Three Things We’re Hearing

- Consumers have trust in the US banking system

- Chase checking acquisition sizzles!

- Performance-based marketing fuels growth

A four-minute read

If the Epic Report was forwarded to you, click here if you’d like to be added to our mailing list

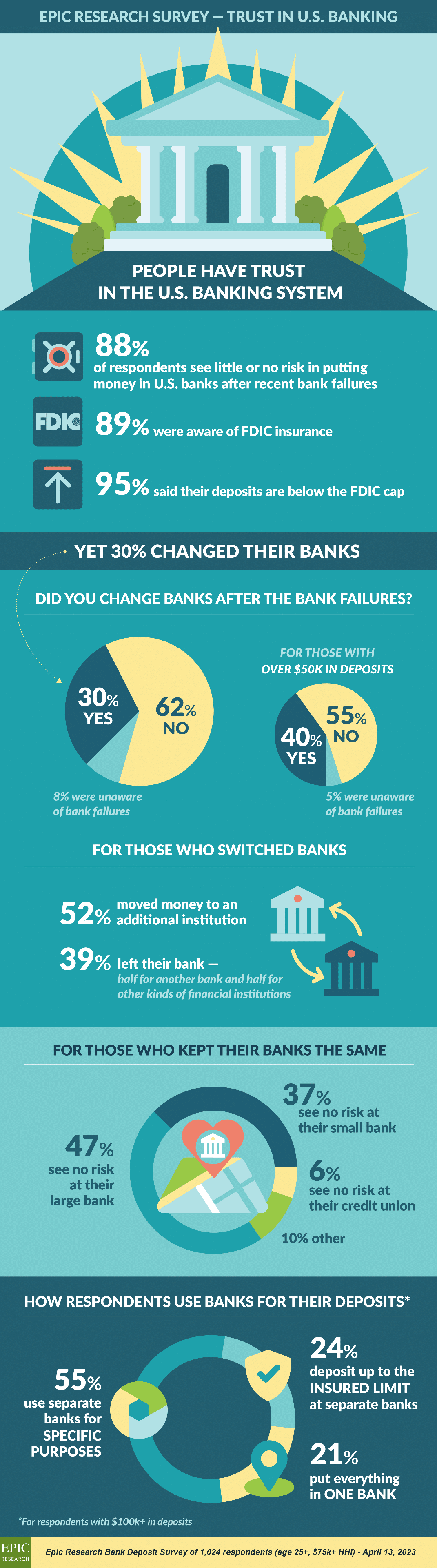

Consumers Have Trust in the US Banking System

- Epic surveyed 1,024 consumers regarding their attitudes and behaviors about banks following the recent turbulence at SVB and other financial institutions

