Three Things We’re Hearing

- Cap One Shocks the World!!!

- Credit card incentives climb

- Card marketing’s shift to digital

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Cap One Shocks the World!!!

- Well, maybe not “the world” but they certainly shocked the readers of the Epic Report!

- Capital One announced the purchase of Discover, which, pending regulatory approval, would:

- Make Cap One the largest US issuer of credit cards with $250 billion in outstandings and 22% market share

- Create one of the largest debit card issuers

- Add Discover’s personal loan business to Capital One’s product offerings

- Cap One has projected synergies of:

- Adding $175+ billion of Capital One purchase volume to the Disco network

- Adding 25+ million Capital One cardholders to the Discover brand

- $100 million savings in marketing expense – likely due to less general brand advertising

- Diving deeper:

- Cap One debit card volume should make up less than half of the total purchase volume target, leaving the conversion of existing Cap One Visa and Mastercard cardmembers to account for the rest

- Believe it or not, Capital One would become exempt from the debit interchange cap imposed by the Durbin Amendment

- JPMorgan Chase is reported to have pursued a deal with Discover in 2022, but could not come to terms with Discover

- There were no specifics about the “25 million cardholders” who will be switched to the Discover network, but presumably some will have to come from current Visa/Mastercard credit cardholders

- Any credit card conversions from Visa/Mastercard to Disco will be tricky due to the potential of massive cardmember attrition (20% - 30%? Who knows!), a loss that would dwarf any network processing fee benefit

- Subprime credit cardholders would be a likely conversion target as they would have a lower risk of attrition

- However, should “Durbin 2.0” pass, merchants could use a network other than Visa or Mastercard, which might allow some Cap One Visa/Mastercard branded cards to go through the Discover network

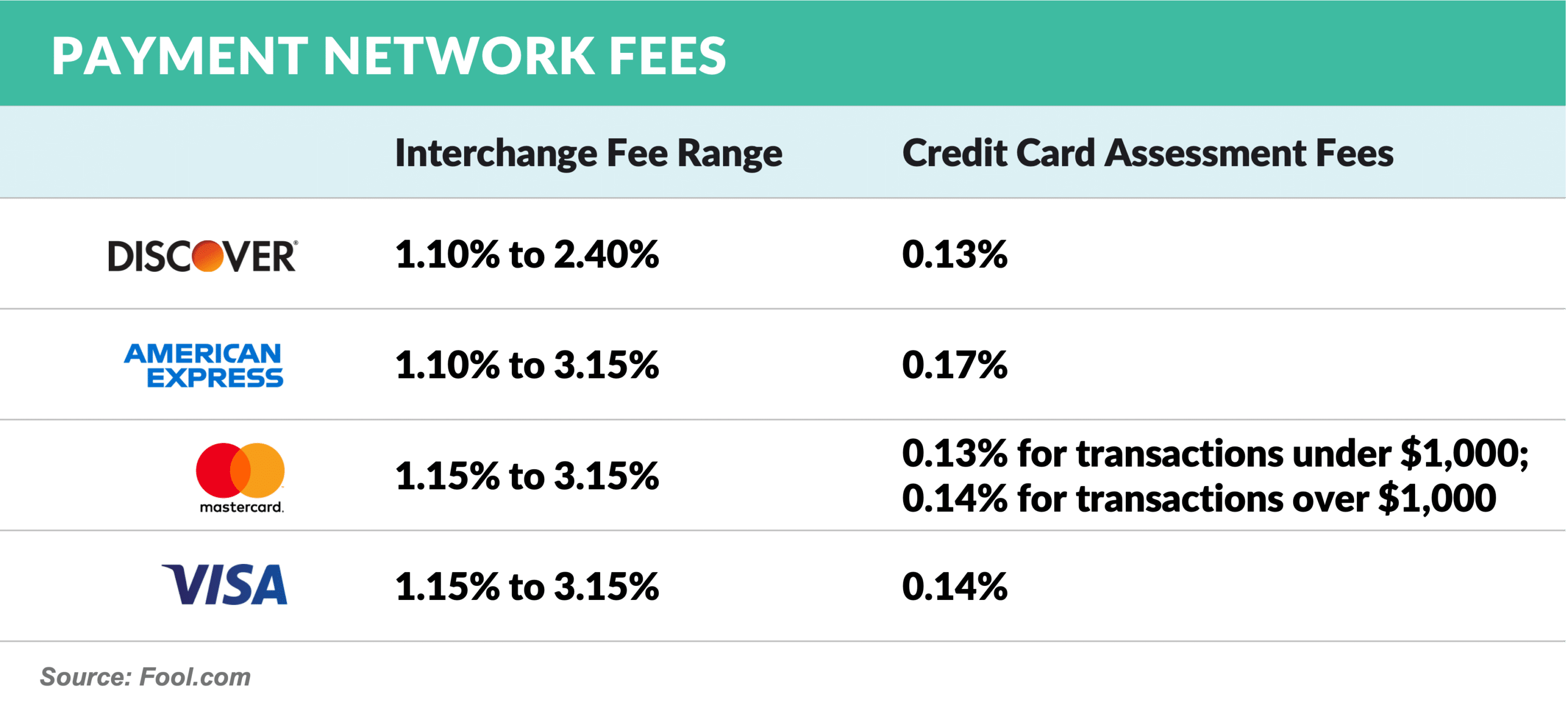

- Merchant interchange averages are similar across networks and network processing fees average ~13–15bps although there is heavy discounting (mid/low single digits?) for large issuers like Capital One

