Three Things We’re Hearing

- BNPL-oozza redux!

- Amex chases the cool kids!!!

- HELOC bump? Nah.

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

BNPL-oozza Redux!

- BNPL has been around for almost 100 years in various forms (e.g., department store layaway programs and other forms of store credit), but “modern,” digitally-based BNPL is a relatively new entrant on the consumer lending scene surfacing just a little over 10 years ago

- Epic’s most recent survey of consumers’ pay over time usage preferences found over a third of respondents used BNPL and/or on-card installments this holiday season, and over 75% spent more because they were able to finance the transaction

Amex Chases the Cool Kids!

- American Express has increased spending on credit card acquisition marketing in the past year, with the primary focus on premium products marketed to a younger segment

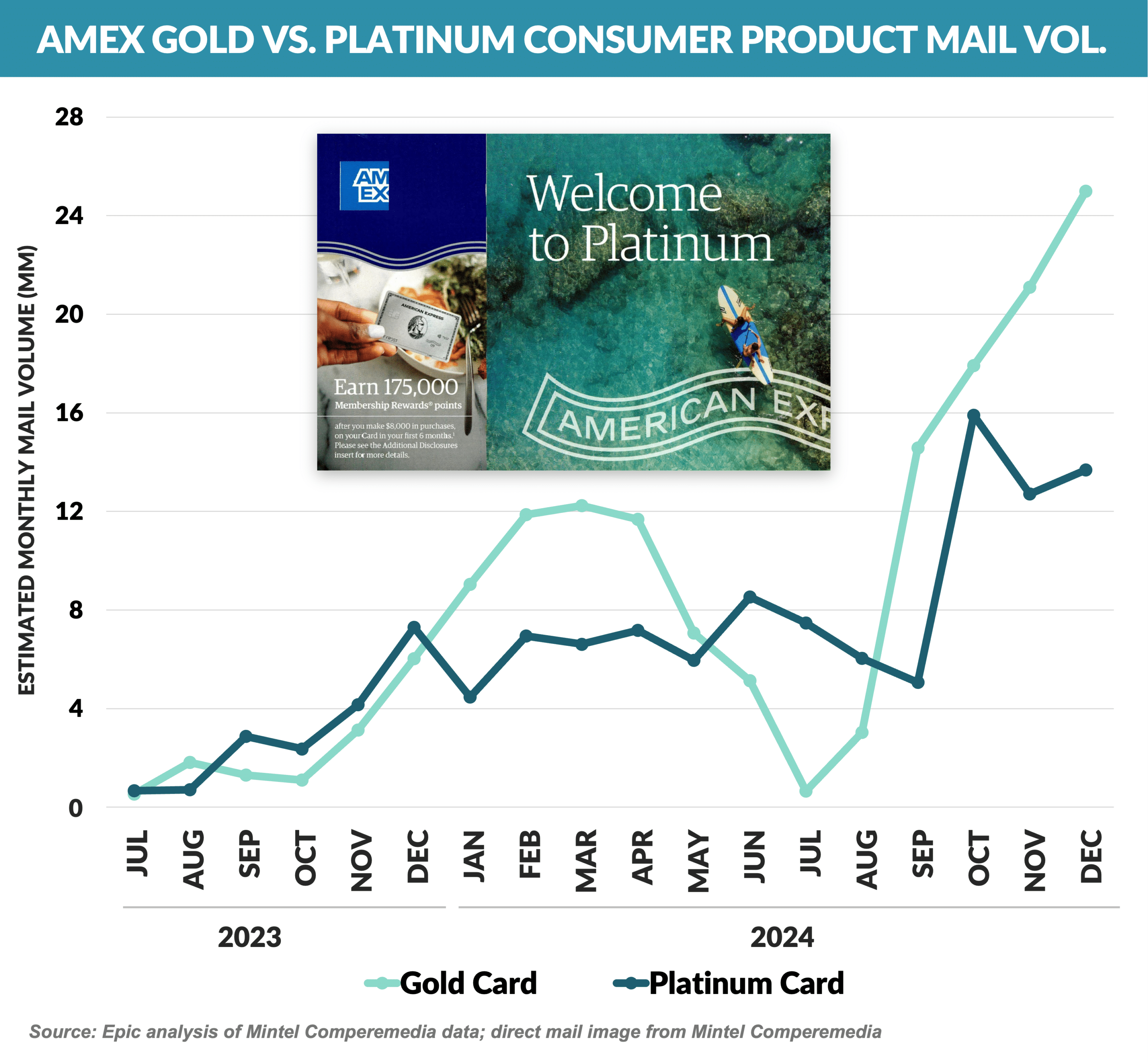

- H1 2024 saw a significant increase in mail volume from prior years, with Q4 showing yet another step up

- Amex card acquisition mail volume in Q4 2024 accounted for 23% of all industry direct mail

- Amex’s 68 million total mail pieces in December represented the most monthly volume of any issuer in 2024 and was 38% higher than number two Capital One

- Amex re-launched a refreshed Gold Card in July 2024 and their product focus has centered on premium cards – of the 3.3 million new accounts landed during the second quarter, 77% were for Gold or Platinum cards

