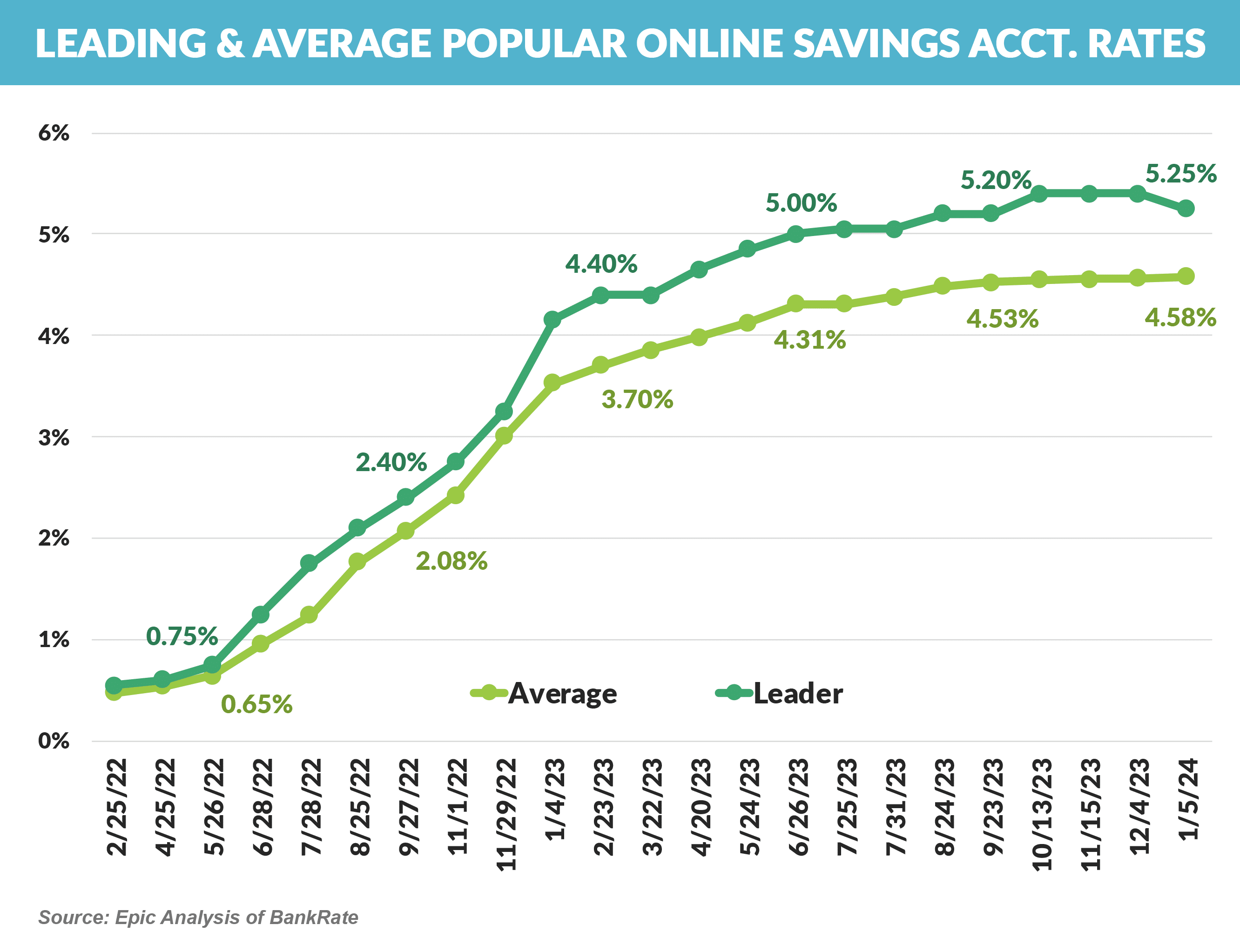

- Deposit product advertising volume remained at an elevated level; however, rates have finally plateaued, with the top offered rate dropping for the first time in years

