What We’re Seeing

As we noted last week, we are monitoring trends in the consumer and small business lending segment in light of the unprecedented impact of the COVID-19 pandemic.

Following is data we are watching along with anecdotal information we have gathered in discussions with industry contacts. Please email me with your thoughts regarding these topics and forward this email to others who might find this information of value. Click here to subscribe to these emails or to let us know if you do not wish to receive future emails.

Consumer Demand

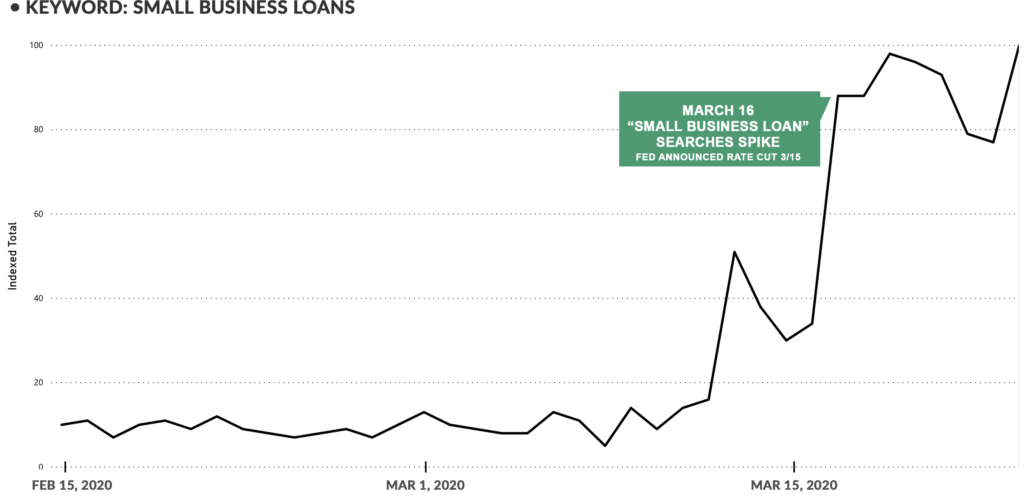

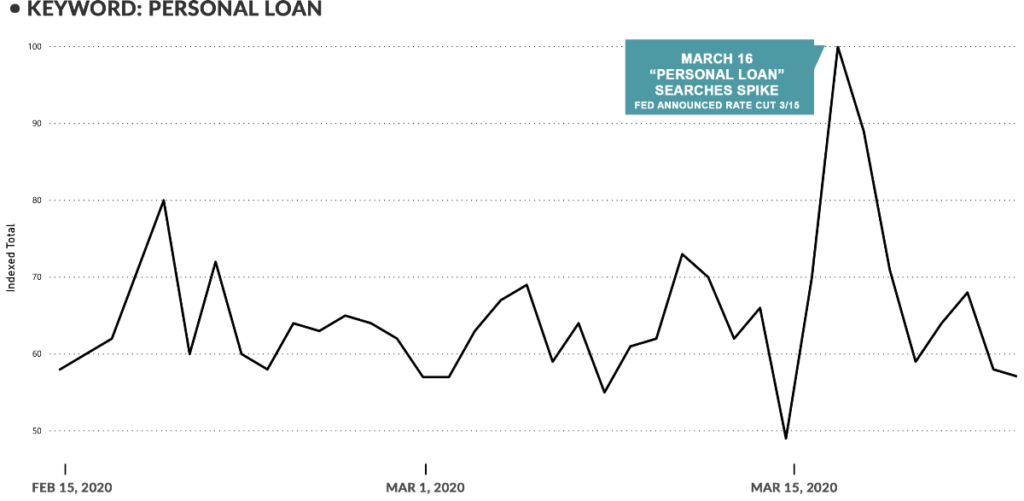

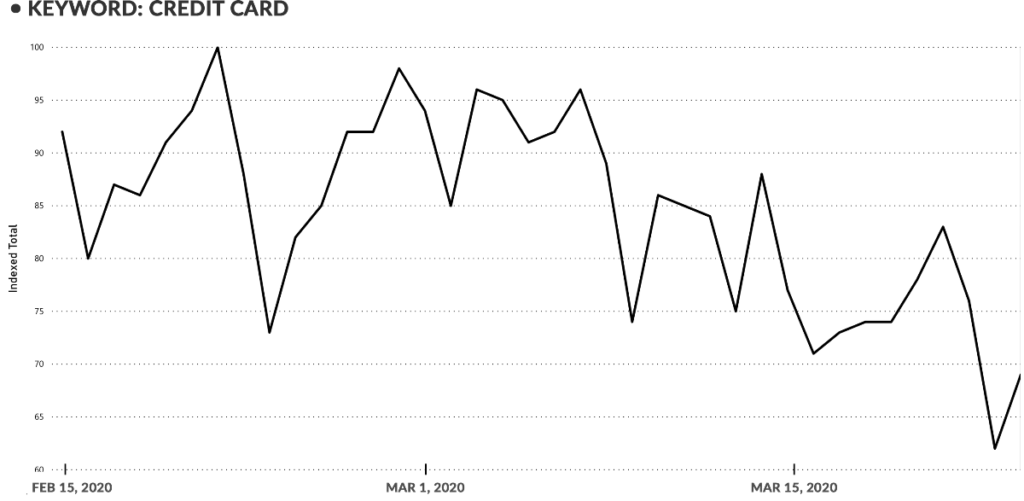

- Following the March 16th post-Fed-rate-cut spike in online search activity for various products, volume for some products has remained high, while activity for many products has come down to prior levels.

