Three Things We’re Hearing

- Apple Card holders love the card!!!

- What happened at Goldman Sachs???

- Online savings rates plateau

A four-minute read

If the Epic Report was forwarded to you, click here if you’d like to be added to our mailing list

Apple Card Holders Love the Card!

- The Apple Card was launched in the fall of 2019 and by March of 2020 a report cited over 3 million US card holders, a number that then doubled by early 2021

- Epic surveyed 172 Apple Card holders in July regarding their opinions of various Apple Card features

What Happened at Goldman Sachs???

- Goldman Sachs entered the consumer banking business in 2016 with a goal of diversifying Goldman's earnings

- The “go big or go home” approach they adopted led to rapid growth in both the Apple Card and consumer loan business

- However, problems later surfaced with Goldman announcing in the Fall of 2022 a restructuring of the business and a cumulative loss of over $3 billion about which CEO David Solomon commented "We tried to do too much too quickly"

- Recent reports focus on Goldman’s decision to exit the consumer business

- Personal loan origination was ended in 2022, and following a sale of over $1 billion in consumer loans earlier this year, another tranche was sold in June at a loss of nearly $500 million

- The GreenSky loan platform, purchased less than two years ago for $2.24 billion, is reported to be for sale

- The Apple Card program is rumored to be transitioning to another card issuer

- As reflected in our survey, the Apple Card is wildly popular amongst its holders, was earlier lauded by Goldman CEO David Solomon as “the most successful credit card launch ever,” and is, by all accounts, an enormous success for Apple

- However, things have changed in the four years since the card launch as more recent news articles suggest Goldman is looking to offload the program

- The Wall Street Journal pointed to American Express as a possible successor Apple Card issuer

- More recently, The Information described possible contractual issues with the Apple Card Mastercard deal that runs until 2026, which might lead to a partnership with a Mastercard issuing bank

- In any case, the rather large size of the Apple Card portfolio would limit the number of potential purchasers

- Goldman does not disclose details of product performance, however publicly available data might provide evidence of what went wrong

- JPMorgan published in September that “Goldman’s loss rate on credit card loans is the worst among big U.S. card issuers and ‘well above subprime lenders’ at 2.93%” with Goldman reporting that 28% of Apple Card customers had FICO scores of less than 660 – roughly double the concentration of issuers such as Citi and JPMorgan

- A look at the Apple Card’s features reflects some other challenges to profitability – in contrast to the higher credit risk profile of its customer base, Goldman has priced the Apple Card below market

- The current APRs for the Apple Card range from 15.99% to 26.99% which are 400 – 500 basis points lower than other major issuers (although somewhat offset by the lack of balance transfer introductory rates)

- The Apple Card also features zero late, overlimit, and foreign exchange fees, which are typically leveraged by issuers to bolster revenue – these fees can typically add over 1% to a card portfolio’s yield

- Pro-forma P&Ls for a cobrand credit card contains many behavior metrics that are unknown – such as purchase volume, revolving behavior, and credit loss rate – and without prior experience with similar programs, these factors can often be overly optimistic when trying to win a deal

Online Savings Rates Plateau

- Overall mail trends remained consistent with recent prior months, with checking and savings the lone gainers compared to 2022