- The findings reflect a continued high degree of trust in the US banking system

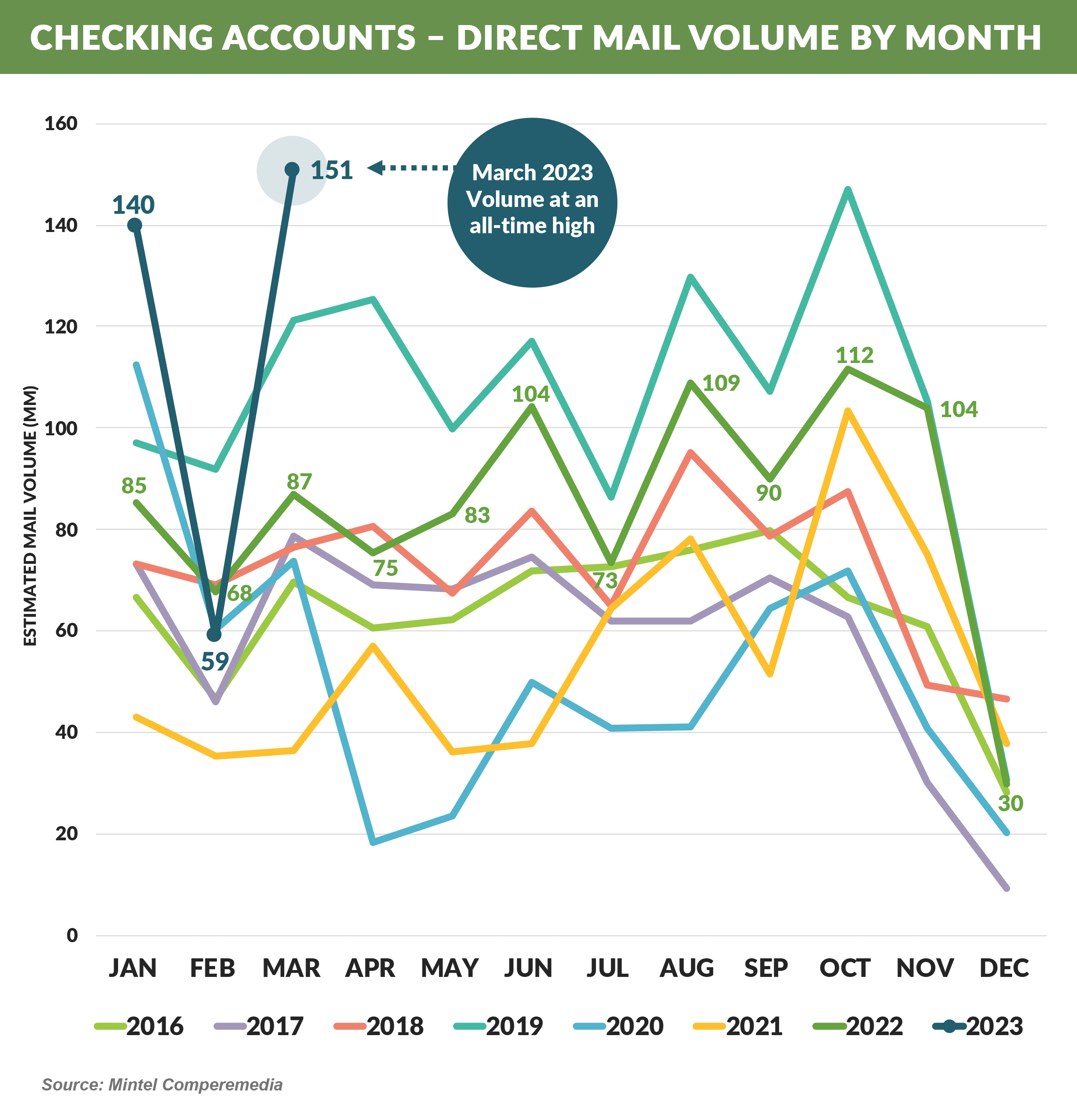

Chase Checking Acquisition Sizzles

- Checking mail volume continued at a break-neck pace, with March at an all-time high

- In past months we noted Chase’s dominance in checking mail volume, and March set a new record

