Three Things We’re Hearing

- Card issuers compete on promotional offers

- Consumers are savvy about balance transfers!

- Personal loan acquisition moves up the credit spectrum

A four-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Card Issuers Compete on Promotional Offers

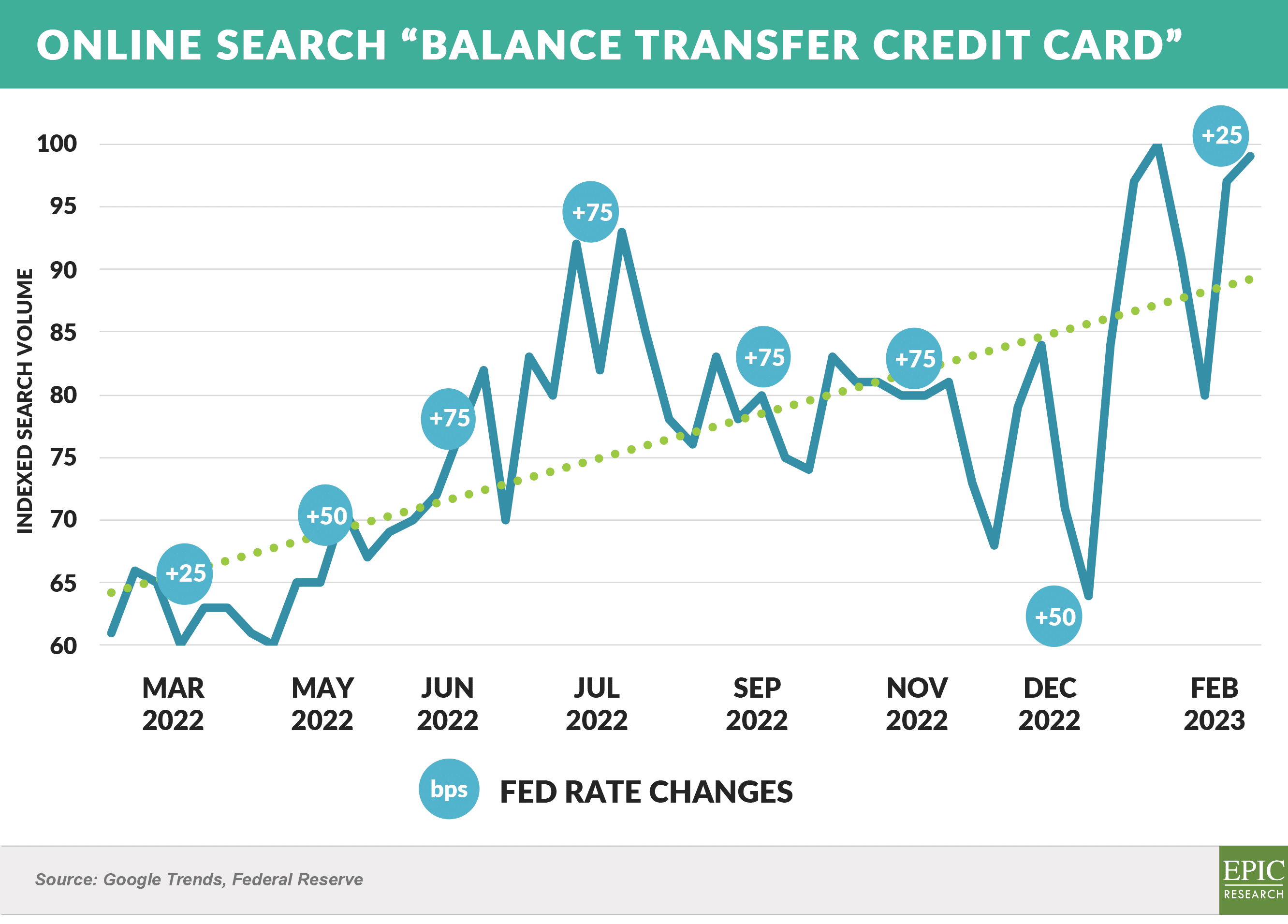

- Since Q2 2022, consumers have reacted rationally to the rising rate environment, searching with increasing intensity for balance transfer credit cards

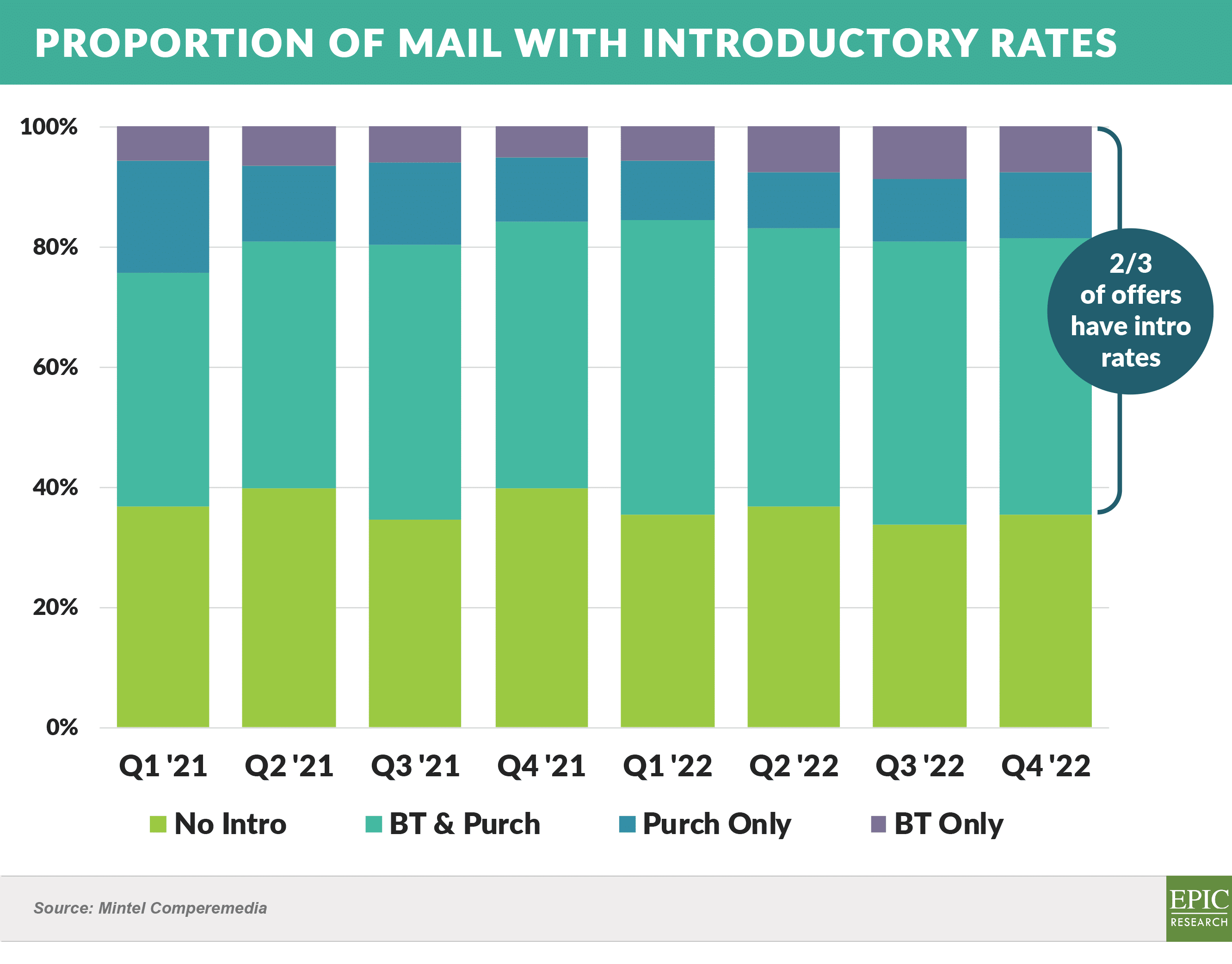

- While consumer interest in balance transfers has risen, the share of new card offers with balance transfer promotions has not changed over the past two years, appearing on two-thirds of all direct mail offers

