Three Things We’re Hearing

- Education lending marketing slowdown

- Big advertising bucks pay off!!!

- Is now the time to refi card balances???

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Education Lending Marketing Slowdown

- Education lending is a niche segment dominated by a few lenders

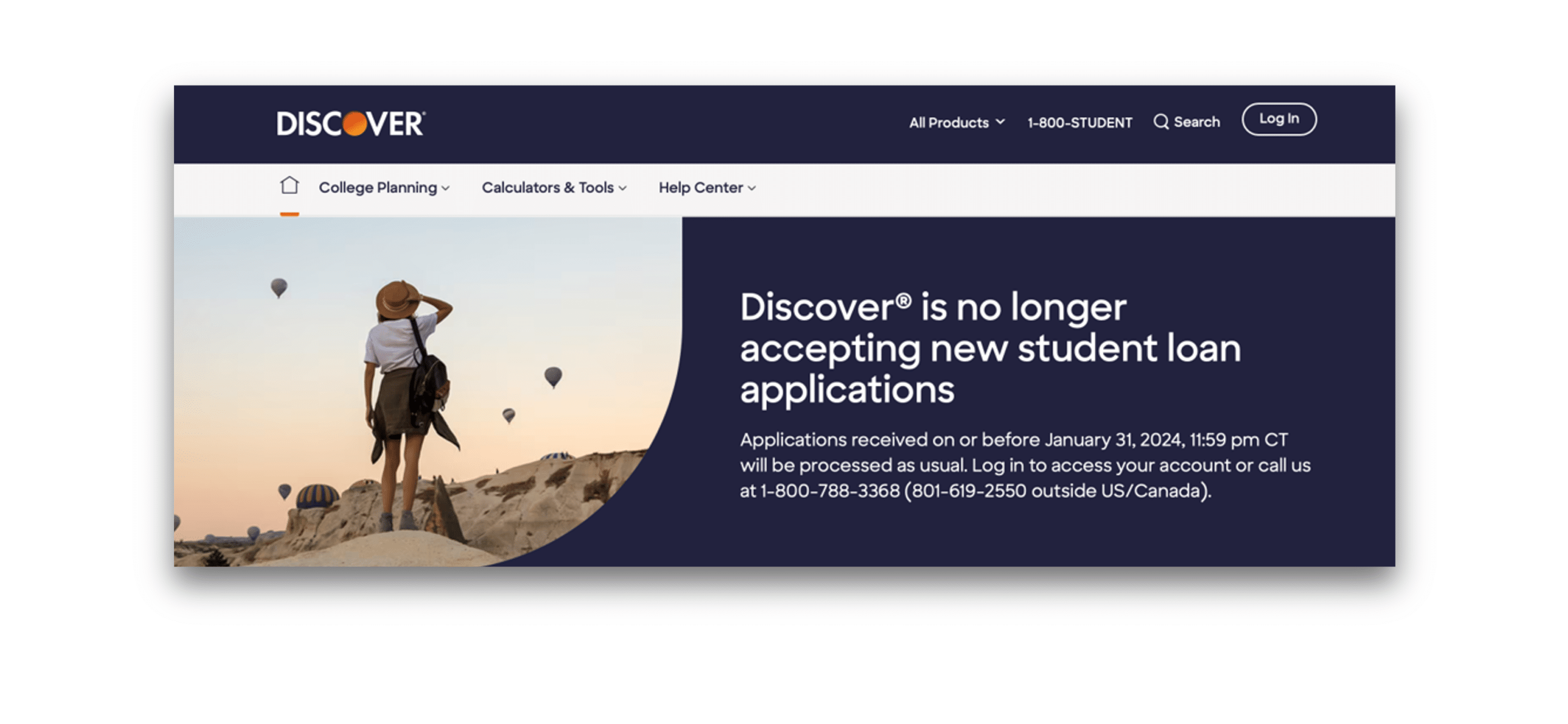

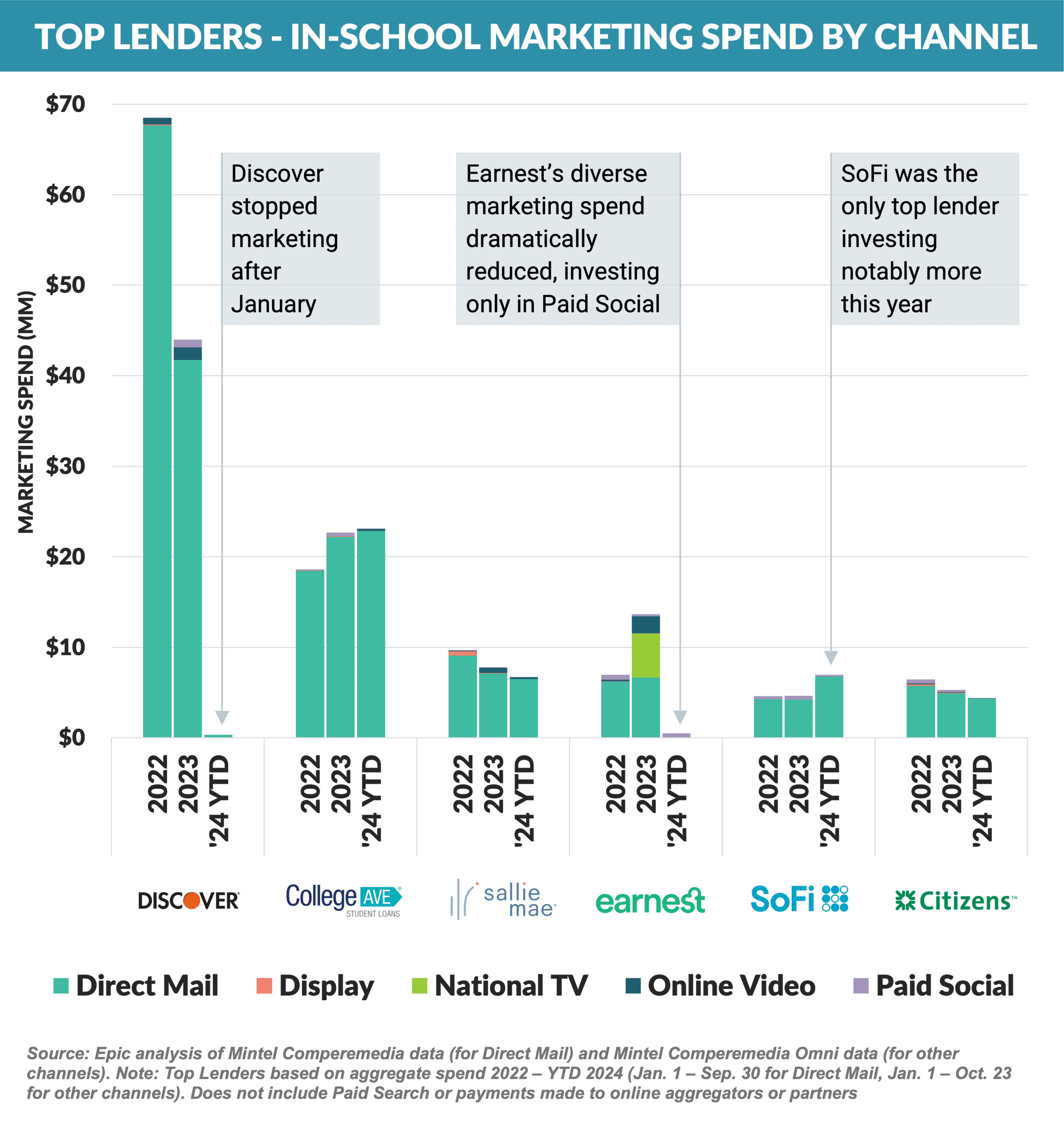

- In-school private student loans are primarily marketed by Sallie Mae, College Ave, SoFi, Citizens, and Earnest – Discover ceased originating private student loans in February

- Education refinance lending has an even smaller group of participants, with SoFi, Navient/Earnest, and Citizens (until recently) marketing most