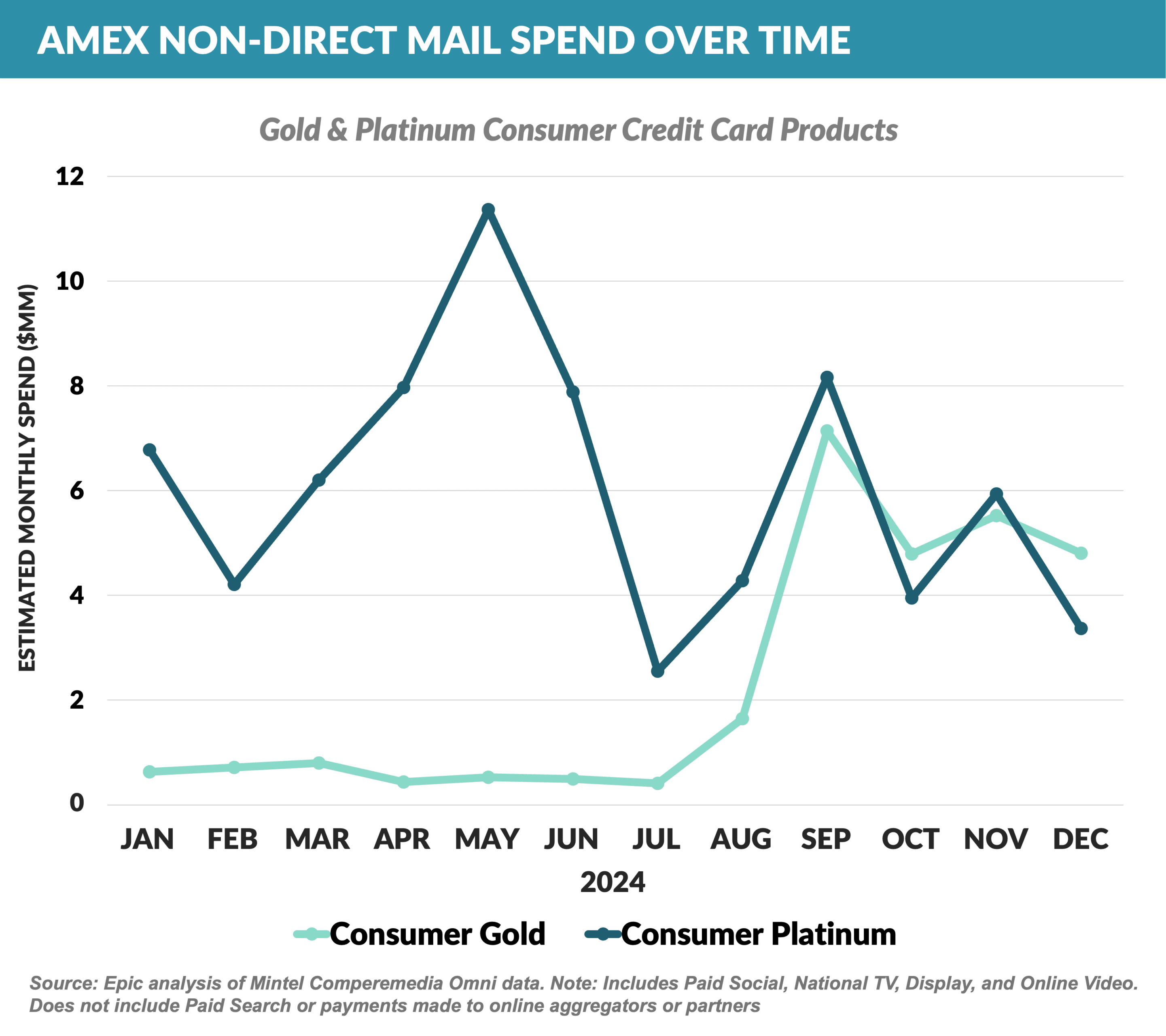

- Non-mail acquisition channels – paid social, national TV, display, and online video – also showed increased Q4 spend with the incremental spend coming from the Gold Card

