Three Things We’re Hearing

- Money markets expand as saving balances shrink

- Consumers still have low yield savings

- Card balance transfer volume grows

A three-minute read

If you would like the Epic Report delivered right to your inbox, click here

Money Markets Expand as Savings Balances Shrink

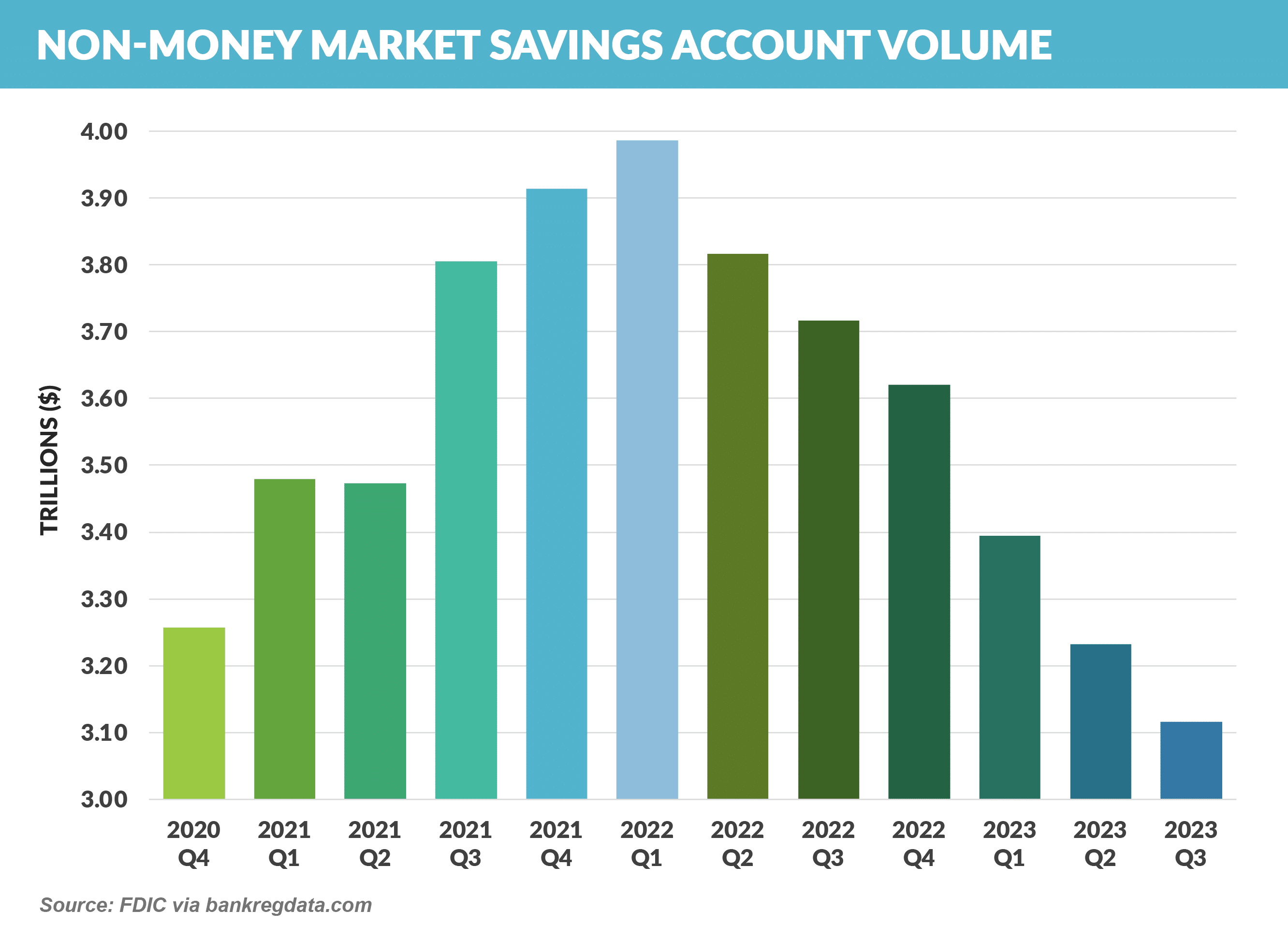

- As savings account deposits have fallen $870 billion (21.8%) since their Q1 2022 peak…