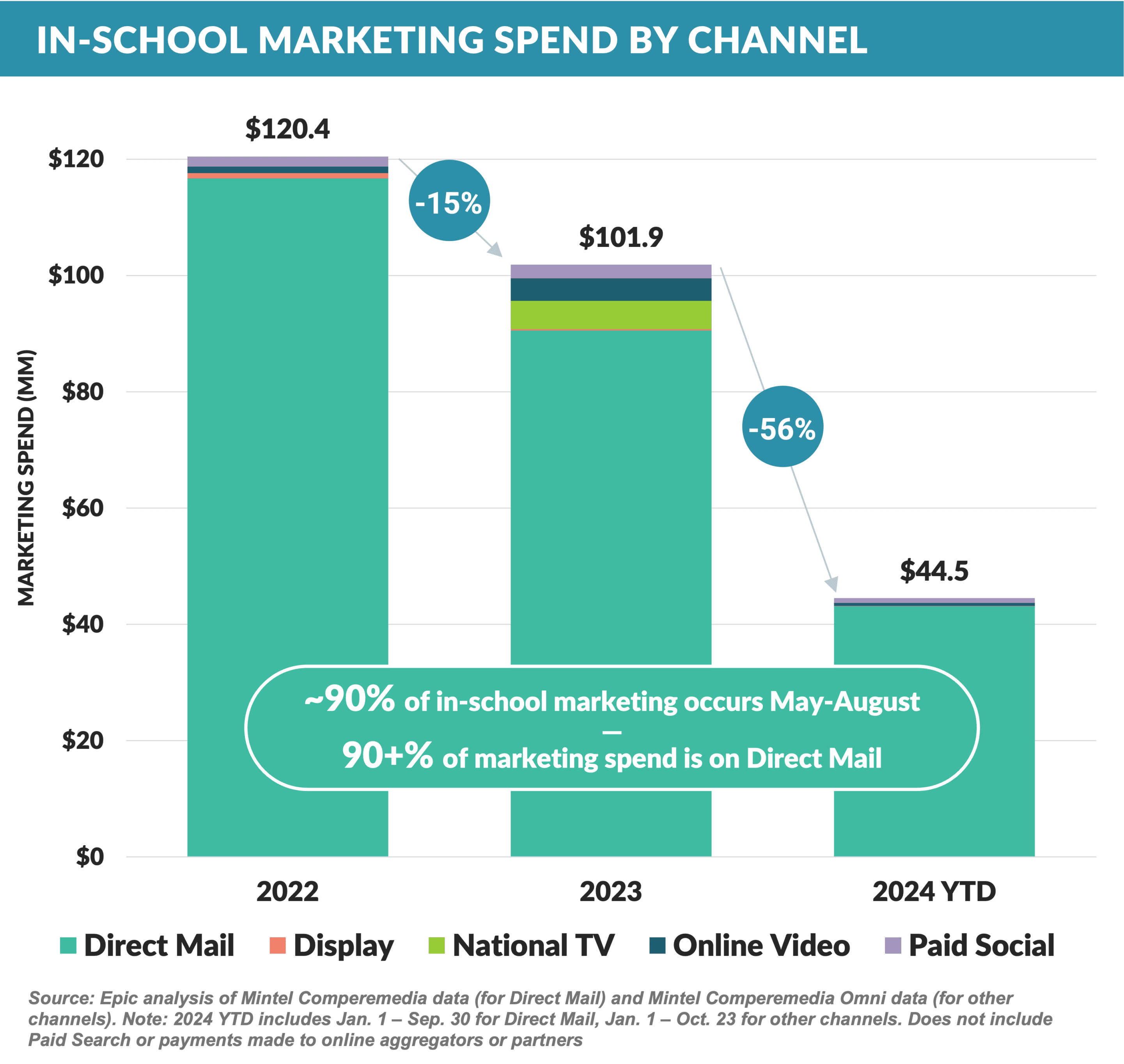

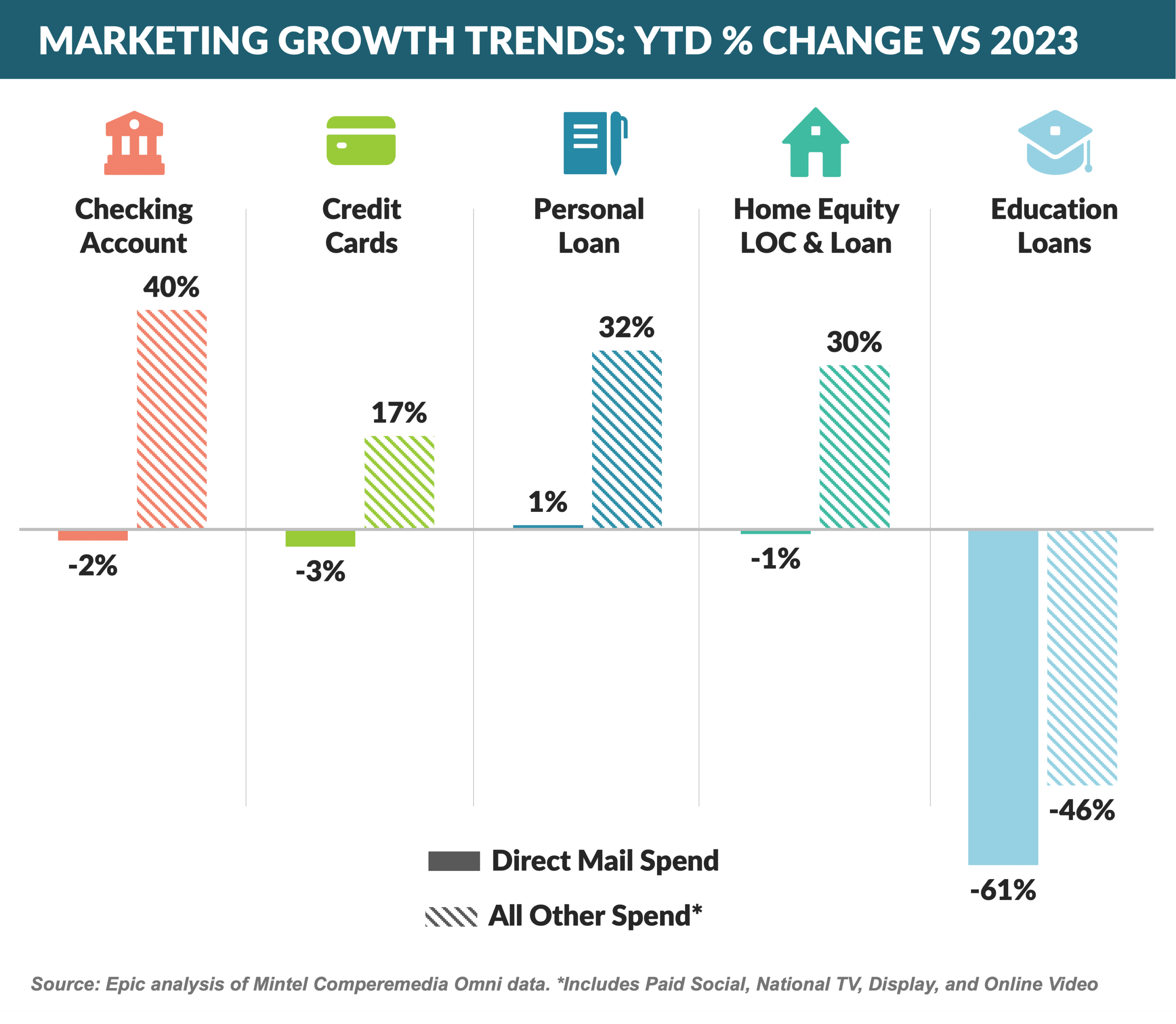

- With the bulk of the in-school lending “season” ending in September, tracked advertising spending in 2024 is down 56% vs. 2023