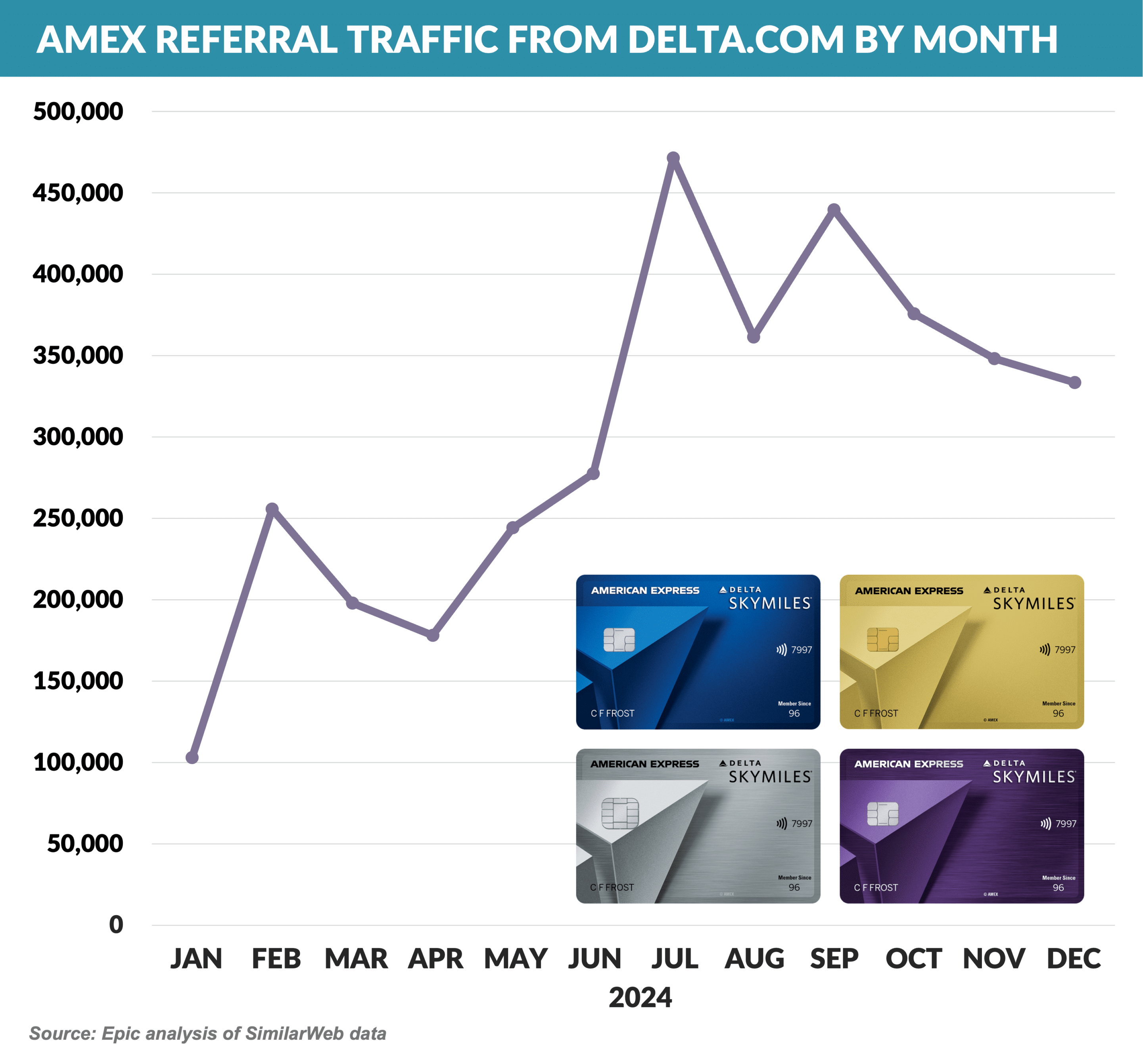

- Online traffic from cobrand partner Delta mirrored the overall Q4 volume bump in other channels

- American Express recently stated that it is focusing credit card acquisition marketing on younger consumers – Gen Z and Millennials, or those 43 years old or younger

“…(Regarding) the recent launch of our new U.S. Consumer Gold Card. The new benefits and capabilities we have added in popular categories like dining are fueling our growth with Millennial and Gen-Z consumers, who represent 80 percent of the new accounts acquired on the U.S. Consumer Gold Card, and remain our fastest growing consumer cohort overall in the U.S.”

Stephen Squeri – American Express Chairman and CEO

- Overall spending by those youngest cardholders amounted to 33% of total spending on Amex cards, which is an all-time high

- American Express offers perks to premium card members that are geared to younger consumers such as $240 toward digital entertainment like streaming services, a $200 annual Uber Cash benefit (provided monthly), and increased dining rewards

