Driving Growth Through Highly Customized Campaigns: Case Studies

Our data-driven approach to direct marketing helps companies achieve their goals faster

Case Study

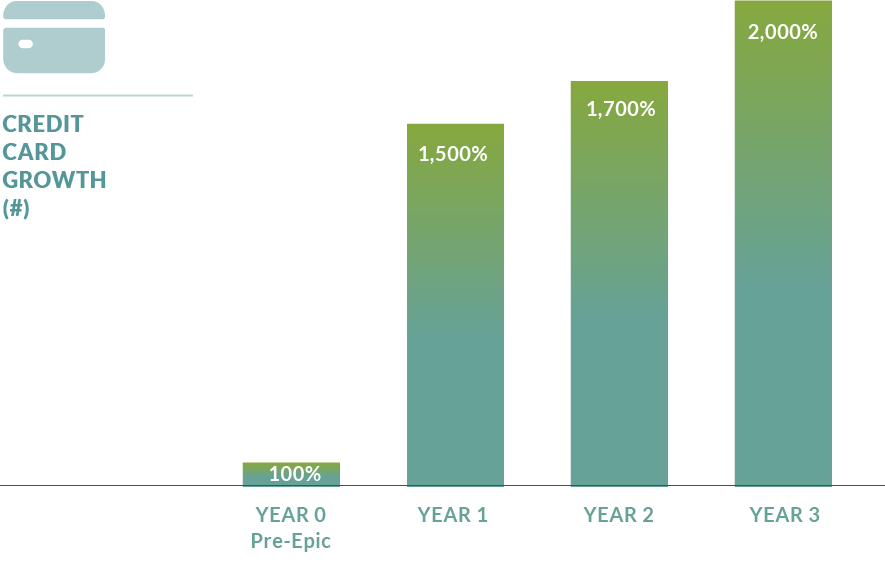

Credit Card Expansion

CHALLENGE

Large regional bank with positive in-footprint brand recognition sought to grow its credit card business but was limited by the size of its existing deposit customer base.

GOAL

Drive incremental revenue by expanding credit card reach to prospect populations within footprint and beyond, with no increase in fraud application rates.

APPROACH

Epic conducted intensive market research, identified opportunities for funnel optimization, and developed and implemented a comprehensive direct marketing plan.

RESULTS

Drove 2,000% growth in new card acquisitions with no increase in fraud.

Case Study

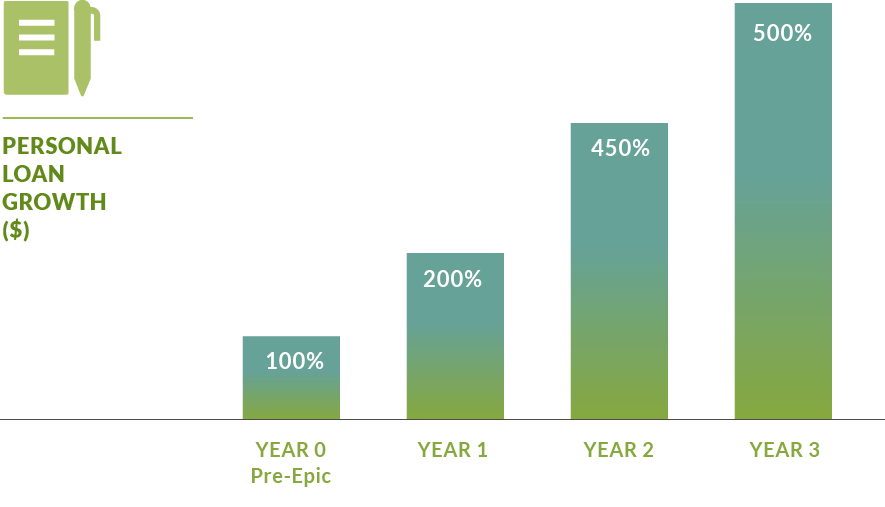

Personal Loan Growth

CHALLENGE

Large regional bank wanted to expand its personal loan marketing beyond current customers.

GOAL

Advance significant personal loan growth in an accelerated time period.

APPROACH

Developed comprehensive operational launch road map and pre-screen direct marketing plan with customized targeting score.

RESULTS

Created national brand recognition beyond footprint and achieved loan growth of 500% by year three.