Three Things We’re Hearing

- Your top credit card issuers – right here!!!

- Mailers push digital response!

- Higher rates = lower response?

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Your Top Credit Card Issuers – Right Here!!!

- The eagerly anticipated “Top Credit Card Issuer” issue of the Nilson Report was published in March, so let’s dig in, shall we???

- We segment the Top 30 list into five categories:

- National – 8 large issuers who have a national solicitation strategy

- Specialty – 5 branchless issuers with a national strategy

- Regional – 8 regional banks

- Near- and Subprime – 6 branchless issuers with a “near/subprime” focus

- Credit Unions – 3 Top 30 credit unions

- 2024 outstandings growth for the Top 30 issuers was 6% vs. 12.2% in 2023

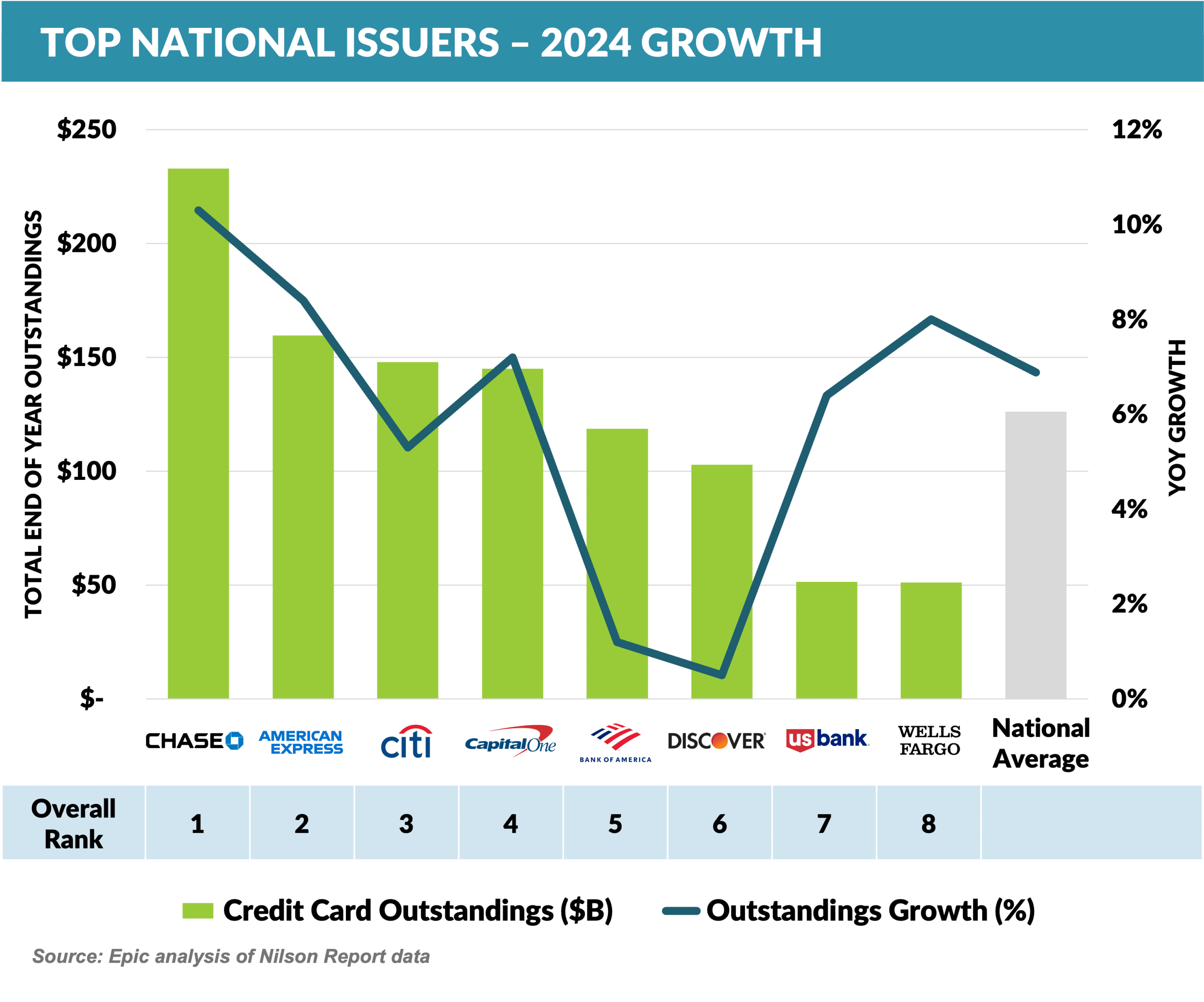

- National Issuers:

- Chase, the number 1 issuer overall, and almost 50% larger than number 2 Amex, led national issuers with 10.3% growth

- Amongst the top National issuers, there was no change in the rankings since 2023, and only one change in the top 5 since 2015 with Bank of America and Citi switching places

- Discover (+0.5%) and Bank of America (+1.2%) were the slowest growing National issuers

- Following the completion of the Capital One/Discover merger, Capital One will soar to the top with a combined card outstandings volume of almost $250 billion

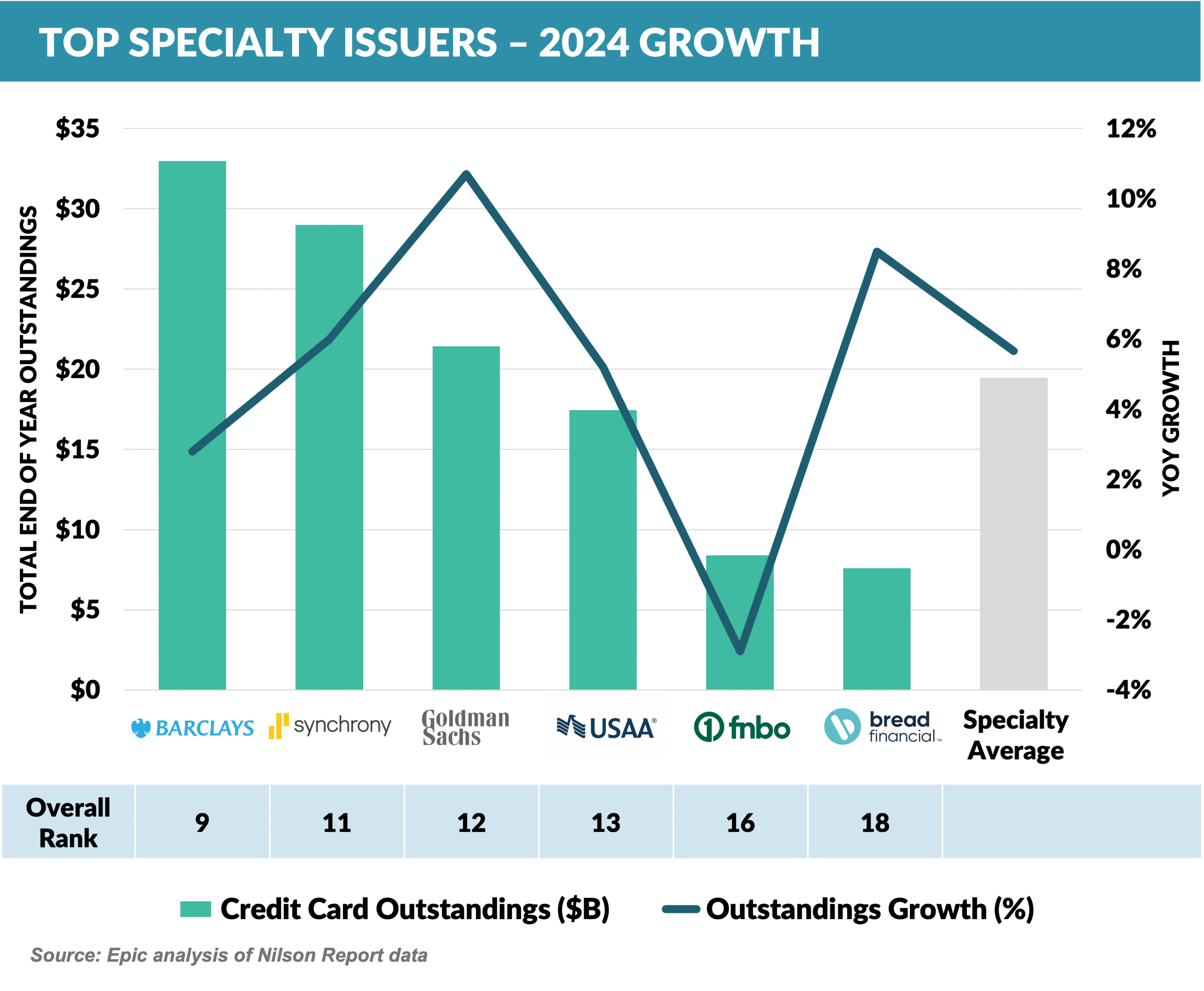

- Specialty Issuers:

- The 5.7% growth for this group was below the 6% growth of the Top 30 overall

- Despite efforts to wind down its consumer lending business, Goldman Sachs was the fastest growing Specialty issuer with 10.7% growth

- There has been much speculation that the Apple Card will transfer to another issuer (see more in the Quick Takes section below)

- The ~$2 billion GM portfolio, which will transition to Barclays in 2025, is included in Goldman’s 2024 year-end numbers

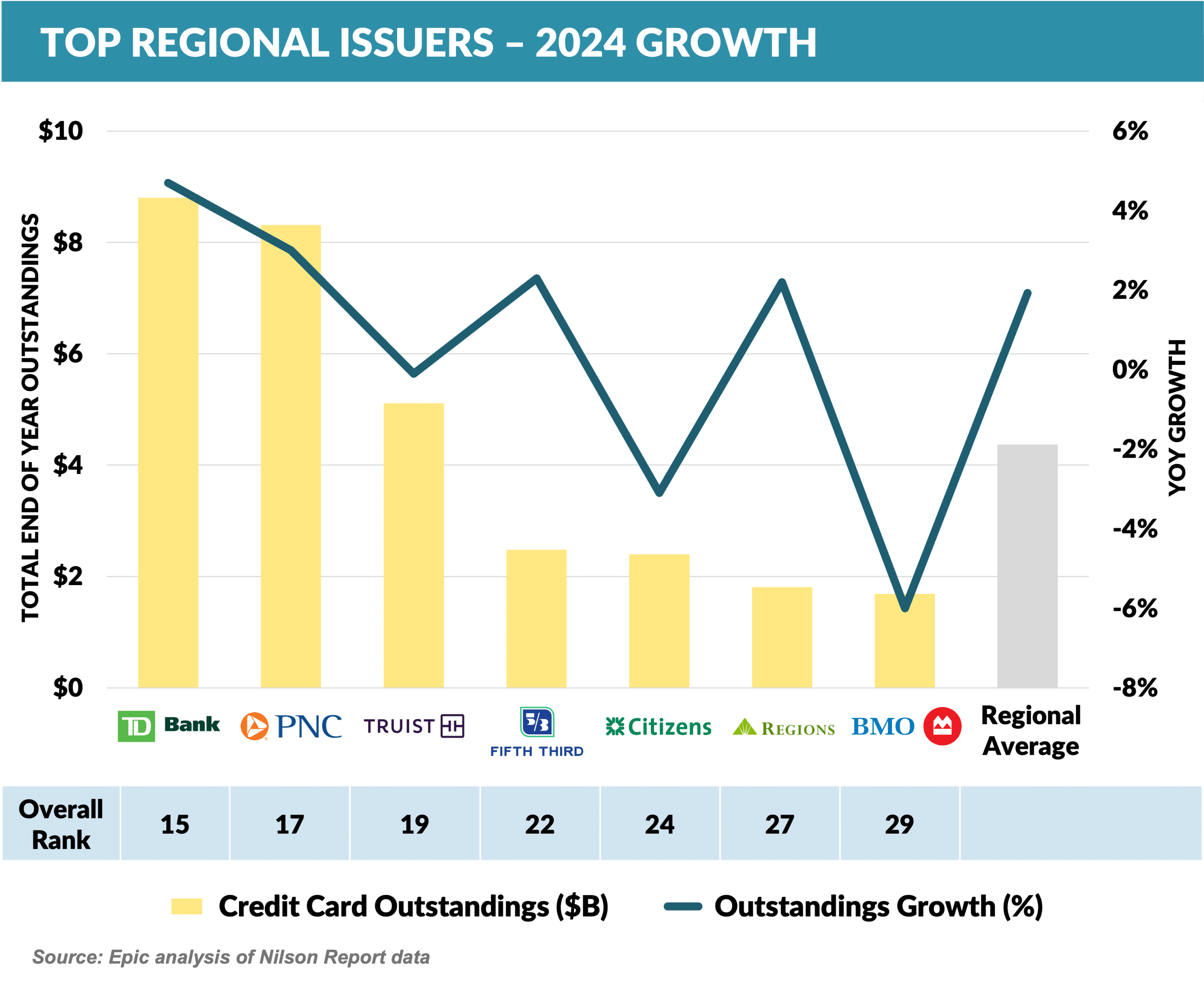

- Regional Banks:

- As was the case in 2023, Regional Banks were the slowest growing segment with outstandings growth of only 1.9%

- TD Bank (+4.7%) led the group with BMO, Truist, and Citizens all reporting lower year-end outstandings

- We continue to think credit card marketing is an unrealized opportunity for retail banks

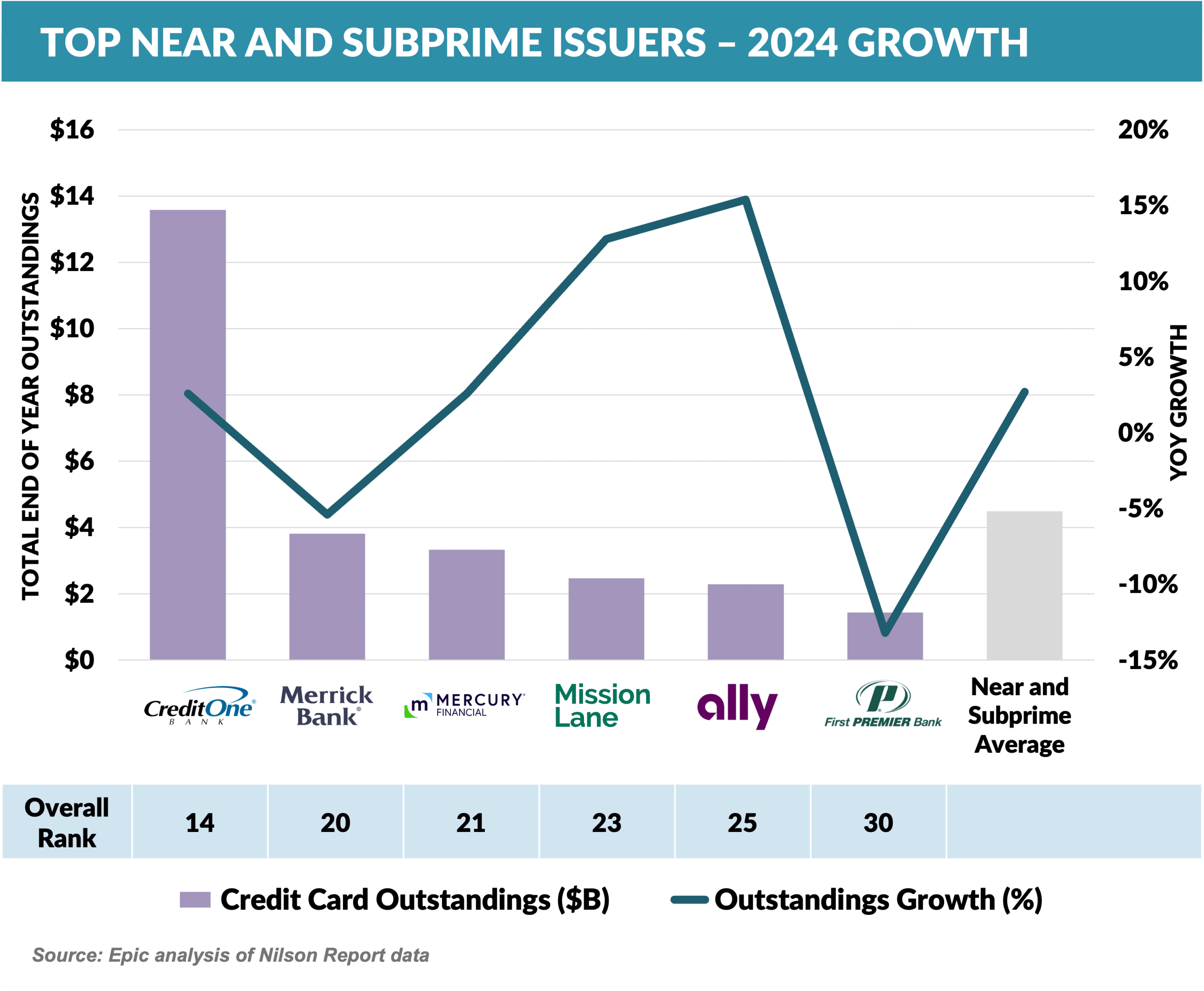

- Near- and Subprime Issuers:

- Unlike 2023 when it had the highest growth of any segment, the Near- and Subprime segment slowed to a relatively low 2.7% growth rate

- Ally (+15.4%) and Mission Lane (+12.8%) had higher than average growth with First Premier (-13.2%) and Merrick (-5.4%) down for the year