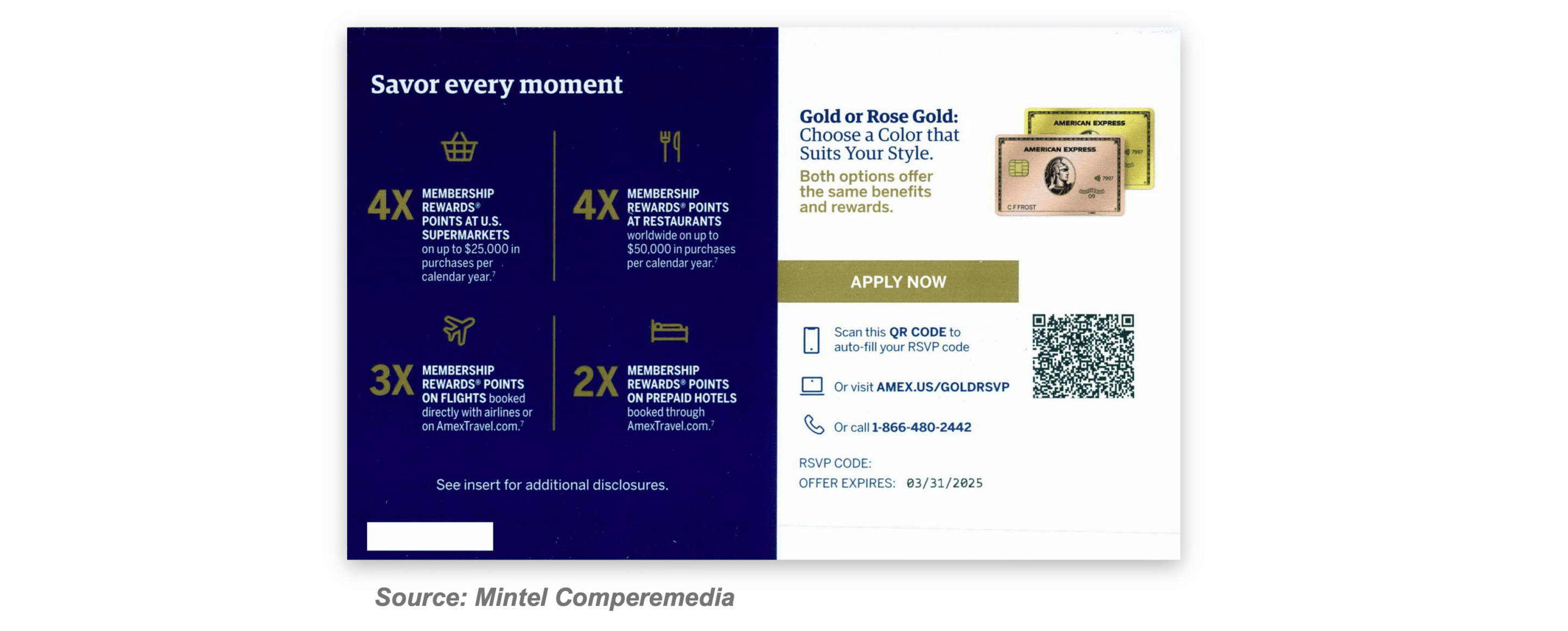

- Amex’s focus on both direct mail and the younger age segment counters the perception that “young people don’t respond to direct mail!”

HELOC Bump? Nah.

