Three Things We’re Hearing

- Credit Unions vs. “Regular ” Banks

- Credit card APRs skyrocket!

- Travel rewards card marketing lags

A four-minute read

If the Epic Report was forwarded to you, click here if you’d like to be added to our mailing list

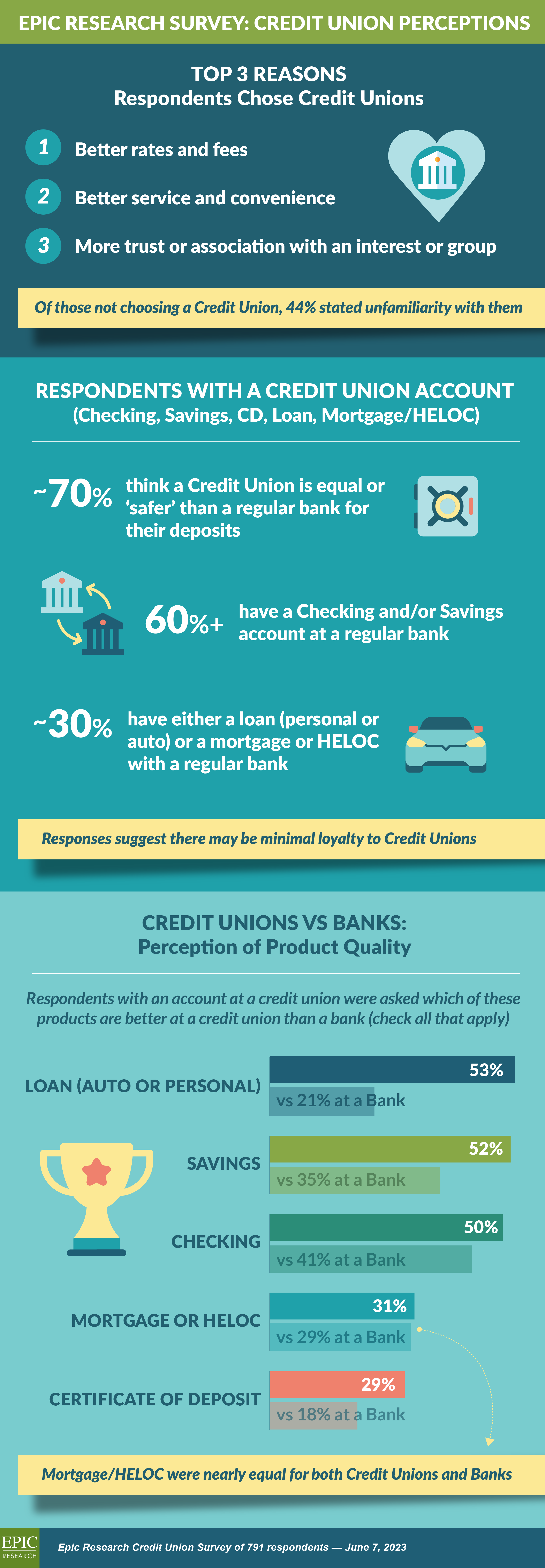

Credit Unions vs. “Regular” Banks

- We tend to focus our attention on banks and fintechs, however Credit Unions are frequently mentioned by responders in our surveys

- The National Credit Union Administration reports that there are 136.6 million Credit Union members as of March 2023 and the Navy Federal Credit Union is the country’s eighth largest bankcard issuer

- We surveyed 791 consumers regarding their thoughts about Credit Unions and were surprised at the number that had both Credit Union and regular bank accounts

Credit Card APRs Skyrocket!

- The bankcard market in the 1980s was dominated by Bank of America, Citi, and several other large New York based banks – generally with uniform pricing of APRs of 19.8% and $20 annual fees

- In the ’90s, competition from monoline issuers such as First USA, Advanta, and Capital One drove APRs lower and introduced low introductory rates, “no annual fee,” and balance transfer offers