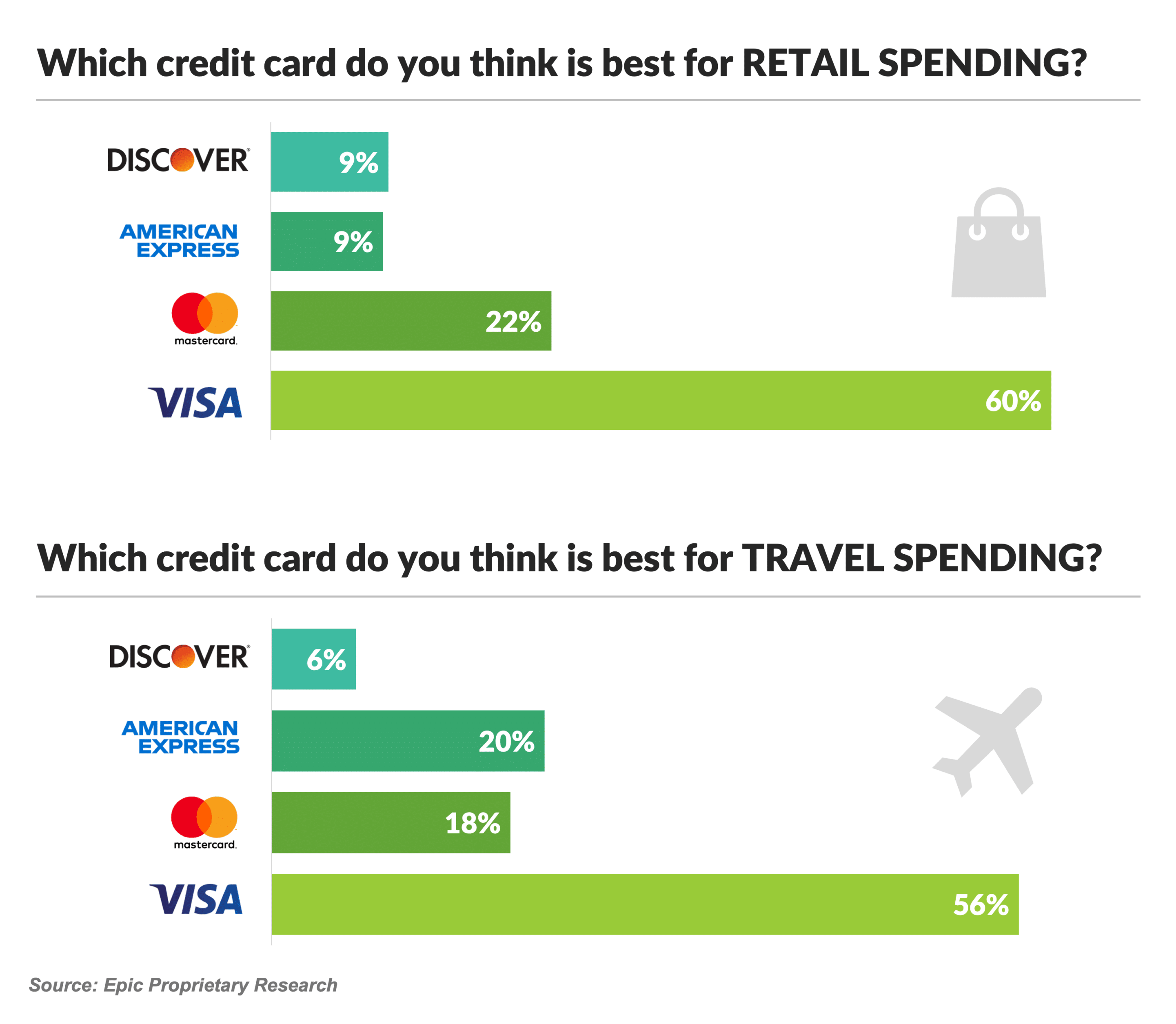

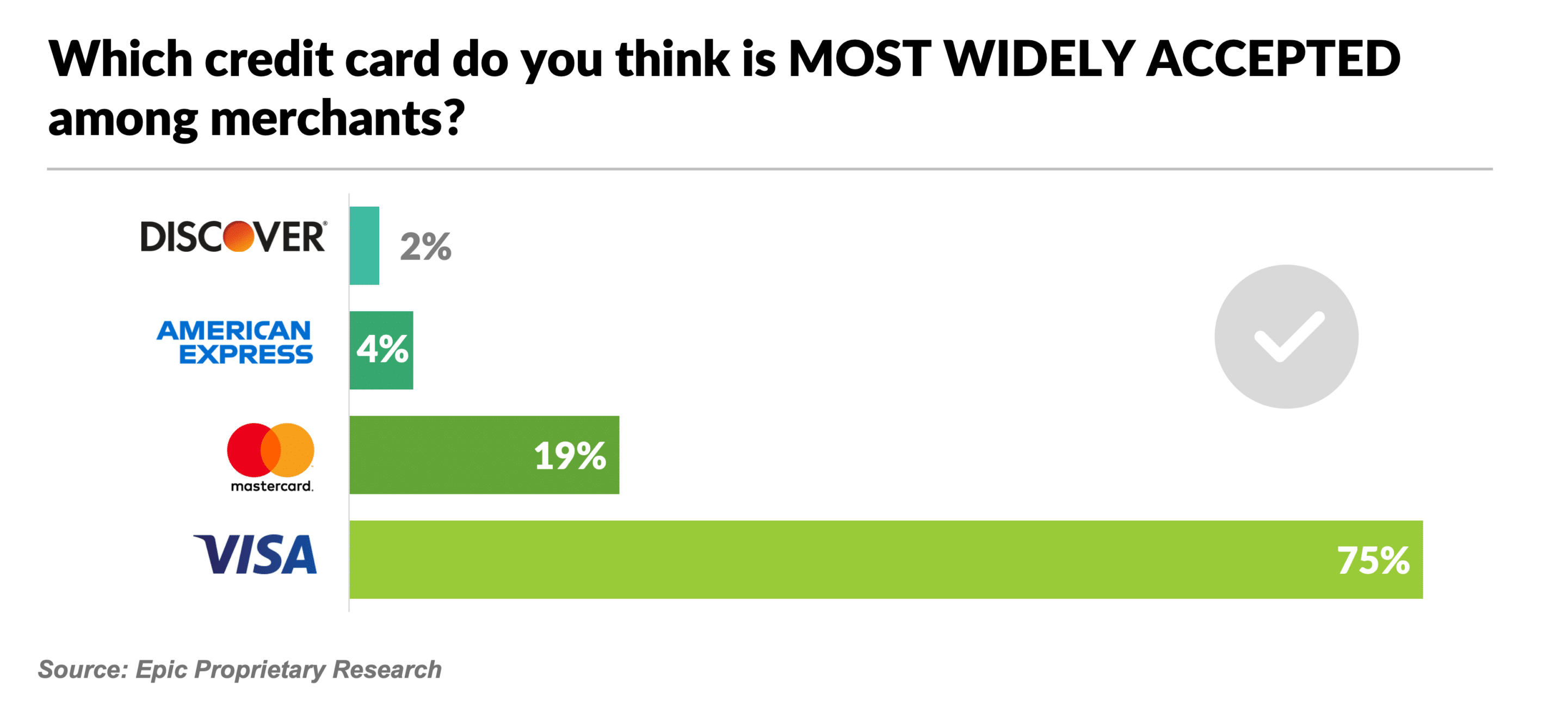

- Proprietary Epic Report research has previously shown a huge consumer preference for Visa and Mastercard over Discover