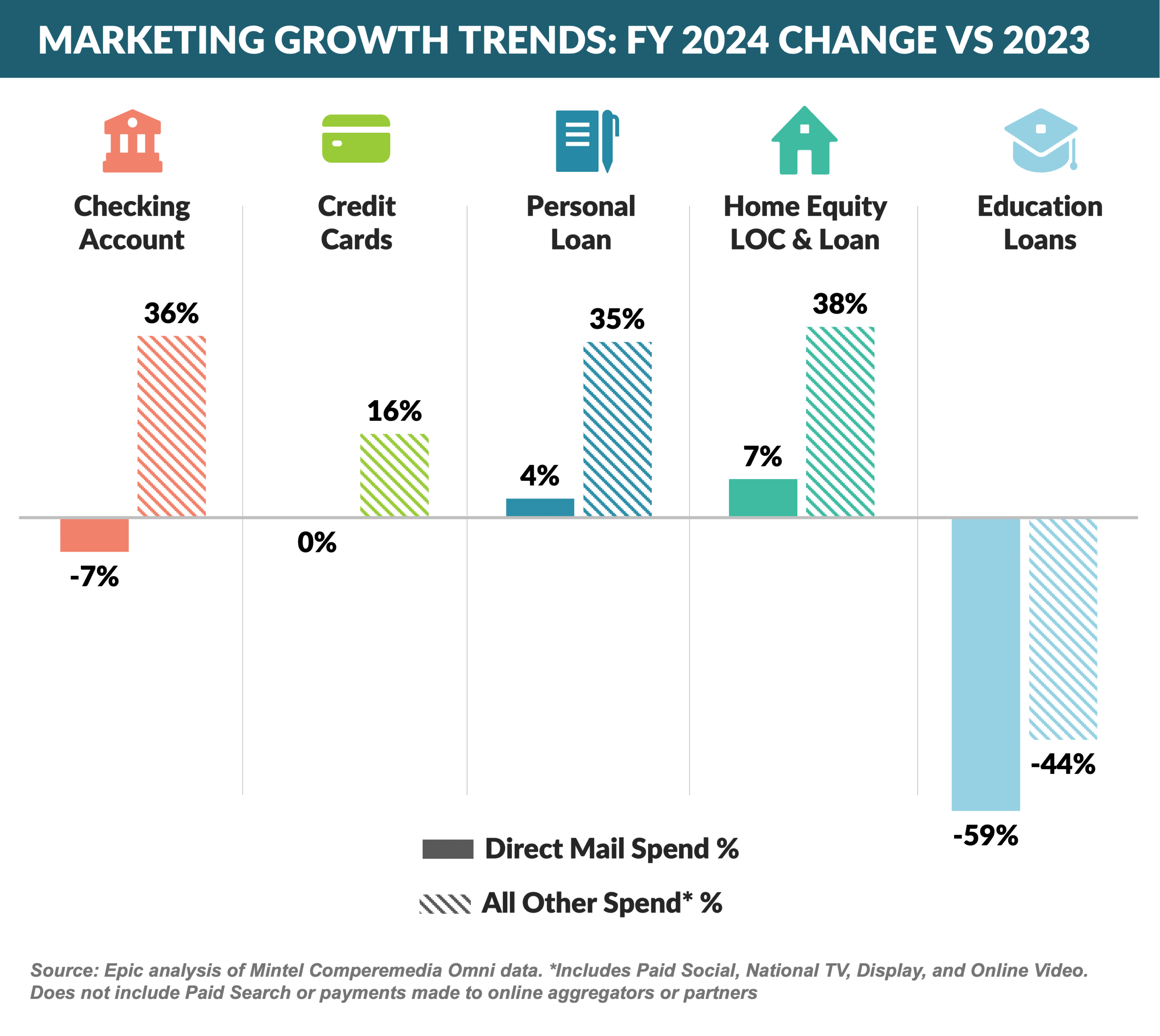

- 2024 saw a marketing spend shift towards non-mail channels – paid social, national TV, display, and online video – while spending on direct mail remained stable (with the exception of education lending which saw lower spending in all channels)