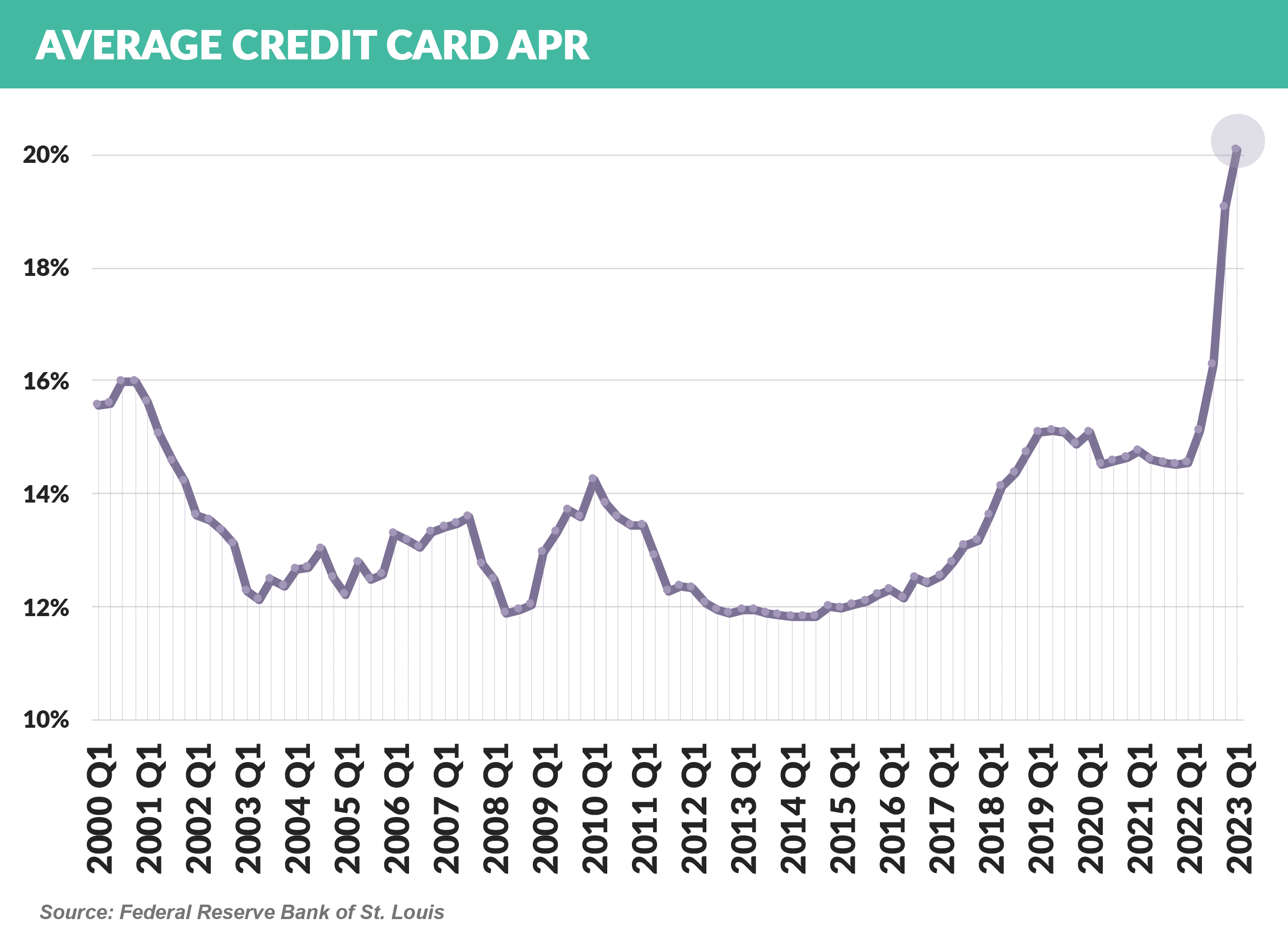

- Since 2000, average card APRs remained in the 12% - 15% range until they began trending upwards in 2020 recently reaching an all-time high of 20.69%