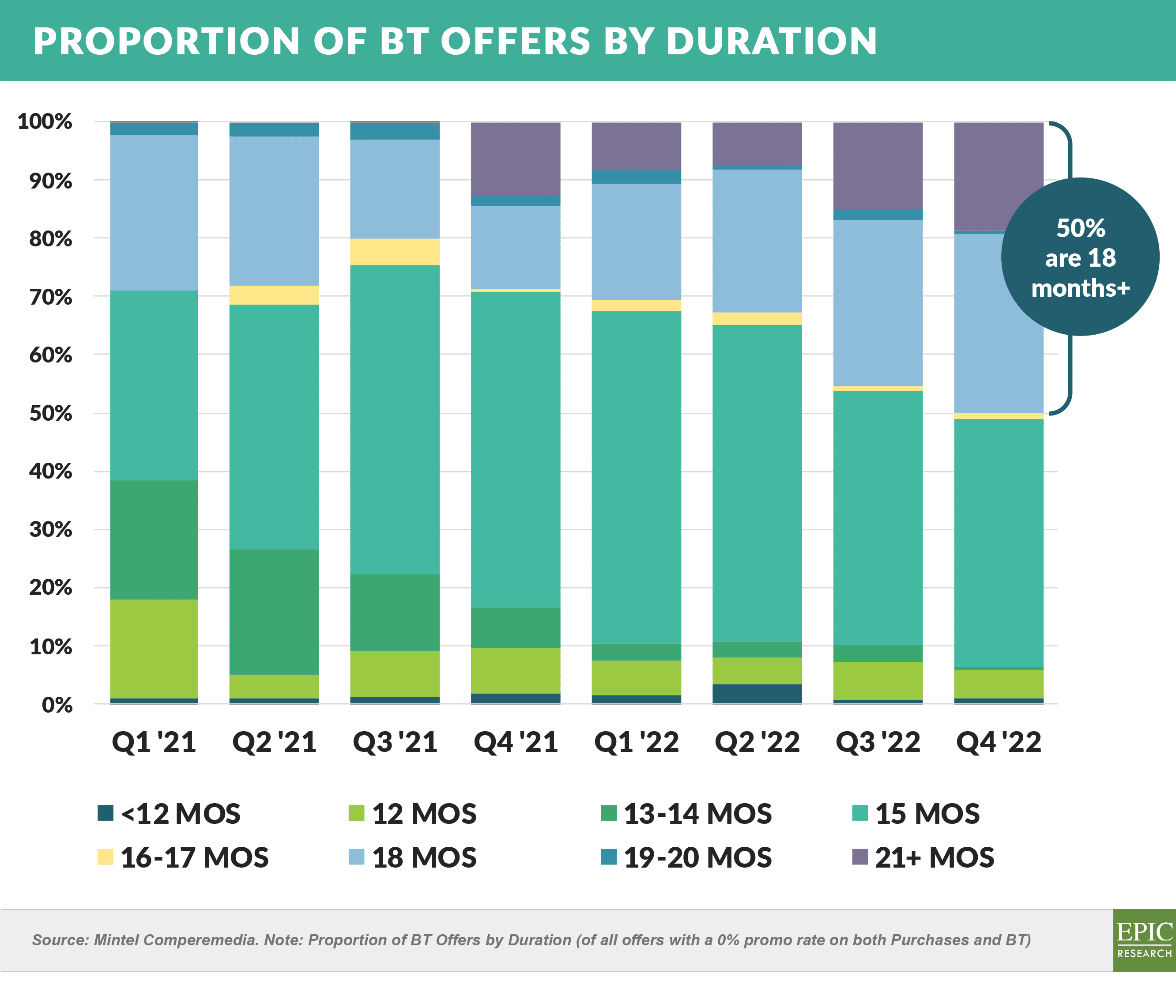

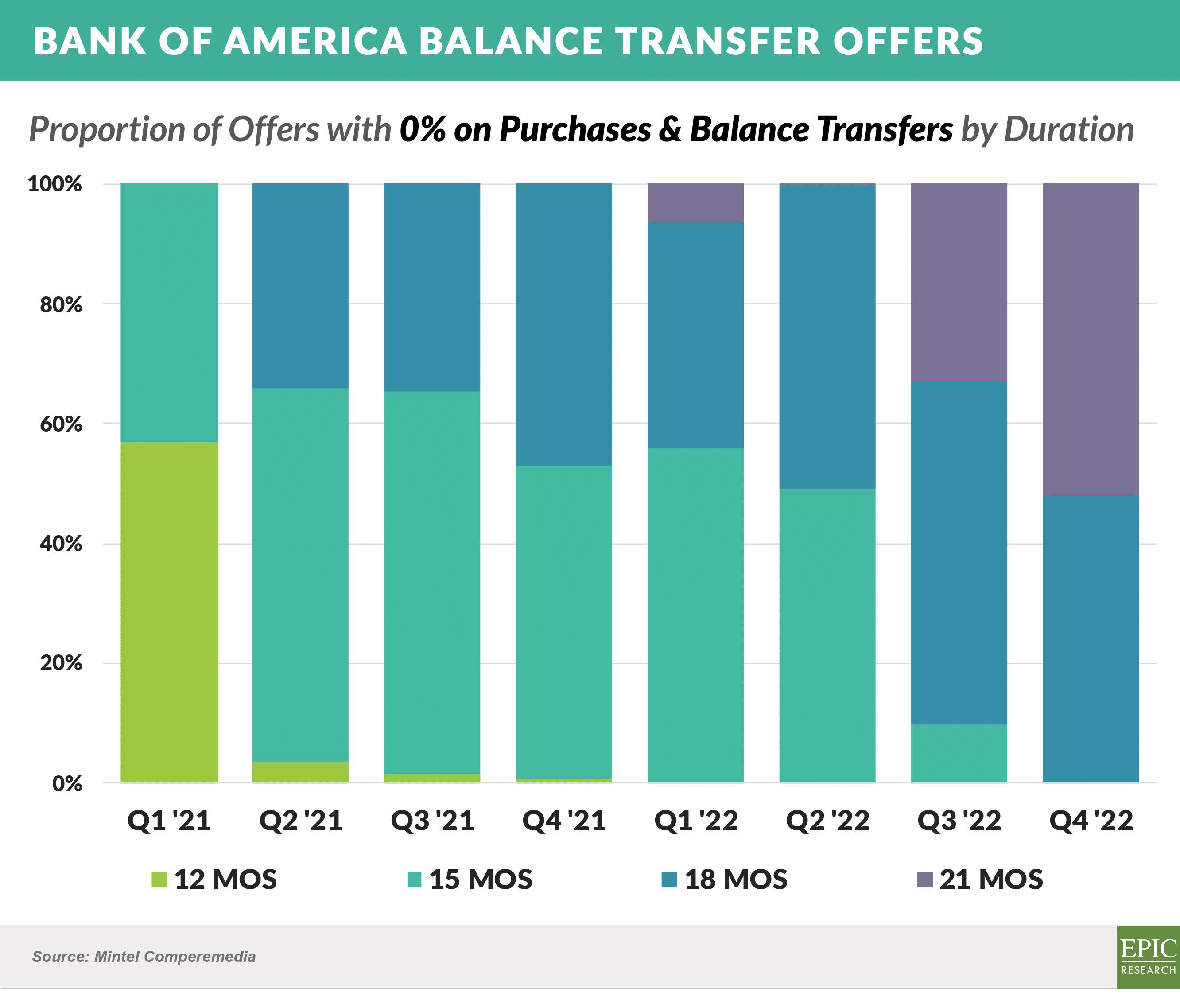

- Issuers have instead responded to the increase in consumer interest primarily by increasing the duration of the 0% BT offers with 50% now offering promotional periods of 18 months or longer

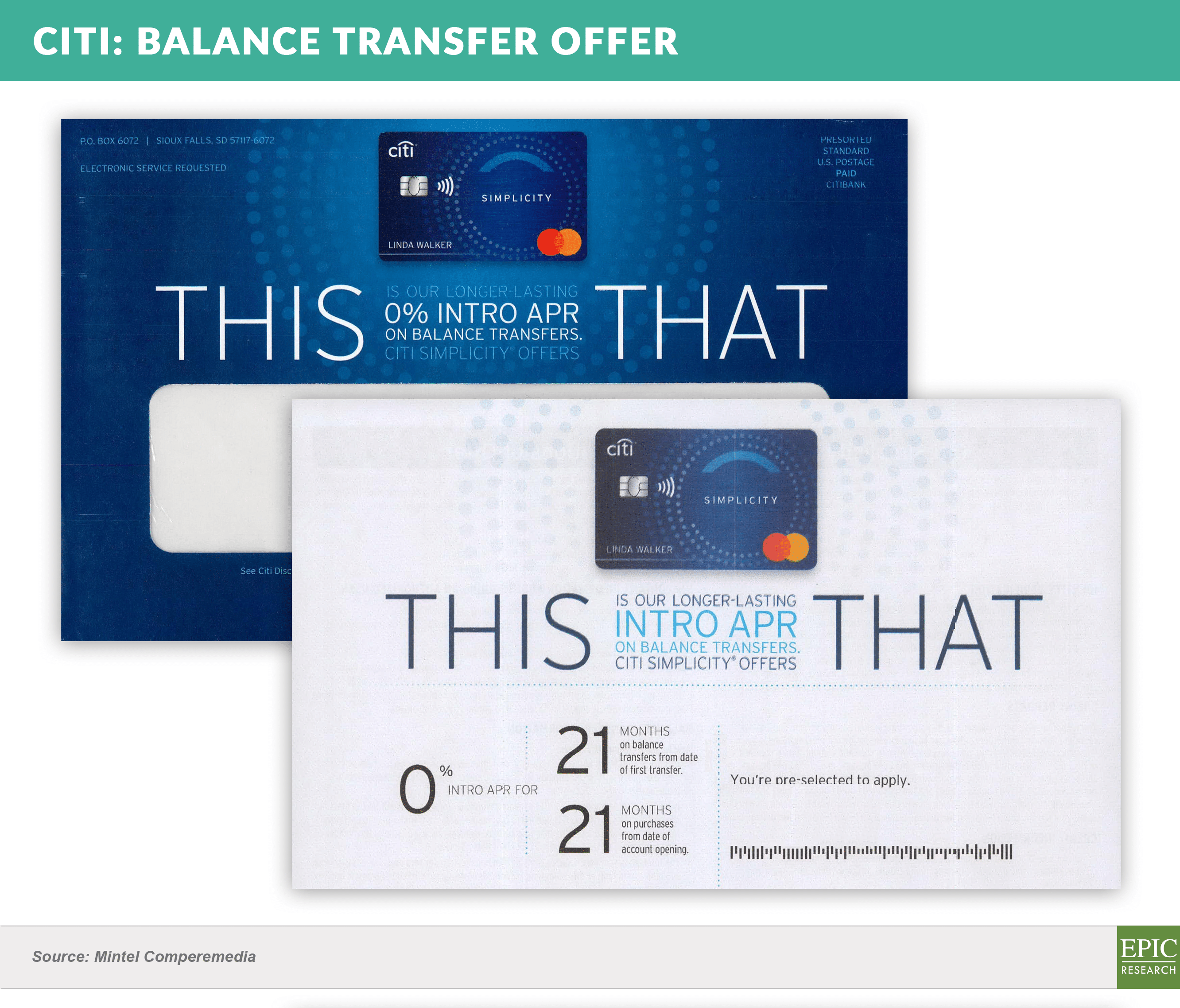

- Citi leads the way with a 21 month offer on BTs (purchases are also at 21 months)

- And Bank of America increased durations on BT offers from 12/15 months to the current 18 or 21 months