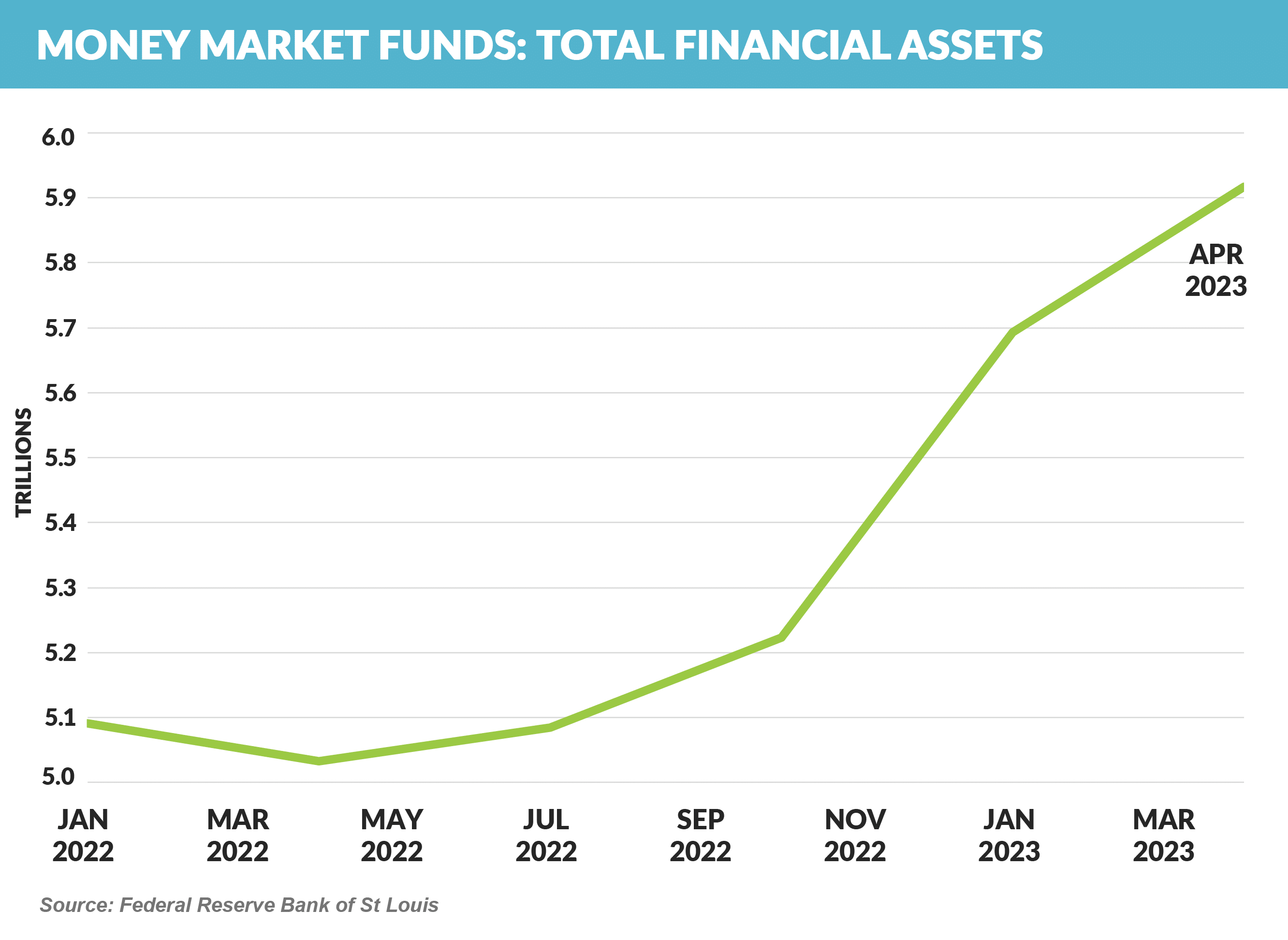

- Money market assets have expanded by $800 billion (16%)