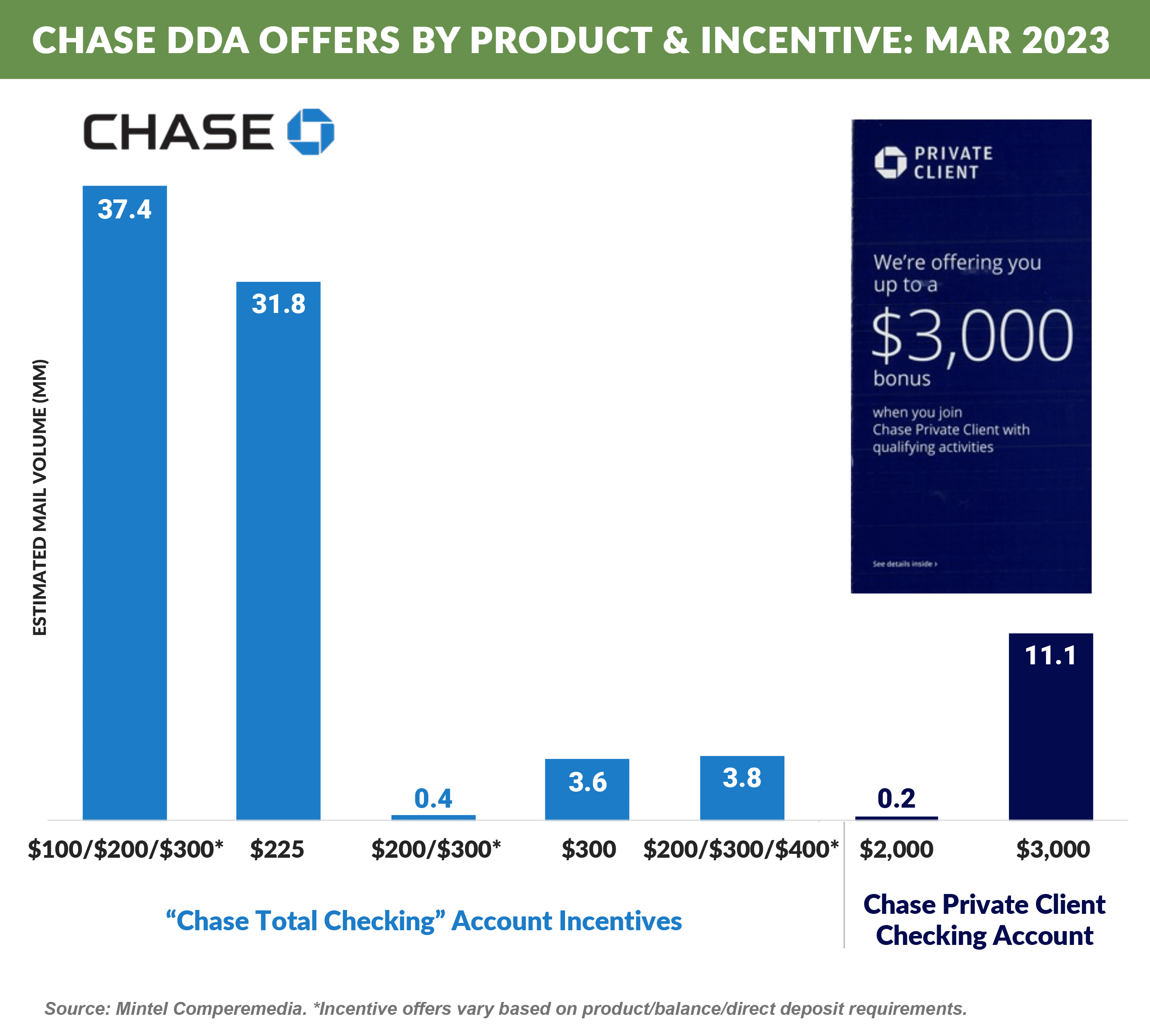

- Comperemedia estimates Chase spent $27.4 million in March on DDA mail

- The core offering features a $100-$300 incentive with a small amount at $400

- Private Client mail volume was 22.7 million, offering a $3,000 incentive for a deposit of $500,000