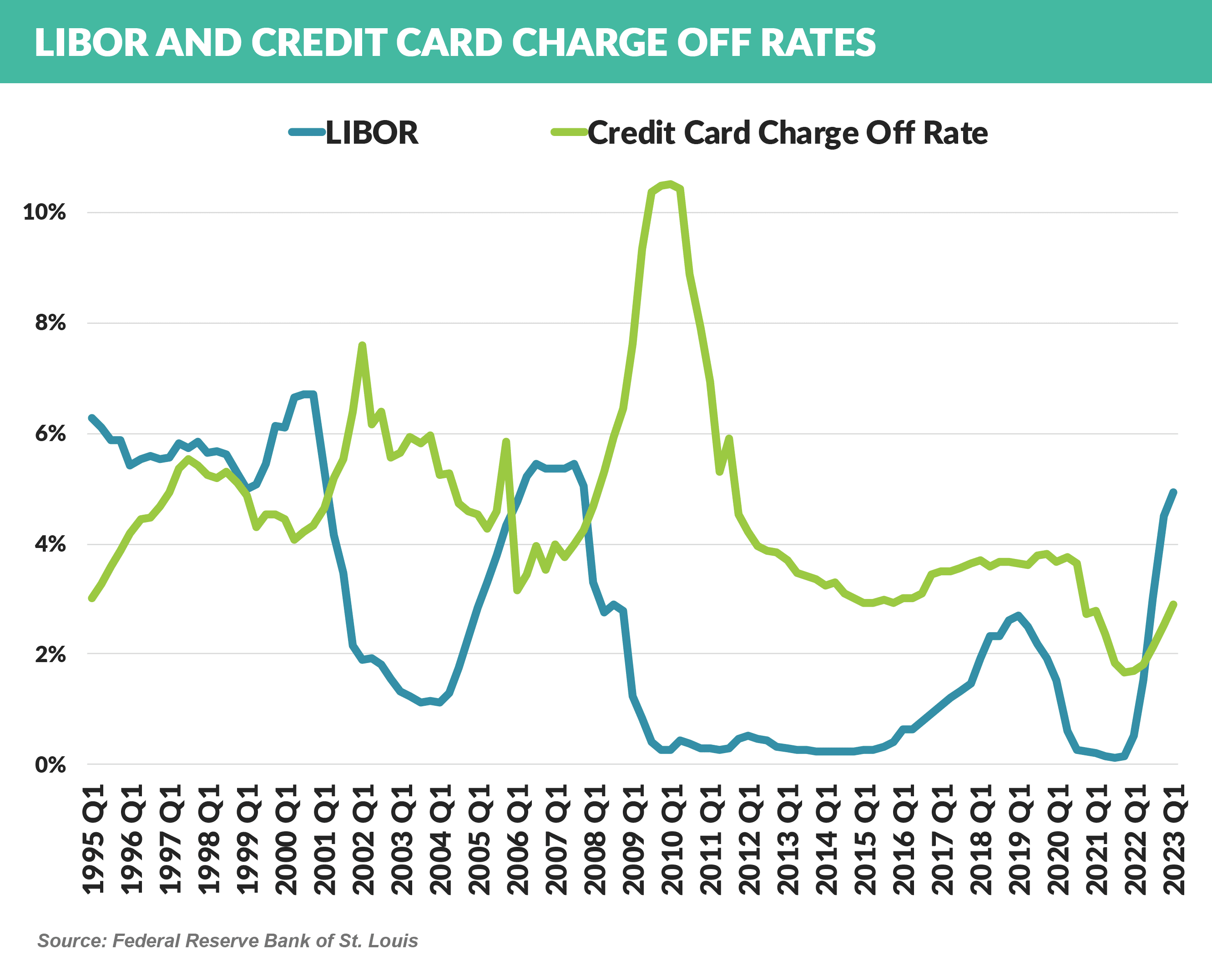

- Of interest is the fact that these historic peaks in APRs come at a time when two of the major cost components of card profitability – funding cost and loss rates – have remained at historically low levels

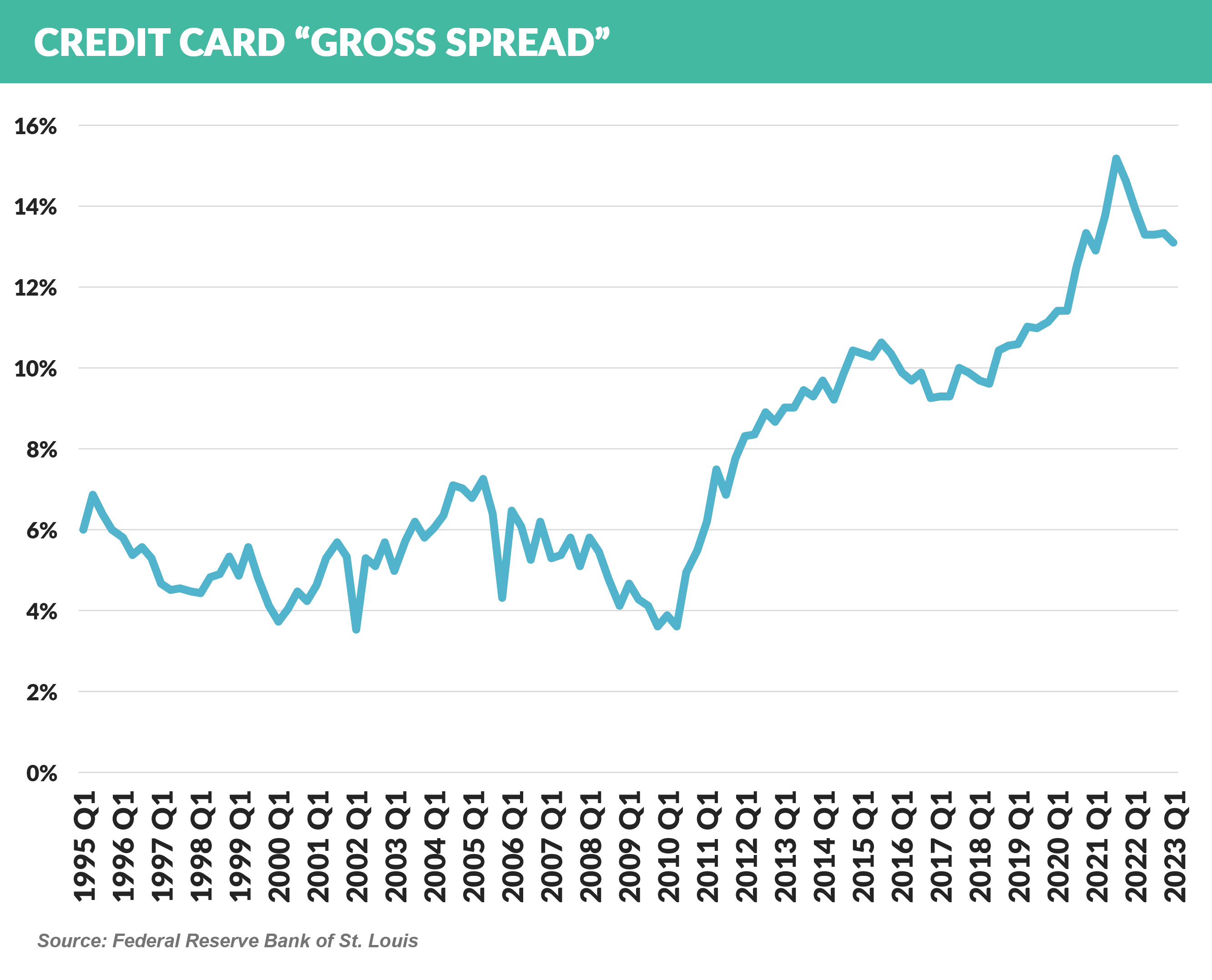

- In fact, the “gross spread” of APR minus losses and funding costs is at an all-time high

- So why are APRs at an all-time high – more than double those of 15+ years ago – when the two largest cost factors are relatively low?