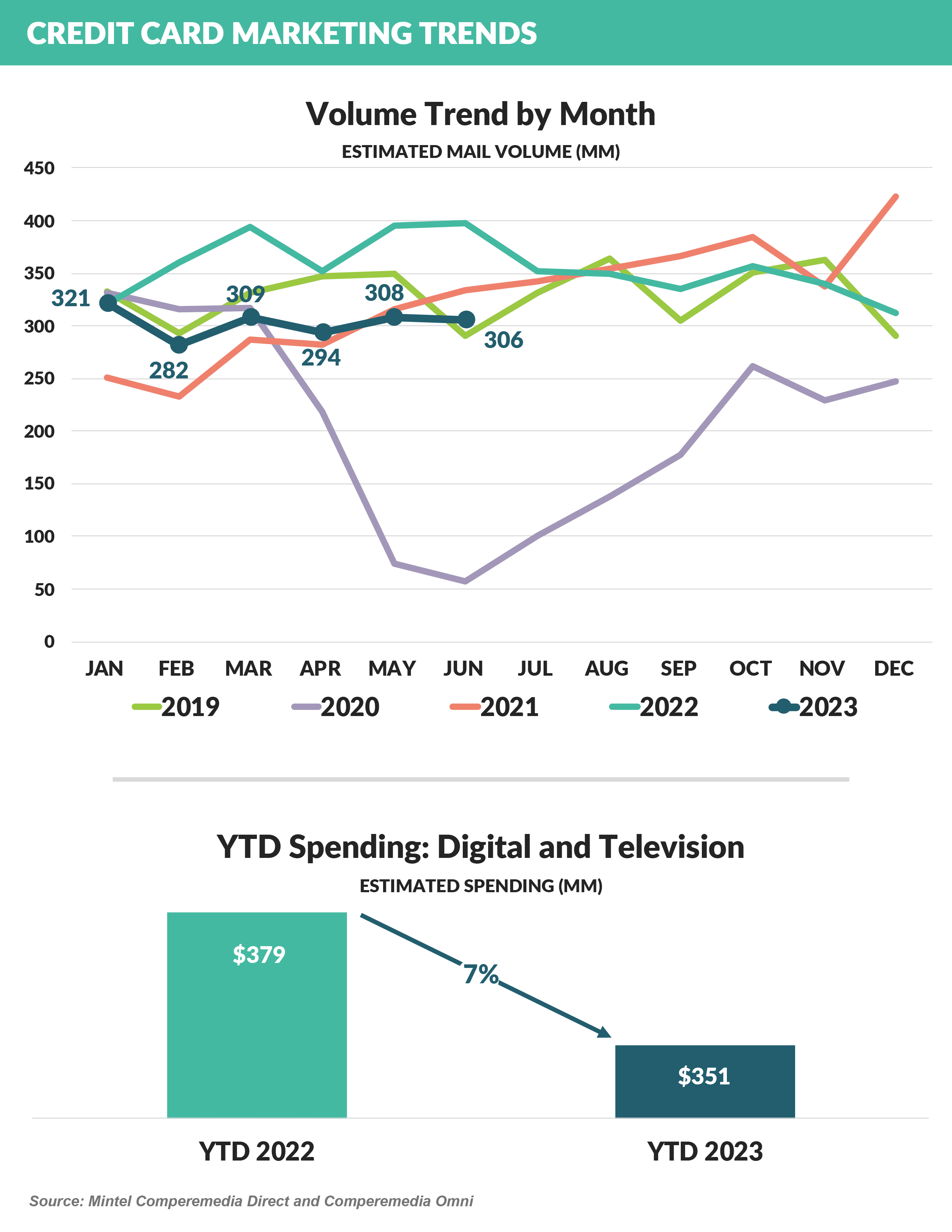

- 2023 credit card mail volume is down 18% from the same period in 2022, and card ad spending on digital and television is down 7%