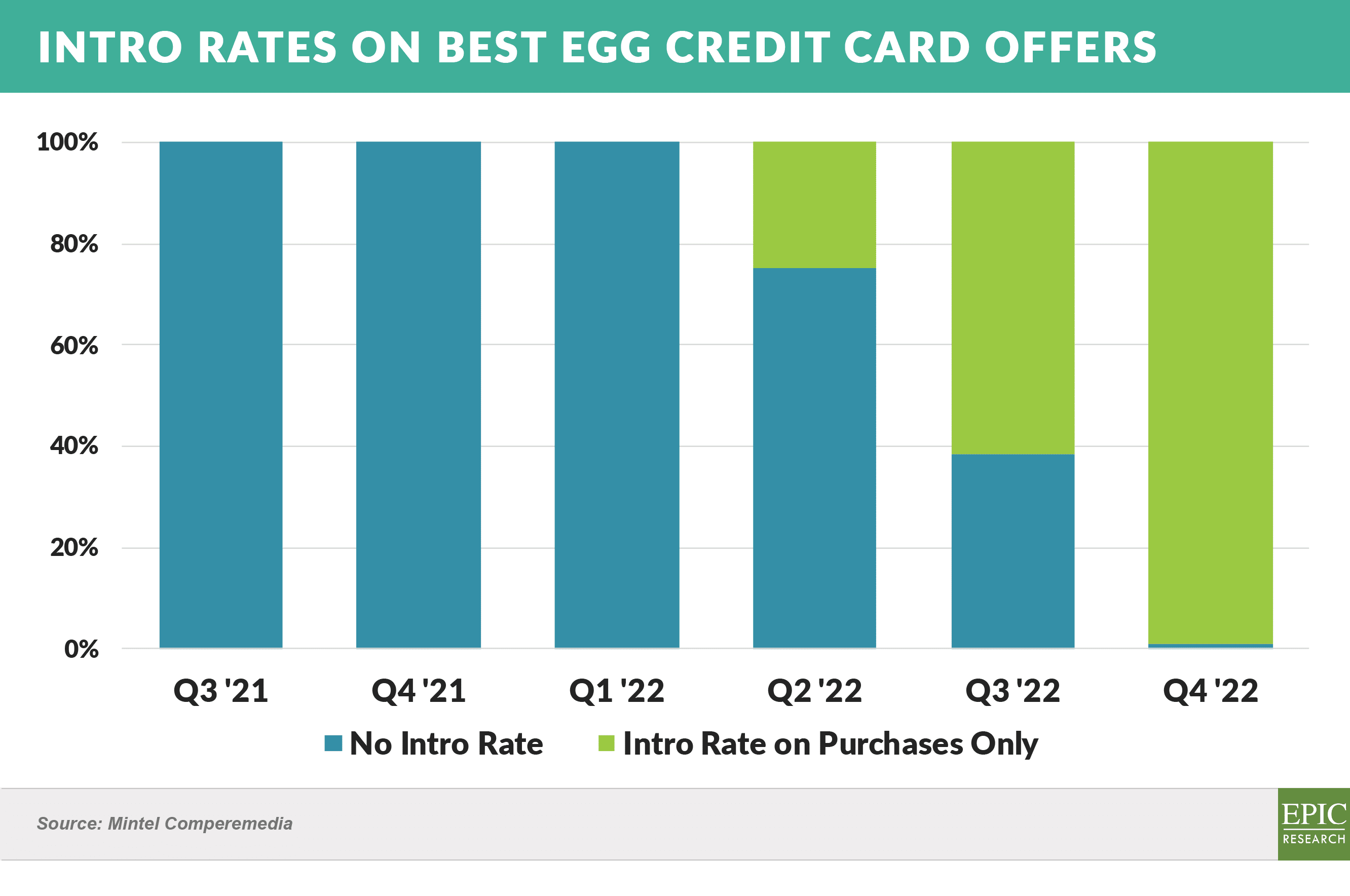

- Near prime/middle market issuer Best Egg recently began offering a 0% for 12 months promotion on purchases, but has yet to introduce BT promotions, likely preferring for customers to use their open to buy for purchase activity

- Other major near-prime mailers – Mission Lane, Mercury, and Credit One – have not yet introduced 0% offers

Consumers are Savvy about Balance Transfers

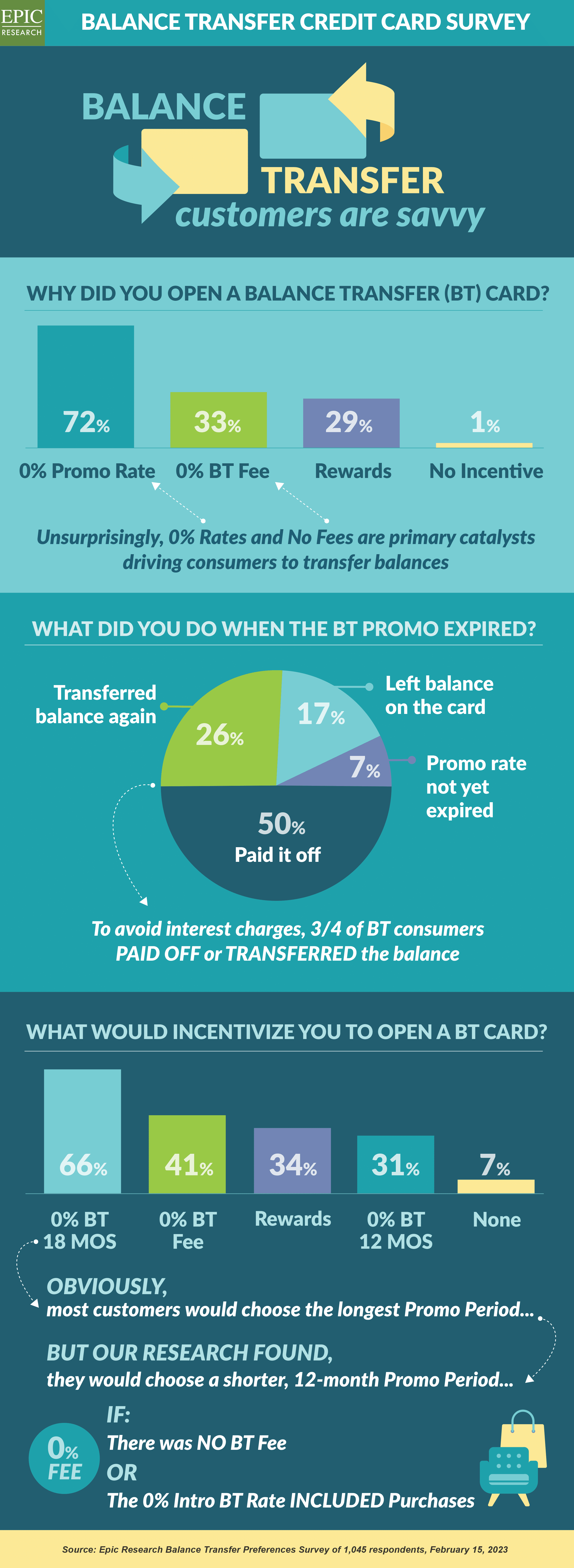

- Given the increased market focus on balance transfers, Epic surveyed 1,045 consumers with self-reported revolving history to assess their preferences regarding credit card balance transfers (“BTs”)

- Consumers are aware of introductory balance transfer offers, and have interesting views on the importance of various BT features

Personal Loan Acquisition Moves up the Credit Spectrum

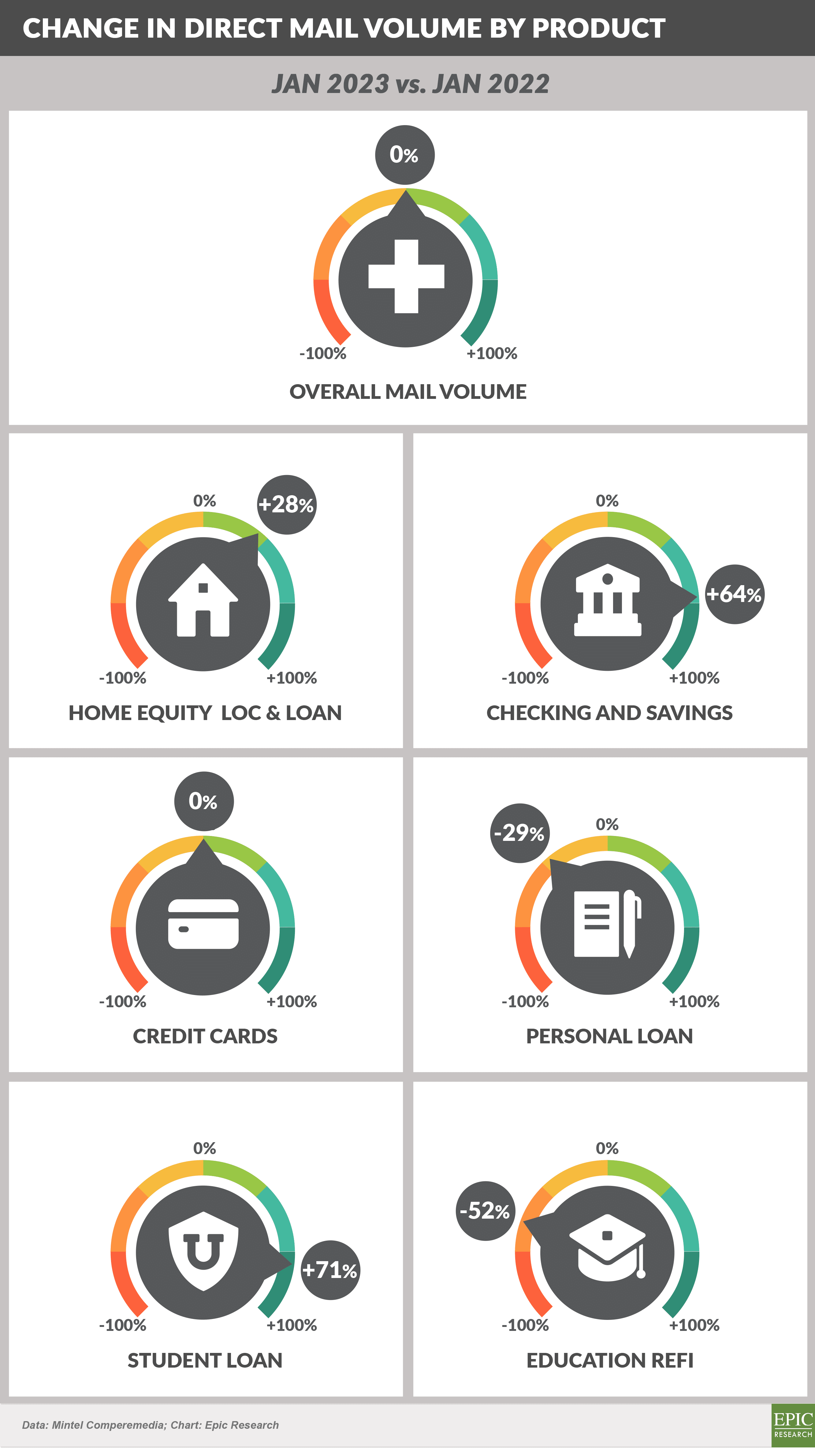

- Overall mail volume in January was flat to January ’22, however several products showed significant year-over-year changes