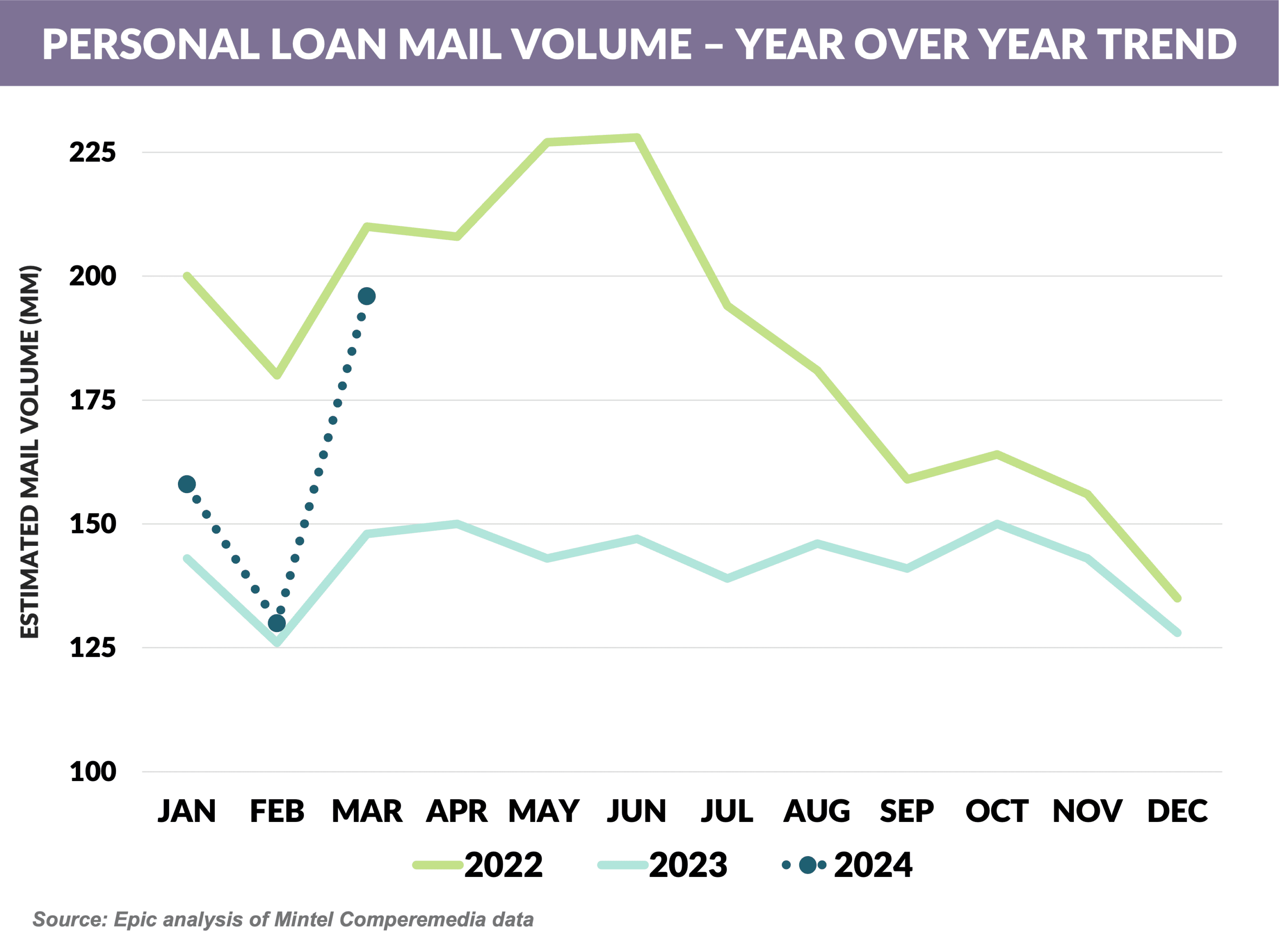

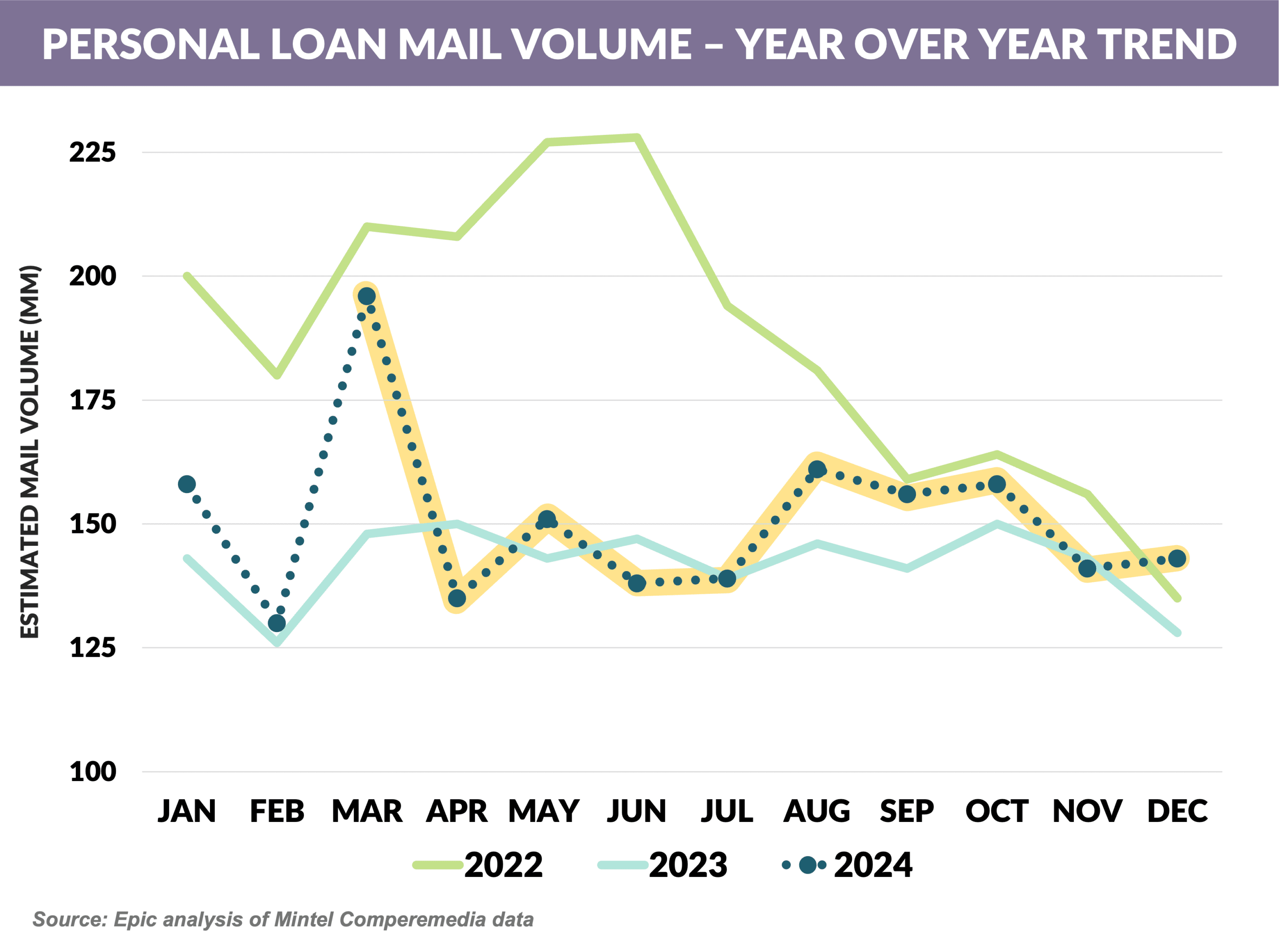

- The Epic Report occasionally looks back at speculation from prior issues such as the May 4, 2024 Epic Report where we asked if “Personal loan volume” was “awakening?”

- The answer given in the following months was “no, no it’s still asleep” as personal loan mail volume returned to the same level as the prior year

- 2025 Predictions!!!

- Near prime credit cards will not go away

- The near prime card segment has shown stress from Covid-era vintage delinquencies and new customer acquisition volumes have dropped

- However, some of the larger, more established issuers in this segment have shown no sign of decline

- We predict that the segment will survive and consolidate

- Education refinance marketing will be back

- Ed Refi marketing was dealt a double blow from Covid-era payment forgiveness programs followed by higher interest rates that made the refinance math more difficult and dropped acquisition mail volume by 80% from 2019

- While rates are projected to decline only 50bps in 2025, we predict that will be enough to stir some issuers to increase marketing efforts