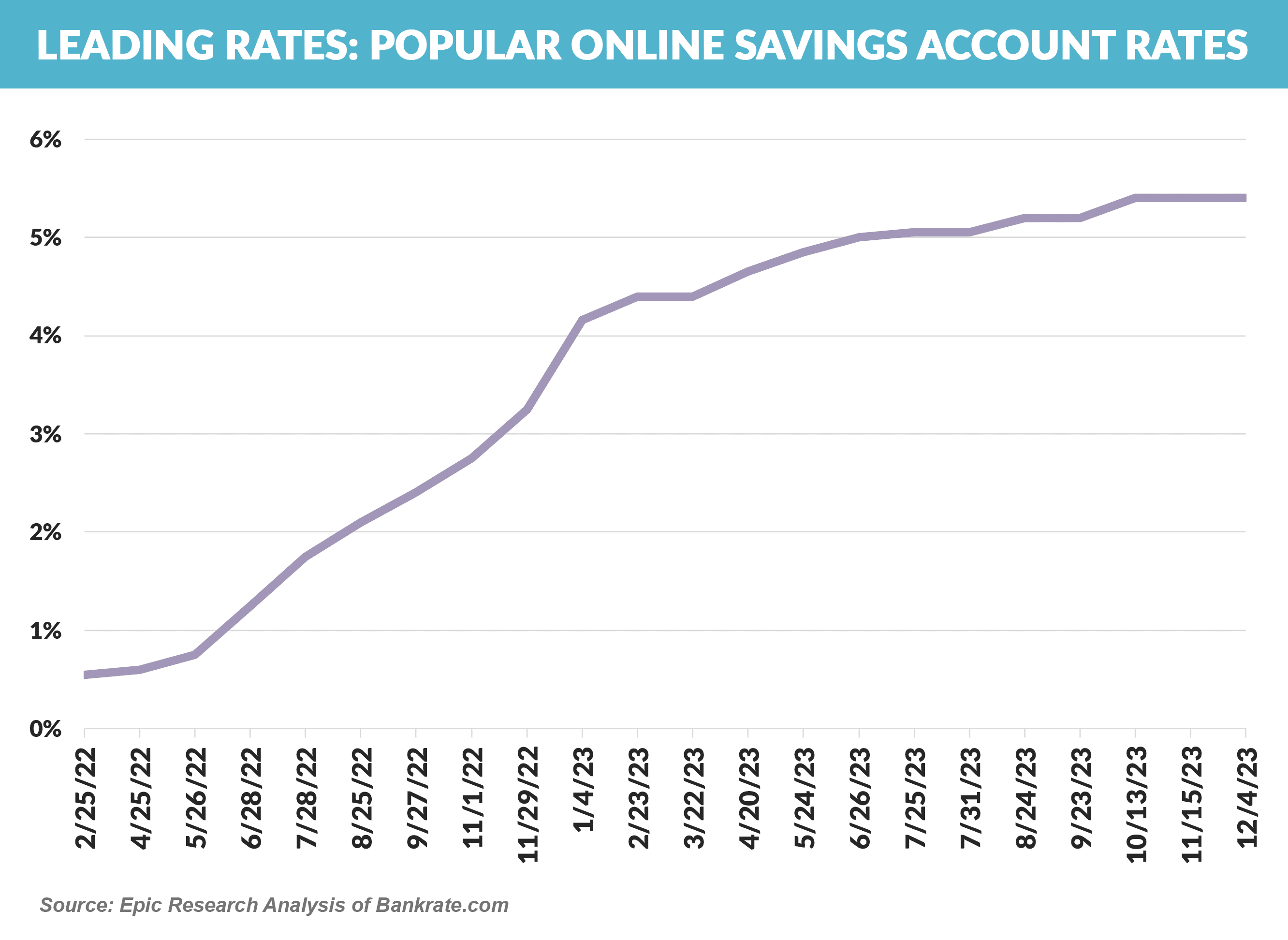

- However, there are still over $3 trillion in “traditional” bank savings accounts earning an average of .46%, that might be lured by the 5.00%+ returns on money market and high yield savings accounts