- Merchant acceptance has long been a perceived weakness for Discover

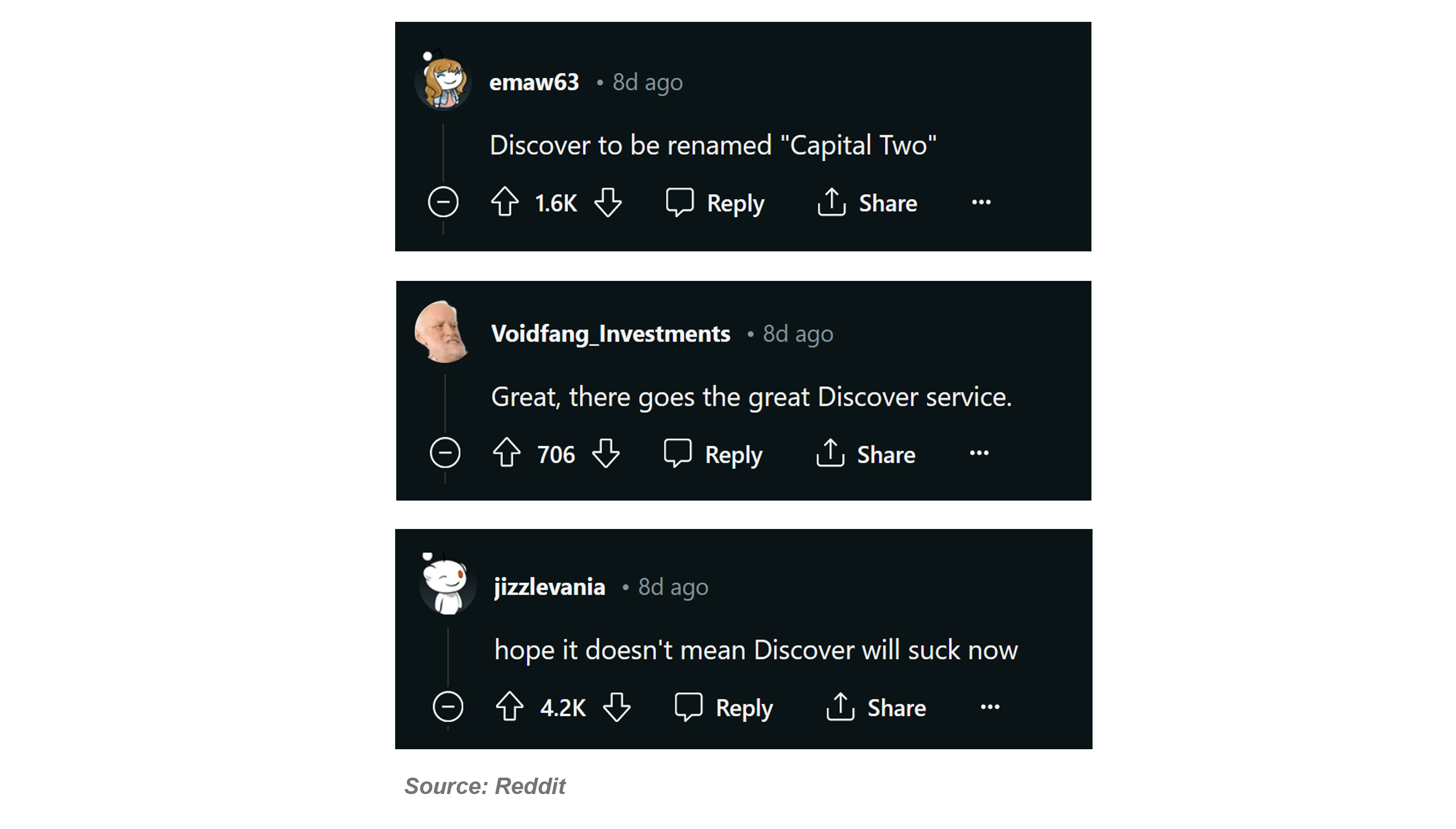

- However, since its founding by Sears in 1985, Discover has built a strong franchise amongst its 60+ million customers, has developed one of the most effective customer cross-sell programs in the industry, and has a good reputation for their service as reflected by their customers in some online forums

- In summary:

- As one of the smartest and most analytical of all issuers, Cap One will do a masterful job of optimizing the combined economics

