Three Things We’re Hearing

- Who is passing along the rate cut???

- Carved in Stone – Epic Credit Card Mt. Rushmore!!!

- Subprime card volume rises

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Who is Passing Along the Rate Cut???

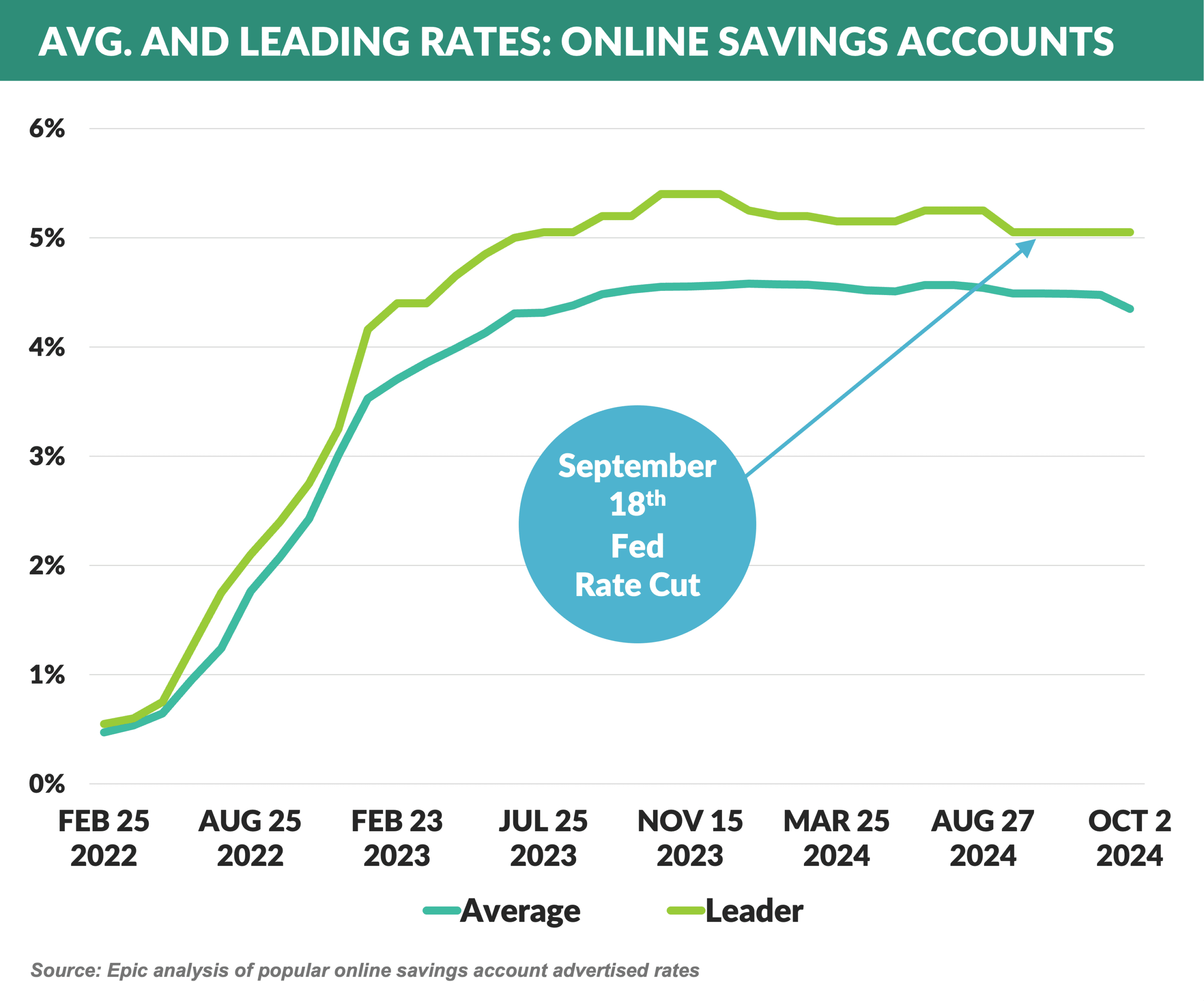

- In declining rate environments, deposit rates typically go down faster than loan rates; however, there has been little movement in loan or deposit rates since the recent Fed action

- Since the Fed cut rates 50 basis points on September 18th, the average APY on high yield savings accounts (HYSAs) for the institutions we track has dropped only 14 bps