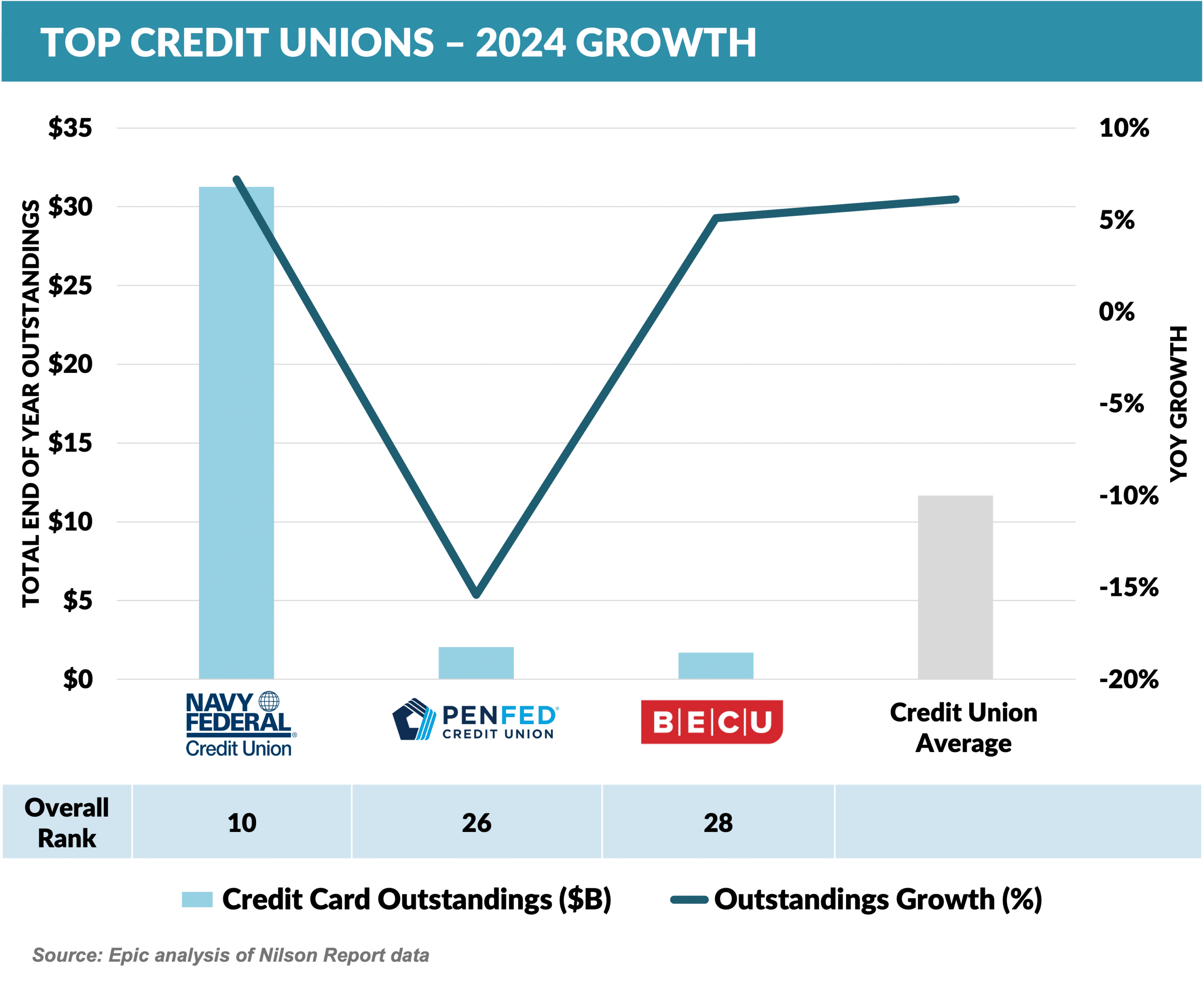

- Credit Unions:

- Credit Unions are often overlooked as “major” players in the credit card industry; however, with a Top 10 (Navy FCU) and two Top 30 (PenFed/Pentagon Federal and BECU/Boeing Employees) entrants, we have chosen to look at them as their own segment

- Growth in the segment (+6.1%) was similar to that of the larger issuers and to that of the Top 30 overall

- Navy FCU (+7.2%) led the group while PenFed shrank by 15%

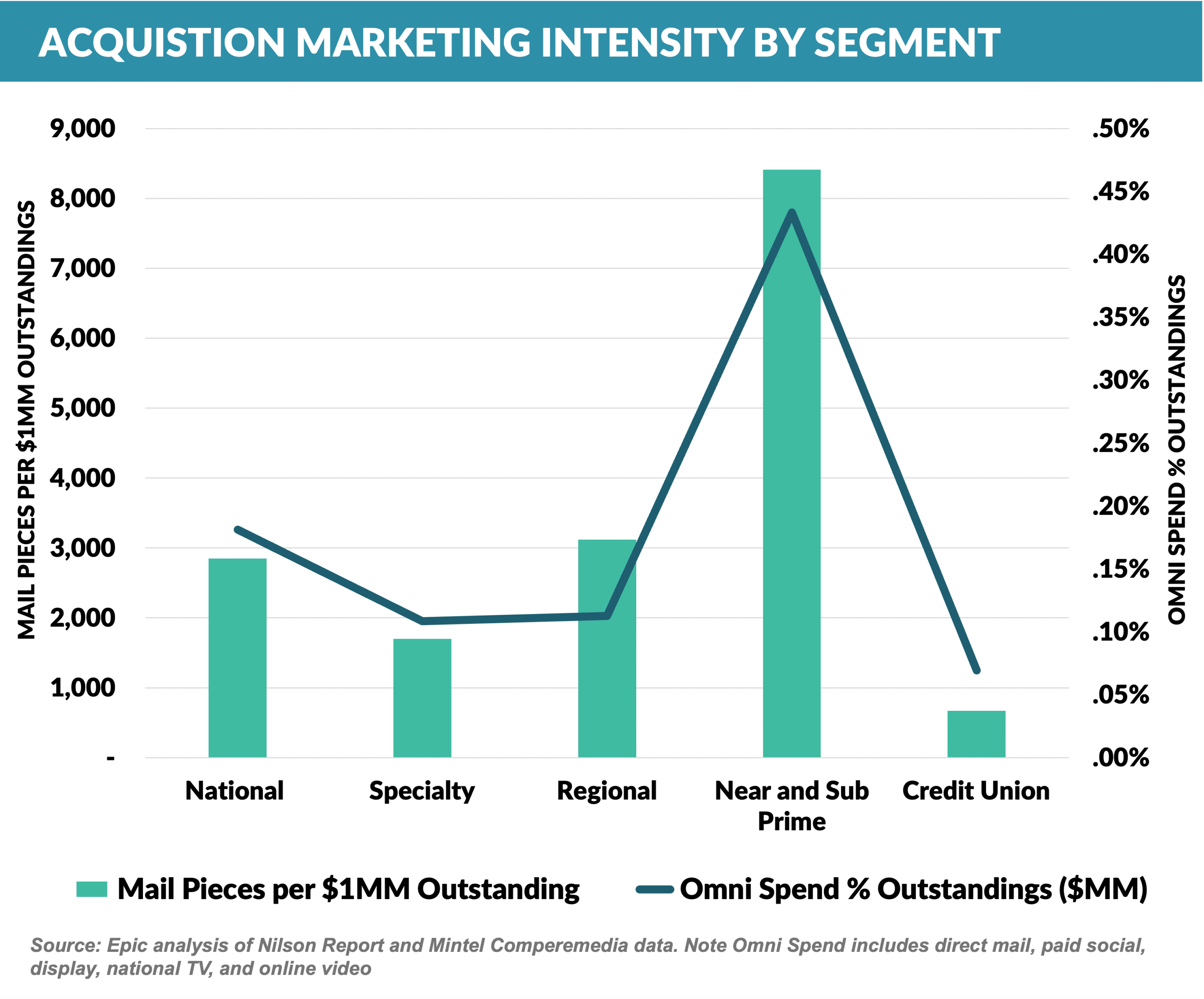

- Near- and Subprime issuers have over twice the acquisition marketing intensity of the National issuers in the “omni” category – direct mail, paid social, national TV, display, and online video

- However, much of this is due to their reliance on direct mail and media vs. other acquisition sources such as branches, cobrand relationships, and aggregators – sources that are not included in the measures shown below