- Our view of the future combined entity is extremely positive

Credit Card Incentives Climb

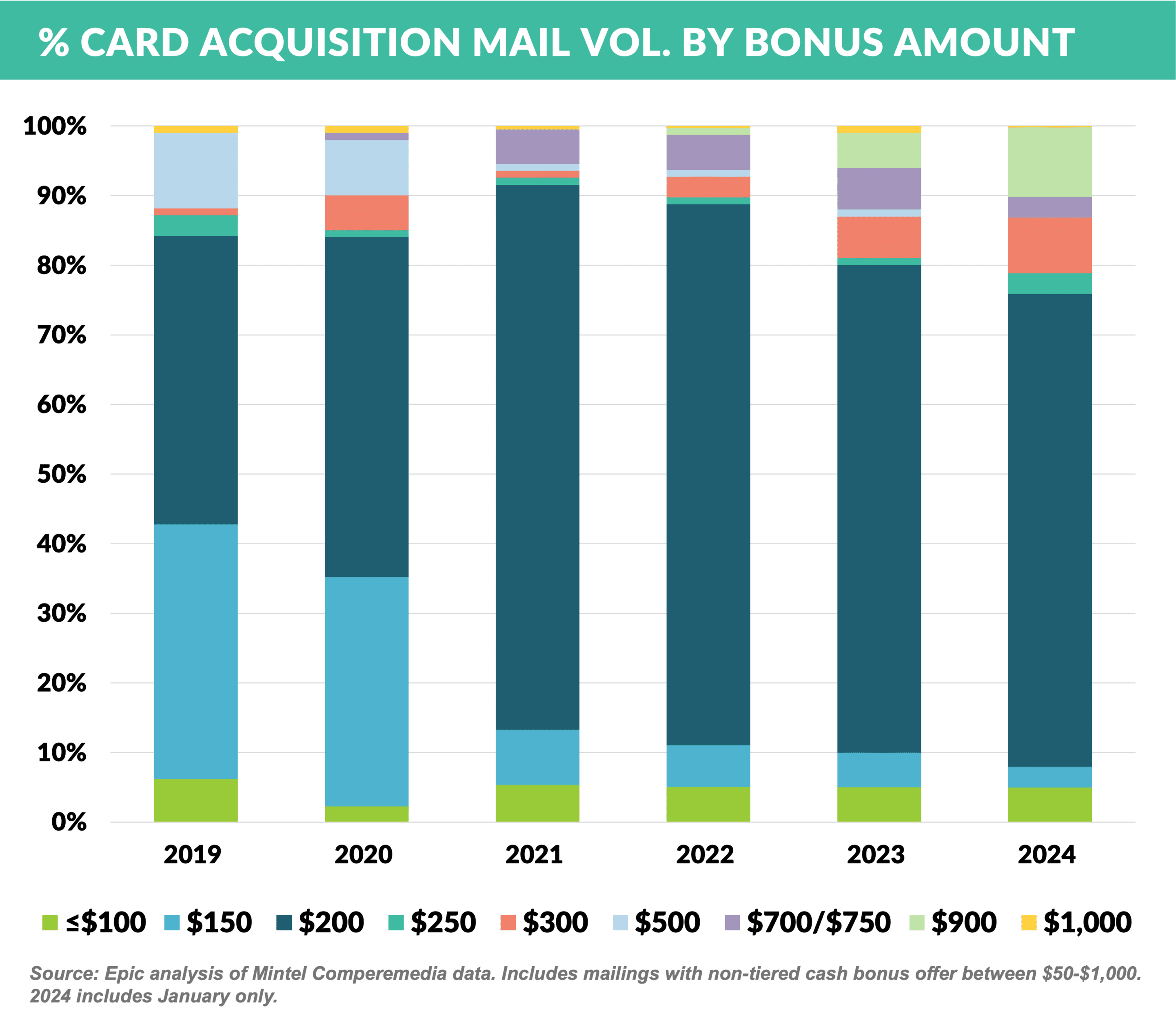

- Cash bonus amounts, a key response driver on ~40% of credit card acquisition mail, have been trending up

- $150 and $200 bonus offers were generally split 50-50 in 2019 and $200 bonuses accounted for most volume from 2020-2023

- $300 bonuses appear to be emerging, accounting for 6% of non-tiered cash bonus mail in 2023 and already represent 8% of 2024 offers

- Chase mailed a $900 bonus offer with the Ink small business card, to the tune of 35mm pieces in 2023

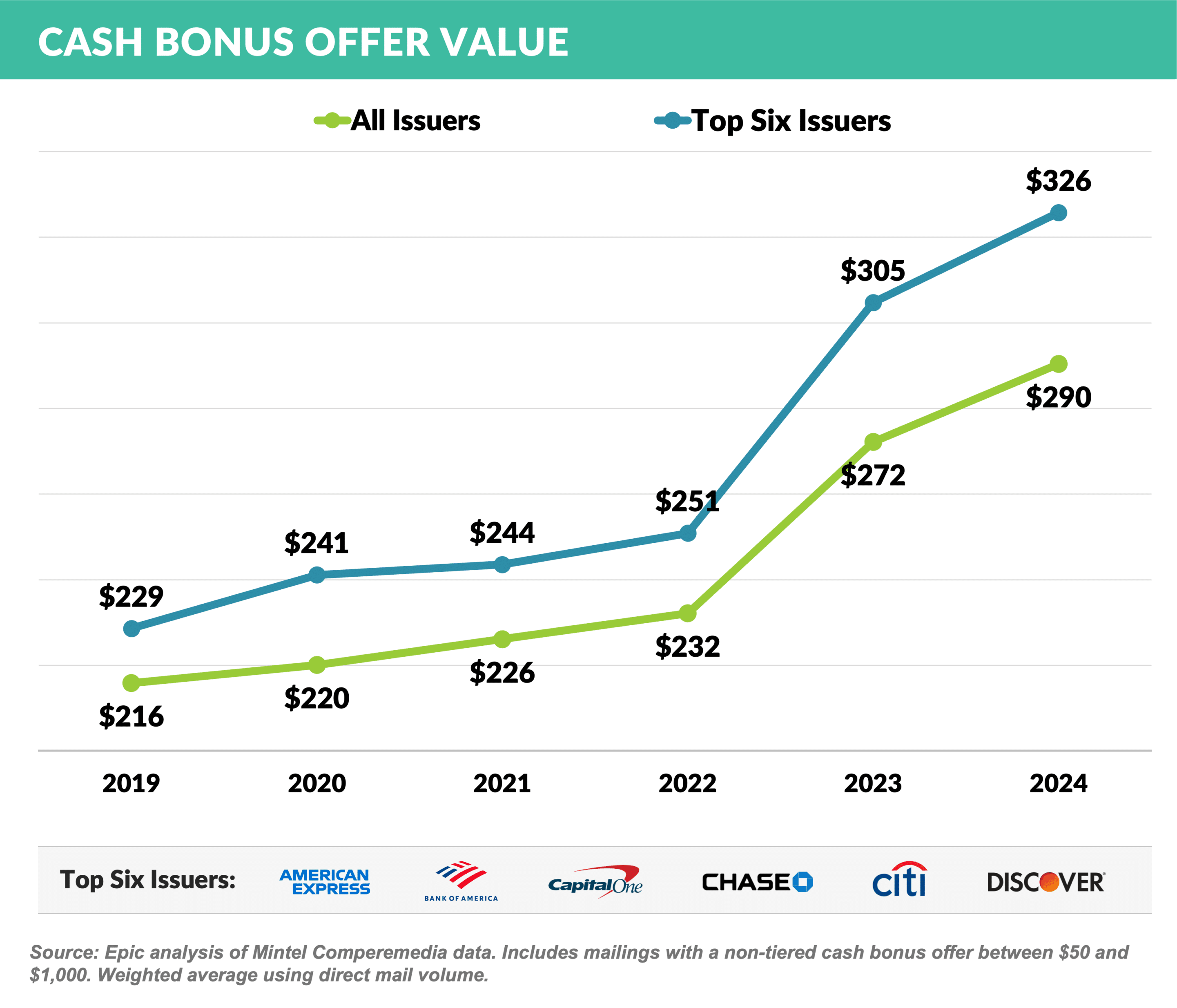

- Overall, the average cash bonus offer climbed from $216 in 2019 to $290 in January 2024, with top issuers, who typically have more advanced profit-based targeting strategies, averaging even higher, coming in at $326 in January 2024