- The elevated level of competitiveness in the card business would seem to provide an opportunity for a “low APR” player

- However, there are other expense dynamics that make overall profitability not as high as the “gross spread” would imply

- The Card Act of 2009 is largely responsible, as it put limitations on card issuer’s ability to re-price card balances to reflect changes in risk and other factors – issuers needed to raise APRs for all customers to offset the loss of yield for riskier accounts

- Second, while operating costs have not risen significantly, the rising popularity of rewards programs has increased the expense of running card portfolios and consumers have shown less rate sensitivity when selecting a rewards card

- While interest rates overall are expected to be lower over time, this will likely be moderated for credit card APRs due to the CFPB’s proposal for an $8 late fee and higher capital requirements dictated by the upcoming implementation of Basel III

Travel Rewards Card Marketing Lags

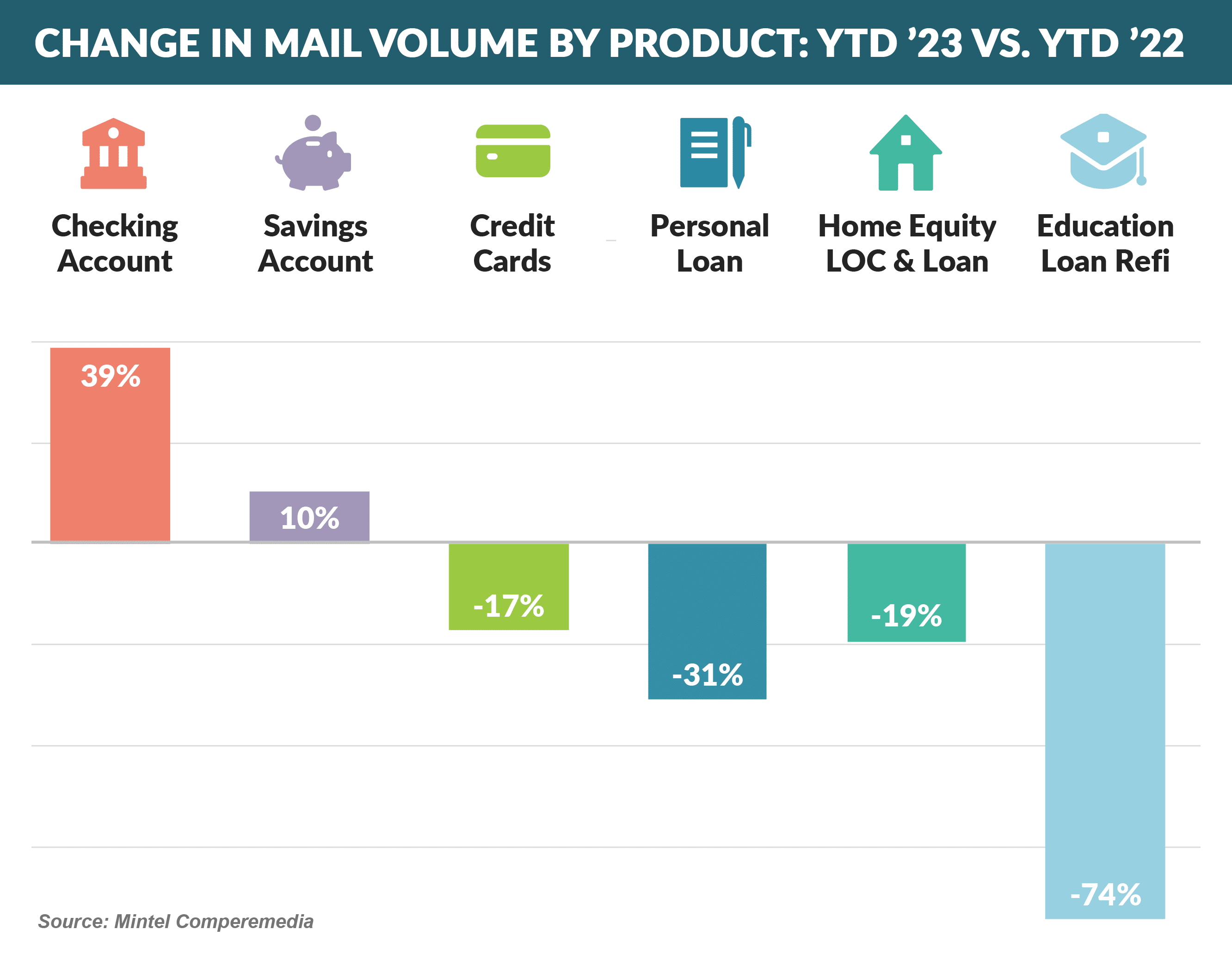

- Overall mail trends have not changed significantly since last month

- Checking and savings mail volume remained significantly higher than in ’22

- Credit card, personal loan, HELOC, and education refi remained at lower levels

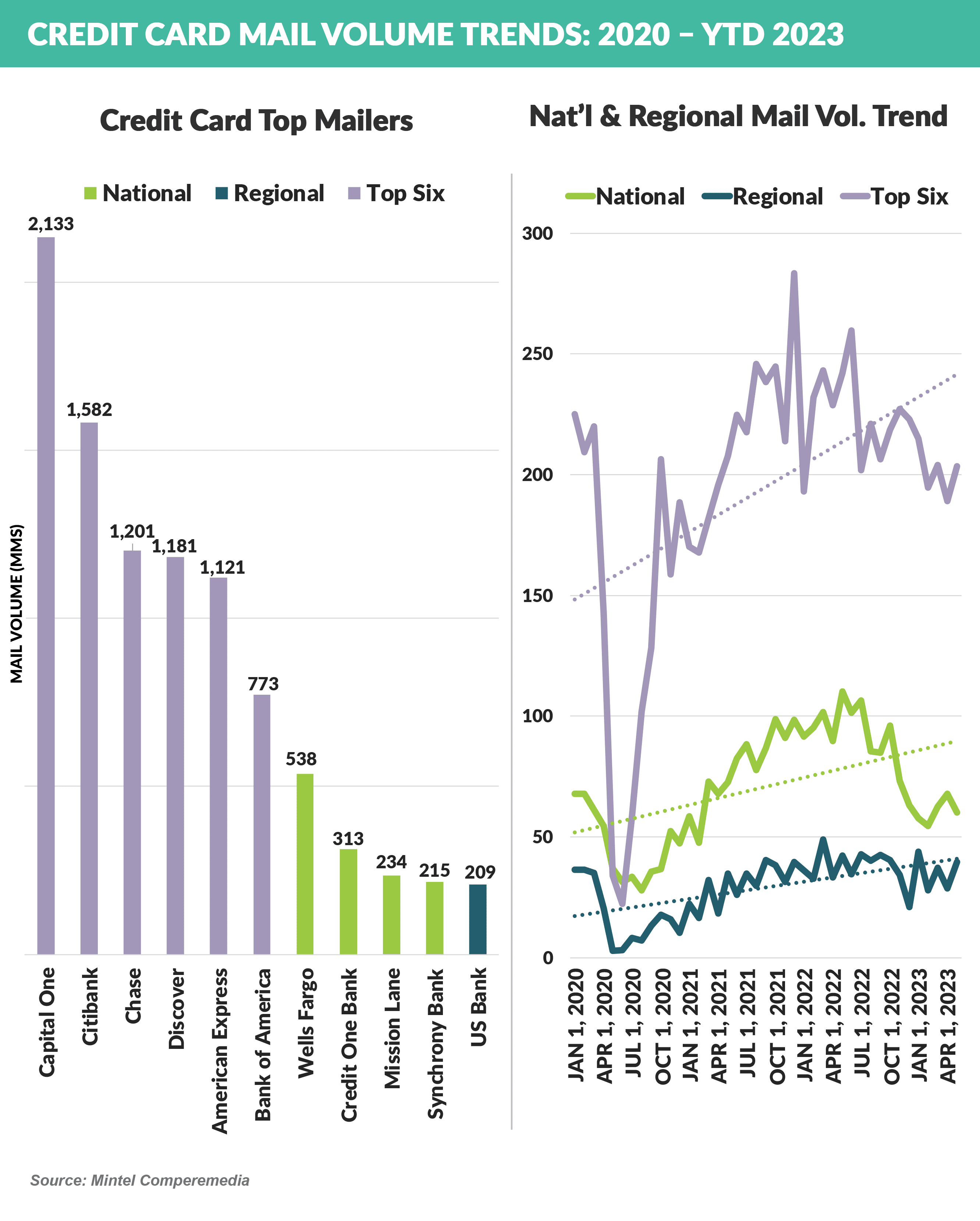

- National card issuers dominate the mailbox, with the top six accounting for two-thirds of all volume