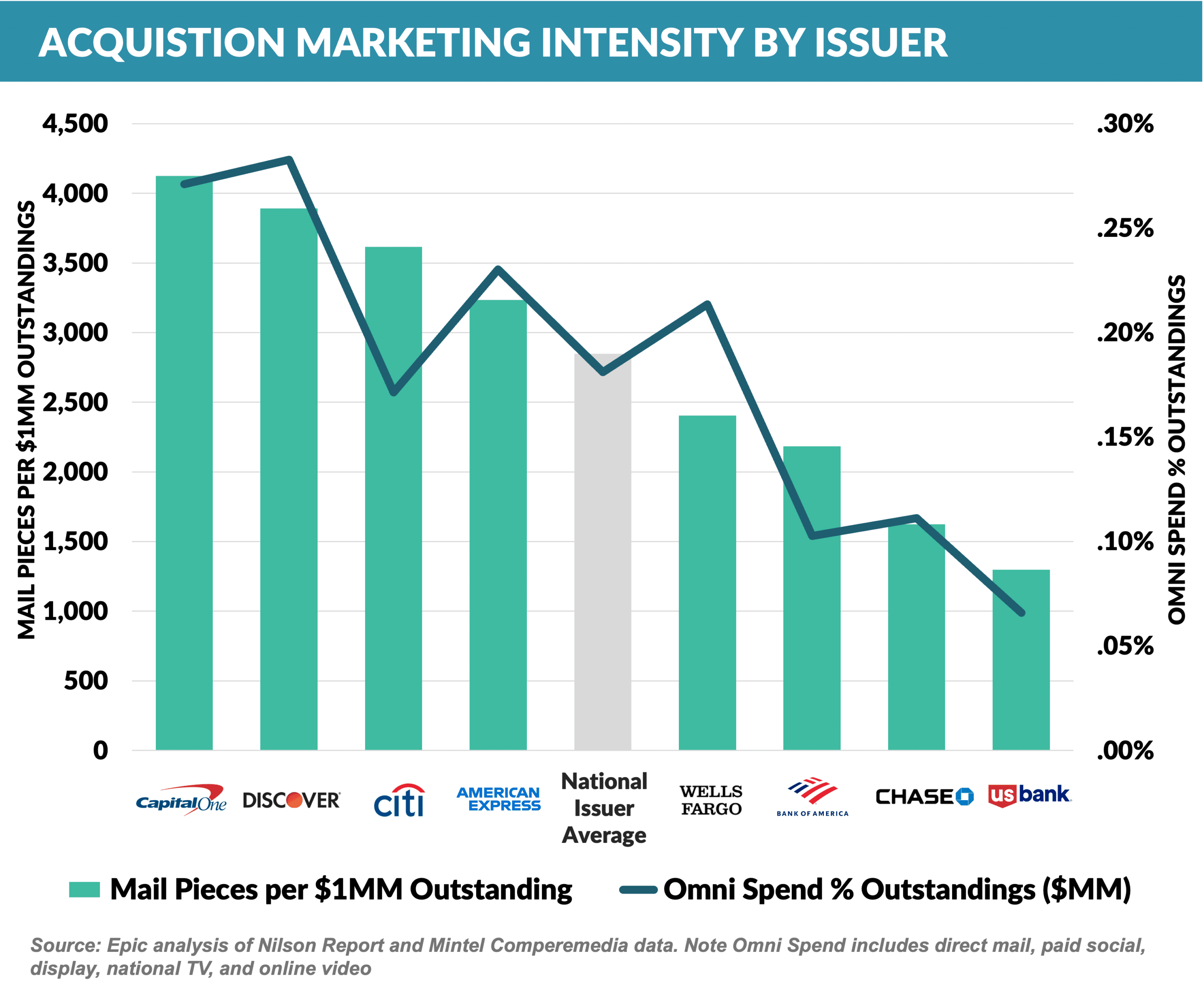

- Capital One and Discover, neither of which depend largely on branch or cobrand acquisition channels, have the highest acquisition marketing intensity across the measured channels (direct mail, paid social, display, national TV, and online video)

- A combined Capital One and Discover should be a dominant presence in card acquisition in 2025

Top Mailers Push Digital Response

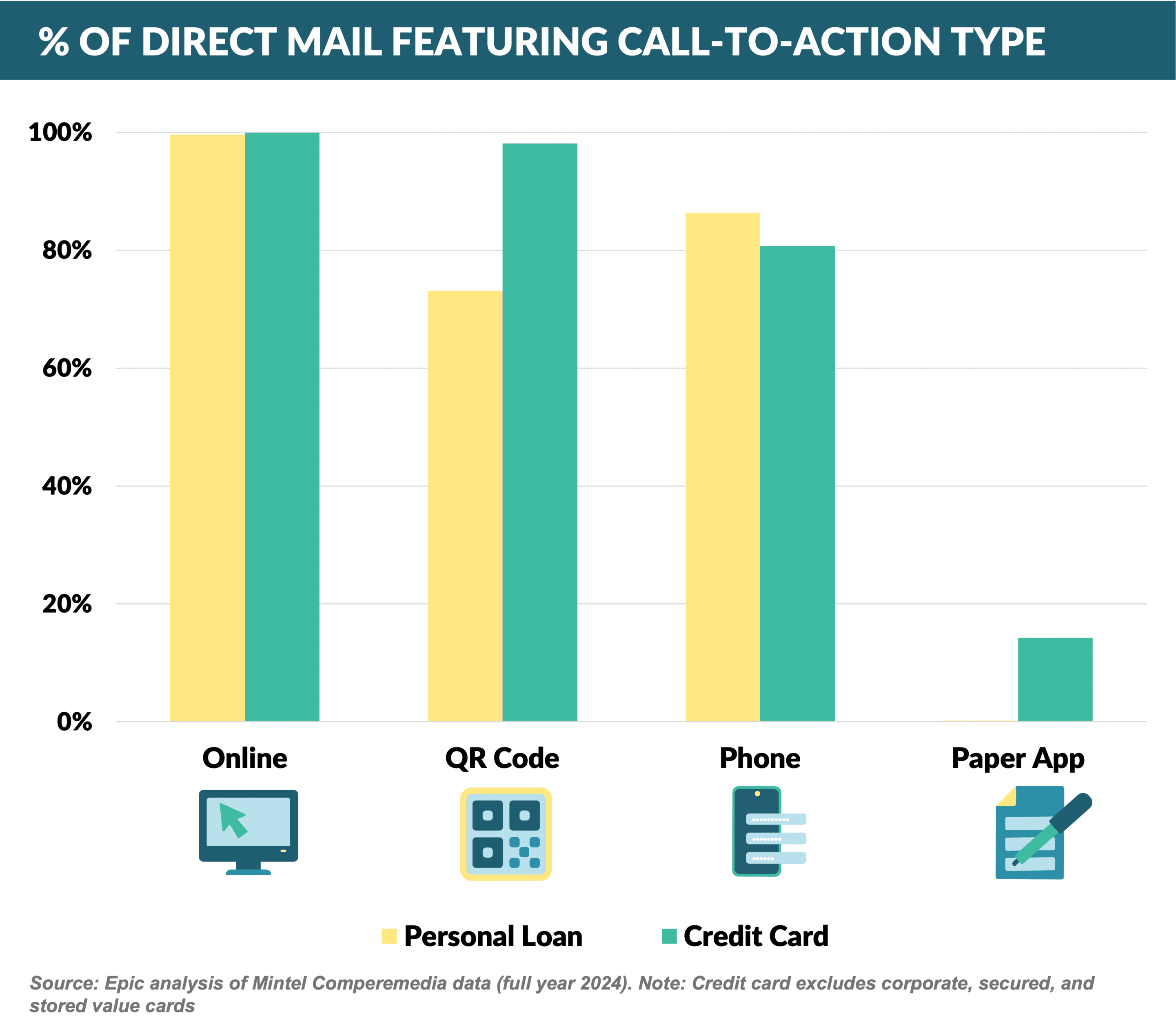

- As lenders strive for digital engagement, an online call to action (CTA) has become ubiquitous in both personal loan and credit card acquisition mail, with 100% of 2024 mail including this response channel

- SoFi features a URL prominently as a key element of their personal loan product