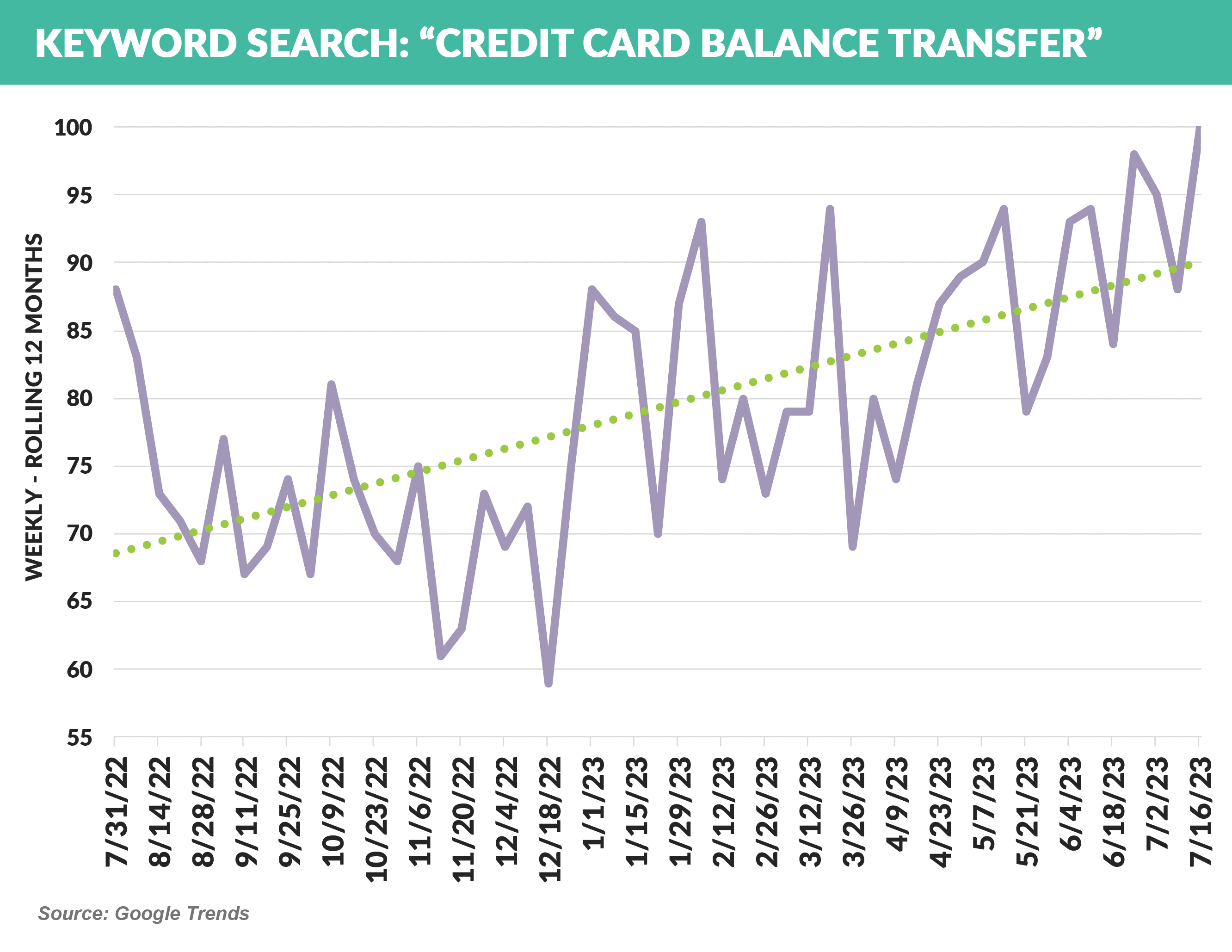

- At the same time, consumer demand, as reflected in 2023 digital search volume for “balance transfer credit cards,” has risen steadily, which might present an opportunity for card marketers