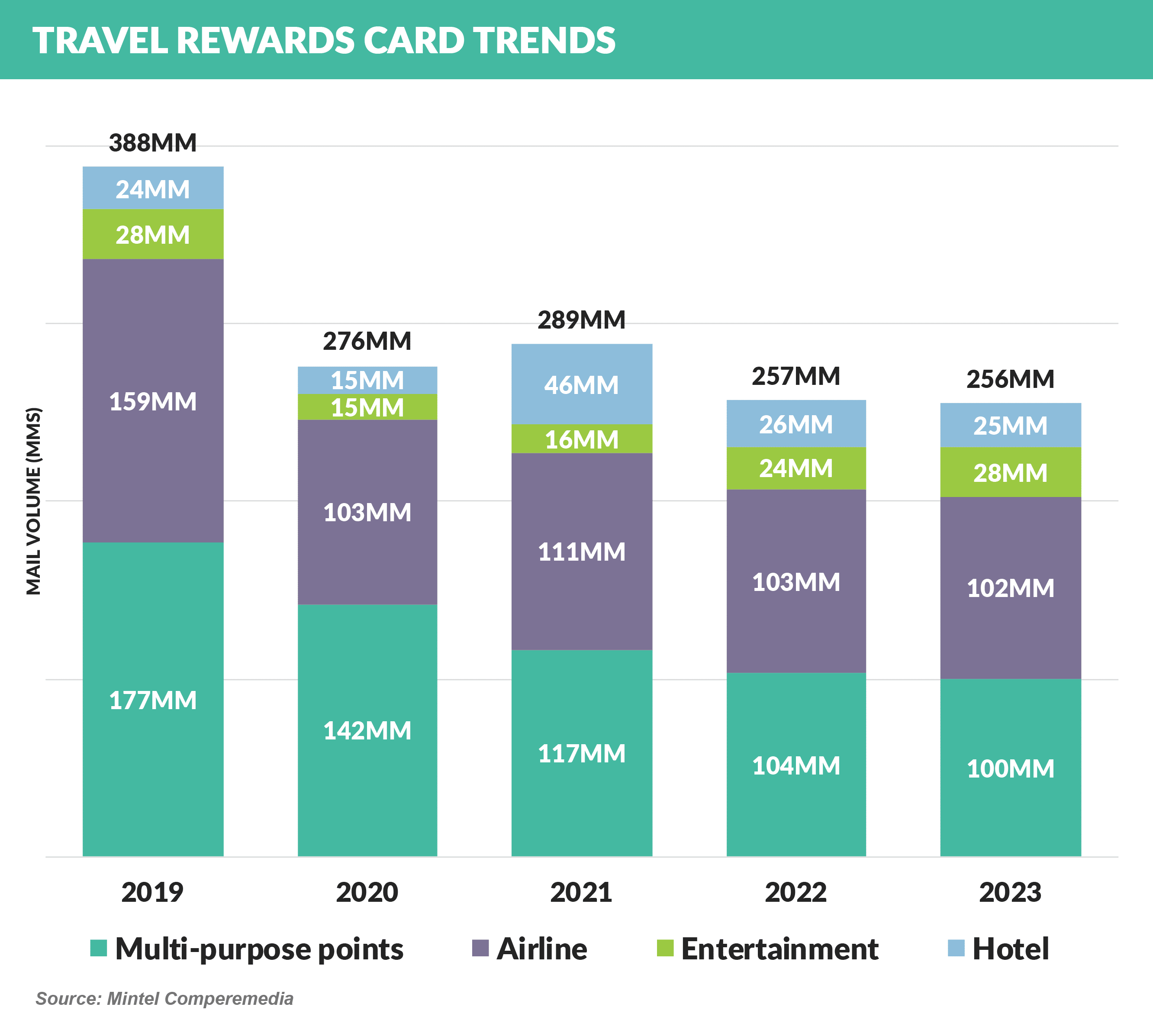

- Travel rewards card direct mail remains at a steady pace however below that of pre-Covid levels, with hotel and entertainment-linked programs holding up best