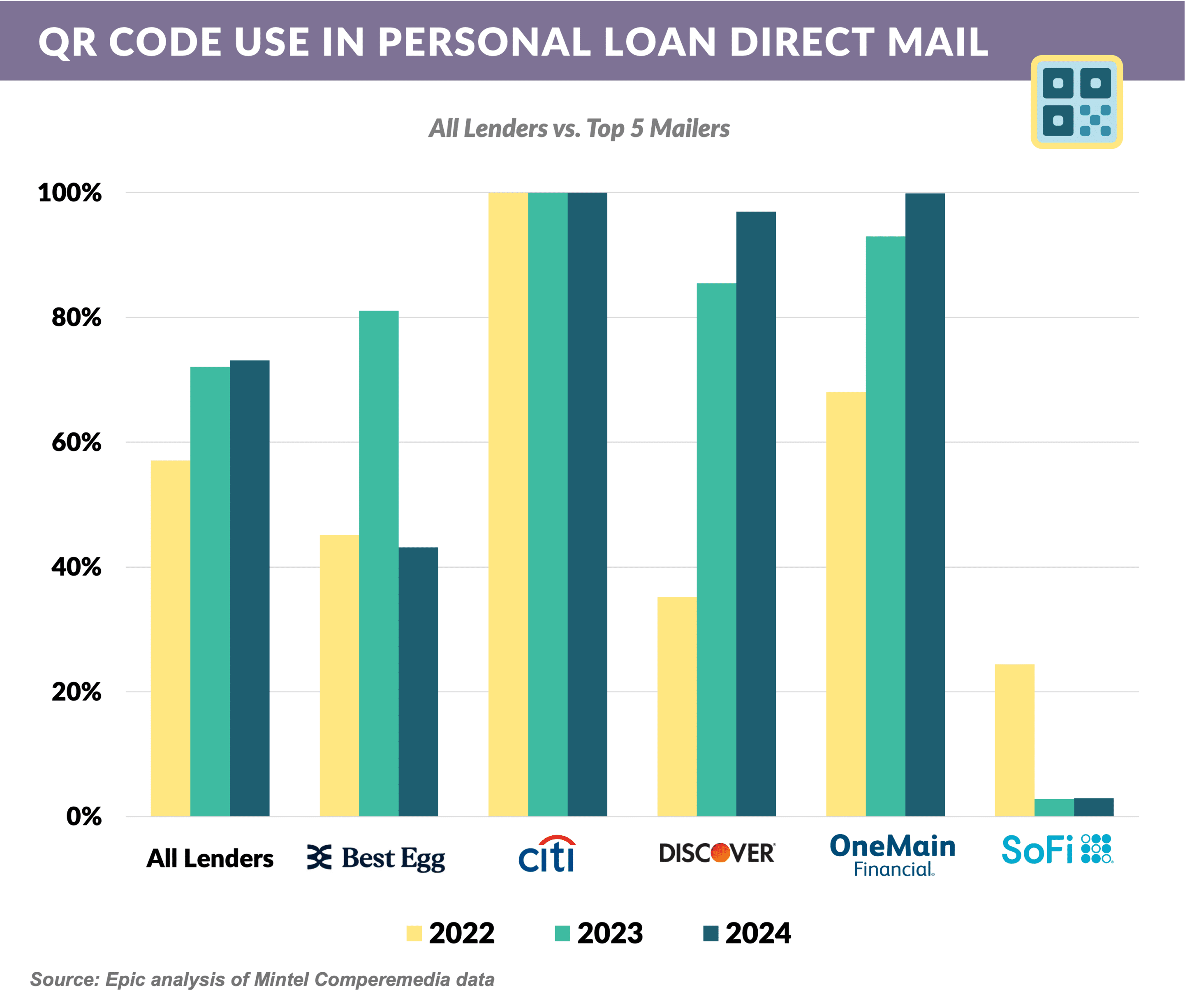

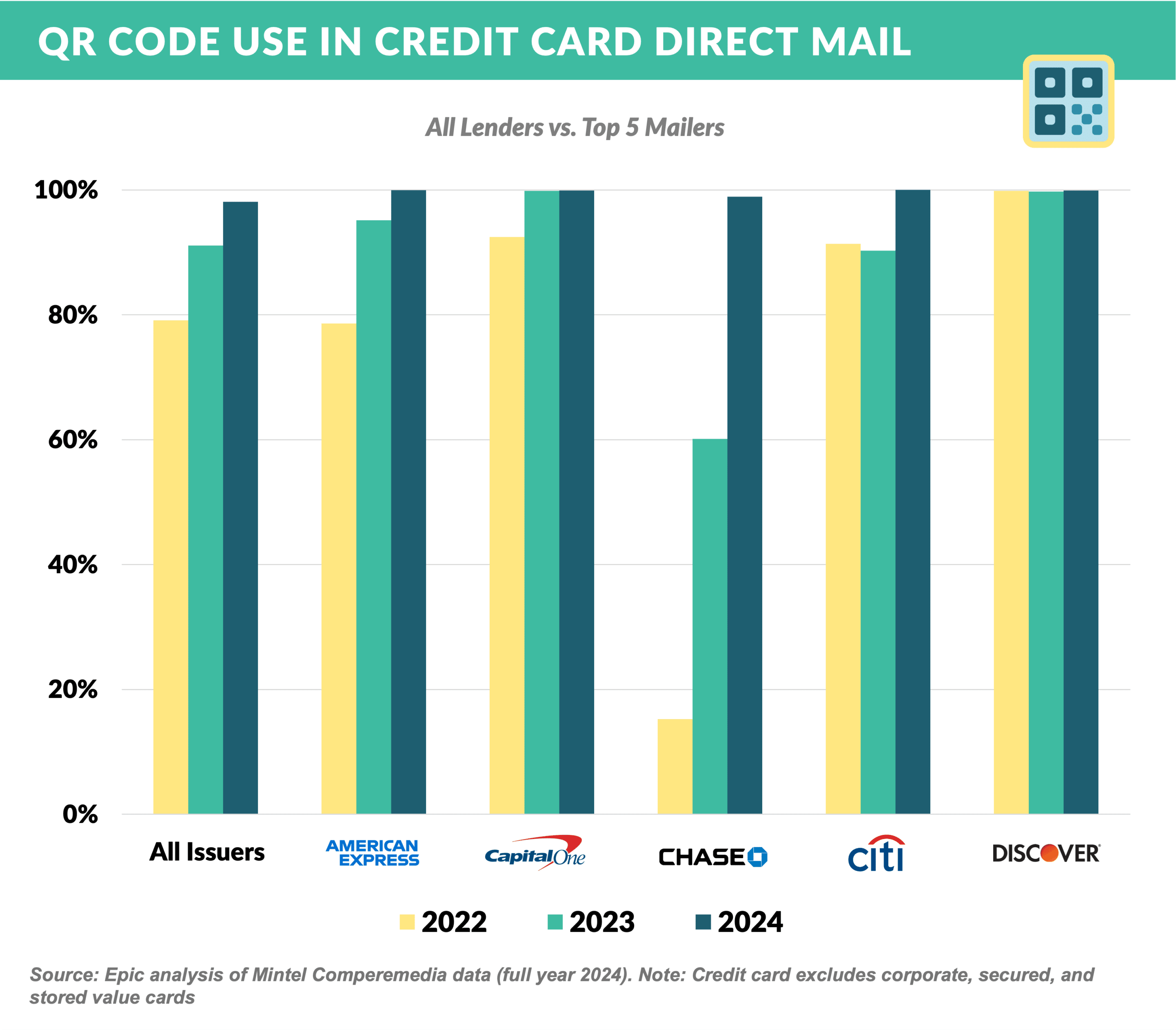

- A more recent tactic to drive online engagement is through including a QR code in the CTA, appearing in 73% of personal loan and 98% of credit card mail last year

- As QR code adoption in personal loan mail has risen 28% overall in the last 3 years – with Discover and OneMain dramatically increasing usage – top mailer SoFi has reduced QR code use

- SoFi reduced QR code usage from 24% in 2022 to just 3% in 2023-2024, presumably due to testing (you should check it out!)