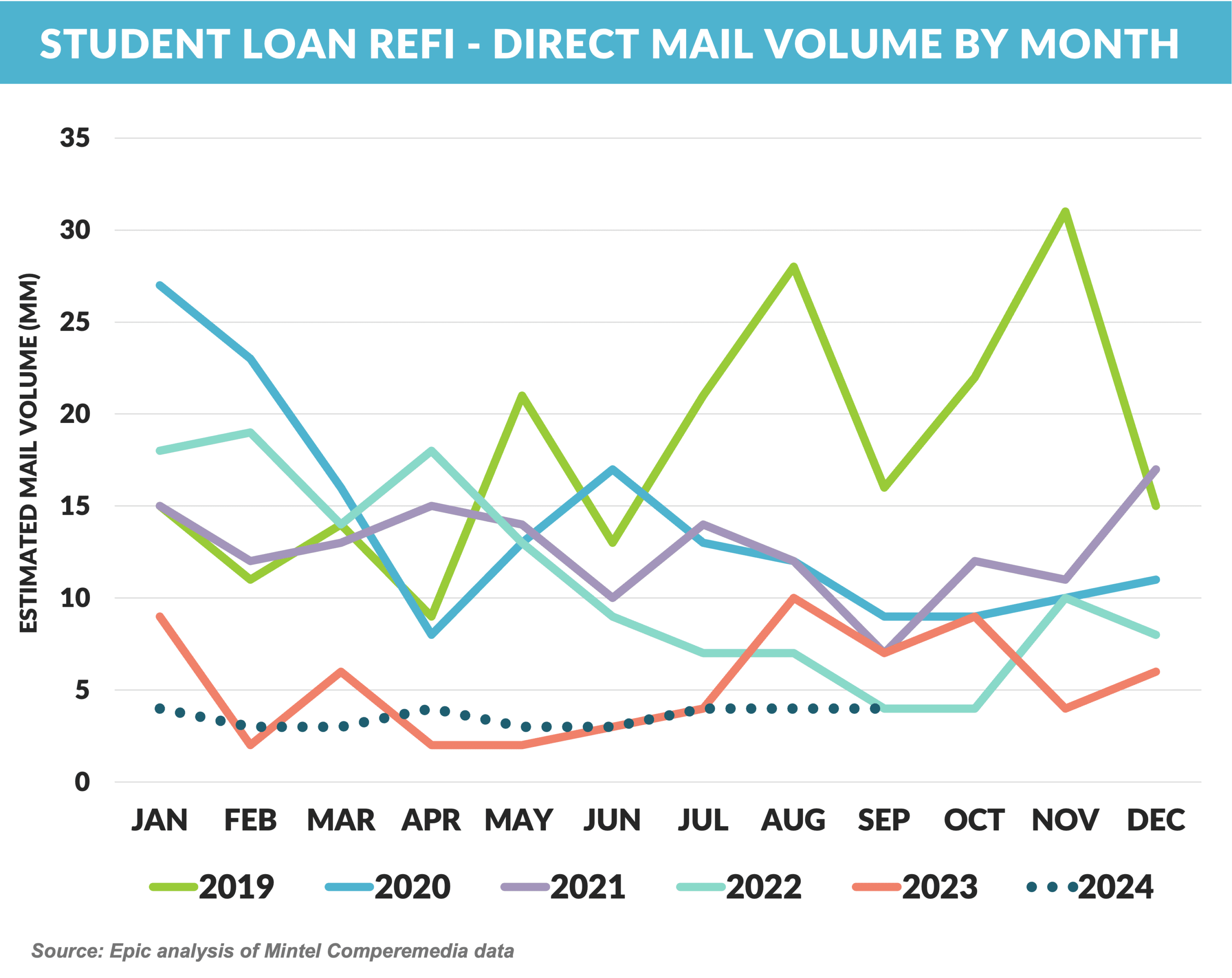

- Education refinance direct mail marketing is a fraction of what it was five years ago due to federal student loan payment deferrals and rising rates