- The CFPB will be de-fanged

- OK, we swear we wrote this before Rohit Chopra was axed and CFPB staff was ordered to cease enforcement actions and decisions on active litigation

- We’ll take the early win and project that new leadership will back off the previously aggressive stance against banks

- “X” has announced a partnership with Visa to launch the “X Money Account”

- X Money users can move funds between traditional bank accounts and their digital wallet and make instant peer-to-peer payments, like with Zelle or Venmo

- X has previously announced the goal of becoming the “everything app,” however there is little apparent differentiation from Venmo, Zelle, etc. at this point

- Citigroup CEO Jane Fraser told the bank’s managing directors that they will continue the policy of allowing employees to work from home two days a week

- Fraser cited the policy as a competitive advantage

- JPMorgan Chase and Goldman Sachs have mandated that their employees work in the office five days a week while Bank of America and Wells Fargo ask most employees to be in the office three days a week

- Barclays and JetBlue launched the Premier JetBlue Mastercard joining a number of other airlines offering super-premium cards

- The Premier card offers perks such as free lounge access, preferred boarding, and additional opportunities to earn points in the TruBlue program

- Barclays has more than doubled the size of the JetBlue cobrand program since taking over from Amex in 2016

- Senators Bernie Sanders and Josh Hawley have proposed a 10% cap on credit card interest rates

- Some may remember Senator Al d’Amato introducing a similar bill in November 1991, which caused a one-day 4% drop in the Dow Jones average

- While it is doubtful this bill will go anywhere, it is impossible to overestimate the negative impact this would have on both the industry and consumers

Thank you for reading.

Please note that as of February 8, 2025, Mintel Comperemedia and Omni data covering Q4’2024 US Consumer Direct Mail volume and spend may be subject to change. Please consider all data directional. Once Mintel updates their data, we will let you know if there are any significant swings that would change the insights included in this Epic Report.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in March.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.