Three Things We’re Hearing

- Reward category tiers rule!

- Epic predictions!

- Chase dominates DDA mailing

A four-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Reward Category Tiers Rule!

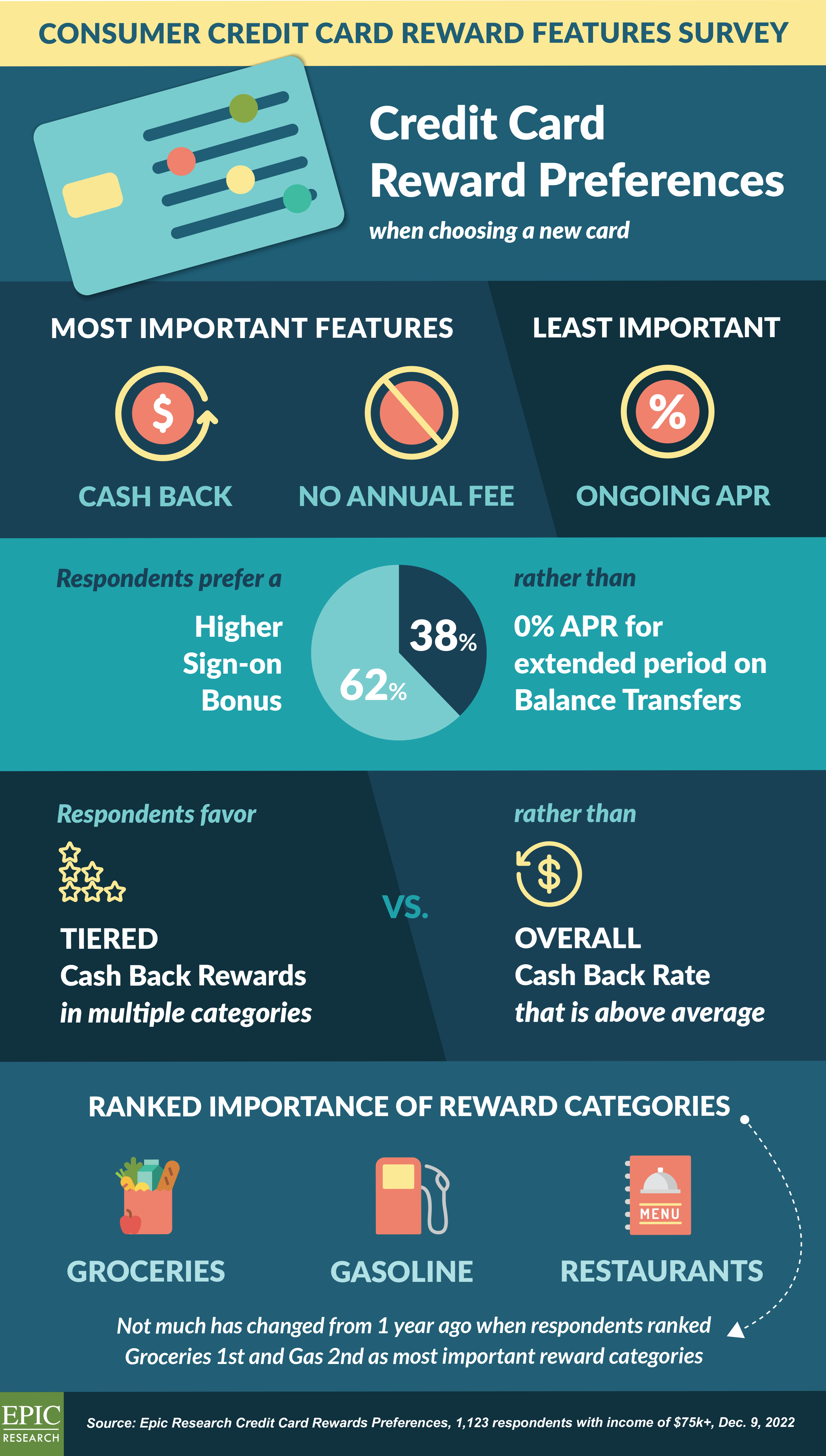

- Epic surveyed 1,123 consumers regarding their credit card rewards preferences, revealing consumers favor rewards programs with tiered cash back rewards in multiple categories

Epic Predictions!

- Before we dive into 2023, let’s first review our 2022 predictions from the January 2022 Epic Report

- We first predicted that “several retail banks will enter the personal loan market”