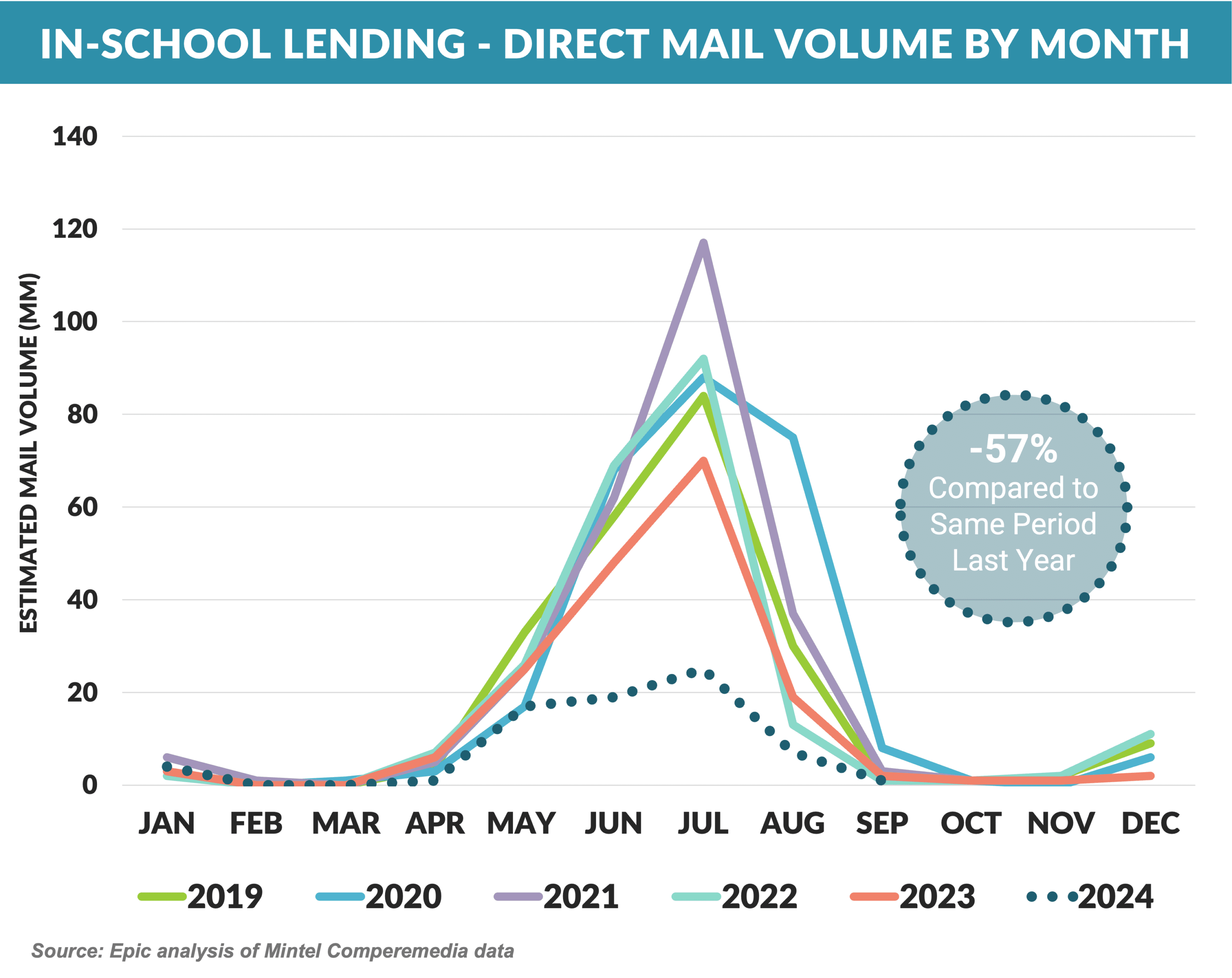

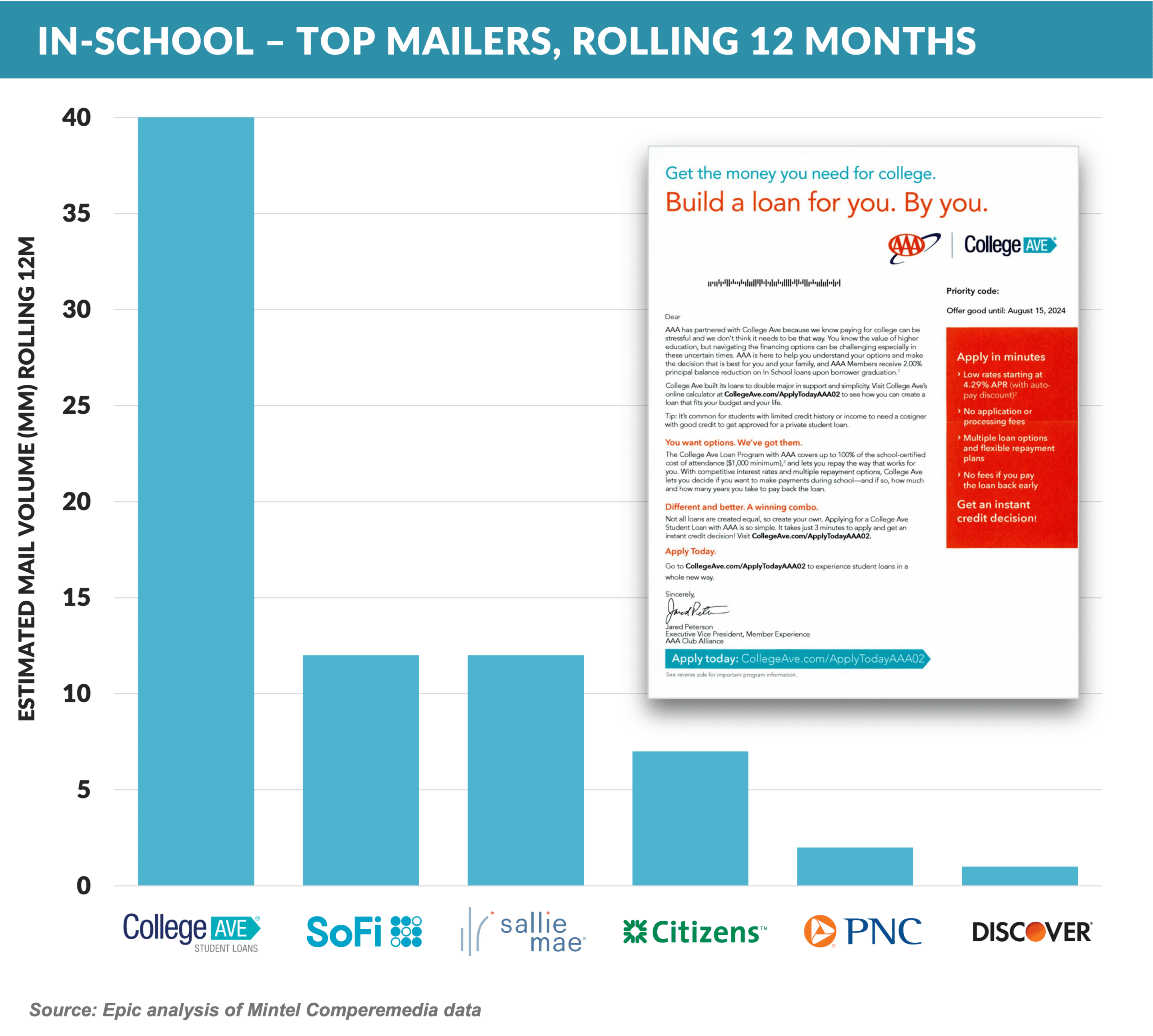

- Private student loan marketing has remained active; however, 2024 direct mail volume is down a whopping 57% year-over-year

- Most of the drop-off is due to the exit from student lending by historically dominant Discover; however, the other private student loan lenders mailed 19% less in ’24

- College Ave has emerged as the new number one mailer, however, at a much lower volume than previous leader Discover

- Despite the drop in marketing, consumer demand for private student loans has remained consistent with prior years

- Sallie Mae seems to have gained some of the prior Discover volume reporting a 9% year-to-date increase in originations

- Another factor impacting private student loan marketing was the major overhaul and subsequent delay in the FAFSA roll out this year, and it will be interesting to see if marketing spending increases in the segment in 2025

Big Advertising Bucks Pay Off!!!

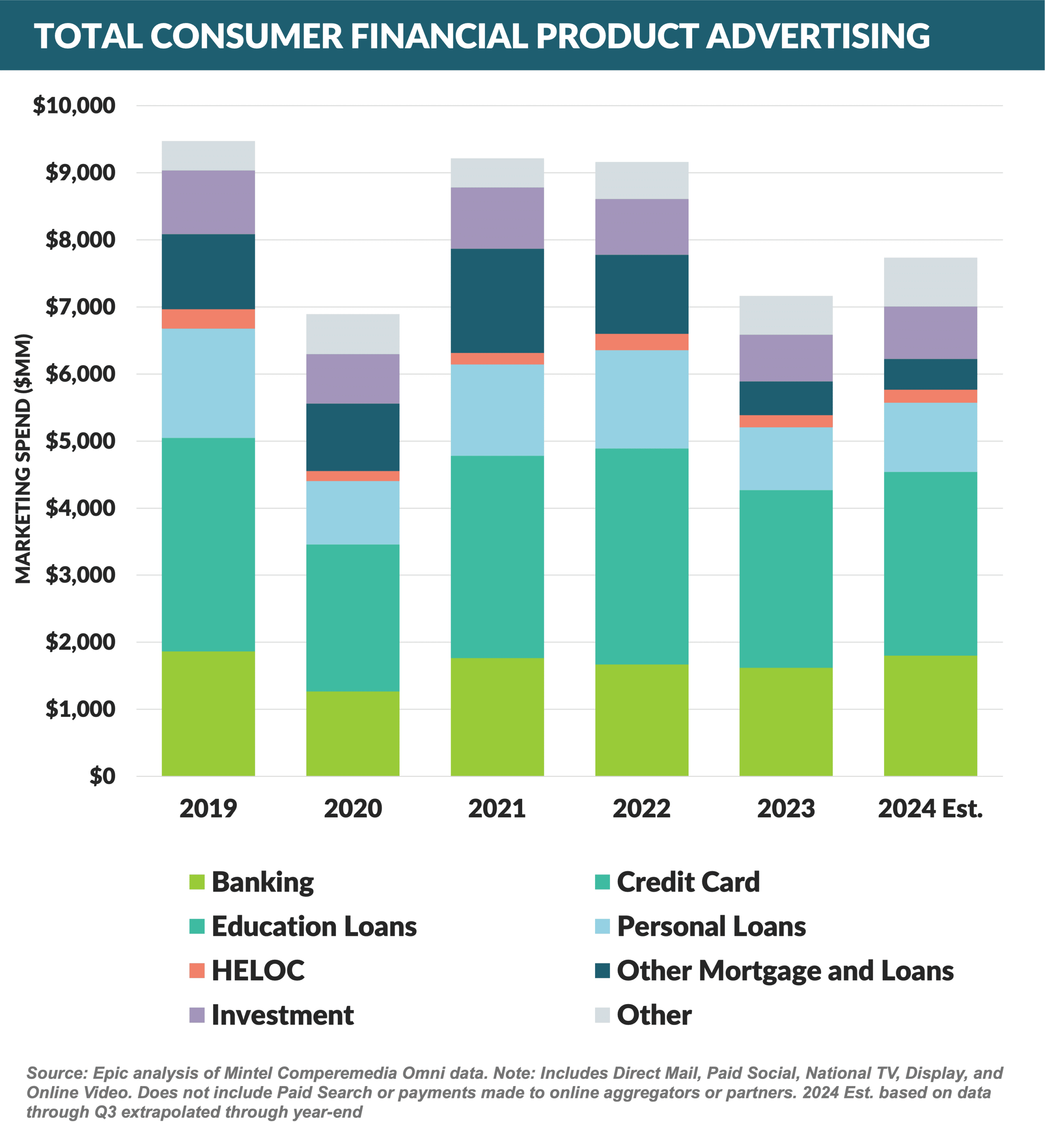

- Billions are spent on consumer financial product advertising each year, with the bulk of it targeted on new customer acquisition