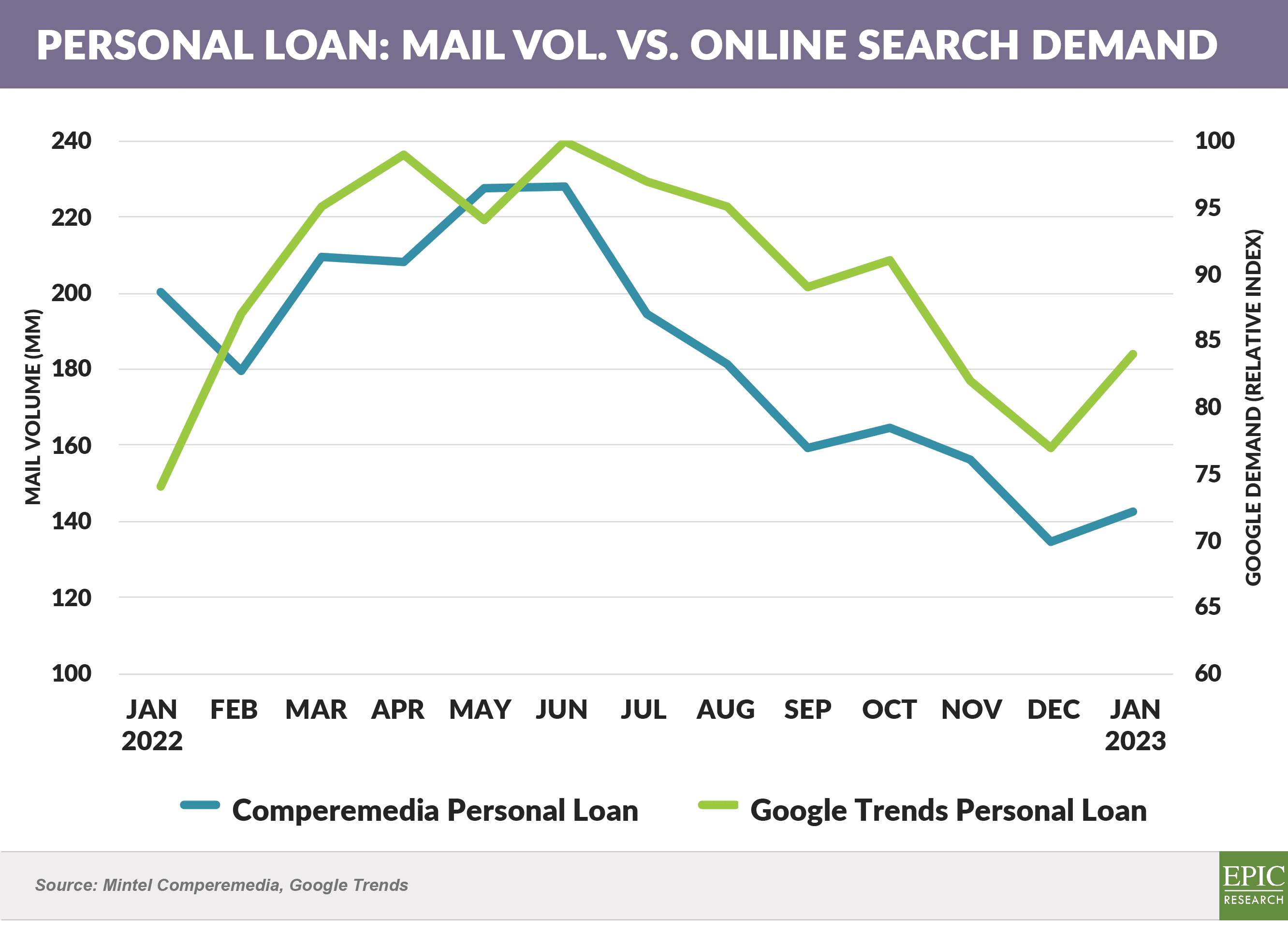

- While personal loan mail volume (“supply”) has declined in the past six months, online search volume (“demand”) has softened at a slower rate

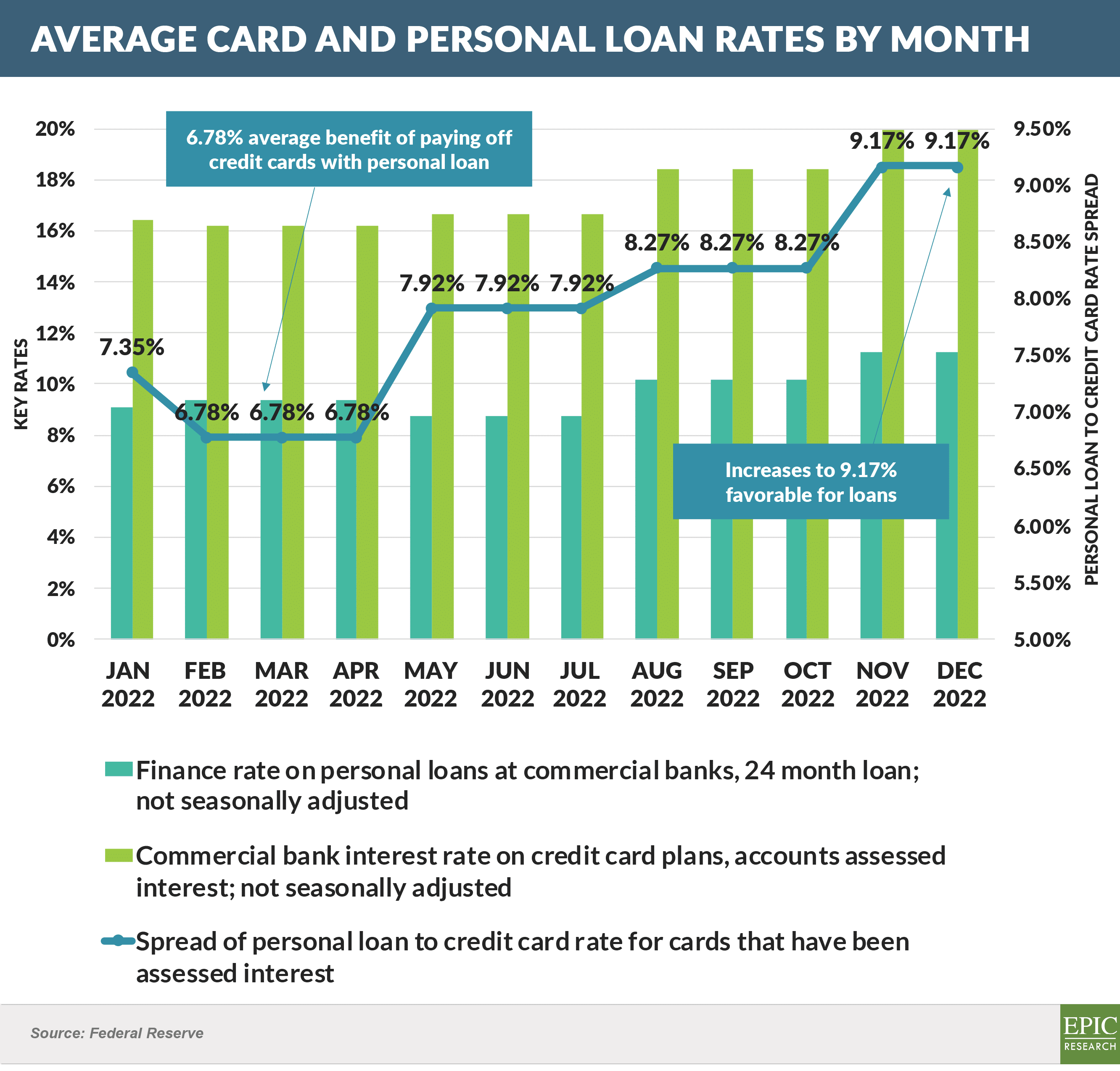

- However, as shown in the February Epic Report, the benefit of refinancing credit card balances with a lower rate personal loan has grown in the past six months

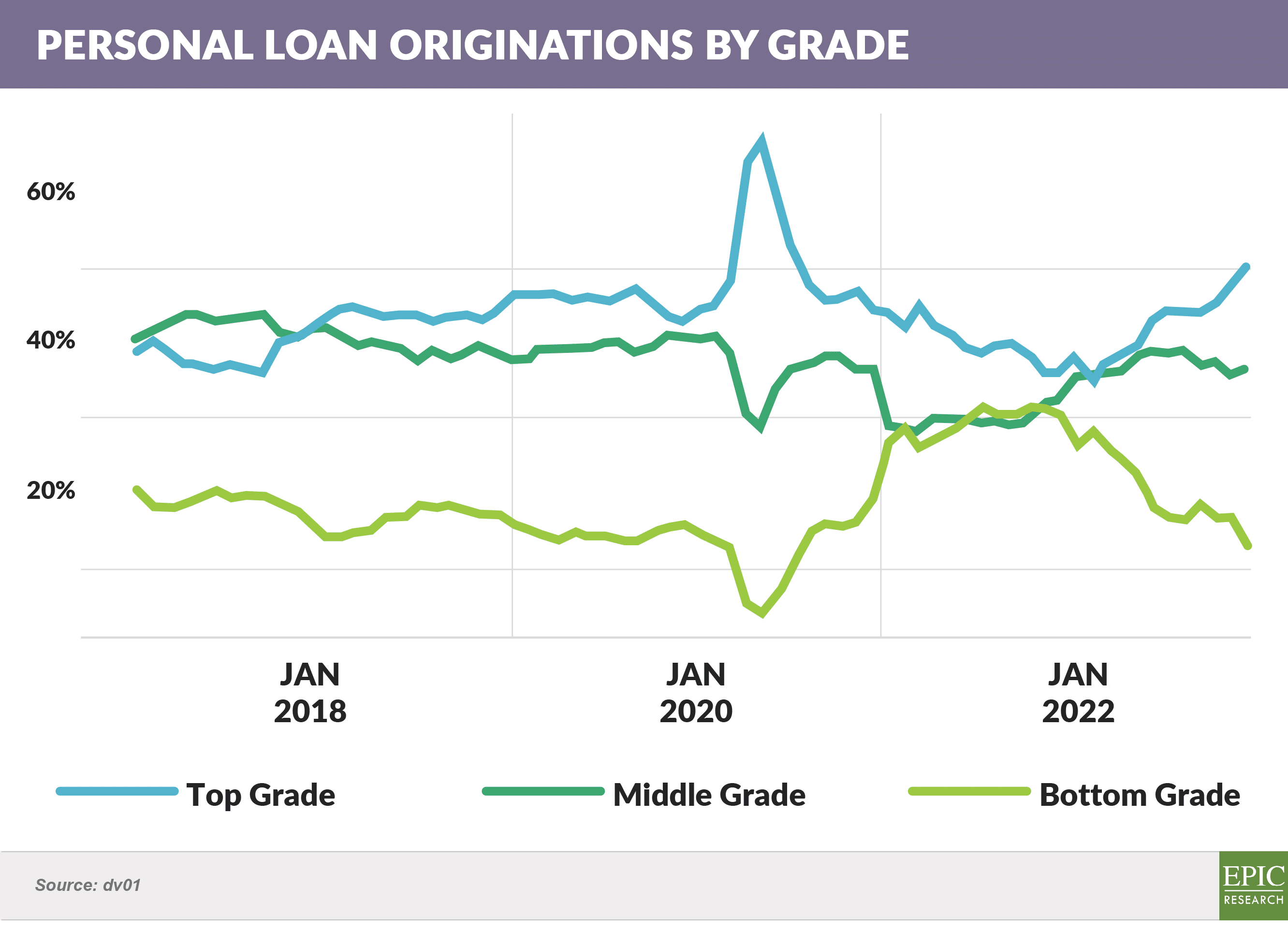

- Personal loan mail volume overall has dropped as lenders prudently tightened credit standards in anticipation of an economic downturn, causing a decrease in the number of loans made in the lower end of the credit spectrum with a corresponding increase in loans in the upper end