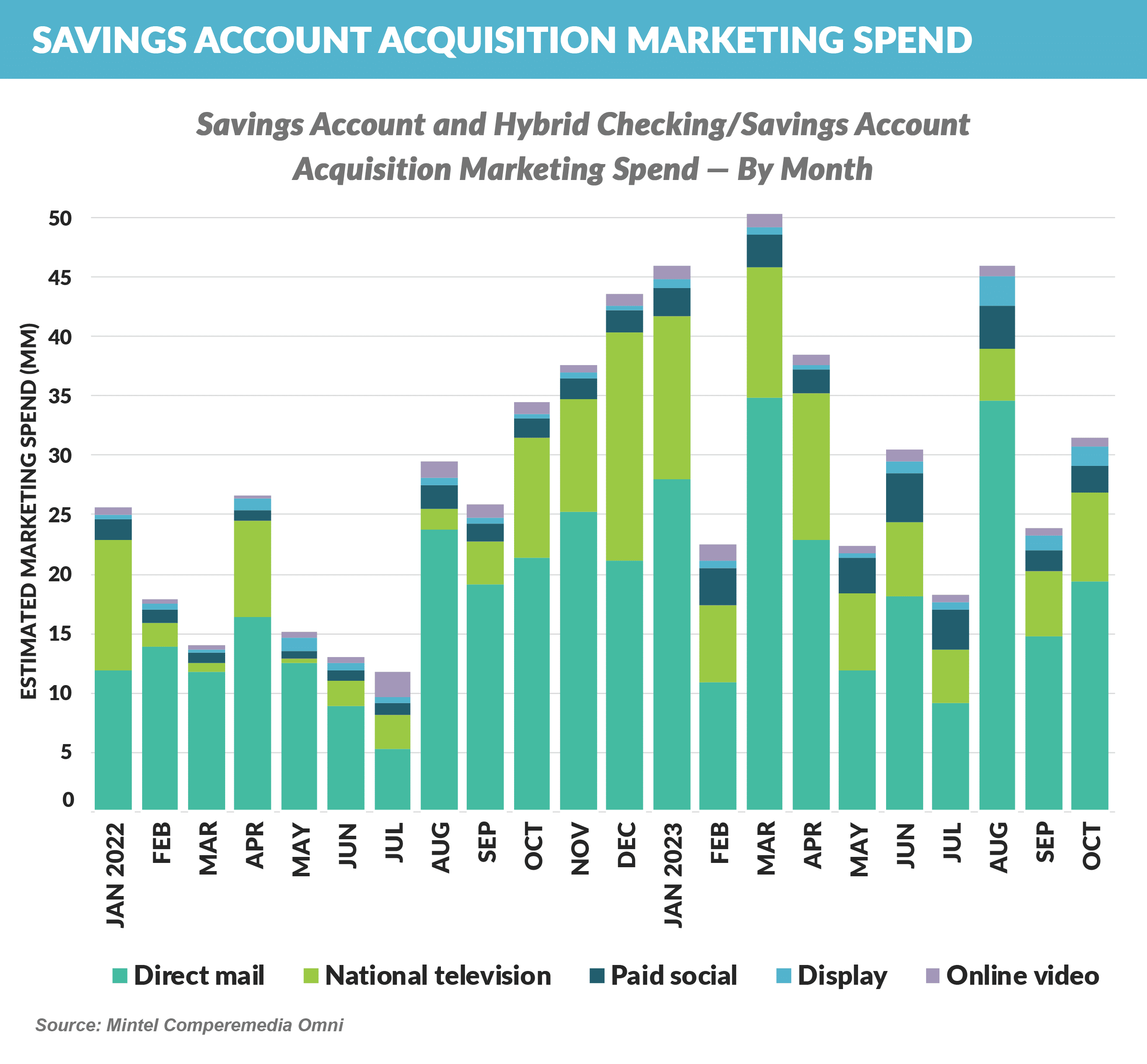

- Marketing spend for savings accounts has spiked since mid-2022 with the bulk of spending on direct mail followed by national television

- Chase and American Express have been the dominant marketers

- Marketing has focused on “hybrid” checking and savings offers as well as high yield savings, CDs, and money market accounts – some with generous incentives

Many Consumers Still Have Low Yield Savings Accounts

- Despite the availability of 5%+ yields on savings and money market accounts, a large percentage of consumers still have low yield savings accounts

- Epic surveyed consumers regarding their attitudes towards savings accounts

Card Balance Transfer Volume Grows

- Other than deposit-related marketing volumes mentioned above, marketing for other products has remained fairly stable this year at levels 15% - 60% lower than 2022