- “Leading” rates for the highest yielding HYSAs have dropped 11 – 50 bps

- Popular Direct – from 5.01% to 4.90%

- Jenius – from 5.25% to 5.05%

- Robinhood Gold – from 5.00% to 4.50%

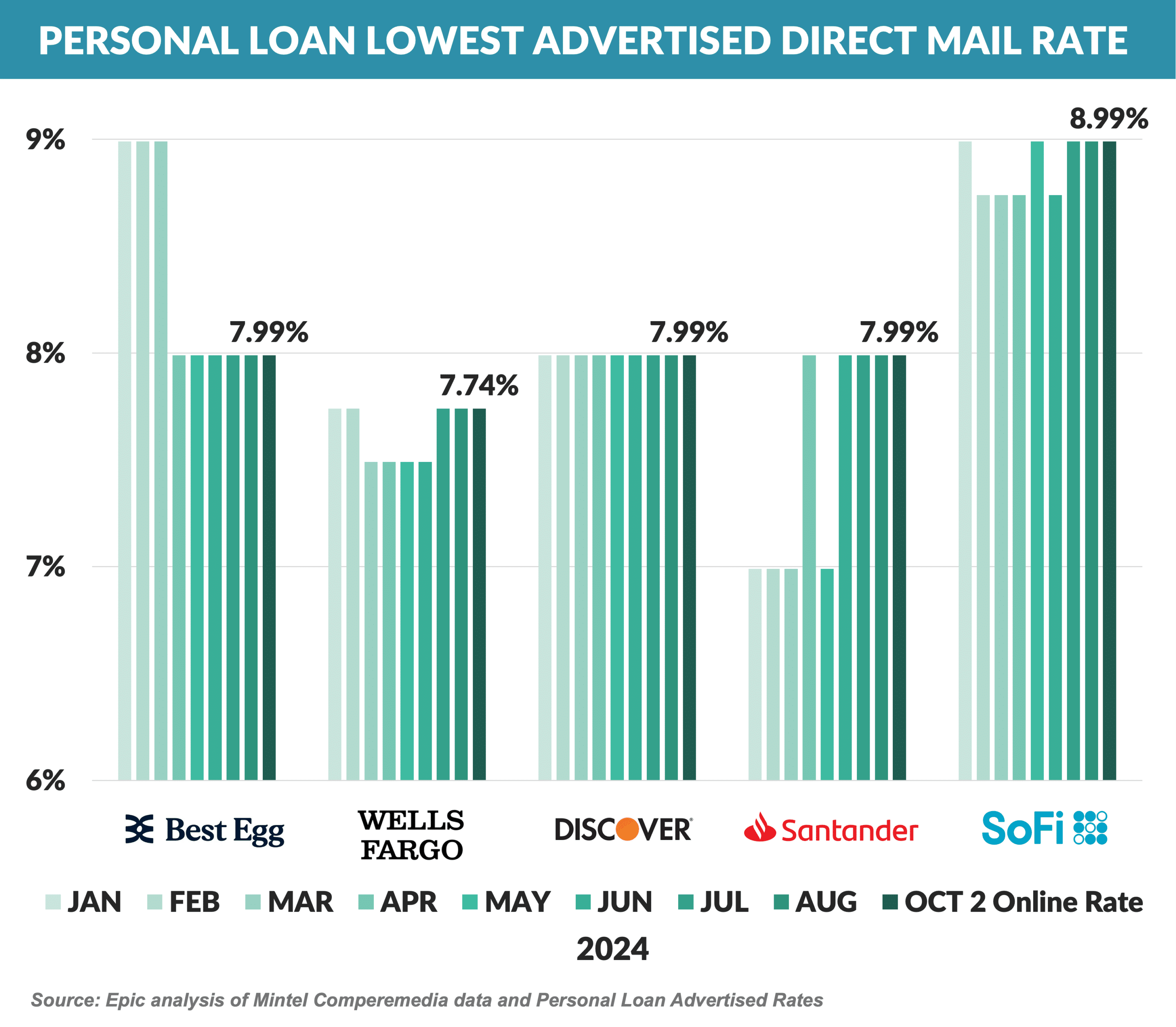

- Advertised lowest rates for personal loans have remained steady for months – the personal loan market is dominated by fintechs that predominantly use wholesale funding that is based on longer term rates

- Credit card rates typically move faster and are generally tied to a spread over prime or some other base rate