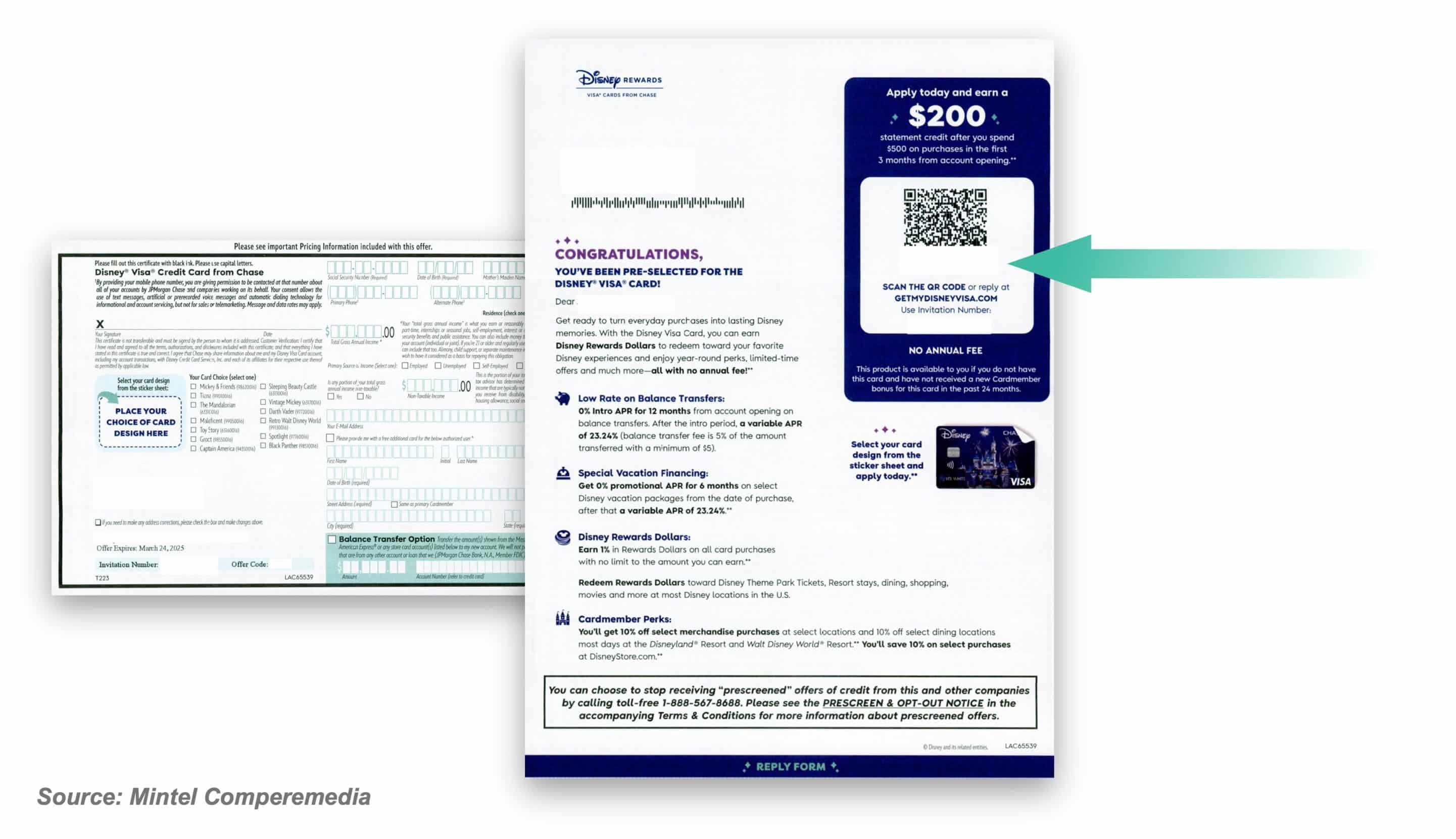

- All five top credit card mailers used a QR code on nearly 100% of their mail last year – a dramatic increase for Chase in particular, who used a QR code on just 60% of 2023 and a meager 15% in 2022

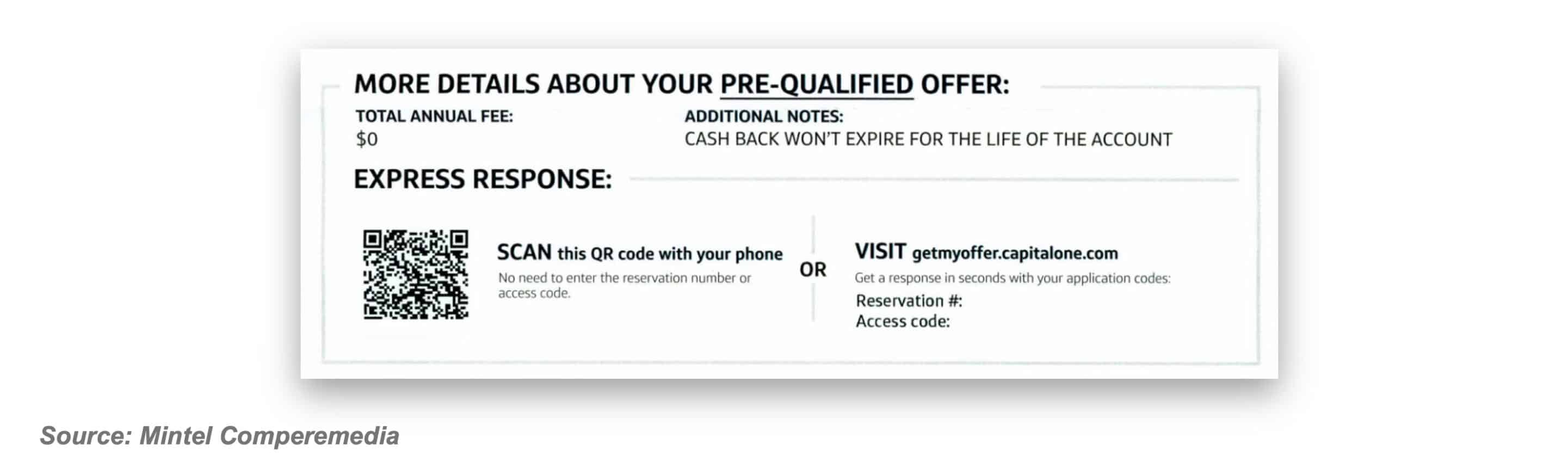

- Some issuers like Capital One maximize the QR code experience by pre-filling information without the consumer needing to type a reservation code

- We also love how Capital One used the entire back of this auto loan solicitation to feature a QR code!

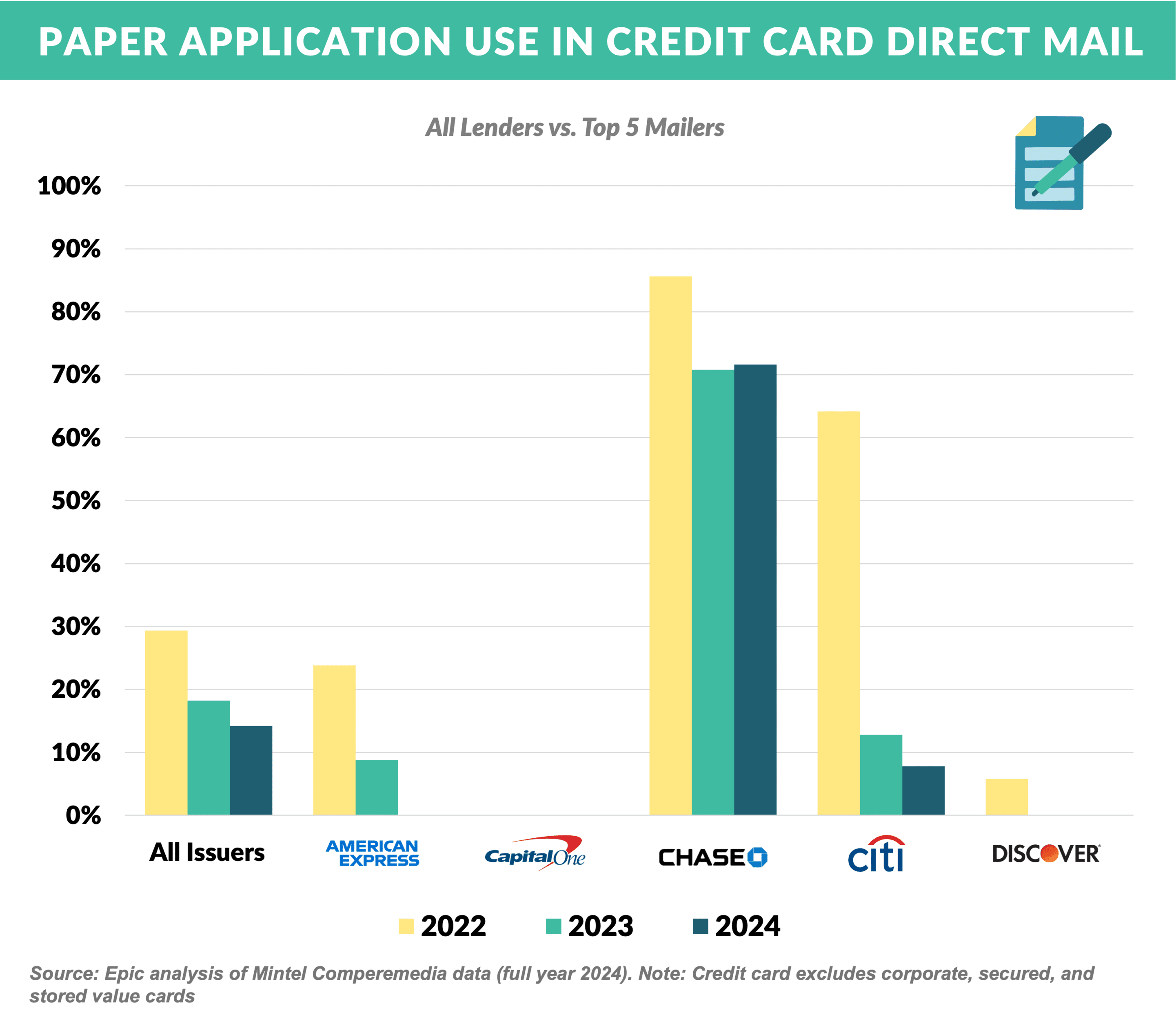

- Not surprisingly, paper applications in credit card mail dropped by 50% between 2022 and 2024 and are now found in just 14% of solicitations; they are virtually non-existent in Personal Loan mail

- Chase is the outlier amongst top card mailers, including a paper application 72% of the time

- Even when including a paper application, Chase still pushes digital response with prominent QR code and URL placement

Higher Rates = Lower Response?