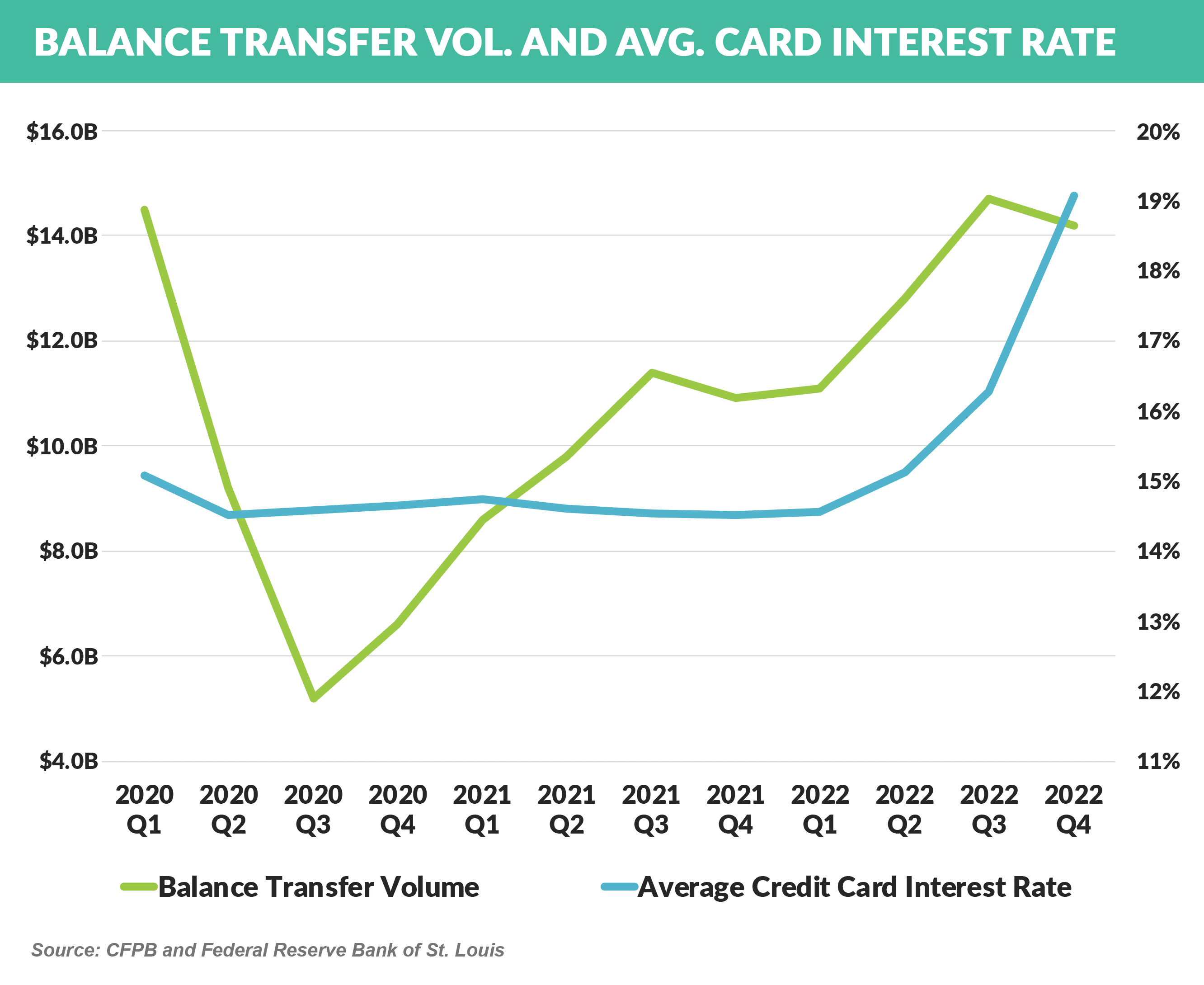

- As card APRs have risen, it is no surprise that balance transfer volume has more than doubled