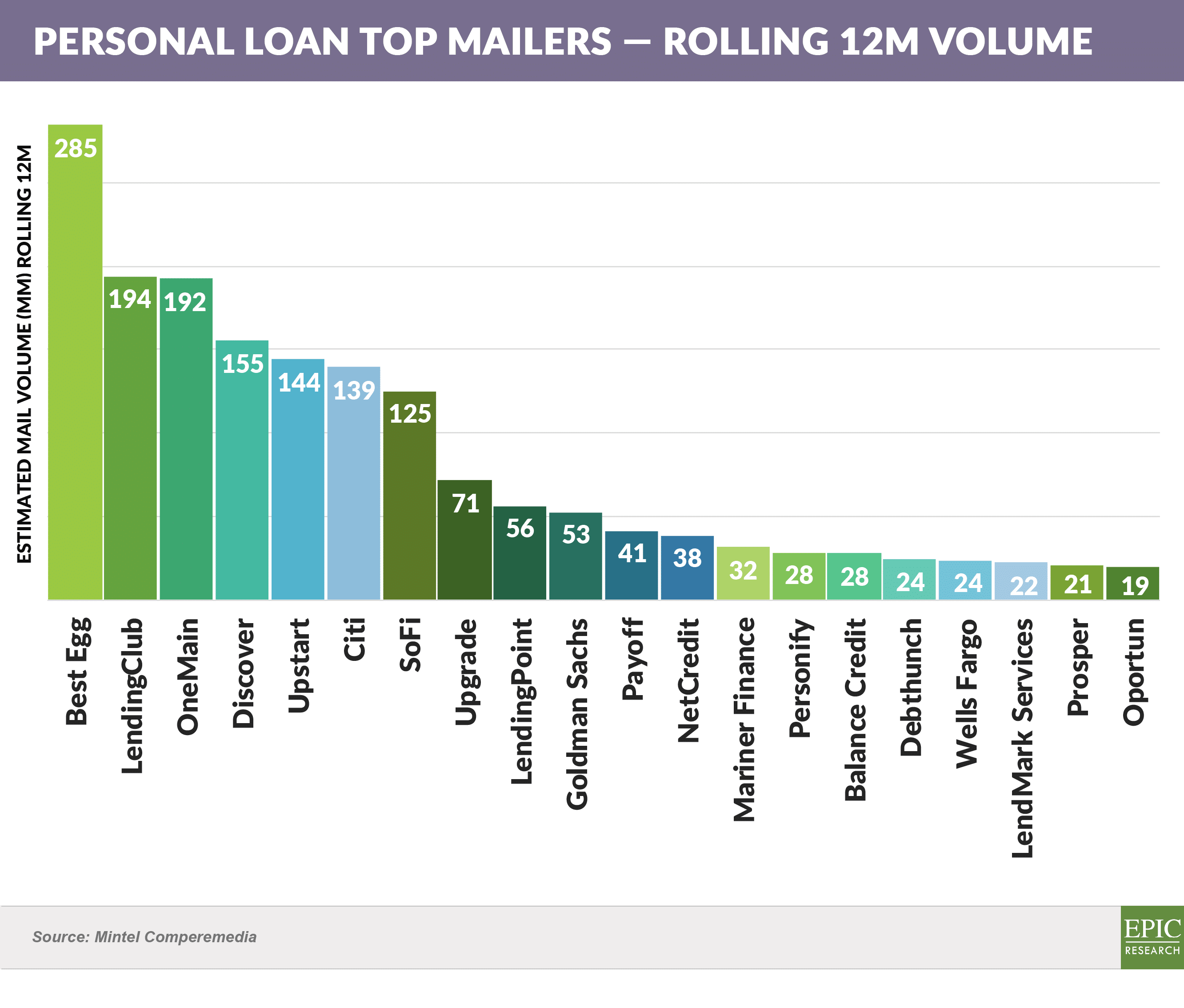

- It seems like every issue of The Epic Report laments the absence of retail banks among the top 20 mailers

- Retail banks have at least two significant advantages over fintechs:

- 1. well recognized brands thanks to large media budgets, branch presence, and length of time in the market; and

- 2. access to less expensive and more stable deposit funding than the wholesale-funded fintechs

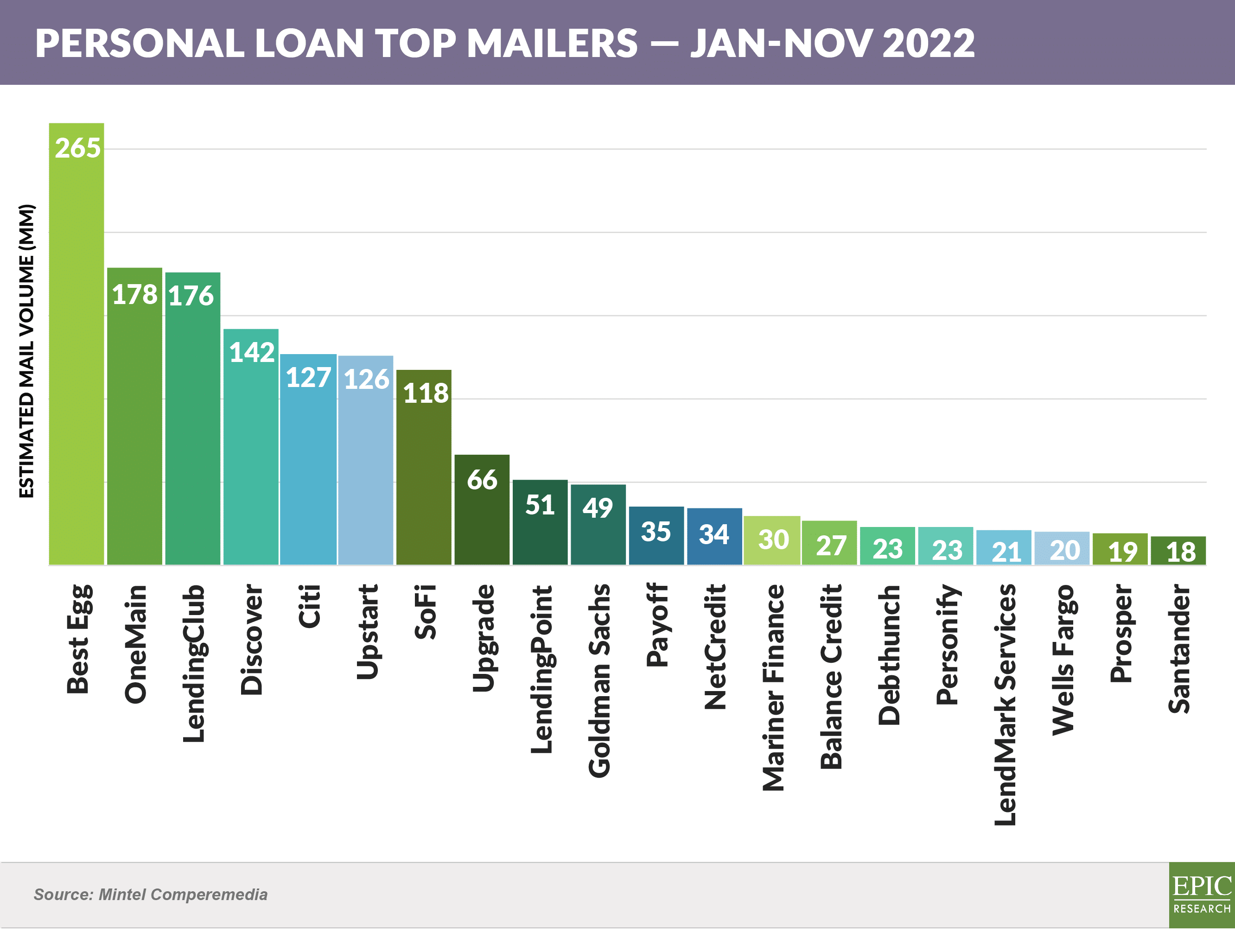

- Despite these advantages, fintechs dominated the top 20 personal loan mailers in 2021, with only Citi and Wells Fargo appearing among the top 25 mailers

- As for our 2022 prediction, we were early (meaning wrong, so far)

- Citi doubled its ’21 volume in ’22 and is the fifth largest mailer through November

- Wells Fargo is the 18th largest mailer in ’22

- Although Santander appeared in the top 25 mailers later in the year, retail banks continue to cede this product to the fintechs with no other significant new retail bank entrants