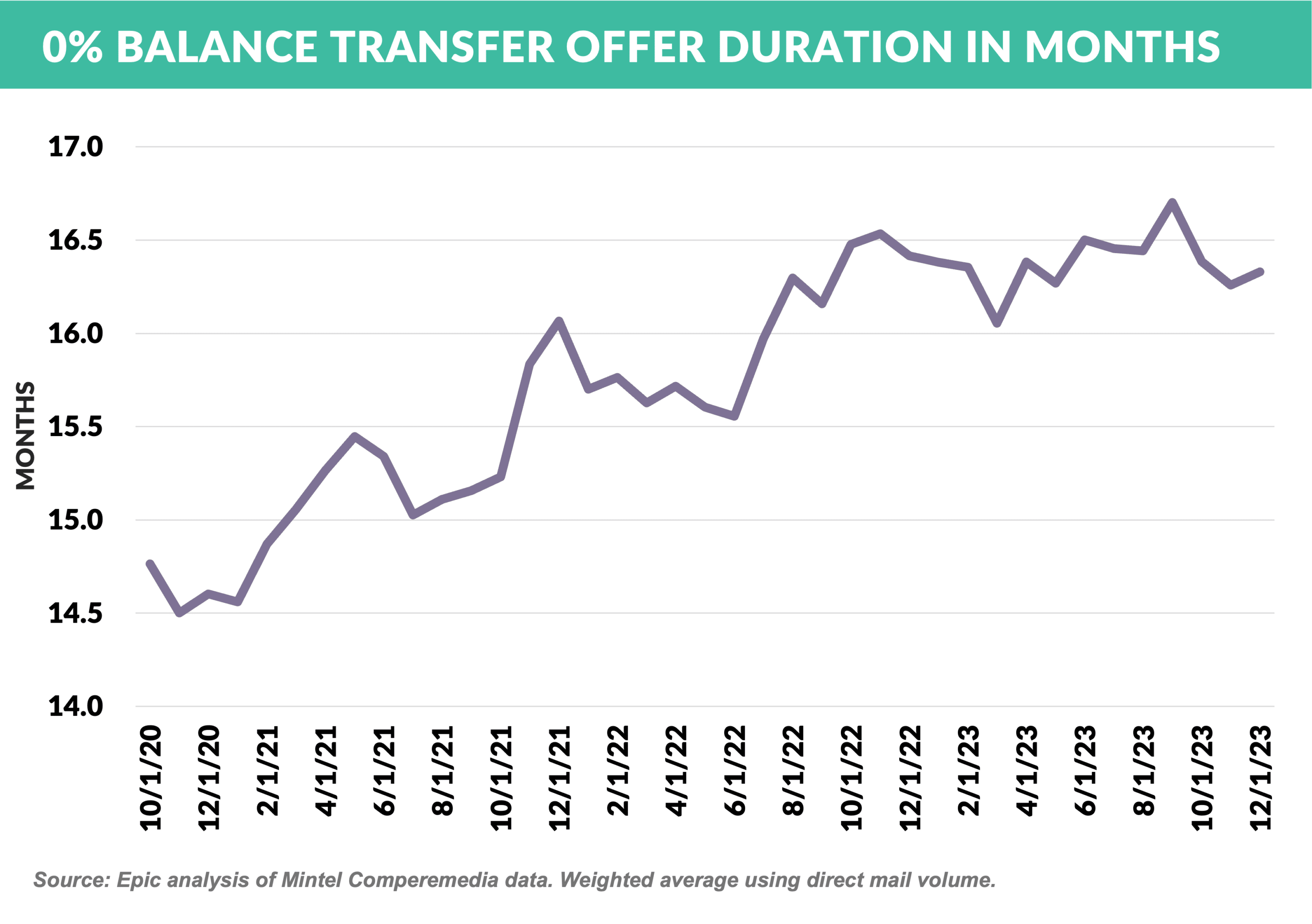

- Similarly, the duration of 0% Balance Transfer offers has trended up in the past several years, climbing from 14.6 months at the end of 2020 and peaking at 16.7 months in September 2023