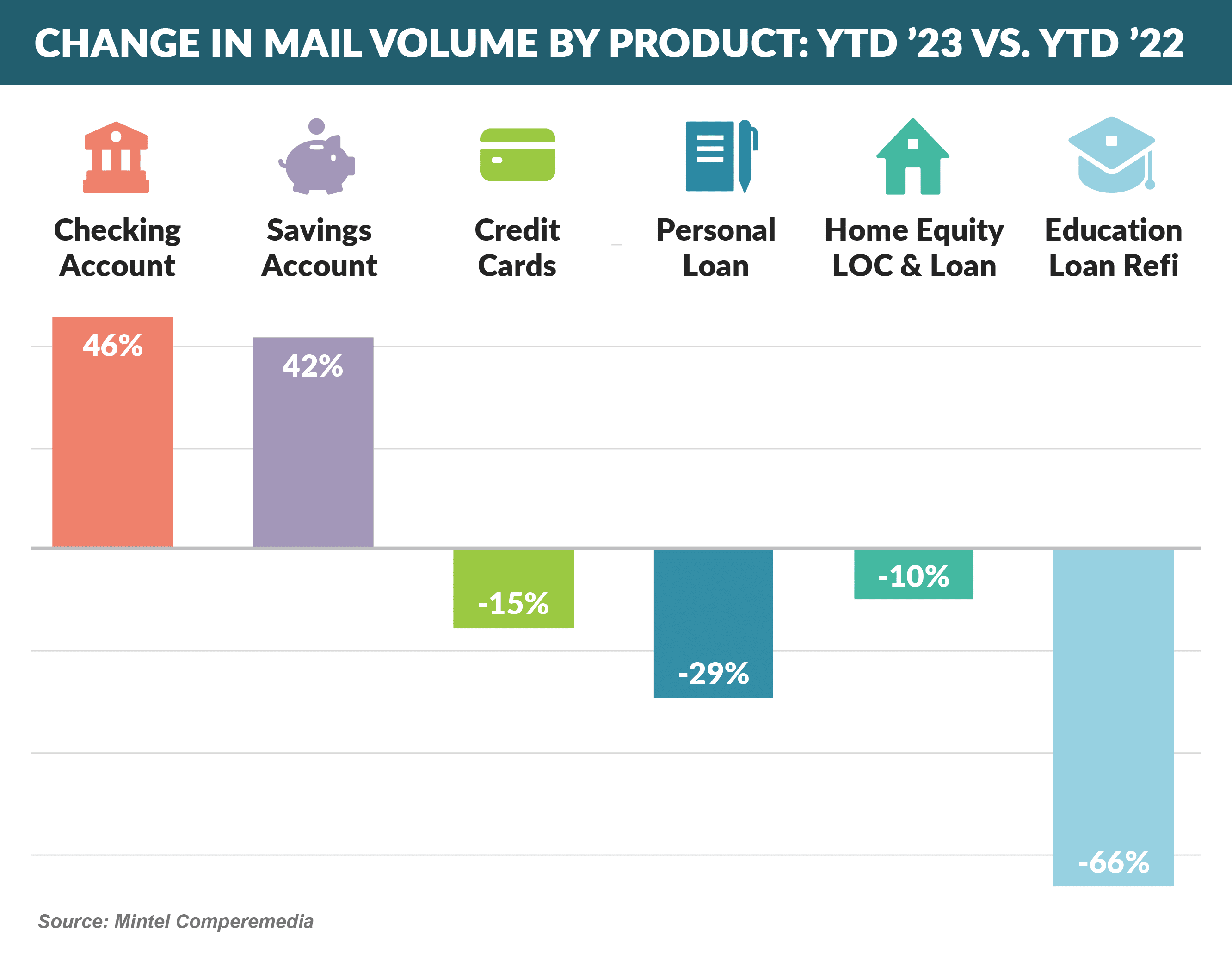

- Other than checking and savings, mail volumes are at a slower pace than last year