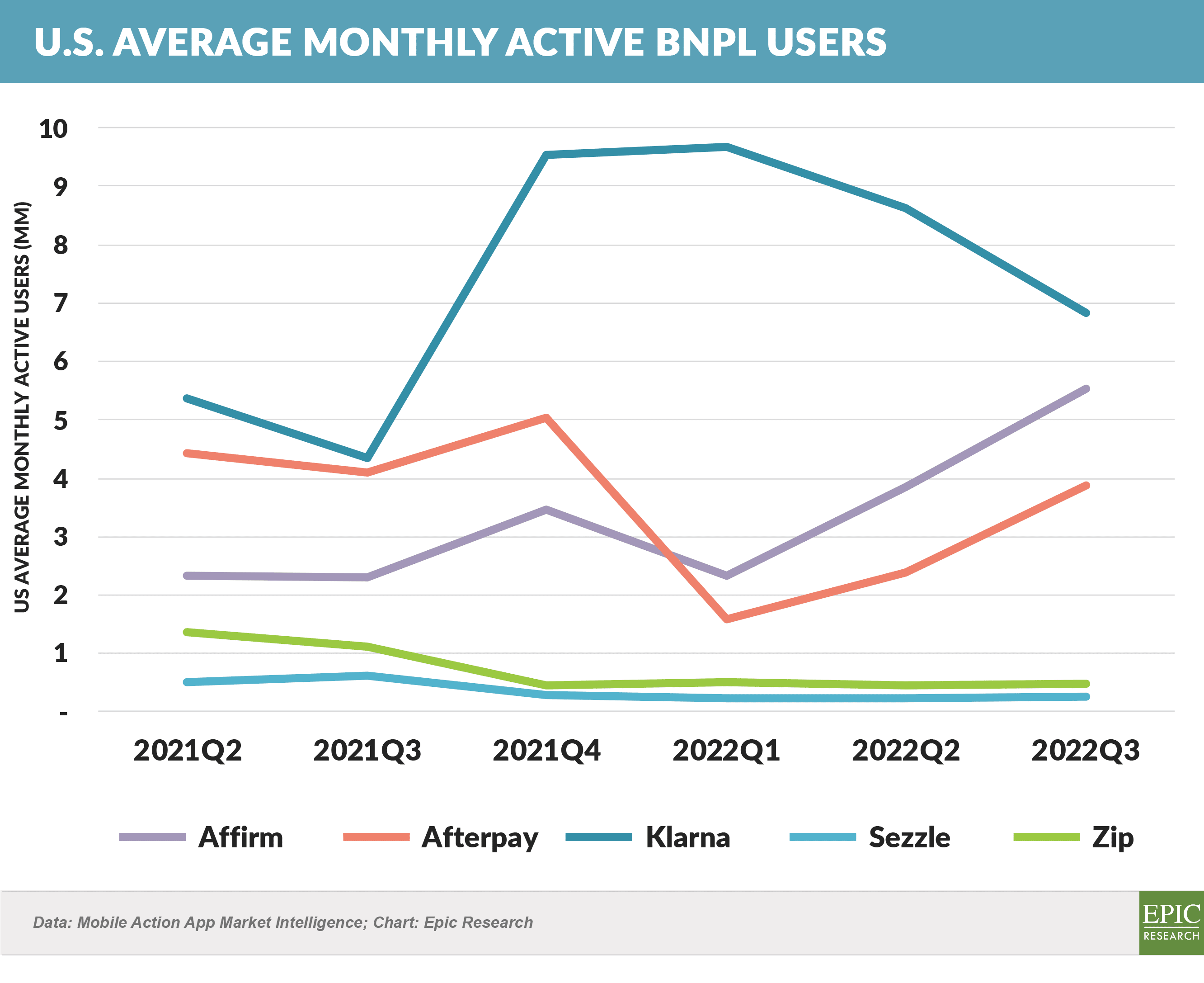

- Next, we predicted “BNPL will level off in its popularity and remain a niche product with low, single-digit market share”

- While BNPL payment volume continues to increase, monthly average usage among five large providers started to flatten in 2022

- Despite the insane amount of publicity it receives, BNPL remains a niche product, as Statista reports, with only 4% market share in the U.S.

- Staying with the “BNPL is a bubble” theme, our last prediction for 2022 was that “at least one BNPL issuer will blow up”

- We were early (notice a theme here?) on this one too (we’re not aware of any BNPL explosions),

- However, valuations have plummeted

- Klarna completed a funding round last summer that was 85% lower than a year earlier

- Affirm’s stock price recently traded 94% lower than its November ’21 all-time high

- Stay tuned…

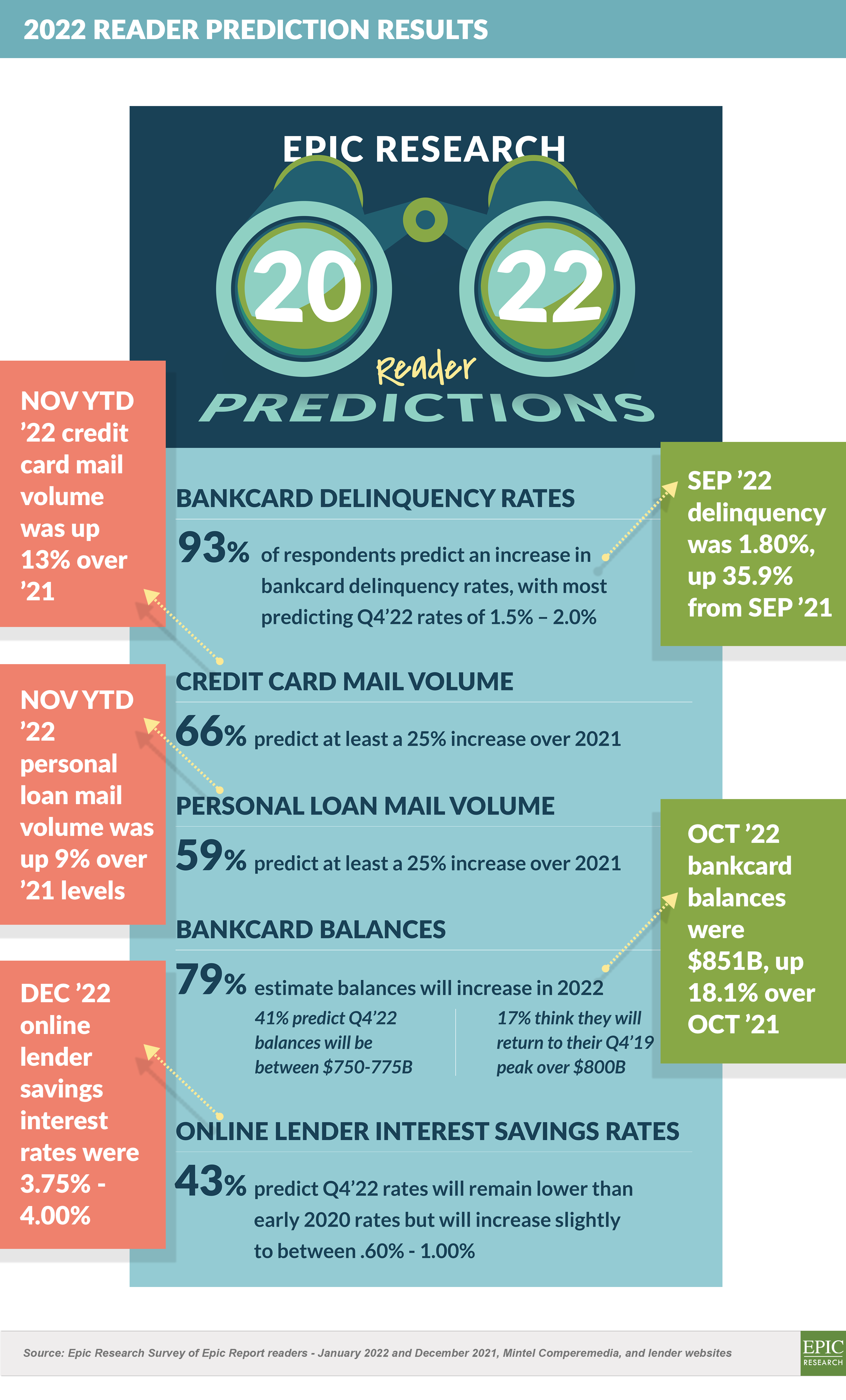

- We also polled our readers in December 2021 to see what you thought might happen in 2022, and our readers had a mixed record