Card Marketing’s Shift to Digital

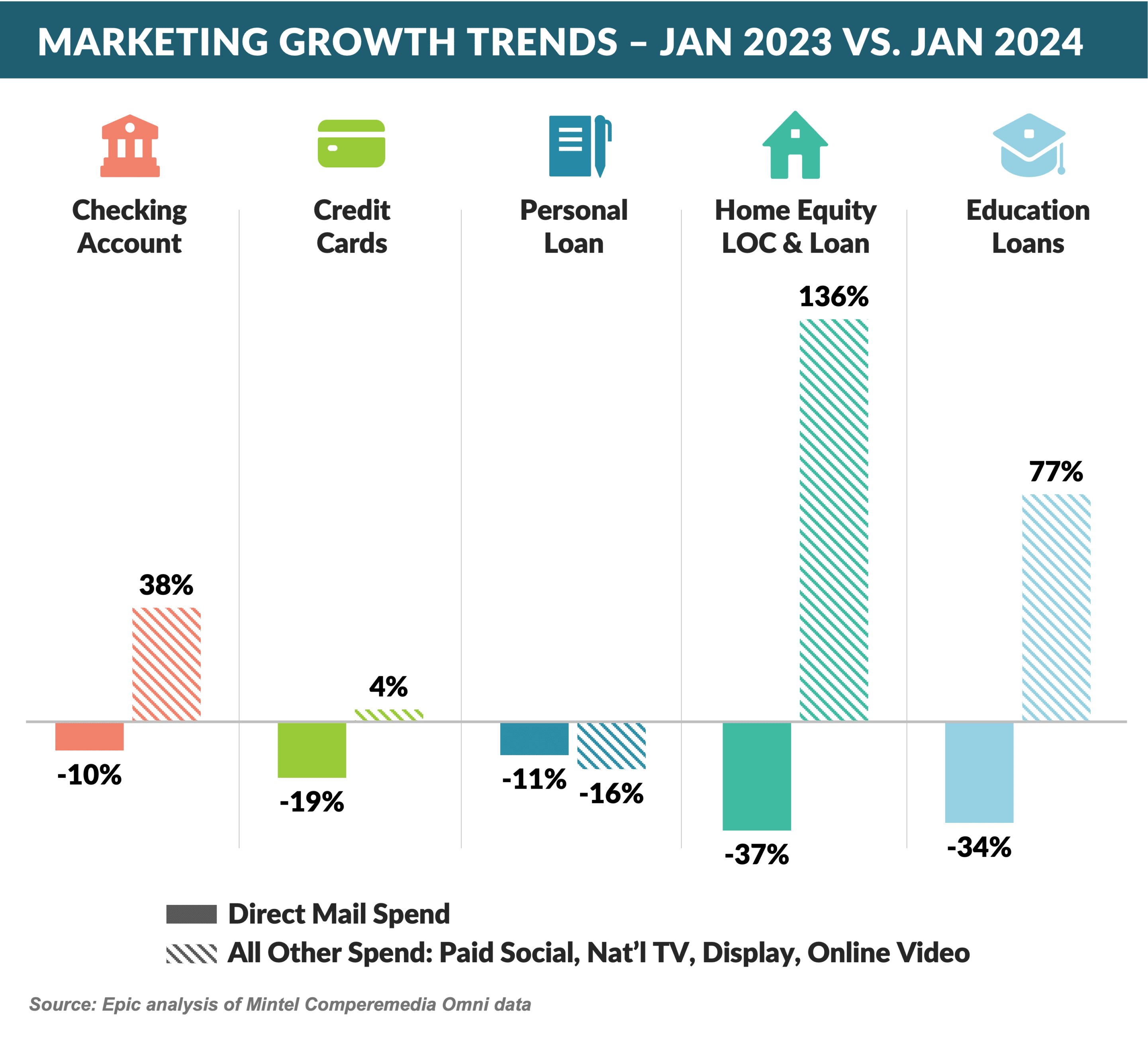

- January marketing volume showed mixed results among products compared to January 2023

- Lead generation companies have emerged amongst the top 20 personal loan mailers, including:

- Golden Eagle Lending – 7 million mail pieces in January

- Panther Lending – 4 million

- Liberty First Lending – 3 million

- The URLs for both Golden Eagle and Panther Lending were active within the past several weeks but appear to be dormant as of our publishing date

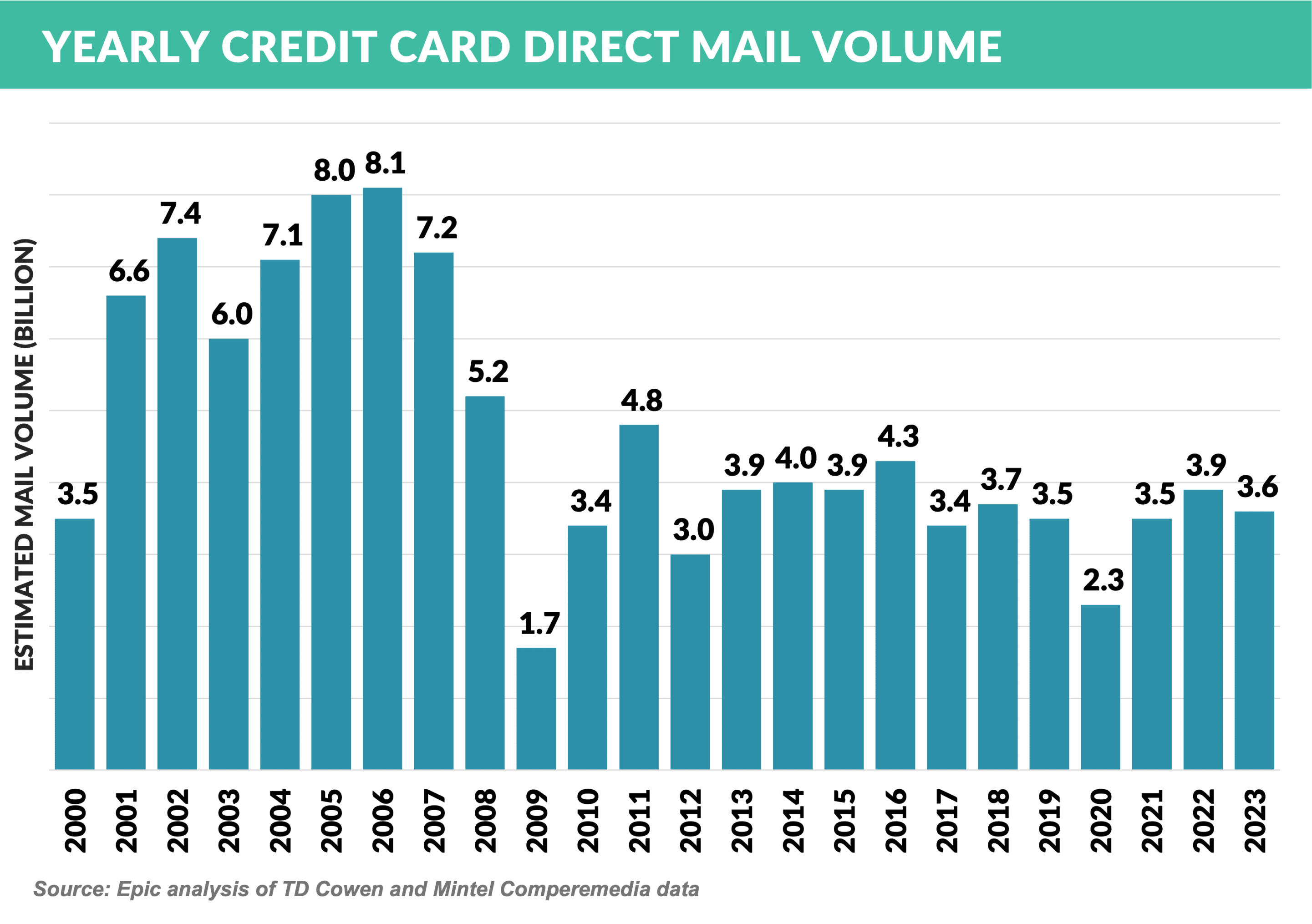

- Annual credit card mail volume has never recovered from the 2008-09 “Great Recession,” falling from an average of 6-8 billion pieces per year to half of that in the past ten years