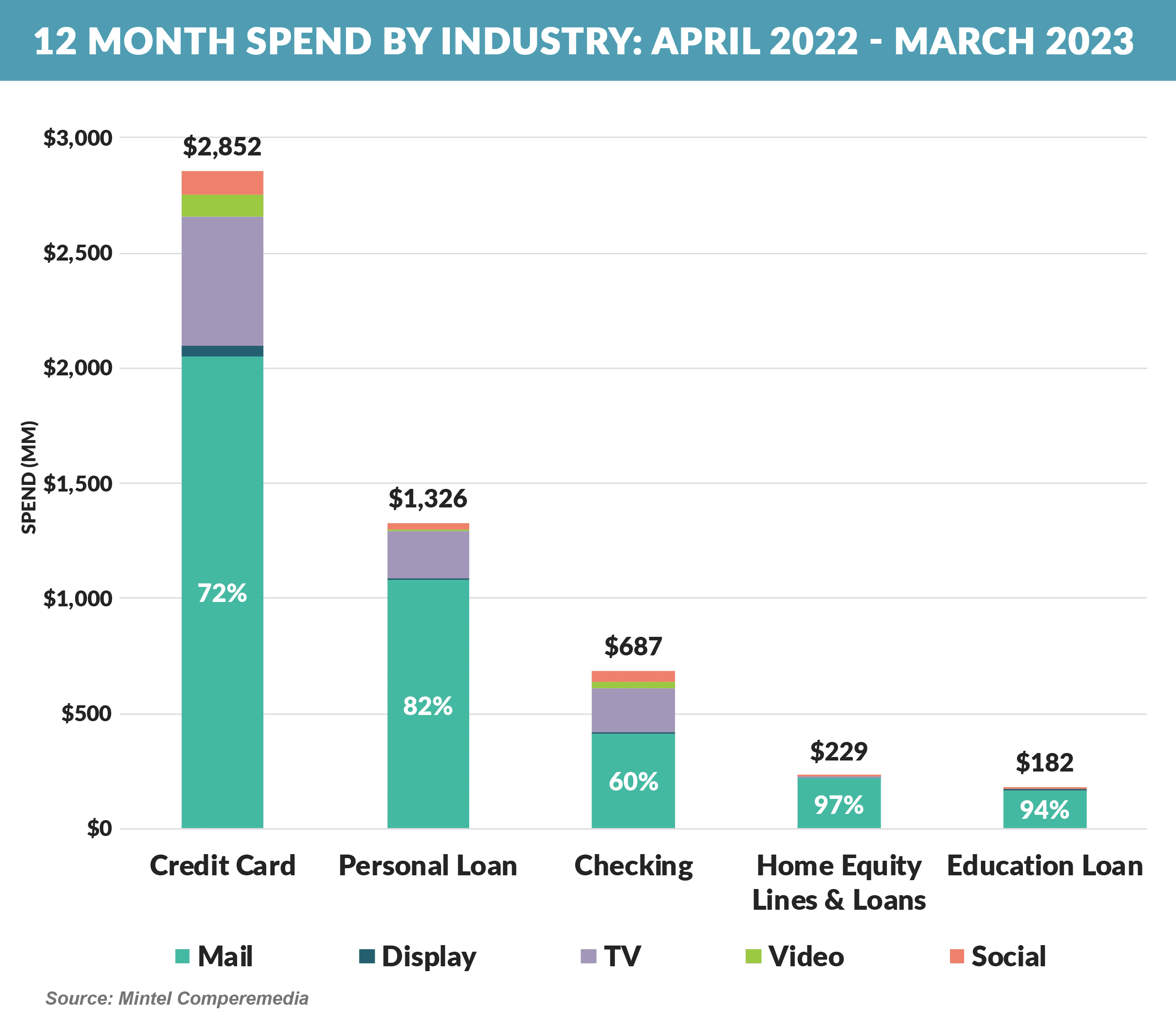

- As frequently noted, direct mail has traditionally been the primary driver of financial services marketing activity – accounting for the majority of marketing spend across all products

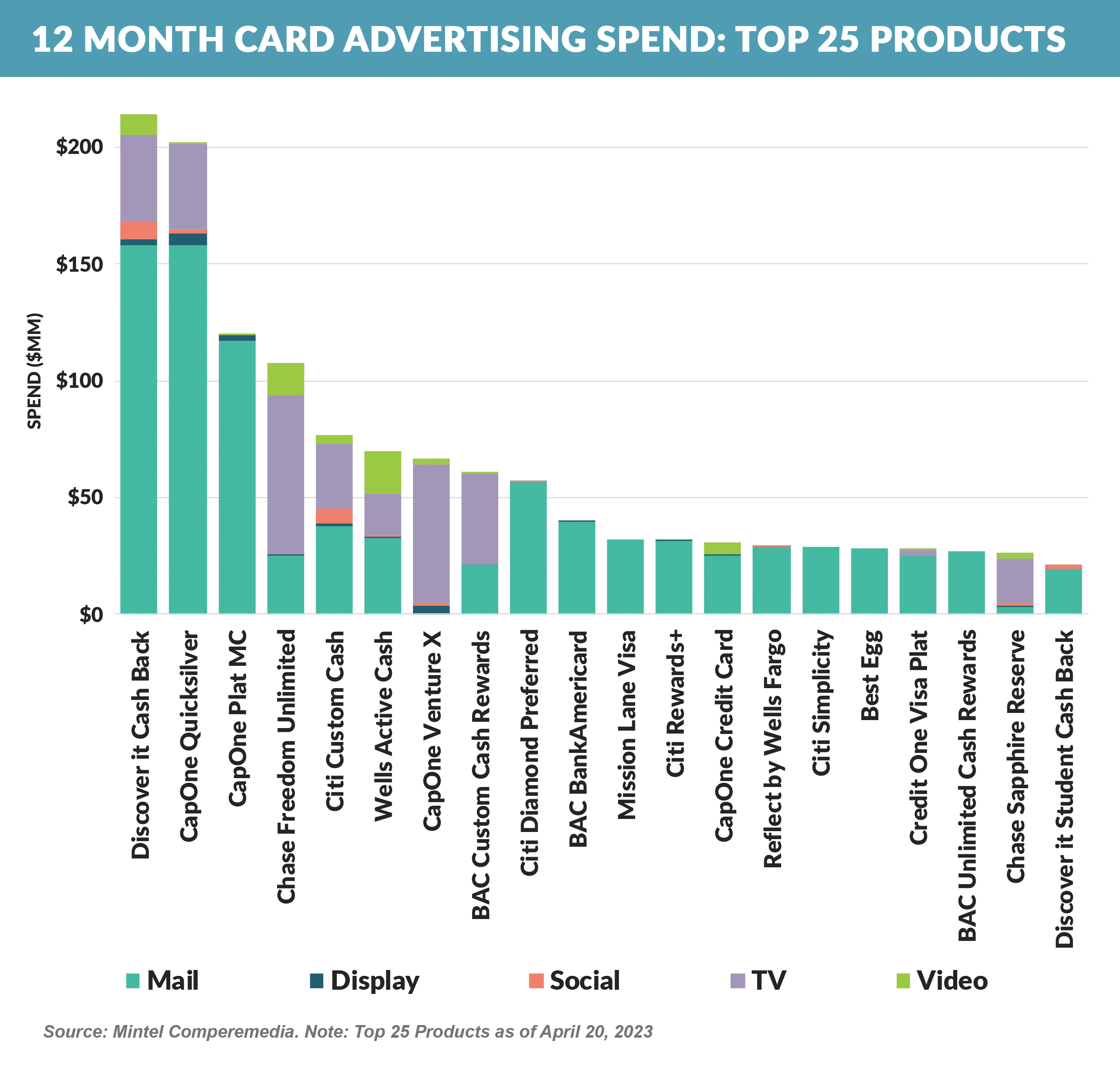

- Despite the bulk of card spending coming in direct mail, several card products – e.g., Chase Freedom Unlimited, Capital One Venture X, and Bank of America Custom Cash Rewards – continue to rely primarily on television for the majority of their advertising