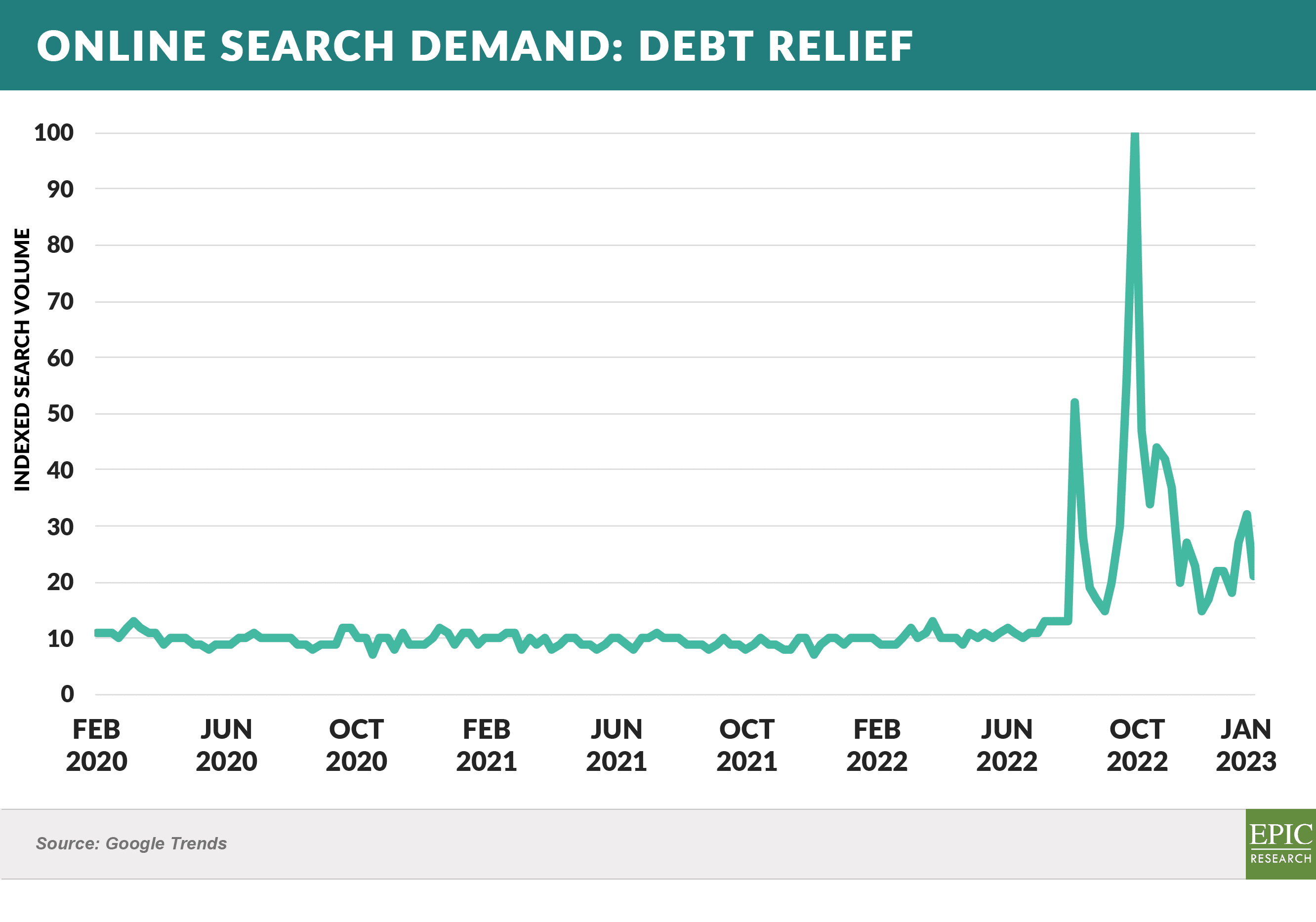

- On a related note, online search volume for “Debt Relief” has spiked since mid-2022

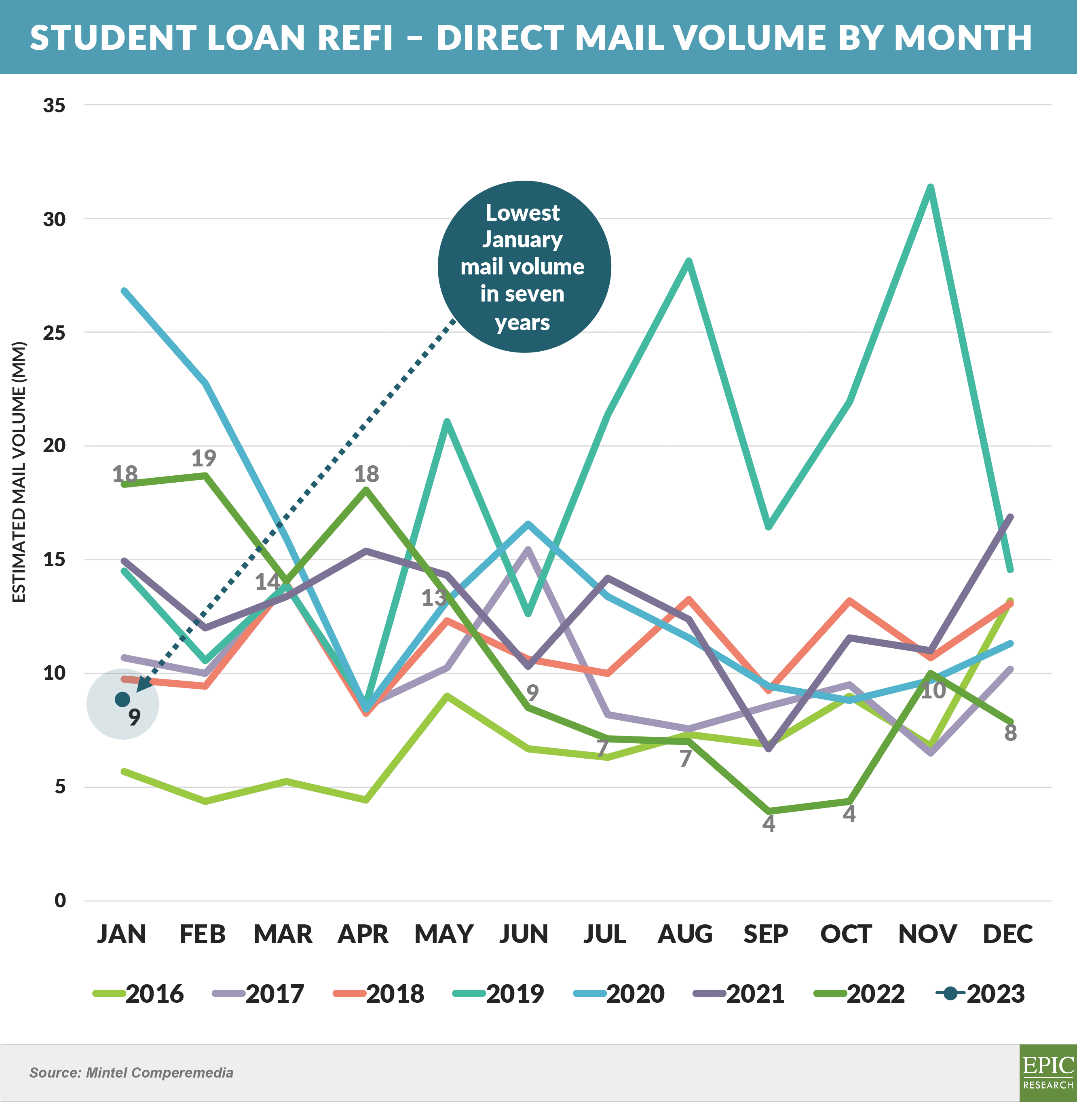

- The ongoing student loan repayment moratorium has resulted in tepid volumes for student loan refinance mailings with last month reaching a seven year low for Januarys, down 50% since ’22 and only one-third the volume of January 2020