- Small business loan online search volume has stabilized at a rate 800%+ higher than in prior months

- While Personal Loan online search activity has come down to Pre-Rate Cut Levels

- And card online search volume continues on a downward slope

Lender Activity

ONLINE

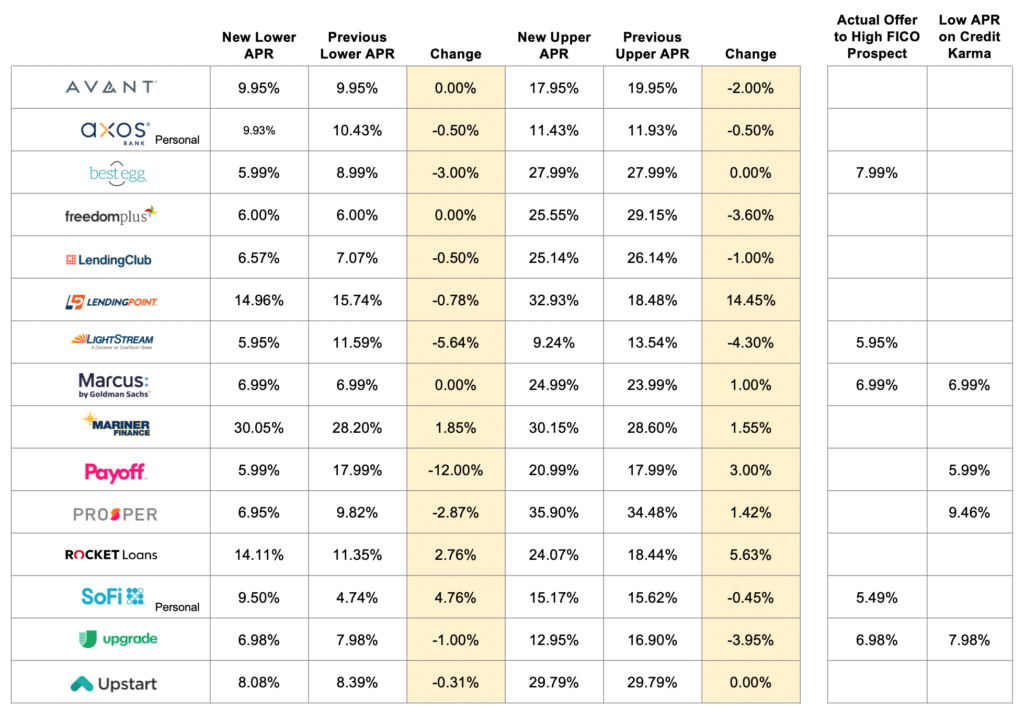

- Personal Loan rates have shown changes in both directions since last week, with a number of lenders lowering the headline rate:

Response to Recent Federal Loan Initiatives

- Several leading student loan refinance lenders added messaging on their websites addressing the recently announced relief measures that will apply to federally held student loans.

- In many cases the messaging reinforces the fluid nature of the announcements and the lack of clarity among lenders and consumers alike.

BRANCHES

- Many retail banks have closed their branches to all but drive through transactions.

- Some banks are allowing customers to come into the branch by appointment.

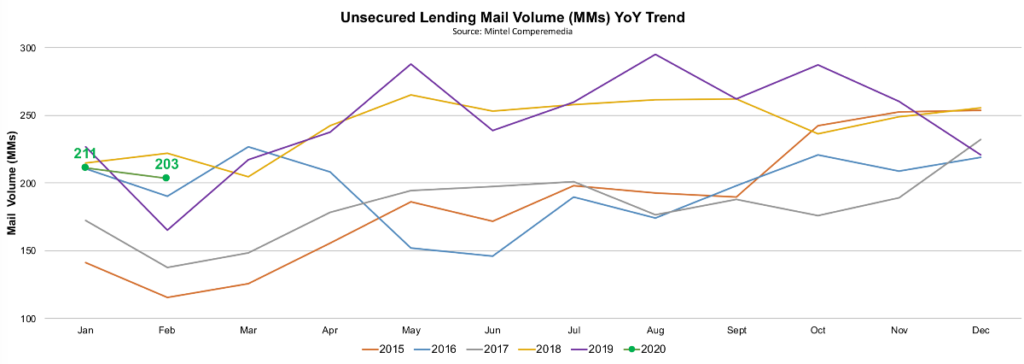

DIRECT MAIL

- We have seen continued anecdotal instances of lenders both cutting back and pausing direct mail campaigns.

- The latest Comperemedia data shows activity through February, well before any impact was felt, and March data will likely not show much effect. April data, which will be the first month of significant change, will be available in late May.

- Unsecured lending mail volume through February was consistent with 2019 volumes

CBA March 24th Call Observations

- FDIC will work with financial institutions helping small businesses and others.

- This is not a banking crisis, but a health crisis that will affect the banking industry.

- So, the FDIC is working with banks. Trying to put in a regulatory framework to pause things for this time period and get back on track when things normalize.

Going Forward

With consumer demand likely remaining at higher than previous levels, lender supply is the large unknown for the foreseeable future.

- It is rational for all lenders to be reassessing all unsecured loan offerings resulting in a significant drop in supply.

- In a slower competitive market, with sound underwriting, there will continue to be opportunities for growth in select product and customer segments.

- The clear unknown is the timeframe for all of this to play out.

Please let us know what you think.