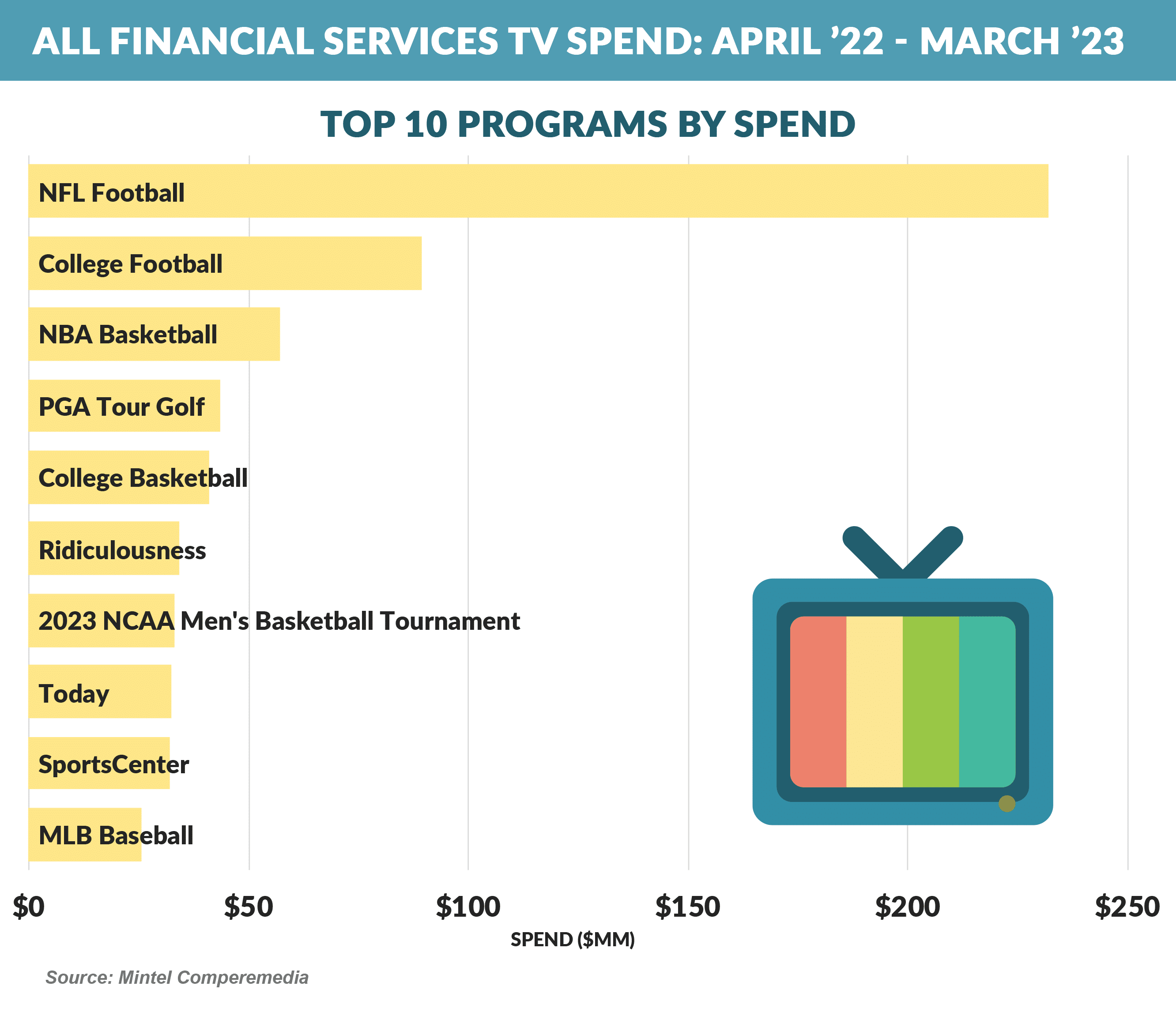

- Sports programming dominated financial services TV advertising spending

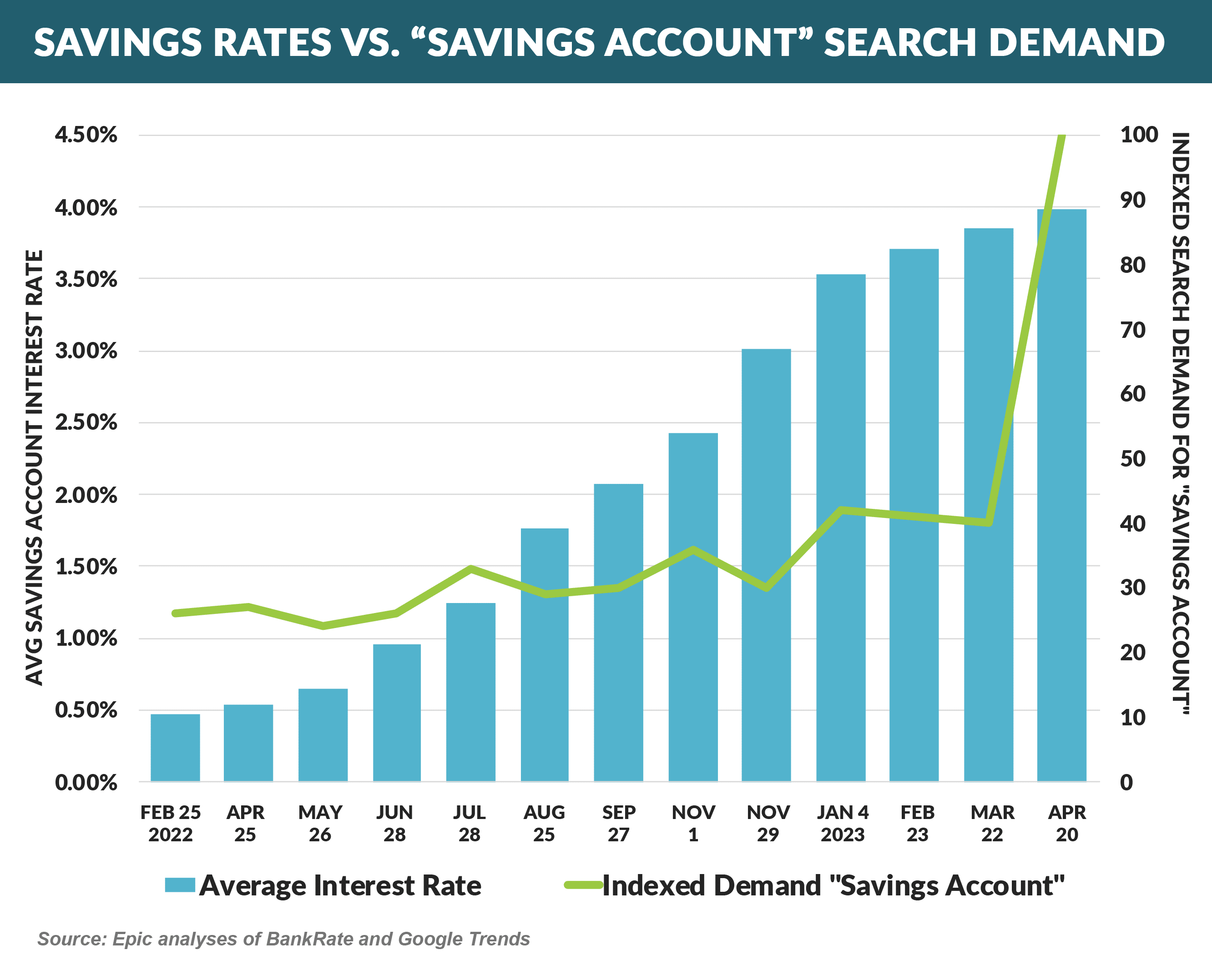

- Rising savings rates have helped fuel a spike in online search volume for “savings account”

Performance-Based Marketing Fuels Growth

- Earnings pressure is causing many banks and fintechs to cut marketing budgets, and some use performance-based marketing to defer marketing expense and fuel growth across direct mail and digital channels despite budget challenges