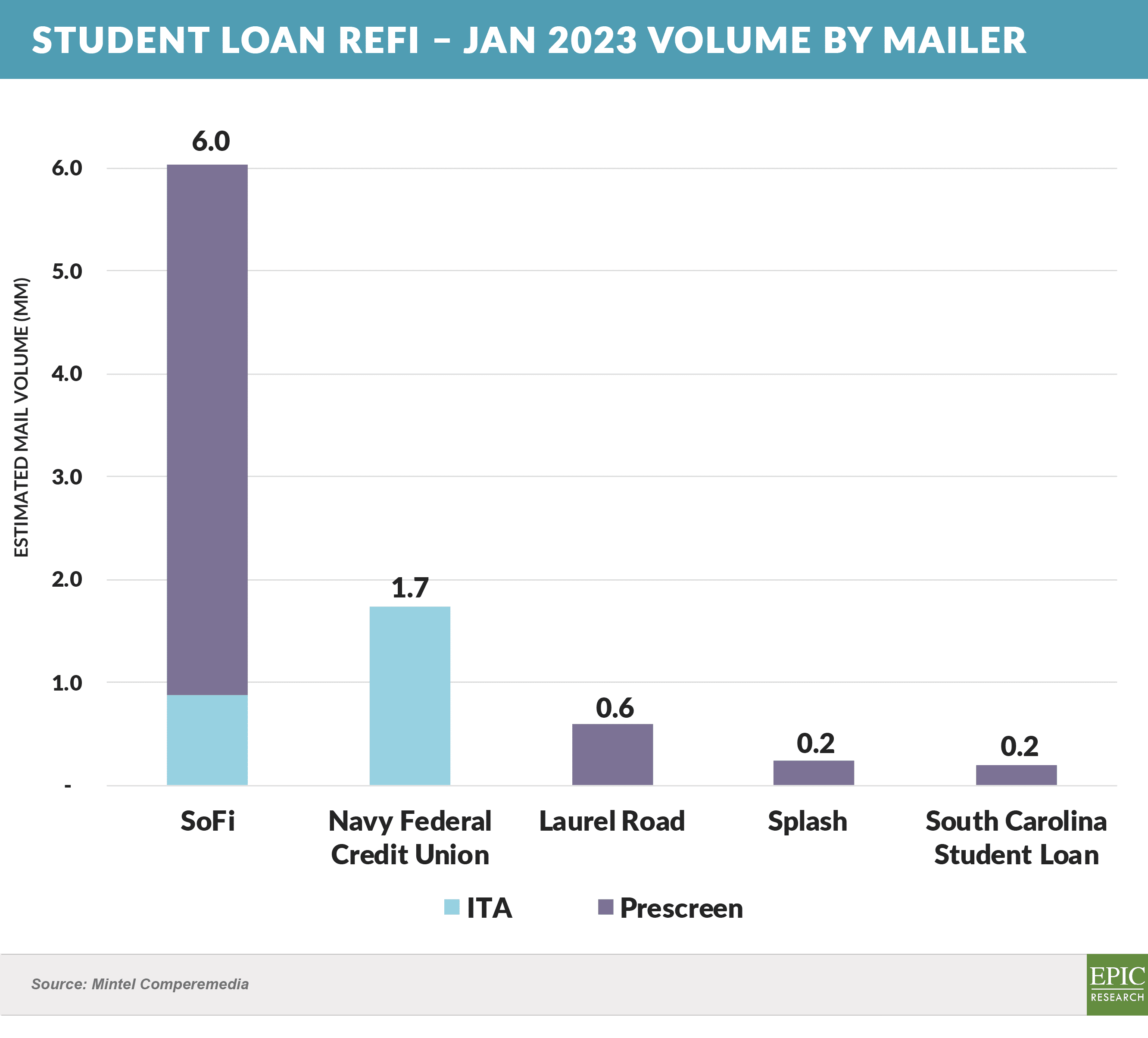

- SoFi, who acquired a banking charter last year, is one of the few lenders still active in the sector, accounting for two-thirds of all January volume

- The Supreme Court held hearings on the challenge to the proposed debt forgiveness program on February 28th and, if the decision goes against the program (with a decision expected in late June), consumer uncertainty may lessen, and marketing activities may pick up

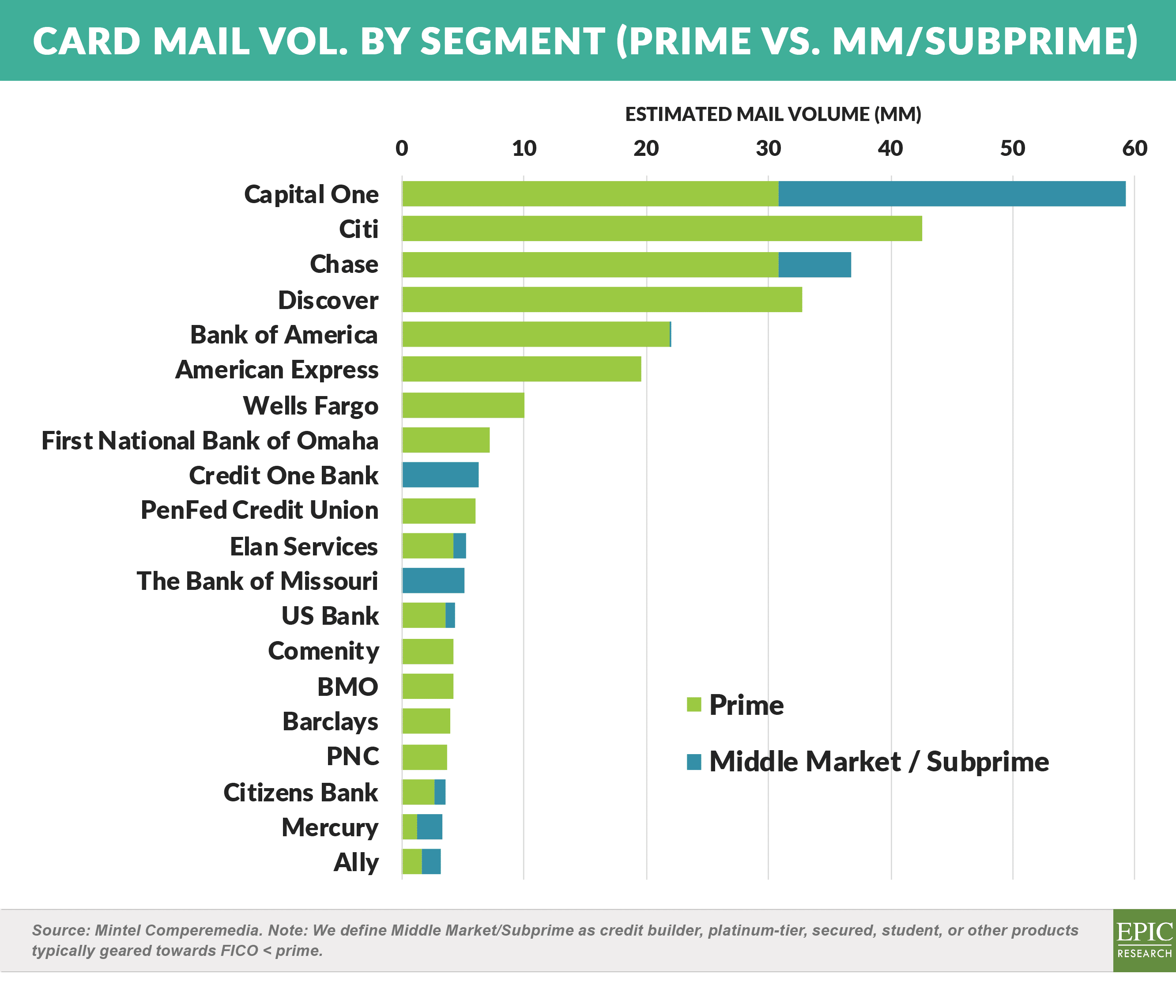

- Near prime offers are still some of the top credit card products mailed, accounting for 18% of top 20 issuer mail volume in January