- And now, we present our Epic predictions for 2023

- At least one large bank CEO will announce their departure

- We have no inside information, but it has been a while since a top job has turned over

- Given the tenure of the top execs, one is bound to retire or step down for other reasons

- Credit card mail volume will outperform other lending products, and 2023 mail volume will be higher than 2022, even in an era of rising interest rates and deteriorating asset quality

- At least one BNPL issuer will blow up – okay, so we were early on this one in ’22 but we are sticking with it in ’23 for the same reasons as last year

- BNPL is a relatively new product, with many BNPL companies led by those with more “tech” experience vs. “fin” experience

- Credit models and underwriting criteria developed in this historically benign credit environment will fail, resulting in high levels of credit losses that severely impact at least one player in the segment

- The result will perhaps lead to additional, or more uniform, credit reporting requirements for all players

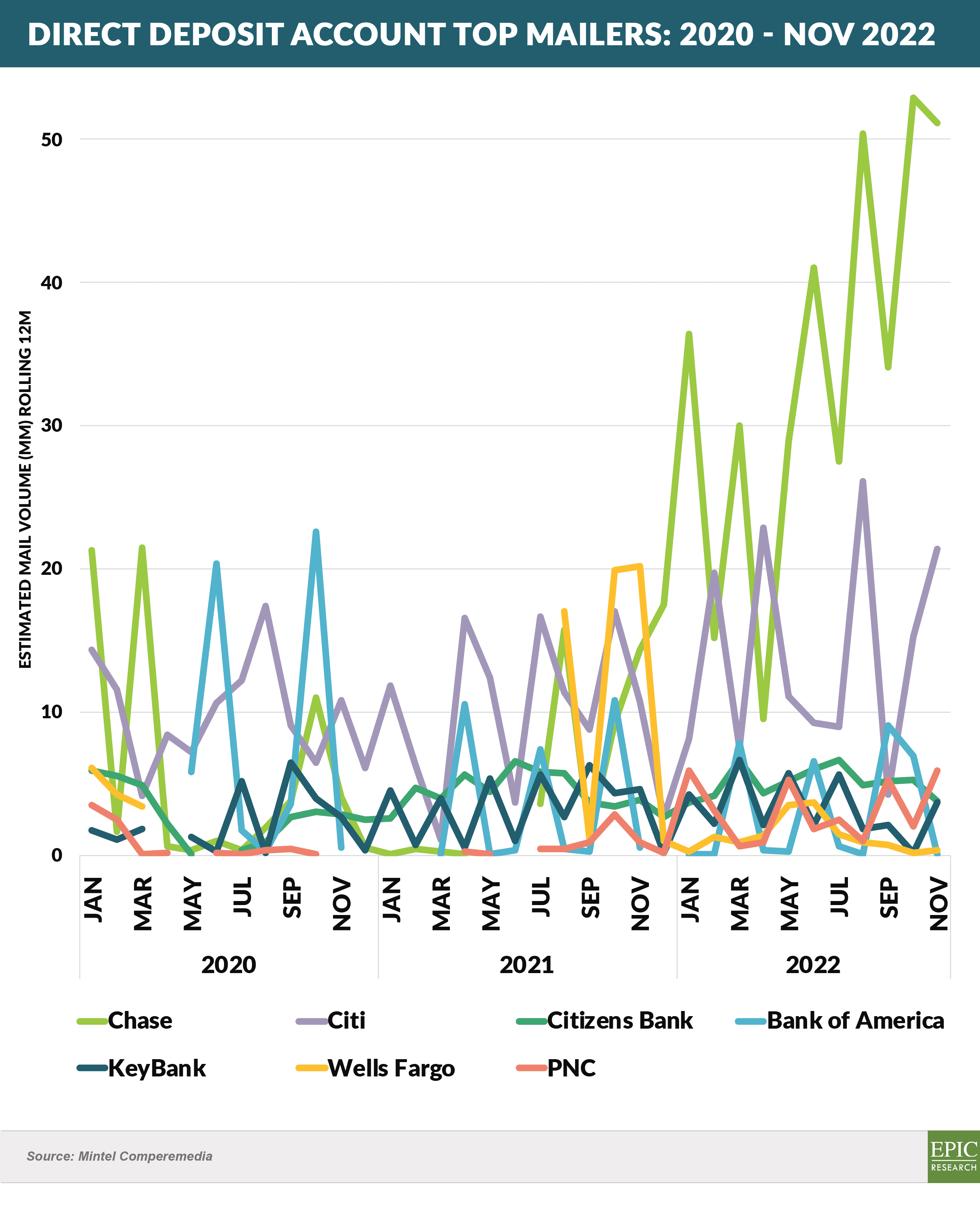

Chase Dominates DDA Mailing

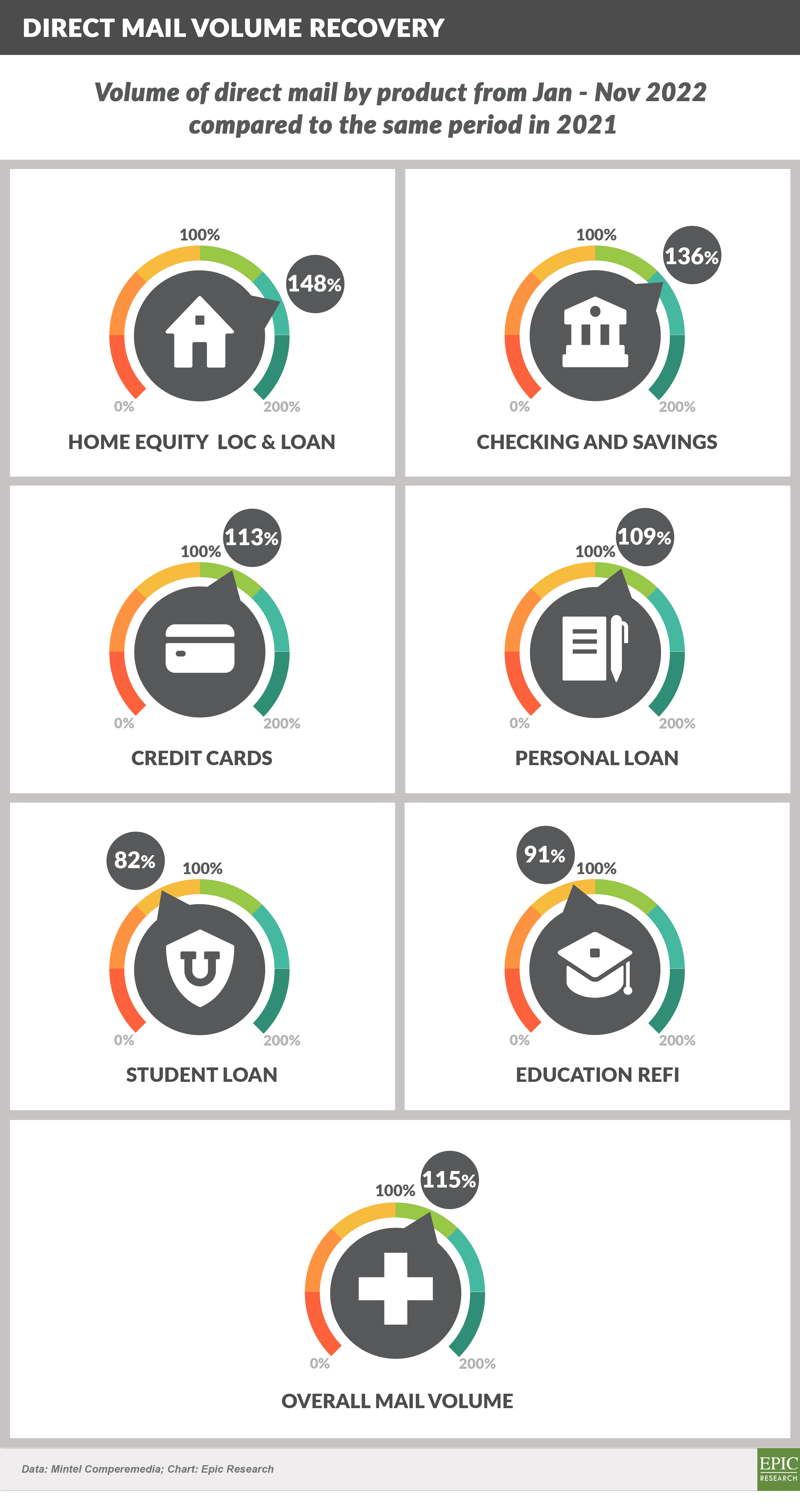

- DDA direct mail is up 60% YTD through November vs. the same period in 2021

- Chase continued its year-long domination of the mail channel with over 50 million pieces in November – half of total industry DDA mail volume

- Citi was a distant number two with 20 million pieces

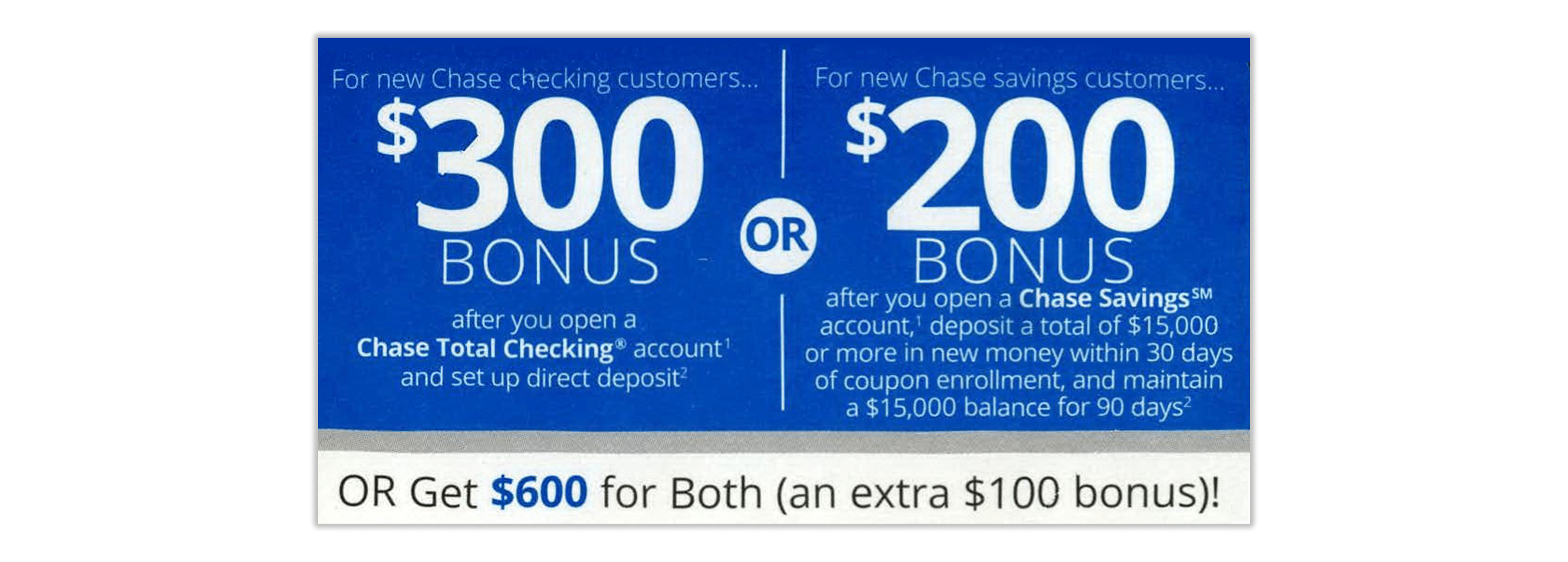

- Chase has had an extremely strong consumer DDA incentive in the mail for quite some time, currently offering up to $600 to open both a checking and savings account