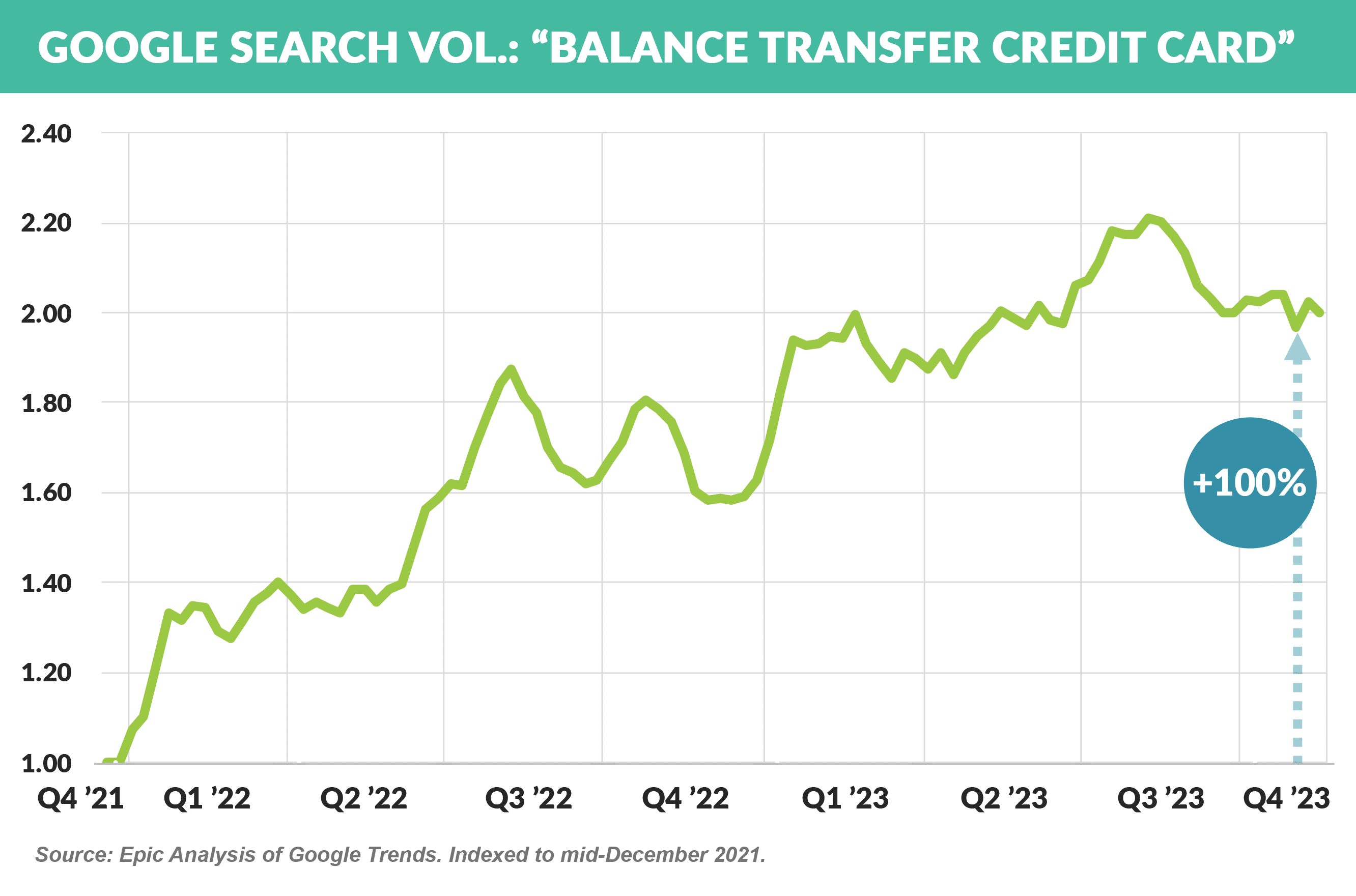

- Online search volume for “credit card balance transfer” is up 100% since Q4 2021

- Recent news reports signal the end of the Goldman Sachs consumer finance venture:

- In early November, Goldman informed employees that it was beginning a process to find a new issuer for the GM Card. It will be interesting to see how much interest there is for the stagnant, decades-old program

- Additionally, a Wall Street Journal headline has Apple “pulling the plug” on its Apple Credit Card and savings account relationship with Goldman Sachs

- Given the reported Apple-friendly revenue sharing terms plus the large size of the portfolio, there may be very few potential bidders to take over the program

- These developments follow the October sale of the GreenSky home improvement finance company and the earlier sale and cessation of new originations of personal loans

- Monday morning quarterbacking this one seems like piling on, so we’ll leave that up to you!

- In case you thought you were missing something about the basic Neobank model, this article by a Neobank founder confirms all doubts you might have had about the basic economics of the product

“During my time at Daylight, I got close with many other neobank founders and realized that everyone is facing the same problem: Customer acquisition is too expensive and the unit economics suck” (emphasis ours)

- Budgeting app Mint will shut down on January 1, 2024, as owner Intuit transitions the Mint customer account data to the Credit Karma platform, which does not currently have similar budgeting functionality

- Mint’s free model depended on advertising and sponsorships, which did not generate enough revenue to make Mint viable

- Personal Finance Management software in general has had difficulty attracting large numbers of users

- Discover will stop accepting student loan applications on February 1, 2024 and is exploring the sale of its student loan business

- Discover is the number two provider of student loans

- If completed, it would benefit number one Sallie Mae as well as Citizens, College Ave, and other providers

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on January 13th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.