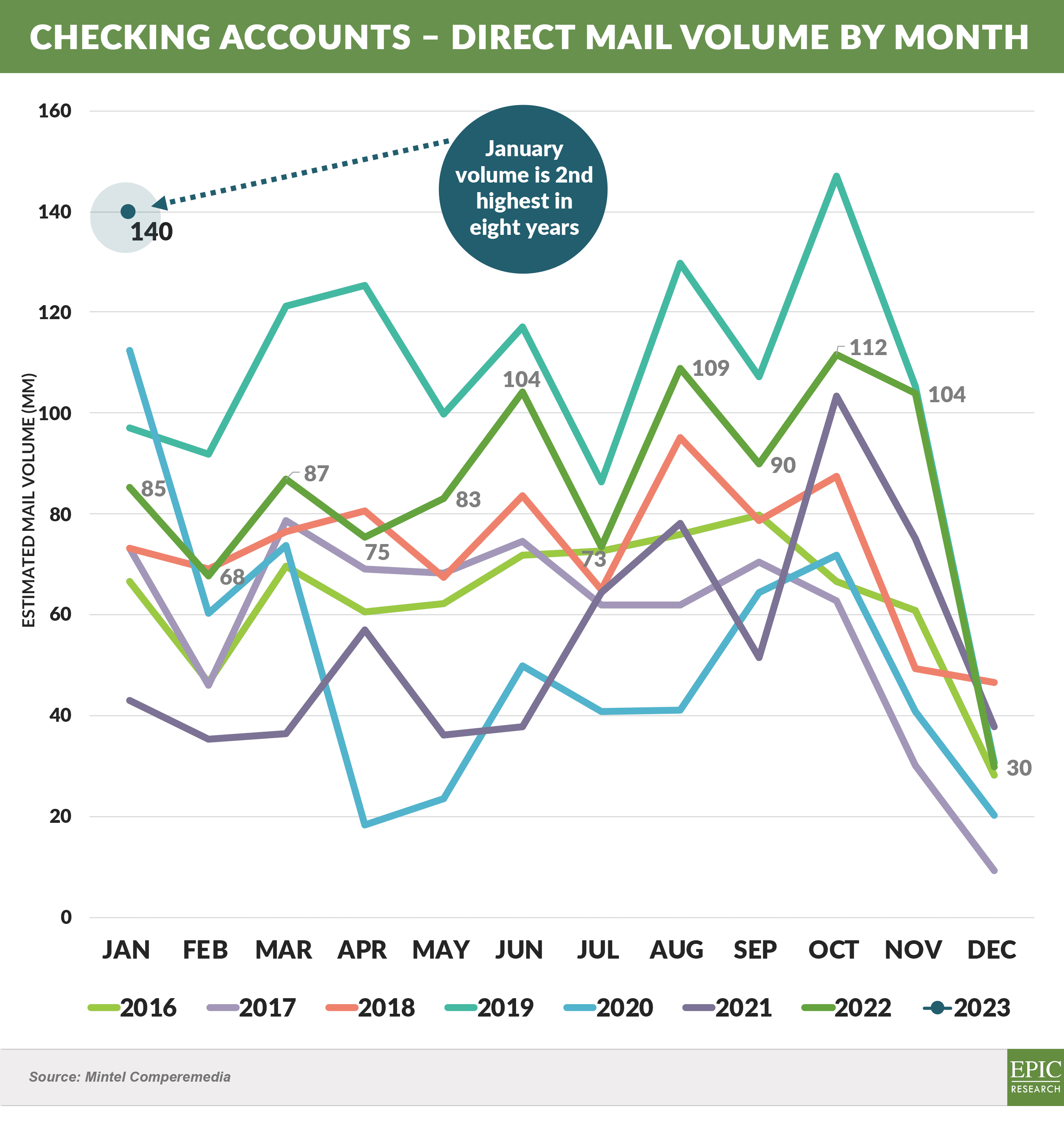

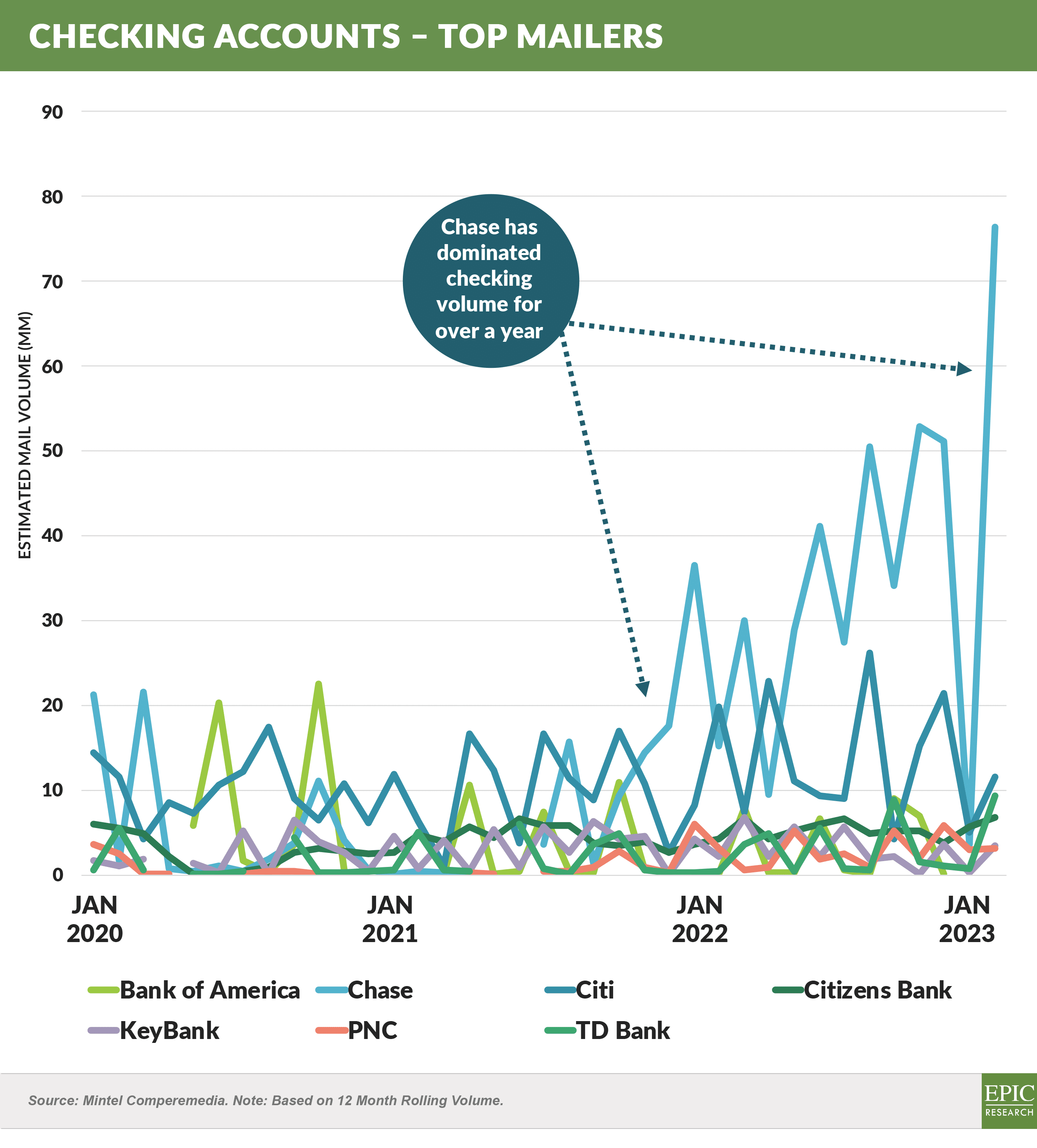

- Checking leads the growth in consumer financial services direct mail offers over the past year, with the 140 million pieces in January ’23 reflecting a 64% increase over January ’22 and the second highest monthly volume in eight years

- As noted in the January Epic Report, Chase has dominated the checking segment over the past year, punctuated by an all-time record volume of 76 million pieces in January, more than the rest of the industry combined!

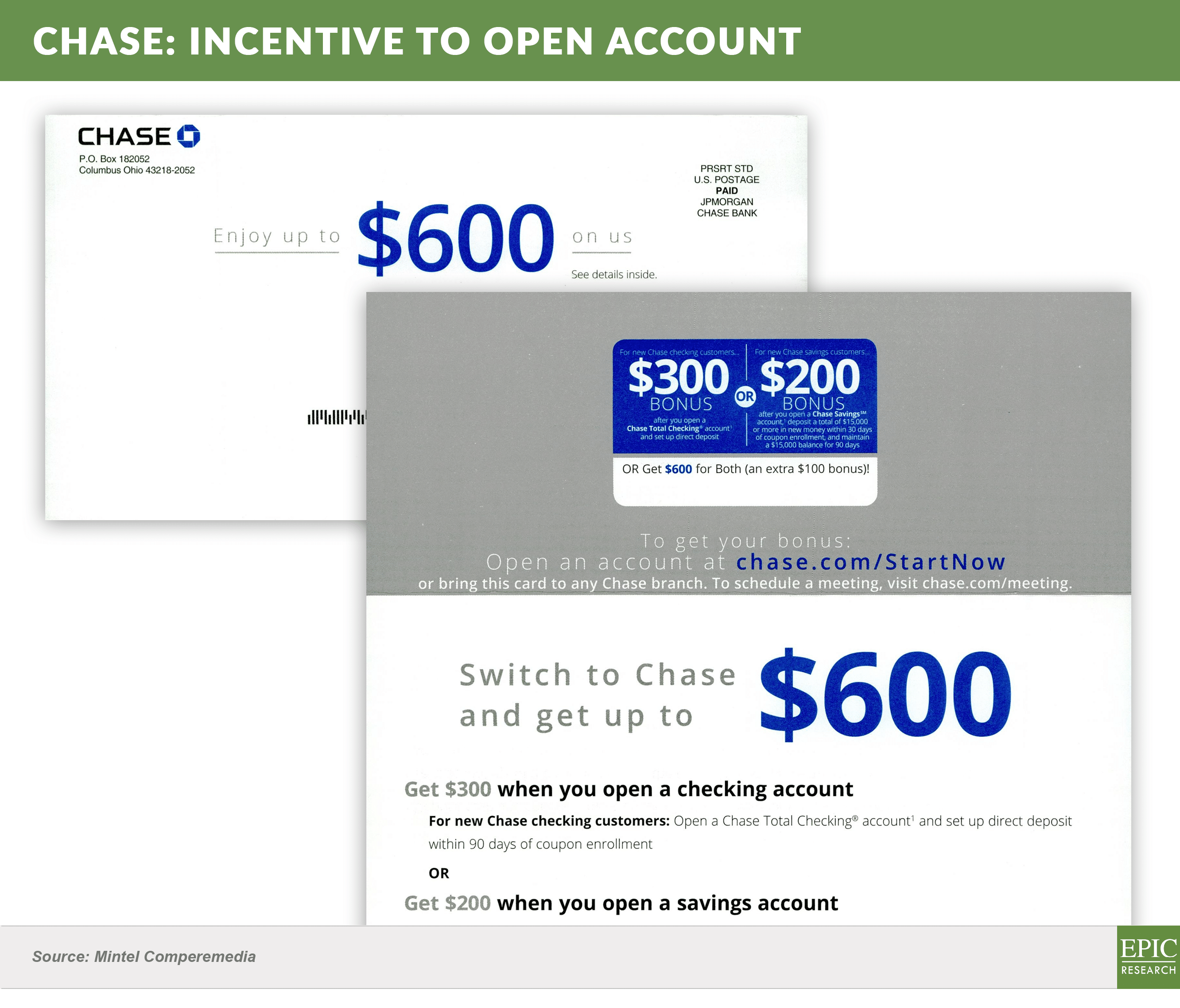

- Chase’s primary product offers a $600 incentive

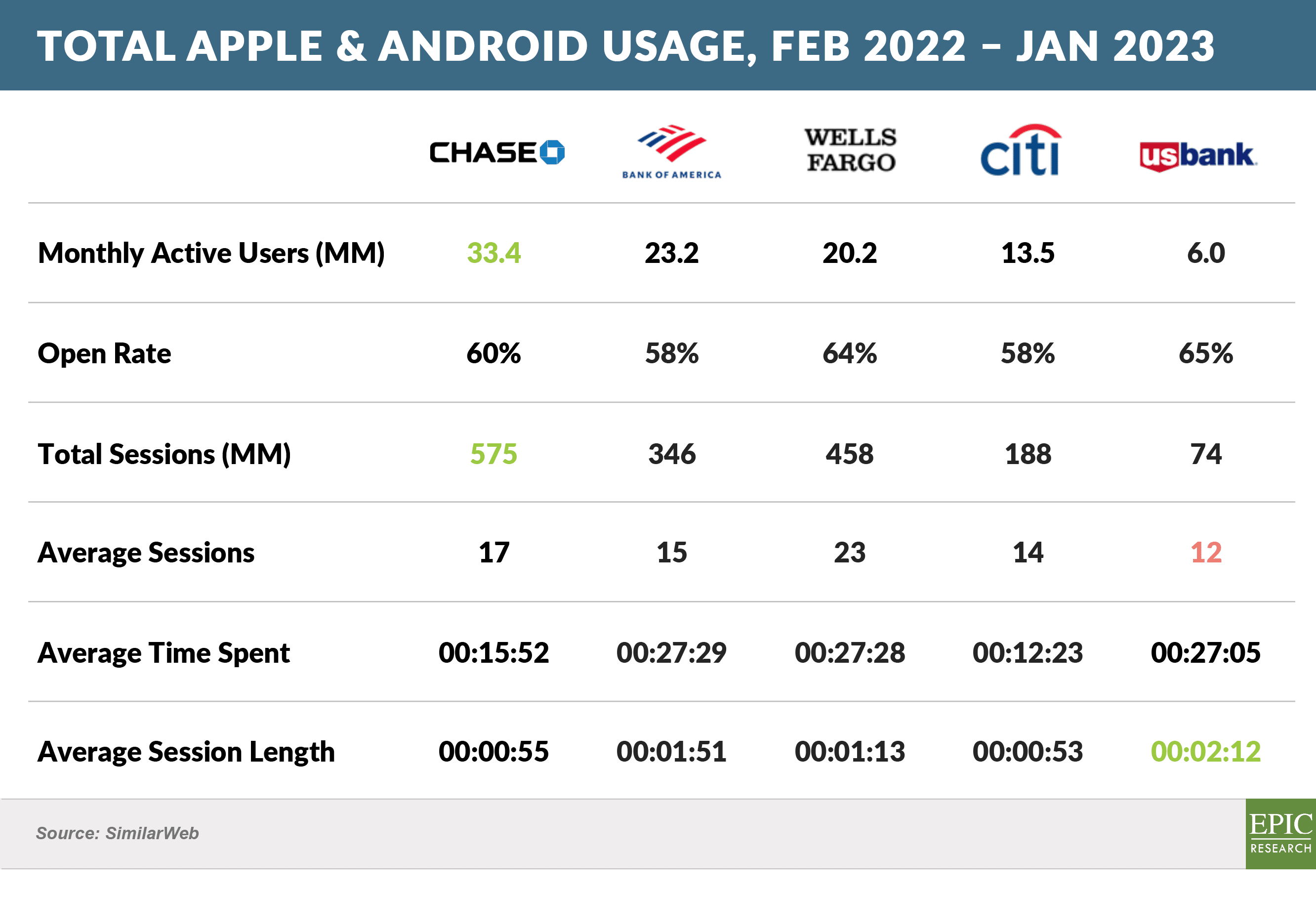

- “Digital Transformation” is mentioned in virtually every major bank investor presentation with $ billions of related investment in recent years