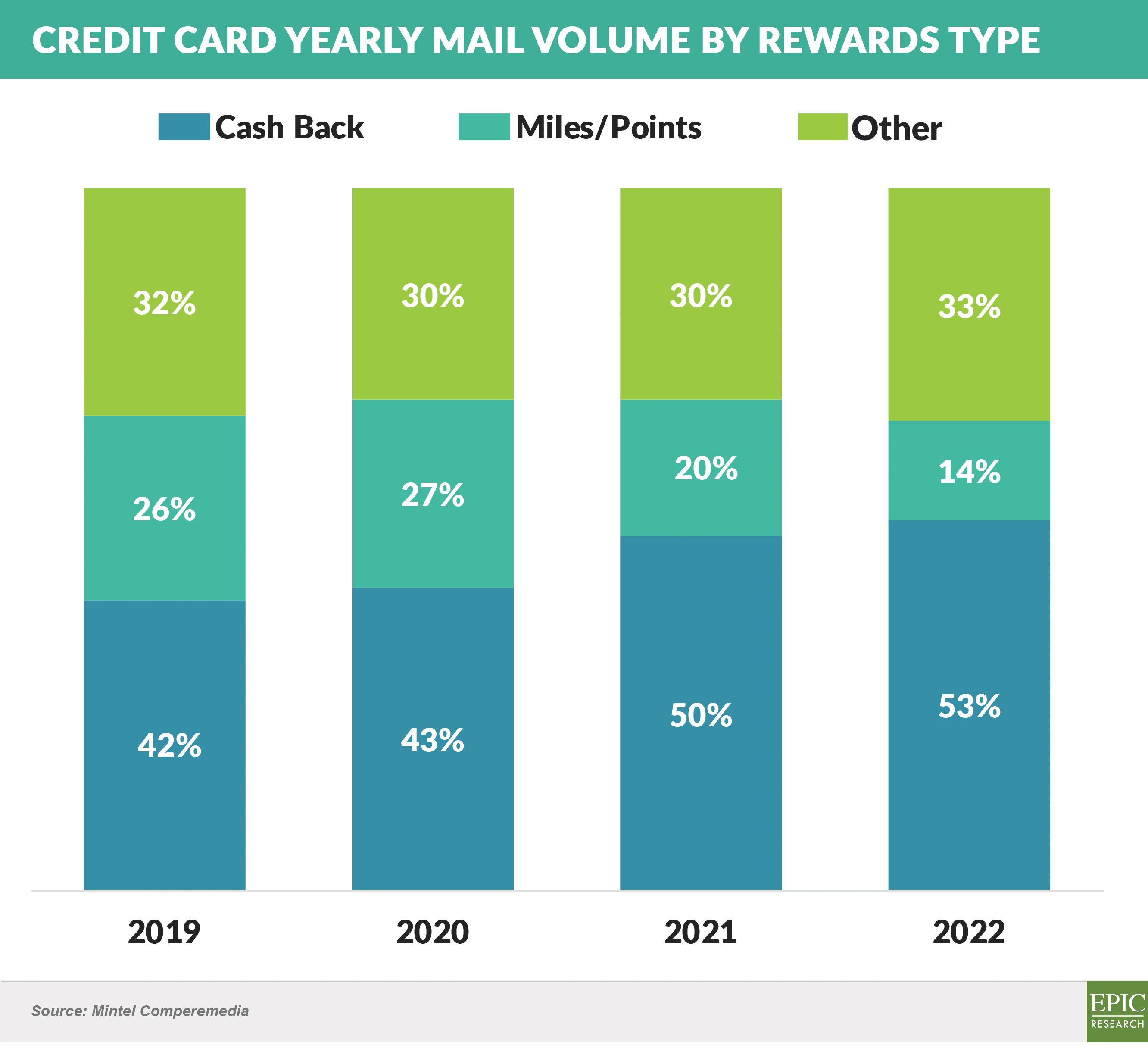

- Credit card cash back offers have grown as a percentage of all direct mail offers, appearing in 53% of 2022 mail pieces, up 29% from 2019 – primarily at the expense of offers featuring miles or points, which are present in only 14% of all mail pieces, down 46% from 2019

- Personal loan direct mail volume has fallen each month since June

- Best Egg has been the top mailer for most months in the past year, mailing 285 million pieces in the past 12 months – 47% higher than number two Lending Club

- OneMain, Discover, and Upstart complete the top five

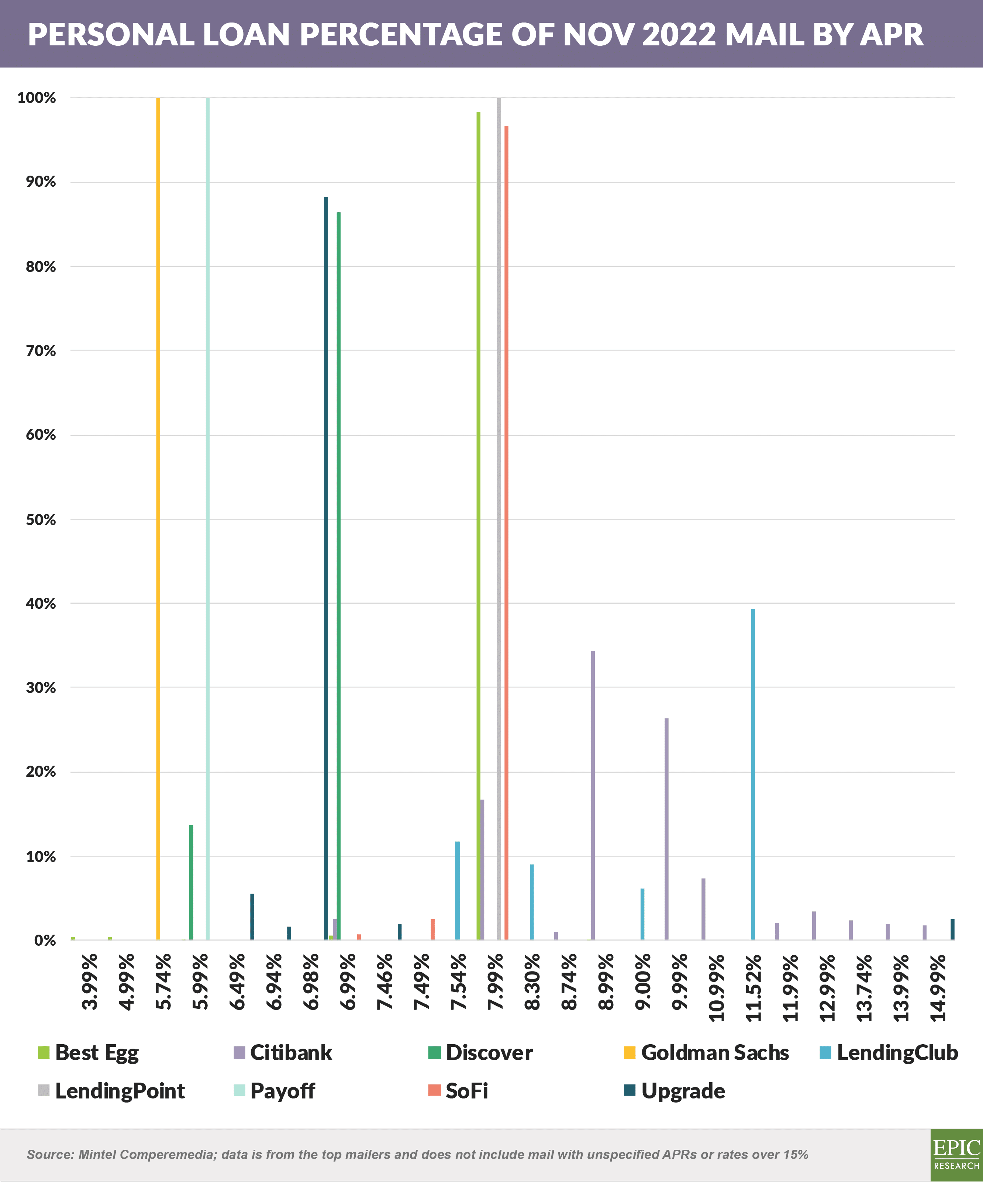

- Best Egg’s advertised rate was 7.99%

- Discover is the only lender with meaningful volume at or under the 6.99% price point

- Upgrade, Payoff, and Goldman had headline rates under 6.99%, albeit with small volumes