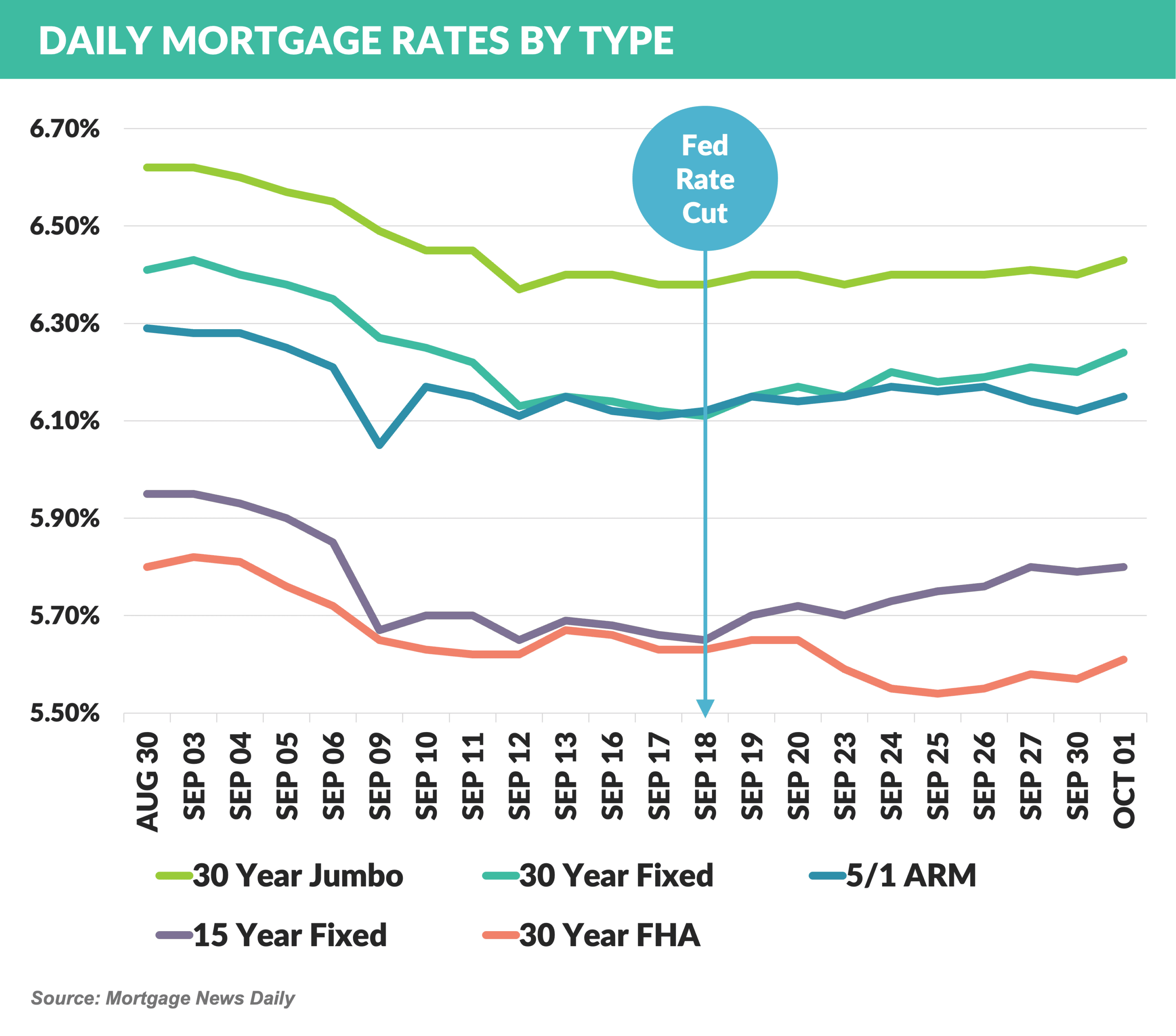

- Mortgage rates are down slightly over the past month, however, with no significant movement since the Fed’s September 18th action