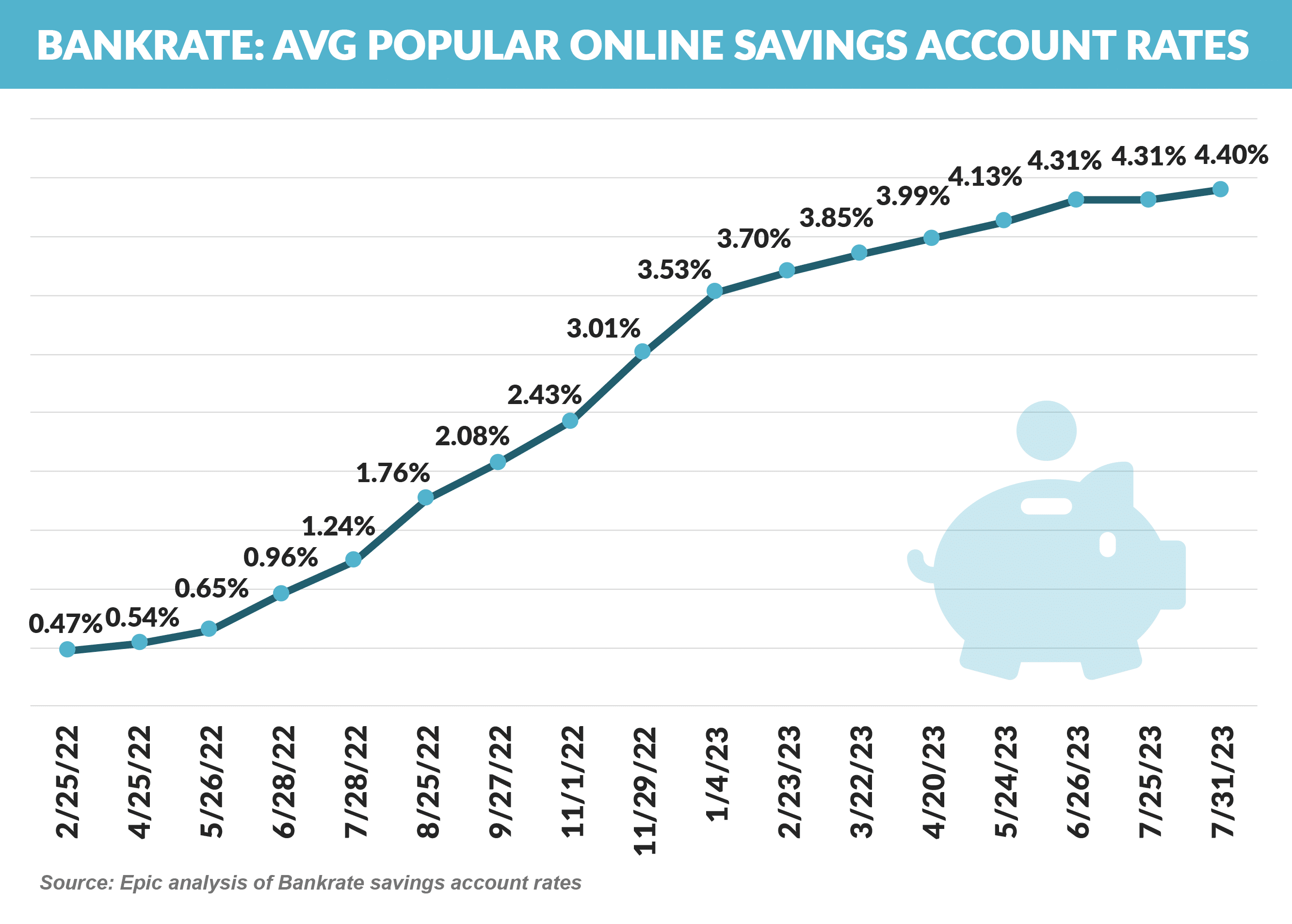

- After rising 8X since early 2022, online savings interest rates have plateaued

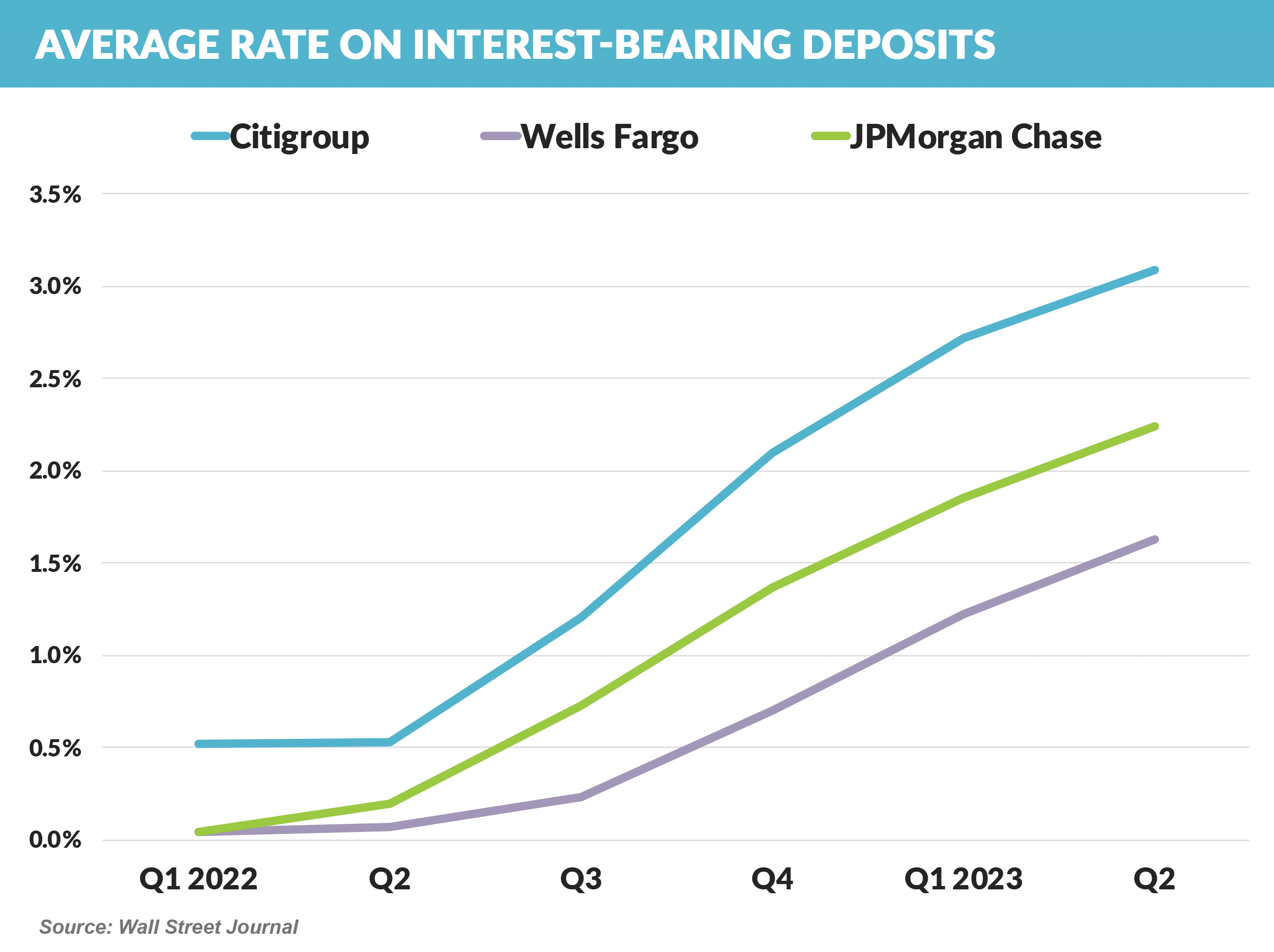

- Deposit rates paid by large banks have risen as well, however there is a significant difference at the largest depositories, with Citi paying the highest