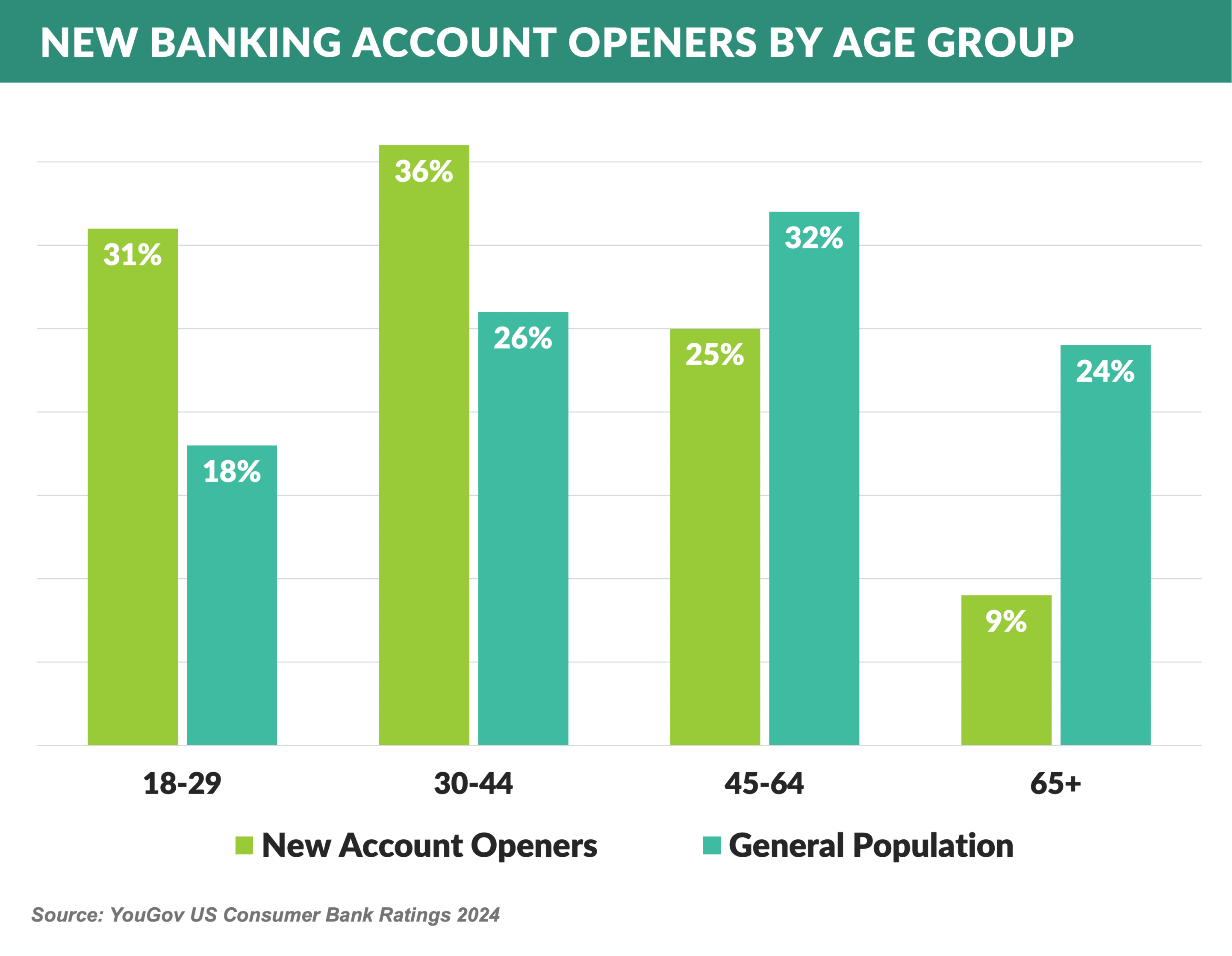

- New banking account openers are concentrated in the 18 – 44-year-old category, a group which represents two-thirds of new account openers but only 44% of American consumers

- Capital One, Chase, and Citi have spent the most on consumer financial product advertising in the past 12 months

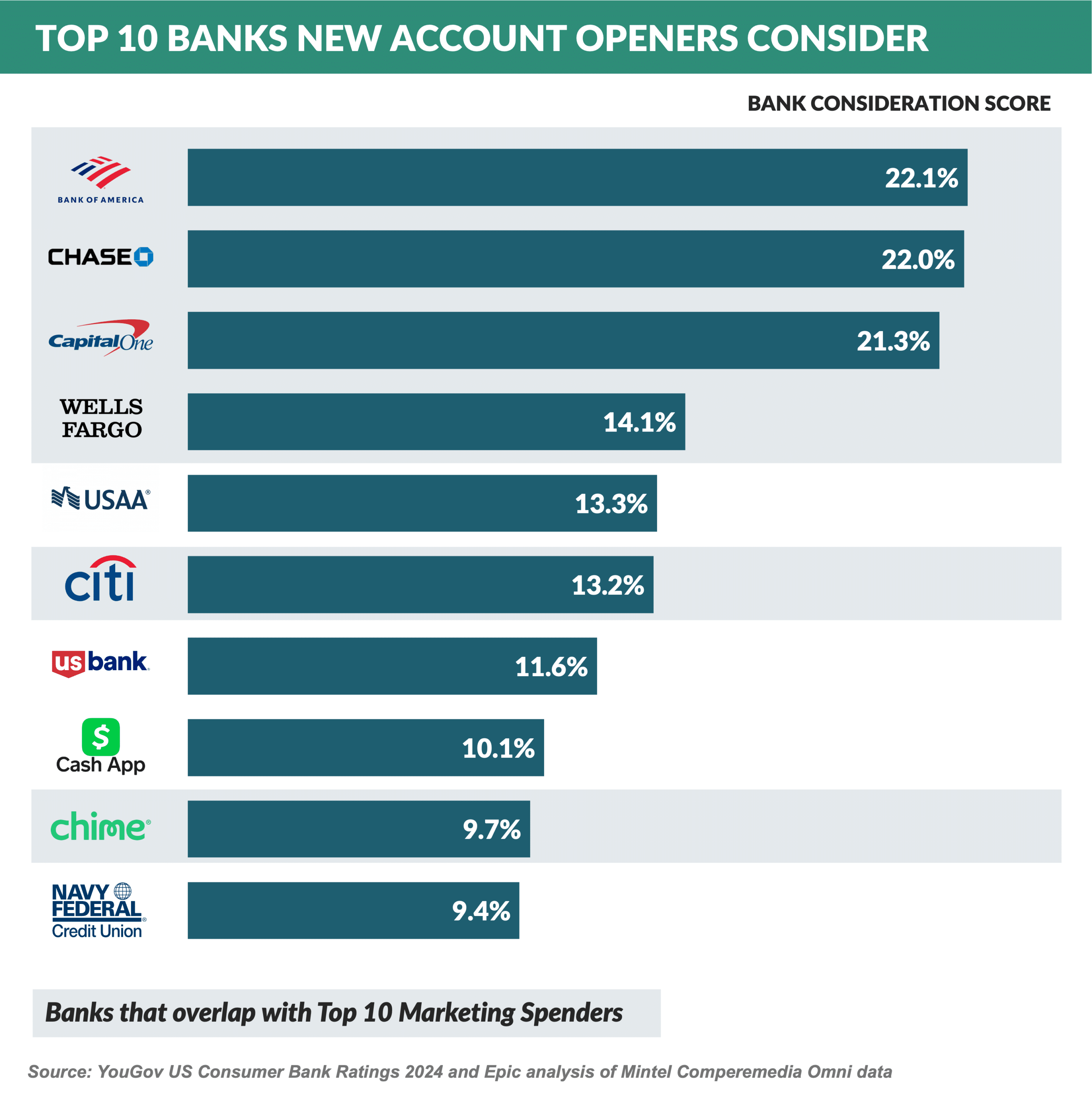

- When potential new account openers are asked which banks they are considering, the list of banks largely overlaps with that of the top 10 advertisers

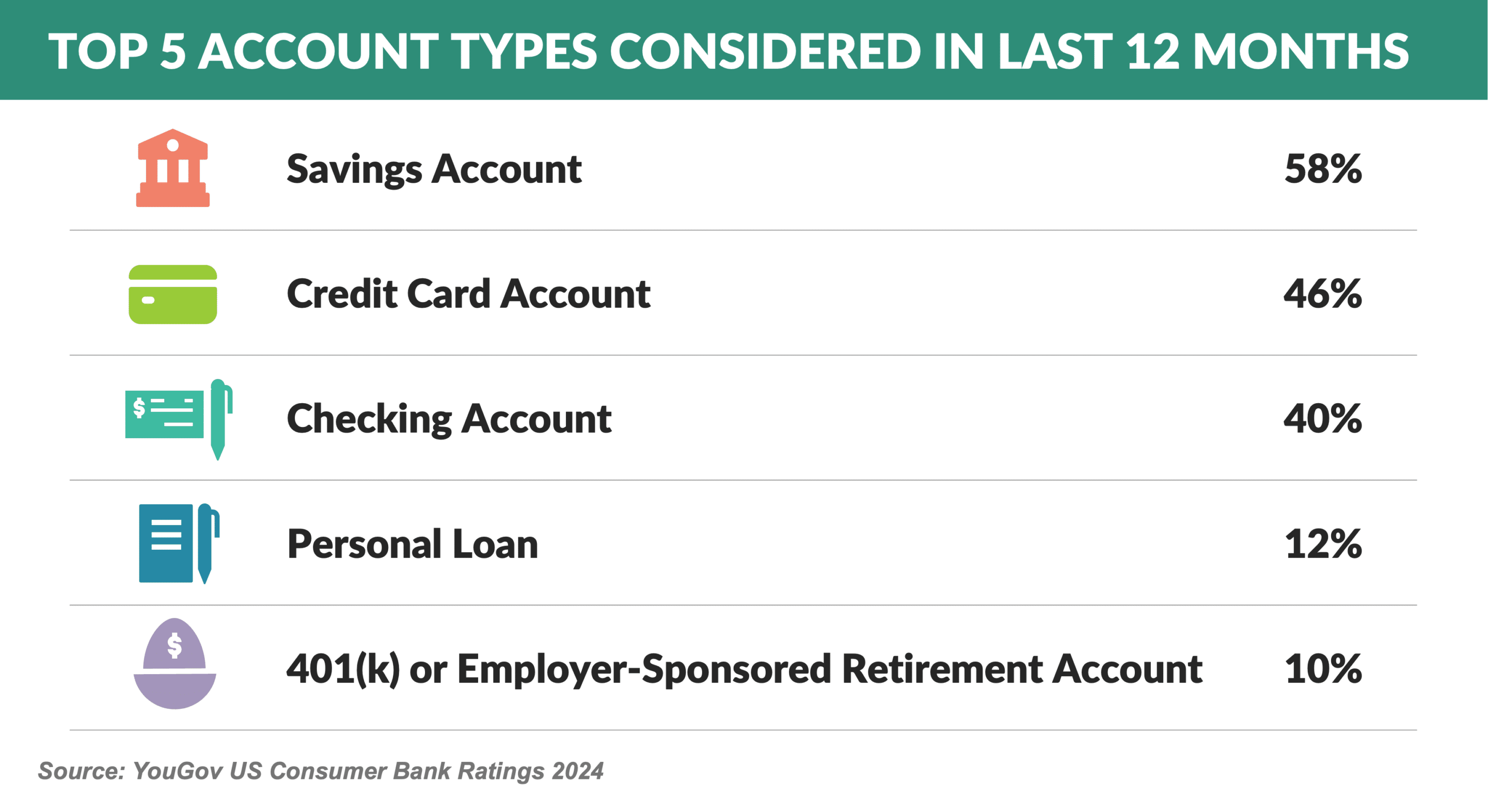

- High deposit rates make savings accounts a popular new account to open, and credit cards have historically been among the most added new products