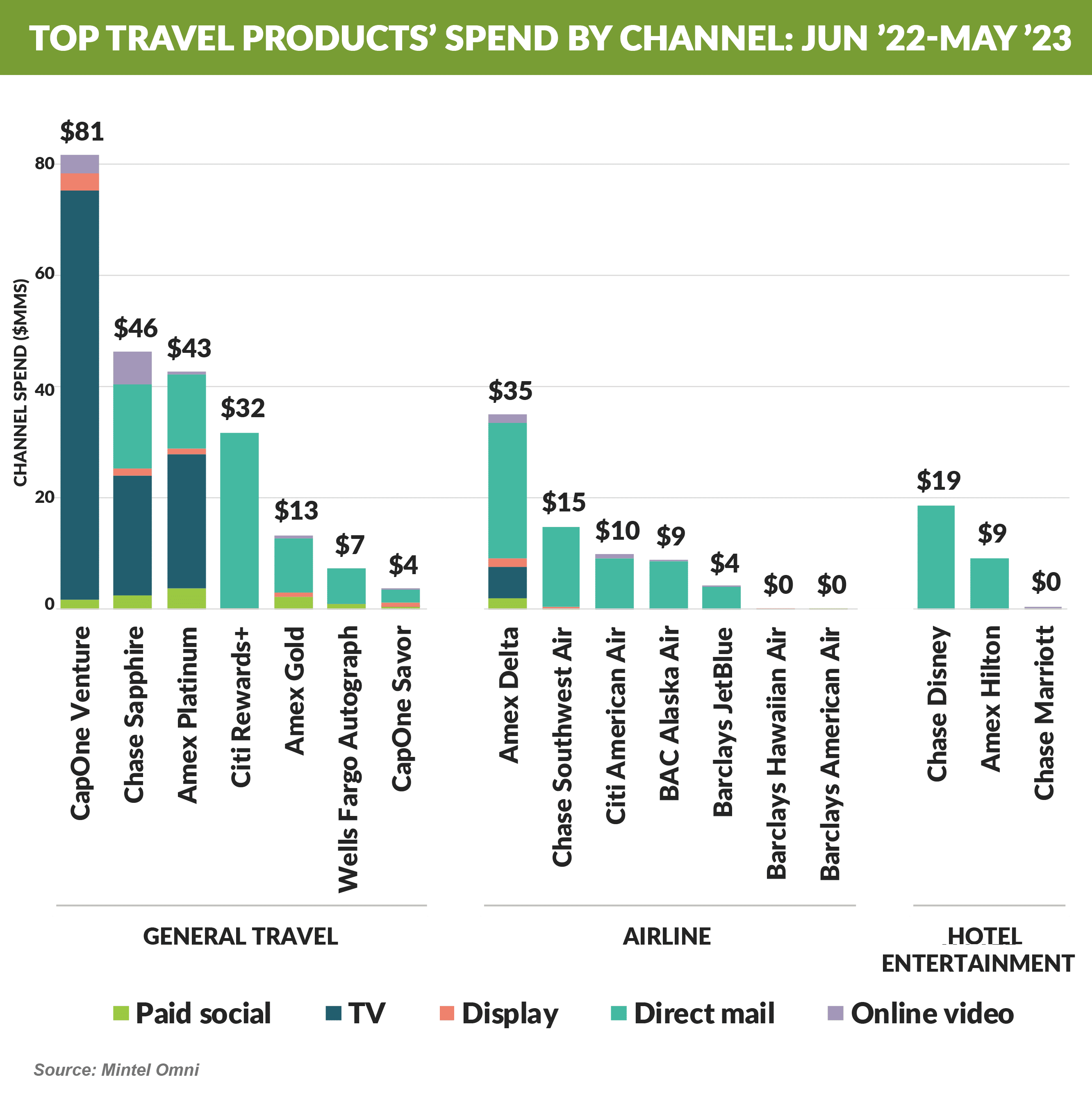

- Co-branded offers, with readily available customer lists, tend to rely more on mail, while high end bank-branded rewards cards, such as Venture and Sapphire, rely more on TV

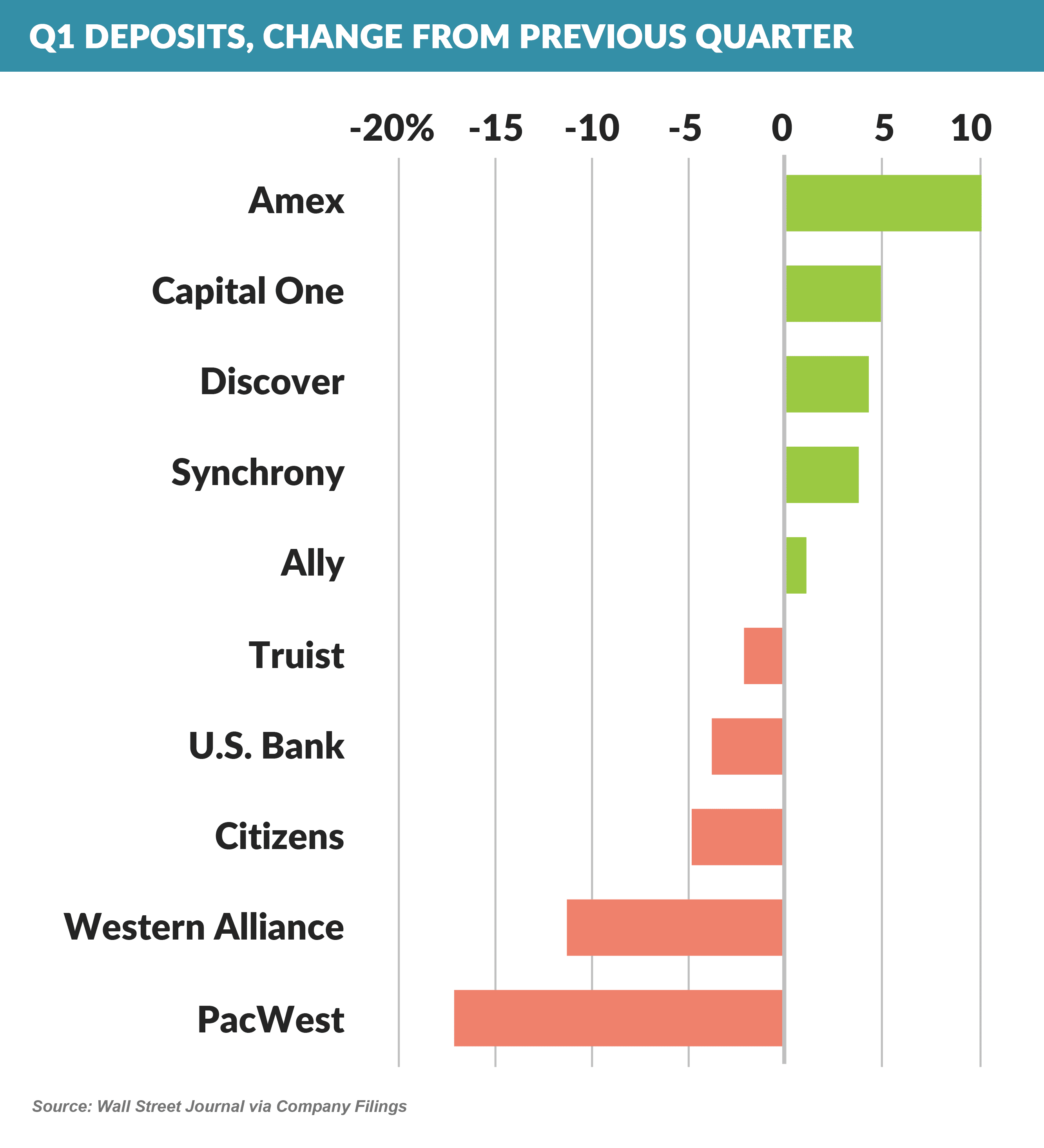

- First quarter reports from selected financial institutions show online banks winning the battle for deposit growth, with branch-based banks, that typically have much lower savings rates, lagging