Carved in Stone!!! – Epic Credit Card Mt. Rushmore

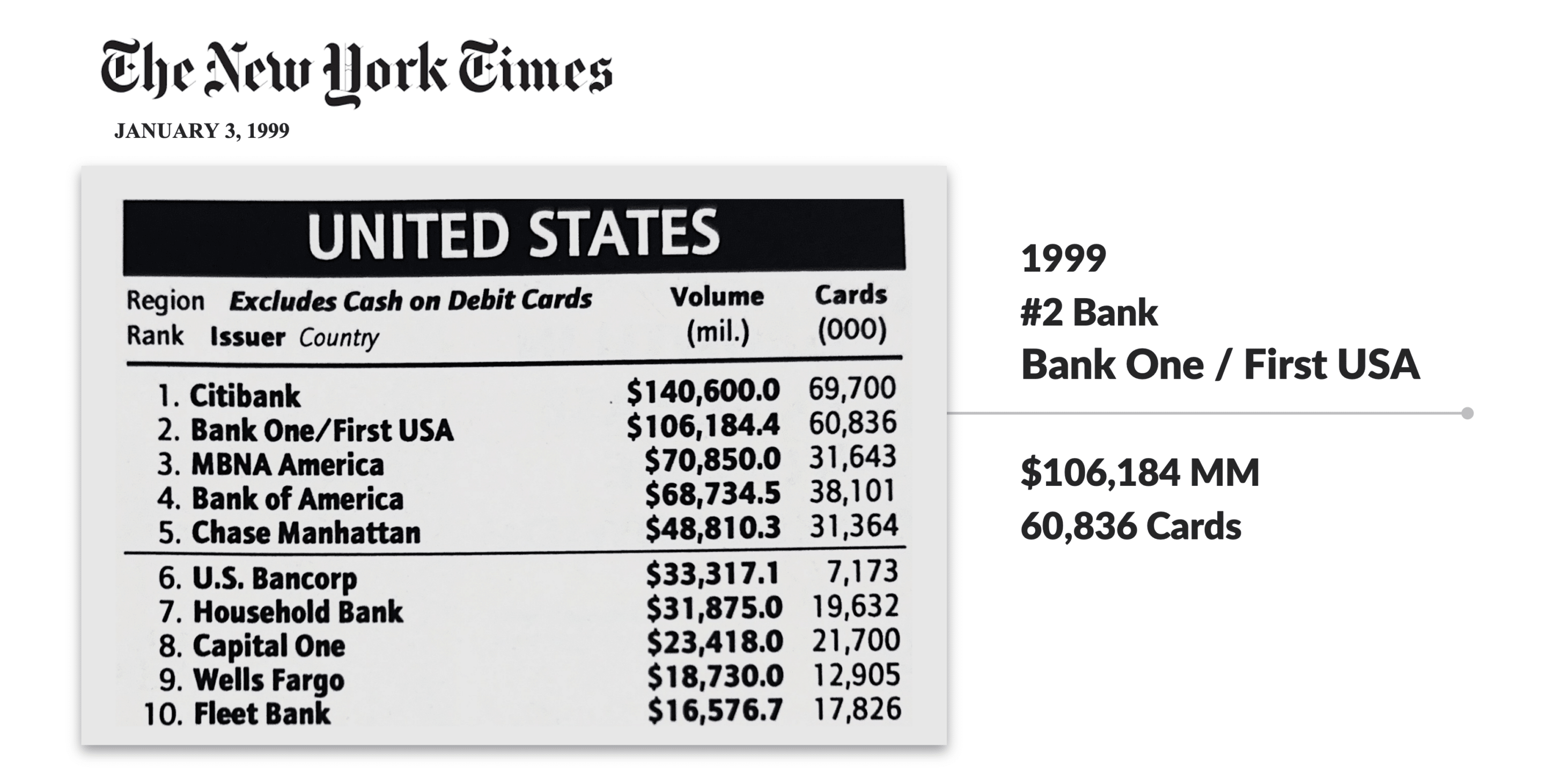

- In previous months, our series about the most influential issuers in the modern credit card industry has added Citi, MBNA, and Capital One to the Epic Credit Card Mt. Rushmore

- This month First USA takes the fourth and final spot

- Lomas Bank USA was spun off from its financially challenged parent in a $500 million management-led leveraged buy-out in 1989, and quickly changed its name to First USA

- Led by Chairman John Tolleson and CEO Richard Vague, the $2 billion monoline bank set off on a growth strategy focusing on two segments

- The first was a “First USA Brand” strategy using advanced analytics and robust testing of various pricing and credit combinations

- First USA was one of the initial issuers to combine the credit and marketing analytics functions, which helped optimize marketing spending

- They were a leader in product innovation, helping popularize introductory rates, no fee cards, the platinum card, and balance transfers among other features

- Second, First USA made a conscious effort to grow the partner credit card business, heretofore dominated by MBNA

- A dedicated sales force signed endorsements with hundreds of affinity groups, including Notre Dame University, The PGA Tour, and The World Wildlife Association

- They also became a dominant player in cobrand marketing, with partners such as Southwest Airlines, United Airlines, and Marriott – all of which remain partners of successor JP Morgan Chase

- In the late 90s, First USA dominated the new “Internet Marketing” segment, signing deals with America Online, Yahoo, Microsoft Network, and Dell while also launching Wingspan Bank, one of the first Internet-only banks