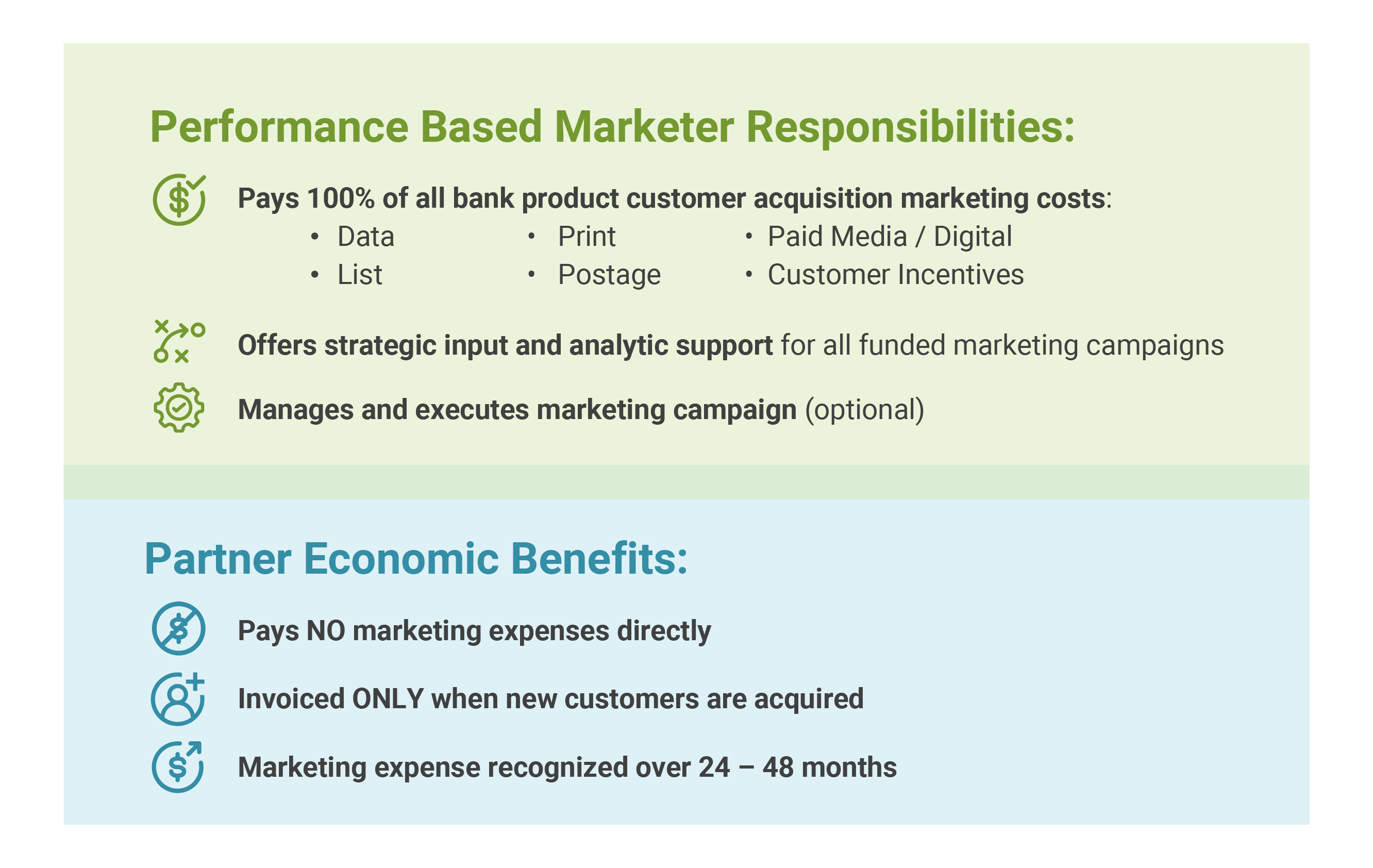

- Performance-based marketing involves a third-party marketing on behalf of the bank, with payments from the bank to the marketer only for “successful efforts,” which allows marketing expense to be deferred

- The program structure can vary, but frequently looks like this:

- Marketing expense recognition varies by product, and results in continued marketing and value creation

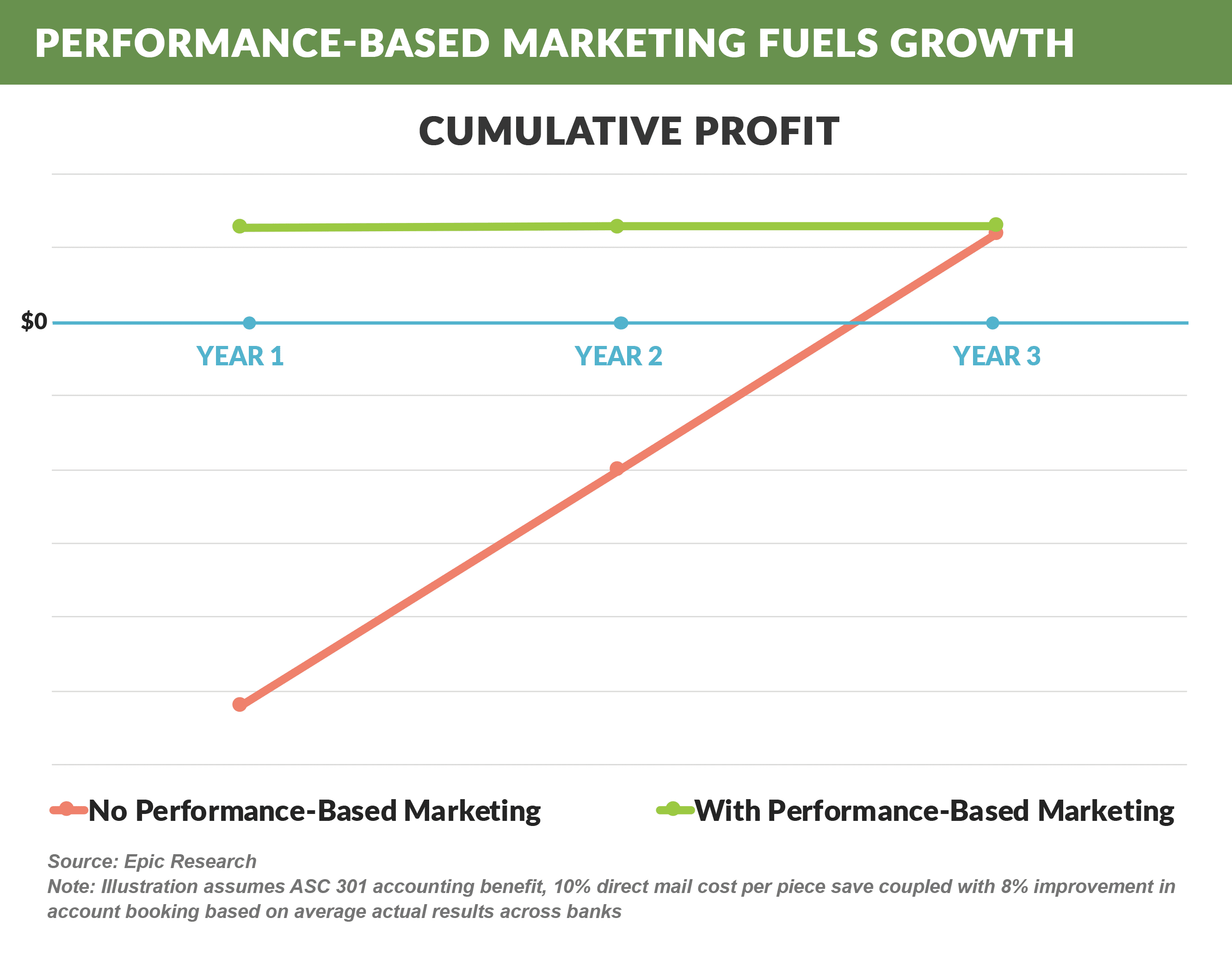

- The benefit of performance-based marketing often results in no impact to cumulative profit while smoothing marketing expense and (most importantly) avoiding the pain of the J curve

- Epic can help design and implement performance marketing services, learn more.