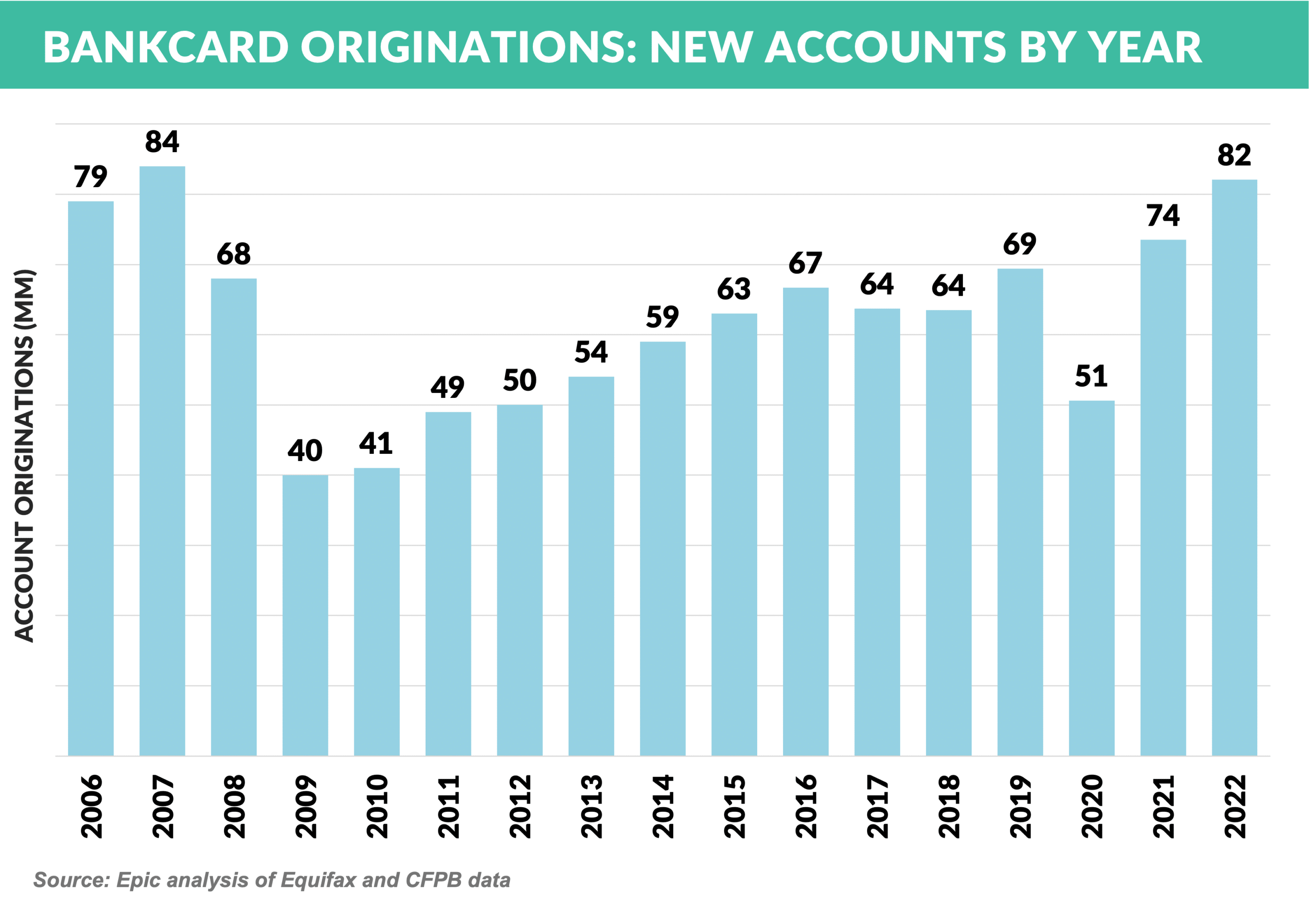

- There were 82 million new bankcard accounts originated in 2022 (the last full year available) – the same number as were originated in 2007 despite 2022 mail volume of just a little more than half that of 2007