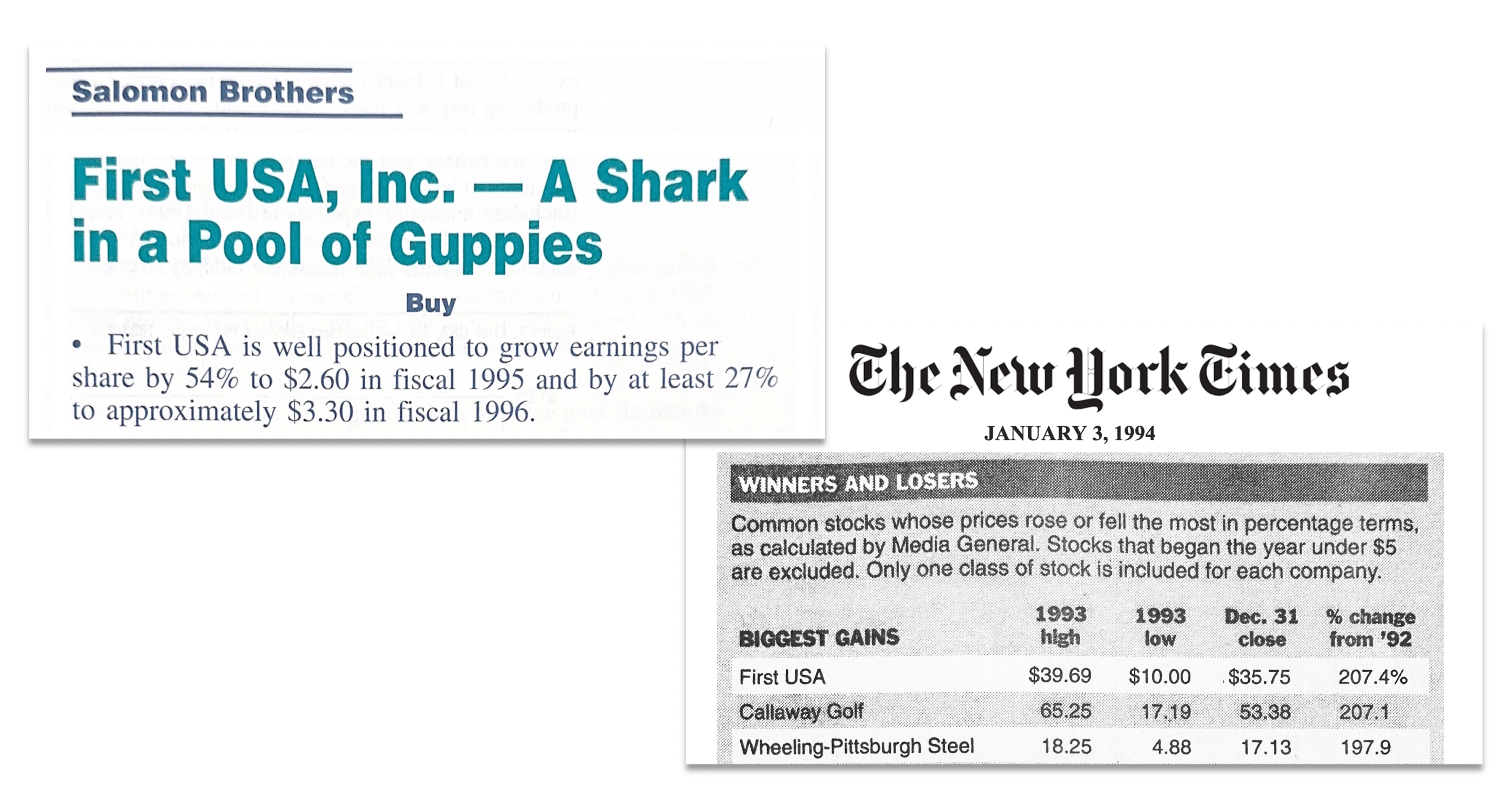

- Execution of these strategies led to explosive growth, and the company completed an IPO in 1992

- In 1993, First USA stock was the number one performing stock on the New York Stock Exchange

- By 1997, First USA’s portfolio exceeded $20 billion when it was acquired by Bank One for $7.9 billion – a gain of 1480% over the $500 million LBO price eight years earlier

- First USA managed the combined $35 billion portfolio of Bank One and First USA, ultimately growing it to more than $100 billion by 1999 – at the time the number two issuer and largest Visa issuer in the world