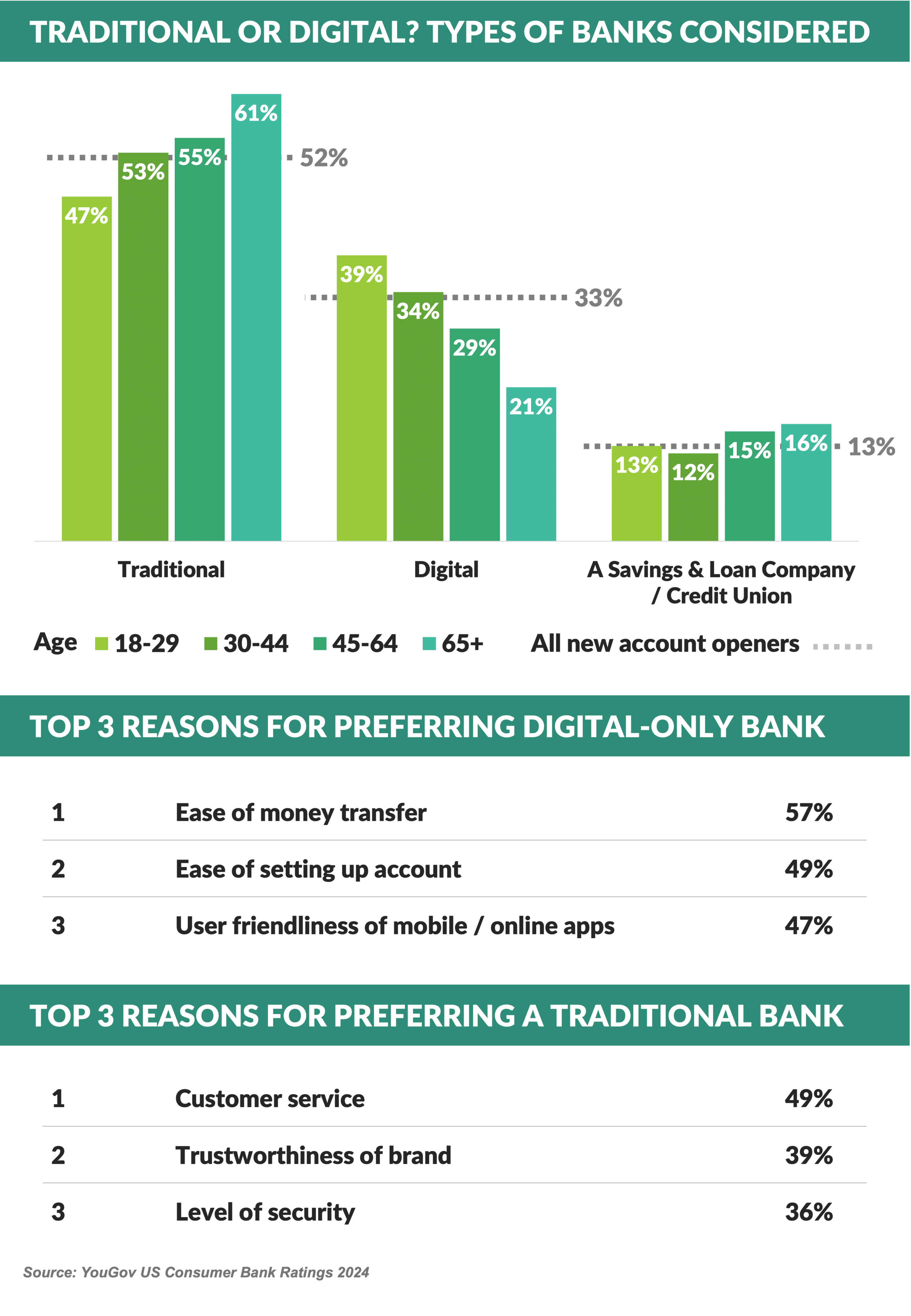

- Younger consumers are more likely to prefer digital-only banks, citing their advantages in money transfer, account opening, and online/mobile features

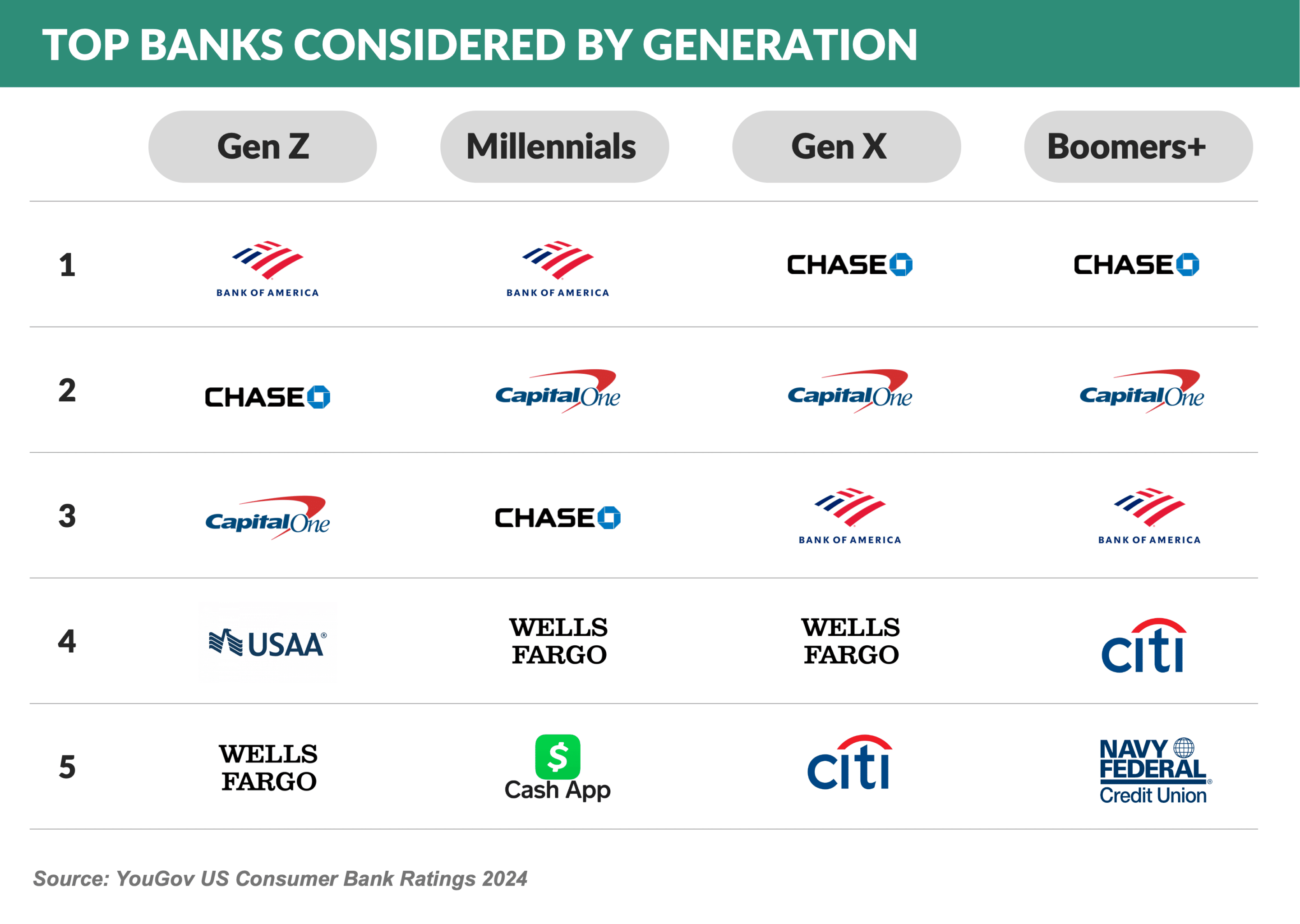

- However, traditional banks such as Chase, Capital One, Bank of America, Citi, and Wells Fargo – the big bucks ad spenders – are popular among all age groups