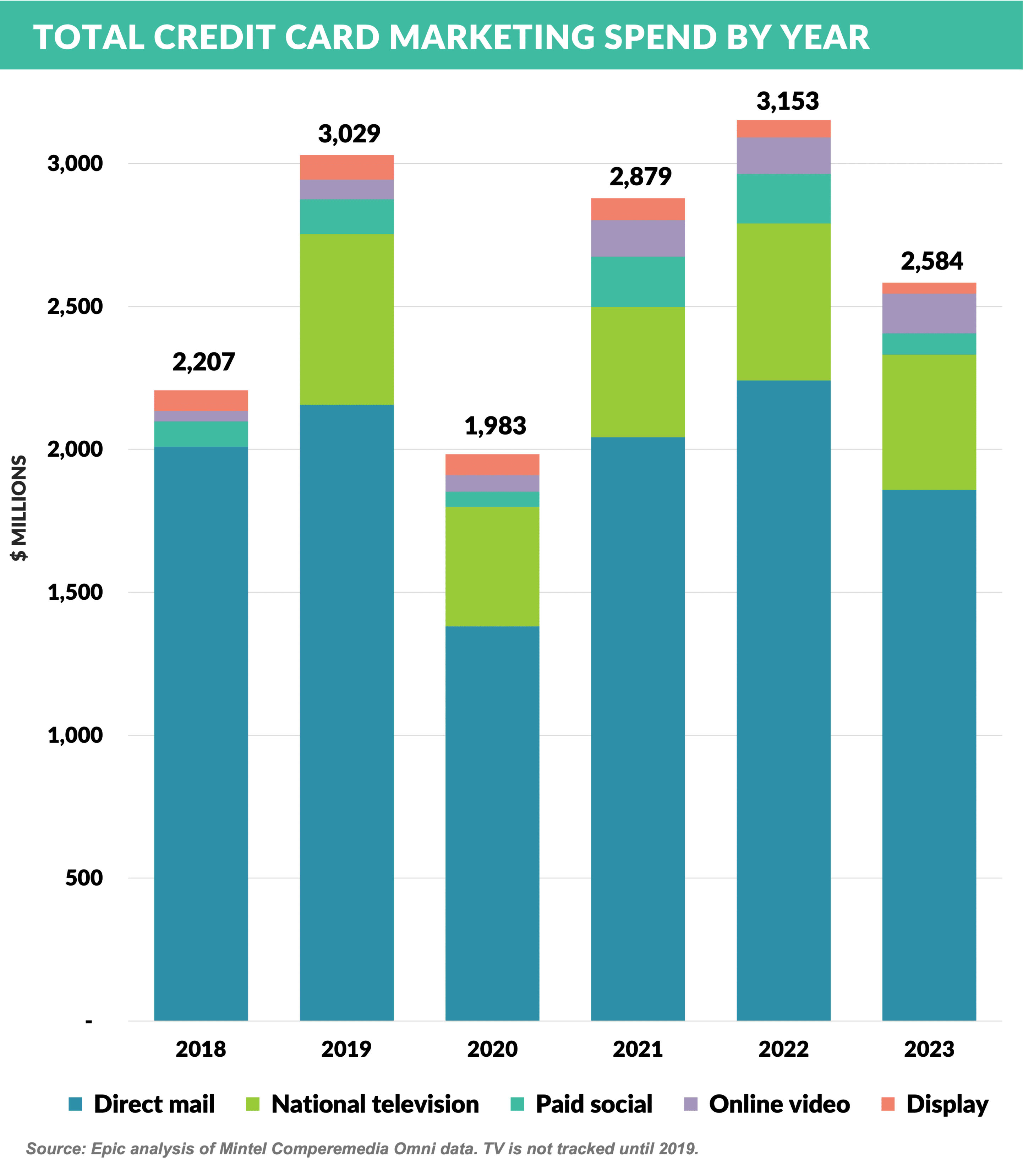

- These numbers indicate there is a lower reliance on direct mail now than 15+ years ago, and advertising dollars previously spent on mail has shifted to other media, such as paid digital, digital marketplaces, television, and partner channels

- Expense figures for non-mail channels is not readily available prior to 2018 and the above chart does not include paid digital, partner channels, or payments to digital marketplaces; however, estimates for large issuers indicate over half of new card accounts now originate from digital channels

- BNPL providers Affirm and Afterpay discontinued their rewards programs

- Afterpay announced the launch of a new rewards program later in 2024

- Competitor Klarna is continuing with their rewards program

- Already tight BNPL margins have been squeezed by higher funding costs causing providers to look for opportunities to cut costs

- We like the Consumer Bankers Association response to the “false narrative” contained in a recent CFPB report that referred to a lack of competition in the credit card sector:

“CFPB data shows the market share of the top ten issuers continues to decline. But more importantly, try naming any other market that has 10 major participants: 10 auto manufacturers; 10 cellphone manufacturers; 10 internet service providers; 10 pizza delivery chains – much less 4,000 options that consumers can obtain by visiting a website on their smartphones.”

- And speaking of a competitive market, the CFPB has just mandated that credit card issuers limit late fees to $8, which they have decided is the actual cost to the issuer of a late payment

- How many other industries with over 4,000 competitors have the federal government setting pricing?

- Issuers have tried over the years to attract customers by lowering various fees, however consumer demand has never been sensitive to any fee other than an annual fee

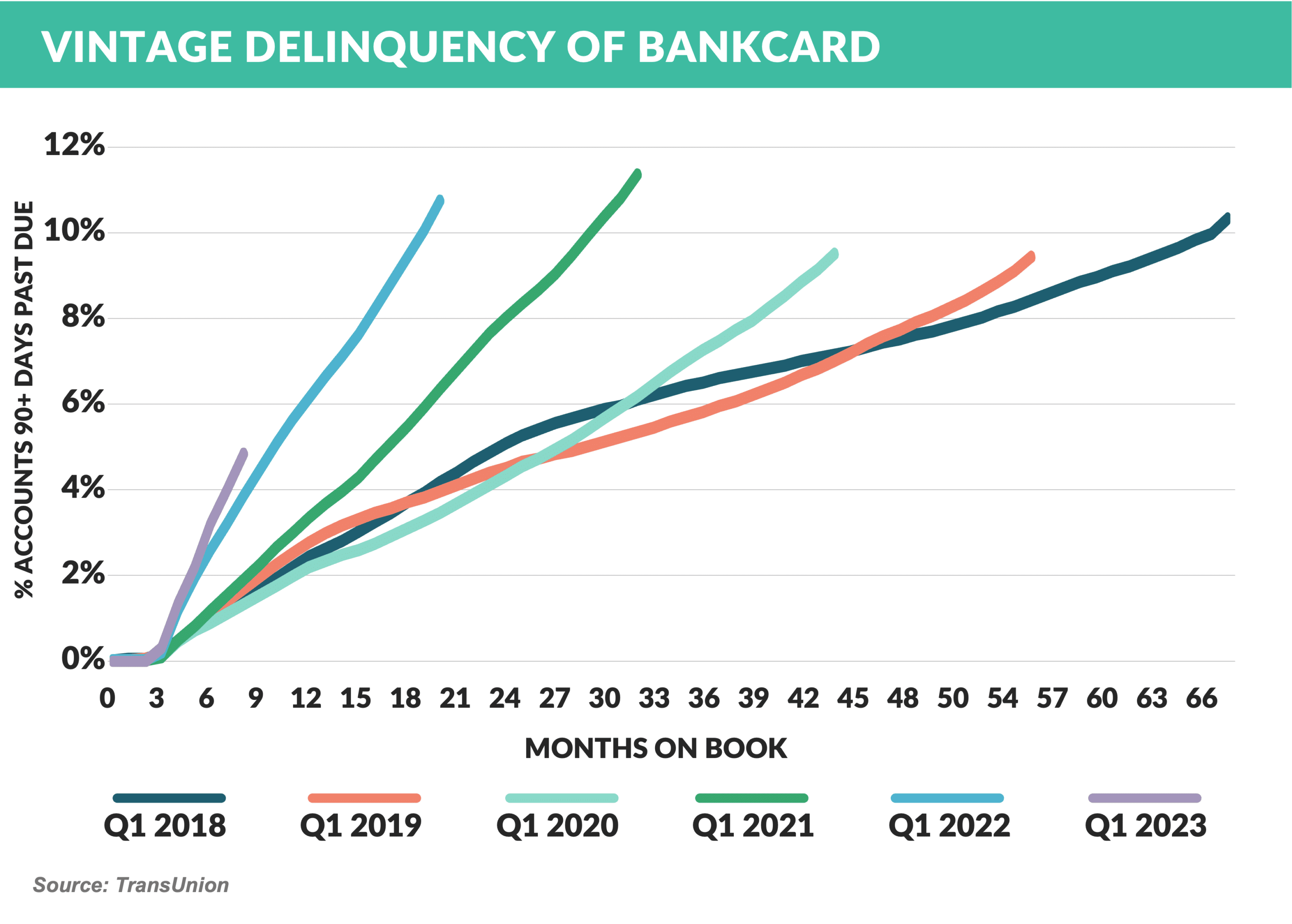

- Recent bankcard vintages continue to show deterioration with each subsequent year performing worse than the prior year

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on April 6th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.