- The First USA name was retired following Bank One’s 2004 merger with Chase, but the First USA assets still remain a large part of JPMorgan’s card business

- First USA becomes the fourth and final issuer added to the Epic Credit Card Mt. Rushmore

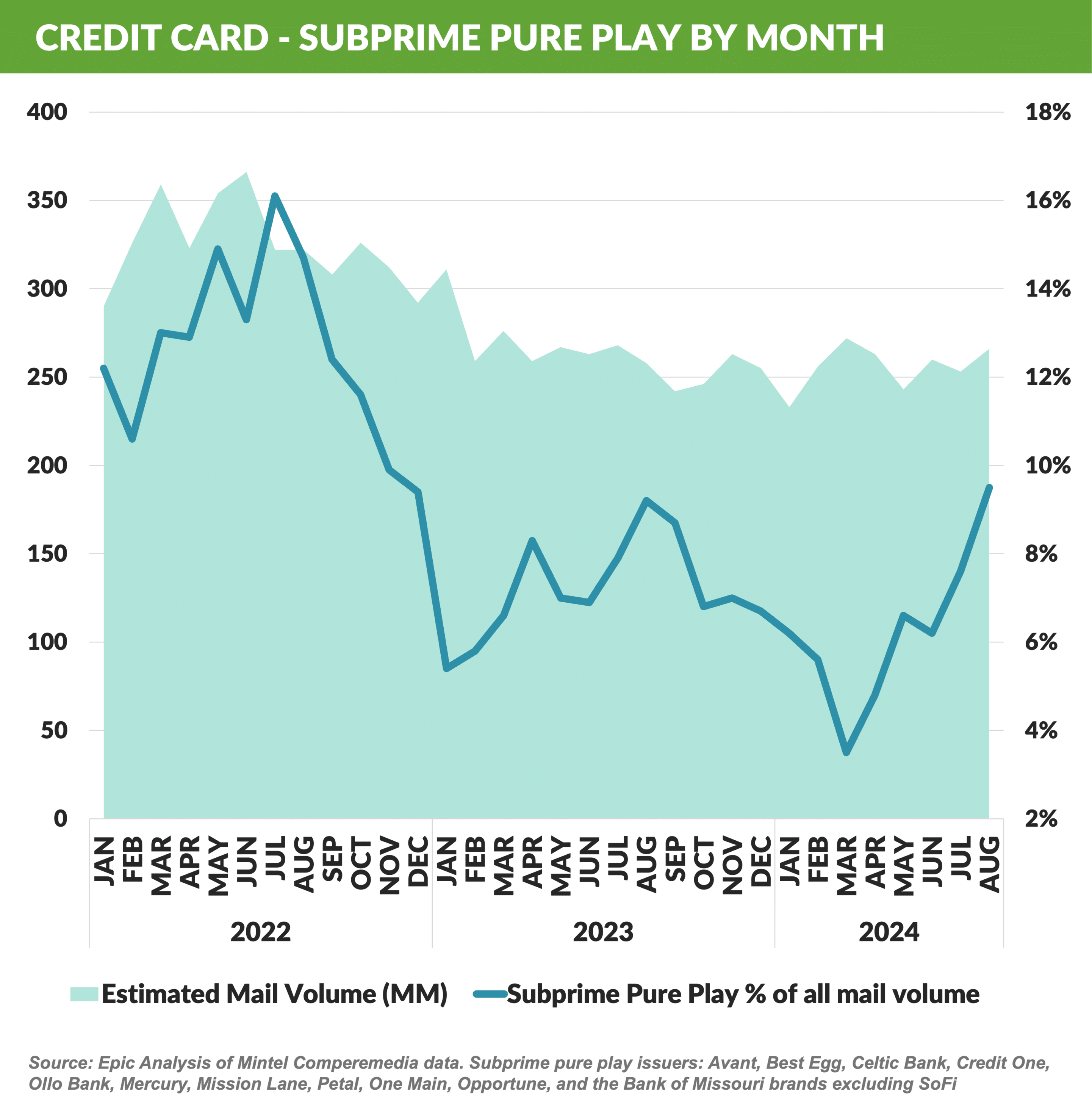

Subprime Card Volume Rises

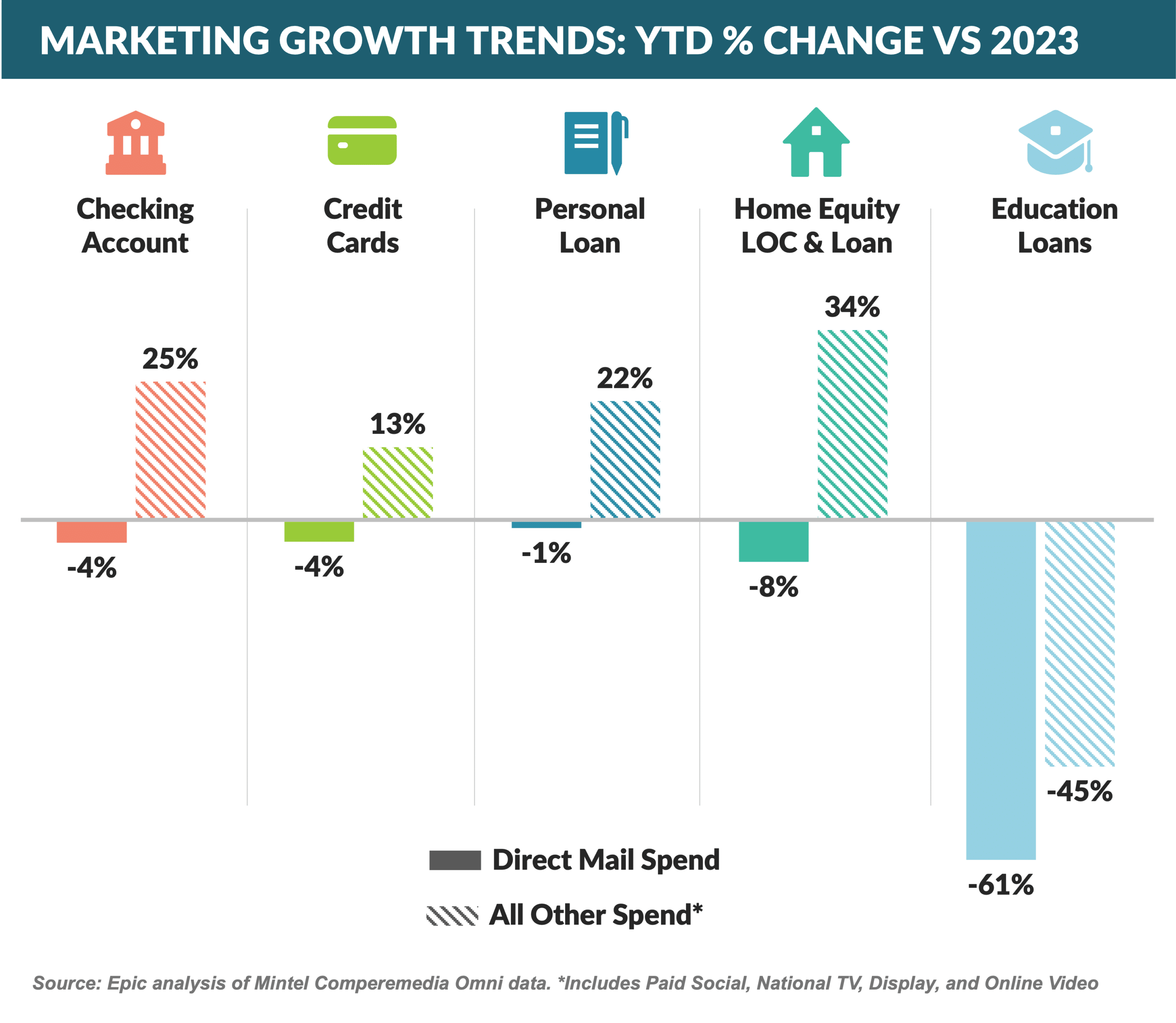

- With the exception of education lending, YTD non-direct mail marketing spend is 13% - 34% higher for the other consumer products

- Direct mail spend, which has lagged other channels so far this year, was 10% - 25% higher in August than August ’23, bringing the year-to-date comparison closer to even

- Deposit product mail fell sharply in August

- Checking – 84 million pieces mailed in August vs. 144 million in July – down 42%