Quick Takes

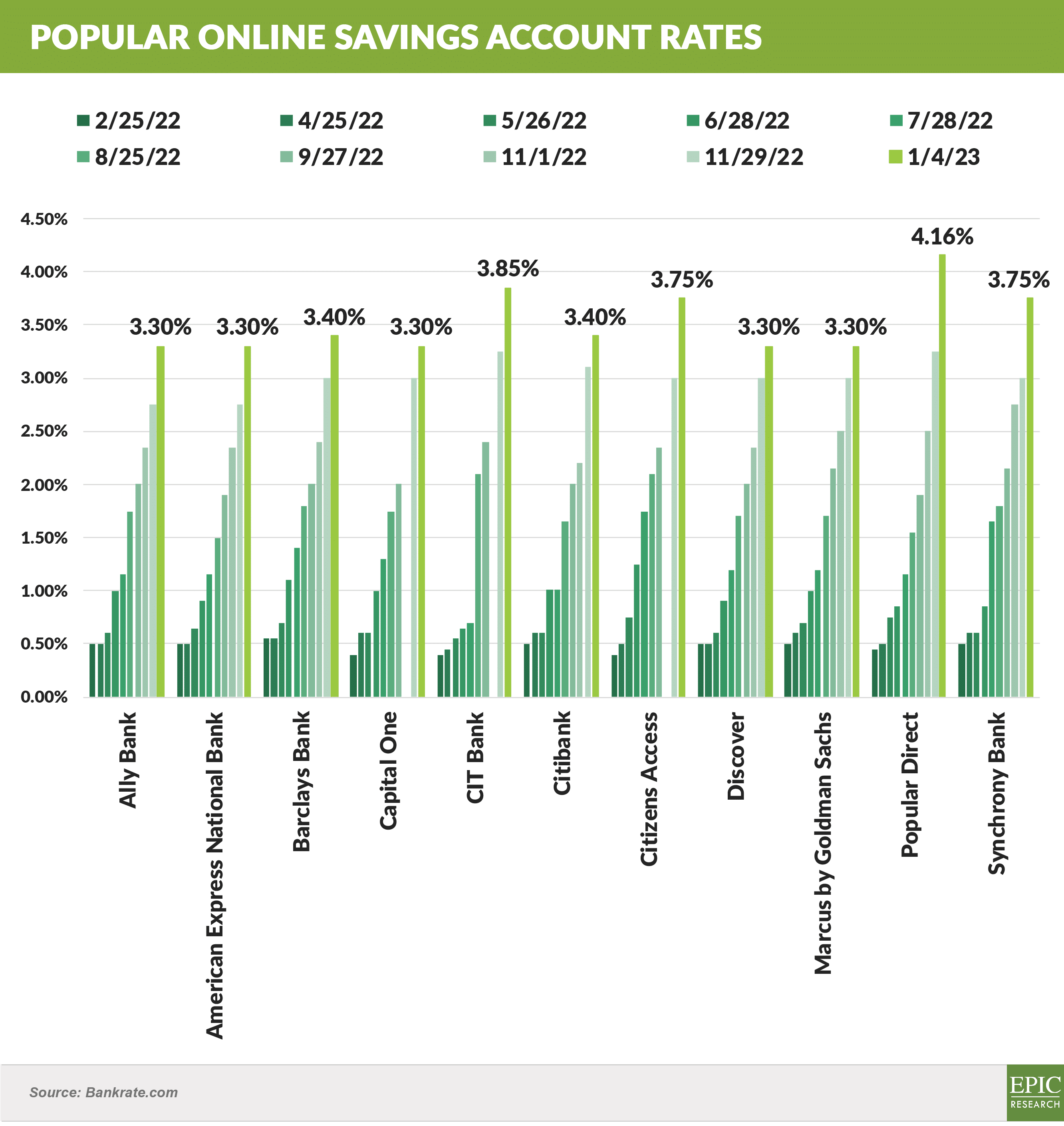

- Online savings rates continued their steady rise with the market leaders offering 3.30% - 4.00% — a dramatic rise from the ~.50% rates of less than one year ago

- A Walmart-backed fintech, called One, plans to offer a buy now, pay later pay option

- The start-up is majority owned by Walmart and led by former Goldman Sachs executives

- The venture is targeting to launch its own version of the payment service as soon as 2023