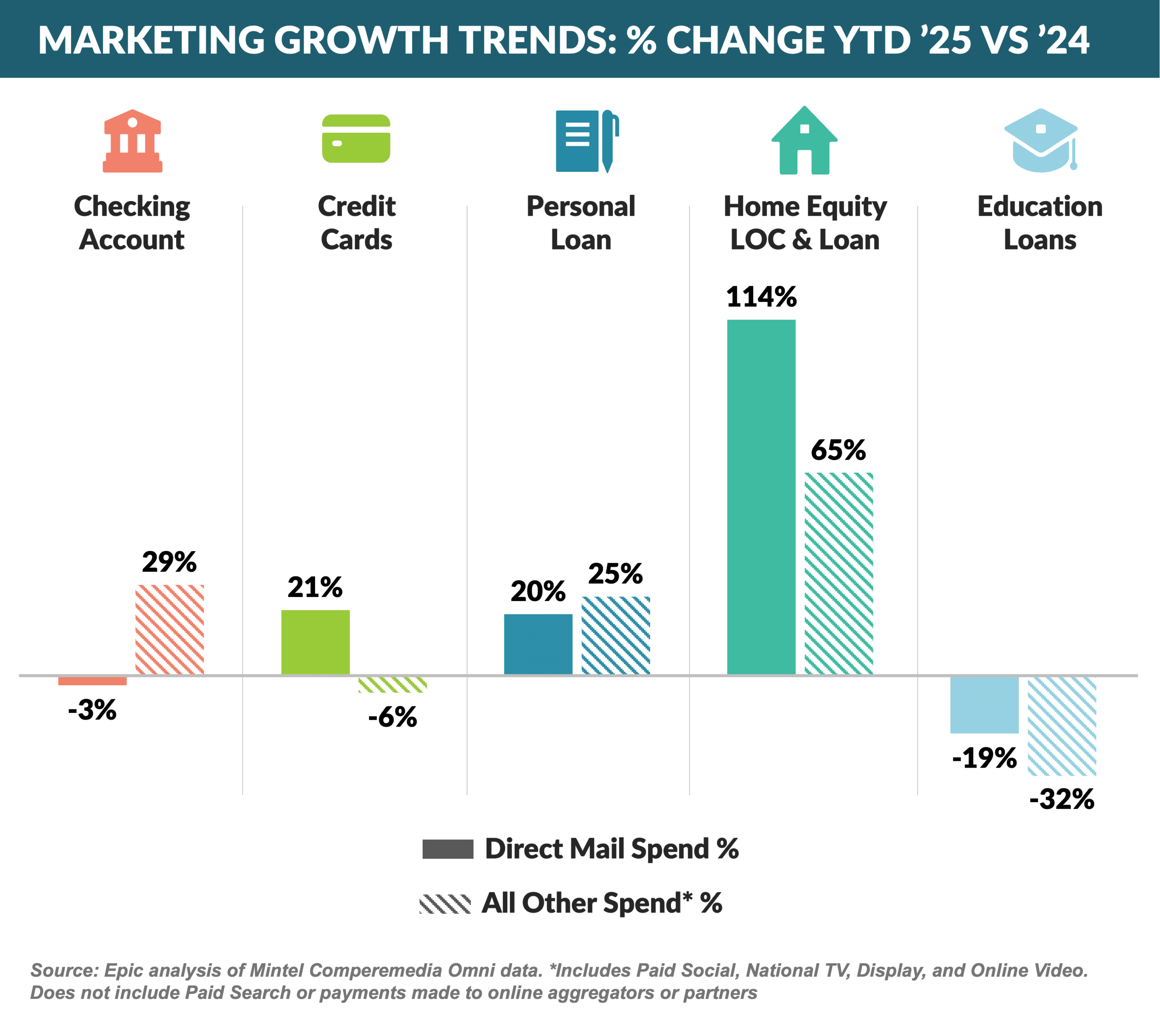

- The start of the year reveals increases in direct marketing activity

- Home equity shows the largest YTD increase, with direct mail up 114% and other spend up 65%

- Checking, credit cards, and personal loans are each up 20% in at least one marketing segment

- Education lending, down close to 50% overall in 2024, starts the year contracting even further due to the withdrawal of Discover from the segment and from the continued malaise in education refinance lending