- Savings – 8 million mail pieces in August vs. 37 million in July – down 78%

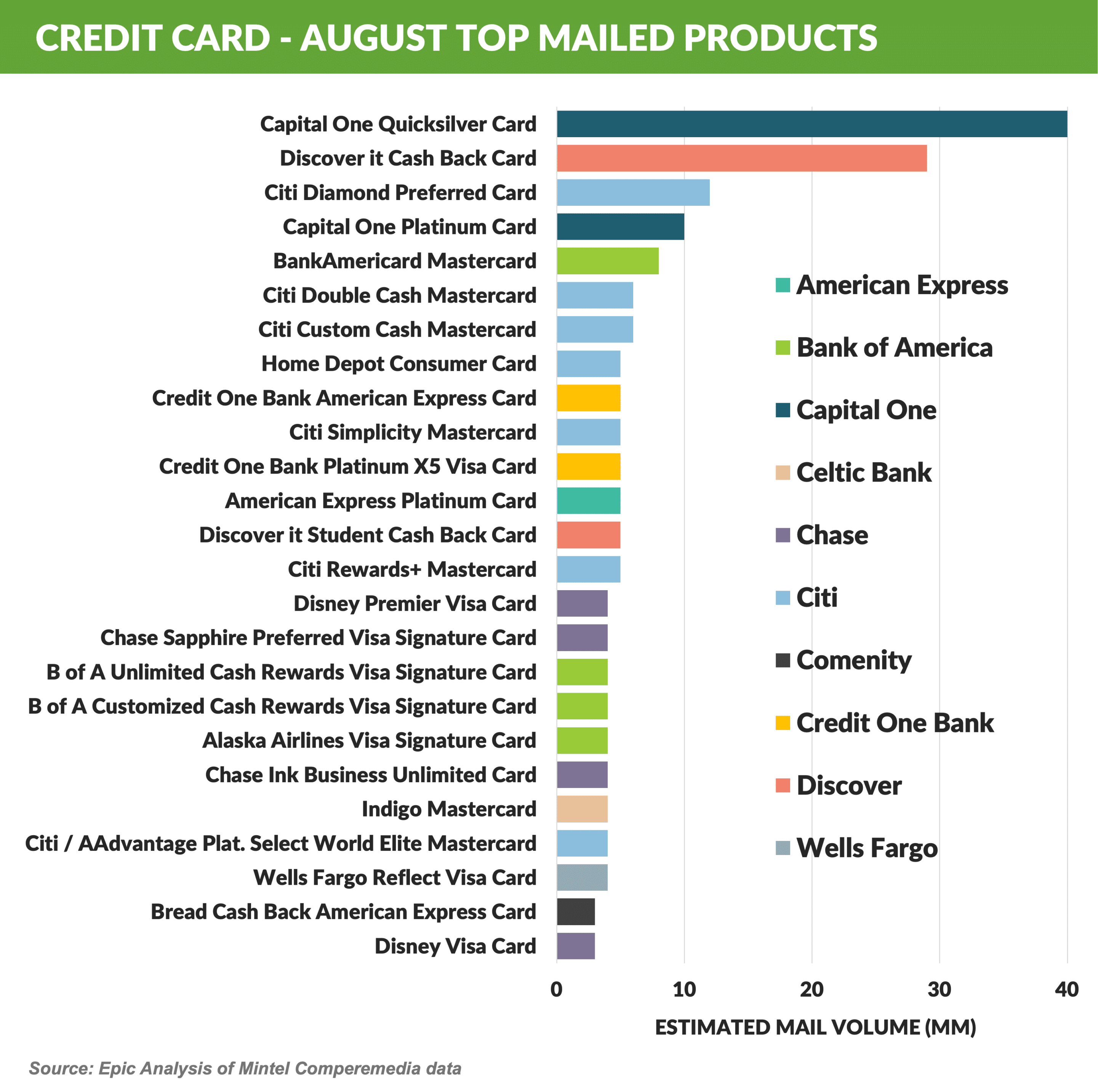

- Second largest credit card mailer Citi has seven different products in the top 20

- Subprime pure play cards are 9.5% of all volume – the highest proportion this year and up from a low of 3.5% – led by Credit One which is outpacing its 2023 volume by 20 million

- Donald Trump has proposed a 10% cap on credit card interest rates

- As the Wall Street Journal editorial board points out, such a cap would limit credit to only those with the most pristine credit, leaving the majority of consumers without access to a card

- Such a cap would also severely impact the banking system – a similar 1991 proposal by NY Senator Al D’Amato helped cause the then fifth largest drop in stock market history

- With Goldman Sachs reported to be shopping both the Apple and GM credit card programs, the company announced a $400 million write-down on its consumer credit venture, adding to the billions of dollars that have already been lost on the program

- Lax underwriting standards that led to loss rates exceeding 10% are partially to blame for the losses

- Goldman also adopted product features such as no fees which hampered the program’s profitability

- Goldman has been reported to be in conversations with JPMorgan regarding the Apple program (~$17 billion) and Barclays on the GM portfolio (~$2 billion)

- Speculation is that both portfolios will have to be sold at a discount due to the unfavorable economics of the deals

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in November.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.

Read our previous newsletters.