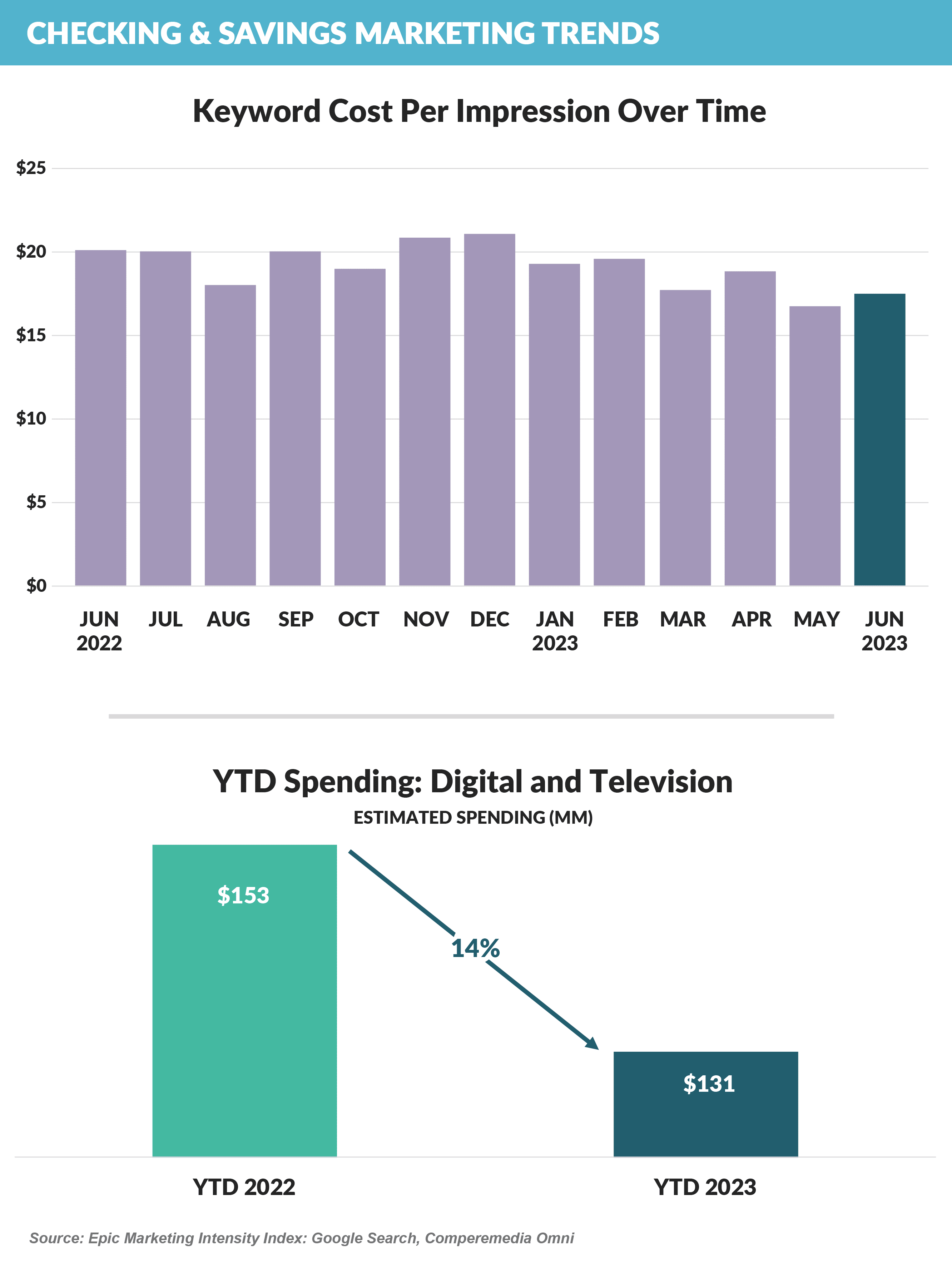

- Savings and checking direct mail is 26% higher YTD, however spending on digital and television channels is down 14% and key word cost for “checking and savings” has dropped since last December

- BNPL usage surged 20% over last year on Amazon Prime Day, accounting for 6.5% of all orders

- Along with low unemployment, excess savings helped support consumer asset quality since the beginning of the pandemic – it will be interesting to gauge the effect when the surplus is gone

- Despite skepticism by some of the fintech lending model, several public consumer lending stocks have fared very well in 2023

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on September 9th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Add jim@epicresearch.net to your contacts to avoid junk filter issues.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.