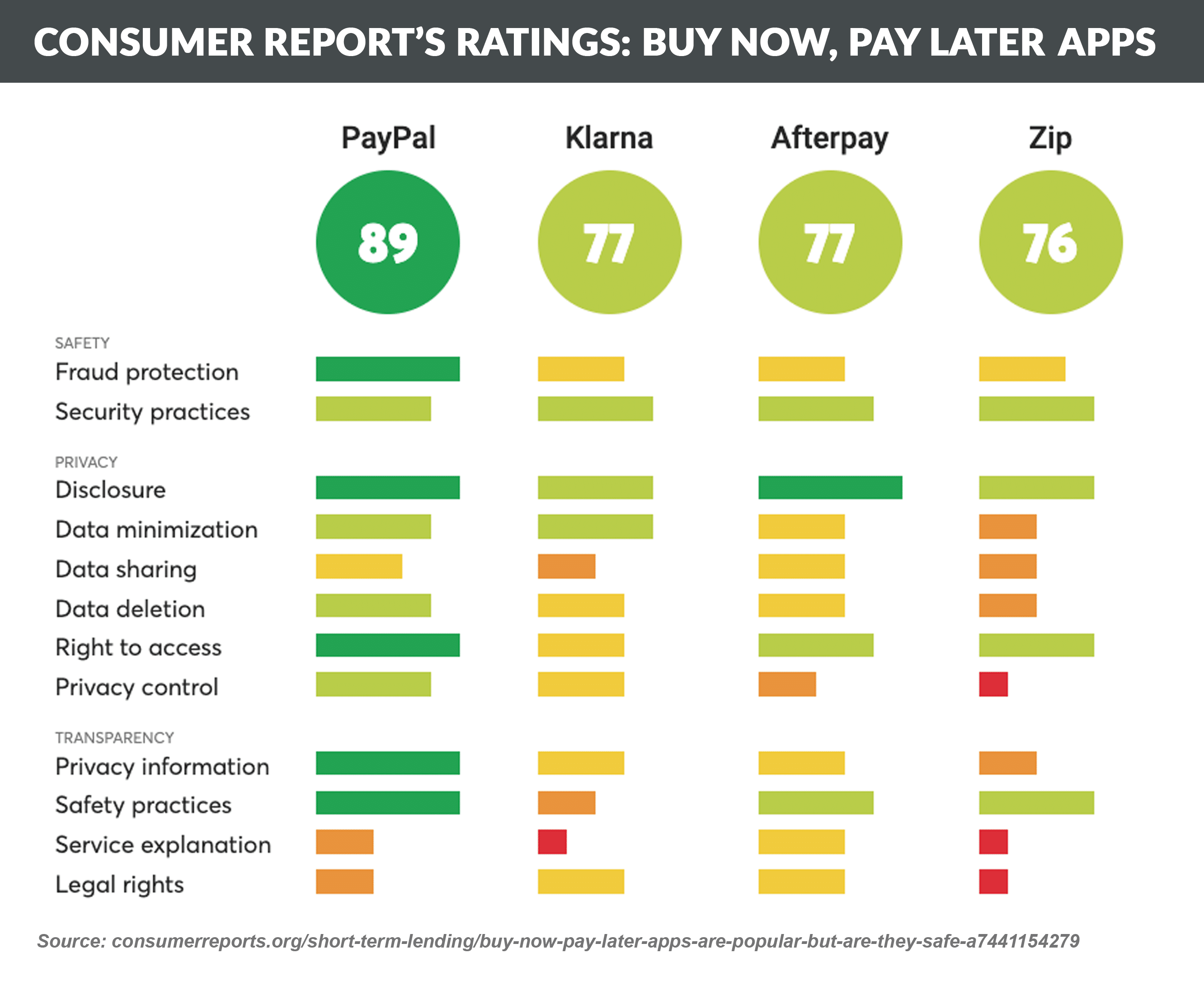

- Consumer Reports recently rated BNPL apps for factors related to safety, privacy, and transparency, with PayPal coming in materially higher than their competitors

- The June Epic Report noted the early success of Apple’s high yield savings account

- Recent news stories have reported customers’ frustrations with withdrawing funds from their newly opened Apple accounts – sometimes taking weeks

- The reports indicate most delays come from anti-money laundering and anti-fraud measures put in place by banking partner Goldman Sachs

- The recently introduced Credit Card Competition Act of 2023 would require large banks to give merchants a choice of at least two different networks to process credit card transactions

- The measure is intended to provide lower costs for merchants

- Industry critics suggest any benefits will accrue to large merchants and that any resulting savings will not be passed along to consumers, but will result in lower interchange and diminished credit card rewards programs

- Discover is relaunching the cash-back rewards debit account that has a checking account and debit card

- The product was launched in 2022, but Discover stopped accepting applications last summer due to fraud issues

- The debit card’s 1% cash-back on purchases feature is rare in the debit world

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on August 5th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.