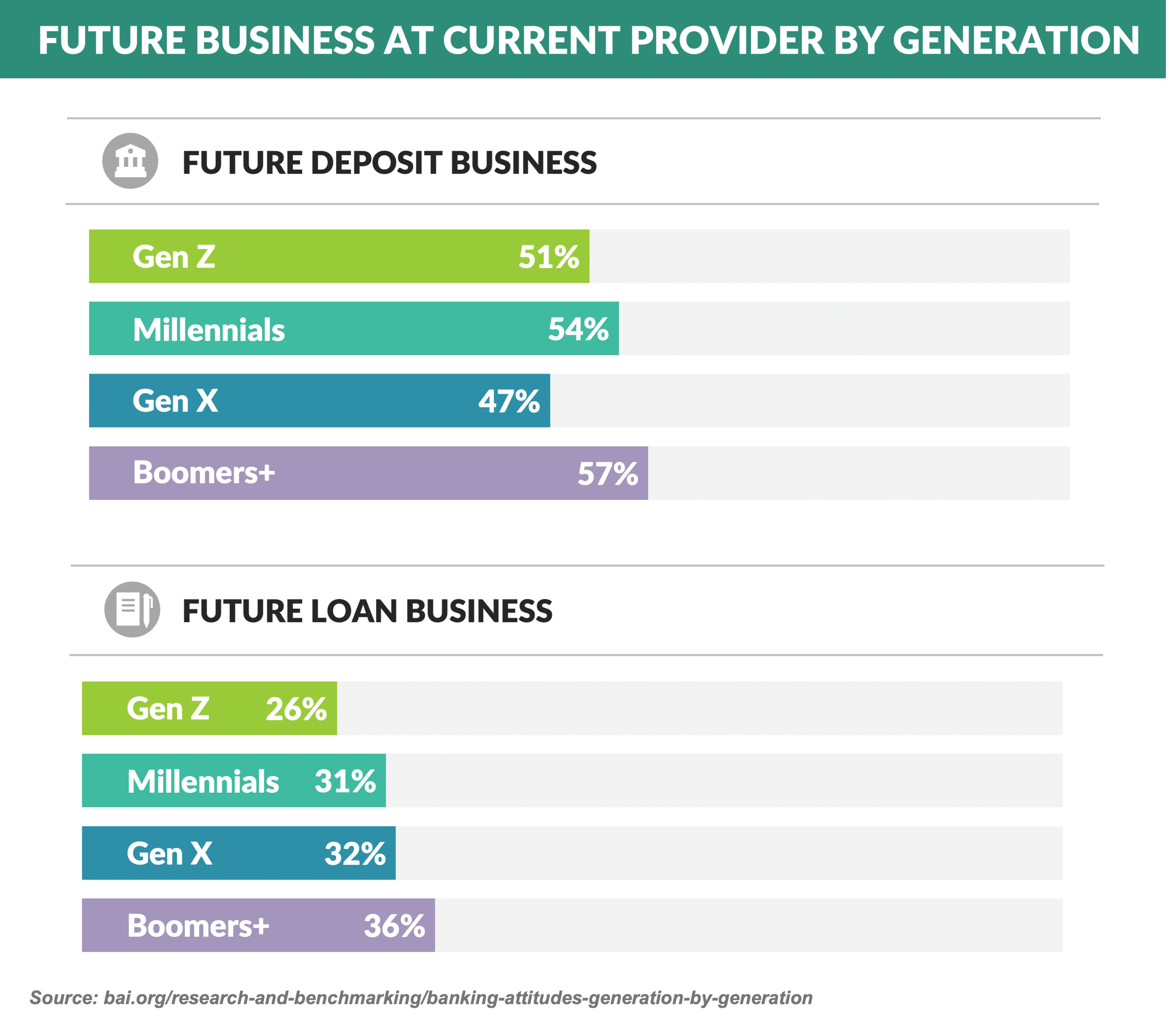

- Bank preference differs across products – consumers in all generations are more likely to pick their current institution for future deposit accounts, less so with loans

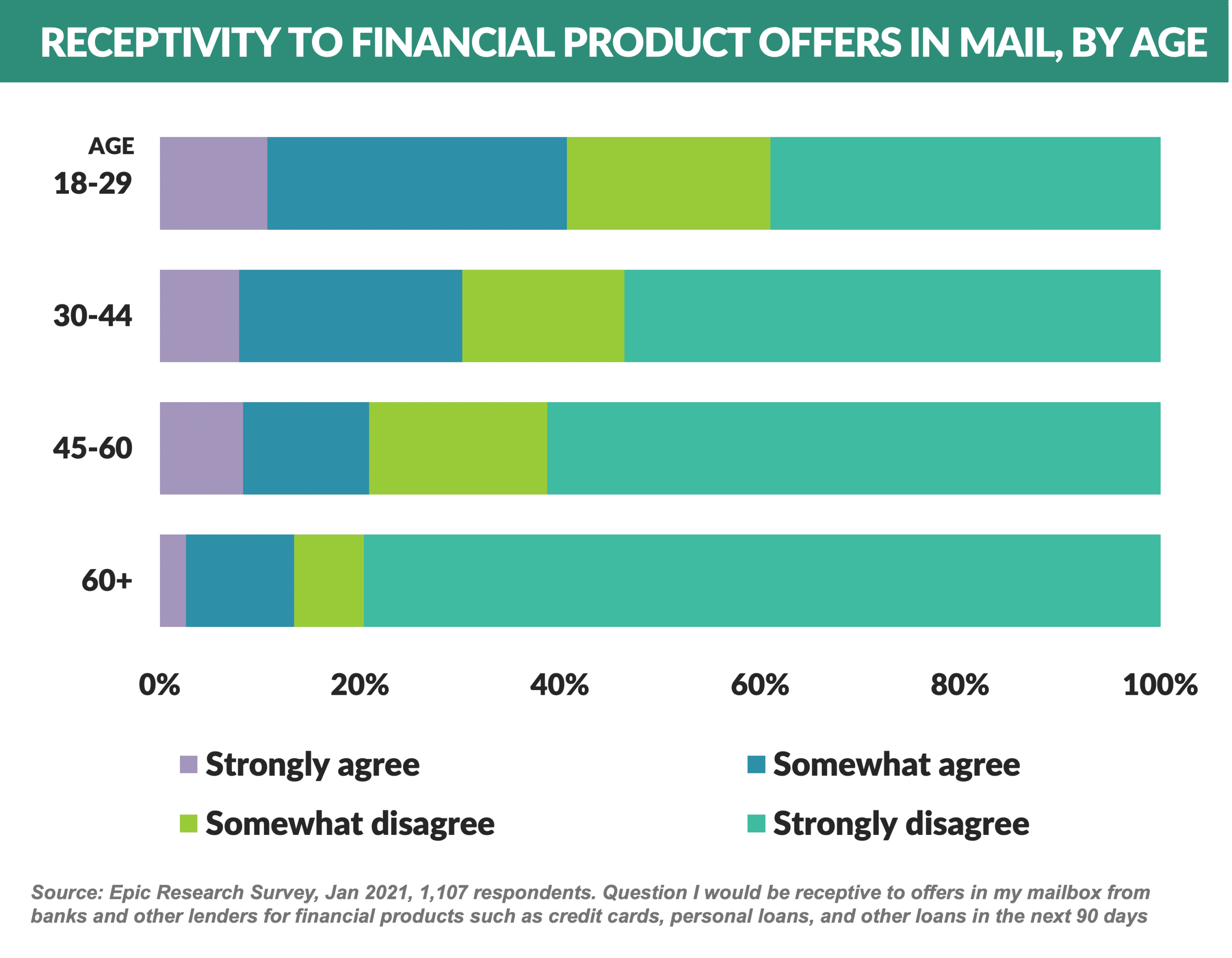

- And despite the preference for digital banking services, our surveys have shown younger consumers almost twice as likely to be responsive to mailed offers

- While digital banking has affected consumer preferences to a large degree, traditional advertising, including direct mail, remains a dominant new customer acquisition source among all age groups

Is Now the Time to Refi Card Balances???