- Walmart is suing Capital One to end its credit card partnership

- Walmart, who also sued their previous partner Synchrony, cited customer service failures that breach the partnership agreement as grounds for termination

- Some large cobrand partners have insisted on profit-sharing agreements in recent contracts, and some in the industry speculate that Walmart was unprepared for the increase in credit losses and may want its fintech start-up “One” to be involved in card issuance

- Apple announced a new savings account in partnership with Goldman Sachs

- The account pays 4.15% interest and is only available to Apple Card holders

- Goldman Sachs also recently announced it is exploring the sale of its Greensky fintech business and has sold some of its personal loan portfolio

- PayPal recently announced several improvements to its small business offerings, including the integration of Apple Pay as a payment option

- PayPal and Venmo have also been added as payment options for Visa+, Visa’s new service that lets users transfer money to people who do not use the same peer-to-peer payment service

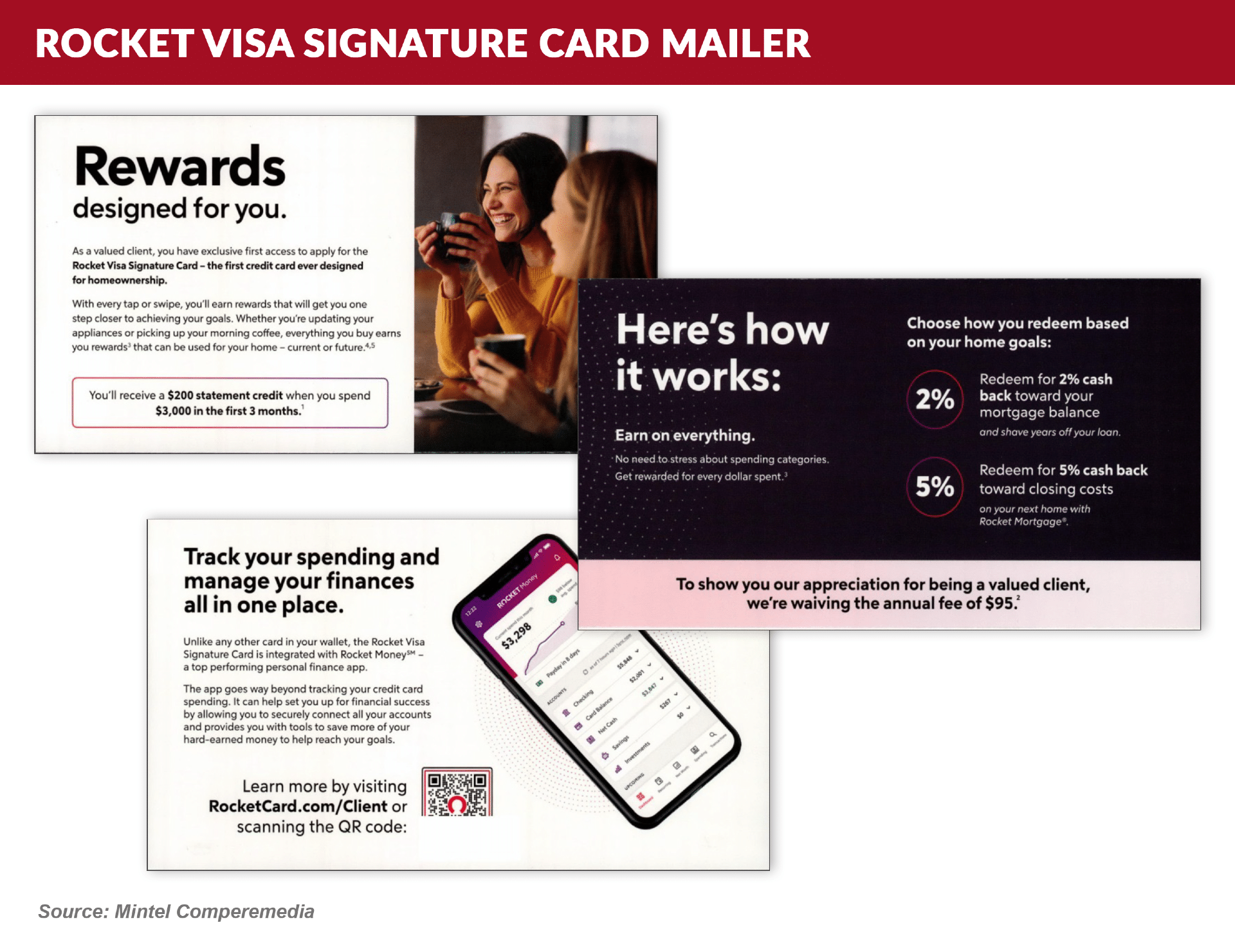

- Rocket introduced the Rocket Card, which offers rewards towards paying your mortgage and buying a home

- The card offers up to 5% cash back towards closing costs when buying a new home, or up to 2% cash back towards existing Rocket mortgage payments

- There is a $95 annual fee, which is waived for Rocket mortgage customers

- A survey conducted by the Consumer Bankers Association showed that 57% of Americans think that credit card late fees are legitimate

The Epic Report is published monthly, with the next issue publishing on June 3rd.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.