- Epic’s review of major bank app usage shows Chase with the highest absolute number of active users and total sessions with among the lowest average time spent

- US Bank shows the lowest number of sessions, but the highest average session length

- Different banks focus on varying products – checking, cards, investments, etc. – which accounts for some of the differences in session length and frequency

- Following its retreat from the personal loan business, Goldman Sachs announced it was “considering strategic alternatives” for its consumer business

- The latest news follows notice that it is discontinuing plans to offer a branded credit card to retail customers and would stop pursuing new cobranded credit card deals

- The strategic review follows a series of moves to scale back the consumer business that has been reported to have lost over $5 billion since inception

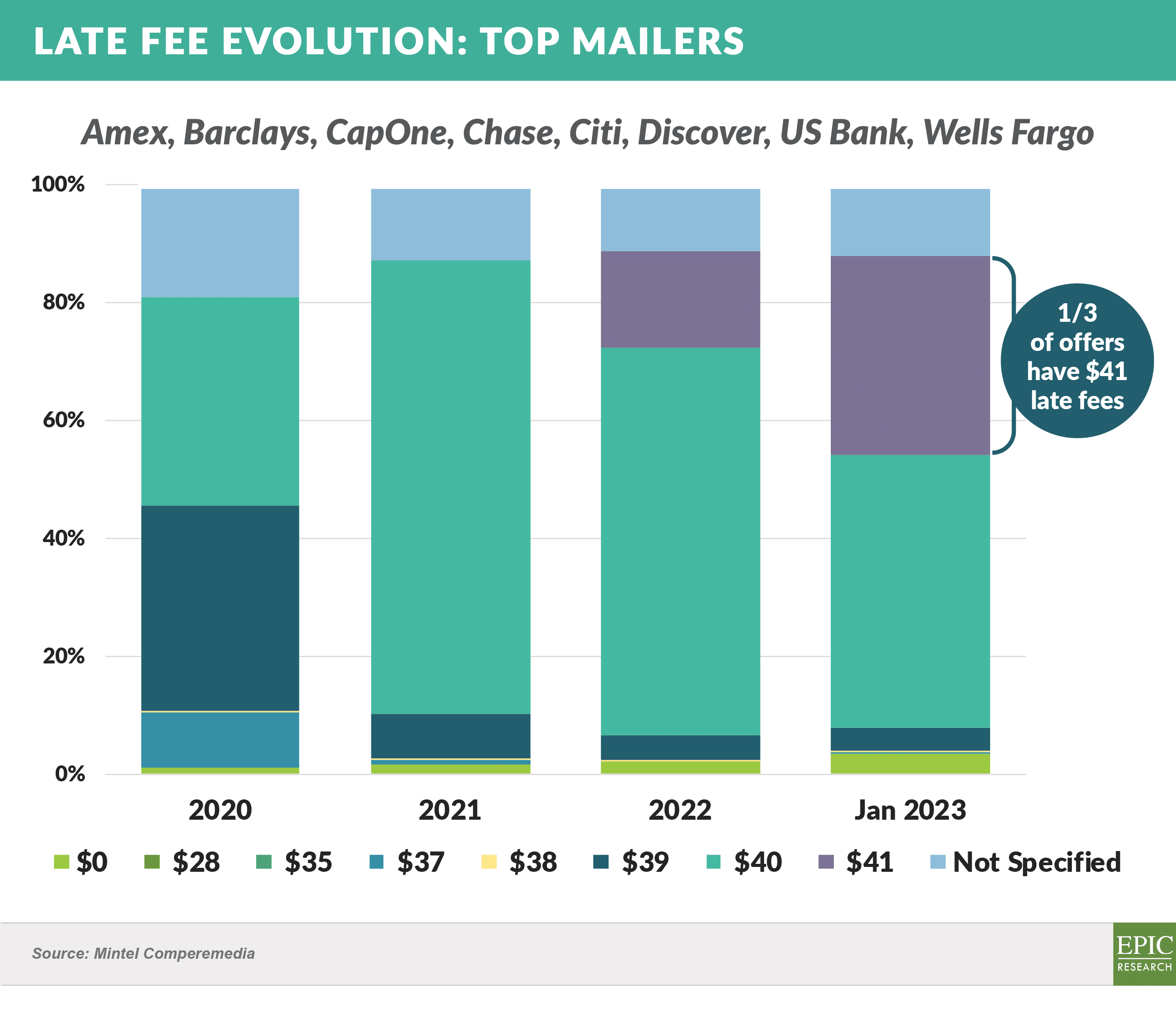

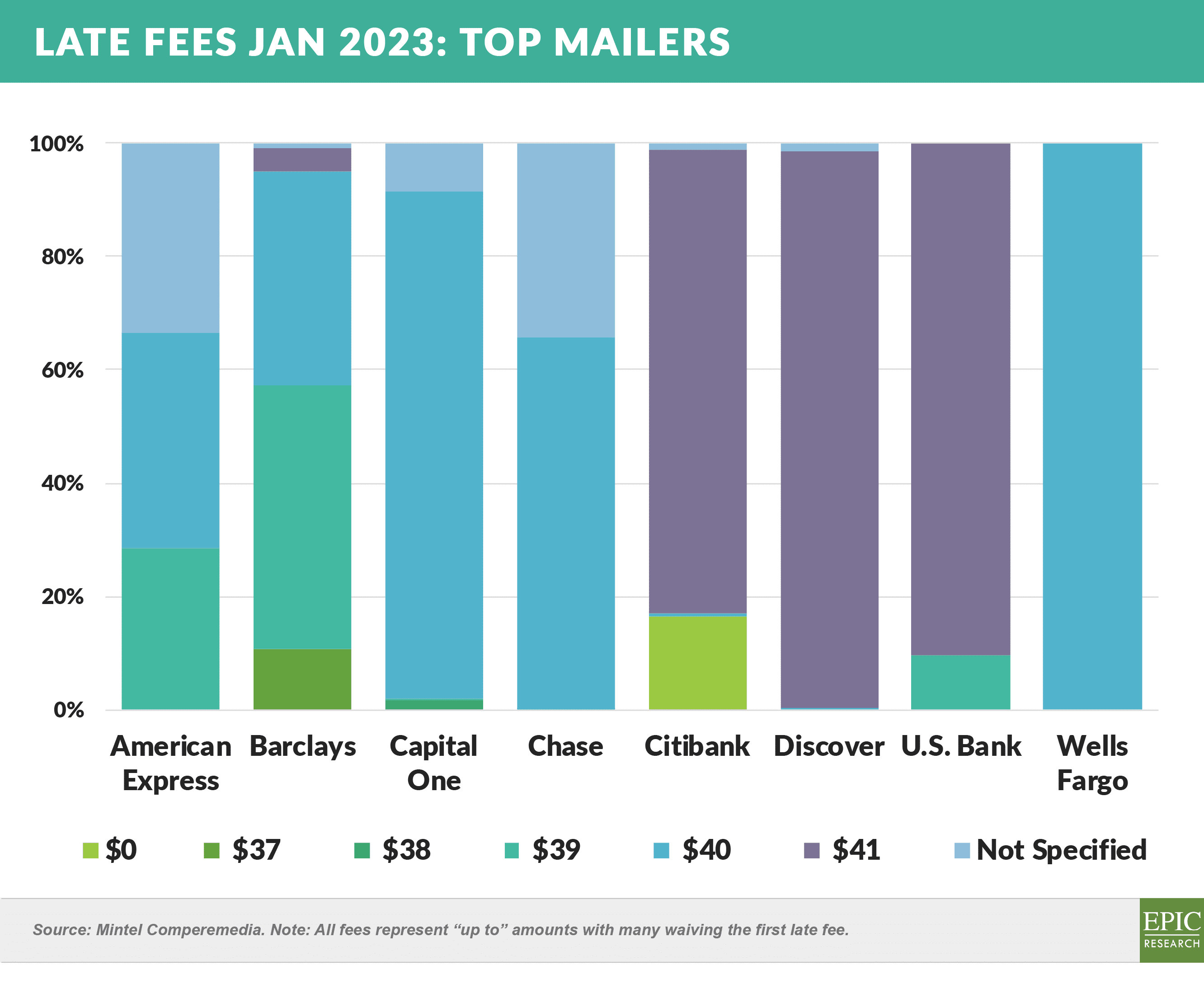

- The CFPB’s new proposal regarding capping credit card late fees at $8 prompts the following review of late fee trends in recent years

- Overall late fees have risen in recent years – there has been a general upward shift among the top mailers with 34% of the mail in January 2023 containing a late fee of up to the maximum permitted ($41)

- Citi, Discover & US Bank led the migration from $40 late fees in 2021 to $41 in 2022

- Amex announced the launch of American Express Business Blueprint, the company’s new digital cash flow management hub designed for small businesses

- The offering will feature cash flow insights, digital financial products (including checking account and line of credit), and an “easy way for small businesses to reach and manage their business cards”

- Blueprint is based on the Kabbage platform, which was acquired by Amex in 2020

The Epic Report is published monthly, with the next issue releasing on April 1st.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Add jim@epicresearch.net to your contacts to avoid junk filter issues.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.