- Walmart currently offers BNPL through Affirm

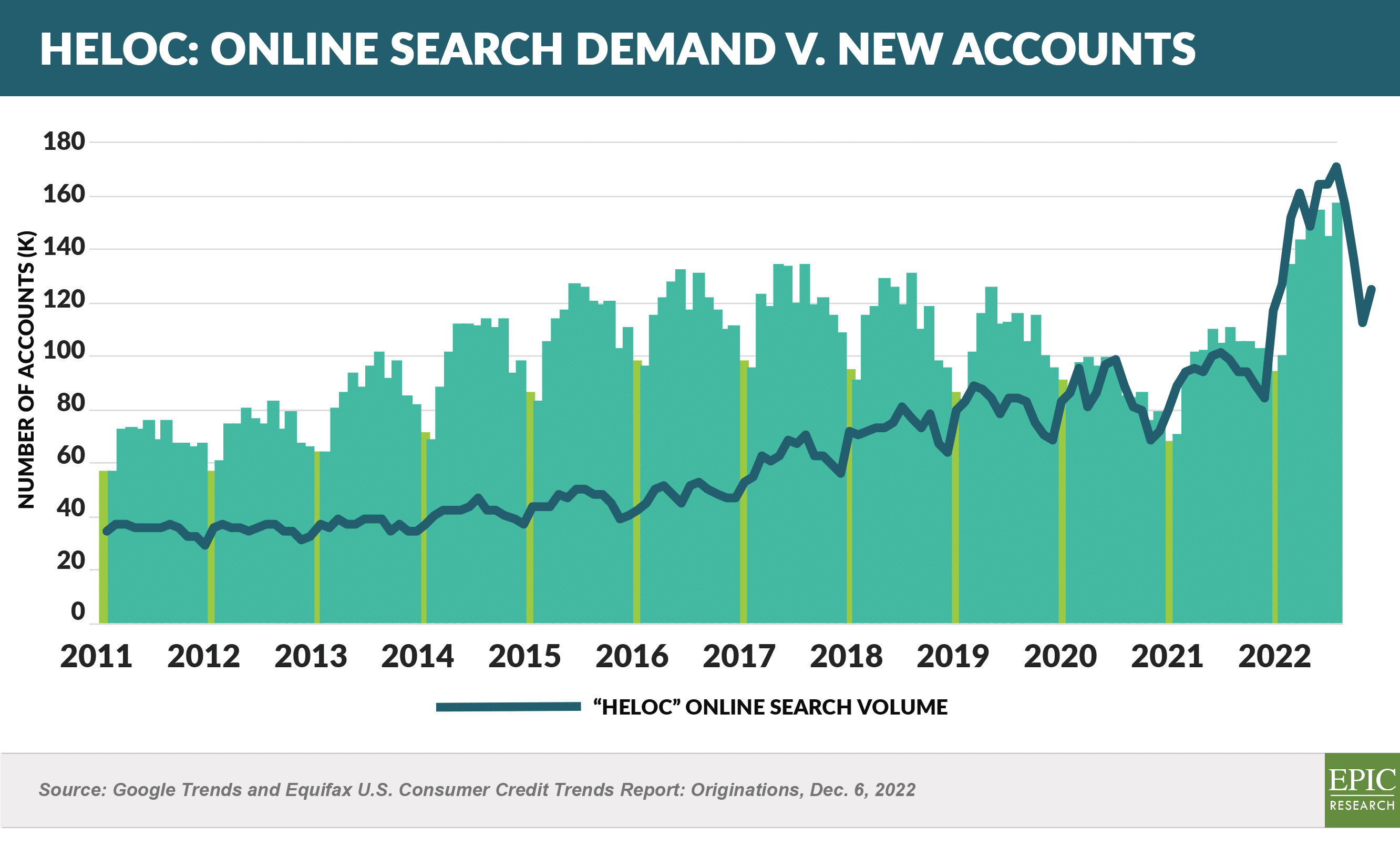

- Google Trends data predicts a decline in HELOC originations

- The Equifax data shown in the chart below reveals that the number of new HELOC loans grew in the first half of 2022

- However, online search volume, usually a leading indicator of future originations, dropped significantly in recent months, likely due to higher interest rates

- Given the 60+ day period between application, funding, and bureau reporting, the drop should appear in the next few months

- Some fintechs are feeling the squeeze of higher interest rates and a tightening of access to capital

- In November, Affirm abandoned plans to issue a $350 million bond due to the market demanding higher interest rates

- Many of the consumer lender fintechs were launched in the past ten years or less and have not operated in an environment with higher interest rates

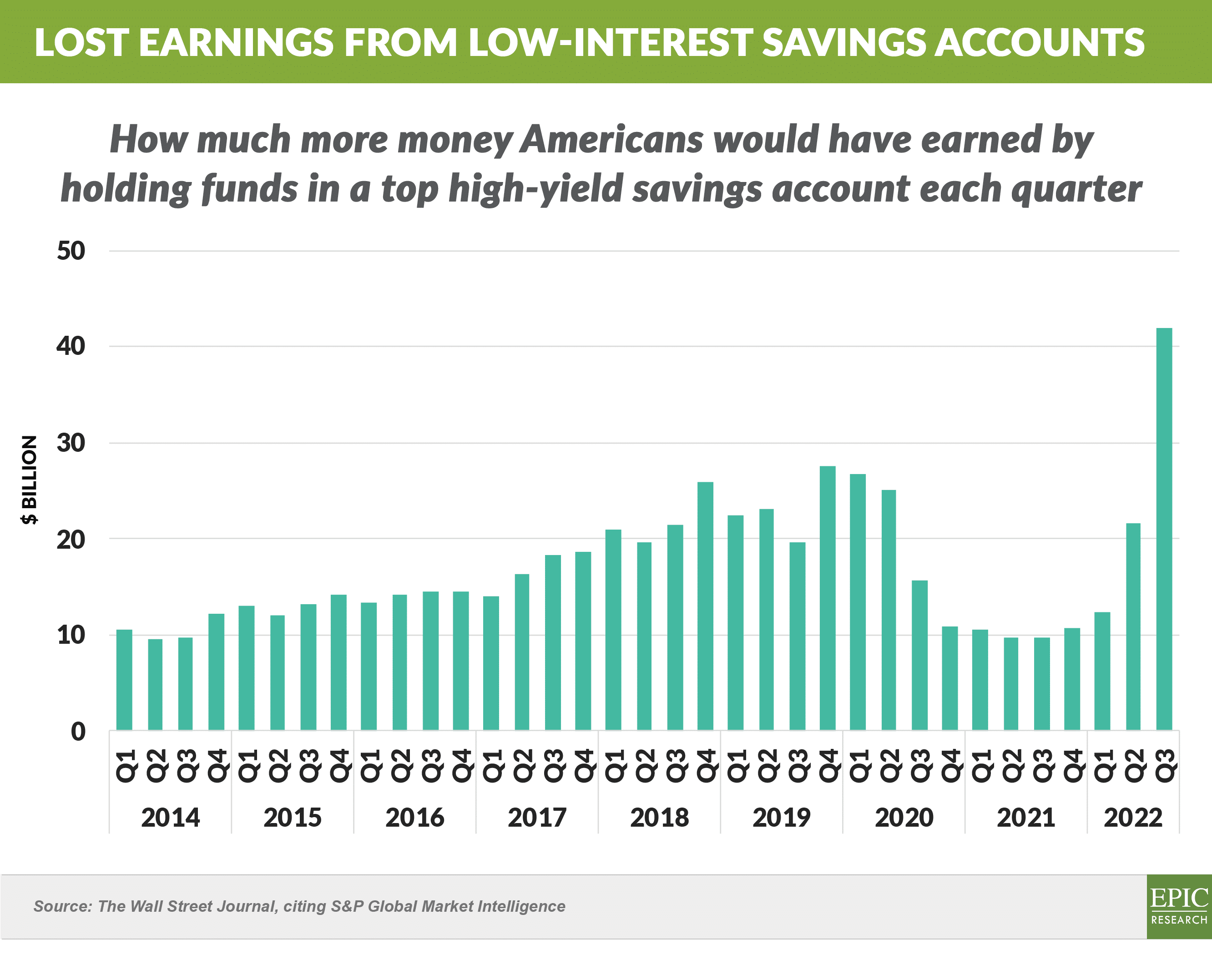

- Big banks still dominate savings accounts – despite interest rates being the highest since 2008, the five largest banks (Bank of America, Citi, Chase, U.S. Bank, and Wells Fargo), which collectively hold about half of all savings and money market deposits, pay an average of 0.4% on their savings accounts

- The highest online savings rates are offered by non-traditional banks and pay interest rates of 3.75% - 4.00%

- The difference amounts to lost interest of over $600 billion for consumers since 2014 when the FDIC started tracking these type of deposits

- We have previously commented on the relatively underappreciated brand value held by branch-based banks – even those banks with less than average market share in a particular area

- The evidence of this comes in looking at thousands of marketing campaigns for hundreds of banks over the past 30 years and measuring response rates “in-footprint,” where banks have relatively high brand recognition, vs. “out-of-footprint,” where they have less

- A rough rule of thumb has the response rates for in-footprint mailings at 2x those of out-of-footprint – the only difference being the geography of the prospective customer and associated degree of brand awareness

- We use the same proxy for fintechs and other national non-branch-based lenders, as their brand recognition generally falls much lower than that of a local bank

- As a result, fintechs require more sophisticated and successful models to effectively compete

- It turns out that all those branches with signs, general media advertising, and stadium sponsorships, the value of which may be hard to quantify, ultimately create an impression of trust that unknown brands lack

- Many branch-based bank marketers may not realize they have this sizable benefit!

The Epic Report is published monthly, with the next issue releasing on February 4th.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.