- Despite flat year-over-year mail volume for checking, credit cards, personal loans, and home equity, spending on TV and digital channels is up 17% - 40%

- The difference between credit card APRs and consumer personal loan rates is at a record high of 7.5% creating a fertile environment for consumers to refinance card debt

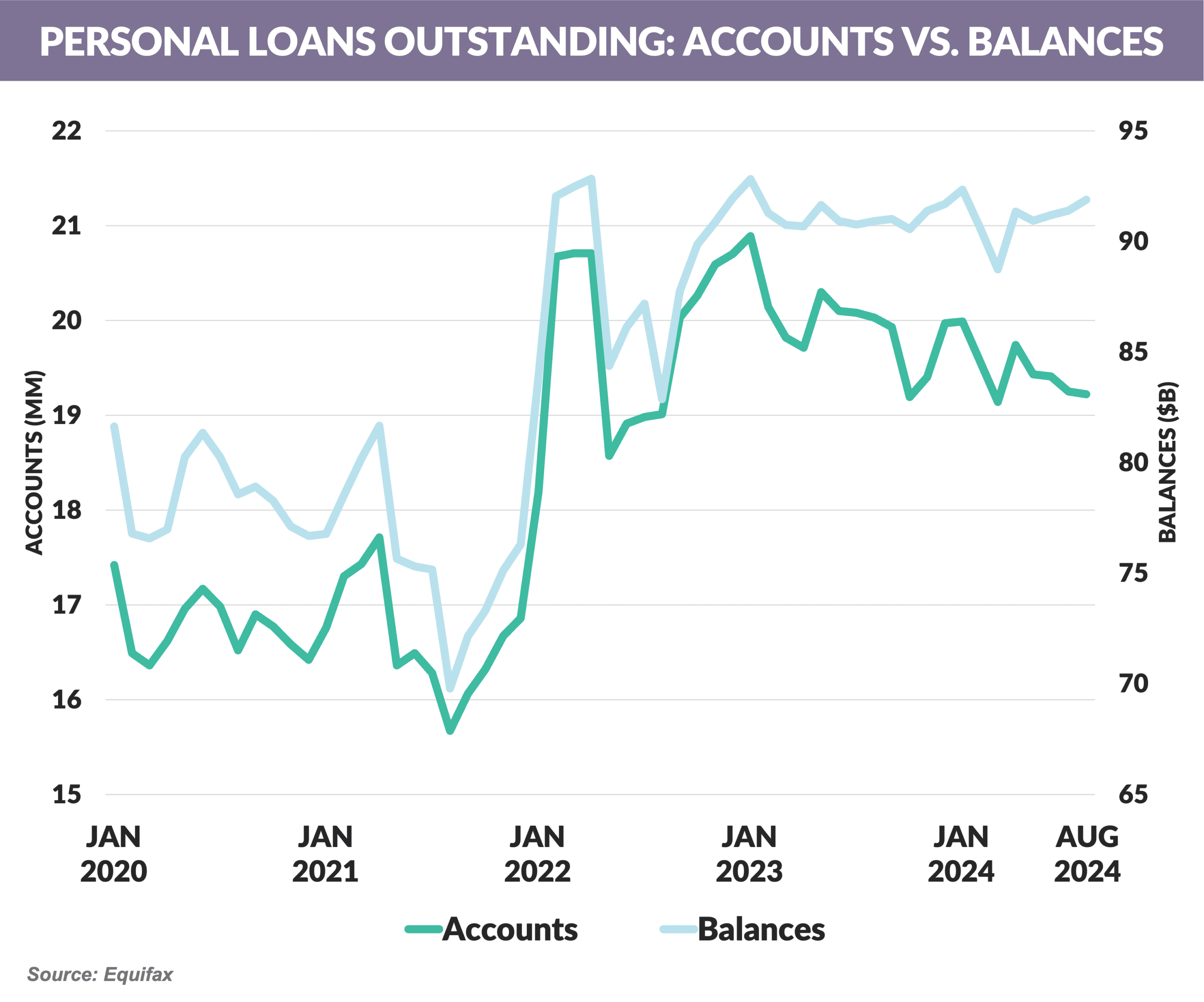

- However, unsecured personal loan balances have been flat for two years

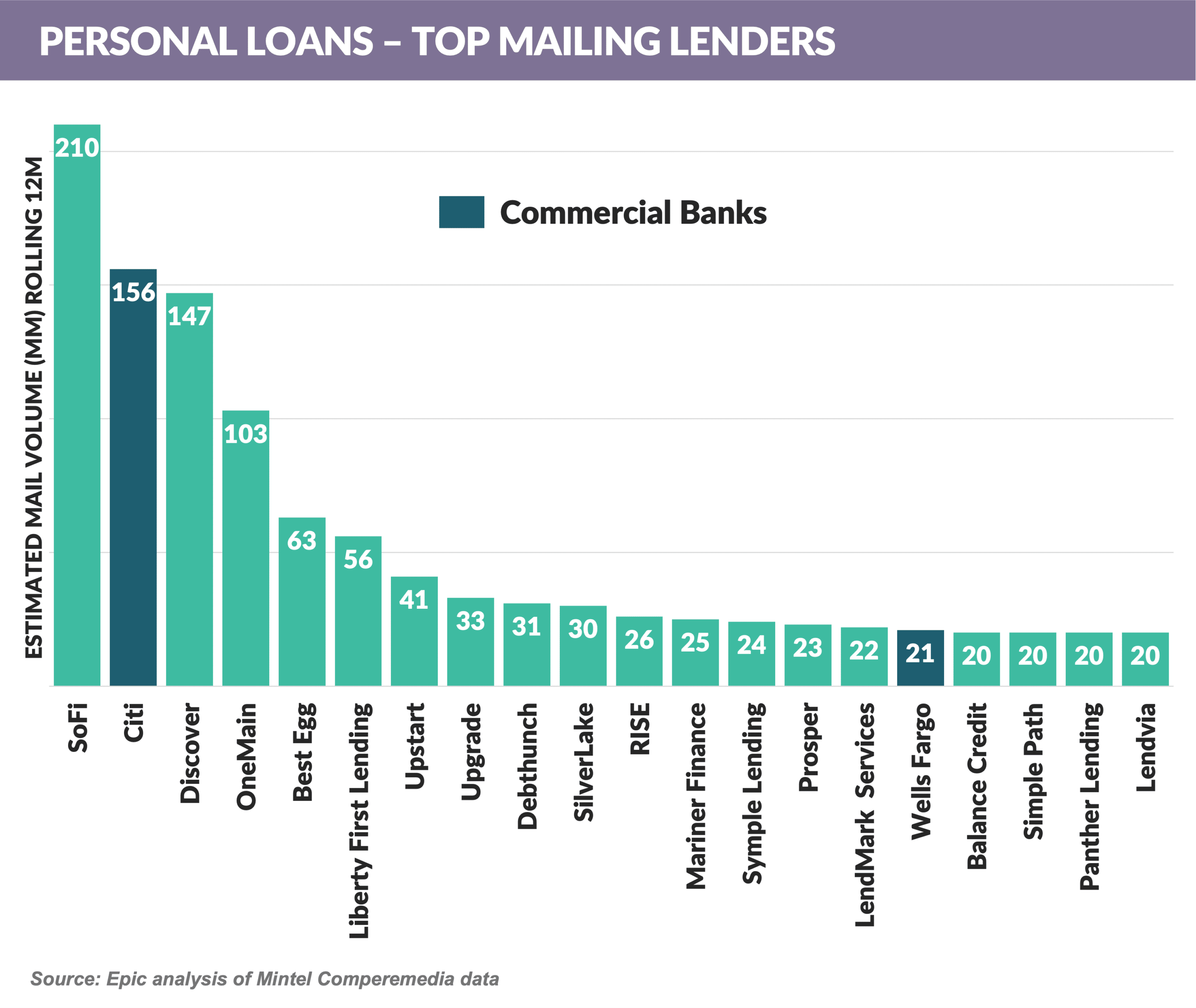

- Personal loan marketing is dominated by fintechs, with only two commercial banks appearing in the top 25 mailers

- Commercial banks – which compared with fintechs have much cheaper and more stable funding, as well as superior brand recognition – have long neglected the promising personal loan sector

- After long being rumored, Barclays announced that it would be taking over the GM credit card program, currently managed by Goldman Sachs

- The existing GM portfolio is reported to have over $2 billion in outstandings

- Goldman is expected to take a sizable loss on the portfolio which is likely being sold at a discount

- SoFi launched two new credit cards:

- Everyday Cash Rewards: 3% cash back on dining, 2% on groceries, 1% on everything else

- Essential: Aimed at building or improving credit

- Previously, SoFi only offered the Unlimited 2% Credit Card

- Klarna is now available on Apple Pay

- Their offers include pay later in three or four installments with no interest or over longer periods with APRs starting at 0%

- Klarna joins Affirm in offering BNPL products on Apple Pay

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in December.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.