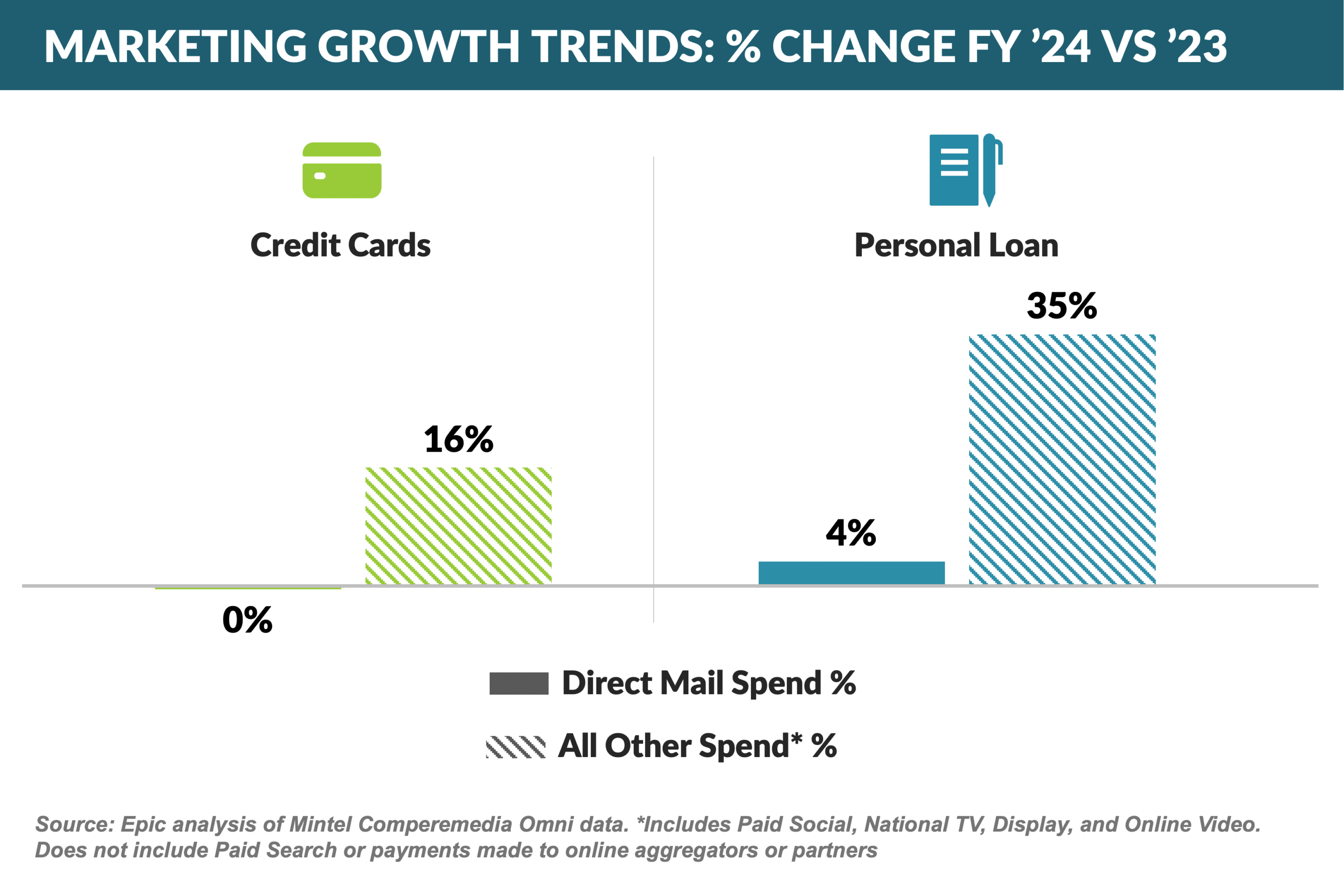

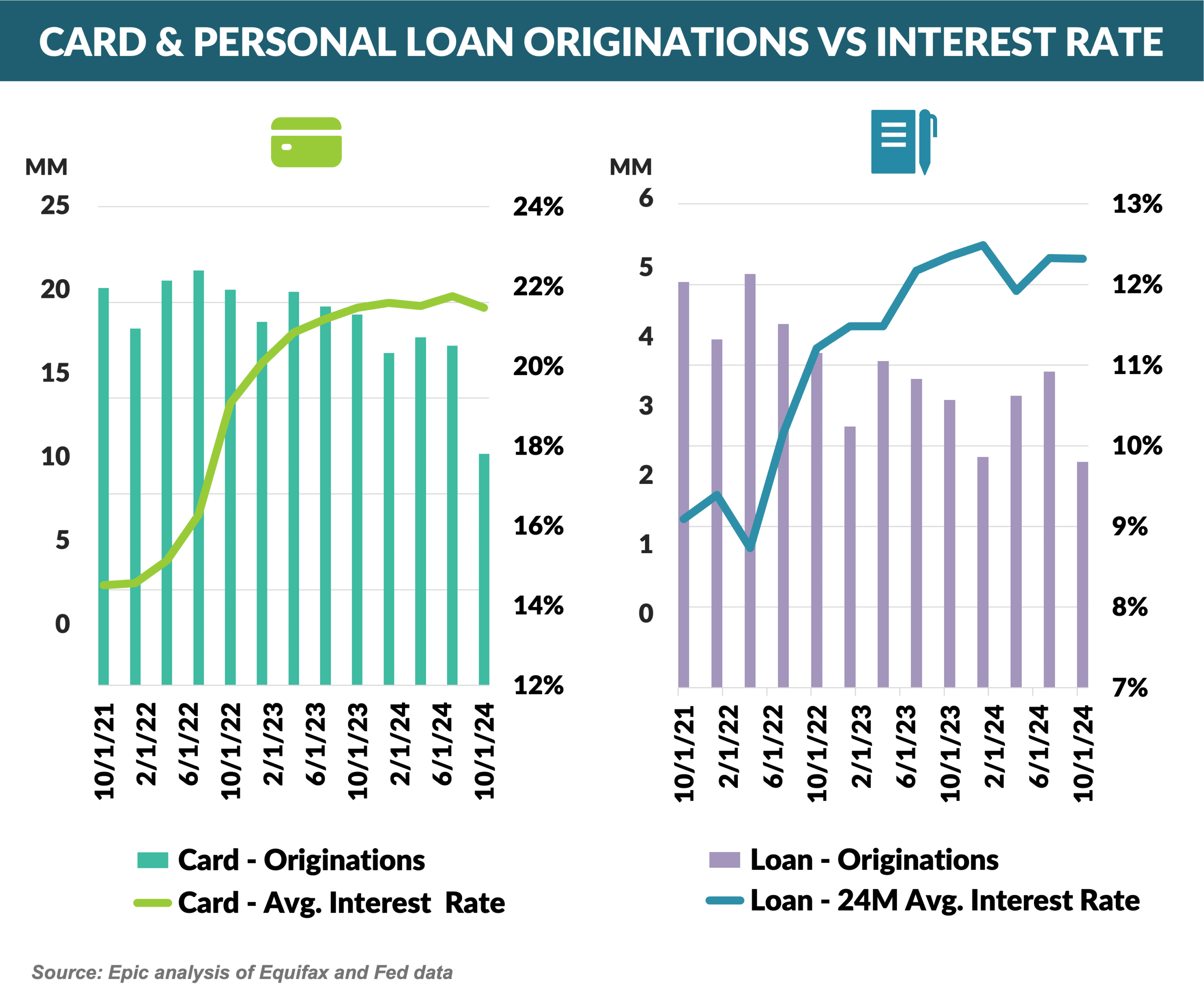

- Following a down year in 2023, acquisition spending for both credit cards and personal loans was up slightly in 2024

- Despite the increase in advertising, card and loan originations were down in 2024

- Lower response rates, due to higher interest rates, and tightened credit criteria pushed net response and originations lower, despite the increased marketing

- The Wall Street Journal reports that Visa has offered Apple roughly $100 million to take over as payment network for the Apple Card

- Both American Express and Mastercard are reportedly bidding as well

- The program is in play since Goldman is exiting the consumer lending business

- It was reported that the Apple Card portfolio had 12 million customers and $17 billion in loans outstanding as of September 2024, numbers that, as a standalone entity, would make it the 10th largest US card issuer

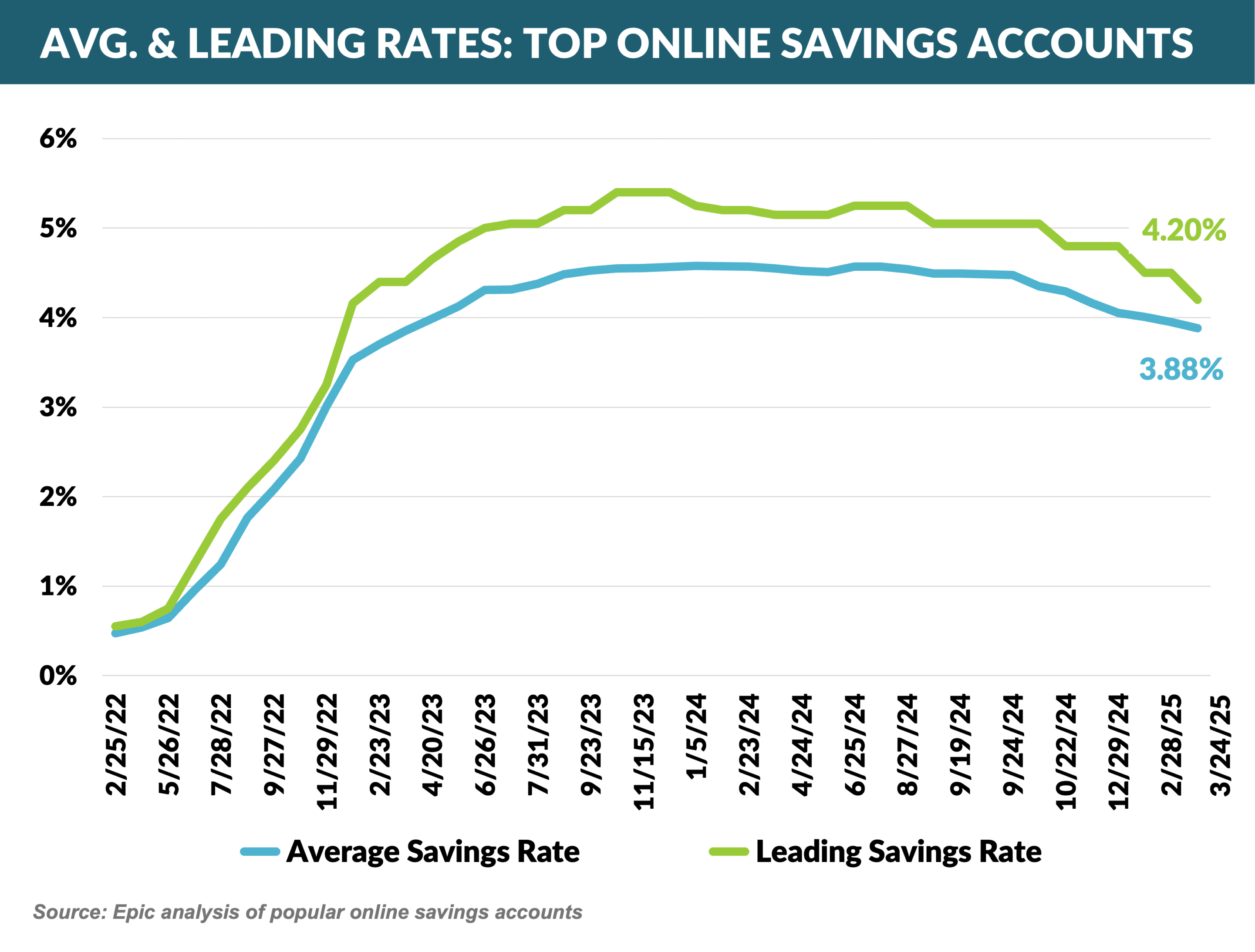

- High Yield Savings rates continue to move downwards with market leader Jenius lowering its rate 30bps from 4.50% to 4.20% and other notable online banks following the same trend

- CIT – 4.30% → 4.10%

- Discover – 3.75% → 3.70%

- Popular Direct – 4.30% → 4.10%

- US Bank turned up the heat in the balance transfer arena announcing the Shield Visa Card offering a 0% introductory rate for 24 months and no annual fee

- The offer is good on both purchases and balance transfers and offers 4% cash back on prepaid air, hotel, and car reservations booked through their Rewards Center – there is no cash back offer on other purchases

- The 24-month intro rate term marks another new high among major issuers – terms have typically been 15 months although we've seen 18 months for Citi Double Cash (balance transfers only) and BankAmericard (balance transfers and purchases), and a generous 21 months on Wells Reflect (balance transfers and purchases)

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in May.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.