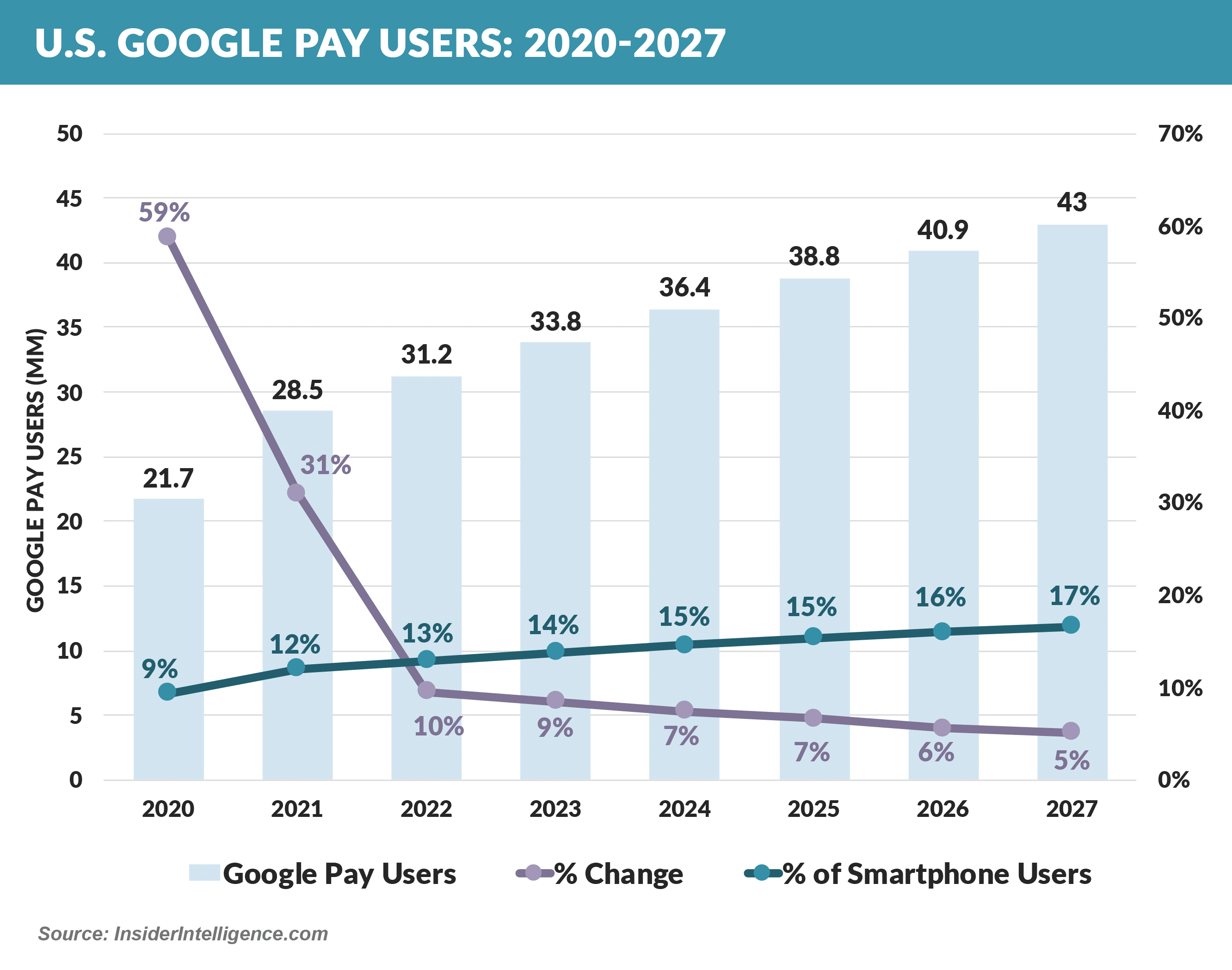

- Google Pay has added BNPL to its wallet, partnering with Affirm and Zip

- Most major wallets such as those offered by Pay Pal, Apple Pay, Amazon Pay, and Shop Pay already offer BNPL

- Business Insider projects Google Pay to grow faster than the mobile wallets from Apple, Google, and Samsung

- Upgrade has launched the Secured OneCard, which offers cash back on card spending and high yields on the deposits used to secure the card

- The Secured OneCard will also include a “graduation” mechanism that automatically elevates users to the unsecured version as certain criteria are met

- The new secured card joins an already competitive market for “credit builder” cards

- The CFPB reported that college-sponsored financial accounts such as credit cards and deposit accounts often come with higher costs than typical market products

- Many colleges offer sponsored and co-branded financial products to students and alumni, such as deposit accounts, credit cards, and prepaid cards

- The CFPB notes that “Schools should take a hard look at the fees and terms of the products they pitch to their students and alumni”

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on February 10th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.